EXECUTIVE SUMMARY

The domestic electronics industry will enjoy an improving outlook over 2025 to 2027. In particular: (i) for integrated circuits, output volume and export value will be up by respectively 6.0-7.0% and 8.0-9.0% per year; while (ii) for hard disk drives, annual production and exports will strengthen by 7.0-8.0% and by 8.5-9.5%. Demand is being boosted by the onset of a new global replacement cycle in the market for electronics and electrical appliances, ongoing growth in both the EV and digital services industries, and the explosion of interest in AI, which is then feeding stronger sales of electronic hardware used in data processing and storage. Nevertheless, players will come under pressure from both the increasing popularity of SSDs and intensifying competition, which is being driven by worsening trade tensions and the ratcheting up of the US-China tech war. As a result, Thai players may have to contend with both an increased inflow of Chinese goods into the domestic market and stiffening competition for market share at the global level.

Krungsri Research view

The electronic industry shows an improving growth trend. On the demand side of the market, players will benefit from growth in downstream industries, while supply will be lifted by increased investment in production facilities and the development of new technologies.

-

Manufacturers of integrated circuits (ICs): Production and exports will recover against last year’s low baseline thanks to: (i) growth in the global computing, communications, and EV industries; and (ii) the rising trends of downstream industries, particularly following increased investment in the manufacture of smart electronics and electrical appliances and the impact of this on the domestic production of semiconductors.

-

Hard disk drives (HDDs): Manufacturers will receive a boost from: (i) HDDs continuing price advantage relative to SSDs, which will lift global demand especially from the digital industries (e.g., cloud computing, data centers, generative AI and 5G networks); (ii) the start of a new replacement cycle for PCs and smartphones in world markets; and (iii) the likely strength of domestic demand, especially given the recent inflow of investment funds into new data centers.

However, the continuous rise in SSD popularity, coupled with the likely intensification of competitive pressures, will pose significant challenges for operators in both industries.

Overview

The Thai electronics industry has been the beneficiary of official support going back to 1972, when the government began to attract foreign capital inflows through the implementation of a range of tax and non-tax investment promotion strategies administered by the Board of Investment (BOI). Between 1972 and 1992, the government promoted the electronics industry as a growing contributor to the export sector, and partly thanks to government policy, foreign investors came to the country in greater numbers to set up production facilities for the manufacture of integrated circuits (ICs), printed circuit boards (PCBs), hard disk drives (HDDs), floppy disks, electric motors, and electric wires and cabling. Thailand was an attractive investment target for overseas players thanks to the country’s relatively low labor costs at that time, though its appeal as an investment target was also helped by the 1987 Plaza Accord1/, which led to a rise in the value of the yen and in the wake of this, many Japanese manufacturers relocated production facilities overseas, including to Thailand. By exploiting its low manufacturing costs, its geographical location at the center of the region, and following the establishment of the ASEAN Free Trade Area (AFTA) in 2004, the increase in the economic potential of the ASEAN zone, Thailand has been able to continue to attract international manufacturers, especially Japanese, Taiwanese and US corporations, and over time, these have steadily increased investment in the production facilities that they operate in Thailand.

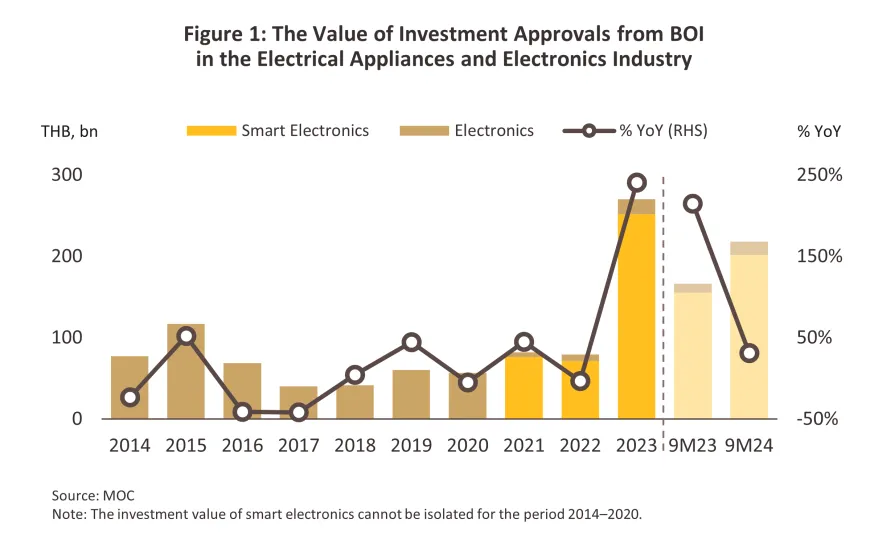

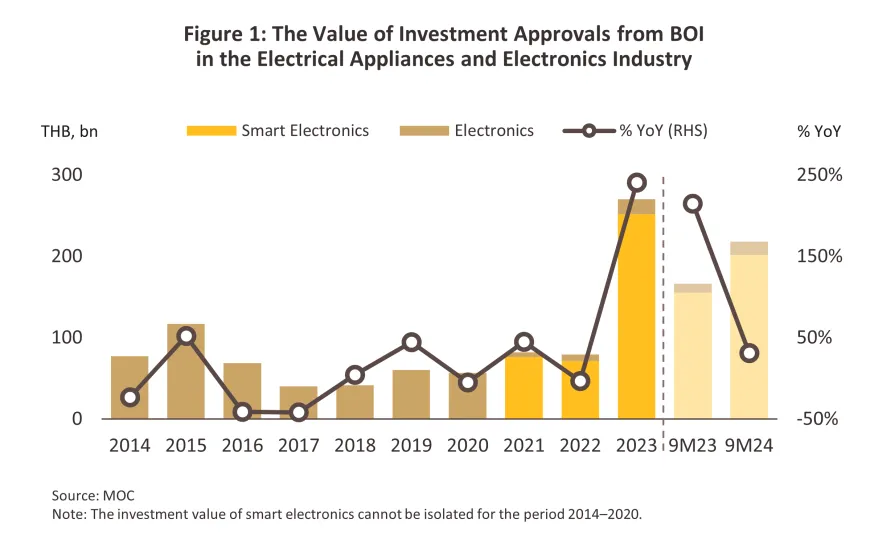

The government has encouraged investment in the electronics industry for some time, but since 2021, this has been designated as a strategic industry targeted for support by the Board of Investment (BOI) (Figure 1). Partly as a result of this, applications for projects targeting the electronics and electrical appliances industry that were approved for BOI investment support surged 240.6% to a total value of THB 269.99 billion in 2023. Almost all of this (93.3%) was directed to the manufacture of smart electronics, a category that includes semiconductors, integrated circuits, hard disk drives and air conditioners, and so total investment inflows to this segment jumped 254.4% to THB 251.98 billion. This has then helped to develop the domestic manufacturing supply chain and to push this further into upstream processes, which will now sustain the development of other modern industries targeted for support by the government, including EVs, data centers and comprehensive healthcare.

