Global: The Great Reopening – is recovery sustainable?

Recovery driven by pent-up demand and supply bottlenecks, inflation not sustainable

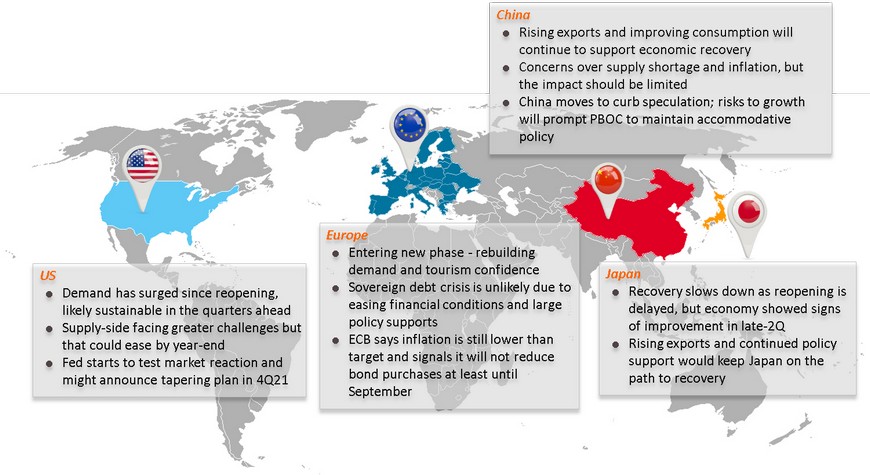

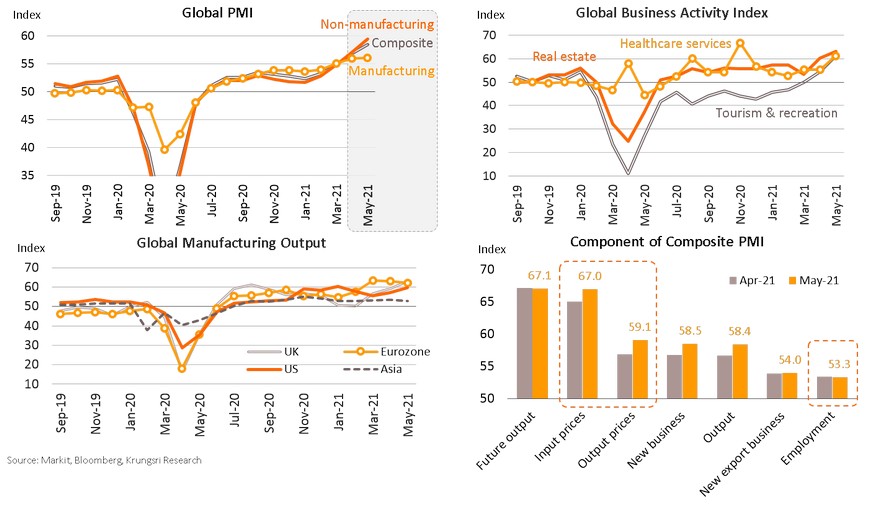

Reopening - especially in the US and Europe - has triggered a sharp rise in economic activity. The Global Composite PMI reached a 15-year high in May. Non-manufacturing PMI has overtaken Manufacturing PMI for the second consecutive month with the surge in tourism activity. Pent-up demand also led to supply bottlenecks, which pushed prices higher. But these are idiosyncratic factors and will not sustain current inflation trends. In fact, employment index is steady and continues to trail other components in the PMI survey. This implies the global economy is still far from a full-fledged recovery and many countries would take a longer time to achieve policy normalization.

Deal to set 15% global minimum tax rate could encourage reshoring, trigger outflows from tax-haven developing markets

The G-7 countries have reached a historical deal to impose a 15% minimum corporate tax rate to eliminate the race to the bottom. Under the deal, countries where big firms operate would get the right to tax at least 20% of profits exceeding a 10% margin. This could also apply as a digital services tax for tech giants such as Amazon, Facebook and Google. Tax revenues are expected to increase, particularly in US where the most profitable multinationals have their headquarters. The minimum rate would reduce the corporate tax gaps between countries and possibly decrease the benefits of being a tax haven such as Ireland, Hungary and most developing nations. Although some companies would not relocate because they focus on responding to local demand, the smaller tax incentive could encourage some firms to return to their home country, but the process would take time. Looking ahead, as floor tax rates are equal worldwide, it would take other factors to attract investments, such as a conducive business environment, easy access to resources, and ease of doing business. This suggests developed countries are likely to benefit more because they have better infrastructure, while the OECD countries have the most-business friendly regulations. Hence, developing countries need to plan and upgrade infrastructure and facilities to retain investments and prevent the loss of business opportunities over the longer-term.

US: Demand has surged since reopening, and is likely to persist in the quarters ahead

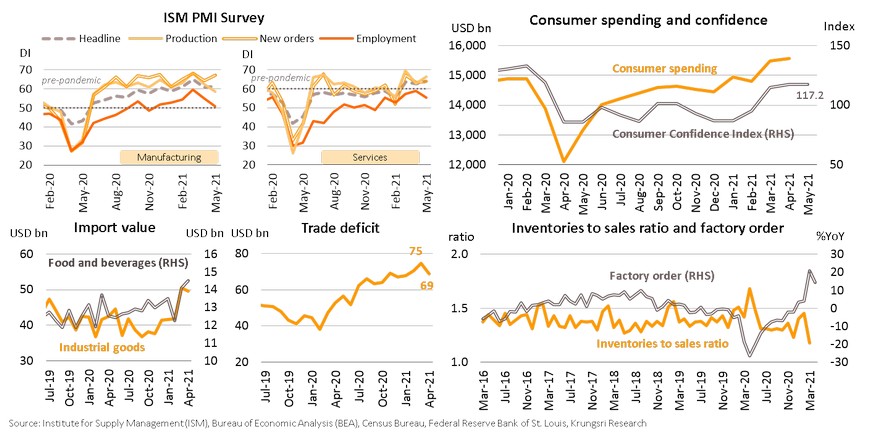

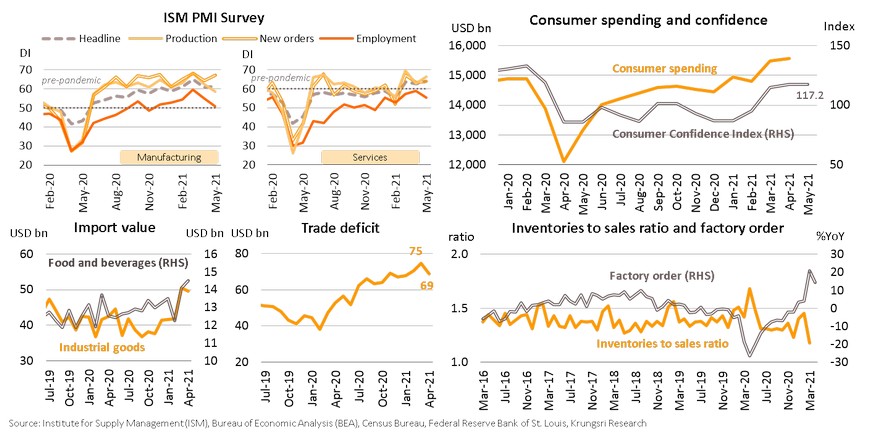

Economic activities continued to gain momentum driven by pent-up demand, remaining cash aid under stimulus packages, and rising employment. Manufacturing PMI expanded in May driven by surging new orders. Employment fell due to supply-demand imbalance in the labor market. Services sector PMI revealed significant developments compared to the previous quarter and the reading is the highest in the series’ history. Spending and confidence continued to trend up. Consumer spending rose in April and has remained above pre-crisis levels. May Consumer Confidence Index is higher than last year. Rising demand is also reflected in escalating import values for industrial and consumer goods, which pushed trade deficit to USD68.9bn in April. However, businesses are struggling to secure supplies. Inventory to sales ratio had started to drop in March. Looking ahead, consumption would continue to expand this year because of available cash aid from stimulus programs and businesses are willing to hire again, which would generate more employment and lift purchasing power. However, consumption would shift from manufacturing products to services upon full reopening.

