Trade war heightens risks to global economy, supporting central banks to cut rates this year. China still depends on economic stimulus.

US

.

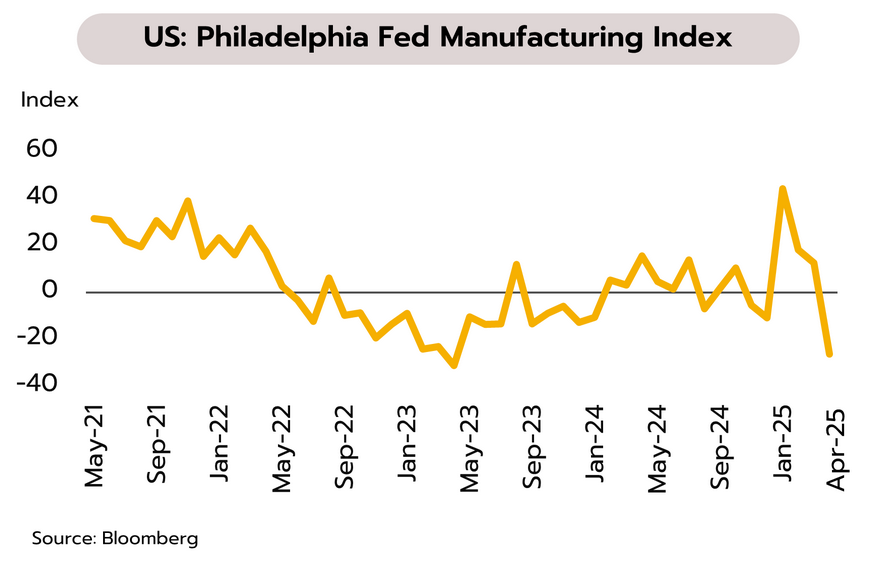

US Fed signals it is in no rush to cut rates amid growing uncertainty over trade policy. The Atlanta Fed revised down its estimate of 1Q25 GDP growth, based on GDPNow model, to a 2.2% contraction from a 2.3% expansion in the previous estimate. Meanwhile, the Philadelphia Fed reported that the manufacturing index fell unexpectedly to -26.4 in April from +12.5 in March.

Fed Chair Jerome Powell signaled that the central bank is in no rush to lower policy rates, even though the data suggests the US economy slowed in 1Q25. Consumer confidence has also declined, as the US new tariffs may push inflation further away from the Fed’s 2% target, prompting the Fed to wait for clearer signs before adjusting its policy stance. Additionally, the 90-day postponement of reciprocal tariffs (excluding China) helped ease financial market volatility, as seen in renewed buying in stock and bond markets following earlier heavy sell-offs. Nevertheless, given more signs of a slowing US economy, Krungsri Research still expects the Fed to begin lowering its policy rates by mid-year, bringing the Fed Funds rate to 3.50–3.75% by end-2025.

Eurozne

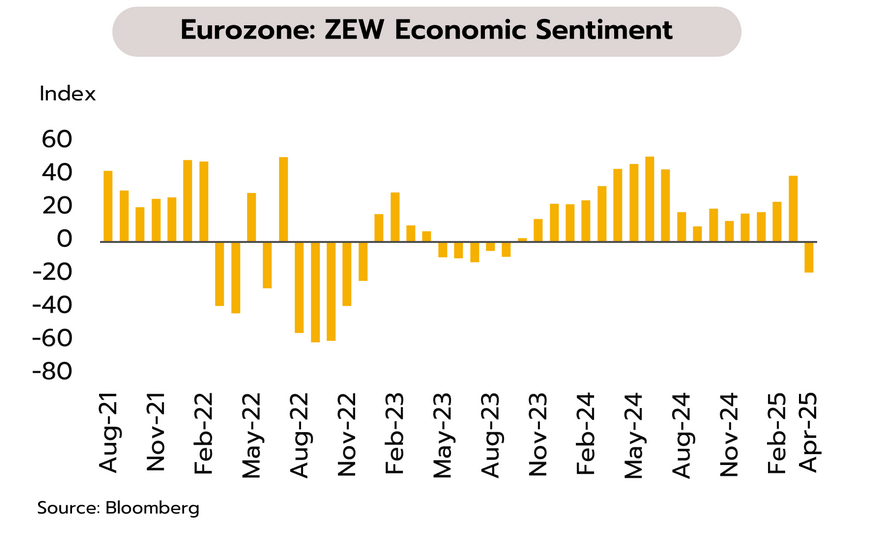

ECB cut its policy rates and may continue to ease monetary policy, as trade war weighs on Eurozone’s recovery. In April, the ZEW Economic Sentiment Index declined to -18.5, the lowest level since December 2022. Headline inflation in March eased to 2.2% YoY, a four-month low, while core inflation slowed to 2.4%, the lowest level in 41 months.

