Introduction

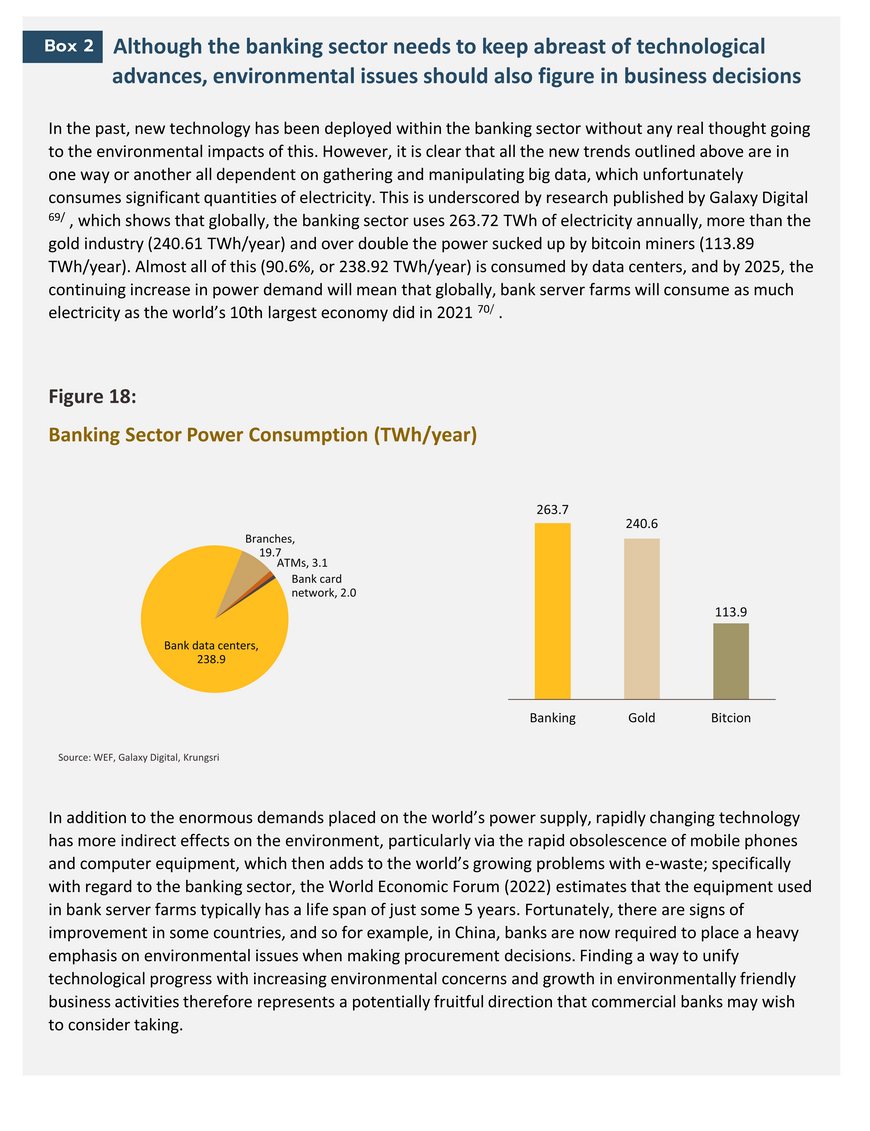

Over the past few years, technological innovation has played an unprecedented and ever-more central role in how at the micro level, individuals live their lives, and at a larger scale, how businesses operate. This technological revolution has brought about a multitude of changes, but the net effect of these has been to make day-to-day life vastly easier and more convenient, while for commercial enterprises, including the banking sector, technology has cut costs, generated new frontiers of business growth, and ushered in an era of large-scale changes to the commercial environment. However, the flip side of this revolution is that organizations that fall behind in the race for technological innovation and mastery run the risk of missing out on new opportunities and of being pushed to the fringes of future commercial arenas.

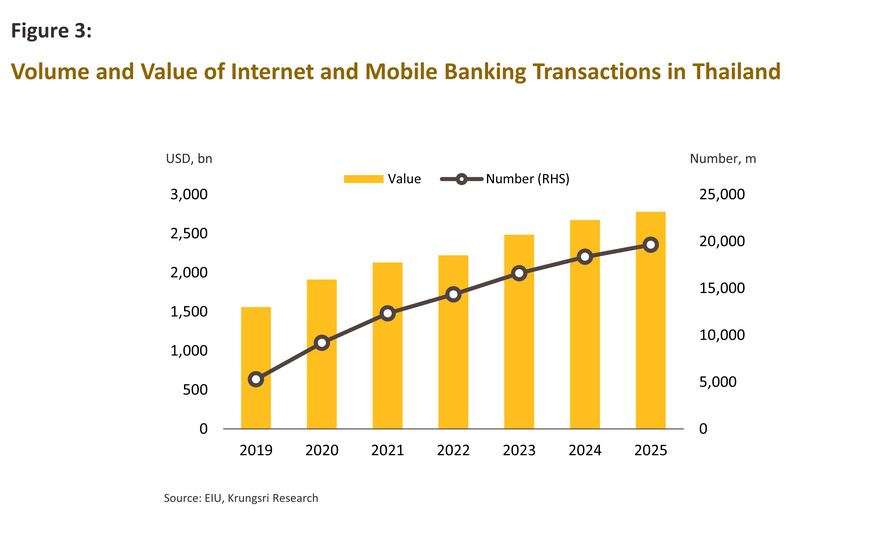

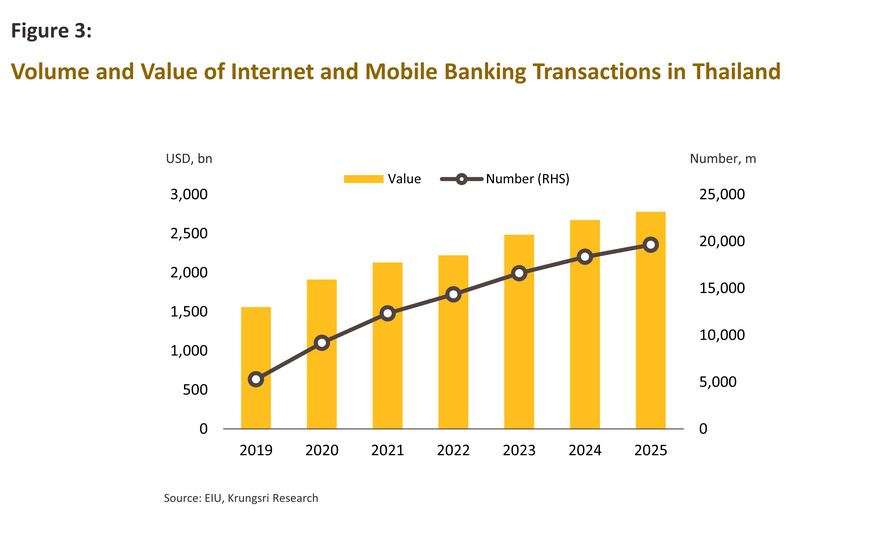

These changes have reached into the banking industry, where the traditional model of banks operating as financial intermediaries, and offering standard services such as deposits, withdrawals and access to credit and loans that are distributed through the fortress-like security of their branch networks has come under considerable threat from internet and mobile banking, developments that allow customers to access financial services from anywhere and at any time. More recently, these longer running changes have been further catalyzed by the Covid-19 pandemic, while on the supply side of the market, traditional financial institutions are coming under significant threat from fintech players looking to steal their client base and market share.

Against this backdrop of fundamental change, how consumers think about the finance sector is likely to undergo constant evolution, as will their expectations with regard to the provision of banking services. This dynamic is being driven by ongoing innovation and the impact that this has on lifestyles and business operations, and so it might thus now be said that the banking industry has moved from being a ‘transaction business’ to an ‘experience business’. The upshot of this is that technological innovation has now displaced more traditional business concerns with expanding branch networks as the central force guiding growth, and clearly, in this environment, technology will be the foundation on which everything else depends.

Banks both rely on and are responsive to rapid technological change

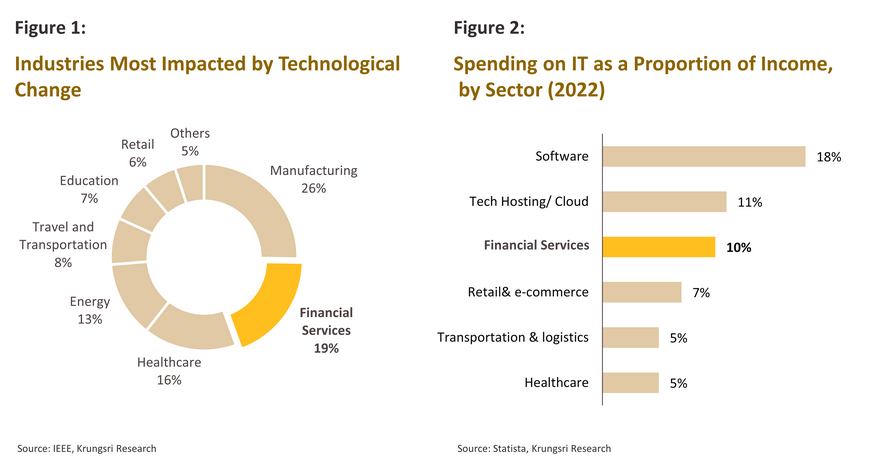

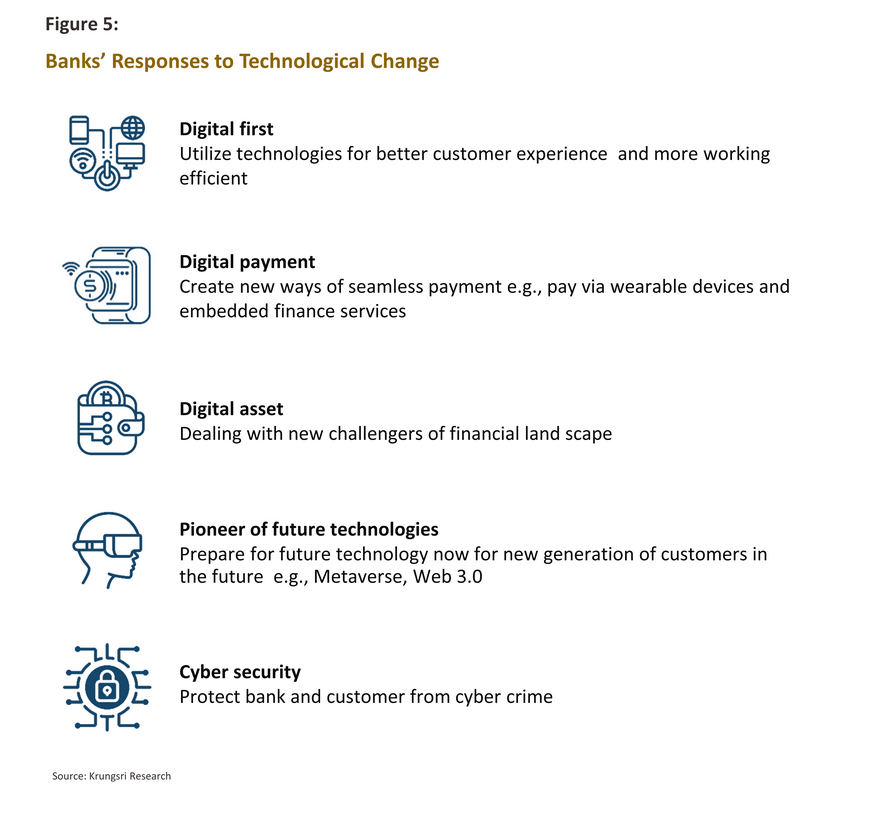

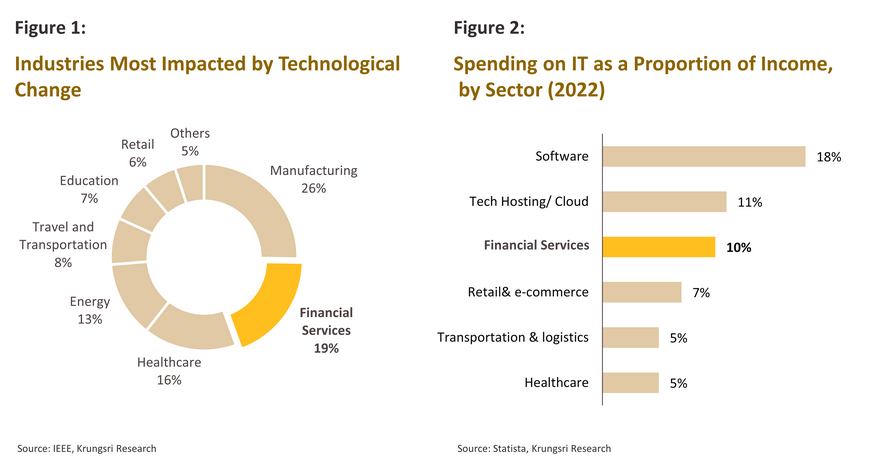

Financial services is now regarded as one of the sectors most exposed to the impacts of technological change. Specifically, the financial services industry was ranked second after only the manufacturing sector in research published by the IEEE in 2022 that assessed vulnerability to innovation[1] . This is thus a major challenge to businesses, and so banks are now attempting to transmute threats into opportunities by adapting their business strategies in ways that include changing the services and products that they offer and transforming internal business processes. One outcome of this is a shift to using technology as a primary tool for dealing with the stiffening competition that is coming from both traditional banks and from new entrants to the market, whether that be Neobanks[2] or big tech players that have their eyes set on staking out a major presence in the market for financial services. With these competitive pressures rising, it is imperative that banks step up their investment in technology, and indeed data from Statista show that spending on IT in the financial services sector is now estimated to soak up some 10% of income. A clear example of this can be seen in the case of the investment bank JP Morgan, which by market capitalization is the world’s biggest bank. JP Morgan’s annual investment in technology currently stands at USD 12 billion[3] , split between: (i) modernization, e.g., shifting to cloud-based services; (ii) data strategy; (iii) efforts to attract top talent; (iv) product operating model; and (v) cyber security.

Looking ahead to 2023, foregrounding the importance of ‘digital first’ strategies will remain important with regard to both managing internal operations within banks themselves and building an engaging customer experience for all consumer groups. The latter will depend in particular on customer insight analytics technology[4] because this will help banks to develop hyper-personalized services targeting individual consumers. This will then allow for one-to-one marketing, and crucially, amid the intense fight for market share in the financial services space, these movements will help to build and sustain consumer loyalty. Research published by BCG[5] indicates that hyper-personalization of products or services can help to increase income by as much as 10%, and because banks are already in possession of a wealth of data on their customers, they are well placed to effectively design and target personalized products, though this will be tempered by the need to keep strictly within the regulatory framework governing the use of private data.

Being able to develop and deploy digital payment systems that make consumer transactions enjoyable, rapid and convenient, or providing ‘payment as an experience[6]’ services, will remain a major mission for banks through 2023 and beyond. The main axis of development will be continuing to make these as smooth and seamless as possible, and to extend access to these services beyond that provided by banking apps. Alan McIntyre, a banking expert at Accenture[7] therefore expects that by 2025, when completing transactions, it may no longer be necessary to use credit cards, to need to confirm one’s identity, or even to use a mobile phone, and instead, payments will be made through wearable devices such as smart watches, or through smart speakers or other smart home systems. In addition, banks will need to develop the ecosystems and technology necessary to support the delivery of embedded finance services, that is, banks will increasingly play a role in consumers’ daily lives, even if the latter remain unaware of this involvement.