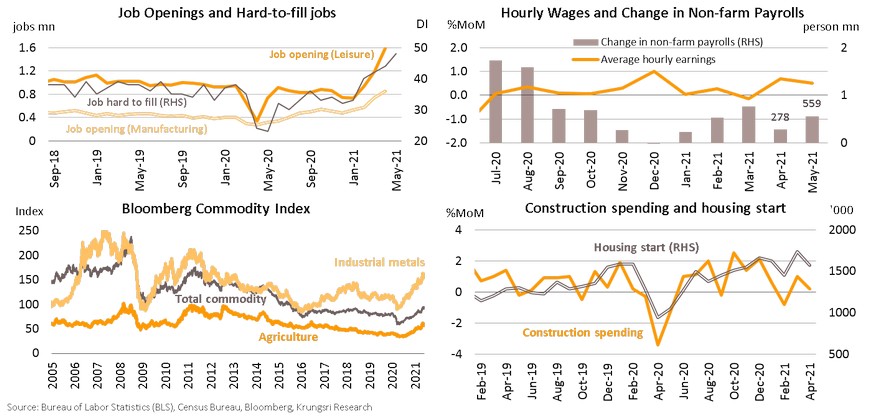

Supply-side facing greater challenges but that could ease by year-end

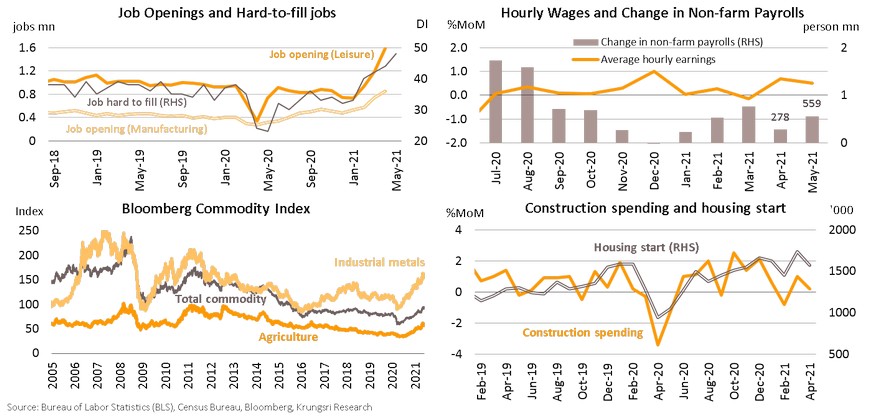

Supply bottlenecks amid surging demand could rein in the acceleration of economic growth but it would ease by year-end. Labor supply is recovering slower than demand. Although reopening the services sector generated the largest gains in employment, workers have little incentive to return to work mainly because of a mismatch in skills and some are still receiving unemployment benefits. Job openings and reports of hard-to-fill vacancies are at their highest, and non-farm payrolls are weaker than consensus expectations. However, that could be resolved by raising wages and offering bonuses. In addition, supply disruptions have pushed up commodity prices. The Commodity Price Index is at its highest since 2015, led by industrial metals prices. This capped construction spending and housing starts in April. Both labor and material shortages would likely cap upside for economic growth and drive up inflation towards 3Q21. However, these problems are transitory and could soften in the last quarter of the year, due to (i) expiry of unemployment benefits in September, (ii) lower demand for industrial goods as consumption would shift towards services, and (iii) production would return to normal in response to recovering global demand. This suggests the economy would be only slightly affected and would continue to recover in 2H21.

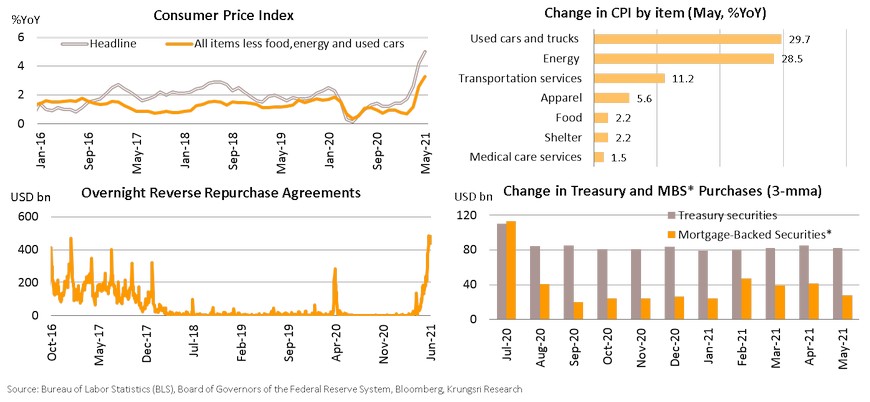

Fed starts to test market reaction and might announce tapering plan in 4Q21

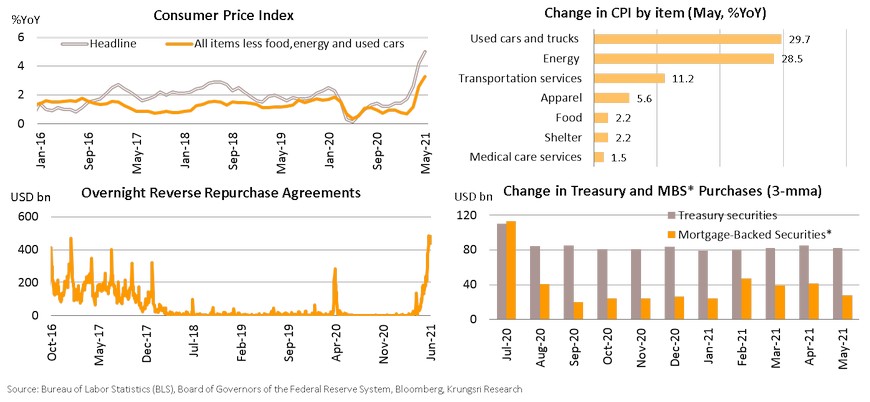

Given the stronger-than-expected economic recovery and rising commodity prices, there is mounting expectations of a policy shift. Headline CPI reached 5.0% YoY in May due to pent-up demand, tighter supply, and low-base effect. The higher inflation was mainly driven by used cars and energy prices, while prices of other goods rose moderately and are unlikely to threaten the real economy. Average CPI inflation could settle down at 2-2.5% in 2H21 after the low-base effect from energy prices fade and supply problems are eased. In late-May, overnight reverse repurchase volume soared to a new high of USD485.3bn as cash from stimulus had flowed into the money market and needs to be invested. And 0% overnight rate is better than negative yields for other bills. Shortly after, the Fed plans to sell corporate bonds and ETFs under the Secondary Market Corporate Credit Facility starting summer. We suspect this is the Fed’s way to test market reaction and would have little impact given the small size of holdings (USD14bn). On the QE program, latest data show purchases of Treasury securities have been stable at around USD80bn per month. They bought slightly less Mortgage-Backed Securities in May but the volume is higher than last year. In our view, the Fed would continue to buy at this pace in 3Q21 and start to talk about tapering at upcoming meetings. However, job numbers are still below expectations at 7.6 million jobs short of pre-pandemic level. This means the Fed is unlikely to signal a policy shift before the Jackson Hole meeting in late-August, which might pave the way for formal tapering announcement in 4Q21.

Europe: Entering new phase - rebuilding demand and tourism confidence

The region has lifted most restrictions in recent weeks and business activities have picked up markedly in 2Q21. The outlook for Eurozone is brighter, driven by strong rebound in the services sector, rising demand, and optimism towards the summer tourist season. Composite PMI rose to 56.9 in May, the highest since the pandemic started. Manufacturing PMI expanded at a steady pace amid supply shortages, while Services PMI confirmed the resumption of activities after reopening. Trade data indicates domestic demand is bouncing back. Eurozone imports from outside the bloc are at their highest since 2017, while exports have started to rebound after tumbling last year. The lifting of lockdowns also unleashed international tourism. European airlines have increased flights for summer season by 5 times compared to March, reaching 70% of pre-pandemic level. Moreover, countries that are welcoming back in-bloc travelers and American tourists could see stronger recovery through 3Q21, due to the largest proportion of arrivals. Rising demand and hopes of rebuilding the tourism sector have lifted the confidence index for services sector to positive level since March 2020. Looking ahead, the eurozone would continue to recover in 2H21. Strong demand in the services sector, which accounts for two-thirds of GDP, could play an important role in supporting growth.

