Executive Summary

Amid concerns over a new round of the US-China trade war following Trump’s re-election as US president, Krungsri Research has conducted this analysis to evaluate its impact on both the global and Thai economies, utilizing the GTAP model under three scenarios: (i) the US imposes a 60% tariff on all imports from China, (ii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and (iii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and China retaliates with an equivalent 60% tariff on all imports from the US. The results indicate that tariff hikes negatively affect the global economy in all scenarios. While Thailand may benefit from production relocation and export substitution in certain industries, these gains may not be as substantial as many expect, especially if the US imposes tariffs on Thai exports and China imposes a retaliatory tariff on the US.

Looking ahead, the Trump administration will likely retain some of Biden’s tariffs on strategic goods while further increasing tariffs on Chinese imports. However, the final tariff may not reach 60% or apply to all goods as previously announced during the election campaign, as such measures may not be worth the cost for the US. Instead, Trump may use tariffs as a “threat” to secure special trade deals with other countries. Meanwhile, Thailand will likely face increasing risks if the US imposes tariffs and countervailing duties on Thai exports. Thailand may also encounter export dumping from China. Therefore, Thailand should adopt a more proactive trade and foreign policy, particularly by accelerating negotiations for trade agreements with both existing and new partners while enhancing the competitiveness of its industries and services to mitigate the impact of the trade war, which is likely to escalate at least over the next four years.

Introduction

Donald Trump’s victory in the US presidential election for a second term has raised concerns in many countries, including Thailand since his policies aimed at protecting US businesses could trigger a new round of the US-China trade war. Recently (as of November 25, 2024), Trump announced an initial plan to impose a 10% tariff on all imported Chinese goods, as well as a 25% tariff on all imports from Canada and Mexico. During the election campaign, Trump also declared his intention to impose tariffs of up to 60% on all imports from China and 10-20% on all imports from other countries.

Given these developments, this analysis will estimate the impact of a new round of the trade war on both the global and Thai economies, with a particular focus on exports, investment, and Gross Domestic Product (GDP) under three scenarios: i) the US imposes a 60% tariff on all imports from China, ii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and iii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and China retaliates with an equivalent 60% tariff on all imports from the US. The analysis will also examine how the trade war will likely progress and its implications for the Thai economy in the next period.

Look Back at Trade War 1.0 Under Trump’s First Presidency and Its Impacts

Thailand’s and ASEAN’s exports have risen due to the substitution effect (i.e., US and Chinese goods have become relatively more expensive).

During Trump’s first term, the US imposed tariffs on Chinese goods under Section 301 for the first time in 2018. The tariff hikes prompted China to respond with similar tariffs, triggering the trade war between the two countries. In December 2019, the US and China reached the “Phase One Trade Deal,” which resulted in tariff reductions on certain products from both countries in January and February 2020. However, as of now, no further trade agreements have been reached between the US and China.

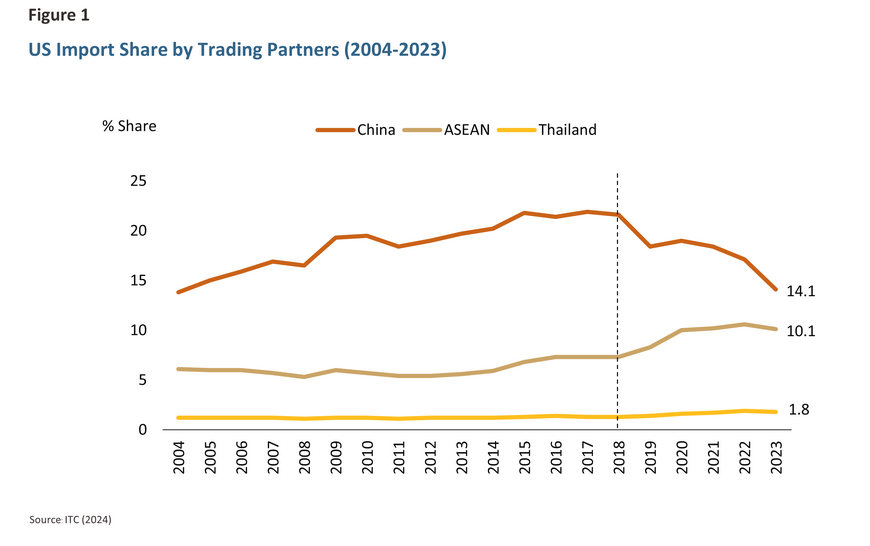

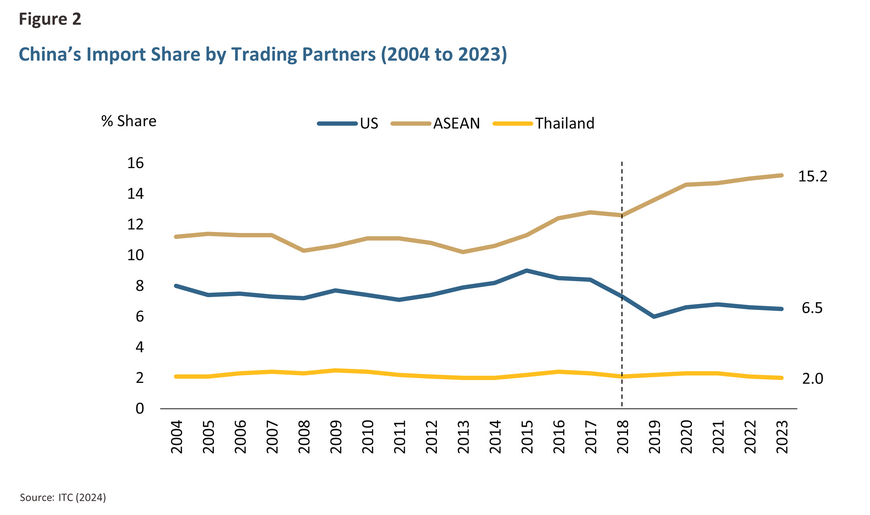

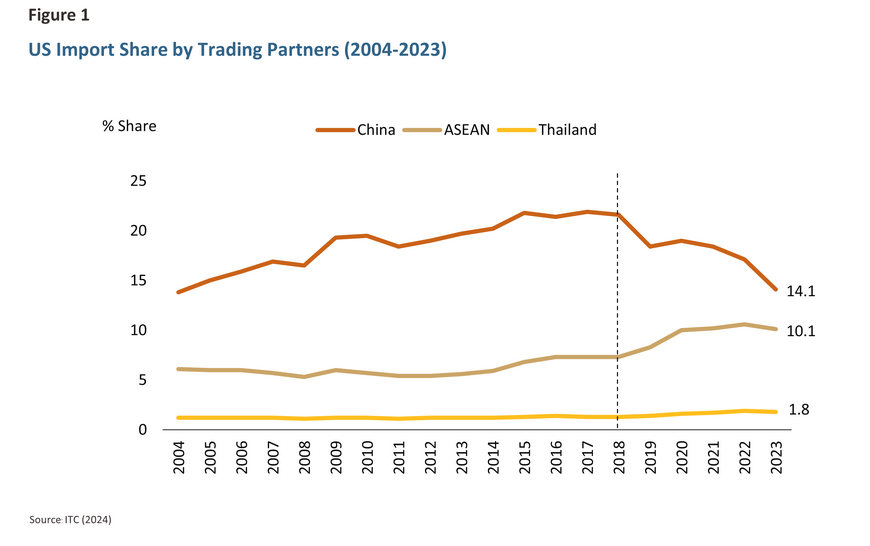

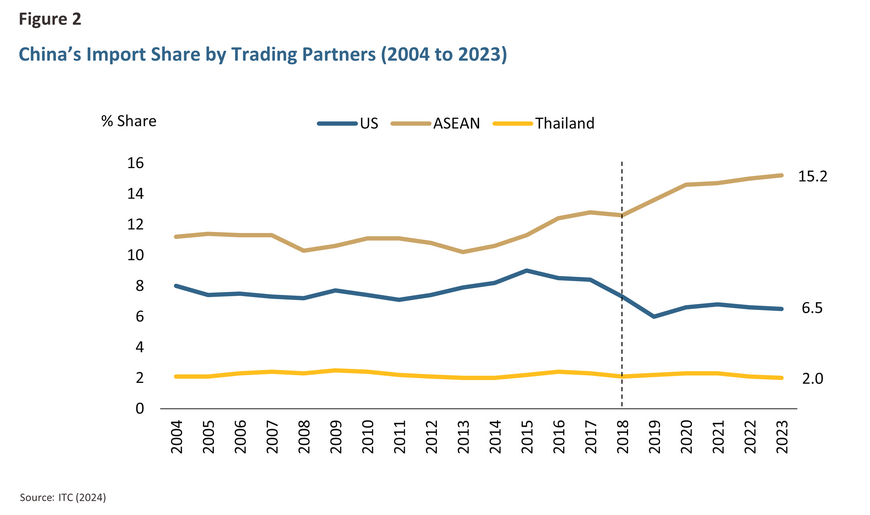

Such tariff hikes have significantly reduced the share of US imports from China, from 21.6% in 2018 to 14.1% in 2023 (Figure 1). Meanwhile, China’s imports from the US have remained relatively unchanged, from 7.3% in 2018 to 6.5% in 2023 (Figure 2). This is because China still depends to a considerable extent on intermediate goods from the US, particularly in key sectors such as Chemicals and Pharmaceuticals (where 80.6% of China’s imports in this category came from the US), Electronics and Electrical Equipment (53.2%), Agriculture (94.2%), and Motor Vehicles and Transport Equipment (42.8%).

