US and Eurozone economies show growing signs of slowdown, while China strives to boost still-weak consumption.

US

.

US Fed holds policy rate at 4.25-4.50% amid rising risk of economic slowdown. The Federal Reserve (Fed) voted to maintain its benchmark interest rate at 4.25-4.50% but announced a reduction in its quantitative tightening (QT) program, scaling back monthly liquidity absorption from $25 bn to $5 bn. Meanwhile, the Fed’s Dot Plot still signaled the likelihood of two rate cuts in 2025. Also, the Fed has revised down its economic growth forecasts for 2025 and 2026 to 1.7% (from 2.1%) and 1.8% (from 2.0%), respectively. The core PCE inflation forecast for 2025 has been raised to 2.8% (from 2.5%).

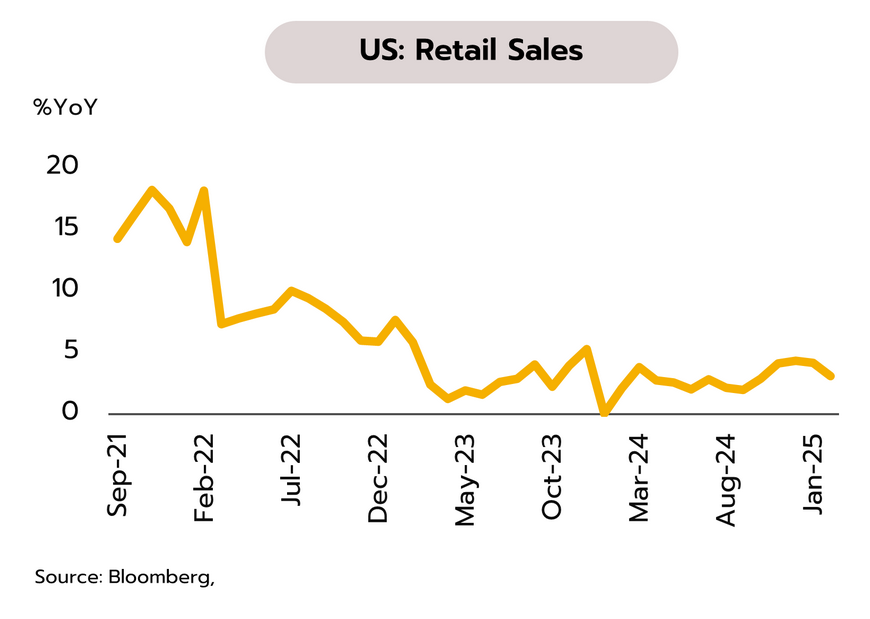

The US economy faces increasing downside risks, as evidenced by: (i) a sharp deceleration in the services PMI, which posted its weakest expansion in 15 months; (ii) rising delinquency rates; (iii) a slowdown in job growth and wage gains; and (iv) weak consumer spending. Furthermore, the Fed views inflationary risks from tariffs as transitory, potentially paving the way for rate cuts this year. Krungsri Research expects the Fed to start cutting its policy rate from mid-year, by a total of 75bps, bringing the rate down to 3.50-3.75% by end-2025.

Eurozone

Eurozone economy remains fragile amid rising trade war risks. The Eurozone economy continues to show signs of weakness, with downside risks from escalating trade tensions. In March, headline inflation (CPI) slowed to 2.3% YoY, marking its lowest level in six months, while core inflation dropped to 2.6%, the slowest in nearly three years. At the same time, ECB President Christine Lagarde warned that rising trade conflicts could trim Eurozone GDP growth by 0.3-0.5% while also fueling inflationary pressures.

Trade war risks remain a key drag on the Eurozone, in addition to existing challenges such as a sluggish services sector, weakening consumer spending, and slowing investment. Meanwhile, German parliament has approved the debt-brake policy, paving the way for increased defense spending, and a EUR 500 bn stimulus fund. While this initiative will provide a boost to German economy next year, its positive impact on the Eurozone remains limited and will take time to materialize. Given these factors, the ECB is expected to cut its key deposit rate to 2.00% by this year. However, the rate cuts may not occur at every meeting, as near-term outlook of inflation remains above the 2% target.