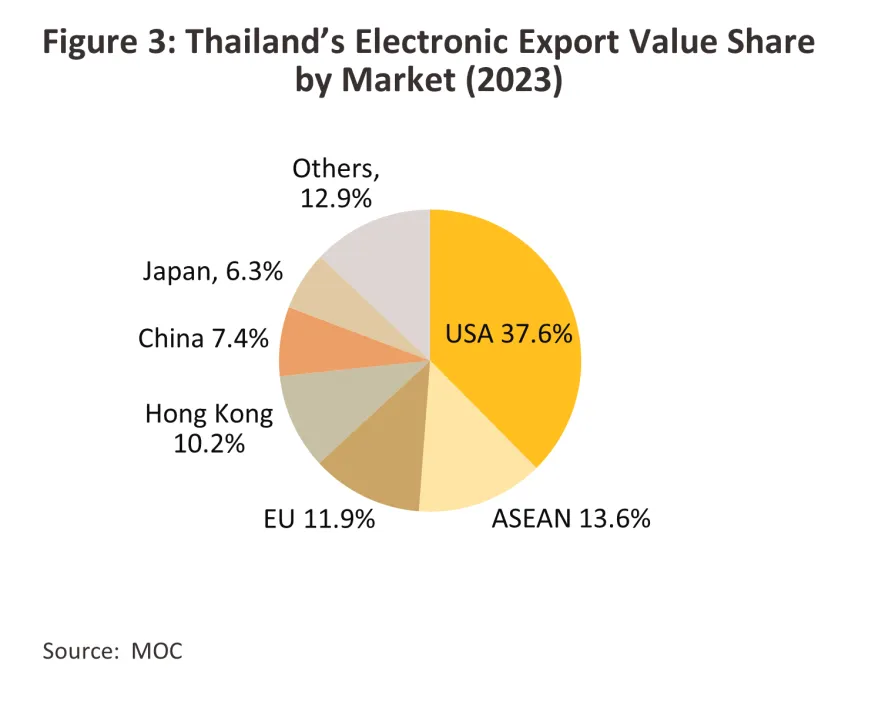

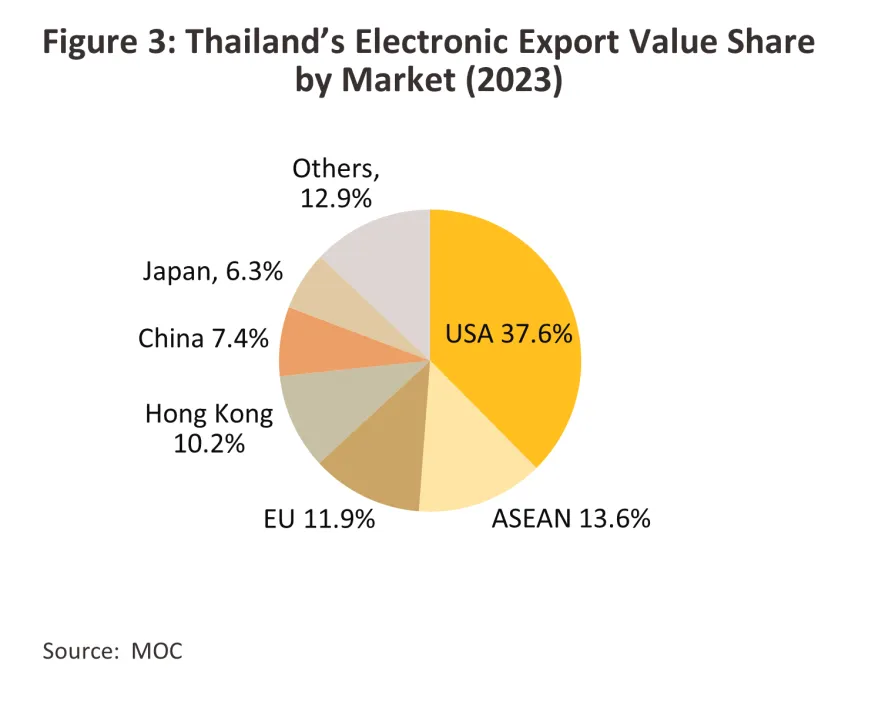

The industry is overwhelmingly focused on exports, and with 90-95% of output absorbed by overseas markets, this is Thailand’s most important goods export. Electronics and electrical appliances thus accounted for a full 27% of all value generated from the export of goods in 2023, having enjoyed compound annual growth of 8.0% over 2019 to 2023 (E&E Intelligence Unit, 2024). The largest single segment of this was integrated circuits (21.0% of the total value of electronic exports, followed by computers and computer equipment and parts (19.9%), hard disk drives (17.7%), semiconductors, transistors and diodes (11.3%), printed circuit boards (2.8%), and ‘other’ items (27.2%) (Figure 2). Thailand’s most important export markets are the US (buyers of 37.6% of all exports by value), the ASEAN zone (13.6%), Europe (11.9%), Hong Kong (10.2%), China (7.4%) and Japan (6.3%) (Figure 3). The remaining 5-10% of production that is distributed to the domestic market is mostly used as components in the production of other final goods such as communications devices, auto components, electrical and office appliances, medical equipment, and other industrial goods.

