Executive Summary

Following the re-election of Donald Trump as President of the United States, he used an executive order to officially initiate tariffs on Chinese imports. In response, the Chinese government implemented countermeasures, including both tariff and non-tariff measures, raising concerns about the economic, trade, and industrial outlook.

Krungsri Research has conducted this analysis to assess the impact of the trade war using the GTAP model under two scenarios. In the first scenario, the US imposes 10% tariffs on imports from China, with China retaliating by imposing 10-15% tariffs on selected US goods (this has already occurred, and retaliatory measures have been implemented). In the second scenario, the US increases tariffs on all Chinese imports by 10% and imposes 25% tariffs on imports from Mexico and Canada, while China retaliates with 10-15% tariffs on selected US goods (this is likely to happen, but there is a temporary delay of at least 30 days, starting from February 4th, 2025, on the tariffs with Canada and Mexico). The analysis finds that the tariff hikes in all cases hurt the global economy, while Thailand is likely to benefit from increased exports and production relocation, particularly in computer, electronics, construction, and leather industries. On the other hand, the negative impacts have caused damage to the chemicals, textiles, and metals industries. These negative impacts were primarily transmitted from the supply chain of basic chemicals, petrochemicals, petroleum and other refined products, and electricity.

Introduction

The US officially began imposing tariffs on imports of Chinese goods, effective Tuesday, February 4th, 2025, while the Chinese government responded with counter-measures, including 10-15% tariffs and non-tariff measures, starting from February 10th, 2025

Given that the US and China are the world’s largest and second-largest economies, the effects of the trade war are inevitably widespread due to the global supply chain linkages, whether through the indirect effects of tariffs on Chinese imports, the relocation of production bases from China, or export substitution of Chinese and US goods. To identify which sectors are likely to benefit or be impacted by the trade war, Krungsri Research utilized the GTAP model (Aguiar et al., 2019) to evaluate the impact on Thai economy through key indicators, including Gross Domestic Product (GDP), exports, and investment. This assessment examines both the overall economic impact and the effects on individual industries under two scenarios: 1) the implemented tariffs, and 2) the high-probability scenario involving additional tariffs on goods from other important US trade partners as follows:

-

In the first scenario, the US places 10% tariffs on Chinese imports, and China responds with 10-15% tariffs on some US imports. This scenario is currently in play.

-

In the second scenario, in addition to the 10% tariffs on Chinese imports and the retaliatory 10-15% Chinese tariffs on specified imports from the US, the US also imposes 25% tariffs on imports from Canada and Mexico. This aligns with Donald Trump's Executive Order and the announcement of retaliatory measures against China. Therefore, there is still a strong possibility that these will be implemented although a temporary stay of at least 30 days was imposed on February 4th, 2025.

Trade War 2.0: Round 1

Krungsri Research applied the GTAP model to assess the impact of the US imposing tariffs on its trading partners by examining the linkages between Thai industries and the global value chain. The analysis can be summarized in terms of the economic and industrial perspectives as follows:

