Despite signs of easing US-China trade tensions, global economy is slowing down amid heightening risks

US

.

US growth outlook worsens amid high uncertainty surrounding trade protectionism policies. The IMF “reference forecast”, based on data available up to April 4 (which has not yet factored in effects of a 90-day pause of Reciprocal Tariffs), viewed the US economy to grow by only 1.8% in 2025 and 1.7% in 2026 (compared to the previous forecast of 2.7% and 2.1%, respectively). This forecast reflects heightened uncertainty over economic and trade policies, as well as weakening demand. Meanwhile, US President Donald Trump stated in an interview that the US would achieve a "complete victory" if it imposed tariffs ranging from 20% to 50% on trading partners within a year.

With rising downside risks from trade tensions, US economic indicators continue to signal a slowdown. This is reflected in: (i) a decline in consumer confidence for the fourth consecutive month to its lowest level since July 2022; (ii) an increase in unemployment rate with the slowest wage growth in eight months; and (iii) a slowdown in the services PMI and a sluggishness in the manufacturing sector. Although de-escalated tariffs and trade agreements could help mitigate the risk of a recession, the US economic slowdown this year appears inevitable. Accordingly, Krungsri Research expects the Fed to begin cutting its policy rate from mid-year, reaching a range of 3.50–3.75% by year-end, in order to support the economic growth and ease financial conditions in the period ahead.

Eurozone and Japan

Eurozone and Japan show signs of a slowdown. Both central banks likely to implement accommodative monetary policies. Amid heightened risks stemming from trade policies, the IMF “reference forecast” assessed the Eurozone economy to grow by 0.8% and 1.2% in 2025 and 2026, respectively, compared to 1.0% and 1.4% in the previous forecast. Meanwhile, Japan’s economy is expected to grow by 0.6% in both 2025 and 2026 (revised from 1.1% and 0.8%), aligning with recent economic data, which has mostly come out below expectations.

The Eurozone economy remains fragile and shows increasing signs of deceleration, as reflected by: (i) consumer confidence plunging in April to its lowest level since November 2023; (ii) the ZEW Economic Sentiment Index falling to its weakest reading since December 2022; and (iii) a renewed contraction in the services PMI, alongside ongoing weakness in the manufacturing sector. In Japan, risks are also mounting, driven by potential headwinds from US tariff policy and domestic price pressures. Tokyo Consumer Price Index (CPI) recorded its fastest increase in two years. These factors could weigh on domestic consumption and business investment going forward. Given the increasingly evident slowdown in both economies, Krungsri Research expects the European Central Bank (ECB) to gradually cut its key policy rate to 1.75% by end-2025 from the current 2.25%, while the Bank of Japan (BOJ) is likely to maintain its policy rate at 0.50% until the second half of the year.

China

China and the US begin easing stances on trade tensions, but a deal may take longer than expected. According to the IMF “reference forecast”, China’s GDP is expected to grow 4.0% in 2025, down from the earlier forecast of 4.6%, amid growing risks from an escalating trade war. Although Donald Trump claimed that China had begun talks with the US, China later denied the claim. China also announced to retaliate against any country that strikes a deal with the US in a way that harms Chinese interests. However, China is considering lifting 125% tariffs on some US imports, such as chemicals.

The US-China latest moves could be an early sign of easing trade tensions. Nonetheless, negotiations and a meaningful agreement on tariff reductions are unlikely to materialize as quickly as many had hoped. We estimate that even if the two countries lower tariffs to around 60%, the impact would still be significant. China’s long-term GDP and exports are expected to decline by -0.63% and -5.71%, respectively. These figures are close to those seen in scenarios where tariffs exceed 100%, which would reduce GDP by -0.75% and exports by -6.08%.

Despite robust Q1 performance, escalating US tariffs could drag Thailand’s full-year exports close to zero growth.

