Global: Challenges on the path to a soft landing

IMF expects global recovery will be slow with greater regional divergence and challenges in returning to pre-pandemic output trends; policy tightening starting to bite

The IMF projects global economic growth will decelerate from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, below the historical average of 3.8% over 2000-2019. Growth in advanced economies is expected to slow from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024. Growth in emerging markets and developing economies are projected to edge down from 4.1% in 2022 to 4.0% in both 2023 and 2024. Despite signs of resilience earlier this year, economic activity is still below pre-pandemic (January 2020) projections by the IMF (see charts). Several forces are holding back recovery, including long-term consequences of the pandemic, the war in Ukraine, and increasing geoeconomic fragmentation. Other forces are cyclical, including effects of monetary policy tightening, withdrawal of fiscal support amid high debt levels, and extreme weather.

Global growth loses momentum after post-covid rebound; manufacturing activity stagnated at end-Q3 and backlog is at post-2009 GFC low (excl. 2020 during lockdown)

US: Rising interest rates are exerting pressure on economic growth, inflation, and the labor market, paving the way for maintaining multi-year-high interest rates

Eurozone: Synchronized slowdown in economic data suggest recession risk in the second half of 2023

China: The economy will see a partial recovery as short-term policy supports and improving financial conditions may drive a modest cyclical rebound in some sectors

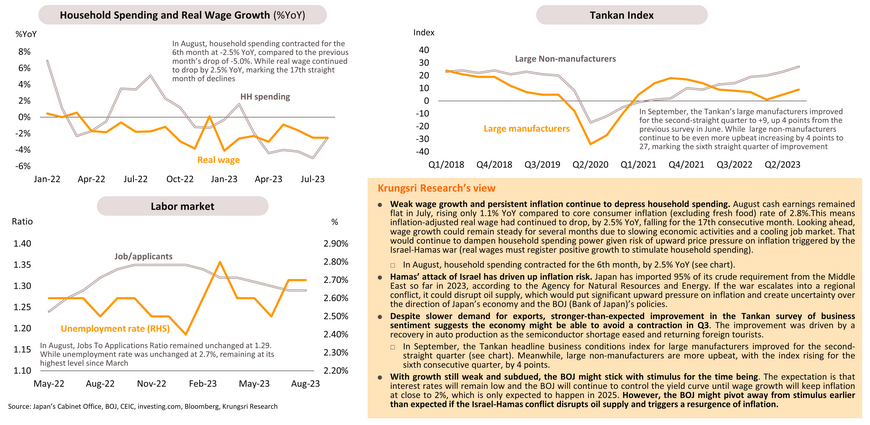

Japan: If Israel-Hamas war is contained and does not disrupt oil supply, the BOJ would likely stick with stimulus for now

Thailand: Obstacles and uncertainties along the path to recovery

Krungsri Research Forecasts for 2023-2024

Key factors in 4Q23: Growth would be driven mainly by tourism sector and domestic policy supports

We estimate 2023 GDP growth at 2.8%; growth should pick up in the last quarter but there are obstacles and uncertainties along the path to recovery

Our economic growth forecast is supported by recovering tourism activity and improving private consumption. Economic growth is expected to inch up from 1.8% YoY in Q2 to 2.0% in Q3 and accelerate to 4.7% in Q4 driven by rising foreign tourist arrivals, domestic policy supports, and the low-base effect last year. However, there is downside risk from domestic and external headwinds as well as growing uncertainty

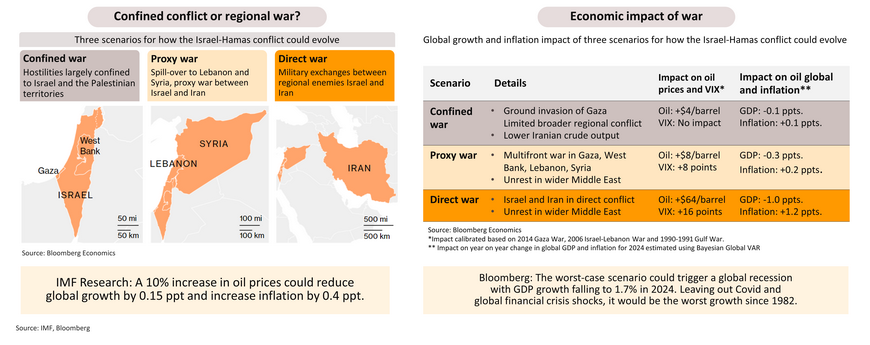

IMF says Israel-Hamas war has darkened the horizon of the world economy which was already experiencing weak growth; Bloomberg expects global growth to lose 0.1-1.0 ppt

