Global: G3 economy is sailing ahead while China is adjusting its sails

Global growth improves slowly led by services activity; manufacturing sector sees mild slowdown although new orders are rising in EMs; input prices increase modestly

US: Sticky price pressure reduces chance of near-term rate cuts, but more signs of slowing growth could soften demand-pull inflation and open door for rate cuts this year

Eurozone: Slowing inflation encourages the ECB to cut interest rates ahead of US Fed

Japan: Gradual recovery with conviction on hitting inflation goal of 2%; yen weakness has become a problem suspecting the need of intervention

China: Manufacturing shows improvement but remains exposed to risks from rising trade tensions; weak domestic demand and the real estate slump continue to drag on

Thailand: Sailing with the wind; structural problems to drag cyclical tailwinds

Thailand: 1Q24 GDP grew better than expected at +1.5% YoY, +1.1% QoQ, boosted by stronger tourism sector and tax refund program; overall growth was not broad-based

Krungsri Research Forecasts for 2024

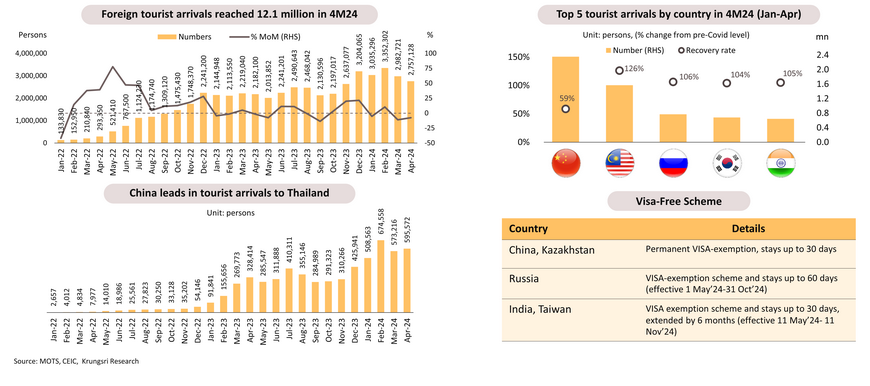

Tourism sector continues to be supported by a cyclical rebound; despite low season in Q2, it is doing better than last year, partly supported by the visa-free program

Thailand welcomed 2.76 million foreign tourists in April, slowing down for the second consecutive month despite the Songkran festival. In the first four months of this year, tourist arrivals reached 12.13 million (87% of pre-Covid level vs 71% in 2023) and generated THB584 bn receipts (88% of pre-Covid level vs 63% in 2023) led by Chinese tourists, which made up the largest group but was still only 59% of pre-Covid level. Tourists from Malaysia, Russia, South Korea, and India surged to 104-126% of pre-pandemic levels. In Q2, which marks the low season, tourist arrivals are normally smaller than the previous quarter. To support the ongoing recovery in the tourism sector, the government has extended visa-free program to nationals of Russia, India, and Taiwan, and granted permanent exemptions to tourists from China and Kazakhstan.

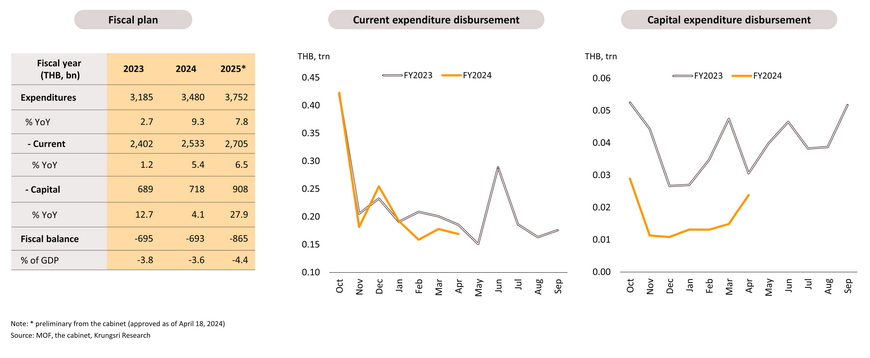

Public investment will be a key tailwind to drive the economy from Q2 onwards after FY2024 Budget Act comes into effect in late-April

The FY2024 Budget Act took effect in late-April. That suggests budget disbursements, particularly for public investment, would accelerate the rest of this year. Data from the Ministry of Finance show that in the first seven months of FY2024 (October 2023 to April 2024), spending of the current budget reached THB 1.56trn or 56% of the annual current budget, down 5.3% YoY. For the capital budget, only THB 0.116trn has been disbursed for public projects in the first seven months of FY2024, or just 13.8% of the annual capital budget, down 60.4% YoY. Hence, during the remaining 5 months of FY2024 (May to September 2024), the NESDC expects disbursements, especially from the investment budget, to accelerate and inject THB510 bn into the economy. In addition, the government has set the preliminary FY2025 capital budget at over THB900 bn and would start disbursements this October (the first month of FY2025).

