EXECUTIVE SUMMARY

During 2025-2027, the total revenue of Thailand’s data center industry is projected to grow at an average annual rate of 7.5-8.5%, driven by the digital transformation of government agencies and enterprises. This transition emphasizes large-scale data processing for strategic marketing planning, supported by continuous advancements in digital technology. Investment trends in the industry are primarily driven by key users in the IT & Telecommunication and the Banking, Financial Services, and Insurance (BFSI) business. Notably, foreign investment in data center industry is expected to rise, driven by government policies to promote development of data center as a fundamental upstream technology industry to support the growth of target industries (S-curve industries) that rely on advanced technologies.

Krungsri Research view

The revenue of the data center business is expected to grow, driven by the increasing adoption of data-driven strategies among organizations and the continued surge in investments within the sector. The outlook for key sub-segments is as follows:

-

Network Infrastructure: Revenue is projected to expand by 5.5-6.5% per year, supported by: (1) Rising internet demand fueled by the growing role of digital technology across businesses and government agencies, such as digital banking, E-commerce, and remote work, (2) The ongoing development of 5G networks by internet service providers, and (3) Increased foreign investment from multinational technology companies.

-

Server System: Revenue is expected to grow by 12.0-13.0% per year, driven by: (1) The increasing adoption of cloud system across industries, (2) The growing integration of AI and Machine Learning, particularly in data analytics and business forecasting, and (3) The expansion of the Internet of Things (IoT), which connects various devices to the internet and network systems.

-

Storage System: Revenue is forecasted to rise by 11.0-12.0% per year, supported by: (1) The surge of Big Data, driven by the increasing volume of in-depth data collection to support the development of AI, (2) The growth of E-commerce and E-payment requiring the storage of vast and rapidly increasing amounts of transaction data, (3) The enforcement of data protection regulations, such as the Personal Data Protection Act (PDPA), which mandates secure and easily retrievable data storage, further driving demand for storage solutions.

Overview

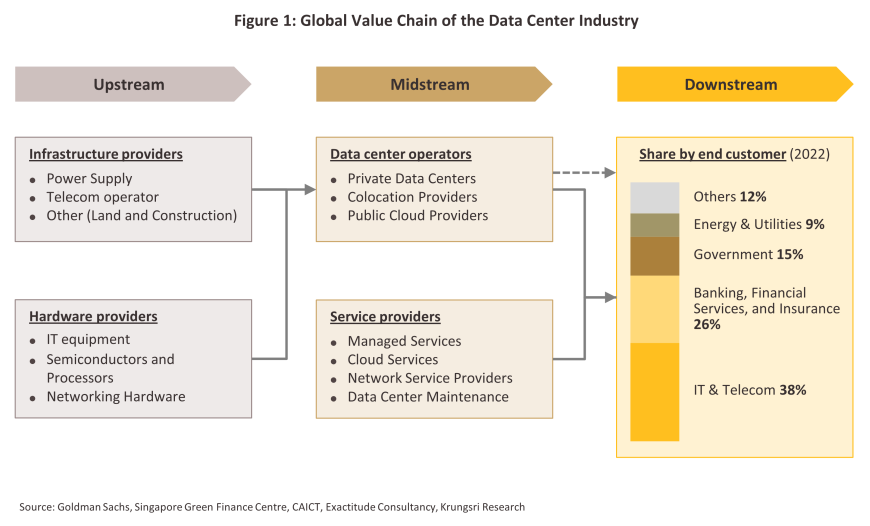

A data center is a systematically designed infrastructure that supports the storage and processing of massive amounts of data generated by individuals, companies, or organizations. This infrastructure is essential for supporting the development and operation of a wide range of digital applications and services. The data center supply chain consists of three main segments (Figure 1):

-

Upstream Industry: (1) Infrastructure Providers, including power providers, telecommunications network providers, and other providers (land, construction, design, and other support systems); and (2) Hardware Suppliers, including IT equipment (e.g., servers, storage units), chips and processors, and network equipment (e.g., switches, routers).

-

Midstream Industry: (1) Data Center Operators, responsible for providing the necessary space and infrastructure, including services related to management and maintenance; and (2) Service Providers, offering value-added services that enhance data centers, such as cloud management or network services. Data center operators and service providers often collaborate to serve customers, but in some cases, Colocation or Public Cloud Providers can serve customers directly.

-

Downstream Industry: consists of customer users, such as internet companies, financial institutions, application providers, manufacturers, software companies, government organizations, and others.

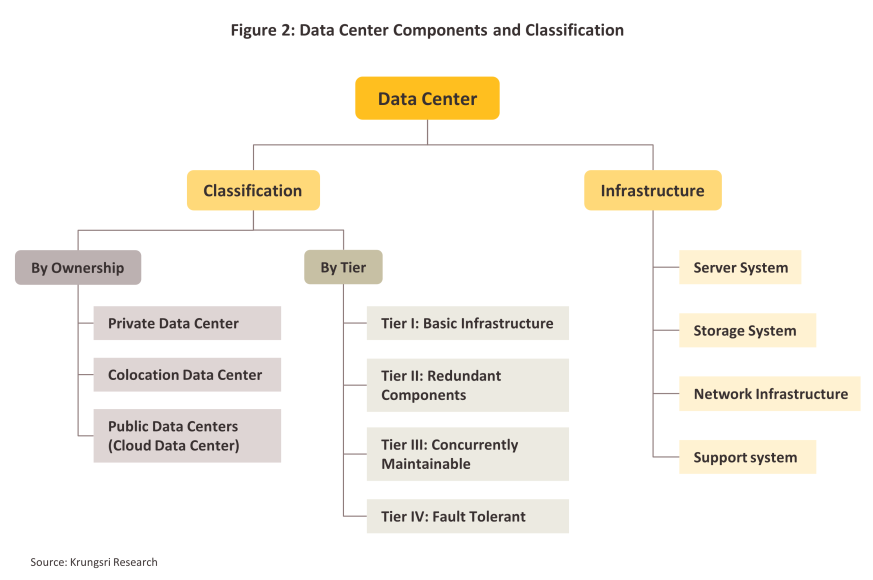

Within a data center, there are four key infrastructure components:

-

Server System is responsible for processing and managing data while supporting the operation of enterprise applications and services. Servers act as the central processing unit of a data center, executing commands, computing tasks, and analyzing incoming data.