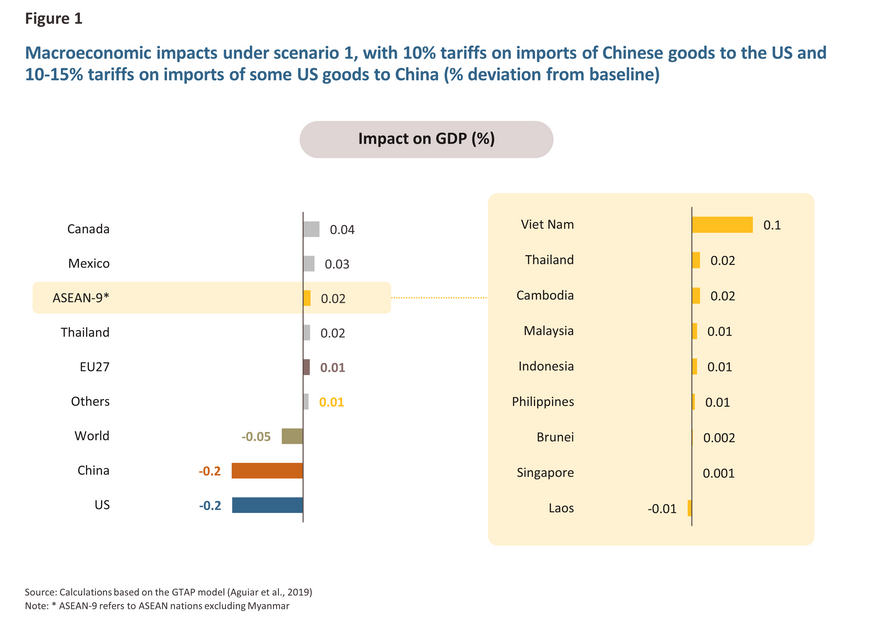

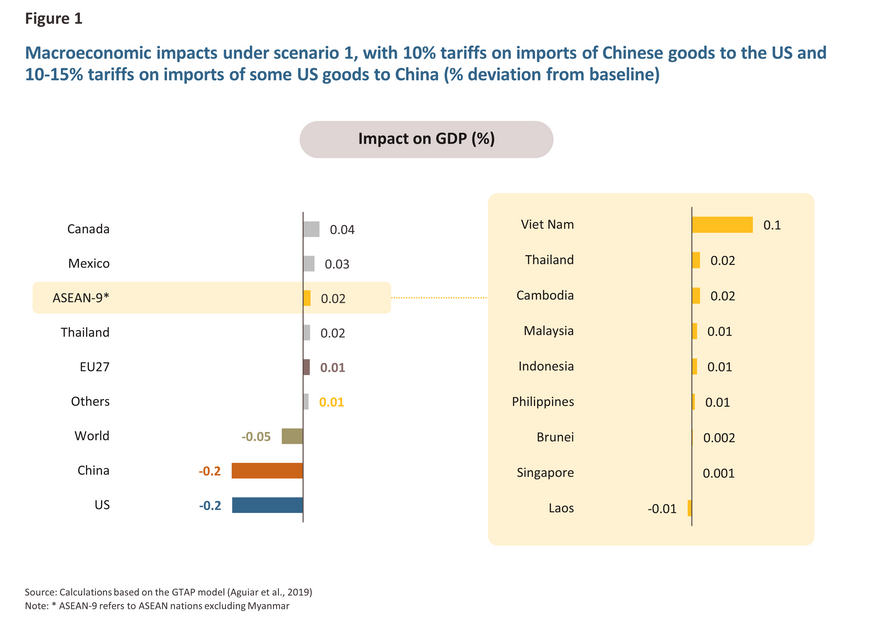

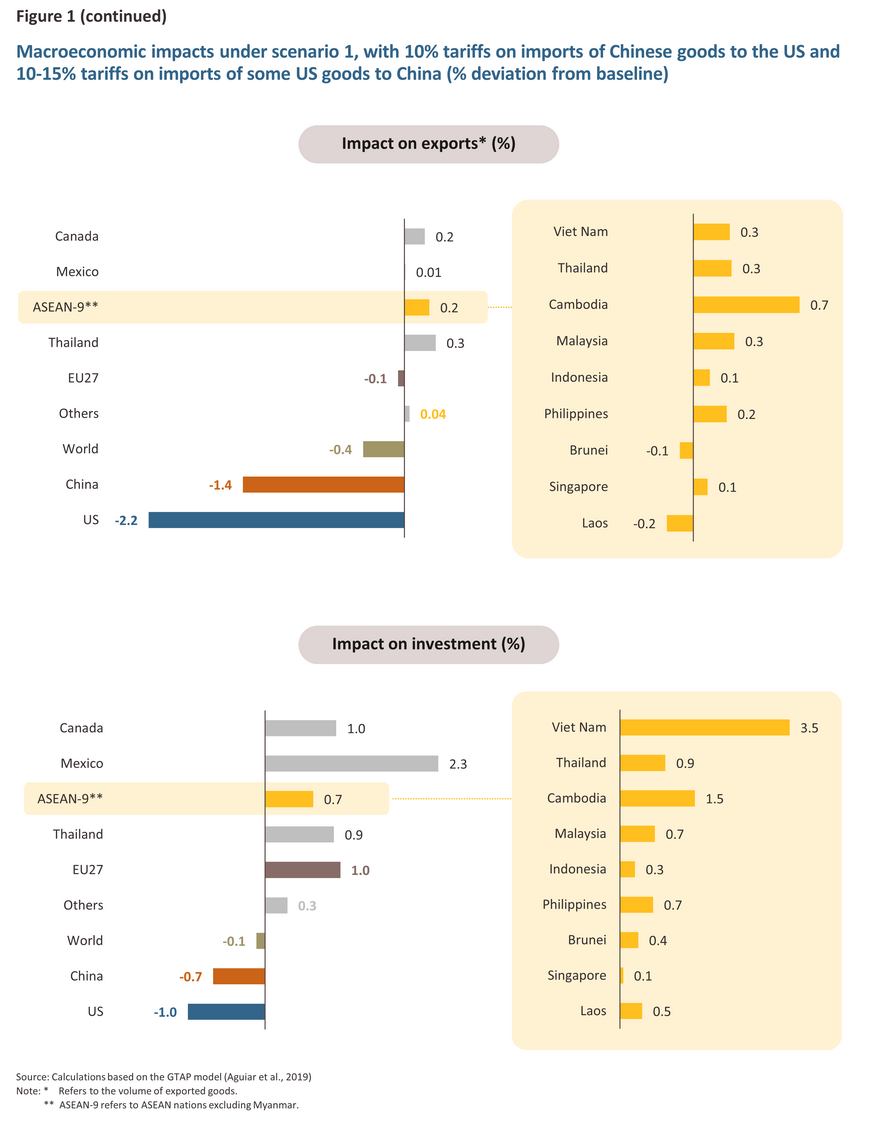

I. The US imposes 10% tariffs on Chinese imports, and China retaliates with 10-15% tariffs on specified US imports

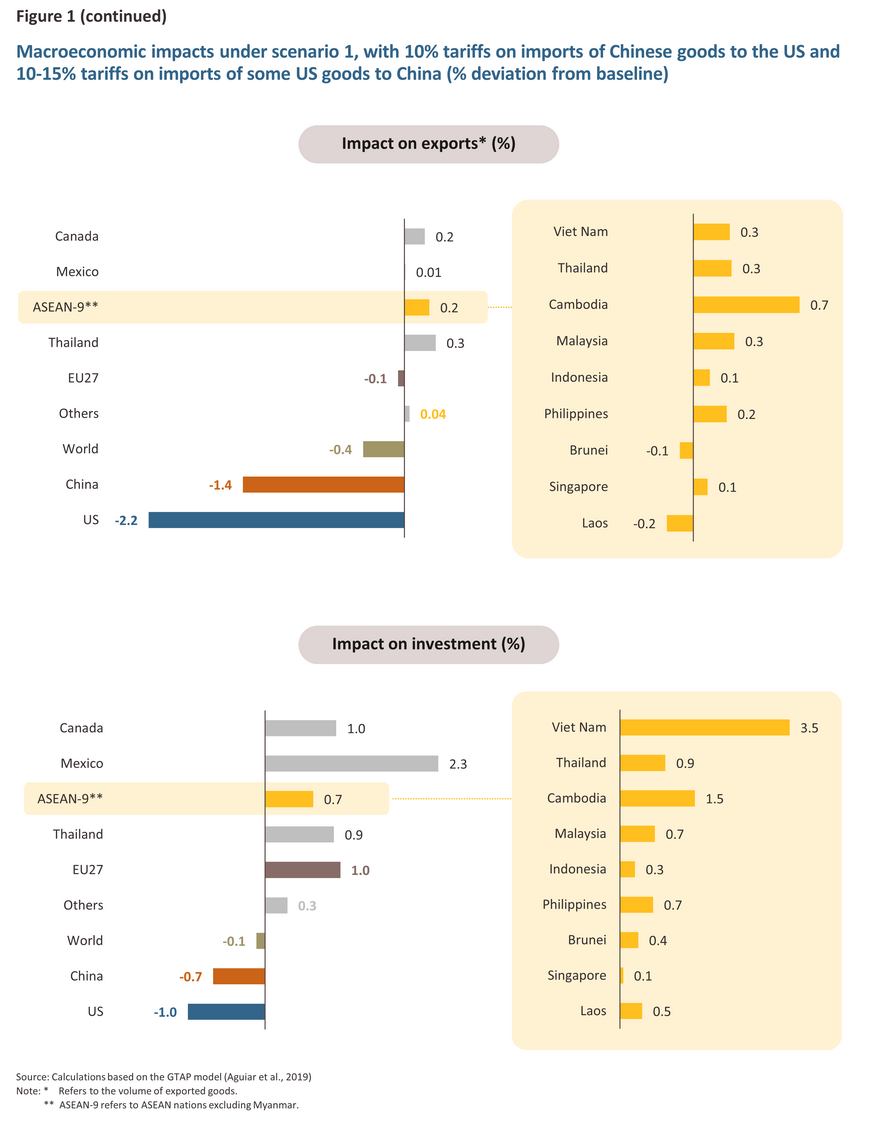

On February 4th, 2025, the US imposed 10% tariffs on all imports from China, to which the Chinese government responded six days later with 10% tariffs on imports of US crude, agricultural machinery and some autos, and 15% tariffs on imports of coal and LNG. Our findings indicate that, compared to the baseline, this will add to manufacturing costs, reduce productivity, and weaken demand in the major economies (especially in China and the US) and as such, global exports and global economy will contract by respectively -0.4% and -0.05% (Figure 1). US exports are expected to a -2.2%, which is more severe than a -1.4% decrease in Chinese exports. Moreover, because US industry is somewhat reliant on inputs that are currently sourced from China, higher tariffs will also weigh more heavily on production costs for US manufacturers. Therefore, the US is expected to see investment fall by -1.0%, greater than China’s -0.7% contraction.

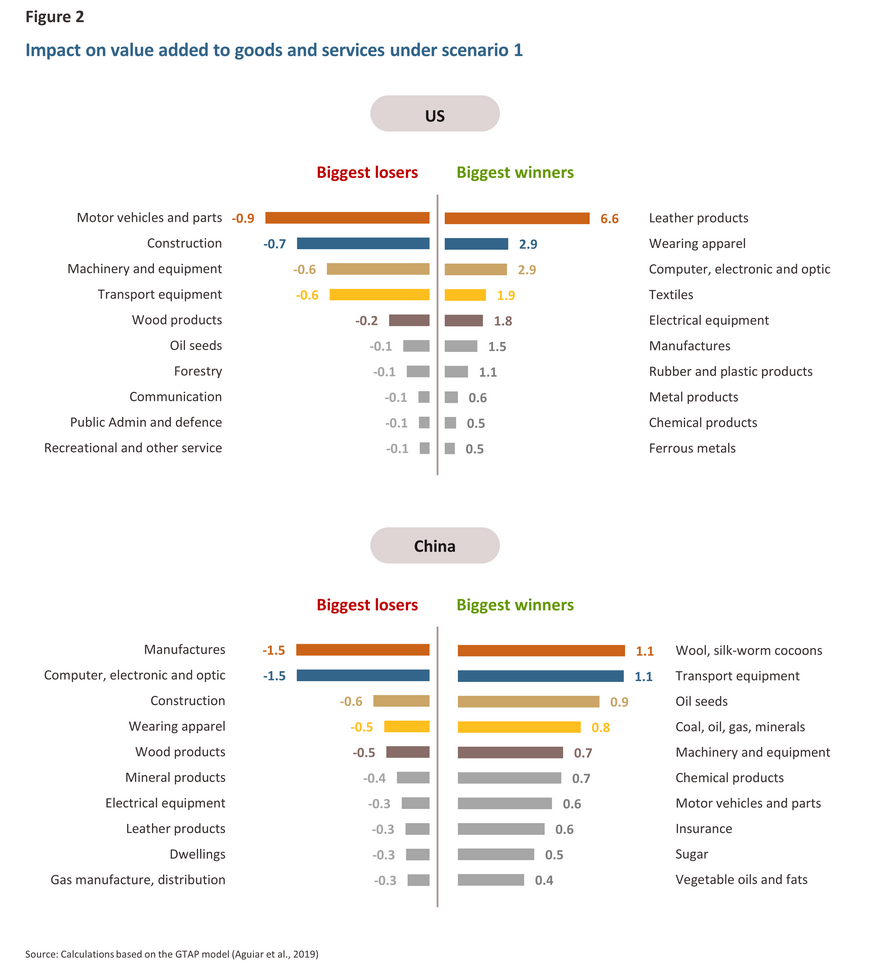

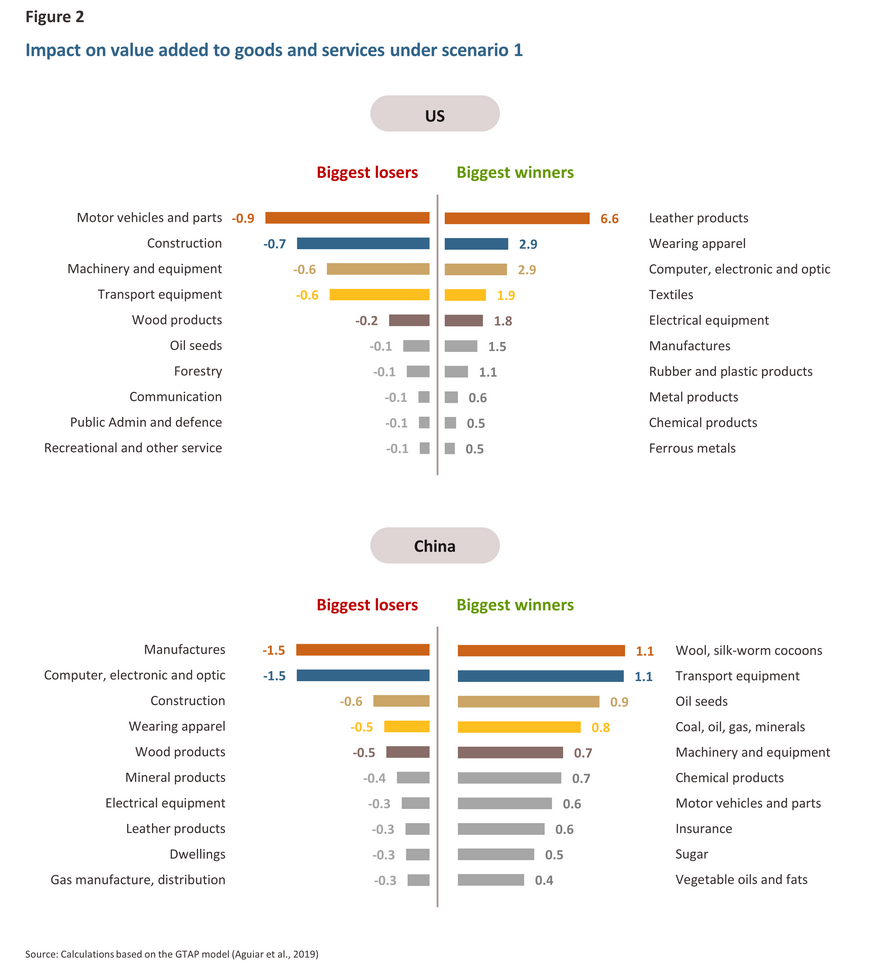

With regard to individual industries, the US sector most affected is autos and auto parts (-0.9% from the baseline). On the other hand, US leather product manufacturers would likely benefit from the trade war (+6.6% from the baseline). For China, losses will be highest in manufacturing (-1.5%), with gains strongest for producers of wool and silk-worm cocoons (+1.1%) (Figure 2).

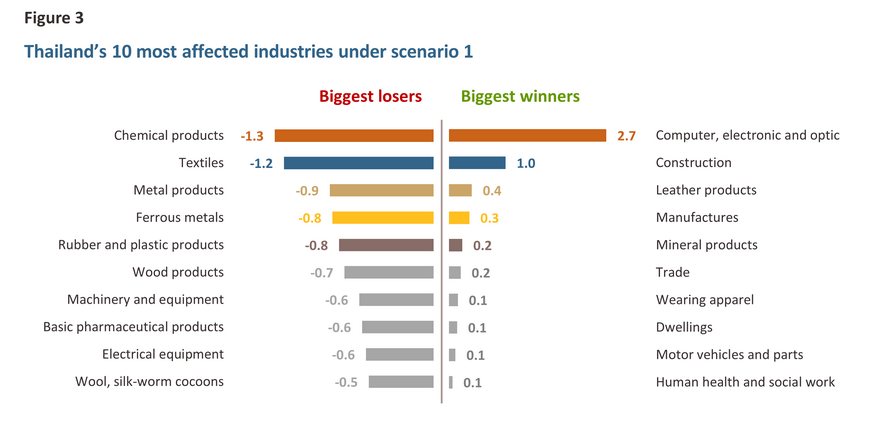

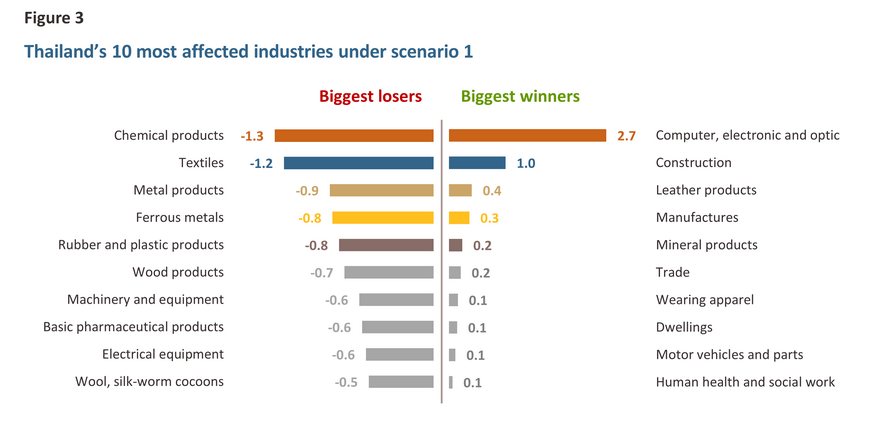

Thailand remains beneficial under the first scenario thanks to export substitution of US and Chinese goods and production relocation out of China and the US. In other words, both exports and investment could increase by respectively 0.3% and 0.9% from the baseline (Figure 1). In particular, gains will be seen in the computing and electronic components (+2.7%), construction (+1.0%) and leather products (+0.4%) (Figure 3).