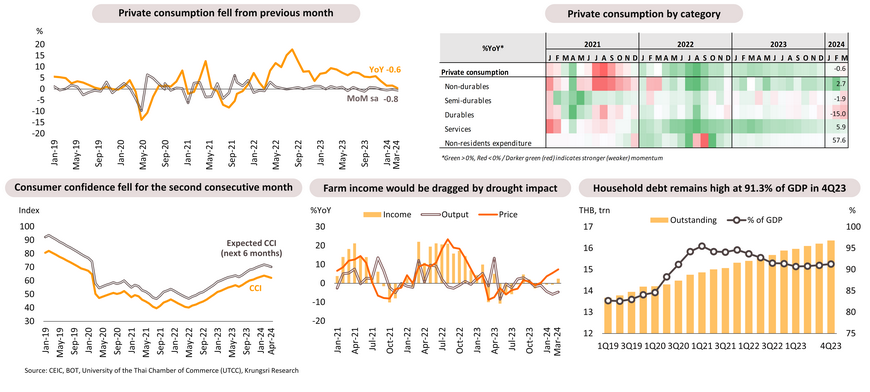

Private consumption showing slower growth after expiry of stimulus measures

Private consumption index fell in March (-0.6% YoY and -0.8% mom sa). Spending on non-durable goods fell after the tax refund program - Easy-E-Receipt - expired. Spending on durable goods also fell, especially in passenger cars. Consumption was also pressured by the drought impact which hit farm output and income as well as high household debt. But recently, commercial banks reduced lending rates for 6 months to help vulnerable groups and the government extended measures to ease living expenses, especially energy costs. These efforts will support purchasing power in some consumer segments.

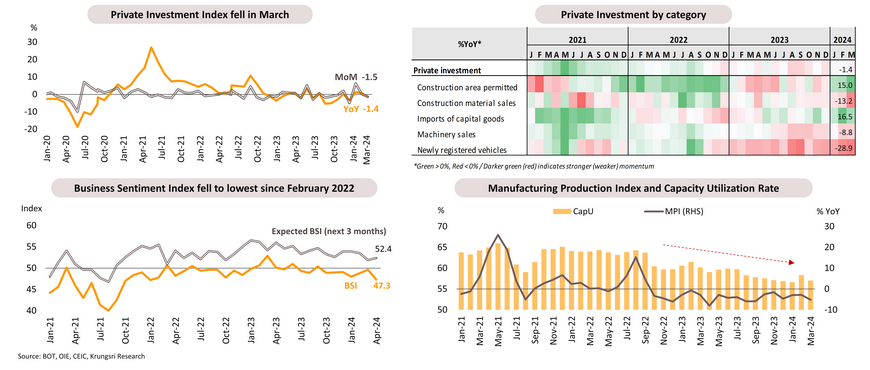

Private investment in some sectors will benefit from a rebound in public investment but overall growth could be impeded by weak manufacturing sector and exports

Investment continued to show signs of weakness, reflected by (i) the April Business Sentiment Index dropping to the lowest level in 27 months or since February 2022; (ii) the Private Investment Index falling in March (-1.4 YoY and -1.5% mom sa), with weaker investment in machinery & equipment and in construction; (iii) the Manufacturing Production Index has continued to contract for more than a year and Capacity Utilization rate is below 60%. However, public investment is expected to accelerate, leading to crowding-in effect of private investment in some segments in the next period. In addition, the latest BOI data indicate private investment would recover in the medium term.

