krungsri app, the latest mobile banking service that simplifies all your financial needs. Whether you're looking to open a savings account, apply for loans, a credit card, or manage your mutual funds, krungsri app has got you covered. It is user-friendly, convenient, and more secure than ever, allowing you to effortlessly monitor your financial transactions and improve your money management.

- Manage all your finances with ease and convenience, now simpler than ever before

- Access the new Quick Menu on the home screen for fast and convenient shortcuts for Transfer, Pay Bill, Top Up and Scan

- Stay up-to-date with the latest transactions, privileges, and news through easily accessible categorized notifications

- Financial Assistant on your Home screen provides valuable insights and ensuring that you will never miss important opportunities

- Customize your home screen to your unique preference by managing widgets for Quick Balance, Favorites, and Quick Menu

- Change Background to fit your own personal lifestyle

- Request an online statement that is available for up to the past 12 months

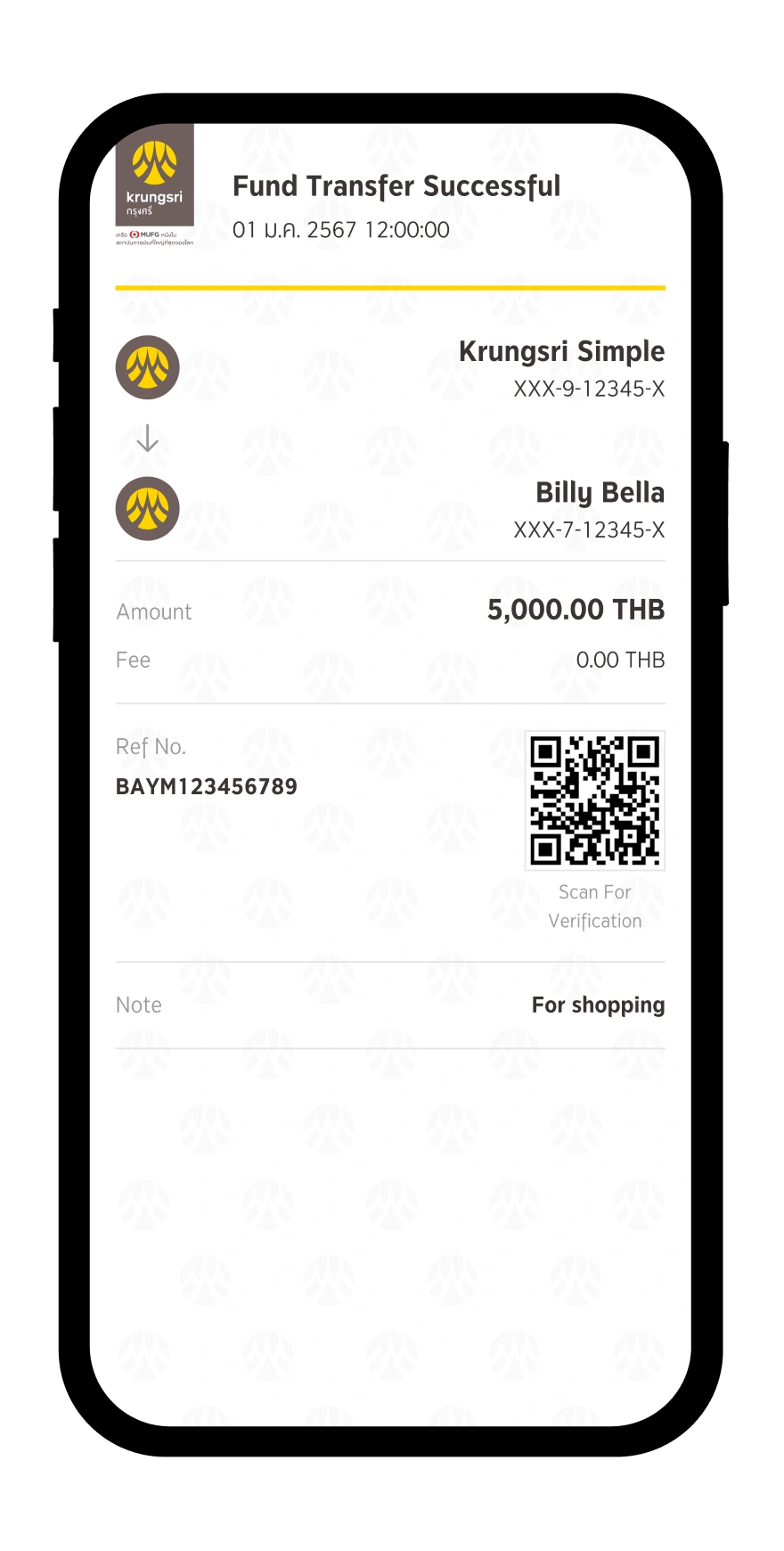

- Get all your needs fulfilled with features such as applying for PromptPay service, cardless withdrawal, managing favorites, scheduling transfers or bill payments, making international transfers, scanning for QR cross-border payments, and much more