Growth in the warehousing sector is dependent on business conditions in manufacturing and commerce, which in turn are strongly influenced by the rate of growth of the economy. The sector displays two important characteristics. (i) Payback period typically average an 8-13-year timeframe. This is because upfront costs, including those for land and construction, tend to be high, while income comes from rent and this accumulates only gradually. Generally, rental rates will vary depending on the size of the rental space, the type of warehouse, its location, and the state of competition in the area. (ii) The location of any particular warehouse plays a major role in determining its commercial success. Warehouses are built in anticipation of future demand since it takes an average of 6-18 months to complete construction, depending on the size of the building, and so an evaluation of a site’s potential is one of factors in deciding likely future demand for rental space, a very significant determiner of income for operators in the long term.

Major factors to consider when renting a warehouse

Customers will consider a variety of factors, including its location, the provision of amenities, utilities and infrastructure, the extent to which the available technology for managing and servicing the warehouse is appropriate for the goods to be stored, and the rental fee. Selecting the right warehouse will help renters manufacture and/or distribute goods more rapidly, reduce time-dependent and transportation costs, and increase business efficiency and competitiveness. For example, (i) warehouses for consumer goods ought to be situated close to markets or to communities, (ii) warehouses for agricultural products should be close to either farms or to food-processing facilities, and (iii) warehouses for industrial raw materials, parts, and finished goods should be near industrial zones or industrial parks to grant the BOI’s privileges.

In terms of types of warehouses, the Department of Business Development (operating under the Ministry of Commerce) specifies three categories. (i) General-purpose warehouses are buildings used for the storage of industrial and commercial goods. (ii) Chilled and frozen warehousing (cold-storage units) provides temperature-controlled spaces for the storage of perishable goods, including agricultural, fisheries, and food-processing goods. Items such as seafood, dairy produce, fresh cut flowers, meat, fruit and vegetables will thus have a longer shelf life if stored in these facilities. (iii) Storage space for cereal crops (silos) are large temperature- and humidity-controlled cylindrical structures used for the bulk storage of cereals and similar crops, including rice, maize, cassava, flour, and rice bran.

Warehouse space is rented or leased according to two general types of rental contracts.

- Short-term contracts (not exceeding three years) mostly are usually rental contracts for mid- to small-sized traditional warehouses and the renters are mainly SMEs and/or businesses which have uncertain or fluctuating business conditions, for example seasonal businesses such as agriculture or fashion. Operators in this segment of the market may experience higher levels of risk as a result of uncertainty over income when rental contracts expire and they may also experience high levels of competition in maintaining their customer base and in finding new customers.

- Long-term contracts (longer than three years) the majority of this type of rental contracts are for large warehouse who take advantages of more competitiveness, offering a full range of warehouse services, and own sites near manufacturers and markets. Some businesses meet the demands of the modern market by offering a choice of ready-built warehousing or build to suit warehousing built. Most major players in this segment are active principally in the real estate and industrial estates sectors. These operators include WHA Corporation, JWD InfoLogistics, Wyncoast Industrial Park, Ticon Logistics Park (a part of the Ticon Industrial Connection group), and Hemaraj Logistics Park. With long-term contracts, operators are mostly able to manage their properties more efficiently and to operate with lower levels of risk to income-streams.

Situation

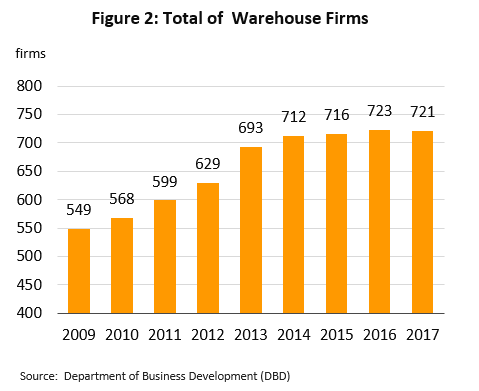

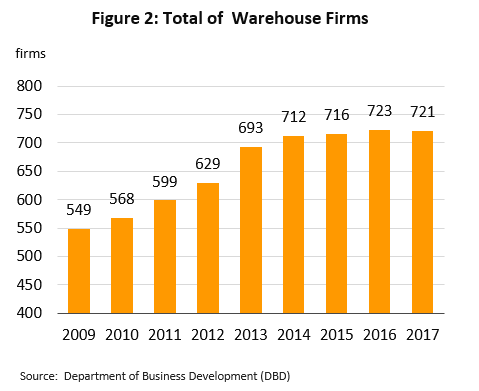

The Investment in warehousing in Thailand has expanded continuously over the past 4-5 years and for 2017 there are 721 businesses registered in the sector (Figure 2). In 2018, overall business situation showed signs of improvement, the demand for rental space inched up following recovery in economic activity but some areas face oversupply. These can be sub-divided as follows.

