Higher-than-expected reciprocal tariff rates raises downside risks to trade and economies worldwide

US

.

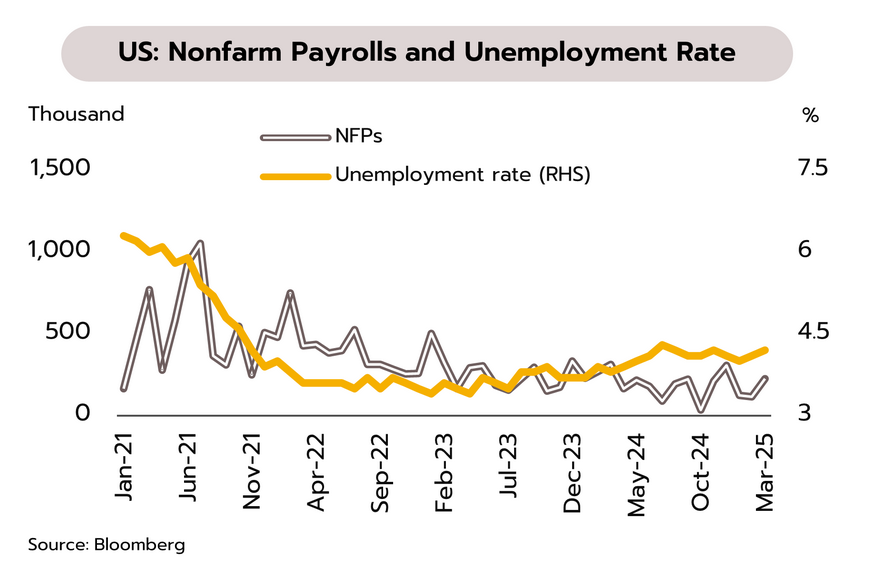

Recession risks in the US increase following the unexpected reciprocal tariff measures. President Donald Trump announced to impose a 10% tariff on most imported goods starting April 5. Furthermore, beginning April 9, the US will implement reciprocal tariffs on nearly 60 countries who posted trade surpluses with the US. The Fed Chair stated that the tariff policy could accelerate inflation and slow down economic growth. He affirmed that the Fed would not rush to cut interest rates until there is greater clarity about the eventual impact. The latest economic data showed mixed signals. March nonfarm payrolls rose more than expected by 228,000, but the unemployment rate edged up to 4.2%.

