Introduction

Attracting foreign investment is crucial for developing countries as it helps stimulate economic growth, develop infrastructure and domestic industries, and create numerous economic opportunities. However, financial and economic stability are key factors determining a country's potential to attract such investment, as they reflect the stability of the financial and economic system, as well as the level of risk and the possibility of future economic crises.

The Lao People’s Democratic Republic (Lao PDR) and Cambodia are countries with high economic growth rates, comparable to the ASEAN average and higher than the global average. However, they differ in terms of economic stability vulnerabilities. Lao PDR faces challenges related to public debt and external stability, while Cambodia is dealing with domestic financial stability issues. These vulnerabilities threaten to obstruct economic growth in both countries at any given time.

In fact, even before the COVID-19 crisis, both Lao PDR and Cambodia were already facing financial stability challenges. The COVID-19 pandemic only exacerbated these issues, making them more prominent and affecting the real economy. Looking ahead, a key concern is that if external risk factors further exacerbate the situation, the resulting impact could be even more severe. Notably, these problems may not only affect the domestic economies but could also have far-reaching effects on the ASEAN region and Thailand, given the high degree of economic interconnection within the region.

Therefore, this study analyzes and compares the economic and financial stability issues in Lao PDR and Cambodia, as well as examines the connections between these stability problems and real economic trends. Furthermore, it assesses the potential impacts on the ASEAN economy.

Lao PDR Under Pressure from External Debt

Lao PDR faces economic vulnerabilities due to its high external debt burden, raising concerns about debt distress. These concerns have led to continuous currency depreciation, negatively impacting the economy. Looking ahead, debt restructuring negotiations with China will be a crucial factor to monitor.

The economy of Lao PDR is mainly driven by the service sector on the supply side, particularly tourism, transportation, and logistics, as well as electricity exports, which serve as the country's main source of revenue. On the demand side, private consumption plays a major role in driving the economy. The country's key export markets include China, Thailand, and Vietnam1/. However, in terms of stability, Lao PDR is facing a public debt crisis and high levels of external public and publicly guaranteed debt (PPG).

Background of the Problem and Its Impact on the Real Economy

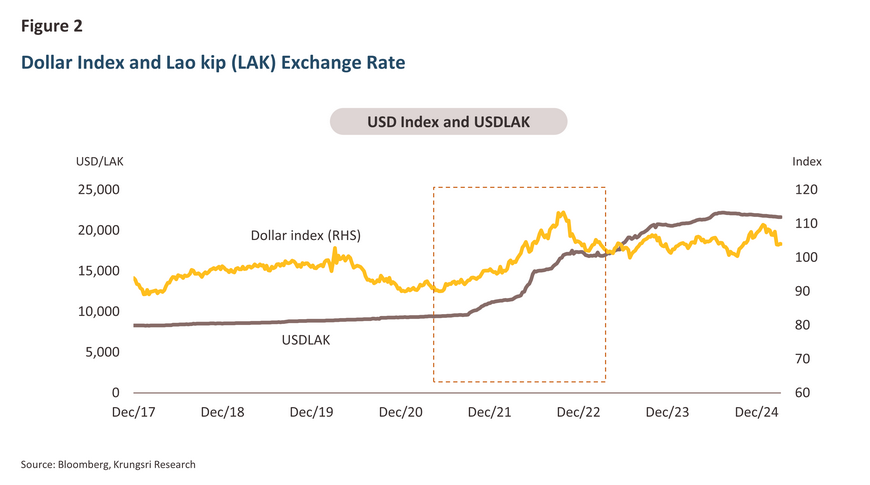

Lao PDR's high external debt burden has been a chronic issue since before the COVID-19 crisis. However, since 2022, severe global financial volatility following the COVID-19 crisis and the Russia-Ukraine war has introduced additional pressures. Factors such as rising commodity prices, the rapid appreciation of the U.S. dollar, and weakened external demand have all contributed to the country’s increasing financial vulnerabilities. These pressures have led to a sharp depreciation of the Lao kip, significantly affecting the real economy.