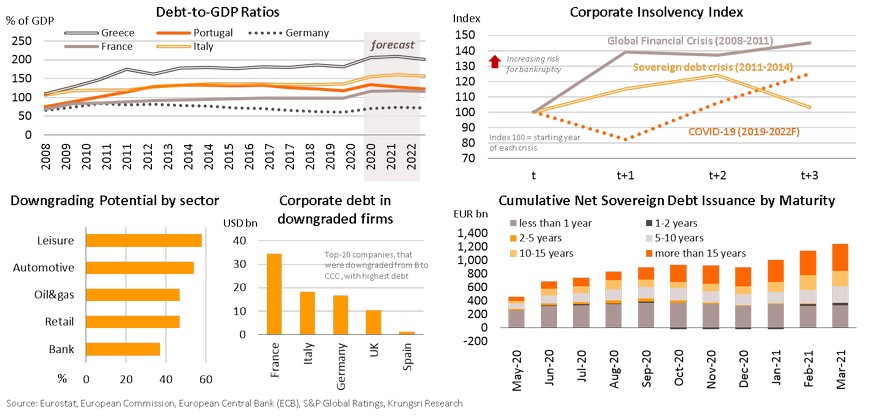

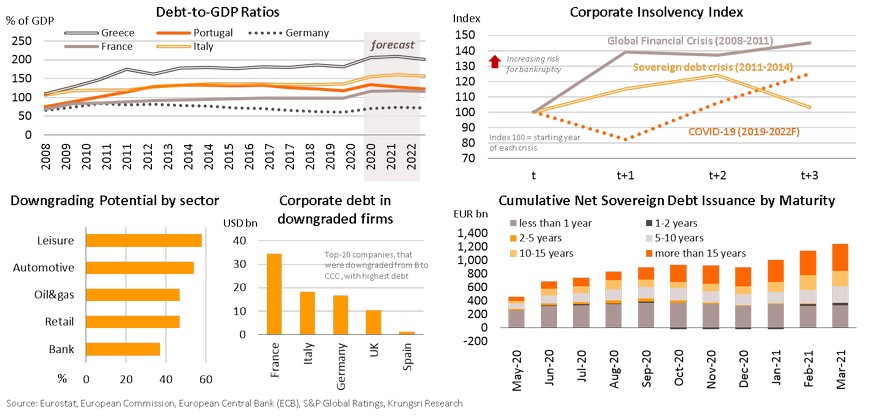

Sovereign debt crisis is unlikely due to easing financial conditions and large policy supports

Although the eurozone is on the path to recovery, the COVID-19 shock has pushed up public debt significantly. Debt-to-GDP ratios will remain well above 100% through to 2022, led by Greece and Italy. For corporates, there would be rising concerns if public supports start to fade in late-2022, especially in countries that are heavily reliant on pandemic-sensitive sectors. Leisure, automotive and transportation sectors have been the hardest hit by the pandemic and would see strongest downgrade potential in Europe. Downgraded companies with the highest debt levels were bunched up in France. However, there is unlikely to be a debt crisis in the next two years as large supports would keep insolvency risks low, unlike during the Global Financial and Sovereign Debt crises. In addition, the companies could rebound significantly from the crisis and resume normal operations after 2023. Moreover, the ECB would maintain favorable financial conditions at least until 2023 and governments are more cautious about issuing debt than during previous crises. In the low interest rates environment, they have decided to shift to issuances with longer-term maturity, especially bonds with more than five years maturity, which would reduce rollover risks. The mix of factors coupled with a stronger economic recovery could offset the impact of rising debt servicing ratios and then would alleviate risk of the debt crisis.

ECB upgrades growth and inflation outlook but signals it would not reduce bond purchases at least until September

The European Central Bank (ECB) had at the 10 June meeting, voted to keep key interest rates and bond-buying packages unchanged despite the relatively strong economic recovery. Their projections signal a more optimistic outlook. The economy is expected to expand by 4.6% in 2021 followed by 4.7% next year, while inflation would likely hit 1.9% this year. Latest data show inflation jumped to 2% in May, which is technical above the ECB’s target of ‘below but close to 2%’. Producer Price Index is at its highest since 2008 but the ECB cited the temporary surges, including supply bottlenecks and higher fuel costs, would not be a threat to the economy. At the June meeting, policy makers renewed their pledge to conduct a 'significantly higher pace’ of PEPP purchases than in 1Q21. The ECB is expected to stick to EUR20bn per week bond purchases at least until the September meeting, to ensure economic recovery is sustainable. In addition, this continued recovery would also be supported by favorable financial conditions and low borrowing costs like in 2Q21. In 2022 and 2023, subdued underlying prices would lead to softer inflation. This means the ECB would continue to provide stimulus through bond purchases until the cumulative amount hits the program’s ceiling of EUR1.85trn. Bond purchases are expected to drop to EUR14.6bn per week from 4Q21 to March 2022.

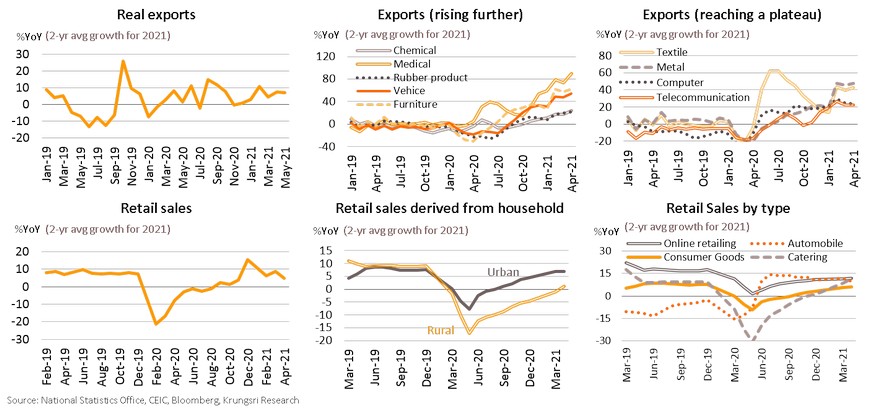

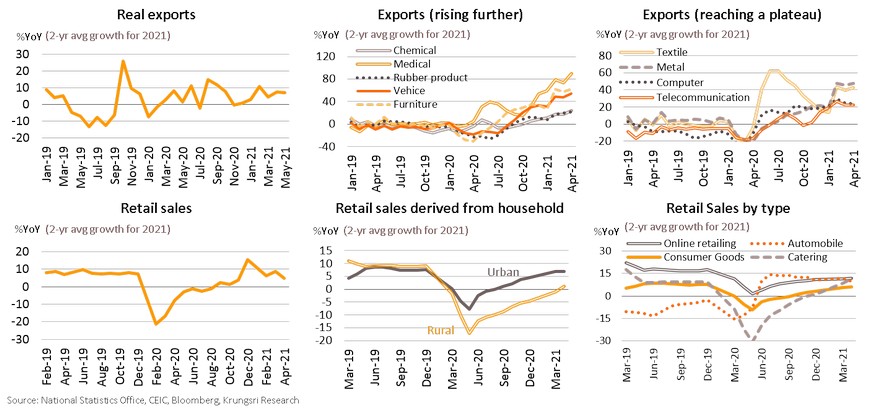

China: Rising exports and improving consumption will continue to support economic recovery

China's exports should continue to grow. Exports to major markets - especially the US and EU - are rising following the resumption of business operations, as well as to Asian markets which will continue to grow along with stronger intra-regional supply chains. Many of the top 10 major export items have continued to gain momentum, including vehicles, furniture, and medical products resulting from rising health awareness and demand for medical supplies. The other top-ranking export products, which account for around one-third of total exports, are experiencing steady growth. Household consumption should continue to improve but pent-up demand will gradually subside. Retail sales derived from urban households has been rising steadily to account for 86.6% of total spending. However, rural household spending has just started to recover, indicating an uneven improvement. Moreover, half of total spending – in automobile and online shopping – is growing moderately, while catering has rebounded at the beginning of this year. In 2H21, China's economic growth is likely to stabilize, premised on expectations of moderate export growth. In addition, an improvement in the labor market – falling unemployment and rising wages - could support a gradual recovery in consumption.

