Global: Trade war and strategic moves reshaping economic outlook

Global growth slows to 14-month low; services sector lost momentum while manufacturing may gain temporarily from front-loading orders ahead of tariffs

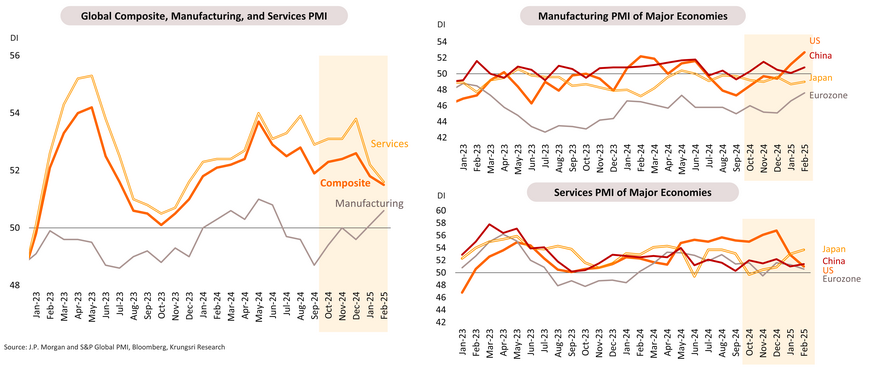

The Global Composite PMI Output Index dropped to a 14-month low of 51.5 in February from 51.8 in January. The global service sector showed the weakest growth since January 2023, although it still outperformed the manufacturing sector. Manufacturing production increased at the fastest pace since June 2024, which should have resulted from front-loading output and new orders ahead of tariffs. For national data, the US lost momentum and was overtaken by Japan and was no longer the fastest-growing of the major developed economies. Growth was weak in Europe, while growth momentum in China remained only moderate.

US: Trade war tactics aim at negotiation, but their consequences and other policies could slow economic growth; Fed expected to cut rates by 75bps this year

Under Trump’s second presidency, a series of tariff hikes would continue and increasingly intensify, potentially accelerating global economic fragmentation

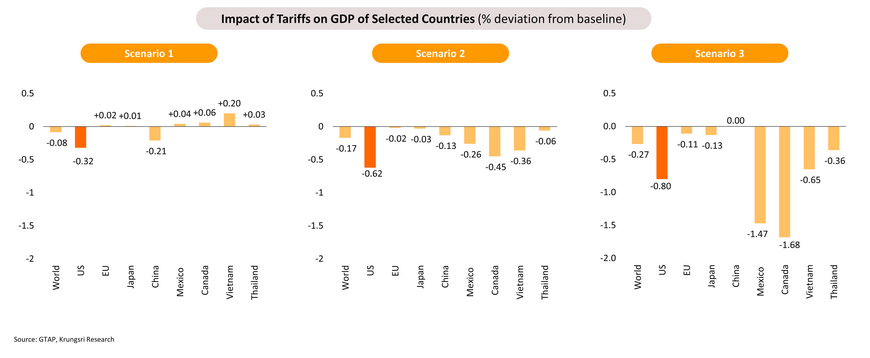

Trump’s recent tariff plans could have a negative impact on global exports and the economy; US growth would be hit larger in case of imposing tariffs to targeted countries

Scenario 1: US imposes 20% tariffs on all Chinese goods and China retaliates with 10-15% tariffs on some US goods.

Scenario 2: Scenario 1 plus US imposing 25% tariffs on all imports from top 10 trading partners with highest trade deficit (Canada, China, EU, India, Japan, South Korea, Mexico, Thailand, Taiwan, and Vietnam).

Scenario 3: Scenario 2 plus retaliation with 25% tariffs on all US goods by top 10 trading partners with highest trade deficit

Eurozone: Pace of rate cuts is expected to slow as inflation may not reach the 2% target in the short term, and Germany’s fiscal stimulus is likely to mitigate downside risks to growth

Japan: BOJ in no rush to hike rates due to weak economic growth, but improving price indicators leave the door open for another hike in 2H25

China: Government to prioritize boosting consumption this year to alleviate oversupply problems and negative impacts from trade war 2.0

Thailand faces economic challenges from structural issues and trade war tactics; Krungsri Research expects 2025 GDP growth at 2.7%

-

2025 growth forecast revised down to 2.7% due to weak domestic economy, slow tourism recovery and limited stimulus impacts.