However, tariff hikes will raise costs across global supply chains. Thus, value of some industries that are dependent on inputs sourced overseas or that are influenced by the prices set on global market would be softened (e.g., chemicals: -1.3%, textiles: -1.2%). With both positive and negative impact, the net impact on GDP growth would be positively limited at just 0.02% compared to the baseline.

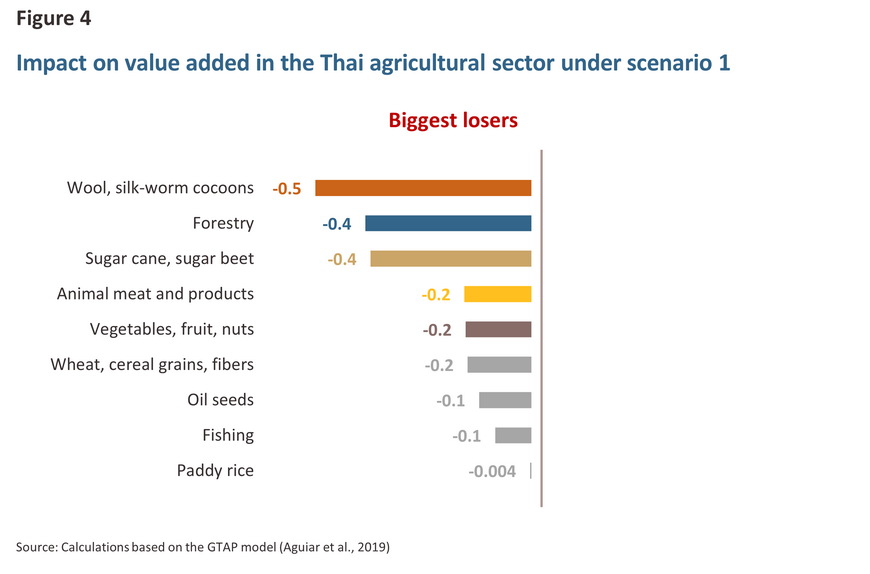

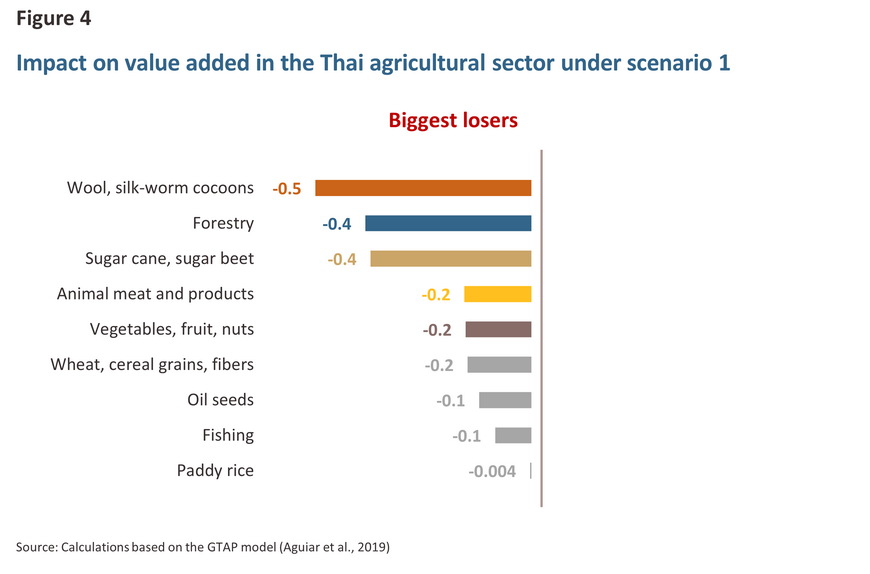

Under scenario 1, the Thai agricultural sector will see net negative impacts across the board (Figure 4). The hardest-hit sectors include silk-worm cocoons and wools (-0.5% compared to the baseline), forestry (-0.4%), sugarcane cultivation (-0.4%), meat and livestock products (-0.2%) and fruit and vegetables (-0.2%).

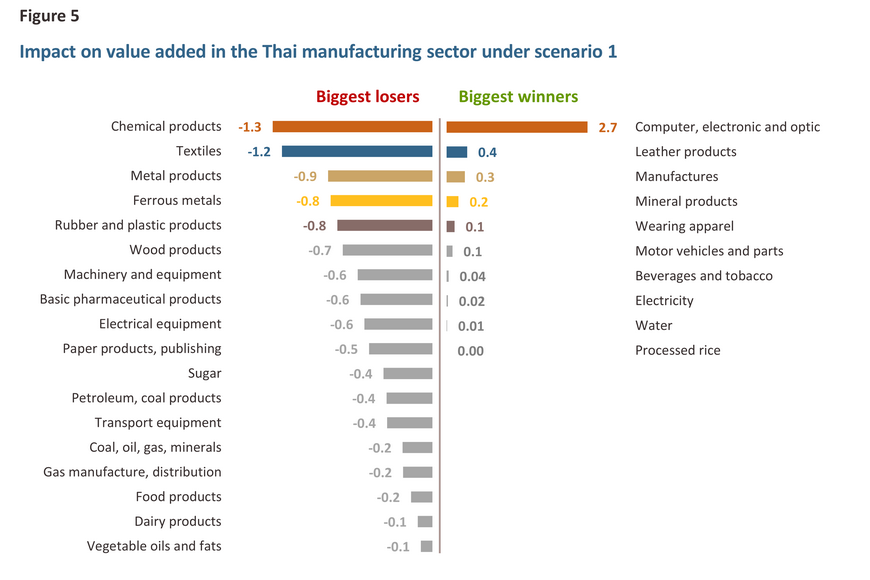

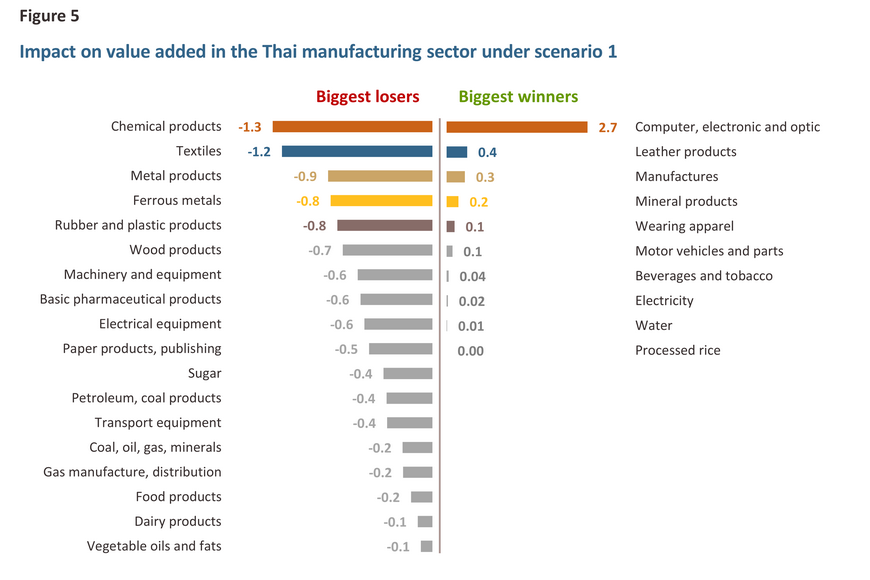

Within the Thai manufacturing sector, computers and electronic components will benefit the most (+2.7% compared to the baseline). This is followed by leather products (+0.4%) and mineral products (+0.2%). By contrast, the greatest losses will be experienced by manufacturers of chemical goods (-1.3%), textiles (-1.2%), metal products (-0.9%), ferrous metals (-0.8%), and rubber and plastic goods (-0.8%) (Figure 5).

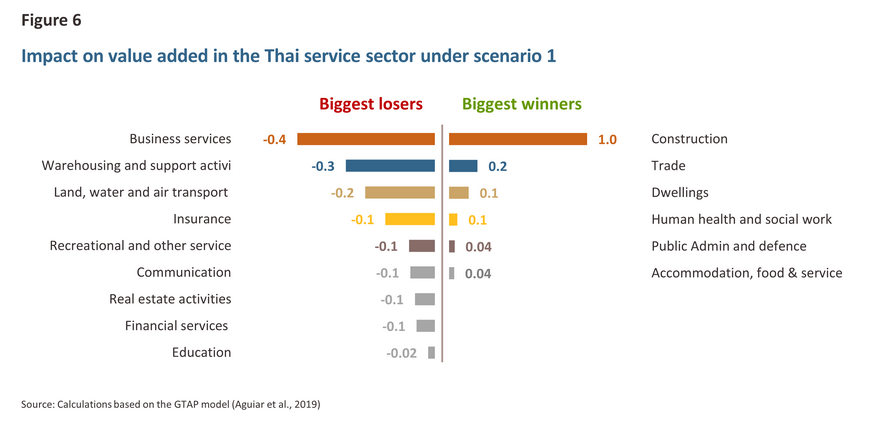

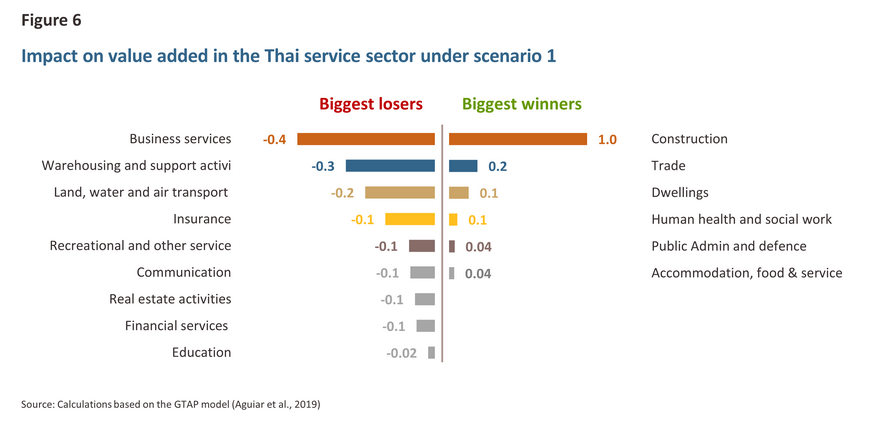

Within the Thai service sector, the construction industry will be the biggest winner, growing by 1.0% relative to the baseline thanks to production relocation to Thailand (Figure 6). This is followed by retail and wholesale businesses (+0.2%), dwellings (+0.1%), and healthcare (+0.1%). However, business services (-0.4%), warehousing (-0.3%), transport (-0.2%) and insurance (-0.1%) will all see losses.

II. The US imposes 10% tariffs on Chinese imports, and China retaliates with 10-15% tariffs on specified US imports. In addition, the US places 25% tariffs on imports from Mexico and Canada.

