Global: Striving with COVID-19 aftershocks

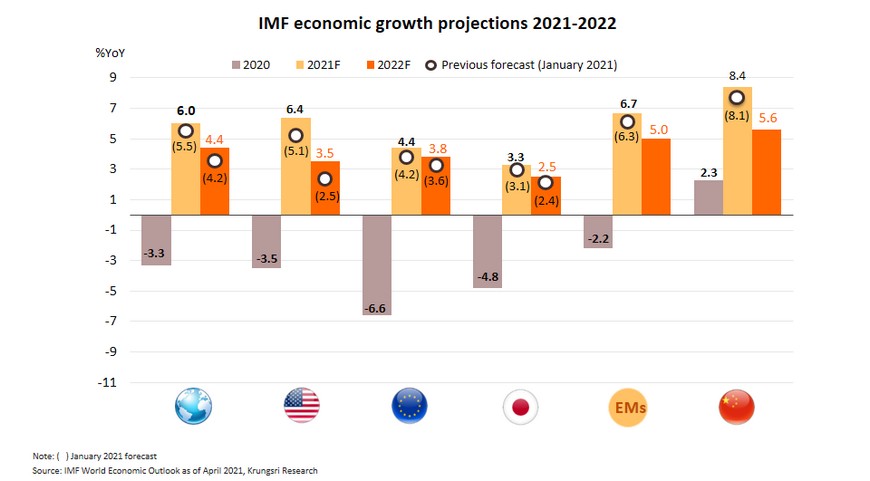

IMF raises 2021 and 2022 global growth forecasts to reflect additional fiscal support and vaccine-powered recovery in 2H21

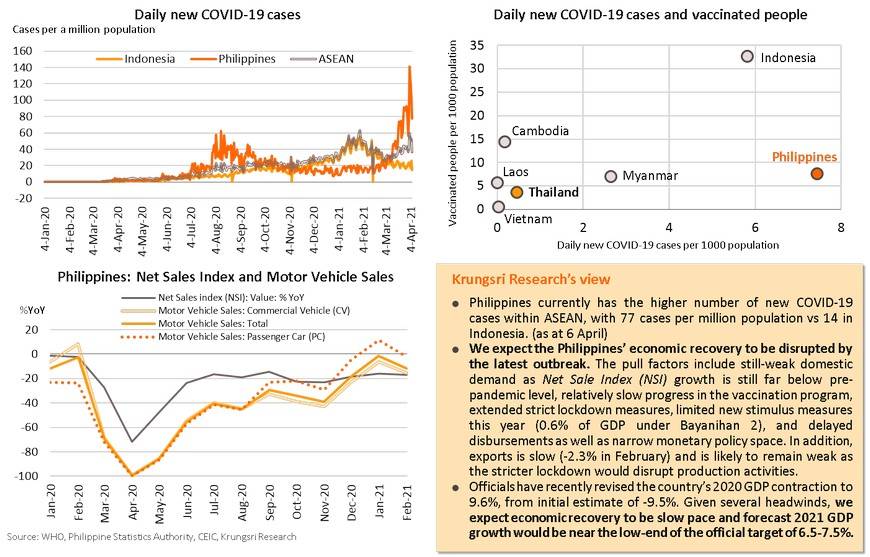

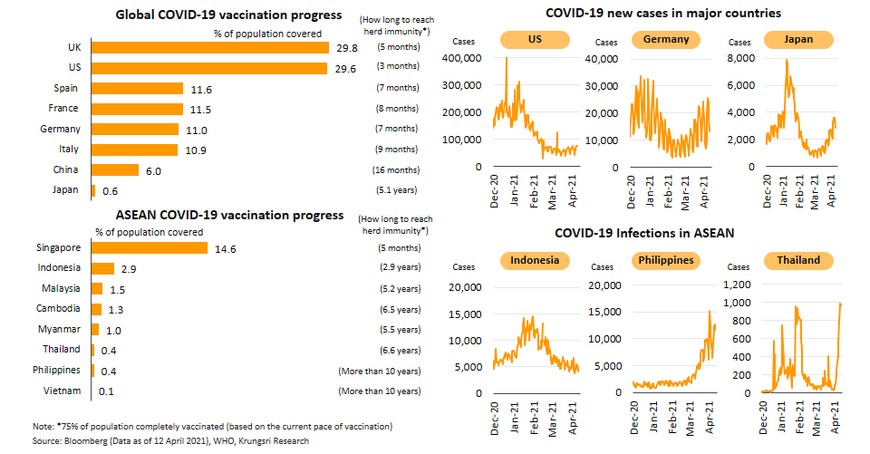

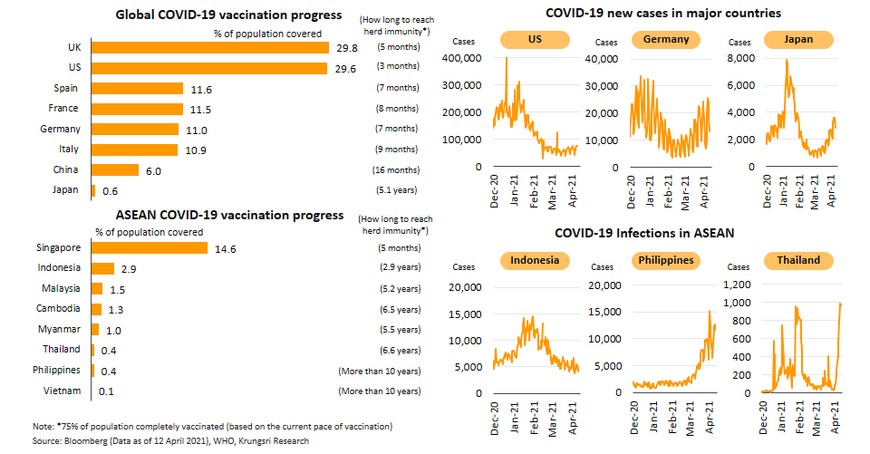

Some countries are accelerating inoculation, but many are still seeing large numbers of new COVID-19 cases

Progress in mass vaccination programs worldwide will determine when activities can return to normal. Currently, the US is ahead among major major countries, and could achieve herd immunity by the middle of this year. However, the rising number of new COVID-19 cases in many countries could delay overall economic recovery. Meanwhile, vaccination progress is slow in countries with relatively low number of infections such as Japan, China, Vietnam and Thailand.

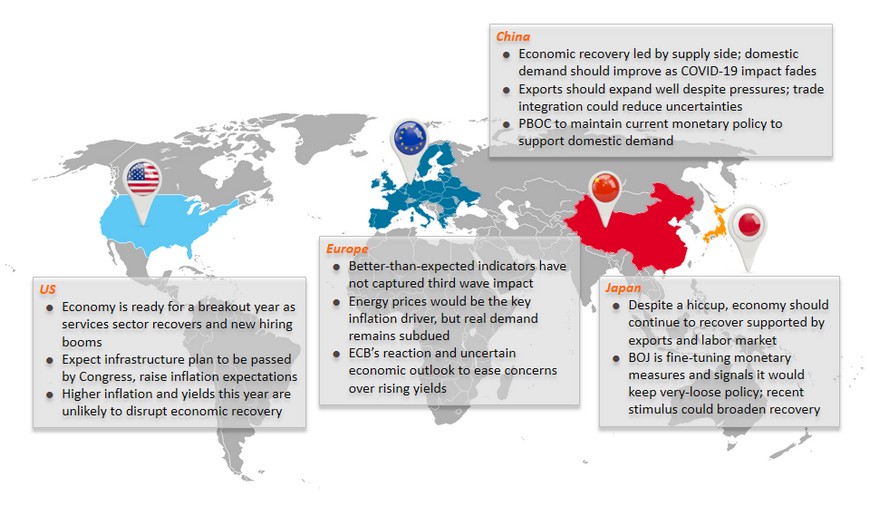

US: Economy is ready for a breakout year as services sector recovers and new hiring booms

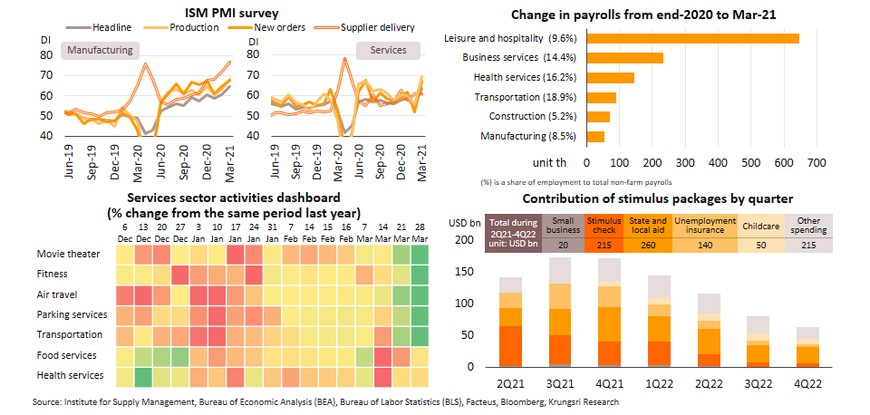

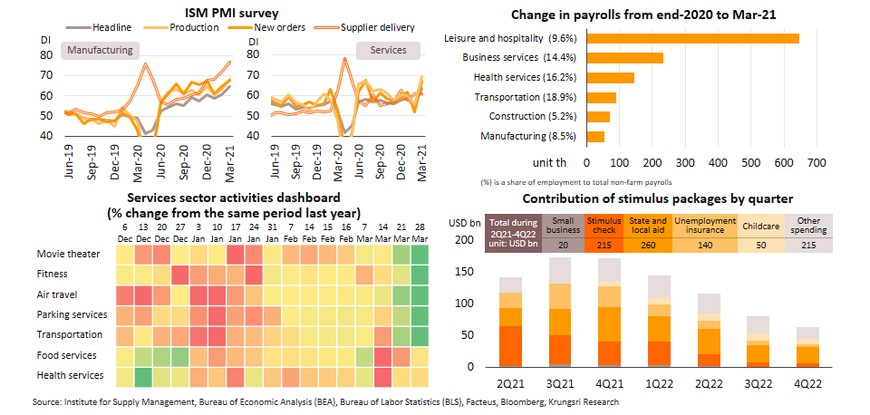

Services sector continued to recover after the country lifted restrictions. Services PMI reached a new high of 63.7 in March driven by new orders and accelerating activities. Manufacturing PMI rose to 64.7 mainly due to longer supplier delivery period and recovering global demand. Latest non-farm payrolls indicate an increase in hiring, with leisure & hospitality and healthcare sectors booking the largest increases of 647k, 234k and 144k jobs since December last year, respectively. High-frequency data suggest services activities have resumed since March along with recovering confidence and notable progress in the mass vaccination program. Consumption would surge in 2Q21 supported by new stimulus and large stimulus checks contribution this year. This could lead to higher inflation in the second-half of 2021 but it will remain manageable. The steady growth of the manufacturing sector, resumption of services activities, and the potentially stronger domestic spending could push the economy to experience impressive expansion this year.

