Introduction

Trade tensions and trade barriers between the United States and China have led to changes in global supply chains and the dynamics of international trade. One of the key strategies manufacturers are using to mitigate risk is the "China+1" approach. This means businesses are expanding their production bases to other countries to reduce reliance on China alone. The ASEAN region has emerged as a significant destination for investors relocating their production bases, representing a major opportunity for countries looking to attract investment.

This study aims to analyze developments in international trade and foreign direct investment (FDI) following the intensification of U.S.-China trade tensions, as well as to examine the strengths and challenges of trade and investment in both the ASEAN region and countries within the region. The article focuses on Indonesia, Thailand, Vietnam, and Malaysia, which play a crucial role in attracting FDI, not only from China but also from the United States and other globally significant economies.

Trade Developments in ASEAN

In recent years, global trade and investment patterns have significantly changed, primarily due to the U.S.-China trade war and the COVID-19 pandemic. These events have disrupted global supply chains and clearly impacted ASEAN’s trade dynamics.

-

Background of U.S.-China Trade Tensions

Trade tensions between the U.S. and China began in 2018 and are likely to persist.

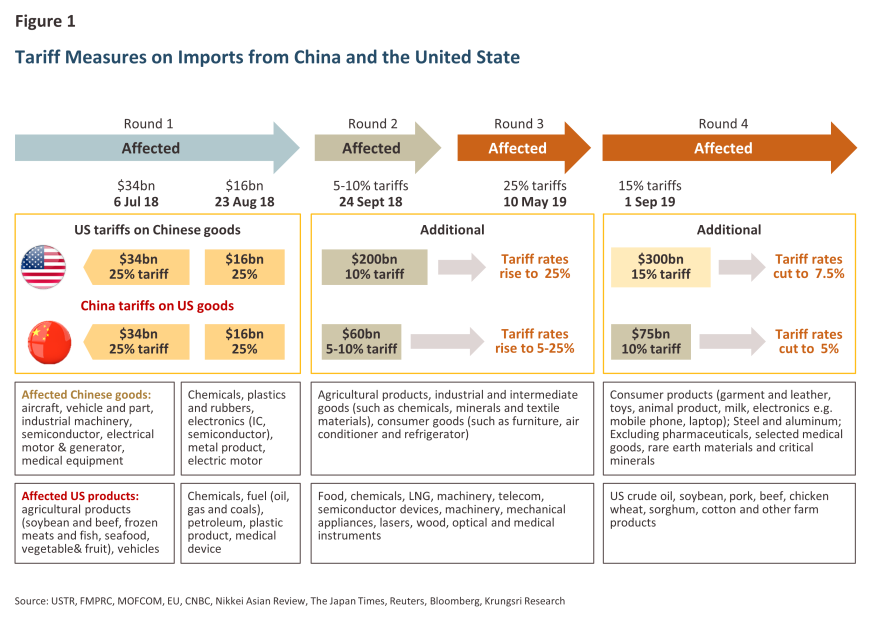

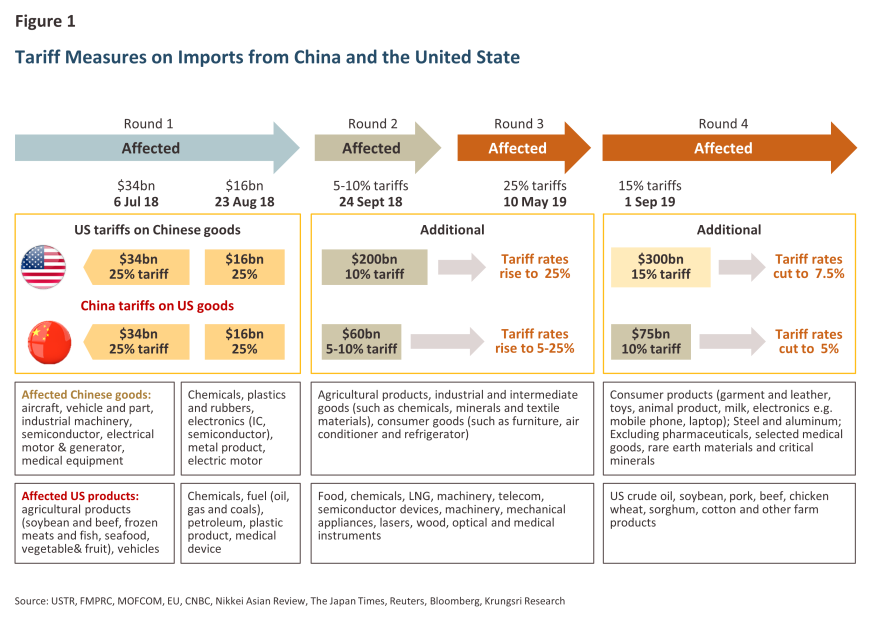

The U.S. has sought to reduce its trade deficit with China by minimizing reliance on Chinese imports. In 2018, President Donald Trump imposed Section 301 tariffs on USD 50 billion worth of Chinese imports, eventually increasing the total to over USD 550 billion. China retaliated by imposing tariffs on U.S. goods, escalating the situation into a full-scale “trade war” that affected global supply chains.

To ease tensions, both countries reached a Phase One trade deal in December 2019. The U.S. agreed to reduce tariffs on USD 300 billion worth of Chinese goods from 15% to 7.5%, while China lowered tariffs on USD 75 billion worth of U.S. goods from 10% to 5% (as illustrated in Figure 1). However, trade tensions persisted, and in May 2023, President Joe Biden announced further tariff increases on a range of Chinese products, including semiconductors, electric vehicles, and solar panels. These tariffs, with rates between 25-100%, apply to approximately USD 18 billion worth of goods, or about 4% of U.S. imports from China, and are set to take effect from 2024 to 2026.

-

Trade Tensions and Changes in U.S. and China Imports

Although the U.S.-China trade war has negatively impacted trade between the two countries, it has benefited ASEAN, with increased export opportunities to both markets.

