Global: New wave of trade protectionism could cap global growth

Global growth is recovering but momentum might be capped by still-restrictive monetary policies, fading fiscal stimulus, and rising trade tensions

US: Fed has to balance between losing growth momentum and reining-in still-high inflation; a soft landing and normalizing labor market might allow two rate cuts this year

Eurozone: ECB delivered its first rate cut in June, but still-tight inflation in services sector could slow down pace of cuts; rising trade tensions could heighten risk to economic growth

Japan: Improving economic data and wage hike gains point to a gradual recovery in 2H24, suggesting BOJ might raise policy interest rates slightly

China: Overall economy is improving but export-led manufacturing could expose the economy to risk of stronger trade protectionism

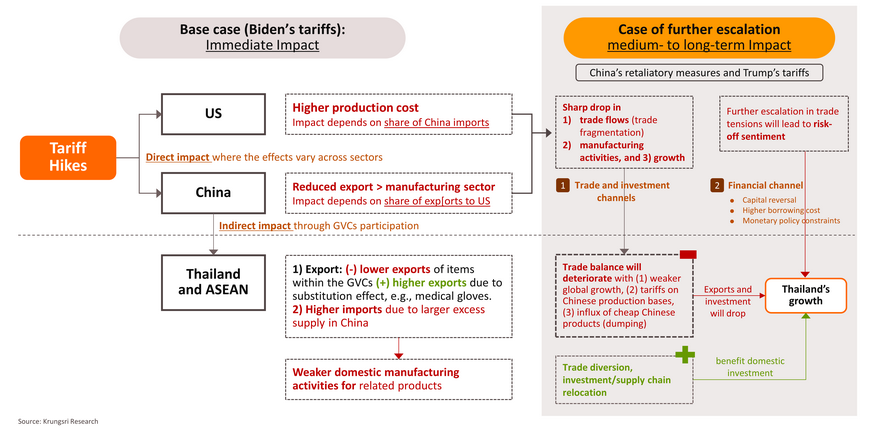

Special Notes: Impact of tariff hikes on Thailand’s economy

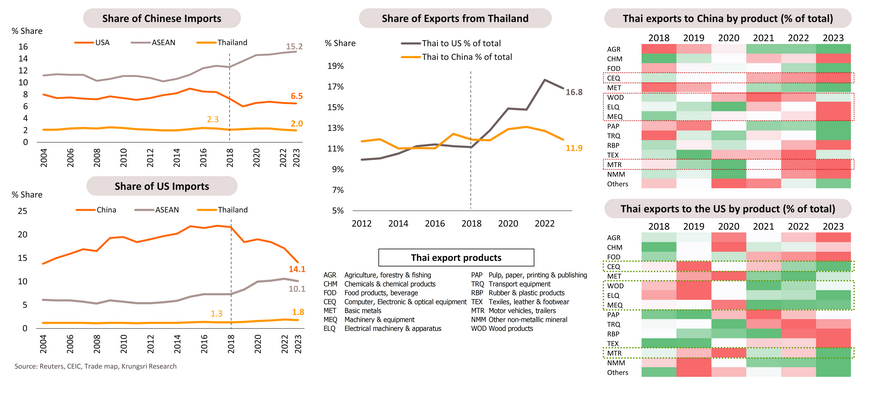

ASEAN and Thai exports to US have gained market share since the trade war

Since 2018, ASEAN has been benefiting from changing trade flow dynamics. Indeed, ASEAN exports to China and the US have increased, while share of Chines imports in the US has tumbled. For Thailand, exports to the US rose from 11.1% of total Thai exports in 2018 to 16.8% in 2023, while Thai exports to China remained stable at 11.9%, suggesting the trade war has led to US importing more goods from other countries, including Thailand. In addition, Thailand’s key export products to the US gained market share, which helped to offset declining exports to China, including computer and electronics (CEQ), wood products (WOD), electronic machinery (ELQ), machinery & equipment (MEQ), and motor vehicles (MTR). To conclude, the escalating US-China trade tensions would damage the global economy through greater protectionist actions, though that could create opportunities for Thai exports in selected products.