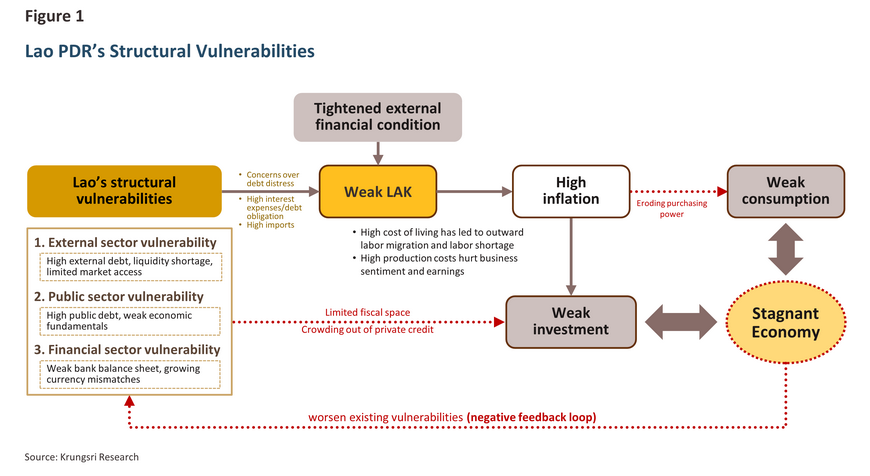

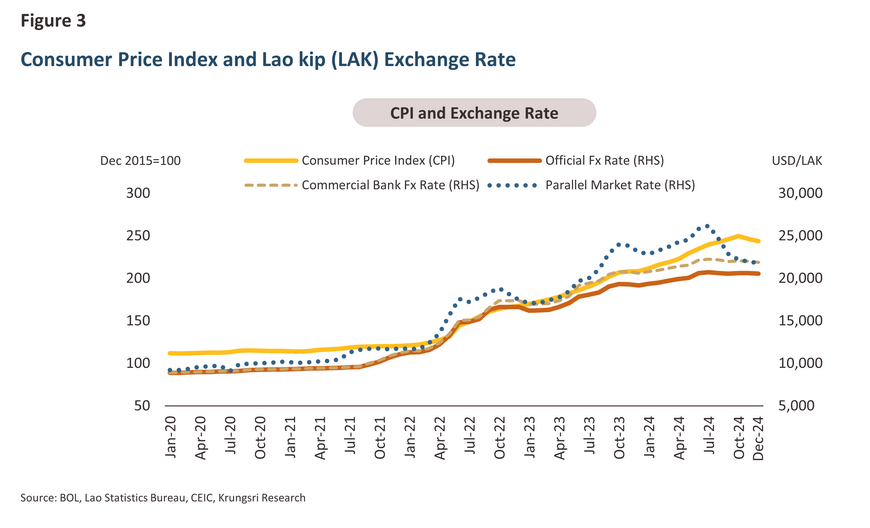

Between 2022 and 2024, the Lao kip depreciated by approximately 88.5%. In addition, the exchange rate in the parallel market weakened by 15–25% compared to the official rate set by the central bank. Given that most of Lao PDR’s debt is external and denominated in U.S. dollars, the country has faced a substantial increase in debt servicing costs. This has raised concerns about debt distress, further exacerbating the depreciation of the currency and creating a negative feedback loop that continues to impact the real economy (Figure 1).

The sharp depreciation of the Lao kip has significantly increased the cost of living for the population, as Lao PDR relies heavily on imports, which account for approximately 50% of its Gross Domestic Product (GDP). As a result, the country has experienced high inflation, averaging around 26% during the 2022–2024 period (Figure 3).

A study by the World Bank found that the depreciation of the Lao kip has negatively impacted private consumption, with a 1% depreciation potentially leading to a -0.6% decline in private consumption. Furthermore, Lao PDR’s limited fiscal space, due to its high debt burden, has restricted the government's ability to use fiscal policy tools to stimulate domestic consumption and investment.

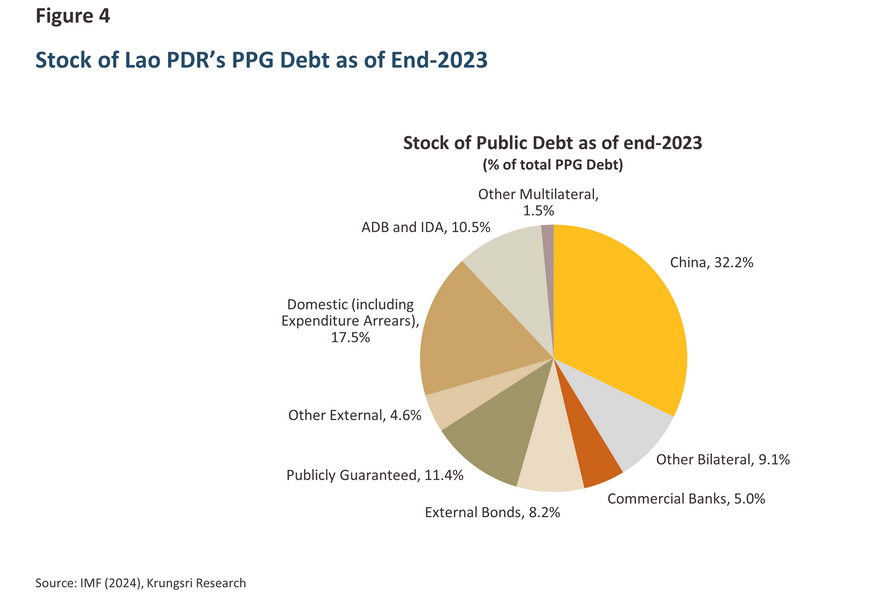

The International Monetary Fund (IMF) recently projected that Lao PDR' public debt will continue to rise over the next five years, reaching 126.7% of GDP by 2029, up from 108.3% in 2024. The proportion of foreign debt is expected to rise from 89.6% of total public debt in 2024 to 99.5% in 2029. The majority of these loans are sourced from China in U.S. dollars (Figure 4). Additionally, Lao PDR still has debt obligations to repay after requesting debt deferrals from China between 2020 and 20232/.