-

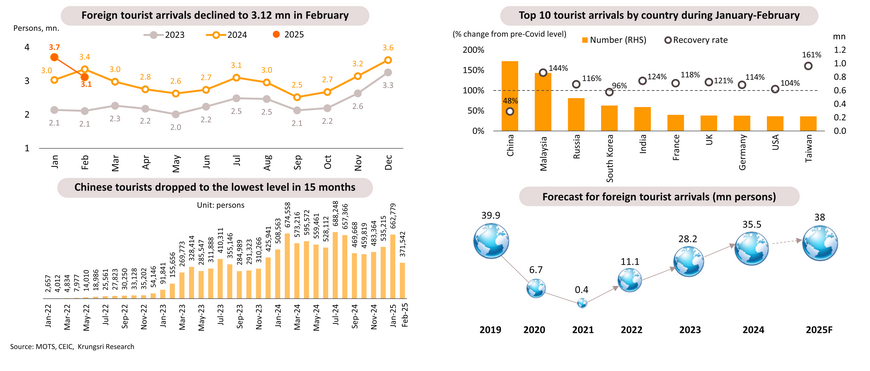

Slower-than-expected recovery of Chinese tourists prompts a revised forecast of 38 mn foreign tourist arrivals in 2025.

-

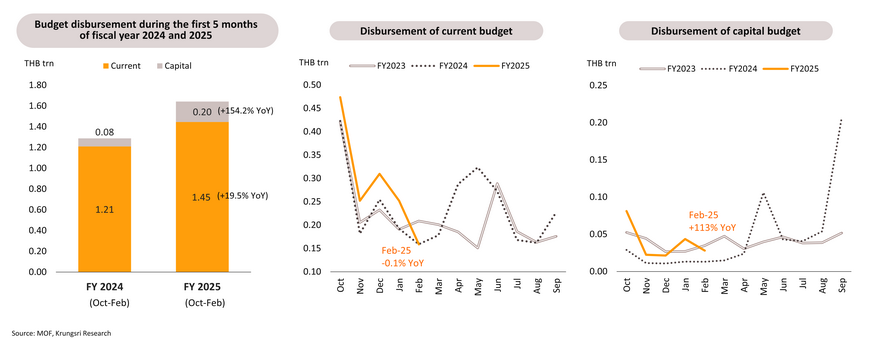

Capital budget disbursement shows signs of acceleration, with public spending expected to remain a key driver in early 2025.

-

Private investment is rebounding from a low base amid structural manufacturing problems and escalating trade wars;

-

BOI indicators signal a positive outlook for investment in high-tech industries.

-

Despite the surprising growth in recent months, Thai exports face risks from trade tensions and manufacturing challenges ahead. Export expansion has not been broad-based and remained fragile amid weak global demand, Trump 2.0 policy, and domestic structural headwinds.

-

Private consumption is expected to grow at a slower pace, close to the overall economic growth rate. Despite low unemployment, average real wage rises only slightly, and the low-income group earns less than the pre-covid levels, reflecting still-weak purchasing power.

-

Inflation slowed in February, with a possibility of falling below the official target range ahead.

-

BOT delivered a rate cut in February as expected to mitigate downside risks, likely to hold at 2% for the rest of this year.

Krungsri Research Forecasts for 2025

2025 growth forecast revised down to 2.7% due to weak domestic economy, slow tourism recovery and limited stimulus impacts

We have revised down our 2025 GDP growth forecast to 2.7% from the previous estimate of 2.9%, due to the following factors: (i) signs of weakness in private consumption and private investment; (ii) limited impact of the cash-handout measure (Phase 2 program, worth just THB 30 bn in 1Q25 vs Phase 1 worth THB 140 bn in 4Q24); additionally, a budget of around THB 157 bn planned to finance the Digital Wallet policy this year is unlikely to contribute significantly to the economy, as observed with the impacts of Phase 1; (iii) a potential shortfall in foreign tourist arrivals, revised from the previous projected of 40 mn to 38 mn, due to the slow recovery of Chinese tourists; and (iv) the potential fading of front-loaded gains in exports, as concerns about US tariff hikes may materialize into actual tariffs.

