EXECUTIVE SUMMARY

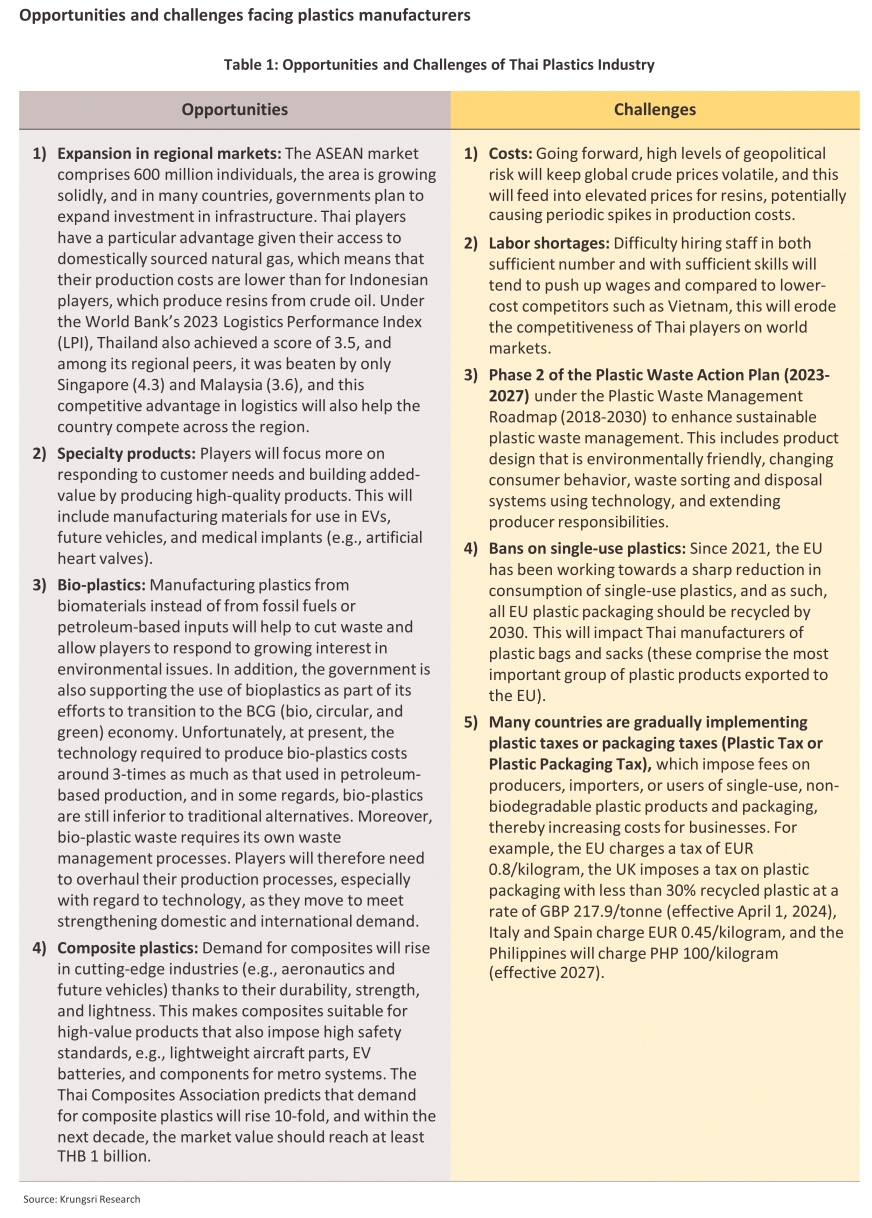

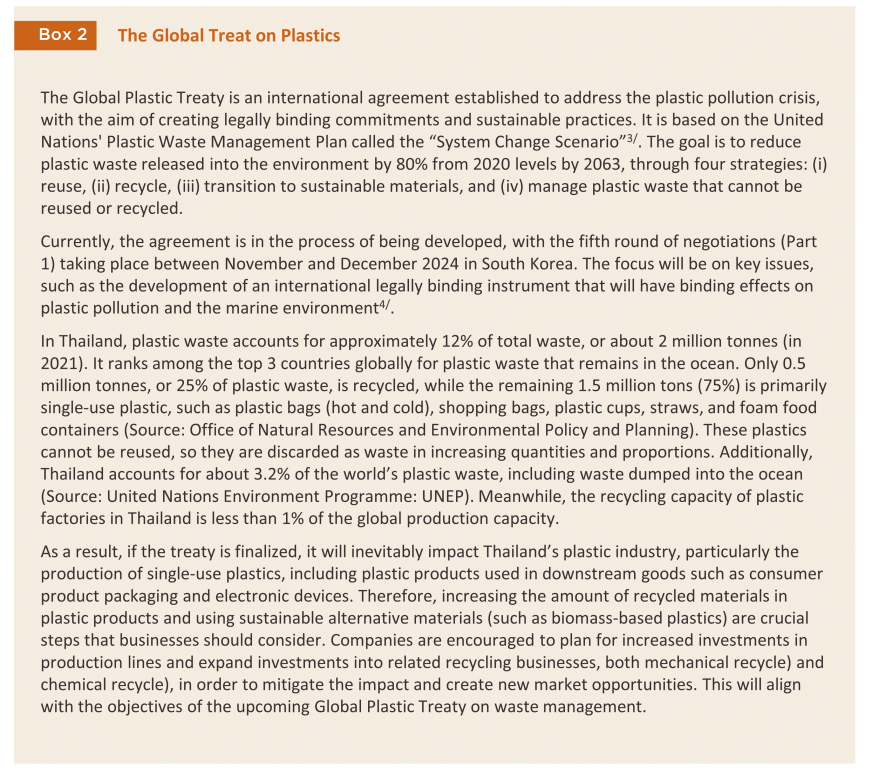

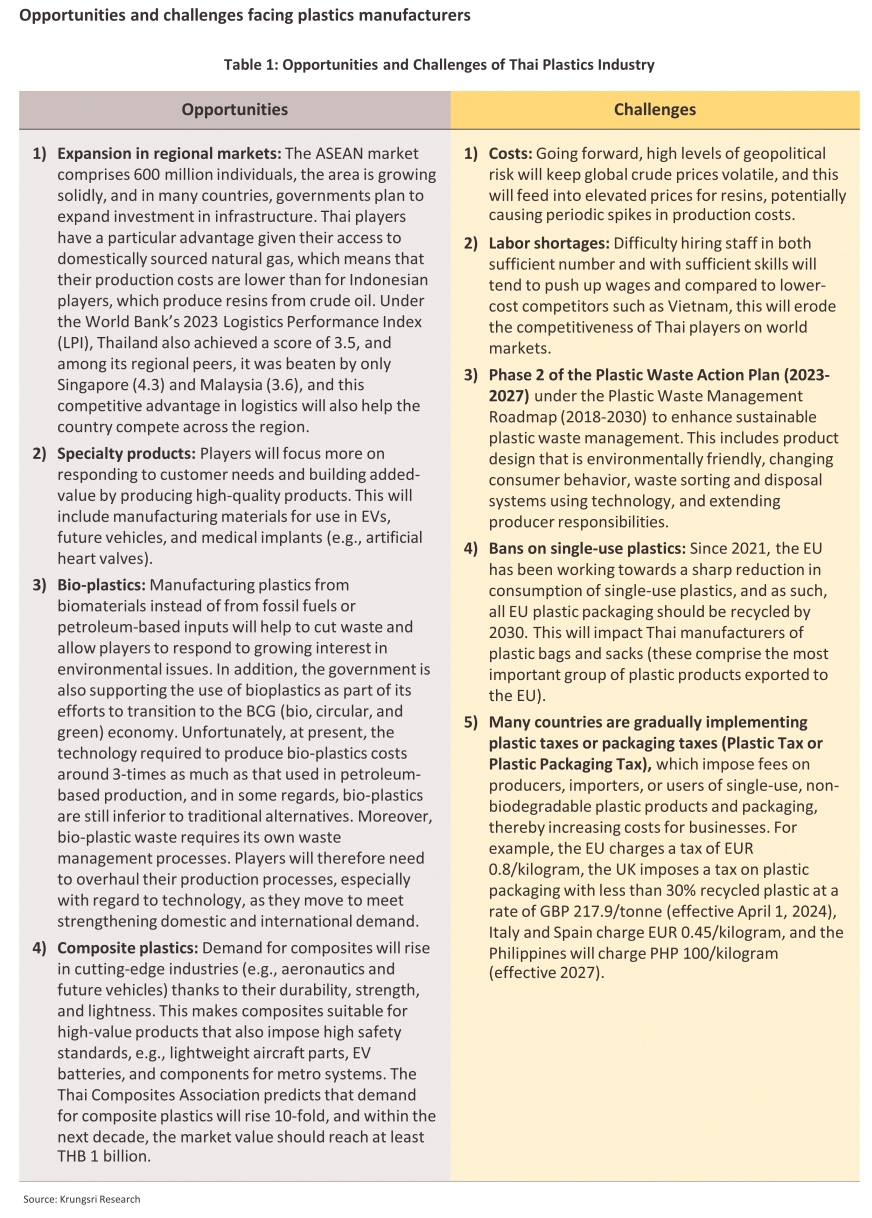

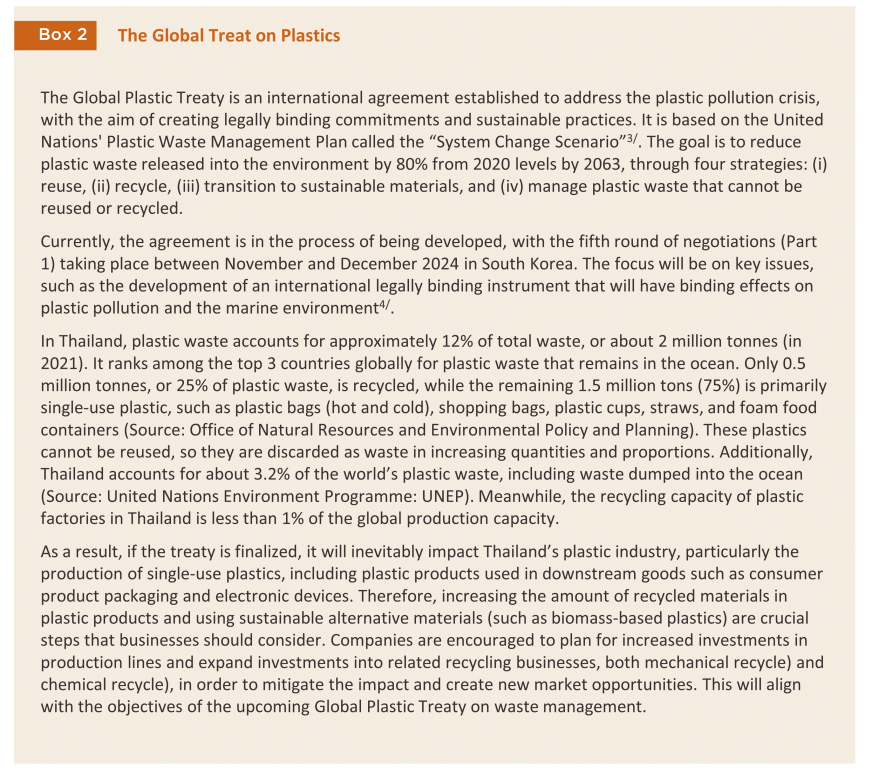

Between 2025 and 2027, the plastic industry is expected to continue its growth, driven by the global and Thai economic recovery, which will increase demand for plastics in end-use industries. Additionally, government policies promoting investment in the New S-Curve industries will support the plastic sector within the supply chains of these industries. However, the plastic industry will face challenges from intensified competition and stricter environmental policies both domestically and in export markets. These include measures to reduce the use of plastic products, particularly single-use plastics, and the promotion of eco-friendly plastics. Furthermore, the Global Plastic Treaty, which is currently under development, will require the plastic supply chain to adapt by investing in production lines that use recycled plastic resins and biomass-based plastics. As a result, production costs may rise, putting pressure on revenue growth and profit margins.

However, operators with businesses covering the entire value chain and who can manage raw material stocks, sales, and distribution efficiently, will be able to maintain their profit margins consistently. On the other hand, smaller operators may face greater challenges in adapting.

Krungsri Research view

Krungsri Research sees growth patterns developing in the different industry segments over 2025-2027 as follows:

-

Plastic packaging: This segment will see ongoing growth, with manufacturers of flexible and semi-rigid plastics benefiting from stronger demand from downstream industries of their products, including the food and beverage, retail, and e-commerce. While demand for some core products (e.g., carrier bags) will decline as consumer concerns with the environment intensify, players that invest in modern production technology and that manufacture a wide range of high-quality products will be able to sustain solid rates of growth.

