Introduction

Even though the digital revolution has impacted Thailand as much as any other country, a large share of the Thai population continues to show a strong adherence to long-standing beliefs connected to good fortune and the power of supernatural forces and sacred objects to influence this and to attract success, or as these are called in Thai, ‘muteluh’. For older individuals brought up in a more traditional environment, manifesting ‘muteluh’ beliefs will likewise generally take on more traditional forms, such as engaging in rituals, visiting holy places, or making use of the power of sacred objects in day-to-day life. However, for younger consumers who have grown up in the shadow of digital technologies, although the underlying beliefs may be largely unchanged, expressing these faith-based or culturally inspired views of the world is much more likely to happen via a digital channel. This has led to the evolution of what has been called

‘digital muteluh’, or

muteluh devotees who make use of modern technology to, for example, have their fortune told via online platforms, engage in e-commerce centered on the sale of amulets and other auspicious items, and attend religious ceremonies virtually.

This very modern blending of timeless beliefs and the most advanced features of tech-based capitalism has joined with traditional spending connected to muteluh to give birth to a vibrant area of economic activity, and significant opportunities exist for those active in this. More broadly, this shift has also paved the way for the creation of new marketing opportunities targeting muteluh devotees, opportunities that extend to include payment systems and the banking sector.

Belief in the supernatural in Asia

The word ‘muteluh’ comes from the Indonesian film ‘Penangkal Ilmu Teluh’, which was screened in Thailand in the 1980s under the name ‘Muteluh: Seuk Saiyasat’ (or ‘Muteluh: Spiritual Warfare’).1/ The word ‘Muteluh’ then passed into Thai to describe beliefs or actions that are not part of orthodox Buddhist doctrines but that center around ways of bringing good fortune or blessings to an individual. This encompasses fortune telling, purchasing amulets or other sacred objects, traveling to sacred sites to make offerings to local spirits or deities, or engaging in magical practices, which might even involve the supernatural or the occult. This is an area that, rather than shrinking, is experiencing significant growth, and so Future Market Insights estimates that the global market for faith-based tourism will have a total value of USD 38.4 billion (around THB 1.3 trillion) by 2034, up from some USD 16 billion (approximately THB 0.56 trillion) in 2024. This thus translates into compound annual growth of 9.1% over the period.2/

Muteluh-type beliefs are very widespread across Asia, although the details of these vary from one country to the next. In Japan, individuals will often visit shrines or temples to buy amulets called omamori, which help to protect that individual, to bring success in work or study, and to ensure good health.3/ In China and countries that are home to the Chinese diaspora, it is common to see strong belief in feng shui and the power of talismans to attract positive energy and to dispel negative influences.4/ By contrast, India is home to an extremely broad range of beliefs, religions and practices and so the country is often a destination for those traveling to worship at sacred sites or to perform religious rituals at holy cities such as Varanasi, Haridwar and Tirupati5/ or along the banks of the Ganges. Some Indians also like to wear amulets to shield them from harm or to ensure that good fortune comes their way.6/

Muteluh in Thailand

Like other populations in Asia, Thais hold a wide range of beliefs connected to good fortune, and these underpin a significant market for goods and services that promise to bend fate in favor of an individual. The depths of these beliefs and the need for spiritual security is reflected in a 2024 survey by the University of the Thai Chamber of Commerce, which indicates that the market for muteluh, fortune-telling and feng shui goods and services is thriving and is now worth some THB 10-15 billion.7/ However, data from the Department of Business Development show that as of November 2024, there were only 164 companies registered as active in Thailand providing astrological or faith-based services (code 96304).8/ These had a total registered capital of THB 181 million, and 72% of these were registered in the Bangkok Metropolitan Region.

However, these figures are somewhat misleading since the muteluh market is not limited to just those businesses formally registered as providers of astrological or faith-based services. Rather, this field extends into many other parts of the economy where religious, magical or belief-related goods and services are offered to consumers through online and offline channels. These include items that bring good fortune, auspicious digital wallpaper or NFTs, and services such as tours of sacred sites where the faithful can make offerings. More broadly, many businesses (including in banking and finance) have leveraged these beliefs in their marketing materials, thereby using what might be called ‘Muketing’ to strengthen their appeal to consumers. The emergence of these phenomena thus confirms that Muteluh remains a prominent factor influencing the consumption behavior of Thai consumers, with its influence increasingly permeating the dynamics of the modern digital economy.

Krungsri Research Survey Results

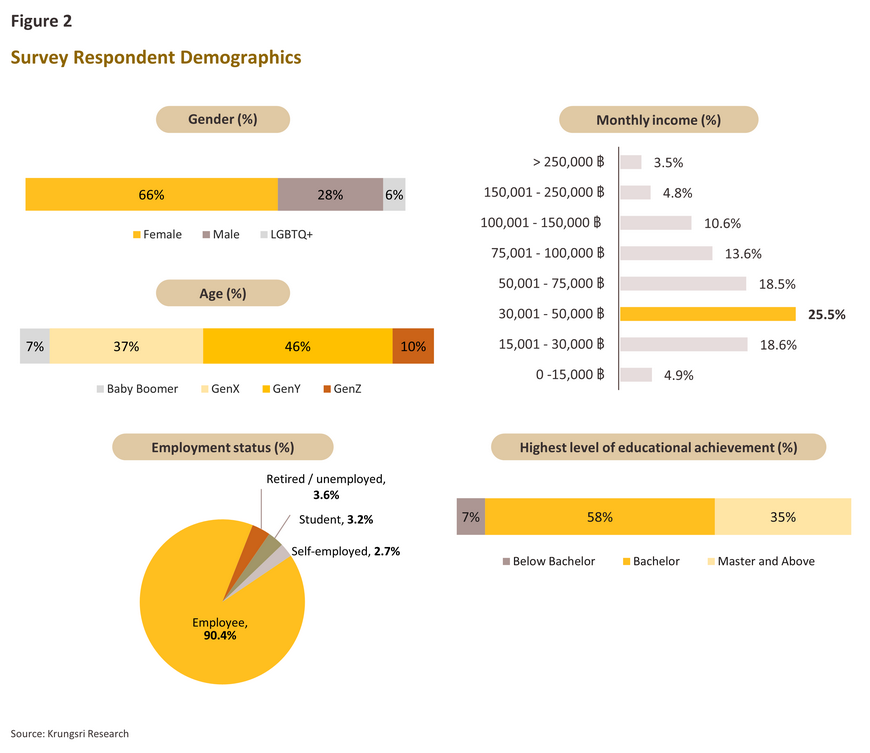

Against this background, Krungsri Research has carried out a survey of domestic Thai attitudes and behaviors with regard to muteluh-related goods and services. Data were collected online through September and October 2024, and a total of 1,213 survey responses were collected. Respondents demonstrated a broad range of educational achievements and incomes and came from the full spectrum of age cohorts.9/