-

Storage System is designed to securely store generated data, including user information, transaction details, and critical company information. Efficient and secure data storage is essential in a data center, so storage systems often include data backup and protection against data loss in emergencies.

-

Network Infrastructure acts as an intermediary that allows server systems and storage systems to connect and exchange data quickly and securely. It also connects the data center to external users via internet or corporate networks.

-

Support System include systems such as power system, cooling system, and other systems to ensure smooth operation.

Data centers can be categorized in two ways (Figure 2): by ownership and by technology level.

By ownership

-

Private Data Center is a data center that fully owned and managed by a company within its own premises, with in-house teams responsible for maintenance and operations. It is suitable for large companies that need full control over their data management systems and infrastructure, such as businesses with high-security needs and those that do not want to disclose sensitive and important information to external parties.

-

Colocation Data Center is a data center provider that offers physical space and infrastructure, but the customer brings their own servers and equipment to store in the rented space without being responsible for maintaining the infrastructure. It is suitable for businesses that need a stable and reliable infrastructure but do not want to invest in their own data center, such as medium to large businesses that want to reduce costs and focus on flexibility in data management.

-

Public Data Center, often referred to as Cloud Data Center, is a data center that service providers, such as AWS, Google Cloud, and Microsoft Azure, own and manage entirely. Customers can lease computing and storage resources over the internet without the need to invest in complex infrastructure. This model is ideal for small businesses and organizations that require scalability and flexibility to adjust resources based on their operational needs.

By technological level (Tier Classification)

-

Tier I: A data center that provides basic service with ~99.671% uptime1/ (approximately 28.8 hours of downtime per year). This tier is suitable for small businesses that require basic IT infrastructure and do not rely on constant system connectivity, such as businesses with minimal data requirements.

-

Tier II: A data center that offers improved stability and redundancy compared to Tier I, with ~99.741% uptime (approximately 22 hours of downtime per year). It is ideal for businesses that require greater reliability while maintaining cost efficiency.

-

Tier III: A data center designed for high reliability, featuring ~99.982% uptime (approximately 1.6 hours of downtime per year). This tier is suitable for businesses that require 24/7 operational continuity with minimal service interruptions, such as business that needs mission-critical applications and industries that demand 24/7 continuous availability.

-

Tier IV: A data center with the highest level of redundancy and fault tolerance, ensuring ~99.995% uptime (approximately 26 minutes of downtime per year). This tier is designed for organizations that handle highly critical operations, such as financial institutions and data-sensitive enterprises, where zero downtime is a priority.

In 2024, the United States had the highest number of data centers in the world (5,388), followed by Germany (522) and the United Kingdom (517). Among ASEAN countries, the number of data centers, in descending order, is as follows: Singapore (99), Indonesia (84), Malaysia (61), Thailand (42), Philippines (39), Vietnam (33), Cambodia (7), Myanmar (6), and Laos (1). In Thailand, data centers are concentrated in Bangkok (37 sites)2/, with the remaining 5 sites distributed across secondary cities and industrial areas in one province each: Chonburi, Pathum Thani, Chiangmai, Phuket, and Khon Kaen. Additionally, Thailand has 65 service providers operating alongside data center businesses3/.