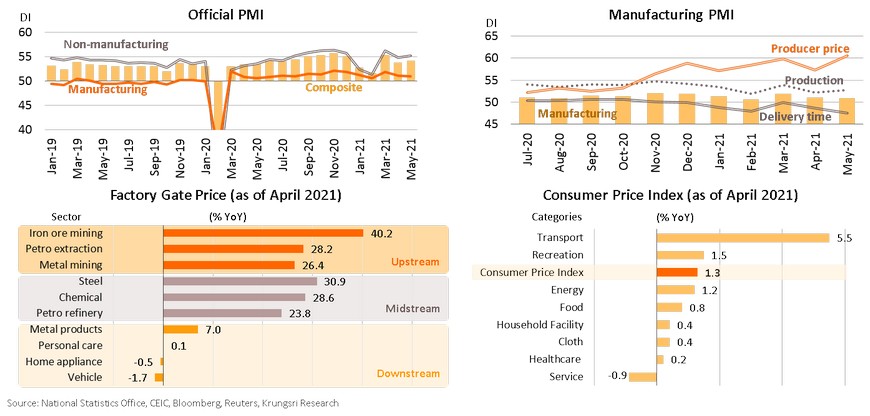

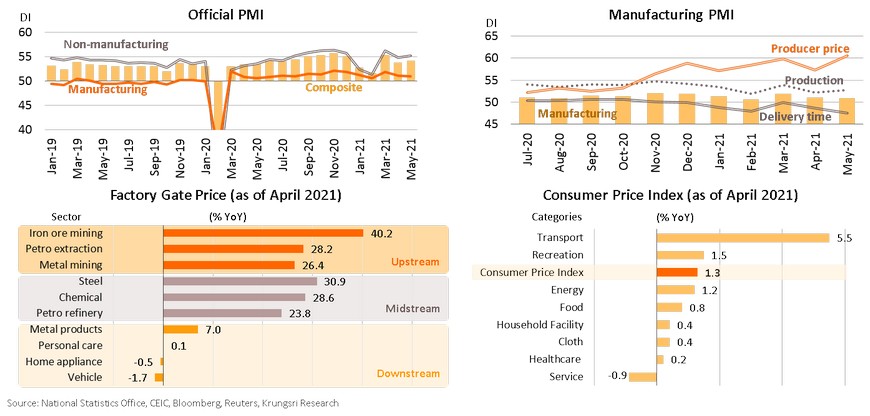

Concerns over supply shortage and inflation, but the impact should be limited

May Composite PMI had risen mainly due to better Non-manufacturing PMI data. Manufacturing PMI fell slightly, reflecting longer delivery time sub-index due to supply constraints. But the production curtailments are expected to be temporary because (i) the surge in consumption triggered by pent-up demand abroad after reopening is not sustainable; (ii) transportation bottlenecks – shortage of container shipping capacity and congestion at southern Chinese ports - triggered by the latest outbreaks should ease next month as officials have started to relax restrictions in response to lower daily COVID-19 cases; and (iii) prompt response from the government to mitigate the impact, including introducing CNY300bn financial supports to help businesses cope with rising costs and liquidity shortage. Commodity prices have risen and driven up production costs for upstream manufacturers. Meanwhile, higher profits at some upstream producers could have spilled over to soften costs at midstream and downstream producers, especially state-owned mining and metal enterprises. This helped to limit the impact on consumer prices as only prices of a few items - like transportation and recreation - have risen in line with the recovery in the services sector. In fact, prices of consumer goods rose only slightly. Looking ahead, supply constraints would have a temporary impact on China’s economy, and we project stable growth for the rest of the year.

China moves to curb speculation; risks to growth will prompt PBOC to maintain accommodative policy

The People’s Bank of China (PBOC) and other regulators have stepped-up prudent measures to curb exposure to risks since the beginning of this year, including restrictions to rein in excess lending in the property sector. Although the measures are aimed at curbing speculation and to prevent the economy from overheating, they have created negative side-effect on the real economy. Property sales have been falling since February. Public and private investment growth have slowed down. Recently, they introduced a range of measures to limit speculation on the yuan, commodities, and even bitcoin. These measures might address the price spikes but could also be a risk to economic growth. Looking forward, Chinese authorities and the PBOC would continue to implement prudent targeted measures to avoid unintended widespread impact. At the same time, the PBOC is expected to maintain an accommodative policy to sustain growth in the private sector and encourage a broad-based recovery in the real sector.

Japan: Recovery slows down as reopening is delayed, but economy showed signs of improvement in late-2Q

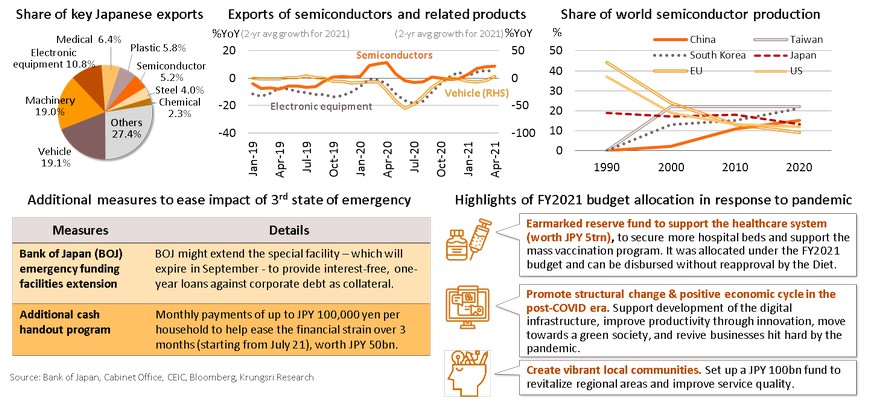

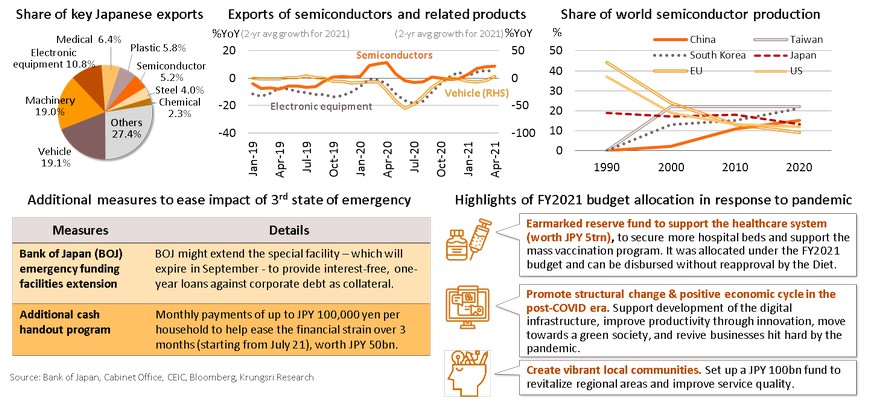

Proclamation of the third state of emergency has affected Japan’s economic recovery. Restrictions to contain domestic COVID-19 cases had reduced retail sales in April and the Services PMI fell to contraction territory in May. The delayed reopening of the economy means Japan’s recovery will trail behind other major countries. If the Olympics is cancelled, it would cause up to JPY 4.8trn economic loss (0.9% of GDP). However, latest high-frequency indicators reflect the situation is improving. The industrial sector has been resilient amid the latest outbreak. Manufacturing PMI has risen along with the Industrial Production Index, suggesting the manufacturing sector could partly offset the slow services sector. Moreover, exports continued to deliver positive signs driven by a cyclical recovery at trading partners’ economies. These improvements also led to better labor market conditions and real wages have risen at the steepest pace since November 2018. Looking forward, there will be positive factors to support economic recovery in 2H21, including the following: (i) exports would continue to rise along with progress in mass vaccinations worldwide, which should support the recovery in production and the labor market, (ii) accelerating vaccination program to reach herd immunity by November (target), and (iii) additional stimulus from FY2021 budget, including a new cash aid from July.

Rising exports and continued policy support would keep Japan on the path to recovery

Exports would be the key driver of the Japanese economy. The top-5 major export items (62.1% of total exports) should continue to register growth given progress in mass vaccination and improving economic activity with the reopening of major trading partners’ economies, which would be more pronounced in 2H21. Despite the global supply shortage, Japan’s exports of vehicles and electronic equipment will grow along with rising shipments of semiconductors. In the global supply chain, Japanese manufacturers have strong advantage in upstream semiconductor materials, accounting for 12% of global semiconductor production in 2020. In terms of policy supports, Japan has introduced more relief schemes in response to the latest outbreak. The Bank of Japan (BOJ) is prepared to extend the emergency funding facilities beyond September 2021 and the government would hand out up to JPY 100,000 cash aid per household starting July, for three months. The government has also introduced (i) a JPY 5trn reserve fund to support the healthcare system, (ii) JPY 100bn local community fund, and (iii) JPY 200bn fund to support domestic chipmakers, to improve their competitiveness and prevent chip shortage. The total value of all the relief measures is JPY5.35bn, or 1% of GDP. Looking ahead, rising exports and the continuation of stimulus measures would soften the impact of the latest outbreak and keep recovery on track.