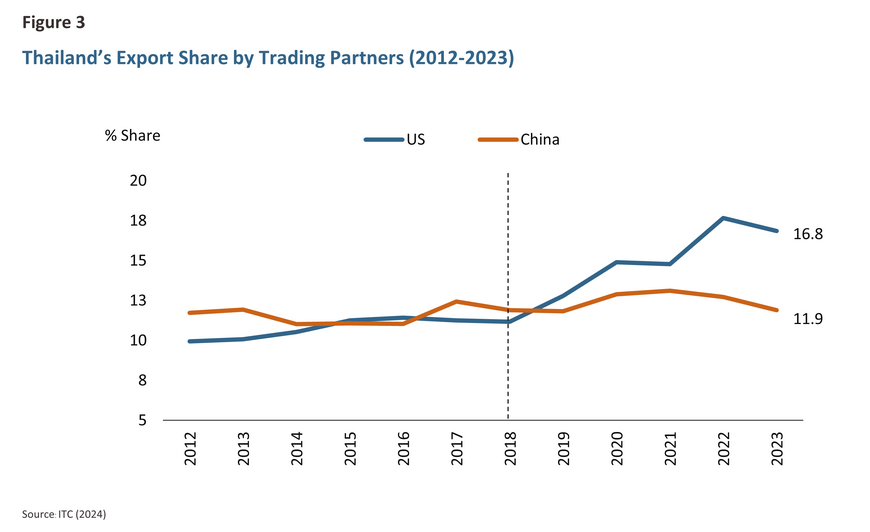

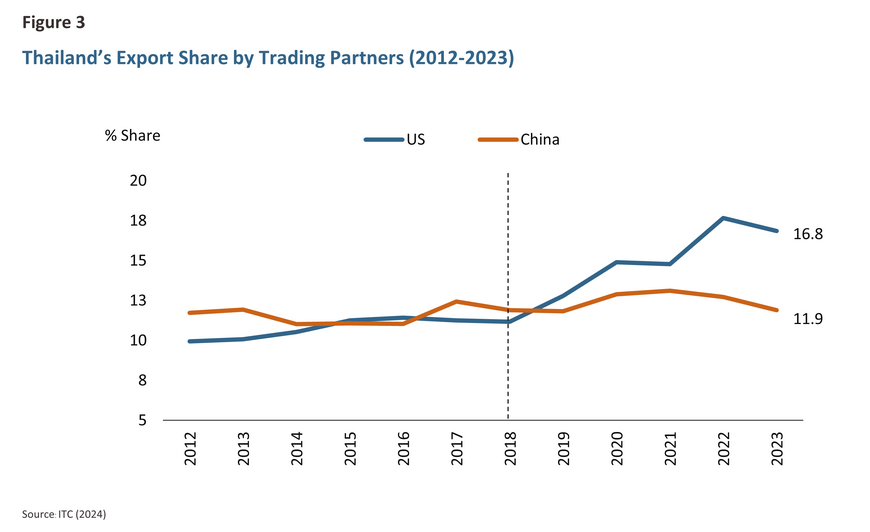

ASEAN has benefited from the US-China trade war since 2018, with the share of US imports from ASEAN rising from 7.3% in 2018 to 10.1% in 2023 (Figure 1), and the share of China’s imports from ASEAN increasing from 12.6% in 2018 to 15.2% in 2023 (Figure 2). Thailand also saw its export share to the US increase from 11.1% in 2018 to 16.8% in 2023 (Figure 3), whereas its export share to China remained relatively constant at around 11.9%. This reflects the benefits ASEAN and Thailand have gained from the substitution effect, as US and Chinese goods have become more expensive due to retaliatory tariffs.

Scenario Analysis of Trade War 2.0 Under Trump’s Second Presidency

Thailand is likely to benefit from the relocation of investments out of China and the export substitution of US and Chinese goods in certain sectors. However, the positive impact may be limited if the US imposes a tariff on Thai exports and China imposes a retaliatory tariff on the US.

As previously mentioned, Thailand benefited to some extent from the US-China trade war under Trump’s first term, as Thailand served as an alternative supplier to both countries. Meanwhile, the negative effects were limited to certain industries. However, Trump’s return to the presidency has raised concerns in many countries as tariff hikes are expected to cover all goods and all countries in the “Trump 2.0” era, unlike Trump’s first term or Biden’s presidency1/. On November 25, 2024 (Gopalan, 2024), Trump announced plans to impose a 10% tariff on all imports from China and a 25% tariff on all imports from Canada and Mexico immediately after taking office on January 20, 2025. Previously, Trump threatened to raise a 60% tariff on all imports from China and a 10-20% on all imports from other countries, including Thailand.

An important question that many may wonder is whether Thailand would still benefit from the trade war this time—either indirectly through tariff hikes on Chinese goods or directly from tariff hikes on Thailand’s exports. Additionally, China may impose a retaliatory tariff on the US. To evaluate the impact of these tariff policies on exports, investment, and Gross Domestic Product (GDP) over the medium to long term, we employed the GTAP model (Aguiar et al., 2019) under three scenarios: (i) the US imposes a 60% tariff on all imports from China, (ii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and (iii) the US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and China retaliates with an equivalent 60% tariff all imports from the US.