Profile of Survey Respondents

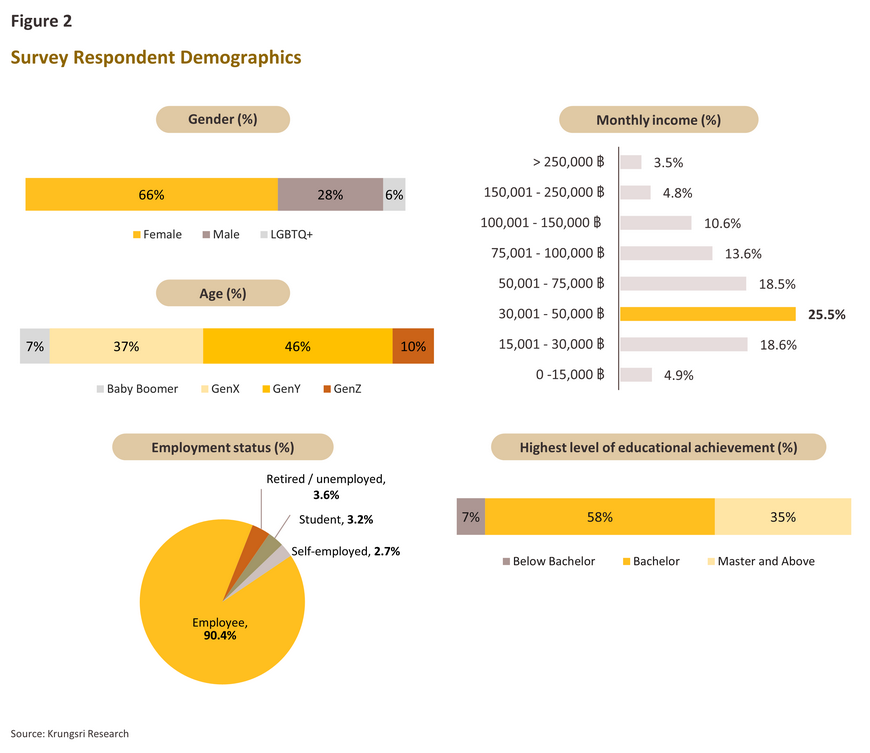

45.8% of respondents were in Gen Y (28-43 years old) and another 37% were in Gen X (44-58 years old). Some two-thirds were women, and around 3 out of 5 had a monthly income of between THB 30,000 and THB 100,000. Over 90% of those surveyed were in regular employment and a similar proportion had attained at least a bachelor’s degree.

Thailand and muteluh

The importance of muteluh: Variations across age cohorts

Overall, the survey shows that the market for muteluh goods and services enjoys broad support across Thai society, regardless of age. Thus, more than 8 out of 10 respondents reported having engaged in some kind of muteluh-related activity, whether that be paying homage to the spirits, changing one’s name, telephone number, car registration number or car color to a more auspicious choice, buying an amulet or other object that claimed to bring good fortune, having one’s fortune told, or other similar activities at least once. The highest response rate was seen in Gen X respondents (90.7%), followed by Gen Y (82.9%), Gen Z (78.5%) and Baby Boomers (67.8%). The motivations for doing so varied, but perhaps unsurprisingly, the most common reason cited by Baby Boomers was to ensure good health (given by 33.9% of the cohort). For Gen Z respondents, the most important motivation was success in study or work (44.2%), while Gen Y and Gen X individuals did so to bring good fortune or to attract wealth (respectively 46.6% and 39.7% of each group).

Considered by sex, for all groups, the most important reason for buying muteluh goods and services or engaging in related practices was also to bring wealth and good fortune. However, for LGBTQ+ respondents, ensuring success at work and in education was also an important factor.

The survey reveals that these beliefs and practices offer a way for individuals to deal with financial troubles, and so when encountering difficulties such as a lack of money or an unexpected loss from an investment, around half of respondents reacted by engaging in some kind of muteluh-related activity. This was most common among Gen Y consumers (59.2% of Gen Y respondents reported doing this when facing financial problems), followed by Gen Z (53.7%), Gen X (43.6%) and Baby Boomers (32.2%). Econometric analysis thus shows that Gen Y is up to 1.7-times more likely to follow this path compared to other age cohorts.10/

Muteluh as a part of life

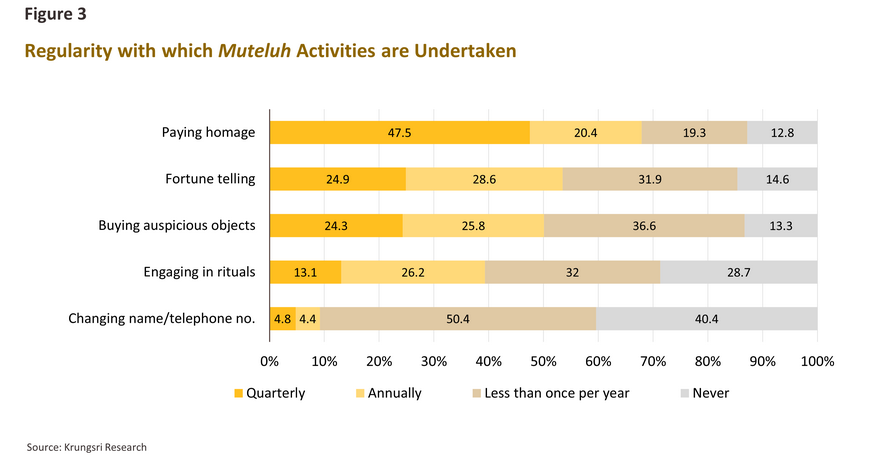

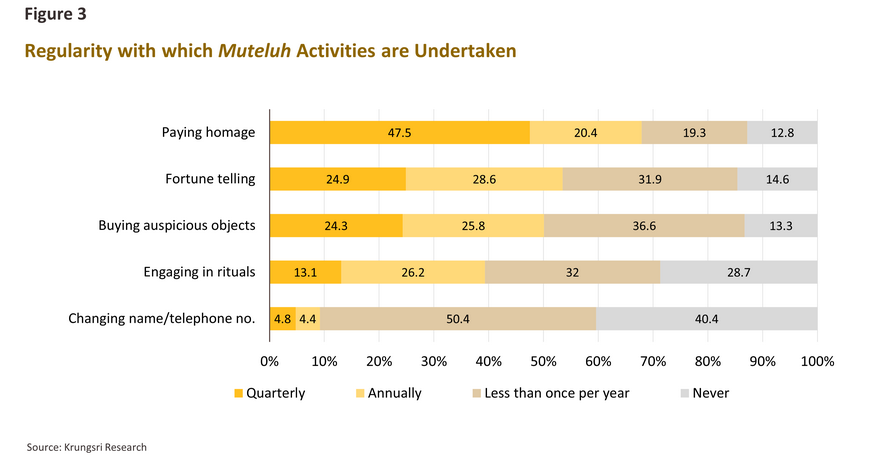

The survey results show that paying homage to the spirits was a widely popular activity of those investigated, and almost half of respondents (47.5%) traveled to do so at least quarterly, although Gen Z consumers were 2.1-times more likely than Baby Boomers to do this. In addition, this tended to be more common lower down the income scale, and so those reporting a monthly income of less than or equal to THB 75,000 were 1.7-times more likely to travel to pay homage than those with an income more than THB 150,000. Looking more deeply into these behaviors reveals that the LGBTQ+ community is the group most likely to travel for spiritual homage or to seek blessings for peace of mind (37.3% of all LGBTQ+ respondents). This fell to 27.8% and 21.2% among respectively women and men.