Expect infrastructure plan to be passed by Congress, raise inflation expectations

President Biden has proposed the “American Jobs Plan”, a USD2.25trn infrastructure expenditure plan that aims to create jobs and lift the US to a stronger position over China in the next 8-10 years. Moreover, there would be an additional USD1trn package for long-term social security and healthcare. Biden also mulled raising corporate income tax rate from 21% to 28% to fund this plan. Due to the large size of the plan, it could raise inflation expectations to more than 2.5% in 2021. However, the impact on actual inflation would be limited as the spending would be distributed over a decade and money velocity would remain low; that means inflation would only tick up and there would be less impact on the real economy. On higher taxes, Republicans are likely to oppose this due to concerns over a larger fiscal deficit and federal public debt had surpassed the size of the economy. This leave two main cards for the Biden administration: (i) increase corporate income tax to only 25% instead of 28%, or (ii) use the budget reconciliation to pass the plan without Republican support. The latter option seems more feasible. In our view, the total packages could be passed in the next fiscal year and the government would allow for larger fiscal deficit before it is offset by tax revenues.

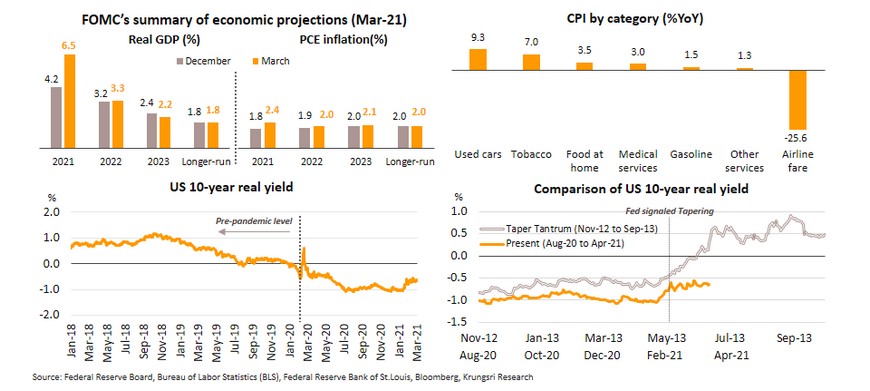

Higher inflation and yields this year are unlikely to disrupt economic recovery

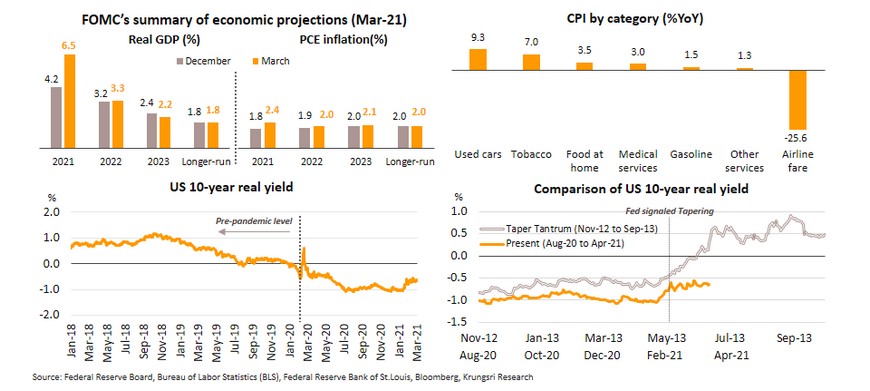

The FOMC upgraded economic and inflation outlook at the latest meeting as more Americans are vaccinated and activities recover faster-than-expected. US Real GDP growth could reach +6.5% this year and +3.3% in 2022. Inflation could rise to 2.4% in 2021 from 1.8% previous forecast, due to base-effects and the spike in energy prices. Inflation would rise again after services activities resume. Airfares will recover in 2H21 as Americans are allowed to travel across states, while services prices had risen 1.6% YoY in March vs +1.3% in February. Bond yields would remain on upward trend due to more optimism on economic outlook. The US 10-year treasury yield could exceed 2% in 2Q21 but is unlikely to disrupt economic recovery as the Fed would allow that to curb market speculation and ease the overheating mortgage sector. The US 10-year “real yield” remains negative compared to pre-pandemic level and remains below the Taper Tantrum level. This implies the steepening yield would be unlikely to have significant impact on borrowing cost for businesses. Furthermore, rising inflation expectations could pressure real yield to remain negative. Therefore, rising yields and inflation should not disrupt economic growth and stability, suggesting the Fed would be patient and not over-react but continue to monitor developments.

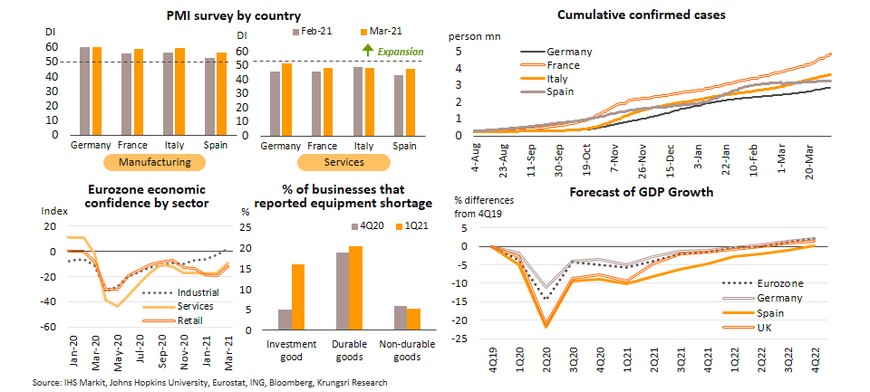

Europe: Better-than-expected indicators have not captured third wave impact

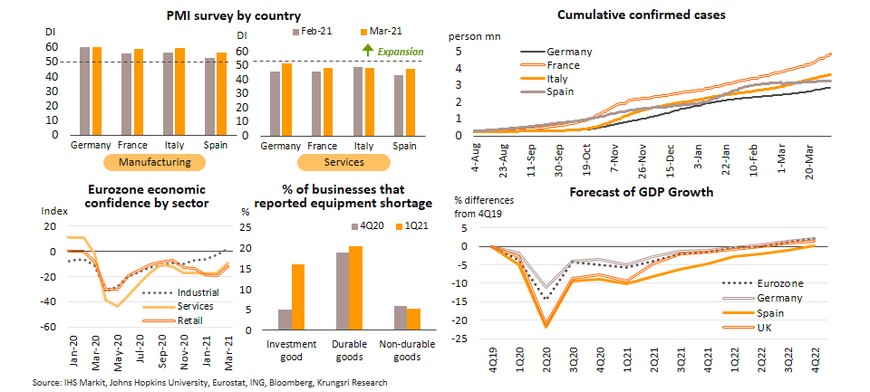

Eurozone activities have improved since mid-February, but the third wave of COVID-19 cases which started in April has returned as a major threat. Manufacturing PMI expanded in March led by Germany (66.6) as manufacturers reported a longer delivery period. Services sector improved slightly but still contracted. These improvements are probably did not capture the impact of the latest outbreak. France and Italy have been registering the highest number of new cases. Economic confidence show a similar development as industrial confidence rebounded to positive territory for the first time since February 2019, to 2.0 in March. However, confidence in the services and retail sectors are still far from pre-crisis levels. Apart from rising COVID-19 cases, supply problem due to ships cargo stuck in the Suez Canal is likely to leave a longer impact as businesses reported more equipment shortage in 1Q21, especially in investment and durable goods. Accounting for the latest outbreak and supply disruption, Germany’s GDP could return to pre-pandemic level (4Q19 level) by 2Q22, the fastest in eurozone. GDP data for the other countries could reach pre-crisis levels from 3Q22 onwards, due to larger output losses. This indicates the EU should not delay the implementation of the EUR750bn Recovery Fund in 2H21 to avoid a bumpy recovery this year.

Energy prices would be the key inflation driver, but real demand remains subdued

Eurozone headline inflation rose from 0.9% YoY in February to 1.3% in March, led by Germany which inflation showed the largest expansion in two years at 2%. Eurozone inflation could stay high throughout this year due to Germany’s large weighting in the inflation calculation. We expect inflation to rise beyond 2% in 2Q21, exceeding the ECB’s target. Higher inflation would be triggered by supply side rather than demand. Energy price index surged to 4.3% in March following the spike in crude oil price to USD64 in March from USD32 in the same period last year. In the second-half, inflation would drop to around 2% due to softer oil prices and limited recovery in the services sector. Moreover, rising inflation in 2021 would be temporary as it would be driven by one-off factors that will fade next year, such as the VAT hike in Germany. Looking forward, headline inflation would drop in 2022 due to the smaller marginal impact of VAT hike, weak demand, absence of additional stimulus, slow progress in vaccination programs, and relatively low wage growth. Germany’s wage growth was -0.5% last December. Although wages could improve in 2021, the historical-low level indicates it would take time to recover and to push spending back to normal.

