Escalating trade war impacts outlook for US and Japan’s economies, while China starts to feel the pain from US tariffs.

US

.

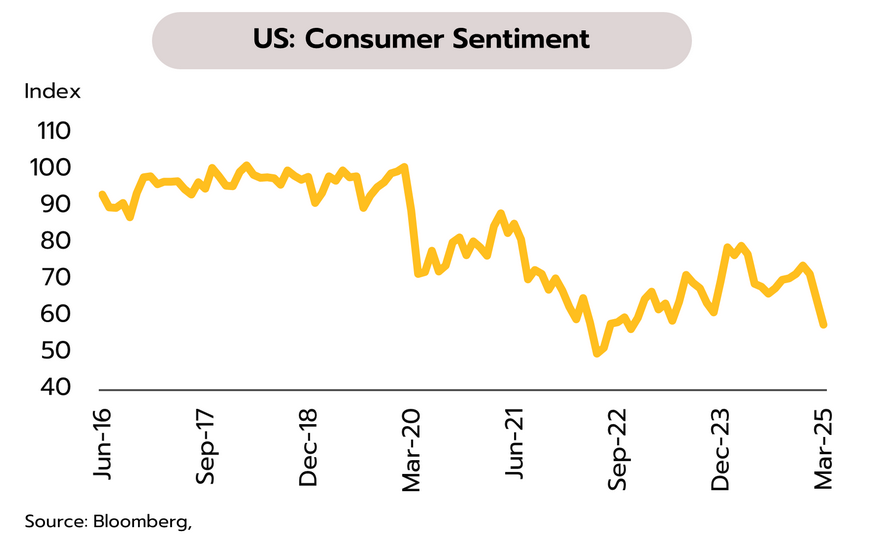

Signs of US slowdown become more evident amid uncertainty surrounding Trump’s economic and trade policies. In February, headline inflation slowed to 2.8% YoY from 3% in the previous month, while core inflation declined to 3.1% from 3.3%. Meanwhile, the Consumer Confidence Index dropped sharply to 57.9 in March, its lowest level since July 2022.

Concerns over US recession have intensified amid new tariff and immigration policies. This is reflected in the US stock market, which has dropped more than 8% over the past 3-4 weeks, alongside negative signals from key economic indicators, including the services PMI, rising delinquency rates, weakening employment figures, and slowing wage growth. Against this backdrop—coupled with pressures from the trade war, tightening financial conditions, and softening labor market—Krungsri Research expects the Fed to begin cutting interest rates by mid-year, with a total reduction of 75bps to a range of 3.50-3.75% at end-2025. However, lingering uncertainty over tariffs and inflation risks could prompt the Fed to hold rates steady at this week’s meeting.

Japan

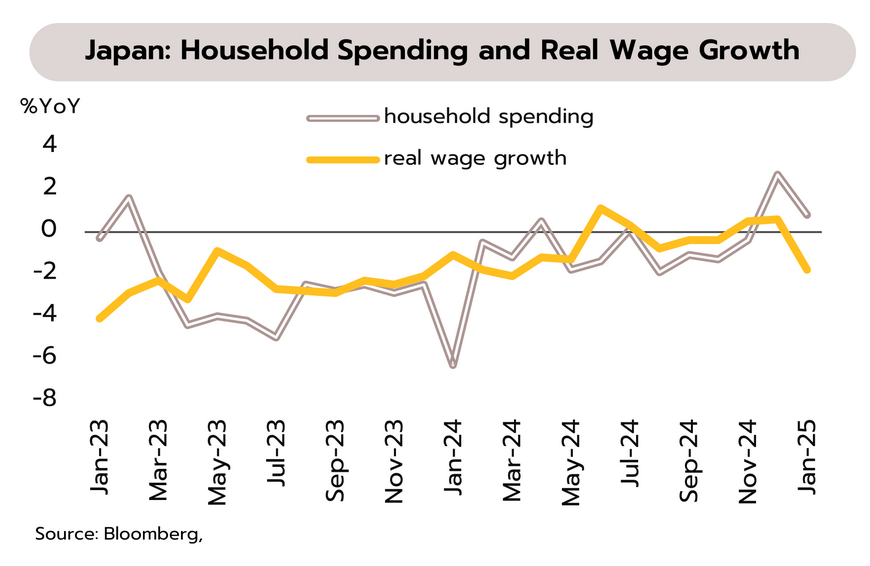

BOJ to take cautious approach on rate hikes amid weak economic data, with the manufacturing and export sectors remaining sluggish. Household spending growth slowed to 0.8% YoY in January from 2.7% in the previous month. Meanwhile, 4Q24 GDP grew 0.6% QoQ, with capital expenditures rebounding by 0.6% after contracting by -0.1% in the prior quarter. However, private consumption growth weakened significantly to 0% from 0.7%.

