The Chinese recovery continues to face obstacles, while worries over inflation may delay rate cuts in the US and the Eurozone

US

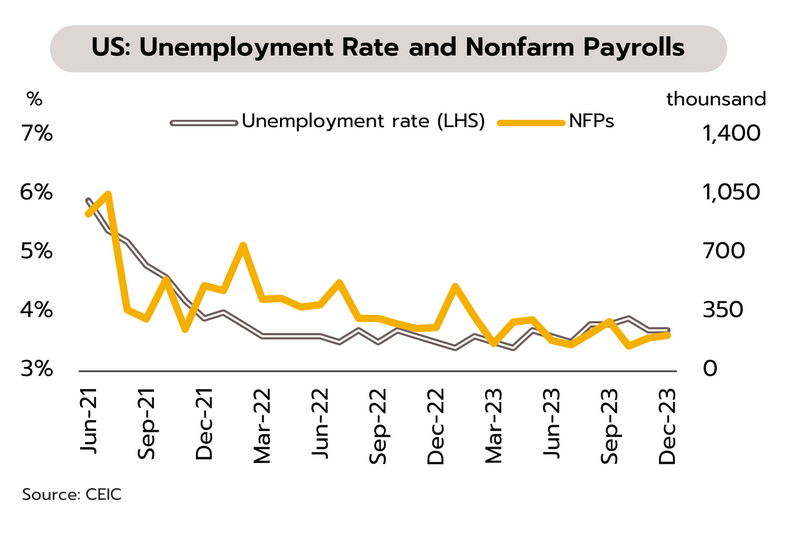

US Strong economic data and a soft-landing expectation have reduced the likelihood of rapid Fed’s rate cuts. November’s JOLTS print showed new job openings falling by 62,000 to 8.79m, their lowest since March 2021. While at 47.4, December’s Manufacturing PMI remained in contractionary territory for the 13th month, the Services PMI remained positive at 50.6. Non-farm payrolls expanded by 216,000, up from 173,000, unemployment remained unchanged at 3.7%, below the 3.8% expected by the markets, and average hourly wages rose 4.1% YoY, again beating expectations of a 3.9%.

The CME Group’s FedWatch tool now sees the markets assigning a 60% probability to a 0.25% rate cut in March, taking Fed Funds Rate to 5.00-5.25%, down from 72% a week earlier on stronger than anticipated prints for GDP growth, private consumption, and employment. Because this will slow declines in inflation and reduce pressure on the Fed to make quick cuts, we see officials waiting for clearer signs to emerge in the data before making a decision on when to begin reducing interest rates. This is likely to happen in the second half of 2024, once both a slowdown in the economy and a softening of inflationary pressures are more evident.

Eurozone

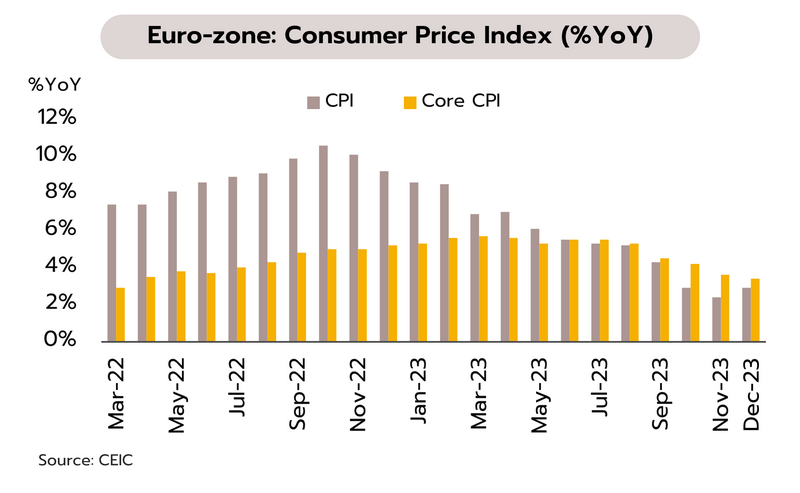

The likelihood of a Q4 Eurozone recession has risen on worsening data. M3 money supply contracted for the 5th month in November at -0.9% YoY alongside 15 months of softening growth in private credit (+0.5% YoY). In December, the Composite PMI came in at 47.6, its 7th month below the 50-point midline, with the Manufacturing and Services PMIs at respectively 44.4 and 48.8. Despite this, headline inflation rose 2.9% YoY, compared to 2.4% a month earlier, though core inflation cooled from 3.6% YoY to 3.4%.