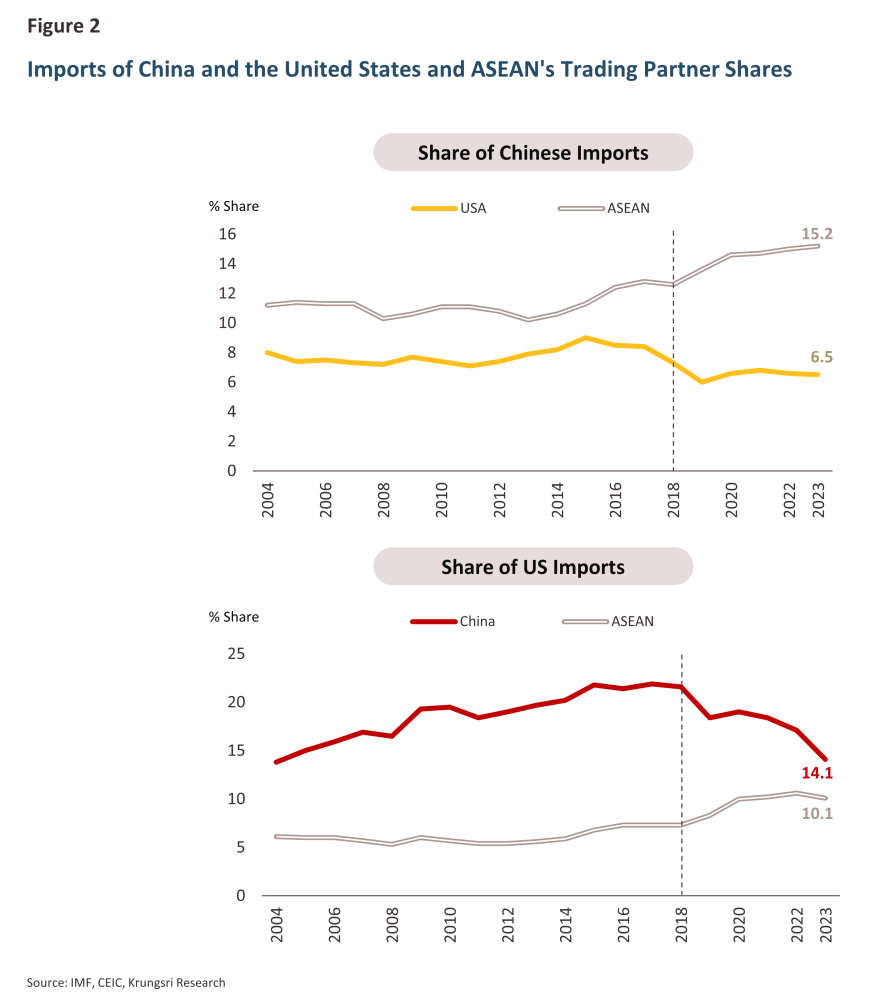

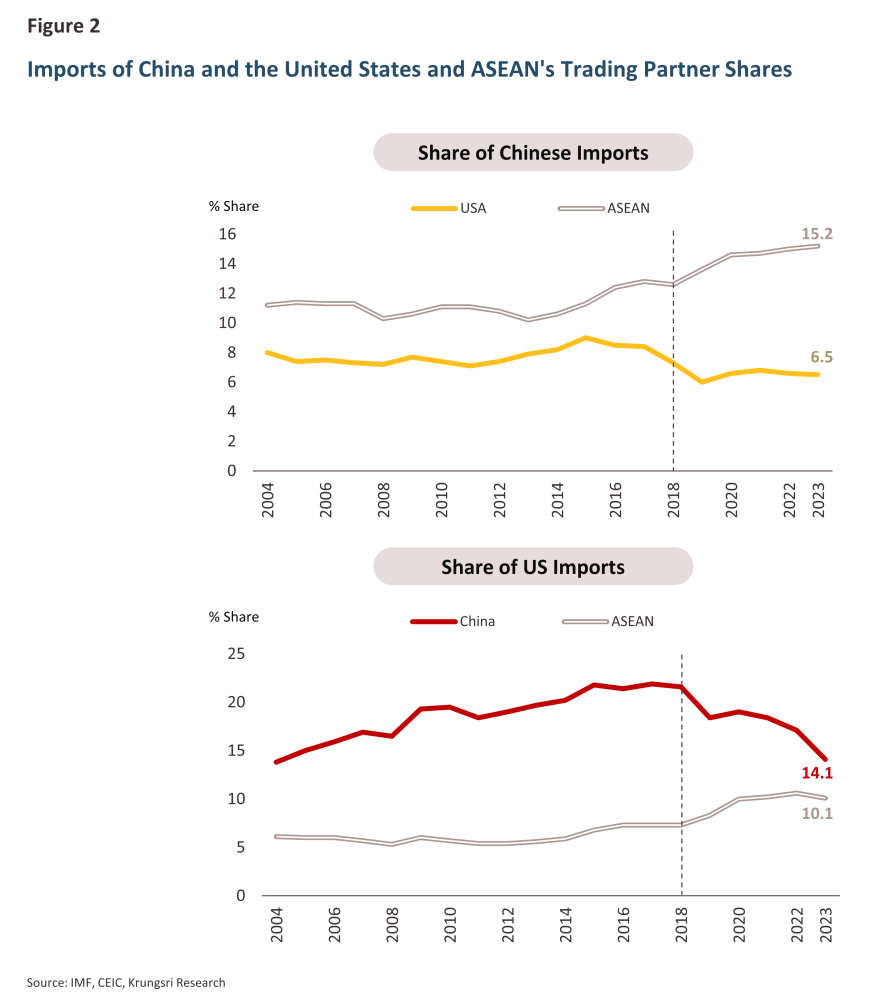

The U.S.-China trade conflict has led to significant changes in ASEAN's trade with both countries. The proportion of U.S. imports from China has dropped considerably, and China's imports from the U.S. have also declined. Meanwhile, both China and the U.S. have increased their import share from ASEAN (Figure 2).