Around a quarter of those surveyed reported buying objects that bring good fortune or having their fortune told at least quarterly. LGBTQ+ individuals were most likely to do this, while considered by age, Gen Y consumers had the highest response rate for purchases of auspicious goods (26.5% of the cohort). These were followed by Gen X (23.8%), Baby Boomers (20.3%) and Gen Z (18.9%). With regard to horoscopes and fortune telling, this was most popular among Gen Z respondents (42.1% of the cohort), followed by Gen Y (24.7%), Gen X (22.8%) and Baby Boomers (13.6%). Econometric analysis thus shows that members of Gen Z are up to 2.6-times more likely than other generations to have their fortune told quarterly.

However, while respondents may wish to engage in these activities, it is entirely possible that factors outside their control will make it impossible for them to travel to pay homage to the spirits, to engage in religious ceremonies, to see a fortune teller, or to travel to buy auspicious objects. This research shows that the most commonly encountered obstacle preventing an individual from undertaking one of these was the pressure of other obligations and a resulting lack of time (42.5% of responses). This was most often reported by working-age respondents in regular employment, the self-employed, and freelancers. The next most common problem was difficulty traveling (25.5%), and this was most often seen among the retired and the non-working, especially Baby Boomers. Other, less common problems included a lack of companionship (8.4%) and a lack of muteluh-related knowledge (8.3%), which were most often reported by Gen Y and Gen X individuals in regular employment.