Leading economic indicators have turned negative in the Eurozone: (i) business and consumer sentiment are both weak; (ii) the Manufacturing and Services PMIs remain in recessionary territory; (iii) declines in retail sales accelerated through Q3; (iv) exports remain soft on the sluggish performance of overseas markets; and (v) M3 money supply is tightening and growth in private credit is slowing. These thus point to the increasing possibility of the bloc having entered a recession in the last quarter of 2023. However, we expect the worsening economic outlook to douse inflationary pressures, thus opening the way for the European Central Bank (ECB) to relax currently tight monetary policy. The ECB may thus consider rate cuts from mid-2024 onwards as it tries to head off the risk of an extended slump.

China

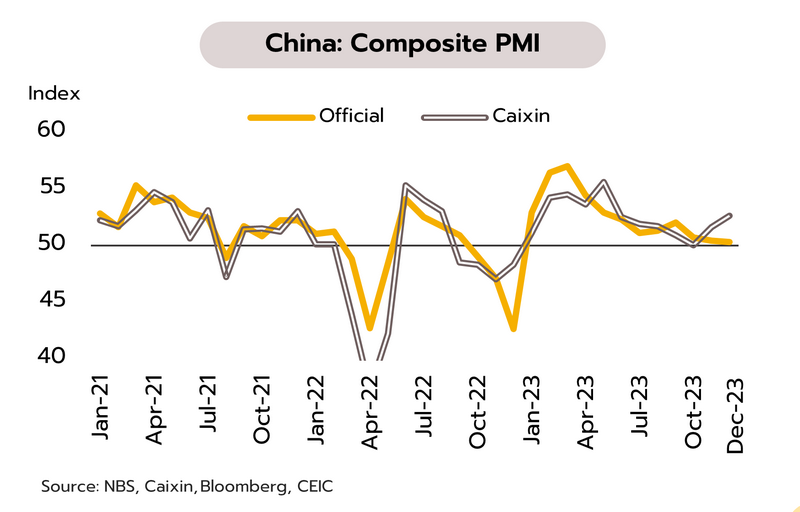

Domestic demand may be recovering, but exports remain sluggish, and the real estate crisis has brought down China’s largest shadow bank. China’s official Manufacturing PMI slipped from 49.4 in November to 49.0 in December, with the Services PMI unchanged at 49.3. However, the private-sector Caixin survey was more positive, with its Manufacturing PMI edging up from 50.7 to a 7-month high of 50.8, its 2nd month in expansionary territory (i.e., over 50), and the Services PMI rising from 51.5 to 52.9, its highest since July.

Combined, the official and private-sector PMIs indicate that the Chinese economy is recovering, partly thanks to an acceleration in government spending on infrastructure, which has then shown up in an improvement in the construction and new orders indices. However, the economy faces challenges from: (i) sluggish overseas demand, evident in weakness in the PMI’s export orders component; (ii) worries over deflation (average wages contracted -1.3% YoY in Q4, the first decline since records began in 2016); and (iii) the spread to the financial sector of the real estate crisis. This has now precipitated the bankruptcy of Zhongzhi Enterprise Group, China’s largest shadow bank, which after facing a liquidity crisis resulting from its exposure to the real estate sector, has folded with debts of CNY420-460 bn against assets of CNY200 bn.