Thailand: Lower risk but high uncertainty during transition period

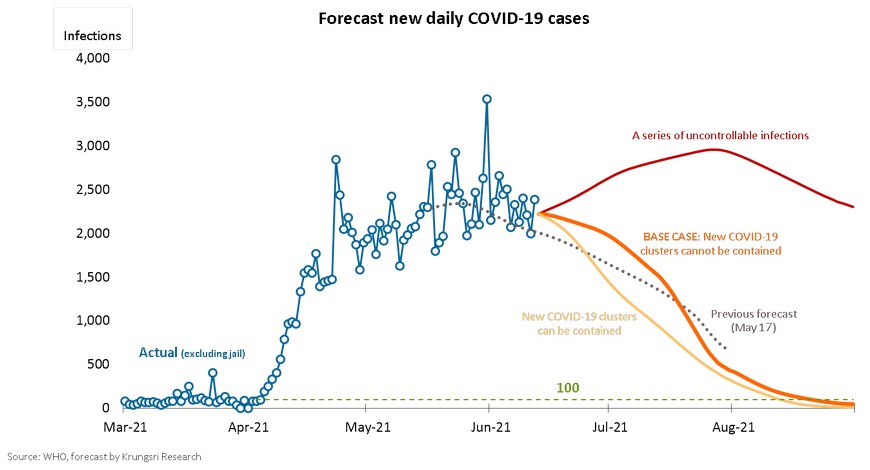

Third wave could be contained by mid-August; lower downside risk to growth

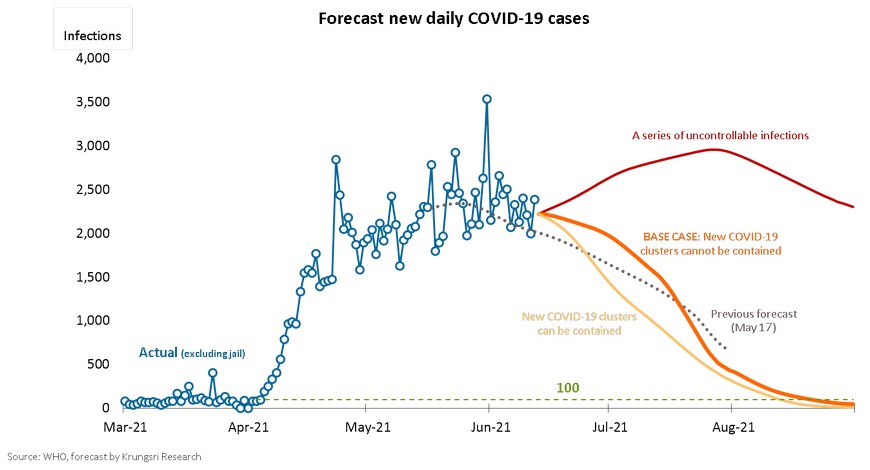

- Based on 250k-270k doses of vaccines dispensed daily (vs 281k average during June 7-13), Thailand would have dispensed 55mn doses by year-end (Thai population is 67mn). The vaccination program is progressing in line with our expectation, so the number of daily new cases should drop. Krungsri Research sees smaller downside risk from COVID-19, especially after July, and we expect the number of new daily cases to drop below 100 by mid-August.

Domestic activities show signs of bottoming out. Phuket Sandbox - One small step for the economy, a giant leap for Thailand.

- In early June, new daily cases remained high but some sectors showed signs of improvement, represented by the Google Mobility Index. Phuket Sandbox is expected to start as planned but the number of foreign tourists in 3Q21 would remain low. Phuket Sandbox is 'the' first step for Thailand, an important move that would determine whether a full reopening is possible.

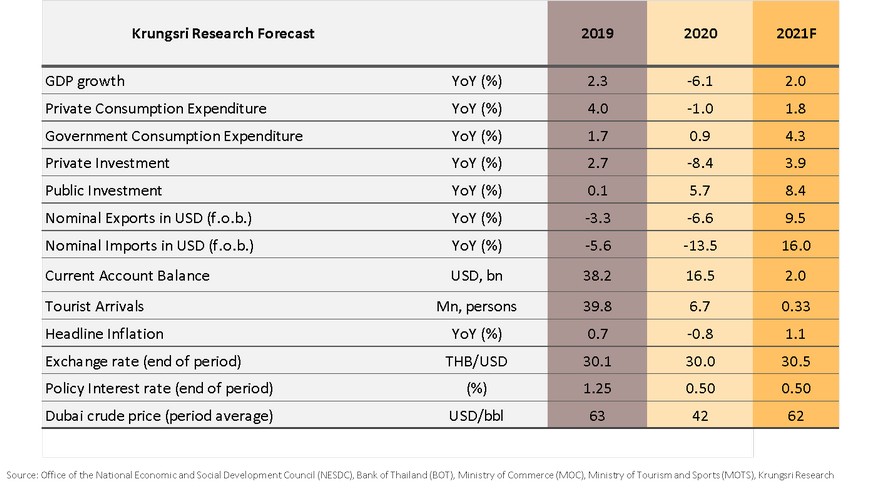

Recovery will remain uneven. The pandemic has hurt consumption but investment is picking up. Policy supports could limit downside risk but we maintain 2021F GDP growth at +2% due to still-high uncertainty.

- More broad-based growth in export products will support manufacturing production and private investment ahead.

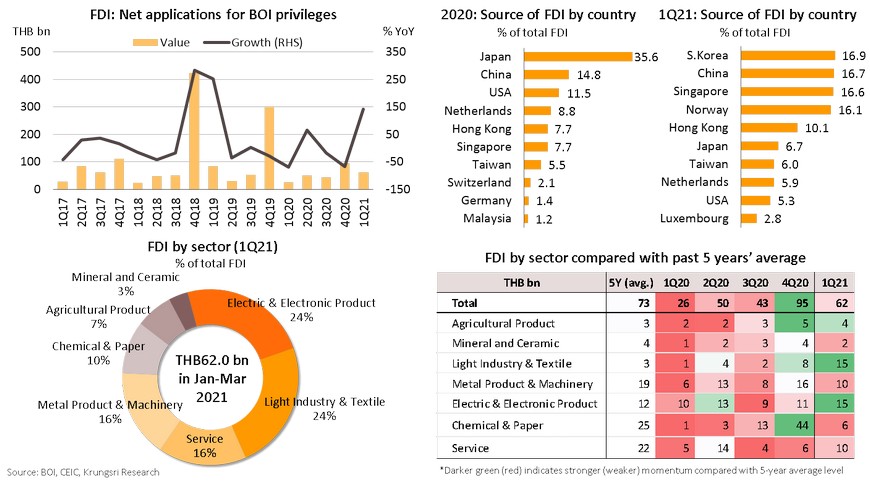

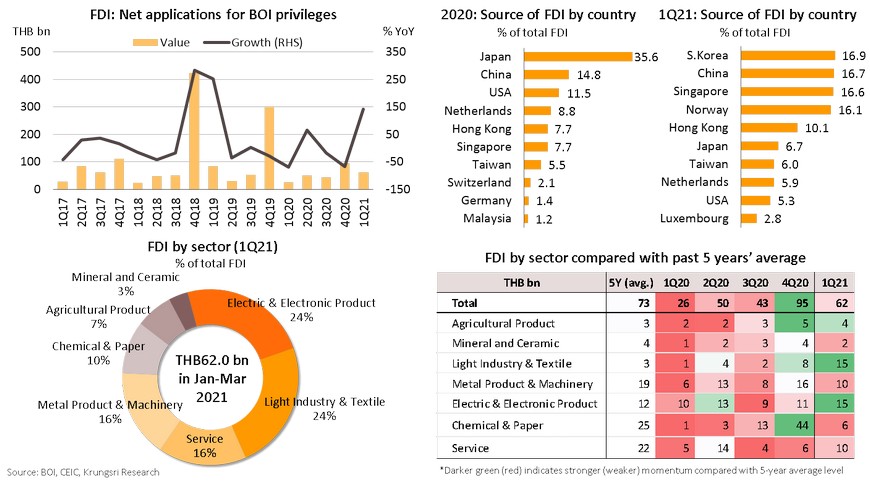

- Consumption remains weak but investment is picking up, reflected by rising investment value of applications for BOI privileges. For FDI, the quarterly value of applications submitted to BOI is not far from the 5-year average.

- Krungsri Research is maintaining 2021F GDP growth at +2.0% despite additional stimulus measures. We are not in a hurry to revise our growth forecast due to high uncertainties over the pandemic, vaccine procurement, and inoculation program.

To continue with targeted policy; peer pressure should not influence Thai policy rate direction this cycle

- Given an uneven economic recovery, authorities are focusing more on a targeted monetary policy. In the foreseeable future, peer pressure from other Asian countries which would signal policy rate hikes next year, should not be a major determinant of policy rate direction in Thailand. This is because the pace of economic recovery is different among countries, and Thailand may take longer to achieve a broad-based recovery. Hence, the MPC is expected to keep the policy rate at a record low this year and next year.