- General-purpose warehousing

This segment is the most dominated in the market (accounting for 77% of registered business operations) and plays the biggest role in warehouse business. Income from this segment represents over 88% of the sector’s total income. General warehousing is therefore, being closely tied to many sectors.

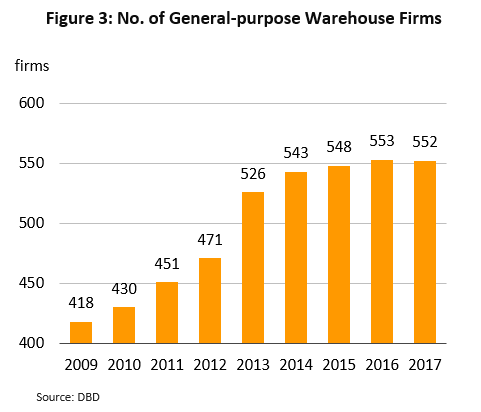

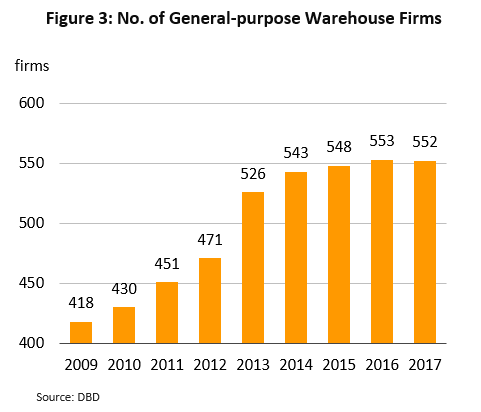

Investment in new general-purpose warehousing facilities has increased markedly over during 2012-2017 as a result of three factors: (i) The extensive flooding at the end of 2011 resulted in the relocation of production base in the central region, which saw the worst of the flooding, and a subsequent increase in investment in new warehousing, especially in industrial estates in the eastern part of the country. (ii) Investment has also been stimulated by increased regional connectivity as a result of progress on the development of new transportation networks and (iii) a revision of the regulations governing investment privileges offered by the BOI, which has switched from zone-based incentives, in which incentives are special granted on a decentralization basis (Zones 1, 2, and 3), to activity-or merit-based incentives resulting in broader coverage of targeted areas. In addition, the establishment of Eastern Economic Corridor (EEC) and the Special Economic Zones (SEZs) and in other, localized areas has also helped to increase the number of registered operators of general-purpose warehouses from 451 in 2011 to 552 in 2017 (2.9% CAGR) (Figure 3) and the total area of this type of warehousing on the Thai market has increased from 1.72 million sq. m. in 2011 to 4.65 million sq. m. in 2017 (15.2% CAGR).

