This paper examines the potential of Thailand and Indonesia to emerge as electric vehicle (EV) production hubs in ASEAN. Each country presents different strengths and opportunities across the EV supply chain and EV segment. Thailand leads in midstream and downstream activities, with notable opportunities in the production of four-wheelers targeting middle- and high-income segments. Meanwhile, Indonesia's advantage lies in upstream activities, and its large population heavily relies on two-wheelers, positioning it well for the lower-to-middle-income EV segment. Despite their unique strengths, both countries can play pivotal roles in global EV manufacturing. Collaborating under regional trade agreements can enhance their competitiveness by facilitating part flow, promoting production synergies, and strengthening the regional EV ecosystem.

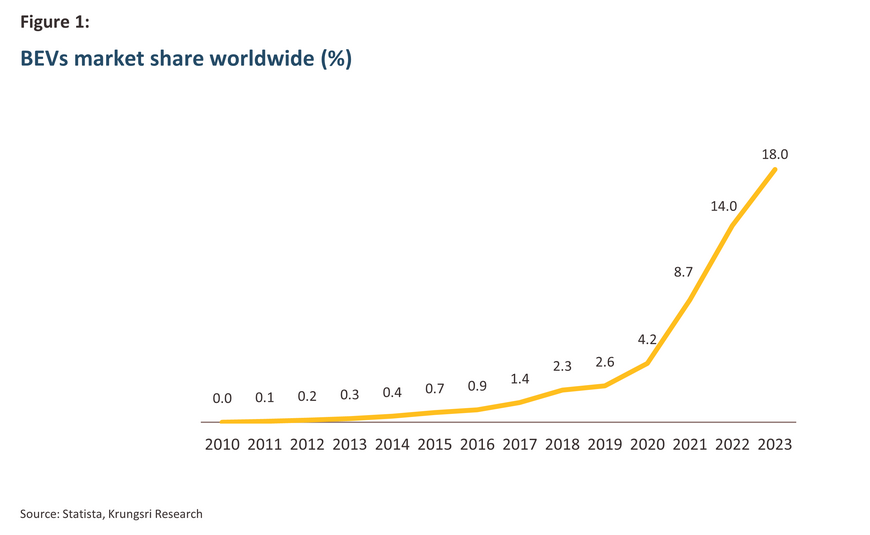

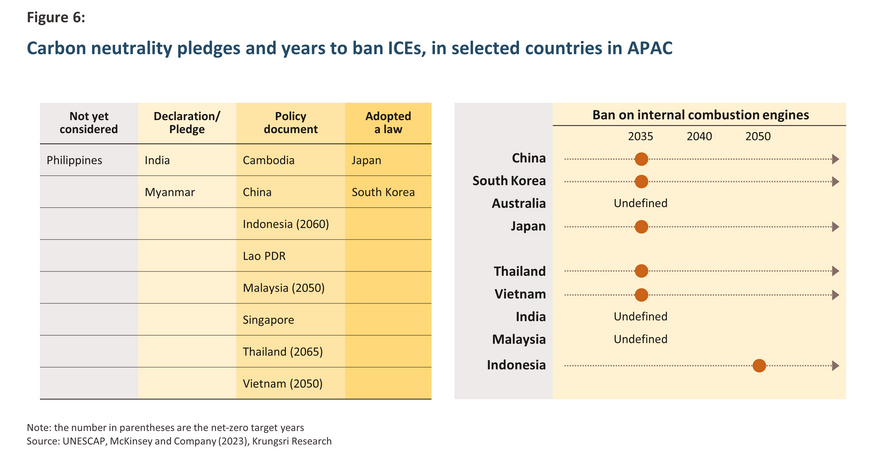

Electric vehicles (EVs) are gaining momentum globally amid megatrends of environmental and climate change awareness. While China currently dominates the Asian EV arena, the ASEAN EV market is anticipated to grow rapidly going forward. Currently, ASEAN countries are aiming to become major EV production hubs. They are leveraging their own strengths to seize opportunities across regional supply chains. This, coupled with the trend of supply chain relocation favoring the region, makes them attractive to international investment.

Within EVs, there exist various subtypes, namely hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). This paper will mainly focus on BEVs, which the government prioritizes as a key solution for achieving net-zero emission targets, a strategic investment opportunity, and a shift in consumer preferences.

The objectives of this paper are to: i) shed light on the EV landscape in ASEAN and its development; ii) identify key factors for success in becoming an EV production hub, focusing on key countries; iii) explore opportunities across the EV supply chain, which can be broadly categorized into four segments: raw materials and battery production, vehicle manufacturing, charging infrastructure, and retail and aftermarket. Opportunities across different EV segments, including two-wheelers and four-wheelers, will also be discussed; iv) discuss the challenges faced in becoming an EV manufacturing hub. The study will specifically focus on Thailand and Indonesia as potential EV hubs within ASEAN.

Firstly, a top-down intention stems from global collaboration efforts such as COP26, aimed at addressing climate change. Individual countries were then showing their commitment to reducing carbon emissions. Secondly, advancements in technology play a crucial role in making EVs more efficient and accessible. Lastly, there is a rapid and significant shift in consumer preferences towards EVs.

In the ASEAN region, governments recognize the significance of EVs not only for environmental reasons but also as a strategic opportunity for industrial growth and sustainability. This section will present the EV landscape and developments in ASEAN. There are two fronts to this landscape: the EV market and the EV industry.

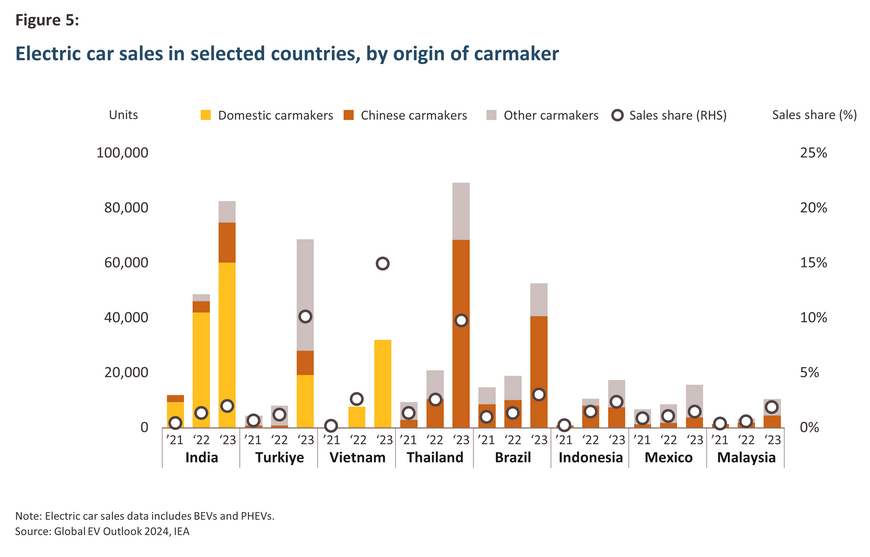

Indonesia experienced rapid growth in EV sales from below 100 units in 2021 to around 17,000 units in 2023, supported by purchase incentives4/. However, the sales share remained nascent at below 3%. Increasing model availability is also helping to boost sales as foreign carmakers, especially Chinese are increasingly entering the market. Chinese companies accounted for 45% of electric car sales given their competitive prices.

In 2023, despite a decrease in total car sales, EV sales still increased to 30,000 units, reaching almost 10% sales share. Domestic front-runner VinFast, established in 2017, accounted for nearly all domestic sales. VinFast also looks to enter regional markets such as India and the Philippines.

The landscape of the ASEAN EV Industry

ASEAN countries have released incentives in recent years aimed at being the next EV manufacturing hub, servicing a growing regional and domestic demand.

