In the period 2019-2021, domestic demand for motorcycles will tend to expand gradually, with trend lines pointing in the same direction as those for overall economic growth. Government welfare projects targeted at low-income groups will also help to stimulate demand by injecting additional money into the economy, as will this year’s (2019) election campaign. These developments will thus support a generally positive outlook for producers and distributors of motorcycles but at the same time, growth in sales will be restrained by weak and uncertain purchasing power in the agricultural sector, where the sector’s core consumer groups are found.

In the same period, the outlook for exports is rather more positive. Growth is expected to pick up on increased exports of ‘big bikes’ following the decision by some manufacturers to use Thailand as a base for producing for export and subsequent to this, the expansion in production capacity. Thailand is also a major regional producer of ‘complete knocked-down’ units (CKD units) for export within the region, and sales of these are also forecast to see good rates of growth on rising demand in the main export targets in the ASEAN zone and Japan. However, there is a risk of the American government hiking duties for imports of motorcycles, which would then put downward pressure on sales to the United States, Thailand’s biggest export market for motorcycles.

Overview

On a global scale, the market for motorcycles is concentrated in the countries of the Asia-Pacific region (Figure 1), an area that accounts for 80% of total annual global sales (source: Statista). Therefore, major motorcycle manufacturers have tended to reduce their transportation costs by moving production facilities closer to the target market. Since the 1960s, the world’s motorcycle production facilities are now found in Asia. Indeed, Thailand is the world’s 5th biggest producer of motorcycles, sitting behind China, India, Indonesia and Vietnam in order of importance (Figure 2).

Production and sales of motorcycles for the domestic Thai market is now centered on the ‘lightweight’ category, that is vehicles with an engine displacement of not more than 250 cc [1]. The history of Thailand’s domestic motorcycle manufacturing sector dates back to 1964 with the decision by the Board of Investment (BOI) to reduce imports by implementing a policy to support the development of motorcycle manufacturing in Thailand. At first, the sector was restricted to importing ‘completely knocked-down’ units (CKDs) which were then re-assembled in Thailand for domestic distribution but in 1971, Thailand issued its first formal policy document covering the motorcycle sector, the most important specification of which was the setting of local content requirements (LCRs) and henceforth, at least 50% of the value of all the

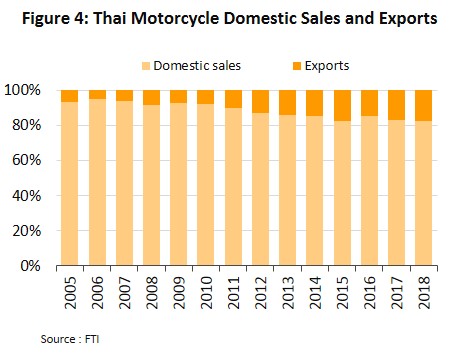

component parts of Thai-assembled motorcycles had to be sourced within the country. At the same time, to allow existing players to expand their outputs with a level of economies of scale, a five-year halt (running from 1971 to 1976) on opening new motorcycle assembly plants was announced. Following the expiry of the ban, Thai officials allowed new investment in the sector on the following conditions: (i) Manufacturers were restricted to producing motorcycles with an engine size of not more than 125 cc, the segment which met the needs of the domestic market most directly; (ii) the local content requirements were raised to a minimum of 70% by value, and producers were required to use Thai-made exhausts and engines [2]; and (iii) imports of motorcycles were banned [3]. These protectionist measures helped to dramatically expand domestic motorcycle production and to develop industries within the motorcycle supply chain in Thailand, and although in 1996 authorities relaxed the local content requirements, current domestic production of motorcycles uses almost entirely Thai-produced parts. Thailand has thus become a major producer in ASEAN of smaller motorcycles and the country is not only a producer for domestic consumption but also for the export of motorcycles and parts to ASEAN; currently, more than 80% of production is for the domestic market and 20% is for export (Figure 4). Thailand is also home to production facilities which are used to assemble motorcycles for export back to the manufacturer’s home country (source: A report on research into the development of global motorcycle production by The Thailand Automotive Institute, September 2012).