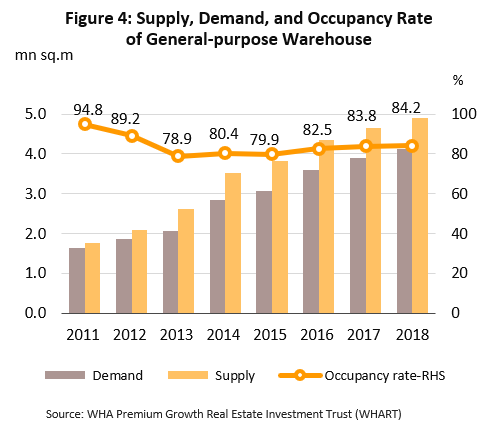

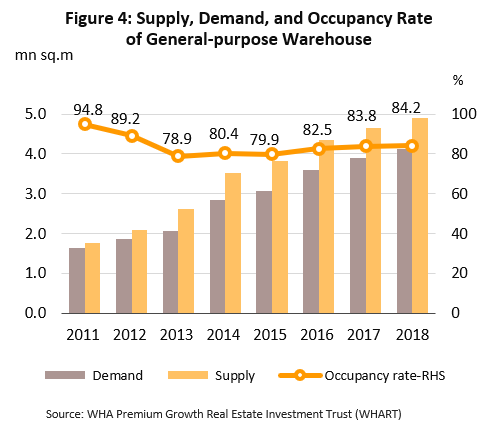

In 2018, total demand for warehouse space came to 4.1 million sq. m., which represented an increase of 11.8% YoY, an improvement on the 2.3% growth recorded in 2017. This strengthening of demand came from e-commerce operations, which need space to store goods before distribution to consumers, and retailers, import-export businesses, and manufacturers, which warehouse goods before they are sent on to final destinations in Thailand or overseas. At the same time, to meet increasing levels of economic activity and investment, warehouse operators increased the combined area of space that they manage to 4.9 million sq. m., which was also an 11.8% YoY increase (up from 1.8% growth in 2017). The majority of this was modern warehousing that was built as extensions to existing sites and the effect of this increase was to keep the warehouse occupancy rate at 84.2%, a level that was close to that of the previous year[2] (Figure 4).

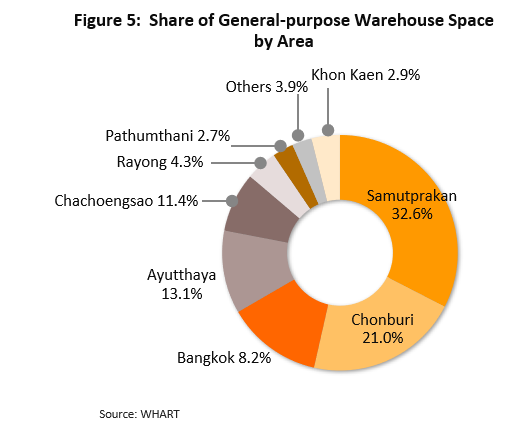

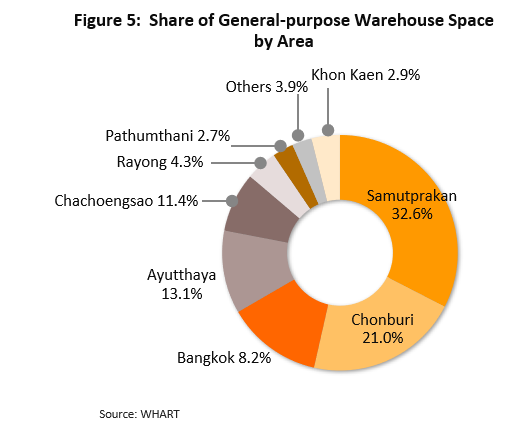

Much of the 2018 increase in the supply of general purpose warehousing was on the perimeter of the EEC or in surrounding provinces, including Samutprakan, Ayutthaya, Chonburi and Chachoengsao, which are locations that enjoy a number of advantages: these provinces are already home to a large number of industrial estates and distribution centers, are well served by accessible transportation networks, are close to major ports and to Suvarnabhumi Airport, and have access to an inland container depot (ICD). However, general purpose rented warehousing is heavily concentrated in Samutprakan province, which is home to 32.6% of all Thailand’s supply (Figure 5), while Chonburi, Ayutthaya, Chachoengsao and Bangkok each have respectively another 21.0%, 13.1%, 11.4% and 8.2% of the total.