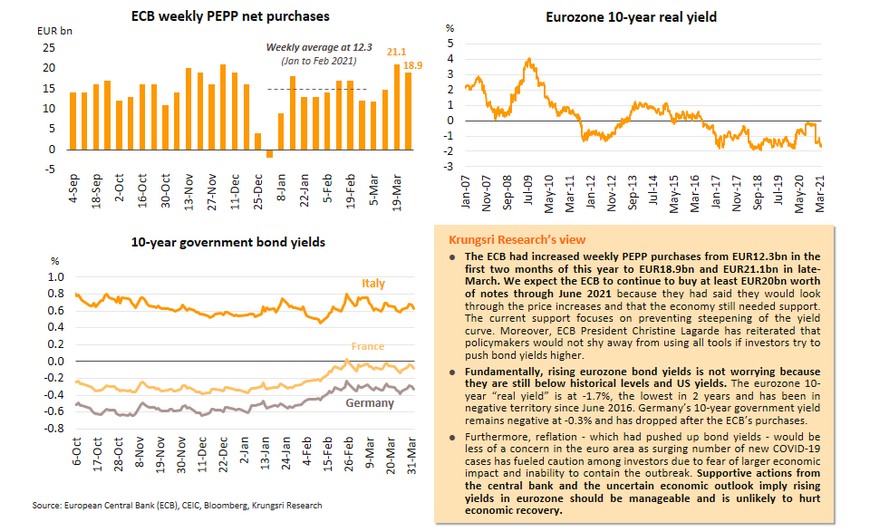

ECB’s reaction and uncertain economic outlook to ease concerns over rising yields

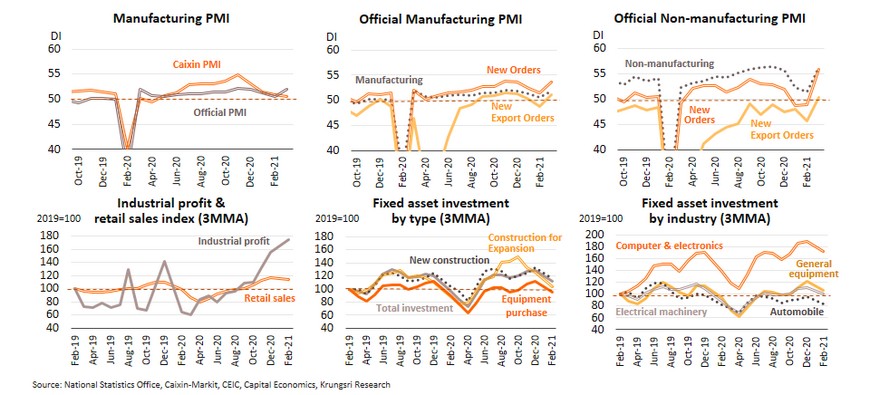

China: Economic recovery led by supply side; domestic demand should improve as COVID-19 impact fades

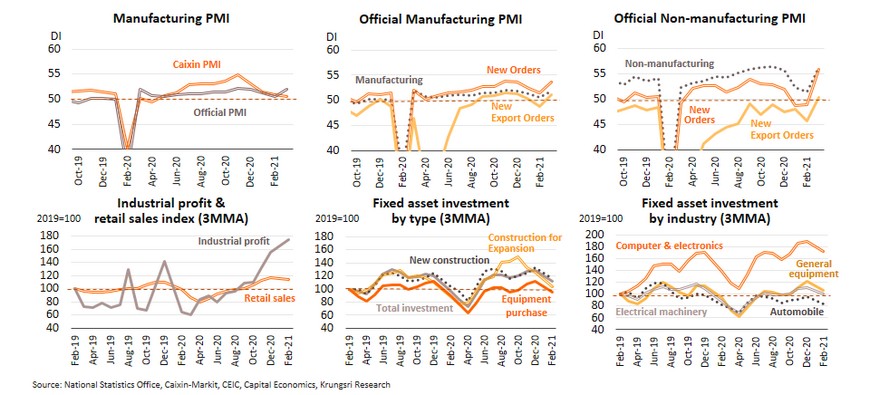

Recovery is being led by supply-side factors, as reflected in the Official and Caixin Composite PMI data for March which remained in expansion territory. In addition, the pick-up in new orders and new export orders sub-indices for both Manufacturing and Non-manufacturing PMI suggest the recovery momentum is driven by both domestic and external demand. The improving export orders implies exports would continue to support recovery. The uptick in supply-side factors was also reflected by rising industrial profits. The improvements in March PMI data signal over February data suggests ongoing recovery. The slowdown in consumption and investment in February reflects the impact of the second wave and temporary shutdown of activities during the Lunar New Year. However, there was continual recovery in investment in the computer & electronics sector, which could be driven by work-from-home policy. Overall, China’s economy should continue to recover, especially demand-side factors, as the pandemic impact fades.

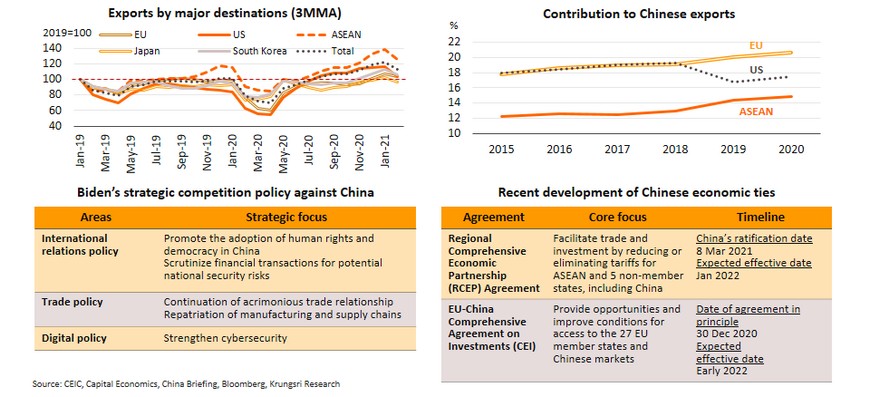

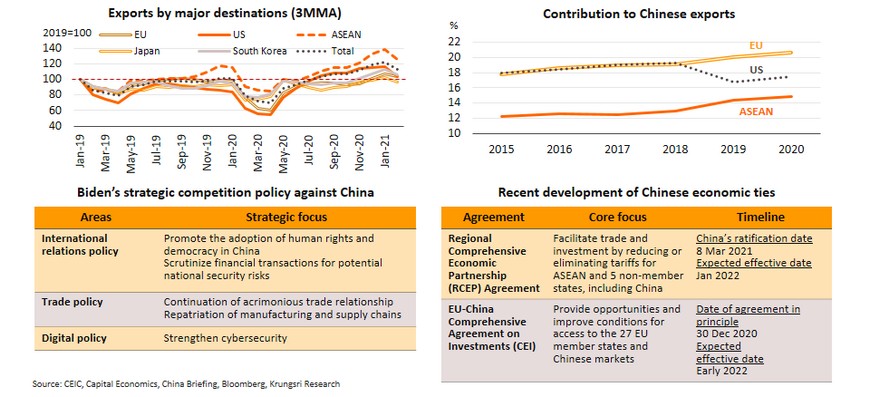

Exports should expand well despite pressures; trade integration could reduce uncertainties

Despite several uncertainties, including the new wave of COVID-19 cases in many countries and the global shortage of container-shipping capacity, Chinese exports in February remained above pre-pandemic levels. The PMI New Export Orders sub-index for March suggests exports would improve in the next period. Meanwhile, the Sino-US tension under President Biden could worsen as the conflict has extended to cover human rights issues and blacklisting supercomputing entities. Although the share of Chinese exports to the US shrank in 2019, China’s trade with the US remains sizeable with the US being China’s second largest export destination in 2020. Looking ahead, China’s trade relations with the EU and ASEAN would further support its exports given several economic deals such as the Regional Comprehensive Economic Partnership (RCEP) and EU-China Comprehensive Agreement on Investments (CEI). Both agreements are expected to enhance China's role in trade and investment in Asia and Europe. Hence, exports would remain crucial to support China’s ongoing economic recovery.

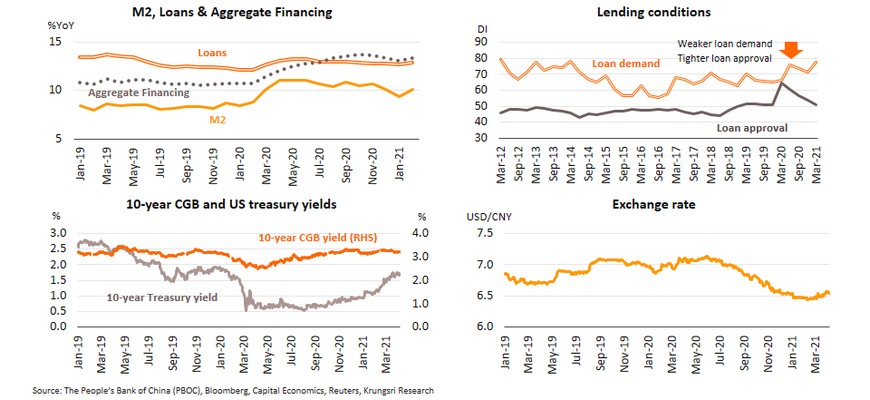

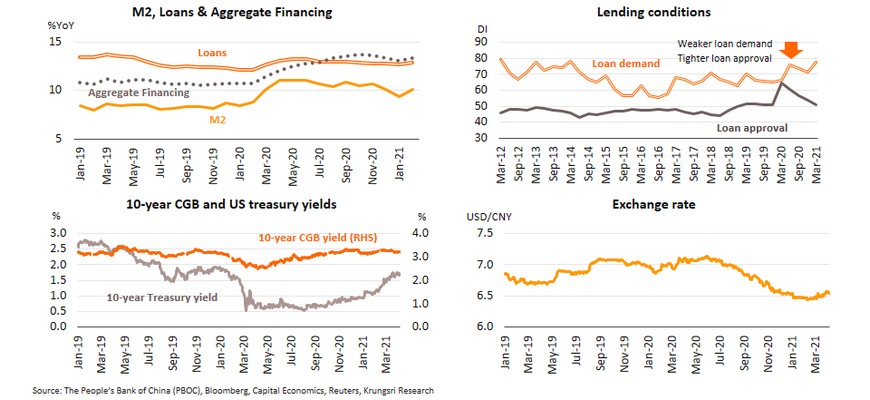

PBOC to maintain current monetary policy to support domestic demand

Krungsri Research maintains view that the People’s Bank of China (PBOC) would keep policy rate unchanged until there are signs that domestic demand is able to drive the broad economy without large stimulus measures. In February, money supply, aggregate financing as well as loans continued to expand, reflecting the continuity of accommodative monetary policy. Demand for loans also increased, while financial institutions are starting to be cautious with approving new loans almost similar to the pre-pandemic period. Recently, narrower spreads between Chinese and US bond yields had led to the depreciation of the Chinese yuan. The PBOC would likely allow the yuan to weaken to support Chinese exports. In addition, the PBOC governor revealed his intension to maintain easing monetary policy with preemptive measures to mitigate financial exposure, explaining “monetary policy should balance between supporting growth and preventing risks”. This statement is in line with our view. The continuity of monetary easing with targeted measures would help to reduce the pandemic impact and continue to support recovery.