In terms of producing motorcycles with engines over 250 cc, or ‘big bikes’, as the category is called in Thailand, domestic production is currently not extensive but the importance of this segment has steadily increased following the government’s 2012 decision to try to attract foreign players to invest in motorcycles production with engine of over 248 cc in Thailand. In addition, operators in Europe and the United States (mainly producing output over-250 cc machines for the markets in Europe and other developed nations), face problems with rising production costs, especially for labor, and so these are increasingly uncompetitive with production coming from Asia. This has then naturally been a strong incentive motivating companies to move production of big bikes to Thailand, from which they can then be exported. Production of heavyweight motorcycle in Thailand during 2011-2018 rose at a CAGR of 13%, higher than a 9% CAGR during 2003-2010.

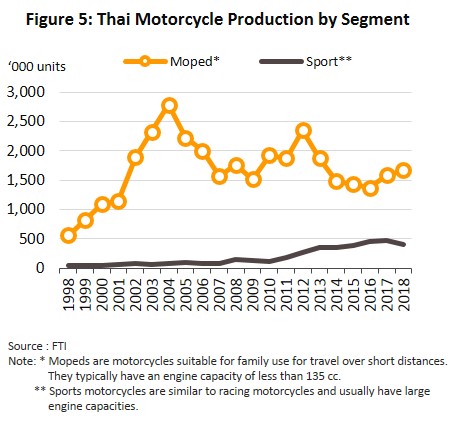

Following the definitions of The United Nations Economic Commission for Europe (UNECE), the output of the Thai motorcycle sector may be split into two basic categories (Figure 5). These are mopeds and sports motorcycles. Moped includes the small family-motorcycles with automatic or semi-automatic gears, most of which have engines of 100-125 cc that are popular in the Thai market. In fact, 80% of domestic production is of this category. The remaining fraction of production is then of sports motorcycles with engines over 248 cc, (including big bikes).

In 2018, Thailand was home to 12 motorcycle factories, which produced vehicles under 14 brand names (Figure 6). These had a total production capacity of 3.66 million units per year [4]. The big four Japanese producers of Honda, Yamaha, Suzuki and Kawasaki dominate output, with a combined 87% of Thailand’s production capacity5/ but SYM (Taiwanese), Ryuka (Chinese) and GPX (Thai), brands producing smaller motorcycles, have found space in the market as have the big bike manufacturers of Benelli (Italian), Keeway (Chinese), Triumph (British), BMW (German), Ducati (Italian) Harley-Davidson (the United States) and CF Moto (China).

The Thai motorcycle sector has tended to focus on producing for the domestic market, and this takes over 80% of all output by volume. This is amplified by the fact that the main customer groups in the domestic market are manual laborers and agricultural workers, In response to this, Thai manufacturers have thus tried to expand their exports. At first, the emphasis was on exporting units with small engines (engine displacements of 50-250 cc) to markets in the ASEAN zone. However, leading global motorcycle manufacturers have expanded their investments in Indonesia and Vietnam in order to take advantage of the large markets in these countries and now these two countries both have production capacities which are larger than Thailand’s. Exports to Vietnam and Indonesia have therefore shrunk and sales of Thai ‘completely built-up’ units (CBUs) to these two countries are down compared to the situation a decade earlier. Instead, Thai producers have had to export ‘completely knocked-down’ units (CKDs), which are exported in a disassembled state and then reassembled at factories in-country. However, Thailand is host to several world-leading big bike production plants, the country is gradually increasing its exports of big bikes and this increase has been clearly visible in the data since 2013 (Figure 7). Accordingly, the structure of the export market for CBUs is also changing. Previously, the focus was primarily on exports of lightweight category were shifted to big bikes while export market was changed from the ASEAN zone and the range of export markets has expanded. In 2018, the major export targets (for all categories of motorcycle) were Europe (which took 36% of exports of CBUs by value), ASEAN (21%), the United States (16%), and Japan (9%), while exports of CKDs go largely to ASEAN and Brazil, which take 49% and 15% of total exports of CKDs by value.