Tourism: Slower-than-expected recovery of Chinese tourists prompts a revised forecast of 38 mn foreign tourist arrivals in 2025

In February 2025, Thailand welcomed 3.12 mn foreign tourists, down from 3.71 mn in January and a -7% decline from the same period last year (YoY). However, tourism revenue reached THB 151 bn, up 2.3% YoY. During January-February, total foreign tourist arrivals reached 6.83 mn (+6.9% YoY), generating THB 332 bn (+17% YoY). Chinese tourist recovery remains slower than expected, with February arrivals dropping to a 15-month low of 371,452 (-44.9% YoY), totaling 1.18 mn for the first two months of this year (-12.6% YoY), mainly due to safety concerns and competition from other destinations. Nevertheless, arrivals from Malaysia, Russia, and India continue to support Thailand’s tourism sector. As a result, we have revised our 2025 foreign tourist arrival forecast to 38 mn, down from the previous estimation of 40 mn.

Capital budget disbursement shows signs of acceleration, with public spending expected to remain a key driver in early 2025

Public spending in 2025 is expected to continue expanding from the previous year. In the first five months of the fiscal year 2025 (October 2024-February 2025), disbursement of the current budget reached THB 1.45 trn (+19.5% YoY), while disbursement of the capital budget totaled THB 0.20 trn (+154% YoY). Notably, capital budget expenditure showed signs of acceleration, as reflected in the February disbursement, which surged more than 100% compared to the same month last year. Additionally, the Eastern Economic Corridor (EEC) recently provided an update on the progress of U-Tapao Airport expansion project, anticipating the commencement of construction for the second runway in 1Q25. The development of U-Tapao Airport is considered one of the key infrastructure projects in the EEC, aimed at upgrading logistics, supporting tourism, and attracting investment.

Private investment is rebounding from a low base amid structural manufacturing problems and escalating trade wars

In January, the private investment index grew by 7.8% YoY (+0.5% MoM sa), mainly driven by investment in machinery and equipment. Meanwhile, investment in vehicles and construction still declined. For 2025, private investment growth is expected to turn positive, expanding by 2.6%, compared to a contraction of -1.6% in 2024. Key supporting factors include (i) government capital disbursements that will crowd in private investment and (ii) BOI's investment promotion by incentivizing projects with actual investments of at least THB 2 bn under specified conditions. Projects that receive a promotion certificate in 2025 must invest within one year to qualify for additional benefits, including a 50% corporate income tax reduction for five years after the tax exemption period ends. However, challenges remain, including persistently low business sentiment, structural problems in the manufacturing sector, and escalating trade wars.

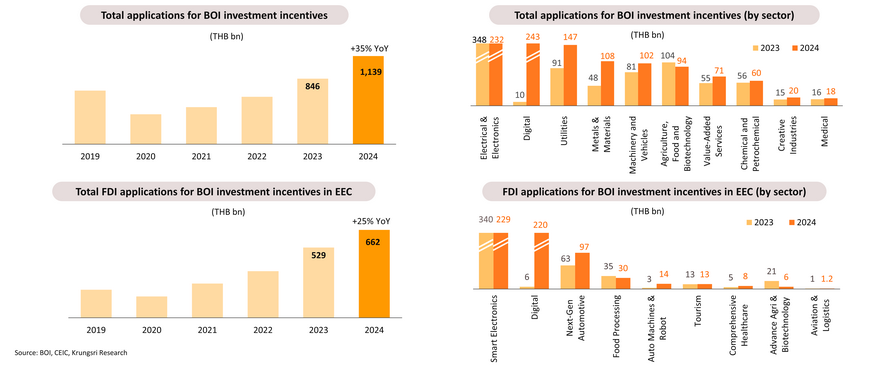

BOI indicators signal positive outlook for investment in high-tech industries

In 2024, the BOI received applications for investment incentives for 3,137 projects (+40% YoY) with a total investment value of THB 1,139 bn (+35%), led by digital industries and electrical & electronics. There were Foreign Direct Investment (FDI) applications for 2,050 projects (+51%) with a total investment value of THB 832 bn (+25%), led by Singapore, China, Hong Kong, Taiwan, and Japan. For FDI applications in the Eastern Economic Corridor (EEC), there were 1,133 projects (+47%) with a total investment of THB 662 bn (+25%), led by smart electronics, the digital industries, and next-generation automotive. The BOI has issued investment certificates for 2,678 projects (+47%) with a total investment of THB 846 bn (+72%), which would likely materialize within the next 1-3 years.