I. The US imposes a 60% tariff on all imports from the US.

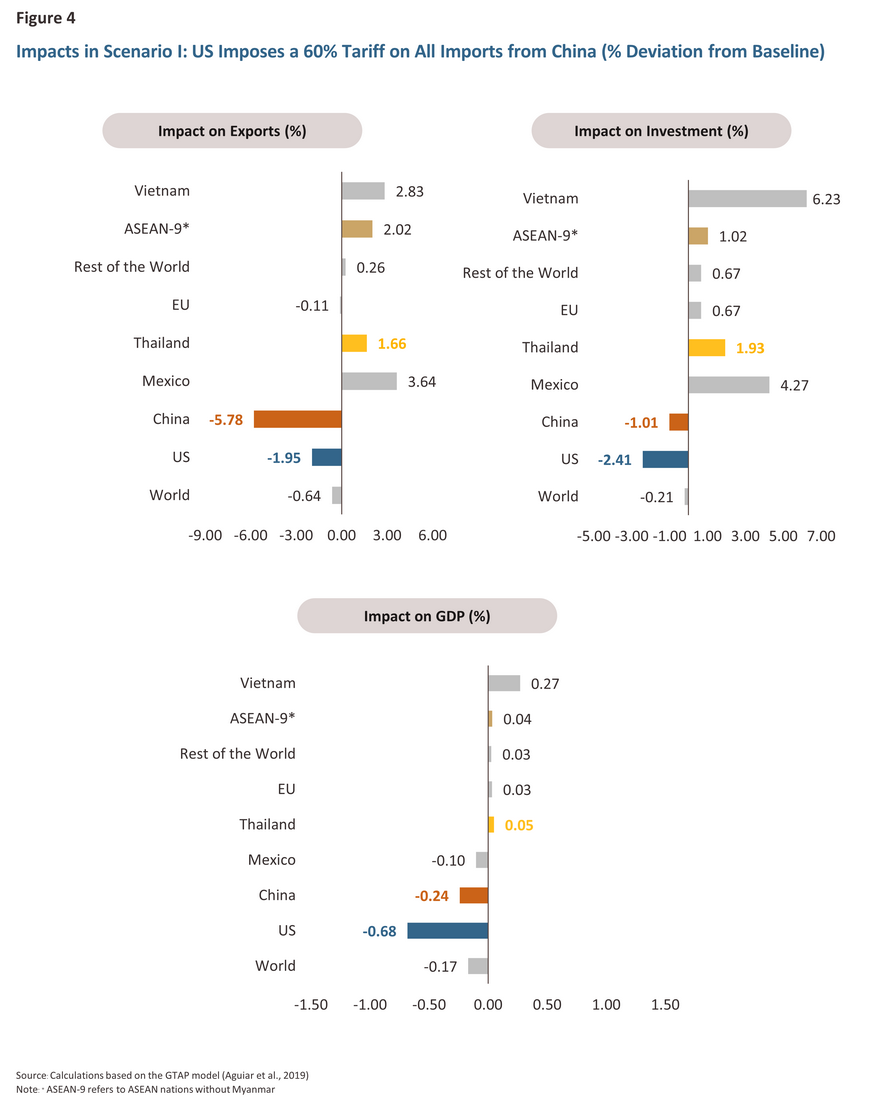

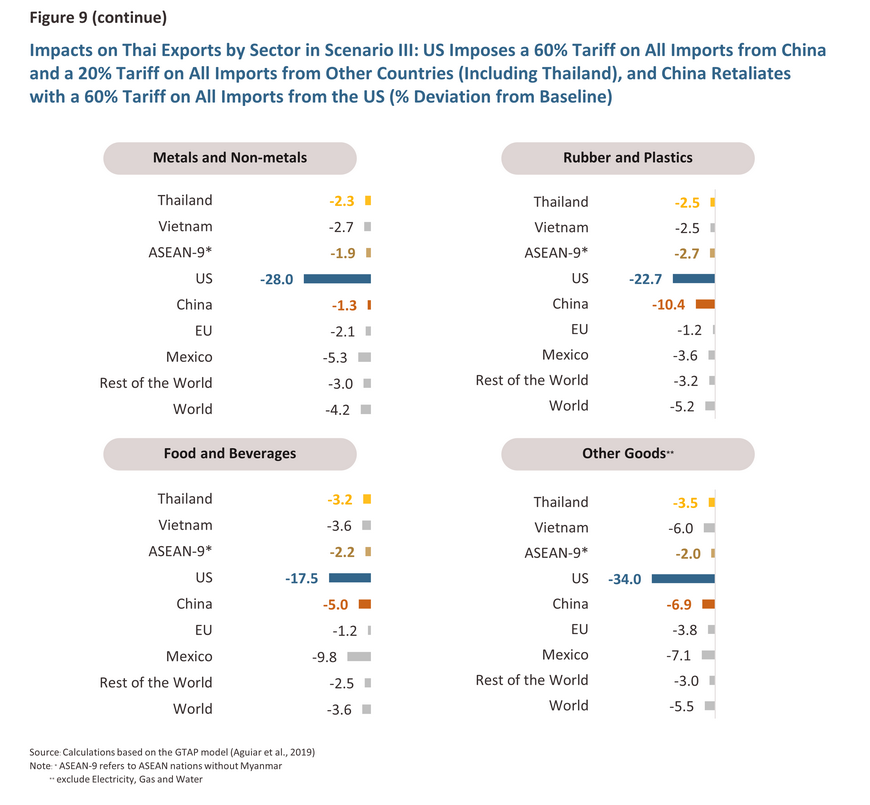

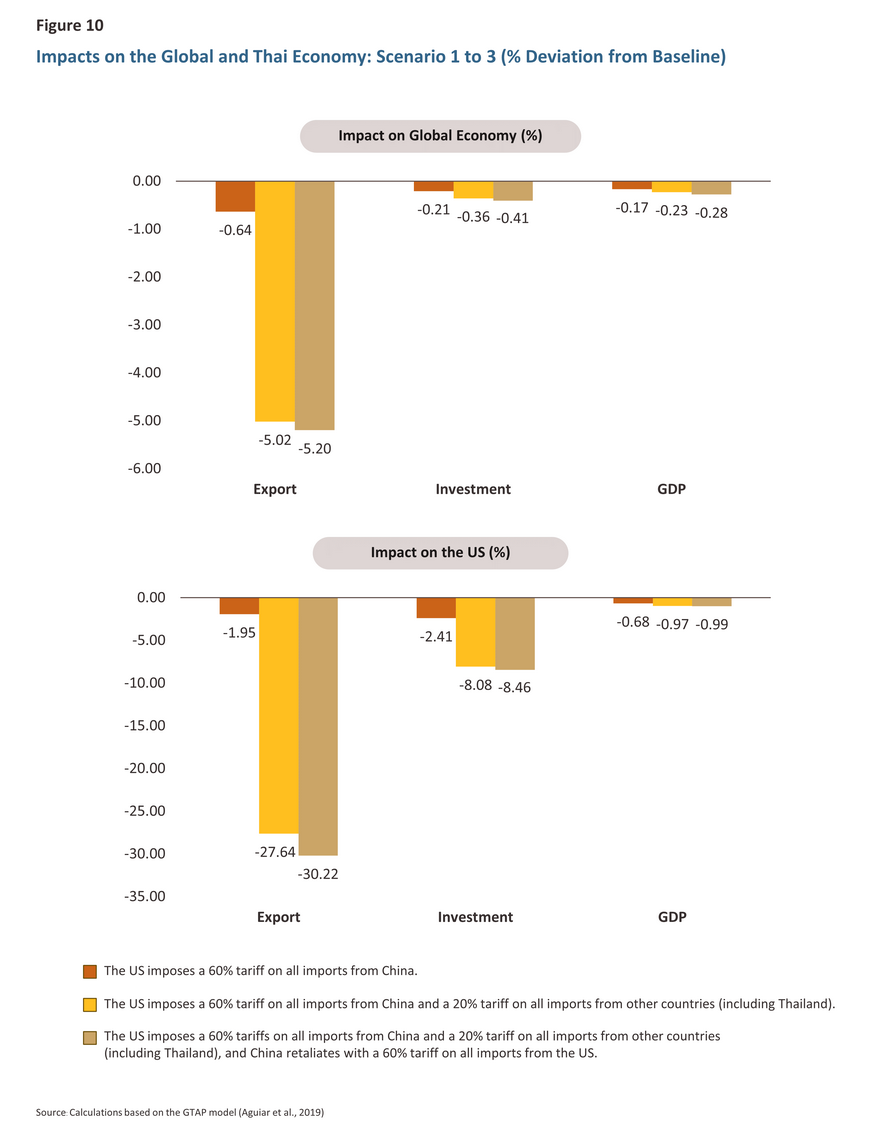

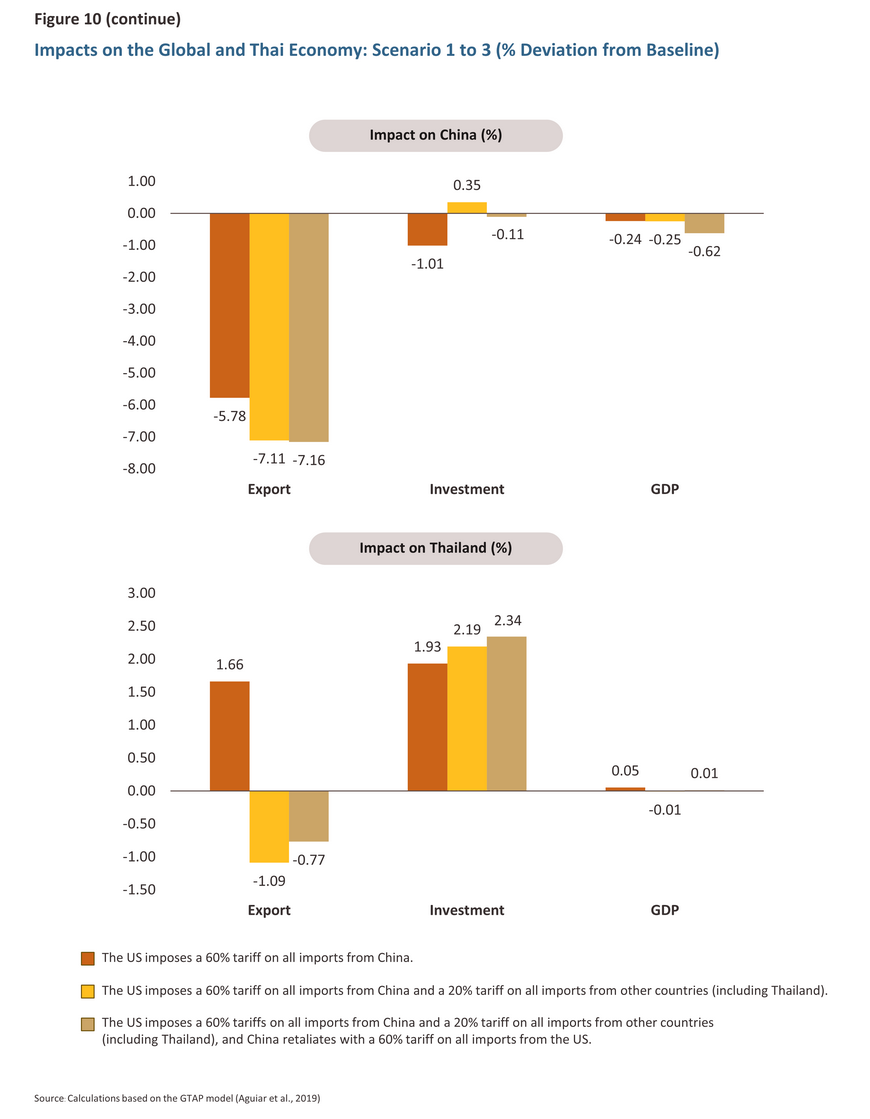

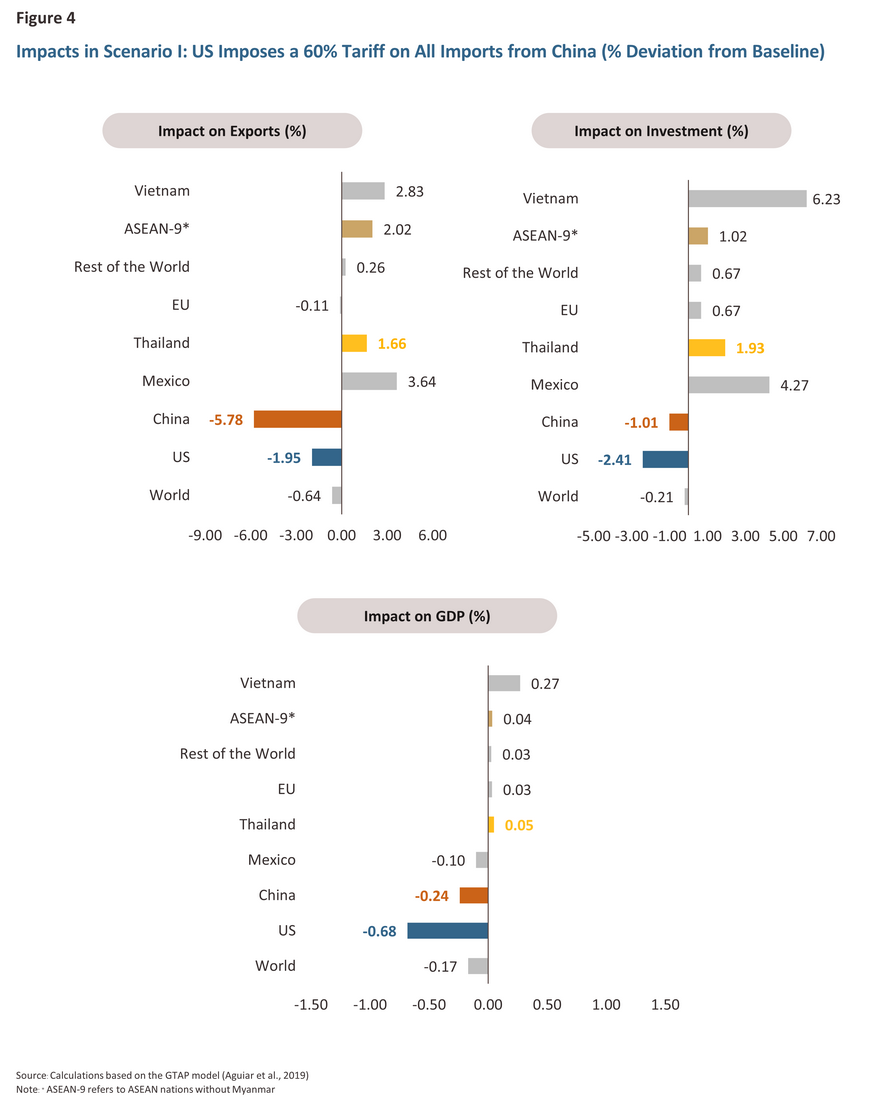

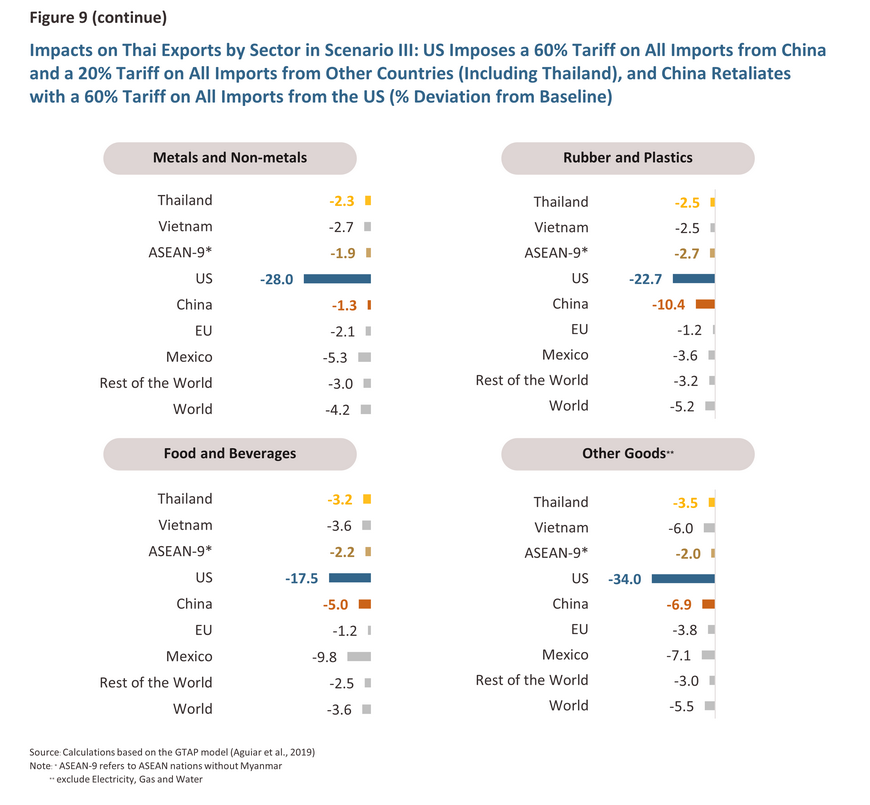

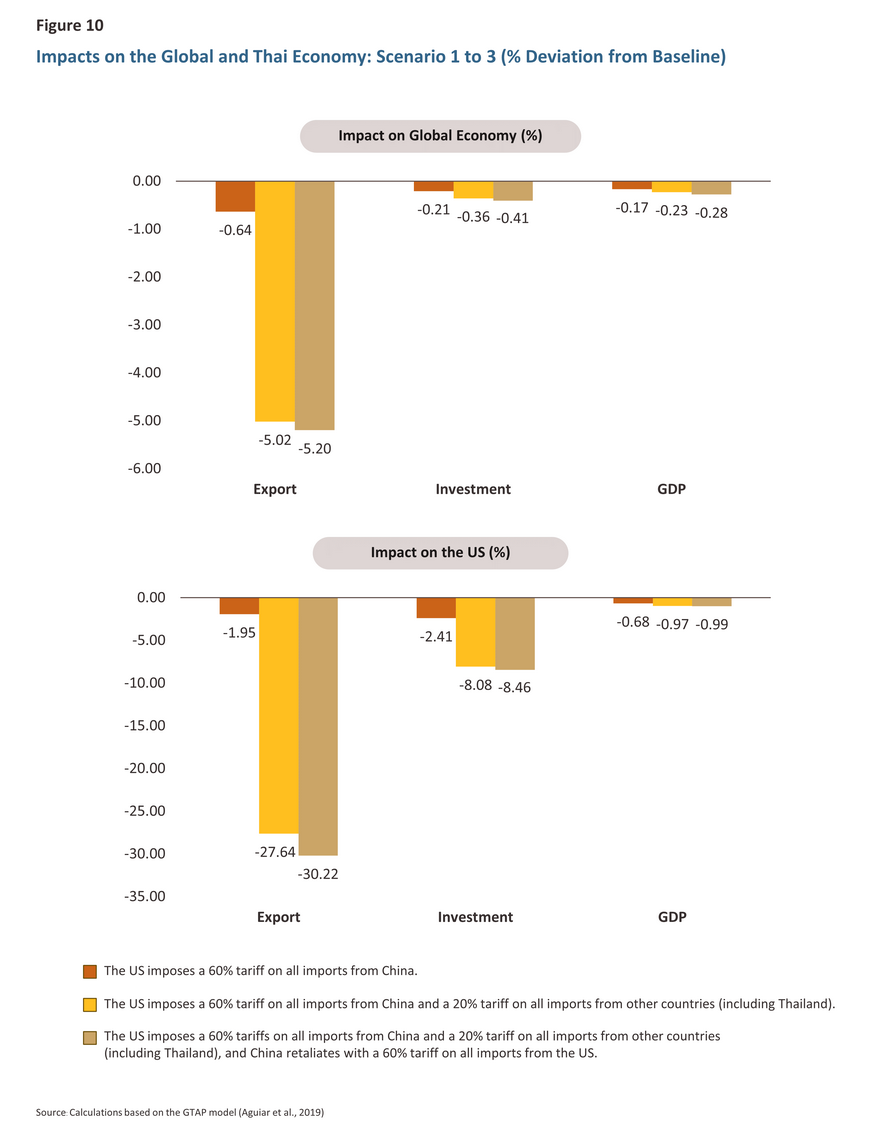

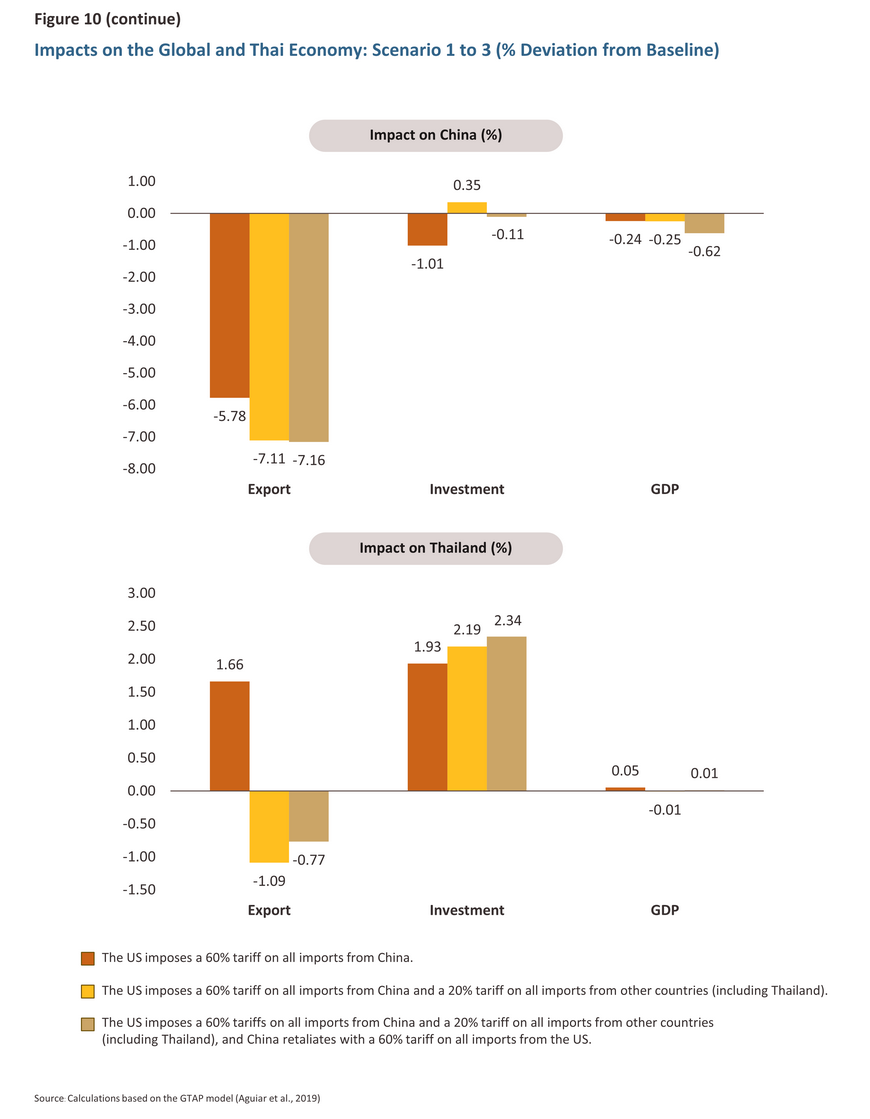

We found that overall (Figure 4), US tariff hikes on imports from China would reduce global exports and GDP by -0.64% and -0.17%, respectively, compared to the baseline. This is due to higher production costs, lower productivity, and weakened demand in major economies, particularly the US, the EU, and China. China’s exports could decline by up to -5.78%, more severe than the -1.95% reduction in US exports. However, the higher costs for businesses in the US due to the tariff hikes on imports from China would lead to a negative repercussion on US investment, with the impact being more than twice as severe as in China, since the US still needs to rely on raw materials from China in many industries.