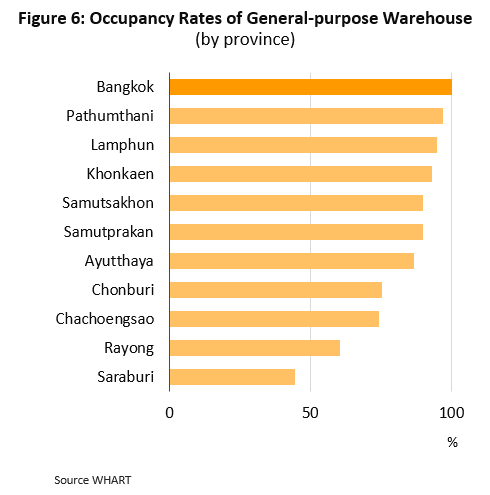

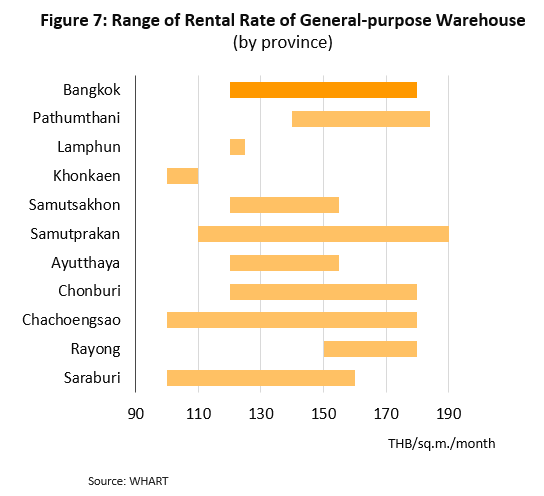

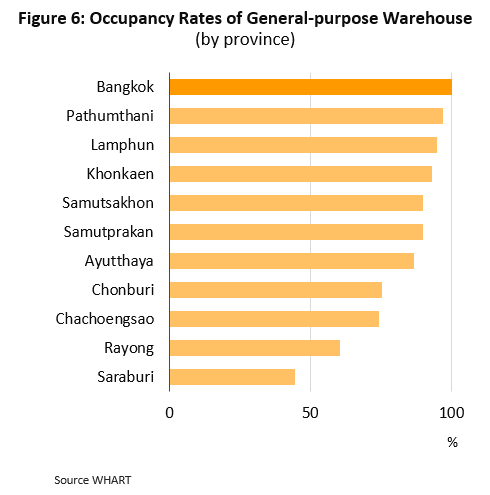

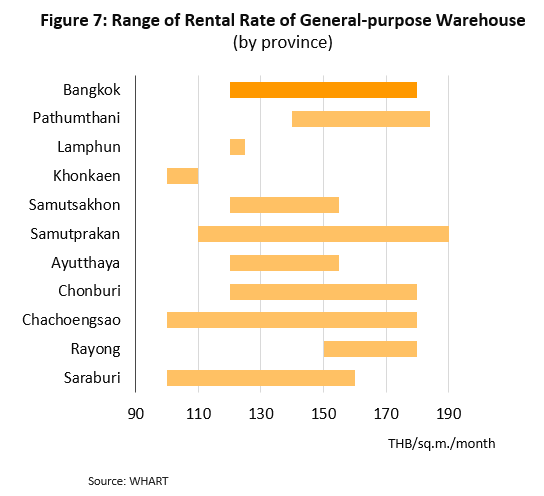

A consideration of the warehouse occupancy rate in a variety of locations shows that this depends on the potential of the area itself, the number of warehouses in the area, the level of competition, and the extent of the area’s transportation links. This will then help to determine rental rates, which also vary from area to area (Figures 6 and 7).

- Chilled and frozen storage space (cold storage units)

During the past several years, cold storage business continuously slowed down because demand for space for the storage of seafood (fish, shrimp, squid, etc.) has been driven down by i) the falling catch and a decline in the quantity of Thai farmed shrimp following the spread of the Early Mortality Syndromes (EMS) in 2012; ii) some seafood producers have begun to invest in their own (such as seafood industry) to enable to control and scrutinize raw materials, product quality products to meet stricter requirement of trading partners.

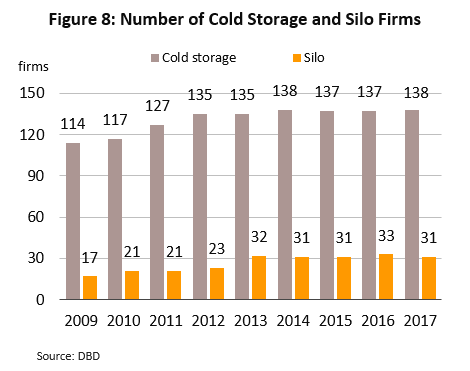

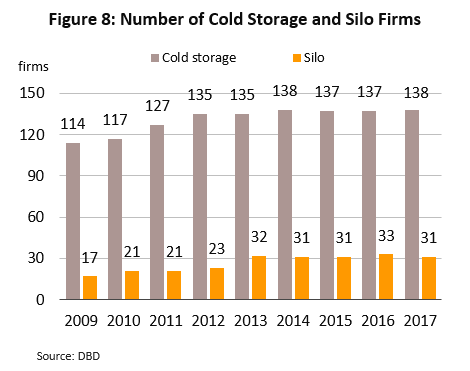

The most recent data is for 2017, 138 operators were active in this segment (Figure 8). Conditions for temperature-controlled warehousing used for the storage of fruit have been generally good as a result of favorable weather that has led to larger harvests, but

space used for storing seafood has done less well as a consequence of shrimp’s soft prices and low yields (in 2017, the shrimp harvest totaled 350,000 tonnes, compared to 600,000 tonnes in 2011), while in addition, the tightening of the regulations governing the Thai fishing fleet and the use of foreign labor in it has caused a further drop in demand. The forecast for 2018 is for business to continue to slow in step with a fall in demand for space to store chilled and frozen seafood bound for export markets; in 2018, exports of shrimp, fish and cephalopods fell by -22.5% YoY, -2.4% YoY and -9.5% YoY respectively.