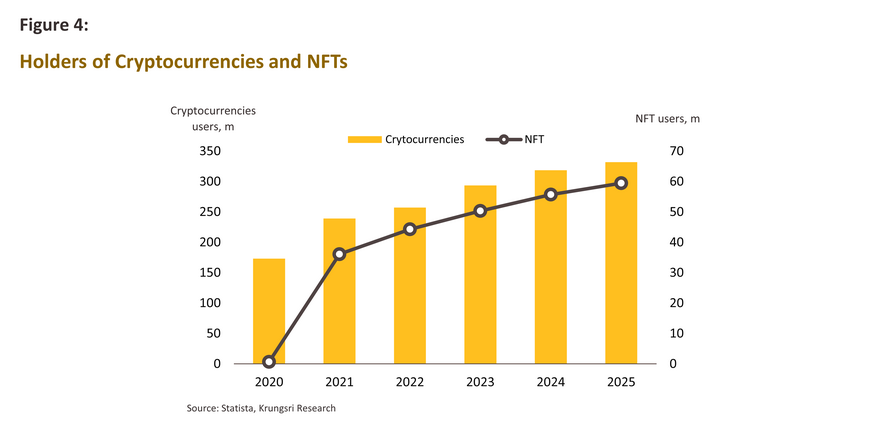

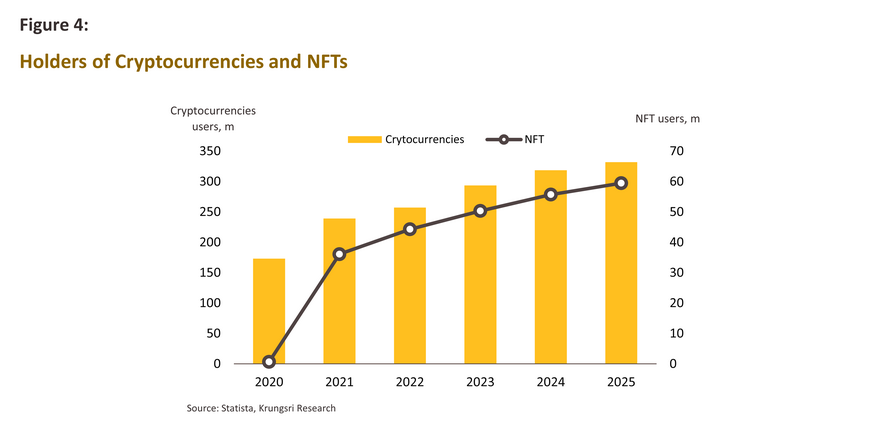

Over the past few years, digital assets[8] have attracted growing interest and acceptance. These are viewed by some as offering potential as both a means of exchange and as an investment vehicle, and as such, the number of individuals holding digital assets has risen steadily (Figure 4). In addition, the growing efficiency with which data is stored and evaluated through blockchains, is also posing a rising threat to the role players in the industry enjoy as financial intermediaries. In response to these twin challenges and the turbulence that these changes are generating in the market, commercial banks are attempting to overhaul their operations, and through 2022, this took banks and other providers of financial services trying to keep pace with developments by offering services that supported those holding digital assets. For example, JP Morgan has begun to research how best to develop a crypto wallet[9], and both Master Card and Visa, the world’s largest providers of payment systems, are planning for how best to support financial institutions that want to provide services for trading in cryptocurrencies[10]. These developments have also extended beyond the sphere of commercial banking, and even in the more conservative and slower-moving world of central banks and regulatory authorities, interest in these areas has picked up. Research on how best to regulate markets for digital assets is therefore underway around the world, and in many countries, central banks are looking into whether and how to introduce their own central bank digital currency (CBDC)[11] . Naturally, this will constitute an additional new threat to how commercial banks operate.

Beyond this, being able to demonstrate a technological lead can play an important role in attracting new customers for a financial product or service, though this will be especially important once tech-driven Gen Z consumers have greater purchasing power and wealth and have developed into banks’ core customer group. This will in fact happen in the relatively near future and so it is necessary for banks to prepare for this situation by adopting roles as pioneers on the technological frontier, for example by becoming early adopters of the metaverse or web 3.0 [12] , or by developing their own super app[13] , and through this, laying out the path to future growth.

However, although ‘the sword’ of technology can be used by banks to hack open pathways to vast new business opportunities, this sword is double-edged, and the greater the reliance on technology as a business tool, the greater the potential threat posed by fraud and cyber threats. Banks thus need to develop their cyber security abilities alongside any extension in technology-driven service offerings, and this will involve fortifying IT systems and engaging in proactive digital threat hunting. These problems will become potentially more acute as banks move into offering ‘anytime, anywhere’ access to financial services or as they allow staff to work offsite. Because these changes multiply access to core banking or operational systems, they also multiply the potential security holes that threat actors are able to exploit, and should these attacks be successful, this can generate significant losses in terms of both money and reputation. Banks thus need to gather their resources and maximize their ability to assess risk and to head off enterprise-level threats, and as part of this, banks will need to be meticulous in establishing and maintaining good governance and compliance.

It is clear that given the need to maintain secure IT systems and through this, sustain consumers’ faith in the organization, the banking sector faces particular challenges to the effective use of technology, but at the same time, the state of market competition means that banks have little choice but to adopt a more aggressively proactive stance towards the rollout of new technologically-driven solutions. In addition, the rapid pace of technological change has the potential to generate significant impacts on operations.

Technological trends affecting the banking industry in 2023

Technology has assumed a central place in the modern world around which almost everything else orbits, and the gravitational pull of modern technology is such that all parts of the economy have to keep a keen eye on the tech world, and when changes occur, move to adapt to these without hesitation. Individuals thus have to develop tech skills and to adjust their patterns of work and consumption as new innovations emerge, while almost all businesses are faced with the challenge of responding to the accelerating pace of digital transformation and the need to incorporate innovation into their business models. For banks, understanding the potential offered by new technology and how this can be used to fight for space in the increasingly contested market for financial services can thus be a matter of life or death. Within this space, Krungsri Research sees certain areas of technology and innovation as being particularly important for the banking industry through 2023, and these are described below.

1. The growing potential of AI

The comments quoted above from the CEO of one of the world’s leading tech players help to underline what is likely to be the central role that AI will play in the coming years and how profoundly this will transform the world around us; in purely monetary terms, PWC estimates that by just 2030, AI will be generating USD 15.7 trillion’s worth of economic value[14]. In the current environment, businesses across the economy are therefore now seeing how important it is to invest in areas related to AI, whether that is using AI-based analytics to build better consumer experiences, for data analysis and insight, or to link this with cloud-based technology (see next part).

AI capabilities: From fiction to fact

Over the past several years, developments in artificial intelligence technology have made ever-greater inroads into the awareness. This has accelerated over the past year or two, and there has recently been a flurry of reports of sudden progress in areas which had previously been assumed to be off-limits to AI, such as generating images, songs, and text. This began with the unveiling of DALL-E by OpenAI, which is able to use text prompts to generate appropriate images[15] . This was followed at the end of November 2022 by the opening to the public of ChatGPT (also built by OpenAI), which was fine-tuned from OpenAI’s GPT-3.5 model. ChatGPT immediately generated a huge volume of discussion given its ability to engage in a staggering range of complicated text-based tasks, including answering complex questions, writing poems and articles, generating working computer code, and even analyzing and correcting its own errors[16] . The shocking abilities of this new generation of models is such that by some estimates, as much as 90% of internet content may be AI-generated by 2026[17]

Unfortunately, not all uses of AI are benign, and so for example, professional criminals have used fake video calls to pose as police and to fraudulently obtain money[18]. These types of activities rely on ‘deep fake’ technologies that use AI[19] to generate fake images of people, for example by taking an actual image of someone, perhaps of a celebrity or an online avatar, and then overlaying this on a video. Deep fake technology allows this image to then be animated and to speak, and in some cases, to answer questions. Naturally, this opens the door to criminal activity and fraud, as well as to the creation of ‘fake news’, which may spread extremely rapidly. One recent example of this was a deep fake video of Barack Obama insulting Donald Trump, though this was created specifically to raise public awareness around the problems of deep fakes[20].

AI is certain to find applications in a rapidly expanding range of use cases, many of which will involve completing work processes more efficiently. For example, developments in the algorithms that lie behind natural language processing systems and that allow computers to respond appropriately to input from users will become more efficient, especially when providing services to customers. The AI chatbots that are used in these situations are able to communicate with customers through digital media in much the same way as a human helpline operator would. Frost & Sullivan (2022) therefore expect that over 2022 to 2026, the use of AI chatbots will increase at a rapid rate in almost all industries, and these interactions will then provide essential data for analysis of consumer demand and the construction of better consumer experiences. Among other potential uses, artificial intelligence will also be used for predictive sales21/ analytics and production planning.

These examples are, however, just a very small sampling of the areas where to the surprise of many, AI is now demonstrating considerable expertise, and in the future, it is extremely likely that further world-changing abilities will emerge. Against this background, commercial organizations across the economy are researching and planning how to implement AI in their own operations. As such, artificial intelligence is now at the forefront of the technology-based strategies being adopted by many companies.

AI is finding applications across banking services

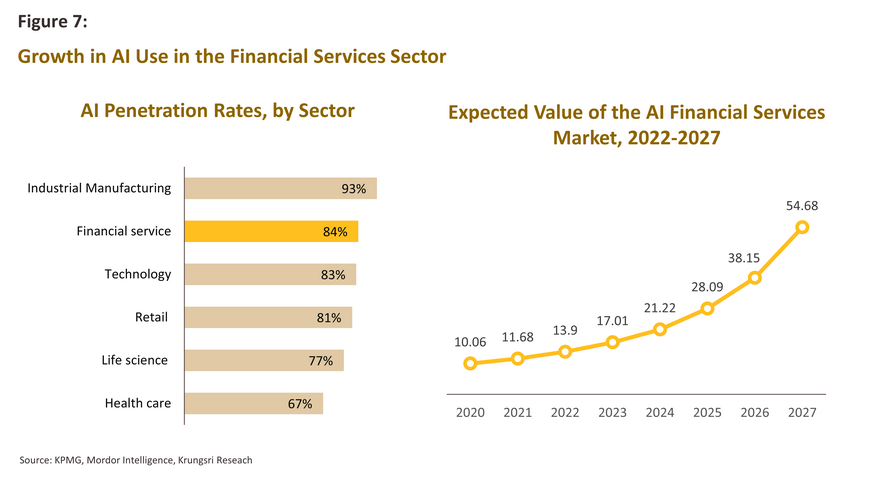

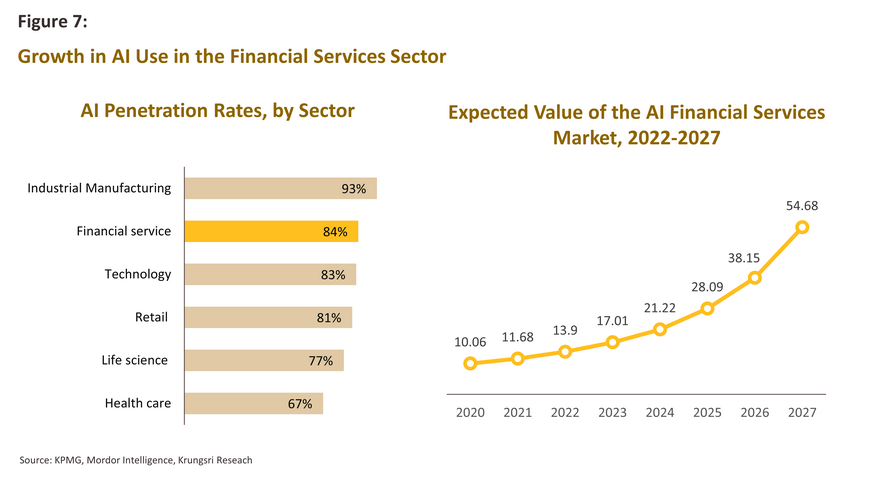

The outbreak of Covid-19 and then the extended pandemic added substantially to demand for the online delivery of financial services, and in response to this, the financial sector has stepped up its investments in and use of artificial intelligence. This is reflected in a survey conducted by KPMG that shows that as of 2021, 83% of players in the financial services sector were using AI of some sort, and so in terms of AI penetration, financial services came behind only the manufacturing sector, which had a 93% penetration rate. Growth rates were also the highest of the industries surveyed, climbing 37% from a year earlier[22] , and KPMG forecasts that over 2022-2027, the value of investments in artificial intelligence by players in banking and financial services will accelerate at an average rate of 31.5% annually, rising from USD 13.9 billion in 2022 to USD 54.7 billion by 2027.