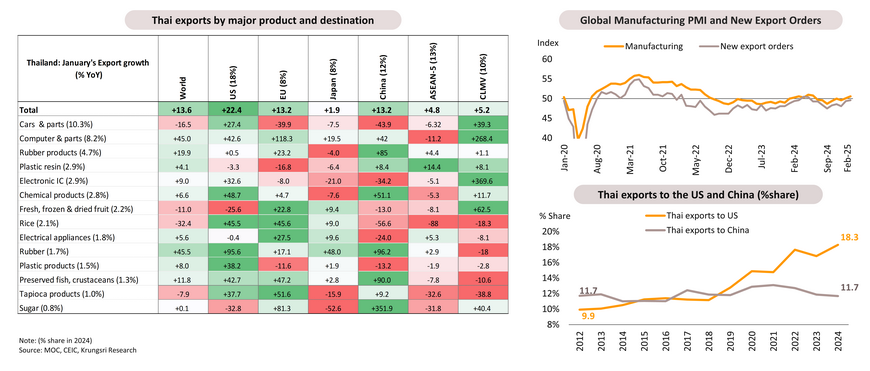

Despite surprised growth in recent months, Thai exports face risks from trade tensions and manufacturing challenges ahead

Export expansion still fragile and not broad-based amid weak global demand, Trump 2.0 policy, and domestic structural headwinds

In January, Thai exports grew 13.6% YoY (based on MOC data), led by Industrial products, which expanded by 17.0% (including computers & components, rubber products, chemical products, and electrical appliances), agro-industrial products which expanded by 3.0% (canned & processed seafood and pet food). However, exports of agricultural products decreased by -2.2%, led by rice and fresh, chilled, frozen & dried fruit. Also, exports of cars and parts continued to contract. Although global manufacturing activity has recently shown signs of improvement, escalating trade tensions may impact Thailand’s exports in the coming period.

Trump’s recent tariff plans could hurt global exports and the economy; the impact on some countries may turn negative in case of US tariffs plus retaliation from trade partners

Scenario 1: The US imposes 20% tariffs on all Chinese goods, and China retaliates with 10-15% tariffs on some US goods.

Scenario 2: Scenario 1 plus the US imposing 25% tariffs on all imports from the top 10 trading partners with the highest trade deficit (Canada, China, EU, India, Japan, South Korea, Mexico, Taiwan, Vietnam, and Thailand).

Scenario 3: Scenario 2 plus retaliations with 25% tariffs on all US goods by top 10 trading partners with the highest trade deficit.

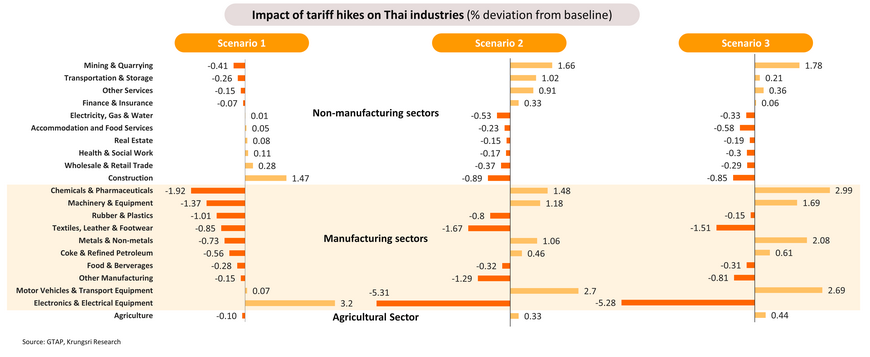

Despite gains in some sectors, negative impacts spread across many industries; the net impact turns negative in scenarios 2 and 3

Scenario 1: US imposes 20% tariffs on all Chinese goods and China retaliates with 10-15% tariffs on some US goods.

