Executive summary

Green tokens are a type of digital asset intended to raise capital from investors or token holders and invest in environmental projects. In exchange, green tokens offer a share of potential profits as agreed. They fall under the category of sustainability-focused digital tokens and are regulated by the Securities and Exchange Commission (SEC). With their distinctive feature of being divisible into smaller units, green tokens make it easier for environmental projects to access funding while enabling investors to directly participate in supporting environmental initiatives. They also represent an efficient and relatively transparent form of fundraising. Although the green token market still faces several challenges due to the novelty of digital token fundraising, green tokens can be another driving force in promoting the country's transition to a green economy.

Understanding Green Tokens

The world is currently facing climate change risks in multiple dimensions, with Thailand being particularly affected by rising average temperatures and increasingly severe floods and droughts each year. These challenges impact both people's livelihoods and the country's overall economy. As a result, the government, private sector, and the public are working together to support climate goals and implement adaptation measures. According to data from the United Nations Development Programme (UNDP),1/ a major challenge shared by all sectors in Thailand is access to funding.

Therefore, the financial sector can play a crucial role in helping each sector prepare for global warming through sustainable investing2/ or investments in activities that reduce carbon dioxide emissions and other greenhouse gases. This approach has gained increasing attention in recent years. Interest in sustainable investing spans a wide range of investment forms, including traditional options such as mutual funds, bonds, and stocks, as well as alternative investments like environmental digital tokens.

What are Green Tokens and Their Origins

Green tokens refer to digital tokens issued with the purpose of using the funds raised from their sale to invest in environmental projects.6/ They fall under the category of sustainability-focused digital tokens, alongside Social tokens, Sustainability tokens, and Sustainability-linked tokens. These sustainability-focused digital tokens align with the vision7/ of the Securities and Exchange Commission (SEC), which aims to expand the range of sustainability-related products that Thailand ESG Fund (ThaiESG)8/ can invest in.

Green tokens focus on raising funds for environmental projects, including projects that reduce or capture greenhouse gas emissions, such as renewable energy projects, electric vehicles, forestation or reforestation, Renewable Energy Certificates (REC), carbon credits,9/ and projects that invest raised funds in green bonds.

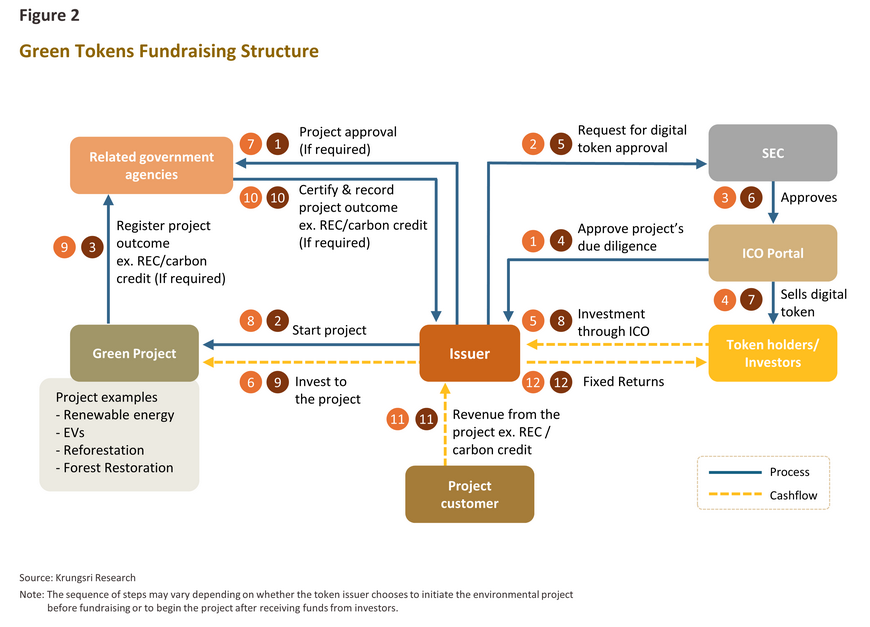

For the Initial Coin Offering (ICO) process of green tokens (Figure 2), the token issuers will operate according to the prospectus, which includes coordinating with relevant agencies to obtain necessary licenses and initiating and implementing environmental projects to achieve contracted outcomes. Additionally, the issuers are responsible for managing the project’s financial flow, including investment funds received from investors through green token offerings, revenue generated from environmental projects, and returns payable to investors as agreed. Meanwhile, ICO Portal10/ service providers, certified by the SEC, will screen the characteristics of the digital tokens and assess the qualifications of issuers. They will also serve as the initial offering channel for investors. After the offering, issuers must disclose project-related information as specified until the project expires. This includes project progress updates and impact reports, which must be provided to investors at least annually.