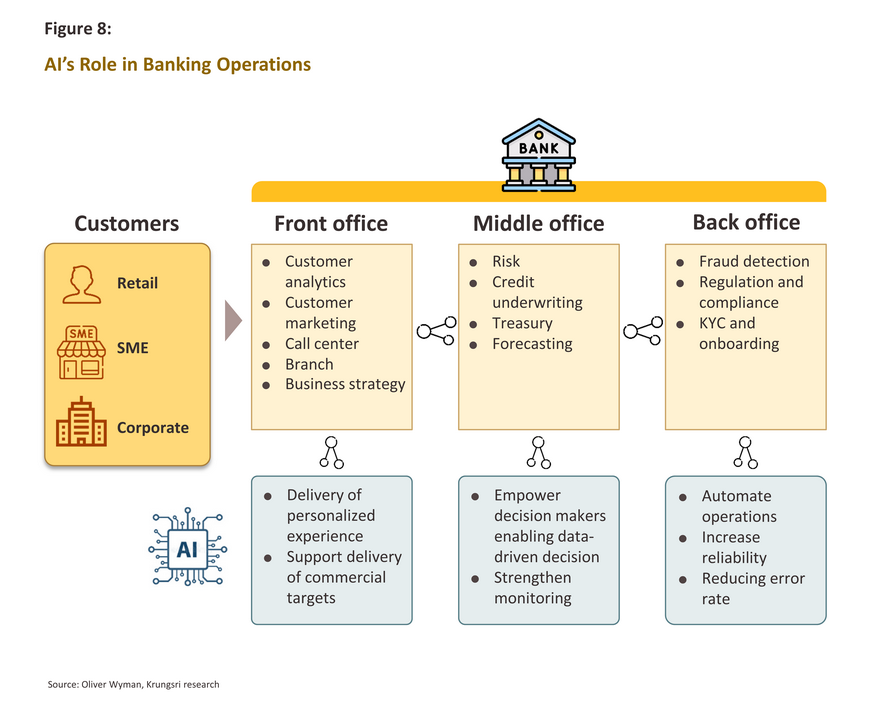

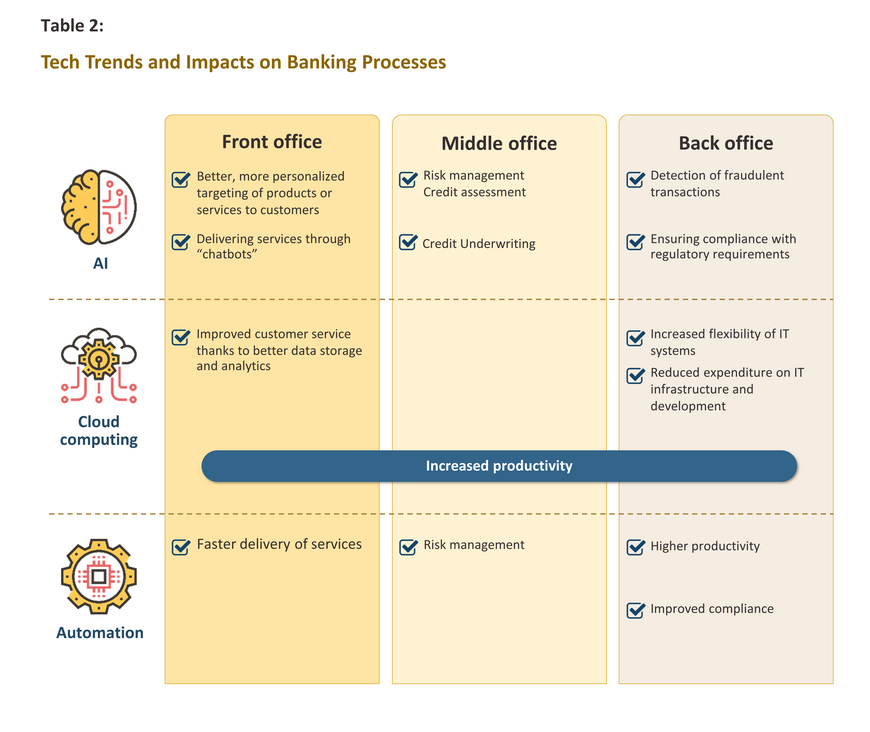

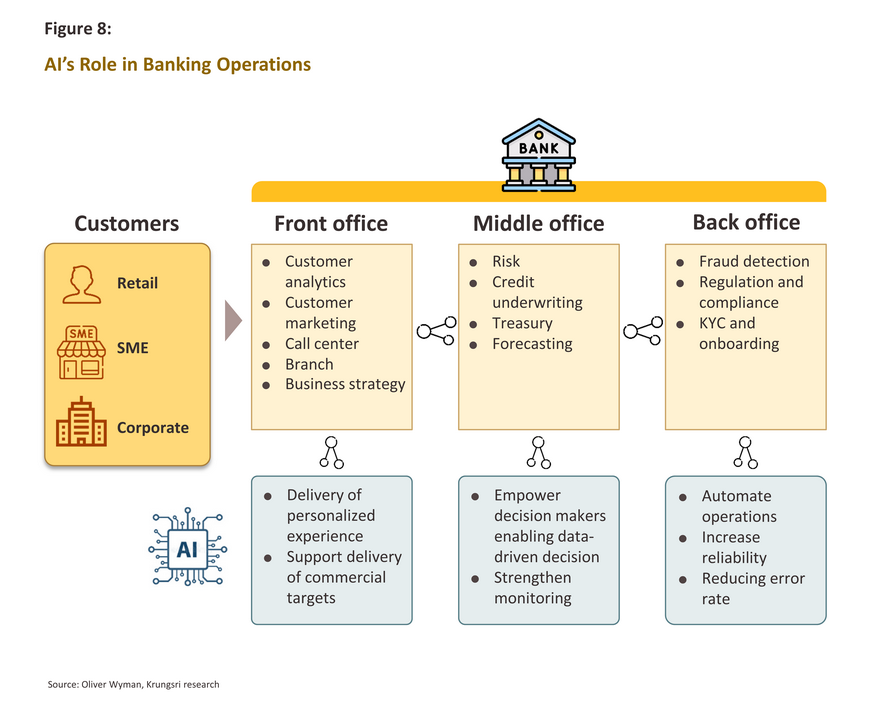

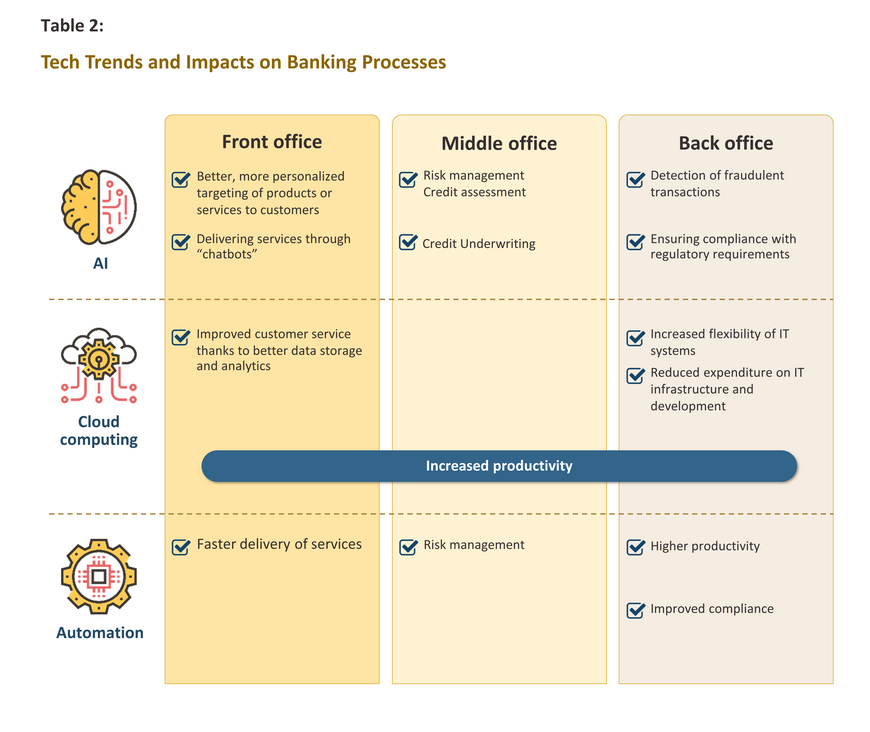

AI has an important role to play in generating value-added for banking services and products, and in improving efficiencies across banking value chains. AI will be able to do this by assisting with decision making, increasing competitiveness, and speeding up business processes. AI will also be used to add value in customer facing or front office situations, for example, by helping with marketing, powering chatbots, supporting improved mobile banking services, and using customer insight analytics to suggest financial products or services to customers that are likely to be to their liking. In middle office environments, where there are no interactions with customers, artificial intelligence can be used for risk management and credit underwriting, while in the back office, AI will find a role in sniffing out fraud, and in ensuring compliance with the relevant legislation and regulations.

In addition to the examples of AI use-cases described above, generative AI is another recent development that holds out interesting possibilities for the banking sector. Under this paradigm, AI can carry out data analysis or generate predictive models that a bank can then use in a wide variety of ways, for example, to detect money laundering, or to accurately predict the volume of future transactions. Gartner expects that Generative AI will play an important role in securing future growth for banking and investment over the next 2-3 years, though when rolling out these AI applications, banks will need to ensure that they have devoted sufficient efforts and resources to addressing issues of trust, risk, and security. Doing so will then help to ensure that AI is accepted by the bank’s customers and that these applications yield the maximum benefit for the organization.

2. Cloud computing: A key technology in the digital era

With many enterprises now committed to business processes that depend on big data analytics, ever greater reliance on new technologies, and the spread of hybrid work patterns, cloud computing is becoming an attractive solution for many organizations. This involves using third party computer systems or server farms to store, process and analyze data, and this then helps enormously in maintaining the stability and nimbleness of business operations and ensuring that IT infrastructure use remains flexible and agile. Indeed, it might be said that as the digital transformation gains ground, cloud technology is becoming a core technology for almost every enterprise-level undertaking.

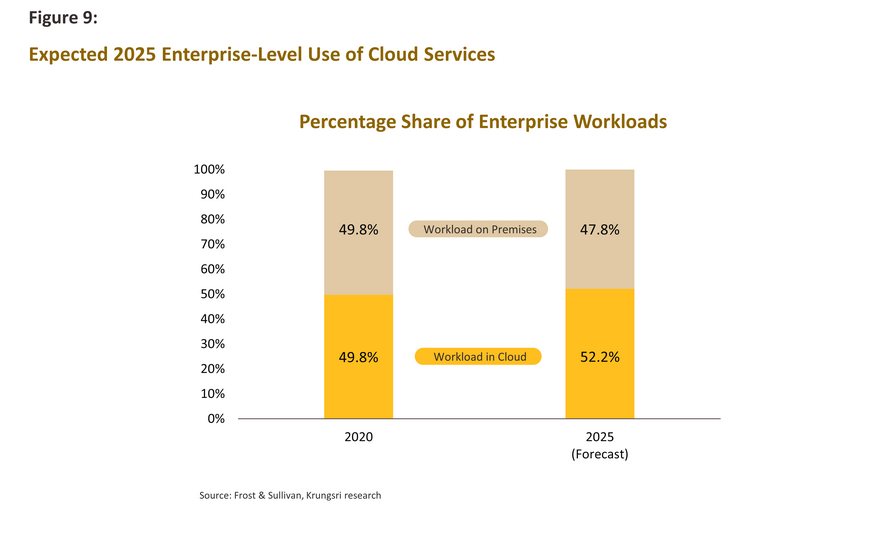

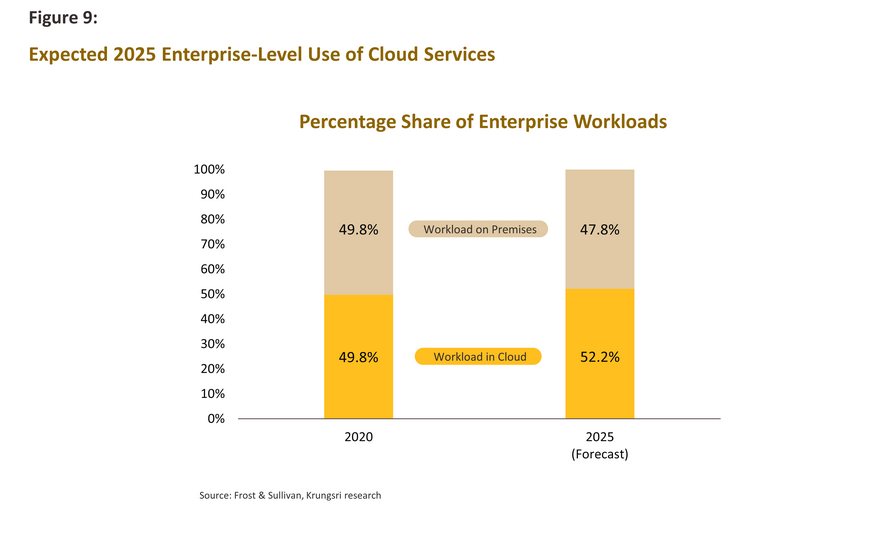

As of 2022, industry experts from the Institute of Electrical and Electronics Engineers (IEEE) saw cloud computing remaining the second most important technology after AI[23] for the next 1-2 years, and enterprises are continuing to shift operations to the cloud. Frost & Sullivan (2022) also expect that by 2025, over half of enterprises will have moved their working operations to the cloud, with a consequent decline in spending on self-managed on-premises IT services and infrastructure.

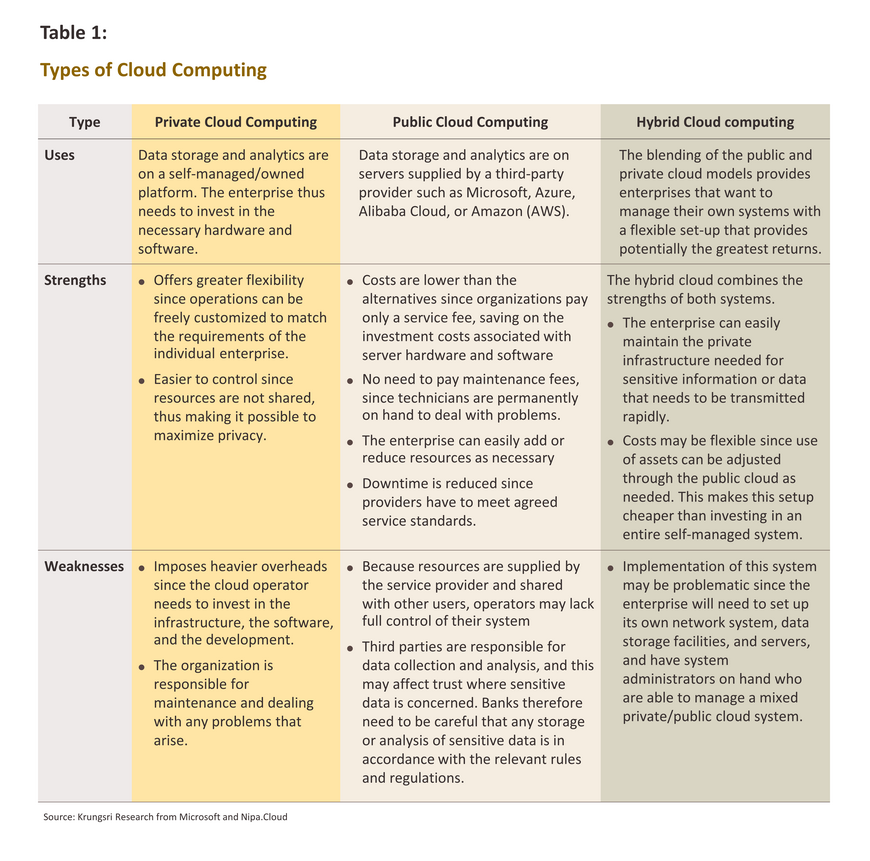

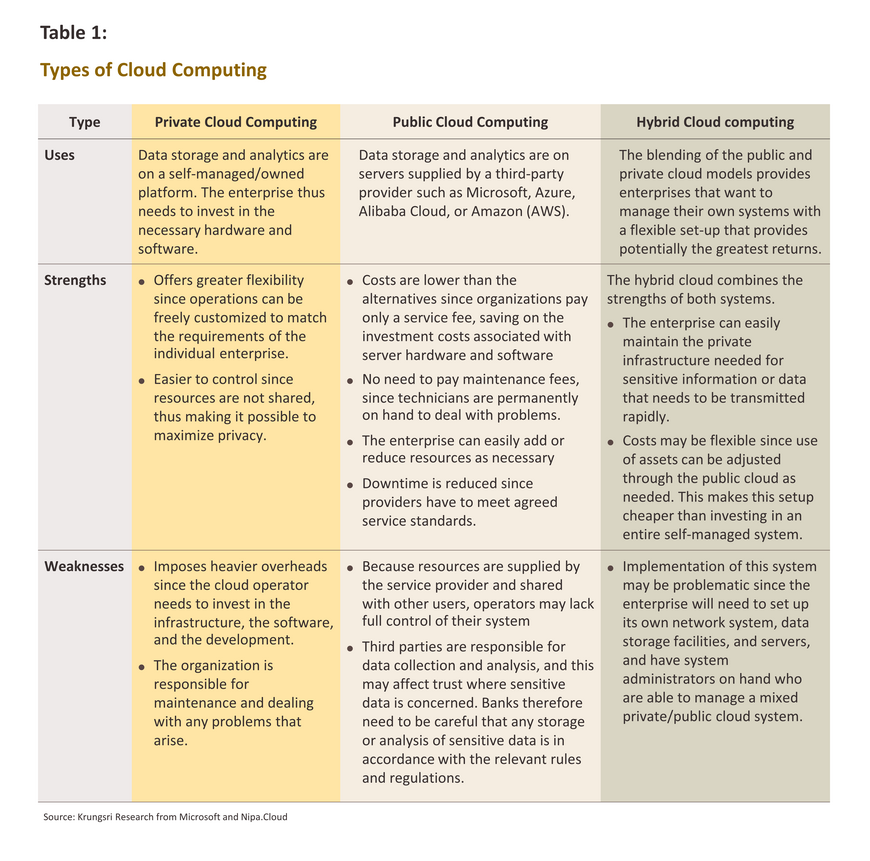

There are three main types of cloud computing: (i) private, (ii) public, and (iii) hybrid (Table 1). Each of these offers its own advantages and disadvantages, and each enterprise will need to make its own assessment of these and choose their model accordingly. Gartner expects that global enterprise-level costs involved in moving to cloud-based services totaled some USD 1.3 trillion in 2022[24] , and as of the end of the year, spending on the public cloud came to USD 490 billion, up over 20% from 2020 and with this expected to hit USD 600 billion in 2023[25] . The major operators of cloud services are thus stepping up investment in capacity, of which Thailand is one beneficiary; Amazon Web Services, the world leader in this market, has announced that it will be sinking over THB 190 billion into developing Thai-based cloud services over the next 15 years[26].