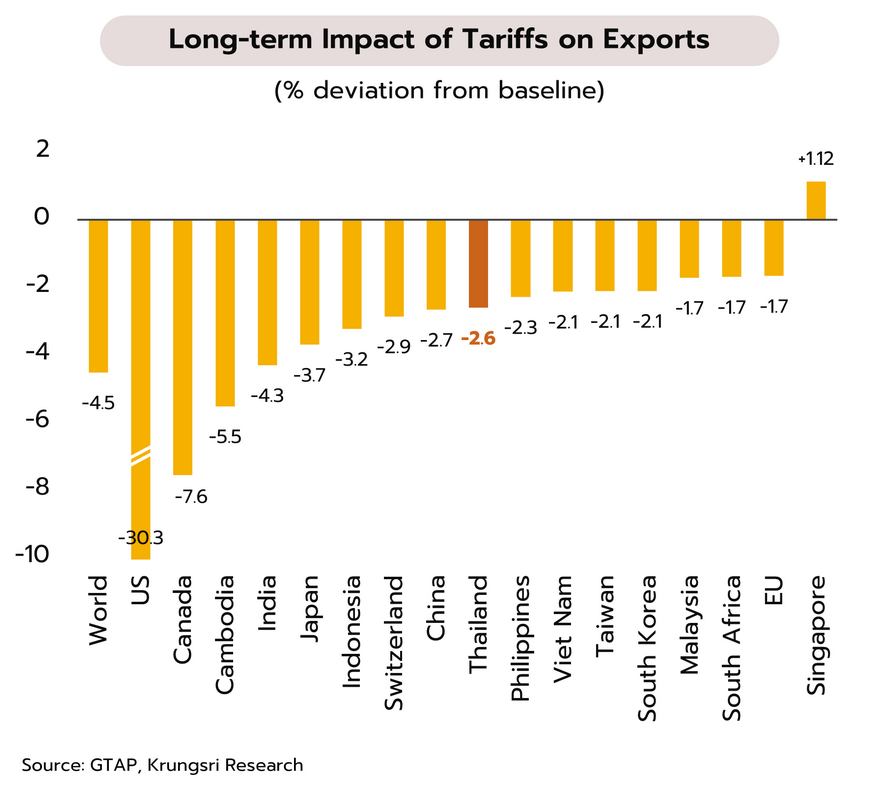

The escalation of the trade wars through the reciprocal tariffs significantly raises the risk of a US economic recession, reinforcing the trend of weakening key economic indicators. Krungsri Research’s study found that if the reciprocal tariffs are fully implemented, US economic growth and exports in the medium to long term could decline by -0.66% and -30.3%, respectively. This is substantially worse than the impact on global GDP and exports which could fall by -0.16% and -4.5%, respectively.

Japan

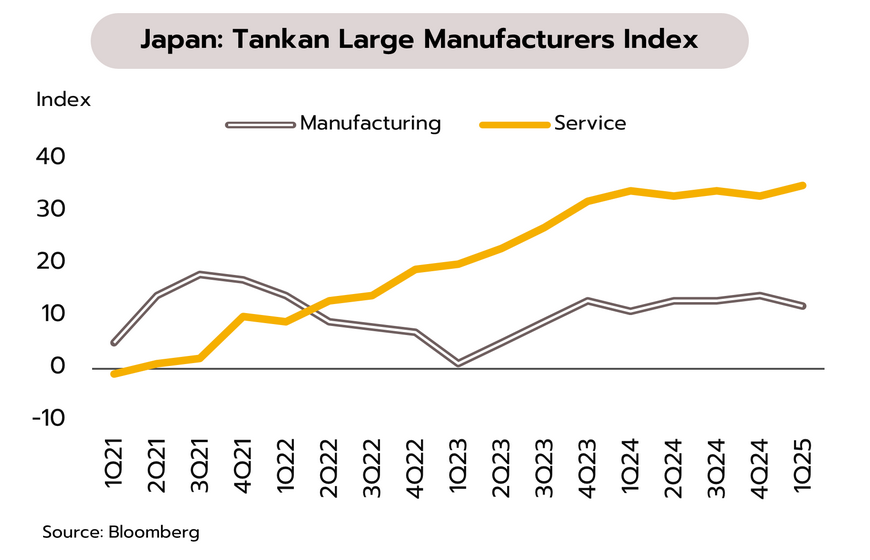

Japan’s growth momentum weakens amid elevated inflation and escalating trade wars. In February, retail sales growth slowed sharply from 4.4% in January to 1.4% YoY. Meanwhile, the Tankan Large Manufacturers Index fell to 12 in 1Q25, indicating a decline in business confidence. However, the sentiment index for non-manufacturing firms—including the services sector—rose for the first time in two quarters to 35 during the same quarter.

Japan’s economic recovery now faces heightened uncertainty as rising inflationary pressure continues to undermine domestic purchasing power. The manufacturing and export sectors are also showing signs of weakness amid escalating trade tensions, following the US's announcement of reciprocal tariffs on many trading partners—including Japan, which will face tariffs as high as 24%, effective April 9. Our study founds that if the US imposed the reciprocal tariffs as announced, Japan’s exports in the medium to long term could fall by -3.7%.