-

Plastic films, pipes, straws, and flexible tubing: Companies active in this segment will enjoy normal levels of growth. Nevertheless, demand for plastic films and straws will soften due to the enforcement of phase 2 of the Action Plan on Plastic Waste Management. The large number of players in this segment will result in an intensification of overall levels of competition, shifting market power towards buyers and away from manufacturers.

-

Household and plastic products: Intense competition will drag on growth in demand. The increasing number of overseas players supplying the market (especially those from China) will be particularly significant since they have lower production costs than Thai manufacturers, and as a result, domestic companies will see their profits come under pressure.

-

Plastic parts and other plastic products: This market will move in step with demand from downstream industries (i.e., the manufacture of autos and auto parts, electronics and electrical appliances, and medical devices). Less positively, players will be exposed to increased risk from non-Thai players, especially Chinese, which face lower production costs than their Thai counterparts. In addition, some players are overly reliant on selling to a small number of major buyers.

Overview

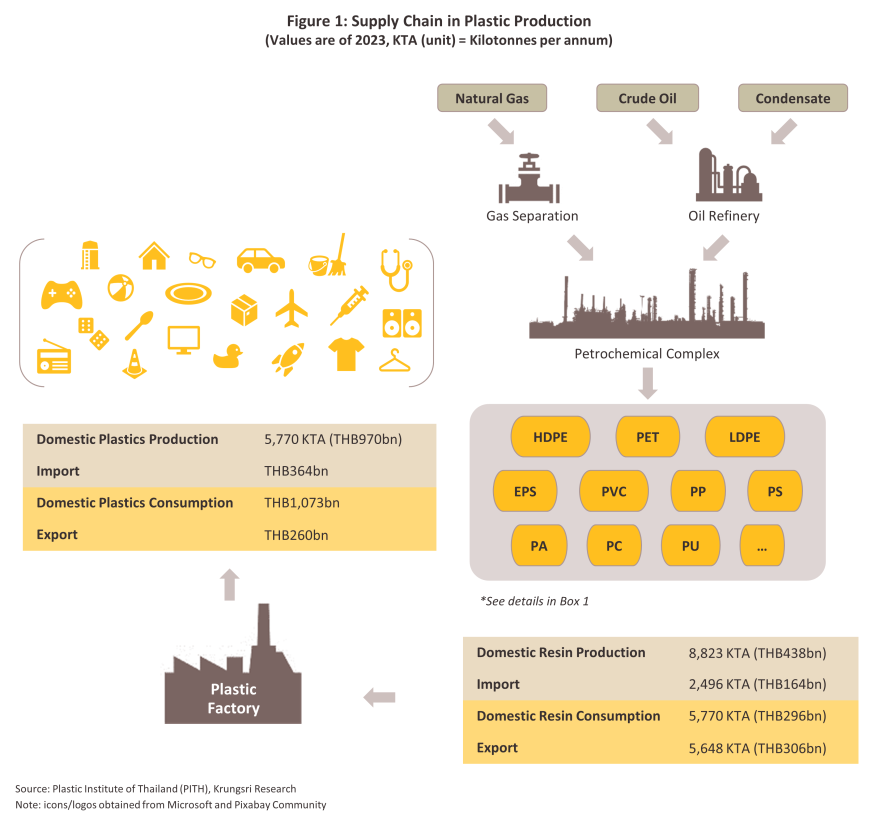

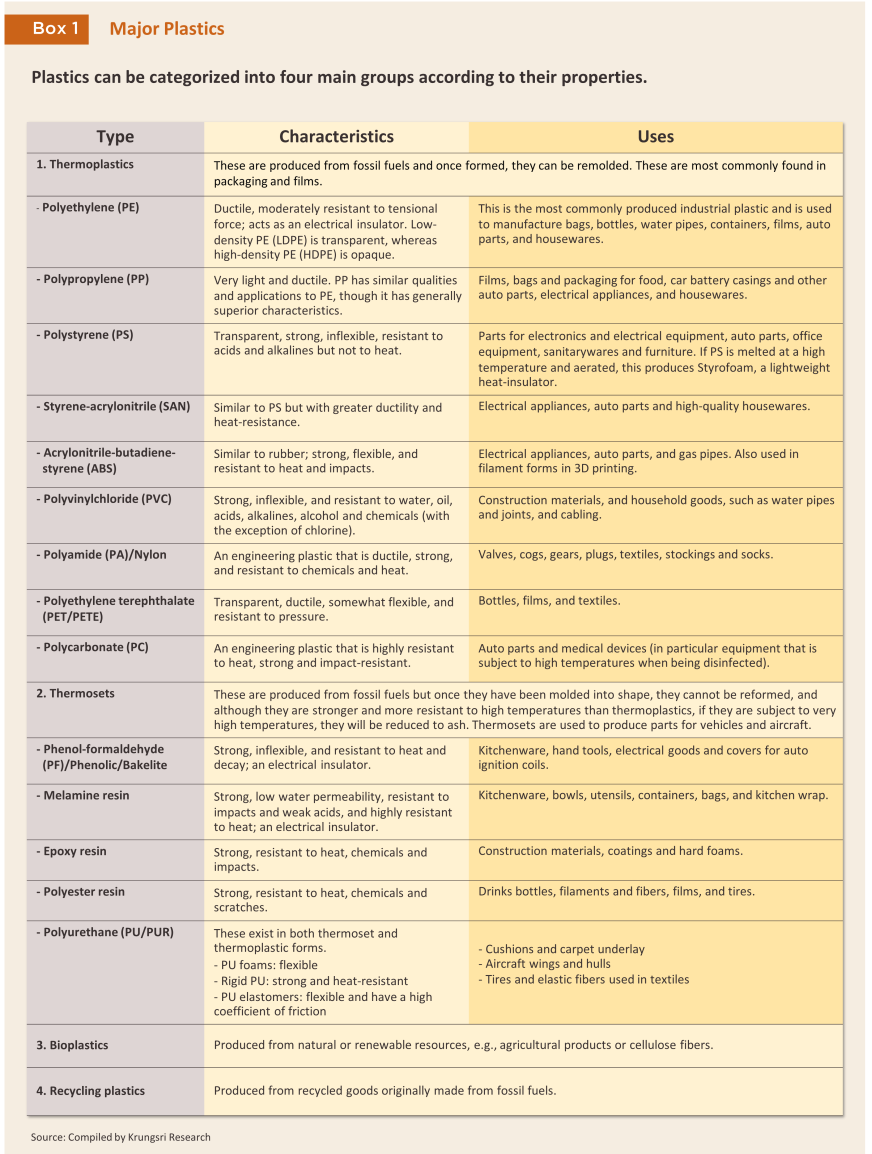

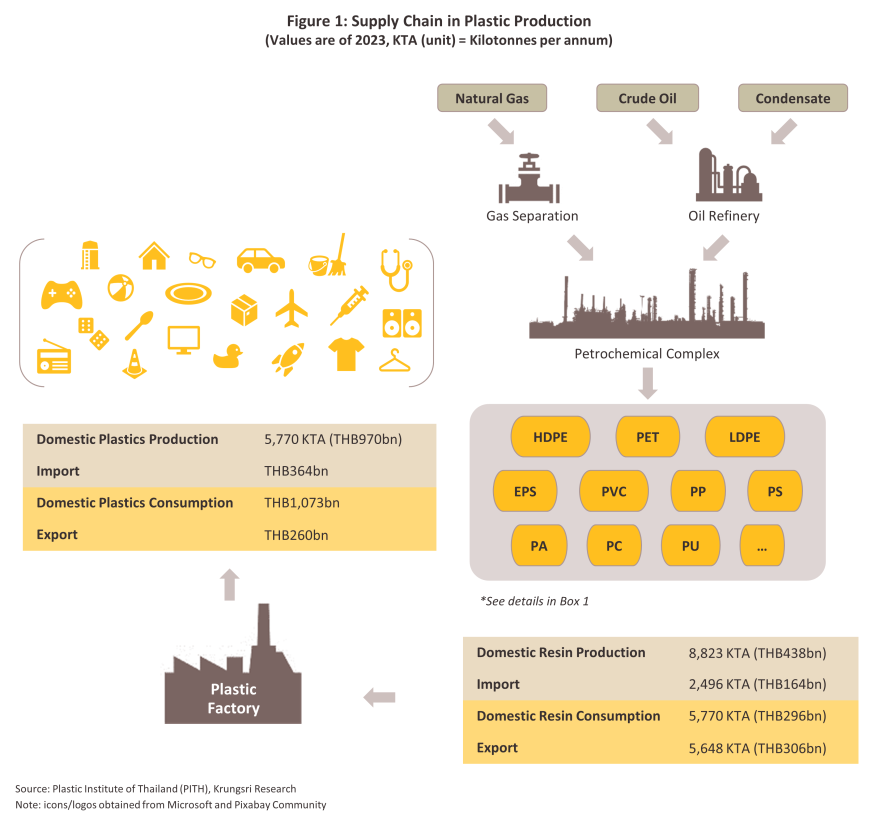

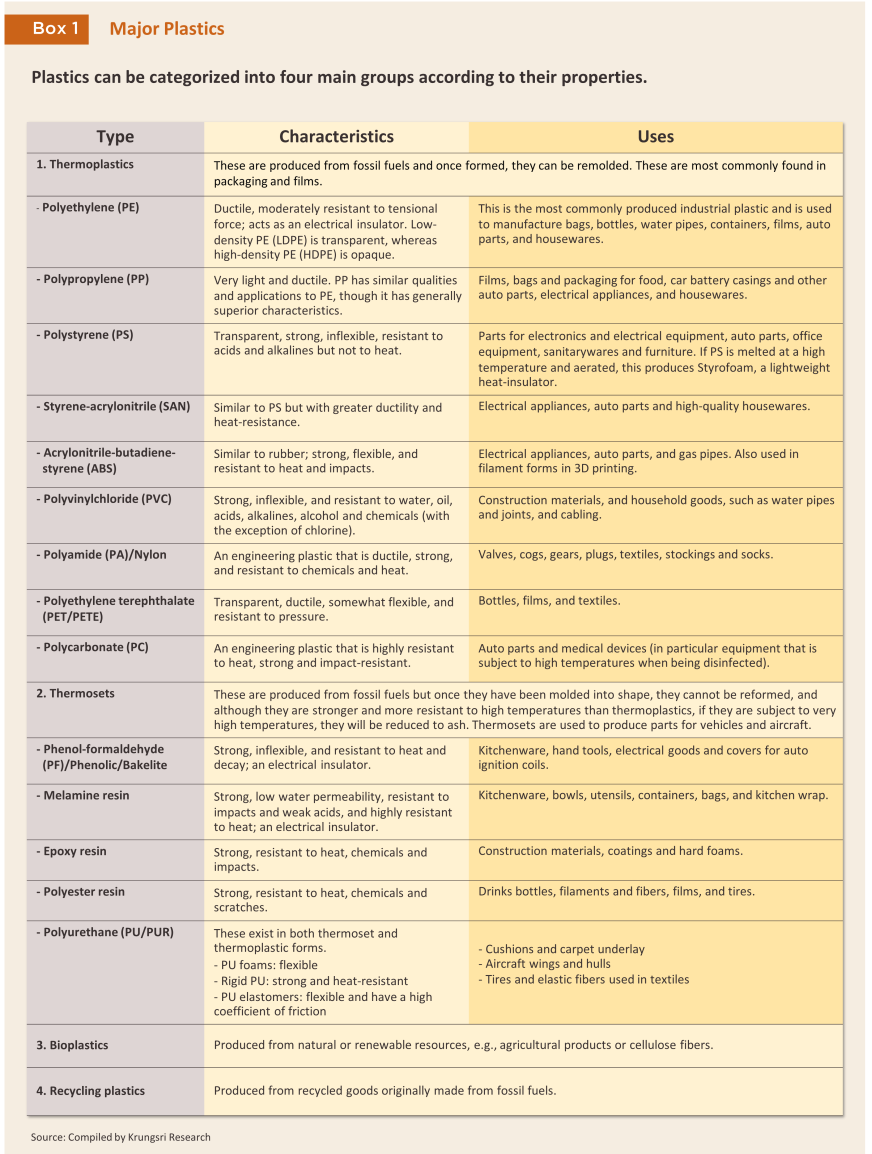

Plastics are produced from hydrocarbons, most commonly from chemicals originating from the distillation of crude oil or the separation of natural gas. These initial processes yield products that are then separated into their component chemicals including ethylene, propylene, styrene, phenol and acrylonitrile, which comprise the major inputs into the production of a range of different plastic resins. These are distinguished by properties such as their ductility and heat-tolerance, and depending on the demands of downstream industries, these resins are then molded and shaped into finished goods for use in an enormous range of applications (Figure 1 and Box 1). Recently, interest has grown in manufacturing plastics from renewable resources, and this has included producing plastic goods from polylactic acid (PLA) derived from corn, sugarcane or cassava. These have the advantage of being biodegradable, while in many cases it is possible to use PLA-based plastics in applications that are identical to those of traditional oil-based plastics.