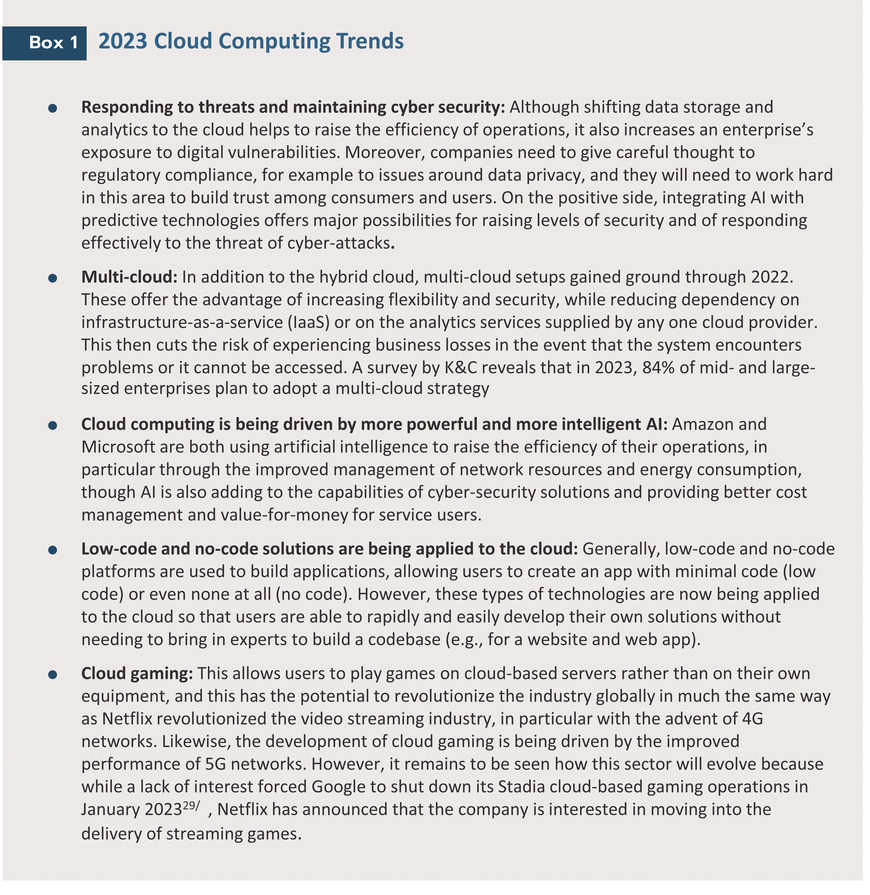

The integration of cloud computing and AI emerged as one of the most promising tech trends in 2022, while cloud computing has also taken up a central position driving the development of other new technologies, including the blockchain, the metaverse, and Web 3.0. As part of this, in 2022, alliances were formed between cloud operators and other tech players, including a partnership between Google and Binance, a major blockchain developer, to allow Smart Chain users to use Google cloud assets to encrypt and analyze on-chain data in real time[27]. Likewise, Alibaba Cloud has joined with MetaverseXR, a leading Thailand-based metaverse developer, to offer comprehensive metaverse solutions to the Thai market[28].

The above quotation from a 2022 publication by Accenture reflects Gartner’s view that adoption and use of the public cloud will be a central tech strategy for the banking sector over 2022 and 2023, despite cloud technology not being a particularly new innovation. Business Insider thus estimates that in 2023, 90% of financial institutions will take advantage of cloud operations[30] and that by 2025, banks’ use of cloud technology will increase 3-fold relative to the 2021 baseline[31]. Factors catalyzing this rapid rate of adoption include the entry into the market of fintech players and the increasing fight for market share, growth in markets for digital assets, changing consumer demand in the digital era, and the need to overhaul internal operations. If banks are genuine in their wish to transform their businesses and to compete effectively in the digital marketplace, it will therefore be necessary for them to migrate their operations and analytics processes to cloud-based platforms.

The advantages offered by the cloud in banking sector

-

Increasing the speed and efficiency of operations: One significant problem faced by banks is linking distributed data, but using advanced cloud analytics can help banks to more effectively store, evaluate, and analyze enormous volumes of customer data, and to do so in real time. This then provides banks with more accurate and more rapid insight into their customers, which in turn allows them to design and promote financial products that are matched to the needs of individuals In addition, operating inside a cloud ecosystem helps to ensure smooth connections within data centers and between customer management and back-office procedures. This accelerates the flowthrough of banks’ operational procedures, their analytics programs, and their ability to make informed judgements on a wide range of matters.

-

Improved customer services: One outcome of being able to link disparate data sources and then to generate near-instantaneous insights from this is that banks are able to develop financial products and services that better address consumer needs. Moreover, cloud-based customer relationship management (cloud-based CRM) is beginning to be used, and this will improve the management of customer data and interactions across a range of communication channels.

-

Improving the agility of the organization’s IT systems: Shifting IT resources to the public cloud offers significant advantages given the fact that the cloud operator is likely to develop their cloud platform as they try to meet the needs of a diverse userbase. This helps banks increase their flexibility when deciding how to allocate or use IT resources and how to match this with changing demand for the system, or to adjust operations and to bring these into line with new regulatory or good governance requirements.

-

Reduced investment and ongoing overheads for infrastructure and IT systems: Because cloud services provide their own infrastructure, shifting operations to the cloud reduces the need to engage in oversized infrastructure investment, thus cutting unnecessary expenses. Using cloud services may also help to reduce repetitive work that may tie up a significant proportion of a bank’s IT infrastructure.

3. Automation: A core plank of banks’ business transformation

Automation is generally associated with the manufacturing sector, where it has certainly played a central role in revolutionizing production lines, but automation is also finding roles to play in the banking sector, especially as players find it increasingly necessary to transform themselves and to ensure that their operations and their service delivery are both rapid and efficient. Automated systems are thus becoming ever more important, and research by Gartner indicates that automation will be one of the three most important technologies for the banking sector in 2022 and for the following 2-3 years as this becomes a central driver of banks’ long-term business transformation [32] .

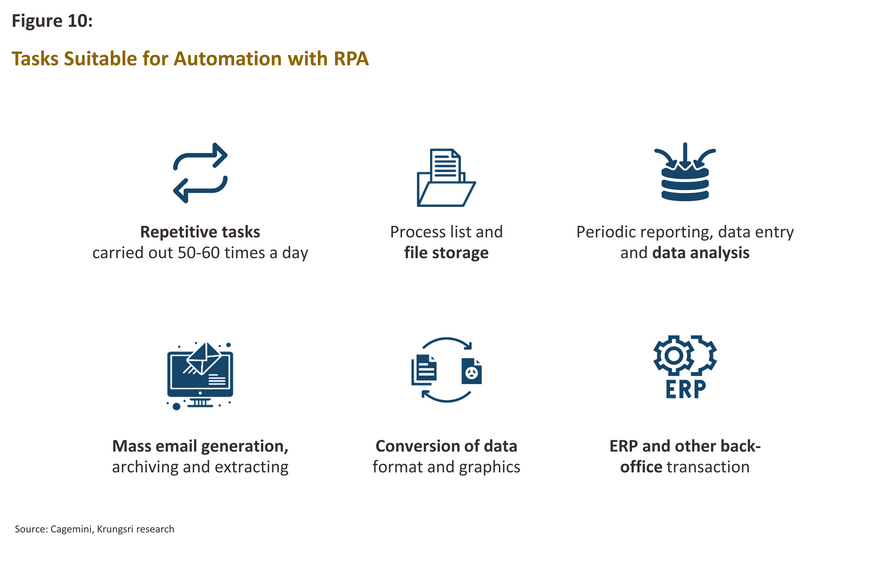

Robotic process automation (RPA) is one widely used type of automation that has been deployed in many different situations to manage documents and data. RPA often takes the form of software that can be used to assess the work of employees engaged in, for example, data entry or data management work, placing orders, or other types of computer-based tasks and then to take over from and replace the human operator. A report by Cagemini (2017) states that tasks that are most suitable for RPA and where this can best replace human workers are those that are repeated many times a day, and/or that involve updating records. data storage, and data manipulation (Figure 10). RPA thus holds the possibility of helping banks make their document and data management much more flexible and responsive, as well as allowing for the real-time monitoring of work processes.

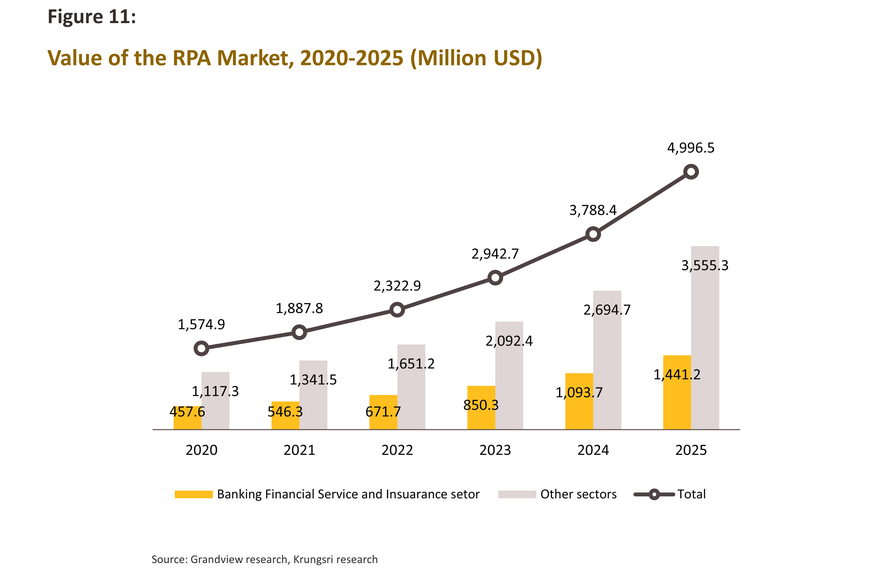

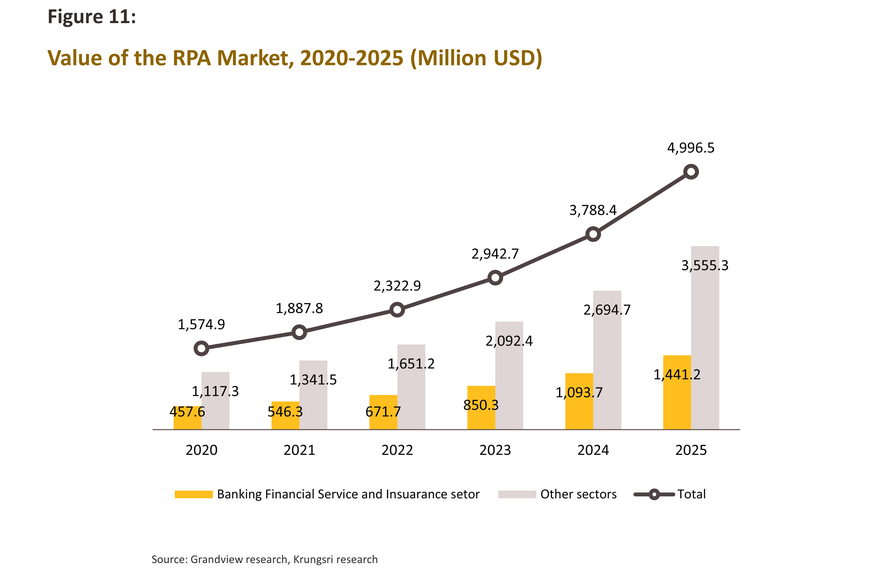

The digitalization of society and the growth in work-from-anywhere have given a strong boost to uptake of RPA around the world, and data shows that as of 2020, the market for RPA technologies was worth USD 1.58 billion, with this expected to grow at an annual rate of 21.2% (CAGR) and so to reach a value of USD 4.99 billion by 2025. Over the period 2020-2025, use of RPA technology is also forecast to be highest in the banking and financial services sector, which is expected to be responsible for 29% of all spending on RPA [33]. Thus, spending will rise from USD 457.6 million in 2020 to USD 3.55 billion by 2025 (Figure 11).

The benefits of automation in banking sector

-

Speeding up delivery of customer services: Providing rapid and responsive customer services is a cornerstone of customer attraction and retention, and automation will provide a useful means by which banks are able to accelerate their service delivery. This includes automated onboarding of new customers to cut delays resulting from problems with documentation or other types of information, automating ‘know your customer’ processes, which results in smoother and quicker processing of customers from their first interaction with the bank onwards, and the automation of transaction processing to ensure that these match the stipulations that have been laid out. One interesting piece of research from Citizens bank in the US shows that following the application of RPA technologies to these processes, the time spent on these types of tasks by customers dropped by as much as 85% [34].Automation can also be used in loan or credit applications to check forms, gather information on the applicant from different sources and use this to assess the application, and then to generate a credit score. The outcome of this is then that in addition to increasing customer satisfaction by giving applicants a rapid response, the bank also gains from the increased accuracy of its risk assessments and credit decisions.

-

Raising productivity: Automation can help to improve the cost efficiencies of banks’ back-office operations by reducing reliance on repetitive work processes that eat up employees’ time. This then helps to cut overheads and frees up staff to add value to business processes or to work on more creative projects. Automation has the additional benefit of reducing or eliminating human error and of sidestepping problems with labor shortages.

-

Helping with compliance and risk management: Combining advances in automation and optical character recognition (OCR) that can be used to scan and process documents facilitates the work of compliance departments and other related parts of the organization. This also reduces the number of mistakes that are made, and slashes the possibility for human interference in the consideration of matters relating to regulatory compliance or risk management. Moreover, automation offers additional possibilities for detecting fraud by automatically filtering and checking the names of those involved in business transactions against a battery of databases, investigating suspicious transactions, and by monitoring the status of customers’ accounts (e.g., to warn or shut accounts if they remain inactive for a specified period of time (i.e., off boarding)). One of the more interesting examples of automation in the banking sector is the development of the ‘Nadia’ system by the Dutch banking giant ING. This is able to interrogate ING’s global databases and to check the approaching expiry of areas of business registered as potentially risky, and then to request that the ‘owner’ of these provides an update. This thus allows for more efficient risk management by the bank[36].

Interestingly, it is not only banks that benefit from the types of automation described above, and if banks acquire expertise in these areas, it may be possible for them to offer robot-as-a-service programs to outsider organizations. For example, since 2016, ING has been offering its AI-powered SAIO[37] automation services, which are used to manage operations, to external clients.

4. The Internet of Things (IoT): Exploiting 5G technologies to create seamless linkages

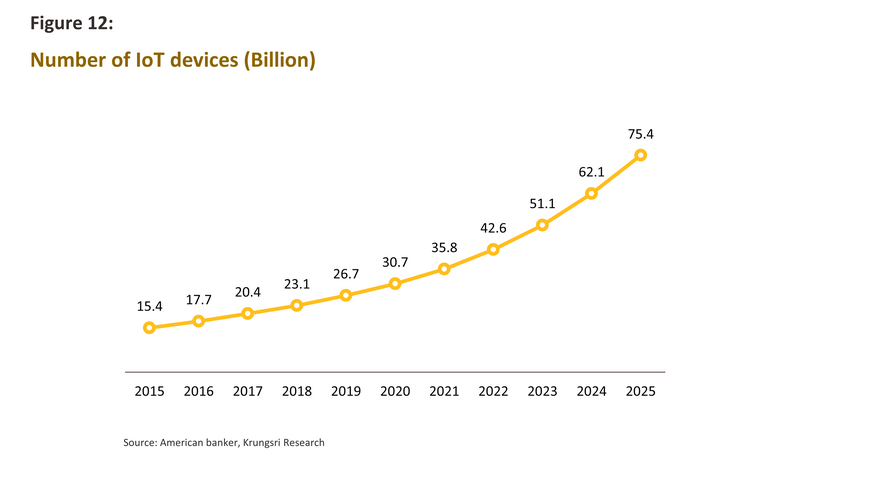

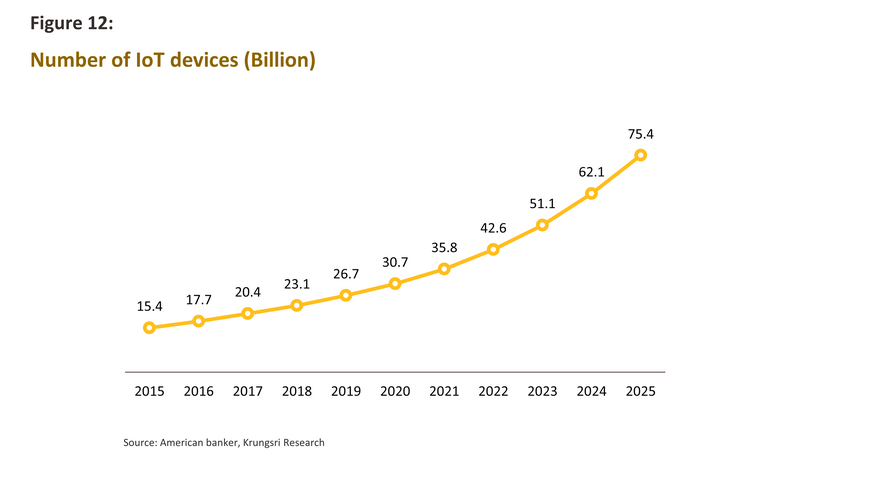

The Internet of Things (IoT) is being used to make daily work and consumption easier and more convenient, to build additional value for businesses, and even to develop smart cities, while in the near future, it is certain that the IoT will have a more important role to play in the economy and will find a much wider range of use cases. One factor underpinning the rapid growth in the internet of things is the rollout of 5G networks since these have much shorter latency times, and because this cuts delays between server requests and responses, data can be transferred much faster. American Banker (2023) thus estimates that as of 2023, there are over 50 million IoT-enabled devices active in the world, and adoption rates will be helped further by falling costs and lower power consumption.