China

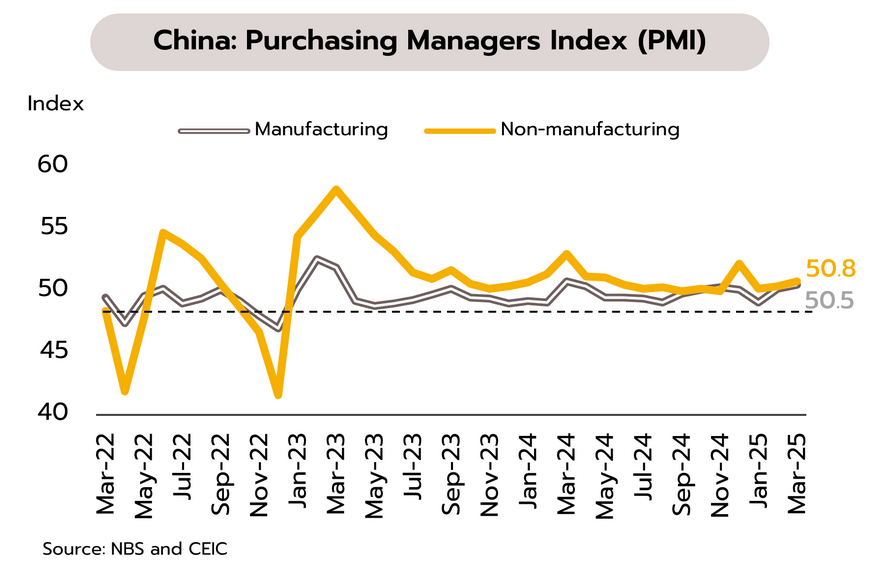

China’s economy shows some improvement but growing risks from US reciprocal tariffs will weigh on exports. The NBS reported that both manufacturing and non-manufacturing PMIs rose in March (see chart). Meanwhile, the US announced reciprocal tariffs of 34% on all Chinese imports, effective from April 9. bringing the total tariffs this year to 54%. In response, China announced to impose 34% tariffs on all US goods, effective April 10.

We expect the reciprocal tariffs would reduce China’s GDP and exports in the medium to long term by -0.04% and -2.7%, respectively. China would face both direct effects from US tariffs and indirect effects through other countries serving as production bases, particularly ASEAN, where US tariff hikes range from 10% to 49%. Additionally, the trade wars may worsen China’s supply glut and undermine the effectiveness of the consumption stimulus framework announced earlier this year. In the near term, China is likely to unveil more details of additional fiscal and monetary easing to deal with the impact of escalating trade tensions.