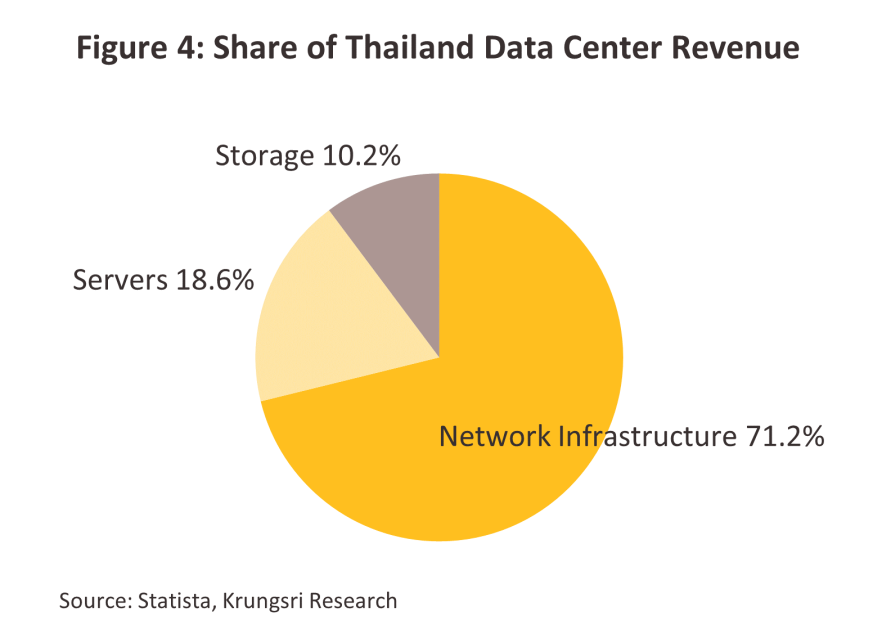

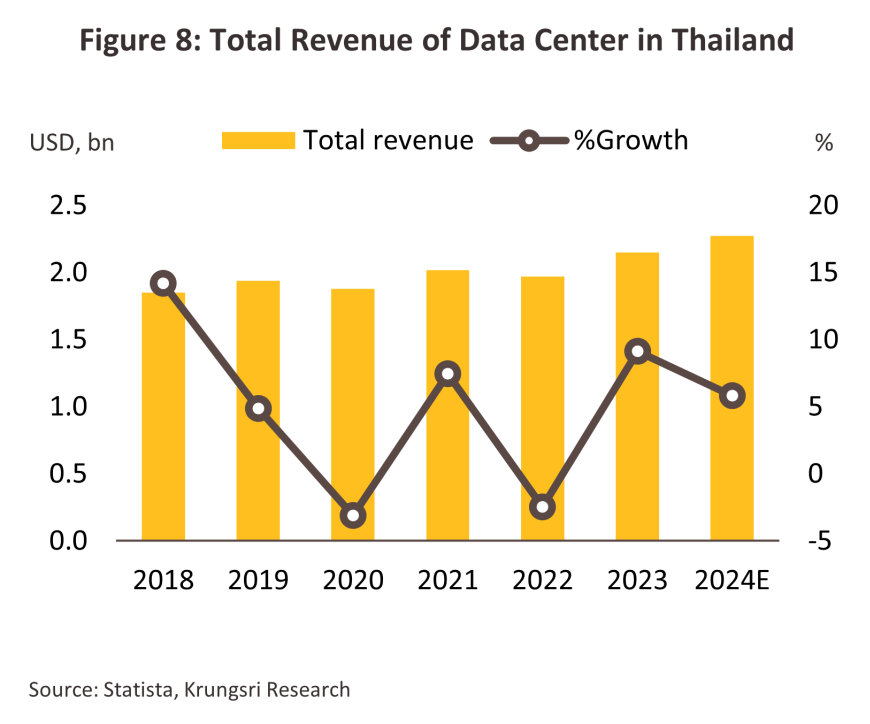

In 2023, the total revenue of the data center industry in Thailand4/ amounted to USD 2.15 billion or THB 74.8 billion5/, comprising three key segments:

-

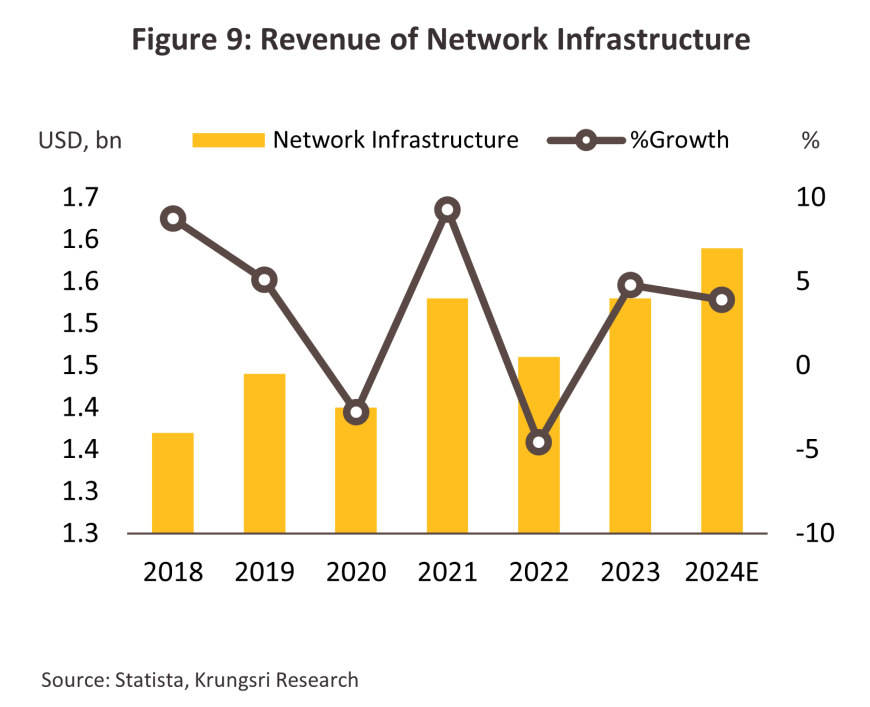

Network Infrastructure: Revenue of USD 1.53 billion or THB 53.2 billion, accounting for 71.2% of the total revenue. This revenue is derived from services related to enterprise network systems and the interconnection of critical hardware, including connectivity and data transmission systems, network security systems, routers, broadband access and switches, enterprise telephony, and infrastructure firewalls.