Benefits and Importance of Green Tokens

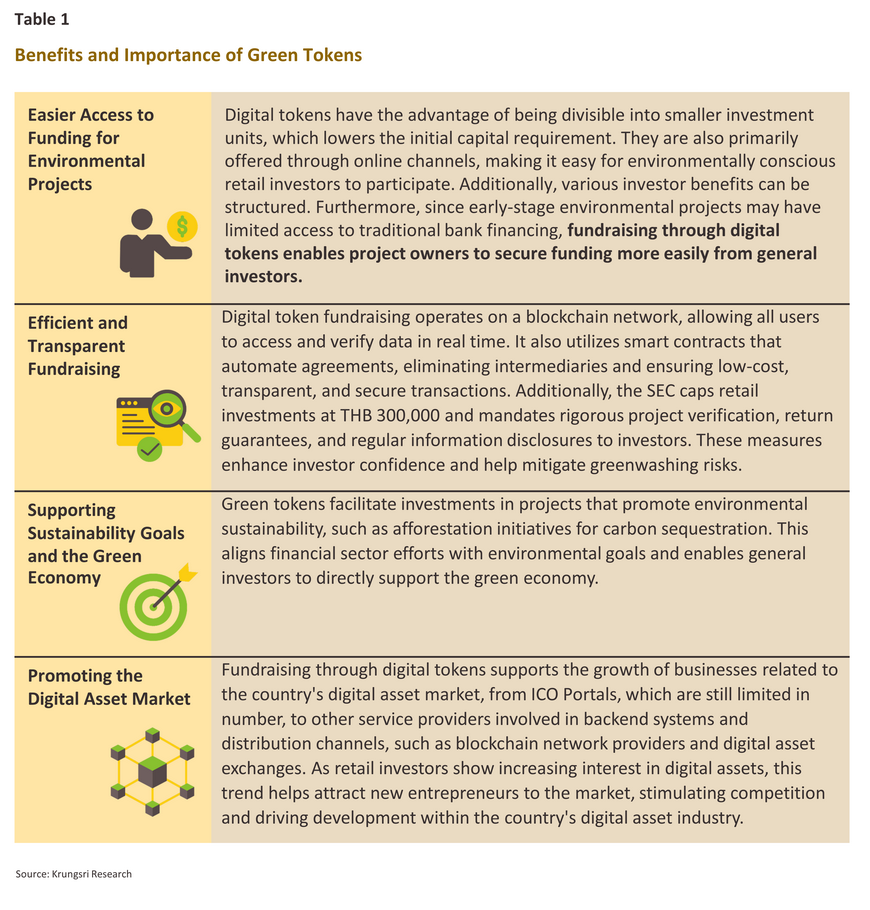

Currently, the allocation of funds for environmental purposes or Green Financing still faces several challenges,11/ particularly issues like greenwashing and the high initial capital requirements that prevent individual investors from independently investing in these environmental projects. Moreover, project owners must bear significant costs related to transactions and project monitoring. Fundraising through digital tokens can help mitigate these challenges (Table 1), while also expanding investment opportunities for both project owners and general investors, ultimately contributing to the development of a Green Economy12/ at the national level.

Current Situation and the Role of Financial Institutions

Global Context

Internationally, funding for environmental projects through digital tokens remains limited due to legal restrictions in some countries and the absence of unified environmental standards. However, with continuous investment and development, governments and financial institutions worldwide--especially in North America, Europe, and Asia--have begun exploring tokenized financial assets,13/ such as bonds and mutual funds. These assets share similarities with investment tokens, aiming to raise funds in exchange for agreed-upon returns, such as revenue shares or interest.