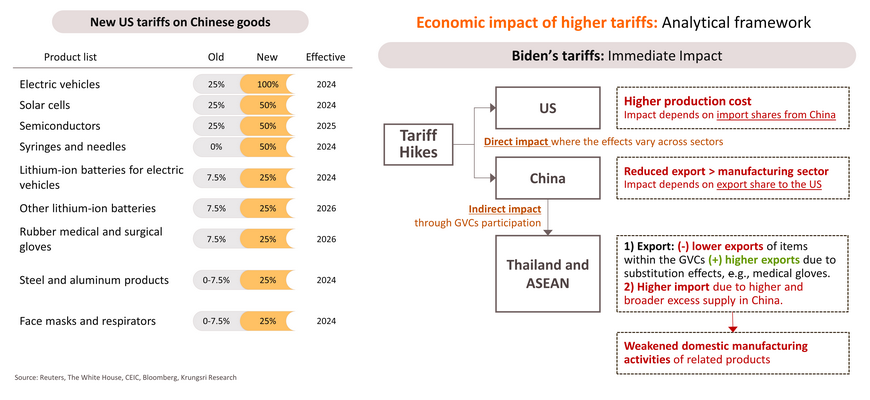

I. US raise new tariffs on USD18 bn worth of Chinese products, effective 2024

On May 14, US President Joe Biden raised tariffs on USD18 bn worth of Chinese imports across a handful of sectors, citing a need to protect American workers and businesses from China’s unfair trade practices. The decision was made after the mandatory four-year review of tariffs imposed by former President Donald Trump in 2018 under Section 301 of the 1974 Trade Act. However, the immediate price impact on the US economy should be minimal as the new tariffs cover only 4% of total US imports from China.

US: Tariff hikes could increase production costs but have minimal impact given diversified markets but there could be backlash from retaliatory measures by China

China: Most of the targeted products command modest market shares in the US, so immediate impact is limited; but it could worsen with additional and broader tariffs

Thailand: Impact could worsen if the US increases tariffs directly or indirectly on key Thai products

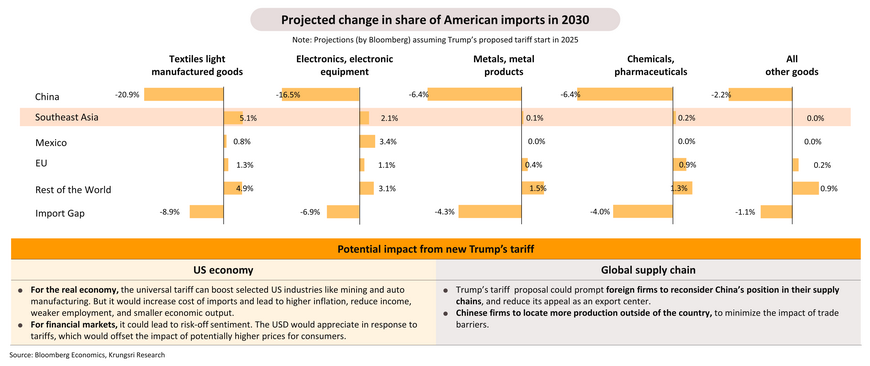

II. Trump’s proposed tariffs would reduce imports from China but create opportunities for ASEAN exporters; retaliatory measures could accelerate global trade fragmentation

In keeping with his MAGA promises, Donald Trump recently proposed to increase tariff to up to 60% on all imports from China and 10% universal baseline tariff across the board. If he wins this year’s election, trade ties between the US and China would worsen in 2025; the share of US imports from China has shrunk from 26.1% in 2018 to 14.1% in 2023, after Trump raised tariffs on China goods. However, China’s loss could be ASEAN’s gain, thanks to trade diversion and relocation. However, China is likely to introduce retaliatory actions to defend its rights and interests. This could lead to an influx of cheap Chinese goods, which would create new trade tensions between China and other countries. This will accelerate global trade fragmentation.