Thailand Economic Outlook 2021

Lower downside risk from COVID-19 but daily new cases are projected to remain high

In our base case (where some COVID-19 clusters cannot be contained; Orange line), daily new cases would remain well above 2,000 up to end-June. However, the mass vaccination program has started in Bangkok on 7 June and we estimate 250k-270k doses of vaccine would be dispensed daily. That implies 55 million doses dispensed by the end of this year. That should reduce new daily cases across the country. Krungsri Research sees smaller downside risk from COVID-19 after July, and expects new daily cases to drop below 100 by mid-August. However, if the vaccination program is progressing slower-than-expected and new COVID variants become a threat, the outlook would be worse. That could lead to several outbreaks (Red line). The number of new daily cases could remain above 2,000 at least until the end of August.

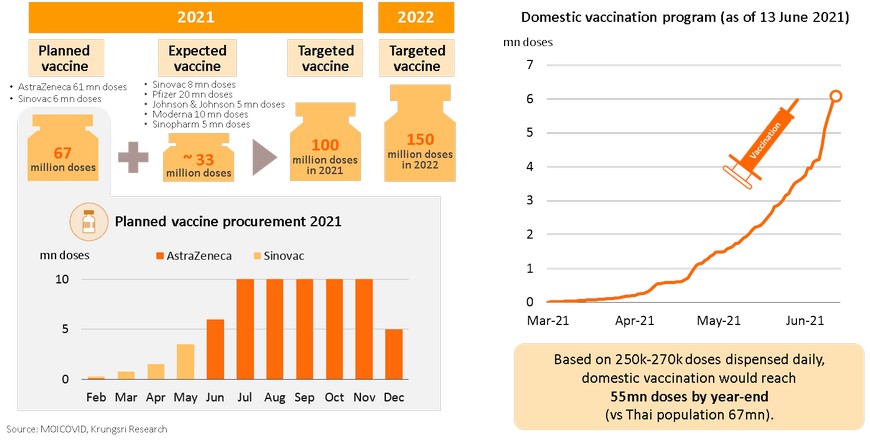

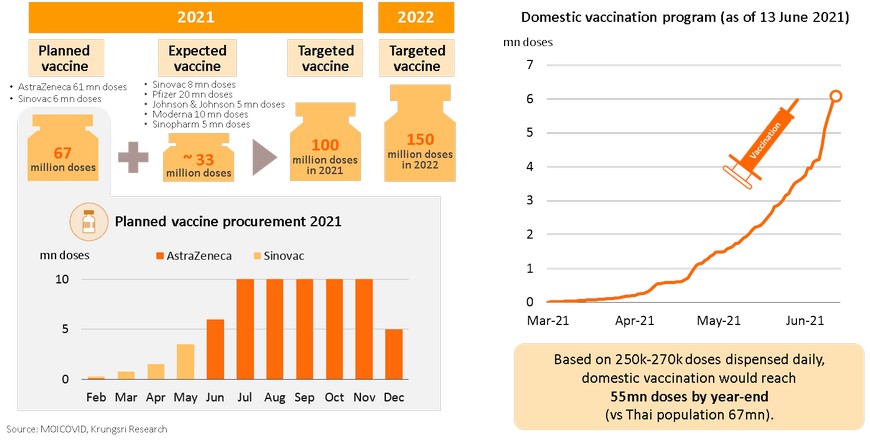

Accelerating vaccination would contain the epidemic in Thailand and boost confidence

The mass vaccination program was rolled out nationwide since June 7. By June 13, Thailand have dispensed 6.2 million doses. The government has planned to procure a total of 25 mn doses of Pfizer and Johnson & Johnson vaccines, 8 mn doses of Sinovac vaccine, 10 mn doses of Moderna vaccine, and 2 mn doses from Sinopharm, to reach its target by end-2021. The government expected to receive 100mn doses by year-end and is targeting 150 mn next year. Based on 250k-270k doses dispensed daily (vs average of 281k daily during June 7-13), Thailand would have dispensed 55mn doses by year-end (vs Thai population 67mn). If the mass vaccination program goes as planned, it would boost confidence substantially and reduce downside risk to Thailand’s economic recovery.

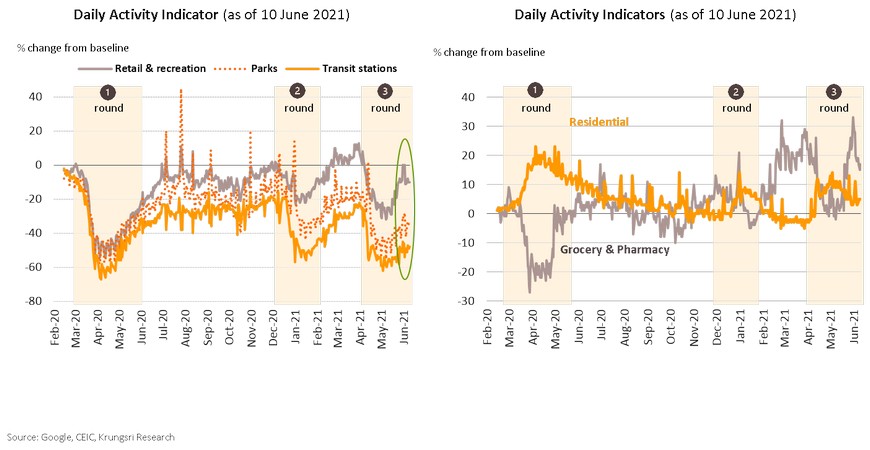

Signs of bottoming out: Domestic activities have been hit hard by third wave in 2Q but has been improving in June

Daily new COVID-19 cases remained high in early June and there were several new clusters, but some sectors showed signs of improvement, reflected by Google Mobility indices for Retail & Recreation and Grocery & Pharmacy.

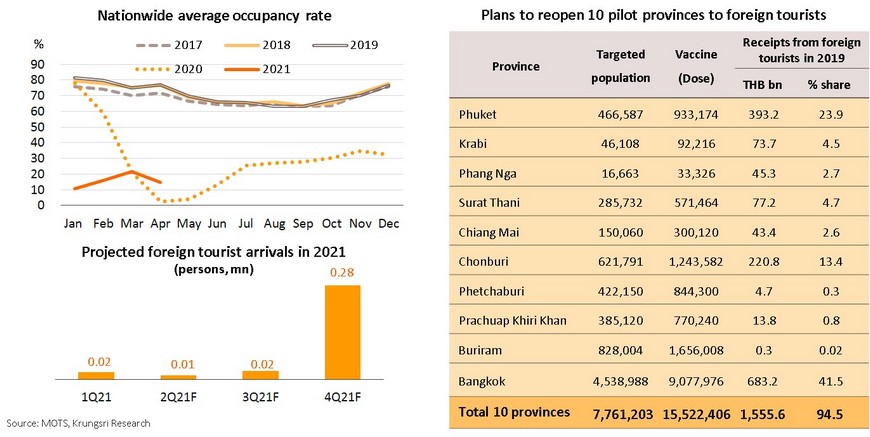

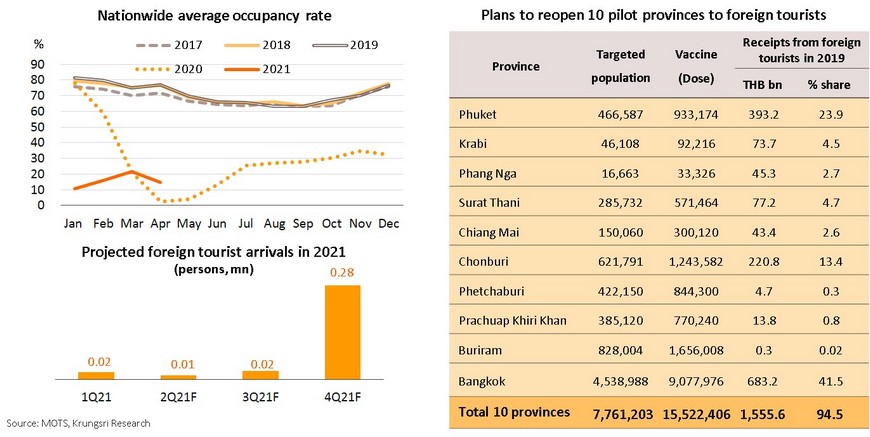

Plans to reopen tourism sector: Phuket Sandbox - One small step for the economy, a giant leap for Thailand

The tourism sector remains lackluster in 1H21, reflected by very-low occupancy rates. The government has identified 10 pilot provinces where they will reopen the tourism industry to foreign tourists, starting with the Phuket Sandbox program on 1 July. They will open other provinces in stages, after they have dispensed sufficient vaccines to achieve herd immunity in each of the provinces. Officials are targeting 129,000 foreign tourist arrivals in 3Q21. In our view, although the Phuket Sandbox could start as planned, we project foreign tourist arrivals in 3Q21 would be half the official target, for the following reasons: (i) foreign tourists would remain worried about the COVID-19 situation in Thailand, (ii) slow recovery of Thailand’s key tourist source markets, such as China, India and Japan; (iii) restrictions at departure cities, and (iv) uncertainty over the procurement and distribution of vaccines. However, Phuket Sandbox will be 'the' first step for Thailand, which is an important move that would determine whether a full reopening is possible. Before the pandemic, foreign tourist receipts at the 10 pilot provinces accounted for up to 95% of total receipts from foreign tourists.