On October 12, the General Secretary of IMF, Kristalina Georgieva, said the IMF was “very closely monitoring how the situation evolves” and how it is affecting oil markets. The IMF Director of the Middle East and Central Asia Department, Jihad Azour called the ongoing armed conflict an economic “earthquake” in a panel discussion at the annual conference, saying it will have challenging repercussions for the Middle East and the larger world economy. Bloomberg Economics analyzed the possibly impact on global growth and inflation under three scenarios. In the first, hostilities remain largely confined to Gaza and Israel. In the second, the conflict spills over to neighboring countries like Lebanon and Syria which host powerful Tehran-backed militias — essentially turning it into a proxy war between Israel and Iran. The third involves escalation into a direct military exchange between the two regional enemies; Bloomberg sees low probability of this panning out but it is a dangerous possibility. Soaring oil prices (to $150 a barrel) and plunging prices of risk assets would deal a substantial blow to growth and take inflation a notch higher. It could trigger a global recession with global GDP growth falling to 1.7% in 2024. Excluding Covid and global financial crisis shocks, it would be the worst growth since 1982.

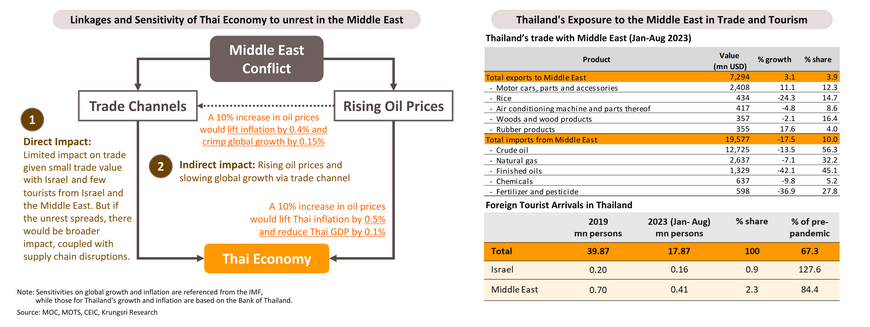

The Middle East conflict and the Thai Economy: Limited impact currently but that could change if unrest spreads to other countries in the Middle East

The conflict would hurt the Thai economy through direct channels (via trade and tourism) and indirect channels (surging oil prices, slowing global growth). Given that the Israel-Hamas conflict is “contained” currently, the primary impact would be triggered by rising oil prices.

1. Direct impact: Israel accounts for only 0.3% of Thailand’s total exports,

so the impact on trade would be minimal. The impact on tourism would also be limited as tourists from Israel and the Middle East account for only 0.9% and 2.3% of total foreign tourist arrivals in Thailand, respectively.

2. Indirect impact: Rising oil prices could hurt global growth. The unrest could affect oil production & supply and transportation within the Middle East. As a net importer of energy, Thailand will see higher inflation, which would pressure purchasing power and economic activities. In addition, slower activity in Thailand's trading partners’ economies triggered by rising oil prices would have an indirect impact on Thailand's trade.

In the worse-case scenario, a “proxy war” would have significant impact on trade. Middle Eastern countries are emerging as potential export markets and are also primary sources of energy imports. Supply chains would be disrupted, which would increase shipping costs and insurance premiums, and delay the delivery of goods.

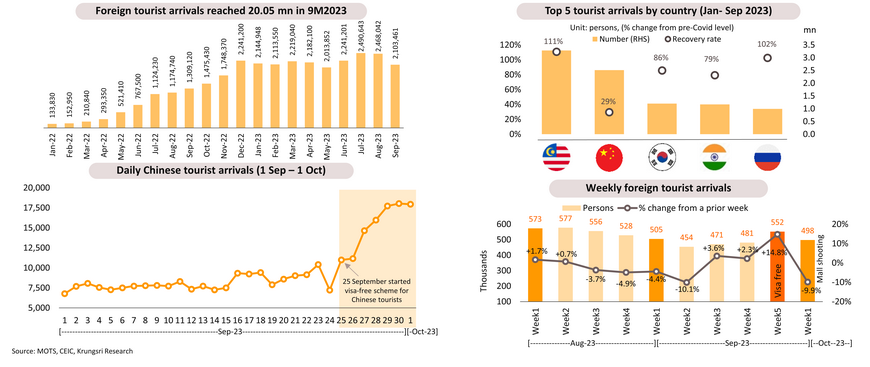

Tourism sector: Chinese tourists start to flock in under visa-free scheme but it is uncertain if this trend is sustainable