China

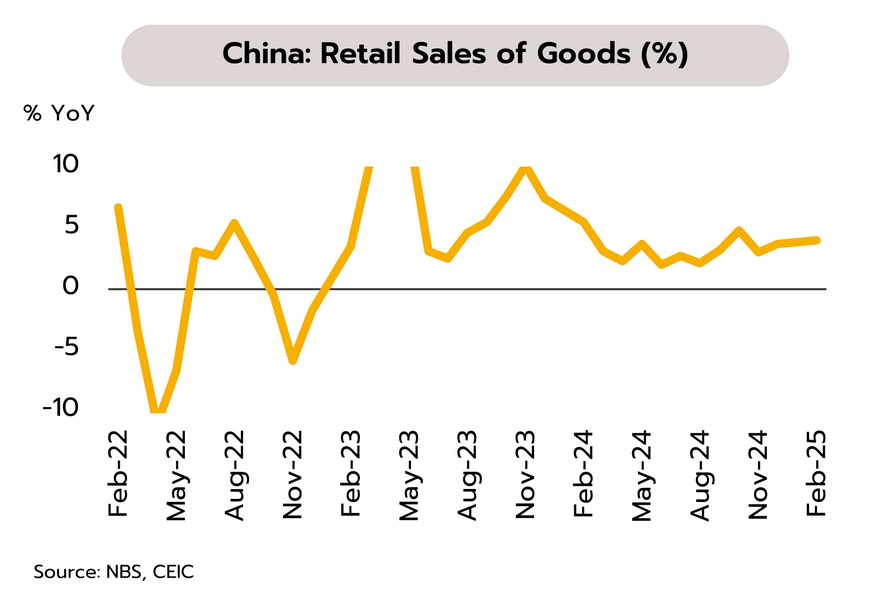

China is set to announce additional plans to stimulate consumption as the trade war heats up. Retail sales growth in January–February edged up to 4% YoY from 3.7% in December, but far below the pre-COVID level of 7–11% (2017–2019). The consumer confidence index rose from 87.5 in January to 88.4 in February. Meanwhile, some banks in Shanghai and Hangzhou have cut interest rates for consumer loans to a low of 2.58% from around 10% two years ago.

China’s consumption remains weak, while exports are likely to weaken due to the trade war. As a result, the government’s shift to prioritize boosting domestic consumption this year is considered as a crucial strategy to help achieve the official economic growth target of around 5% for 2025. The key measures include boosting household income, trade-in subsidies, stabilizing capital and real-estate markets, and encouraging banks to expand more consumer loans. However, the recovery in consumption may take longer than expected, as consumer confidence remains about 30% lower than pre-COVID levels.

Private consumption growth is expected to slow down this year, partly due to ongoing weakness in low-income earners' purchasing power.

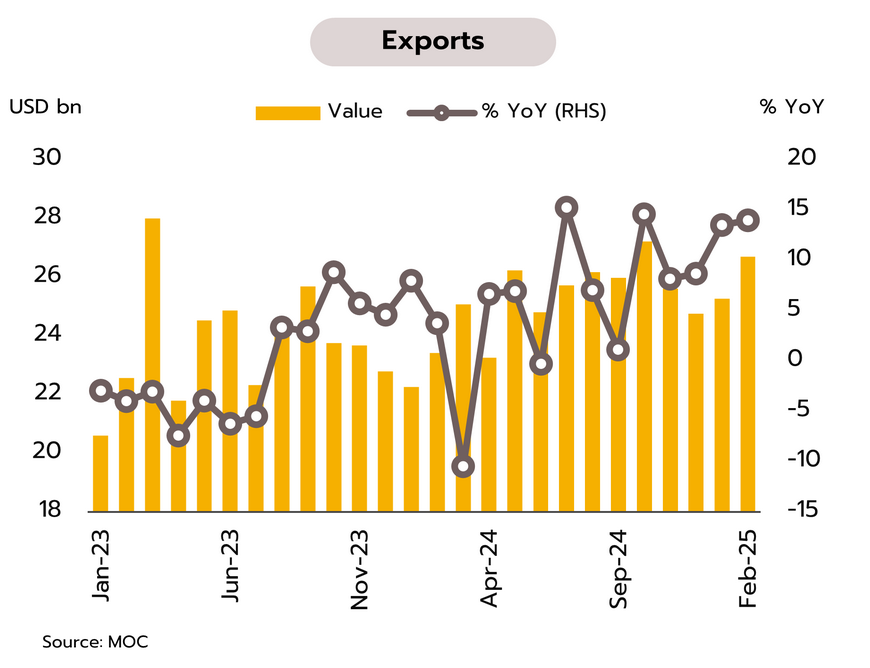

The export recovery faces challenges, despite February’s export value posting double-digit growth for the second consecutive month. The Ministry of Commerce reported February export value at USD 26.7 bn, marking the 8th consecutive month of growth, up 14.0% YoY (above market expectations of 9.7%). Excluding oil-related products and gold, exports rose 14.6%. Key products showing strong growth included computers & parts (+51.3%), air conditioners & components (+32.8%), circuit boards (+24.8%), and automobiles, equipment & parts, of which its growth turned positive for the first time in three months (+4.5%). However, some key categories contracted, such as rice (-34.3%), iron, steel & products (-13.2%), and fresh, chilled, frozen & dried fruits (-3.7%). On the export-market side, growth was seen in major markets such as the US, China, and the European Union. However, exports to Japan, ASEAN-5, and CLMV markets contracted. For the first two months of 2025, export value expanded by 13.8%.

