Global: It’s not how low you go but how long it lasts

Supply chains are recovering but demand shock will continue, implying weak global trade lies ahead

US: Economic data show improvement but consumer demand is still far below pre-pandemic level

US Composite PMI inched up in May after several states reopened for business. Specifically, Non-manufacturing Index jumped to 45.4 from 41.8 in April and Manufacturing PMI rose from 41.5 to 43.1, indicating a gradual recovery on the supply side. Consumer Confidence Index inched up to 86.6 in May, suggesting a mild improvement in consumer sentiment. But retail sales tumbled by a record 16.4% in April, mainly due to slower sales of clothing and electrical appliances. Consumer spending contracted by 13.6% MoM in April, indicating demand remained weak. Non-farm payrolls rose by 2.5 mn in May compared with median projection of 7.5 mn job losses. However, unemployment rate improved to 13.3% in May from 14.7% in April, reflecting better labor market conditions after businesses distributed funds under the Paycheck Protection Program to keep their workers. Nevertheless, these indicators are still far from pre-pandemic levels and the economy requires more stimulus to boost spending.

May expand monetary and fiscal policies to address the economic fallout

FOMC might hold rates until 2022, consider Yield-Curve Control policy

The FOMC kept Fed Funds Rate at 0.00-0.25% at the June meeting. CPI fell 0.1% in May, dropping for the third consecutive month, implying weak consumption which accounts for two-thirds of US GDP. Though markets have priced-in expectations of the Fed introducing negative interest rates this year, the FOMC’s dot plot suggests they would keep interest rates low but above zero through to 2022. The Fed might consider alternative action at the late-July meeting, such as setting target yields for treasury securities or Yield-Curve Control (YCC). The Bank of Japan (BOJ) and the Reserve Bank of Australia (RBA) have adopted this tool to fight deflation. The YCC action could ensure low borrowing costs over the longer-term by allowing the Fed to buy the required securities to peg interest rates. The steepening bond yield curve is a major concern for the Fed. That could increase the probability of implementing YCC later this year as a strategic tool to support forward guidance for low benchmark rates in medium-term.

Europe: Economic Sentiment Index suggests slow recovery, while jobs data is distorted by policy support

EU Economic Sentiment Index improved slightly to 66.7 in May from 63.8 in April and Consumer Confidence Index rose to -19.5 from -22.0, following reopening optimism in major economies and slower rise in infections. However, these indicators remain weak at close to Global Financial Crisis levels. Markit PMI data suggest manufacturing and services sectors are crawling off their record lows but still posted a sharp contraction. In the labor market, unemployment rate across Eurozone rose only slightly to 7.3% in April, reflecting positive effects of short-term working schemes subsidized by governments in several countries. HICP inflation continued to decelerate to 0.1% due to lower energy prices and weaker demand. This could pressure the European Central Bank to implement a policy to boost inflation to return to its target of 2.0%.

ECB scales up bond-buying program to battle economic recession and to support the long road to recovery

Releasing massive relief package but delivery would be delayed

The ECB’s net asset purchases remain high although the pace slowed in May as countries eased restrictions and activities resumed. The largest purchases under the PEPP during the outbreak were German bonds, followed by bonds from Italy, France and Spain. This implies strong efforts to support both core and peripheral economies. In addition to monetary easing, the European Commission (EC) announced a €1.85 trn financial firepower with €750bn for Covid recovery (€250bn in loans and €500bn in grants) and €1.1 trn for the long-term budget. The EC’s largest allocation is for Italy (€172bn), followed by Spain €140bn, France €38bn, and Germany €28bn. However, they have yet to finalize the terms and conditions, funding form, and delivery dates, which could be opposed by the Frugal Four. Negotiations could take months. The EC expects the new multi-annual financial framework to be implemented in Jan 2021. This policy could affect the pace of recovery in the region.

