The positive influence played on the economy by strong domestic spending and the vibrant service sector stems at least in part from the country’s demography. In particular, the Philippines has a population of 110 million that has an average age of just 25 (this compares to the ASEAN average of 31.5 and Thailand’s average age of 40). Moreover, over 90% of the population speaks English, albeit as a second language, and so the labor force is well positioned to support future expansion in the economy. Given this, it is very likely that ongoing economic growth and rising personal income and wealth will support broadening demand for financial services, both domestically and internationally.

Regarding the financial landscape of the Philippines, the banking sector plays a significant role and continues to grow. Although retail customers and small businesses often face difficulties accessing capital and other financial services, especially when dealing with commercial banks themselves, the scenario is improving. The rapid growth of digital technology in finance and the support to the sector provided by the government will expand business opportunities for the banking sector, which will then be well placed to connect to new consumer groups and to meet broadening future demand for financial services.

This paper therefore seeks to answer the following set of related questions: How is the Philippine financial landscape developing? How is the financial sector linked to the real economy? And what are the business opportunities and challenges in the Philippine banking sector that should be monitored?

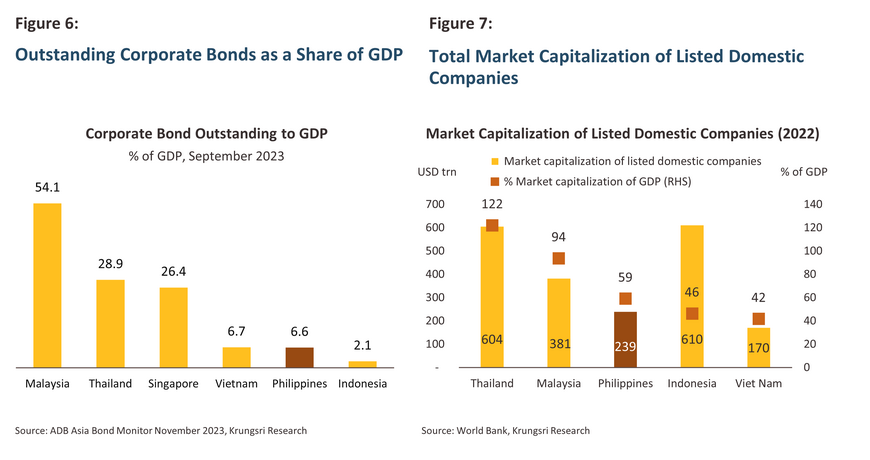

Compared to its regional peers, the Philippine banking sector is somewhat large, and this reflects the fact that corporations typically remain relatively disengaged from bond and stock markets and instead rely on large banks as sources of capital. Although the microfinance initiatives, the development of the fintech industry, and government efforts have helped to broaden access to financial services for retail customers and small businesses, collaboration from the banking sector is crucial to enhance the efficiency of capital allocation and to boost economic potential.

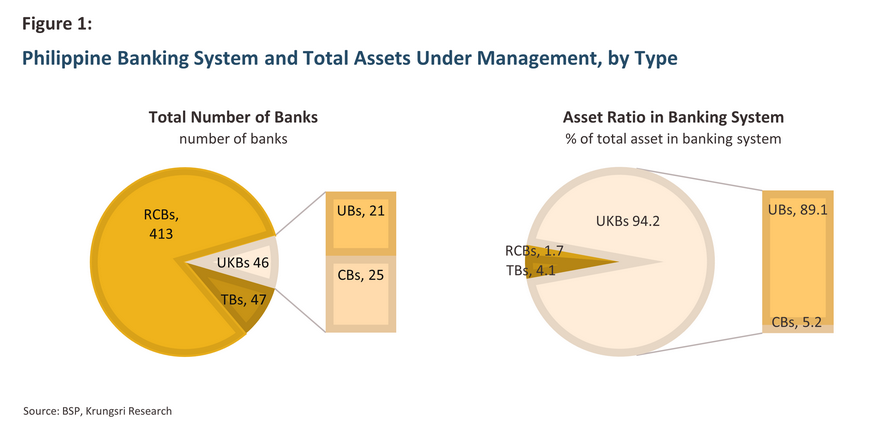

Although there are more than 450 institutions, TBs and RCBs are relatively insignificant as they hold respectively just 4.1% and 1.7% of total banking industry assets (Figure 1).