-

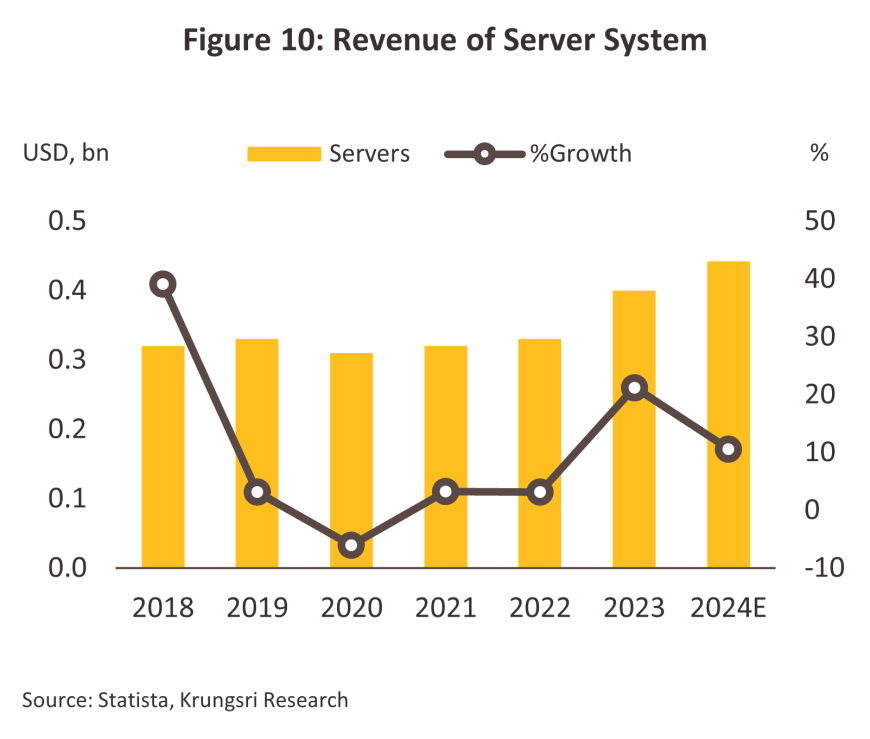

Server system: Revenue of USD 0.40 billion or THB 13.9 billion, accounting for 18.6% of the total revenue. This revenue is derived from services related to high-performance computing equipment, including website hosting solutions, database management, compute-intensive servers, enterprise volume servers, standalone servers, and server racks.

-

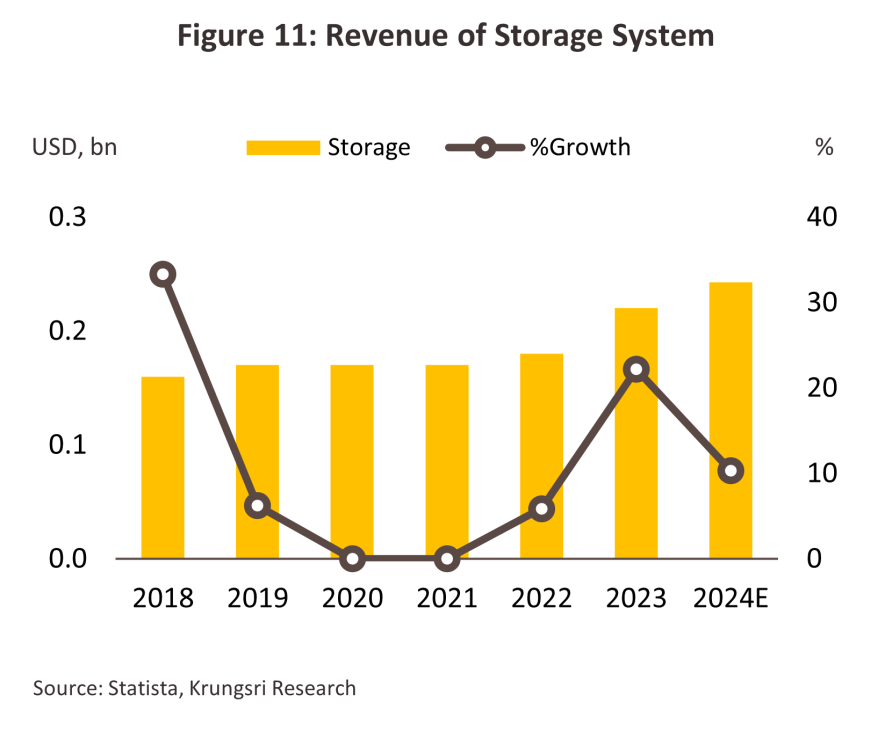

Storage system: Revenue of USD 0.22 billion or THB 7.7 billion, accounting for 10.2% of the total revenue. This revenue is derived from services related to data storage systems, including enterprise storage devices, storage-intensive servers, and cloud storage solutions.