One notable example of a tokenized financial asset for environmental projects is Hong Kong’s Green Bond Framework.14/

As a regional leader in financial technology, Hong Kong has prioritized innovation. In collaboration with the Bank for International Settlements (BIS) Innovation Hub, the Hong Kong Monetary Authority tested tokenized green bonds through Project Genesis in 2021. Subsequently, in February 2023, the Hong Kong government issued the world’s first tokenized green bond, worth HKD 800 million. In 2024, Hong Kong issued its first multi-currency tokenized green bond with varying interest rates, totaling HKD 6 billion, across HKD, RMB, USD, and EUR. This issuance attracted global investor interest. Proceeds from these bonds will fund environmental projects under Hong Kong’s Green Bond Framework.

Although the Hong Kong government pioneered the tokenized green bond project, financial institutions played crucial roles as distributors, custodians, and tokenization platform providers. For example, Goldman Sachs’ GS DAP™ platform and HSBC’s Orion platform supported the first and second issuance of the bonds, respectively.

Thai Context

As of December 15, 2024, Thailand has yet to see any green tokens offered to investors. However, some interested parties have already submitted prospectuses to the SEC. Thai entrepreneurs involved in businesses or projects supporting the environment are increasingly interested in raising funds through digital tokens, particularly for projects related to Renewable Energy Certificates (REC) and carbon credits. Under these projects, token issuers will use the funds raised to invest in projects that generate these certificates or purchase them directly from environmental projects, then offer fixed returns to token holders upon selling the certificates.

Example: A token issuer seeks to raise funds for a reforestation project aiming to benefit from generated carbon credits through a green token. The initial coin offering (ICO) will not exceed THB 350 million, with proceeds covering project expenses such as seedling costs, carbon credit certification, and transaction fees. According to the prospectus, token holders will begin receiving returns once carbon credit sales commence, expected in the 6th and 10th years after the project's launch. Each digital token represents one tonne of carbon dioxide equivalent (tCO2e), meaning that holding one token entitles the investor to returns from selling one tCO2e of carbon credits. The return rate depends on the number of tokens held and the carbon credit price at the time of sale. During the holding period, investors can trade tokens on the secondary market. After selling carbon credits in the 10th year, the issuer will burn the tokens once the project concludes. (Figure 3)

If the project fails to generate sufficient carbon credits to match the number of digital tokens issued, the issuer must acquire carbon credits from other certified environmental projects to compensate token holders. In cases where the project cannot proceed, the issuer must repay token holders with both principal and compounded interest as outlined in the prospectus.

As investment tokens have been present in Thailand for some time, fintech companies and subsidiaries of financial institutions play significant roles in the token issuance process. These roles include serving as ICO Portals. As of December 20, 2024, Thailand has eight licensed ICO Portal providers15/ approved by the SEC. Additionally, the SEC mandates that digital tokens backed by real estate involve a licensed trustee.16/ Trustees are responsible for overseeing the actions of token issuers, safeguarding the rights of token holders, and holding real estate assets under a passive trust structure. Currently, there are four asset management companies17/ in Thailand licensed to operate as trustees.