The rise in demand for EVs and the region’s commitment to energy transition, coupled with the supply chain relocation trend, have incentivized EV manufacturers to invest in EV production chains and develop new EV models tailored to the ASEAN markets. ASEAN governments thus see this as an opportunity to become the EV production hub, leading them to implement policy measures including subsidies and incentives for EV manufacturers to attract foreign investment.

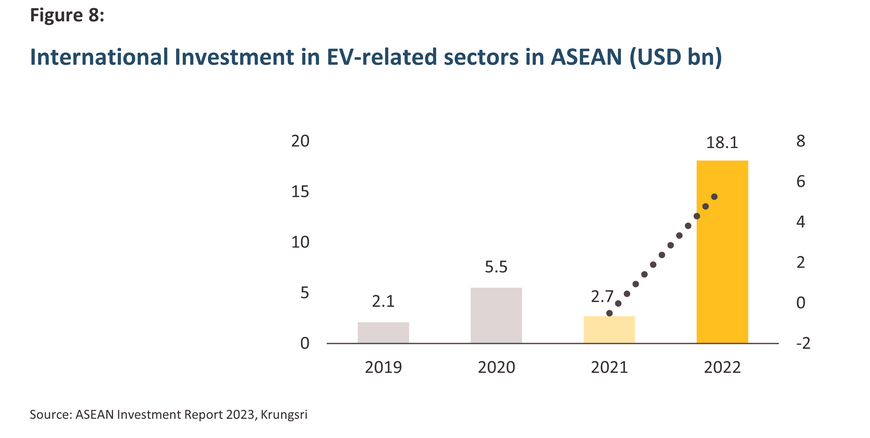

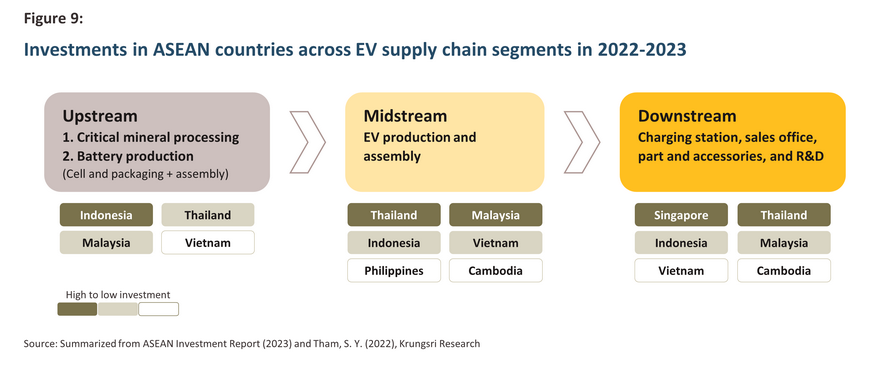

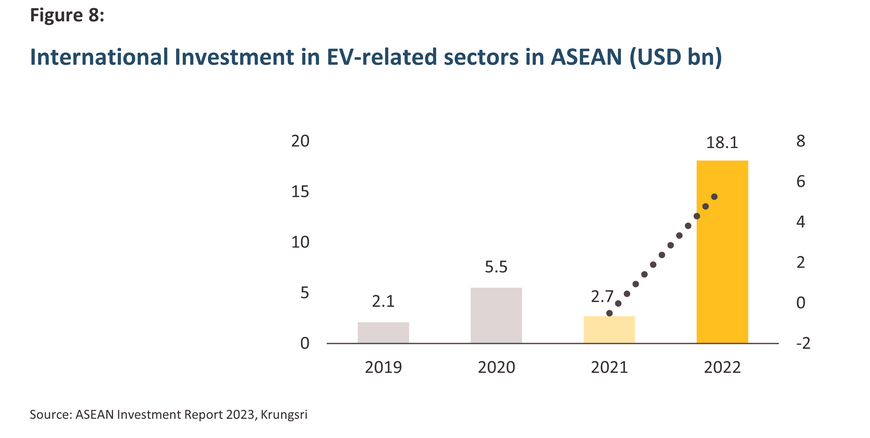

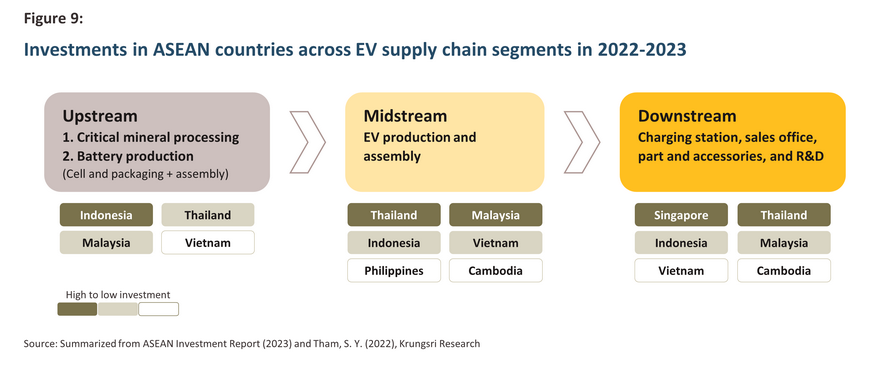

Regarding the investment situation in EV-related industries, international investment in ASEAN soared by 570 percent to USD 18 billion in 2022 (Figure 8). The rise spanned supply chain segments (upstream, midstream, and downstream), reflecting robust investor interest (Figure 9). Upstream investment concentrates on securing critical minerals, primarily in Indonesia, the world’s big producer of nickel and cobalt (both are key minerals for manufacturing batteries). The 2020 export ban on nickel by Indonesia drove significant investment in processing and smelting operations in past years. FDI in midstream or EV manufacturing, body assembly, and parts, mostly occurs in Thailand and Malaysia or the traditional regional automotive hubs. For downstream activities, multinational enterprises (MNEs) in different industries have invested across the region. Given that the top ten global EV manufacturers, e.g., BYD and Hyundai, are based in ASEAN and keep expanding there, this indicates the region's attraction for investment in EVs in the future6/.

- Countries in focus of the study

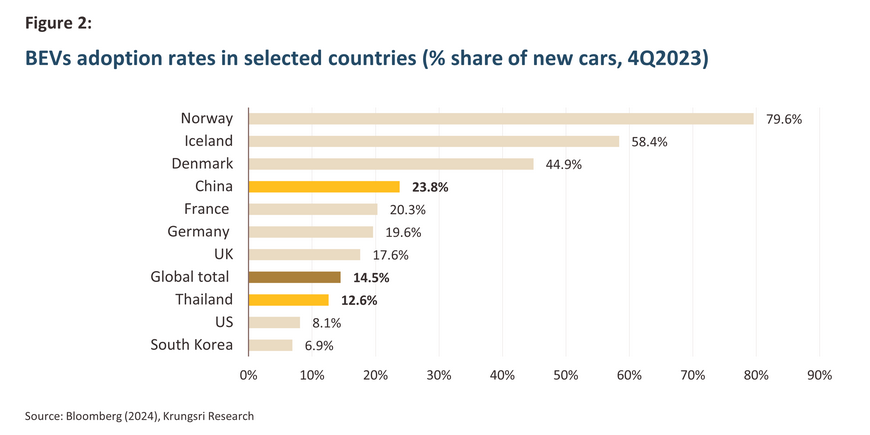

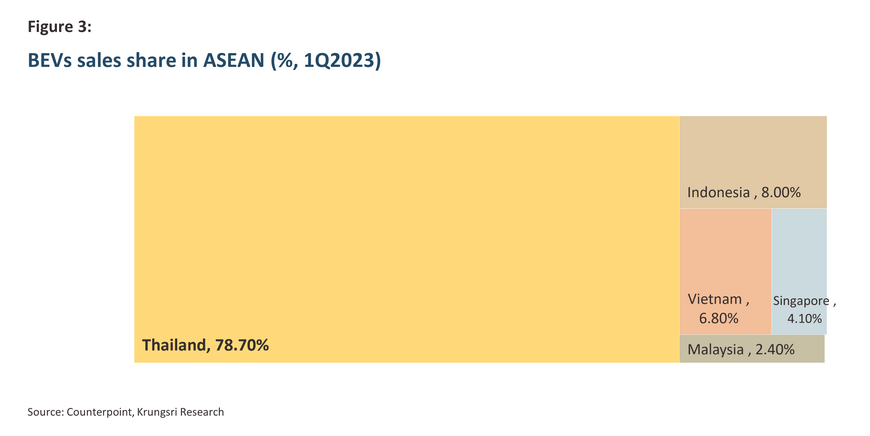

While Thailand, Indonesia, and Vietnam are among the biggest EV markets in the region, Thailand and Indonesia are the focus of this study due to their large production bases for automobiles, strengths, and their governments’ ambitious targets to become EV production hubs in ASEAN.