China: Economic activities have bottomed-out faster than other major countries, but recovery is uneven

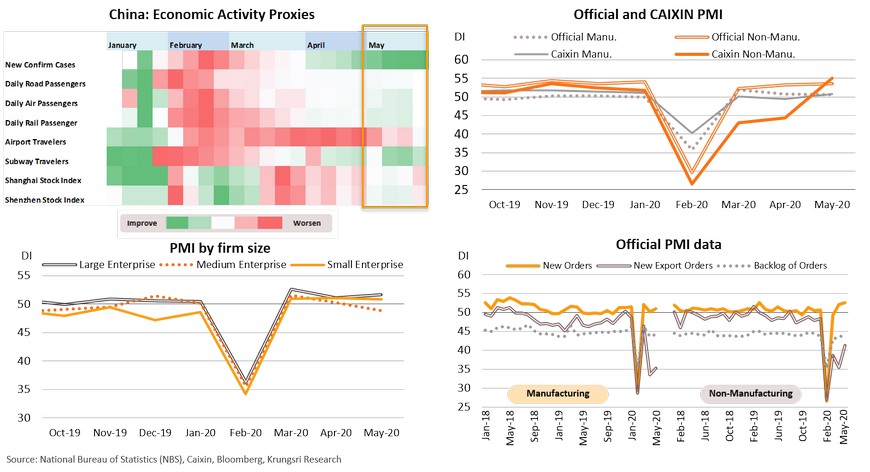

China’s economy continues to recover as workers resume work, reflected by a recovery in daily road and rail passenger traffic. Air travel remains muted. May Caixin PMI data for manufacturing and non-manufacturing sectors rose to 50.7 and 55.0, respectively. This implies output has started to expand. Official PMI for non-manufacturing inched up to 53.6 while that for manufacturing eased to 50.6. However, the recovery is not broad-based because PMI data dropped for medium and small enterprises which are vulnerable to subdued demand. The sub-indices for new export orders and orders backlog continued to contract sharply amid the global economic slowdown. Looking forward, although China is recovering ahead of other countries, there is risk from declining new export orders.

Pace of economic recovery capped by weak domestic and external demand

Although the supply-side continued to improve, both domestic and external demand remain lethargic. In April, retail sales contracted by 7.5% YoY, especially for clothing (-20.7%) and home appliances (-8.5%). Fixed asset investment also fell in April led by both private investment (-13.3%) and public investment (-6.9%). Imports also tumbled 16.7%. The contraction in retail sales, fixed asset investment and imports, reflect subdued domestic demand. High unemployment (6% in April) would further undermine purchasing power. Looking at external demand, Chinese exports fell 3.3% in May as Covid-19 continued to devastate global demand at most of its major export destinations, except Japan which saw demand for electronic products. Looking forward, China domestic demand is likely still far below pre-pandemic level, while exports may be weaker due to a contraction in global trade and worsening US-China relations.

For the first time, the NPC refused to set a growth target; other targets suggest more stimulus is needed

Japan: Several indicators tumble; recovery could be slow

Japan’s industrial production index plunged 15.7% YoY in April, the worst drop since the global financial crisis in 2009. Manufacturing activities were halted under state emergency measures and the global lockdown disrupted supply chains. Retail sales also tumbled 13.7%, the most severe decline since 1998, as deteriorating income weighed on spending. Monthly cash earnings fell 0.6% due to an unprecedented decline in overtime income, while unemployment rate inched up to 2.6%, implying weaker domestic demand. Looking at external demand, exports tumbled 21.9% in April, the sharpest drop since 2009. And, May Manufacturing PMI slid to 38.4, specifically, the new export orders sub-index fell to 30.0, reflecting the impact of subdued global trade. Services PMI remained low at 26.5. More importantly, PMI indices and sub-indices are still far below 50.0, implying activities continue to contract. Capital Economics projects Japan’s economy would worsen and contract by 14.1% YoY, compared to -2.2% YoY growth in 1Q20. Looking ahead, production should improve gradually, especially after the government said it would remove the state of emergency, but external demand would remain subdued because of the global economic contraction.