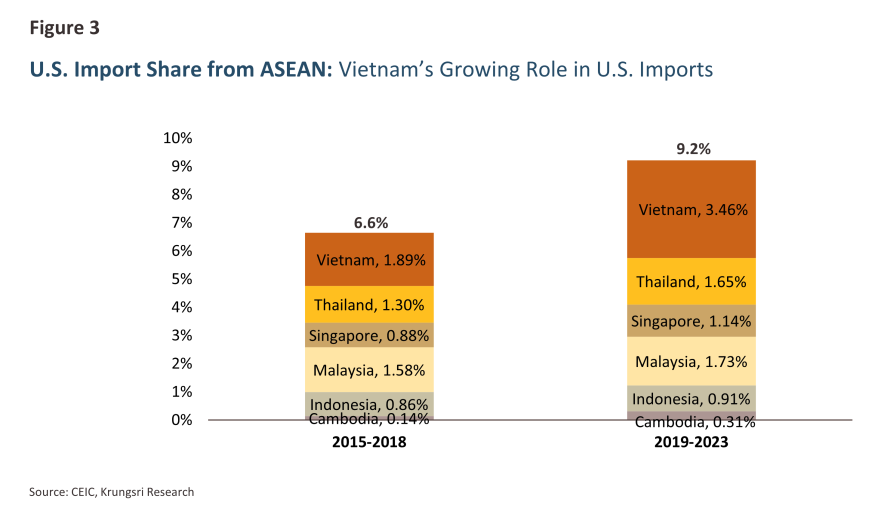

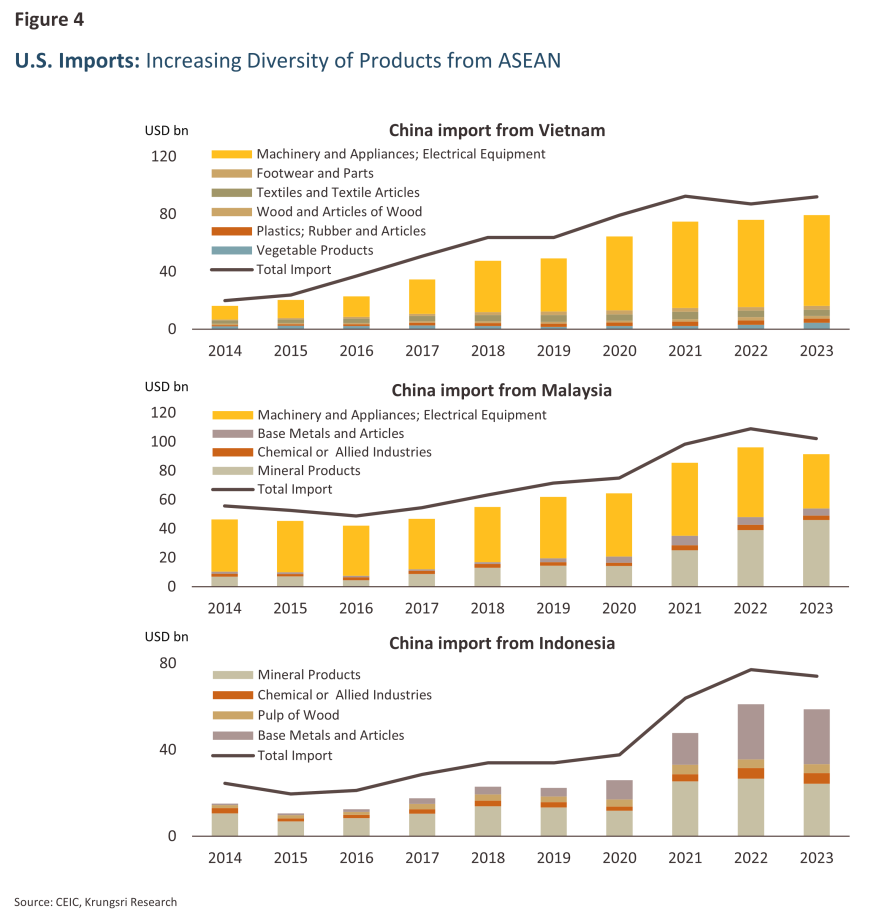

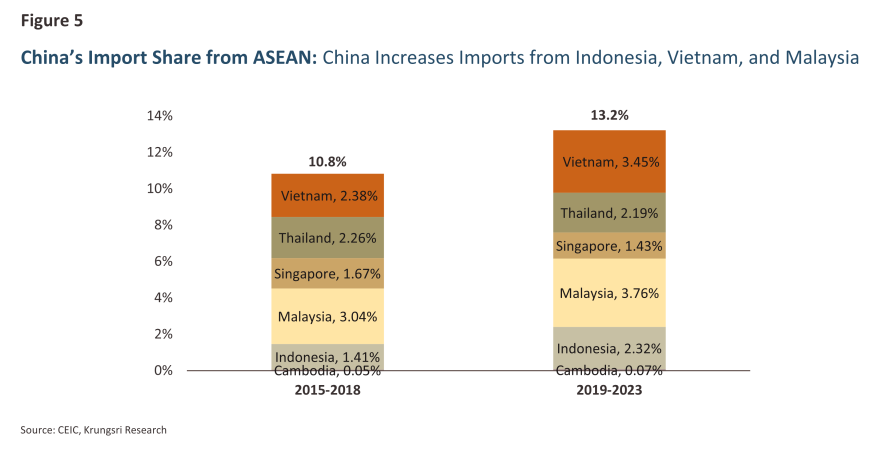

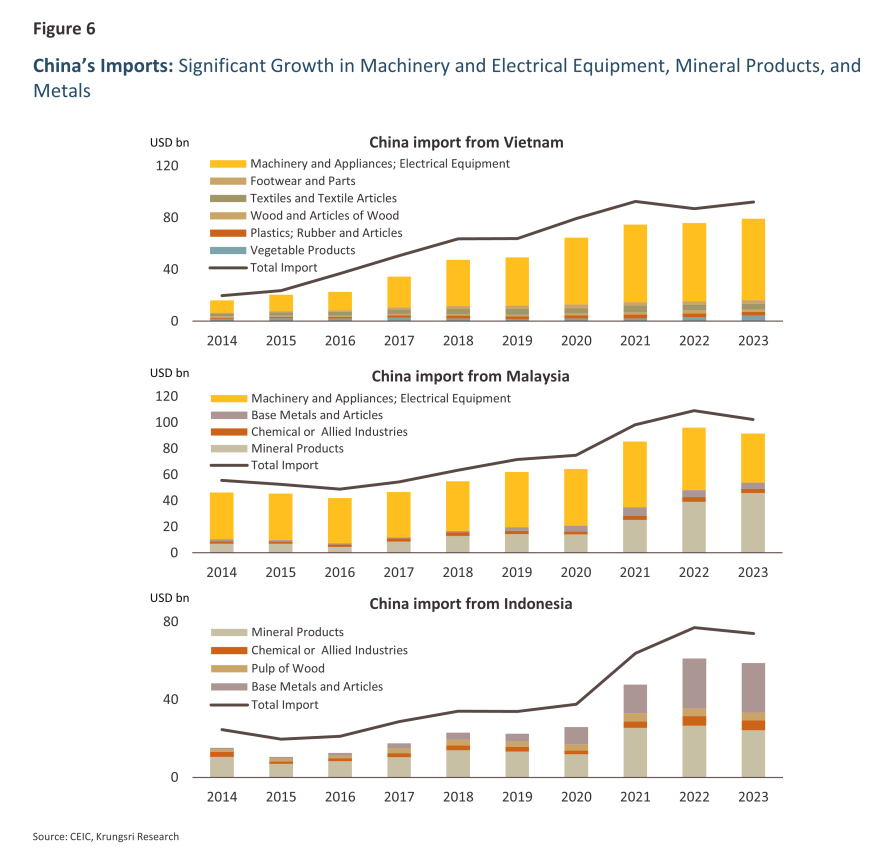

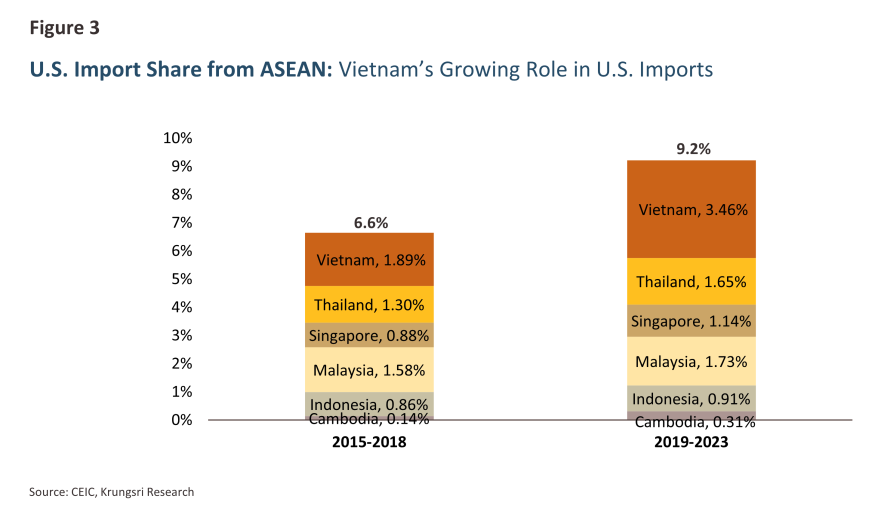

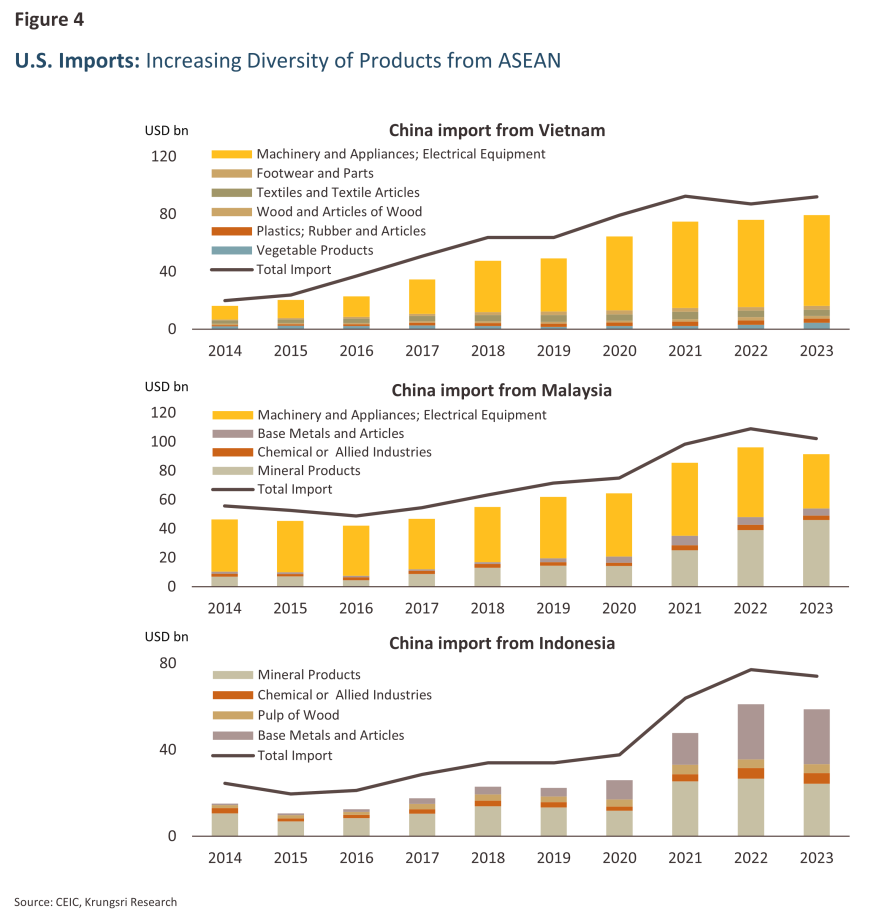

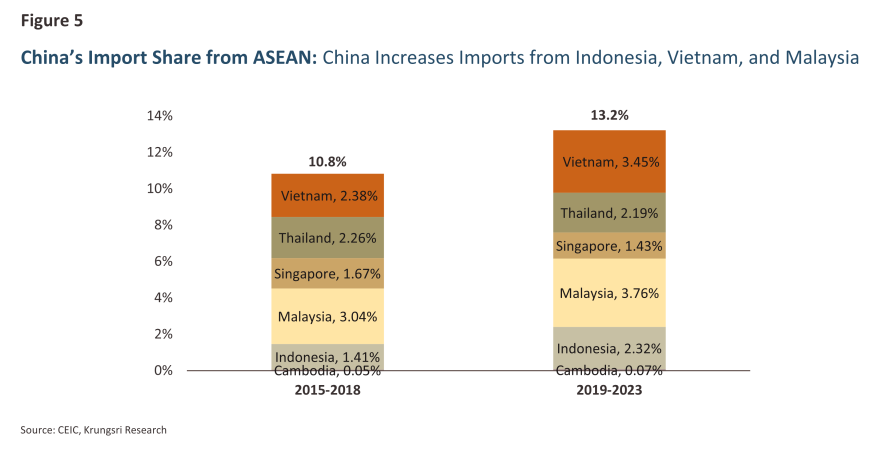

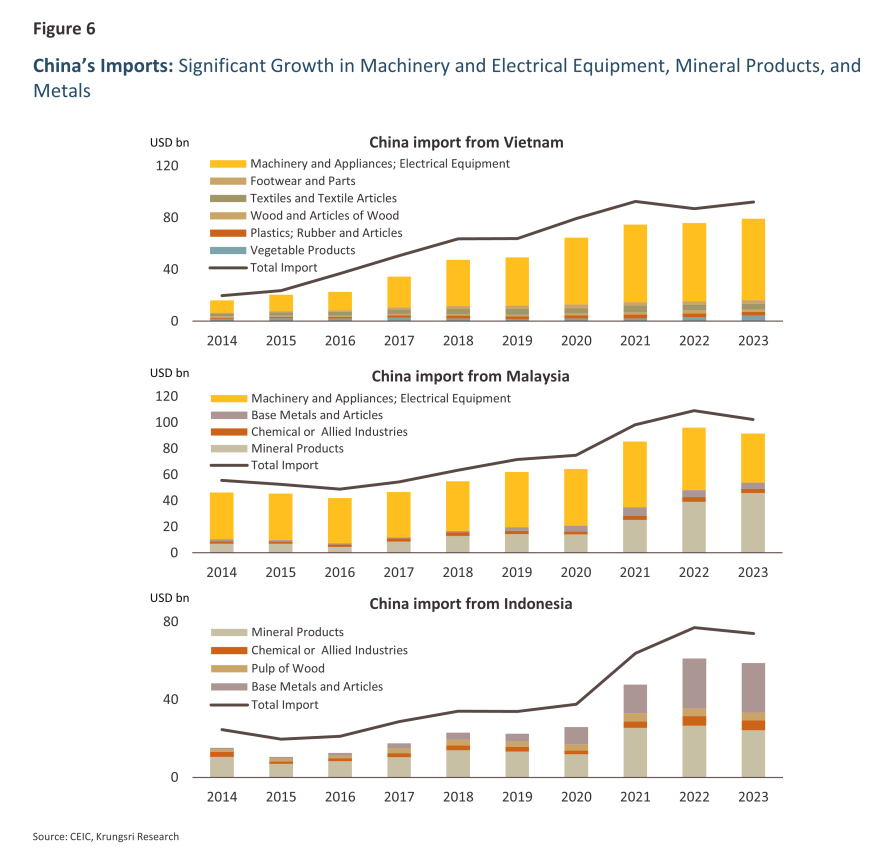

At the same time, the U.S. has increased its import share from ASEAN (Figure 3). Vietnam has notably expanded its share of U.S. imports, particularly in electronics, apparel, and machinery, while Thailand has gained a stronger presence in electronics and machinery (Figure 4). In addition, following the trade tensions between the U.S. and China, China has also increased its imports from ASEAN (Figures 5 and 6), especially from Vietnam, Malaysia, and Indonesia, in categories such as electronics and electrical appliances, mineral products, and metals.

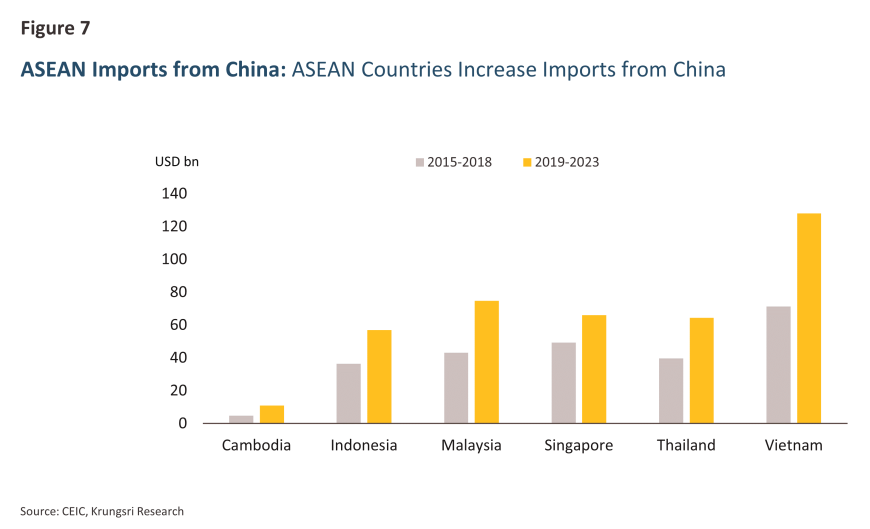

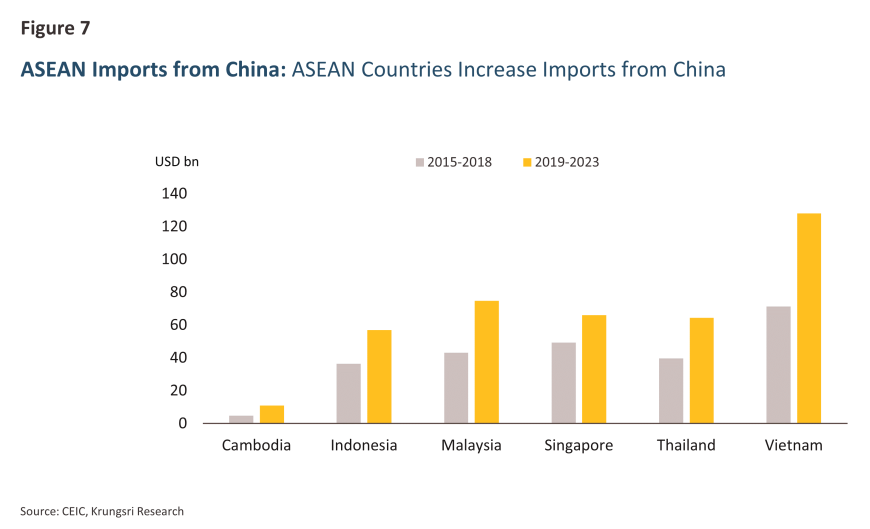

The increase in exports from ASEAN to both the U.S. and China can be summarized as a result of trade diversion caused by the tariffs imposed. This has led to significant changes in the import routes of both the U.S. and China. At the same time, ASEAN has been continuously increasing its imports from China (Figure 7), while also boosting exports to the U.S. This raises the question of how much value ASEAN's increased exports are adding to their own economies.