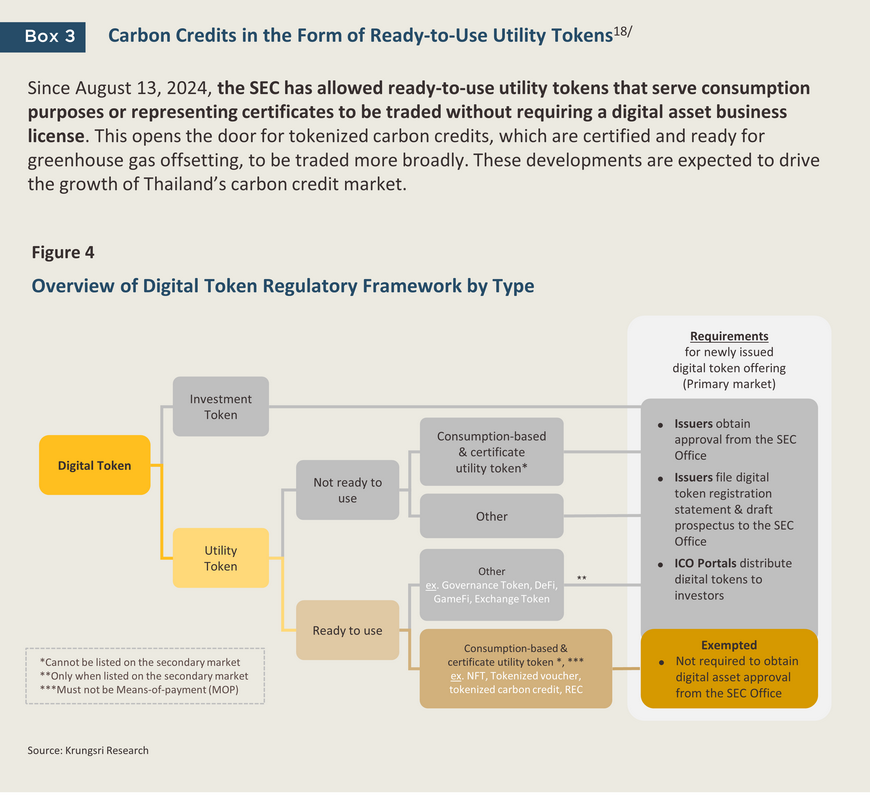

Apart from green tokens as investment vehicles, the SEC is also promoting the carbon credit market by revising regulations concerning ready-to-use utility tokens. These adjustments aim to expand the scope of carbon credit trading (Box 3).

Opportunities and Challenges for Green Tokens in Thailand

Opportunities

-

Supportive Law and Policies: Relevant authorities, particularly the SEC, encourage the growth of green tokens by refining digital asset regulations and waiving licensing fees for sustainability-focused token offerings for one year, starting June 1, 2024. The government has also incentivized investment in environmental projects by aligning national policies toward achieving carbon neutrality by 205019/ and offering tax benefits to investors in Thai ESG funds, which focus on equities, bonds, and green tokens. Additionally, dividends or benefits from holding investment tokens received from January 1, 2024, are exempt from personal income tax after a 15% withholding tax is deducted.20/

-

Digital Asset Market Infrastructure and Ecosystem: In addition to Thailand’s fast, convenient, and easily accessible digital payment system, both the public and private sectors are continuously developing the digital asset market ecosystem. This is particularly important as more new players enter the market, whether as providers of related technologies, ICO portals, or digital asset custodial wallet providers.

-

Growing Awareness of Environmental and Sustainable Investments: Thai investors are increasingly interested in sustainable investments, as reflected in the rising number21/ of listed companies in the SET-ESG list, spanning various industries. Additionally, a survey by UOB Bank22/ found that Thai investors have the highest interest in environmentally focused investments in the ASEAN region. This growing awareness presents opportunities for increased investment in sustainability-focused digital tokens.

Challenges

-

Regulatory Barriers for Small-Scale Token Issuers: Although the government has implemented policies to support the issuance of sustainability-focused digital tokens, regulatory requirements remain a challenge for smaller issuers. To ensure investors receive returns as promised, token issuers must comply with strict regulations, such as providing a guarantee mechanism in case a project fails to meet its commitments. As a result, issuers must demonstrate sufficient liquidity or have strong backing from a parent company to obtain approval for token offerings.

-

Limited Market Participants: Since Thailand’s digital token market is still in its early stages, the number of businesses involved in digital token offerings remains low. As a result, fundraising through digital tokens faces less competition compared to traditional investment methods, reducing the urgency for existing players to drive rapid innovation.

-

Digital Tokens Are Still New and Complex: Since digital token fundraising in Thailand is still in its infancy and environmental-focused projects, as underlying assets, differ significantly from traditional assets, there are complexities that must be addressed in the future, particularly in risk assessment for both investors and token issuers. If a project is affected by natural disasters, current regulations do not yet provide comprehensive protections for token issuers. Additionally, the secondary market for digital tokens has limited liquidity, posing further investment risks. There are also concerns regarding value-added tax (VAT) implications for both issuers and buyers. Furthermore, a lack of investor knowledge and understanding about digital tokens could lead to hesitation in participating, and if project returns or benefits are not attractive enough, it may be difficult to draw in new investors.