Muteluh goods and Thai society

Thai consumers’ purchasing behaviors of muteluh goods

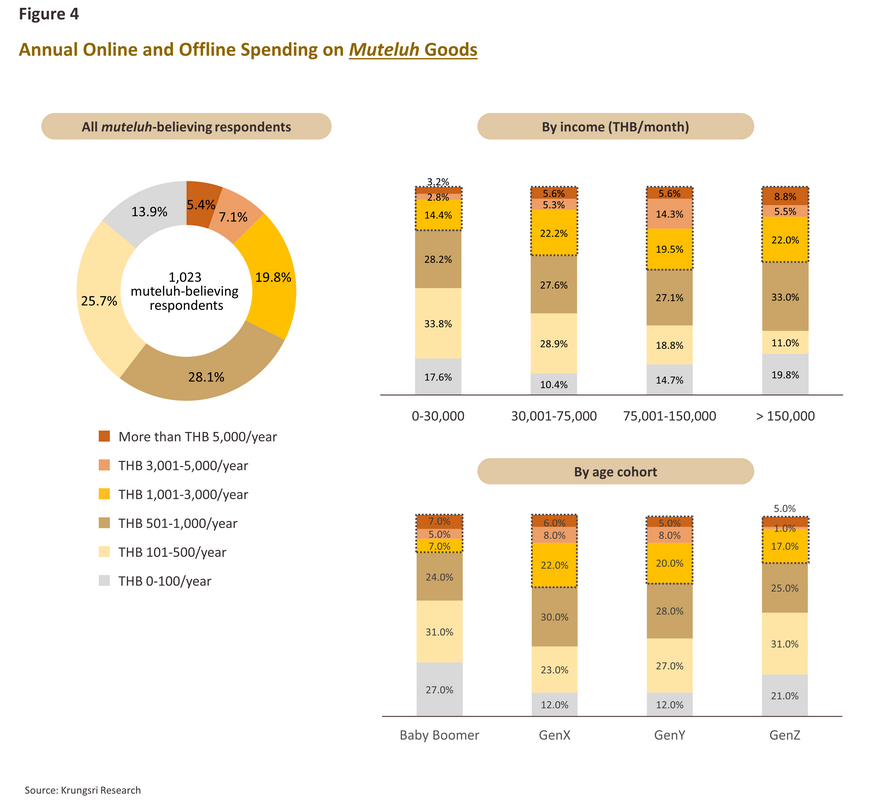

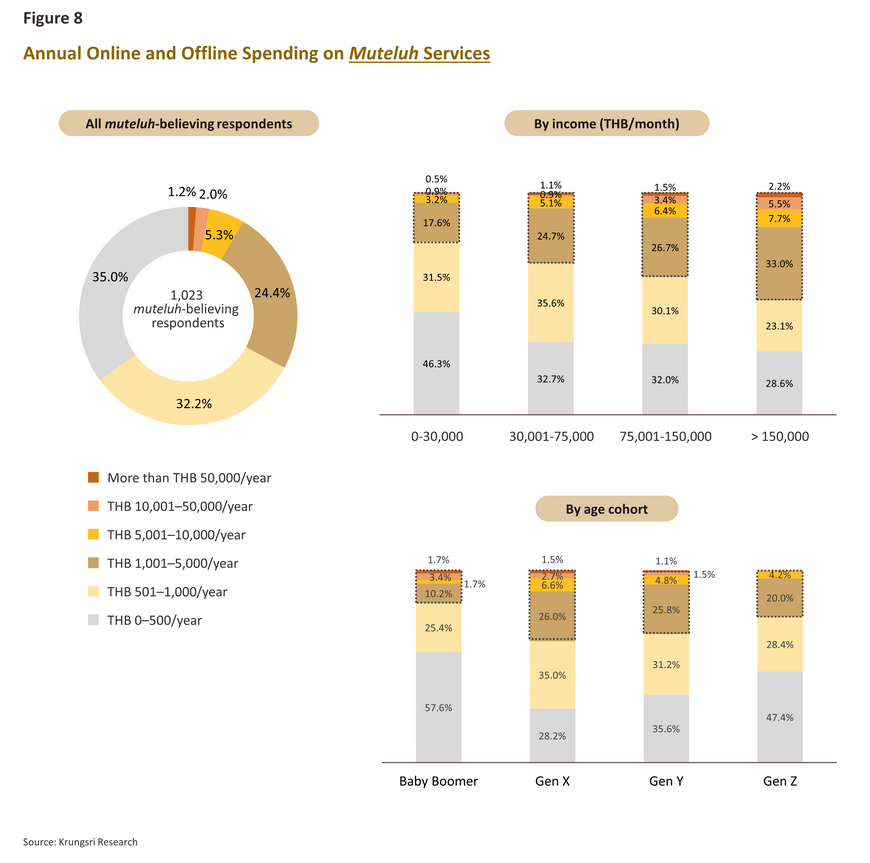

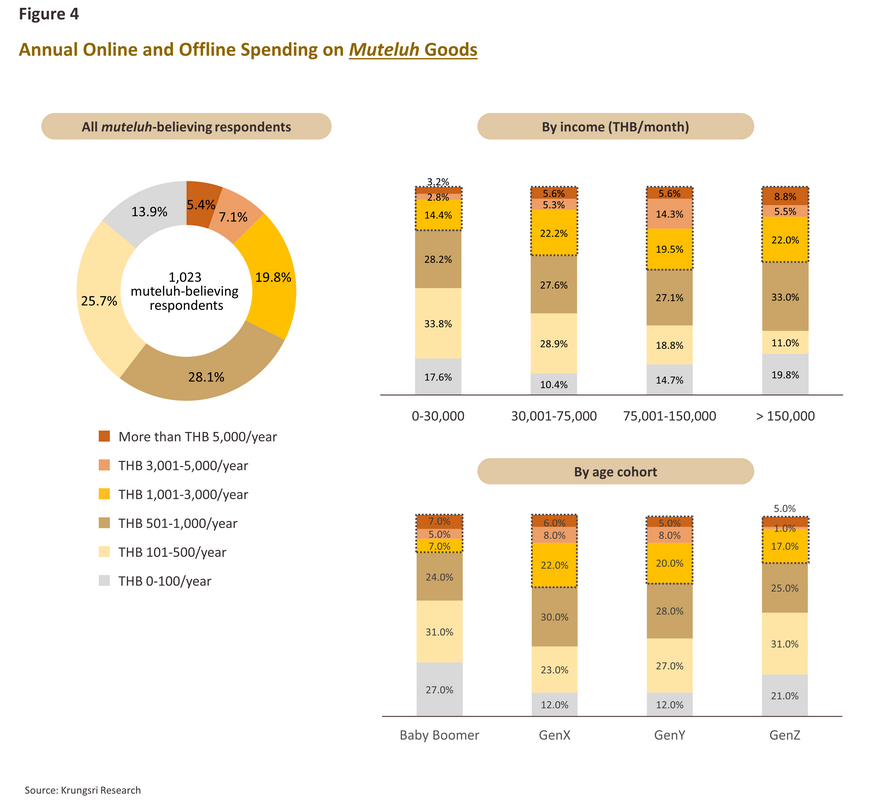

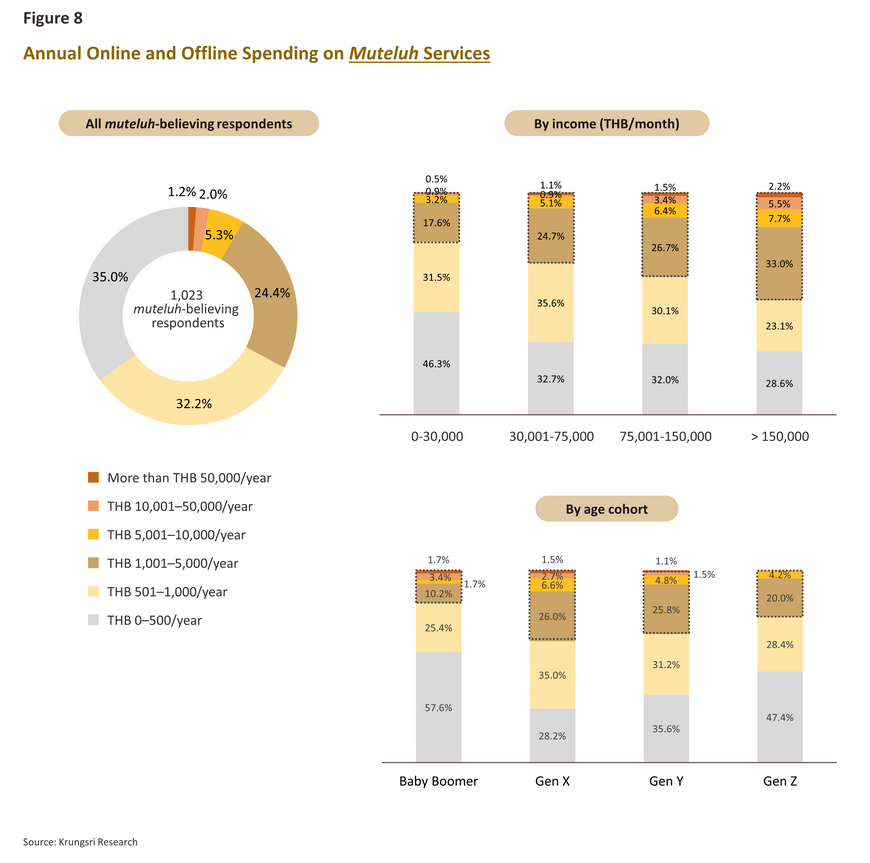

Approximately a third of those who completed the survey reported that they spend more than THB 1,000 annually on online and offline purchases of auspicious items, with average spending positively correlated with income. In-depth analysis of the data therefore shows that those with a monthly income of THB 30,000-75,000 are 1.9-times more likely than those with an income of less than THB 30,000 to spend at least THB 1,000 annually on purchases of these goods. For those with an income in the range of THB 75,000-150,000 this rises to a 2.6-times greater likelihood, while the richest respondents (those with an income more than THB 150,000 monthly) are the most likely to spend at least THB 5,000 annually on auspicious goods (8.8% of this group).

By age, over a third of Gen Y and Gen X consumers spend more than THB 1,000 per year on items that held out the promise of improving an individual’s fortune, but the heaviest spenders were the baby boomer cohort, and among this age group, 7% of respondents spent more than THB 5,000 annually. This is thus higher than Gen X (6%), Gen Y (5%) and Gen Z (5%).

It is also instructive to note that around a tenth of men spent on muteluh goods more than THB 5,000 per year, significantly higher than both self-identifying LGBTQ+ and female respondents (around 3-4% each), and among heavy spending men, almost two-thirds reported buying auspicious items, amulets, charms and similar goods at least monthly.