China’s Role in the Financial Stability of Lao PDR

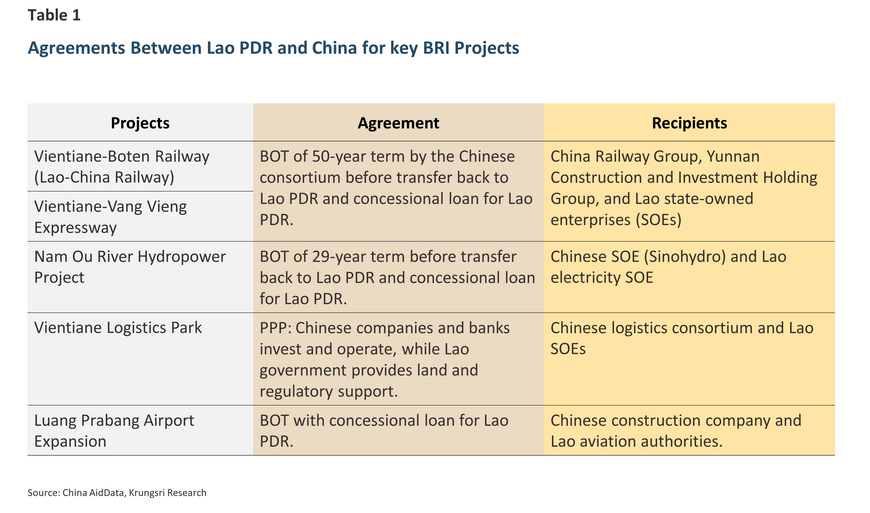

China plays a significant role in the economic development and financial stability of Lao PDR, primarily through loans provided to the country. Most of these loans are used to finance infrastructure projects related to the Belt and Road Initiative (BRI), such as railway construction, expressways, and hydropower plants3/. The lending is mainly in the form of bilateral loans, with China being Lao PDR’s largest creditor. According to the IMF, Lao PDR has borrowed approximately USD 5.5 billion from China, accounting for about 39% of its total external public debt as of the end of 2023. This highlights China's dominant role as the country’s main creditor. In addition to lending, China is also the largest foreign direct investor (FDI) in Lao PDR, with more than 900 investment projects worth over USD 13 billion4/.

However, most infrastructure investment agreements are structured as concession contracts, which include asset transfer conditions under the Build-Operate-Transfer (BOT)5/ model and Public-Private Partnership (PPP) arrangements (as shown in Table 1). Some projects, particularly hydropower plants, have failed to generate the expected profits, further exacerbating Lao PDR’s debt burden. Furthermore, the lack of transparency regarding agreements between the two countries has raised concerns about Lao PDR’s financial position, particularly regarding its ability to repay debts in the near future. This has heightened fears of a potential debt default, especially as Lao PDR has struggled to meet its debt obligations and has had to defer repayments to China in recent years.

Measures to Address Financial Stability Issues

Currently, Lao PDR is attempting to raise funds to repay its debt by selling state assets, such as shares in hydropower plants6/. While this measure may help alleviate financial pressure this year, it does not provide a sustainable solution to the debt problem.

Furthermore, the Lao government’s measures in 2023-2024 mainly focus on eliminating excess liquidity of the kip in the financial system to reduce pressure on the depreciation of the currency and manage high inflation7/. However, these measures have limitations due to the widespread use of foreign currencies (especially the U.S. dollar and Thai baht) and the underdeveloped financial market infrastructure. As a result, the transmission of policy to the economy is limited. Most importantly, Lao PDR’s economic stability will not improve through these policies, as the underlying issue stems from the high external debt, which has not been systematically addressed.

Risks Affecting the Economy and Stability of Lao PDR

Lao PDR is highly dependent on the external economy, given its high import ratio and sensitivity to global financial conditions. Therefore, significant external risks that could impact the economy include global economic slowdowns (such as trade policies under the Trump administration), rising commodity prices, including crude oil. If the U.S. dollar appreciates alongside these factors, it will inevitably increase Lao PDR's debt burden. These factors will exacerbate the weaknesses in Lao PDR's economy, including its high external debt, foreign currency shortages, and high cost of living.

In the medium term, the risk of Lao PDR’s debt default on its external debt will depend on debt negotiations with China. If there is a debt restructuring or partial debt relief, the risk may decrease. However, if the negotiations fail or China imposes stricter repayment terms, Lao PDR may inevitably face a foreign debt crisis.

Cambodia and its Domestic Stability Challenges

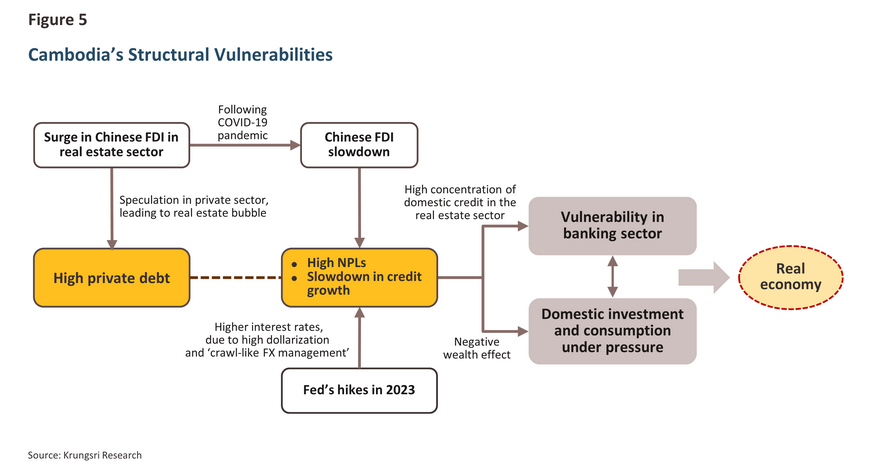

Cambodia is facing a slowdown in private credit growth and a rise in non-performing loans, reflecting the vulnerability of the banking sector stability and the impact of a property market bubble burst. Looking ahead, over-reliance on Chinese investment and geopolitical conflicts pose significant risks to the economy.

In terms of economic structure, Cambodia's economy is driven by exports8/ and is one of the ASEAN countries experiencing high growth. The IMF forecasts an average growth rate of about 6% over the next five years. However, in the financial sector, Cambodia is facing a high level of private sector debt along with a deterioration in the quality of assets within the banking sector.