Summary: Economic impact of higher tariffs

Thailand: We trimmed 2024 GDP growth forecast to 2.4%; cyclical recovery in 2H24 to be capped by domestic and external headwinds

Krungsri Research Forecasts for 2024

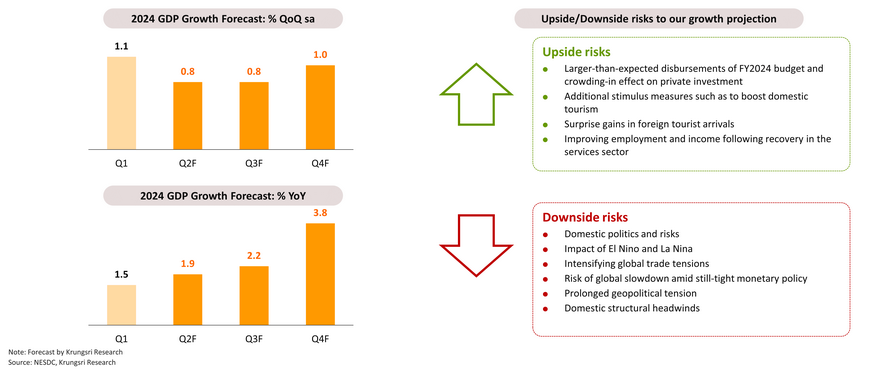

We trimmed 2024 GDP growth forecast to 2.4%; year-on-year growth should improve the rest of this year

We trimmed 2024 GDP growth forecast from +2.7% to +2.4% to reflect longer-than-expected delays in public spending, weak exports, and structural headwinds. Our forecast is supported by cyclical factors, including recovering tourism activity and accelerating government spending. GDP growth marked +1.5% YoY in 1Q24 and is projected to improve to 1.9-2.2% in 2Q24 and 3Q24, before accelerating in 4Q24 supported by peak tourist season and a low base. However, there is downside risk from domestic politics, structural problems (such as in the production sector, exports and consumption), and possibly worsening trade war.

Key growth drivers in 2H24: Accelerating public spending and recovering tourism sector; domestic politics could hurt investor sentiment

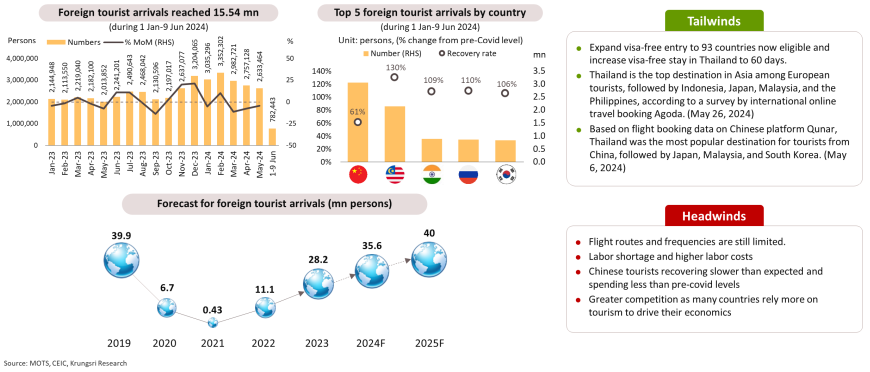

Tourism sector: Extending free visa to more countries should boost foreign tourist arrivals; maintain foreign tourist arrivals at 35.6mn this year

Thailand welcomed 2.63 mn foreign tourists in May, slowing down for the third consecutive month following seasonally-fewer European tourists. During 1 Jan-9 Jun 2024, tourist arrivals reached 15.54 mn (88% of pre-Covid level vs 71% in 2023) and generated THB736 bn receipts (90% of pre-Covid level vs 63% in 2023) led by Chinese tourists which made up the largest group; however, that is only 61% of pre-Covid level. Tourists from Malaysia, India, Russia and South Korea surged to 106-130% of pre-pandemic levels. In the second half of this year, tourism sector would be encouraged by positive factors, including measures to extend free visas to tourists from 93 countries (vs 57 currently), extend length of visa-free stay in Thailand from 30 days to 60 days, and increase flight routes and frequency, especially from India.