- Storage space for cereal crops (silos)

Between 2012 and 2015, operators of grain silos engaged in a significant build-out of new supply to meet the large increase in demand stemming from the universal rice pledging scheme. This ran in the growing seasons of 2011, 2012 and 2013, and raised the annual total of rice held by the government roughly 5-fold from the normal levels of 5-6 million tonnes. Unfortunately, following the termination of the rice pledging scheme and then from 2014, the steady running down of government rice stocks, demand for space in grain silos contracted again until by 2017, the government had stocks of just 3-5 million tonnes of rice remaining, compared to the holdings of some 18 million tonnes that it had maintained during the period when the scheme was in operation. This has naturally led to sluggish business conditions and in 2017, the number of players within the segment dropped to 31 from the 33 active in 2016 (Figure 8), but in 2018, conditions improved somewhat on better prices and yields of rice and maize. Thus, the index of paddy rice prices rose 15% YoY, the index of paddy rice production rose 1.7% YoY, the index of maize prices rose 28% YoY and the index of maize production rose 9.9% YoY. These increases were supported by an increasing number of government-to-government agreements to purchase rice and this in turn helped to lift demand for storage space.

Industry Outlook

The forecast for 2019-2021 is for the demand for warehousing to remain broadly stable relative to its state in 2018. This will be in line with the direction of change in investment in industry and demand for logistics services to manage the centralization and distribution of goods. Nevertheless, continuing investment in the expansion of warehouse space to rent in certain areas will likely increase the pre-existing oversupply to the market, and this will then translate into stiffer competition and rental prices that will remain stuck at low levels.