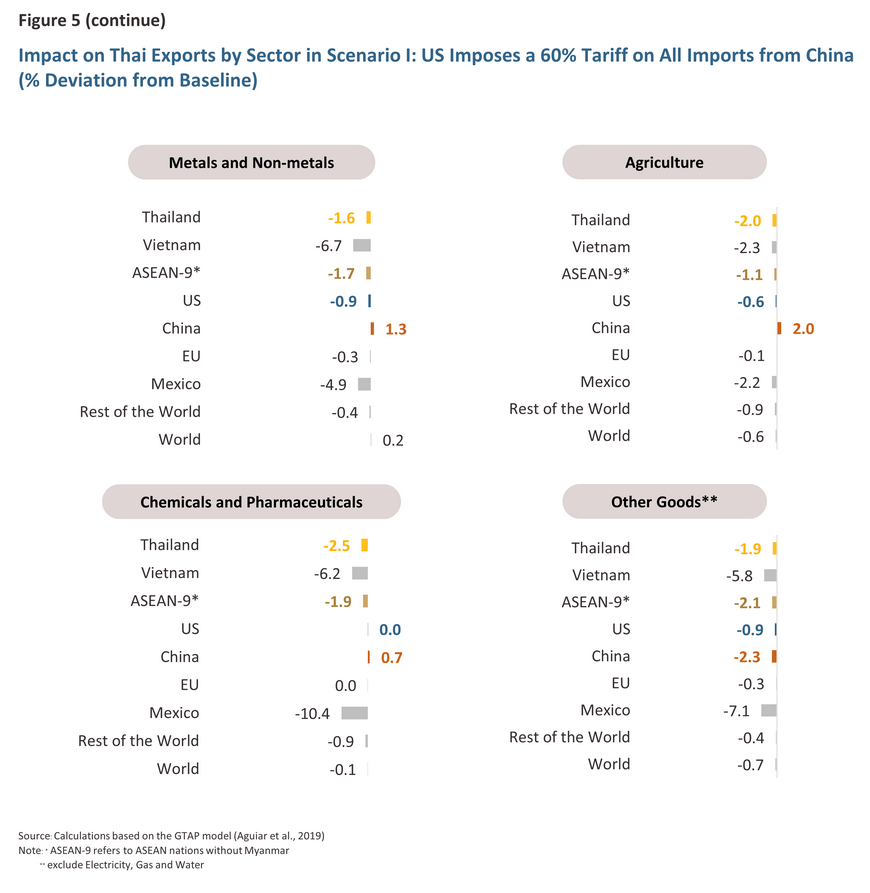

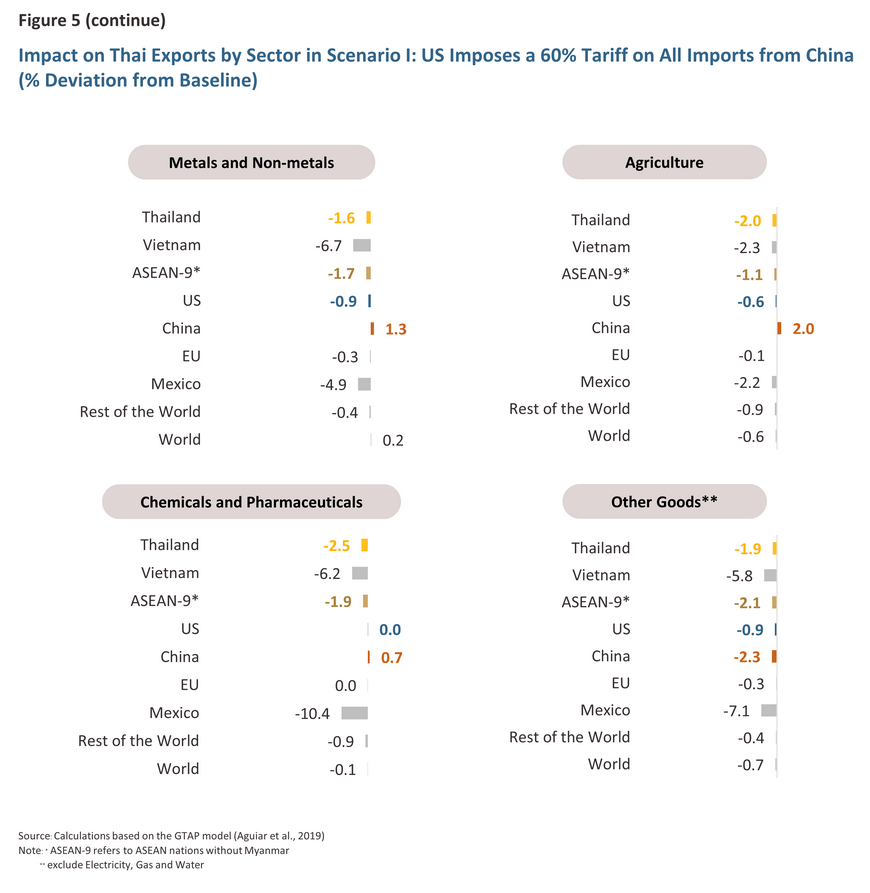

From Thailand’s perspective, this scenario remains beneficial, as the country could increase exports to substitute goods previously imported from China and the US. Additionally, Thailand could benefit from investment relocation out of China and the US. As a result, Thai exports and investments would rise by +1.66% and +1.93%, respectively, compared to the baseline (Figure 4). However, the positive impact on Thai exports is still concentrated in some industries (Figure 5), such as Electronics and Electrical Equipment (China’s exports: -10.1%, Thailand’s exports: +9.2%) and Textiles, Leather, and Footwear (China’s exports: -7.4%, Thailand’s exports: +3.4%). These limited gains, combined with Thailand’s participation in China’s supply chain, mean that the positive impact on GDP growth remains limited at +0.05% from the baseline, even though higher investment helps offset some of the negative effects.

II. The US imposes 60% tariffs on all imports from China and 20% tariffs on all imports from other countries (including Thailand).

The imposition of 20% tariffs on all goods from all countries, in addition to the first scenario, would exacerbate the negative impacts on the global economy compared to the first scenario (Figure 6). Global exports, investment, and GDP would decrease by -5.02%, -0.36%, and -0.23% from the baseline, respectively, which are approximately 7.8, 1.7, and 1.4 times more severe than in the first scenario. The negative impact on the US in this scenario is more pronounced, with US exports, investment, and GDP decreasing around 14.2, 3.4, and 1.4 times more than in the first scenario, respectively. This is partly due to higher import costs that affect US manufacturers, especially upstream industries that heavily rely on China. Meanwhile, the impact on China’s exports and GDP is close to the first scenario, at -7.11% and -0.25%, respectively. However, the impact on China’s investment improves compared to the first scenario, as the tariff rates on imports from China and other countries are more closely aligned, combined with China’s relatively lower production costs. Thus, its competitive advantages are not significantly different.