In terms of strengths, Thailand is known for a relatively high end-user demand for EVs and a well-developed supply chain for traditional vehicles, which could be leveraged for EV production. Indonesia, with its abundant natural resources, growing consumer sentiments towards EVs, and the rigid plan to build an EV battery production hub, is also well-positioned to be a major EV producer. Meanwhile, the supply chain in Vietnam’s automotive industry is still in development. The country has been slower to engage foreign manufacturers, possibly due to the presence of its domestic brand, VinFast, with global ambitions.

The governments’ ambitions and initiatives to become EV production hubs of Thailand and Indonesia are also one of the drivers of the trend. In Thailand, the country’s commitment to becoming the regional hub in EV production has been emphasized through “30@30” policy, which aims for 30% of all vehicles produced in Thailand to be zero-emission vehicles (ZEVs) by 20307/. This plan includes substantial incentives for EV manufacturers and investments in EV infrastructure. In Indonesia, President Joko Widodo has repeatedly emphasized Indonesia’s ambition to become a global leader in the EV industry. In various speeches, he has outlined the strategic importance of developing an end-to-end domestic EV ecosystem . For instance, at the 2022 Kompas100 CEO Forum, he stated, “We have nickel. We have copper. We have tin. All components needed in producing electric cars are in Indonesia… everything can be integrated so the EV battery and its ecosystem can grow even bigger to produce electric cars which, in the future, are needed by all countries.”

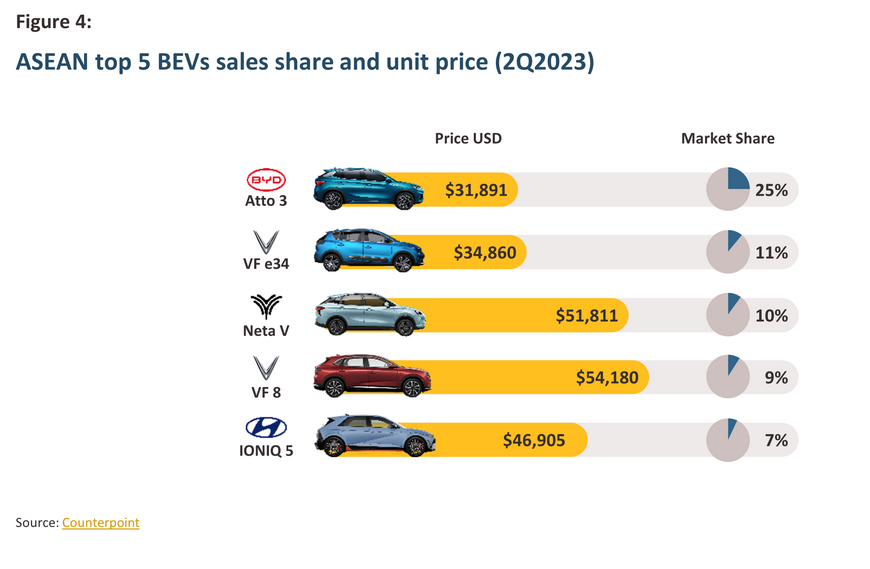

Currently, major investors in ASEAN EV production include Chinese, European, Japanese, and South Korean. In Thailand, China is a major player with companies like BYD which is already a leader in terms of sales in the country. European companies, such as Mercedes Benz and BMW, are also making investments. However, amid rising competition from Chinese firms, four Japanese automakers8/, that have dominated the Thai automotive sector for decades have pledged to invest a combined THB 150 billion to produce BEVs in Thailand over the next five years. In Indonesia, investment is coming from China, Japan, and South Korea. Players like the LG Energy Solution, Hyundai Motor Group from South Korea, and the SAIC-GM-Wuling Group from China are making significant investments.

Key success factors for EV manufacturing hub

Last section reveals that ASEAN holds significant market potential for EVs. Accelerating the adoption of EVs is expected not only to expand market opportunities but also to attract new foreign direct investments. ASEAN is thus aiming to be a regional manufacturing hub for EVs.

Scalability and automotive knowledge are crucial for success in the EV industry. This section seeks to identify the factors used to foster the development of countries as EV manufacturing hubs. The factors can mainly be categorized into demand-side and supply-side. While demand-side factors are important for manufacturers to estimate their ability to achieve 'economies of scale', supply-side factors can pinpoint a country’s competitive edge in terms of production along the EV supply chain.

Demand Side

Thailand leads the EV market penetration; Indonesia’s market is set to surge

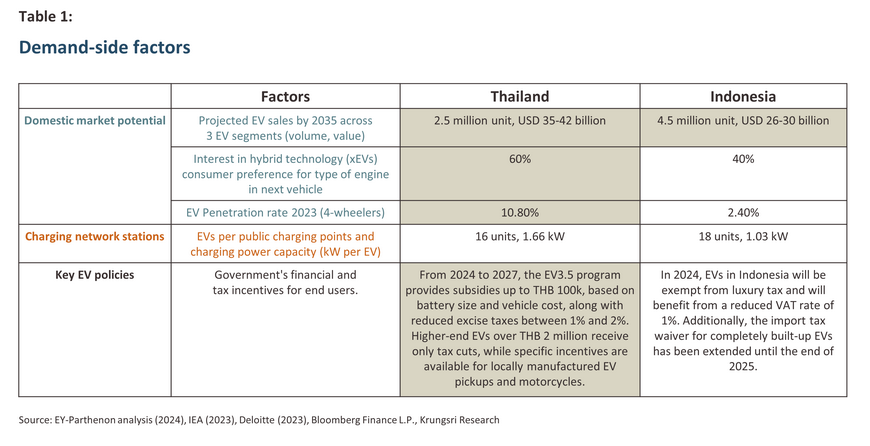

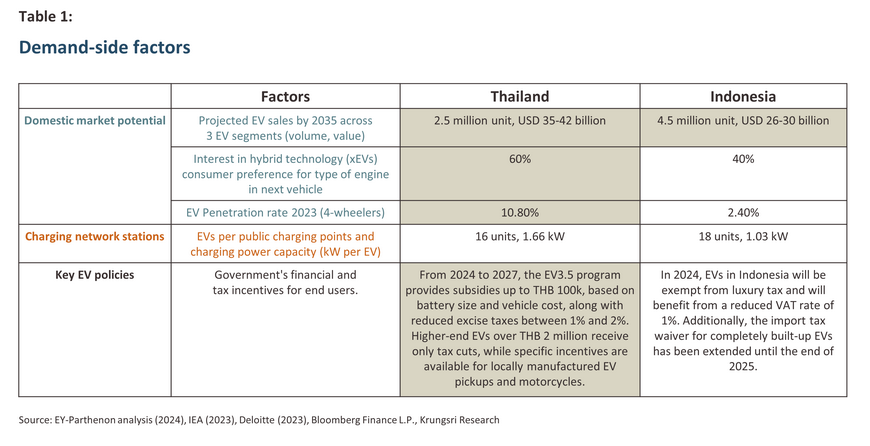

Demand-side factors include domestic market potential, the availability of charging stations, and financial incentives for end-users. Limited charging infrastructure, tumbling resale values, and the relatively high cost of ownership are often cited as key factors stalling EV adoption . Consequently, reducing taxes is a common incentive used to lower the cost of owning EVs, in addition to improving charging networks. The indicators used and details are provided in Table 1.