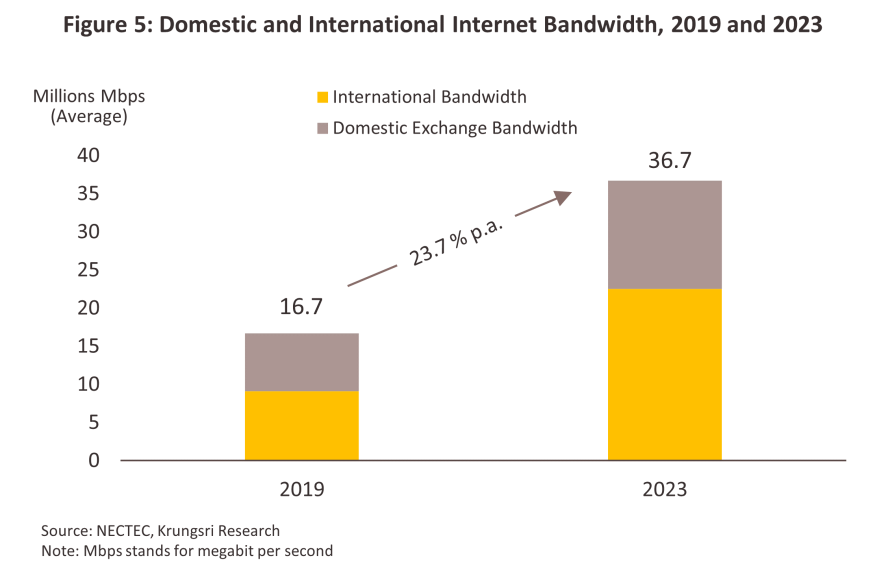

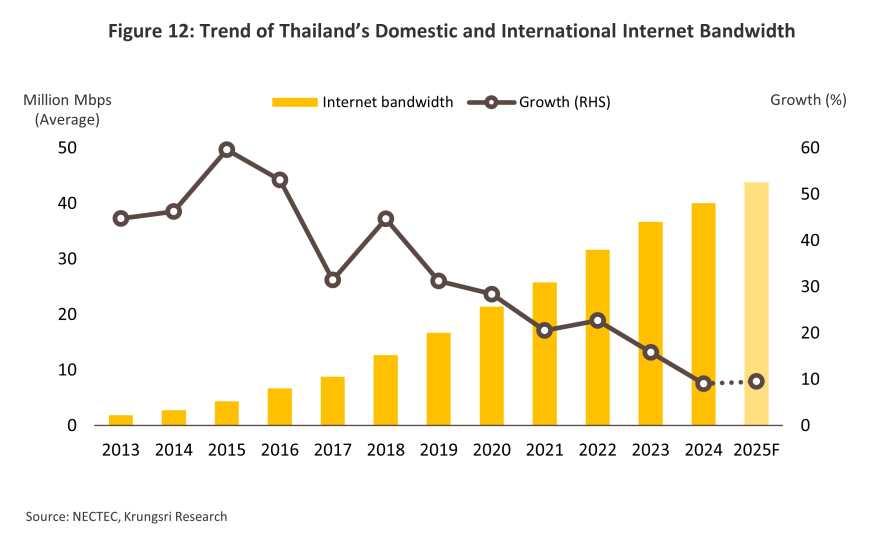

The demand for data centers can be partially reflected through internet bandwidth, which refers to the amount of internet data transmission over a period of time, measured in megabits per second (Mbps) or gigabits per second (Gbps). It represents the capacity of an internet connection to transfer data per second. Internet bandwidth is categorized into two types:

1. Domestic Bandwidth refers to the total bandwidth of all Internet service providers connected to exchange data at the National Internet Exchange (NIX).

2. International Bandwidth refers to the total bandwidth of all Internet service providers connected to exchange data at the International Internet Gateway (IIG) and from Internet service providers directly connected abroad. (Source: NSTDA)

The increase in bandwidth reflects the growing volume of data transmission, which in turn boosts the demand for data storage and processing. This is because the growing volume of data generated (e.g., from data communication, streaming, cloud data processing, or the use of various applications) needs to be stored and managed in data centers. This is particularly true for services requiring high bandwidth such as 5G, IoT, 4K/8K streaming, and AI further underscores the continuous expansion of data center infrastructure.

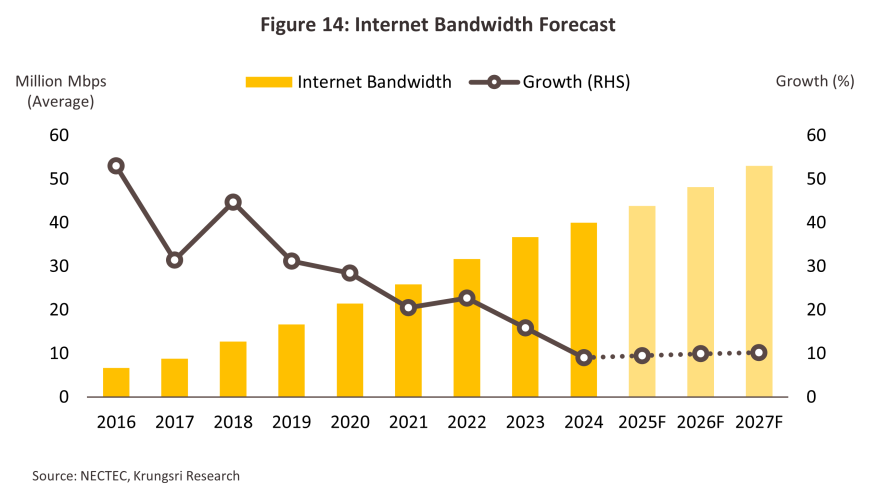

In 2023, Thailand's average internet bandwidth reached up to 36.7 million Mbps, comprising domestic bandwidth of 14.2 million Mbps (38.6%) and international bandwidth of 22.5 million Mbps (61.4%). Compared to pre-COVID-19 times, internet bandwidth has grown at an average annual rate of 23.7% from 2019 to 2023. Notably, the proportion of domestic bandwidth has decreased by 6.8%, while international bandwidth has increased by the same percentage.

The data center industry is an emerging sector that serves as a critical upstream component in the supply chain of technology-driven industries. Thailand offers several key advantages that make it an attractive destination for investment, including:

1) Thailand's electrical infrastructure, a crucial foundation for this business, is stable compared to other ASEAN countries.

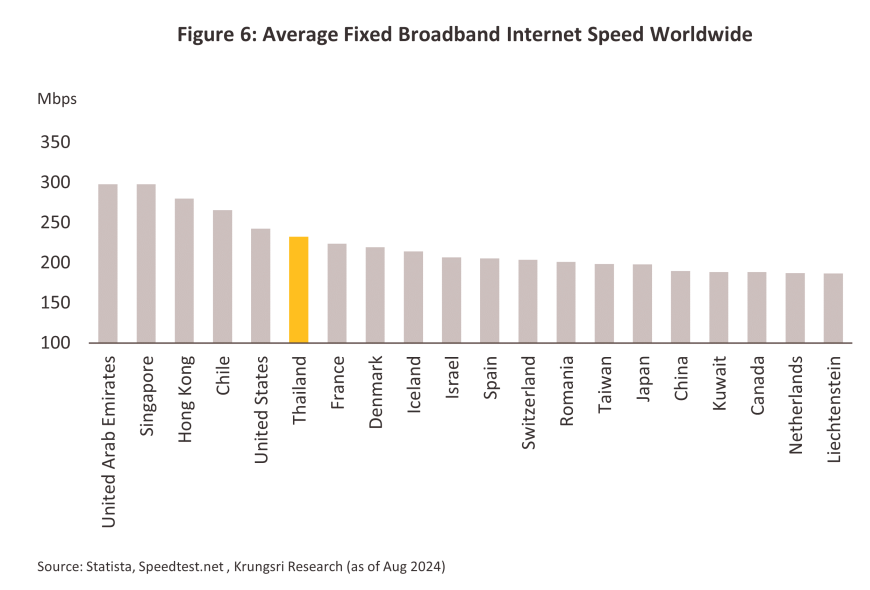

2) Thailand's internet speed ranks among the top 10 globally (Figure 6).