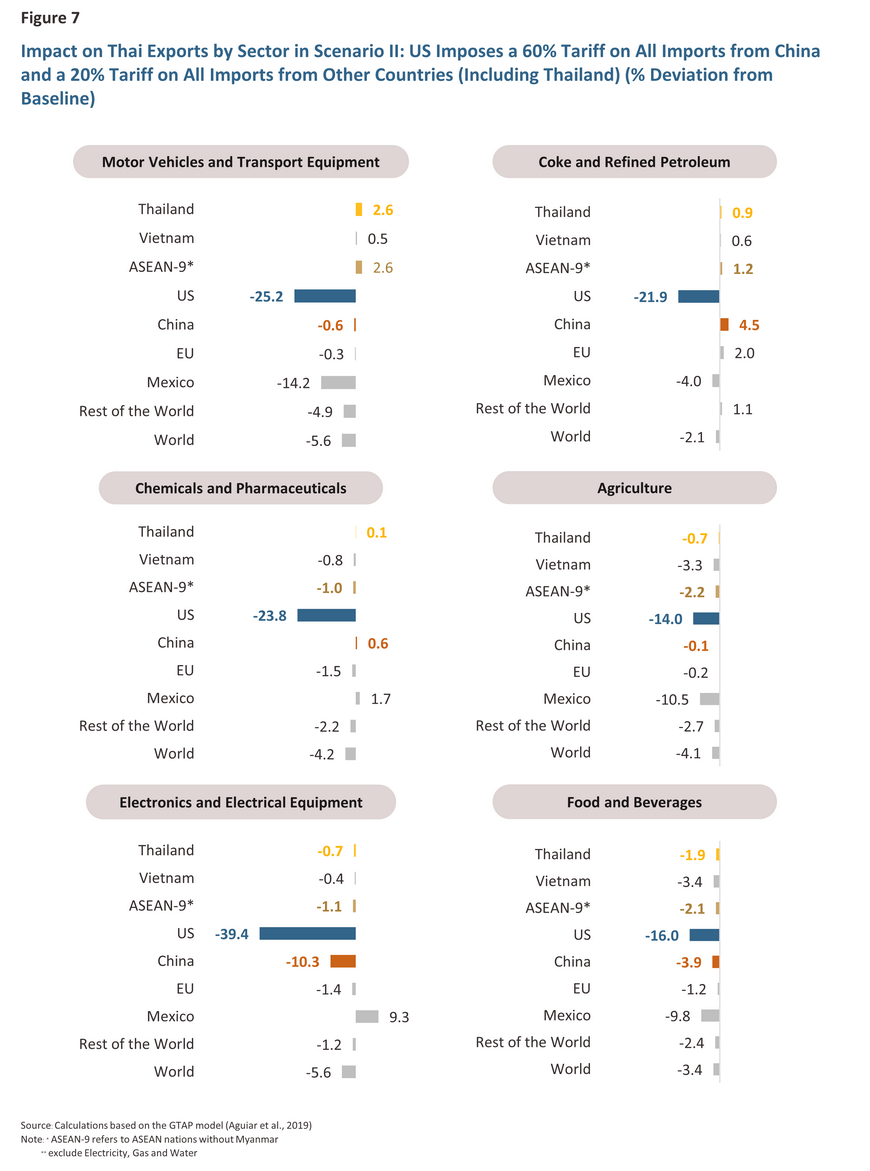

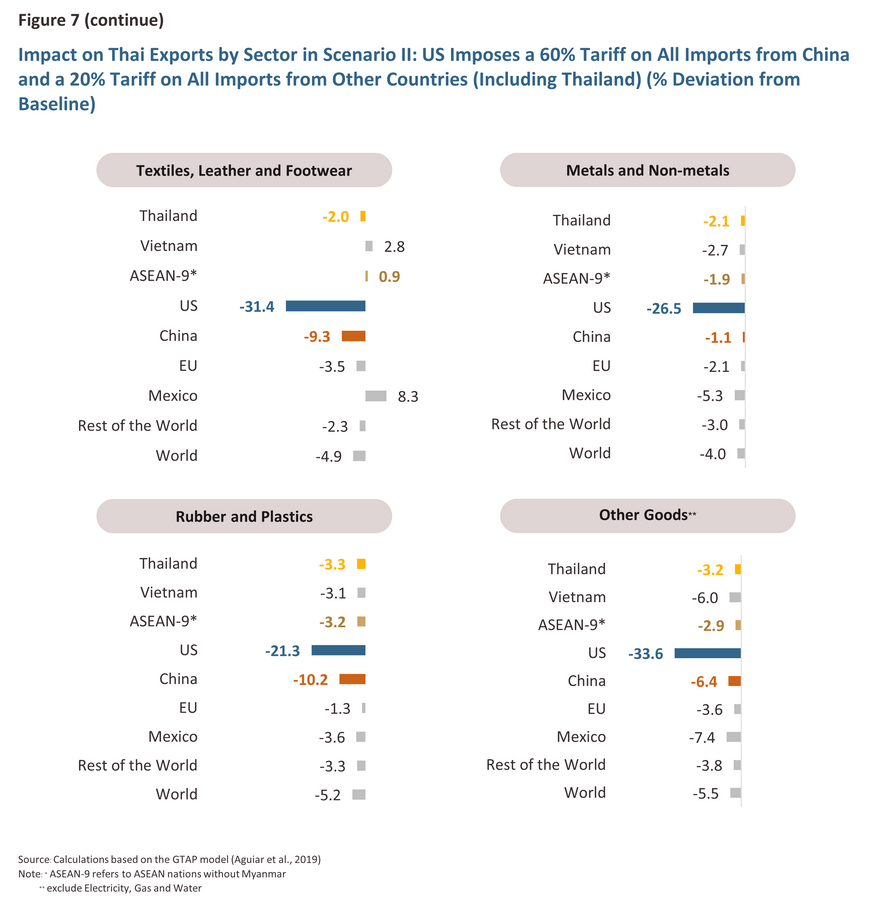

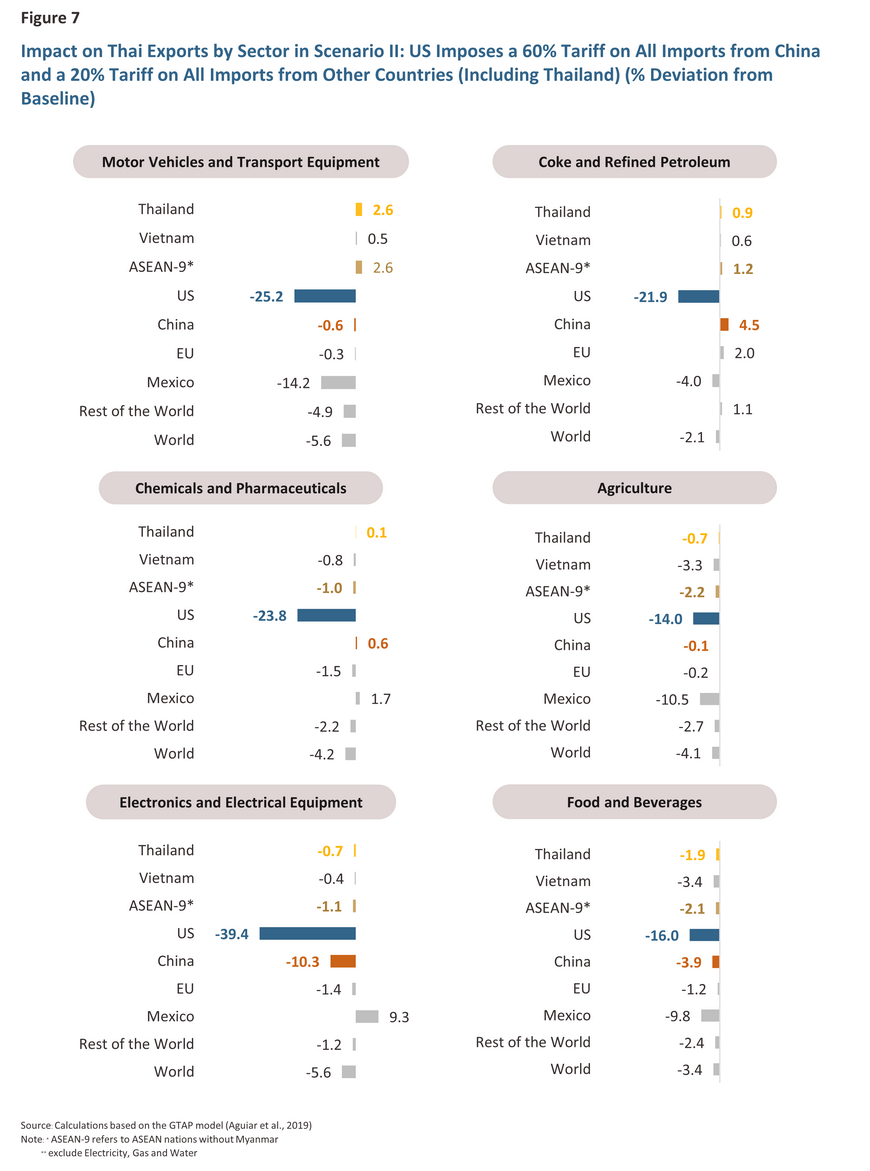

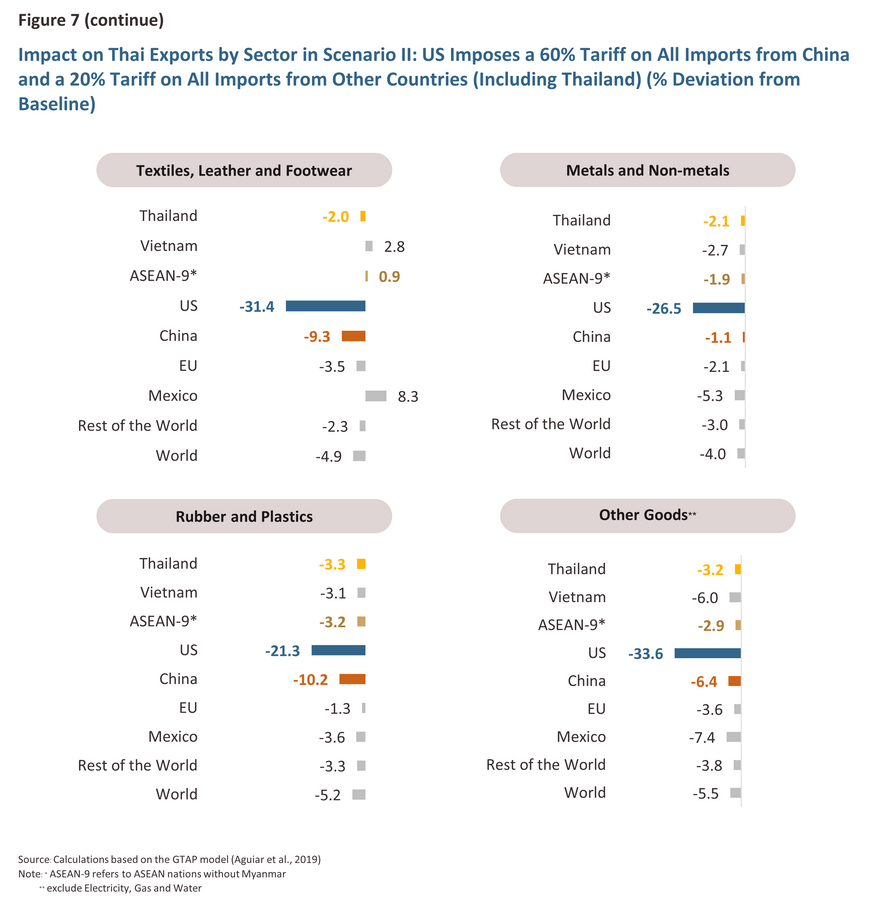

In the second scenario, the negative impact on Thailand’s exports—both directly from the US tariff hikes and indirectly through its linkage with China’s supply chain—could lead to a decrease of -1.09% in exports, reversing the +1.66% gain seen in Scenario 1. This is particularly evident in exports of Electronics and Electrical Equipment (from +9.2% to -0.7%), as well as Textiles, Leather, and Footwear (from +3.4% to -2%) (Figure 7). Furthermore, Thailand might still benefit from production relocation out of China to some degree, but in terms of overall impacts, Thailand’s GDP could shift from a positive net effect in the first scenario to a slightly negative net effect in the second scenario.