The digitalization of muteluh consumption

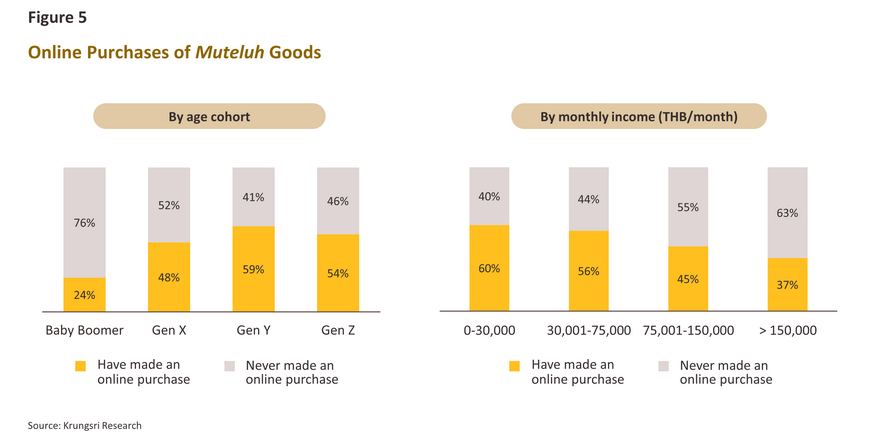

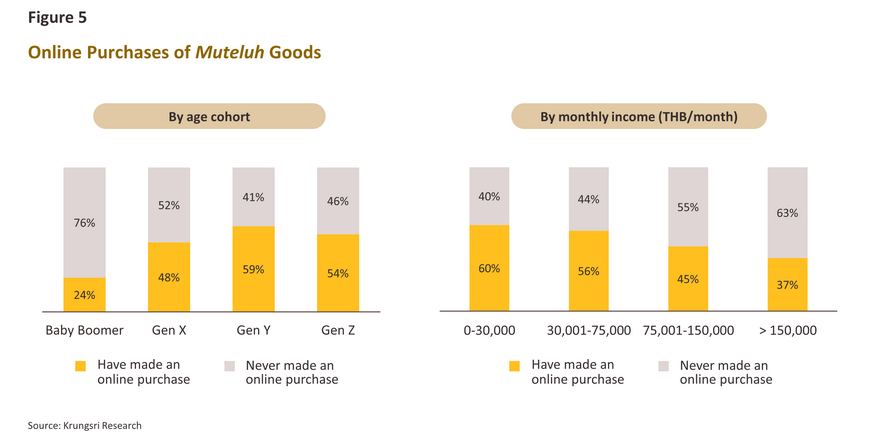

Around a half of survey respondents stated that they had bought a muteluh product online (Figure 5). As might be expected, this was least common among Baby Boomers, with this falling to 23.7% among those aged 60 and over, while it was most prevalent among Gen Y (reported by 59.2% of this cohort). Gen Y individuals were thus 2.8-times more likely than Baby Boomers to make these purchases online. More interestingly, the propensity to shop online was negatively correlated with earnings, and so consumers with an income of less than THB 30,000 per month were 2.2-times more likely than those earning more than THB 150,000 to shop online for religious-type goods.

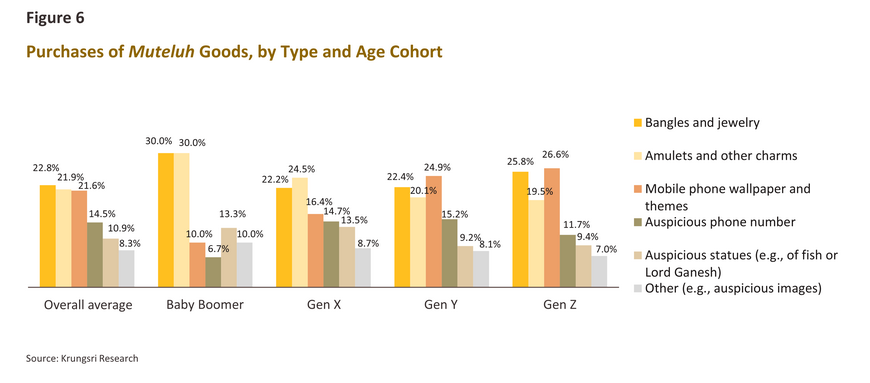

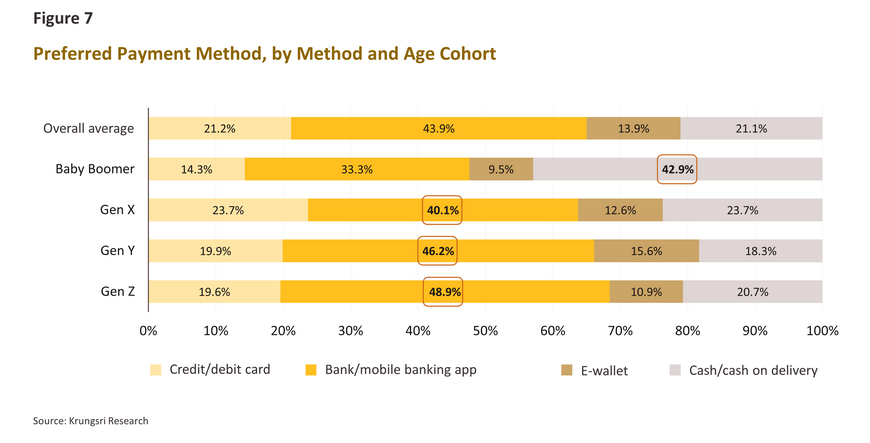

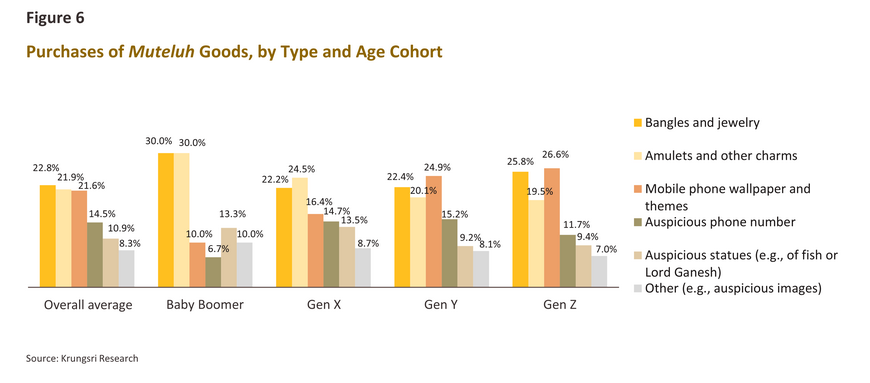

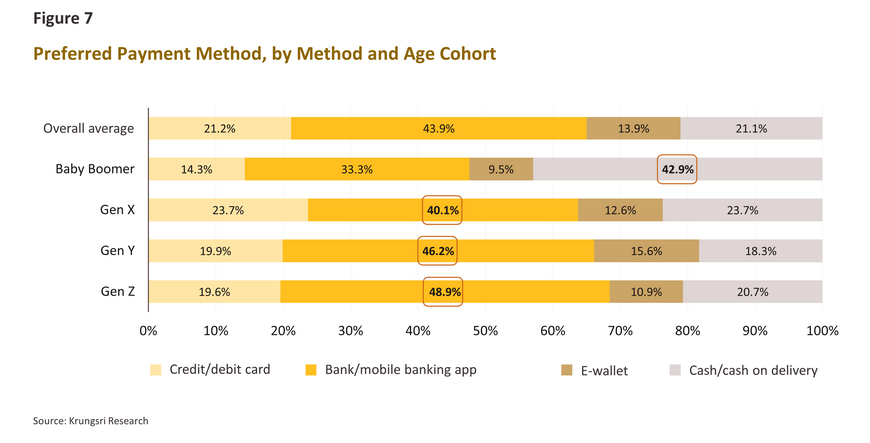

The items most commonly bought online were bangles and other types of jewelry (22.8% of respondents), amulets and other types of portable charms (21.9%) and mutuleh-inspired mobile phone wallpaper and themes (21.6%) (Figure 6). Purchases of wallpaper and themes were lowest among Baby Boomers (10%) and so Gen Y and Gen Z consumers were around 9-times more likely to buy these than Baby Boomers. This sharp difference reflects variations in preferred payment methods (Figure 7), with 42.9% of Baby Boomers choosing to pay for purchases with the low-tech choices of cash and cash on delivery, while Gen X, Gen Y and Gen Z consumers strongly favored the use of banking apps to make transfers (around 40-50%), significantly higher than other payment methods. There is also a clear but negative correlation between income level and likelihood of making payments with cash.