Background of the Problem and Its Impact on the Real Economy

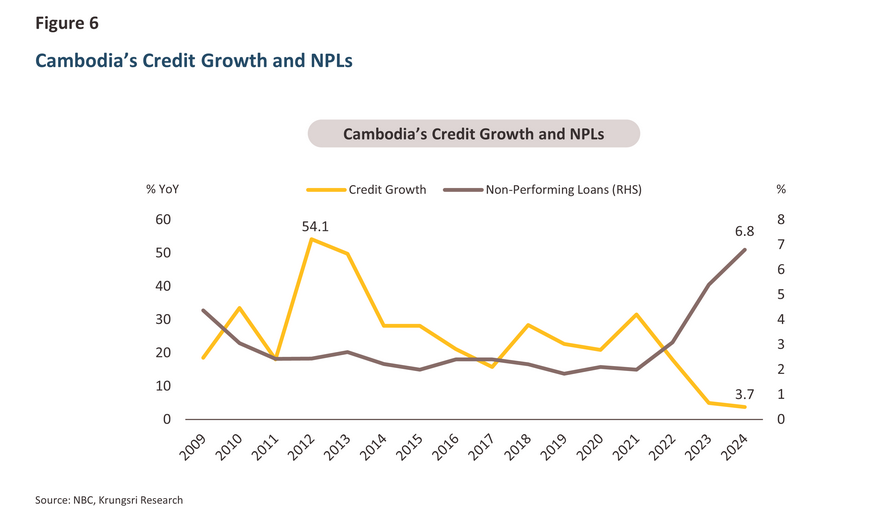

Between 2009 and 2021, Cambodia experienced rapid private credit expansion (an average of 27.2% annually), with over 30% of the total credit allocated to the real estate and construction sectors. However, after the COVID-19 crisis, particularly from 2022 onwards, credit growth slowed significantly to only 2.1% by the end of 2024 (Figure 6), as real estate activities contracted, and financial conditions tightened.

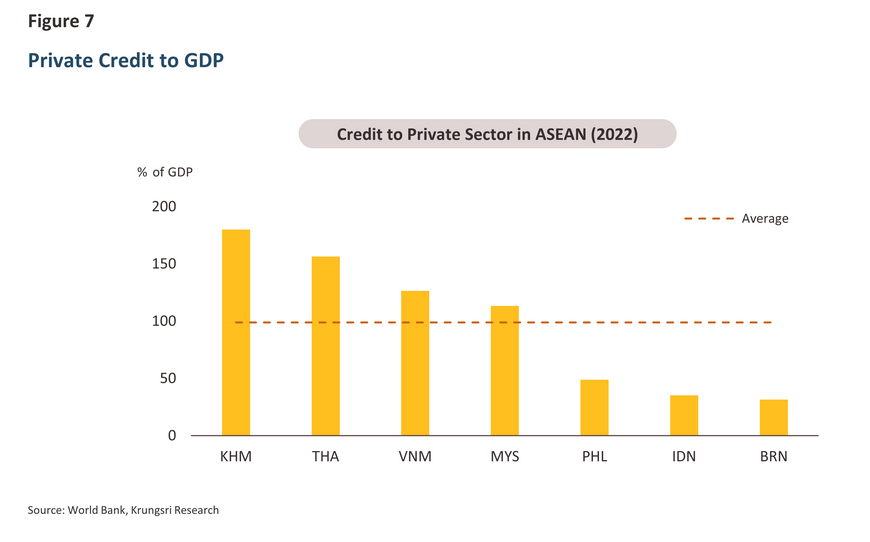

This situation has led to a rise in Non-Performing Loans (NPLs) in commercial banks from around 3% in 2022 to 6.8% by June 2024, reflecting a deterioration in the quality of bank assets. Furthermore, despite the slowdown in credit growth, the ratio of private sector debt to GDP (Private credit to GDP) remained high at 173% in 2026, which is considered very high relative to the country's level of development (Figure 7).

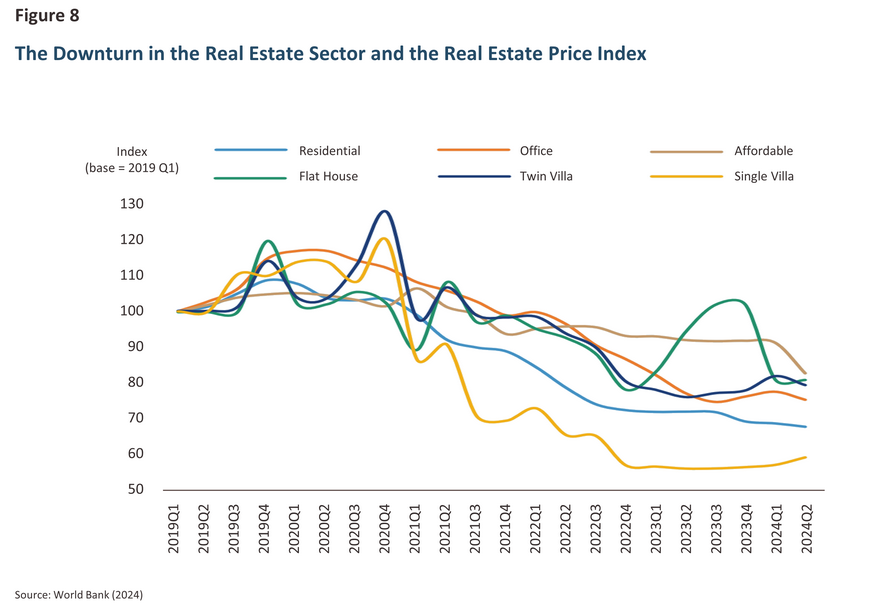

The financial instability has impacted economic activities, particularly consumption and investment. The recovery in domestic consumption, which accounts for about two-thirds of GDP, is limited by the prolonged downturn in the construction and real estate sectors. People’s wealth has been reduced due to falling real estate prices (Negative wealth effect). Moreover, the high level of household debt, with debt service-to-income (DSTI) at nearly 50% of income9/, is expected to further limit consumption. Investment in the private sector has also slowed down, particularly in construction and real estate activities. Although investment in Sihanoukville has continued to grow, it is not of high quality or sustainable.