Many IoT applications have the potential to affect individuals directly and their use, or lack of it, can even be a matter of life and death. For example, to help prevent children being locked into vehicles, smart school buses are fitted with heat and motion sensors such that if a child is trapped inside during hot weather, these sensors will connect to an IoT system to send an alert to a teacher or another individual[38]. In the business world, the IoT is also becoming much more important and finding an ever-larger number of uses including: collecting data on consumer behavior that can then be used to develop better products and services; smart farming applications, which use sensors to check on yields and on atmospheric and soil conditions; supply chain management; the development of next-generation autos; and healthcare. Beyond this, the IoT also plays a very important role as the infrastructure connecting and linking other technologies (including supporting and connecting to the metaverse) and in providing training data gathered from a broad range of sources for use in the improvement of AI capabilities. These types of applications rely on the ability to connect with the wider environment through sensors and then to exchange data via the internet.

The benefits of IoT in banking sector

-

Real-time collection and analysis of data on customer behavior: High-speed 5G networks can be combined with sensors and smart systems to gather data on consumer behavior[39], and this can then be used by banks to generate new insights into their customers. This analysis can provide the basis for producing real-time suggestions for financial products and services matched to individuals’ needs, or even for generating personalized products that are targeted at the needs of particular bank clients. For example, banks might use data gathered from sensors to suggest that customers apply for credit, data about customers’ driving habits could be used to promote insurance policies that are closely aligned with the individual’s needs, or in the future, the data could be used to design new types of financial products or services that will be of use in the metaverse. Bank branches could also install sensors to detect the number of customers using particular branch services and then use this information to optimize how they deliver services, possibly also allowing customers to check how busy a branch is on an app before making a visit.

-

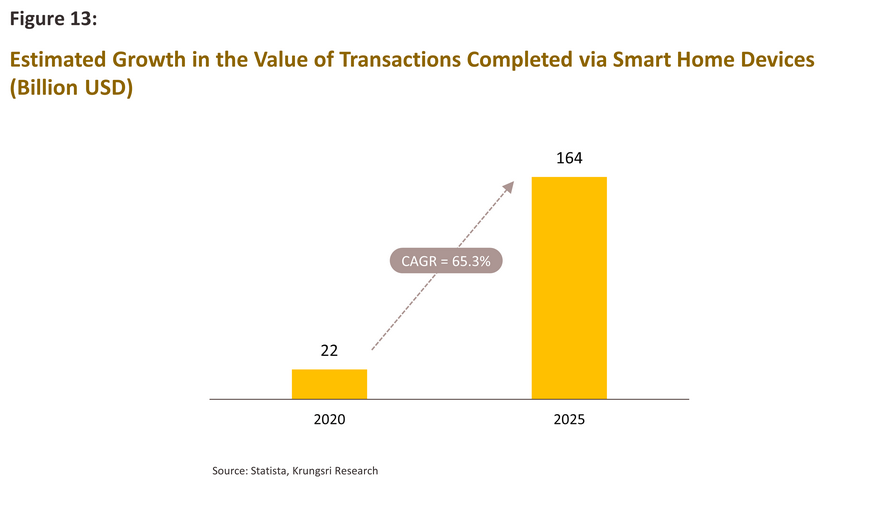

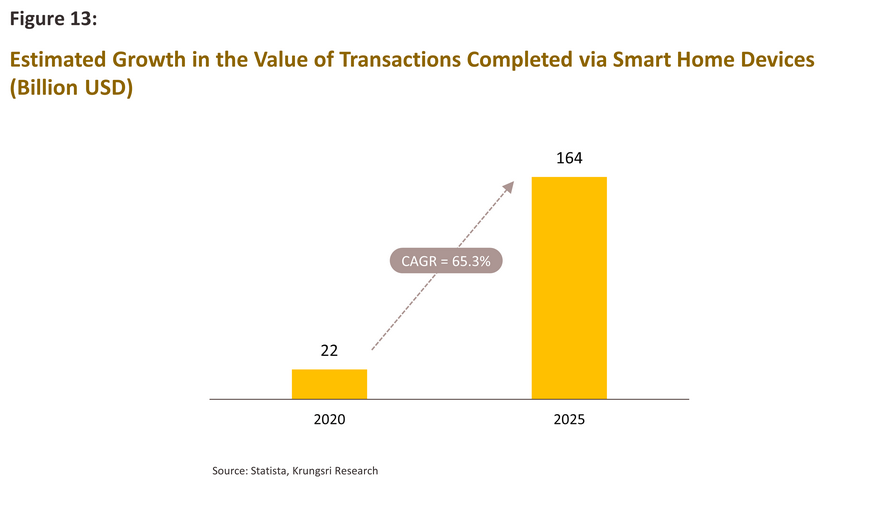

Making payments through smart devices: Technological advances have made it possible for people to order and pay for goods and services through smart speakers or other smart home devices. Statista estimates that by 2025, the value of these types of transactions will total USD 164 billion, though development of these will depend on further integrating the IoT with biometrics to assist with confirmation of identities and to process verbal instructions.

-

Tighter security: Banks are able to use IoT-enabled devices to improve the security of their offices, branches and other assets. Sensors are able to detect the entry of unauthorized individuals into restricted areas, and when security systems become aware of unusual behavior, they can send warnings over the internet to the bank’s security team. These can then instantly be put on alert to investigate further or take other action as necessary.

5. Immersive technology: Ready for the metaverse

During the Covid-19 pandemic, talk about the metaverse[40] became much more widespread, partly because as people sat through lockdowns in the real world, they increasingly dreamt of breaking out into the virtual world instead. Beyond this, at the end of 2021, Facebook relaunched itself as Meta as part of its move to focus more heavily on developing applications within the metaverse. Indeed, it appeared for a while as if the metaverse was a new El Dorado, with corporations from across the economy (including banks) waiting their turn to stake out a claim and then reap the enormous profits that would surely flow from their ability to generate exciting new online user experiences. In fact, at the time, McKinsey (2022) estimated that the metaverse would be generating USD 5 trillion in income by 2030[41], but questions remain, and the tech giants of Meta, Apple and Amazon are uncertain about what consumers understand the metaverse to be and whether interest in using the metaverse is even as widespread as initially hoped [42] .

However, before the fully realized metaverse experience becomes available, over the shorter-term, immersive technology will disrupt many industries given its ability to alter the human-machine interface by sidestepping the need to use screens, mice, and keyboards when interacting with digital devices. Immersive technology will also play an important role in building and facilitating novel customer experiences across a wide range of businesses, including within the banking industry itself.

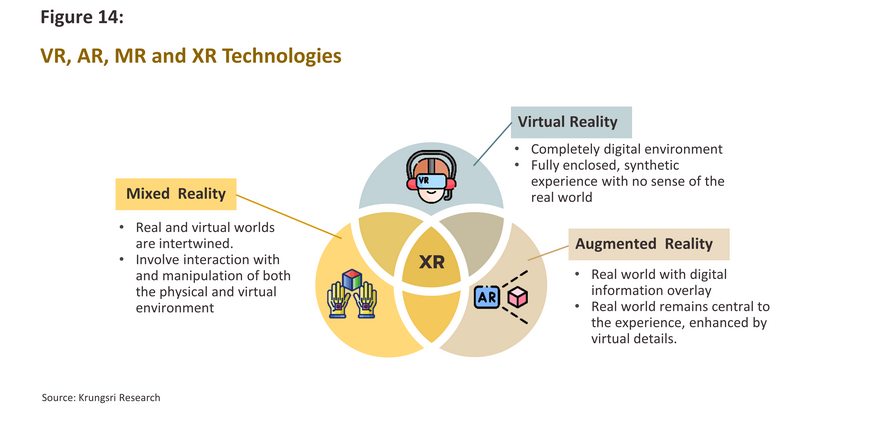

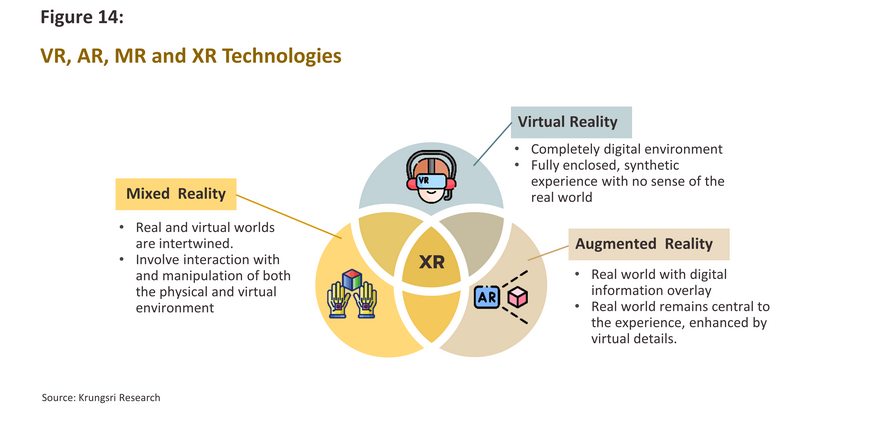

Immersive technology is really composed of several individual digital technologies: (i) Virtual reality (VR) entirely replaces the real world, and when users enter this virtual space (through a VR headset or glasses), they experience an entirely separate digital world. (ii) Augmented reality (AR) combines the real and the virtual worlds, which can then be experienced via a computer or a phone app. (iii) Mixed reality (MR) mixes the real and virtual worlds, which are linked together with virtual objects that behave as they would if they were real. (iv) Extended reality (XR) mixes the potential offered by virtual, augmented, and mixed realities to create a mixed virtual-real environment and within which users are able to interact with one another, though this is currently under development. A survey by Meta carried out in Thailand revealed that 74% of respondents reported using technologies connected to the metaverse at some point in 2022[43].

Immersive technology has the potential to outpace human imagination, connect the virtual and physical worlds, and create enormous opportunities across the economy. The latter includes: (i) generating consumer interest in goods and services and easing purchasing decisions[44], for example through Amazon’s ‘virtual try-on’ services[45], which allow buyers to virtually try-on shoes on their mobile phone before making a purchasing decision; (ii) boosting tourism by allowing tourists to experience virtual versions of tourist sites or even to take a virtual tour of, for example, Singapore[46] or Thailand[47]; and (iii) helping in medical applications by providing medical students with the opportunity to practice surgical procedures in virtual environments[48] or by helping patients with Alzheimer’s preserve or recover their memories[49].

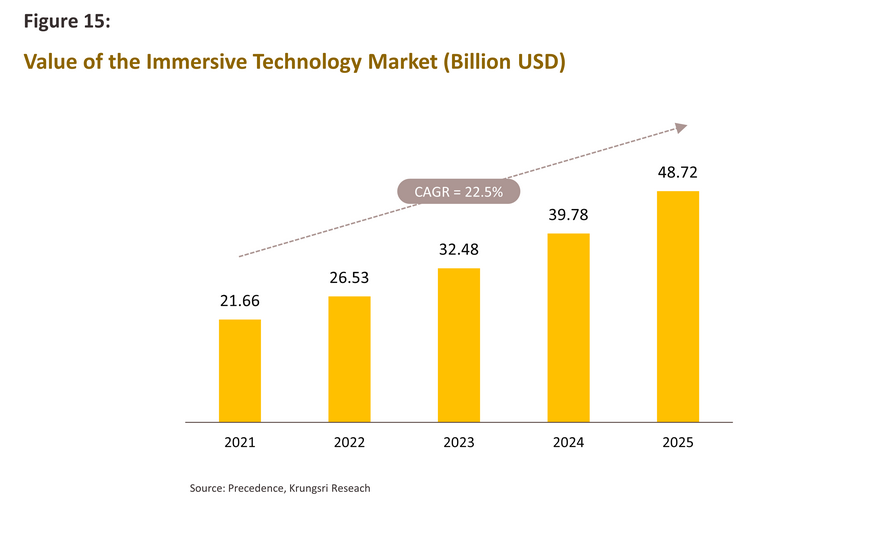

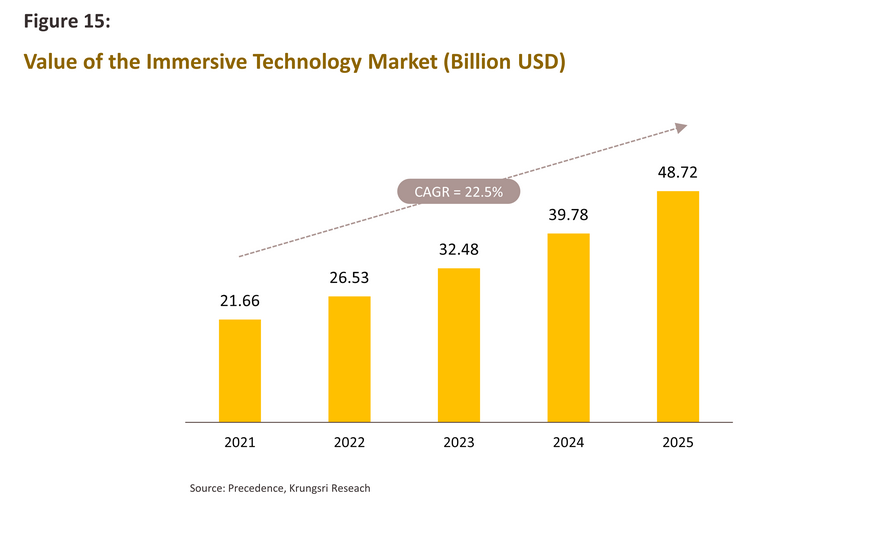

The cost of developing immersive environments is also dropping, as is that of the consumer equipment needed to access VR worlds. Moreover, the higher speeds and lower latency of 5G networks will also make accessing virtual worlds significantly easier, and as such, the market for metaverse services and products continues to climb rapidly. Precedence (2022) thus sees the value of the VR technology market jumping from USD 21.7 billion in 2021 to USD 48.7 billion by 2025.