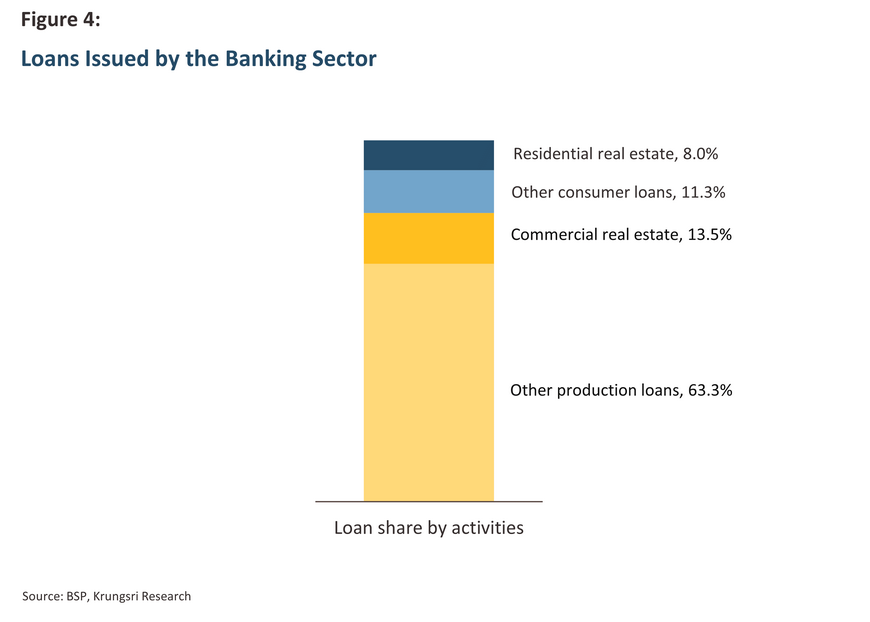

Data from the BSP show that as of the end of September 2023, the value of outstanding loans across the banking industry totaled PHP 12.55 trillion (USD 221.07 billion), or approximately 57% of GDP. 92.6% of this was held by UKBs, with TBs and RCBs accounting for respectively 5.4% and 1.9%. Given their disproportionately large market share, the lending practices of UKBs define the overall credit profile of the banking sector.

1.2 Non-Bank Financial Intermediaries (NBFIs)

The Philippines is home to a wide range of non-bank financial intermediaries or NBFIs, including mutual funds, securities traders and brokers, savings associations, credit unions, insurance companies, and retirement funds. Other NBFIs target retail customers and small businesses, including different types of microfinance institutions, such as microfinance non-governmental organizations (MF NGOs), pawn shops, and cooperatives. These are an important source of finance for low-income earners and micro-, small-, and medium-sized enterprises (MSMEs).

2. Important developments in the financial sector

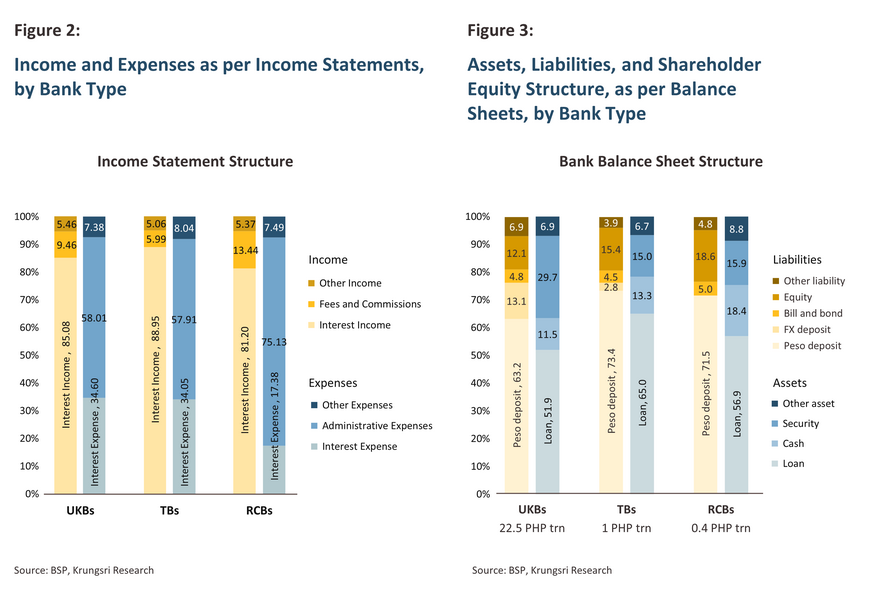

Growth in the Philippine banking sector has been made possible by its close relationship with NFCs, but rising demand for financial services and the rapid development of financial technology has encouraged banks to begin expanding their offerings and to attempt to more deeply penetrate markets for retail clients.

