Products

Products

Recommendation

Personal

Personal

Personal

Personal

Personal

Personal

Business

Business

Business

Trade Services

Products

Import Services

Export Services

International Transfer

Trade Finance

Digital Channel

Krungsri Structured Trade Solutions

Business

Global Markets

Services

Global Markets

FX & Derivatives

Exchange Rates

Market Commentary

Digital Channel

recommend

FX@Krungsri

Business

Business

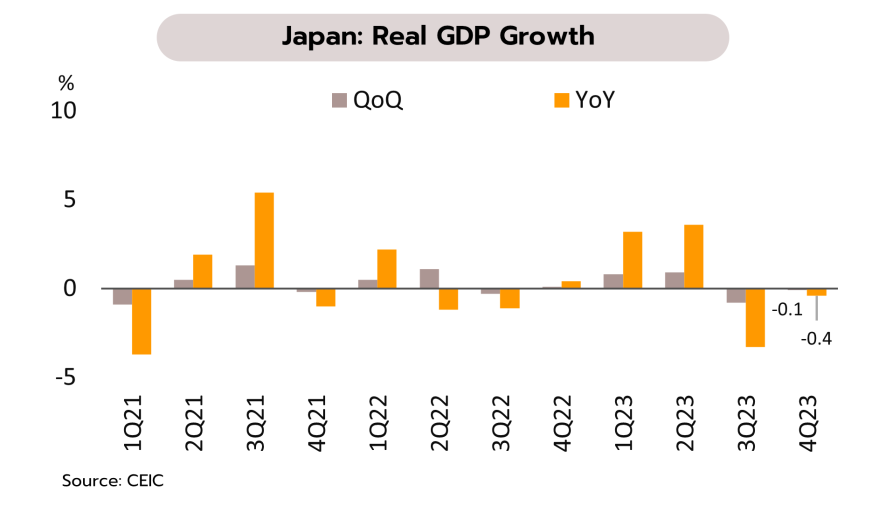

Although Japan entered a technical recession in Q4 of 2023, rising wages should provide the space for the BOJ to abandon its negative interest rate policy in mid-2024. With private sector consumption down -0.2% QoQ and business expenditure falling -0.1%, the Japanese economy shrank by -0.4% YoY and -0.1% QoQ in Q4. Given that GDP contracted -3.3% YoY and -0.8% QoQ in Q3 of 2023, Japan thus tipped into a technical recession.

Although Japan entered a technical recession in Q4 of 2023, rising wages should provide the space for the BOJ to abandon its negative interest rate policy in mid-2024. With private sector consumption down -0.2% QoQ and business expenditure falling -0.1%, the Japanese economy shrank by -0.4% YoY and -0.1% QoQ in Q4. Given that GDP contracted -3.3% YoY and -0.8% QoQ in Q3 of 2023, Japan thus tipped into a technical recession.