-

Regulations on Digital Assets and Environmental Policies May Change: Both environmental agencies and financial regulators may need to adjust digital token regulations to accommodate new environmental-focused projects in the future. This means token issuers and project owners must spend additional time studying regulatory changes and preparing for compliance. As a result, both regulators and digital token issuers must continually adapt to evolving rules while ensuring effective communication regarding any policy changes.

Krungsri Research view

Green tokens are an innovative tool that enables the general public to support sustainability projects. A key advantage of digital tokens is their fundraising model, which allows retail investors to directly invest in specific 'projects' of interest without needing to invest in or be tied to the issuing company. Although the market is still in its early stages, with limited participants and activity, it has the potential to grow if supported by regulatory factors and increasing public interest in environmental and sustainability issues.

The government can play a role in supporting the growth of green tokens in several ways, including raising public awareness about digital token investments, offering direct tax incentives for investors in green tokens, and implementing protective measures for both investors and issuers. This could involve establishing an environmental project guarantee system, particularly in cases where projects cannot proceed due to natural disasters, which may require collaboration with the insurance industry. Such measures would enable smaller token issuers without large corporate backing to raise funds through green tokens. Additionally, the government can support mechanisms for measuring, reporting, and verifying (MRV) greenhouse gas emissions, ensuring that businesses can easily access these tools.

In parallel, green token issuers might also consider adjusting investment unit sizes to make them more accessible to retail investors, developing user-friendly investment platforms, and incorporating marketing incentives beyond financial returns. For example, investors could be given opportunities to participate in reforestation projects, such as tree planting, or receive eco-themed memorabilia to engage environmentally conscious communities. Additionally, forming partnerships with like-minded organizations could foster new collaborations. These strategies may help attract more investors to digital tokens and make environmental project investments more inclusive, fostering competition and development in both the digital asset market and the country’s green economy.

On the other hand, the token issuance via blockchain networks, particularly some consensus algorithms, requires substantial energy consumption. Moreover, tokenization and blockchain technology rely on specialized hardware and electronic devices, which may generate electronic waste that poses environmental risks if not properly managed. Therefore, digital token fundraising for environmental projects must consider both the benefits and potential impacts across the entire value chain. Currently, token issuers have more sustainable options, such as energy-efficient consensus mechanisms or ‘environmentally friendly’ blockchains powered by renewable energy. Additionally, issuers can offset carbon emissions from the token issuance process by purchasing carbon credits, ensuring that funded projects align with comprehensive sustainability goals.

Overall, green tokens have the potential to support the growth of the country’s green economy by providing funding opportunities for environmental projects while enabling broader investor participation. However, beyond the ongoing development of digital asset regulations, environmental policies must also evolve in parallel to ensure that digital token fundraising genuinely serves environmental objectives.

References

Morgan Stanley. (2018). Could Sustainable Investing be the Key to Our Survival? Morgan Stanley. Retrieved from https://www.morganstanley.com

Hong Kong Monetary Authority. (2023). HKMA. Retrieved from https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/02/20230216-3/ HKSAR Government’s Inaugural Tokenised Green Bond Offering [Press release].

Hong Kong Monetary Authority. (2024). HKSAR Government’s Digital Green Bonds Offering [Press release]. HKMA. Retrieved from https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/02/20240207-6/

Rooz, Y. (2024). How tokenization is transforming global finance and investment. World Economic Forum. Retrieved from https://www.weforum.org/stories/2024/12/tokenization-blockchain-assets-finance/

Schletz, M., D. Nassiry, and M.-K. Lee. (2020). Blockchain and Tokenized Securities: The Potential for Green Finance. Tokyo: Asian Development Bank Institute. Retrieved from https://www.adb.org/publications/blockchain-tokenized-securities-potential-green-finance