3) Thailand's 5G network covers over 89%6/ of the population, it has the second-highest 5G7/ connectivity index in ASEAN.

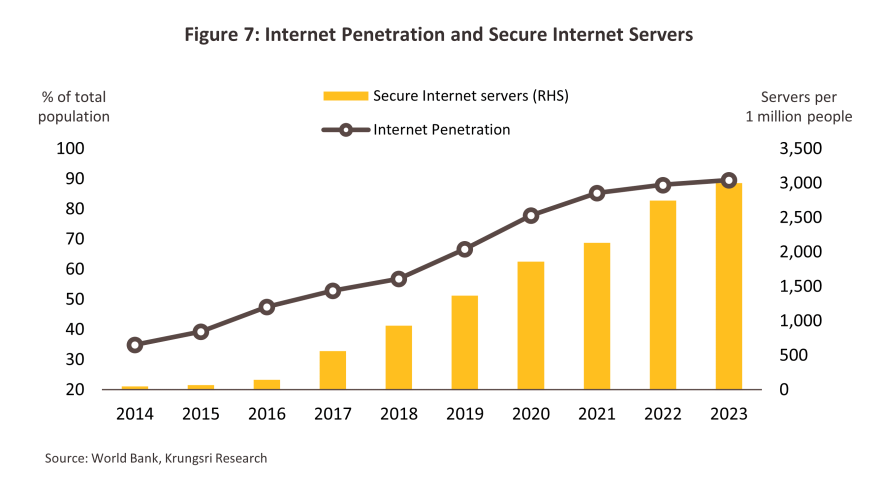

4) Domestic demand is continuously growing, which is reflected in increasing internet bandwidth and high internet penetration, reaching 89.5%, up from 66.7% before the COVID-19 crisis.

5) In 2023, Thailand’s secure internet servers8/ grew 3,002 servers per million people (a 9.3% increase from the previous year), indicating improved internet security standards.

6) Thailand strategically locates in the center of Southeast Asia, which can be positioned as a hub of the region.

7) Thailand has low construction and operating costs, along with greater land availability, compared to current regional hubs like Singapore. (Source: CGSI Research, Cushman & Wakefield)

These factors position Thailand as an attractive investment destination for multinational companies.

Situation

In 2023, the total revenue of the data center industry in Thailand was valued at USD 2.15 billion (THB 74.8 billion), marking a growth of 9.1%. This reflects the rising demand for data center services, particularly from key sectors such as IT & Telecommunication and Banking, Financial Services, and Insurance (BFSI), which are driving market expansion. These supporting factors are expected to sustain industry growth, with total revenue projected to increase by 5.5–6.5% in 2024. The industry’s revenue breakdown by business segment is as follows:

1. Network Infrastructure: Revenue grew by 4.8% to USD1.53 billion (THB 53.2 billion) in 2023 and is projected to expand by 3.5-4.5% in 2024. This growth is driven by (1) increasing demand for internet connectivity from both businesses and individual consumers, in line with the growing use of online services such as digital banking, E-commerce, and remote work; (2) expanding investment in digital infrastructure by organizations of all sizes to support future business growth; and (3) the expansion of 5G networks in the country to support increased connectivity and data volumes, resulting in increased investment in network infrastructure by data center service providers.

2. Server System: Revenue expanded by 21.2% to USD 0.40 billion (THB 13.9 billion) in 2023 and is projected to grow by 10.0-11.0% in 2024, driven by (1) rising demand for data processing due to the growth of AI, Machine Learning, and Big Data, prompting businesses to invest in more efficient servers; (2) the expansion of cloud services for data processing, data storage, and application hosting, which require servers with greater computational power and storage capacity; and (3) competition in the technology market, particularly among cloud service providers and other digital service providers, leading to investments in faster and more stable servers.

3. Storage Systems: Revenue expanded by 22.2% to USD 0.22 billion (THB 7.7 billion) in 2023 and is projected to grow by 10.0-11.0% in 2024, driven by (1) the continuous increase in data volume, including the growth of Big Data from various business sectors, driving demand for higher-capacity storage solutions; (2) Increased adoption of cloud storage by businesses and consumers due to its scalability and convenience; and (3) the growing importance of data as a key factor in driving strategic planning and improving the operations of government and private sectors

The continued growth trajectory of the data center industry's revenue in 2023 and 2024 aligns with Thailand's internet bandwidth expansion which grew by 15.8% in 2023 (averaging 36.7 million Mbps) and 9.0% in 2024 (averaging 40.0 million Mbps). This growth is driven by rising data consumption, investments in technological infrastructure, and the expansion of the digital economy, leading to increased demand for high-speed data in both the business and consumer sectors. It is anticipated that in 2025, Thailand's average internet bandwidth will grow by 9.0-10.0%, in line with the expected 14.0-15.0% expansion in digital service business revenues (Source: Krungsri Research). This growth is supported by evolving consumer behavior favoring transactions on integrated platforms (all-in-one apps) across various activities, including shopping, payments, travel, healthcare, and online media.