As of 2023 (the latest data available), the plastics industry accounted for 6.7% of Thai GDP, playing an important role linking the petrochemicals sector, which supplies upstream inputs of resins, with end-user industries, to which the plastics industry provides finished and semi-finished products. The most important of these industrial consumers are manufacturers of construction materials, autos, electronics and electrical appliances, and medical equipment.

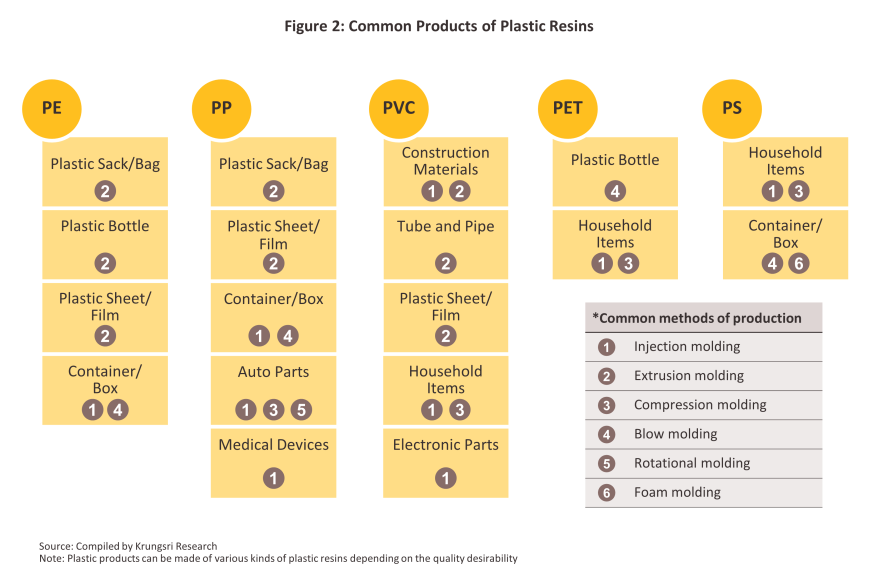

Manufacturing plastic products involves melting and molding resins that usually come in the form of plastic pellets (or nurdles) and then cooling the molded plastic to produce finished goods that are of the required shape. In addition, dyes and plasticizers may be added to change the color and characteristics of the goods and to make them better suited to their intended use, for example by raising their tolerance to high and low pH values, by making them more resistant to fire or ultra-violet radiation, or by increasing their flexibility. There are many different ways to mold plastics, but deciding which technique to use will depend on how the goods being produced will be used. The main methods are: blow molding, which is suitable for packaging, such as water, oil and shampoo bottles; injection molding, which tends to be used for the manufacture of goods including kitchenwares, toys and parts used in the assembly of electronics, autos, and electrical appliances; compression molding, which is generally used for goods such as plates, bowls, cups and other kitchenwares manufactured from melamine; and extrusion molding, which is used to manufacture plastic bags and sacks, thin films, and PVC water pipes. A survey carried out by the Plastics Institute of Thailand in 2021 revealed that some 36.5% of Thai plastics producers use injection molding, which is followed in importance by films and blow molding1/.

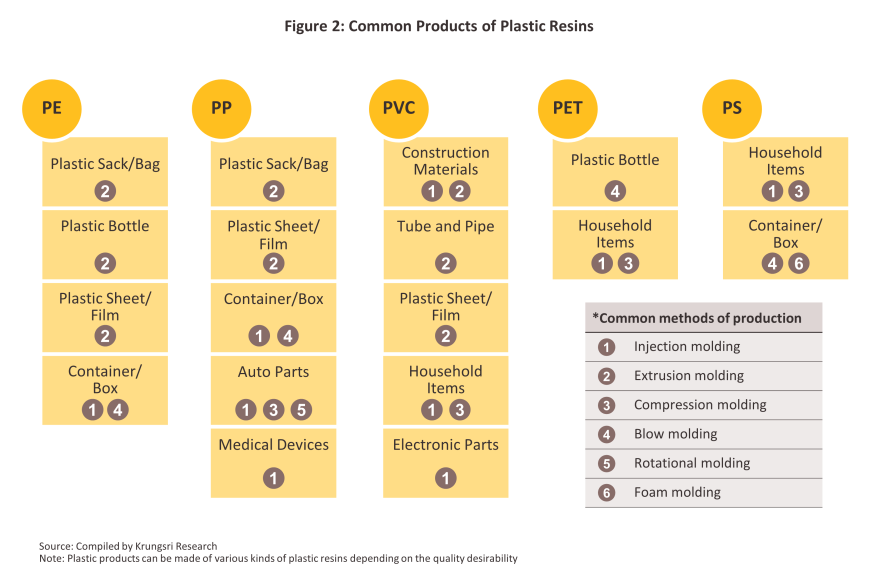

Given the range of physical and mechanical properties displayed by different plastics (e.g., their weight, moldability, flexibility, and gas- and water-permeability), these have assumed an extremely important role as upstream inputs into a large number of industries, with particular types of plastic solving problems unique to these downstream consumers. Thus, manufacturers of auto parts use plastics to reduce the weight of components and so increase fuel efficiency, producers of construction materials use plastic products that are long-lasting and resistant to attack by chemicals, and the medical equipment industry uses plastics to add value to their products (Figure 2).

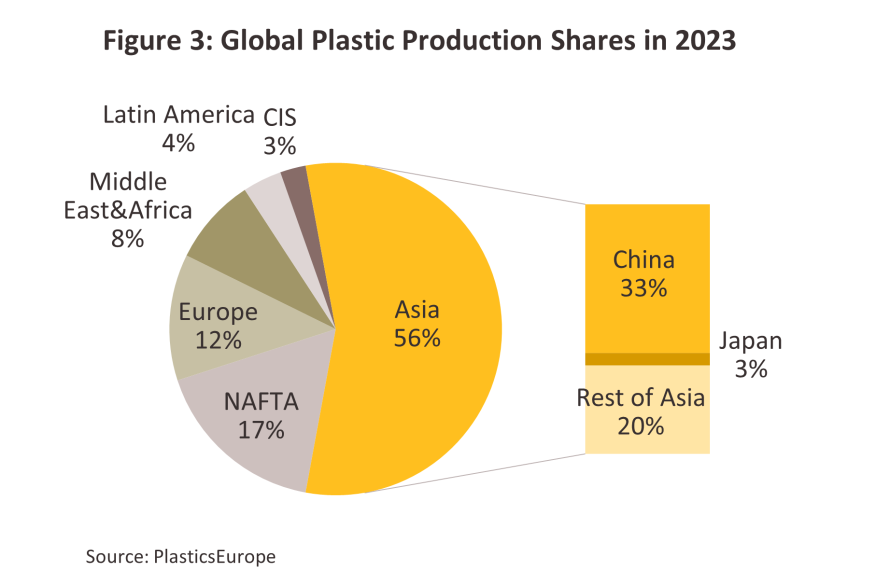

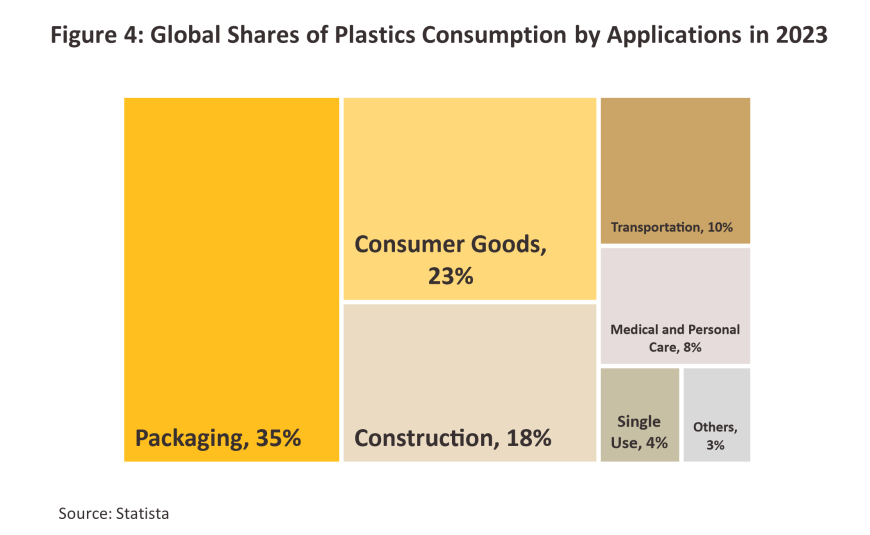

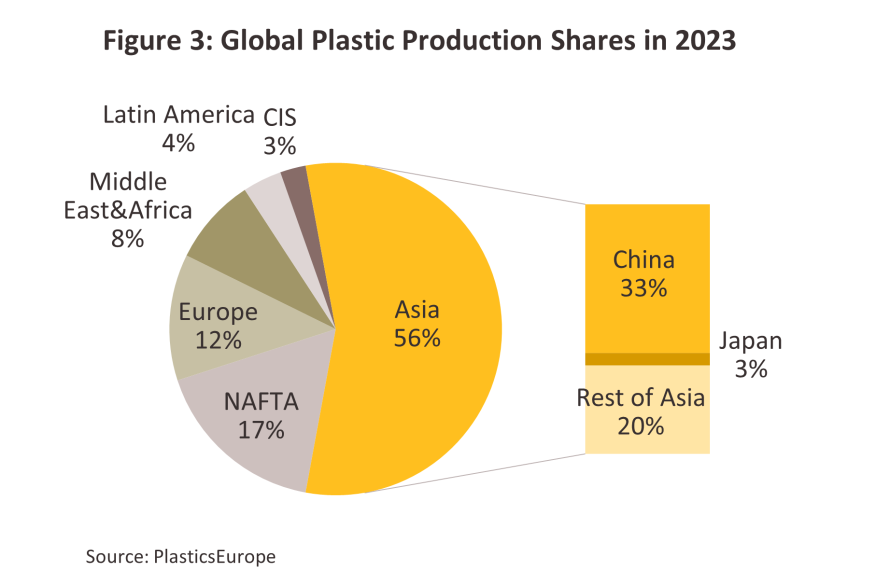

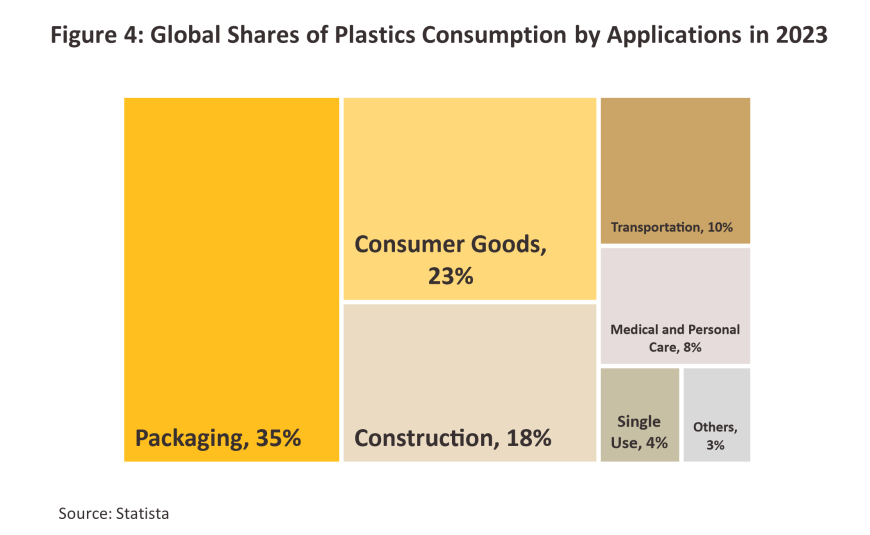

In 2023, 413.8 million tonnes of plastic were produced globally, a 3.3% increase on 2022’s figure2/. Asia is the principal source of this, accounting for 55.8% of the world total (Figure 3), with regional production led by China, which alone produces 33.3% of all plastic manufactured globally. Asia is followed in importance by North America (the NAFTA region, though led by the United States), which produces 17.1% of the global total, and then Europe, with a further 12.3% led by Germany. With regard to downstream consumers of plastic nurdles or resins, the packaging industry is the biggest buyer (this absorbs 35% of all output), followed by consumer products (23%) and construction (18%) (Figure 4).