China’s Role in the Financial Stability of Cambodia

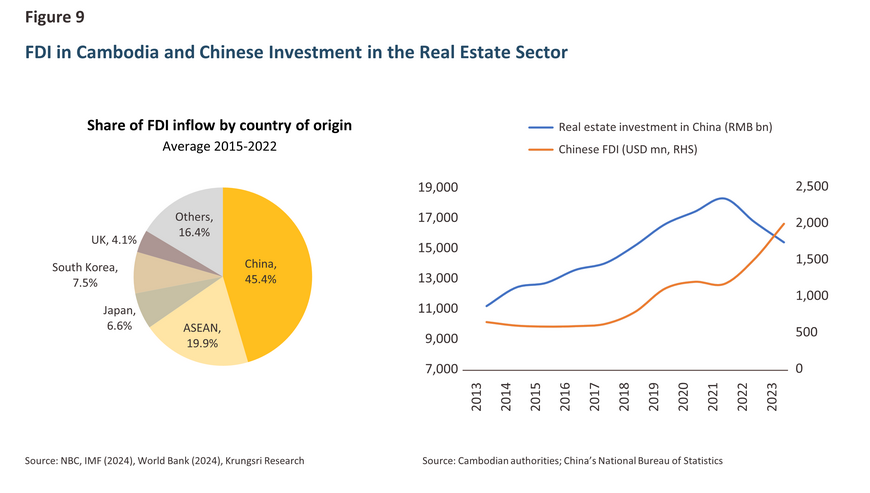

For Cambodia, China plays a key role as a source of FDI. Chinese FDI accounts for about half of Cambodia’s total FDI. Since the early 2010s, Cambodia has received large investments from China under the Belt and Road Initiative (BRI), particularly in the construction and real estate sectors (Figure 9).

Chinese investments have transformed the real estate market in Cambodia, especially in Sihanoukville and Phnom Penh, where housing prices have skyrocketed since 2017. Real estate developers and private investors borrowed from banks and informal financial institutions to purchase land and properties, hoping to profit from rising prices. This led to a rapid increase in private sector debt beyond levels suitable for the country’s economic development.

However, the COVID-19 crisis and the slowdown in Chinese investment have caused a significant decline in property prices, leading Cambodia's banking sector to face stability risks. Thus, while Chinese investments have spurred growth in real estate and construction activities, they have raised concerns about the over-reliance on Chinese capital, creating vulnerabilities in the financial sector.

Measures to Address Financial Stability Issues

The Cambodian government has yet to implement concrete policies to alleviate the problem of private sector debt. In the past, the National Bank of Cambodia has only assessed the financial status of households based on loan-to-value (LTV) ratios and debt-service-to-income (DSTI) ratios. Additionally, several laws have been enacted concerning capital requirements to strengthen the quality and quantity of capital held by financial institutions.

Risks Affecting the Economy and Stability of Cambodia

Cambodia is facing the risk of a property market bubble burst, reflected in the decline of land prices accompanied by a slowdown in the extension of credit to the real estate sector. At the same time, the rapid increase in NPLs indicates the fragile stability of the banking sector. Additionally, over-reliance on Chinese investment remains a significant risk factor for Cambodia’s economy. If China decides to reduce imports from Cambodia and cut back on foreign investments, especially in the real estate sector, industries related to real estate in the country would face a downturn, and this would have a continuing impact on the real economy. According to a World Bank study, a 1% slowdown in China’s economy could reduce Cambodia’s economic growth by about 0.6% within a year.

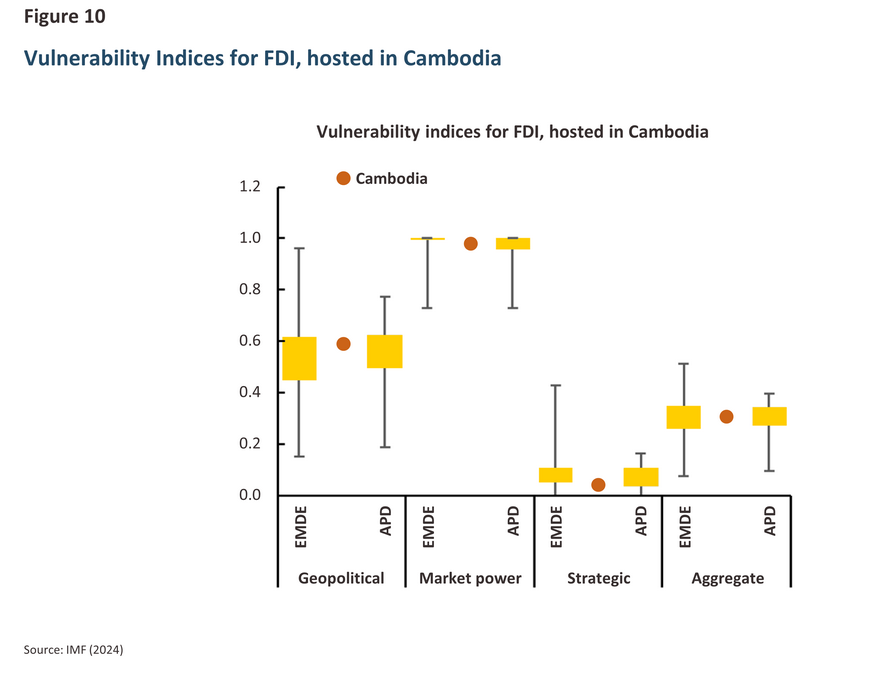

Moreover, geopolitical conflicts and trade disputes could also affect FDI in Cambodia. An IMF study has shown that when considering geopolitical distance and market power, Cambodia is more vulnerable to foreign direct investment than other developing countries and many countries in Asia (Figure 10).

Differences and Common Factors of Financial Stability Issues in Lao PDR and Cambodia

Lao PDR and Cambodia are both facing financial stability issues that impact the real economy. The factors contributing to their current vulnerabilities are both distinct and shared, including the background of the problems, economic structures, and the risks they may face in the future.