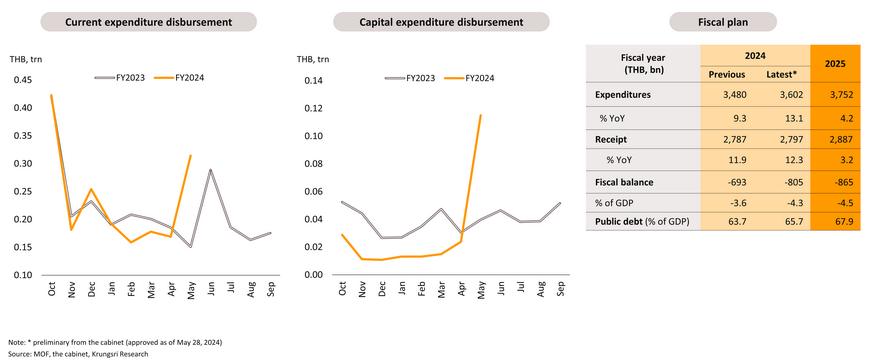

Public investment is accelerating, supporting economic recovery in the next period; but fiscal stability could weaken

Public spending has picked up since the FY2024 Budget Act came into effect in late-April. Data from the Ministry of Finance show that in May, disbursements of the current budget and capital budget had expanded by 108% and 189% YoY, respectively. In the first 8 months of FY2024 (October 2023 to May 2024), spending of the current budget reached THB1.86 trn, or 71% of the annual budget and rising 4.3% YoY. For the capital budget, the government disbursed THB0.23 trn, or only 27% of the annual capital budget and falling 23.7% YoY. Recently, the Cabinet agreed to increase FY2024 budget expenditure by THB122bn to fund economic stimulus projects. This raised the annual expenditure budget to THB3,602bn from THB3,480 bn and the fiscal deficit would rise to 4.3% of GDP (previously -3.6% of GDP), which implies weaker fiscal stability in the next period.

Private investment is improving, induced by accelerating public investment, but upside would be capped by weak manufacturing sector and domestic politics