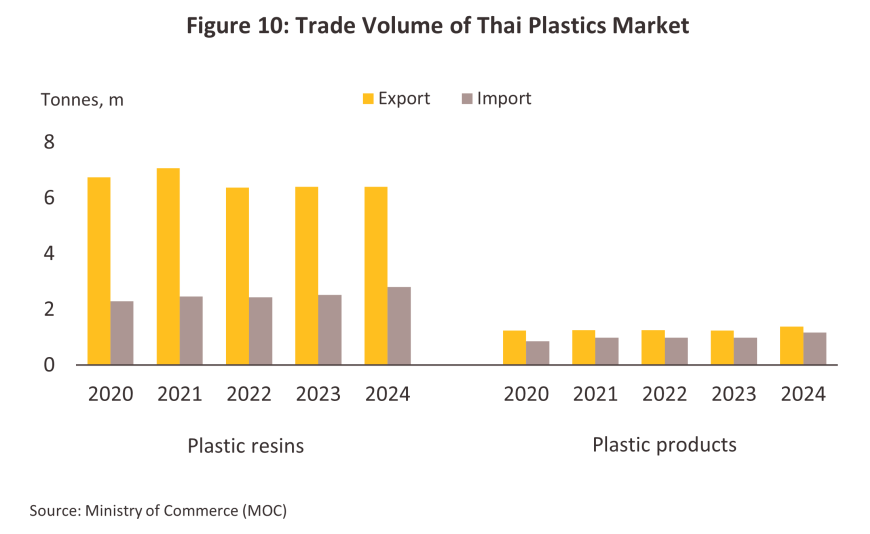

Thailand occupies an important place in the global plastics industry, and as of 2023, the domestic industry generated market value of around THB 1.3 trillion annually. Production benefits from a domestic petrochemicals industry that is both sizeable and highly efficient compared to its competitors in the ASEAN region, and because plastic resins are products that sit downstream from the petrochemicals industry, this then helps to boost the competitiveness of Thai manufacturers. Major Thai players are also skilled in the research and development of the new products demanded by an ever-shifting market, and by producing a wide range of resins at a spread of price points, Thai companies are able to support the output of a large number of different industries. Indeed, in 2023, Thai manufacturers produced 8.8 million tonnes of plastics, while the country imported just 2.4 million tonnes. 49% of output is consumed on export markets, with the remaining 51% used to manufacture products for domestic industries, most notably for players in auto assembly, electronics and electrical appliances, and construction. Thai plastics converters are therefore embedded in comprehensive supply chains that stretch from upstream raw materials (i.e., domestic producers of natural gas products), through intermediate goods (i.e., petrochemical players manufacturing plastic resins), and down to a large number of downstream industries.

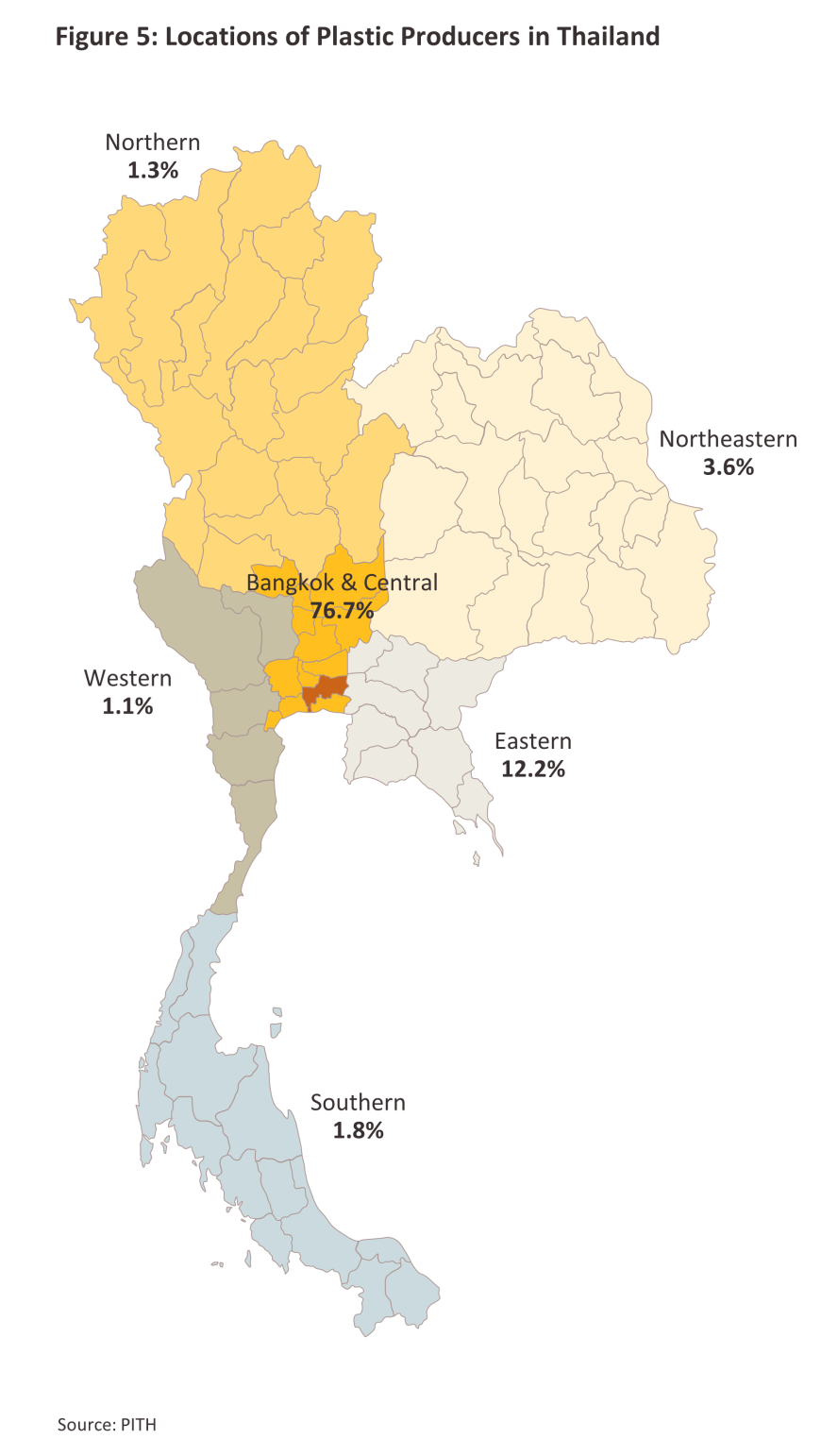

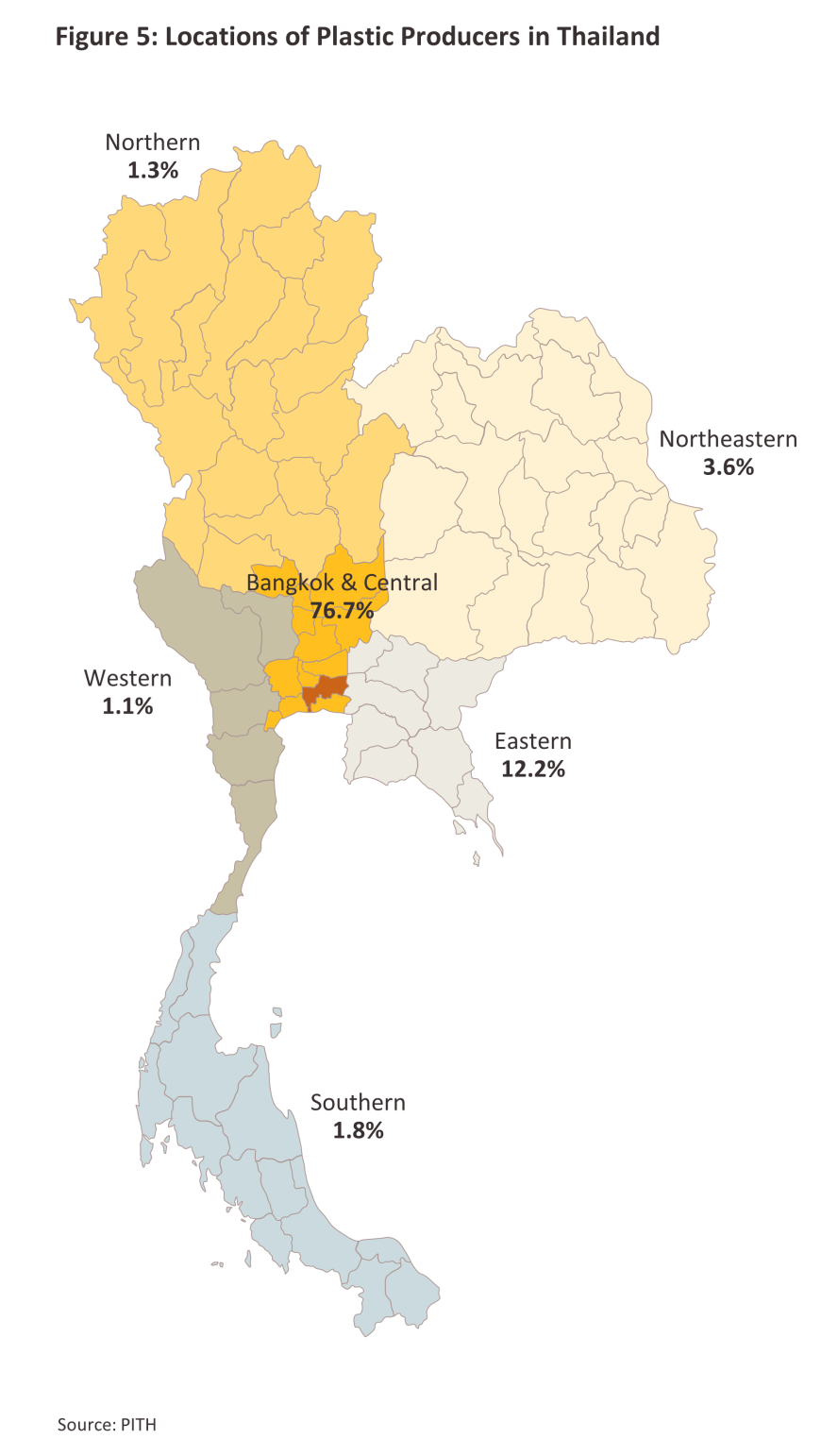

There were 3,217 plastics converters active in Thailand as of 2023, these split 88.2% SMEs and 11.8% large players. The significant number of SMEs in the industry is explained by the fact that barriers to the market are relatively low (the up-front investment costs are moderate, and production utilizes only low to mid-level technology) but the outcome of this is that most output is of general commodity-level products, competition is fairly stiff, and margins are narrow. In terms of geographical distribution, the vast majority of players (76.7%) are clustered in the central region, especially in the Bangkok Metropolitan Region, Samut Prakan and Samut Sakhon, followed by the east (12.2%) and the northeast (3.6%) (Figure 5). Almost half (45.5%) are active in the packaging industry, which is followed in importance by furniture and housewares (12.3%), and electronics and electrical appliances (8.7%).