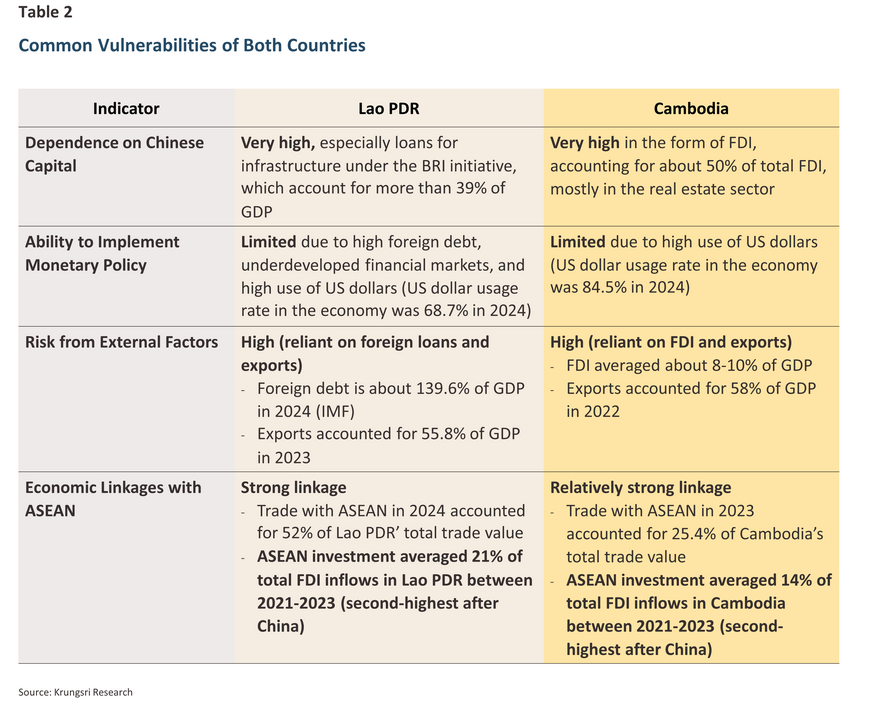

In this section, the financial stability issues of both countries will be analyzed, focusing on the shared factors and differences they are facing through the analysis of key indicators as shown in Table 2.

From the table above, we can summarize the common vulnerabilities of both countries as follows:

-

Excessive Dependence on Chinese Capital: While the forms of investment from China differ, both countries rely heavily on Chinese capital. In Lao PDR, there are more than six investment projects10/ related to the BRI, with a value of over USD 5.5 billion in loans from China. Cambodia has a particularly high proportion of FDI from China, with more than half of the foreign capital coming from China, primarily in the real estate and construction sectors.

-

Constraints on Monetary Policy: The high use of US dollars, as well as the high foreign debt burden in Lao PDR, limits the central bank's ability to control domestic price stability. Additionally, Cambodia's extremely high financial dollarization forces the central bank of Cambodia to follow the US Federal Reserve’s monetary policies, severely limiting its ability to manage the domestic money supply.

-

Vulnerability to External Factors (High external exposure): Both countries’ economic structures are highly sensitive to external factors. Lao PDR is vulnerable to global financial conditions through exchange rates, and both countries are exposed to external demand and investment from China.