Before 2008, the majority of imports of motorcycles to Thailand were of big bikes (with engine sizes over 501 cc) but following Thailand’s elevation to the status of being a globally important producer of this category of motorcycles (since 2012), imports of larger engine-sized units has declined. However, imports of smaller units, with engine displacements of 50-250 cc have increased significantly (Figure 8), in particular from Vietnam and Indonesia. This has been a result of the decision by the big Japanese manufacturers to base production of some models (including the Exciter, R15, R3, MT-03, Nmax and Spark) in these two countries and then to export these to the rest of the ASEAN region. Thus, in 2018, of all imports of motorcycles by value, imports from Vietnam and Indonesia accounted for 71% of the total. Japan was the next most important source of imports, with 19% of the total.

Situation

The general situation for the Thai motorcycle sector between 2012 and 2017 has been one of fluctuating circumstances (Figures 9 and 10). The domestic market contracted sharply as the purchasing power of manual laborers and farm workers. Meanwhile, Export markets were volatile following trading partners’ economic conditions. However, the export of motorcycles from Thailand increased to 280,000 - 350,000 units per year as Japanese manufacturers responded to the disaster by moving part of their production facilities (or production of some models) from Japan to Thailand following the 2011 Tohoku tsunami. Meanwhile, during this same period, the domestic market contracted sharply as the purchasing power of manual laborers and farm workers, the main buyers of motorcycles, shrank. The recent history of the sector is thus as follows.

- In 2012, sales of motorcycles on the domestic market hit a record high of 2.13 million units. The following year, 2013, sales fell back slightly to 2.0 million units. A number of factors supported this buoyancy in the market. (i) The government’s stimulus measures on grassroots economies such as the rice pledging scheme and similar schemes for other agricultural commodities. (ii) The price for agricultural goods was strong in line with global prices. This raised spending power in the agricultural sector. (iii) Incomes were improved across the country by the raising of the national minimum wage to THB 300/day[6]. These factors helped to increase 2012 and 2013 up-country registrations of new motorcycles[7] by areas in each province and the Bangkok Metropolitan Region – BMR (including the five provinces of Nonthaburi, Pathum Thani, Samut Prakan, Samut Sakhon and Nakhon Pathom) surged to an average of 1.68 million and 0.51 million motorcycles per year. This compares with registrations of an average of 1.47 and 0.41 million units annually between 2008 and 2011.

- Between 2014 and 2017, the market for motorcycles entered a period of sluggishness and as a consequence of shrinking markets up-country, total sales for the country as a whole fell to an annual average of just 1.72 million vehicles. During these two years, registrations of new motorcycles in the provinces fell to an average of 1.41 million vehicles, driven down by a drought-induced fall in the yields and prices of agricultural goods, which in turn held back the spending power of consumers in some areas. In addition, domestic political conflict had delayed the government’s budget disbursement which would have helped to distribute funds to the regions. As a consequence, the economy in the upcountry slowed and, because the purchasing power of low-income groups is more sensitive towards adverse economic conditions, the core customer group was strongly affected by this. The market returned to more positive conditions in the second half of 2016 and throughout 2017, when the Thai economy began to recover and, following the gradual easing of the drought, the spending power of those in the agricultural sector and of up-country consumers strengthened. However, new registered motorcycles in the BMR remained fairly stable in this period, underpinned by steadily increasing sales of big bikes because targeted customers are high-incomer earners, who are less sensitive to the economic condition.

In 2018, total Thai production of motorcycles ran to 2.1 million units, which represented growth of 0.4% YoY; an increase in exports helped to lift production, while in the same year, domestic demand shrank slightly.