US reciprocal tariffs weighed down on Thailand's already-weak recovery

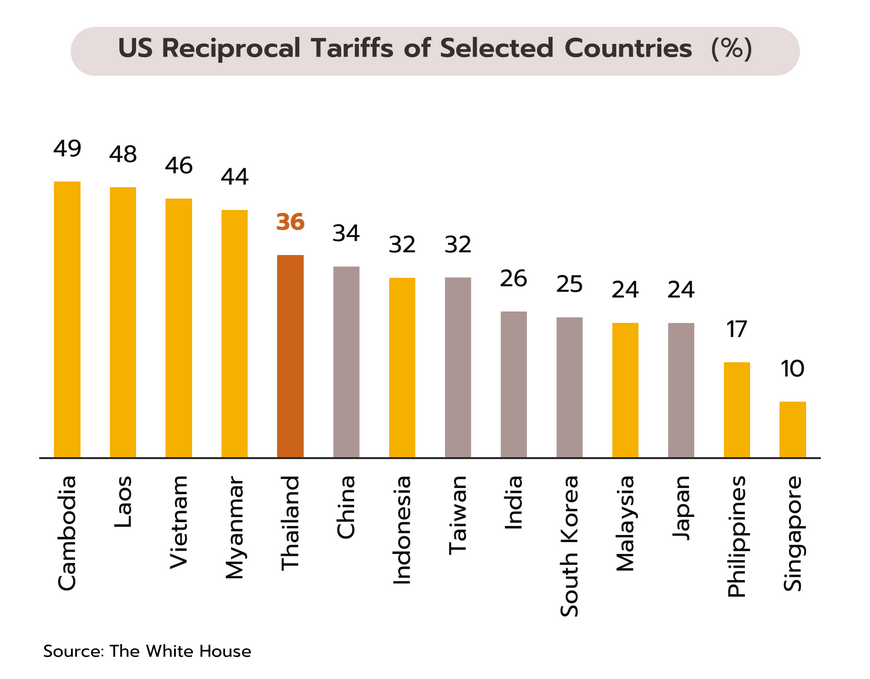

Thai exports face unexpectedly high US reciprocal tariffs of 36%, potentially stalling export growth this year. Thailand is one of nearly 60 countries subject to the US newly announced reciprocal tariff measures. Thai goods will face a tariff rate of 36%, the fifth highest in ASEAN, following Cambodia (49%), Laos (48%), Vietnam (46%), and Myanmar (44%). The measure will take effect on April 9.

Krungsri Research estimates that the US reciprocal tariffs could significantly drag down Thai exports. For the full year 2025, export growth may hover near zero if no progress is made in tariff reduction negotiations. The following export sectors are expected to experience significant impacts:

-

High impacts include Processed Seafood, Tires, HDDs, Electrical Appliances, Rubber gloves. Recently, the US has imposed low tariffs on these Thai products, and the US has consistently been the top market for these goods. So, a substantial increase in US tariff rates could severely impact Thai exports and production of there products.

-

Moderate impacts include Rubber, Rice, Motorcycle, Auto parts, Jewelry, Textiles and apparels, Plastics, Other medical devices, and Iron and Steel Products. While the US remains Thailand’s largest market for these goods, other markets hold substantial shares. Additionally, Thailand primarily produces these products for domestic use.

These industries, especially processed seafood and tires, could trigger spillover effects along supply chains, negatively impacting both agricultural and manufacturing productions, Thailand's labor market, and overall purchasing power.

Global trade tensions are heightening and remain uncertain, putting pressure on Thailand’s economy. The reciprocal tariff imposed by the US on Thai goods came in higher than expected at 36%, while Thai authorities had previously estimated it would be around 11% (within a 10–15% range). Previously, the average tariff gap between Thailand and the US was about 6%. When adding Thailand’s 7% value-added tax (VAT), the tariff rate expected to be imposed by the US was estimated at around 13%. In the medium to long term, the potential impacts of reciprocal tariffs appear less severe compared to the short term. This is because the US new tariff rate imposed on Thailand (36%) remain significantly lower than those of key competitors, including China (54%, derived from a 34% reciprocal tariff added to the 20% tariff earlier this year) and Vietnam (46%). As a result, investment relocation and substitution effects could provide some relative positive impacts on certain Thai exports and production. According to the Global Trade Analysis Project (GTAP) model, which assesses medium- to long-term effects, Krungsri Research has found that, based on the reciprocal tariffs recently announced by the US, Thailand’s exports and GDP could decline by -2.6% and -0.11%, respectively. In ASEAN, Vietnam and Cambodia could experience greater GDP losses than Thailand due to higher tariff rates and relatively higher reliance on US market, while Indonesia, Malaysia, and the Philippines would see smaller losses.

Looking forward, potential developments of global trade tensions could be: (i) negotiations leading to bilateral agreements with the US, (ii) retaliatory measures escalating into prolonged trade conflicts, or (iii) heightened uncertainty weighing on global economic conditions. These developments could suppress market sentiment, elevate production costs, erode productivity across multiple economies, and affect global supply chains.

For Thailand, with the economy already experiencing a K-shaped recovery—where many manufacturing sectors continue to underperform and lag significantly behind the services sector—the new reciprocal tariffs could further weaken Thailand’s key manufacturing industries and exert downward pressure on economic growth prospects in the short to medium term.