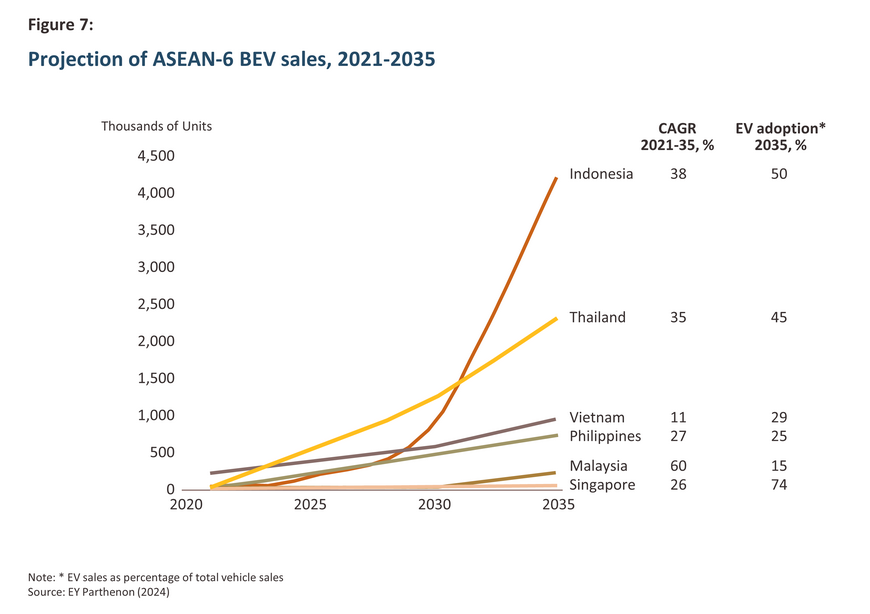

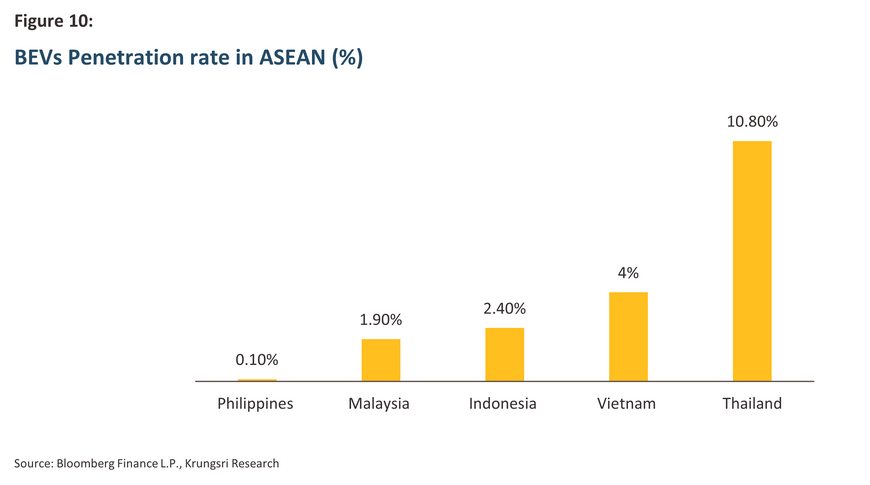

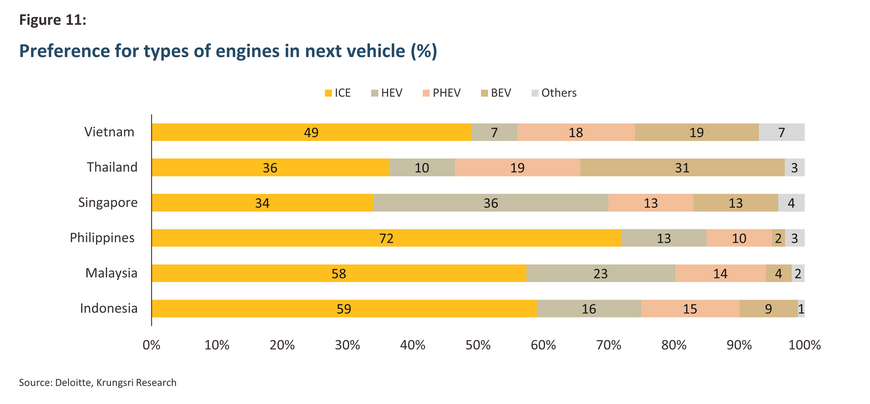

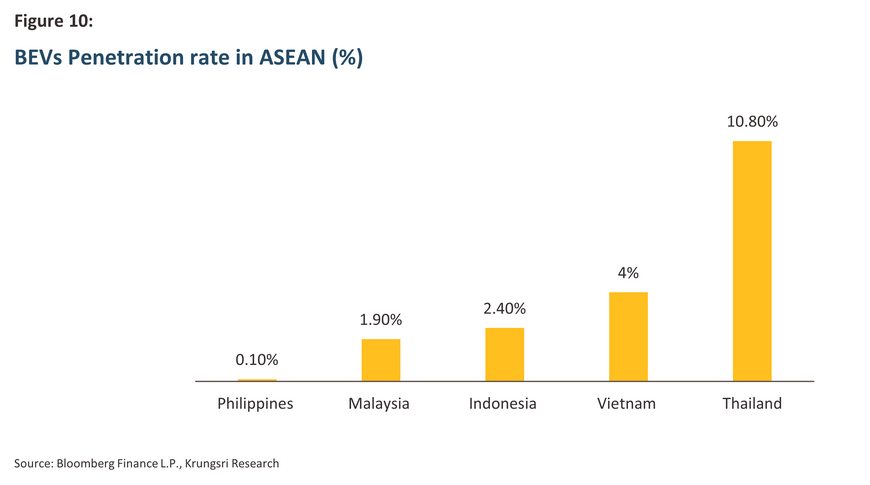

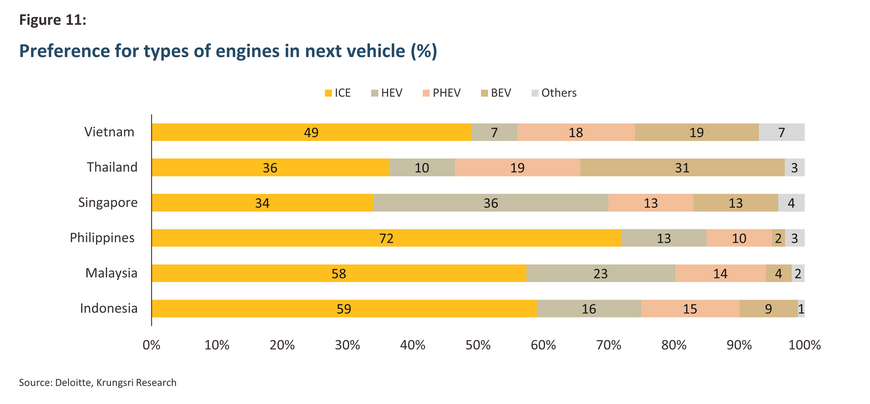

From this point of view, Thailand currently appears to have a more established consumer base for EVs, evidenced by its higher existing BEV market penetration (Figure 10) and more positive consumer preference for EVs (Figure 11). Additionally, Thailand's incentives are modestly more extensive, considering subsidies. However, in the next 5-10 years the trend for EV demand in Indonesia is more favorable, with a larger projected market size across three EV segments9/, as seen in Figure 7. This is majorly driven by the country’s large population (roughly four times larger than Thailand's, as of 202310/), rising consumer preference for EVs, supportive government policies, and the mandate for EVs in the new capital city “Nusantara”. Although both countries’ charging network stations are relatively limited and mostly concentrated in urban areas, the government’s incentives are leading to significant expansion in charging stations.