- The total number of motorcycles distributed to the domestic market shrank by -1.2% YoY in 2018 on low prices for agricultural goods. This pulled down incomes in the agricultural sector and with this, purchasing power in the provinces (the sector’s principal consumer group) was weakened. In addition, persistent high levels of household debt have continued to weigh on the market, while the decision by lenders to tighten regulations on the release of small loans also dampened demand. These combined to outweigh a number of factors that had a positive effect on the market, including the government’s welfare scheme for low-income earners and manufacturers’ efforts to stimulate the market. The latter encompassed the release of new models and the implementation of marketing strategies including the distribution of free gifts with new purchases (gold jewelry, motorcycle accessories, etc.) and on hire-purchase sales, the waiving of down-payments and the lengthening of repayment periods. Unfortunately, these failed to compensate for factors pulling in the opposite direction and as such, in 2018, 1.79 million units were distributed to the domestic market, a fall of 1.2% YoY (this figure includes imported motorcycles [8]). This total can be divided into two main segments. Around 80% of registered motorcycles in Thailand are classified as ‘small’ and these thus comprise the main segment within the sector, with a customer base that is predominantly composed of poorer, ‘grassroots’ consumers. In 2018, registrations of new small motorcycles slipped by 5.5% YoY. The second group, with a 20% share, is ‘big bikes’. Here, the situation is rather different; sales are continuing to grow, and a 20.5% YoY increase in new registrations was recorded in 2018 (Figure 11). Overall, Honda is the current market leader in all categories with a 78.4% market share of all motorcycles (by volume) distributed to the domestic market. Honda is followed by Yamaha, which has a 15.1% market share (Table 1).

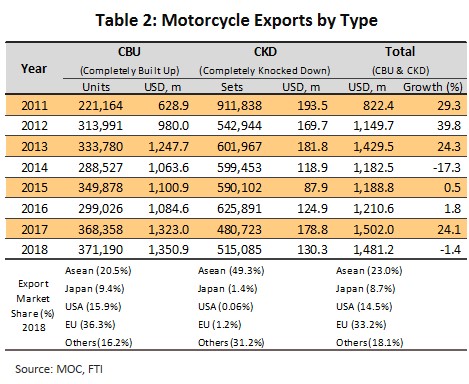

- In 2018, exports of motorcycles rose, though growth was only weak (Table 2). Exports of ‘complete built-up’ (CBU) motorcycles totaled 371,000 units (up 0.8% YoY), generating income of USD 1.35 bn, an increase of 2.1% YoY. Again, this is split between the two groups of ‘small’ and ‘big’ motorcycles. (i) Exports of small motorcycles (i.e. those with an engine capacity of less than 250 cc.) brought in USD 563.7 m. (up 10.5% YoY) with the majority of exports going to neighboring countries, including Myanmar, Cambodia, Vietnam and Laos PDR (which combined to take 42% of exports by value), where expanding economies and rising spending power have helped to boost demand, though in addition, in these countries, high levels of consumer confidence in Thai manufacturing is also underpinning increased demand. (ii) Sales of big bikes (i.e. those with an engine capacity over 250 cc.) shrank 7.1% YoY to USD 909.0 m. on a weakening of the economies in the main export targets, especially in the EU, where exports were also affected by manufacturers’ decision to await greater clarity over the EU’s new Worldwide Harmonized Light vehicle Test Procedure (WLTP), which came into effect in September 2018. In addition, though, 2018 export figures suffer from comparison with the high baseline set in the previous year, when importers pushed through purchases in anticipation of expected increases in American import duties. The main export markets for big bikes include the United Kingdom (21.6% of exports of big bikes, by value), the United States (17.5%) and The Netherlands (11.7%).

As regards exports of complete knocked-down units (CKDs) from Thailand, these came to 512,000 units (+7.2% YoY), with a value of USD 130.3 m, a fall of 27.1% YoY. This apparent contradiction of rising sales volume but falling sales income was the result of increasing exports of CKDs for small-sized motorcycle with lower prices. Here, the main export markets are Japan and the ASEAN zone, which take 51% of exports of CKDs as the major Japanese motorcycle manufacturers use Thailand as a base to produce parts which are then distributed to other parts of the region for assembly. These manufacturers are able to do this by exploiting the low-tax regimes of the ASEAN Free Trade Area (AFTA) and the Japan-Thailand Economic Partnership Agreement (JTEPA).