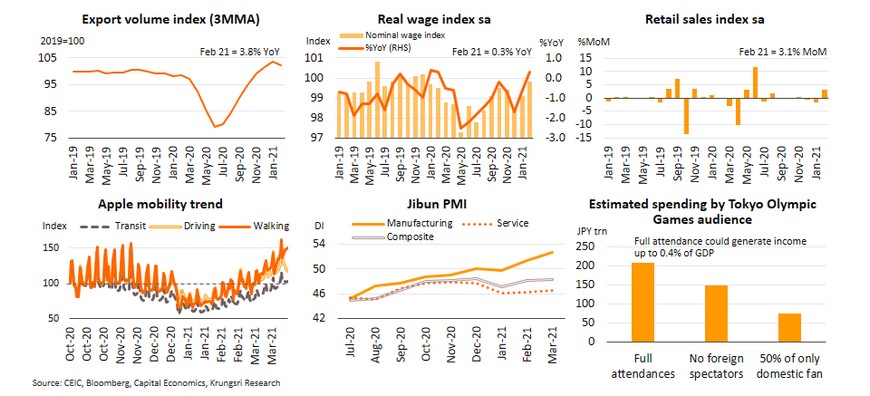

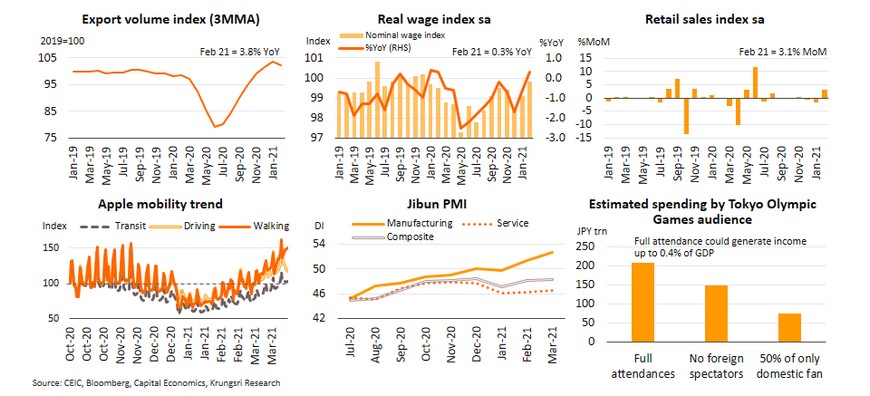

Japan: Despite a hiccup, economy should continue to recover supported by exports and labour market

The economy should continue to recover, driven by a further expansion in exports. The gradual rebound in exports would support employment. Real wage rose for the first time in a year in February. The higher purchasing power helped boost retail sales to register positive growth. Economic activity should improve, as reflected in an increase in the Apple mobility index after the state of emergency was lifted in March. The resumption of activities was also reflected in better PMI in March. Manufacturing PMI data was at its highest since December 2018, while Services PMI data has climbed to a 3-month high. However, there could be a hiccup due to the latest quasi-emergency measures imposed in some areas of Tokyo, Osaka and 4 other prefectures, though the impact should be limited. The mass vaccination program is progressing slower than expected as only 1.3 million doses have been administered. The decision to ban foreign spectators from the Tokyo Olympic games is estimated to result in limited loss, at 0.1% of GDP. In all, despite several headwinds, the overall economy should continue to recover gradually but Japan would still need stimulus measures.

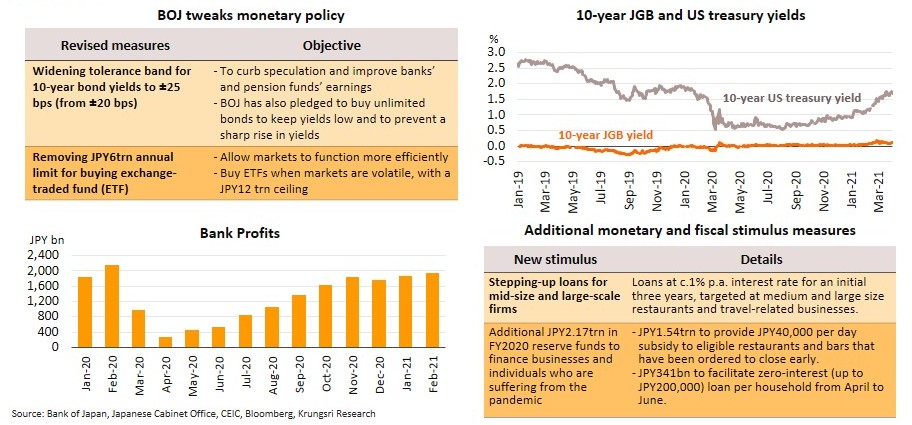

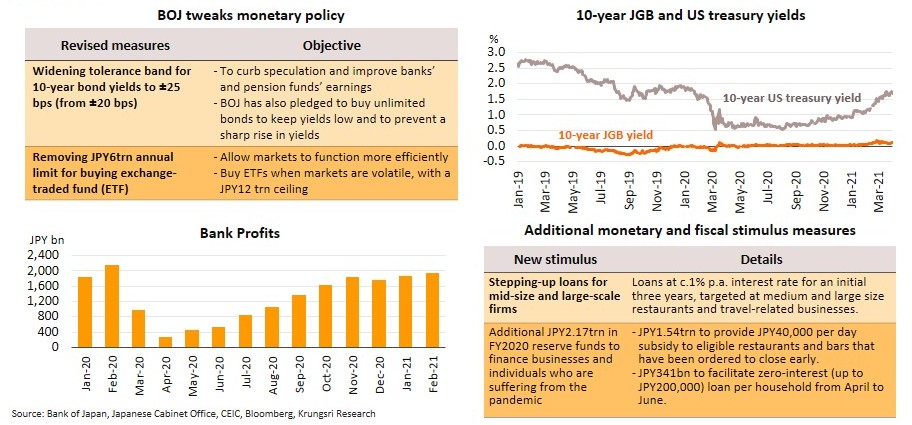

BOJ is fine-tuning monetary measures and signals it would keep very-loose policy; recent stimulus could broaden recovery

At the last monetary policy meeting on 18-19 March, the Bank of Japan (BOJ) kept policy interest rates unchanged and continued to employ QE and yield curve control measures. It also widened the tolerance band for 10-year bond yield and scrapped its annual target of JPY 6trn ETF purchases. This move is only a policy tweak to allow financial markets to function more freely, and the BOJ is expected to maintain very accommodative policy stance by (i) widening tolerance band for bond yield by only ±5 bps, and (ii) Governor Kuroda assuring “the BOJ would not stop buying the ETFs”. The rising yields could also improve the banks’ profitability. Nonetheless, higher bond yields should not adversely affect the real sector since policy makers have announced additional supportive measures, including soft loans for mid- and large-size firms and subsidies for restaurants and bars. These measures could ease the impact on those hit hardest by the latest wave of infections. Looking ahead, the targeted stimulus packages coupled with very-loose monetary policy could support recovery in laggard sectors, especially service-related businesses, and lift domestic demand going forward.

Thailand: Déjà vu, but in a different setting

Third wave of COVID-19 could be more severe

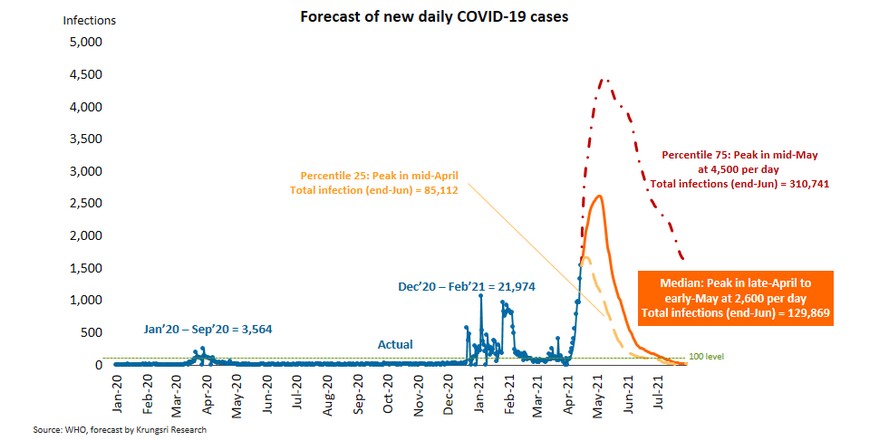

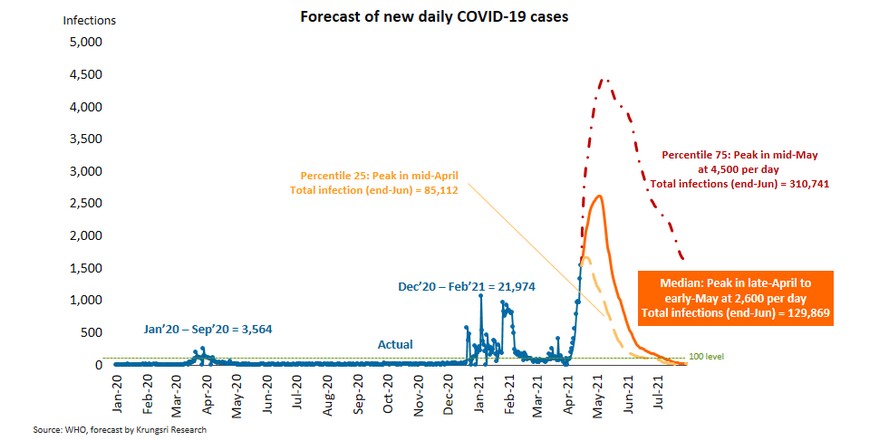

The latest COVID-19 outbreak which started in early April is spreading much faster than the previous outbreaks in March-April last year and early this year, in term of pace and number of clusters. Our model suggests this wave could peak in late-April to early-May and the cumulative number of cases in Thailand could surge above 100,000. At worst, the toll could reach over 300,000 and the pandemic could stretch into 3Q21. And given slow progress in vaccination, the Thai economy might not recover so soon.