The benefits of immersive technology in banking sector

-

Increased consumer interest in banking products and services: immersive technology offers the possibility of combining utility with entertainment for customers accessing banking services, for example, by adding functions or gimmicks to banking apps so that users can ‘scan’ their credit card or bank book with their mobile phone, which would then give them access to personal banking information[50]. These types of functions could then be extended to suggest financial products or services to customers. Hopefully, customers would be interested in these, and this would help to increase their understanding of the bank’s products. Banking customer services could be further improved by the use of VR technology, for example, by providing customers with an immersive experience or by increasing contact between bank staff and customers when promoting financial services to them. This could even entail stepping up the realism of the interaction to make it seem as if, when the customer contacts the bank, they are actually visiting a real bank branch.

-

Greater appeal to younger generations by appearing to be contemporary and on-trend: The design and development of materials to educate the public on financial matters, though especially when these target younger consumers, can help to build the corporate image of banks by making them appear more contemporary. This can also help to build customer engagement, as is seen in the example of the major South Korean bank Kookmin, which targeted educational services related to financial products at younger customers[51].

-

Helping with banking operations and staff training: One use of immersive technology is to increase participation and involvement in the office and to raise the overall quality of employee’s experience at work. One part of this could involve Meta’s ‘Horizon Workroom’ application, which was released in August 2022 and that allows individuals in different locations or distributed teams to come together in a virtual meeting simply by putting on a VR headset[52]. In addition, VR technology can also improve the efficiency of staff training programs, as seen for example in Bank of America’s use of VR to train 50,000 staff on customer services within a virtual environment. This could then be extended by using data collected during the training session to better understand and gain insights into staff behavior[53].

It is clear that in addition to providing direct benefits to banks, exploiting the potential offered by immersive technology will also help organizations prepare for the transition to the metaverse. In addition, although experts believe that it will be at least another 5-10 years until this becomes both a technological reality and is widely accepted and used, the earlier that banks begin to plan and prepare for the use of VR worlds and to design products and services that take advantage of immersive technology, the better, since this will provide them with a launch pad from which to begin to seize opportunities in the virgin territories of the metaverse.

6. The blockchain: A revolutionary approach to data storage [54]

The emergence of blockchain technology has been hailed as a revolution in how data is stored and processed, with clear implications across a wide swathe of the economy, including importantly how business transactions are processed and recorded. This is because the blockchain ensures that data storage is largely immutable, though blockchain’s advantages also include its being decentralized. Blockchains are governed by protocols that determine how transactions are recorded, and these operate over peer-to-peer networks. The blockchain is thus a type of digitally distributed ledger technology (DLT) that records data in individual blocks that are cryptographically linked to form a chain, and hence the ‘blockchain’

Blockchains have five salient features, namely: (i) they are reliable and secure; (ii) they are low-cost and efficient; (iii) they are transparent and verifiable; (iv) they serve as a means of exchanging value so they can be used to digitize assets; and (v) they are programable. Thanks to the advantages that these features offer, over the past few years, blockchain technology has played an ever-greater role in a wide range of industries, including finance, public health, manufacturing, transport, and many others. EU Blockchain estimates that the size of the blockchain finance market will explode by 73% annually between 2021 to 2026, rising from a value of just USD 1.46 billion at the start of the period to USD 22.46 billion 5 years later.

The benefits of using the blockchain in banking sector

In the near future, blockchain technology is likely to exert a revolutionary influence on the banking industry in areas including payments, capital markets, risk assessment, and back-office services, and in response to this, banks worldwide are rushing to embrace the blockchain and to find applications for it across their operations. Among the first of these, JP Morgan has conducted tests on a cross-border DeFi payment system that is built on a public blockchain, and as of 2 November 2022[55], this has been approved by the Singaporean central bank . Other benefits accruing to banks from the use of blockchain technology include the following.

-

Reduced operating costs: One effect of the introduction of blockchain technology is to disintermediate transactions. However, on the one hand, the continuing presence of these intermediaries may help to sustain trust in the system overall, while on the other, the reduction in the scale of their role may also help to cut costs arising from transaction processing. An interesting example of this is the use of blockchains as the foundation for cross-border payment systems, which is estimated to have cut costs for the global banking system by USD 0.3 billion in 2021, with this rising to USD 10 billion by 2030[56]. Nevertheless, it remains the case that banks may face greater competition from blockchain-based businesses, especially in the area of payment systems, and this is likely to eat into revenues generated from service charges. In addition, banks may also see their customer engagement or even the overall size of their customer base decline as new players offering blockchain-based payment platforms enter the market.

-

More efficient credit allocation: By allowing access to, for example, payment history that is recorded on a public blockchain, greater use of blockchains may help banks make more rapid credit assessments and to cut the risk of defaults. In addition, credit may be approved in the form of smart contracts[57], which will also help to reduce counterparty exposure to the risk of default and further, to automate the international trade credit system.

-

Improved authentication systems and reduced opportunities for fraud: As well as cutting banks’ overheads, using blockchains also makes KYC procedures easier. Goldman Sachs thus estimates that introducing blockchains into identity confirmation or authentication processes could result in annual savings for banks of more than USD 160 million[58]

7. Zero trust: Improved security

Although the technological revolution has brought enormous benefits to the economy, this has come at the expense of making businesses vulnerable to cyber security threats, and as dependency on IT has risen, the number of hackers and professional criminals looking for security holes that can be exploited for theft or ransom has risen. Indeed, Cybersecurity Ventures estimates that as of 2022, global cyber security losses totaled USD 7 trillion, a massive jump from 2015’s USD 3 trillion[59].

This is a particular problem for the banking sector since its operations and services are dependent upon data storage and manipulation, and technology is woven into all aspects of corporate processes. At the same time, banking customers expect to be able to access services instantly and seamlessly, which further deepens the industry’s dependency on technology. Given this, banks are exposed to a significant threat from cybercrime, which can take the form of phishing scams[60] that target bank customers or attacks directed squarely at banking infrastructure, such as data breaches or the use of ransomware[61], and although successful attacks targeting banks directly are less successful than those aimed at banks’ customers, when these occur, the losses can be significant. A report by IBM[62] thus estimates that in 2022, average losses[63] arising from data breaches came to USD 4.35 million. Digital security and digital trust are therefore issues that banks absolutely cannot afford to neglect since not only do successful hacks undermine consumer trust, they also directly threaten data integrity and may result in the release of confidential business information.

Zero trust security: Shielding the banking sector from cyber threats

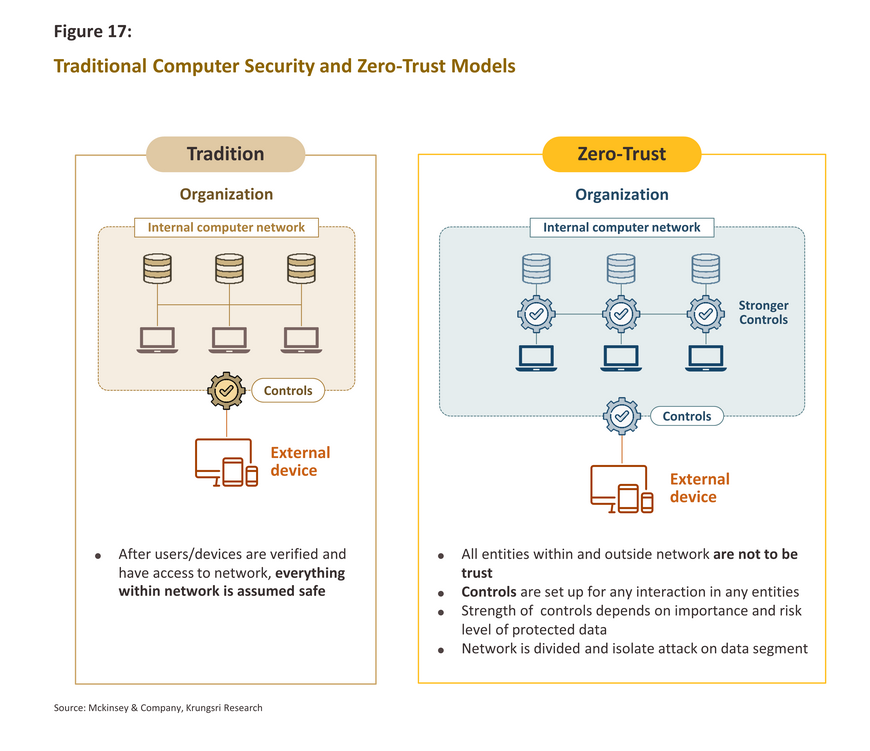

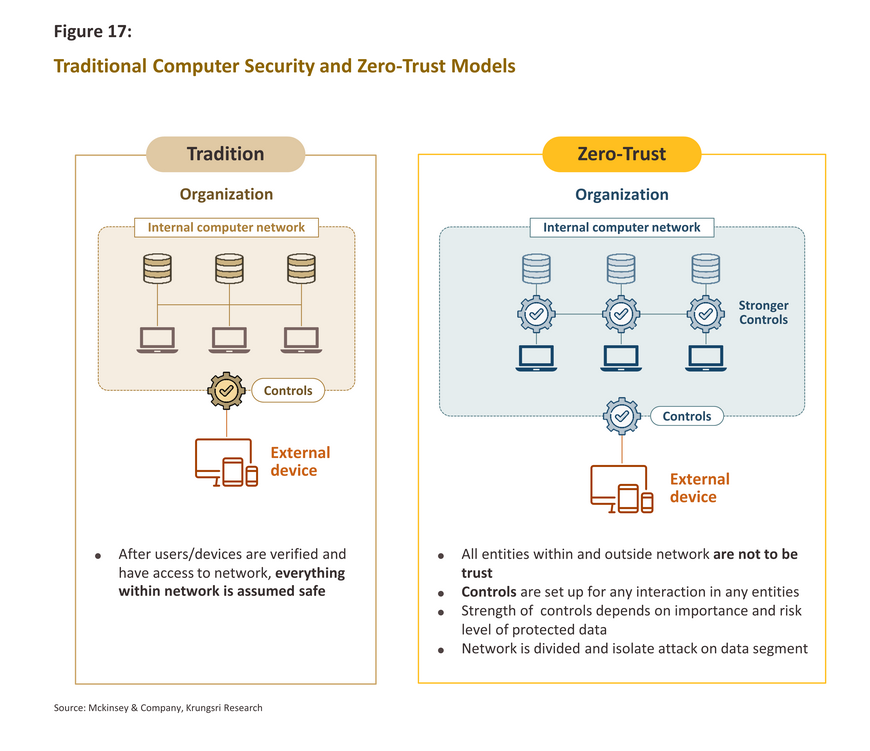

The trends in computer security that are assembled under the heading ‘zero trust’ have been recognized by McKinsey as a tech trend of major importance since 2022, while a year earlier, Deloitte said that zero trust was one of the four most important tech trends for the banking sector. In reality, zero trust (or ‘don’t trust anyone or anything’) has been discussed in cybersecurity circles since 2010 [64], when it began to be impossible to ignore problems with traditional castle-and-moat security systems. This is a metaphor that uses the idea of a medieval European castle surrounded by a water-filled moat to describe how firewalls[65] protect data or networks from attack . In this metaphor, when users or devices are approved, the drawbridge is lowered and the portcullis raised, and approved entities–and only these–are then granted access to the inner castle. However, it became clear over time that a security model built on this design was inadequate to meet modern threats, and too many outsiders were finding ways across the moat and over the castle walls. Unfortunately, once inside, there is nothing to stop these from accessing any part of the castle and so if all that stands between bank infrastructure and a threat actor is a single line of defense, breaching that defense leaves the bank wholly exposed to exploitation.

Zero trust security arose in response to these problems, and in place of the castle-and-moat system, it proposes a new security architecture that includes: (i) a default stance of mistrust towards users or devices; (ii) strict requirements for authentication, or the enforcement of multi-factor authentication; (iii) authorizing access to the network only in as far as this is necessary to complete a given task; and (iv) introducing micro-segmentation of networks so that access to data or networks can be further restricted as necessary.

In 2022, leading tech players including Google, Netflix, Microsoft and even the US Department of Defense[66] set out roadmaps for the development and implementation of zero trust cybersecurity policies .This is clearly a growing trend, and with the number of cyber-attacks rising and losses mounting, Gartner estimates that the market for zero trust security solutions will jump from a value of USD 19.6 billion in 2020 to USD 51.6 billion in 2026[67]. The market will also be boosted by stricter regulations on data security such that by 2024, it is estimated that three-quarters of the global population will be covered by data protection laws and regulations[68].

The benefits of zero trust in banking sector

-

Reduced risk of cyber-attack or the unauthorized release or use of confidential data: Zero trust security architectures involves segmenting systems or networks and restricting security levels for users or devices to the least privileged level that is compatible with completing a given task, with access to data or networks only available on this basis. This then works to place checkpoints across the system that prevent unauthorized users from accessing data or disrupting the system.

-

Increased security for remote and hybrid working: The Covid-19 pandemic has had a major impact on patterns of office work across many industries, including the banking sector. This has meant that IT systems have had to be altered through the use of VPNs or by shifting resources and processes to the cloud, thus making it possible to remotely access core IT systems. Unfortunately, the benefits of doing this come at the cost of possibly increasing the number of security flaws, though this problem can be ameliorated by the introduction of zero trust architectures. As described above, under the latter, users and devices are granted the minimum necessary localized access, which differs from the situation with VPNs, since these provide implicit ‘all or nothing’ trust, that is, once users have gained network access via a VPN, they are viewed by the system as being universally authorized, whether that should be the case or not.

-

Greater compliance with regulatory requirements: Implementing zero trust protocols makes unauthorized access to sensitive data and networks more difficult, which helps to ensure that companies using zero trust security will be in greater compliance with privacy regulations and legislation on data access and usage.

-

Accelerated overhaul of legacy IT systems: Implementing zero trust systems in banks requires corporations to assess their entire IT infrastructure, which may reveal problems with the ability of currently installed systems to, for example, support the complicated authorization procedures required to ensure that network access is secure. Shifting to a zero-trust system and taking a more forward-looking stance with regard to cyberthreats may therefore encourage banks to modernize their IT systems.

However, fully implementing a zero-trust security system is a costly and time-consuming undertaking, and to achieve this, banks will need to engage in a careful planning process and ensure that participation extends across the enterprise and encompasses all stakeholders. A 2021 report by Deloitte estimates that it could take up to a decade for the banking sector to completely shift to the zero trust model, though this could begin with work on high-risk processes or those likely to be heavily impacted by cyber-attacks, such as those that support payment services or that involve access to and storage of confidential data. Alternatively, banks might begin with pilot projects, such as implementing zero-trust protocols when moving a particular process or activity to the cloud.

Unfortunately, there may be a trade-off between effectiveness and usability for online security systems, and so implementing zero trust protocols may involve a worsening of the user experience when accessing a banking app. Nevertheless, this is a case of prevention being better than the cure because if banks are negligent in this area, this can generate incalculable losses. Given this, it is imperative that when tightening security, banks communicate these issues clearly to their customers and work hard to raise awareness about the importance of cyber security among both staff and the public.