Muteluh services: Another option in the market for faith

Spending by Thai consumers on muteluh services

Within the broader space of muteluh consumption, significant spending on services occurs alongside that made on goods. This includes horoscopes and fortune telling, faith-based themed tours, making offerings at holy sites, and engaging in other religious rituals. The survey responses show that approximately a third of respondents spent more than THB 1,000 per year (offline and online) on these types of services, which was in line with the proportion spending a similar amount on physical goods. Moreover, as with the purchase of muteluh goods, spending on muteluh services rises with income. Higher income groups are more likely to spend over THB 1,000 on these services. Analysis of the data therefore shows that those in the highest income bracket (i.e., those earning more than THB 150,000 per month) were 3.2-times more likely than those in the lowest income bracket (i.e., those with a monthly salary of less than THB 30,000) to spend at least THB 1,000 on muteluh services per year.

The survey shows that Gen X spent most heavily on muteluh services, with 36.8% of these individuals reporting that they spend more than THB 1,000 annually on these. Gen X was followed by Gen Y, with 33.2% of this cohort spending more than THB 1,000 per year, but both Baby Boomers and Gen Z were less inclined to purchase these services and so respectively 57.6% and 47.4% of these age cohorts spent less than THB 500 annually on these.

Online muteluh services

It is increasingly common to see individuals delivering muteluh services via digital platforms, in particular by offering to carry out a ritual or rite on behalf of a paying client. Among those completing the survey, 9.1% reported having used such a service, and two-thirds of these preferred to pay for this using a banking app. The most commonly given reasons for paying for these services were because the individual was unable to travel to do this in person (29.2% of responses) and because the individual believed that the service provider would perform the ritual correctly (19.9%). However, among those who had yet to pay for an online muteluh service, while 16.5% were interested, 21.1% were unsure, most commonly because survey respondents were not convinced that paying someone to carry out the ritual on their behalf would yield the results that they were looking for or because they were unsure about the reliability of those offering these services. Overall, women were 2.6-times more likely than men to report using these services.

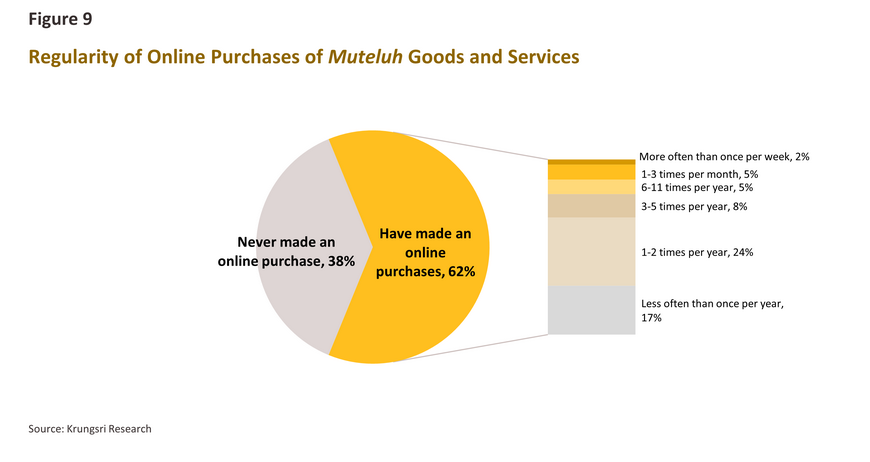

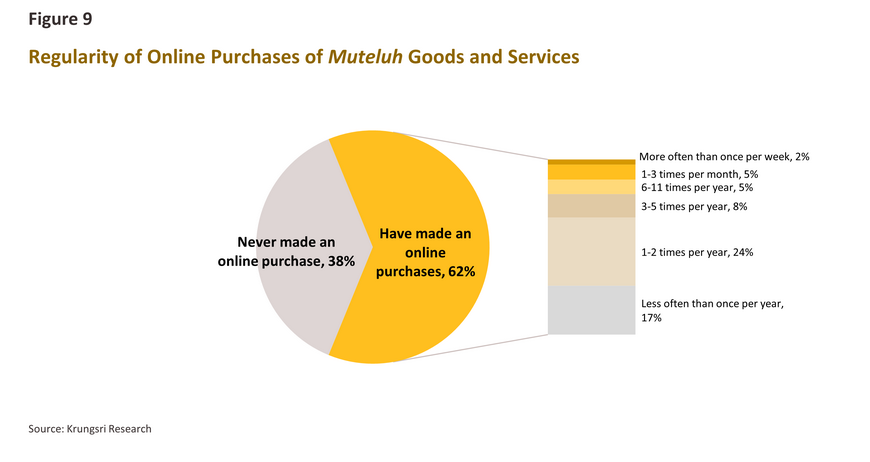

Regularity of online purchases of muteluh goods and services

Although about 6 out of 10 respondents had previously paid for muteluh goods or services delivered via on online platform, a quarter of these made these purchases only once or twice per year. By contrast, just 2% made weekly purchases and so it appears that fully embracing digital muteluh has not yet become widely popular at present.

Considered by age cohort, it is perhaps to be expected that the younger the respondent, the greater the chance that they had made an online purchase of muteluh goods or services. Thus, 70.5% of Gen Z respondents reported having done so, with this falling to 67.2% for Gen Y, 59.3% for Gen X, and just 32.2% for Baby Boomers. Gen Z consumers are therefore 3.7-times more likely than Baby Boomers to purchase these goods and services online.