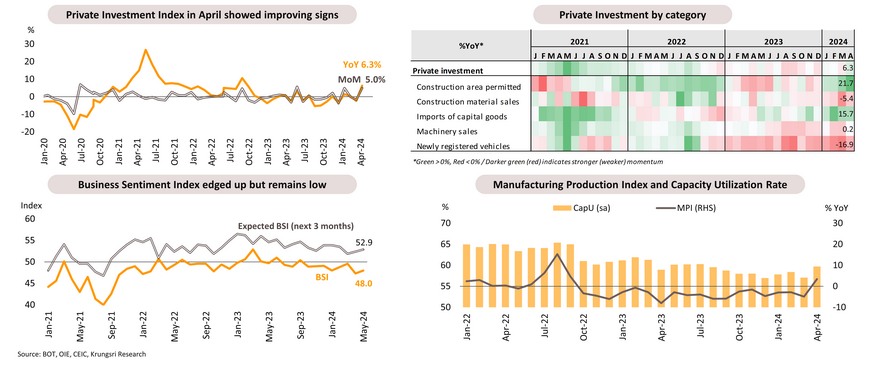

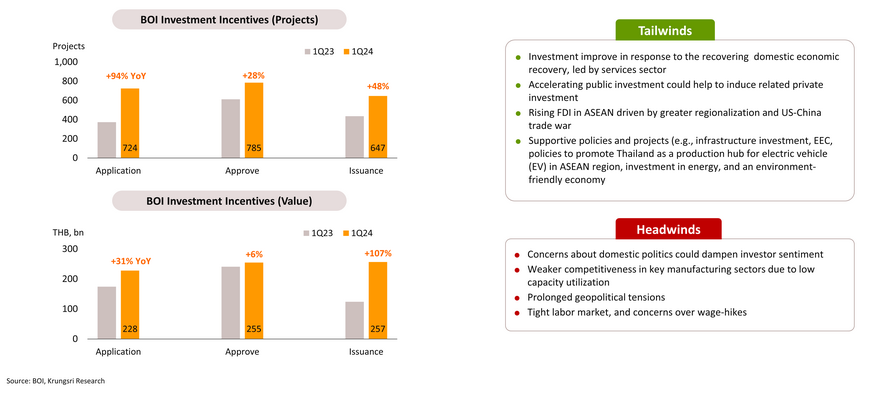

Private investment is improving, albeit slowly. That is reflected in the following: (i) Business Sentiment Index improved in May from a 27-month low in April; (ii) Private Investment Index returned to expansion zone in April (+6.3% YoY and +5.0% MoM sa); and (iii) Manufacturing Production Index returned to expansion zone for the first time in 19 months, though capacity utilization rate remained below 60%. For the rest of this year, we expect positive impact from the accelerating disbursement of capital budgets, which will support crowding-in effect on private investment. However, weak exports could cap private investment and domestic politics could continue to pressure investor confidence.

Government to boost private investment by introducing more investment incentives

Board of Investment (BOI) data for the first quarter of this year revealed it received applications for 724 projects (+94% YoY) with total investment value of THB228 bn (+31% YoY). The board approved 785 projects (+28%) with total investment value of THB255 bn (+6%) and issued promotional certificates for 647 projects (+48%) with total investment value of THB257 bn (+107%). Recently, the government said it would expedite private investment through the BOI. In 2023, the BOI approved incentives for more than THB800 bn worth of projects. If actual investment accelerate to THB30-40 bn this year, that will lift GDP by 0.14-0.15%.

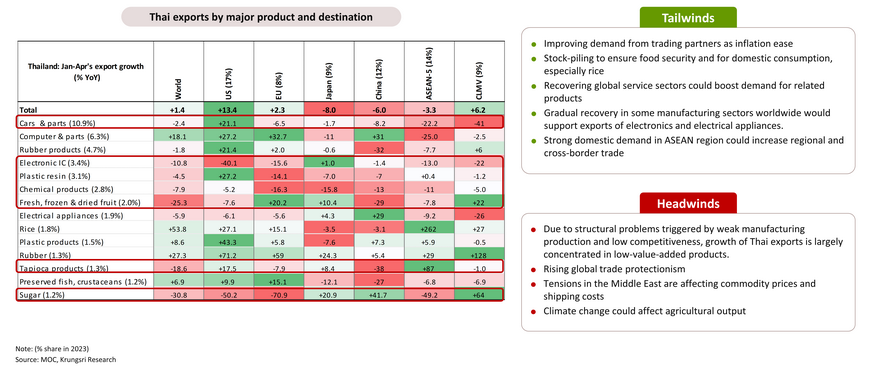

Exports is projected to grow by only 1.8% this year amid headwinds from structural problems and risk of rising trade tensions

Exports could be capped by structural problems in manufacturing sector and rising trade protectionism

In the first four months of this year, Thai exports grew 1.4% YoY led by industrial products which marked 1.8% growth (including computers & parts, and plastic products). Exports of agricultural products (rice and rubber) expanded by 3.1%, while exports of agro-industrial products (rubber products, cassava products, and sugar) fell by 1.8%. Exports remained weak in many Thai industries (including cars & parts, electronic ICs, chemical products, and plastic resin), reflecting structural problems in Thailand's industrial production sector.