The Tourism Authority of Thailand’s data show the country welcomed 2.10 mn foreign tourists in September, falling from 2.47 mn in August. In the first nine months of this year, tourist arrivals reached 20 mn (68% of pre-Covid level) and generated THB834 bn receipts (60% of pre-Covid level). Arrivals from Malaysia, Russia, South Korea and India reached 79-111% of pre-pandemic levels. Chinese tourists are returning slowly (29% of pre-Covid level). In the first week of visa-free entry for Chinese tourists (September 24th to October 1st), their arrivals increased by 72.5% from the previous week to 106,472. However, it dropped to 75,093 in the subsequent week, partly due to safety concerns after the shooting at a Bangkok mall on October 3rd. We forecast 28.5mn foreign tourists would visit Thailand this year but that implies there should be over 2.8mn arrivals per month in the last quarter compared to an average of 2.4mn in Q3. The latest mall shooting has made this challenging.

Bangkok mall shooting might deter foreign arrivals in Q4 but peak tourist season and visa-free entry will mitigate the impact

Exports: Reversed to growth again in August led by recovery in some major markets, but uncertainties loom on the horizon

Rising prices lift Thai export value but annual trends remain negative

The Ministry of Commerce reported export value expanded for the first time in 11 months in August. However, data from the Bank of Thailand show exports had contracted for the 11th consecutive month, by 1.8% YoY, albeit the magnitude is smaller than in the previous month (-5.5%). This was due to generally higher prices for goods as export volume had continued to shrink. However, many countries in Asia are still see weak exports. Furthermore, the WTO has downgraded its forecast for global trade growth to 0.8% from its previous estimate of 1.7% and forecast global trade would expand by 3.3% in 2024, a notch higher than its previous estimate of 3.2%. Given that the Israel-Hamas conflict is “contained” currently, it is initially projected to have limited direct impact on Thai exports because Israel is Thailand's 40th largest trading partner. In the first 8 months of this year, Thailand's exports to Israel jumped 12.6% YoY to $546 million (0.3% of national export value). Imports from Israel fell 14.2% YoY to $311 million (0.2% of national import value). If the Israel-Hamas conflict is not contained soon, it could increase risks to Thailand’s international trade.

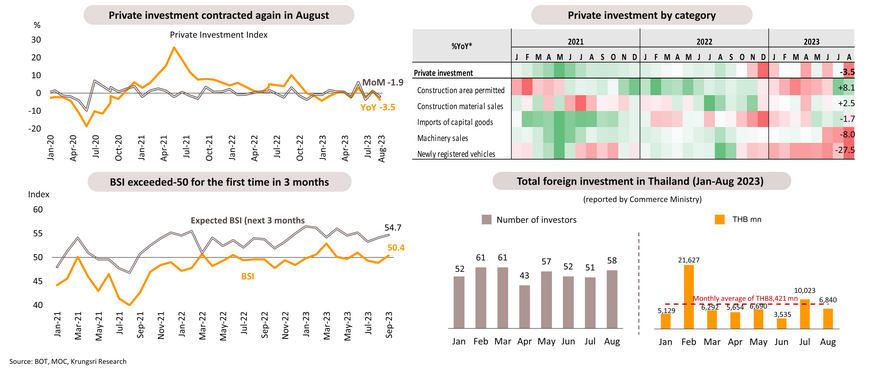

Private investment remains volatile after contracting again in September, suggesting slow growth this year

The Private Investment Index fell 3.5% YoY in August, reversing from +1.3 in July. This was mainly due to smaller investments in machinery & equipment, which is reflected in the drop in capital goods imports and slower sales of machinery in Thailand, especially in food & beverage and tobacco sectors. However, the construction sector saw an uptick in investment. Looking ahead, private investment could remain volatile, influenced by the weak export sector, despite positive signs that include (i) Business Sentiment Index (BSI) exceeding-50 in September; (ii) Ministry of Commerce data showing 435 FDI applications in the first 8 months of 2023 with a total value of THB65.8 bn; and (iii) the BOI had approved investment incentives for 1,106 projects (+17% YoY) with a total investment value of THB288 bn (close to the same period last year).