Escalating trade tensions and policy uncertainty have heightened downside risks to the Eurozone economy. These concerns are evident in sharply declining business and household confidence, slower growth in the services sector, and continued sluggishness in manufacturing and exports. In response, the European Central Bank (ECB) cut its key deposit rate by 25bps to 2.25% at its meeting on April 17. Moreover, US’s plans to impose tariffs on pharmaceuticals and medical supplies are expected to have a significant impact on the European medical technology ecosystem, as the US has remained the top destination for extra-EU exports of medicinal and pharmaceutical products in 2024, accounting for 38.2% of all exports outside the EU. This could also trigger a shift in investment to the US. Given these economic risks, Krungsri Research expects the ECB to gradually lower interest rates to 1.75% by year-end from the current 2.25%.

China

China still benefits from stimulus measures, but the escalating trade war may weigh on the economy in the period ahead. China’s GDP grew by 5.4% YoY in 1Q25. Retail sales growth improved from 4% in the first two months to 5.9% in March. Export growth also accelerated from 2.3% to 12.4%. However, new home sales turned to post a 11.4% contraction, compared to a 3.2% rise in February. Meanwhile, the US raised tariffs on Chinese imports to 145%, effective April 10, while China retaliated with tariff hikes to 125%, effective April 12.

China’s economy still performed well in 1Q25, partly due to trade-in subsidies. However, for the remainder of the year, the economy faces downside risks from slowing exports, which could affect employment and purchasing power. The latest data show that consumer confidence and the labor market remain fragile, with high unemployment rate among youth aged 16–24 at 16.5% in March. Therefore, the government may need to speed up the implementation of income-boosting measures as it has previously pledged to boost 2025 economic growth to close to the 5% target.

Thai economy hit by twin shocks, raising chances of policy rate cut this year.

BOT sees risk of Thai GDP falling below 2.5% this year. Krungsri Research expects MPC to adopt a wait-and-see stance this month, preserving its limited policy space for potential use in 2H25. The Bank of Thailand (BOT) noted that the rate-cut decision at the March MPC meeting was based on the assumption that the US would impose a 10% tariff on Thai goods. Under that scenario, Thailand’s economy was projected to grow by 2.5% in 2025. However, if US tariffs exceed 10%, the impact could be more severe, potentially dragging GDP growth below 2.5% this year.

Krungsri Research expects the twin shocks from the March earthquake and US tariff hikes will inevitably weigh on the Thai economy, causing 2025 GDP to fall short of our current forecast. This also increases the likelihood of monetary easing later this year. However, we expect the MPC to maintain the policy rate at its April 30 meeting, in line with recent forward guidance from the BOT: (i) The BOT noted that although the reciprocal US tariff on Thai goods (36%) is higher than expected, the 90-day grace period is expected to delay the economic impact until 2H25 and 2026. (ii) The BOT’s latest GDP forecast is based on the assumption that the reciprocal tariff will be around 10% this year — which aligns with the current situation. (iii) The BOT added that the impact would be limited to “some” sectors, mostly on the supply side. The BOT has consistently stated that such supply-side problems should be addressed through targeted or supply-side policies rather than monetary policy. (iv) Despite inflation remaining below the target range, the BOT attributes this to supply-side factors that monetary policy cannot influence. It also views that inflation will return to the target range over the medium term. The BOT’s comments signal that the MPC is likely to adopt a wait-and-see stance this month, preserving its limited policy space for potential use in 2H25 should trade tensions escalate and broadly impact Thailand’s overall economy.