Ramping up fiscal and monetary stimulus to reduce downside risks, but weak demand will dampen growth

In May, Japan introduced additional fiscal packages to help SMEs retain workers. These measures will complement the earlier JPY117trn packages, and take total government support to JPY234trn, or 40% of GDP. However, actual fiscal spending is at 10.4% of GDP and Bloomberg expects it would contribute only 0.7 ppt to 2020 GDP growth. Also this stimulus package would lift bond issuance to JPY212trn in FY2020, and take budget deficit to over 13% of GDP and raise public debt to 270% of GDP, the highest among any major economies. Meanwhile, the Bank of Japan (BOJ) has ramped up massive stimulus measures to boost lending to small firms. The new lending facility will offer incentives to the banks, 0.1% interest on the amount they lend out. Since many firms are facing tight cash flows, there was a surge in demand for liquidity. Banking system loan growth improved from +1.9% in January to +4.8% in May, the highest since 2004. This program could reduce downside risk. Nonetheless, Japan will continue to implement several lockdown measures, consumer spending is weak, business investment will slump (machinery orders have dropped), and external demand remains weak. All these will increase pressure on the Japanese government and the BOJ to introduce additional stimulus package.

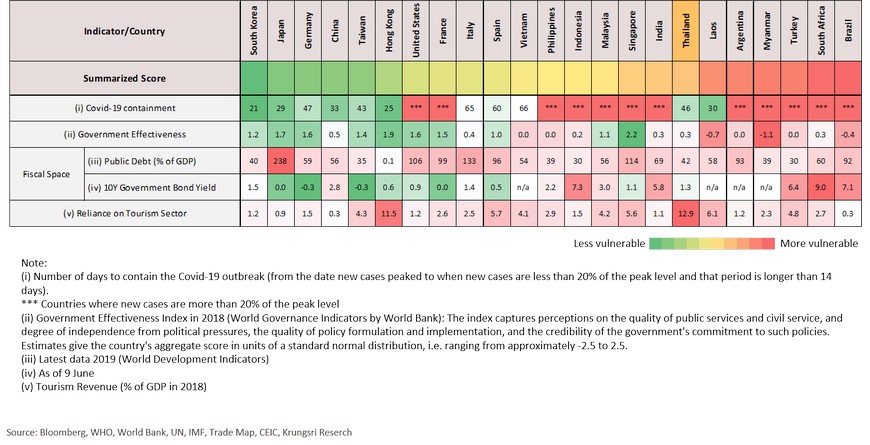

Covid-19 vulnerability dashboard: Uneven global recovery

The dashboard reveals the vulnerability of each country affected by the Covid-19 crisis and recovery prospects. Countries which managed to contain the outbreak faster, have more effective policy response, more fiscal space, and relies less on the tourism sector, would recover faster. South Korea, Japan, Germany, China, and Taiwan rank at the top. Brazil, South Africa, Turkey and Myanmar are the most vulnerable. The dashboard comprises four factors: (i) Covid-19 containment: the number of new cases remains high in many countries and regions (still higher than 20% of their peak levels) despite fewer new infections; (ii) government effectiveness: EMs are the most vulnerable, led by Myanmar, Laos, and Brazil; (iii) fiscal space: South Africa, Argentina, and Brazil have the smallest space for fiscal response; and (iv) reliance on the tourism sector: Thailand and Hong Kong are the worst hit, and would take longer to recover.

Thailand: Covid-19 crisis and path of sectoral recovery

An improvement in the supply side has lifted market sentiment but demand remains weak

- COVID-19 pandemic has pushed the Thai economy into a recession since 1Q20.

- In April, there were no foreign tourist arrivals, exports contracted, consumption tumbled, and sentiment indices hit historical lows.