Growth is continuing to be driven by the rebound in the tourism sector, while inflation may remain negative through the start of the year

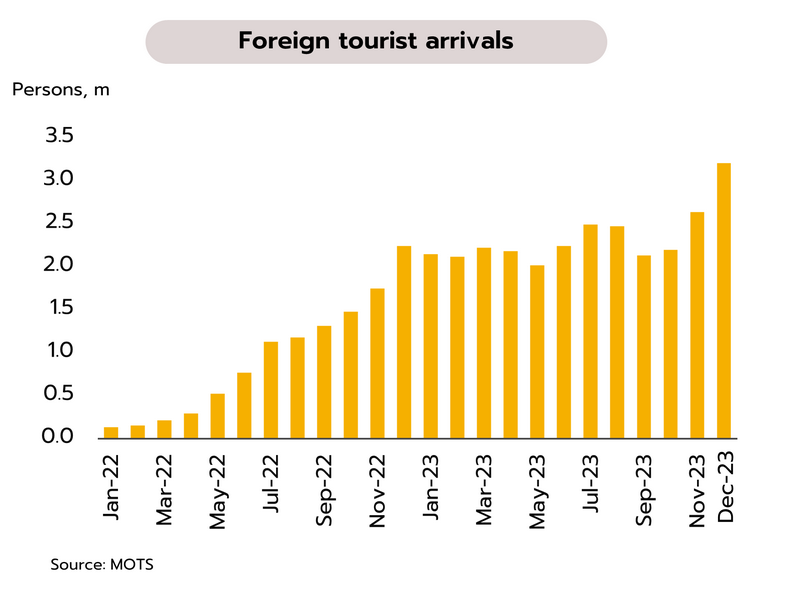

December arrivals topped 3m, and the outlook for the tourism sector remains positive, helped further by the recent Thai-China agreement on visa-free travel. The Ministry of Tourism and Sports reports that in December, 3.2m foreign arrivals were recorded, the highest monthly total since the reopening of the country. This then brough total 2023 arrivals to over 28m, up sharply from 2022’s 11.2m. For the year, the 5 most important originating nations were Malaysia, China, South Korea, India, and Russia.

Arrivals from most of the major markets have returned to, or are close to, their pre-Covid level. Thus, Malaysian and Russian arrivals are at respectively 108% and 100% of their pre-pandemic totals, while South Korean and Indian arrivals are now above 80% of theirs. However, slow recovery in the Chinese market means that this segment is just 32% of its pre-Covid size. Although total 2023 arrivals hit the official target of 70% of their pre-pandemic level, receipts from foreign tourism came to just THB 1.2tn (or 63% of the total prior to the pandemic), significantly below the target of THB 1.6tn. Nevertheless, positive momentum should continue through the start of 2024, and the recent agreement between the Thai and Chinese governments to allow visa-free travel for citizens of the two countries will help to further remove obstacles limiting Thai-Chinese tourism. This agreement is expected to come into force on 1 March, 2024, and with temporary measures to suspend the requirement for visas for Chinese arrivals expiring at the end of February, the introduction of these changes to visa regulations will help to improve recovery in the Chinese market. We therefore see 2024 foreign arrivals totaling 35.6m, up from 2023’s 28m.

Headline inflation contracted at the sharpest rate in 34 months in December, and inflation should return to the target range in mid-2024. At -0.83% YoY (compared to -0.44% YoY in November), headline inflation remained negative for the 3rd month in December. This was a consequence of government measures to address problems with the cost of living that then translated into falling energy prices (i.e., for transport fuels and electricity), as well as softening prices for fresh vegetables, meat, and cooking appliances. December’s core inflation, which excludes more volatile prices for raw food and energy, was also unchanged at 0.58%, and for 2023, headline and core inflation thus averaged 1.23% and 1.27%, down from 2022’s averages of respectively 6.08% and 2.51%.

In light of the extension until the end of March of measures to keep diesel prices below THB 30/liter and subsidies for electricity bills for January to April for those consuming fewer than 300 units/month, we expect inflation to remain negative at the start of 2024. However, this should return to the target range in the middle of the year thanks to: (i) an uptick in economic activity and strengthening domestic demand; and (ii) increasing cost pressures resulting from the rise in the minimum wage and possible volatility in commodity prices, which could be driven by a potential worsening of drought conditions and geopolitical risks. With inflation likely to climb back into the target range, officials wishing to support a return of the economic growth to its long-term trends, and the need to maintain the policy space required to deal with future risk and uncertainty, the Monetary Policy Committee is expected to maintain the policy rate at 2.50% through 2024.