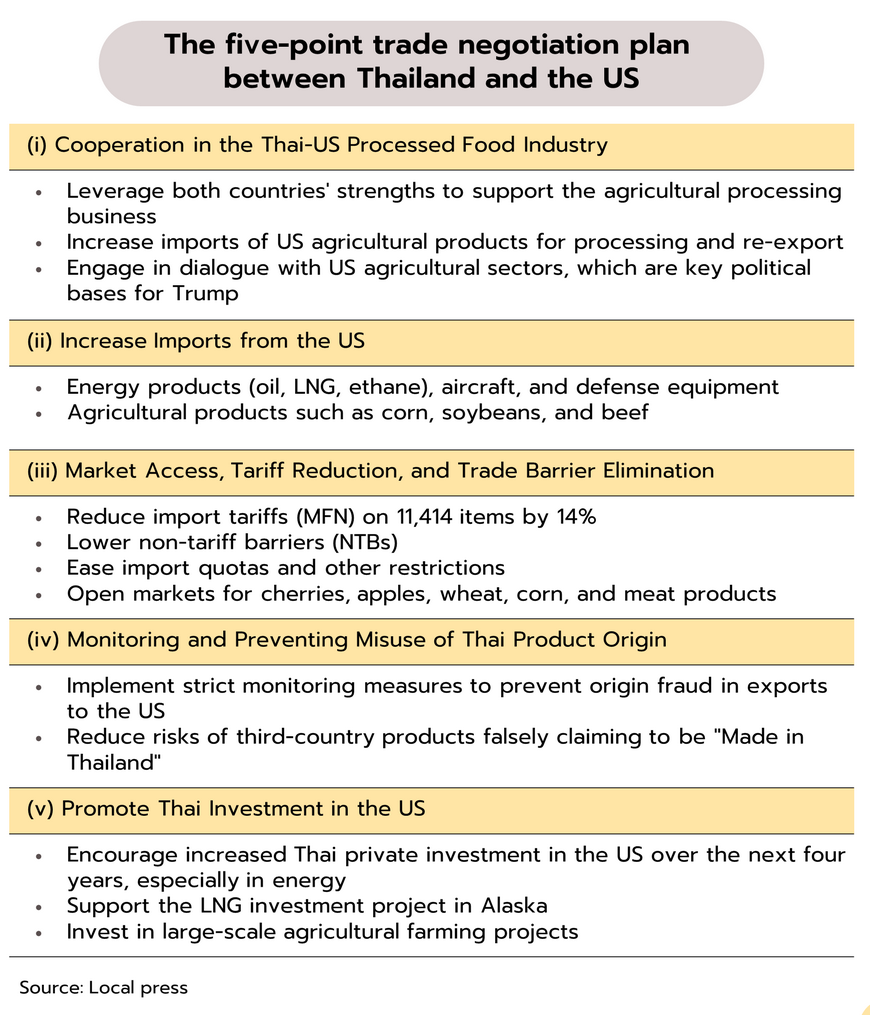

Midweek trade talks between Thailand and the US are under close watch, with Thailand set to propose measures to reduce its trade surplus with the US. The Prime Minister announced that the US has agreed to hold trade negotiations with Thailand, scheduled for April 23. The preliminary negotiation framework outlines five key areas of cooperation: (i) strengthening collaboration in the Thai-U.S. processed food sector; (ii) increasing imports from the US, including energy, aircraft, and other goods; (iii) opening markets, reducing import tariffs, and lowering trade barriers; (iv) verifying and preventing false claims of product origin; and (v) promoting greater Thai investment in the US (as detailed in the table).

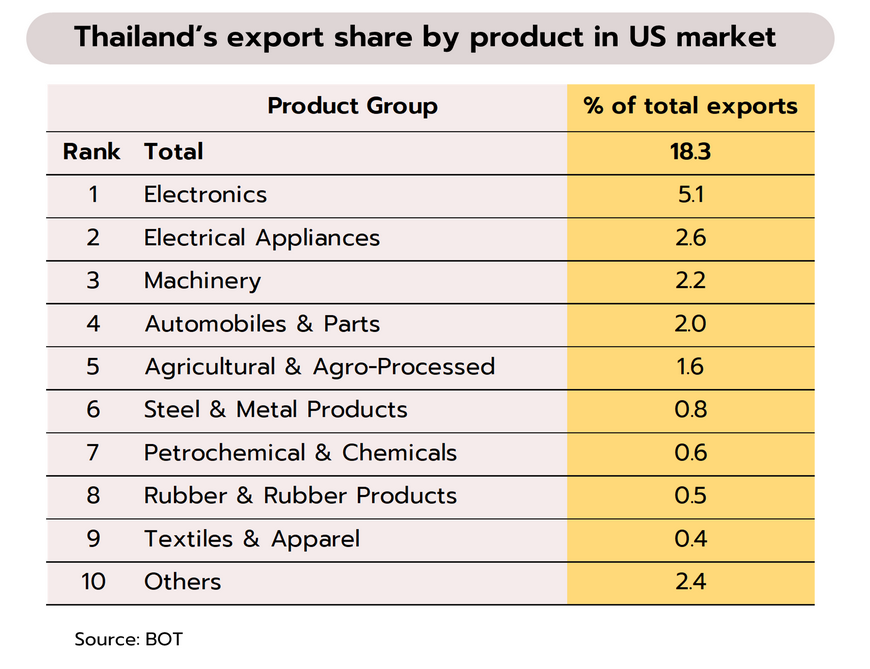

The trade negotiations between Thailand and the US on April 23 represent an initial step toward easing tensions in bilateral trade relations. Thailand intends to propose a strategy to halve its trade surplus with the US within five years, based on the five key approaches outlined earlier. Should the talks yield progress, they may help reduce the risk of reciprocal US tariffs, which could potentially rise as high as 36%. Conversely, if Thailand fails to deliver tangible results while competing countries successfully deepen their cooperation with the US, it could place Thailand at a disadvantage in accessing the US market—which currently accounts for 18.3% of the country’s total exports.