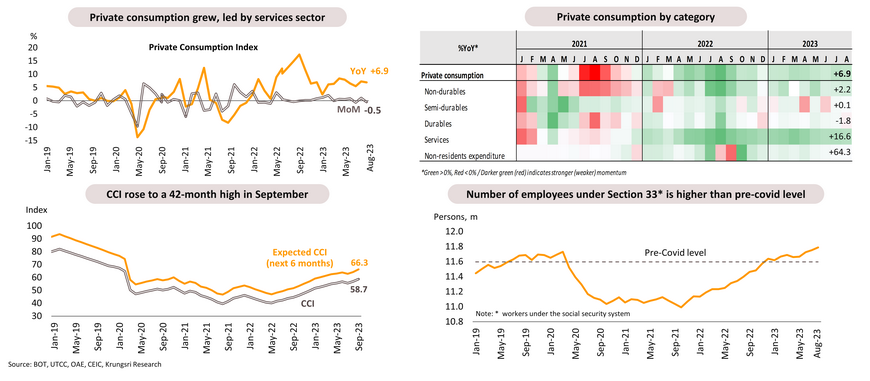

Private consumption will improve driven by stimulus measures such as that to reduce energy costs, but upside would be limited by several headwinds

The Private Consumption Index rose by 6.9% YoY in August, slowing from +7.3% in July, mainly due to reduced spending on durable and semi-durable goods categories. In contrast, service spending continued to flourish, supported by the long holiday. For the rest of the year, private consumption is expected to benefit from rising consumer confidence, employment returning to normal levels, and measures to boost purchasing power by reducing energy costs and suspending debt repayment for farmers and small enterprises. However, there are challenges ahead, including high household debt, high interest rates, and the potential impact of drought on agricultural products and farm incomes.

Inflation is likely to stay below the lower bound of the official 1-3% target range in the last quarter of this year; reduction in energy costs could reduce inflation by 0.2 ppt

BOT hiked policy rate to 2.50% citing upbeat growth outlook; given its latest signal and ongoing economic challenges, it might hold policy rate next year

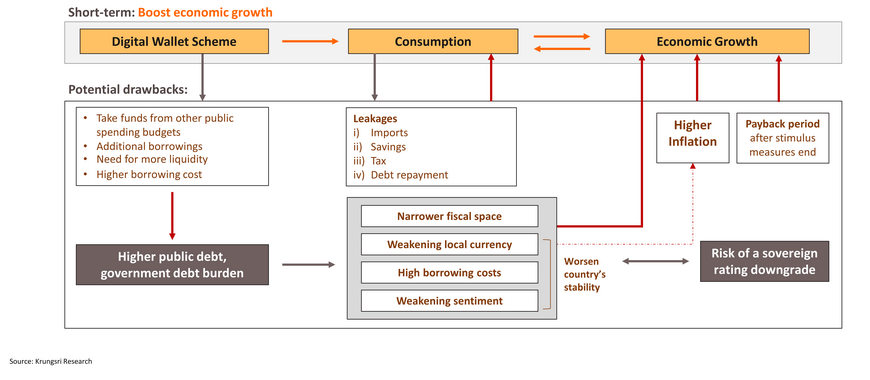

Digital Wallet: Demand-side analysis suggests it would boost GDP growth by 0.4-1.1 ppt and push up inflation by 0.005-0.015 ppt from the baseline

The impact of the Digital Wallet scheme 2024 GDP and inflation would depend on the debt incurred to implement that scheme. The scheme requires THB 560 bn in funding. There are limited details on how it would be financed, so we present two possible scenarios below. The most likely scenario would be a combination of Scenario 1 and 2:

- Scenario 1: (i) retrieve over THB 300 bn from the budget reallocation and undisbursed FY2023 budget; and (ii) increase FY2024 annual budget deficit by THB 130 bn

- Scenario 2: Increase off-budget expenditure under Article 28 of the Fiscal Discipline Act from 32% to 45% of the annual budget. This will involve borrowing THB400 bn from Specialized Financial Institutions (SFIs). Additionally, the government could draw from the repayment budget for SOEs (c. THB 200 bn) which is not included in the public debt calculation. The government will gradually repay the principal and interest under this scenario.