III. The US imposes a 60% tariff on all imports from China and a 20% tariff on all imports from other countries (including Thailand), and China retaliates with a 60% tariff on all imports from the US.

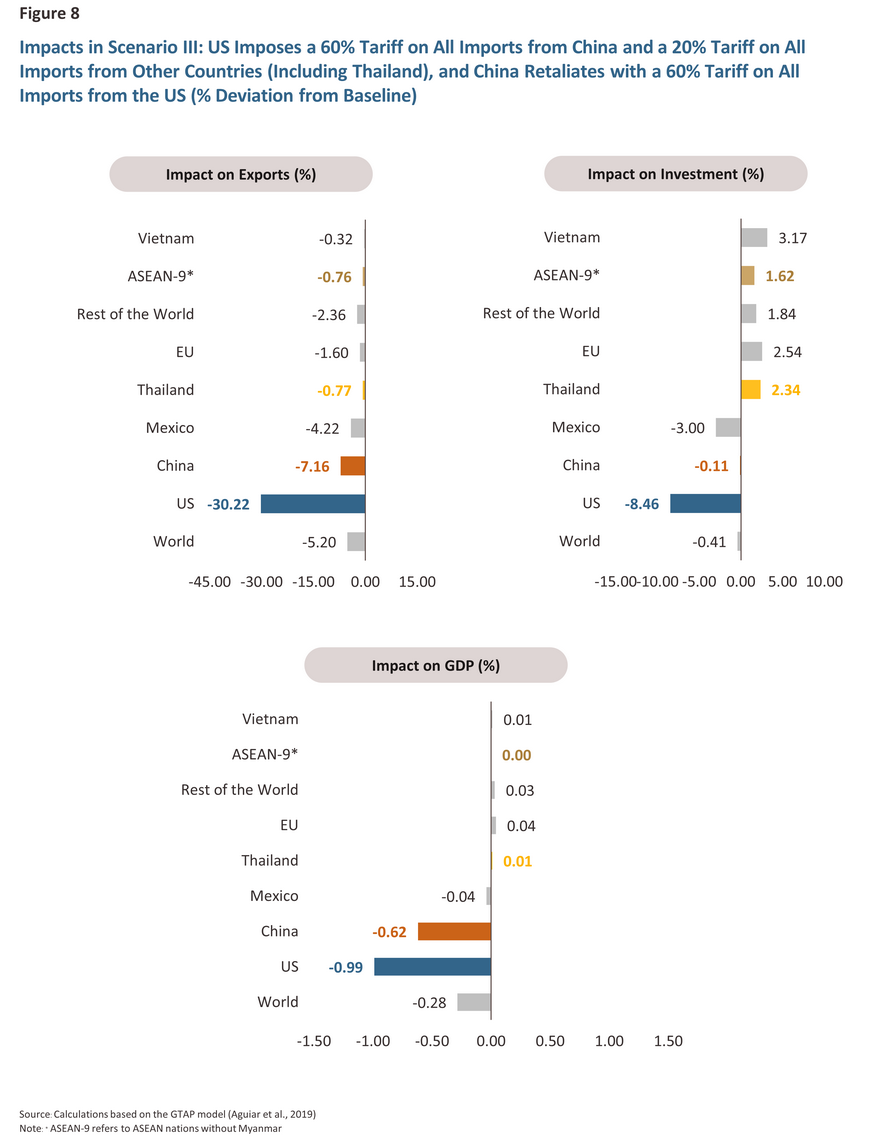

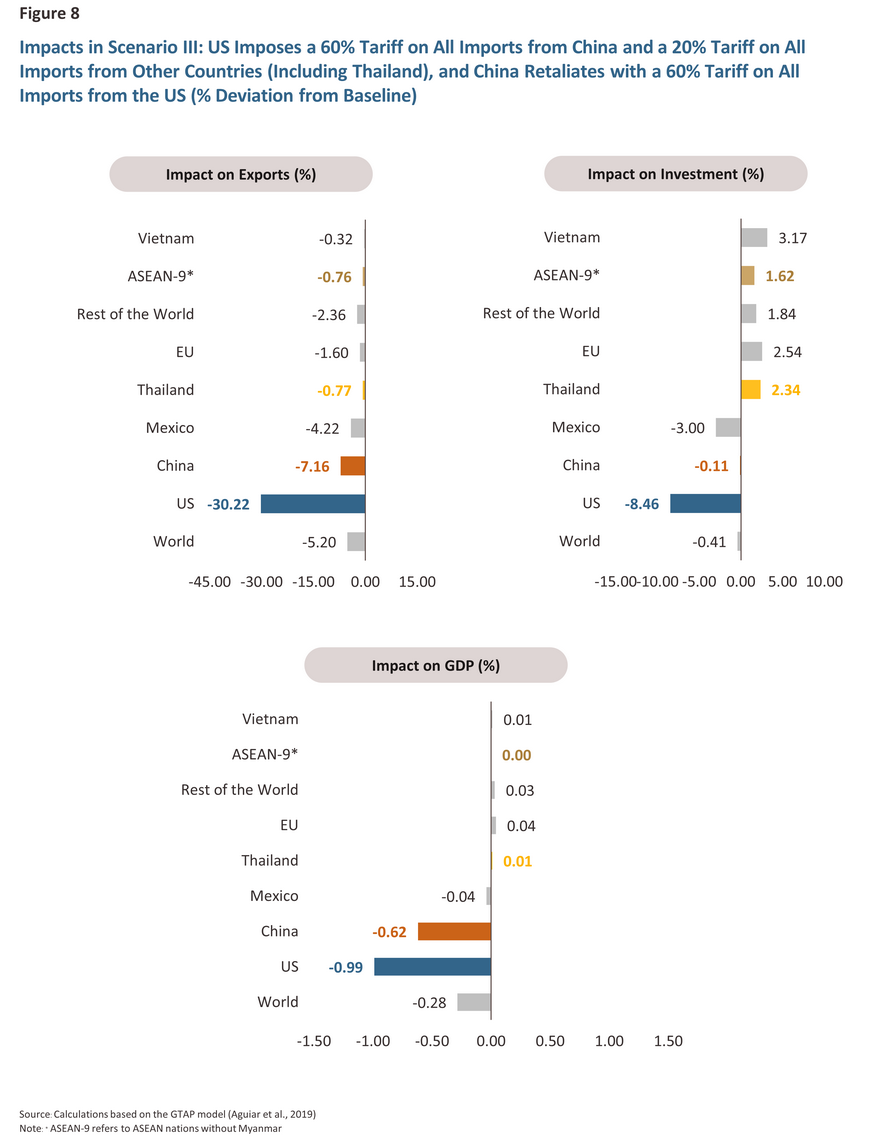

The negative impact in this scenario, which represents Scenario II combined with China’s retaliatory tariff, is even more severe than in the first two scenarios (Figure 8). Global exports, investment, and GDP would decline by 8.1, 2, and 1.7 times more than in Scenario I, respectively. Notably, US exports would decline 15.5 times more than in Scenario I. Meanwhile, China’s exports would drop further compared to Scenario I (1.2 times) due to a retaliatory tariff that raises costs for its domestic industries and limits access to key US goods, potentially accelerating the global supply chain disruption. On the other hand, the impact on US GDP is not significantly different from the other scenarios, with the model suggesting that one reason for this is that US consumers are likely to shift their consumption from imported goods (-35.2%) to domestic goods (+8.2%).