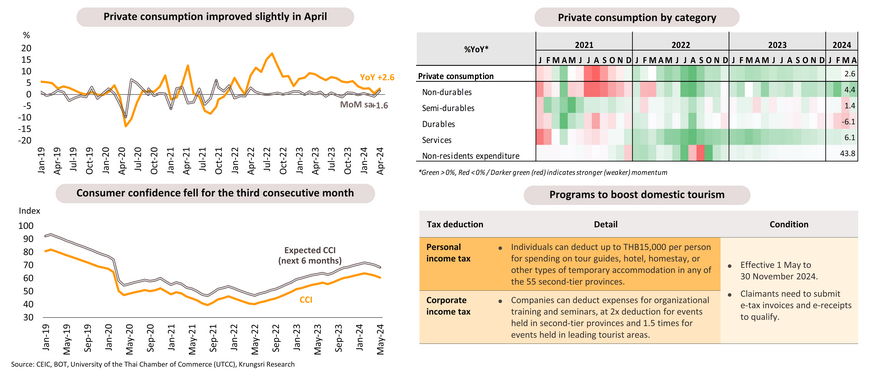

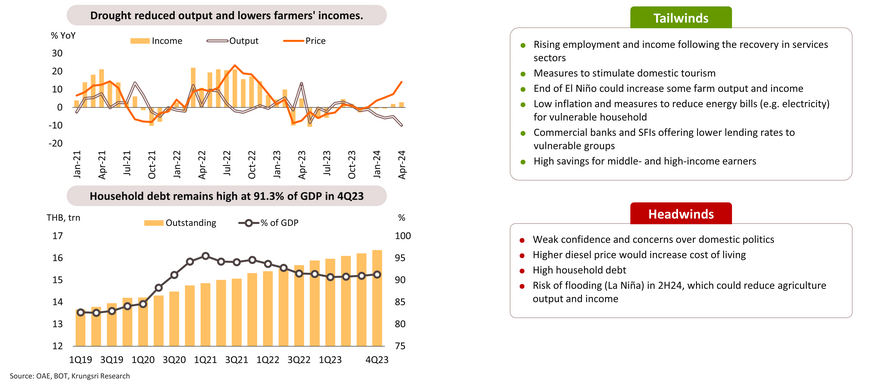

Private consumption: Slower growth despite measures to boost domestic tourism

Private consumption index rose in April (+2.6% YoY and +1.6% mom sa). Spending in the services sector increased in line with the tourism sector which experienced a boost during Songkran holidays. This trend is consistent with stronger spending on non-durable and consumer goods. In the second half of this year, private consumption would continue to be supported by (i) the improving tourism sector following recent measures to stimulate tourist spending in secondary cities in Thailand; (ii) measures to reduce energy bills; (iii) offering lower lending interest rates to help vulnerable groups; and (iv) the end of El Nino (characterized by dry weather) during mid-year which should improve farm output and income. However, projected La Nina conditions in 2H24 could hurt farm output in flood-prone areas and structural problems arising from high household debt could cap consumption growth.

Slower rise in farm income and structural problems arising from high household debt could cap consumption growth

In the first four months of 2024, agricultural prices rose 7.7% YoY but output fell 6.1%, which led farm income to rise by only 1.1%. Looking ahead, farm output could improve as El Nino conditions (dry weather) start to fade soon, but growth could be limited by risk of flooding in some areas with the predicted onset of La Nina (risk of flood) in 2H24. Consumption would be pressured by high household debt at 91.3% of GDP, mostly in the low-to medium-income groups. Vulnerable households might need additional support from the government.

Headline inflation returned to target range for the first time in 13 months in May; expect full-year inflation to average +0.7%

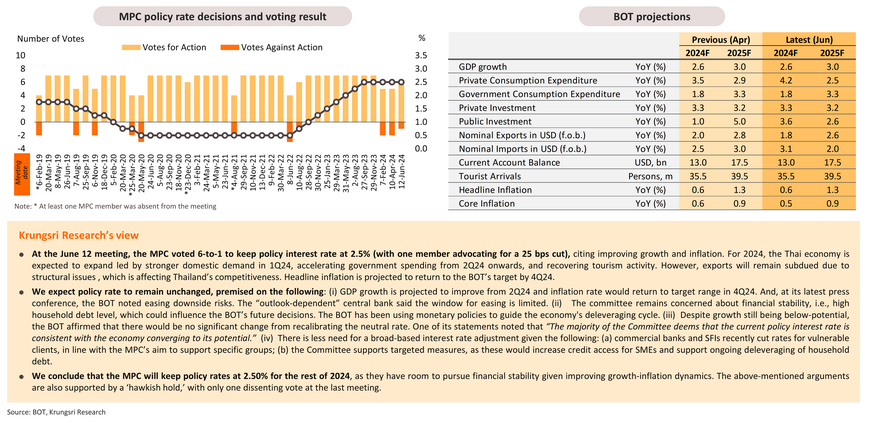

MPC voted to keep policy rate at June 12 meeting, with hawkish tone; expect BOT to hold the rate throughout this year