- Latest high-frequency data show that a recovery in the supply side of the economy has lifted market sentiment but domestic demand remains weak amid rising unemployment.

- Bleak economic outlook and deflation risk might force the MPC to relax monetary policy further, despite no rate cut.

Krungsri Research predicts a U-shaped recovery

- Looking ahead, it is difficult to predict when the Covid-19 impact would end, and there is still large downside risks. The economic direction in the coming months would depend on COVID-19 situation and effectiveness of policy responses.

- The global pandemic might have peaked in 2Q20, but there is lingering threat of a second outbreak. Krungsri Research is predicting a U-shaped recovery for Thailand based on assumptions the outbreak would be contained in Thailand by the end of 2Q20 and economic policy responses are moderately effective. However, there is still a chance of a deeper recession, or worse, a financial contagion leading to an L-shaped recovery and a second wave of severe outbreak.

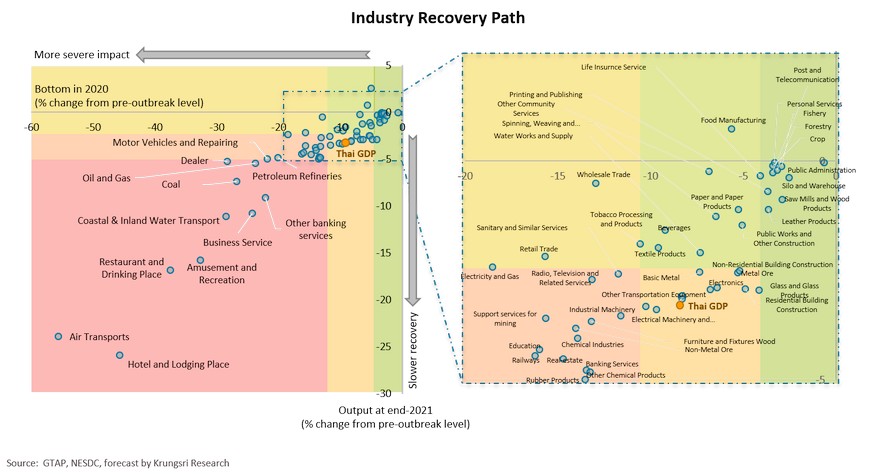

Most industries and business sectors are unlikely to return to pre-pandemic levels before 2022

- The pandemic has hit the economy through four channels: business closures under lockdown measures, a decline in overall demand, disruptions to global supply chains, and a shift in consumer behavior. Each business sector has responded to the economic recovery differently, and their response will determine their recovery trajectories.

- Our analysis of global production network data from the Global Trade Analysis Project (GTAP) suggests most industries/business sectors are unlikely to return to pre-pandemic levels before 2022. The only exceptions are hospital and food manufacturing sectors, which could return to pre-outbreak level in 2021. Air transportation, hotel, restaurant, and amusement & recreation centers will continue to suffer in 2021. Retail, wholesale, and electricity & gas industries have been severely affected but they might rebound faster than other sectors.

Recent development: Pandemic has pushed the Thai economy into a recession since 1Q20

Thailand registered the sharpest GDP contraction since the severe flooding in 4Q11, at -1.8% YoY vs +1.5% in 4Q19. Sequential growth dropped sharply to -2.2% QoQ sa from -0.2% in 4Q19. This means the output gap is negative for the second consecutive quarter, indicating Thailand is already in an economic recession. 1Q20 GDP growth was dragged by falling domestic investment (-6.5% YoY), weaker private consumption (+3.0% vs +4.1% in 4Q19), and a sharp drop in exports of services (-29.8%), mainly due to the Covid-19 impact.

Temporary tailwinds for consumption and exports lifted 1Q GDP; supply-side hit by Covid-19 and drought

In April, zero foreign tourists, exports and consumption tumbled, and sentiment indices hit historical lows

Due to Covid-19 fears and travel restrictions, there were no foreign tourists in April. External demand weakened substantially, with April exports (excluding gold) falling 10.3% YoY, the lowest since August 2015. In April, business sentiment and consumer confidence also hit record lows. Private investment fell 6.1% and private consumption contracted by 15.2%.