Supply Side

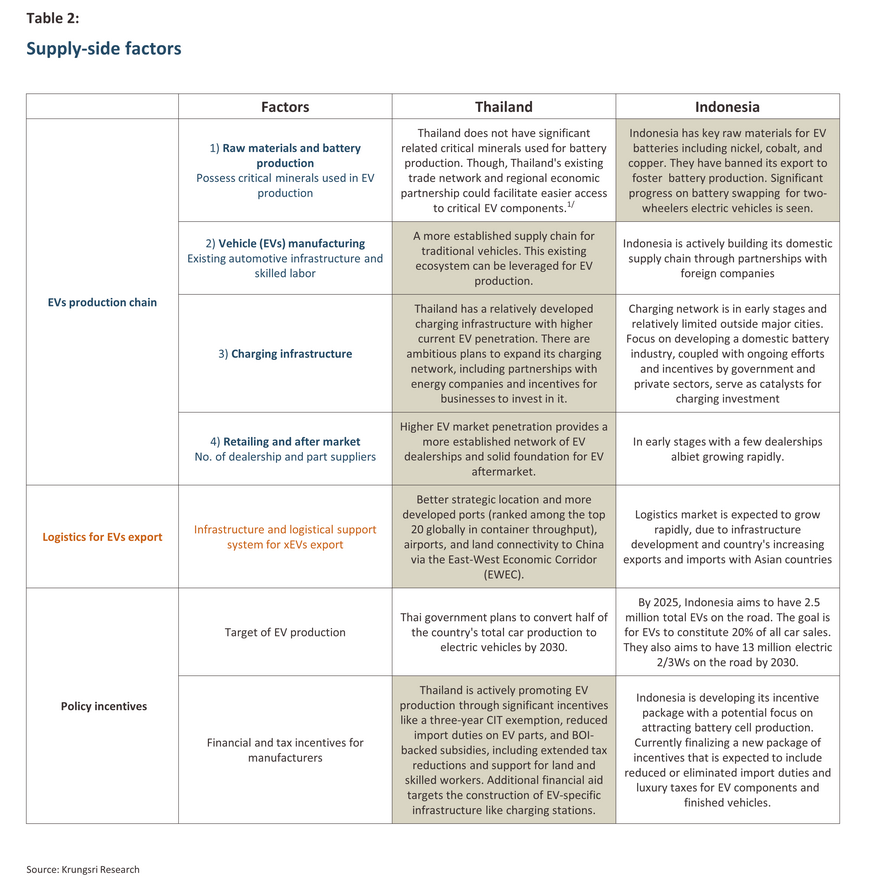

A well-established supply chain, a robust logistical support system for exports, and higher EV adoption compared to Indonesia have provided Thailand a competitive edge in EV manufacturing.

Supply-side factors involve the country’s strength along the EV supply chain, as identified in the introduction section. According to EY Parthenon, vehicle manufacturing, retailing, and aftermarket account for about 69% of the region’s total EV ecosystem value in 2035,

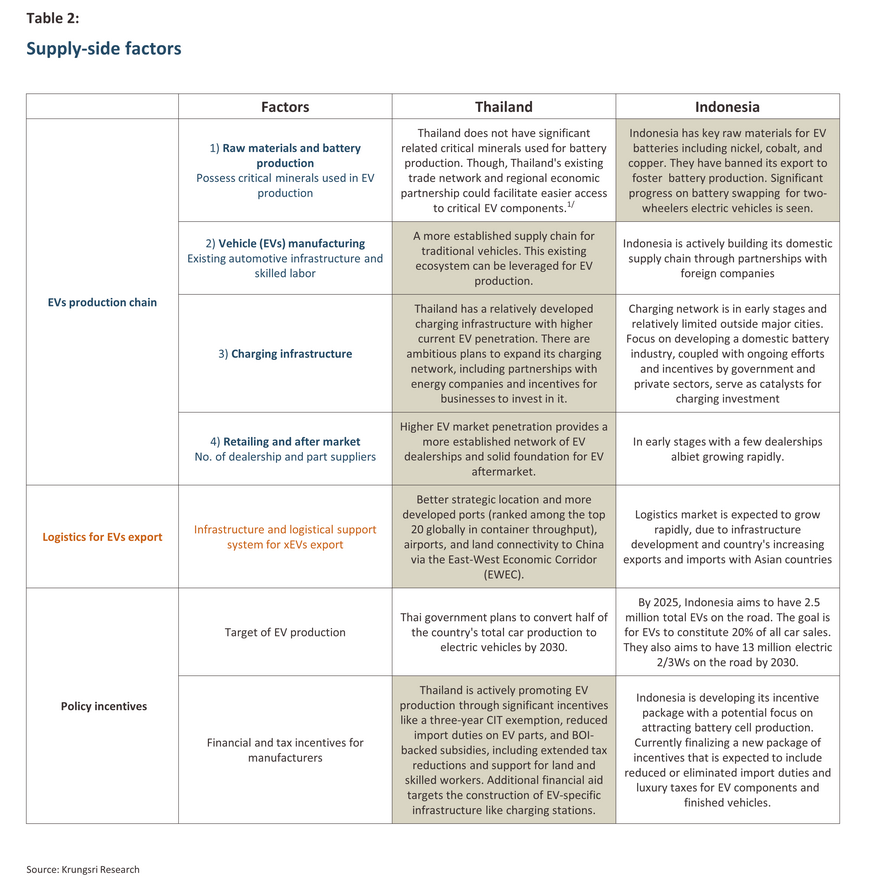

As seen in Table 2, while Indonesia has an advantage in terms of natural resources for battery production, Thailand's existing large automotive industry, more developed logistics for EV export, and early EV consumer exposure provide a more attractive environment for EV manufacturers over the near future. In terms of government incentives for EV manufacturers, Thailand has an established system of tax breaks and subsidies for EV producers. Indonesia is developing its incentive package for foreign automotive manufacturers with a potential focus on attracting battery cell production, as it ramps up efforts to establish the domestic EV ecosystem.