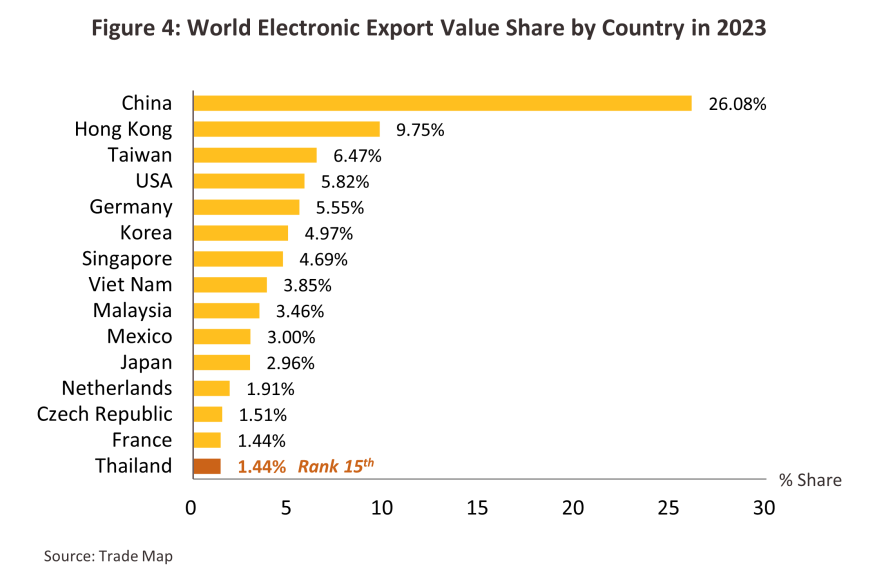

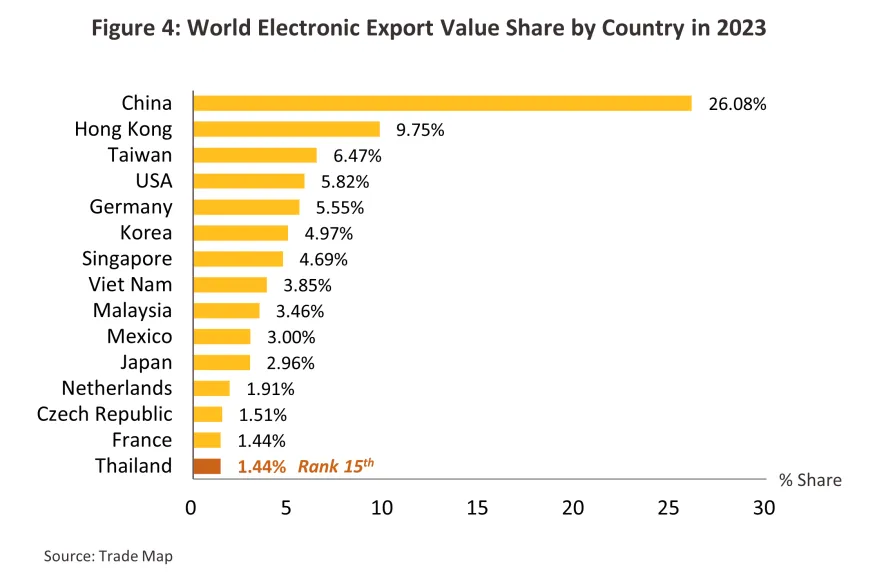

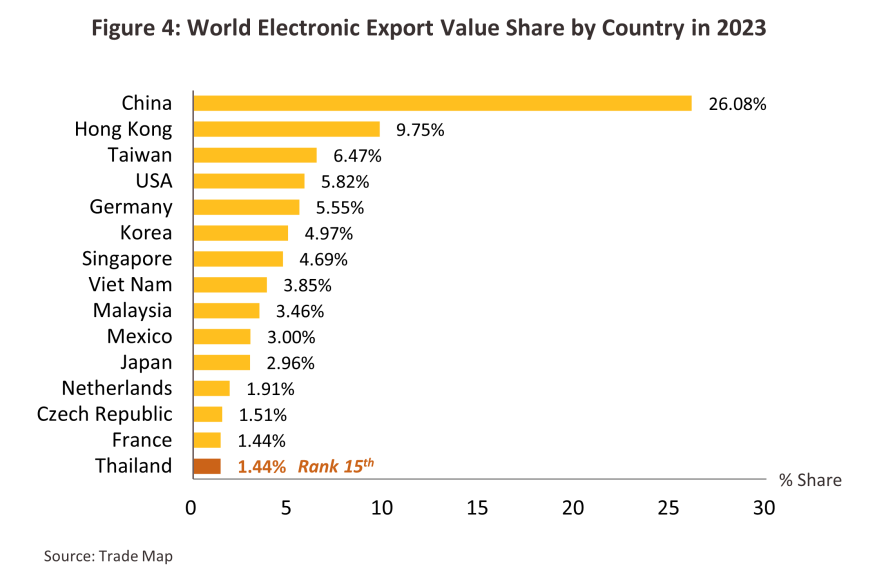

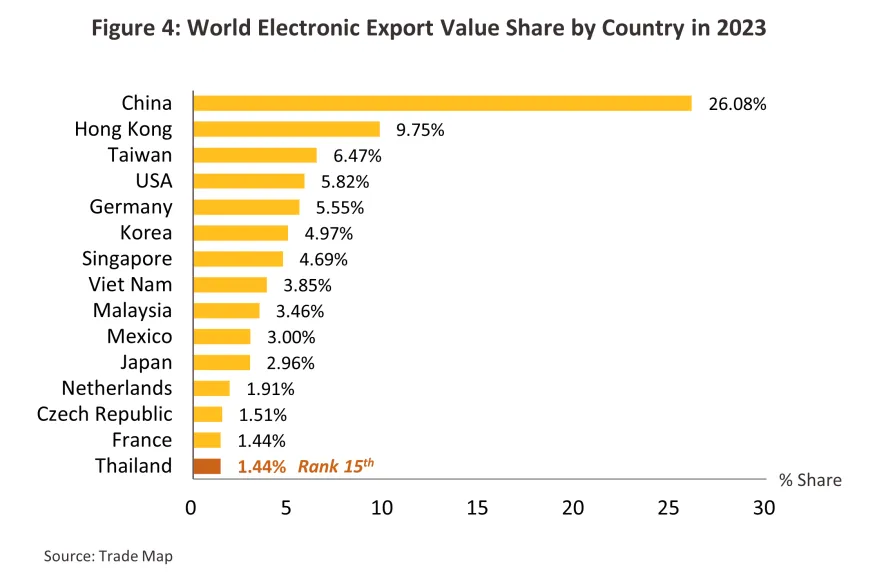

In 2023, output of electronics was sufficiently strong to place Thailand 15th in the world rankings, although the country has just a 1.4% share of global exports, coming some way after China (26.1% share of global electronic exports by value) and Hong Kong (9.8%), Taiwan (6.5%), the US (5.8%) and Germany (5.5%) (Figure 4).

The structure of Thai export markets is described below, divided by major product segments and export targets.

