Global: Supply disruption, inflation threat, and policy diversion

Global manufacturing activity decelerated in March; downside bias to growth outlook given weaker future output, renewed supply disruptions, and rising price pressure

For the first time in 2 years, the pandemic has not been cited as the top risk to global growth; geopolitical conflict overshadows all other risks; sentiment is waning

US: Stronger economy could prevent a sharp slowdown, but Ukraine war has hurt sentiment and will have visible impact soon

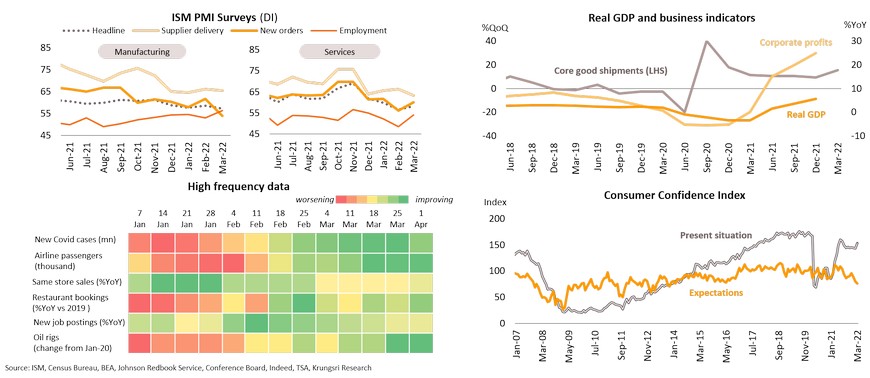

Manufacturing sector activity decelerated in March while Services sector expanded stronger than consensus expectations. The Russia-Ukraine war reduced new orders and worsened supply bottle-necks but rising employment prevented a contraction in the PMI. The firm data confirms a solid performance as corporate profits rose by double-digit percentage in 4Q21, in line with improving real GDP. The uptick in goods shipment in early 2022 also support stronger investment ahead. We expect profits to decelerate this year but remain favorable. On private consumption, high frequency data has yet to show significant impact from rising fuel prices on shopping, travel and dining out. And, declining Covid-19 cases is encouraging more outdoor activities. Current consumption and business performance could prevent a sharp economic slowdown and calm fears of a recession in this year. However, the Ukraine war impacts would have visible impact in the coming months. The Consumer Confidence Index fell in March, and especially, expectations for the next 6 months is at the lowest since 2013. Confidence would show a larger drop by mid-year. Mounting concerns over household financials could contribute to slower spending growth in 2022.

Higher prices driven by renewed supply shortages would reduce demand in 2022

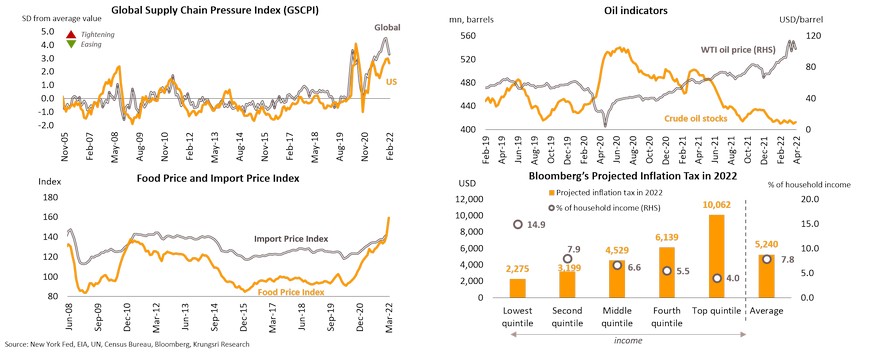

Supply problems had started to ease early this year but there were bottlenecks again following the Ukraine invasion and Covid-19 lockdown in Shanghai and Shenzhen. These suggest the economy would face slower growth and higher inflation. Oil prices jumped in the beginning of April after reports of civilian deaths near Kyiv triggered new sanctions from the West. The US has announced more sanctions against individuals and banned new investment from Russia, which have elevated uncertainties. The US also plans to release oil from strategic reserves, at 1 million barrels per day, to curb rising fuel prices across the country. However, Americans will have to deal with rising energy and food costs. Food Price Index hit record-high in March and could rise further as Ukraine’s agricultural industry has been destroyed. Plus, lockdown measures in China could also pressure global supply chains through transportation logjams and higher US import prices due to its major trade partner status. We estimate US households would pay USD5,240 inflation tax this year, and the poorest group would be the worst hit. However, all households will have to face rising prices and higher cost of living, implying softer consumer demand the rest of the year.