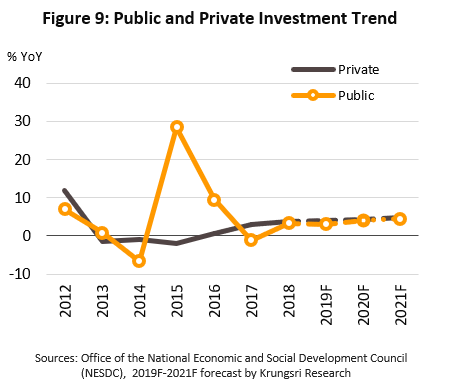

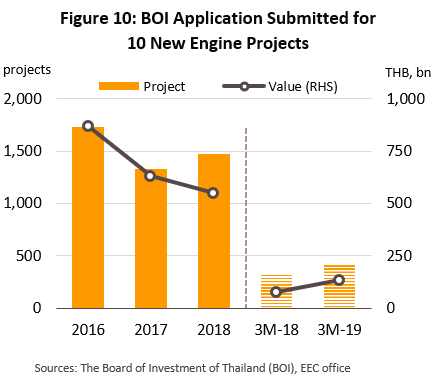

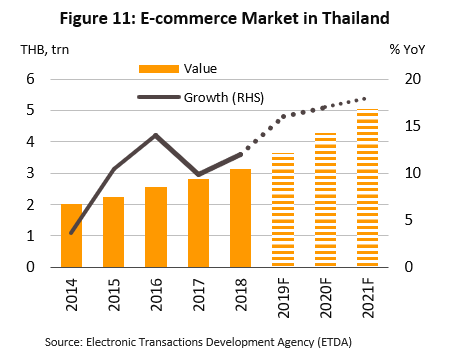

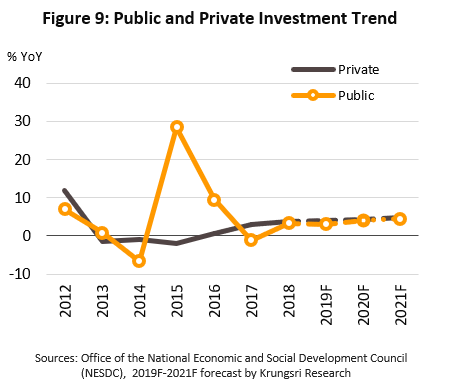

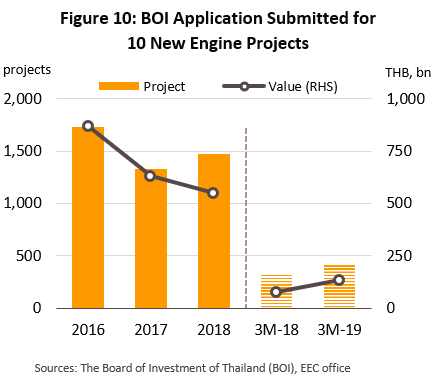

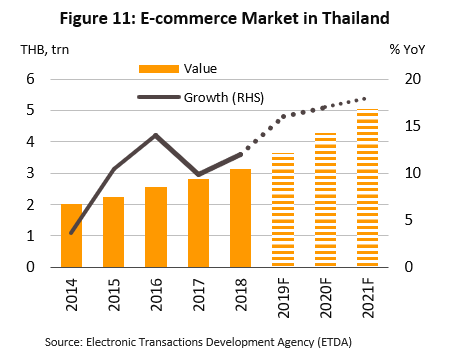

- General-purpose warehousing: Demand will tend to rise, though only weakly. Positive factors affecting the segment will include: (i) improving investor confidence that is becoming more apparent following the election earlier in 2019 (Krungsri Research forecasts steady growth in both private and public sector investment in this period, see Figure 9); (ii) the steady transfer of production facilities into Thailand from other countries, especially from Japan and China (the latter partly being a consequence of the US-China trade war); (iii) moves to stimulate investment in the government’s 10 targeted industries[3] (Figure 10); and (iv) the continuing growth of Thai e-commerce and online businesses[4] (Figure 11), which will need additional warehouse space to store goods before they are distributed to customers.

- Chilled and frozen storage space: For cold storage units, the outlook is for conditions to continue to be flat or depressed on a slowing of both the Thai and the world economies, while at the same time, the oversupply of capacity will likely worsen. Several different groups of suppliers are responsible for problems with excessive supply, including: (i) operators of chilled and frozen facilities that store fruit on behalf of other organizations, or that hold or process agricultural produce from different locations before this is distributed to buyers or exported, e.g. cold rooms run by agricultural cooperatives[5]; (ii) cold storage facilities in the Smart Park industrial estate in Rayong that service the so-called ‘Eastern Fruit Corridor’ (EFC); (iii) privately-run chilled and frozen storage space owned and run by large players in the seafood sector that they maintain so that their customers can inspect the facilities themselves and be assured that the storage sites meet the standards or specifications set in export markets; and (iv) ‘super-frozen’ storage facilities, a new type of temperature-controlled warehousing that is receiving increasing amounts of investment in response to consumer demand for healthier and fresher food (a change from earlier patterns of consumption, when ready-to-eat frozen meals were more popular).

- Storage space for cereal crops (silos): The oversupply of silo space continues to weigh on the market and to depress rental rates. This situation will persist into the coming period due to (i) the likely softening of demand for space to store cereal crops bound for domestic and export markets caused by the El Niño-driven weakening of the 2019 rainy season6/ and (ii) from 2019, the complete emptying of government stocks of rice accumulated under the earlier rice pledging scheme. These factors will then tend to provoke greater competition to buy produce to store in these facilities, and this will affect operators of silos themselves, traders and middlemen, and packing houses.