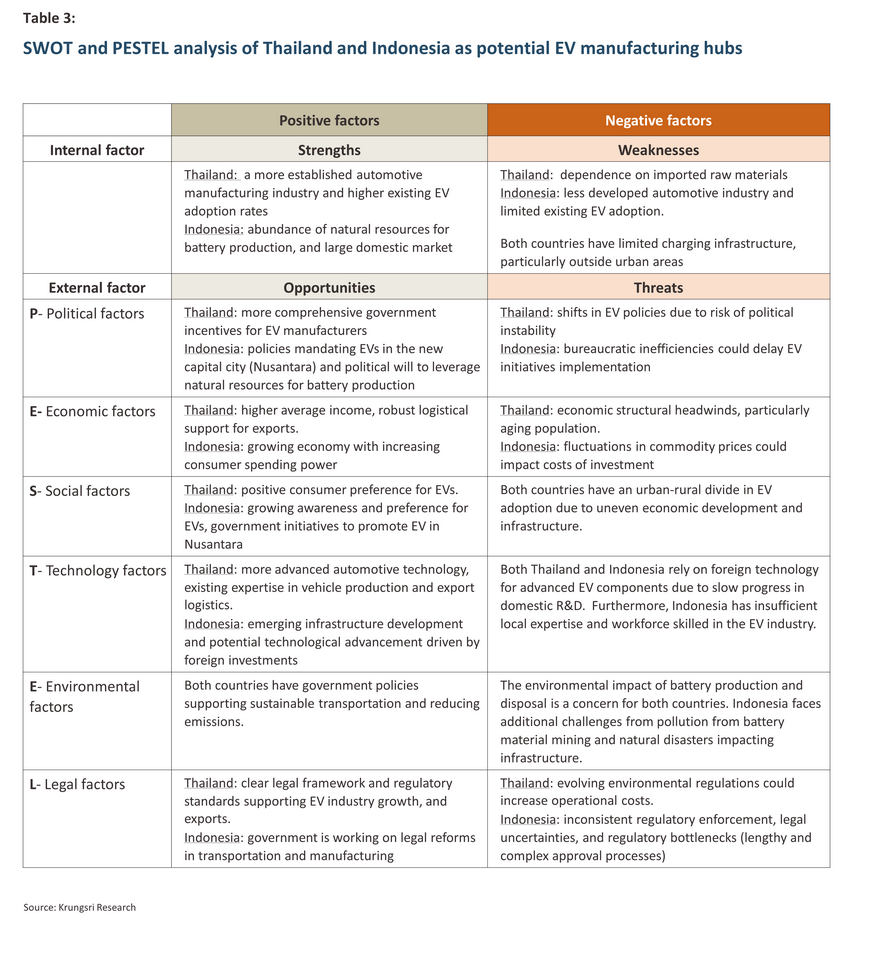

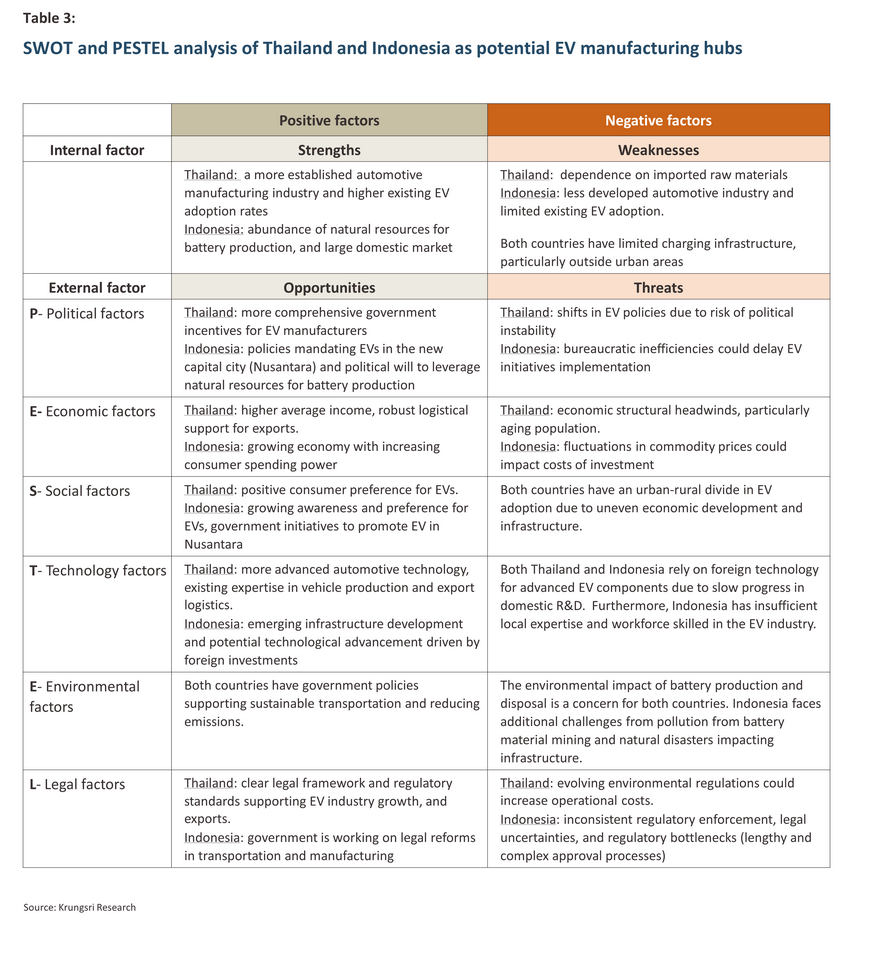

After considering the demand- and supply-side factors mentioned above, Krungsri Research has combined the SWOT and PESTEL frameworks (Table 3) to assess the potential of Indonesia and Thailand as EV manufacturing hubs. These frameworks analyze internal factors (Strengths & Weaknesses) and external factors (Opportunities & Threats) impacting both countries. For external factors, we examine the broader business environment through PESTEL analysis, considering political (P), economic (E), social (S), technological (T), environmental (E), and legal (L) factors.

Pinpointing opportunities in the EV industry of Thailand and Indonesia

From last section we can see that both Thailand and Indonesia have different strengths and opportunities that can be leveraged into investments in particular spaces along the EV supply chain. This section will explore opportunities for manufacturers across the EV supply chain and EV segments.

Across EV supply chain

Thailand and Indonesia present different opportunities across the EV supply chain. Indonesia holds a competitive advantage in upstream, while Thailand has a well-established midstream and downstream. Currently, Thailand appears to have a more robust EV ecosystem. With Indonesia’s long-term potential, both countries have the potential to be key EV manufacturers in the region.

- Raw material and battery production

Indonesia has a competitive edge in this area of the EV supply chain with abundant reserves of raw materials used to produce lithium-ion batteries, as well as a strong government incentive to strengthen battery manufacturing through local component requirements. They also aim to become the largest lithium-ion battery (EV battery production hub) in ASEAN. Furthermore, Indonesia has made significant progress in the development of battery swapping for two-wheeler vehicles, which is a convenient and efficient way to recharge. Thailand is also catching up on this opportunity with its local company, ARUN Plus, which is partnering with CATL, the world's largest battery manufacturer, to produce EV batteries in Thailand (starting in 2024).

With a more established automotive industry, as well as a higher number of skilled workers, Thailand holds a near-term advantage in the chain of EV vehicle manufacturing, particularly in body assembly, which is a critical part of the vehicle manufacturing process. However, Indonesia’s aggressive government policies aimed at fostering the domestic EV value chain indicate its long-term potential. Currently, Thailand is home to a number of major EV manufacturers, particularly Chinese companies. Indonesia has attracted investment from many global companies in recent years, which will help them develop their capability in this process.

With the concentration of charging stations in major areas for both countries, particularly for passenger vehicles, and ongoing proactive government plans to promote EV charging infrastructure, there are opportunities for businesses in both Thailand and Indonesia. In Thailand, the government has been proactive in promoting EV infrastructure development. They have partnered with private companies and utilities to expand the network, supporting the rising EV adoption in the country. The Indonesian government is also actively working to enhance its EV charging infrastructure. The development of the new capital city, Nusantara, as an EV-friendly city will catalyze nationwide infrastructure improvements.

- Retailing and aftermarket

With its higher market penetration of EVs and the presence of major automakers, Thailand’s retail network and aftermarket for spare parts are more established and expanding. Despite its early stages in retailing and aftermarket, Indonesia is rapidly developing its retail infrastructure and supply chain for spare parts. Both countries offer significant investment opportunities in this chain, each with its unique potential. In Thailand, there are opportunities for investment in expanding and enhancing the existing retail and aftermarket networks. In Indonesia, potential opportunities include building a new, robust ecosystem from the ground up by developing retail networks and a local supply chain for EV parts and accessories. The opportunities could extend to battery recycling and second-life applications for used EV batteries, addressing both environmental concerns and creating new business opportunities.

Considering the readiness of the EV ecosystem between the two countries, Thailand currently appears to have a more robust ecosystem. Local companies in both countries have formed partnerships with international brands in the hope of fostering technology transfer and capability development. While the partnerships between local firms in Indonesia mainly focused on building local battery production, Thailand’s firms are working on building comprehensive EV ecosystems. Examples include:

-

Thailand

-

Horizon Plus: This joint venture between PTT, a Thai state-owned energy company, and Foxconn, a global leader in electronics manufacturing, serves as the operational arm managing a comprehensive EV manufacturing facility in Thailand. This collaboration leverages Foxconn's expertise to produce EV components within Thailand.

-

Arun Plus: Established by PTT, Arun Plus takes a broader approach, aiming to develop a comprehensive EV ecosystem in Thailand. They have partnered with industry leaders like CATL, to establish domestic EV battery production in 2024. They are also collaborating with other companies to foster innovative EV solutions and promote widespread EV adoption.