Outlook

Thai motorcycle production is forecast to grow steadily between 2019 and 2021. In 2019, output is expected to increase by 2-4% YoY to 2.10-2.15 million units, while in 2020 and 2021, growth should be in the range of 0-2% YoY, pushing output to 2.12-2.17 million units by 2020 and 2.14-2.19 million units in 2021. This forecast is supported by positive factors affecting both the domestic and export markets.

- Following falls in 2018, domestic sales of motorcycles should return to a period of sustained growth as a result of several factors. (i) Overall, the Thai economy is forecast to see steady expansion (Figure 13). (ii) The ‘Rak pee Win’ program initiated by the Small Business Credit Guarantee Company (TCG) aims to assist motorcycle taxi drivers by providing them with credit to buy a new motorcycle. Applicants to the scheme are eligible for a loan with a value of up to THB 100,000, with an additional THB 50,000 available for motorcycle repairs, and it is hoped that this will go some way towards solving problems with debts to unregistered lenders and excessive outstanding credit card balances. Applications may be made for participation in the program between February 21 and December 30, 2019; as of February 25, 4,895 applications had been made from a total of over 200,000 motorcycle taxi drivers registered with the Department of Land Transport. (iii) The government’s welfare system, administered through the welfare card, is continuing to make additional funds available to potential motorcycle purchasers (Table 4). (iv) The national election, held on March 24, 2019 should also have increased the amount of money in circulation in provincial economies. It is thus expected that in 2019, sales of motorcycles to the domestic market will grow by 2-4% YoY to 1.82-1.86 million units and then in 2020 and 2021 by 0-2% per year to 1.84-1.88 and then 1.86-1.90 million units in these two years. Following 2019, rates of growth are likely to slow, partly due to adjustments to motorcycle excise duties that are being revised in line with CO2 emissions, which will be enforced from January 1, 2020 and that will tend to raise prices for motorcycles 9/, while in addition, farm incomes are still only slowly gaining ground. Competition within the sector is therefore somewhat intense between both domestically manufactured motorcycles and imports from China and the ASEAN zone 10/ and this may increase costs for manufacturers and distributors, which will have to spend more on marketing in order to preserve market share.

- Exports of CBUs are anticipated to grow at a faster rate thanks to Harley Davidson’s recent decision to base its export production in Thailand, with units assembled in the country being sent to China and the rest of the ASEAN zone. Exports should thus increase from 2019 onwards, while slow but steady growth in the global economy will also help. Given this, the forecast is that 2019 exports of CBUs will rise by 2-4% YoY to 0.38-0.39 million units and then by 3-5% YoY in 2020 and 2021 to 0.39-0.40 and 0.41-0.42 million units, respectively. However, there are also clouds on the horizon in the form of possible increases in import duties; the United States is currently considering raising tariffs on imports of motorcycles from Thailand under section 232 of the Trade Expansion Act, 1962. With regard to exports of CKDs over the next three years, these should also rise steadily on increased demand for units to reassemble in Japan and elsewhere in the ASEAN zone.

Krungsri Research view:

Incomes for both manufacturers and distributors of motorcycles will tend to improve but distributors that operate hire-purchase schemes may be exposed to risks arising from borrowers defaulting on debts, especially in the case of workers in the agricultural sector, where income growth remains weak. In addition, competition will also tend to stiffen.