The trade tensions have led to global trade diversion, as the U.S. imports goods from other countries to replace imports from China

Trade Diversion refers to the shift in imports from sources with lower production costs to those with higher production costs due to external factors, such as changes in import tariffs or supply chain disruptions. This occurs when production or exports from more efficient countries (with lower costs and prices) are replaced by trade partners who benefit from preferential treatment or are not subject to trade barriers.

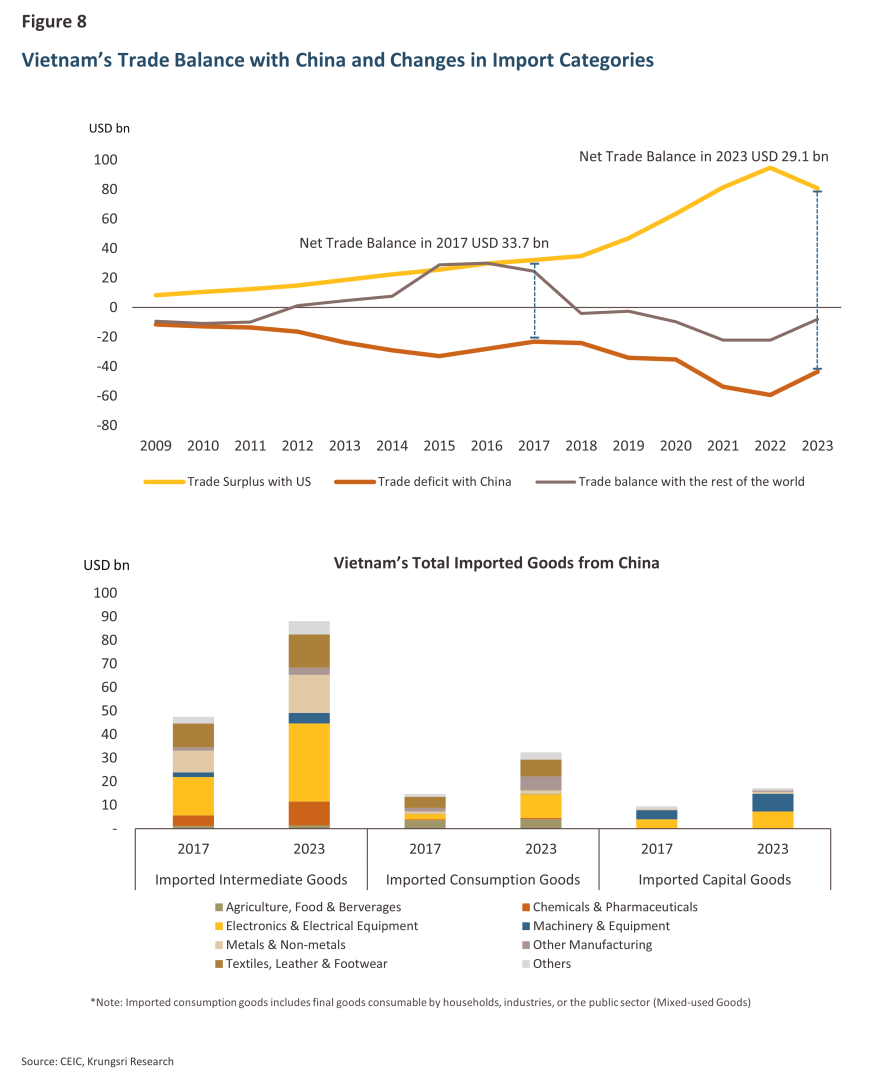

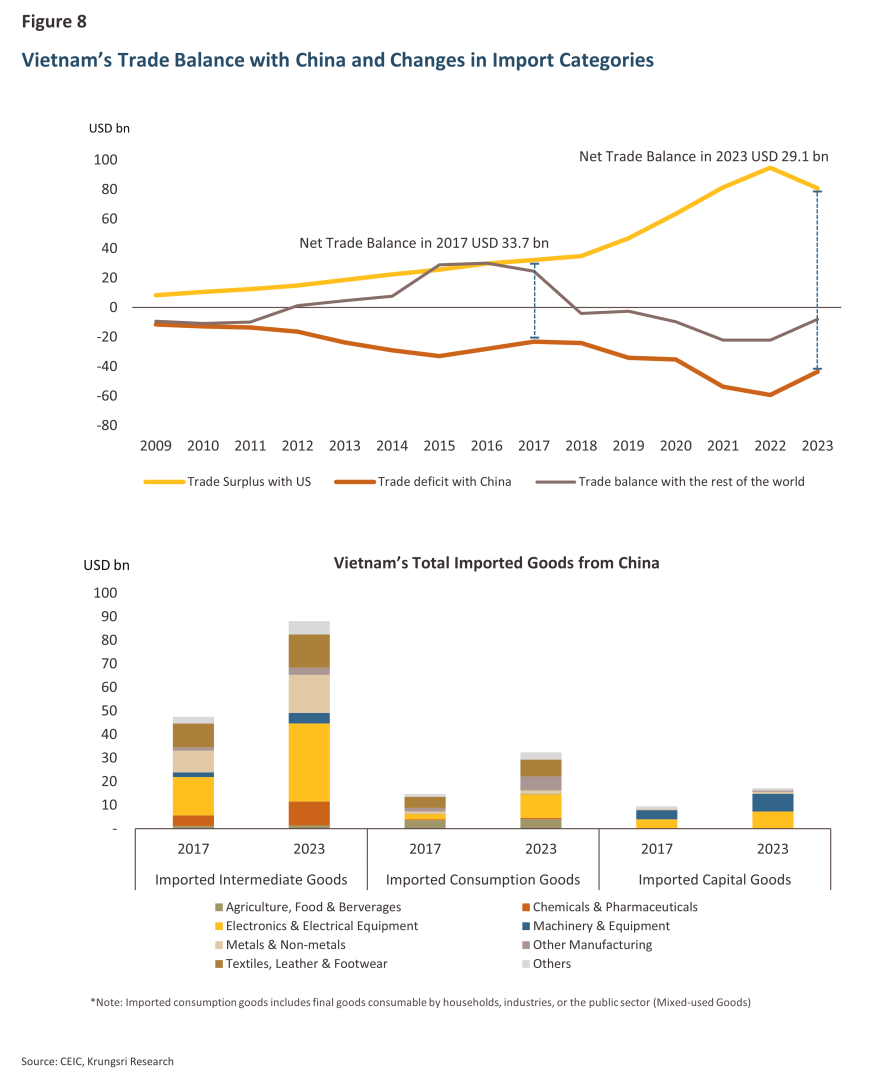

In this case, the U.S. has imposed tariffs on imports from China, leading the U.S. to source goods from other regions, including ASEAN, as a replacement. This reflects a pattern of trade diversion. The country that has benefited the most from increased exports is Vietnam, which has significantly boosted its exports of final goods, particularly electronics and electrical appliances, to both the U.S. and China. However, Vietnam continues to run a growing trade deficit with China (Figure 8), in contrast to its trade surplus with other countries. This suggests that Vietnam's export production may rely heavily on raw materials and intermediate goods from China. Therefore, some of Vietnam’s increased exports to the U.S. may be re-exported Chinese goods passing through Vietnam, limiting the broader benefits for domestic industry development. However, it is difficult to draw a definitive conclusion without considering the development of FDI, which will help assess whether these investments are enhancing the industrial production capacity in the long run and elevating manufacturing in Vietnam and other countries in the region.

Foreign Direct Investment (FDI) Developments in ASEAN

In recent years, the trend of FDI in ASEAN has been heavily influenced by changes in global megatrends, particularly the trend of deglobalization and the trade tensions between the U.S. and China.1/

-

FDI Development in ASEAN: Continued Growth Despite Global Economic Slowdown

The trade tensions between the U.S. and China have led countries, particularly the U.S., China, and Japan, to focus more on investing in the ASEAN region. This shift is driven by the desire to reduce risks by relocating investments away from China. This change has created long-term growth opportunities in the ASEAN region.

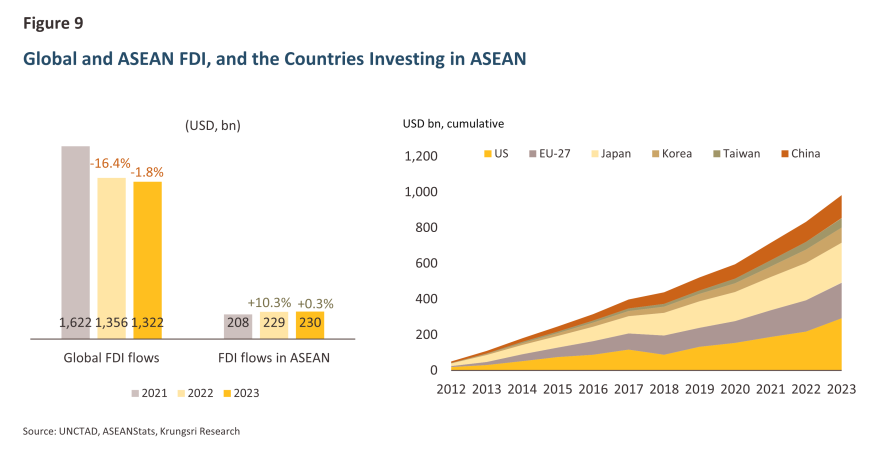

Looking at the overall picture, in 2023, global Foreign Direct Investment (FDI) decreased by 2%, marking a second consecutive year of decline. However, FDI in ASEAN continued to rise for the third consecutive year, with ASEAN remaining the largest recipient of FDI among developing regions, accounting for 17% of global FDI. This share has been steadily increasing since 2019. When examining the countries investing, the U.S., the European Union, and Japan have been the top investors in ASEAN (Figure 9). In terms of industry sectors, the financial sector received the highest investment inflows into ASEAN in 2023, totaling USD 92 billion, led by investments in Singapore. The manufacturing sector ranked second, with investments amounting to USD 50 billion.