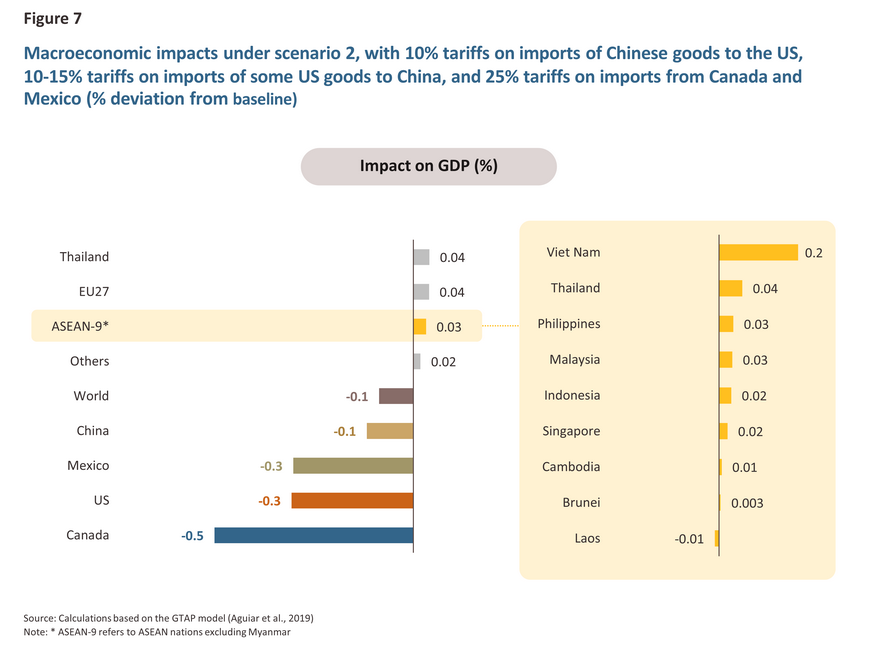

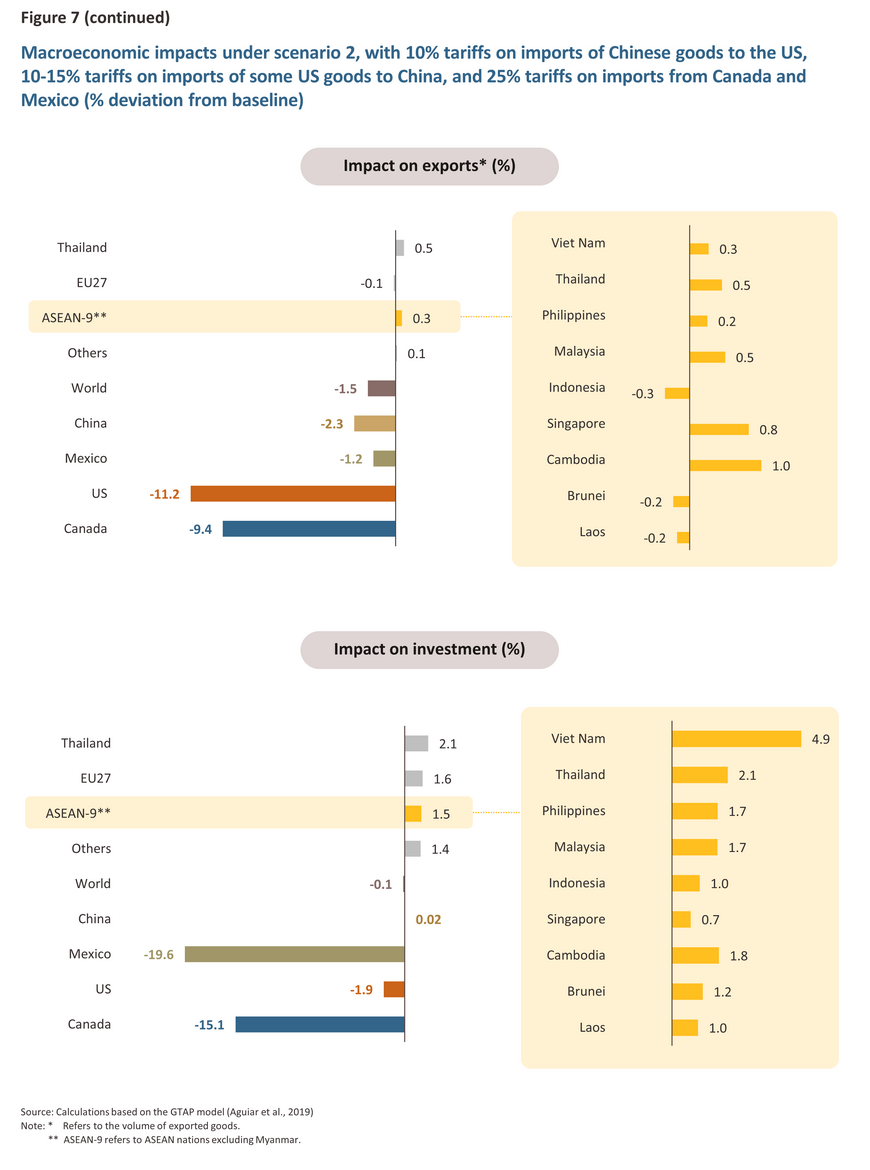

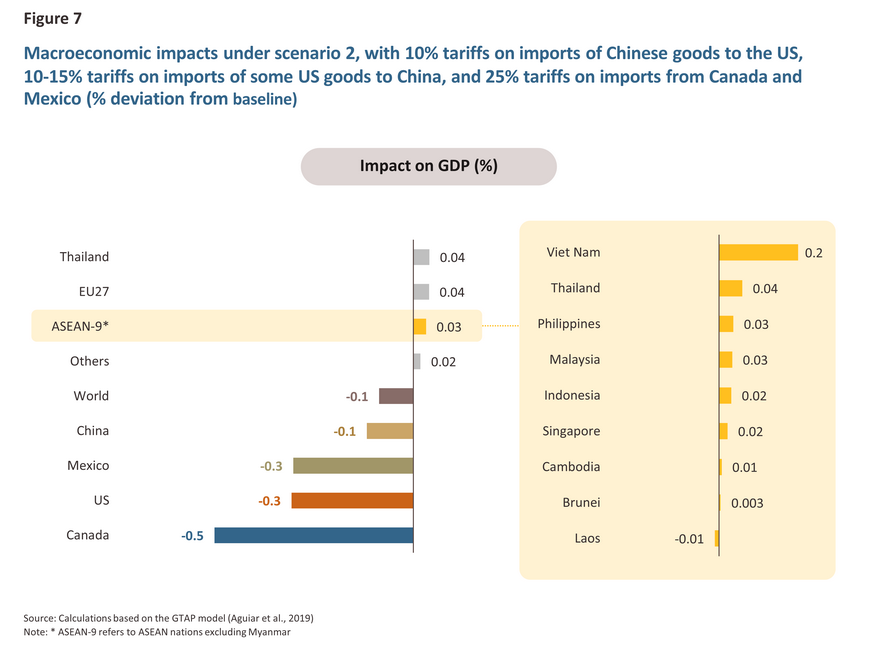

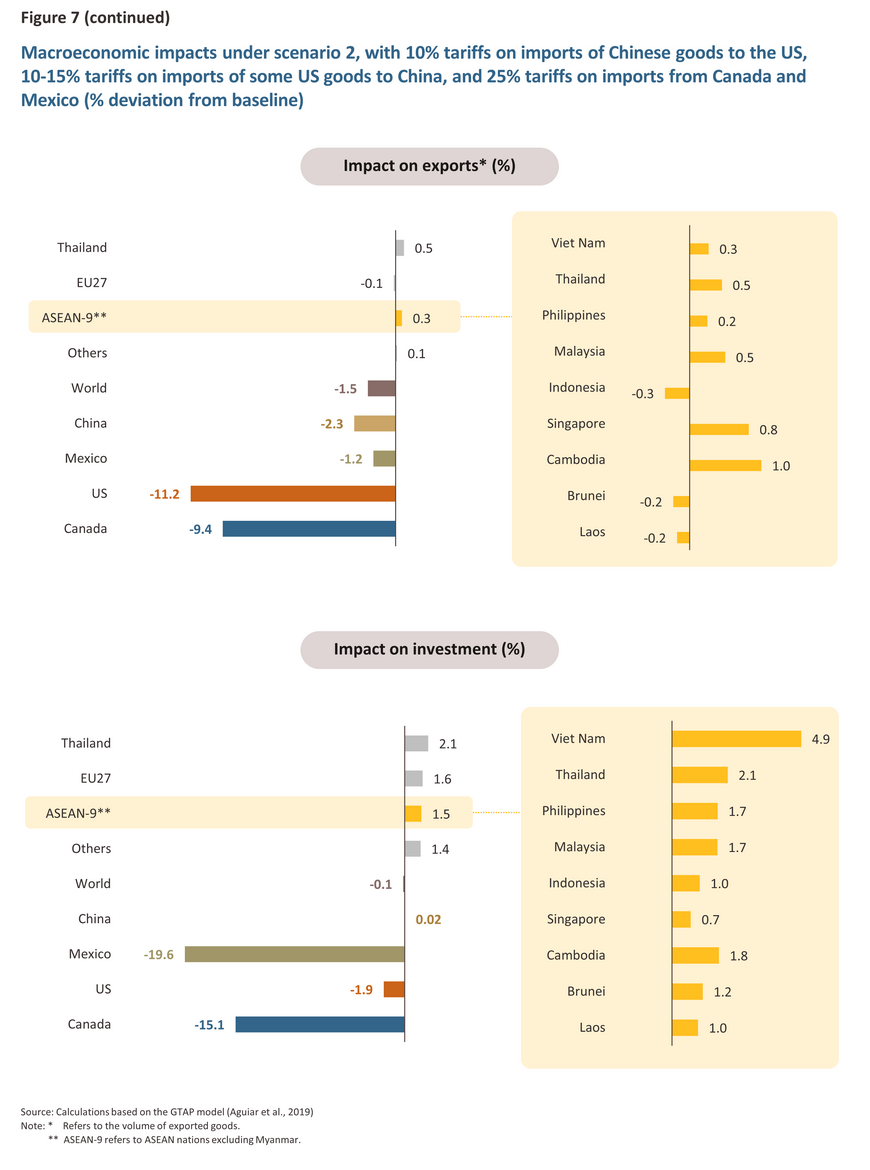

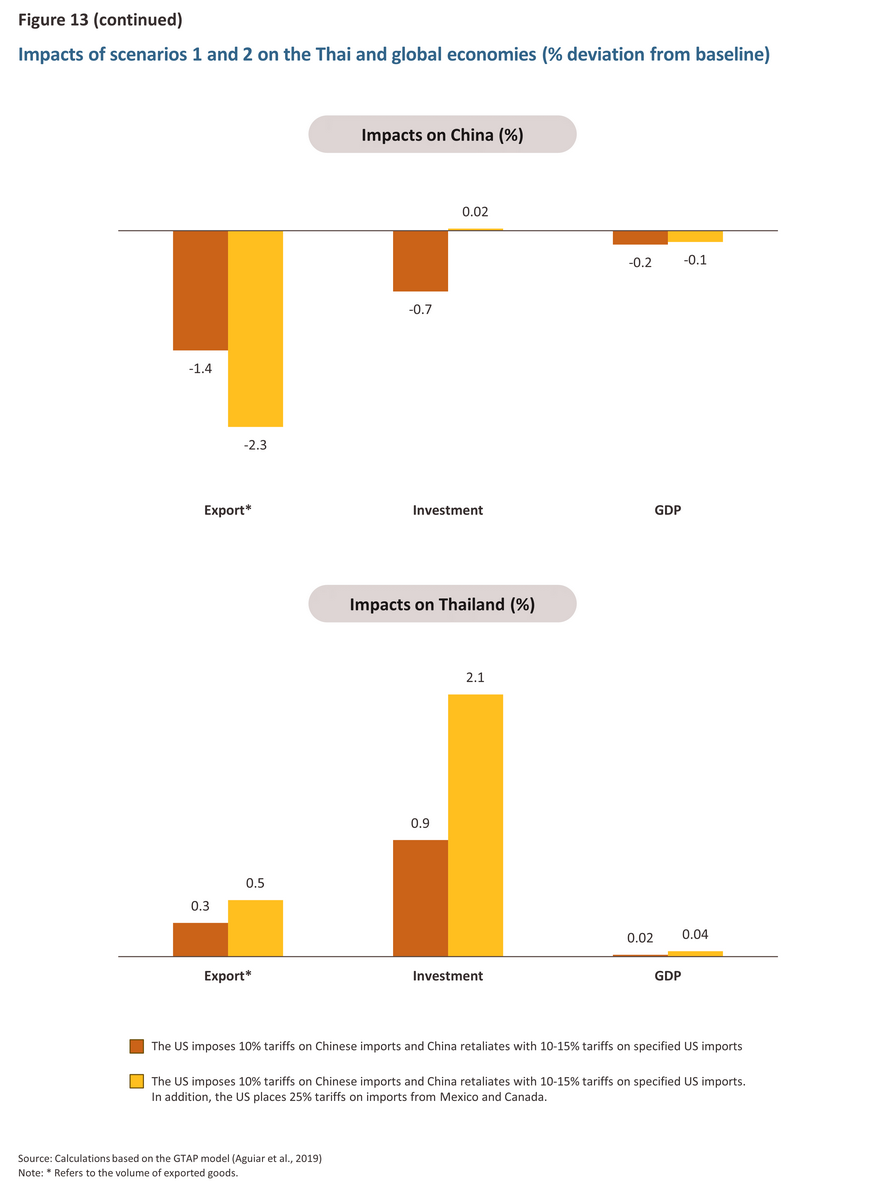

In the second scenario, in addition to tariffs on Chinese goods (and retaliatory tariffs from China), the US imposes additional 25% tariffs on all imports from Mexico and Canada. This study shows that under this scenario, the overall impacts on global export and GDP growth are consequently more severe, with these declining by respectively -1.5% and -0.1% from the baseline as a result of higher costs, worsening productivity and weaker demand in the major economies (Figure 7). For the US, exports will likely shrink by -11.2%, while for Mexico and Canada, losses will come to respectively -1.2% and -9.4%. Likewise, investment in the US will decline by -1.9%, partly due to the higher cost of imports from China, Mexico and Canada. Meanwhile, investment in Mexico and Canada will decline by -19.6% and -15.1% from the baseline, respectively, partly due to