Modern technology and muteluh

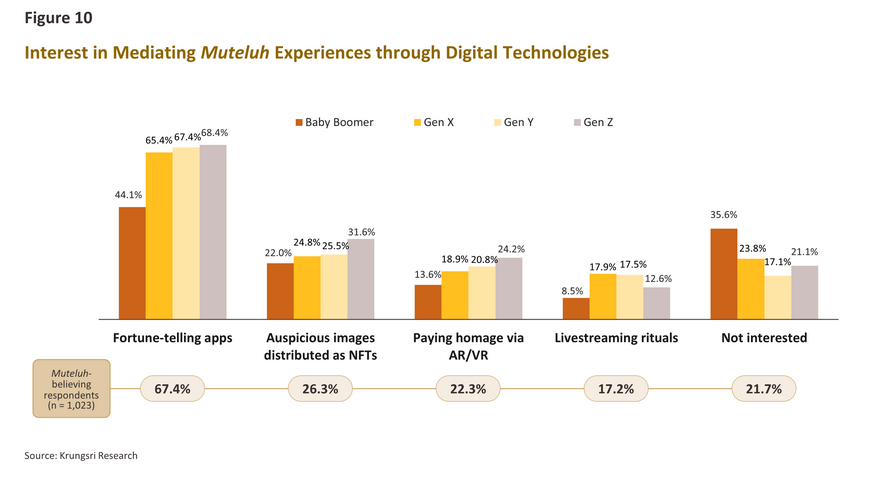

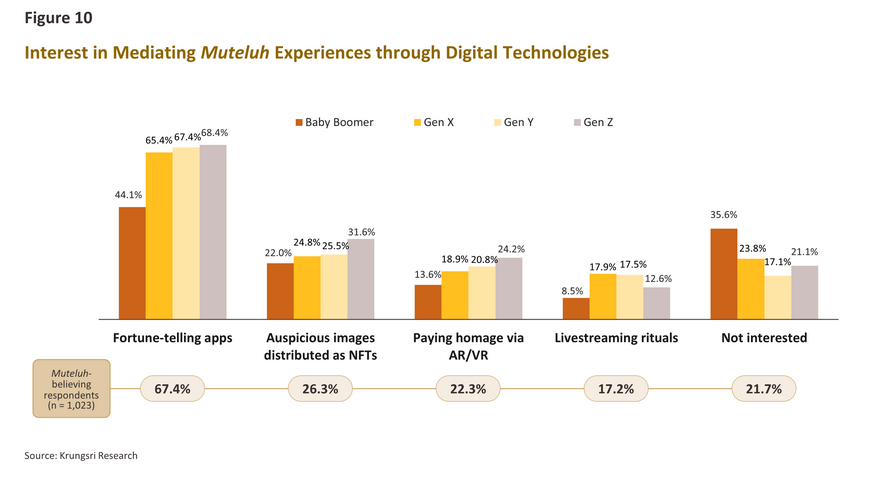

As with a huge range of other activities, digital technologies are finding a role in developing the consumer experience within the realm of muteluh-type goods and services. Of these, survey respondents reported being most interested in fortune-telling apps, with 67.4% positively inclined towards these. These were followed in importance by auspicious images distributed as NFTs (26.3%), using AR and VR to pay homage to spirits and deities (22.3%), and participating in livestreamed rituals and rites (17.2%), although around a fifth of respondents said that they were not interested in any of these. The latter was most pronounced among Baby Boomers, where the proportion hit 35.6%, and so overall, members of Gen X, Gen Y and Gen Z were twice as likely as Baby Boomers to be interested in adopting these technologies for muteluh activities.

Thai perspectives on AI-powered fortune-telling

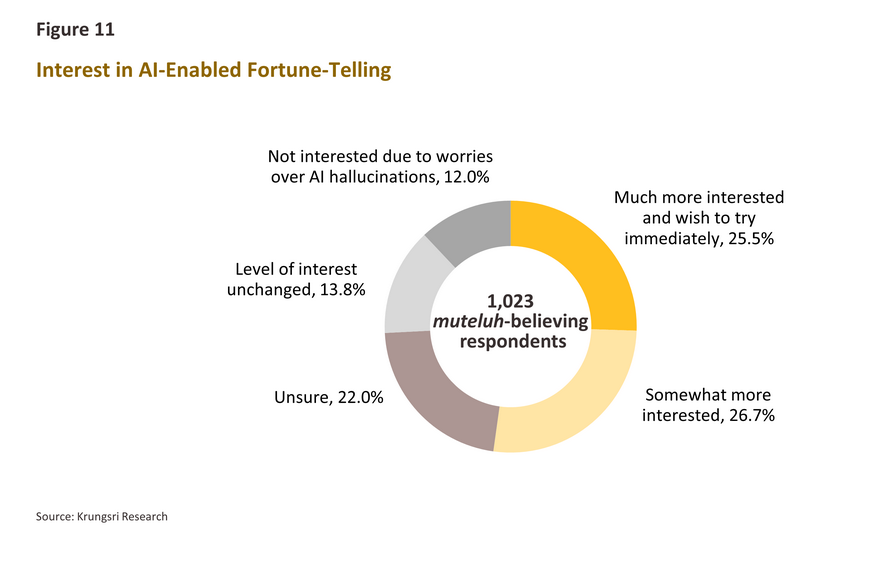

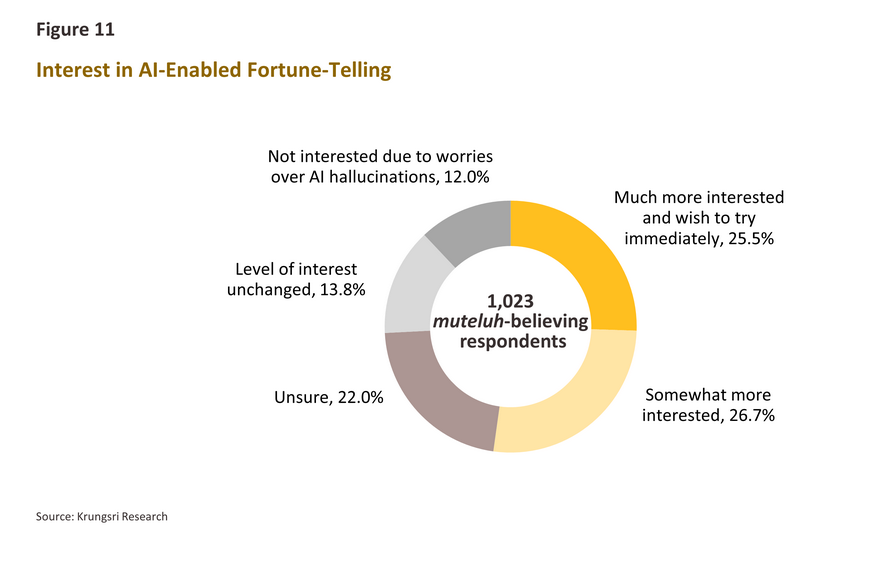

AI is finding roles in many areas of human activity, and muteluh practices have not escaped this trend. Among the latter, fortune telling is one area that is ripe for AI automation,11/ and 52.2% of respondents said that they would be more interested in fortune telling if this involved AI. For Gen Y and Gen X, interest came to respectively 55.7% and 52.0% of the total cohort, and so for these two groups, interest was 2.3-times that of Baby Boomers.

In addition, around a quarter of survey respondents were extremely interested in using AI for fortune-telling and eager to try it immediately. This level of interest was highest among Gen Z respondents, where it reached 28.4% of the total. Younger respondents were thus more excited about engaging with AI-enabled fortune-telling than were older individuals, and so for Gen Y, the share expressing this interest came to 26.2% of the cohort, falling to 25.7% and 13.6% for Gen X and Baby Boomers, respectively. By contrast, 12% of respondents were not interested in this, as they were concerned that AI might generate inaccurate answers or predictions due to technological failures (Figure 11).