However, this study does not focus on the investments flowing into Singapore and the financial sector, as the nature of these investments is driven by specific factors distinct from other ASEAN countries. The next section will therefore focus on analyzing the investments flowing into the manufacturing sector of ASEAN, which is a key part of economic activity and shows significant growth potential. This sector has seen a 114% increase in Greenfield investments in ASEAN in 2023, compared to a 74% increase in developing countries overall.

-

FDI in ASEAN's Manufacturing Sector and Its Connection to Trade Diversion

Several ASEAN countries have seen an increase in FDI in the manufacturing sector, which is related to the trade diversion observed in recent years.

Notable ASEAN countries receiving increased FDI in manufacturing include Indonesia, Vietnam, and Malaysia (Figure 10). In Vietnam, significant investments have been directed towards the production of electronic equipment and components.2/ At the same time, Indonesia has attracted more FDI, particularly in the nickel industry, which is crucial for the production of electric vehicle (EV) batteries, aligning with global trends. In addition, Malaysia and Thailand have also seen growth in FDI, particularly in the manufacturing of electronic equipment and components, along with investments in the EV industry in Thailand.

FDI in ASEAN is linked to changes in trade routes, especially in the manufacturing sector, which is closely tied to exports. In 2025-2026, Vietnam and Indonesia saw significant increases in FDI in manufacturing, indicating a shift in industrial locations previously concentrated in China. For example, the export of electronic parts from Vietnam to the U.S. has occurred alongside an increase in investments in the same sector, reinforcing Vietnam's role as a hub for electronic manufacturing in ASEAN. Similarly, Indonesia's nickel exports are closely linked to increased FDI from China in the processing of nickel, an essential industry for global EV battery production.

Although China currently holds a smaller share of investment in ASEAN's manufacturing sector compared to the U.S. and the European Union, we have started to see an increase in China's investments in ASEAN since 2018, the year when trade tensions between the U.S. and China began.

-

Role of Chinese Investment in ASEAN

China's role in direct investment in ASEAN has been increasing, as it seeks to diversify its production bases and still sees potential for further investment in the region.

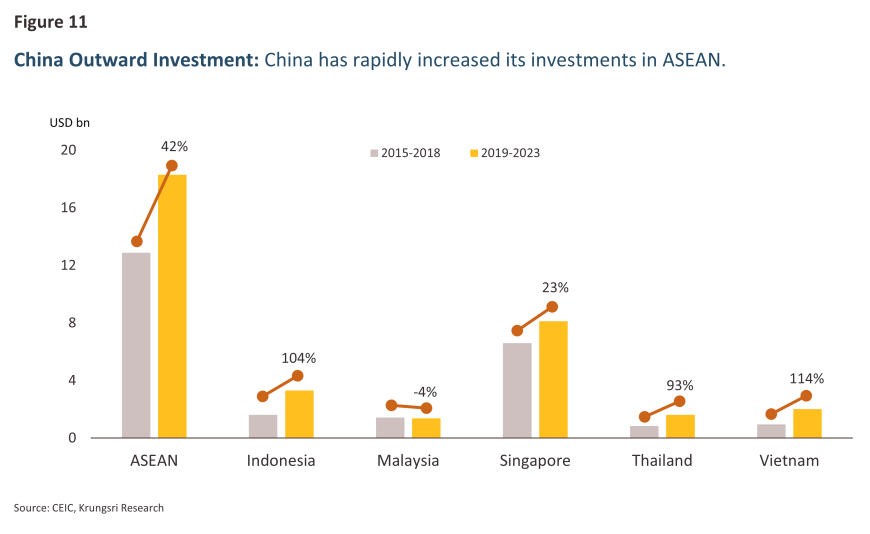

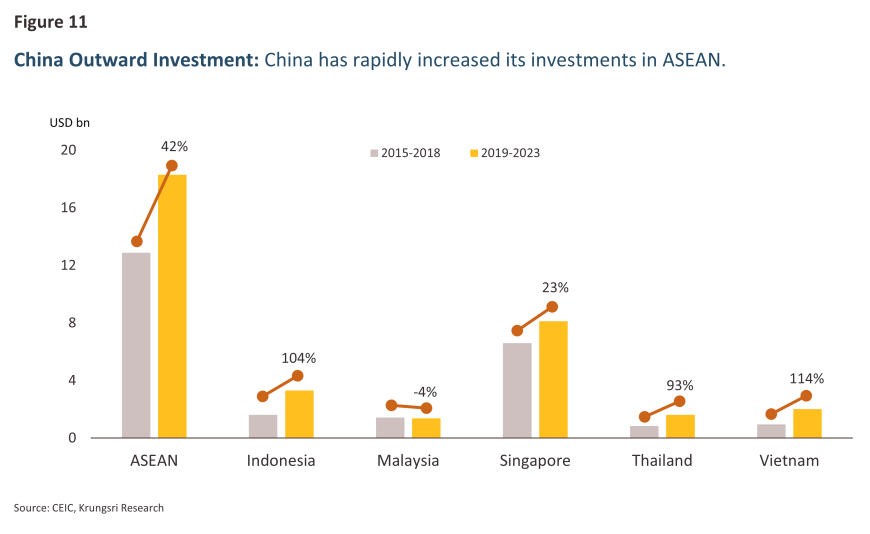

The Outward Direct Investment (ODI) from China in ASEAN has risen significantly, particularly in Vietnam, Indonesia, and Thailand, reflecting China's growing economic influence in the region. Additionally, the manufacturing sector remains the primary focus of Chinese investment. However, while Malaysia has seen a decline in ODI from China, it has experienced a notable increase in direct investment from within ASEAN and the U.S.

There are three key observations from the data above. First, although wages and production costs in China have risen, most companies have maintained high-value production processes in China while relocating final product manufacturing to other countries, particularly in the electronics and electrical appliances industries. For example, China has increased exports of electronic components and smartphones to ASEAN, especially Vietnam, for final-stage production and export, as shown in Figure 4 (Vietnam's exports to the U.S.) and Figure 8 (Vietnam's imports from China). Second, this trend reflects China's strategy of diversifying its manufacturing base to ASEAN, reducing reliance on domestic production to mitigate risks from geopolitical tensions and maintain its position in global supply chains. Third, as shown in Figure 10 (left), the share of FDI from China into ASEAN's manufacturing sector has gradually increased over the past decade, though it remains relatively low compared to the U.S., EU, and Japan. However, Figure 11 demonstrates the continued growth of Chinese investments in ASEAN, and this trend is expected to persist, driven by the shifting manufacturing base due to intensifying global trade tensions. This suggests a strong potential for further growth in Chinese investments in ASEAN in the future.

Strengths of ASEAN that Make It an Attractive Destination for Investors and Challenges

ASEAN stands out due to its market size, demographic structure, and investment-friendly policies. However, several countries in the region are adjusting to create an environment conducive to investment in industries aligned with global trends.

For investors, ASEAN is increasingly attractive due to its economic and social advantages that can accommodate major global megatrends.3/ The key strengths can be summarized as follows:

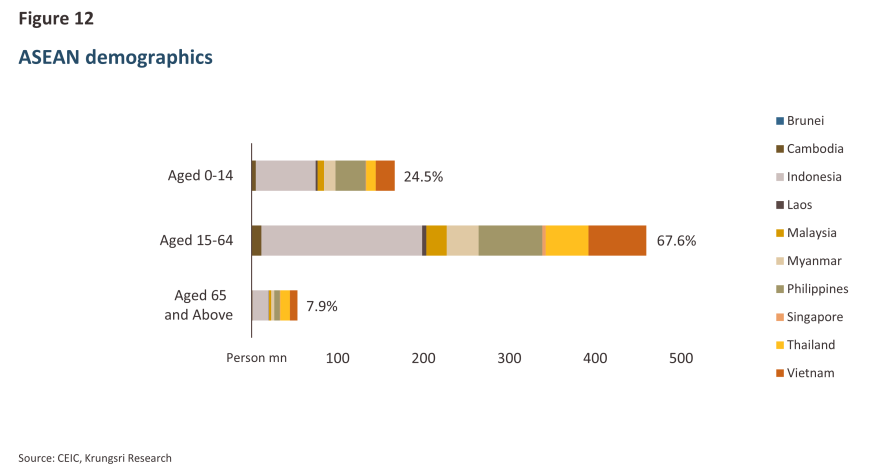

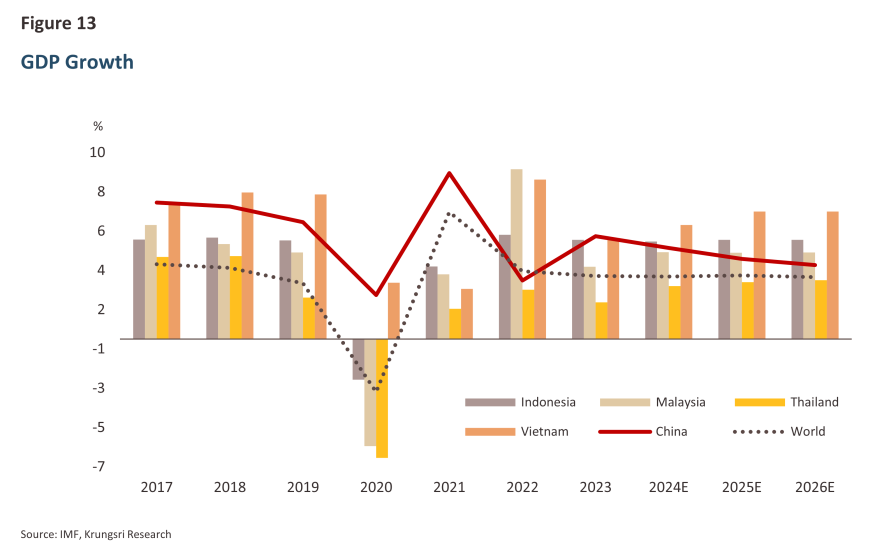

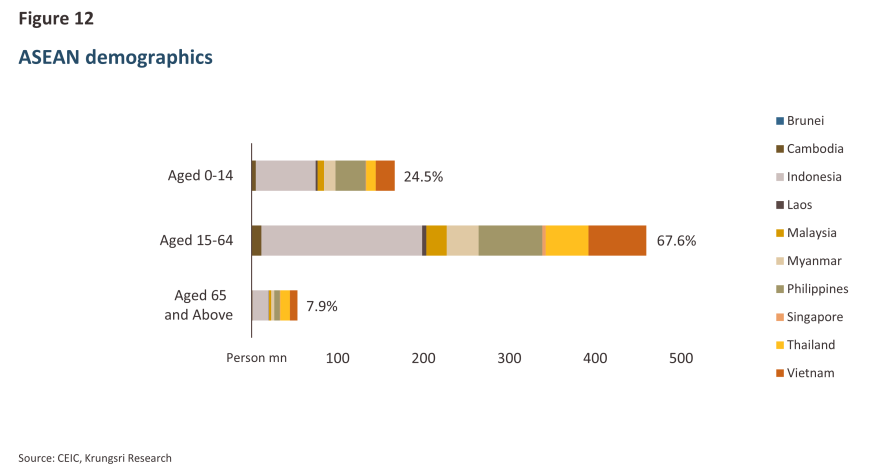

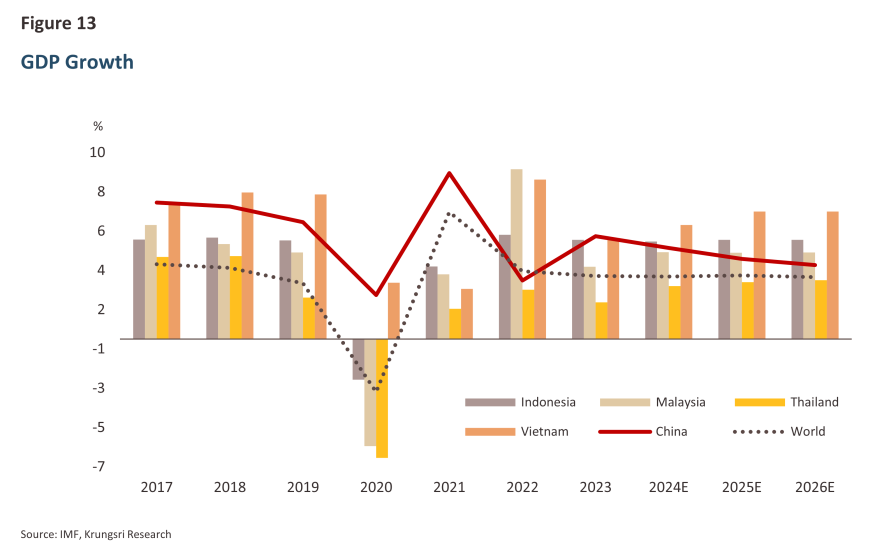

1.Large Market and High Economic Growth Rates: ASEAN has a population of over 680 million people, with countries like Indonesia and Vietnam having an average age of just 30 and 32 years, respectively. This reflects a large consumer base with a rapidly expanding middle class. Furthermore, ASEAN has the highest economic growth rate compared to other regions.

2.Strategic Geographic Location: ASEAN benefits from its strategic position in the global supply chain, as it is located close to major manufacturing hubs like China, as well as large consumer markets in Asia. This makes the region a prime location for shifting production bases. Vietnam, in particular, has a geographic advantage due to its proximity to China, making it a key destination for multinational companies following the "China +1" strategy.

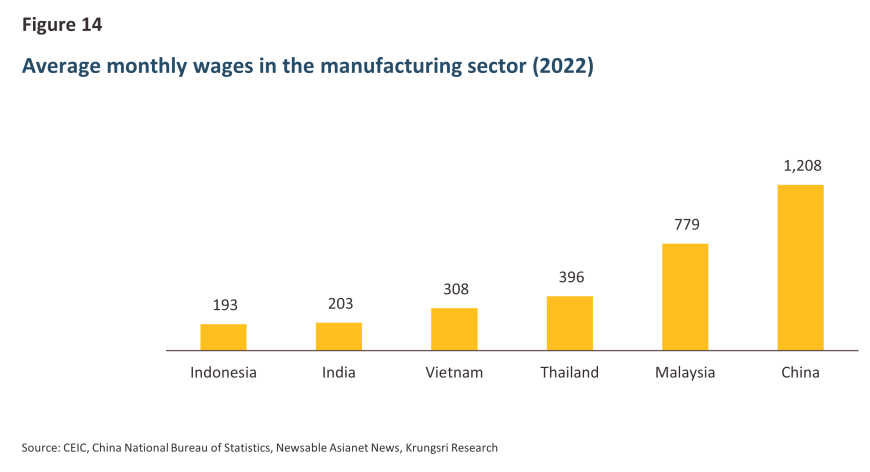

3.Abundant Labor and Resources: With its large population and relatively young average age, ASEAN offers a substantial labor force at competitive costs, making it ideal for labor-intensive industries. Vietnam and Indonesia have the advantage of a large working-age population and relatively low labor costs. Additionally, Indonesia is rich in natural resources, especially nickel, which is crucial for the electric vehicle manufacturing industry.

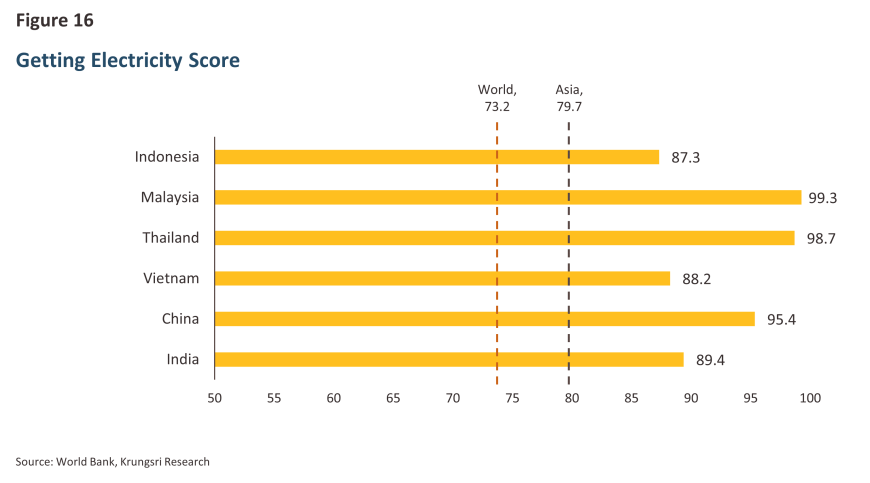

4.Developing Infrastructure: Many countries in the region are accelerating investments to develop their infrastructure and facilitate trade to attract foreign investments. Currently, Thailand stands out with its well-developed infrastructure compared to other countries in the region, particularly in the automotive manufacturing sector. Malaysia also has strong infrastructure conducive to the electronics and semiconductor industries, supported by a skilled labor force and technological expertise.