-

Indonesia

-

PT Anteka Tamban (Antam) and Indonesia Battery Production (IBC): Antam signed an agreement with Hongkong’s company CBL in the EV battery project. This collaboration is expected to cover processing stages from nickel mining to giga factory battery cells and packs, as well as recycling. Recently, Antam and IBC have started working with LG Energy Solutions, the world’s second-largest battery maker, to fast-track the establishment of a factory for manufacturing EV battery cells and associated facilities.

Across EV segments

Factors determining opportunities across EV segments include consumer preferences, production capacity and infrastructure development, and policy environment.

While overall ASEAN countries continue to see strong momentum in adopting electric four-wheelers or vehicle cars, two-wheelers or motorcycles are still the primary mode of transportation for the lower-income group in both countries. This section will focus on comparing opportunities for electric two-wheelers (E2Ws) and four-wheelers (E4Ws) including passenger vehicles and commercial vehicles (e-pickups). Economic factors influencing market demand and production capacities are listed below.

-

Consumer preferences: There are two main sub-factors. Firstly, income levels determine affordability. E4Ws are generally more expensive than E2Ws so countries with higher average incomes might see quicker adoption of E4Ws rather than E2Ws. Secondly, the urbanization rate influences transportation modes in the countries. High urbanization rates lead to parking constraints and traffic congestion, which favor the use of E2Ws.

-

Production capacity and charging infrastructure: These factors affect the scalability of E4Ws and E2Ws, which, accordingly, affects production cost, cost of ownership or feasibility. The availability and density of charging stations are crucial for the adoption of electric passenger cars more than for two-wheelers, which can often be charged at home easily.

-

Policy environment: More specific national development objectives and targets play a significant role in encouraging the use of E4Ws and E2Ws.