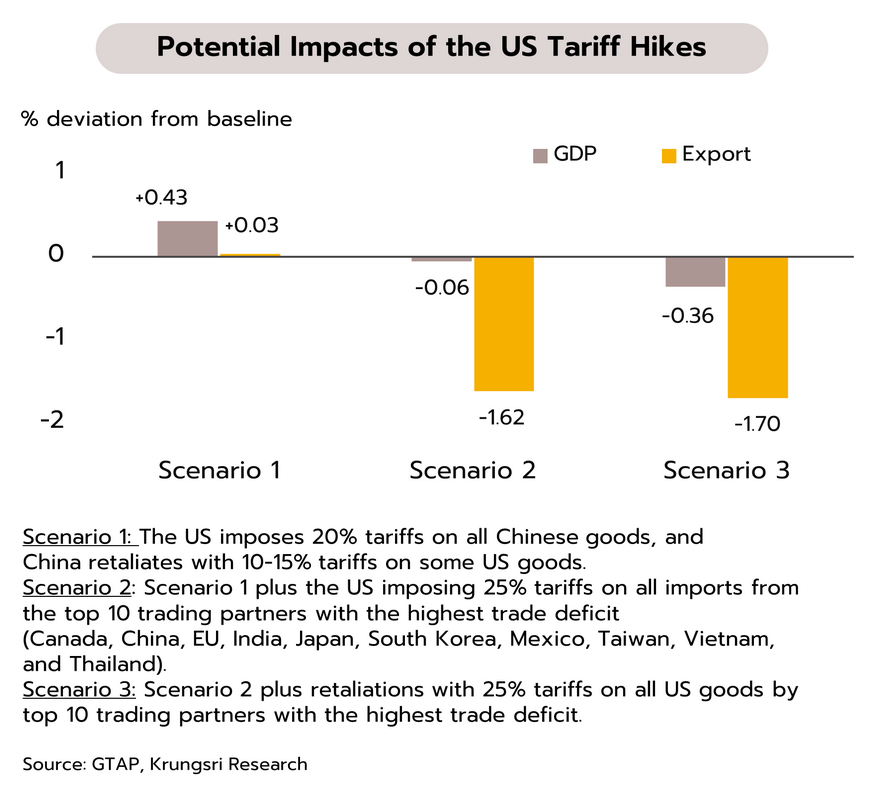

Thai exports continued to grow (vs January’s +13.6% YoY), supported by rising demand for electronic products and a temporary boost from US imports in response to uncertainty over President Trump’s tariff measures. Looking ahead, Thai exports will continue to face challenges. Krungsri Research has assessed that, under the current scenario where the US imposes 20% tariffs on all Chinese goods and China imposes 10-15% tariffs on certain US goods, Thailand’s exports and GDP could increase from the baseline by only +0.43% and +0.03%, respectively. However, gains would be concentrated in just a few product categories, while losses would spread across many industries. Furthermore, if the US imposes 25% tariffs on countries who post a trade surplus with the US, including Thailand, net impacts on the Thai economy would turn negative, with its exports and GDP falling from the baseline by a range of -1.6% to -1.7% and a range of -0.06% to -0.36%, respectively.

BOT sees uneven economic recovery and temporarily eases LTV rules for real estate. The minutes of the Monetary Policy Committee (MPC) meeting in February stated that Thai economic growth this year is expected to be slightly higher than the previous year’s growth of 2.5%, but lower than the earlier forecast of 2.9%. The report also noted growing signs of an uneven (K-shaped) recovery across sectors. The service sector, particularly tourism-related industries, is expected to perform well. The electronics sector could benefit from the technology product cycle. However, the industrial sector faces structural challenges, particularly in the automotive segment. The real estate sector continues to deteriorate.

The MPC’s view of weaker-than-expected economic recovery and increasing disparities across sectors was one of the key factors behind its decision to ease monetary policy at the February meeting. The Bank of Thailand (BOT) recently announced a temporary relaxation of regulations on housing loans and related loans (Loan-to-Value: LTV). Under the new rule, the LTV ceiling is set at 100% for: (i) housing loans with collateral value below THB 10 mn, starting from the second loan contract onward, and (ii) housing loans with collateral value of THB 10 mn or more, starting from the first loan contract onward. This relaxation will apply to loan contracts made between May 1, 2025, and June 30, 2026. The measure aims to support the real estate sector, which is slowing due to weakening domestic demand, and to help ease the issue of high housing inventory. Additionally, the relaxation of LTV rule serves as a targeted policy to reduce the need for broad-based monetary easing.