Krungsri Research’s view: When faith opens doors to business opportunities

This study underlines that belief in sacred powers, supernatural and/or auspicious forces continue to play an important role and remains a part of Thai life in the present day, despite economic, social, or technological changes. However, the expression of these beliefs may be adapted to align with the use of modern technology and life by screen cultures. Krungsri Research offers insights that could benefit businesses seeking to reach and win the loyalty of the so-called "digital muteluh" consumers or those aiming to create a meaningful and tailored experience for this customer segment as follows:

Targeting different muteluh consumers across generations

Baby Boomers are the heaviest spenders on muteluh goods and services, with a higher proportion of respondents in this age cohort spending more than THB 5,000 annually on these compared to any other group. Age and spending are in fact positively correlated and so the share of the cohort qualifying as a ‘heavy spender’ declines as one moves through Gen X, Gen Y and Gen Z. Baby Boomers reported the most interest in muteluh as way of ensuring good health, so products targeting this aspect would be of greatest interest to this group. This could include health bracelets made from semi-precious stones believed to promote health and auspicious jewelry that enhances the life energy of the wearer. However, when it comes to muteluh products, members of this group are largely insulated from the appeal of the digital world and so it is important that promotions focus on physical rather than virtual goods.

Gen X and Gen Y are more likely than Baby Boomers to be interested in digitally mediated or delivered spiritual goods and services, and while Baby Boomers are more concerned with ensuring good health, these two cohorts are more focused on generating wealth and good fortune. Nevertheless, the share of individuals in these two groups spending more than THB 5,000 annually on muteluh goods is similar to that of Baby Boomers, and around a third spend at least THB 1,000 per year on muteluh goods, with the same amount going to muteluh services. Gen X and Gen Y thus comprise a major market for both physical and virtual muteluh goods and services ranging across areas such as bangles and jewelry that bring good fortune, digital amulets, and the use of mobile phone apps to check one’s horoscope or fortune, especially when these are AI-enabled. However, differences exist between the two cohorts, with Gen X sharing Baby Boomers’ preference for amulets and charms, and Gen Y preferring to buy digital goods, such as auspicious wallpaper for use on mobile phones.

Gen Z individuals are generally still in education or at the start of their working life, and so they are mostly concerned with using muteluh goods and services to secure good outcomes in these two areas. The youngest cohort has a higher frequency of fortune-telling than other age groups, with the most common being at least once every three months. Moreover, these individuals are more interested than other cohorts in horoscope/fortune-telling apps, auspicious NFTs, and paying homage via AR and VR. It is therefore possible that in the future, as Gen Z’s purchasing power strengthens, the market for digitally delivered or tech-based muteluh goods and services will expand. Integrating belief with innovations that appeal to the younger generation, such as AI-powered fortune-telling that learns users' personal information and preferences to provide specific predictions, will further attract new customers in the future.

The market for digital muteluh services

Across all age cohorts, respondents reported enjoying traveling to pay homage to the spirits or to receive a blessing, but for some working-age individuals, their other responsibilities made this difficult. Some older respondents also faced problems when traveling to engage in these types of activities, and so these two factors may support the development of a market for online, digitally delivered services whereby a user can pay another person to perform these rituals on their behalf. LGBTQ+ individuals were keener than other groups to travel to pay homage and so these comprise an important target group for any promotions that involve these kinds of activities. For LGBTQ+ individuals, the most important motivations for seeking a blessing were to achieve success in work or study, and to attract good fortune and wealth.

For working-age respondents (in particular Gen X and Gen Y individuals), a lack of companionship or muteluh-related knowledge was also cited as a reason that may prevent them from engaging in spiritual activities. This thus represents an opportunity for providers of digitally mediated muteluh services to, for example, organize tours that prioritize both convenience and a worship experience, but which may be delivered online or for which bookings might be made via a platform.

Society is evolving, yet the strength of faith endures.

Going forward, the muteluh market will be more than just a matter of belief. As it increasingly enters the digital economy, new opportunities will emerge. These opportunities will blend technology and business, especially in areas like products that promise good fortune, muteluh tours, and the delivery of financial services. As such, building a ‘mu-market’, or a platform that unifies the distribution of muteluh goods and services, will help better meet consumer needs and stimulate growth in this new demand.

Moreover, the merger of modern technology with the power of long-standing beliefs and faiths will give birth to new possibilities within the digital economy. This will include developments in areas such as AI, AR/VR, and NFTs—all technologies that will play an important role in transforming how traditional rituals are performed. For their part, consumers will increasingly seek digitally mediated faith-based experiences, such as participating in ceremonies online or virtually, having horoscopes read or fortunes told through an app, or purchasing virtual amulets. Thus, while ongoing technological progress may change the forms through which faith is expressed, the core beliefs themselves and the power of faith will remain a part of human society in the future.

References

กรุงเทพธุรกิจ (2024): “ธุรกิจสายมู สุดปัง จัดตั้งใหม่เพิ่มทุกปี” Retrieved October 12 2024 from “ธุรกิจสายมู”สุดปัง จัดตั้งใหม่เพิ่มทุกปี

Future Market Insights (2024): “Faith-based Tourism Market Outlook from 2024 to 2034” Retrieved October 1 2024 from

Faith Based Tourism Market Growth, Trends & Forecast 2034

Japan Living Guide (2023): “Omamori: A Guide to Japanese Amulets” Retrieved October 1 2024 from Omamori: A Guide to Japanese Amulets - Living Guide in Japan

Springnews (2024): “ดูดวงไพ่ยิปซี กับเทคโนโลยี AI ผ่านปลั๊กอินบน ChatGPT-4” Retrieved October 12 2024 from ดูดวงไพ่ยิปซี กับเทคโนโลยี AI ผ่านปลั๊กอินบน ChatGPT-4

The Enlightenment Journey (2024): Feng Shui Symbols of Protection and How to Use Them” Retrieved October 1 2024 from

Feng Shui Symbols Of Protection And How To Use Them

Wego Travel (2024): “50 Pilgrimage Destinations and Religious Places in India You Have to Visit at Least Once in Your Life” Retrieved October 1 2024 from 50 Beautiful and Popular Religious Places in India - Wego Travel Blog

1/ มูเตลู (Thai): meaning, translation – WordSense

2/ Faith Based Tourism Market Growth, Trends & Forecast 2034 (futuremarketinsights.com)

3/ Omamori: A Guide to Japanese Amulets - JapanLivingGuide.net - Living Guide in Japan

4/ Feng Shui Symbols Of Protection And How To Use Them (theenlightenmentjourney.com)

5/ 50 Beautiful and Popular Religious Places in India - Wego Travel Blog

6/ Indian amulets - ethnicadornment

7/ https://www.bangkokbiznews.com/business/economic/1121072

8/ https://datawarehouse.dbd.go.th/area/overview/96304

9/ These were Baby Boomers (59 years old and up), Gen X (44-58 years old), Gen Y (28-43 years old) and Gen Z (18-27 years old).

10/ Calculated using the odds ratio. This uses logistic regression, an econometric tool for assessing the probability of a particular outcome given the influence of other factors.

11/ https://www.springnews.co.th/digital-tech/technology/848799