concerns over reduced competitiveness. Compared to the first scenario, the impact will likely worsen for China. Exports will contract by -2.3%, while investment will remain relatively unchanged (+0.02%). It is noteworthy although the tariff hikes will undermine investment in the US, Canada and Mexico, investment in other regions is expected to rise, such as ASEAN (+1.5%), the EU (+1.6%), and other countries (+1.4%)

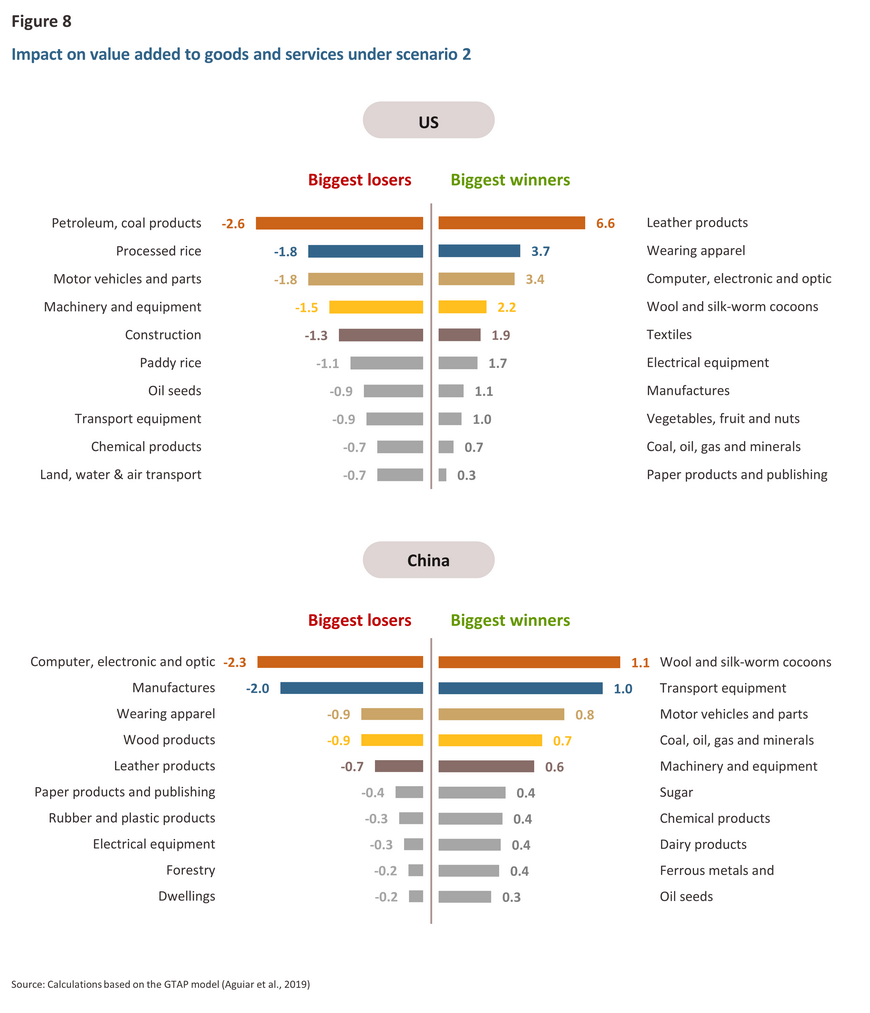

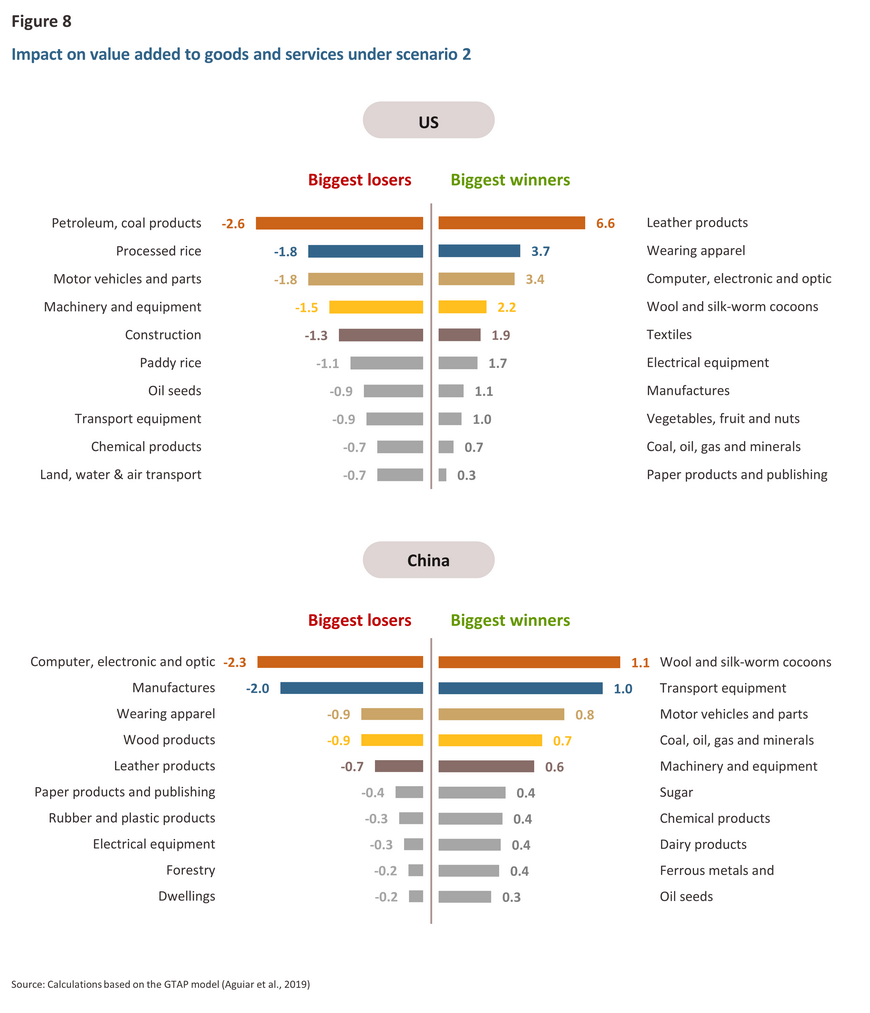

Under the second scenario, US producers of coal and petroleum products will be the most affected, with a contraction of -2.6% from the baseline. Negative impacts will also extend to manufacturers of processed rice (-1.8%) and manufacturers of autos and auto parts (-1.8%) (Figure 8). Conversely, the leather products industry will be the greatest beneficiary (+6.6%). In China, the most significant losers will be manufacturers of computers and electronic components (-2.3%), while producers of wool and silk products will be the most significant winners (+1.1%).

