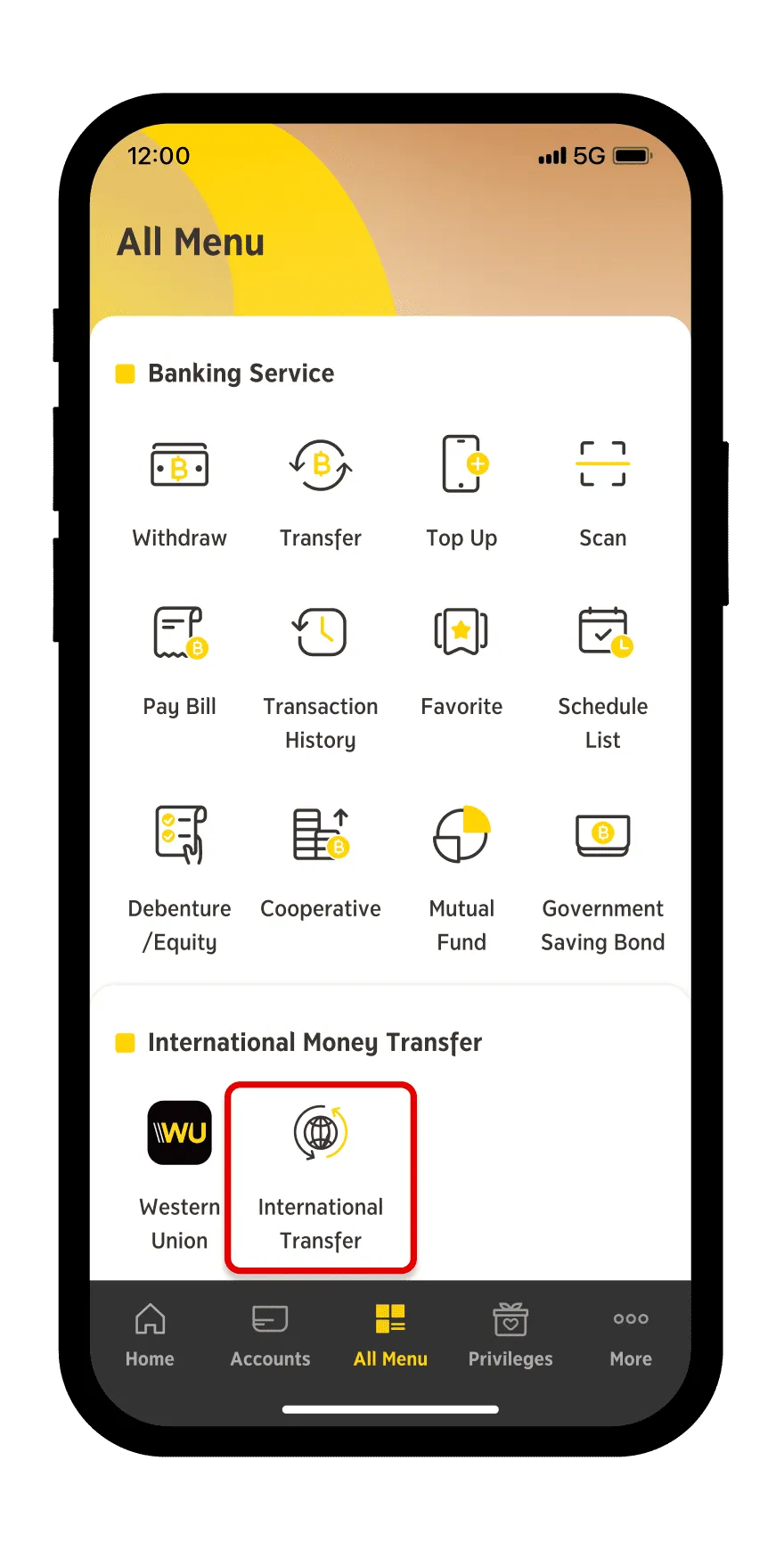

Step 1

Select "All Menu"

| Currency | Recipient’s Country | Recipient’s Account Information | Recipient’s Bank Branch Code | Estimated Time to Transfer |

|---|---|---|---|---|

| USD | United States of America | Account Number | ACH Code (9 digits) | Within 3 working days |

| EUR | European countries: Germany, France, Italy, Spain, Netherland, Ireland, Austria, Belgium and Portugal | IBAN (16 to 31 digits) | SWIFT Code (8 to 11 digits) | Within 3 working days |

| GBP | United Kingdom | Account Number | Sort Code (6 digits) | Real time |

| SGD | Singapore | Account Number | SWIFT Code (8 to 11 digits) | Real time |

| AUD | Australia | Account Number | BSB Code (6 digits) | Within 3 working days |

| International Transfer from Thailand to Singapore (Outbound) | |

|---|---|

| Transaction channel | • krungsri app |

| Transaction period | • 24 hours Daily |

| Information used for making international transfer | • Beneficiary’s mobile number registered for PayNow service with DBS, OCBC, UOB banks in Singapore |