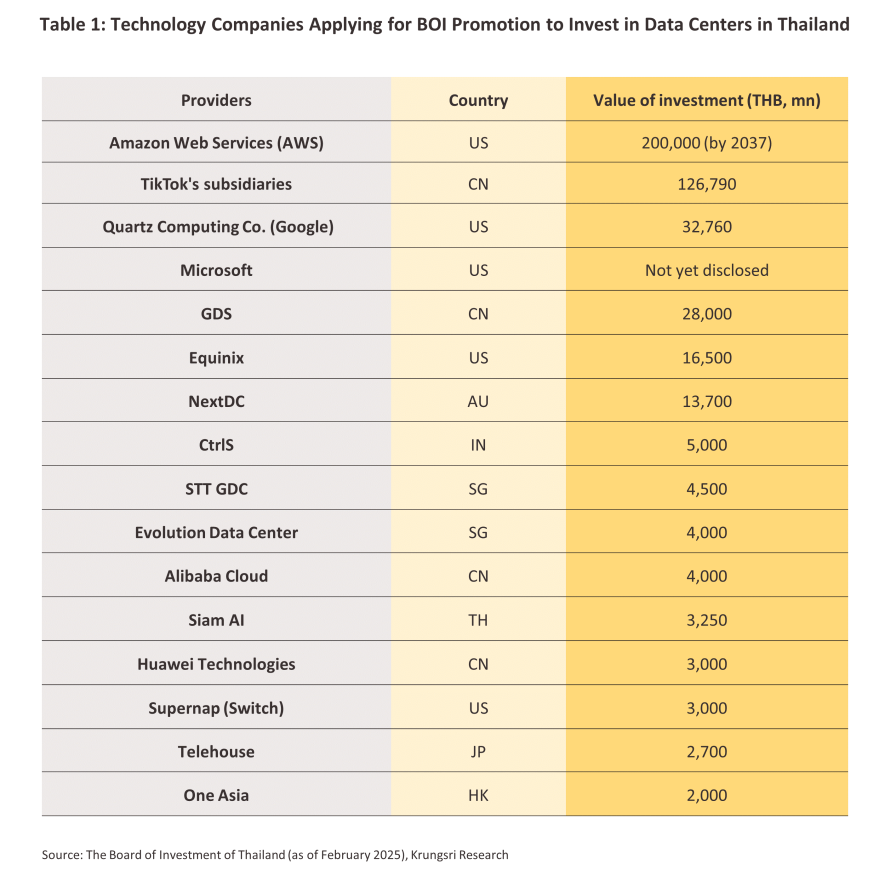

Leading technology companies in both the data center and cloud service sectors have planned significant investments in Thailand. According to the Board of Investment (BOI), in 2024, the digital industry received over 150 investment applications, totaling THB 243,308 million. Most of these applications were for data center and cloud service businesses, with an investment value of THB 240,000 million. These investments come from leading companies from various countries, including the United States, Australia, China, Hong Kong, Singapore, Japan, India, and Thailand. Most data center developments are concentrated in Bangkok and its metropolitan area, given its status as a central business district, which enables seamless business operations and reduces data transmission latency. Additionally, the secondary investment hub is in Chonburi and Rayong, within the Eastern Economic Corridor (EEC) as government’s strategic target area, well-equipped with infrastructure, including reliable power supply and convenient submarine cable connections. These areas offer robust power infrastructure, and convenient access to submarine cable connections. Notably, the Asia-America Gateway (AAG) cable system, linking Asia to the U.S., lands in Si Racha, Chonburi, further enhancing connectivity. Furthermore, in January 2025, BOI approved two additional data center investment projects: A subsidiary of TikTok, with a total investment value of THB 126,790 million (in Bangkok, Samut Prakan, and Chachoengsao areas), and Siam AI with a total investment value of THB 3,250 baht (in Chonburi and Pathum Thani areas).

Outlook

From 2025 to 2027, the total revenue of the data center industry in Thailand is expected to grow at an average annual rate of 7.5%-8.5%. The main driving force is the digital transformation of government agencies and other organizations, which are increasingly focusing on using data for strategic planning and decision-making. This is supported by continuous developments in digital technology, which contribute to increased capacity for developing data storage and processing systems. Investment trends in database systems linked to data centers will largely continue to come from major users in the Information Technology and Telecommunications (IT & Telecommunication) sector, as well as the Banking, Financial Services, and Insurance (BFSI) industry. Notably, foreign investments are expected to increase due to government policies supporting data center investments, which are crucial for the development of upstream technology industries, fostering the growth of target industries that focus on modern technologies (S-curve industries). Krungsri Research forecasts revenue growth trends in sub-sectors of the data center industry as follows:

Network Infrastructure: Revenue is projected to expand by 5.5-6.5% per year, driven by:

1) Increased internet usage due to the growing importance of digital technologies across all sectors, including businesses and government organizations. This has led to a continuous rise in internet and online application usage, such as digital banking, E-commerce, and remote work. This trend increases the demand for IT infrastructure and data centers. The value of digital payment in Thailand is expected to rise from USD141 billion (THB 4.9 trillion) in 2024 to USD 250-310 billion (THB 8.7-10.8 trillion) in 2030, representing an annual growth of 10.0-14.0%. Additionally, the gross merchandise value (GMV) of E-commerce transactions is forecast to rise from USD 26 billion (THB 0.9 trillion) to USD 60 billion (THB 2.1 trillion) over the same period, growing at 15.0% per year9/.

2) The ongoing development of 5G networks by internet service providers in Thailand which is expected to drive higher demand for network connectivity between data centers and end-users. This requires investment in high-capacity network infrastructure to accommodate increasing data traffic. Currently, there are approximately 24.4 million 5G users in Thailand, representing 24.4% of the total 99.8 million mobile phone users. It's projected that by 2030, 94% of all mobile subscribers will be using 5G services10/.