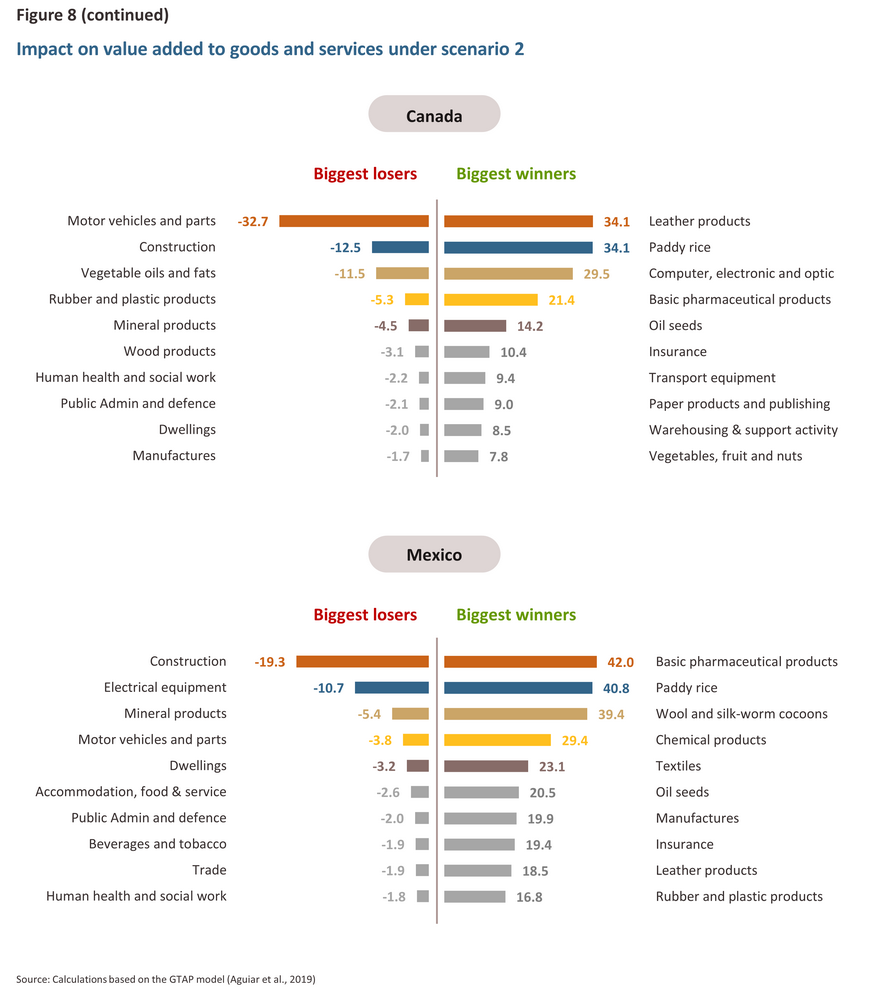

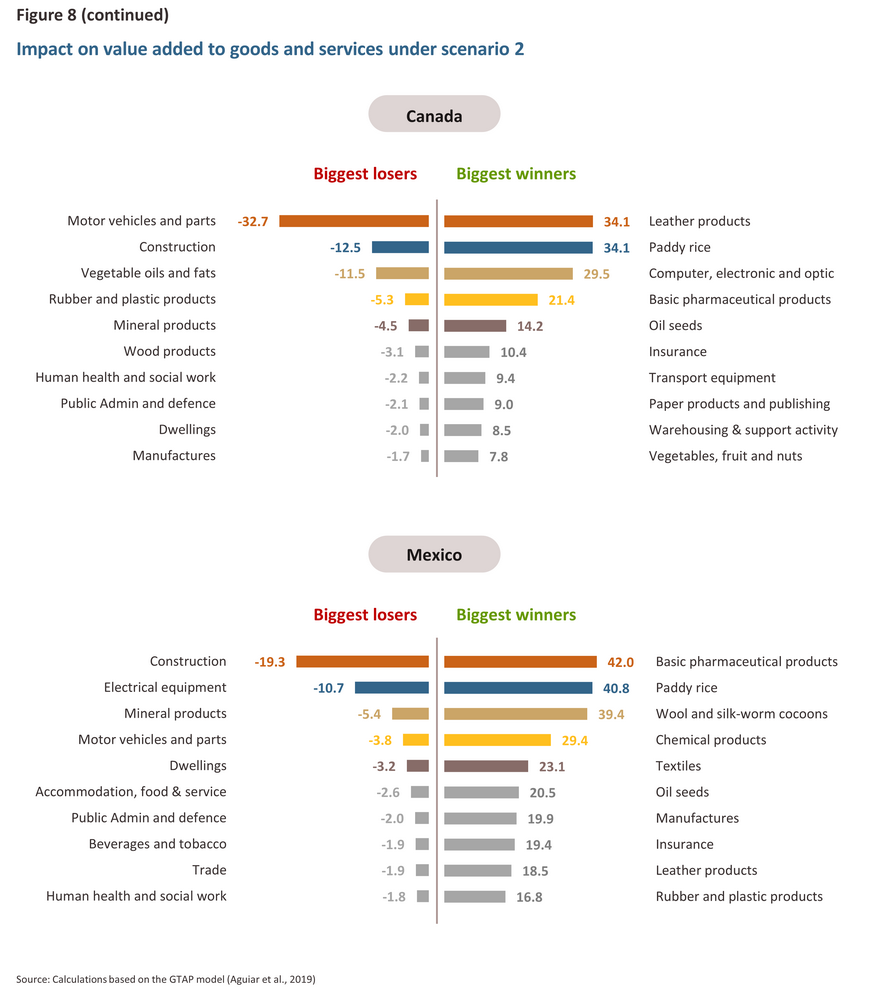

Under Scenario 2, the Canadian industry most affected is the auto and auto parts industry, with a contraction of -32.7% from the baseline. The next worst hit industries will be construction (-12.5%) and vegetable oils (-11.5%) (Figure 8 (continued)), while the top winner is leather product manufacturers (+34.1%). Meanwhile, the construction industry in Mexico faces the most significant impact, contracting by -19.3% compared to the baseline, aligning with the negative effect on investment. The industries that stand to benefit the most include pharmaceuticals (+42.0%), paddy rice (+40.8%), and wool and silk-worm cocoons (+39.4%).

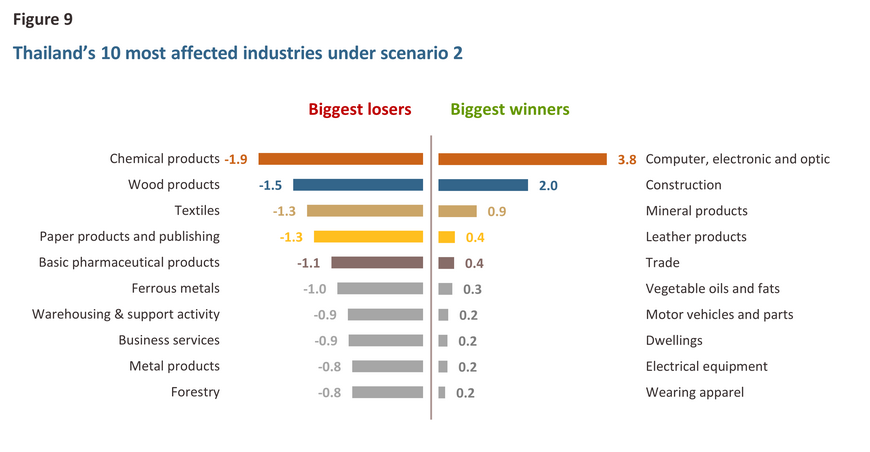

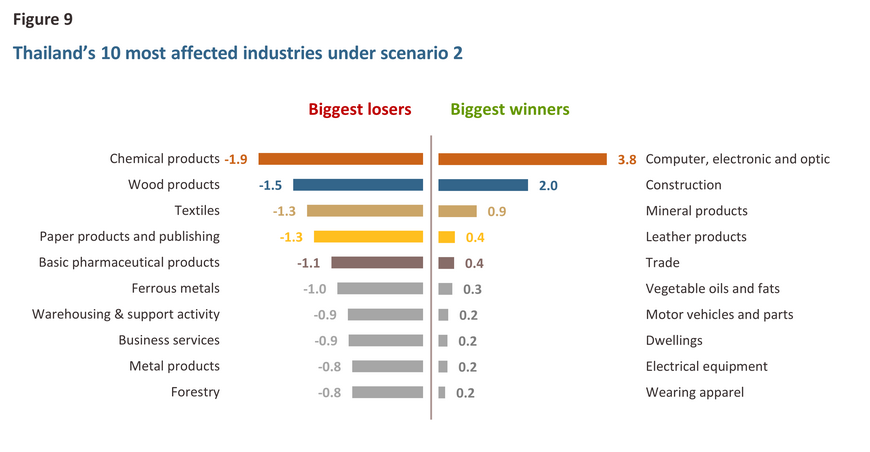

For Thailand, Scenario 2 will generate stronger benefits compared to Scenario 1, with overall GDP growth increasing by 0.04% relative to the baseline. Exports and investment will also rise by 0.5% and 2.1%, respectively, from the baseline. The industries most likely to benefit (see Figure 9) are computer and electronics manufacturing (+3.8%), followed by construction (+2.0%) and mineral products (+0.9%). However, the most negatively affected industries are chemicals production (-1.9%), followed by wood products (-1.5%), and textiles (-1.3%).

However, the agricultural sector will see losses across all sub-sectors (Figure 10). This will be the worst impact on forestry products (-0.8%), followed by sugarcane cultivation (-0.6%), meat and livestock products (-0.5%), wool and silk-worm cocoons (-0.3%) and fruit and vegetables (-0.2%).

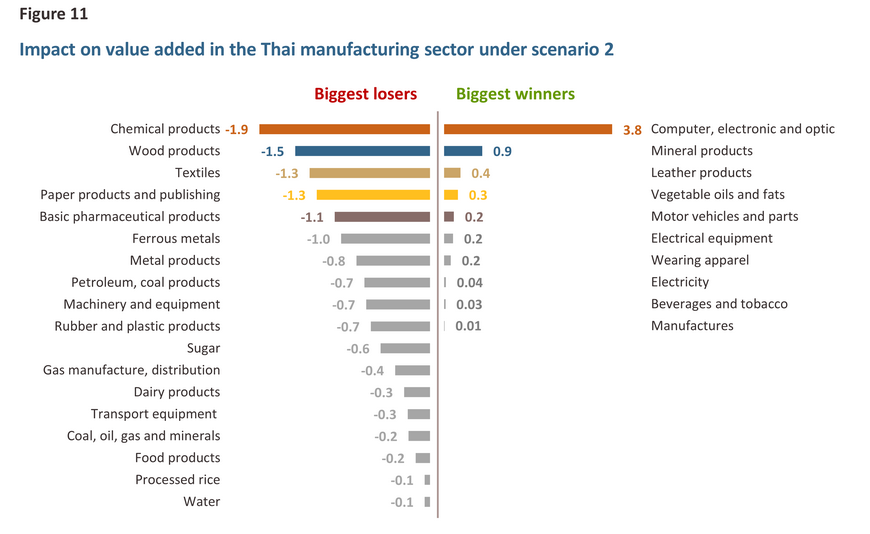

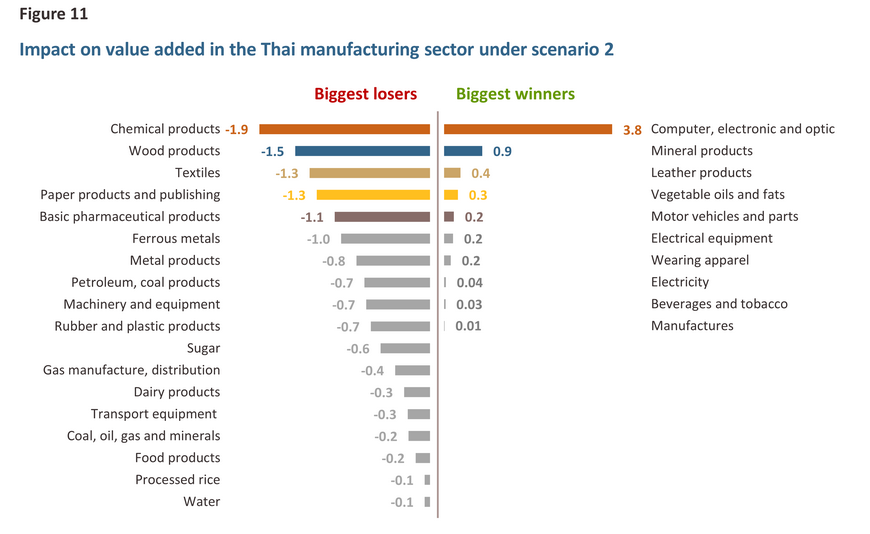

Within the Thai manufacturing sector, the biggest gains from scenario 2 will be seen in the manufacture of computers and electronic components, where growth will expand by 3.8% relative to the baseline. This will be followed by mineral products (+0.9%), leather products (+0.4%) and vegetable oils (+0.3%). However, the greatest costs will be borne by the chemicals industry (-1.9%), wood products (-1.5%), textiles (-1.3%) and paper and printed products (-1.3%) (Figure 11).