The Revenue Department. (2024). กรมสรรพากรออกมาตรการภาษีเพื่อส่งเสริมการระดมทุนด้วยโทเคนดิจิทัลเพื่อการลงทุน (Investment Token) [Press release]. The Revenue Department. Retrieved from https://www.rd.go.th/fileadmin/user_upload/news/2567thai/news14_2567.pdf

The Securities and Exchange Commission (SEC). (2024). ก.ล.ต. ปักหมุดพัฒนาตลาดทุนเพื่อความยั่งยืน ส่งเสริมการซื้อขาย “คาร์บอนเครดิต”[Press release]. SEC. Retrieved from https://www.sec.or.th/TH/Pages/News_Detail.aspx?SECID=11130&NewsNo=11130&NewsYear=11130&Lang=11130

The Stock Exchange of Thailand (SET). (2024). ส่องเทรนด์แห่งการลงทุนยุคใหม่ ในโลกของ Digital Token. SET Invest Now. Retrieved from https://www.setinvestnow.com/th/knowledge/article/459-new-investment-trend-world-of-digital-token

United Nations Development Programme Thailand. (2024). เมื่อโลกร้อนใครๆ ก็รู้ แต่ประเทศไทยทำอะไรอยู่เพื่อแก้ไขปัญหา? ชวนจับตาดูแผนงานระดับชาติ!. UNDP. Retrieved from https://www.undp.org/stories-climate-master-plan-th

Zezas, M. (2023). 3 Investing Trends for the Long Term. Morgan Stanley. Retrieved from https://www.morganstanley.com/ideas/global-investing-themes-2023

Zezas, M. (2024). Three Investing Trends for 2024 and Beyond. Morgan Stanley. Retrieved from https://www.morganstanley.com

1/ https://www.undp.org/stories-climate-master-plan-th

2/ an investment strategy that mobilizes capital in consideration of Environmental, Social and Governance (ESG) factors.

3/ For further reading, see “The role of banks in the new world of NFTs”

4/ Digital tokens offered through a shelf filing must have underlying assets of the same type as specified by the SEC, including projects in the soft power industries, such as music, film, theater, and art. Those who are authorized will be able to offer the tokens without limits on value or the number of offerings within a 2-year period.

5/ For further reading, see “Banking and blockchain technology”

6/ https://ratchakitcha.soc.go.th/documents/30916.pdf

7/ https://moneyandbanking.co.th/2024/110251/

8/ A mutual fund focused on investing in businesses that operate with consideration for environmental, social, and governance (ESG) factors, offering personal income tax deductions as a benefit to investors. Eligible assets under the program include Thai stocks, Thai government bonds or debt instruments, and investment digital tokens.

9/ For further reading, see “Carbon Credit”

10/ The ICO Portal is responsible for screening the characteristics of digital tokens to be offered to investors and serving as the offering channel. The list of authorized ICO Portals can be verified on the website of the Securities and Exchange Commission (SEC).

11/ For further reading, see “Green Financing: Accelerating the Green Transition” and https://www.adb.org/sites/default/files/publication/566271/adbi-wp1079.pdf

12/ An approach that focuses on economic development alongside environmental conservation.

13/ https://www.weforum.org/stories/2024/12/tokenization-blockchain-assets-finance/

14/ https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/02/20230216-3/, https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/02/20240207-6/

15/ As of Dec 20, 2024

16/ the party that receives the transfer of asset rights from the trust manager under the trust establishment agreement. The trustee is responsible for managing the assets for the benefit of the trust beneficiaries. The trustee must be independent of the trust founder and must hold a trustee business license issued by the Securities and Exchange Commission (SEC).

17/ As of Dec 20, 2024

18/ https://www.sec.or.th/TH/Pages/News_Detail.aspx?SECID=11130&NewsNo=11130&NewsYear=11130&Lang=11130, https://www.infoquest.co.th/2023/270381

19/ https://policywatch.thaipbs.or.th/article/environment-79

20/ https://www.rd.go.th/fileadmin/user_upload/news/2567thai/news14_2567.pdf

21/ https://www.setinvestnow.com/th/knowledge/article/459-new-investment-trend-world-of-digital-token

22/ https://www.uob.co.th/investor-en/news/press-news/2022/news-8-8-2022.page#tab2