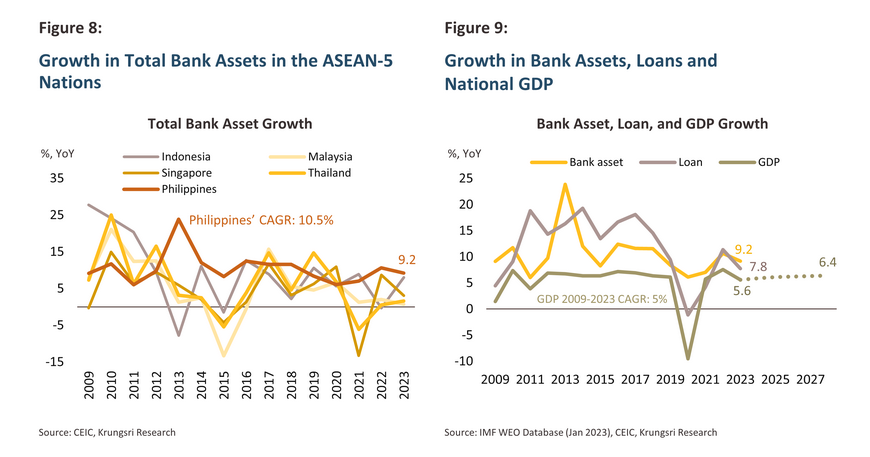

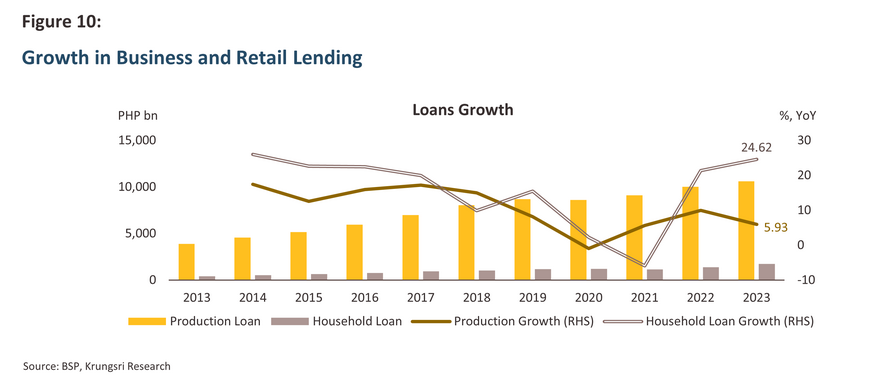

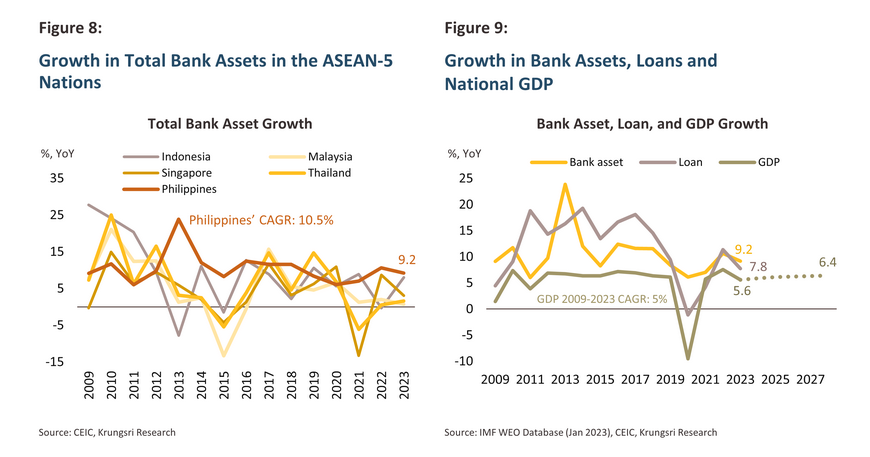

Over the past decade, the total value of assets controlled by Philippine banks grew by an average of slightly more than 10% annually, ahead of growth rates recorded elsewhere in the region (Figure 8). This rapid increase reflects expansion in the financial sector overall, which has been lifted by rising incomes and broader growth in the economy, and this in turn has boosted demand for financial services such as for savings, loans, and financial planning (Figure 9).

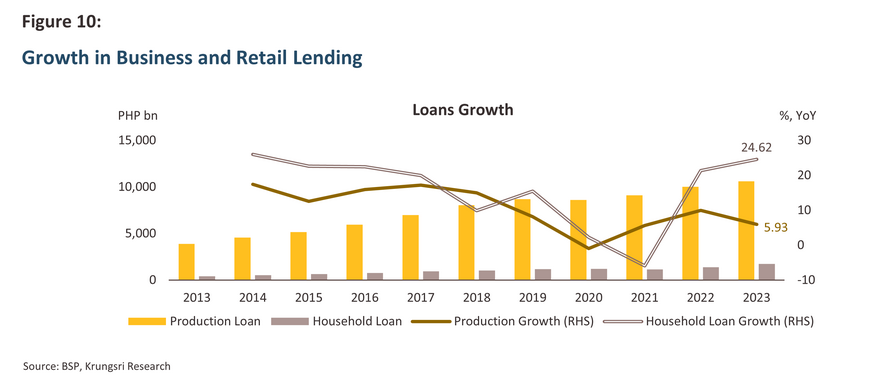

As stated above, most large Philippine banks are part of major conglomerates, growth in total assets within the banking sector has been dependent on its close relationship with NFCs rather than retail customers’ lending portfolio. Nevertheless, over the past decade, many banks have begun to recognize the potential implicit in the market for personal loans and so banks have started to target retail customers more aggressively. In addition, the development of financial technology has helped banks extend their reach more deeply into Philippine households, and this is reflected in expansion in the market for consumer lending. Nevertheless, compared to corporate lending, consumer or retail lending remains limited (Figure 10) and this imbalance has enabled NBFIs to consistently secure an important place in serving retail customers.

Another important development within the Philippine financial landscape has been the rapid growth in financial technology. In response to changing consumer preferences, players across the financial sector have moved to a much greater reliance on digital channels for the delivery of financial services. This process has been significantly accelerated by the Covid-19 pandemic and government support for financial digitalization. Thus, in 2020, the Overseas Filipino Bank4/ became the first institution to be licensed as a digital-only bank by the BSP, though following this, the Philippine central bank then went on to license another 5 digital banks5/. The BSP has said that it expects that it will take 5-7 years for digital banks to fully align their products with the market and to become profitable, and data from the central bank show that as of March 2024, only 2 of the Philippines’ 6 digital banks had moved into profit, though this is in line with digital bank operations in other countries. The BSP will continue to report on the performance of the country’s digital banks periodically.

Besides digital banks, a recent report by the BSP shows that uptake of digital payment services by retail customers has accelerated sharply, with the share of total payments made by retail customers attributable to digital channels rising from just 10% in 2018 to 42.1% in 2022. This matches the increase in the share of Philippine citizens with a bank or online bank account, which jumped from 22.6% in 2017 to 65% in 2022, and this is expected to have reached more than 70% in 2023. In particular, the number of Filipinos with an e-money account has risen sharply, and use of online banks or mobile applications has thus risen in step with this change in consumer behavior in digital payment. Especially notable apps include GCash and PayMaya, which allow users to make payments, transfers, and deposits without visiting a bank branch in person. However, digital delivery of financial services related to loans, insurance, and investments remains patchy and there is significant room for future development in these areas.

3. Linkages between the financial sector and the real economy

Access to financial services remains a problem for retail customers. However, growth in the microfinance institutions, digital financial services, and government efforts to broaden financial inclusion are bridging financial gaps.