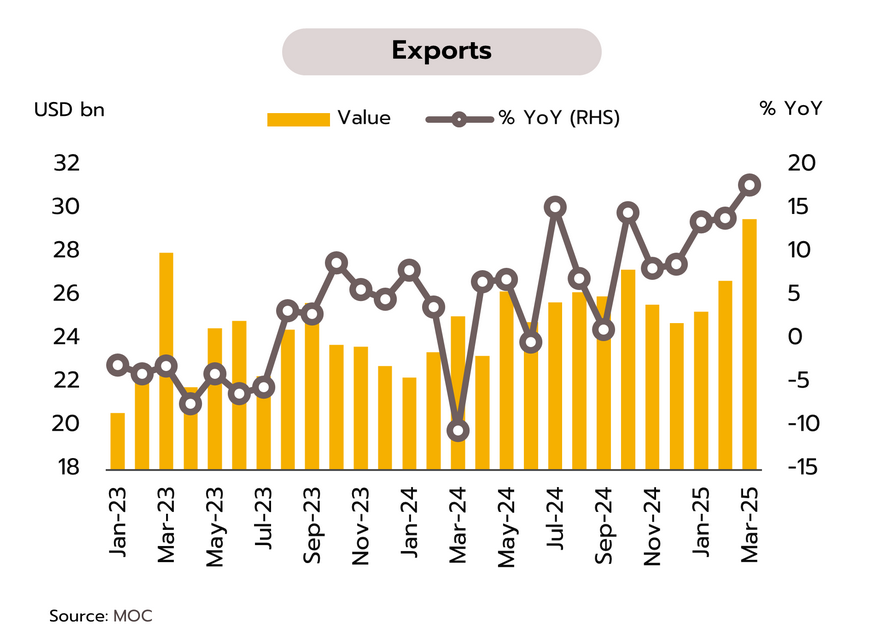

Export value in March hit an all-time high and recorded the fastest growth in three years, with pressures from uncertainties over US tariff policy. The Ministry of Commerce reported March export value at USD 29.5 bn, marking the 9th consecutive month of growth, up 17.8% YoY. Excluding oil-related products and gold, exports rose by 15.1%. Key products showing a strong expansion included computers & parts (+80.2%), circuit boards (+41.5%), rubber (+19.5%), air conditioners & components (+19.1%), machinery & components (+17.3%), and automobiles, equipment & parts (+5.6%). However, exports of some key sectors contracted, led by sugar (-27.7%), rice (-23.4%), and cassava products (-15.1%). On the export-market side, growth was seen across all major markets, led by the US and China, with exports surging 34.3% and 22.2%, respectively. For the first quarter of 2025, export value totaled USD 81.5 bn, expanding by 15.2% YoY.

The record-high exports in March may have been driven by temporary factors, including front-loading demand ahead of uncertainties surrounding US tariff policy. Although the US recently announced a 90-day pause of reciprocal tariffs on many countries, it has imposed a 10% base tariff on their goods and imposed a 145% tariff on Chinese imports. China retaliated with a 125% tariff on US goods. The situation remains highly uncertain going forward, particularly when the 90-day pause expires in early July.

Krungsri Research assesses that, under a worse-case scenario where Thailand faces a 36% reciprocal tariff for more than six months, or if trade negotiations result in Thailand facing higher tariff rates than competitors such as Vietnam (in which the US previously announced reciprocal tariff at 46%), Thailand’s competitiveness could be severely undermined. In this case, Thailand’s overall exports for the whole of this year could stagnate or even register zero growth.

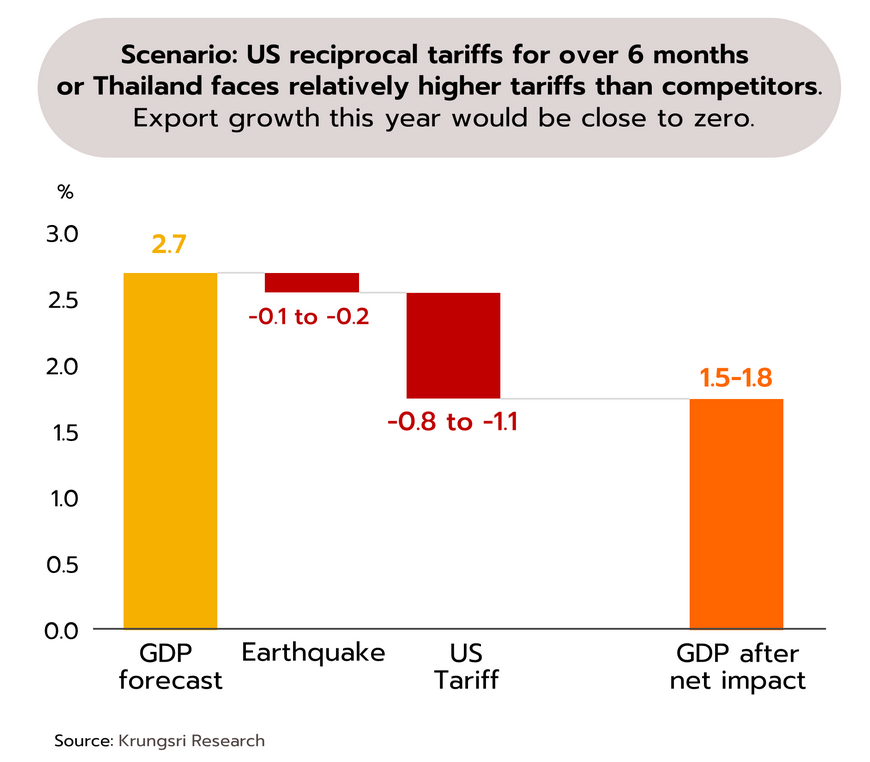

IMF sees Thai GDP this year to be the weakest among emerging market and developing economies in Asia. Krungsri Research assesses that if 2025 exports fail to expand, Thai GDP growth could slow to just 1.5–1.8%. The International Monetary Fund (IMF) released its “reference forecast”, which is not yet the baseline scenario, taking into account the US tariffs announced up to April 4 and the retaliatory actions from trading partners. Regarding the “reference forecast” for Thailand, the IMF projects GDP growth of only 1.8% in 2025 and 1.6% in 2026, compared to previous estimates of 2.9% and 2.6%, respectively. Thailand would be the only ASEAN country with GDP growth falling below 2%. Also, the IMF noted that ASEAN economies would be significantly impacted by the US reciprocal tariff policy, given their strong trade linkages with China and the US—the two economies directly affected by these tariff measures.

Krungsri Research projects that the Thai economy is likely to grow at a slower pace than the previous forecast of 2.7% in 2025, due to the combined effects of a short-term disruption from the earthquake and additional pressure from US tariff policies. We preliminarily provide three scenarios for Thai economic growth in 2025:

(i) If the US maintains a 10% base tariff throughout the year, Thai GDP is expected to grow by 2.2–2.4%.

(ii) If the US imposes a 36% reciprocal tariff for 3–6 months, GDP growth may slow to 1.9–2.1%.

(iii) Should reciprocal tariffs last beyond six months, or if rival countries succeed in negotiating lower tariffs than Thailand, GDP growth could weaken to just 1.5–1.8%.

These scenarios reflect rising uncertainties in the global economy, which could weigh on Thailand’s exports, investment, and business sentiment for the remainder of the year.