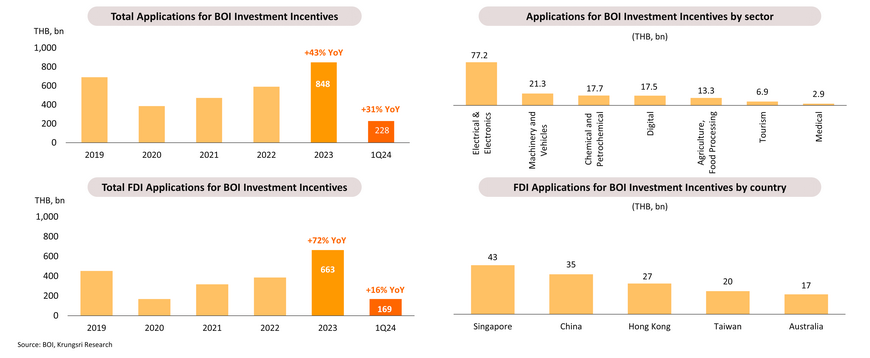

Applications for BOI incentives surged by over 30% in Q1, potentially signaling a boost in investments for some key sectors in the medium-term

In the first quarter of this year, the Board of Investment (BOI) received applications for investment incentives for 724 projects (+94% YoY) with a total investment value of THB228.21 bn (+31% YoY). The three industries with the highest investments were Electrical & Electronics, Machinery & Vehicle and Chemical & Petrochemical. Foreign direct investment (FDI) applications for BOI incentives rose by 130% to 460 projects valued at THB169 bn (+16%), led by Singapore, China and Hong Kong. The value of Singapore's investment has risen due to significant investments by Singaporean businesses with Chinese parent companies in printed circuit board (PCB) manufacturing. Meanwhile, the BOI has approved 647 projects with a total investment value of THB 256.93 bn (+107% YoY). This is a promising sign for domestic investment in key industrial sectors over the next 1-2 years.

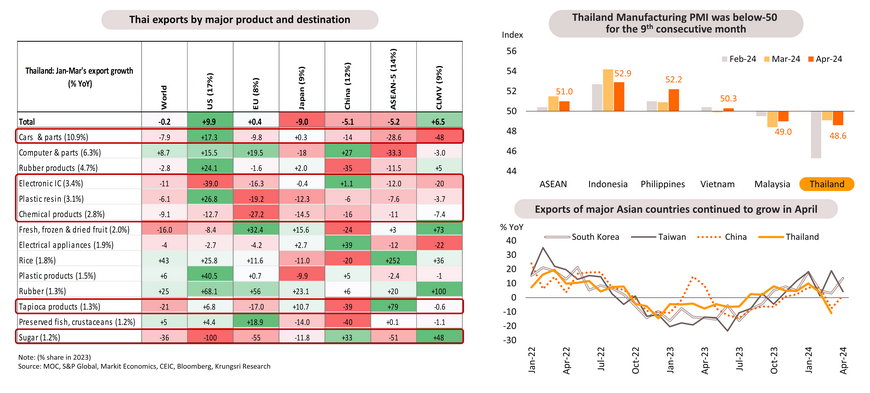

Exports shrank in the first quarter; full-year growth might be below our 2.5% expectation

Positive growth in some export products amid weak industrial production; structural headwinds undermine growth in major industries

In the first quarter of this year, Thai exports fell by 0.2% YoY due to a 6.0% drop in agro-industrial product exports (including rubber products, tapioca products and sugar) and a 0.3% drop in industrial product exports (including cars & parts, electronic IC, chemical products and plastic resin). Exports of agricultural products (including rice and rubber) expanded by 6.8%. However, Thai exports are still concentrated in low value-added products. There are negative signals from still-weak Thailand’s Manufacturing PMI data and Manufacturing Production Index which has contracted for more than a year. This reflects structural problems in Thai exports.

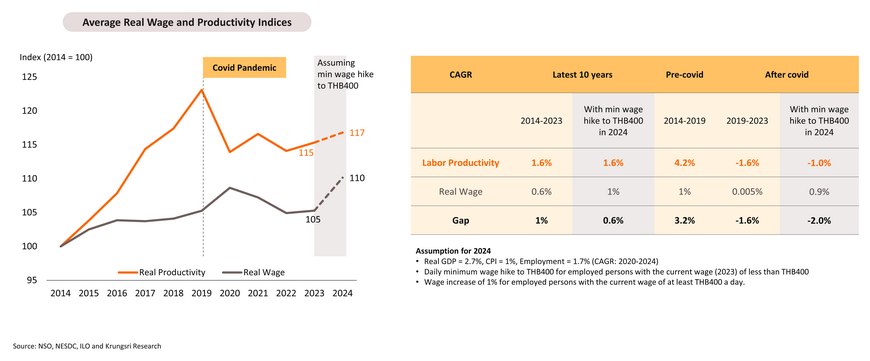

Jump in minimum wage would narrow the productivity-wage gap significantly, making it more challenging for firms to improve performance