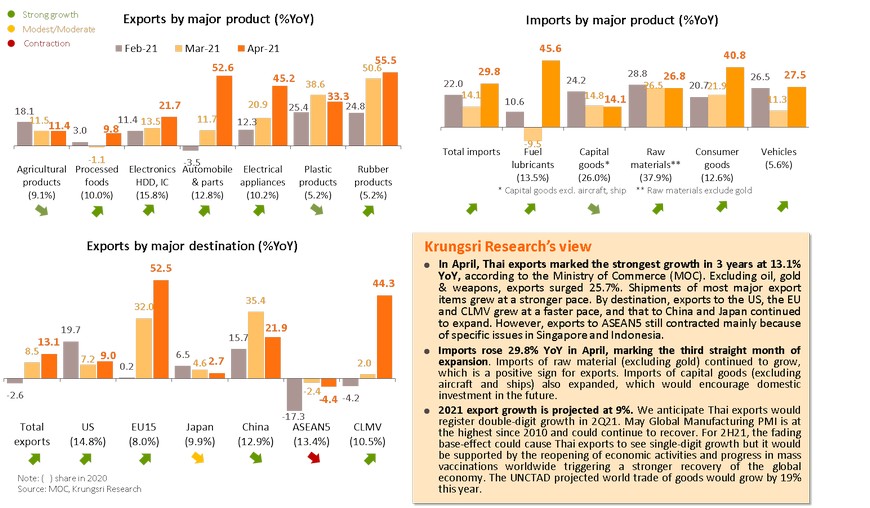

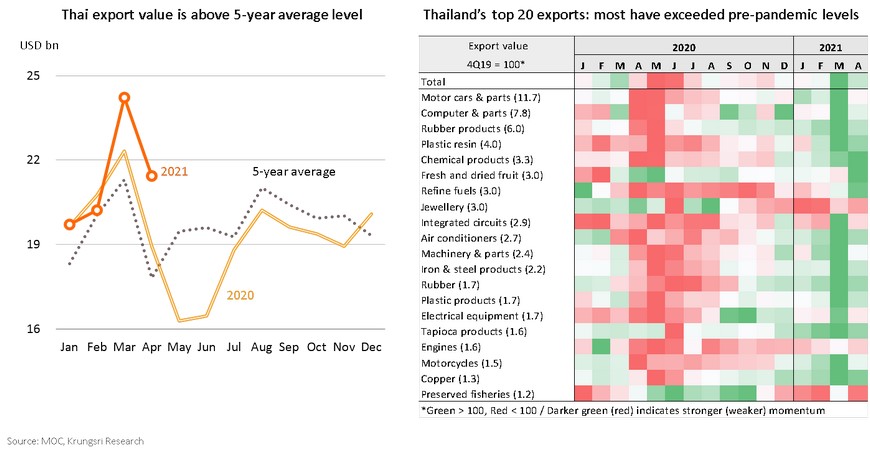

Key driver: Exports gain momentum; imports signal rising external and domestic demands

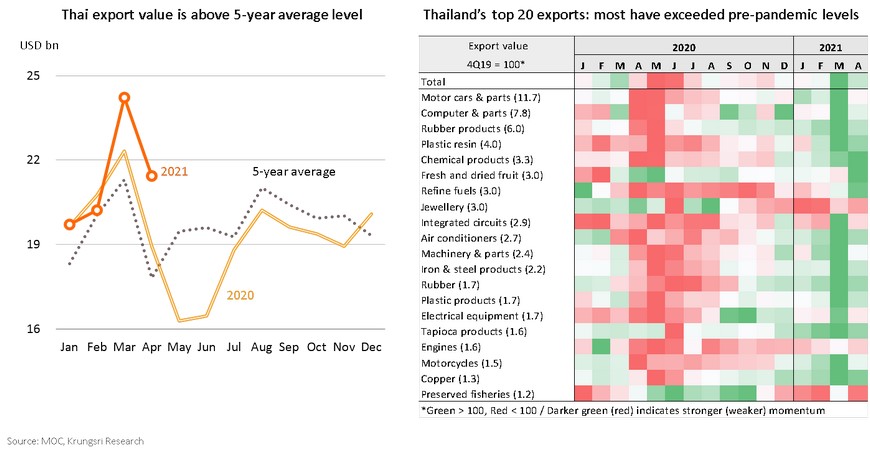

April export value well above its 5-year average; more broad-based recovery in terms of export products

Thai exports are gaining momentum. Despite the long Songkran holidays, April export value (USD 21.43bn) was close to the monthly average during January-March (at USD 21.38bn) and well above the past 5-years’ April average of USD 17.81bn. Out of Thailand’s top 20 export products (64.5% of total exports), the export value of 14 products (42.3% of total exports) has exceeded pre-COVID levels, led by chemical products, rubber products, and fresh, frozen & dried fruit. More broad-based increases in terms of export products would support domestic manufacturing production and private investment ahead.

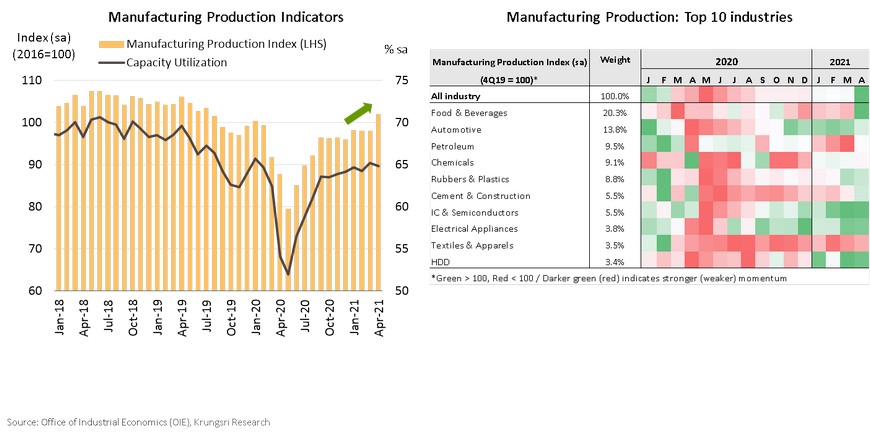

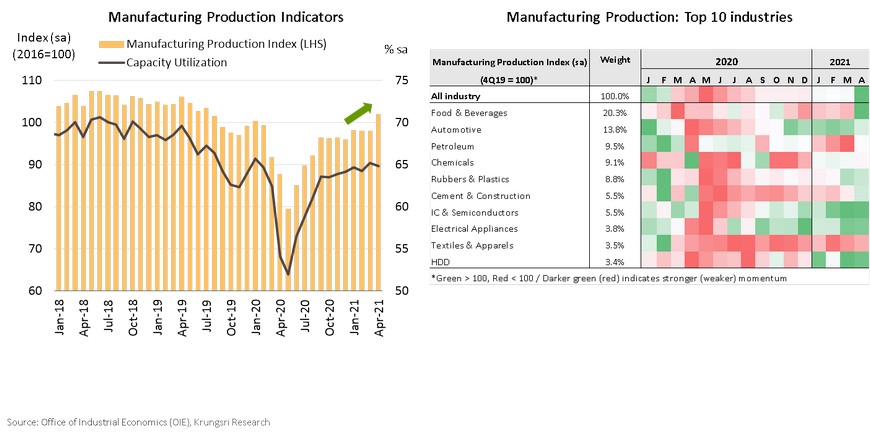

Manufacturing production in many sectors has exceeded pre-COVID levels although domestic demand is weak

Although the third wave and containment measures have hurt domestic economic activity, the Manufacturing Production Index rose for the second straight month in April and has exceeded pre-pandemic level, supported by rising exports following recovering demand at trading partners’ economies and the upward cycle for electronic products. Capacity utilization rate (sa) averaged only 64.8% in April but is higher than pre-pandemic level. In 2H21, we expect a global economic recovery, mass vaccination in major countries, and domestic stimulus measures, to boost spending and underpin manufacturing production.