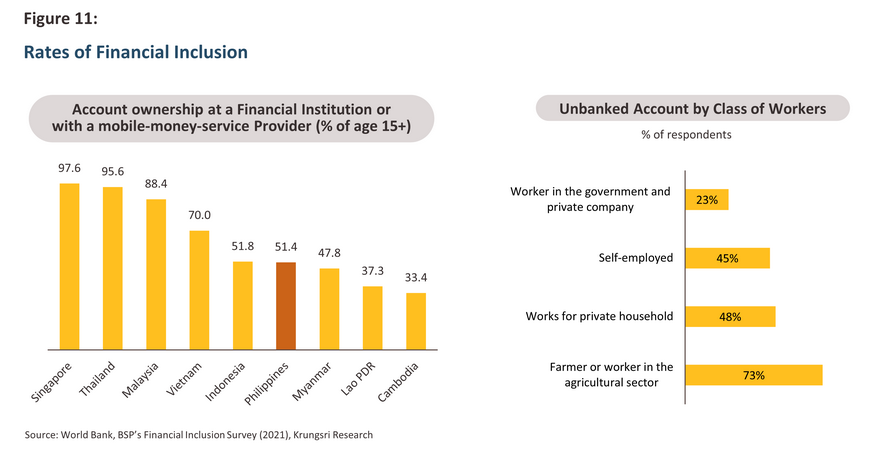

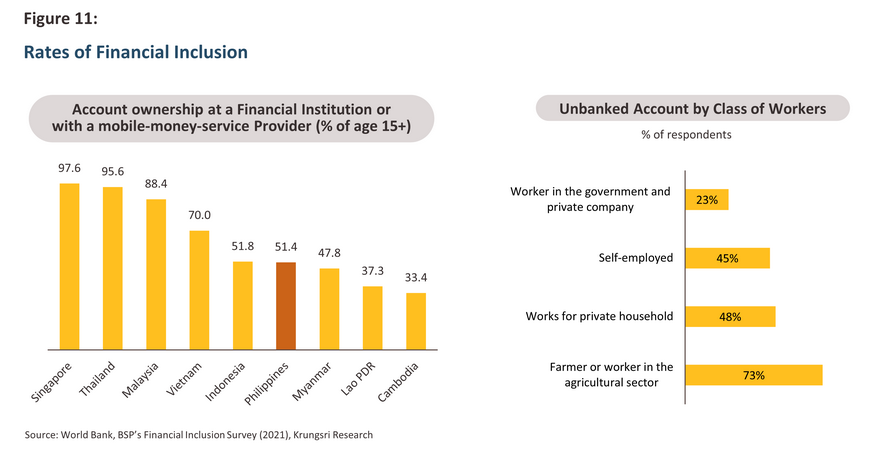

Although the Philippines has enjoyed rapid economic growth in recent years, both households and MSMEs continue to experience difficulty accessing financial services, leading to low financial inclusion, which is a major factor constraining the potential for future economic growth. A report by the World Bank shows that in 2021, 49% of Filipinos aged over 15 did not have a bank account at financial institutions or with mobile money service providers (Figure 11). A problem that was underlined by a 2021 survey by the BSP indicating that 73% of farmers belong to the group of occupations without bank accounts, which is the highest proportion compared to other occupations. Among those without an account, the most commonly cited reason was insufficient income, followed by problems securing the relevant documentation.