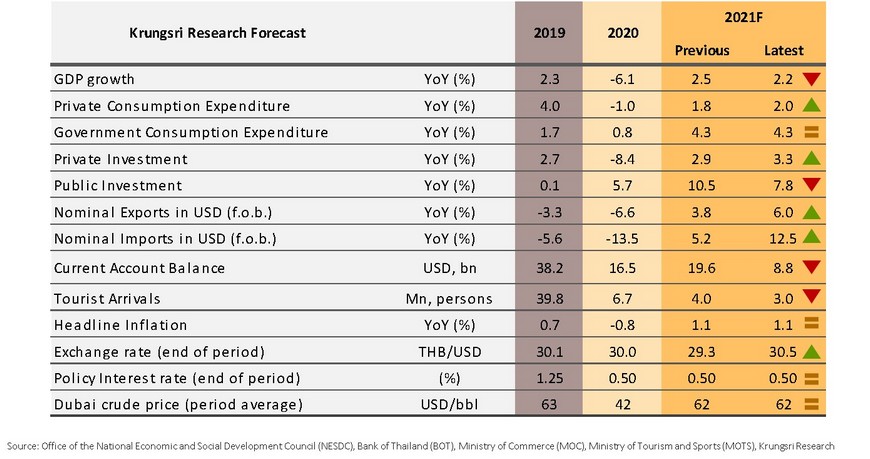

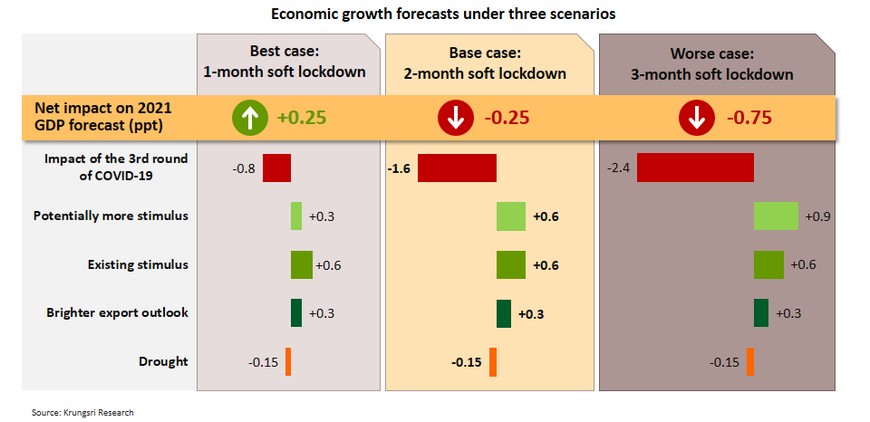

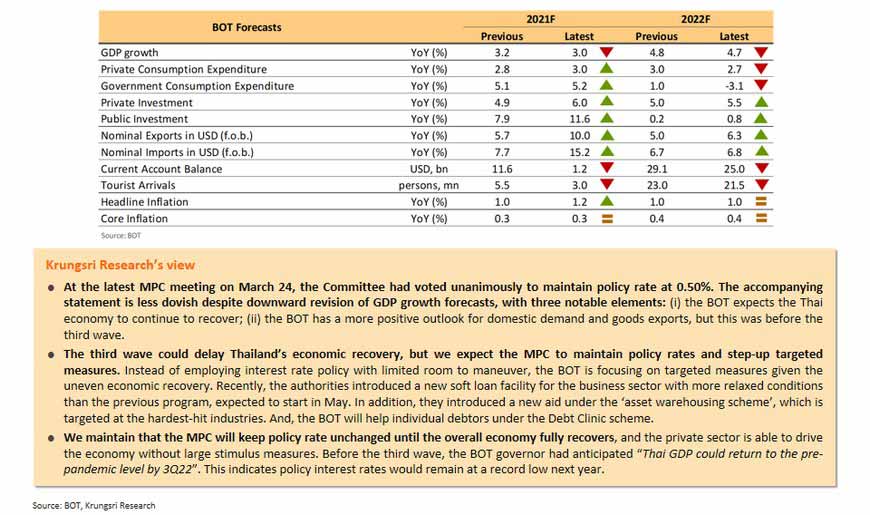

We trimmed 2021 GDP growth forecast by 0.25ppt to 2.2% to reflect COVID-19 and drought impacts; upbeat exports and stimulus to limit downside

The third wave will delay Thailand’s economic recovery. Our base case scenario assumes new daily COVID-19 cases will peak in late-April to early-May and drop within two-months of a soft lockdown, and that would reduce Thai GDP growth by 1.6 ppt this year. Moreover, the drought is estimated to shave 0.15 ppt off growth. Nonetheless, the better-than-expected export performance would lift GDP growth by 0.3 ppt. In addition, the larger-than-anticipated stimulus measures and expectations of more stimulus programs to cushion the COVID-19 impacts could lift GDP growth by a total of 1.2 ppt. As a result, the net impact on GDP growth would be minus 0.25 ppt, which would take 2021 full-year growth forecast to 2.2% vs 2.5% in the previous projection.

Despite rising risk to growth, MPC is likely to maintain record-low policy rates and step-up targeted measures

Instead of employing an interest rate policy with limited room to maneuver, the BOT is employing targeted measures because of the uneven economic recovery. Before the third wave hit Thailand, the BOT governor had expected “Thai GDP could return to pre-pandemic level by 3Q22”. This indicates policy interest rate would remain at record low through next year.

Thailand Economic Outlook 2021

COVID-19 pandemic: Third wave could be more severe

The latest COVID-19 outbreak which started in early April is spreading much faster than the previous outbreaks in March-April last year and early this year, in term of pace and number of clusters. Our model suggests this wave could peak in late-April to early-May with the number of new daily infections of 2,600. The cumulative number of cases in Thailand could surge above 100,000. The number of new daily infections is expected to fall below 100 in early July. At worst, the toll could reach over 300,000 and the pandemic could stretch into 3Q21. And given slow progress in vaccination, the Thai economy might not recover so soon.

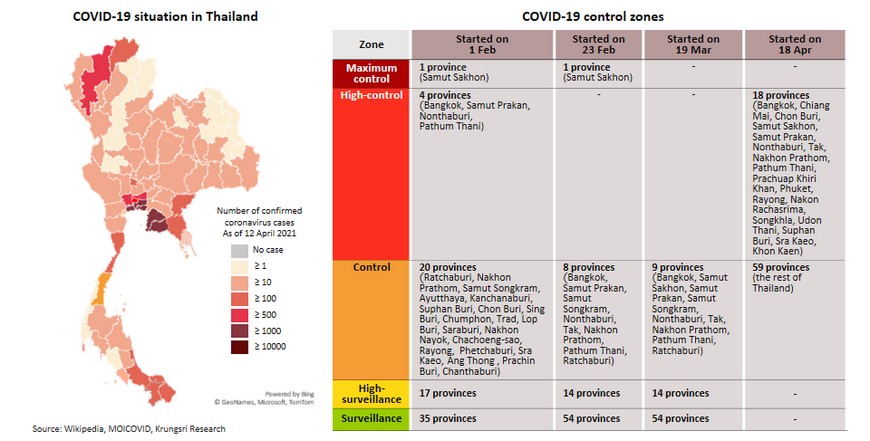

Rising COVID-19 cases have led to stricter restrictions, which would delay economic recovery

The latest outbreak that started in early-April has spread to many provinces. Before the long Songkran holidays, the government maintained nine provinces including Bangkok under “Control Zone“ (orange zone) to avoid a lockdown of economic activity. However, after ending the holidays, the government has classified 18 provinces as “High-Control Zone” (red zone) by introducing stricter restrictions, including social distancing rules, to control the latest outbreak which saw a surge in the number of inflections in wider areas. This could disrupt economic activity and delay recovery in the Thai economy.

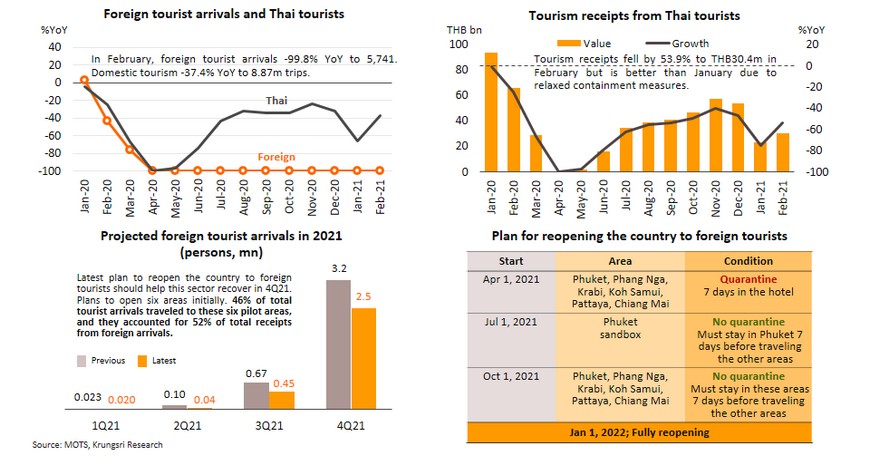

Slashed 2021 foreign tourist arrivals to 3 million despite expecting an improvement in 4Q

The latest outbreak in Thailand, rising cases in major countries, and slow progress in the domestic vaccination program, prompted us to revise down foreign tourist arrivals for 2021 to 3 million (from 4 million). To boost domestic tourism, the government has announced measures to boost the sector, including (i) phase III of ‘We Travel Together’ program (THB5.5bn), and (ii) ‘Tour Tiew Thai’ program (THB5bn) effective May to August. However, the latest wave of COVID-19 could derail these programs.