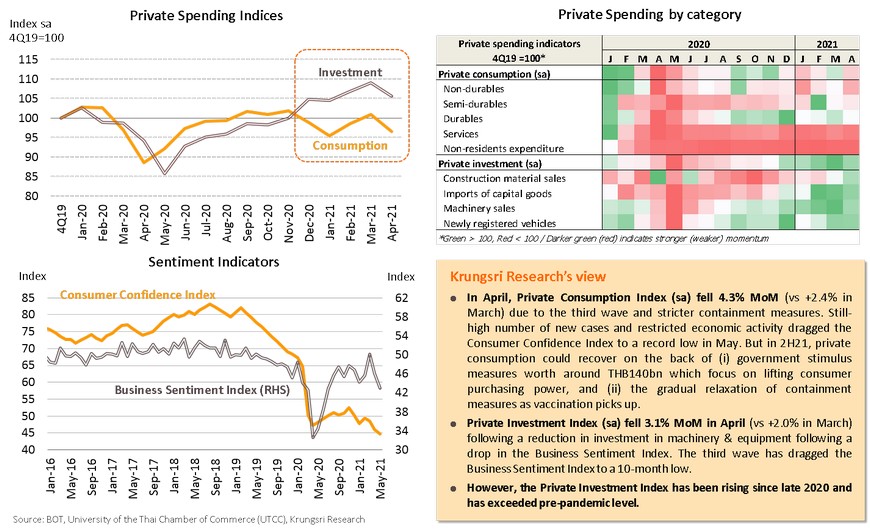

Uneven recovery: Consumption tumbles but investment index remains above pre-pandemic level

Investment is picking up, supported by rising value of applications for BOI privileges

The value of applications for investment incentives remains weak but is improving. In 1Q21, the Board of Investment (BOI) received 401 applications. They had an investment value of THB123.4bn, 80% higher than in the same period last year. Of that, THB74.8 bn (+212%) or 61% were for investment in Thailand’s targeted industries. The top investment destinations were medical sector, electric & electronic products, tourism, agriculture & food processing, automobile & parts, and petrochemical & chemical products. The rising value of applications to invest in many industries suggest domestic investments would accelerate in the foreseeable future.

FDI applications to BOI reached THB62bn in 1Q21, rising 143% YoY to near 5-year average of THB73bn per quarter

In 1Q21, the largest share of applications (by value) was from South Korea (a joint-venture between Norwegian and South Korean companies to manufacture medical rubber gloves). In 2020, Japan and China were the top two contributors. There were more FDI applications to invest in agricultural products, light industry, and electric & electronic products, which investment value exceeded the 5-year average. These three sectors accounted for more than a half of total FDI applications.

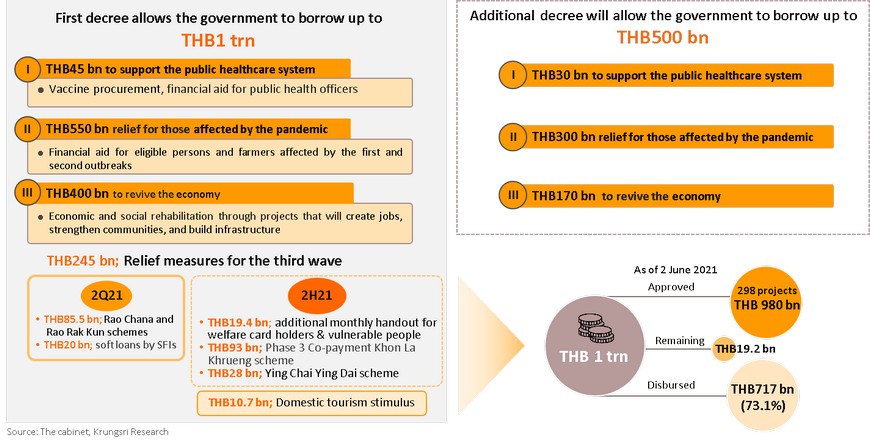

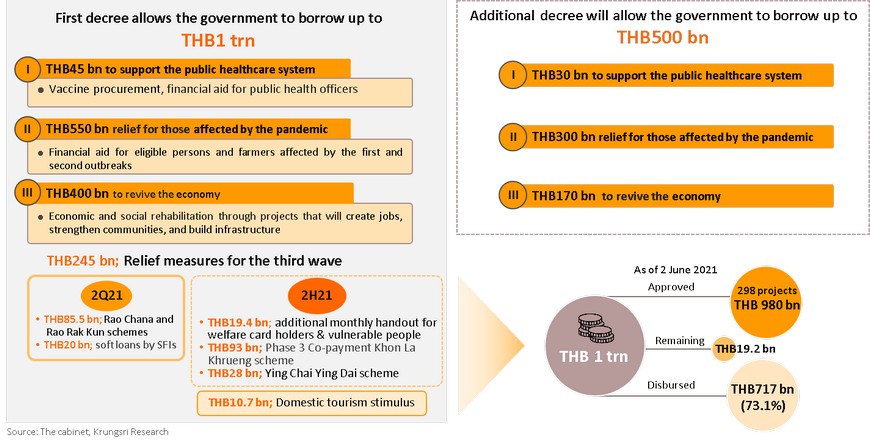

Downside should be limited by additional fiscal supports, but we maintain 2021F GDP growth at +2% given high uncertainty

The new decree authorizing the Ministry of Finance (MOF) to borrow additional THB500bn to mitigate the social and economic effects of COVID-19 was effective on 25 May 2021, following publication in the Royal Gazette. Under the first rollout of THB1.0trn borrowing decree, after the government approved THB160bn (Cabinet meeting on 2 June) to reduce the third wave impact, there is only THB19.2bn left. Therefore, it needs additional loans for new measures. Preliminarily, the MOF estimates it needs to borrow THB100bn under the new decree this year to revive the economy when the third wave eases. This would reduce downside risk to Thailand’s economic recovery. But, premised on very-high uncertainty surrounding the pandemic, vaccination procurement, and inoculation program, we maintain economic growth forecast at +2.0% for this year.

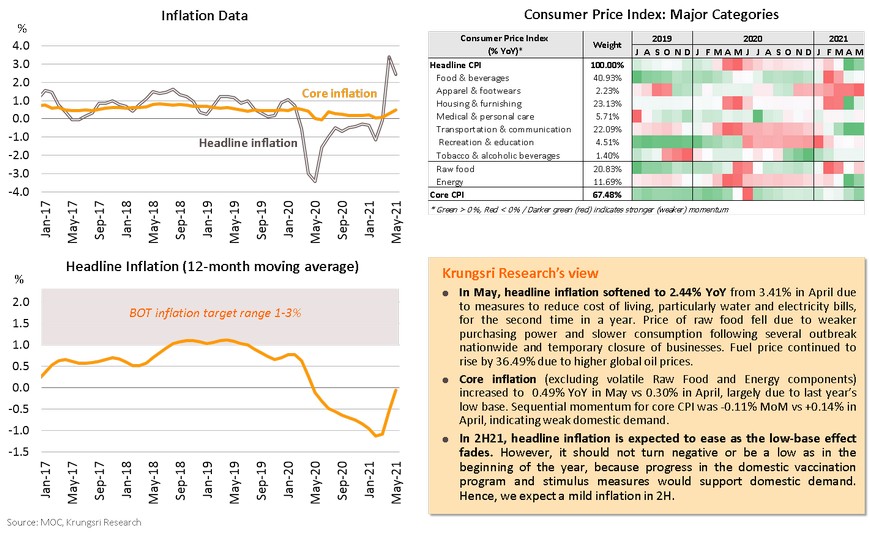

Measure to ease cost of living slowed down headline inflation in May, and it is expected to decelerate in 2H

To continue with targeted policy; peer pressure should not influence policy rate direction this cycle

Given an uneven economic recovery, authorities are focusing on targeted monetary easing to help affected sectors directly. Recently, the BOT announced additional measures to assist SMEs and support debt restructuring. Looking forward, many economies in Asia, including Thailand, could see a gradual recovery in 2H21 but only a few key countries like South Korea would signal policy rate hikes next year. However, peer pressure from other countries should not influence the direction of Thailand’s policy interest rate in the current economic cycle. This is because the pace of recovery is different among countries and Thailand could take longer to see a broad-based recovery given its strong dependence on the tourism and related sectors. Therefore, Thailand is expected to employ a very-accommodative policy to nurture a sustainable economic recovery by maintaining policy rate at a record low this year and next year.