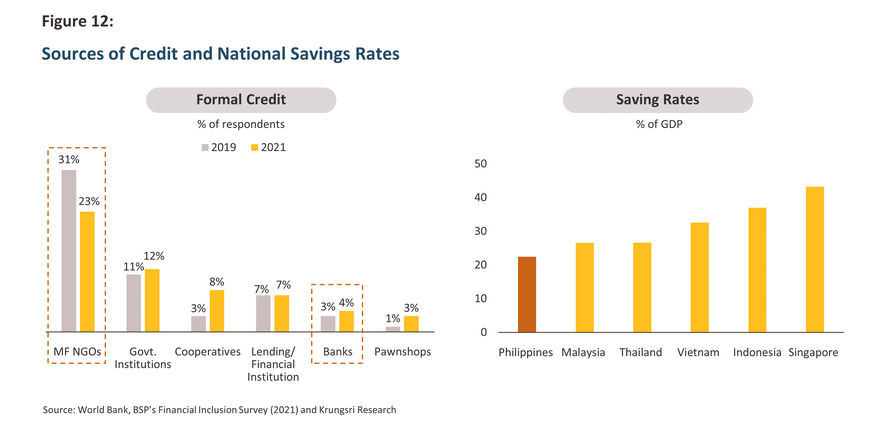

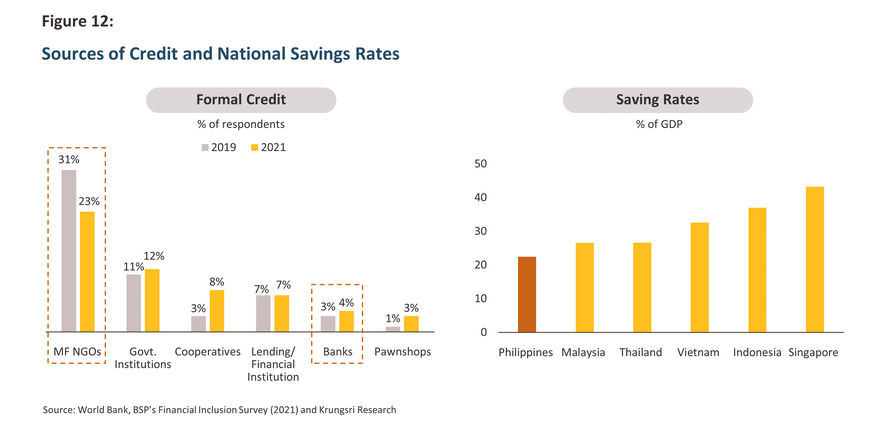

For potential borrowers, access to credit is complicated by the geography of the country, which makes it difficult for banks to extend their branch networks to more distant regions, as well as by the fact that the large banks are more focused on providing services to other companies within conglomerates than they are on broadening their customer base to include a greater proportion of retail savers and borrowers. Given this, data from the BSP show that credit is accessed from formal and informal sources in almost equal proportions (respectively 57% and 56% of survey respondents). The most common source of finance in the formal sector is microfinance NGOs (23% of survey respondents), but it is interesting to note that only 4% accessed credit from banks themselves, a figure that is almost unchanged from 2019 (Figure 12). Respondents most likely to have access to bank credit include those who live in urban areas (i.e., the VisMin region of Visaya and Mindanao Island groups), high-income earners (socio-economic classes ABC), business owners, and those aged 50 and over.

The fact that such a high proportion of retail and MSME borrowers have difficulty accessing bank services and so remain reliant on informal lending reflects the underlying problem of accessing loan in the Philippines' financial system. From the point of view of borrowers, over half of individual and MSME businesses believe that borrowing from formal financial institutions such as banks is excessively difficult due to the need for copious supporting documentation, the time-consuming application process, and borrowers’ low income and lack of collateral. Many small businesses thus turn instead to informal lenders. Meanwhile, from the point of view of lenders, banks may feel that extending credit to individuals and small businesses in rural areas carries with it too high a risk of default. Other factors that restrain the supply of credit from banks include the lack of infrastructure in remoter parts of the country, which then makes it prohibitively expensive to open traditional brick-and-mortar branches, while the Philippines also has one of the lowest savings rates in the world (Figure 12). Given this and likely insufficient short-term returns, banks are not strongly incentivized to invest in operations in rural regions.

These problems have significant economic costs, particularly to the extent that MSMEs face obstacles securing loans. This is because MSMEs account for 99.6% of all businesses in the Philippines and provide 65% of all jobs, and so if MSMEs are forced to seek out financing from informal lenders, this will add to their costs, reduce the efficiency of capital allocation, and drag on their and the economy’s growth potential.

At present, microfinance lenders play an important role overcoming some of these problems. By explicitly targeting both small businesses and farmers and fishermen in rural regions, who are generally unable to access bank loans, microfinance institutions have been able to provide finance to MSMEs and low-income earners. Much research in this area has shown that microfinance initiatives have significant potential to increase businesses’ operating efficiencies and growth potential, and so official bodies have been active in promoting greater uptake of microfinance services6/.

Another significant development that has made financial services more accessible to people, even in rural areas of the Philippines, is the increasing importance of digital financial services. In fact, research has demonstrated digital financial services’ potential to achieve just these ends. This is reflected in data showing that access to financial services jumped from 34% of the population in 2017 to 51% in 2021 following the rapid development of digital financial services, as described above.

Although uptake of digitally delivered financial services has grown rapidly, at 74% of the population, mobile phone ownership rates remain significantly ahead of the share of the population with a bank account (51%). Therefore, the BSP plans to fully exploit financial technology’s potential to improve access to financial services. In particular, the central bank plans to broaden access for both the financially ‘unserved’ (i.e., those with no access to the banking sector) and the ‘underserved’ (i.e., those with insufficient access to this). To this end, the government has relaxed the rules on foreign participation in the financial sector, in particular by: (i) raising the limit on foreign ownership of Philippine financial institutions from 40% to 60%; (ii) maintaining restrictions on foreign participation in areas reserved for Filipino nationals; (iii) making the process of applying for a banking license easier and quicker; and (iv) imposing very low capital requirements for businesses registering as digital banks and allowing full foreign ownership of these. It is hoped that these moves will help to stimulate increased foreign investment in the Philippine financial system and through this, expand financial inclusion for households and small businesses.

While the government emphasizes promoting access to credit and financial services for MSMEs and marginalized populations, collaboration with the private sector to address these gaps is equally crucial. In particular, financial institutions such as banks will have a major role to play in this process, though their centrality to these plans will open up exciting new business opportunities for companies in the finance sector to expand their service offerings and to extend their customer base.

Business opportunities in the financial sector

The gaps in accessing financial services represent a business opportunity in the banking sector, especially for those issuing loans. Most notably, opportunities will be presented to those able to use digital financial products to develop new service delivery models and to target individual consumer groups more tightly.