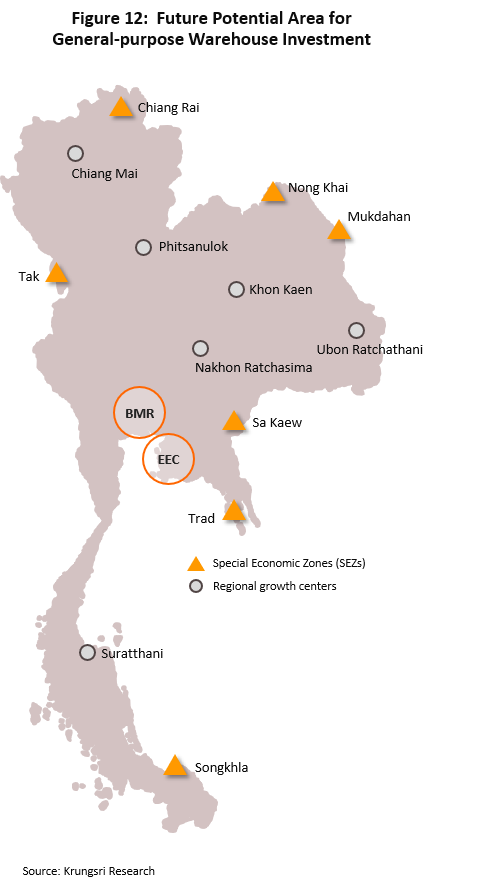

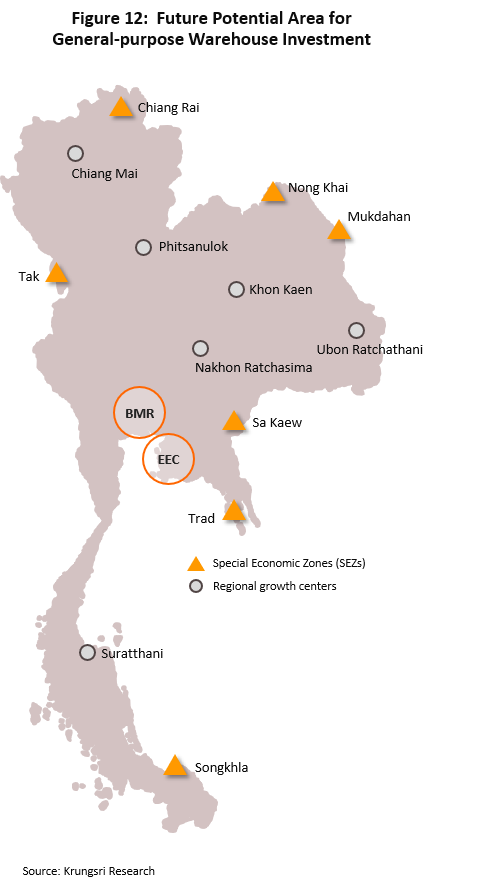

Investment in new supply will mostly be made by large industrial estates and real estate developers, and will typically be general-purpose modern warehousing built to meet additional demand from manufacturing, retail and domestic investment. New warehousing will be found in all regions of the country but will be concentrated in more important locations within the central and eastern regions. Areas that are likely to see solid growth in warehousing in the coming period are described below (Figure 12).

- Warehouse space located close to production facilities: Rising demand is forecast for warehousing in existing industrial zones and in areas which are the target of government support: (i) the BMR; (ii) areas near the EEC; (iii) provinces that are regional centers.

- Warehouse space located close to consumer markets: Sites in these locations will continue to benefit from their role as distribution centers and from meeting increasing demand due to the expansion of online retail. Provinces in this category include BMR, Chonburi, Phitsanulok, Nakhon Ratchasrima, Khon Kaen, Ubon Ratchathani, and Surat Thani.

- Warehousing in border regions: It is expected that demand for warehouse space near the country’s borders will begin to strengthen in the wake of progress by the government on its plans to develop the national air, road and rail transportation networks connecting the nearby countries, the Thai regions, and the areas around the new special economic zones (SEZs), and that demand will be boosted by the natural advantages that the country derives from being located at the center of South-East Asia such as Tak, Mukdahan, Sakaew, Trat, Songkhla, Chiang Rai, and NongKhai.

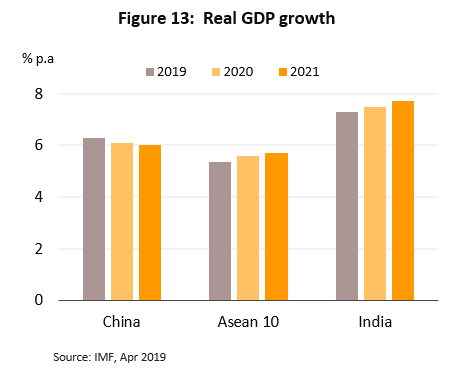

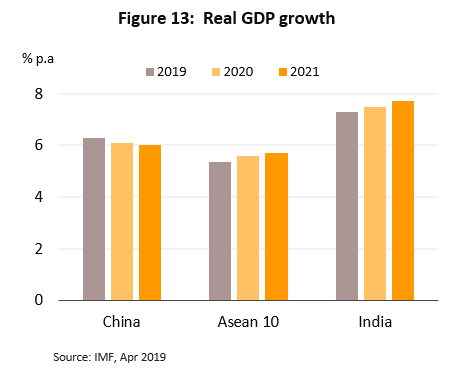

In addition, large-scale players from the real estate and industrial estates sectors have expanded into warehouse business in other countries where have a strong potential of economic growth such as ASEAN, China, and with India. Moreover, many countries have opened the path for warehouse investment from other ASEAN members such as Vietnam (ASEAN investors may be 100% shareholders in warehousing), 49-51% in Indonesia, 49% in Cambodia, and 40% in the Philippines. Promising economic outlook for neighboring countries (Figure 13) and the rapid rise in investment in industry in these countries, together with growing cross-border trade will all also stoke strengthening demand for warehousing and so open the way for Thai players to expand across the region and to increase their income.