Recovering supply-side of economy improves sentiment but demand remains weak amid rising unemployment

Bleak economic outlook and deflation risk might force the MPC to relax monetary policy further

MPC cuts rate to new low of 0.50%, signaling end of rate cut cycle; but policy easing is underway

COVID-19 pandemic: Global cases exceed 7 million and continue to rise

Since news about the COVID-19 outbreak in December last year, it has spread to 213 countries and the number of reported cases has exceeded 7 million. The number of active cases are just over 3 million currently. This forced authorities to impose strict lockdown measures in several countries to contain the pandemic. This has hurt confidence and the global economy severely.

Pandemic had peaked in 2Q20, but there is lingering threat of a second coronavirus outbreak

The number of new cases has reduced considerably in the second quarter of 2020, leading to expectations the lockdown restrictions would be lifted soon. However, the world would remain cautious until at least September, and would continue to impose social distancing and other restrictions to prevent a second outbreak. And given uncertainty over whether the colder weather (autumn and winter) would see a resurgence in infections, the restrictions could remain until the end of the year.

In Thailand, sharp drop in new cases has led to gradual easing of lockdown measures

The number of new infections in Thailand has dropped substantially since early May, with total number cases at just over 3,000. This prompted the government to ease lockdown measures gradually. Small restaurants, barbers, and fresh markets are among places that are allowed to reopen for business. The situation will be assessed every 14 days to determine if further easing is viable. Meanwhile, the Emergency Decree could be extended at least until the end of June.

Scenarios: Lingering downside risks due to unknown disease pattern and uncertainty over policy effectiveness

Looking ahead, there is lingering downside risk even though new cases have peaked in several areas. Firstly, there is fear of a second wave of severe outbreak. Given that the world expects an effective vaccine only in the second half of 2021, a second pandemic before then could drag the global economy into a long recession. Secondly, an economic recovery would depend on the effectiveness of policy response.

Our analysis suggests a U-shaped recovery ahead, but there is also risk of a deeper recession

Krungsri Research expects the number of new cases to peak in 1H20 and observes the economic policy responses have been moderately effective. This suggests a U-shaped economic recovery. However, the Thai economy will continue to face a challenging situation with some degree of lockdown in the country and globally. And there are still relatively high risks of a financial contagion leading to an L-shaped recovery, and a second pandemic.

At baseline, economic activity would return to pre-pandemic level in 4Q 2022

Different recovery trajectory for each sector: Recovery of mobility-related sectors to lag others due to behavior shift

COVID-19 has hit the economy through four channels: business closures under lockdown measures, a decline in overall demand, disruption to global supply chains, and changes in medium- to long-term behavior. These factor will determine the recovery trajectory for each sector. The sectors affected by lockdown measures, such as retail trade, would be severely affected but might recover faster than other sectors. However, sectors affected by a change in demand pattern, such as air transportation and hospitality, would take longer to recover.

Most sectors are unlikely to recover to pre-pandemic levels before 2022; retail, wholesale and electricity & gas sectors are hit hard but would recover faster than others

Our analysis shows that only hospital and food manufacturing sectors would return to pre-pandemic level in 2021. Air transportation, hotel, restaurant, and amusement and recreation sectors would continue to suffer in 2021. Retail, wholesale, and electricity & gas sectors have been severely affected but they might rebound faster than other sectors.

Impact on business sectors and recovery trajectories

Almost half of Thai industries are severely hit

Most industries in Thailand are badly affected by COVID-19. 26 of 60 sectors are severely affected. This accounts for 46.0% of total output, of which 11 sectors (or 15.3% of total output) would not recover to pre-pandemic levels before 2022. Another 24 sectors (43.1% of total output) are moderately affected. Only 10 sectors (10.9% of total output) were only mildly affected.