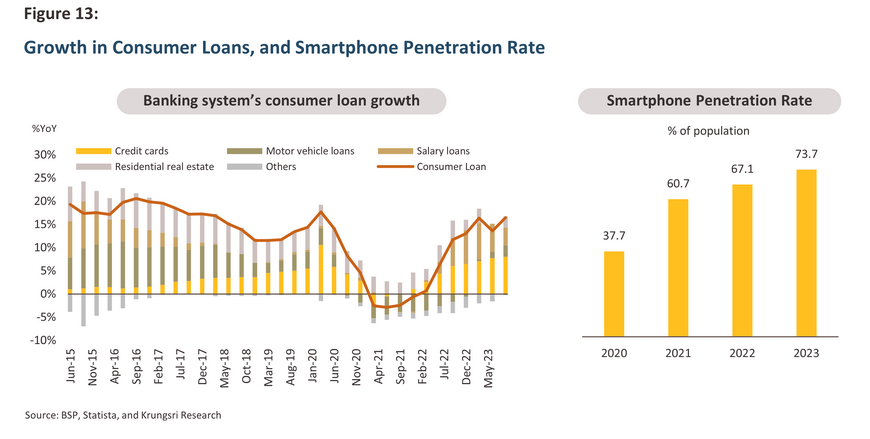

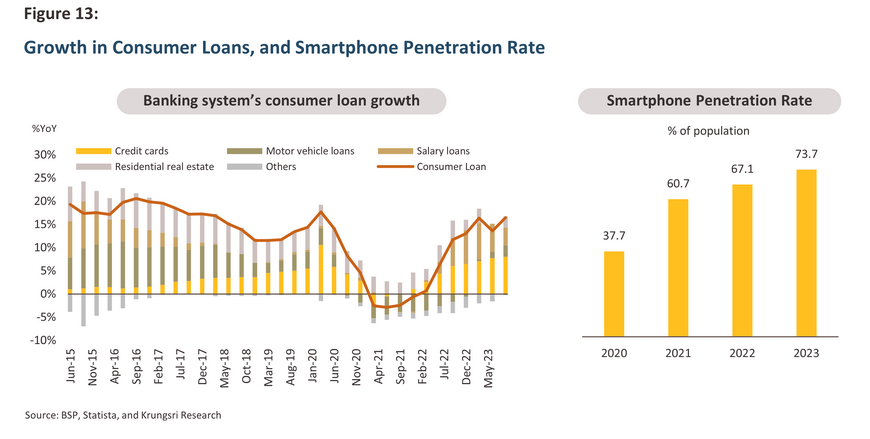

Business opportunities in the Philippine financial sector will in particular be related to lending, especially by banks, due to several driving factors. Firstly, the high growth potential of this market will be supported by the current low rates of access to the formal credit system, thus indicating that there is significant unmet demand among retail and MSMEs borrowers for reasonable-cost financial services. Secondly, the Philippine middle class is also expanding (as of 2020, 43.5% of the country was classified as middle class7/) and the population is young, and these groups typically have increasing incomes and exhibit stronger demand for financial services. This will then allow banks to open up new markets, especially various types of credit products (Figure 13). In addition, a rapidly growing economy that is being driven by strong domestic consumption will add to demand for this. Finally, although remoter and more rural parts of the country may lack the infrastructure to maintain reliable connections, mobile phone and internet penetration rates continue to rise (Figure 13), and this will then support increased access to digitally delivered financial services among the general public.

Another important factor influencing the business landscape is the ongoing efforts by the Philippine government to expand access to financing and financial services. In 2017, the government unveiled its National Strategy for Financial Inclusion (NSFI), which in its 2022-2028 iteration is currently focused on addressing unequal access to finance for MSMEs, low-income earners, and farmers (these representing 24.5% of all workers). This is being achieved through the continuing promotion of microfinance, the development of digital finance infrastructure, and training in financial literacy. The Financial Inclusion Steering Committee (FISC) has primary responsibility for this and for coordinating the work of other state bodies, and officials hope that the long-term outcome of this strategy will be to create a more inclusive financial system and to raise the country’s growth potential.

In addition, the government is itself developing and extending the nation’s digital infrastructure and this will facilitate the transition to a digital financial system. This includes the development of the Philippines Identification System, or PhilSys8/, a digital national ID system that aims to address widespread problems with a lack of personal identification, a common factor preventing individuals from opening personal bank accounts. The PhilSys project should also help to accelerate the development of new digital financial products.

Considering the supportive factors above and the continuing unequal access to financial services (especially to sources of fund) faced by those in different professions or with different levels of income, it is clear that business strategies will need to focus on the design of financial products and services that meet the particular needs of the population. This will include developing loans for low-income personal borrowers, loans for small businesses, and home loans that address households’ financial needs.

The rapid spread of digital technologies within the Philippines will also help to catalyze the development of additional business opportunities in the banking industry. A 2021 survey carried out by the BSP9/ shows that most low-income borrowers who turn to informal sources of credit do so because these are easier to access, and repayments are simpler to make than is the case when dealing with the formal banking system. Thus, if banks are able to leverage digital financial technology that make the process of applying for loans simpler, quicker and less dependent on assembling a complicated set of supporting documents, this should help people to find it easier to access to sources of fund from banks. Wider use of digital technologies will also make it possible to better exploit customer databases and data analytics systems, therefore allowing banks to connect with a broader customer base, carry out better risk assessments of individual borrowers, and better target their promotions and marketing efforts.

On a wider scale, the Philippine central bank has joined with the Regional Payment Connectivity (RPC) system. This supports a number of payment methods, including QR codes and the fast payment system, to facilitate transfers between member states (Thailand, Indonesia, Malaysia, Singapore, and Vietnam) as well as other countries in Asia including Japan and South Korea. The RPC system aims to help build a seamless and cost-effective cross-border payment system for individuals and businesses in the ASEAN, and this will help to open new business possibilities for Philippine businesses transacting with partners across the ASEAN region.

In conclusion, business opportunities in the Philippine banking industry will be concentrated in financial services for those who currently have difficulties gaining access to the formal lending system. Of particular importance will be loans targeting MSMEs and personal and home loans for retail borrowers, for which demand is increasing. In addition, intelligent applications of digital financial technology will improve banks’ risk management and make accessing bank facilities much easier for unserved or underserved borrowers than is currently the case, thereby helping banks compete better with informal sources of credit. This will then reduce financial constraints and unlock greater growth potential. Furthermore, improved regional cooperation over payment systems will also help businesses widen their horizons and encourage them to explore new business opportunities in markets across the ASEAN region.