Integrated circuits

-

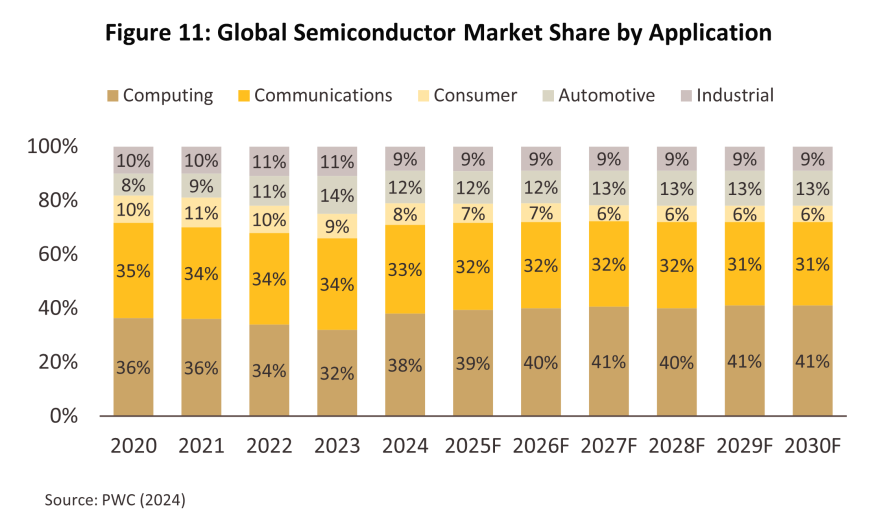

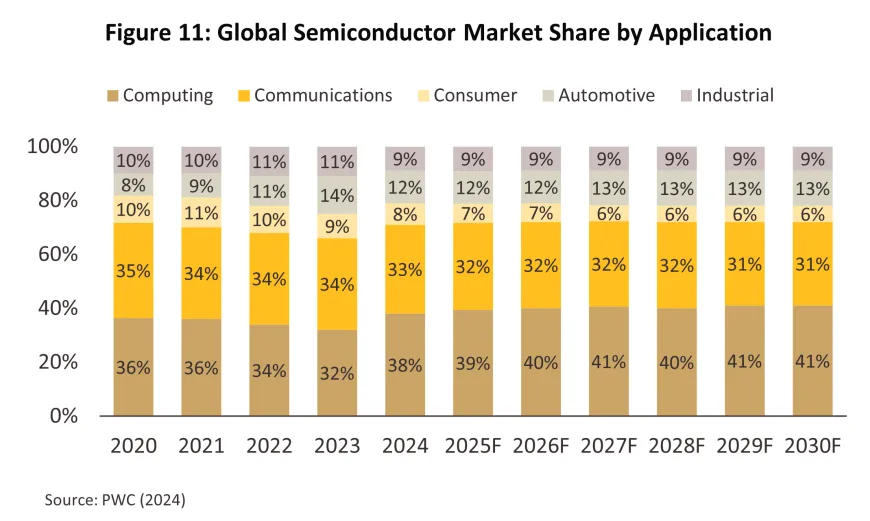

The market for integrated circuits (ICs) is closely connected to that of the semiconductor industry, which itself forms a major part of modern economies. Growth is largely dictated by the state of the global economy and the intensity of demand from downstream industrial consumers, which in 2023 was dominated by the computing, communication and auto industries (the source of respectively 34%, 32% and 14% of global demand for semiconductors). The most important semiconductor types are logic, memory and microcomponent chips, which account for 34%, 17% and 17% of the global market respectively (PWC, 2024). The major influences on demand are described below.

-

Demand for use in computing and communications applications is being driven by rapid recent progress in AI, machine learning, neural networks and data analytics. This has then boosted sales of high-end chips, especially for memory chips with the density, capacity, speed and bandwidth most in demand by the market.

-

On average, EVs contain six-times as many chips as traditional internal combustion engine-powered vehicles and so the recent surge in sales of these has fed through into much stronger demand for chips from the auto industry. In particular, these are used in motor and battery management systems (e.g., in inverters, DC-DC converters, on-board chargers and battery management systems).

-

Thanks to the central role of semiconductors in the production of advanced high-tech products, their manufacture has been designated as a strategic industry by the government and being one of the main BOI targets to draw FDI. The value of approvals for BOI investment support in projects connected to smart electronics has risen through recent years. Semiconductors are particularly important in parts of the economy that have recently attracted increased levels of investment, including automation, medicine, and next generation automotive. However, the Thai economy lacks domestic sources of the raw materials needed for the full development of this industry, while the country also faces challenges developing upstream technologies since the research and development needed for this is highly capital intensive. As such, the Thai industry remains largely focused on feeding global supply chains with intermediate and downstream goods (E&E Intelligence, 2024). Nevertheless, pro-investment government policies have helped to raise the possibility of Thailand developing its own advanced semiconductor capabilities.

-

Thai exports of ICs generated receipts of USD 9.6 billion in 2023. This represented 1.0% of global IC exports and this made Thailand the world’s 13th largest supplier of these (Trademap, data for 2023). The most important domestic players active in this market are Hana Microelectronics, Stars Microelectronics, Maxim Integrated Products, Microchip Technology, and Rohm Integrated Systems.

Hard disk drives (HDDs)

-

The outlook for the HDD industry typically moves in line with growth in the electronics and computing industries, and at present, demand for HDDs is rising thanks to a surge in interest in AI and strong growth in investment in data centers, which has generated massive demand for data storage units (McKinsey, 2024). At the same time, the development of the new generation of smart electronic devices that have increased processing power, storage capabilities, and connectivity is adding further to demand for data storage devices (Mordor Intelligence, 2024).

-

The major global manufacturers (i.e., Seagate, Western Digital and Toshiba) are currently working on developing higher capacity HDDs, for example through the application of heat-assisted magnetic recording technologies that will also allow storage devices to be shrunk (Mordor Intelligence (2024) and Seagate). Western Digital and Seagate are the major HDD manufacturers present in Thailand.

-

The development of solid-state drive (SSDs) has had a significant impact on the global market for HDDs since the former offer advantages with regard to their durability, speed, and energy efficiency. Development of SSDs is continuing and so while SSD per-unit capacity is increasing, costs per unit have fallen in recent years (E&E Intelligence, 2024).