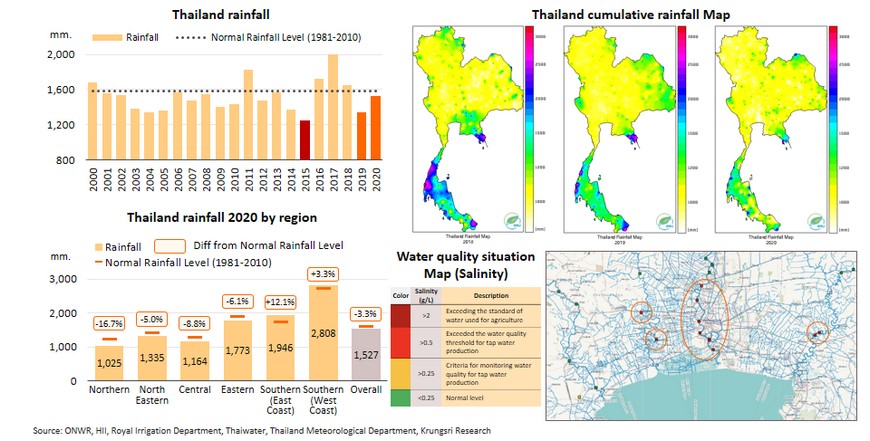

Drought: Indicators increasingly point to another drought in Thailand in 2021

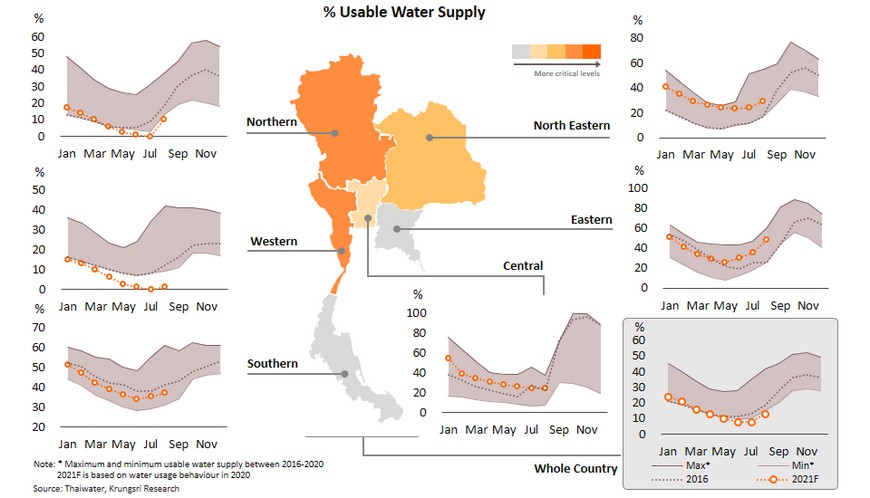

This is premised on the following: (i) less rainfall than normal for two consecutive years (2019-2020); (ii) a large amount of rainfall in the country fell outside water catchment areas (reservoirs and dams) in 2020; (iii) water-holding capacity has been reduced due to the extended dry period; and (iv) more severe salt water intrusion. At the end of 2020, a total of 43,155 mn cubic meters of water was stored in reservoirs across the country. This represented 61% of storage capacity, close to the situation in 2019 with 44,281 mn cubic meters of water or 62% of capacity. But the most important data is the volume of usable water in reservoirs. At end-2020, usable water supply was critically-low at only 19,613 mn cubic meters or 28% of capacity.

Northern and Western regions to face severe drought

The impact will vary depending on region, but the most seriously affected areas are likely the northern and western regions because the supply of usable water may be exhausted by July. This would be followed by northeastern Thailand.

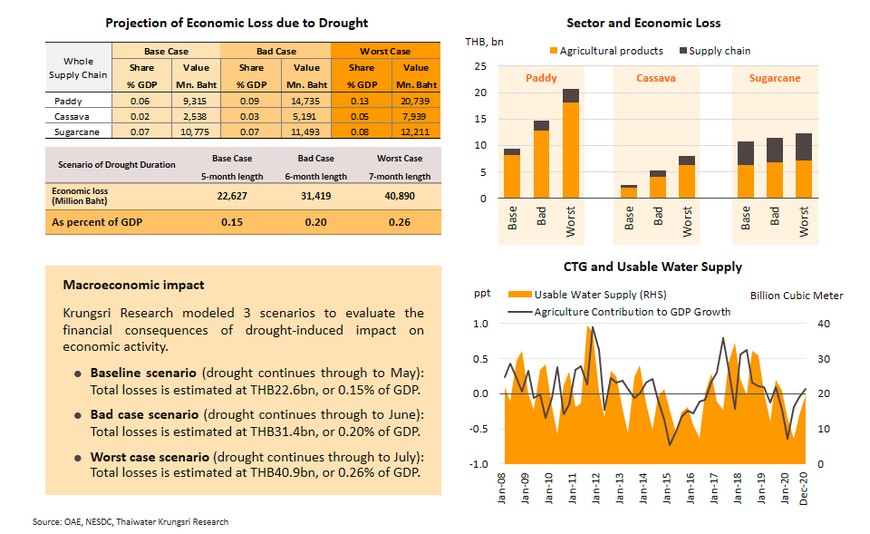

Drought is estimated to shave 0.15 ppt off GDP growth

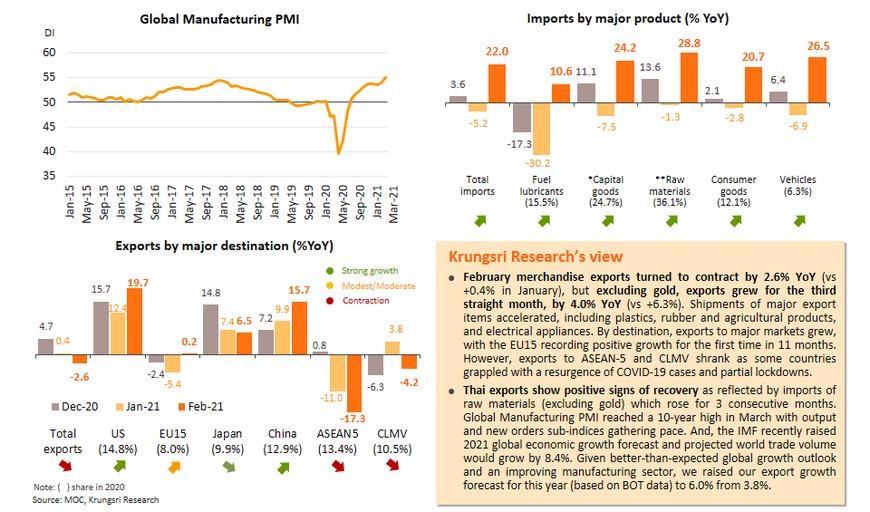

However, export growth forecast is revised up to reflect better outlook for global growth and manufacturing

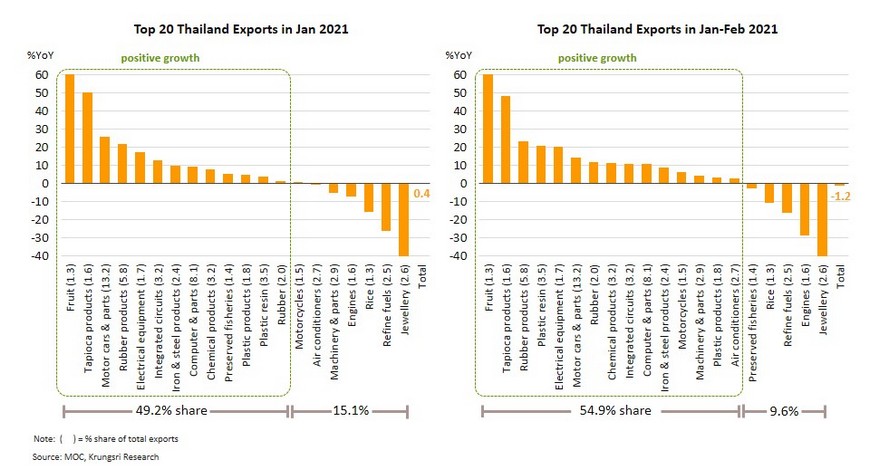

By sector, exports show more broad-based recovery

In the first 2 months of this year (January-February), 15 of the top 20 export items showed positive growth. The combined share of these items accounted for 55% of total exports, larger than 49% in January. This suggests a more broad-based recovery of exports.

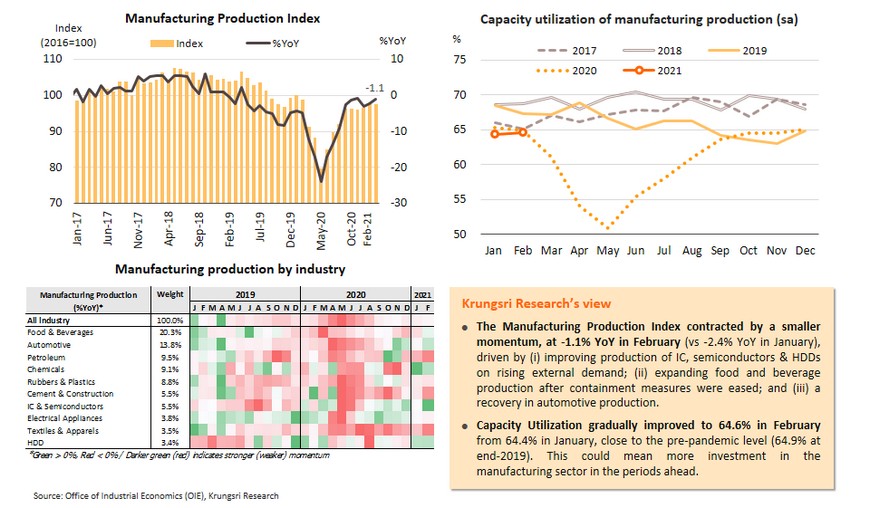

Rising external demand is supporting manufacturing production though domestic demand remains weak

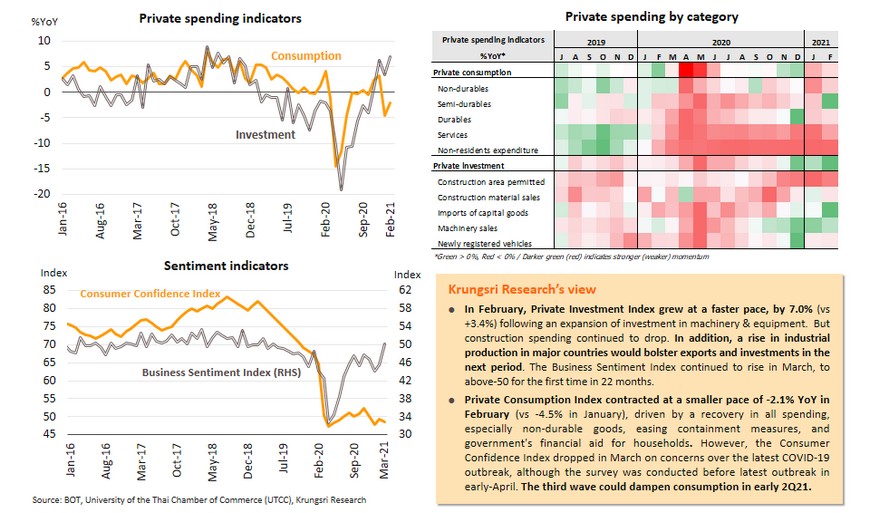

Investment to rise along with exports, but consumption could remain weak given latest outbreak

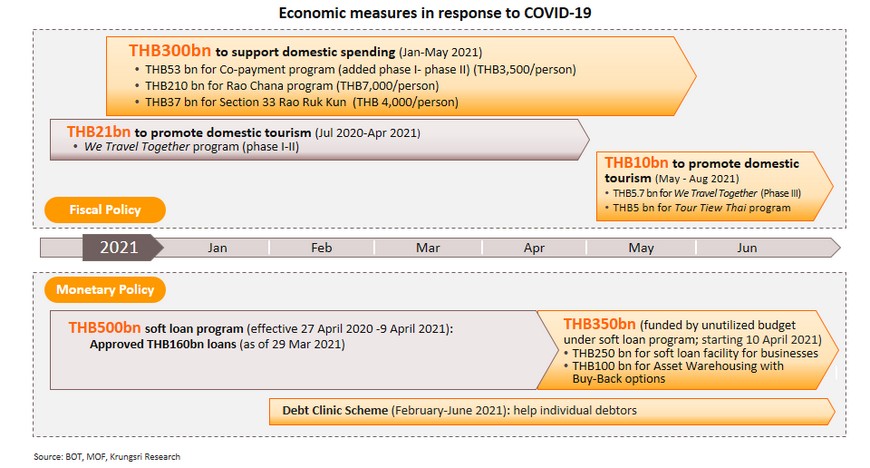

Stimulus measures larger than we expected, mostly cash aid to boost private spending

The government’s existing stimulus measures worth THB300bn is larger than our expectation of THB200bn. They comprise mostly cash aid to Thai citizens to boost domestic spending in the first half of this year. And, we expect the government to introduce more stimulus measures worth THB100bn to help cushion the impact of the third wave.