- Manufacturers: Manufacturers’ turnover will rise in step with the volume of goods distributed to domestic and export markets. Within Thailand, growth in the market for motorcycles will reflect that of the economy overall, though additional support for the sector will come both from the government’s ongoing policy efforts to provide financial assistance to low-income groups and the after-effects of the 2019 election. Exports will rise at a faster rate, supported by an expanding world economy, albeit one that is growing at a slower rate than in the past. Beyond this, exports will also be boosted by the establishment of production facilities by major motorcycle manufacturers in Thailand and the expansion of their export production capacity, together with the opening of new export possibilities thanks to the ASEAN free trade agreement. However, exports to the United States are threatened by the possibility of increases to import duties under section 232 (see above). Should the decision be made to push forward with these increases, imports to the United States of motorcycles from a number of countries, including Thailand, will slow.

- Distributors and sales agents: Turnover for distributors will rise on an increase in the new motorcycle sales and on additional income from repairs and the sale of spare parts to the sizeable national motorcycle fleet (currently numbering around 25 million vehicles). However, operators that offer hire-purchase financing may have exposed themselves to the risk of bad debts, as the main buyers of these motorcycles are agricultural workers, whose income is unstable, and manual laborers, whose income is only at the low- to mid-level. Distributors of big bikes will be exempt from these fears, as customers in this group typically have higher spending power that is less influenced by movements in the economy. Competition within the sector is also forecast to stiffen, especially for smaller capacity motorcycles, with this taking place both over price and interest rates for hire-purchase sales. As such, distributors’ profit rates may come under pressure.

[1] The specifications used by customs officials (HS codes) divide motorcycles into 4 categories: (i) Lightweight motorcycles have an engine displacement of not more than 250 cc; (ii) middleweight vehicles are those with an engine size of 251-500 cc; (iii) motorcycles with an engine size of 501-800 cc are classed as heavyweight; and (iv) the remaining units (i.e. those over 800 cc) are in the category of super-heavyweight motorcycles.

[2] When local content requirements specifying at least 70% by value local parts were first specified, parts manufacturers were unable to meet demand from motorcycle manufacturers in terms of the standards or costs of their parts. Manufacturers were therefore unable to produce vehicles using locally sourced items, as required by the government, which in response relaxed the deadline for implementation of the local content requirements, postponing this from 1979 to 1984.

[3] Subsequent to Thailand’s entry into GATT, which emphasized free-trade in goods and services, in 2000, Thai government was required to abandon the blanket ban on the import of finished motorcycles.

[4] Compiled from announcements of planned investment by motorcycle manufacturers. Of total Thailand’s capacity in 2017, capacity of Harley-Davidson was not included

[5] Honda, Suzuki and Kawasaki have factories in Thailand producing both small motorcycles and big bikes, whereas Yamaha produces only mopeds]small motorcycles in Thailand and imports its larger models from Japan, taking advantage of the Japan-Thailand Economic Partnership Agreement (JTEPA).

[6] This was by an announcement of the National Wage Committee on 17th October 2011, which raised the minimum wage to THB 300]day in 77 provinces. In the 7 pilot provinces of Bangkok, Samut Prakan, Samut Sakhon, Pathum Thani, Nakhon Pathom, Nonthaburi and Phuket, this was with effect from 1st April 2012 and in the other 70 provinces, the raise was effective from 1st January 2013.

[7] Based on information on new motorcycle registrations from the Department of Land Transport for individual provinces, since aggregated data on registrations is not available.

[8] In 2018, imports of motorcycles rose 17.4% YoY to a value of USD 295.1 m.

[9] The new excise rates for motorcycles are split into 5 bands: (i) Motorcycles with CO2 emissions of not more than 10 g]km will have excise levied at the rate of 1% of the sale price. (ii) Motorcycles with CO2 emissions of 10-50 g]km will have excise levied at the rate of 3% of the sale price. (iii) Motorcycles with CO2 emissions in the range of 50-90 g]km will have excise levied at the rate of 6% of the sale price. (iv) Motorcycles with CO2 emissions in the range of 90-130 g]km will have excise levied at the rate of 9% of the sale price. (v) Motorcycles with CO2 emissions of more than 130 g]km will have excise levied at the rate of 18% of the sale price.

[10] Thailand mostly imports electric motorcycles from China.