Krungsri Research’s view:

Between 2019 and 2021, despite continuing demand for warehouse space to rent from the agricultural, industrial, retail and service sectors, businesses are forecast to experience depressed conditions. A continuing expansion in supply may trigger a glut of warehousing space in some locations. In this situation, competition on price will intensify and operators will find it very difficult to raise rents.

- General-purpose warehousing: The modern warehousing segment will tend to grow as major players from the real estate and industrial estates sectors increase their investments in this area. This will then raise the level of price competition that operators will have to deal with and in some locations, they will find that the room to increase rents will be limited. This will be a problem that will particularly affect SMEs and providers of traditional warehousing services, some of which will in addition face the risk of losing market share as their customers increasingly look to warehousing operations to supply a more comprehensive range of additional services beyond the simple act of providing space for the storage of goods. This change in consumer expectations will force operators to speed up the revision of their services and may encourage them to enter into partnerships or to make joint investments with large Thai or international companies. Doing so would then allow them to build competitiveness of their businesses and provide a full range of modern warehouse services, thus allowing them to build additional income over the long-term.

- Chilled and frozen warehousing (cold storage units): Demand for rented temperature-controlled storage space will likely soften in line with the export direction of the food processing sector, while pressure from the over-supply of space will weaken suppliers’ position relative to their customers and so turnover is forecast to fall.

- Storage space for cereal crops (silos): The terminating of demand from the government for the storage of rice combined with the continuing sizeable over-supply of storage space following the ending of the rice pledging scheme will put pressure on operators to compete more fiercely.

[1] The Public Warehouse Organization (PWO), a state enterprise, is responsible for ensuring the stability of agricultural prices by storing agricultural produce and then gradually releasing this to domestic and export markets as directed by the government. In addition, the PWO offers services for storing and pledging agricultural goods for both the public and private sectors, as well as managing wharfs used for the import and export of goods.

[2] From the report ‘An Overview of Investment Returns in Real Estate’ produced by the Real Estate Investment Trust and WHA Premium Growth Freehold and Leasehold Real Estate (WHART). This was the result of a survey conducted by the research and consulting arm of Knight Frank (Thailand) of the value of warehousing businesses in Bangkok and provinces that are home to industries that have received large investment inflows.

[3] The ten targeted industries are: next-generation automobiles; smart electronics; affluent, medical and wellness tourism; agriculture and biotechnology; ‘food for the future’; automation and robotics; aviation and logistics; biofuels and biochemicals; digital technologies; and a medical hub.

[4] The Thai e-Commerce Association estimates that the total e-commerce market will grow 10-fold from its current level of approximately 1-2% of the value of the entire retail trade, while Euromonitor International forecasts that the value of the home shopping market will increase from THB 12 bn in 2018 to THB 16 bn in 2023.

[5] A case study of the use of cold storage in the distribution of durian (the ‘cold chain’) by the Khao Khitchakut Agricultural Cooperative (based in Chantaburi province) carried out in the 2018 fiscal year showed that constructing a cold room resulted in durian maintaining its freshness and quality for an extended period, and that by using cold storage, farmers could sell all their fruit at a better price, both for their fresh and their processed durian. (The project was both researched and funded by the government and covered the production and distribution of a range of fruits and vegetables, including rambutan, durian, mangosteen, jackfruit, Thai basil, cucumber, asparagus and mushrooms. Agricultural sites in the five provinces of Chonburi, Chachoengsao, Rayong, Chantaburi and Trat were also included in the project.)

[6] Research by the National Oceanic and Atmospheric Administration (NOAA) shows that over the past 60 years, strong El Niños and La Niñas emerge roughly every 12-15 years. The last strong La Niña appeared in 2010-2011, while the last strong El Niño was seen in 2015-2016 but the data indicates that the periods between El Niños] La Niñas is shortening and they are appearing every 4-5 years now. Krungsri Research thus estimates that the climate will next be seriously disrupted in 2021-2022.

.webp.aspx)