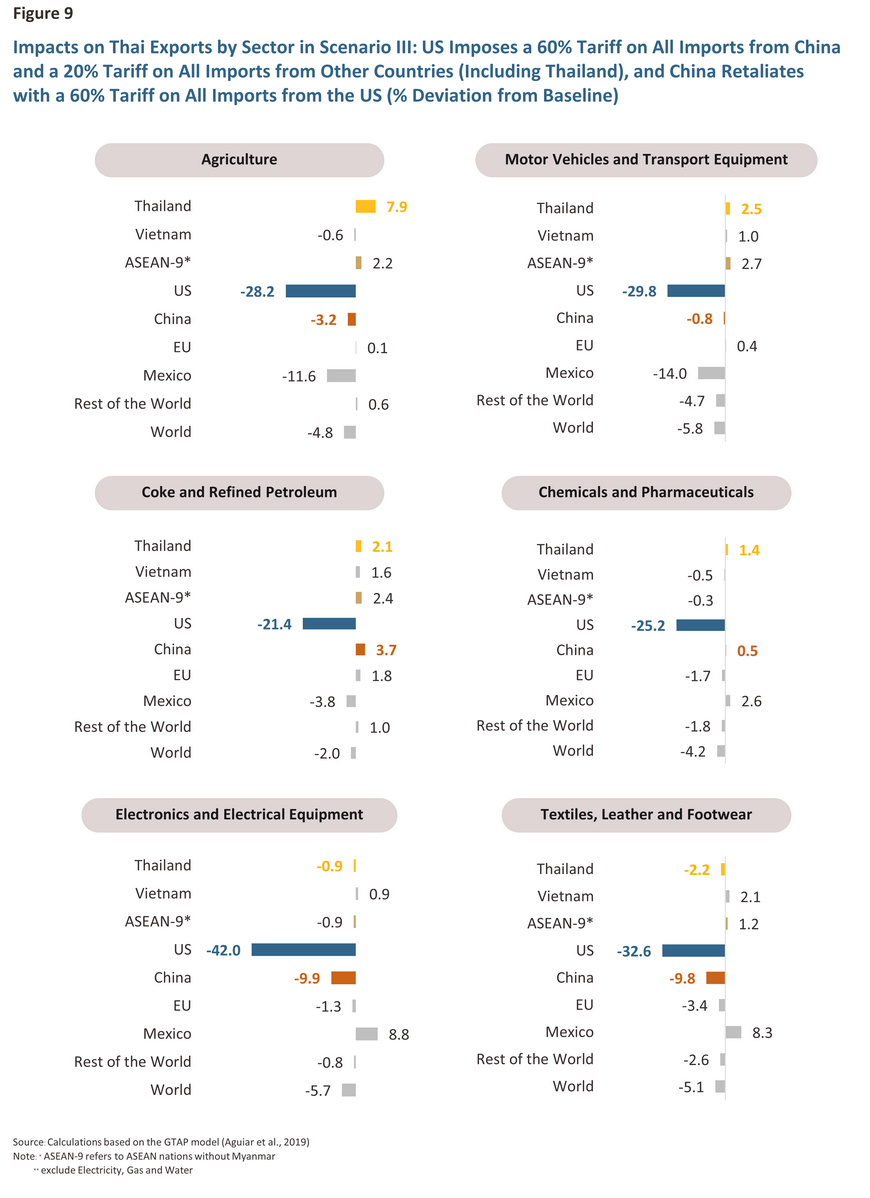

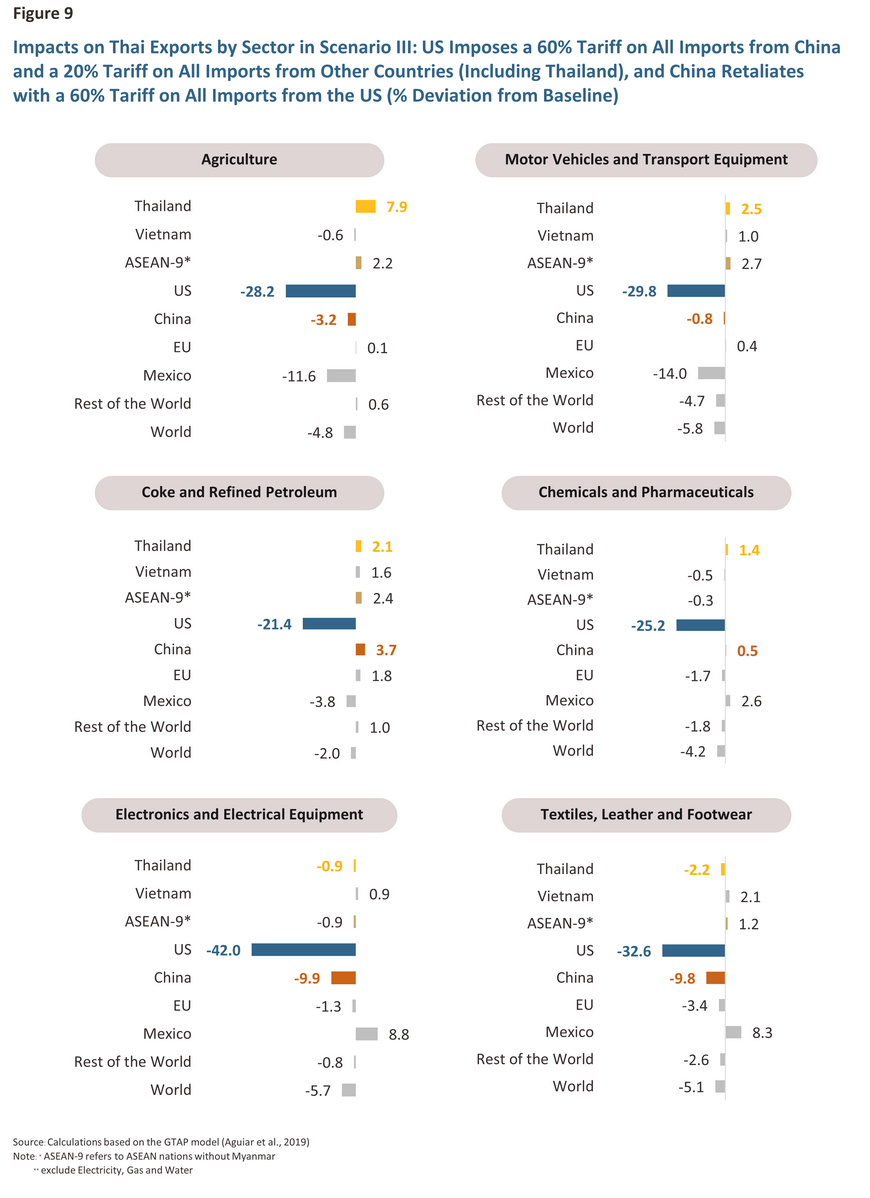

Thailand is likely to continue benefiting from production relocation and experience a smaller negative impact on exports compared to Scenario II, as all countries, including the US, face tariff barriers, whether imposed by the US or China. Thailand could see export gains in certain industries (Figure 9), such as Agriculture (+7.9%), Motor Vehicles and Transportation Equipment (+2.5%), and Coke and Refined Petroleum (+2.1%). However, Thai exports in many sectors would be negatively affected by the trade war. As a result, the overall positive effects would still be limited, with the net impact on Thailand’s GDP remaining relatively small, similar to Scenario I.

In summary, regardless of the scenarios, US tariff hikes would hurt the global economy (Figure 10), as rising consumer prices and higher production costs could raise costa of living and decrease global production efficiency. At the same time, the US would experience negative repercussions on its exports, investment, and overall economy. In other words, higher production costs and supply chain linkages between the US and China would result in a 4.2 times greater decrease in US exports than China’s in Scenario III (where China imposes a retaliatory tariff). Furthermore, US efforts to relocate production back to its home country (reshoring) may be more challenging, particularly in industries where China dominates the upstream supply chain, as China benefits from economies of scale. For Thailand, although some industries may benefit from production relocation and increased exports to substitute Chinese and US goods, the negative impact on Thai exports would spread across many sectors. This is especially evident in Scenario II (where the US imposes tariffs on all countries, including Thailand) and Scenario III (where China imposes a retaliatory tariff), due to weaker global demand, higher production costs, Thailand’s close ties to the Chinese supply chain in some sectors, and an influx of cheaper Chinese goods that were previously exported to the US. As a result, Thailand’s net gains from the trade war may not be as substantial as many expect and may even turn negative.

Krungsri Research View: Trade War Outlook and Implications for Thai Economy

In the near future, the Trump administration is likely to maintain some of the tariffs on specific goods initially planned by the Biden administration, particularly on electric vehicles, lithium-ion batteries, and semiconductors, while imposing additional tariffs on imports from China. The final tariff rate could exceed the initial 10% set by Trump, but it might not reach the 60% that he campaigned for during the election. This is because such a high tariff on all imports from China might not be worth the cost for the US. We expect that Trump may use tariff hikes as a “threat” to negotiate special trade agreements with other countries, similar to the trade deal with China during his first administration. This strategy offers more flexibility and could help reduce the overall negative impact on the US economy while still allowing the US to achieve strategic gains.

Meanwhile, China has fewer options to retaliate compared to the US, as most of its imports from the US are raw materials or intermediate goods used in production processes. Additionally, with weakened domestic consumption, China has relied on exports to some extent to fuel its economy. We expect China may opt for export controls on key goods, rather than aggressively imposing tariffs on the US, similar to its recent export controls on critical minerals. As a result, the impact on the global economy may not be as severe as in the three scenarios. Regardless of the outcome, this new round of the trade war could accelerate economic decoupling between major countries (or fragmented globalization) like never before. In the worst-case scenario, this could lead to supply chain disruptions, particularly in industries where China dominates the upstream market.

Thailand is likely to benefit from production relocation out of China and the US, as well as from export substitution in certain industries. However, Thailand would face growing risks, as many sectors would still be negatively affected by the trade war. Additionally, the US could directly impose additional tariffs on Thai exports, along with countervailing duties (CVDs) on sectors where Thailand serves as a production base for China—potentially extending beyond solar panels to other industries. Moreover, Thailand may experience an influx of Chinese goods as China redirects its exports to alternative markets due to reduced access to the US. Given this delicate situation, Thailand’s ability to negotiate special trade agreements with the US may help mitigate the impact on industries closely linked to China’s supply chain, such as Chemicals and Pharmaceuticals (exports to China account for 26% of total exports in this category) and Rubber and Plastics (11.9%). Therefore, Thailand should adopt a more proactive trade and foreign policy, particularly by accelerating negotiations for trade agreements with both existing and new partners while also addressing internal structural issues. These include enhancing the competitiveness of Thailand’s industries and services and supporting high-tech industries and modern services that generate high value-added across the supply chain. These strategies could help, to some extent, alleviate the impact of the trade war, which is likely to escalate at least over the next four years.

References

Aguiar, A., Chepeliev, M., Corong, E., McDougall, R., & van der Mensbrugghe, D. (2019). The GTAP Data Base: Version 10. Journal of Global Economic Analysis, 4(1), 1-27. Retrieved from https://www.jgea.org/ojs/index.php/jgea/article/view/77

Gopalan, N. (2024). Trump Threatens 25% Import Tariffs on Mexico, Canada, Additional 10% on China. Investopedia. Retrieved from https://www.investopedia.com/trump-threatens-25-percent-import-tariffs-on-mexico-canada-additional-10-percent-on-china-8751871

International Trade Centre (ITC). (2024). Trade Map [Database]. Retrieved from https://www.trademap.org/Index.aspx

The White House. (2024, May 14). Fact sheet: President Biden takes action to protect American workers and businesses from China’s unfair trade practices. The White House. Retrieved from https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/

1/ The Biden administration has largely maintained tariffs on Chinese goods that were set during Trump’s first term and additionally focus on key industries. On May 14, 2024, the Biden administration announced new tariffs on Chinese imports in as electric vehicles, solar panels, syringes and needles, lithium-ion batteries, steel and aluminum, face masks and respirators, ship-to-shore cranes, semiconductors, and medical gloves. These tariffs will be implemented in different years between 2024 and 2026 (The White House, 2024).