Krungsri Research Forecast

Regional Economic and Policy Developments in June 2020

ASEAN: Accelerating infrastructure investment would improve regional competitiveness in the medium-term

- ASEAN countries are accelerating public infrastructure investment spending to stimulate economic growth to address the COVID-19 impact. Vietnam has recently announced it would hasten approval and disbursement of funds for infrastructure projects worth VND700trn (USD30bn, 11.5% of GDP) in 2020. In early June, the Philippines passed a bill to support a 3-year investment plan under the Build-Build-Build program worth PHP1.5 trillion (USD30bn, 9.1% of GDP), at PHP500bn per year over 2020-2022. In addition to the 223 national investment projects worth IDR4.2qdn, Indonesian has vowed to add 89 new infrastructure investment projects worth IDR1.422 quadrillion (USD110bn, 10.4% of GDP).

- These infrastructure investments cover various sectors, including transportation (road, rail, seaport, airport), dam and irrigation, energy, and border infrastructure. Specifically, the projects cover both urban and rural areas.

- The primary aim is to stimulate economic growth, but we anticipate it would difficult to realize all the investments this year, which means 2020 economic growth would miss targets. Given that most of the public infrastructure projects are huge and require a lengthy regulatory process, especially disbursement and land allocation, it would take some time before the funds would be injected into the economies.

- Over the longer term, these projects would strengthen the SE Asian countries’ competitiveness, especially Logistic Performance Index (LPI), and create a more attractive environment for investment in the region. For example, Vietnam is currently ranked third in LPI and fourth in the LPI’s Infrastructure Index among ASEAN countries, and accelerating several projects would push the country up the rankings and improve its competitiveness.

ASEAN countries to revive domestic and international tourism sectors via travel bubble strategy

- In the early stage of reopening, ASEAN countries are gradually resuming domestic travel and tourism. For example, Vietnam has introduced the Vietnamese people travel Vietnam campaign, and the Philippines recently allowed domestic flights with some restrictions to avoid a second outbreak. In the next stage, several countries are eyeing international tourists by implementing travel bubbles to allow tourists/travelers from selected countries under bilateral schemes. This would start with countries within the region, especially Asia and Oceania countries which have contained the outbreak.

- Most ASEAN countries depend heavily on international tourists from Asian countries. Specifically, more than 90% of tourist arrivals in Laos were from Asia during pre-COVID-19, while it was 74% for Myanmar & Vietnam, and 69% for Cambodia. Asian tourists are among the top foreign visitors in ASEAN countries, but these countries are also the key destinations for outbound ASEAN tourists. For example, about 15% of Chinese outbound tourists and 25% of Japanese outbound tourists visit SE Asian countries (source: news media, JTB Tourism Research & Consulting Co.).

- The travel bubble strategy would help ASEAN countries to revive international tourism industry and revenues. However, the impact would be limited this year because of lingering uncertainties, including the following: (i) possibility of a second COVID-19 outbreak, (ii) some countries have not eased travel restrictions, and (iii) only a selected few countries might participate in the travel bubble strategy, which might not be sufficient to drive a material recovery of the tourism industry in the region.

Cambodia is accelerating bilateral FTA deals to diversify export markets; Cambodia-China FTA will be the first one

Lao PDR: Pushing ahead mainstream hydropower projects; concerns on external financing are rising

Myanmar to receive USD2bn loans to fund COVID-19 Economic Relief Plan

Vietnam: National Assembly ratifies the EVFTA, to take effect by August 2020; strengthening its position in the EU market

Indonesia: Government releases up to IDR677.2trn budget, targeting positive GDP growth this year

Philippines: Unemployment rate in April 2020 hits record high; further easing for monetary policy is required

Massive fiscal stimulus worth up to c.15.5% of GDP to boost economic growth in 2020-2022