Healthy labor market and persistent inflation suggest a 50-bp rate hike in May and possibly at June meeting

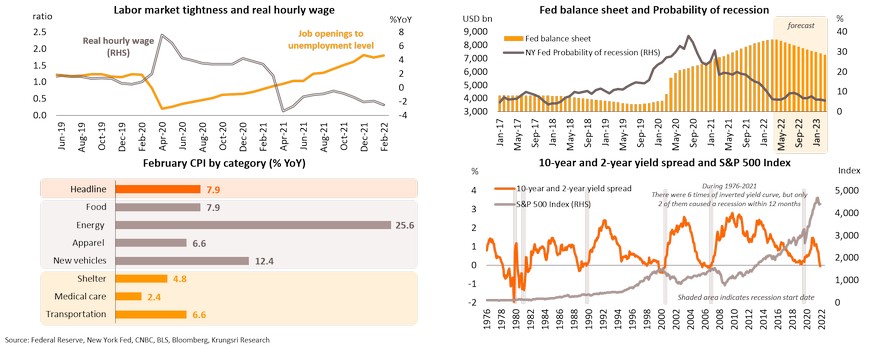

US labor market added 1.7 million jobs in 1Q22, indicating the strong return of workers. Job openings to unemployment ratio is at a record high of 1.8, reflecting a tight labor market. Although this could push up nominal wage and inflation, it would be a smaller problem than declining real wage. Prices are accelerating across the board as inflation is also rising in the services sector, reflecting demand-pull inflation. This could prompt the Fed to raise rates aggressively to allow demand to catch up with supply and reduce inflation. The Fed’s March meeting minutes revealed they might launch a balance sheet reduction program in May at USD 95 billion a month. The governors also signaled they were prepared to hike rates at every meeting this year. We expect a half-point hike in May and see higher probability of a 50 bps hike in June to combat the hottest inflation rate in four decades. Interest rates could hit 2.0-2.5% by year-end. The hawkish tone has triggered selling in short-term bonds and an ‘inverted yield curve’, leading to recession fears. Historical data does not show strong correlation between an inverted yield-curve and recession, which suggests minimal risk of a recession within the next 12 months. Sometimes, the stock market gained following negative yield spreads. So, war and inflation will hit the economy but is unlikely to trigger a recession in 2022.

Europe: Economic recovery will be delayed by war, supply chain disruptions, and weaker spending power

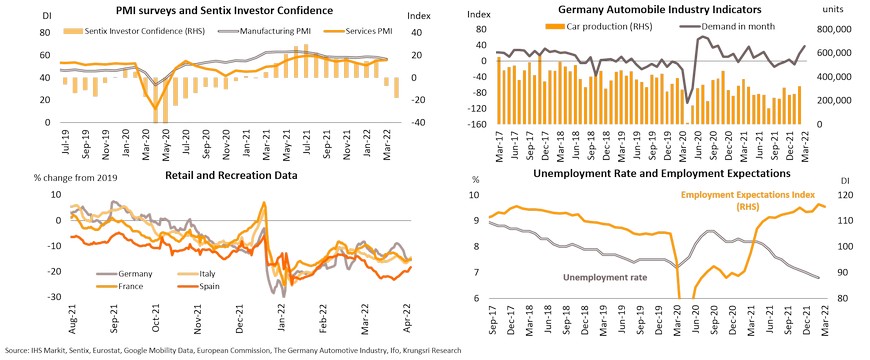

The Ukraine war is threatening Eurozone economic recovery through various channels, including weaker sentiment, supply disruptions, and tempering household demand. The war has pushed investor confidence to its lowest since late-2020. Manufacturing PMI fell in March to a 14-month low as factory orders slowed. Supply chains are being disrupted again and is hurting the economy, especially the automobile industry in Germany which relies on intermediate inputs from Russia and Ukraine. Despite improving demand for cars, the recent bottlenecks would limit production and supply might not catch up with demand. In the Services sector, PMI data is stable but we see signs of slower activity in 2Q22 because of more cases with Omicron sub-variant BA.2 and weaker aggregate demand. Recreation data showed slower mobility compared to 4Q21, led by Spain. There is uncertainty over household income, indicated by a slump in the Consumer Confidence Index (-9.4 points) in March, which could delay spending in the services and tourism sectors. The labor market has improved with unemployment rate at a record-low, but the impacts of the war and softer demand could hurt employment expectations and nudge up jobless rate in the coming months, leading to a slowdown in consumption. Given these headwinds, the Eurozone could see slower growth in 2Q22 with economies in several countries contracting, and recovery would be delayed.