-

Domestic investment in HDD manufacture is increasing again as, following a period of decline, the industry moves to meet anticipated growth in demand. This is coming from the leading players Seagate and Western Digital, which invested THB 16 billion in 2023 and THB 23 billion in 2024 in the expansion of Thailand-based production facilities and the development of new smaller, higher capacity HDDs. This should help HDDs compete more effectively with comparatively higher-priced SSDs in the rapidly expanding market for storage units for use in data centers (Prachachat, 26 August 2024, and E&E Intelligence, 2024). The future outlook for the industry is thus one of potential growth, which would be a turnaround from the sluggish conditions experienced over the past few years.

-

Thailand remains a globally important center of HDD production, and with receipts totaling USD 8.2 billion in 2023, the country was the source of 16.4% of global HDD exports. This placed Thailand second only to China in its importance to the market (Trademap, data for 2023).

Situation

Integrated circuits

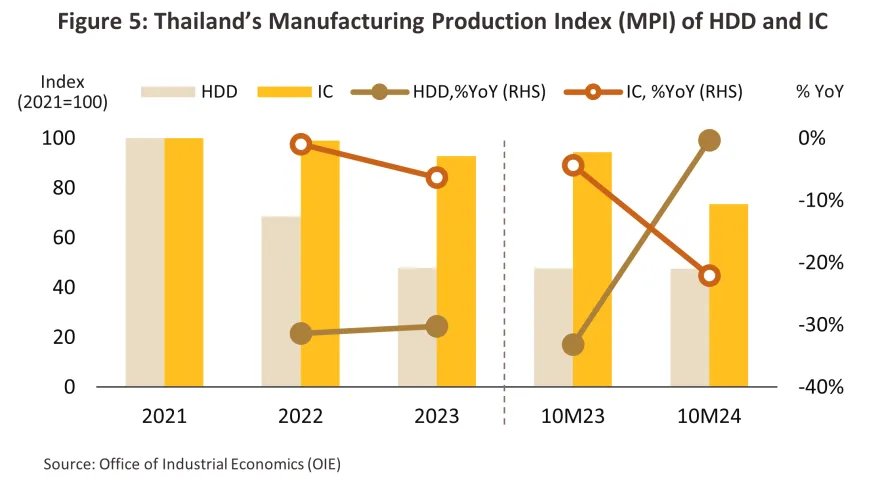

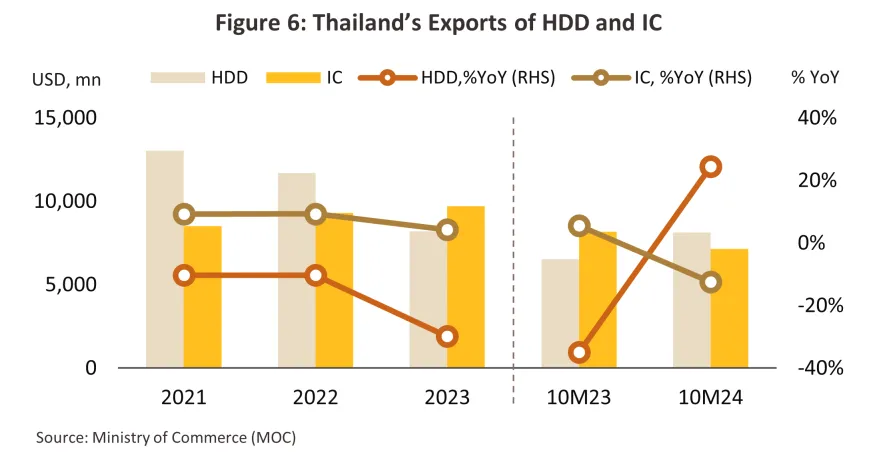

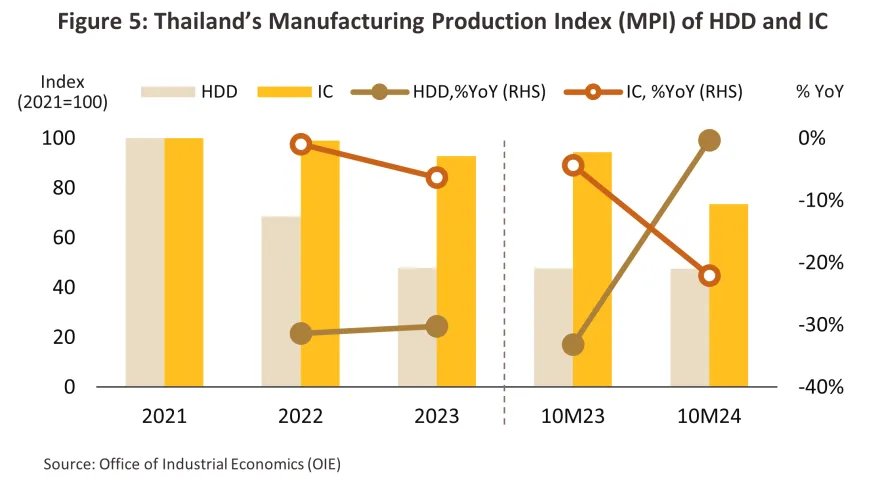

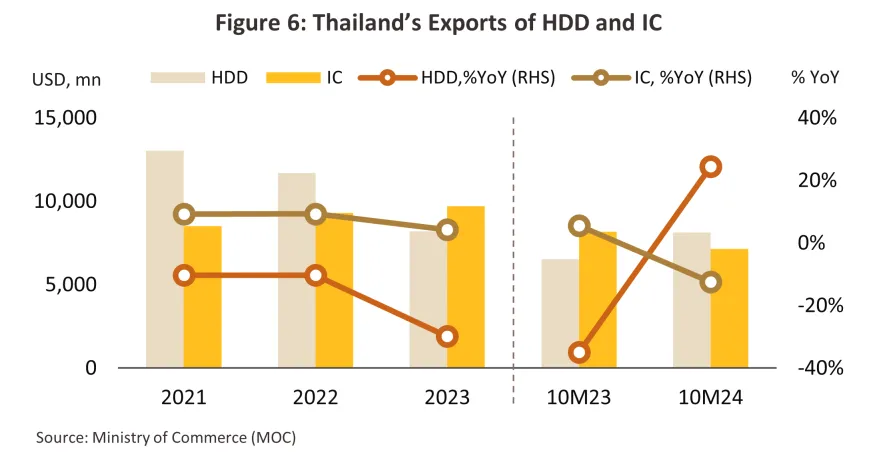

Over the first 10 months of 2024, the IC industry suffered from declines in the manufacturing production index (Figure 5) and export value (Figure 6) of respectively -22.0% YoY and -12.5% YoY. In the latter case, this dropped to a total of USD 7.1 billion. Factors contributing to this slowdown included the following.