Challenges facing players in the Philippine financial system

Undertaking business activities in the Philippine financial system entails confronting a certain number of challenges, particularly in terms of systemic risk. But, overall, the system is strong and stable, and regulatory oversight should help mitigate these risks.

Challenges facing players in the Philippine financial system include the following.

-

The country’s geography and the current state of infrastructure: In remoter parts of the Philippines, population density may not be sufficient to justify banks extending their branch networks into these areas, while overall, national infrastructure requires further improvements and upgrades to meet the requirements of commercial banks before these are able to expand deeper into areas outside urban centers. In addition, internet access is limited in some areas, and this is thus another obstacle in the way of the digitalization of the financial system.

-

Risk management and data security: Risk management within the domestic financial system has a number of limitations, and banks are only able to assess this based on general data relating to work and income. This may then encourage lenders to view some groups as being excessively risky, which may then impact lending rates or encourage lenders to impose excessively tight loan conditions10/. Many members of the public also worry about the security of personal data when using digital financial services11/.

-

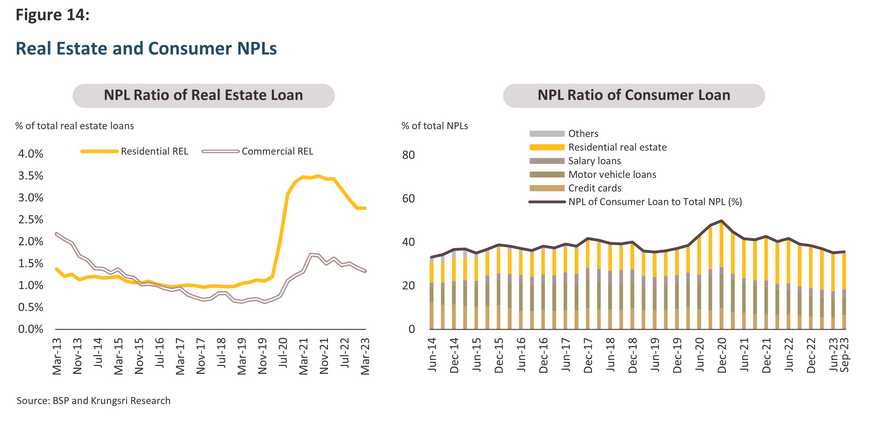

Financial stability: Assessment of overall systemic risk within the Philippine financial system is required to identify systemic risks that may impact banking operations and credit activities. However, at present, the system is strong and stable with a Capital Adequacy Ratio (CAR) at 16.01%, exceeding the threshold (as per BSP reports in March 2022). NPLs have also declined to around 3%, though these remain above the pre-Covid average of 2%. Nevertheless, other issues that may pose a problem and that need to be tracked include risk arising from specific loan types, particularly real estate and consumer loans, and systemic risk connected to linkages between the financial sector and non-financial parts of the economy.

- Risk from real estate loans and consumer loans

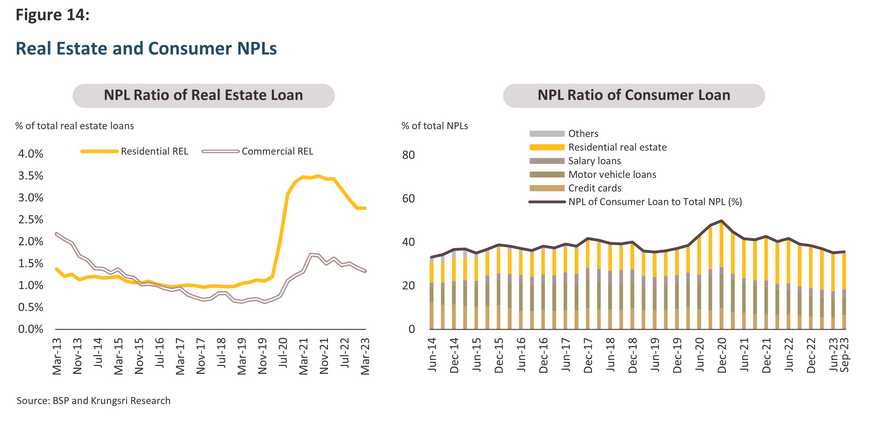

Real estate loans are a significant part of overall bank lending (21.13% in March 2022) and at present, NPLs within this segment remain above their pre-Covid level. This is particularly the case for residential real estate loans, the performance of which has been hit by the slowdown in the economy and the run-up in interest rates. NPLs for commercial real estate loans have also risen on the post-pandemic preference for working from home and the drop off in demand from overseas games platforms, which has then pushed up the vacancy rate12/. Thus, in the second quarter of 2023, the vacancy rate for offices and condominiums in the Metro Manila region stood at respectively 18.4% and 17.2%, a sharp rise from pre-pandemic rates of respectively 5% and 10%13/. This could then put downward pressure on real estate prices, potentially undercutting the financial stability of those who have lent heavily in this area. Although real estate lending is limited to a maximum of 25% of a bank’s total lending, a drawn-out slowdown in commercial property markets would impact profits.

Furthermore, consumer loans still maintain a higher NPL rate compared to other loan types. Although consumer loans represent only 20% of the value of all outstanding loans within the banking system, non-performing consumer loans accounted for 35% of all NPLs as of the third quarter of 2023 (Figure 14).