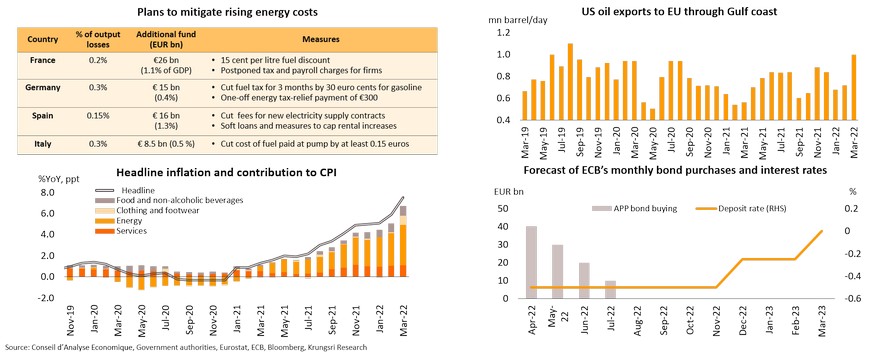

Mitigation policies could avoid an energy shock, but high inflation coupled with weaker growth would be a problem for central banks

Several countries have attempted to cushion the impact of rising energy prices through subsidies and cutting fuel tax, to prevent an economic slowdown and reduce the burden on consumers. Based on estimated output losses triggered by energy shock and the additional fund data, these measures could alleviate energy price shocks in the major economies. In addition, the US has committed to supplying natural gas to Europe this year, at least 15 billion cubic meters of LNG which accounts for half of the the EU’s increasing gas import plan. The US’s current oil exports to Europe has risen to 1 million barrels/day, the highest since 2019. These will help to mitigate energy supply concerns. However, skyrocketing energy prices will still trickle down to consumers through higher inflation and could dampen spending power. Eurozone inflation reached a new high of 7.5% in March led by higher car fuel cost and household energy bills. Uncertain gas supply from Russia could push up energy costs further. Inflation has yet to peak. It could exceed 8% YoY in 2Q22 and push up costs for both households and businesses. The dilemma of high inflation vs economic growth is becoming a problem for the ECB. However, cost-push inflation in Eurozone with a weaker growth outlook would induce muted policy reaction in the near-term, in contrast with other aggressive central banks. Given the Eurozone economy is expected to start to recover from the war impact in 2H22, the ECB might gradually wind down asset purchases in 3Q and start to hike rates in December by 25 bps, followed by one more in March next year.

UK: BOE will continue to tackle inflation by hiking rates in May, but recession fears could limit the magnitude of hikes in 2H22

China: Shocks from extended lockdowns following the biggest outbreak since 2020 will drag economic growth in 1H22

The Chinese economy is showing signs of further slowdown in 2Q22 following recent outbreaks driven by domestic transmission of the Omicron variant and extended zero-COVID policy. Daily cases are at a record high of over 20,000 since COVID-19 erupted in 2020. The subsequent lockdowns have hurt production and consumption in several key economic areas, which together account for 30.7% of GDP, and the effects have spilled over to other parts of the country. High-frequency data indicate economic activity is at its lowest since the pandemic started in 2020. In March, the Official Composite PMI slipped to 48.8, staying under the 50-point waterline for the first time in 7 months. Both Manufacturing and Non-manufacturing PMI data has slipped into recessionary territory for the first time since February 2020. Moreover, port congestion has worsened in February after authorities stepped up intensive surveillance and epidemiological investigations to prevent imported infections, causing container throughput to drop to a one-year low. The reimposition of lockdown in Shanghai, one of the most populous mega cities and gateway to maritime trade routes, since 28th March will exacerbate supply chain disruptions globally. Looking ahead, the extended lockdowns and lingering effects as well as Ukraine crisis are expected to nudge down growth in 1H22.