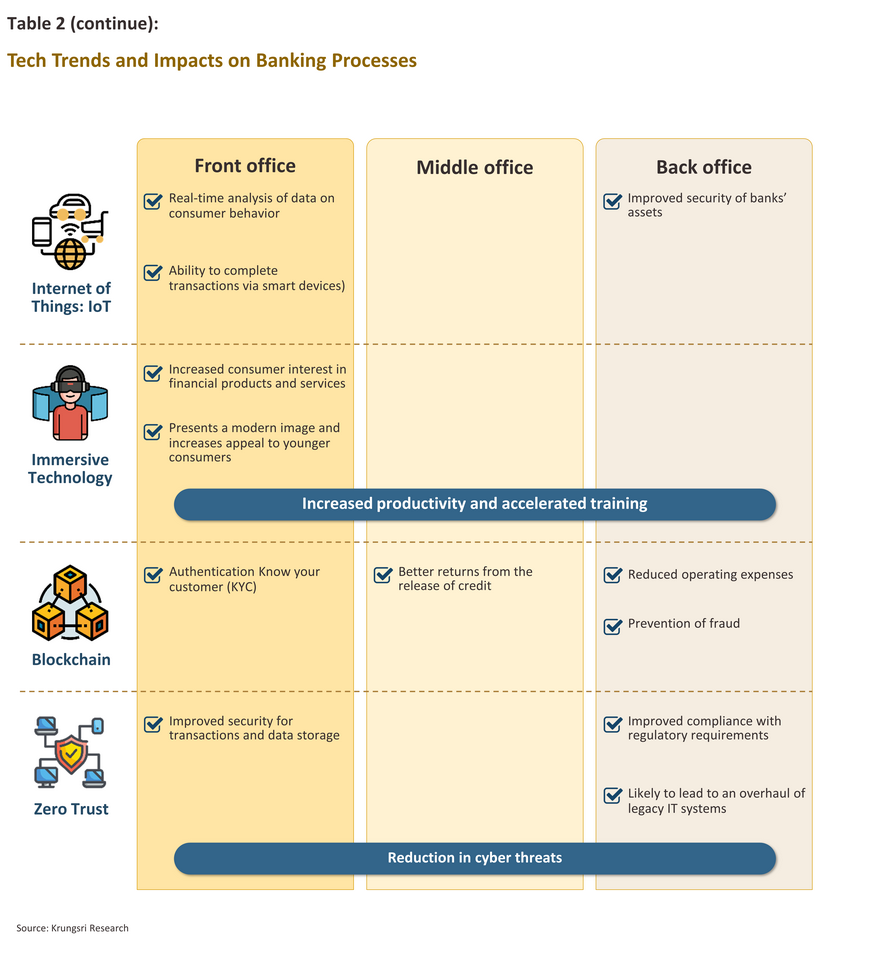

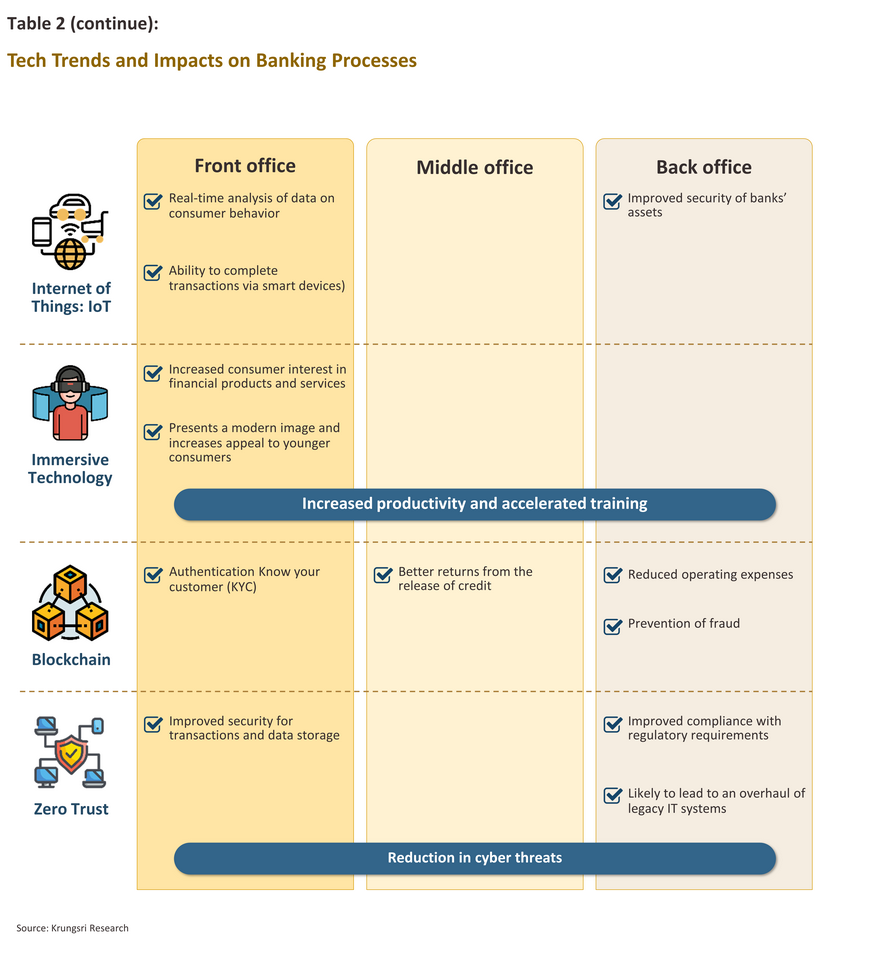

The various trends and developments in technology described above are summarized in Table 2, alongside their likely impact on bank processes.

Krungsri Research view: How can commercial banks adapt to rapidly evolving technology?

As has been shown, the financial landscape is being profoundly reshaped by fast-flowing rivers of technological change, and among the boulders that are being carried downstream to collide with the banking industry are fintech players, which are now competing directly with banks for market share, and digital assets, the importance of which is set to grow substantially in the future. Faced with this onslaught, incumbents within the financial services sector, and most obviously commercial banks themselves, need to do what they can to brace themselves, and while it is impossible to predict the future impacts of technological change on banks’ core activities with absolute certainty, preparing well will provide banks’ with both the armor and the weapons needed to survive and then thrive in the coming struggle for market share and access to customers.

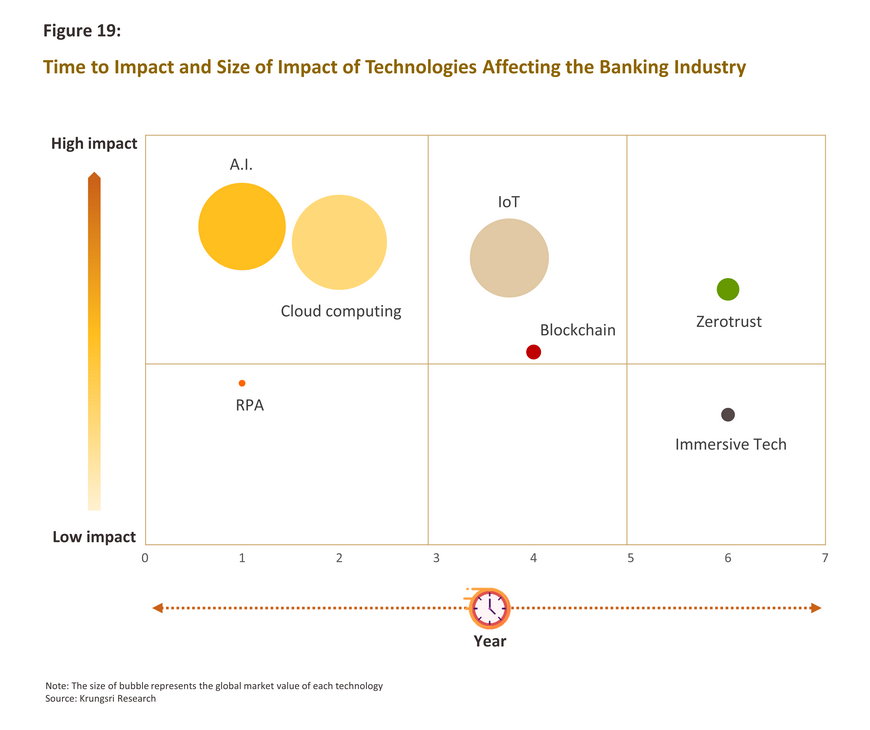

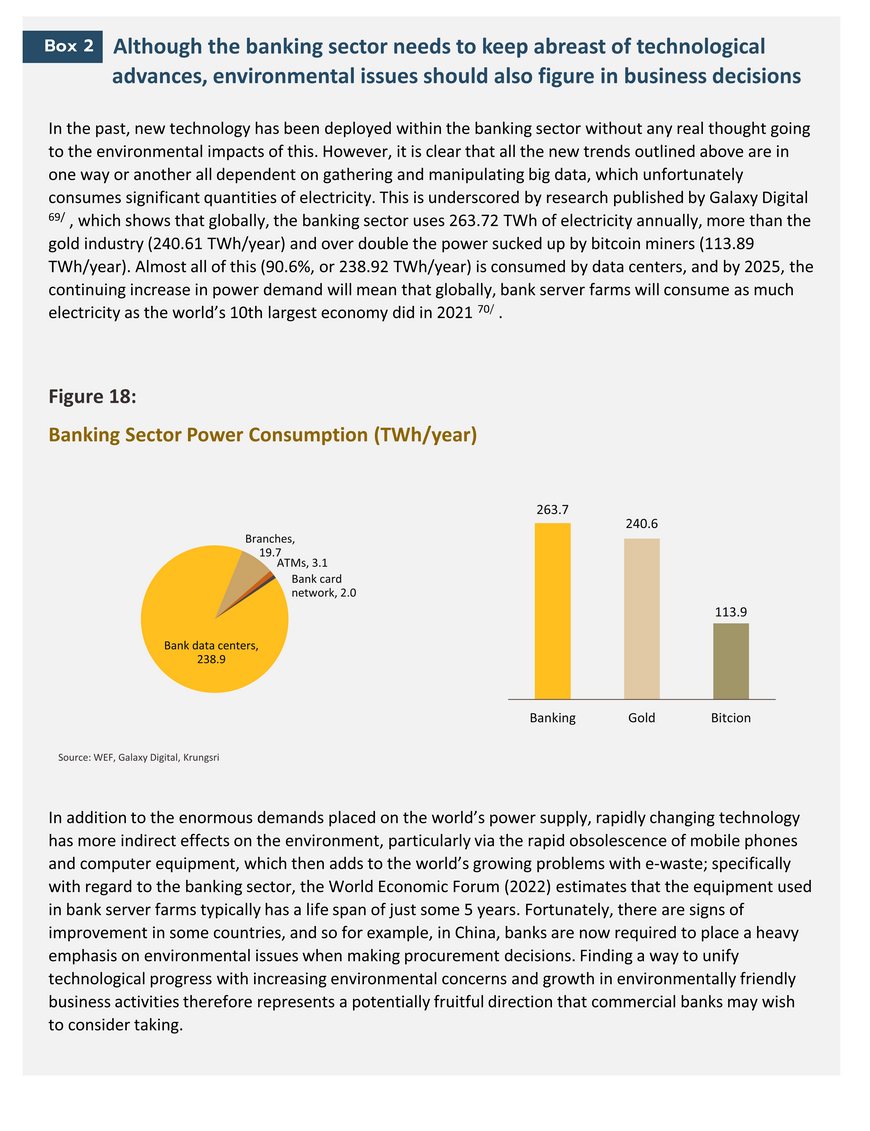

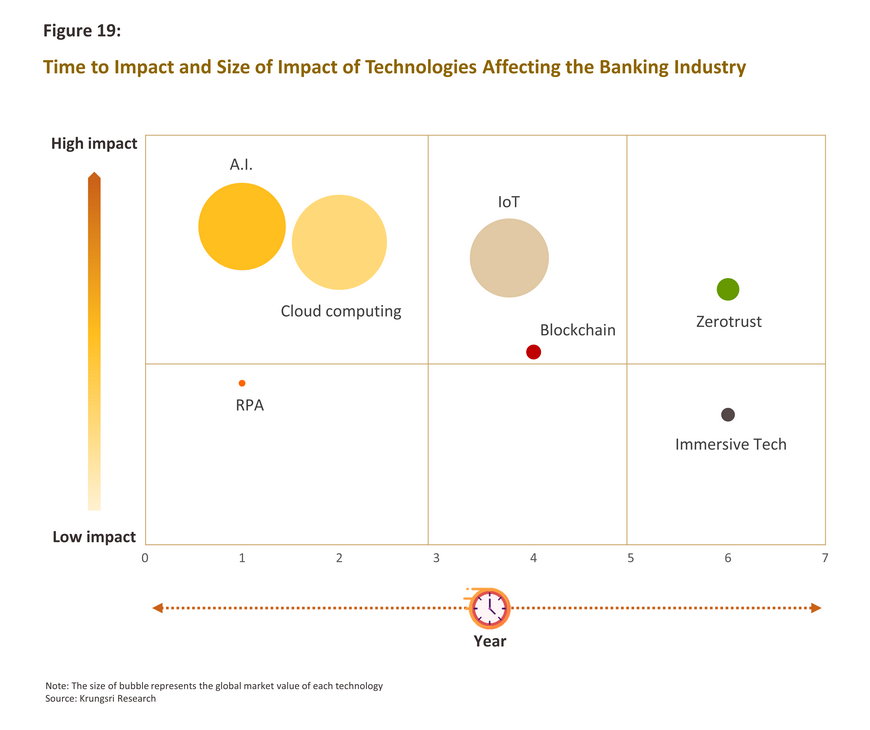

Any progress towards these ends should begin with a careful review of how each type of technology is likely to impact the banking industry because this will then help to ensure that each is applied in ways that maximize its benefits. Considering these trends in terms of both their time to impact and their size of impact, these trends can be divided into the following five groups (Figure 19).

Group 1: These will have an impact on banks from 2023 onwards, and this will be significant in extent. Technologies in this group include: (i) AI, which will transform banking from front office (e.g., for use in developing new products and services) all the way through to the back office, where it will help to make operations more efficient; and (ii) Cloud computing, which has the potential to revolutionize data storage and analytics and to help make operations more agile. Banks are in fact already making use of the public cloud, but Gartner predicts that over the next 2-5 years, hybrid cloud systems will gain ground in the banking industry.

Group 2: In this group, technologies will also begin to impact the banking industry from 2023 onwards but their impact will be less pronounced than those in group 1. RPA automation systems are in this group since these will be one way by which routine work processes are accelerated and improved.

Group 3: These developments are expected to find widespread application over the next 3-5 years but when they do, the impacts may be significant. These include the following: (i) Blockchain technologies clearly have great potential to disrupt the banking and the financial sector by disintermediating processes from data storage through to transaction processing. (ii) The IoT will help to make it possible to complete transactions easily and seamlessly through the use of IoT banking, while also helping banks to extend their data collection abilities.

Group 4: These technologies are expected to take longer than 5 years to become widely used, but with relatively significant impacts when this happens. Zero trust security architectures are the only member of group 4, though the use of these will indicate that thinking about security has changed fairly profoundly and as such, the banking sector will have become more secure and collectively more able to protect itself against cyber threats. It may take some time to get to this point, but banks can begin to prepare for this transition without delay.

Group 5: This group comprises technologies that are likely to take longer than 5 years to become broadly established in the banking industry but that will also have impacts that are less noticeable than those in group 4. Immersive technologies are thus placed in group 5. These are likely to have significant impacts only after at least a decade but banks that are able to establish a presence as pioneers in this space will be much better placed to take advantage of the metaverse and to profit from its development.

It is also necessary to raise awareness within banks of the vitally important role that technology has to play not just in shaping the future of the banking industry but also in providing a major tool with which to build competitive advantage. Technology will therefore provide valuable assistance to individual banks when fighting for market share against other banks, fintech operations, and the big tech players that are forcing their way into the financial services industry, and because of this, these issues will become relevant to individuals across the enterprise. As part of these shifts, the entire bank will need to adjust and to raise productivity, to build and maintain a modern computing environment, and to adopt a more flexible stance towards the adoption of new technology and innovations.

Faced with the challenges that lie ahead, one option that is available to banks is to establish a subsidiary that has the agility to adopt and adapt financial technology more rapidly than can the parent company. Indeed, the stiffening competition within the financial services industry is already encouraging organizations to accelerate their push for new technology, and over the past few years, we have seen several banks set up subsidiaries to act as technological shock troops. Working through a subsidiary has the advantage of providing the management team with greater freedom of maneuver and of cutting the burden of regulatory oversight. Subsidiaries may therefore be given the primary mission of improving the group’s overall efficiency and productivity, developing new technology, and of establishing an ecosystem that supports the nurturing and application of new innovations relevant to the banking industry.