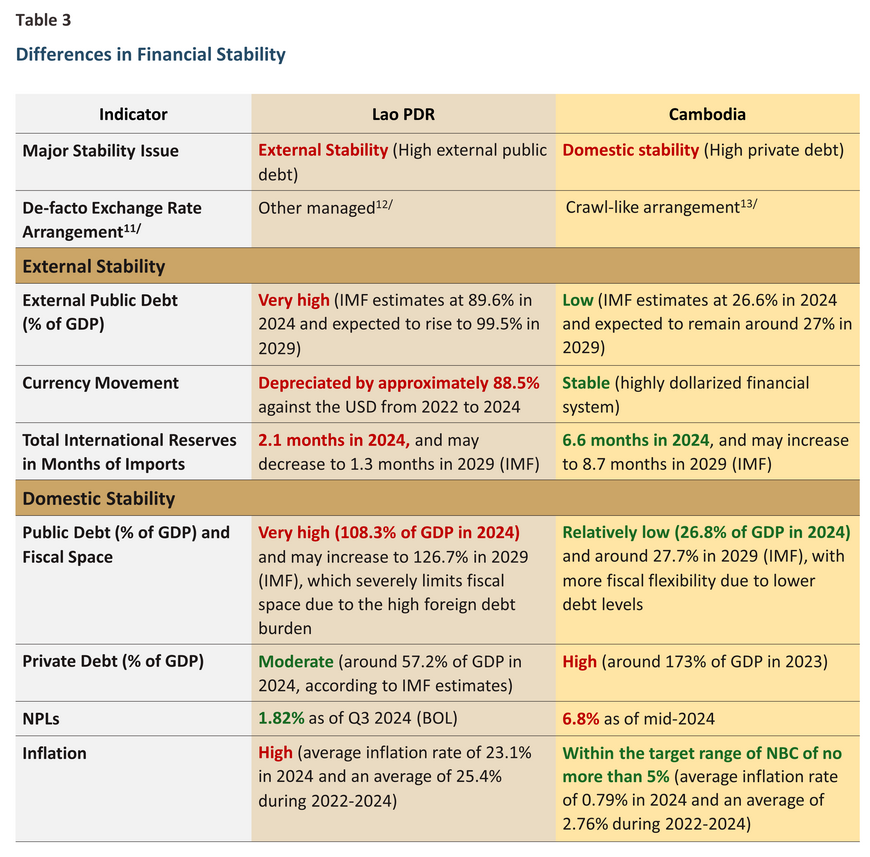

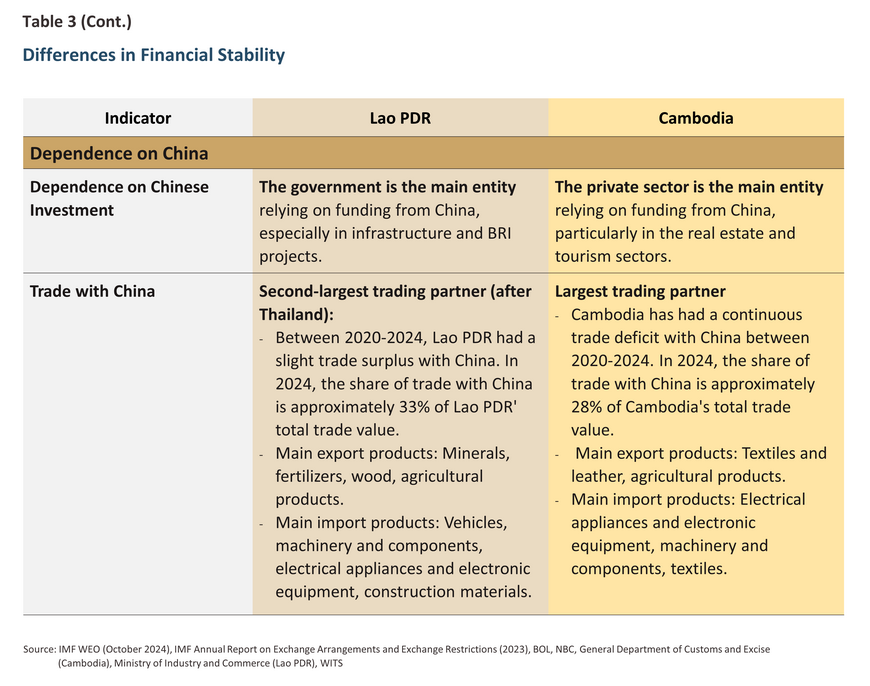

Despite these shared risk factors, Lao PDR and Cambodia have distinct vulnerabilities, as shown in Table 3.

The main differences can be summarized from the table above as follows:

-

External vs. Internal Stability: Lao PDR faces vulnerabilities in the financial sector mainly due to external factors, particularly public debt (almost all of which is foreign debt) at a high level, reflecting the reliance on borrowing from China for infrastructure projects. On the other hand, Cambodia's financial risk stems from the private sector, where the real estate market, which grew rapidly due to the influx of Chinese capital, led to growth in private sector loans, often driven by speculative investments.

-

Exchange Rate System and Price Stability: The movement of the Lao kip is largely aligned with market forces, partly due to Lao PDR having low foreign reserves, which limits its ability to intervene in the exchange rate. This has led to depreciation of the kip, creating inflationary pressure and increasing foreign debt burdens. In contrast, Cambodia has a high level of financial dollarization, meaning the riel exchange rate remains relatively stable against the US dollar.

-

Fiscal Space: Cambodia has greater fiscal flexibility, while Lao PDR faces fiscal constraints due to high debt levels. This results in Lao PDR having limited fiscal capacity to cope with an economic slowdown.

-

Pattern of Chinese Investment: In Lao PDR, Chinese investments are largely driven by the government, focusing on large-scale projects such as hydropower plants and railways, which are managed by Chinese state-owned enterprises. This has resulted in Lao PDR having high debt to China. In contrast, Cambodia receives funding from China mainly through the private sector, focusing on real estate, casinos, and tourism in areas such as Sihanoukville and Phnom Penh.

Krungsri Research View

Attracting foreign investment is crucial for the development of emerging economies like Lao PDR and Cambodia. However, over-reliance on investment from a single source without proper diversification and quality funding has led to vulnerabilities in the financial sectors. Lao PDR is facing foreign debt issues, while Cambodia is encountering high private sector debt, particularly in real estate.

The risk outlook for Lao PDR remains relatively high and uncertain, as in 2024, the Lao government must begin repaying some of its debt to China after deferring payment from 2020-2023. Meanwhile, the domestic economy is under pressure from high living costs, and the global economy is becoming riskier. Therefore, a key factor will be negotiating debt restructuring with China; otherwise, debt default may occur, which would impact confidence and the overall economy both domestically and regionally.

For Cambodia, its economy remains highly vulnerable to external shocks due to the high level of private sector debt and deteriorating asset quality in the banking sector. In sectors with high borrowing, especially real estate, and wholesale and retail, there are solvency risks if there is pressure from high interest rates and declining profits in these sectors. This could lead to systemic risks, impacting the entire economy and financial system of the country.

If the vulnerabilities and risks in both countries become more pronounced, they could impact Thailand and ASEAN through trade, investment, and investor confidence, as follows:

-

If a debt crisis occurs in Lao PDR, border trade and electricity exports to neighboring countries (such as Thailand and Vietnam) will be affected, increasing business operating costs. Moreover, investors in Lao PDR, especially in logistics, energy, and retail businesses, may need to reduce investment due to economic policy uncertainties and exchange rate volatility.

-

If systemic risks arise in Cambodia, it will lead to a contraction in economic activities. If commercial banks face significant defaults, liquidity in the financial system will be reduced, impacting credit supply to other businesses and pulling down domestic consumption. This event will affect Thailand and ASEAN as a whole, as Cambodia is an important export market and investment source for many countries in the region14/.

-

Furthermore, a crisis in Lao PDR and Cambodia could undermine confidence in ASEAN as a dynamic and investable region. The impact on other countries in the region may be limited due to both countries' relatively small economies and limited financial linkages with other ASEAN countries. In addition, most countries in the region have domestic factors that continue to drive economic growth, and their financial systems remain relatively stable.