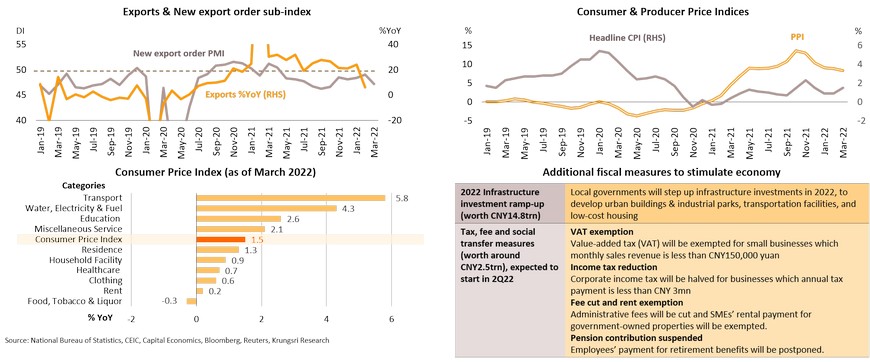

Signs of weakening external demand triggered by Ukraine crisis, impact on inflationary pressure will be manageable

The extended Russia-Ukraine war and intensifying sanctions have started to hurt China’s economy. Escalating tensions, supply disruption and soaring commodity prices have weighed on the global economy and international trade, which would in turn dampen exports. The was that erupted in late-February is likely to worsen exports to key trading partners as the March New Export Order sub-index of Manufacturing PMI has dropped to the lowest level since November. In terms of price shock, CPI inflation has risen following cost pass-through for some items in the household consumption basket, especially transportation, utilities & fuel and services, though PPI inflation edged down from last year’s high base. Noticeably, the rising price pressure was concentrated only in some categories, while demand-pull inflationary pressure is still subdued, which could not lead to broad-based inflation. To sustain an economy that is still experiencing weak domestic demand amid external risk factors, authorities have introduced additional fiscal measures, including stepping-up infrastructure investments, and implementation of tax and social transfer reduction measures. Looking forward, these fiscal measures might help to mitigate a sharp slowdown but it would still be challenging for the government to meet its 5.5% GDP growth target.

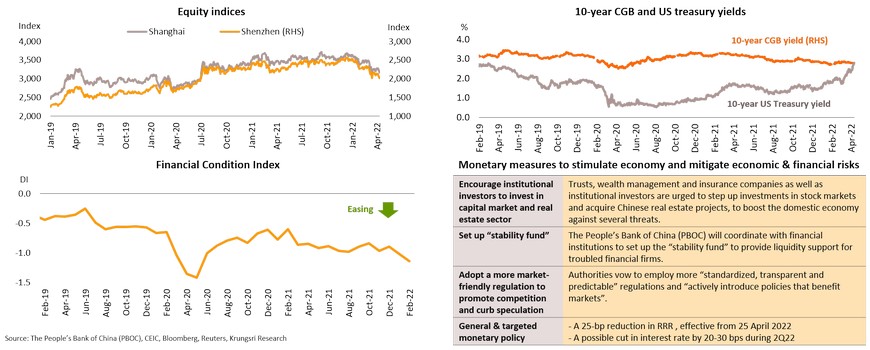

Escalating risks to economy and financial market implies more accommodative monetary policy stance

Several lingering risks have overshadowed China’s economic growth and financial markets. Fears of a further economic slowdown, coupled with extended lockdown have triggered strong equity sell-off since early-March. In addition, the US-China policy divergence has caused yield spread of 10-year CGB over US Treasuries to turn negative in mid-April for the first time since June 2010, which triggered capital outflow and caused the Chinese yuan to depreciate. Meanwhile, the People’s Bank of China (PBOC) has committed to implementing concrete measures that will protect against escalating risks to the economy. The central bank has urged commercial banks to provide more credit, reflected by easing financial conditions which has caused credit growth to rebound to an 8-month high of 10.6% YoY in March. On 15 April, the PBOC cut commercial banks’ reserve requirement ratio (RRR) by 25 bps, effective from 25 April, after two cuts of 50 bps each in July and December 2021. Authorities have also pledged to focus on stimulus to ensure economic growth and have introduced additional measures to boost the domestic economy and promote financial stability. We expect China to ease monetary policy further by cutting policy rate by another 20-30 bps in 2Q22. This would be a negligible move given limited room to maneuver monetary policy but it would help to avoid a sharp slowdown. However, it would still be challenging to meet the official GDP growth target of 5.5%.