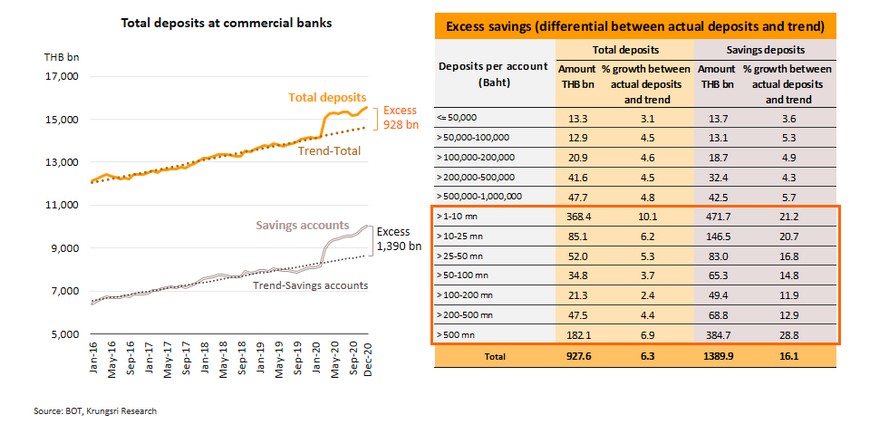

Large excess savings mostly parked in savings accounts, reflecting readiness to spend when pandemic ends

Since the pandemic started, excess savings (defined as the differential between actual savings and its trend) has surged to THB928bn, accounting for almost 6% of GDP. By type of account (including demand deposits, savings deposits, and time deposits), savings accounts registered THB1,390bn excess savings, led by accounts with THB1-10mn each which accounted for 34% of total excess savings in savings account. This not only indicates precautionary savings but also reflects readiness to spend by the middle- and upper-income groups. When the pandemic ends or there are stimulus measures for these groups, their large excess savings would drive domestic spending in the future.

Our GDP forecast trimmed by 0.25ppt amid COVID-19 and drought; upbeat exports and stimulus limit the downside

The third wave will delay Thailand’s economic recovery. Our base-case scenario assumes new daily COVID-19 cases will peak in late-April to early-May and drop within two-months of a soft lockdown, and that would reduce Thai GDP growth by 1.6 ppt this year. Moreover, the drought is estimated to shave 0.15 ppt off growth. Nonetheless, the better-than-expected export performance would lift GDP growth by 0.3 ppt. In addition, existing stimulus measures worth about THB300bn are larger than our previous expectation of THB200bn, which could add 0.6 ppt to GDP growth, and potentially more stimulus programs to help cushion the impact of the third wave, could lift GDP growth by another 0.6 ppt. As a result, the net impact on GDP growth would be minus 0.25 ppt, taking 2021 full-year growth forecast to 2.2% vs 2.5% in the previous projection.

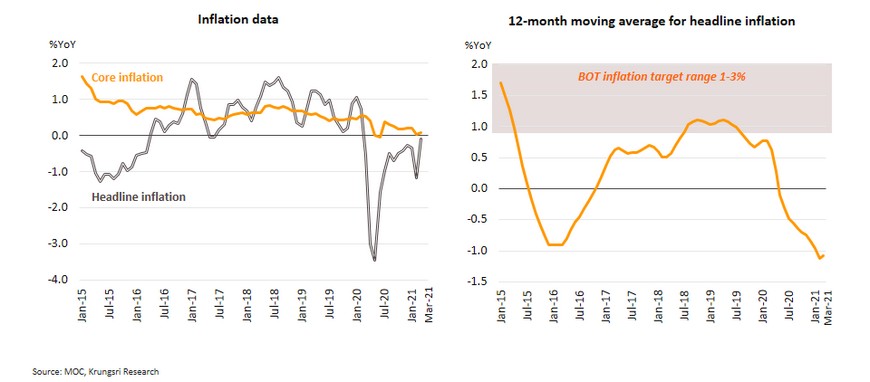

Inflation at near-positive territory due to higher fuel prices; full-year inflation is estimated at 1.1%

March headline inflation is the smallest negative rate in 13 months, at -0.08% YoY vs -1.17% in February. This was driven by higher energy prices, which turned positive for the first time in 14 months, in line with global crude oil prices. However, fresh food prices continued to drop. Also, electricity and water bills fell on due to government relief measures. Core inflation (excluding volatile raw food and energy components) rose by 0.09% in March vs 0.04% in February, led by the gradual recovery in domestic demand. In 1Q21, average headline and core inflation came in at -0.53% and 0.12%, respectively. Looking ahead, we project inflation would rise to positive territory from 2Q21, partly due to the low base effect since 2020 and the expiry of relief measures to reduce living costs (electricity and tab water bills). We revised up 2021 average inflation to 1.1% from 0.8%, after revising assumption for full-year Dubai crude price to USD62/bbl from USD48 in the previous forecast.

Despite rising cases, MPC is likely to hold rates and step up targeted measures to support recovery

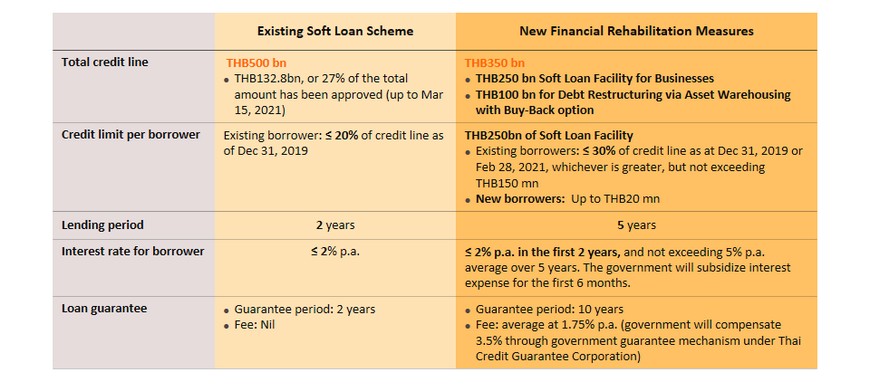

Authorities relax rules for soft loan program to help more businesses hit by pandemic impact

Last year, the BOT introduced a soft loan program worth up to THB500bn to help SMEs that are hurt by the pandemic impact. However, only THB132.8bn has been utilized up to 15 March because of strict conditions for eligibility. Recently, the cabinet approved new Financial Rehabilitation Measures worth THB350bn (funded by unutilized budget under soft loan program) to help pandemic-stricken businesses. They comprise two programs: (i) THB250bn Soft Loan Facility for Businesses, and (ii) THB100 bn Debt Restructuring program via Asset Warehousing with Buy-Back option. The latter program is scheduled to start in May and is expected to help tourism-related businesses.

Regional Economic and Policy Developments in April

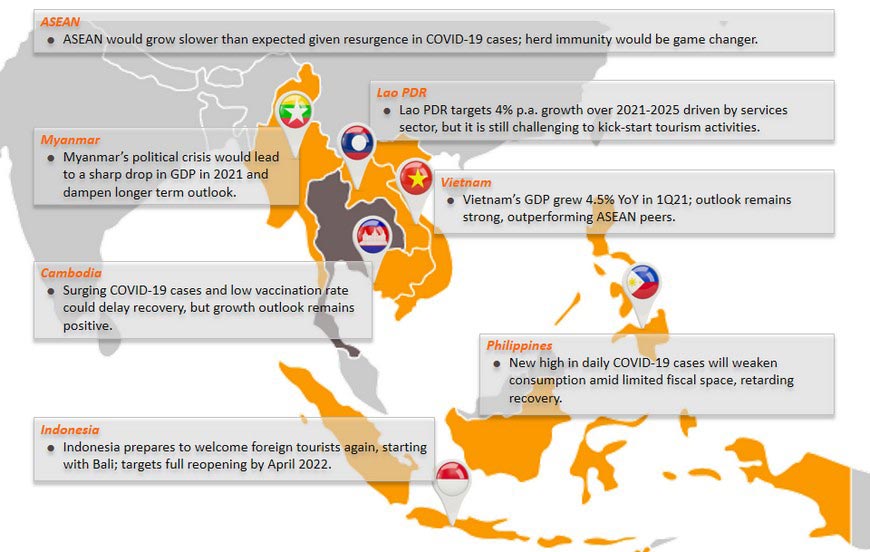

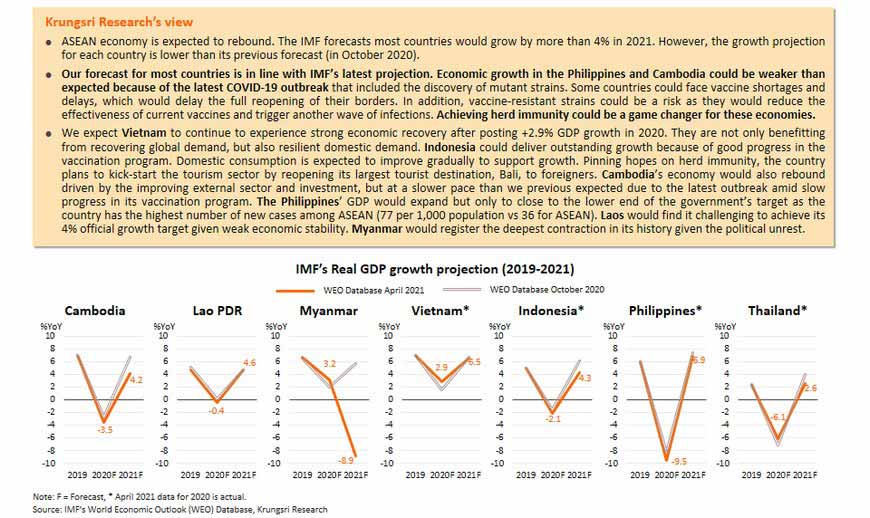

ASEAN would grow slower than expected given resurgence in COVID-19 cases; herd immunity could be game changer