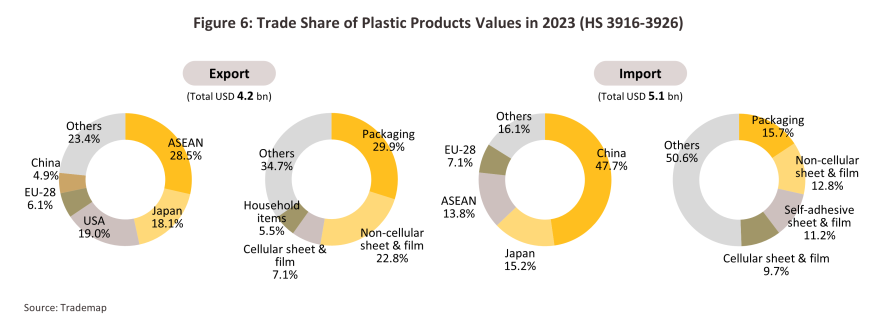

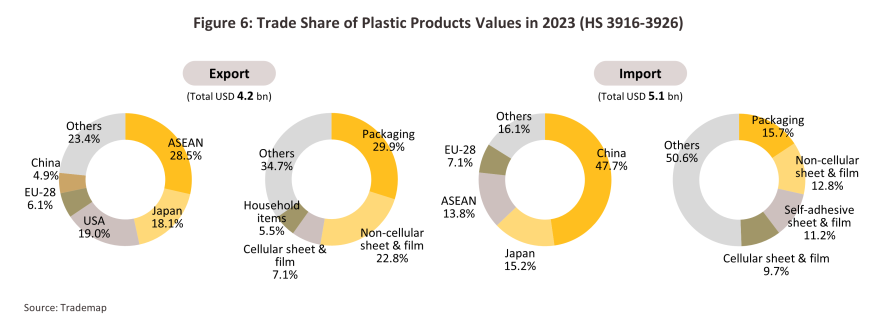

The domestic market accounts for around 80% of Thai plastics production, with this split between the two primary segments of: (i) the consumer market, which meets consumer demand directly through the production of goods such as housewares, bags and straws; and (ii) the market supplying end-user industries, which comprise the five major markets of packaging, electronics and electrical appliances, construction materials, auto parts, and medical devices and supplies. The remaining 20% is sold into export markets, but much of this is of low-value commodity-grade products used in the production of packaging (the most important export segment) and cellular and non-cellular films. The main export markets are the ASEAN zone (28.5% of all exports by value), the US (19.0%) and Japan (18.1%). The most significant imports are plastic packaging (15.7% of all imports), non-cellular films (12.8%) and self-adhesive films (11.2%), the major sources of these being China (44.7% of all imports by value), Japan (15.2%) and the ASEAN region (13.8%) (Figure 6).

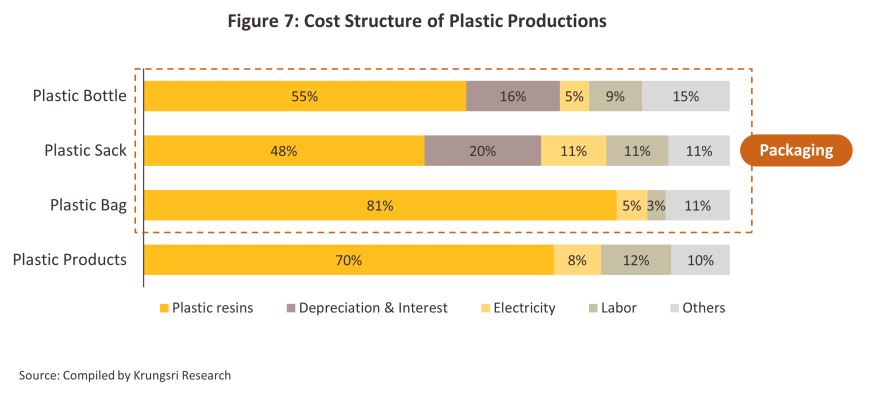

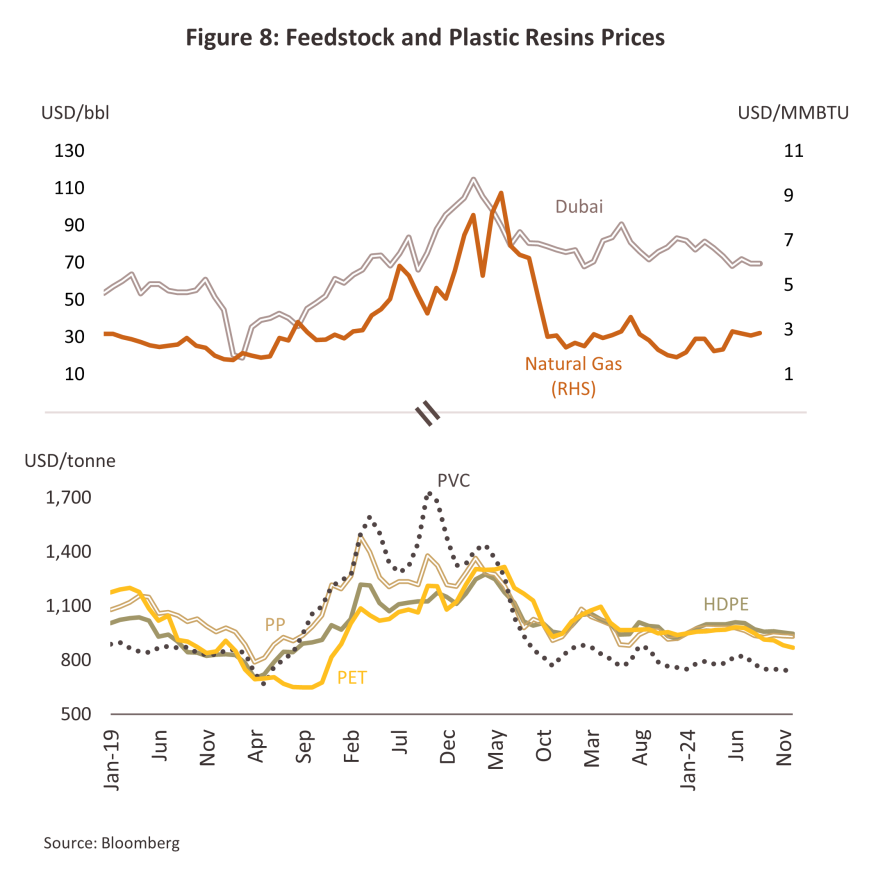

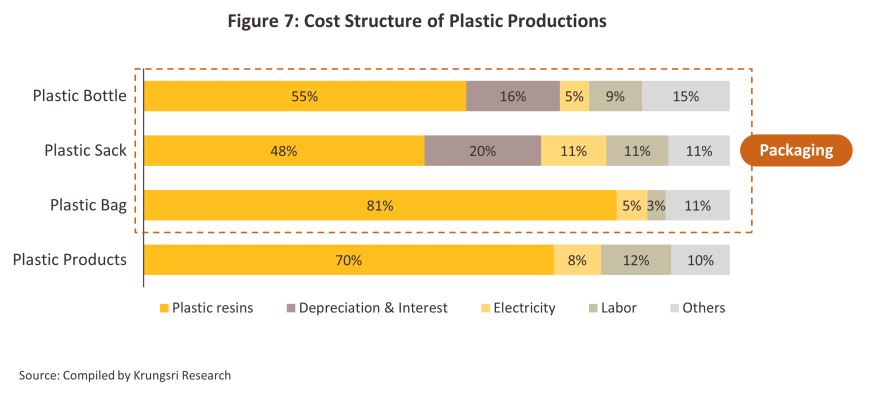

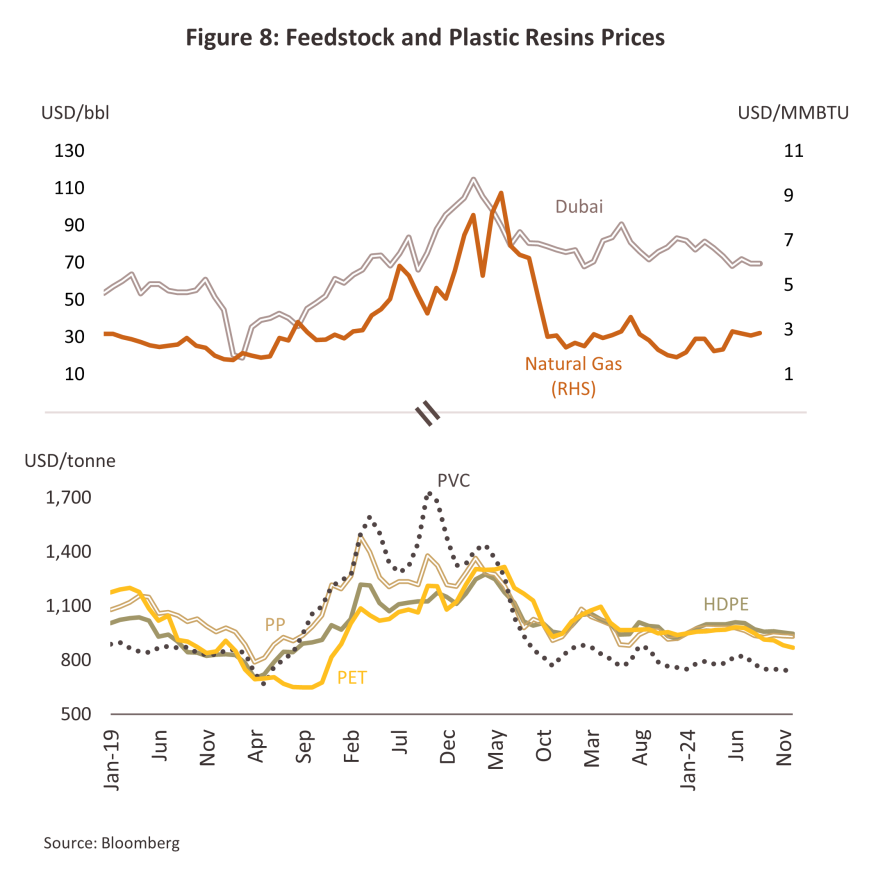

Generally, raw materials (i.e., plastic nurdles or resins) account for around 70% of production costs, with another 10-15% coming from labor, 8% from energy and 7-12% attributable to other expenses. In the case of plastic packaging, (the most important product category) the primary expense is for resins (50-80% of production costs) but the extent of energy and labor costs will depend on the type of inputs being used and the products being manufactured, and with plastic packaging that requires the utilization of more advanced production technology and more expensive machinery, depreciation and interest costs will be relatively high (Figure 7). Overall, the industry’s cost structure is such that fluctuating crude and natural gas prices have a significant impact on manufacturers’ costs and competitiveness.

Situation

In 2024, Thailand's plastic industry experienced slower growth due to the country's gradual economic recovery, which rose by 2.5%. The demand for plastic products was supported by: (i) the growth of the service sector related to tourism, such as hotels, restaurants, and healthcare services; (ii) government economic stimulus measures that boosted consumer confidence, such as the Free-Visa policy that increased the number of international tourists, the 10,000 baht cash handout program in September, and the acceleration of government budget spending, all of which helped stimulate economic growth; (iii) the expansion of e-commerce, with consumer behavior favoring food delivery services, driving demand for food and beverage products and essential consumer goods, thereby increasing the need for plastic products, particularly in packaging.

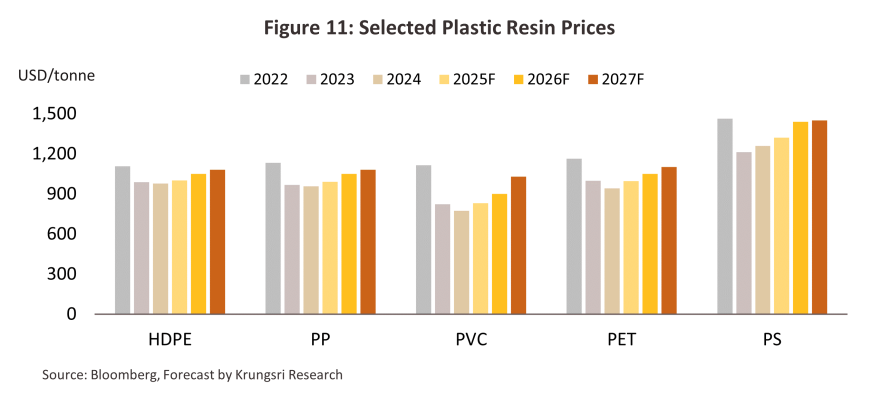

However, domestic demand for plastic resins and products has been pressured from several factors, including: (i) the slow recovery of domestic purchasing power, particularly among low-income households burdened by high levels of household debt. This has led consumers to be more cautious with their spending, postponing purchases of durable goods such as homes and vehicles; (ii) an influx of inexpensive goods from China, which has intensified price competition in the domestic market; (iii) the slow global economic recovery, including in China, a key export market for Thailand, which is hindering the recovery of the downstream industries using plastic as an input; and (iv) the increased production capacity of petrochemical plants, particularly in China, leading to an oversupply of certain plastic resins (e.g., HDPE), which has resulted in lower prices. Additionally, unrest in the Middle East has caused fluctuations in energy prices, affecting raw material costs and increasing transportation expenses, with Dubai crude oil prices remaining high at an average of USD 80/bbl (Figure 8). These factors have limited the growth of the industry.

The situation for the domestic industry in 2024 is summarized below.