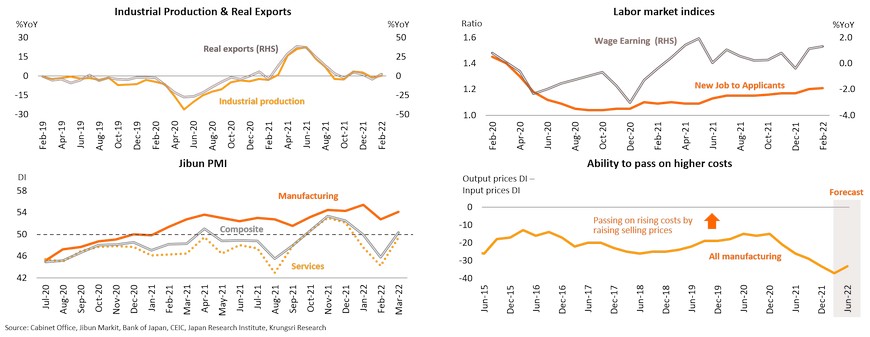

Japan: Expect a volatile recovery with several downside risks, including risk to global trade, supply disruption, and earnings

The economy has shown positive signs since daily new Covid-19 cases started to drop. In February, industrial production rebounded in line with with a mild improvement in export volume mainly due to easing supply bottlenecks and improving external demand as Covid-19 cases dropped worldwide. The resumption of domestic economic activities also helped to strengthen the labor market with more job openings and rising wages. The Composite PMI picked up in March, implying better performance in both Manufacturing and Services PMI data after the gradual removal of the quasi-state of emergency. However, the encouraging indicators could be short-lived and the economy could be pressured by negative factors in 2Q22, including: (i) the prolonged Ukraine war and more severe sanctions, which would slow down the global economic recovery and dampen international trade; this is reflected by a drop in the new export orders component in March PMI, (ii) worsening supply chain disruption triggered by the Russia-Ukraine conflict, and the worsening outbreak in China would exacerbate shortages and disrupt transportation, and (iii) pressure on earnings as businesses would find in increasingly difficult to pass on rising commodity costs. These concerns are reflected by a drop in Tankan business sentiment for the first time in 5 quarters, in 1Q22. Looking ahead, economic recovery will be bumpy and trail behind that in other advanced economies. This suggests Japan would need more accommodative policies to cushion the headwinds.

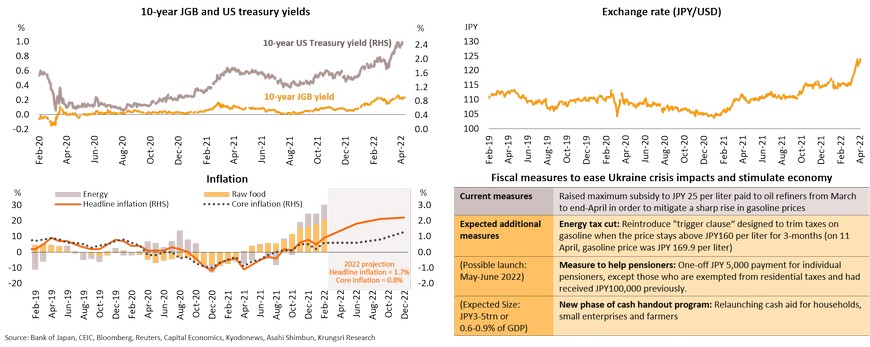

Despite expecting inflation to exceed 2% this year, the BOJ is unlikely to tighten monetary policy, will maintain accommodative stance

Apart from higher risks to global trade, supply chains and corporate earnings, the Ukraine crisis has created greater volatility in the financial sector as well as significant upward pressure on inflation. The widening interest rate differential with its US counterpart has led to a huge selloff in JGB, which led 10-year JGB yield to rise above ±0.25% target range. The widening gap between US and Japan bond yields has caused the Japanese Yen to depreciate; that will benefit exports but would have negative consequences on inflation through higher import costs. The effect of the Ukraine war has also elevated cost-push pressure on inflation. In February, headline inflation rose to 0.9%, almost at a 3-year high, due mainly to a jump in energy and food prices. Headline inflation is expected to soar above the 2.0% official target in 2Q22 when the low-base effect (reduction in cell phone fess since April 2021) starts to kick in. But despite rising risks to inflation, the BOJ is unlikely to tighten monetary policy because demand-pull pressure remains weak as inflation is currently concentrated in the food and energy categories. On the fiscal front, the government has prepared to launch extra stimulus package to alleviate the impact of rising household expenses and production cost. Given uncertainties over the still-fragile recovery and economic activity will remain below pre-pandemic level in 1H22, Japan is likely to keep the expansionary policies to support economic recovery.