Despite several headwinds, Japan’s economy is expected to recover gradually through the rest of the year, supported by (i) the highest wage hike in 34 years, averaging +5.46%; (ii) improving business confidence; and (iii) government stimulus measures. However, the slowdown in household spending, real wages, and the manufacturing PMI, combined with trade war risks, all suggests that the BOJ might delay its rate hike at the March 19 meeting to maintain accommodative policies for economic recovery. A rate hike is more likely in the second half of the year, once the recovery gains traction.

China

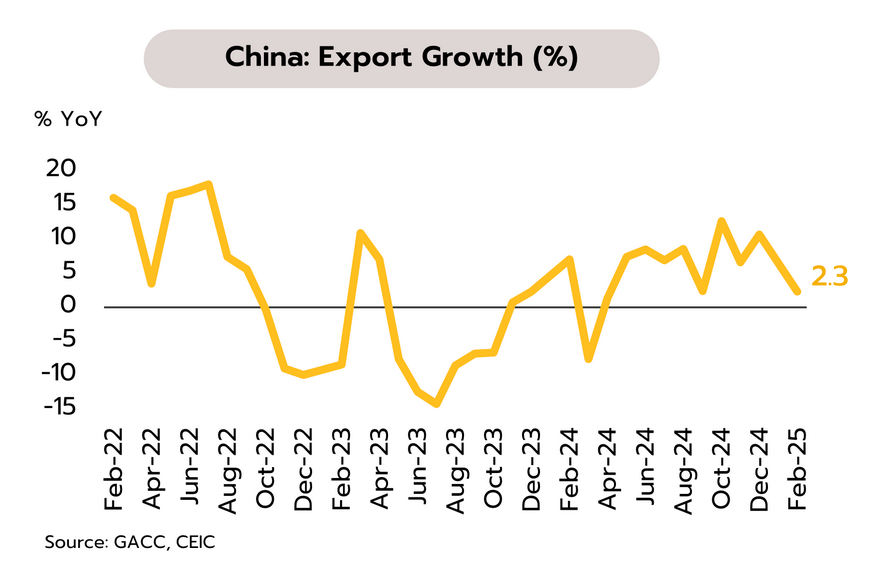

China’s economy remains fragile, while the trade war begins to weigh on exports. Headline inflation turned negative for the first time in over a year, at -0.7% YoY in February, compared to 0.5% in January. This aligns with core inflation, which eased to -0.1% from 0.6%. The producer price inflation remained close to the previous month at -2.2%. Meanwhile, exports grew by just 2.3% YoY in January-February, compared to 6-13% in 4Q24.

Persistently low inflation reflects excess supply and weak consumption. Meanwhile, China’s export growth have begun to slow, thanks partly to seasonal factors and the impact of US tariff hikes on Chinese goods, which took effect for the first time on February 4. We expect that a total tariff of 20% imposed by the US on all Chinese imports, along with China’s retaliatory tariffs of 10-15% on some US products, could reduce China’s exports and GDP from the baseline by 2.15% and 0.21%, respectively. Electronics & Electrical Equipment and Construction would be the most at risk.

Private consumption growth is expected to slow down this year, partly due to ongoing weakness in low-income earners' purchasing power.