Therefore, if these issues are not appropriately addressed, both countries, already on the edge of stability, could face a triggering event that severely impacts their domestic economies. Although these challenges are largely domestic and may not spread to other ASEAN countries, Thailand, with its significant economic ties to both nations, may experience a diminished role as a sub-regional hub and be more affected than other countries in the region. Furthermore, the instability in Lao PDR and Cambodia, which presents significant risks and high uncertainty, could weaken investor confidence in ASEAN and potentially impede the region’s long-term economic growth.

References

International Monetary Fund. (2023, May 22). Lao People's Democratic Republic: 2023 Article IV Consultation Staff Report. Retrieved from https://www.imf.org/-/media/Files/Publications/CR/2023/English/

1LAOEA2023001.ashx

International Monetary Fund. (2024, December 19). Annual Report on Exchange Arrangements and Exchange Restrictions 2023. doi:https://doi.org/10.5089/9798400260391.012

International Monetary Fund. (2024, January 31). Cambodia: 2023 Article IV Consultation Staff Report. Retrieved from https://www.imf.org/-/media/Files/Publications/CR/2024/English/1KHMEA2024001.ashx

International Monetary Fund. (2024, November 8). Lao People's Democratic Republic: 2024 Article IV Consultation Staff Report. doi:https://doi.org/10.5089/9798400293283.002

International Monetary Fund. (2025, January 27). Cambodia: 2024 Article IV Consultation Staff Report. doi:https://doi.org/10.5089/9798400299711.002

Khaosan Pathet Lao (KPL). (2023, November 15). China invests more than 900 projects in Laos.

Kuik, C.-C., & Rosli, Z. (2023). Laos-China infrastructure cooperation: legitimation and the limits of host-country agency. Journal of Contemporary East Asia Studies, 32-58. doi:https://doi.org/10.1080/24761028.

2023.2274236

World Bank. (2020). From Landlocked to Land-Linked: Unlocking the Potential of Lao-China Rail Connectivity. Retrieved from https://hdl.handle.net/10986/33891

World Bank. (2024, December 16). Cambodia Economic Update, December 2024: From Recovery to Resilience: Harnessing Tourism and Trade as Drivers of Growth. Retrieved from http://hdl.handle.net/10986/42539

World Bank. (2024, April 29). Lao PDR Economic Growth : Accelerating Reforms for Growth - Thematic Section : Education for Growth and Development. Retrieved from http://documents.worldbank.org/curated/en/

099042724011042913

World Bank. (2024, November 7). Lao PDR Economic Monitor: Reforms for Stability and Growth. Retrieved from https://thedocs.worldbank.org/en/doc/5c2594a0cc6846465fe3bafda50ad993-0070062024/related/

LEM-October-2024-Final.pdf

ศูนย์ข้อมูลเพื่อธุรกิจไทยในลาว Business Information Center (BIC). (2021, March 1). จีนลงทุนใน 16 เขื่อนผลิตไฟฟ้า และ 79 กิจการเหมืองแร่ใน สปป. ลาว.

1/ With export shares of 30%, 27%, and 24% of Lao PDR' total exports in 2024, respectively (according to the Lao PDR Ministry of Industry and Commerce).

2/ Although the government has not publicly disclosed information regarding the debt deferment, the IMF estimates that the debt deferred to China from 2020 to 2023 has accumulated to approximately USD 1.9 billion. In 2023, Lao PDR was scheduled to repay USD 150 million in principal, while the principal and interest deferred from 2020 to 2022 are expected to be postponed until 2027 but will be fully paid in the long term.

3/ By the end of 2020, Chinese companies had invested in 11 hydropower development projects in Lao PDR, with 44% of the installed capacity dedicated to electricity sales for domestic use. Additionally, there were 79 geological and mining ventures, and the Lao government had approved investments for Chinese investors to explore and process minerals in 67 projects. There was also investment in renewable energy power plants (solar and wind), as well as in two special economic zones. (https://thaibizLao PDR.com/lao/news/detail.php?cate=news-hilight&id=22165)

4/ https://kpl.gov.la/EN/detail.aspx?id=78213

5/ The investment model in which the private sector constructs and operates a project for a specified period before transferring it back to the government.

6/ The Lao government plans to raise funds for debt repayment in 2024-2025. One of the main methods, in addition to negotiating an extension of the repayment period with China, is the sale of state assets, particularly shares in hydroelectric power plants. It is expected that the government will raise USD 300 million from asset sales in 2024 and USD 600-700 million in 2025.

7/ The measures include raising the policy interest rate from 6.5% to 10.5% over the course of two years, increasing the reserve ratio for banks, and issuing short-term bonds to help improve liquidity in the money market.

8/ Especially in textiles and footwear, as well as the tourism sector, with the United States as the top trading partner, followed by the European Union.

9/ World Bank (December 2024)

10/ The 6 types of projects include railway projects, road construction projects, hydropower plants, special economic zones, mining projects, and agricultural sector projects.

11/ The exchange rate management system, in a de facto manner, is determined by IMF officials, which may differ from the official exchange rate system (de jure).

12/ The official exchange rate management system (de jure) of Lao PDR is a managed float system. However, increased pressure on the currency since 2022 has led the central bank to allow the kip to move more in line with the market. As a result, the IMF classifies the exchange rate system in de facto terms as 'other managed,’ a category used for exchange rate regimes that do not meet the criteria of other categories and are typically used when policy changes occur frequently.

13/ Due to the high financial dollarization, the National Bank of Cambodia has intervened in the foreign exchange market to support the demand for riel and maintain exchange rate stability. Since March 2022, the exchange rate has been gradually depreciating within a set band, which aligns with the criteria for a 'crawl-like arrangement' exchange rate regime, where the spot exchange rate is controlled to move within a band of 2% for at least six months.

14/ Thailand's main exports to Cambodia include refined petroleum, consumer goods, vehicles, and construction materials.