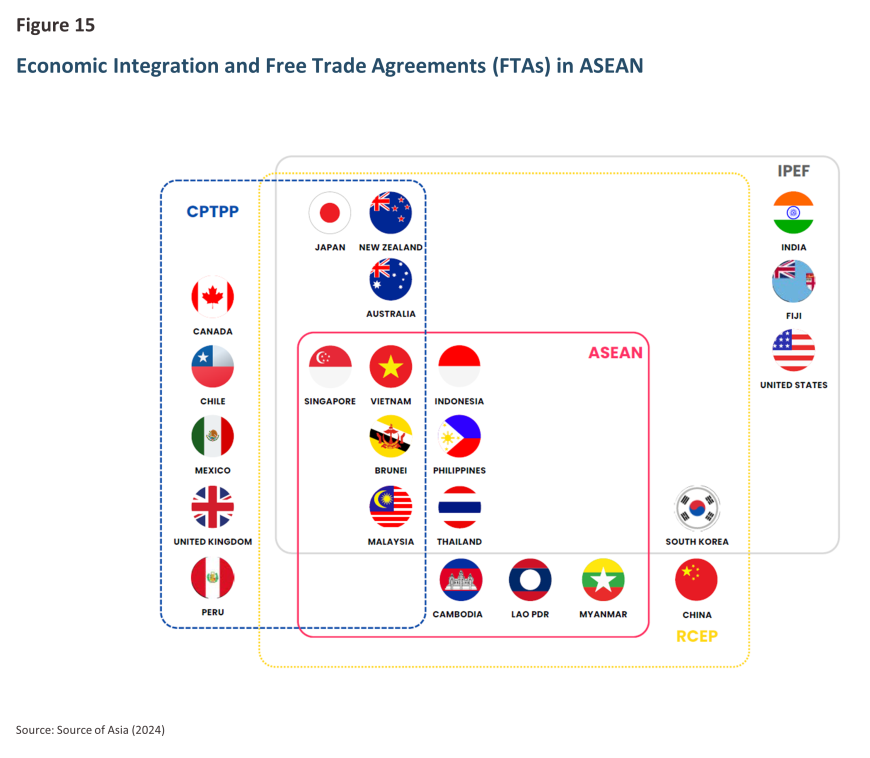

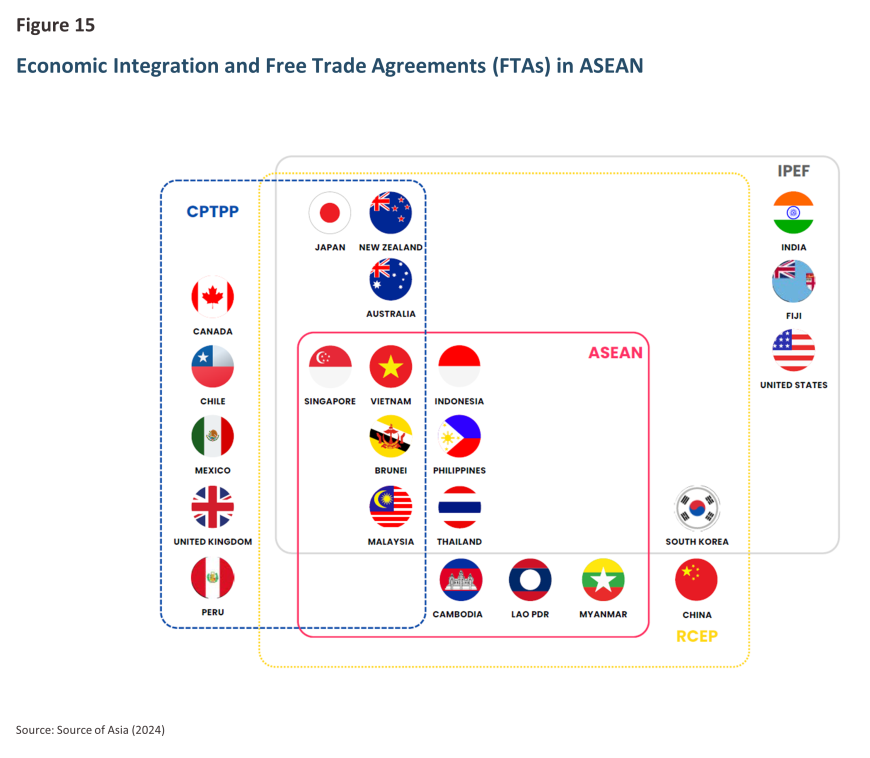

5.Economic and Financial Integration: The trend of regionalization in ASEAN, along with key trade partners, has become a significant feature, particularly with the Regional Comprehensive Economic Partnership (RCEP).4/ This agreement aims to facilitate smoother trade and investment across the region. Vietnam is one of the countries in the region with the most international trade agreements, second only to Singapore.5/

6.Government Policies to Attract Investment: Each ASEAN country has developed policies aimed at attracting foreign investment, particularly in targeted industries such as technology and environmental sustainability. These policies often include tax incentives and facilitation measures to support investors, making the region more attractive for business opportunities and investment in emerging sectors.

However, ASEAN countries still face significant challenges in attracting foreign investment, which can be identified as follows:

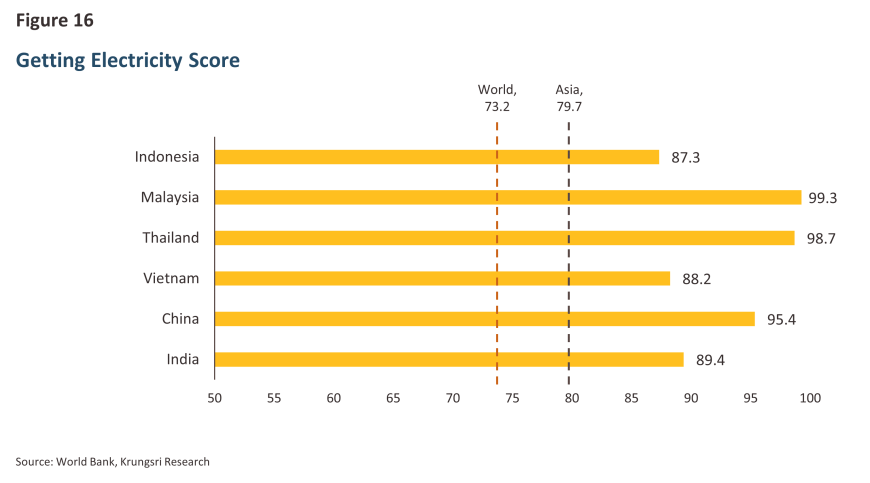

1.Inadequate Infrastructure: While infrastructure development is ongoing in many ASEAN countries, there are still gaps, particularly in the transportation and energy sectors. A notable issue is the shortage of electricity in the manufacturing sector. For example, Vietnam has experienced rapid growth in electricity demand over the past decade due to the expanding manufacturing industry, which has not kept pace with electricity production capabilities. The World Bank’s Getting Electricity index (Figure 16)6/ indicates that Vietnam and Indonesia have higher power supply disruptions compared to other countries, which impacts stability in the manufacturing sector.

2.Regulatory Challenges: The complex and time-consuming legal and regulatory environment in many ASEAN countries may pose challenges for investors. This can lead to delays in business operations and investment decisions. For instance, Indonesia's decentralized legal system, which spreads across various regions, makes regulatory management complex, especially regarding land laws and investment permits. Similarly, Vietnam has complicated regulations, from business establishment to permit applications.

3.Environmental and Sustainability Concerns: As the world places more emphasis on sustainable development, ASEAN countries face the challenge of balancing rapid industrial growth with environmental responsibility. This is particularly evident in energy-intensive industries such as manufacturing and energy production, where managing environmental impact becomes more difficult amid fast-paced industrialization.