Scenario 2: Scenario 1 plus US imposing 25% tariffs on all imports from top 10 trading partners with highest trade deficit (Canada, China, EU, India, Japan, South Korea, Mexico, Taiwan, Vietnam and Thailand).

Scenario 3: Scenario 2 plus retaliations with 25% tariffs on all US goods by top 10 trading partners with highest trade deficit.

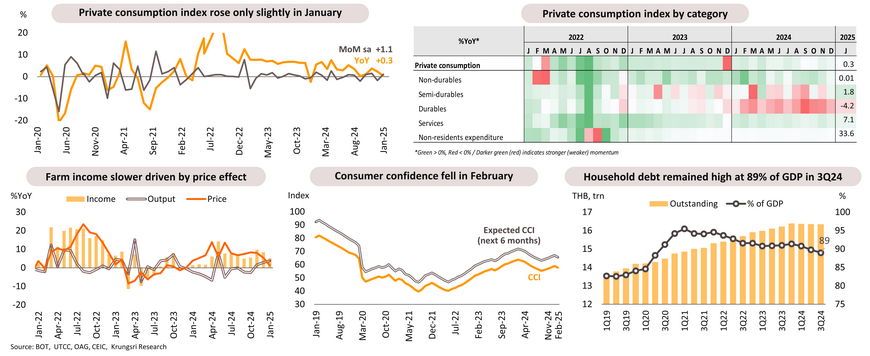

Private consumption is expected to grow at a slower pace, close to the overall economic growth rate

In January, private consumption index (PCI) grew slightly by 0.3% YoY,. Growth was supported by (i) tourism and service sector recovery, boosting employment, and (ii) short-term government stimulus measures, such as the Easy E-Receipt scheme and a THB 10,000 cash handout (Phase 2, worth THB 30 bn). However, consumption growth would be limited by several headwinds, including; (i) low consumer confidence, (ii) slowing growth of farm income due to price factors, and (iii) high household debt. We expect private consumption growth to slow from 4.4% in 2024 to 2.8% in 2025. Additionally, the government recently approved the THB 10,000 digital wallet program for 2.7 mn registered individuals aged 16-20, set to launch in June or July.

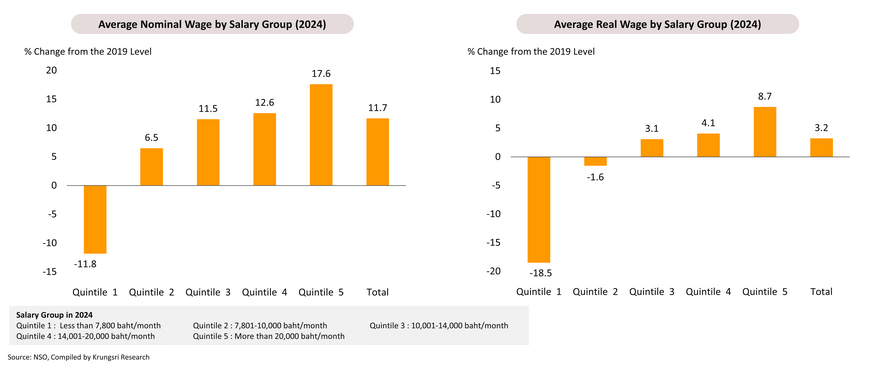

Despite low unemployment, average real wage rises only slightly, and the low-income group earns less than the pre-covid levels, reflecting still-weak purchasing power

Overall, the average nominal wage increased by 11.7% in 2024 compared to the pre-COVID level, while the average real wage grew by just 3.2%. This reflects a sluggish recovery in workers’ real purchasing power post-COVID, despite Thailand’s unemployment rate remaining around 1%. Moreover, the lowest 20% of income earners—accounting for up to 6.7 million people in 2024—face a very concerning situation, as their income remains significantly lower than pre-pandemic levels in both nominal and real terms. This reinforces the notion of slower consumption in the period ahead and the need for additional targeted stimulus for the lowest-income group instead of broad-based measures.

Inflation slows in February, with a possibility of falling below the official target range ahead

BOT delivered a rate cut in February as expected to mitigate downside risks, likely to hold at 2% for the rest of this year

Key factors in 2025: Growth to pick up only slightly with limited stimulus impacts, slow tourism recovery, structural headwinds and external risks