3) Investments by foreign technology companies such as AWS, Microsoft Azure, and Google Cloud, supported by government policies that promote investment in digital infrastructure development. This will contribute to the revenue growth of network infrastructure in data center industry.

Server System: Revenue is projected to grow by 12.0-13.0% annually, driven by:

1) Increasing cloud adoption continues to drive demand for high-performance and secure servers. Many businesses are restructuring their IT infrastructure by migrating data and applications to the cloud to enhance efficiency, reduce costs, strengthen cybersecurity, and improve flexibility in adopting new technologies. Similarly, government agencies are shifting their data management structures towards the cloud, supported by government’s Cloud First Policy11/, which aims to support the innovation development of public service and enhance accessibility.

2) The growing application of the Internet of Things (IoT) across various industries, including smart factories, logistics management, and autonomous vehicles, is expected to drive demand for high-capacity servers. These applications require massive amounts of data to be processed efficiently in real-time, leading to increased demand for servers in terms of both quantity and diversity.

3) The use of AI and Machine Learning, particularly in data analysis and business trend forecasting, requires high-performance servers. In 2024, approximately 17.8% of organizations in Thailand use AI (up from 15.2% in 2023), with 73.3%12/ of organizations planning to use AI in the future. Additionally, Bloomberg Intelligence projects that the global generative AI industry will expand significantly, reaching USD 1.3 trillion by 2035, up from USD 40 billion in 2025, reflecting an annual growth rate of over 40.0%.

Storage System: Revenue is projected to grow by 11.0-12.0% annually, driven by:

1) Expansion of Big Data from the increasing volume of in-depth data storage is essential for AI-driven analytics, which are advancing rapidly to analyzing consumer behavior, purchasing decisions, and online transactions. This trend is driving demand for large-scale, high-performance storage solutions.

2) The growth of E-commerce and E-payment markets rely on storing large and rapidly increasing amounts of customer transaction data. This compels businesses in these areas to invest in secure, real-time, and scalable storage systems to support higher security standards, seamless data access, and unlimited storage capacity expansion.

3) The enforcement of data protection laws, such as the Personal Data Protection Act (PDPA), is pushing businesses to adopt secure and easily retrievable storage solutions. As data privacy regulations continue to tighten, demand for compliant and advanced storage infrastructure is expected to rise, supporting sustained revenue growth in this segment.

Furthermore, Internet Bandwidth is another important factor supporting the demand for data centers. Krungsri Research estimates that during 2025-2027, Thailand's average Internet Bandwidth usage will expand by 9.5-10.5% annually, resulting in an average data transmission volume of 53.1 million Mbps, up from 40.0 million Mbps in 2024. This reflects the increasing volume of internet usage within the country to support the continued growth of online service businesses such as online education, digital transactions, and e-commerce. Additionally, international bandwidth plays a critical role in facilitating cross-border data exchange for global businesses. The increasing capacity of both domestic and international bandwidth will drive the expansion of data center infrastructure, including storage systems, servers, and network infrastructure, to accommodate the growing demand for data processing and connectivity.

Challenges in the Data Center Industry

-

Energy Costs and Dependency: The data center industry, particularly hyperscale data centers, requires substantial energy for both data processing and cooling systems. Rising energy prices or potential energy crises could significantly increase operating costs. If operators fail to secure energy at competitive prices, they may lose their competitive advantage. Additionally, transitioning to renewable energy to align with ESG goals could further add cost pressures to the industry.

-

Rapid Technological Change: Emerging technologies such as AI, Edge Computing, and Quantum Computing could reshape data processing models, requiring frequent hardware upgrades and infrastructure modernization. This poses a challenge for data center operators, as continuous investment in upgrades is necessary, demanding high capital expenditures and long-term strategic planning.

-

Shortage of Skilled Personnel: Due to the rapid growth of digital technologies such as AI, the demand for specialized personnel is increasing, but skilled personnel remain scarce, while the production of new personnel cannot keep up with demand. Large corporations often have a competitive edge in attracting top talent, leaving smaller providers struggling to secure sufficient skilled workers. This talent gap could hinder the overall growth of the data center industry.

-

Transition to Sustainability: In addition to being an energy-intensive industry, consuming both electricity and water for cooling, the data center industry also generates a large amount of electronic waste. These factors have an environmental impact, requiring businesses to invest more in sustainable practices, such as using renewable energy or efficient cooling systems, while complying with data security standards and stringent legal requirements.

1/ The uninterrupted operating time of a system, expressed as a percentage of its availability throughout the year.

2/ Cloudscene.com (2024)

3/ For example, telecommunications network providers, digital infrastructure service providers, and cloud service providers.

4/ The total revenue from data center services excludes revenue from cloud hosting providers such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform. And it does not account for network infrastructure service providers, including IT support services and internet service providers.

5/ Based on the Bank of Thailand’s average exchange rate for 2023 of THB 34.8068 to USD 1.

6/ International Telecommunication Union (2023)

7/ GSMA Intelligence (as of 2Q/2024), The 5G Connectivity Index evaluates multiple aspects of 5G deployment, such as spectrum availability, network performance, affordability, adoption, and market development.

8/ The number of secure internet servers refers to the number of servers that encrypt transmitted data using TLS/SSL certificates. This metric reflects the quality and security of a country's internet infrastructure (World Bank)

9/ Estimated by Google, Temasek, and Bain & Company from the E-conomy SEA 2024 report.

10/ Bangkokbiznews by Dr. Supot Thianwut from the Digital Government Development Agency or DGA (August 22, 2024).

11/ The Digital Government Development Committee approved and assigned DGA to proceed with the plan to drive the Cloud-first policy on December 16, 2024.

12/ Artificial Intelligence Governance Center (AIGC) under the Electronic Transactions Development Agency (ETDA).