Another option is for a bank to convert tech or fintech competitors into business partners by leveraging the advantages offered by their significant customer base, the high levels of trust that they enjoy, and their access to capital. When these positives are combined with tech or fintech players’ know how and ability to innovate rapidly, the resulting synergies will help both sides of the partnership move forward with the development of new financial services and products, and will therefore yield benefits for both. For their part, customers’ will benefit from the development and advancement of the financial landscape.

Beyond this, it is also important that banks ensure that staff throughout the enterprise have the necessary IT skills, and so the focus on tech skills should not be limited to only those working in the IT department. In fact, as the World Economic Forum [71] has shown, digital skills or workplace IT skills, such as being familiar with and being able to exploit AI or the IoT, will be one of the top five work trends in the coming period, and in addition to developing the skills required for a particular position, it will be just as important to develop employees’ all-round IT skills. This will help to drive the organization’s adaptation to technological disruption and to turn tumult into opportunity.

A final challenge that lies in front of banks is winning the technology talent war because at present, enterprises across the economy are realizing the importance of the technological changes that are underway, and these are responding to this situation by rushing to build their human resources. As such, a tech talent war has broken out as organizations compete for a limited talent pool, and to win out, it will be necessary to offer an attractive, modern, well-equipped work environment, flexible work arrangements, ample opportunities for staff to display their abilities, and, of course, competitive compensation. If banks are able to do this, they will be well placed to marshal the forces necessary to fight for market share.

Alongside this, regulators also need to give careful but urgent consideration to adjusting controls on the use of new technology, since this would help the banking industry as a whole adapt in a timely manner to changes in the technological environment.

References

Accenture (July, 2022) “The ultimate guide to banking in the cloud”. Retrieved October 17, 2022 from https://bankingblog.accenture.com/the-ultimate-guide-to-banking-in-the-cloud

Adam Picker (July, 2022) “7 Trends for Banks that Can’t Be Ignored in 2023”. Phase2 Web. Retrieved September 17, 2022 from https://www.phase2technology.com/blog/7-trends-for-banks-that-cant-be-ignored-in-2023

Bernad Mar (October, 2022) “The top 5 cloud computing trends in 2023”. Forbes Web. Retrieved October 20, 2022 from https://www.forbes.com/sites/bernardmarr/2022/10/17/the-top-5-cloud-computing-trends-in-2023/?sh=7e2223bd4648

Bernad Mar (September, 2022) “The 5 biggest technology trends in 2023 everyone must get ready for now”. Forbes Web. Retrieved October 16, 2022 from https://www.forbes.com/sites/bernardmarr/2022/09/26/the-5-biggest-technology-trends-in-2023-everyone-must-get-ready-for-now/?sh=9db9a1f55d90

Cagemini (July, 2017) “Robotic Process Automation Robots conquer business processes in back offices”. Retrieved November 24, 2022 from https://www.capgemini.com/consulting-de/wp-content/uploads/sites/32/2017/08/robotic-process-automation-study.pdf

Deloitte Insight (September, 2022) “2023 banking and capital markets outlook” Retrieved October 17, 2022 from https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

EIU (August, 2022) “Industry Report: Financial Service in Thailand 3rd Quarter, 2022”. Retrieved November 18, 2022 from EMIS Database.

Forst & Sullivan (January, 2022) “Digital Trust and Safety Growth Opportunities”. Retrieved October 9, 2022 from EMIS Database.

Forst & Sullivan (January, 2022) “Disruptive Technologies are Driving the Need for High-density Colocation”. Retrieved October 9, 2022 from EMIS Database.

Gang Peng (May, 2022) “Here's how to reap benefits of the 'digitalization in banking' trend”. World Economic Forum Web. Retrieved October 20, 2022 from https://www.weforum.org/agenda/2022/05/heres-how-to-really-reap-the-benefits-of-the-digitalization-in-banking-trend/

Grand view research (2021) “Robotic Process Automation: Market estimates & trend analysis to 2028”. Retrieved November 23, 2022 from EMIS Database.

Institute of Electrical and Electronics Engineers (2022) “The Impact of Tech in 2022 and Beyond”. Retrieved November 2, 2022 from https://transmitter.ieee.org/impact-of-technology-2022/

Jim Marous (September, 2022) “Four Essential Digital Trends for Banks in 2023 (and Beyond)”. The Financial brand Web. Retrieved October 17, 2022 from https://thefinancialbrand.com/news/digital-transformation-banking/banking-must-focus-on-4-digital-trends-152426/

Mckinsey and Company (August, 2022) “McKinsey Technology Trends Outlook 2022”. Retrieved September 16, 2022 from https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-top-trends-in-tech

Microsoft (2022) “What are public, private, and hybrid clouds?” Retrieved September 17, 2022 from https://azure.microsoft.com/en-us/resources/cloud-computing-dictionary/what-are-private-public-hybrid-clouds/#overview

Molek (2015) “รู้จัก Gartner Hype Cycle เครื่องมือทำนายอนาคตของนักการตลาด”. Retrieved September 17, 2022 from https://www.marketingoops.com/exclusive/how-to/garner-hype-cycle-tools-for-prediction/

Mordor Intelligent (2021) “Global Artificial Intelligence (2022-2027)”. Retrieved October 18, 2022 from EMIS Database

Nipa.Cloud (2022) “เปรียบเทียบ Public Cloud คืออะไร และ Private Cloud คืออะไร ต่างกันอย่างไร?”. Retrieved September 17, 2022 from https://www.nipa.cloud/blog/what-is-public-private-cloud

Oliver Wyman (2022) “The AI revolution in banking”. Retrieved October 18, 2022 from EMIS Database.

Opal A Roszell (April, 2022) “The Future of Technology in 2023”. Meduim Web. Retrieved September 23, 2022 from https://medium.com/technology-hits/the-future-of-technology-in-2023-48ec56b7d809

Penny Crosman (2022) “The rise of the invisible bank”. American Banker Web. Retrieved October 20, 2022 from https://www.americanbanker.com/news/the-rise-of-the-invisible-bank

Precedence research (September, 2022) “Immersive Technology Market”. Retrieved November 24, 2022 from https://www.precedenceresearch.com/immersive-technology-market

Statista (March, 2022) “Transactions value of connected home device payments worldwide from 2020 to 2025”. Retrieved October 25, 2022 from https://www.statista.com/statistics/1186644/smart-home-devices-voice-assistant-transactions/

Statista (November, 2022) “IT spending as share of company revenue in 2022, by industry”. Retrieved December 3, 2022 from https://www.statista.com/statistics/1105798/it-spending-share-revenue-by-industry/

Statista (October, 2022) “Digital Assets – Worldwide”. Retrieved December 3, 2022 from https://www.statista.com/outlook/dmo/fintech/digital-assets/worldwide#users

.https://www.computereconomics.com/article.cfm?id=3112Tom Dunlap (February, 2022) “Four Technology Trends for 2022—Putting People Back in the Picture”. Computereconomics Web. Retrieved October 16, 2022 from

[1] Data from a survey of expert opinion published by the Institute of Electrical and Electronics Engineers (IEEE) in the report “The Impact of Technology in 2022 and Beyond”.

[2] Neobanks, or challenger banks (some are also called virtual banks), are commercial banks that operate entirely in the digital space and so have no branches. The Bank of Thailand plans to complete the drafting of regulations on establishing virtual banks in 2023 and approval of these should be granted by the Ministry of Finance in 2024. Source: : https://www.bot.or.th/landscape/virtual-bank/results/

[3] https://tearsheet.co/new-banks/what-jpmorgan-is-doing-with-that-12-billion-tech-spend/

[4] Customer insight analytics is a type of technology that Gartner assigned to its ‘peak of inflated expectations’ category (i.e., the point when there is ‘more hype than proof that the innovation can deliver what you need’) in 2022.

[5] https://www.bcg.com/publications/2019/what-does-personalization-banking-really-mean

[6] https://hbr.org/sponsored/2022/10/whats-next-in-payments

[7] https://www.americanbanker.com/news/the-rise-of-the-invisible-bank

[8] Digital assets can be split into the 2 types of: (i) digital currencies, such as cryptocurrencies, stablecoins and CBDCs; and (ii) digital tokens, including investment tokens, utility tokens, and non-fungible tokens (NFTs). For more information, please refer to “The role of banks in the new world of NFTs”

[9] https://www.investing.com/news/cryptocurrency-news/jpmorgan-to-launch-crypto-wallet-under-new-trademark-2949846

[10] https://thestandard.co/mastercard-crypto-mass-adoption/

[11] Central bank digital currencies (CBDCs) are a type of digital currency issued by national central banks. These do not differ substantially from the notes and coins used in everyday life, except with regard to their digital rather than physical form. They are however, significantly different from cryptocurrencies and stablecoins. For more details, please see the Krungsri Research paper “Central Bank Digital Currencies: A Challenge for Commercial Banks”

[12] Web 3.0 is a catchall phrase describing the future development of the internet, which will be smarter and involve the use of new technology to store data in decentralized, open and verifiable forms. This should also allow for the monetization of individually produced content. Web 3.0 is also related to the development of innovations such as cryptocurrency, defi, the metaverse and NFTs.

[13] Super apps are apps that offer a comprehensive or broad-based range of services within that same app. This means that it is not necessary to quit that app to access other services. Gartner forecasts that as of 2027, half of the global population will use what will be a wide number of super apps in their day-to-day lives.

[14] https://www.pwc.com/gx/en/issues/data-and-analytics/artificial-intelligence.html

[15] https://openai.com/blog/dall-e/

[16] https://openai.com/blog/chatgpt/

[17] https://www.analyticsinsight.net/internet-in-2026-is-non-reliable-could-be-filled-with-ai-generated-content

[18] https://mgronline.com/onlinesection/detail/9650000023797

[19] Deep fakes rely on a type of technology called generative adversarial networks (GANs), which are a type of deep learning. These can then be used to generate videos.

[20] https://www.businessinsider.com/obama-deepfake-video-insulting-trump-2018-4

[21] An interesting example is the use of AI to predict hourly sales of pumpkin pie by Sam’s Club (a part of the Walmart Group) over Thanksgiving. For more details see: https://www.washingtonpost.com/technology/2022/11/24/thanksgiving-pumpkin-pie-ai-walmart-sams-club/

[22] https://info.kpmg.us/news-perspectives/technology-innovation/thriving-in-an-ai-world/ai-adoption-accelerated-during-pandemic.html

[23] https://transmitter.ieee.org/impact-of-technology-2022/

[24] https://www.gartner.com/en/newsroom/press-releases/2022-02-09-gartner-says-more-than-half-of-enterprise-it-spending

[25] https://www.gartner.com/en/newsroom/press-releases/2022-04-19-gartner-forecasts-worldwide-public-cloud-end-user-spending-to-reach-nearly-500-billion-in-2022

[26] https://www.thansettakij.com/technology/technology/544203

[27] https://www.bangkokbiznews.com/finance/cryptocurrency/1026886

[28] https://www.thansettakij.com/tech/innovation/541746

[29] https://www.thairath.co.th/news/tech/2514150

[30] https://markets.businessinsider.com/news/stocks/financial-institutions-partnering-with-a-cloud-service-provider-can-better-leverage-technological-innovations-1030752746

[31] From a survey carried out by Publicis Sapient and Google Cloud of senior banking executives at over 250 institutions.

[32] https://markets.businessinsider.com/news/stocks/financial-institutions-partnering-with-a-cloud-service-provider-can-better-leverage-technological-innovations-1030752746

[33] In 2020, after the banking and finance sector, spending on RPA was highest in the IT sector (USD 254.78 million), logistics (USD 251.06 million), and healthcare and medicines (USD 185.34 million).

[34] https://www.bizagi.com/en/customers/case-studies/financial-services-citizens-bank

[35] OCR is a technology used to read and change text, for example, by scanning and extracting text from a written document. Likewise, OCR technology can be used to digitize text for further processing or analysis.

[36] https://www.ing.com/Newsroom/News/The-rise-of-the-robots.htm

[37] For further details, please see: https://saio.com/about-saio

[38] https://www.thebangkokinsight.com/news/digital-economy/technology/939084/

[39] With their consent

[40] The metaverse is a 3-dimensional immersive environment to which users connect via the internet and which seamlessly mixes the real and the virtual worlds. The metaverse provides a space within which users are able to live out all aspects of their normal day-to-day lives, including working, relaxation, consuming media, playing games, socializing, and engaging in business transactions, much as one would do in the real world. The metaverse is experienced from a first-person point-of-view, and so objects and the wider environment are seen just as they are normally. For more details, please see “The Metaverse: When virtuality becomes reality”

[41] https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/value-creation-in-the-metaverse

[42] https://www.theverge.com/2022/10/3/23384708/tim-cook-metaverse-skeptical-meta-ar-vr-headset

[43] https://mgronline.com/cyberbiz/detail/9650000099907

[44] SnapInc (2020) states that using AR in sales presentations can lift the customer conversion rate by as much as 90%. For more information, please see: https://www.retailcustomerexperience.com/articles/why-retailers-should-embrace-augmented-reality-in-the-wake-of-covid-19/

[45] https://techcrunch.com/2022/06/09/amazon-gets-into-ar-shopping-with-launch-of-virtual-try-on-for-shoes/

[46] https://360tours.sg/tours/

[47] https://www.tourismthailand.org/Articles/virtual-tours-thailand

[48] https://www.techhub.in.th/fundamental-vr-technology-for-health/

[49] https://techsauce.co/metaverse/vr-technology-for-seniors

[50] For example, the New Zealand Westpac bank introduced something similar in its banking app in 2014. For more details, see https://www.retaildive.com/ex/mobilecommercedaily/westpac-integrates-augmented-reality-into-bank-account-management

[51] https://thepaypers.com/online-mobile-banking/kb-kookmin-bank-to-develop-financial-services-using-vr-technology--1253118#

[52] https://www.tnnthailand.com/news/tech/88727/

[53] https://newsroom.bankofamerica.com/content/newsroom/press-releases/2021/10/bank-of-america-is-first-in-industry-to-launch-virtual-reality-t.html

[54] For more information, please see “Banking and blockchain technology”

[55] https://cointelegraph.com/news/jp-morgan-executes-first-defi-trade-on-public-blockchain

[56] https://www.computerweekly.com/news/252509262/Blockchain-technology-will-help-banks-will-cut-cross-border-payment-costs-by-10bn-in-2030

[57] Smart contracts are programs embedded in blockchains that are automatically triggered when specified conditions are met, and in this way, they are similar to traditional paper contracts.

[58] https://www.finextra.com/blogposting/18914/how-to-enhance-kyc-systems-with-blockchain

[59] https://cybersecurityventures.com/boardroom-cybersecurity-report/

[60] Phishing involves using email, text messages, websites, etc. to trick individuals into revealing personal information (e.g., usernames, passwords, etc.) that can then be used to gain unauthorized entry to a computer system.

[61] Ransomware is a type of malware but unlike other types of malware, which try to exfiltrate data, ransomware encrypts an individual’s or organization’s data and then demands a ransom to restore access.

[62] https://www.ibm.com/reports/data-breach

[63] This includes losses resulting from legal costs, regulation and compliance issues, damage to the brand, and productivity losses.

[64] https://media.paloaltonetworks.com/documents/Forrester-No-More-Chewy-Centers.pdf

[65] Firewalls are software or hardware that filter data entering and leaving networks to check that this is authorized. This helps to ensure that data passing through the firewall is safe and not a danger to the network.

[66] https://www.defense.gov/News/Releases/Release/Article/3225919/department-of-defense-releases-zero-trust-strategy-and-roadmap/

[67] https://www.cnbc.com/2022/03/01/why-companies-are-moving-to-a-zero-trust-model-of-cyber-security-.html

[68] https://itbrief.com.au/story/gartner-top-five-trends-in-privacy-through-to-2024

[69] https://docsend.com/view/adwmdeeyfvqwecj2

[70] Forecast by China Construction Bank

[71] https://www.weforum.org/agenda/2022/09/five-trends-endure-world-of-work/