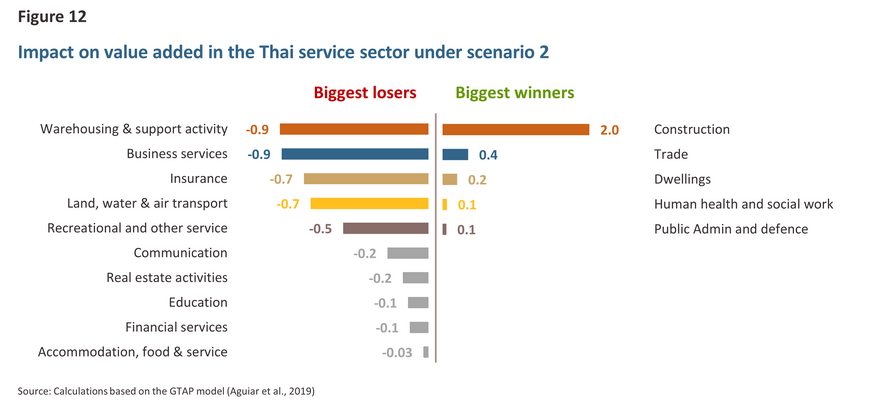

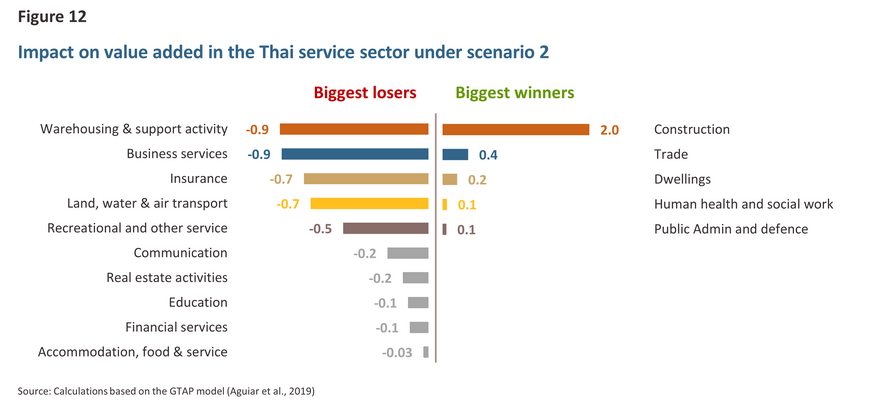

The construction sector continues to be the biggest beneficiary within Thailand’s service industry (+2.0% relative to the baseline). As a result of trend of a production relocation, demand for construction, trade, investment, residential accommodation, and services related to these and the labor is expected to increase. This is followed by retail and wholesale (+0.4%), dwellings (+0.2%), and healthcare (+0.1%). On the other hand, service industries experiencing negative impacts include warehousing (-0.9%), business services (-0.9%), insurance (-0.7%) and transportation services (-0.7%) (Figure 12).

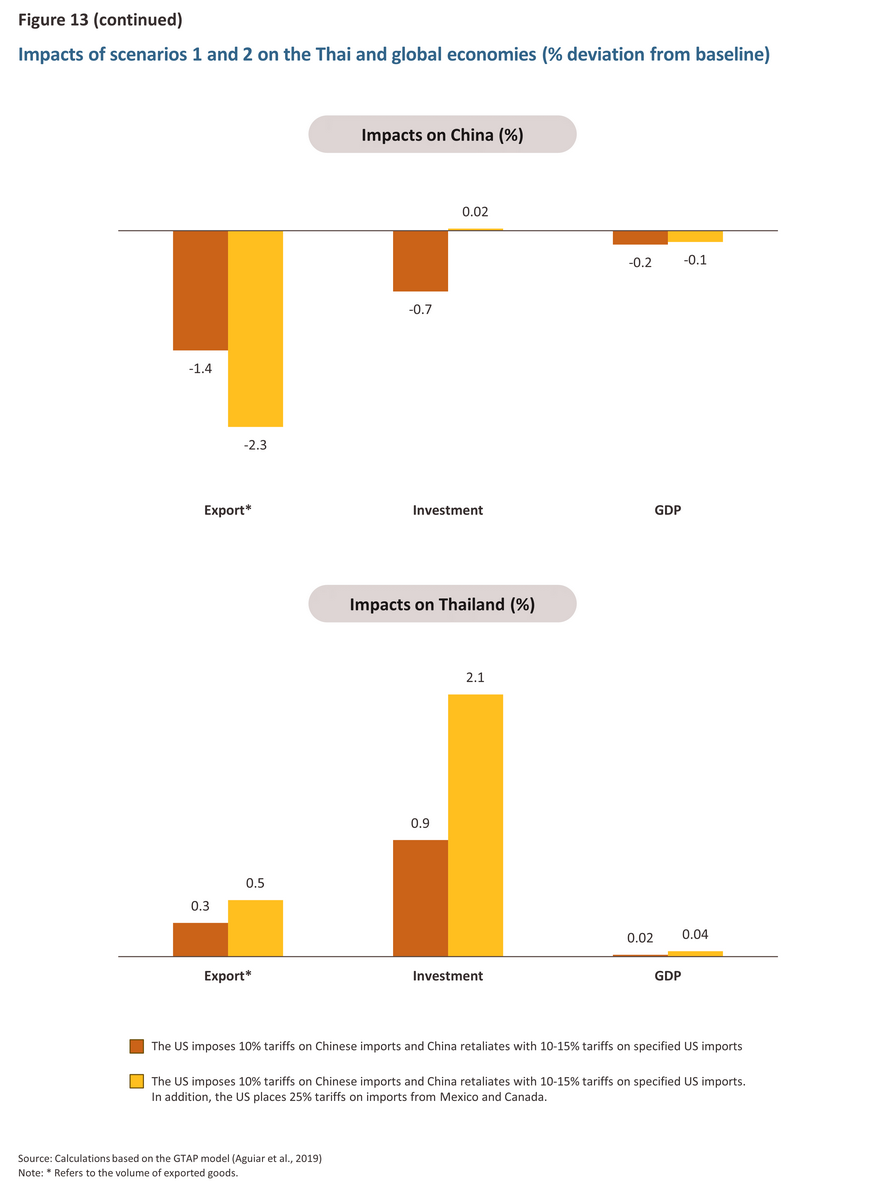

In summary, this round of the trade war negatively affect both the global economy and the conflicting countries, as both sides rely on increasingly complex global supply chains. While Thailand experiences both positive and negative impacts, the extent of which will depend on the particular circumstances of individual industries. However, the overall net effect at the macroeconomic level remains positive in terms of GDP, exports, and investment (Figure 13).