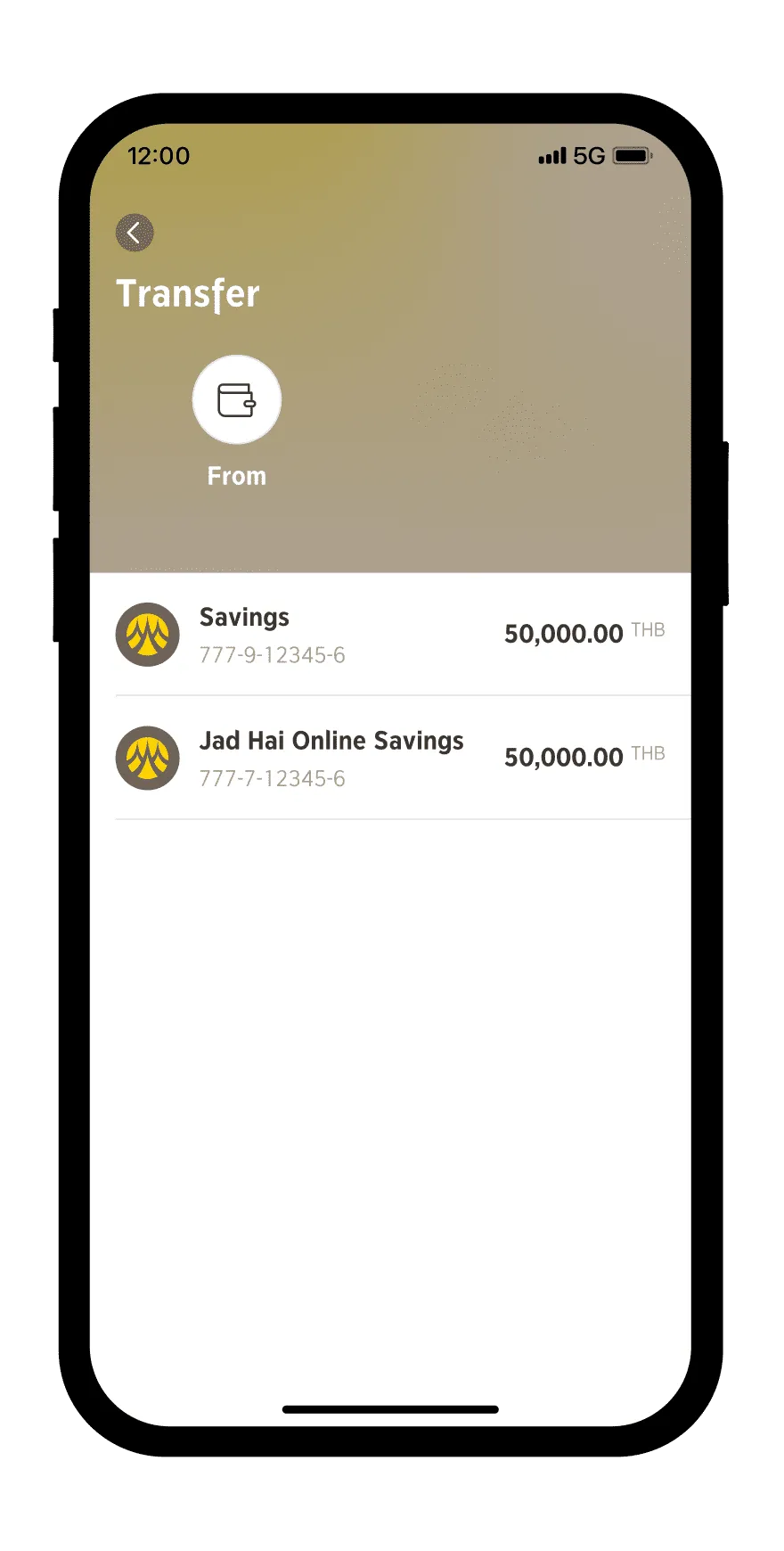

| Available account types | • Current, Savings and Special Savings |

| Currency (Beneficiary) | • SGD |

| Exchange rate | • The exchange rate is set by the Bank, which is displayed when making a transaction |

| Transfer amount | • Limited up to SGD 1,000/ transaction/ day/ User ID • The beneficiary receives the full transfer amount in SGD |

| Processing Time | • Near real-time |

| Fee | • 150 Baht per transaction (Deducted from the sender’s account, separated from the transfer amount) |

| Notification | • Via krungsri app under 'Notification' Menu |

| Activation | Able to specify an account to be used for money transfer to Singapore via krungsri app |

| International Transfer from Singapore to Thailand (Inbound) | |

|---|---|

| Condition of beneficiary | • Beneficiary must register Krungsri PromptPay with his/her mobile number |

| Transaction Period | • 24 hours Daily |

| Information used for receiving money transfer | • Beneficiary’s mobile number registered for Krungsri PromptPay |

| Available account types | • Current, Savings and Special Savings |

| Currency (Beneficiary) | • Baht (THB) |

| Transfer amount | • Limited up to 25,000 Baht/ transaction/ day/ customer • The beneficiary receives the full transfer amount in Thai Baht (THB) |

| Processing time | • Near real-time |

| Fee | • Exempted |

| Notification | • Via SMS and krungsri app notification (in case that the beneficiary using krungsri app) |

| Activation | • Subscribe/unsubscribe the service of inbound money transfer from Singapore through the following channels:

- krungsri app

(For customers who have already registered for Krungsri PromptPay with a mobile number with Krungsri before September 7, 2022, Krungsri has already provided the inbound transfer service in order to comply with terms and conditions of the Bank of Thailand’s regulations.)- Krungsri branch |