- Systemic risk arising from linkages within the financial system and NFCs

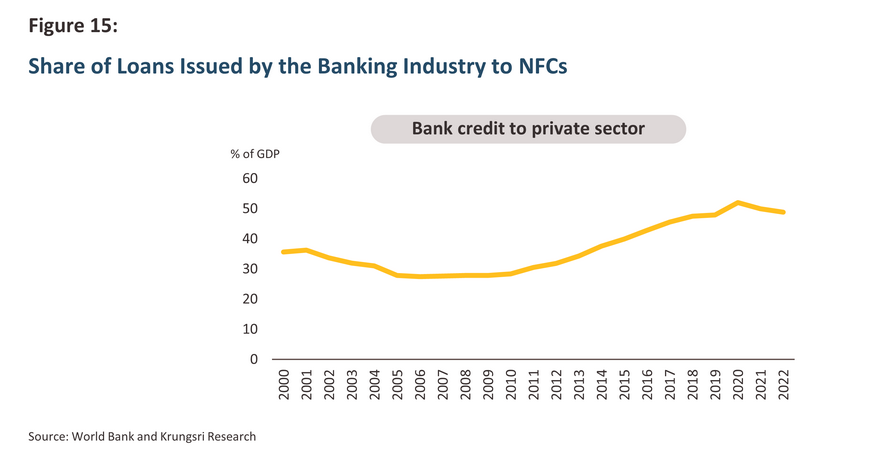

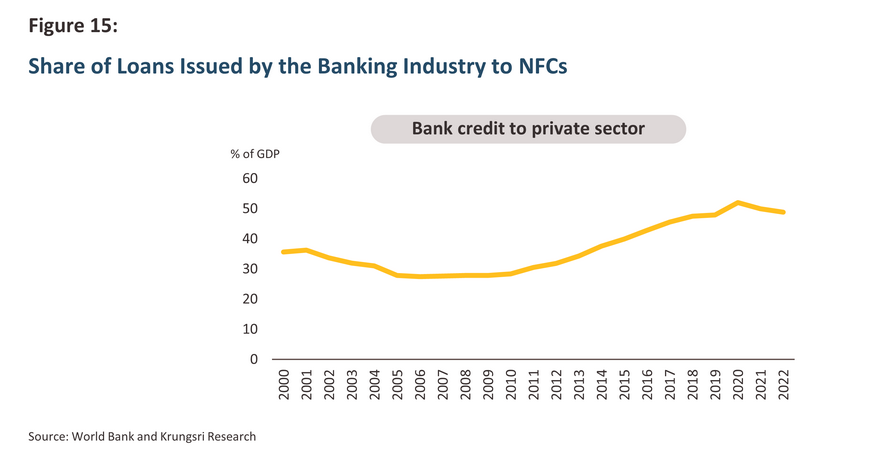

In addition to focusing on lending to NFCs that belong to the same business conglomerate, the large number of financial conglomerates14/ reflect the linkages that exist within the financial system itself and between the financial system and the real economy, which has the potential to generate systemic risk. Moreover, NFCs in the Philippines have increased their borrowing as these companies have sought capital from banks to fund operating costs and investments in financial assets (Figure 15). The increasing level of indebtedness has also raised exposure to risk arising from changes to interest and exchange rates15/. Thus, if an event negatively impacts the income of NFCs, connections within the financial system and between this and different parts of the economy could cause these problems to multiply, affecting the stability of the banking sector.

In response, the Philippine authorities have instituted a regulatory regime to monitor and reduce systemic risk connected to the activities of major players within the financial system, and so in 2004, the BSP established the Financial Sector Forum (FSF). This was tasked with improving cooperation between regulatory agencies including the Securities and Exchange Commission (SEC), the Insurance Commission (IC) and the Philippine Deposit Insurance Corporation (PDIC), which are responsible for oversight of 12 financial conglomerates. In 2022, the FSF tightened regulation of the market by extending this to include risk reviews, scenario planning, and the monitoring of business structures, the latter with the aim of reducing the risk of negative impacts affecting other businesses in the same group in the event that one business in the group encounters financial difficulties. Over 2023 to 2024, the FSF carried out risk assessment for 3 conglomerates, and it expects to complete this process for all 12 groups within the next 5 years.

Krungsri Research view

The Philippine financial landscape is centered principally on the banking sector. Although the sector has enjoyed ongoing growth through the recent past, the banks have been largely focused on securing sources of credit for other businesses within same conglomerate. Banks have thus failed to establish themselves as secure sources of financing for small businesses or retail customers, for whom access to financial services remains patchy and inadequate. This issue is considered a structural problem in accessing capital and financial services that have long troubled the country. However, the development of the Bangladeshi Grameen Bank16/ has shown how financial inclusion can be extended to embrace low-income earners, in particular through the development of new credit models, for example microloans that do not require collateral. In 1997, the Philippines therefore created a rural bank of Grameen-style banking, and this has been successful in extending access to capital for those in rural areas. This has then provided the motivation for promoting MF NGO-backed group lending through to the present day.

Given ongoing domestic economic growth and government initiatives to expand access, demand for financial services will strengthen in the coming period, and clearly the banking sector will have a major role to play in meeting this. This will be especially the case for providing loans and credit to small businesses and retail customers, which will likely open up significant business opportunities for banks to expand the customer base going forward. Against this background, designing new products and services that are a better match for particular occupational or income groups, leveraging financial technology to enhance accessibility to financial services, and improving risk management will all help to raise banks’ competitiveness and sharpen their ability to compete with informal lenders for market share. However, challenges in banking operations and transitioning to digital finance persist. Overcoming these problems will depend on the ongoing collaboration and cooperation of all stakeholders to create favorable business environment in the financial sector. This includes infrastructure development, cost reduction, stronger motivation for both borrowers and lenders to participate in the market, and greater transparency and stability across the financial system.