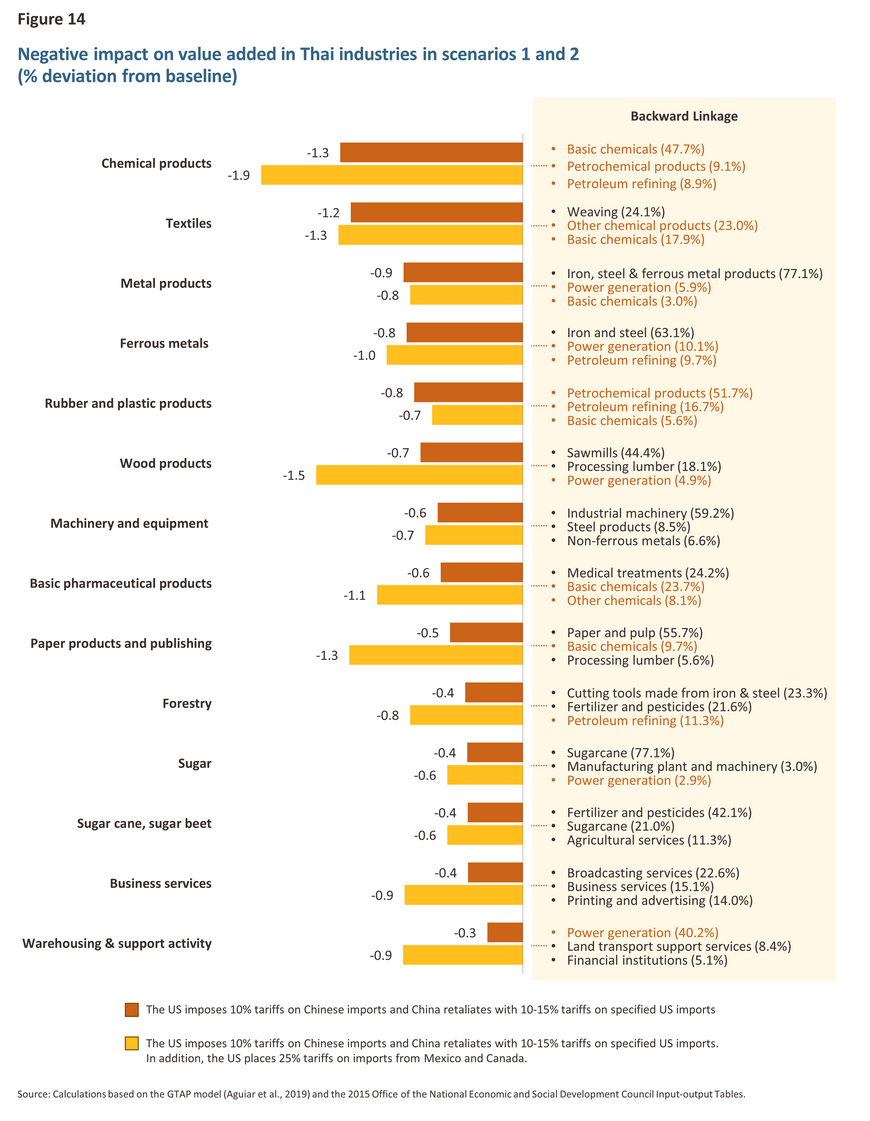

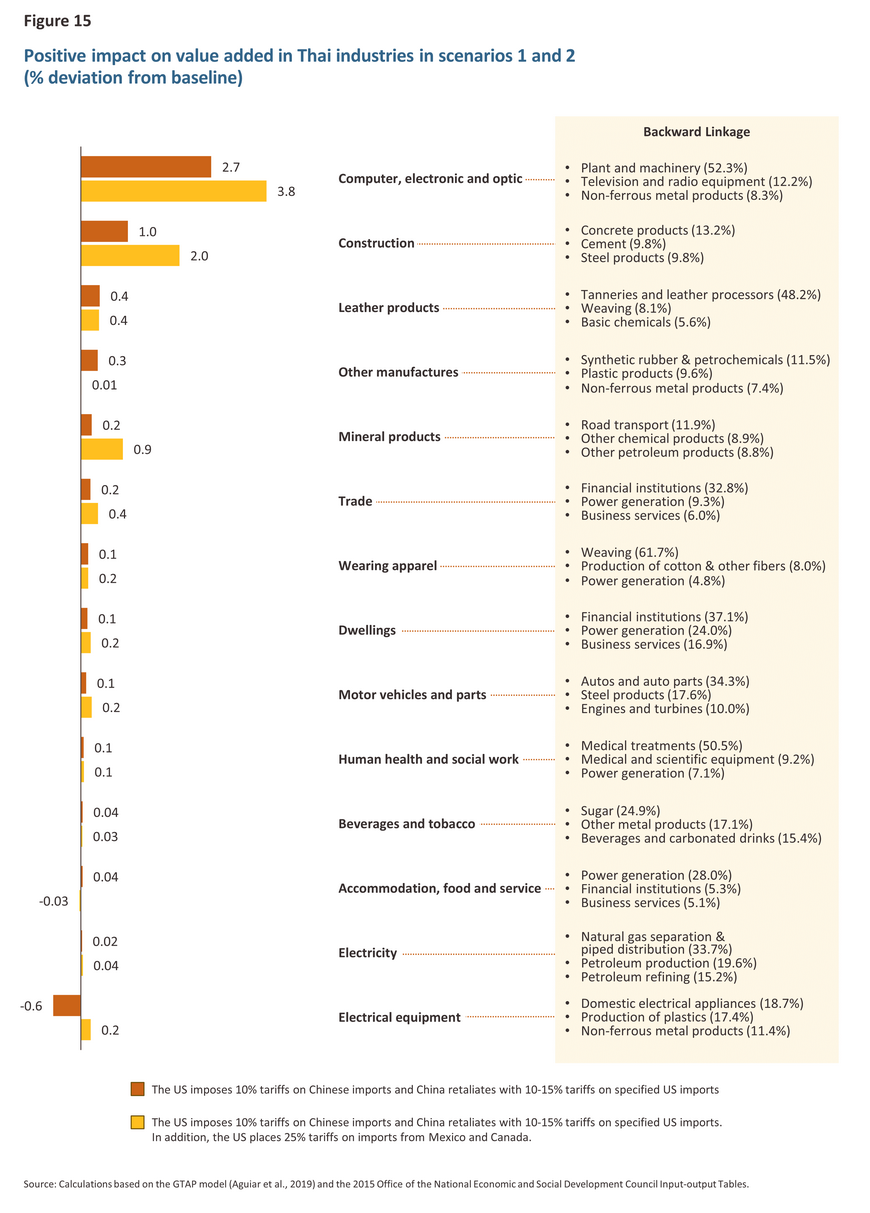

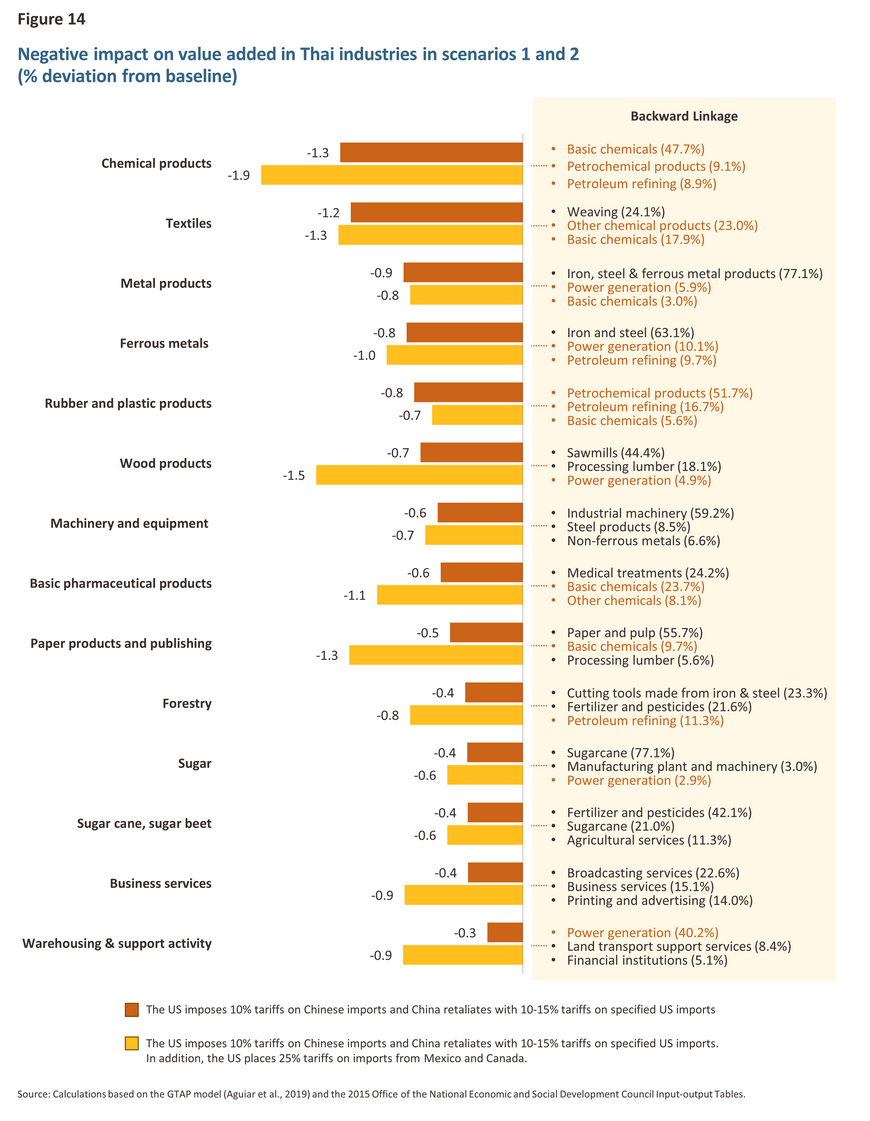

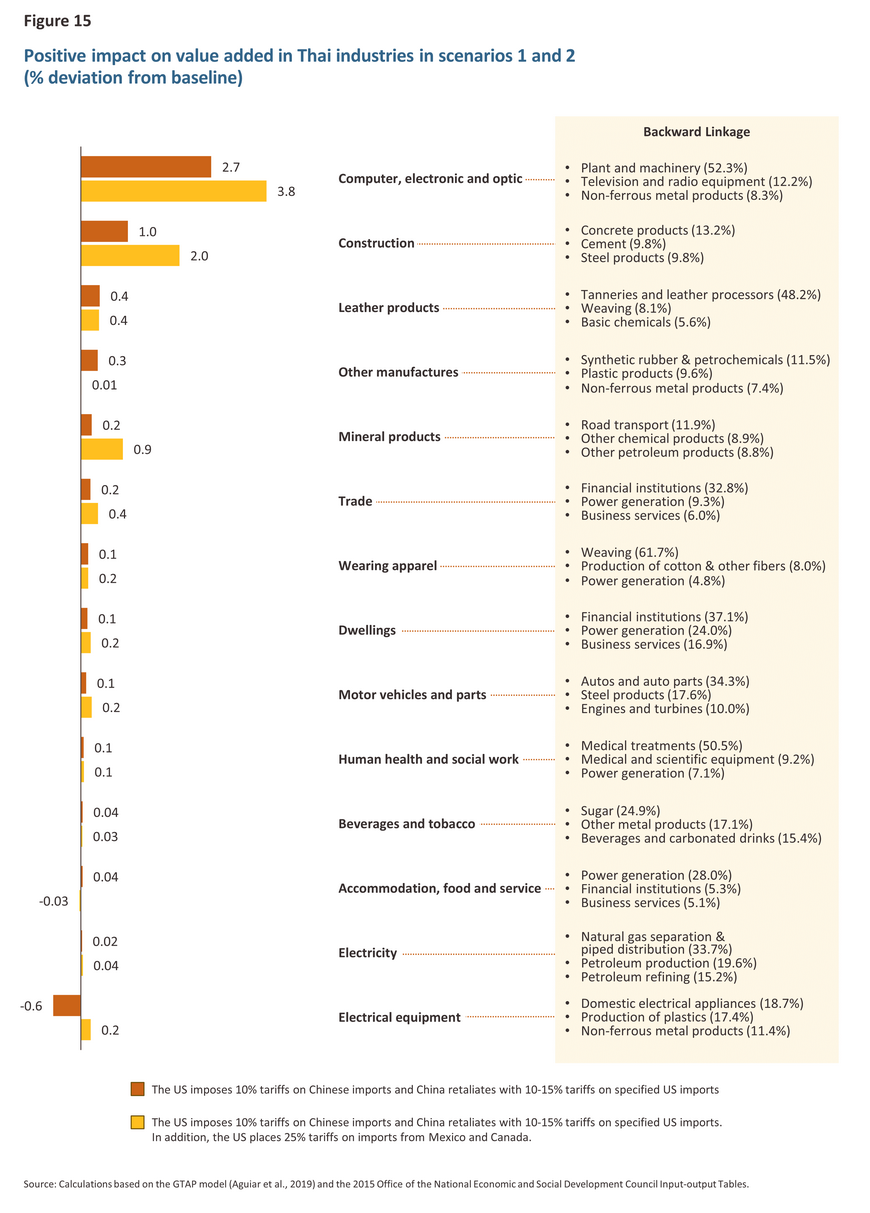

Comparing the impacts of the first and second scenarios on Thai industry, it is evident that Scenario 2 has a greater impact than Scenario 1. The negative effects are primarily transmitted through supply chain linkages of key industries such as basic chemicals, petrochemical products, petroleum refining, and electricity generation (Figure 14 and Figure 15).

Krungsri Research view

This analysis shows that tariff hikes will significantly affect the US economy under both scenarios while exerting varying pressures on trading partners, which can be categorized into two groups. First, countries that have not previously faced severe tariffs -namely Canada and Mexico- are likely to experience greater economic impacts than others. It is, therefore, not surprising that both nations are actively seeking negotiations or measures to address issues raised by the US. This reflects, to some extent, the US effectiveness of using tariffs as a bargaining tool. Second, countries that have already faced US tariff hikes, such as China, will experience a less severe impact compared to the first group due to the already high base tariffs. Therefore, we expect that tariff hikes will serve as a political tool that will benefit the US in the short term, leading to negotiations for special trade agreements. However, it could cause repercussions for the US economy in the long run.

Nevertheless, the analysis using the GTAP (Global Trade Analysis Project) model has certain limitations, and some situations may not be fully captured by the model. For example, the movement of factors of production (capital and labor) in the model still cannot immediately respond to demand and supply. Additionally, the database is somewhat lagging behind the current situation. Therefore, while the GTAP model can assess the impacts of tariff hikes to some extent, it should be considered alongside current conditions, serving as qualitative data for Thailand to prepare for and adapt to the rapid changes in the complex and dynamic global economy.

Given the deep integration of Thailand’s industries into the global supply chain, although, as of the publication date of this article, the US has not directly imposed tariffs on Thailand, the country could still face indirect effects transmitted through the related upstream industries of other countries. As such, adjusting strategies to keep up with the situation may help mitigate negative external effects more effectively, especially by strengthening the domestic economy through increasing domestic consumption and spending, diversifying export markets to reduce dependence on conflicting countries, pursuing a proactive trade policy in negotiating with both existing and new trading partners, and developing industries and innovation to enhance the competitiveness of Thai industrial and service sectors. These strategies could, to some extent, help alleviate the impact of the intensifying trade war, at least over the next four years.

1/ On February 4th, 2025, the US announced that plans to impose tariffs on imports from Canada and Mexico would be suspended for at least 30 days.