-

Uncertainty over the outlook for the world economy has dragged on recovery in purchasing power, and as such, global sales of electronics goods and electrical appliances have slipped. For all of 2024, these are thus forecast to contract by -0.6% to a value of USD 950 billion (Statista, June 2024).

-

IC inventories have surged 72.0% YoY to an average of 25.3 million pieces monthly (OIE, 2024). This follows an earlier global chip shortage, which caused significant disruptions to electronics supply chains and in response, manufacturers stepped up production of ICs from 2022 onwards. However, tight supply began to ease in 2023 but with demand cooling, production then outpaced the capacity of the market to absorb this (PWC, 2021) and as a result, a supply glut began to accumulate. Thus, while domestic output contracted -4.3%, exports dropped at the significantly faster rate of -11.2% and the discrepancy between the two has meant that inventories have expanded.

-

Geopolitical conflicts and worsening trade tensions, in particular the tech war between the US and China, have weighed on demand from industries that are major consumers of ICs. In addition, China continues to be troubled by an oversupply of capacity and so Chinese manufacturers have been dumping stock on overseas markets. As a result, exports of ICs from Thailand to the main markets of the US and China have shrunk by -36.6% and -8.7% YoY respectively.

Nevertheless, despite these headwinds, IC export value declined at a slower rate than the industry’s manufacturing production index (Figure 5 and Figure 6). This therefore indicates that Thai IC production is moving towards the manufacture and export of higher value ICs as the industry responds to demand from modern high-tech industrial buyers in the EV, data center, smart phone, medical device, and power supply markets.

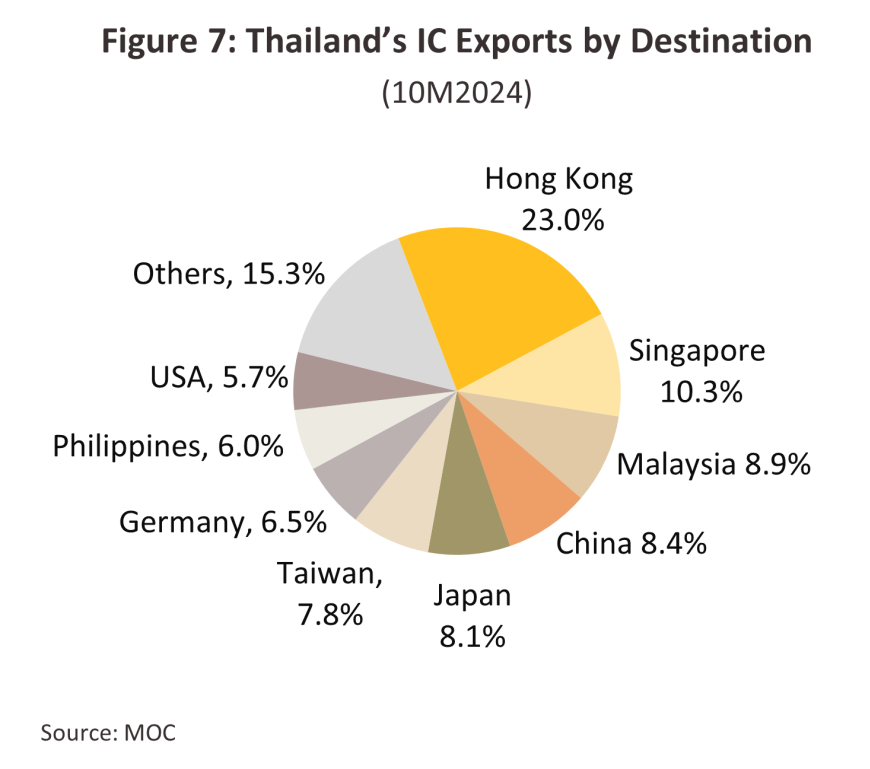

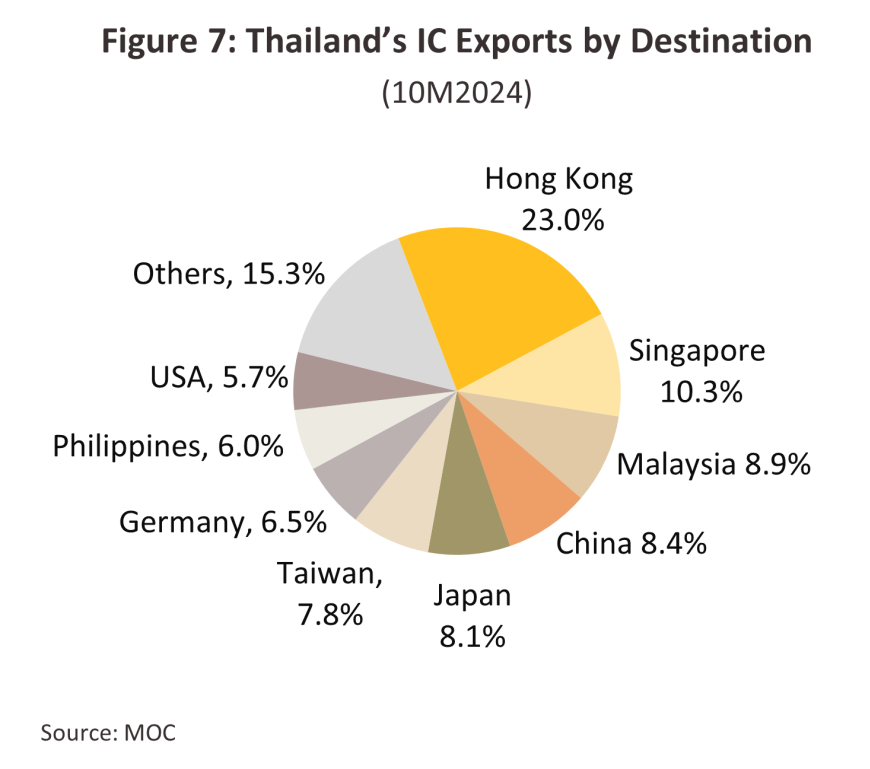

In the period, the most important export markets were Hong Kong, Singapore and Malaysia (Figure 7).