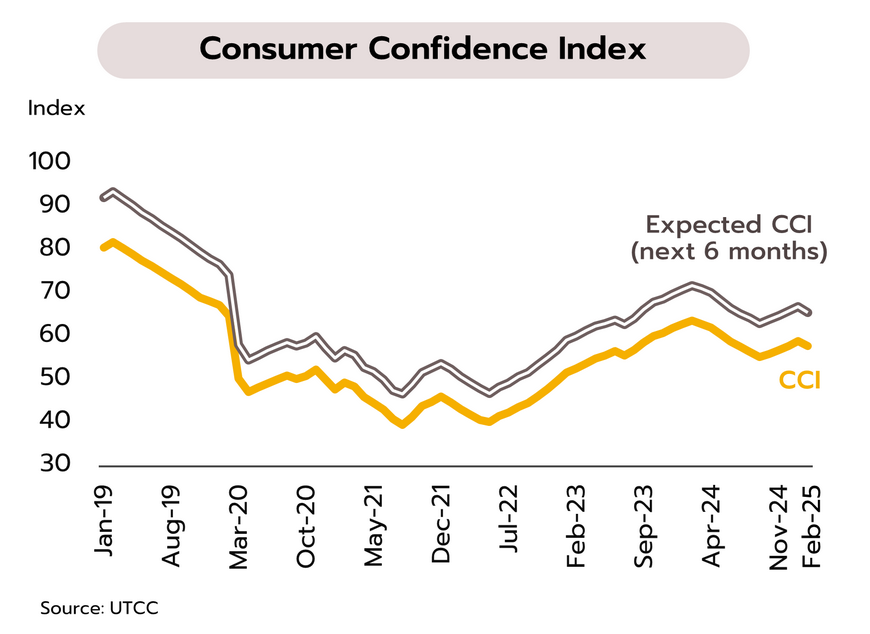

Consumer confidence declined in February, while government approved a digital wallet program for ages 16-20 years, with a budget of THB 27 bn. In February, Consumer confidence index declined for the first time in five months to 57.8 from 59.0 in January. The drop was driven by concerns over (i) Thailand’s slow economic recovery; (ii) domestic political uncertainty; and (iii) escalating trade wars, which pose risks to the Thai economy.

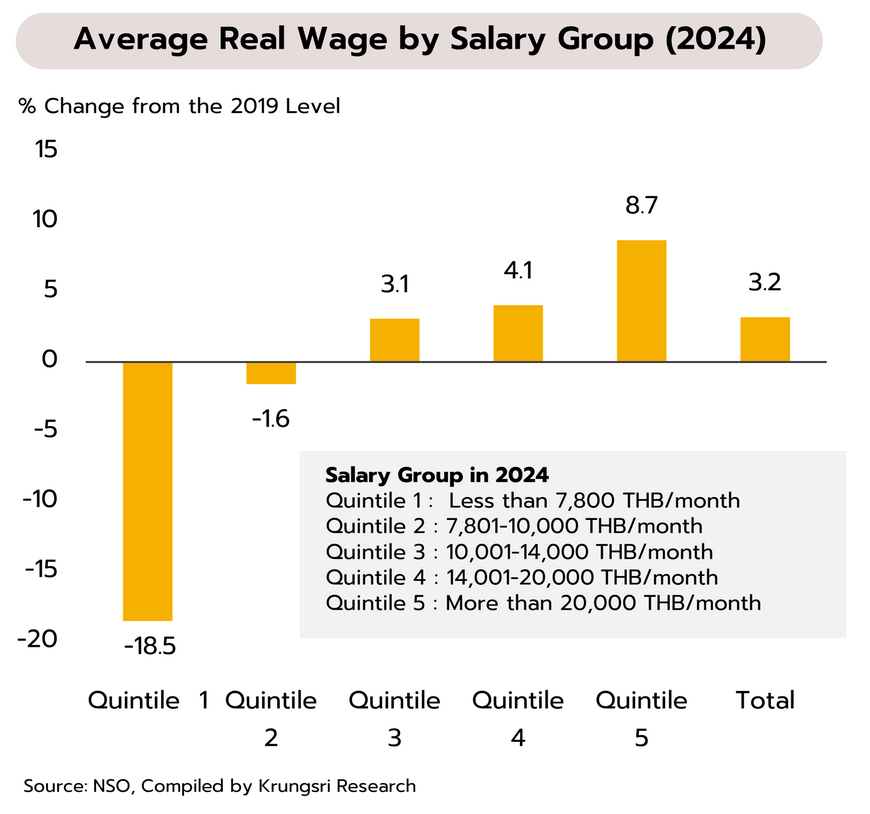

The decline in the consumer confidence index, which remains significantly low compared to the pre-COVID average of 75.5 in 2019, reflects weak domestic consumption. This is despite early-year support from stimulus measures, including the second phase of the THB 10,000 cash handout for over 3 mn elderly individuals and the Easy-E-Receipt program. The government has approved a THB 10,000 digital wallet program for individuals aged 16-20 years (approximately 2.7 mn people), expected to be distributed between June and July. For private consumption outlook this year, Krungsri Research forecasts its growth of only 2.8%, slowing from 4.4% in 2024. This is partly due to weak purchasing power among workers, as reflected in the slow recovery of real wages. In 2024, average real wages have increased from pre-covid levels in 2019 by just 3.2%. More importantly, a major concern is on the lowest-income workers (who earn less than THB 7,800 per month), which account for around 20% of total workforce or approximately 6.7 mn people. These workers’ real wages remain significantly below pre-COVID levels (as shown in the chart).

Government prepares projects to drive Thai economy to reach its growth target. The Economic Stimulus Policy Committee meeting on February 13 discussed plans to boost Thailand’s economic growth to achieve the government’s target of 3-3.5%. The strategy is divided into four key areas, comprising a total of 12 projects (as shown in the table).

Some of the above projects, such as Digital Wallet Phase 3, have an implementation plan. Other measures to boost consumption and tourism sector are expected to have more details in the period ahead. However, public investment projects will likely take time before delivering positive economic impacts. Meanwhile, projects related to private investment and exports remain uncertain amid structural challenges and escalating risks from trade wars.