-

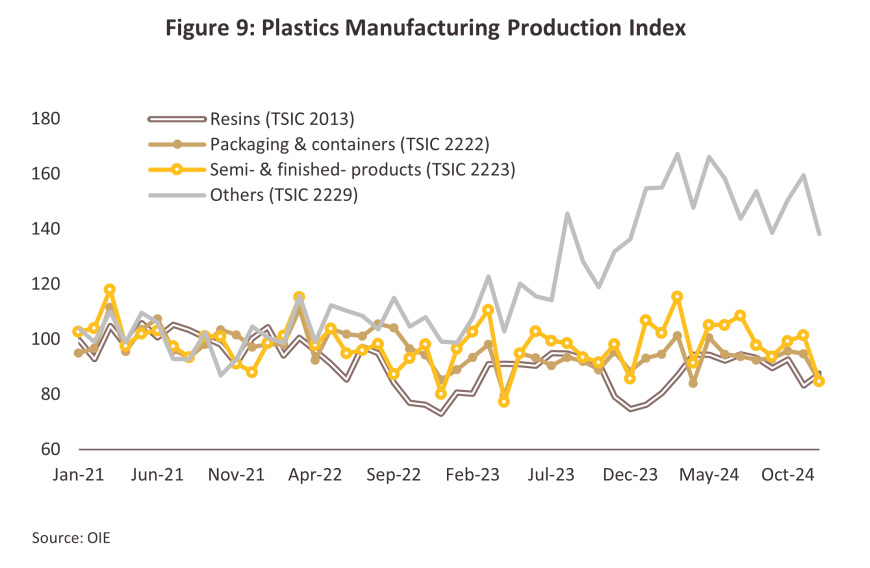

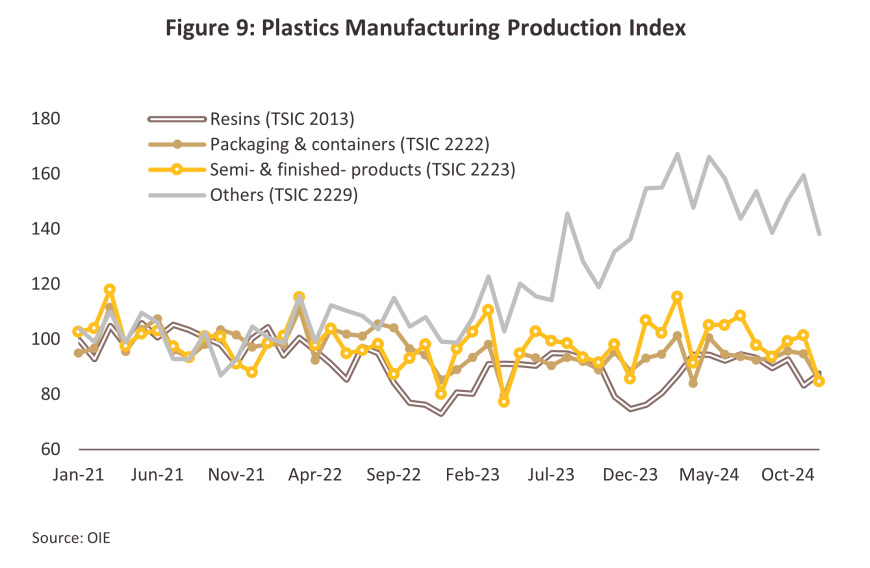

The plastic resin production index grew at a low rate of 0.4% compared to 2023 (Figure 9), but it still outperformed the overall manufacturing production index (MPI), which contracted by an average of -1.8%. This was due to the production growth of certain types of plastic resins, such as Polyethylene Terephthalate (PET), which grew by 11.2% from 2023 in response to the demand for food and beverage packaging. However, the downstream industries remain relatively weak, leading producers to adjust their production capacity to align with demand. For example, the production of Polyethylene (PE) and Polypropylene (PP), raw materials for manufacturing plastic parts used in vehicles, decreased by -1.9% and -1.4%, respectively. This aligns with the MPI of the automotive industry, which contracted by -17%. In addition, Thailand’s petrochemical products face reduced competitiveness compared to producers in China, the United States, and the Middle East, where production capacity is continuously expanding and production costs are lower. As a result, Thai plastic resins have lost market share to producers from these countries, affecting Thailand's plastic resin production.

-

Plastic product production increased by 3.6% compared to 2023. This growth was driven by the production of packaging and semi-finished and finished plastic products, following efforts by producers to reduce inventory stockpiles (inventory destocking) in the previous years. Additionally, the acceleration of government budget spending has allowed infrastructure investment projects to continue smoothly. This is reflected in the significant recovery of public sector construction activities during the second half of 2024.

-

Domestic sales of plastic products increased slightly by 0.7% compared to 2023, driven by growth in products such as plastic sheets (+13.6%) and plastic film (+12.8%). However, sales of plastic pipes and fittings decreased by -4.8%, partly due to a -1.7% decline in private sector construction. Additionally, plastic product sales were impacted by the US tariff increase on imported goods from countries with a trade surplus, particularly China, leading to an increase in some foreign products entering Thailand. Combined with the slowdown in consumer demand, this resulted in limited overall sales growth.

-

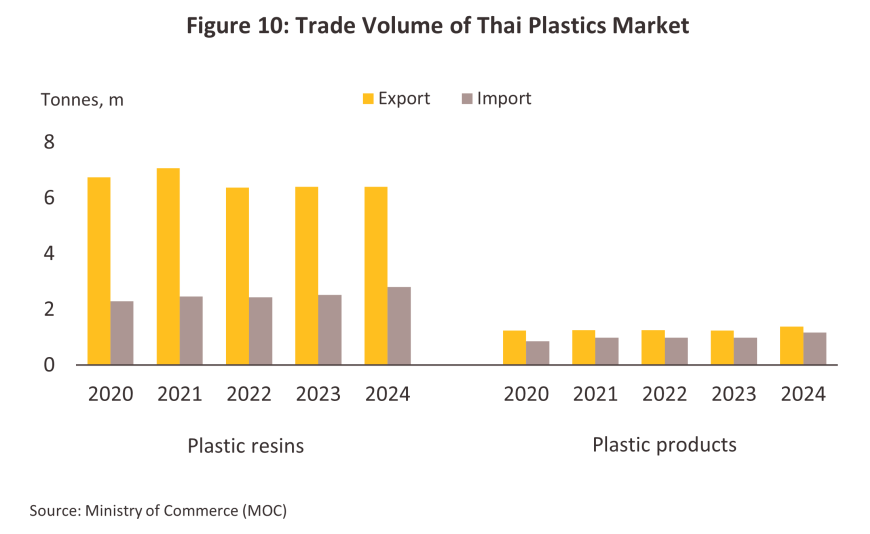

The export volume of plastic resins and plastic products grew by 0.2% and 12.2%, respectively. Exports of plastic resins increased in the Polyacetal (POM) category, used in automotive manufacturing, which saw a 14.7% rise in exports, aligning with the 25.0% global increase in electric vehicle sales in 2024, following a 35% increase in 2023. However, exports of major plastic resins, such as Polyethylene (PE), decreased by -4.1% from 2023, due to the global economic slowdown and increased new supply, more than half of which came from China. Exports to key markets, such as China (which accounts for 26.9% of plastic resin exports), contracted by -7.1%, and exports to India decreased by -6.0%. The import volume of plastic resins reached 2.8 million tonnes, a 11% increase from the previous year (Figure 10). As for plastic product exports, growth was seen in categories such as plastic bags, sacks, plastic sheets, flooring, household plastic items, and plastic packaging. Exports to key markets, including ASEAN (accounting for 27.9% of exports), grew by 2.8%, and exports to Japan (accounting for 12.9%) increased by 2.6%. Imports of plastic products also strengthened, rising 18.7% YoY to 1.2 million tonnes.

Outlook

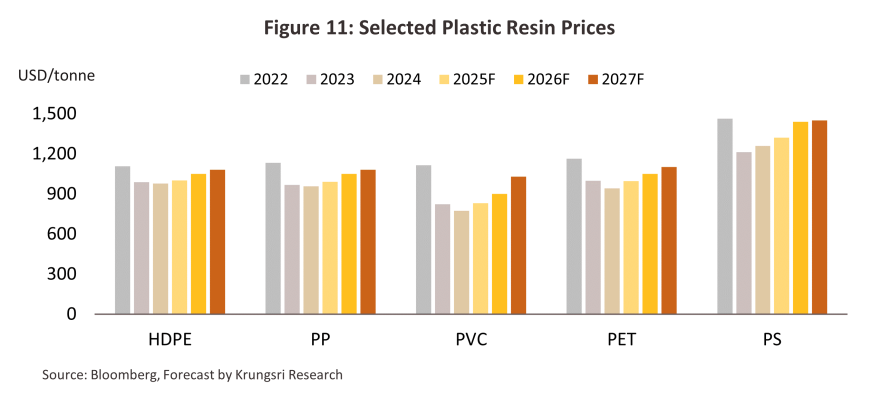

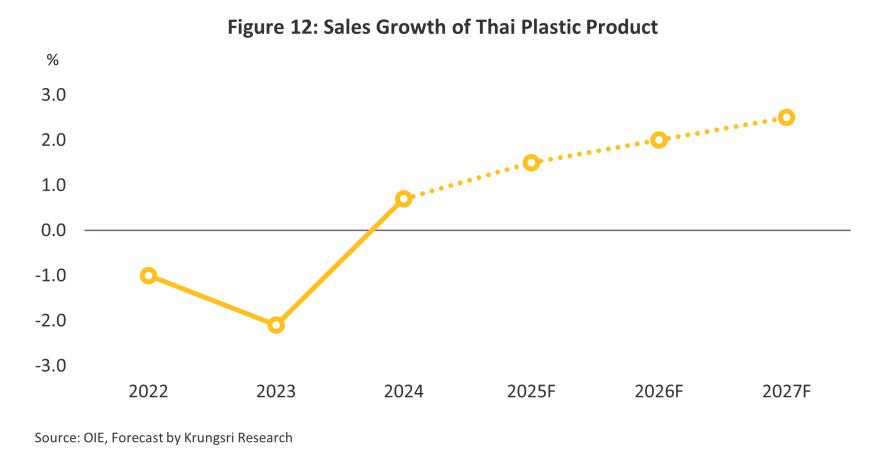

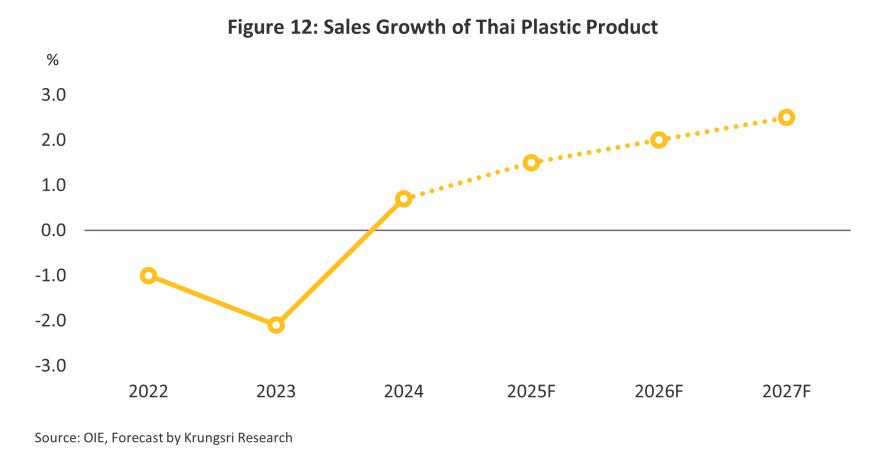

Krungsri Research forecasts that global demand for plastics will grow by approximately 2.0-3.0% annually over the 2025-2027 period. This growth will be supported by moderate global economic expansion, with the IMF projecting growth at 3.0-3.5% per year, alongside large-scale stimulus packages expected from the Chinese government starting in late 2024. However, global growth is likely to remain below pre-pandemic levels, which averaged 3.7% annually from 2010 to 2019. Additionally, the market will face pressure from the expansion of resin production capacity in Asia, which is currently contributing to a growing supply glut and limiting manufacturers' ability to raise prices (Figure 11). Domestically, Thailand's economy is expected to strengthen steadily, driven by the recovery of the tourism sector, with foreign arrivals anticipated to return to pre-COVID levels by 2027. Specifically, industries such as packaging materials, electronics, electrical appliances, auto parts, construction, and medical devices—which together account for around 80% of plastic product demand—will see growth. Furthermore, government initiatives to promote investment in targeted industries will further boost demand for plastics within related supply chains. However, the domestic industry will face rising uncertainties, particularly those stemming from the US-China trade war, which may shift Chinese production to the Thai market and other markets where Thai exporters are active, increasing competitive pressures. Growing concerns over sustainability and environmental impact are also prompting manufacturers to incorporate more environmentally friendly inputs in the production of some downstream goods. Geopolitical risks are expected to escalate periodically, influencing crude oil prices and manufacturing costs (the base case anticipates Dubai crude prices averaging USD 75-80/bbl). Given these factors, Krungsri Research projects that plastic product sales, both domestically and internationally, will grow by 2.0-3.0% annually over the next three years (Figure 12). However, the outlook for individual downstream segments will vary, and these are described below.