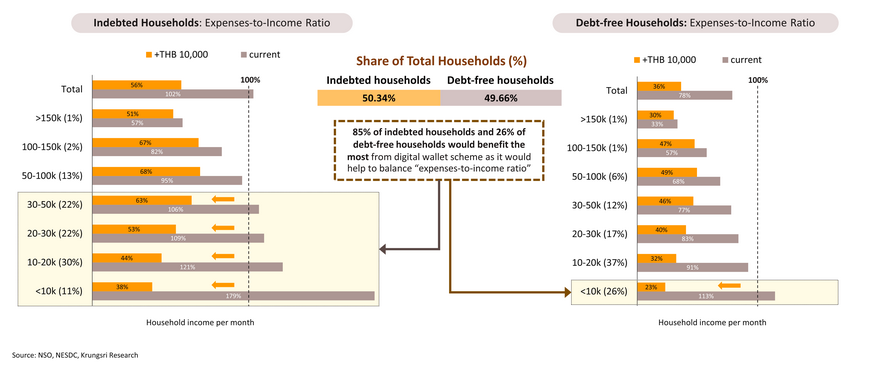

Digital Wallet can boost purchasing power of low-income households and stimulate the economy, but the effect might last only a year

NSO data suggests indebted households with monthly income below THB50,000 and debt-free households with monthly income below THB10,000 have weak purchasing power as total expenses including debt repayments exceed income. The THB 10,000 digital wallet scheme – planned to be implemented in 2024 – would boost these household’s purchasing power significantly but only for a year. It will help those under financial stress (85% of indebted households and 26% of debt-free households) by reducing their expense-to-income ratio to below 100%. However, there would be little impact on high-income households (more than THB50,000 for indebted households) and debt-free households (monthly income above THB10,000) because these households have low marginal propensity to consume (MPC).

Digital Wallet: Supply-side analysis suggests that crops sector would be the largest contributor to GDP growth in 2024, but forward and backward linkages are low

Digital Wallet could be a fiscal burden and raise implicit public debt to 65-66% of GDP

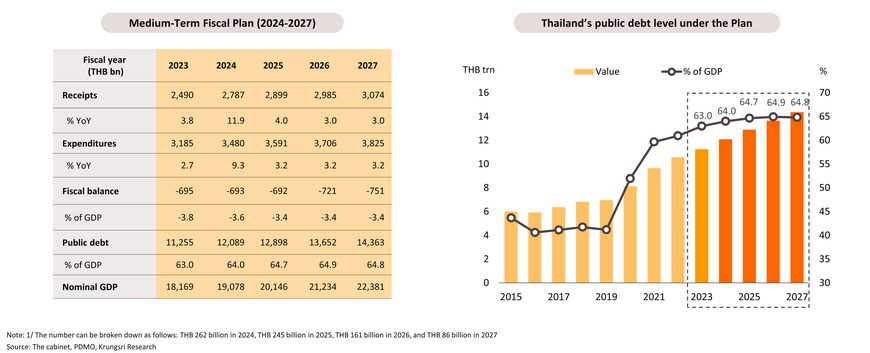

- The Cabinet has approved the Medium-Term Fiscal Plan (2024-2027) with a total expenditure budget of THB 14,602 billion, THB 11,745 billion total revenue, and a borrowing plan totaling over THB 3,611 billion over four years as follows : (i) borrowing to offset THB 2,857 billion deficit, and (ii) borrowings by the government and SOEs amounting to THB 754 billion1/.

- The Public Debt Management Office (PDMO) estimates public debt under the Plan would increase from 63% of GDP in 2023 to 64% in 2024 and 64.8% in 2027. Our funding scenarios suggest funding for the Digital Wallet scheme would be repaid between 2024 and 2027, based on the following assumptions:

- Scenario 1: Borrowing additional THB 130 billion would push up public debt to 64.8% of GDP in 2027, as outlined in the 2024-2027 fiscal plan; this would serve as the baseline.

- Scenario 2: Public debt will be unchanged is the government borrows from SFIs (quasi-fiscal expenditures), but this approach will amplify the fiscal burden when setting the budget for repayment. This could potentially elevate implicit public debt to 65.6% of GDP by 2027.

Digital Wallet scheme would boost growth temporarily but higher public debt could raise concerns about fiscal stability

The potential risks associated with rising public debt and implicit debt burden triggered by the quasi-fiscal scheme include (i) higher borrowing costs, which could lead to ‘crowding-out’ effect; (ii) a narrower fiscal space, which would limit the ability to implement counter-cyclical measures and to advance growth-promoting policies; and (iii) worsen the country’s stability with a weaker local currency, poor sentiment, and high borrowing costs. These could also trigger a sovereign rating downgrade.