Hard disk drives

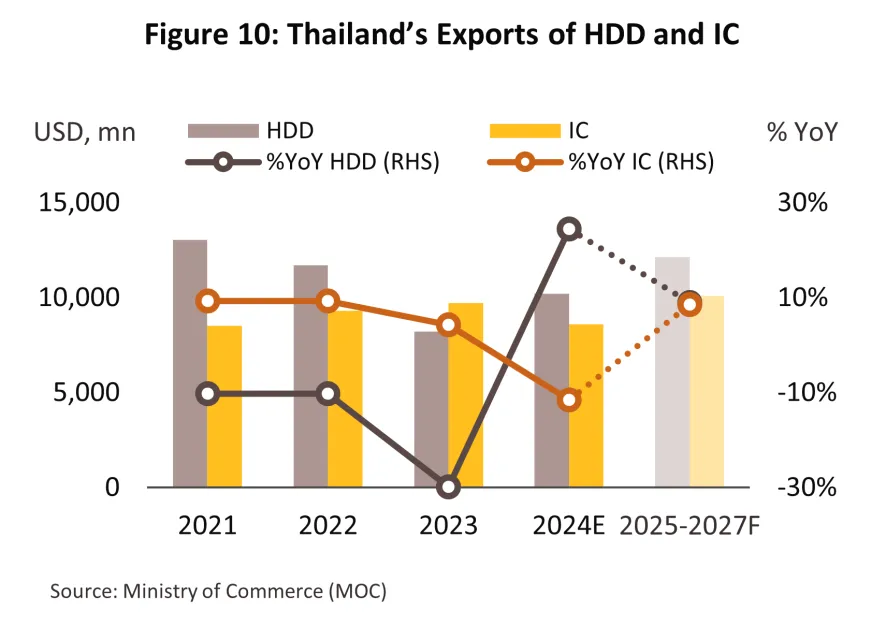

The MPI for the HDD industry also contracted over the first 10 months of 2024, and although this is down by only -0.3% YoY, output is just 47.5% of the peak hit in 2021, when production and exports were turbocharged by the start of the Covid-19 pandemic and the resulting global surge in demand for computer equipment. In the current environment, sales have come under pressure from the switch in the market from HDDs to SSDs, which are faster, smaller and lighter and so are especially suitable for use in laptops and other devices where space and weight are at a premium. Demand for SDDs has thus built steadily through recent years, and in 2024, global sales are forecast to climb by another 19.0% to reach USD 47 billion (Precedence Research, 2024). Nevertheless, despite these headwinds, the value of HDD exports is up 24.4% YoY to USD 8.1 billion. The industry has benefited from the following factors.

-

New HDDs have an increased capacity and greater value, and this is reflected in the simultaneous rise in export value and decline in the MPI. This follows a spike in investments by major manufacturers in the development and production of smaller but higher capacity HDDs, and as such these now have a higher value per unit.

-

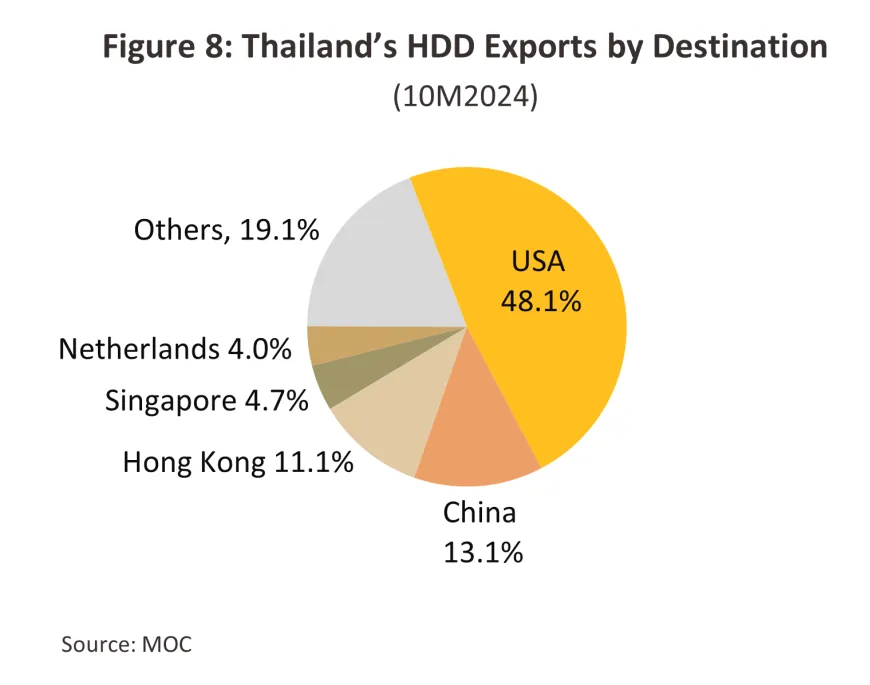

The build out of new data centers is accelerating around the world, but this is particularly noticeable in the US and China, which are also Thailand’s main export markets for HDDs. Sales to these thus increased by 60.3% and 48.6% YoY to generate income worth respectively USD 3.9 billion and USD 1.1 billion. Investment in new data centers is being driven by advances in AI and machine learning technologies, which increase the need to store the enormous volumes of data that support these systems, and so for all of 2024, these investments are expected to jump 34.7% to USD 318.0 billion (Mordor Intelligence (2024), Grand View Research (2024) and Gartner (23 October, 2024)). However, following an earlier surge in investment in data centers, exports to some other countries are now being affected by the onset of a destocking cycle. These include Hong Kong and Singapore (Thailand’s third and fourth largest HDD export markets), where imports of HDDs from Thailand are down by -17.9% and -21.6% YoY to USD 0.9 billion and USD 0.4 billion respectively.

-

Global PC sales have been growing since Q4 of 2023. This follows the peak (and subsequent slump) in purchases at the onset of the pandemic, when lockdowns around the world added to demand for the computer equipment needed to support individuals suddenly working and socializing from home. Sales thus rose 7.8% YoY in the first half of 2024. In the US, Thailand’s most important market for HDD exports, Q2 2024 sales of PCs rose 3.4% YoY to 18 million units (Gartner, 10 July, 2024).

Additionally, Thailand’s three most important overseas markets are the US, China, and Hong Kong (Figure 8).