Thailand: Bracing for a surge in inflation amid an uneven recovery

-

Despite reopening effects and stimulus measures, Thailand’s economic recovery is being challenged by spillover effects of the Russia-Ukraine crisis impact on global growth, international trade and tourism, and inflation risk. China’s strict containment measures could disrupt global supply chains and domestic manufacturing production.

-

Domestic economic activity could see limited growth given the high number of Covid-19 cases, which could rise again after Songkran holidays. Despite rising farm income, private consumption growth could be weighed down by soaring cost of living.

-

Headline inflation rate surged to a 13-year high in March and is likely to stay above the BOT’s 1-3% target range the rest of this year. Major contributors to inflation would be rising price of food-at-home and vehicles.

-

Different consumption baskets indicate uneven inflation burden across households. The low-income groups would suffer the most from soaring inflation because of high weighting of food in this group’s consumption basket.

-

Our analysis indicate the lowest-income group’s inflation burden this year would be about 6 times higher than last year. However, the high-income groups would see only a moderate increase in inflation burden this year. Declining real wages in low-income households will worsen the gap in spending power.

-

To assist low-income households and support economic recovery, the government needs to pick the appropriate policies to provide a safe way forward, such as increasing employment of unskilled labor and boosting business investment through fiscal measures, which are more effective than hiking minimum wage. A 10% rise in the minimum wage would increase real wages in only some industries but it would hit many sectors, especially labor-intensive industries. The overall impact would reduce Thai GDP growth by 2.4ppt and add 0.5ppt to inflation rate.

-

Even if inflation exceeds target, the MPC is likely to maintain policy rate to support economic recovery. We expect monetary policy to focus on managing inflation expectations.

Krungsri Research Forecasts for 2022

Tourism sector had been mainly supported by tourists from Europe in 1Q22, so recovery may be hurt by the Russia-Ukraine crisis

Exports surged in Jan-Feb but Ukraine crisis will have visible impact soon

Manufacturing sector could weaken in anticipation of slower exports coupled with downside risk from supply chain disruption as a result of China’s lockdown

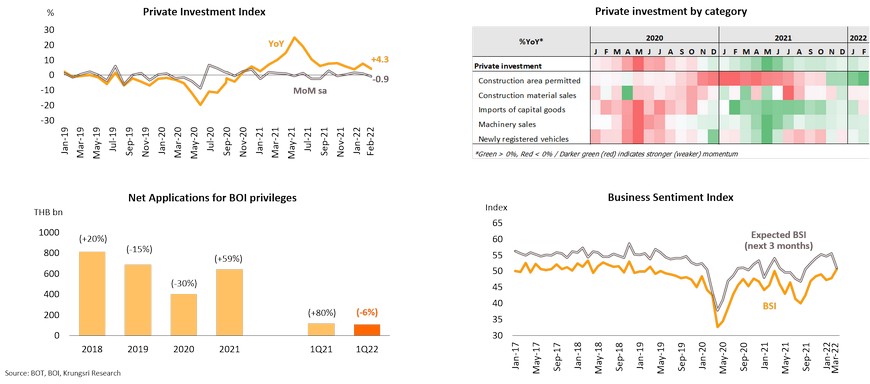

Private investment will recover slowly amid fears of the impact of the Russia-Ukraine crisis

Private Investment Index (PCI) grew 4.3% YoY in February, down from 7.8% in January, mainly due to a drop in capital goods imports. Construction investment was stable. In addition, the BoI reported a 6% YoY drop in investment applications to THB110 bn in 1Q22 although the number of applications rose 1% YoY to 378 projects. Business Sentiment Index (BSI) for 3-months ahead tumbled to near-50 in March because of concerns the prolonged fighting in Ukraine and sanctions against Russia would push up production costs, creating uncertainty over the business outlook. Looking ahead, private investment growth could be weighed down by slower export growth and weaker business sentiment.

Domestic economic activity could be pressured by high number of Covid-19 cases, which could increase after the Songkran festival

Private consumption undermined by soaring cost of living despite higher farm income

Private Consumption Index (PCI) rose 2.3% YoY in February, slowing down from 5.0% in January. Meanwhile, Phase 4 of the Co-payment program will expire at end-April, and farm income and private consumption growth would be pressured by the rising number of daily Covid-19 cases and prices of energy and food are rising. These could dampen confidence and undermine purchasing power ahead. The government has launched relief measures to ease the impact of higher cost of living, including subsidies for welfare card holders, freezing energy prices, and reducing social security contributions temporarily. However, these measures are worth THB80bn and account for only 0.4% of GDP.