-

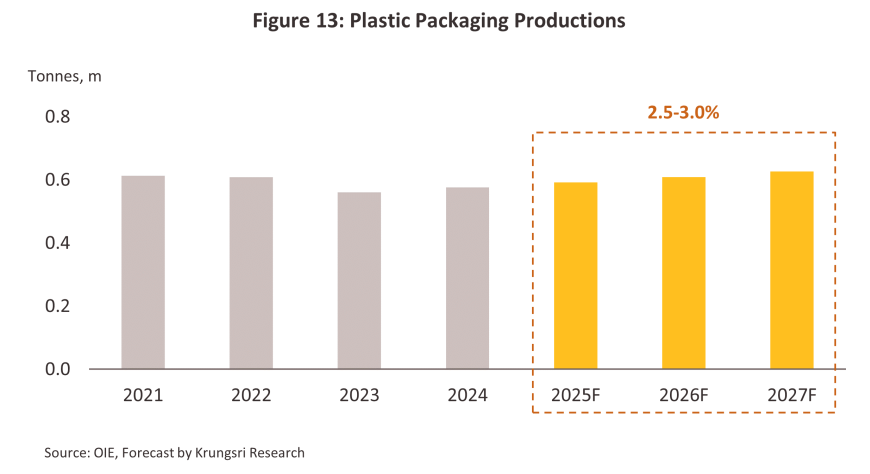

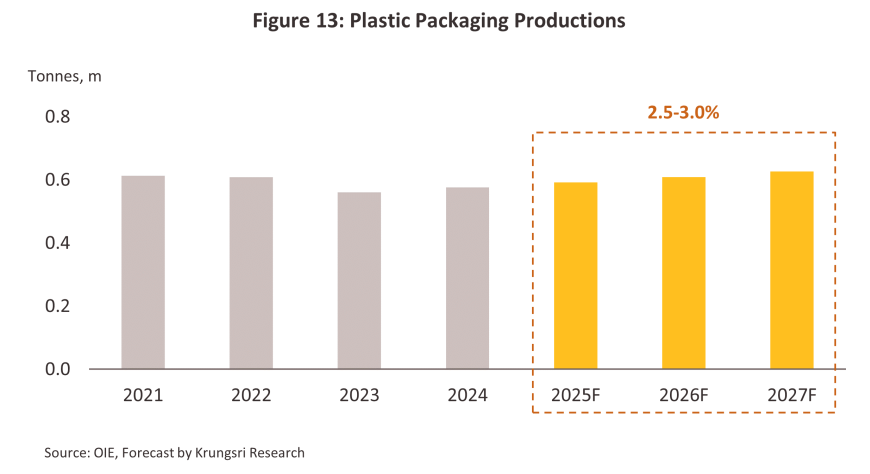

Plastic packaging: Global consumption of flexible plastic packaging is expected to increase at an average rate of 4.5% per year (source: Grand View Research), while rigid plastic packaging is forecasted to grow at an average rate of 3.3% per year (source: Technavio). This is due to flexible packaging being lighter, having lower transportation costs, and offering more diverse applications compared to rigid packaging. The ASEAN and Indian export markets are identified as high-potential markets, driven by strong domestic demand. For Thailand, Krungsri Research projects that between 2025 and 2027, the production of plastic packaging will grow at an average rate of 2.5-3.0% per year, similar to the 2.7% growth in 2024 (Figure 13). This growth is driven by the continued expansion of the consumption and services sectors, leading to increased demand for both flexible and rigid plastic packaging. Specifically: (i) Demand for packaging in fast-moving consumer goods is expected to rise in line with the recovery of purchasing power, including food, beverages, and consumer goods. Plastic packaging will be used for food and beverages by as much as 70%, with the remaining 30% used for non-food products. (ii) Demand for ready-to-eat, frozen, and processed foods is expected to continue growing, driven by urbanization and the fast-paced lifestyles of city consumers, who demand convenient food options. These products are easily accessible at convenience stores, which are widely distributed across the country, supporting the production of plastic packaging, especially plastic bags and plastic film sheets for food. (iii) Growth in the retail and e-commerce sectors will positively impact plastic packaging demand, such as films, plastic containers for food packaging, plastic bags, and bottles, as well as packaging design services (Packaging Solutions) that attract online shoppers.

However, the demand for basic plastic packaging, particularly plastic bags, has shown some signs of slowing down due to the growing demand for more environmentally friendly plastics. This is reflected in government policies aimed at promoting sustainable plastic consumption, as outlined in the Plastic Waste Action Plan Phase 2 (2023-2027), which supports the use of bioplastics and recyclable plastics as alternatives to single-use petroleum-based plastics that are difficult to decompose. Furthermore, pressure also arises from the continuous high cost of raw materials (plastic resins), which tends to remain high in line with global crude oil prices.

-

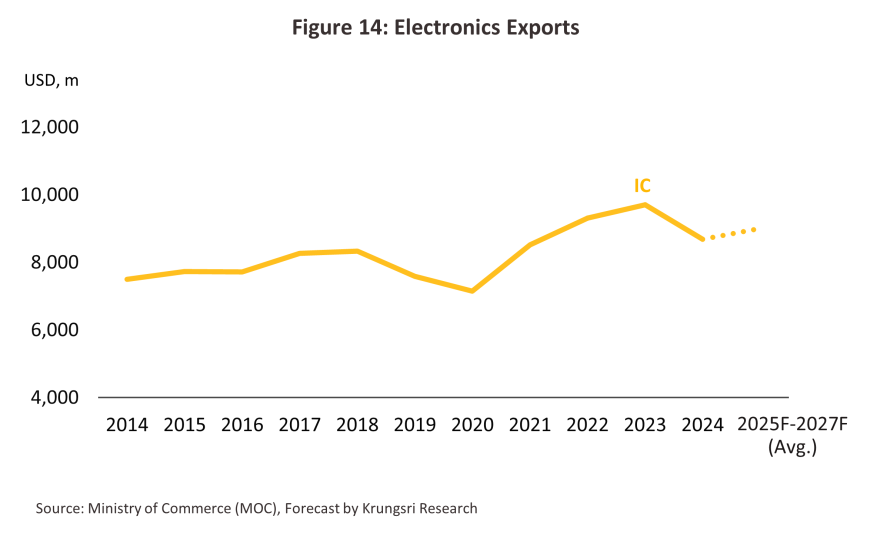

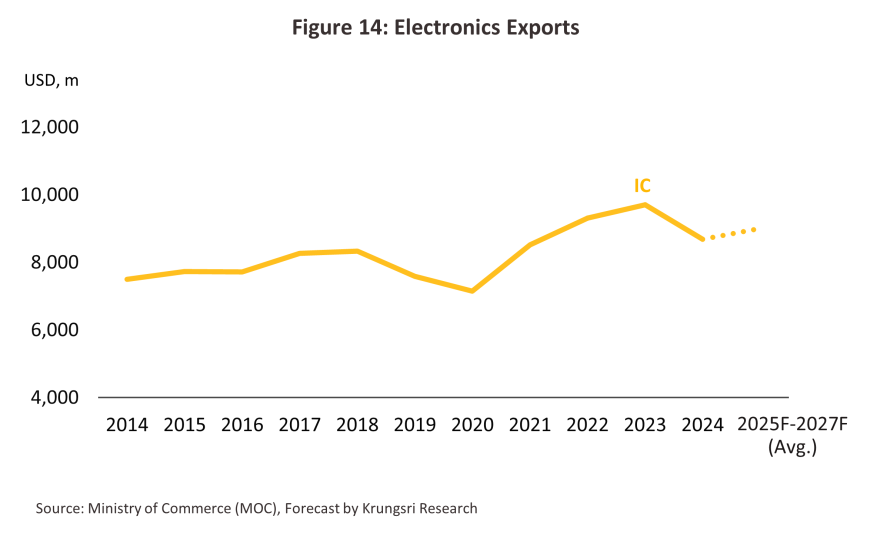

Electronics and electrical appliances: It is expected that production volume and export value will increase by an average of 10-15% and 6.5-7.5% per year, respectively. This is due to the recovery trend in global sales of Integrated Circuits (ICs) (Figure 14), supported by (i) the increasing demand for AI Chips in AI-based applications (such as Generative AI Models, Data Centers, Edge Infrastructure, and Endpoint Devices). Gartner forecasts that sales of AI Chips will grow by 29.1% in 2025; (ii) the rising demand for electronic components or semiconductors for Electric Vehicles (EVs) in the global market (the IEA expects the demand for EVs to grow at an average of 18.2% from 2024 to 2030), as well as the acceleration in the development of Autonomous Vehicles at the Full Driving Automation level. Currently, semiconductors used in automobiles account for 42% of global semiconductor usage; and (iii) the new cycle of PC replacements expected in 2024-2025. On the supply side, one of the driving factors is the increasing foreign investment in Thailand’s electronics industry. In 2023, the Board of Investment (BOI) approved a 233.6% increase in investment promotion for the electronics and electrical appliance industries, particularly in printed circuit board (PCB) manufacturing, with investments from companies in China, Taiwan, Japan, and Thailand growing by a combined rate of 343.2%. In the first 9 months of 2024, investments continued to grow by 31.1% YoY, helping Thailand become the largest PCB manufacturing cluster in ASEAN. As for electrical appliance manufacturing, growth will continue to meet the increasing demand in both domestic and export markets, especially in Asia, where the ownership rate of appliances is still relatively low. For example, air conditioners have an ownership rate of less than 20% of total households in many countries, providing an opportunity for Thailand, which serves as a production base and exporter to global markets.

-

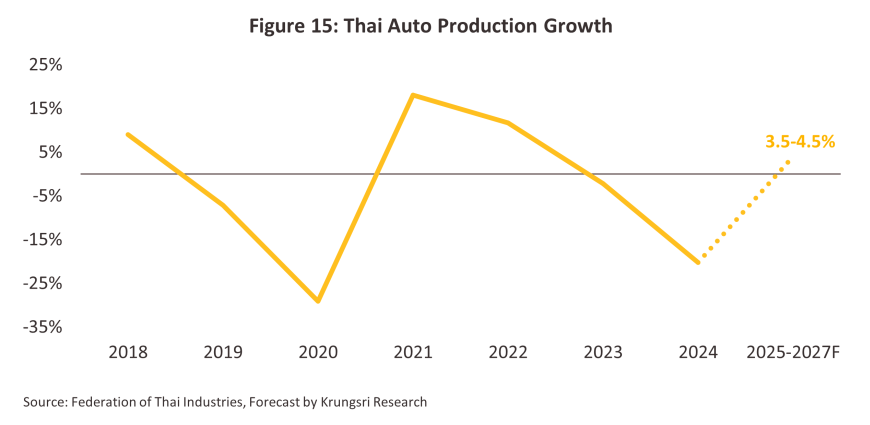

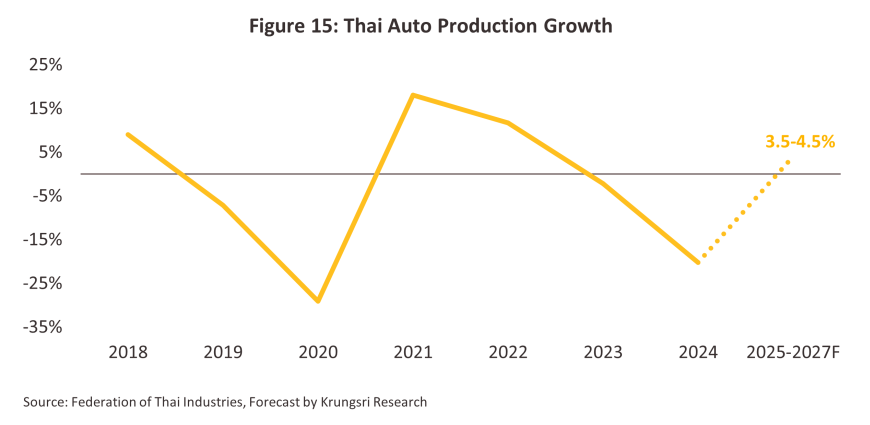

Automotive Parts: The industry is expected to slow down in line with automotive production trends. From 2025 to 2027, domestic vehicle production is forecasted to increase slightly by an average of 3.5% to 4.5% per year (1.57-1.60 million units per year) after a sharp contraction of -20.2% in 2024 (Figure 15). Factors supporting the increased demand for vehicles include (i) business activities and investment improving with the recovery of the Thai economy, particularly with the accelerated investment in transportation infrastructure and growth in the tourism sector, which will drive the demand for both passenger and commercial vehicles. Additionally, the expected increase in agricultural output (as rainfall is expected to rise from the La Niña phenomenon in 2025, benefiting crops) will boost the demand for pickup trucks for transporting agricultural products. (ii) Government support measures, such as reducing excise tax rates on HEV vehicles from 2024 to 2027 and the production of BEVs under the EV 3.0 and 3.5 support schemes, will positively impact the demand for related plastics. This is because the production of EVs uses more than 50% plastic per vehicle to reduce the weight, including specialty plastics such as Polypropylene Compound. (iii) The export market for vehicles is expected to recover in line with the economic growth of trading partner countries, particularly in the ASEAN market.