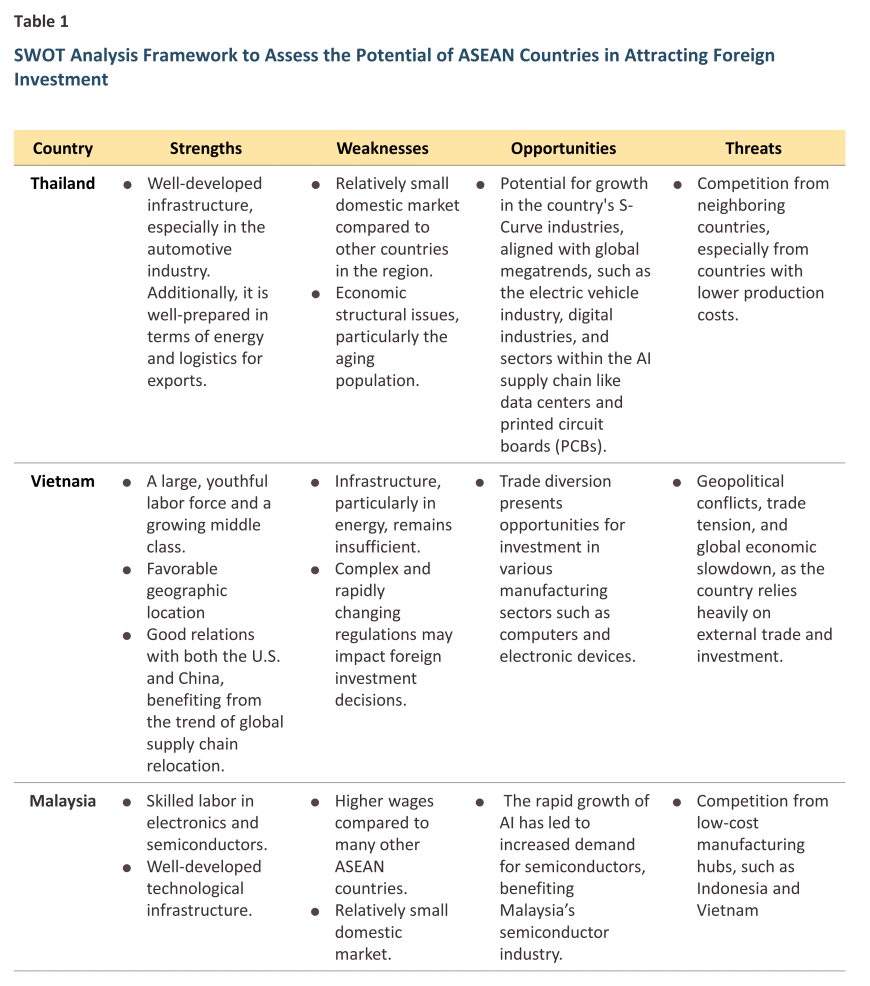

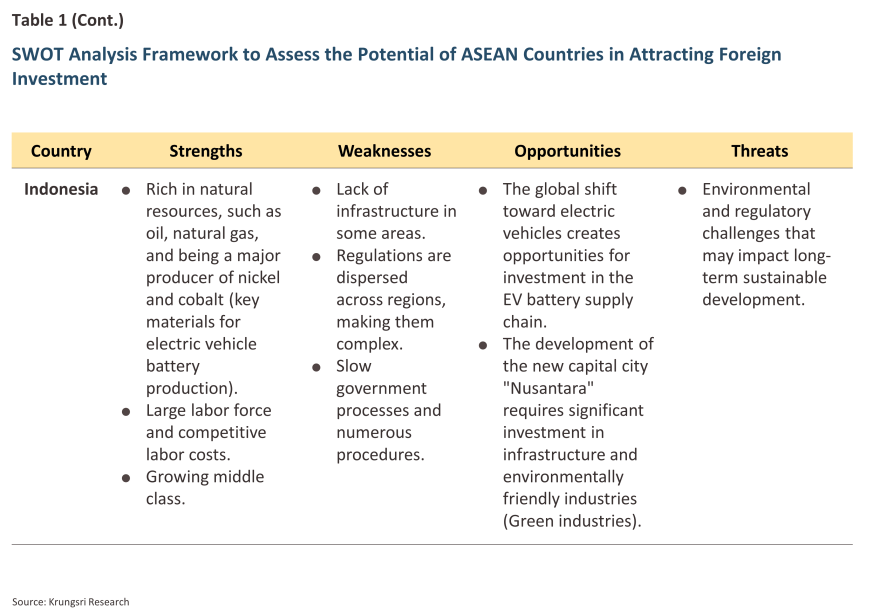

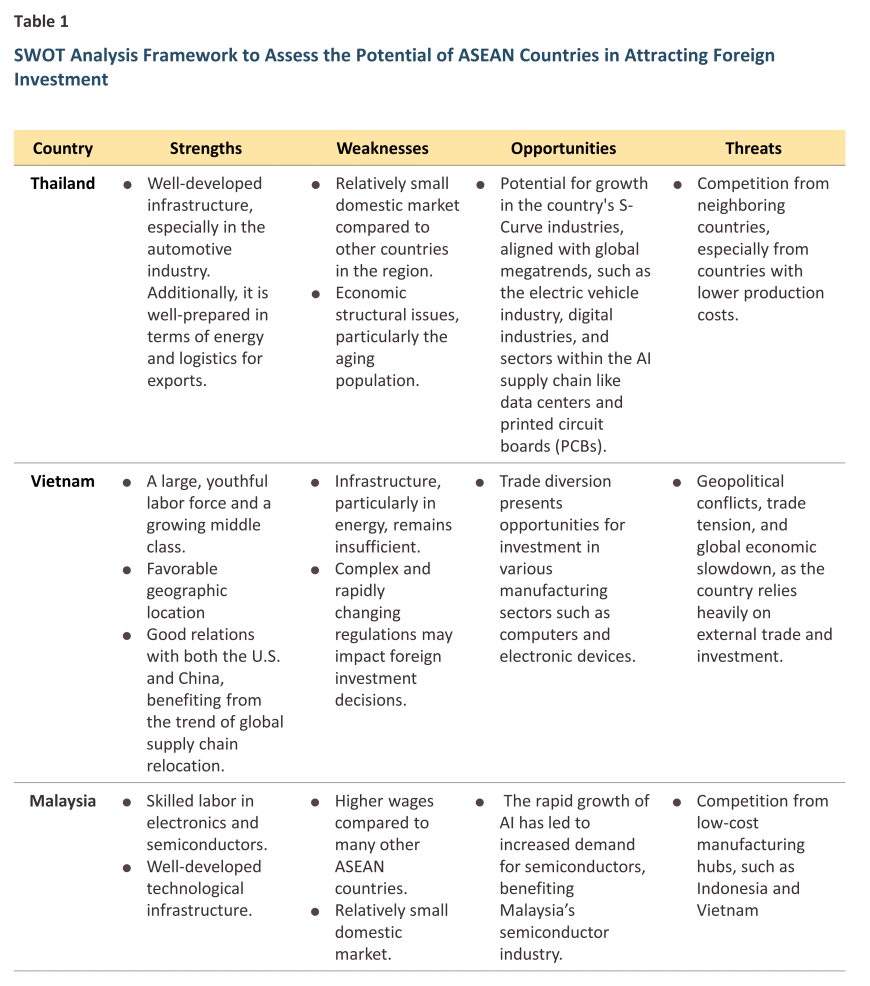

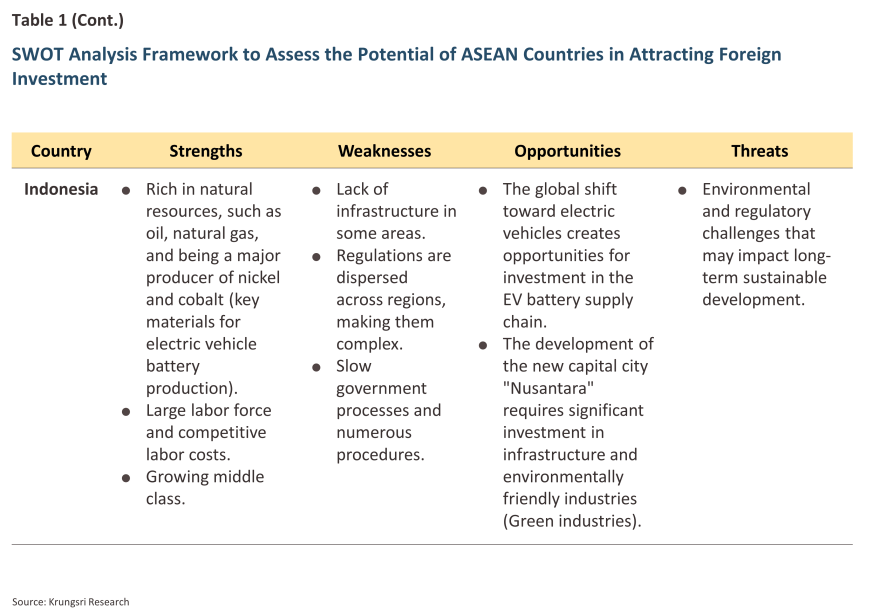

After analyzing the strengths and challenges of the ASEAN region in attracting foreign investment, Krungsri Research has developed a SWOT analysis framework to assess the potential of each ASEAN country in attracting foreign investment in the future. This framework helps provide an overview of the strengths, weaknesses, opportunities, and threats each ASEAN country faces, as shown in Table 1.

The ASEAN region is adapting to align with global megatrends, with each country striving to develop regulations, infrastructure, and industries that support global shifts focused on technology and sustainability. For example, Thailand is working to streamline regulations to reduce steps for investors and promote the digital economy and electric vehicles. Vietnam and Indonesia are developing infrastructure to support the growth of the manufacturing sector while opening up to investments in renewable energy and the electric vehicle battery industry. Malaysia is advancing high-tech capabilities and promoting production in the semiconductor industry. Furthermore, ASEAN benefits from its youthful population, which gives it an advantage in economic growth and the ability to develop a skilled workforce. This is a key factor in attracting investments and business expansion from countries facing challenges with aging populations.

Krungsri Research View

When comparing the past Japanese "Flying Geese" model of production relocation7/, following the impact of the Plaza Accord, with the current "China+1" strategy, both Japan and China share similarities in facing domestic demand weakening, rising labor costs, and the motivation to expand into larger markets. However, a key difference is that Japan did not face the same level of trade tensions that China is experiencing today, which presents an opportunity for ASEAN to attract investments not only from China but also from the U.S., EU, and other countries.

The positive effect on ASEAN is that the increased investment will enhance production capabilities and provide ongoing economic opportunities, leading to job creation and increased income for ASEAN countries. However, a cautionary point is that the benefits to domestic manufacturing may be limited if investment conditions do not clearly specify local content ratios or the transfer of critical technologies. Additionally, the entry of large multinational corporations may pose competitive challenges for small local businesses in terms of cost competition. Another risk to monitor is the trade barrier policies under President Trump's administration, which could directly affect ASEAN exports to the U.S. and diminish ASEAN's appeal as a key investment destination.

This study finds that ASEAN countries have advantages in terms of their working-age population structure, competitive production costs, and favorable strategic geographic location. However, there are areas where ASEAN countries should continue to enhance their potential to seize opportunities amidst the changing supply chain dynamics, as outlined below:

-

First, the development of infrastructure and regulations to support the expansion of foreign investment, including simplifying regulatory systems and trade policies, to enhance ease of doing business.

-

Second, investing in human resources to increase labor potential in high-value industries, such as technology and the production of electric vehicle parts, which meet global market demand and create long-term advantages.

-

Third, increasing regional cooperation to strengthen connections between ASEAN countries, ensuring readiness for the relocation of production bases. This can enhance supply chain flexibility and help mitigate the impact of trade barriers in the future.

In summary, the current global supply chain changes present significant opportunities for ASEAN to attract foreign investment, enhancing its economic growth potential. By leveraging the strengths of each ASEAN country and fostering regional economic cooperation that stands out globally, combined with addressing existing weaknesses, it is expected that investor confidence will be boosted. This will help position the region as a key investment hub in the new era, aligning with global megatrends.

References

Angsana Council, Bain & Company, and DBS Bank. (2024). Navigating High Winds: Southeast Asia Outlook 2024-2034. FBN Asia.

ASEAN Secretariat & UNCTAD. (2024). ASEAN Investment Report 2024: ASEAN Economic Community 2025 and Foreign Direct Investment. ASEAN Secretariat.

Dacanay, A. (2024, August 29). ASEAN Perspectives. Retrieved from gbm.hsbc: https://www.gbm.hsbc.com/en-gb/insights/global-research/asean-perspectives-bucking-the-global-trend-in-trade

Gembah. (n.d.). Vietnam Supply Chain: Trends, Issues, and. Retrieved from https://gembah.com/blog/vietnam-supply-chain/

Kumra, G., & Seong, J. (2024, September 3). Asia: The epicenter of global trade shifts. Retrieved from McKinsey & Company: https://www.mckinsey.com/featured-insights/future-of-asia/asia-the-epicenter-of-global-trade-shifts

McKinsey & Company. (2024, September 5). Diversifying global supply chains: Opportunities in Southeast Asia. Retrieved from McKinsey & Company: https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/diversifying-global-supply-chains-opportunities-in-southeast-asia

McKinsey Global Institute. (2024, January 17). Geopolitics and the geometry of global trade. Retrieved from mckinsey: https://www.mckinsey.com/mgi/our-research/geopolitics-and-the-geometry-of-global-trade

Source of Asia. (2024). Doing Business in ASEAN 2024-2025.

1/ The trend of "deglobalization" has emerged in recent years, as countries and businesses increasingly focus on domestic production and diversifying sources of raw materials. This shift aims to reduce risks from external factors such as trade barriers and the impacts of the COVID-19 pandemic.

2/ For example, investments by component manufacturers for Apple, investments by Samsung, and semiconductor manufacturing investments.

3/ Important global megatrends include deglobalization, shifting in economic power, demographic changes, urbanization, technological advancement, and environmental sustainability.

4/ The ASEAN region has made the RCEP agreement, a free trade agreement consisting of 15 member countries: the 10 ASEAN countries and 5 negotiating partners: China, Japan, South Korea, Australia, and New Zealand. It covers approximately 30% of the global GDP and aims to eliminate trade barriers and promote investment (Department of International Trade, Ministry of Commerce, 2023)

5/ Currently, Vietnam has 16 free trade agreements with 54 countries, consisting of 7 bilateral agreements and 9 regional agreements.

6/ It is an index used by the World Bank to measure the ease of obtaining electricity for businesses, considering factors such as time, cost, and procedures. A high score indicates that the process of obtaining electricity is easy, fast, and reasonably priced, which attracts foreign investors, promotes economic growth, and improves the overall business environment.

7/ Following the Plaza Accord in 1985, which caused the Japanese yen to appreciate significantly, Japan's export costs increased. As a result, Japan shifted its production base to lower-cost Asian countries such as South Korea and China. This led to the realization of the "Flying Geese" model, where the countries receiving investment from Japan developed their economies by adopting industries with lower technology levels from Japan. This process contributed to continuous economic growth at the regional level.