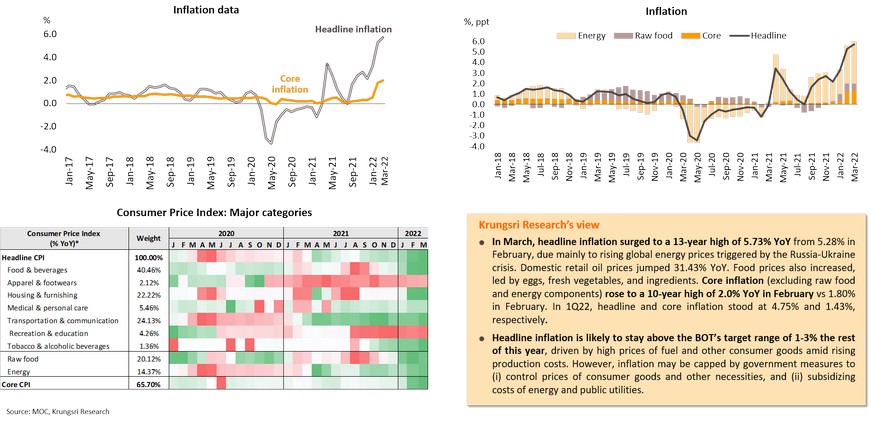

Inflation rate soared to 13-year high in March and could stay above the BOT’s target range throughout this year

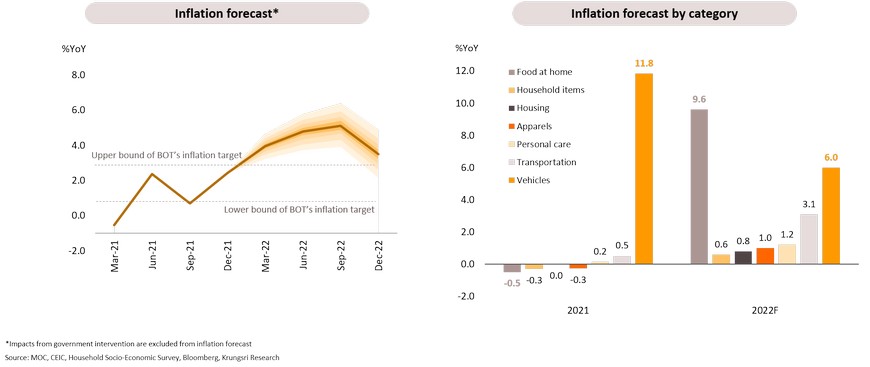

Major contributors to inflation this year would be prices of food-at-home and vehicles

We now expect inflation to exceed 4% this year given pressure from more expensive vehicles and higher household food bills. Inflation would also be driven by the surge in oil prices following Russia’s invasion of Ukraine. Crude price is expected to stay high at c.USD 100 per barrel and push up manufacturing and transportation costs. This will keep inflation above the central bank’s target band. Inflation might only start to cool down in 4Q22.

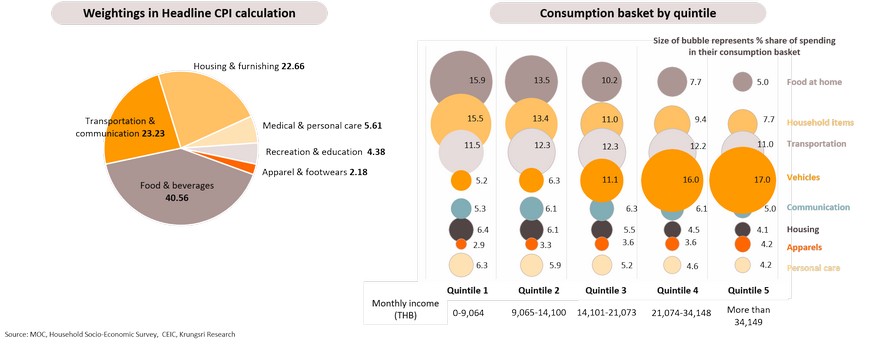

Different consumption baskets indicate uneven inflation burden across households; low-income group would be worst-hit by rising food prices

Households in different income groups would experience varying degrees of impact from higher cost of living due to different weightings in their consumption baskets. To analyze consumption expenditure by category, we classified households into 5 quintiles based on income level. We found the largest expenditure category for the lowest-income group was food-at-home (15.9% of their total spending), followed by household items (15.5%) and transportation (11.5%). In contrast, the highest-income group’s spending was led by vehicles (17.0%) while spending on food-at-home was only 5.0% in their consumption basket. This suggests the low- to medium-income groups would be worst-hit by rising inflation this year because of rising food prices.