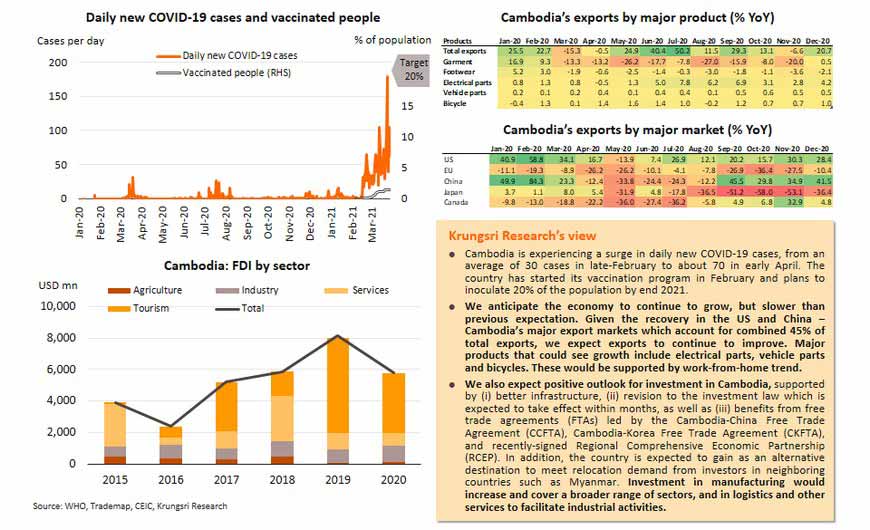

Cambodia: Surging virus cases and slow vaccination could delay recovery, but growth outlook remains positive

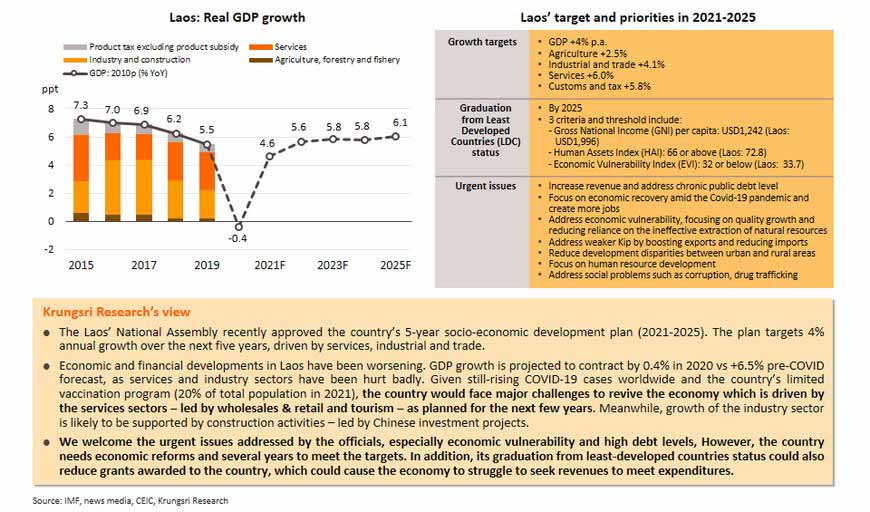

Lao PDR targets 4% p.a. growth over 2021-2025 driven by services sector, but tourism sector remains weak

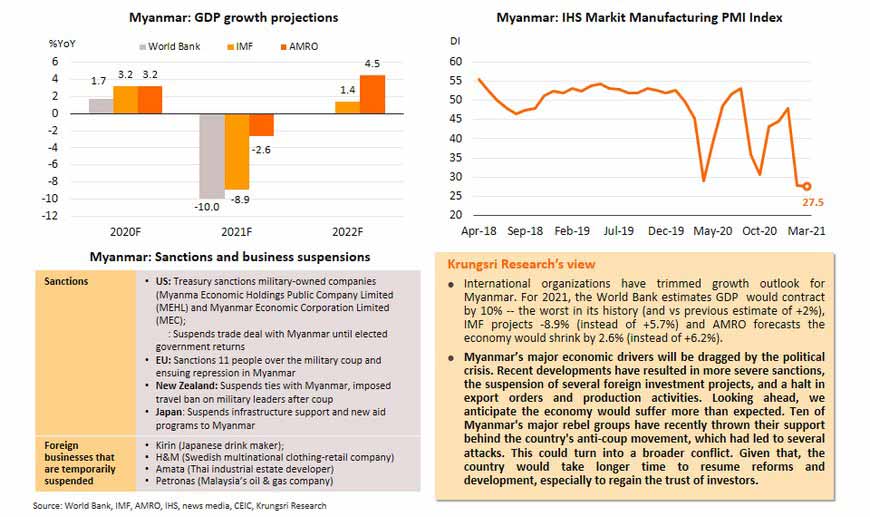

Myanmar’s political crisis would lead to a sharp drop in GDP in 2021 and dampen longer term outlook

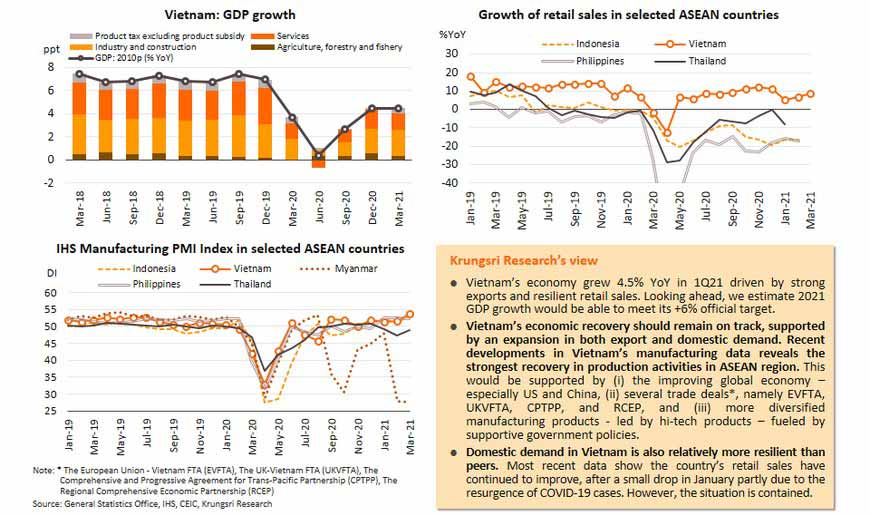

Vietnam’s GDP grew 4.5% YoY in 1Q21; outlook remains strong, outperforming ASEAN peers

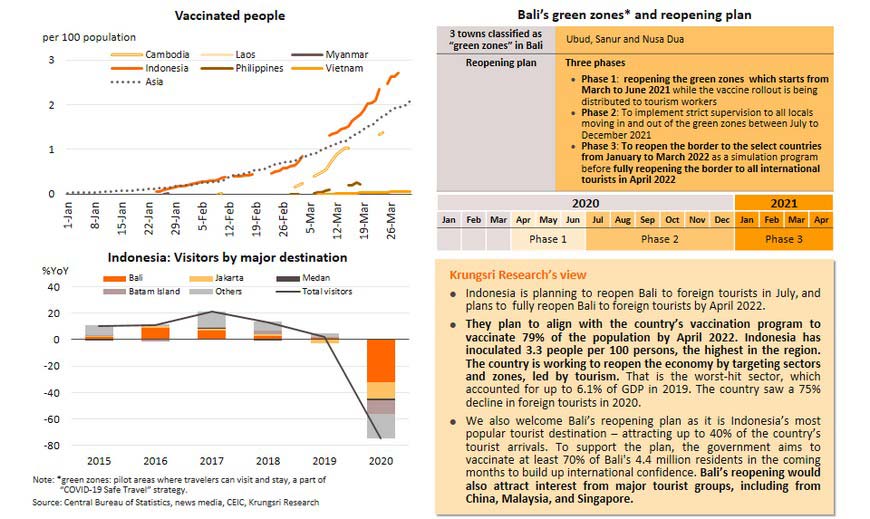

Indonesia prepares to welcome foreign tourists starting with Bali; targets full reopening by April 2022

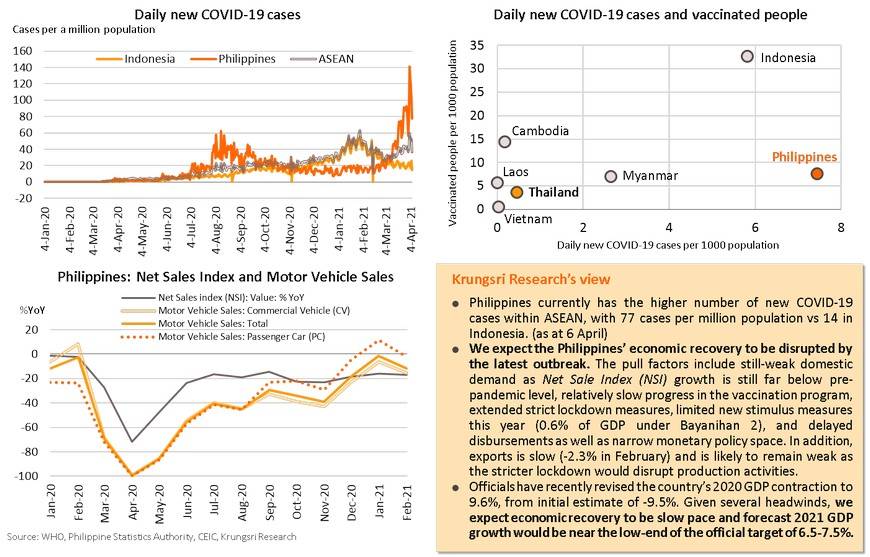

Philippines: New high in daily COVID-19 cases will dampen consumption amid limited fiscal space, disrupting recovery