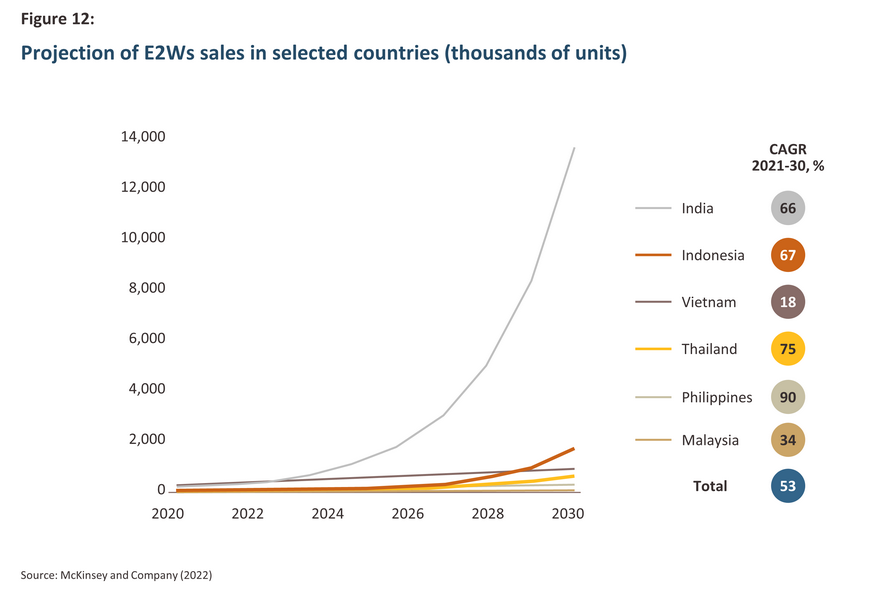

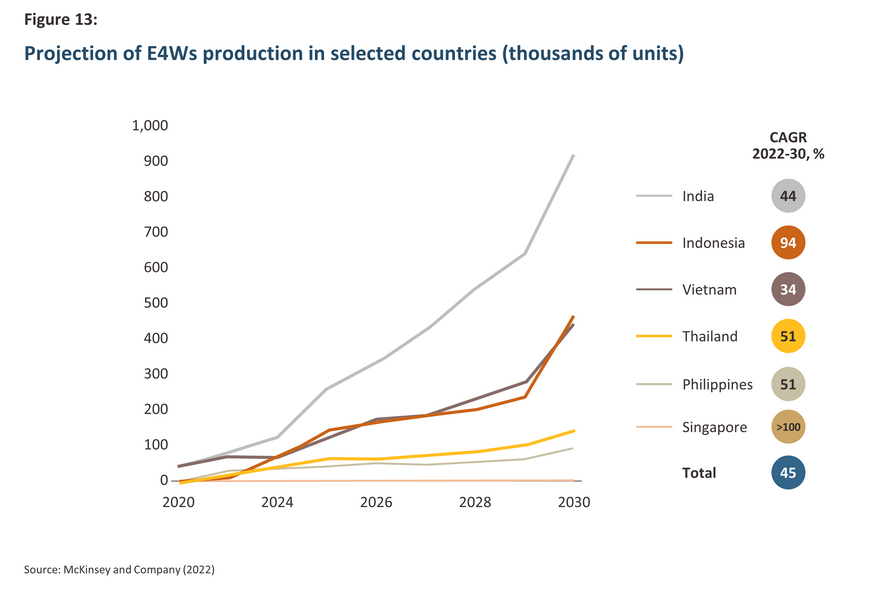

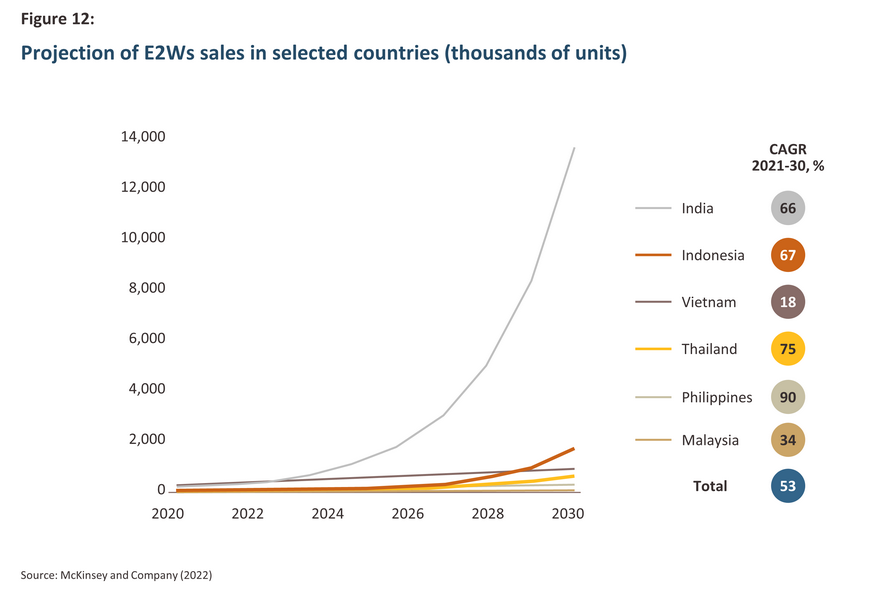

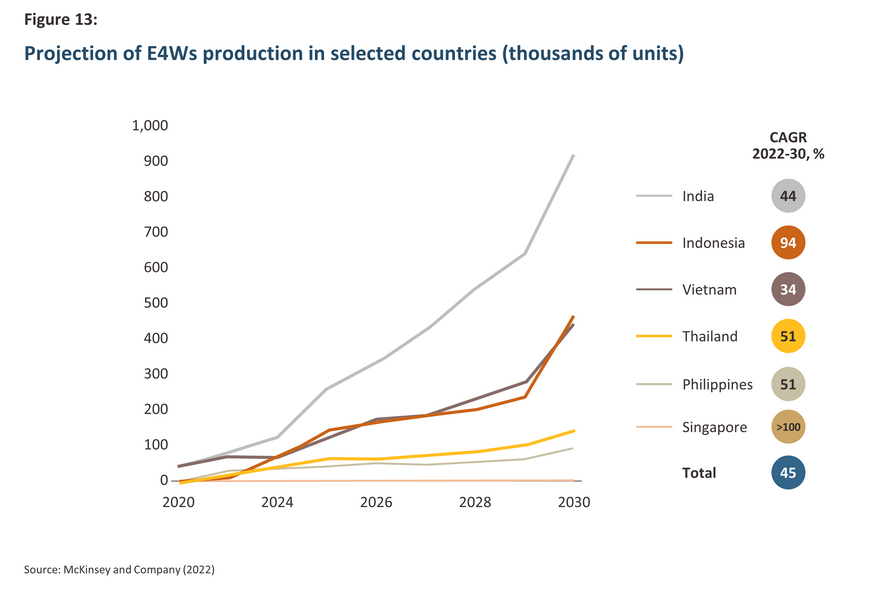

When comparing the two countries, Indonesia has a faster-growing market for E2Ws. Apart from its larger population, consumers might prefer E2Ws given the relatively lower average income and more traffic congestion (Jakarta’s traffic is consistently ranked among the worst in the world) due to a vast urban population and higher urbanization rate11/. Furthermore, a combination of the swift growth of e-bike market12/ and rapid development in its local battery manufacturing would benefit Indonesia as a key player in the E2Ws market. This is reflected in projected sales of electric two-wheeler vehicles, making Indonesia one of the world’s top three markets (Figure 12). In the next 5 years, however, Indonesia is also expected to be another potential market for E4Ws (Figure 13).

On the contrary, Thailand is currently more favorable for the adoption of E4Ws, given its current more established automotive industry and higher average income, which attracts more consumer preferences towards electric passenger cars at higher prices. Additionally, Thailand also appears to be taking the lead for the electric commercial cars market, or e-pickups. A major development is Isuzu Motors' plan to use Thailand as a production base for electric versions of its D-MAX pickup truck13/. The electric pickup truck segment in Indonesia is in its early stages. Chinese company BYD has expressed interest in the e-pickups market, but concrete plans have not been announced yet. However, it is important to consider that consumer adoption of e-pickups in both countries may face challenges. Existing buyers of commercial vehicles are often located in non-urban areas with relatively lower incomes, and they may not be familiar with BEVs, hindering high adoption compared with passenger BEVs.

Key challenges in becoming EV manufacturing hub

Key challenges include constraints for EV adoption and production, trade protectionist measures, and sustainability concerns.

-

Constraints for EV adoption and production: while ASEAN remains a large emerging market with high potential, the EV adoption rate is still low. A survey conducted by Deloitte in 2023 shows that the lack of public charging infrastructure, limited capacity of batteries to cover long-distance travel, and high cost remain barriers to adoption. From the production point of view, limited market size and thus difficulty in achieving economies of scale, skilled labor shortage, reliability of power supply, and relatively less technology development in EV and battery manufacturing in the region could be major challenges for manufacturers when making an investment decision.

-

Trade protectionist measures: Thailand’s and Indonesia’s EVs and parts may have limited access to the US. This is because the Inflation Reduction Act, passed in 2021, withholds a key EV tax credit from buyers of vehicles with parts made by companies with heavy investment from companies in China, Iraq, North Korea, or Iran14/. This is particularly the case because major EV manufacturers in both countries are Chinese.

-

Sustainability concerns: Regarding the EV as a green transition, electricity in ASEAN countries still largely relies on fossil fuels, meaning EV adoption might not be truly a solution for the energy transition. The International Energy Agency (IEA) recorded in 2019 that more than 60 percent of Indonesia’s electricity was still powered by coal while Singapore and Thailand were mostly fired by natural gas at 96 percent and 60 percent respectively15/. Furthermore, sustainability concerns in the use of lithium-ion batteries remain, including repurposing and recycling when these batteries reach the end of their shelf-life, as well as the search for better and more sustainable EV battery options.

To tackle the challenges holding back EV adoption and production, besides offering financial incentives to attract foreign manufacturers, collaboration among governments, industry stakeholders, and academia is essential. This collaboration boosts innovation through research and development, along with investments in reliable power infrastructure. To mitigate the impact of trade protectionist measures and seize the opportunities, diversifying investments besides China and fostering technology transfer through strategic partnerships with major EV producers are essential steps for relying less on China and achieving a higher localization rate for EVs and their components. To rely less on fossil fuels, countries in the region should prioritize investments in renewable energy sources. Regional cooperation and collaboration can play a crucial role in advancing the transition to green energy.

Krungsri Research view

Thailand and Indonesia present different strengths in potentially becoming an EV manufacturing hub. Each offers different opportunities across the EV supply chain and the EV segment. Thailand's high EV penetration rate, coupled with its well-established automotive industry and partnerships with major international automotive players, positions it as a leader in vehicle manufacturing, particularly in body assembly capabilities. Opportunities are observed in four-wheelers targeting upper-middle and high-income segments. On the other hand, Indonesia holds a significant advantage in battery production, a critical component for EVs. Coupled with its large population in the lower-to-middle-income bracket, heavily reliant on two-wheelers, Indonesia is well-positioned to cater to a distinct market segment within the EV space.

Despite their differing strengths, both countries have the potential to become key players in global EV manufacturing. However, the two countries can complement each other to improve efficiency under several regional trade agreements, particularly the Regional Comprehensive Economic Partnership (RCEP), which aims to make ASEAN "a promising regional manufacturing hub for EVs." The RCEP provides preferential tariffs for those that meet its 40% Regional Value Content Requirement, facilitating the flow of automotive parts within the region, promoting production synergies, and strengthening the regional supply chain. In this regard, at a regional level, the strengths of these two countries can also complement the expertise of other Southeast Asian nations and help build the regional EV ecosystem as a whole.

References

ASEAN Secretariat. (2022). ASEAN Monthly Bulletin, In Focus: ASEAN as Market and Regional Manufacturing Hub for Electric Vehicles.

ASEAN Secretariat. (2023). ASEAN Investment Report 2023 - International Investment Trends: Key Issues and Policy Options. Jakarta: ASEAN Secretariat.

Deloitte. (2023). 2023 Global Automotive Consumer Study: Southeast Asia Perspective.

ERIA Study Team. (2023). Future Mobility Scenarios for East Asia Summit Countries. S., S. Gheewala, N. Chollacoop, and V. Anbumozhi. ERIA Research Project Report FY2023 No. 16, Jakarta: ERIA, pp. 34-96.

EY-Parthenon. (2024). How to Seize Opportunities Across Southeast Asia’s EV Value Chain.

International Energy Agency. (2023). Global EV Outlook 2023: Catching Up with Climate Ambitions. Paris: IEA.

International Energy Agency. (2024). Global EV Outlook 2024: Moving Towards Increased Affordability. Paris: IEA.

McKinsey & Company. (2022). Recharging Economies: The EV Battery Manufacturing Outlook for Europe.

McKinsey & Company. (2023). How to Succeed in the Electric Two-Wheelers Market.

Tham, S. Y. (2022). Mapping the Surge in EV Production in Southeast Asia. Yusof Ishak Institute Perspective, 2022 No. 112.

Thailand Board of Investment (BOI). (2023). Opportunities and Support Measures for Automotive & EV Industry in Thailand.

UNESCAP. (2022). Review of Climate Ambition in Asia and the Pacific.

News

Bloomberg, Electric Cars Pass the Tipping Point to Mass Adoption in 31 Countries, March 2024

Bangkokpost, Japan automakers to invest B150bn in Thailand over 5 years, December 2023

S&P Global, Indonesia on track to create a local EV supply chain off nickel success, February 2024

The Jakartapost, Don’t rush on EV in ASEAN, May 2023.

The Diplomat, Can Indonesia Achieve Its Electric Vehicle Ambitions?, February 2023