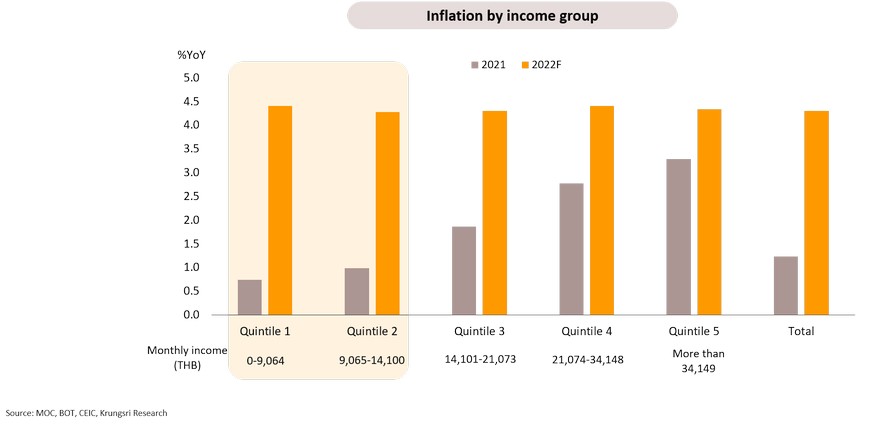

Low-income group’s inflation burden this year would be 6 times higher than last year; all households will experience higher inflation

Based on the different consumption baskets, Krungsri Research estimates effective inflation in the lowest-income group (Quintile 1) will exceed 4% in 2022, compared to just 0.7% in 2021. This means low-income households’ inflation burden this year will be around six times higher than a year earlier. For high-income earners (Quintile 5), effective inflation would also exceed 4% this year but the YoY increment would be mild given 3.3% inflation last year. This indicates all households will have to deal with the effects of higher inflation on income and expenditure and low-income groups will suffer the most with larger jump in their inflation burden this year.

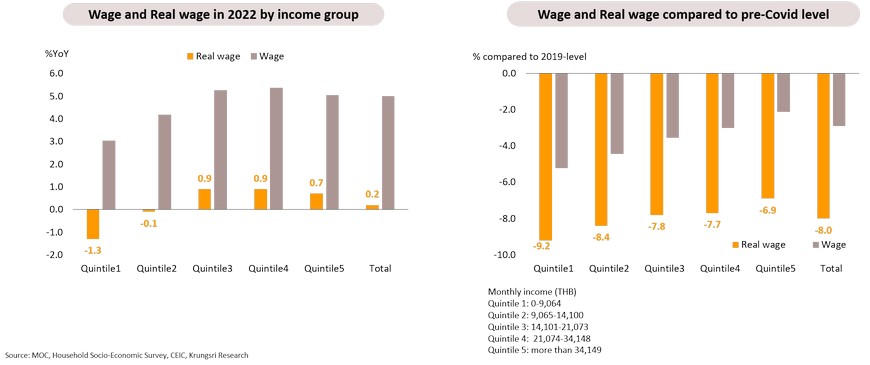

Declining real wages for low-income households will worsen the gap in spending power; wages across income groups are expected to stay below pre-crisis levels in 2022

Krungsri Research analyzed real wage (wage adjusted for inflation) across households to gauge their respective purchasing power on goods and services. The conclusion is that real wage growth in all income groups are lower than nominal wage growth. Real wage in the lowest-income group could decline by 1.3% YoY compared to +0.7% in the highest-income group. Furthermore, real wage across households would remain below pre-Covid levels and that for the lowest-income group would be 9.2% below pre-Covid level. This implies weaker purchasing power especially in the poorer group, caused by not only lower nominal income but also higher inflation and a different consumption basket.

Picking appropriate policies such as increasing employment and boosting business investment would be more effective than hiking minimum wage

Even if inflation exceeds target, MPC is likely to maintain policy rate to support economic recovery; monetary policy should be aimed at managing inflation expectations