-

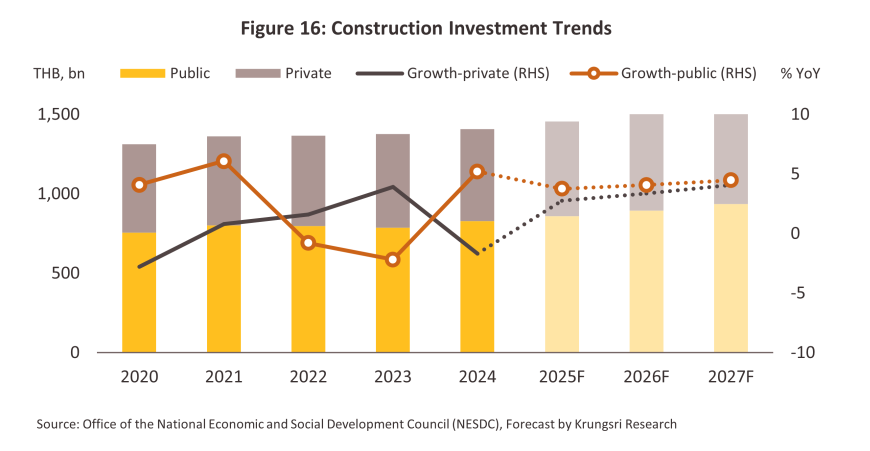

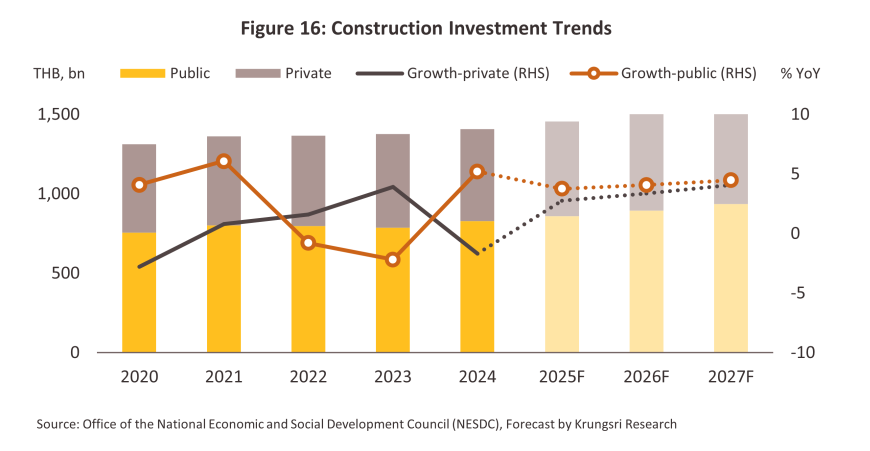

Construction: The overall construction investment is expected to grow by an average of 3.5-4.0% per year, compared to 2.2% in 2024. This growth is supported by the government's plan to accelerate the implementation of large-scale infrastructure projects, particularly in the Eastern Economic Corridor (EEC), which will result in government construction projects growing at a rate of 4.0-4.5% per year. Private sector construction projects will grow by 3.5-4.0% per year, driven by the development of residential real estate projects and commercial projects. These factors will increase the demand for construction materials made from or containing plastics, such as PVC (used for pipes, electrical conduit, window frames, doors, and vinyl flooring), Polycarbonate (used for translucent roofing, awnings, room dividers, and safety glass), and PP (used for water storage tanks, drainage pipes, and waterproof sheets) (Figure 16). The demand for plastics in the construction sector will focus on durable, high-quality, and environmentally friendly materials.

-

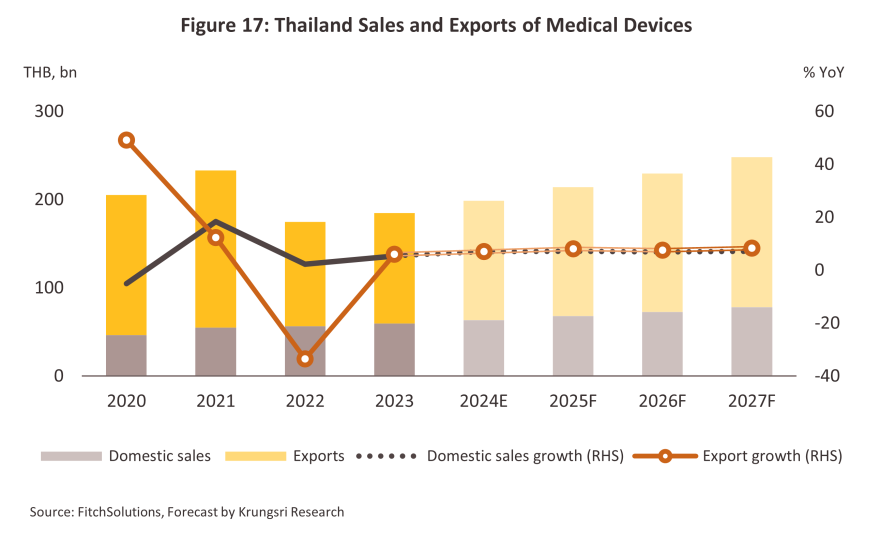

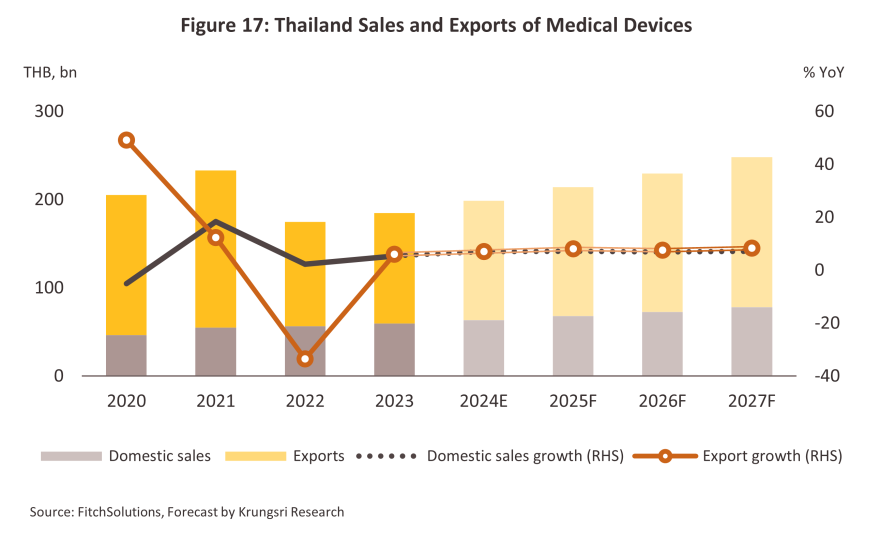

Medical devices: Domestic sales are expected to grow by an average of 6.5-7.0% per year, while export value is forecasted to increase by an average of 7.5-8.5% per year (Figure 17). The demand for medical equipment is supported by (i) Thailand’s transition into an aged society, which increases the need for treatment of complex and chronic diseases, as well as equipment for the elderly for daily living (such as oxygen machines, nebulizers, and mobility aids); (ii) the rising prevalence of non-communicable chronic diseases (such as diabetes, heart disease, and stroke) due to unhealthy lifestyle behaviors; (iii) the growing medical tourism market in Thailand, which is expected to continue its expansion. Allied Market Research forecasts the market value to reach USD 24.4 billion by 2027, up from USD 9.9 billion in 2023. Additionally, the global trend of preventive self-care will increase demand for home-use medical devices, such as home blood pressure monitors, blood glucose meters, and thermometers; (iv) government policies that aim to position Thailand as the medical device manufacturing hub of ASEAN by 2027; and (v) continuing demand for medical equipment from Thailand's trading partners, such as the US, which requires consumables (medical gloves) and diagnostic reagents and kits, and China and Japan, which need in vitro diagnostic devices, as well as medical equipment for elderly care.

In the next phase, the use of plastics in the production of medical devices is expected to increase, replacing metals, ceramics, and glass, due to their lower raw material costs while still having suitable properties. Plastics are easy to shape, can be molded to meet specific needs, are lightweight, and resistant to chemicals and radiation sterilization processes, preventing contamination from corrosion like metals. Additionally, plastics can be combined with other materials, such as rubber or bio-chemicals, to create composite materials that are efficient, safe, and meet required specifications. This is especially true for specialty plastic resins, which can be used to produce smart materials and medical devices, such as implants, including artificial heart valve structures.

Thai manufacturers with potential are expected to accelerate their adaptation to maintain growth by developing high-value-added plastic products to meet the increasing demand for high-quality materials in industries such as electric vehicles, medical devices, robotics, and aviation. This also includes the production of environmentally friendly alternative plastics or 'bioplastics' (e.g., Sustainable Polypropylene Products, the development of PE100RC resins for manufacturing HDPE pipes for infrastructure, and the production of stretch film from recycled plastic resins or Post-Consumer-Recycled resin (PCR) in line with government support policies. These policies have adjusted regulations to foster industrial development, such as allowing factories that use sugarcane as a raw material, such as bio-chemical plants and ethanol factories, to be located closer to sugar mills, where previously there had to be a 50-kilometer distance. Additionally, there is a measure to provide a 25% reduction in corporate tax for spending on biodegradable plastic products (2022-2024). Combined with the country’s position as a source of raw materials (e.g., sugarcane, cassava, and corn), this has positioned Thailand as a key exporter of bioplastics in the global market. The Thai Bioplastic Industry Association (TBIA) expects bioplastic resin production to increase to 375,000-400,000 tonnes per year in the future, up from the current production capacity of 95,000 tonnes per year. Additionally, major Thai private sector companies are joint venturing with large international companies (e.g., NatureWorks, a joint venture between the US Cargill and Thailand’s PTT Global Chemical (GC), which will produce PLA plastic with a production capacity of 75,000 tonnes per year, expected to start production in 2025; and Braskem, a major Brazilian bioplastic company, with SCG Chemicals of Thailand, to establish a Green-Ethylene plant to produce Green-Polyethylene resins as raw material for bioplastics. These efforts aim to meet the growing demand for environmentally friendly plastics, which is continuously expanding in global markets, particularly in Asia and Europe, and will create new opportunities for businesses in the near future.

The challenges facing the industry in the near future will stem from: (i) The slow recovery of purchasing power both domestically and internationally, while China has made significant investments in establishing large petrochemical industrial estates within the country in recent years, leading to a gradual decline in plastic resin imports from Thailand; (ii) Increasingly stringent environmental regulations abroad, especially in the European Union. For example, the EU Bottle Cap Regulation mandates that all plastic bottle caps must remain attached to containers with a capacity of less than 3 liters after opening, which will be officially enforced starting July 3, 2024. Additionally, the Carbon Border Adjustment Mechanism (CBAM) does not currently include plastics in the list of products required to report carbon emissions, but plastics could be affected in the future due to their high greenhouse gas emissions during production. Therefore, plastic manufacturers need to prepare for potentially stricter measures in the future; and (iii) The focus on developing sustainable and efficient plastic production in terms of energy use and enhancing competitiveness, along with preparing for Extended Producer Responsibility (EPR), which will require producers to manage waste and resources from production and consumer usage. EPR legislation is expected to be enacted in the next 2-3 years.

1/ This involved a survey of 3,065 manufacturers, or 64.8% of the companies active in the industry. It should be noted that manufacturers may use more than one molding method.

2/ Source: Statista

3/ For more details on the United Nation’s “System change scenario”, please see https://wedocs.unep.org/bitstream/handle/20.500.11822/42277/Plastic_pollution.pdf?sequence=3

4/ For details on round 5 of the global plastics treaty negotiations, please see https://www.unep.org/news-and-stories/press-release/decisive-fifth-session-negotiations-global-plastic-pollution-treaty

.webp.aspx)