The hike in daily minimum wage to THB400 nationwide would translate to 1% p.a. compounded growth in average real wage over the last 10 years, compared to only 0.6% without the latest wage hike. And, productivity-wage gap would narrow significantly to 0.6% from 1%. And post-pandemic, the minimum wage hike could also cause productivity-wage gap to narrow to -2.0% compared to -1.6% without. This suggests many firms will suffer from the wage hike, especially the manufacturing sectors which already register a negative gap such as textile & apparel, electronics, rubber & plastics, food & beverages and vehicles & transport equipment.

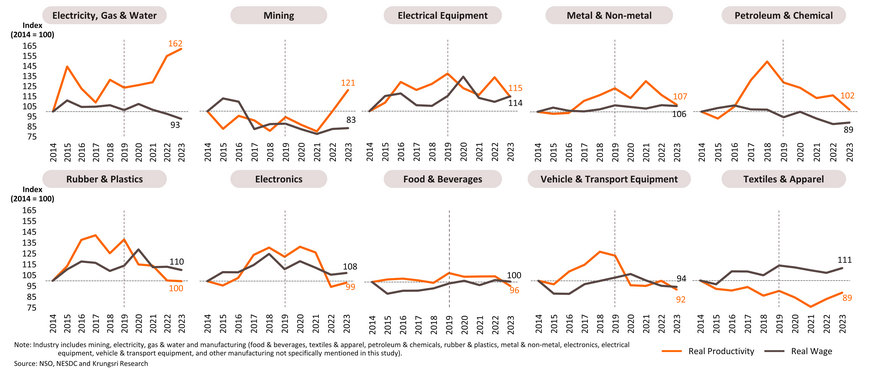

Industry: Current productivity-wage gap in most industries close to zero, indicating risks of higher costs, except for electricity, gas & water

Prior to the pandemic, labor productivity in most sectors, except textiles & apparel, grew faster than real wages. However, only electricity, gas & water can maintain pre-covid trends, with the gap growing wider. Meanwhile, vehicle & transport equipment and electronics experienced a drop in labor productivity, indicating they are still being dragged by negative factors post-covid. These suggests stronger need for technological transformation, such as digital adoption and automation, in major industries in Thailand.

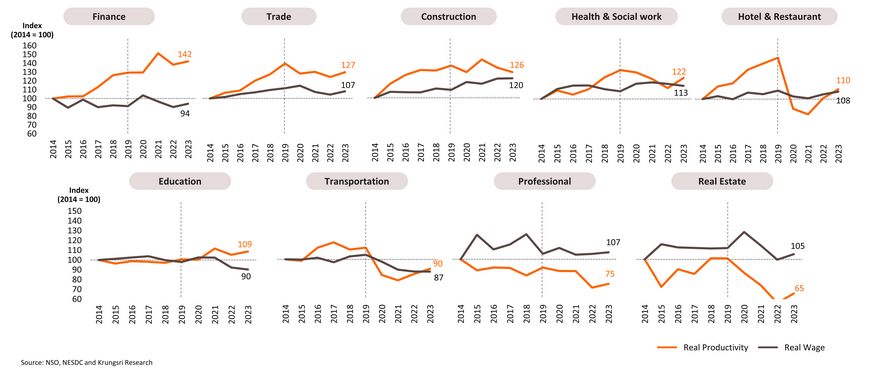

Services: Productivity-wage gap remains positive in several services sectors but most show smaller gaps

Most services sectors have recorded positive productivity-wage gaps post-pandemic, with finance having the largest positive gap. Meanwhile, productivity growth in hotel & restaurant, health & social work, and transportation show signs of improvement, outpacing the steady change in real wages. Given this constant change in real wages, the positive gaps are expected to widen. However, large negative gaps persist in real estate and professional sectors with no clear signs of recovery.

Headline inflation reversed to positive territory in April and is inching forward to meet the target range later this year, but full-year average is expected to stay below 1%

1Q24 GDP data (close to the BOT’s estimate) and recent developments suggest that the MPC could take rate cuts off the table