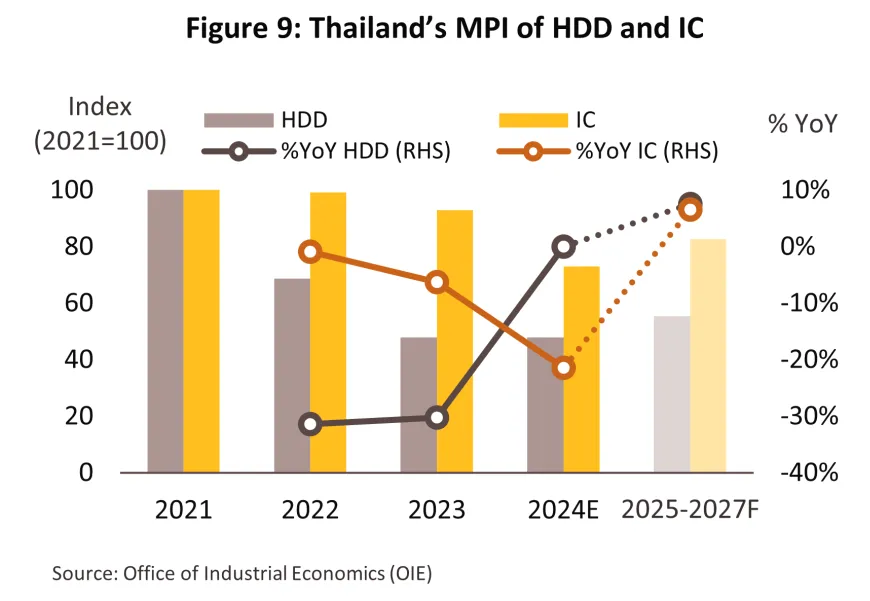

Through the remainder of 2024, the domestic electronics industry will be buoyed by the rebound in global demand for PCs that set in this year1/ (Gartner, 2024) and the resulting onset of cyclical recovery in the IC industry worldwide. Given this, declines in both output and exports of electronics goods should slacken, and so for the year as a whole, falls in the production and export value of ICs will come to -21.0% to -22.0% YoY and -11.0% to -12.0% YoY, while for HDDs, output will remain broadly flat (any change is likely to remain between -0.5% and 0.5% YoY) but export value should be up by 24.0-25.0% YoY.

Outlook

Integrated circuits

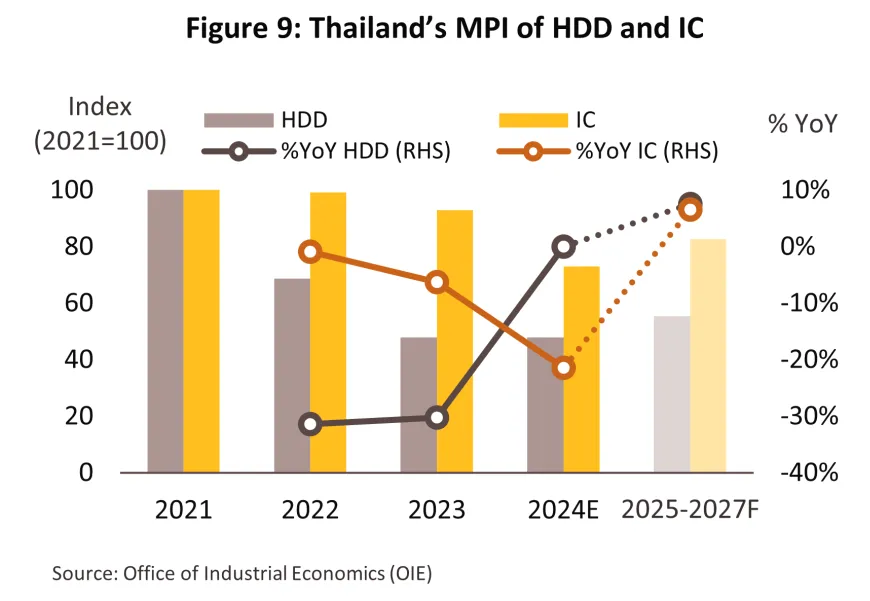

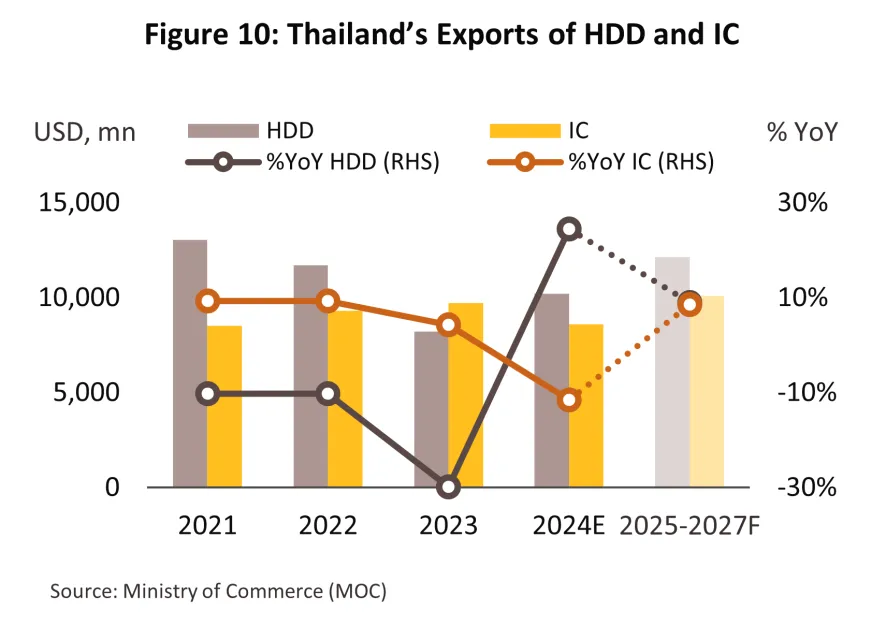

The annual output of ICs is forecast to rise by 6.0-7.0% over 2025 to 2027 (Figure 9), while export value will accelerate at the slightly faster rate of 8.0-9.0% (Figure 10). Sales figures will be helped by recent weakness in the market, as well as by recovery in global demand. Over the short term (i.e., in 2025), world demand will therefore strengthen by 13.8% to bring export value to USD 720 billion (Gartner, 28 October 2024), although over the longer term of 2024-2033, annual growth should slow to 5.8% CAGR (Precedence Research, 2024). The market will be boosted by a number of different factors.

-

The start of a new global replacement cycle is lifting demand for ICs as consumers upgrade electrical appliances, smart phones, PCs, and other electronic devices. This is being driven in particular by the development and release to the market of AI-capable PCs, and Gartner expects that this segment will begin to see significant growth over 2025 and 2026, further lifting global demand for ICs (Source: Canalys PC analysis).

-

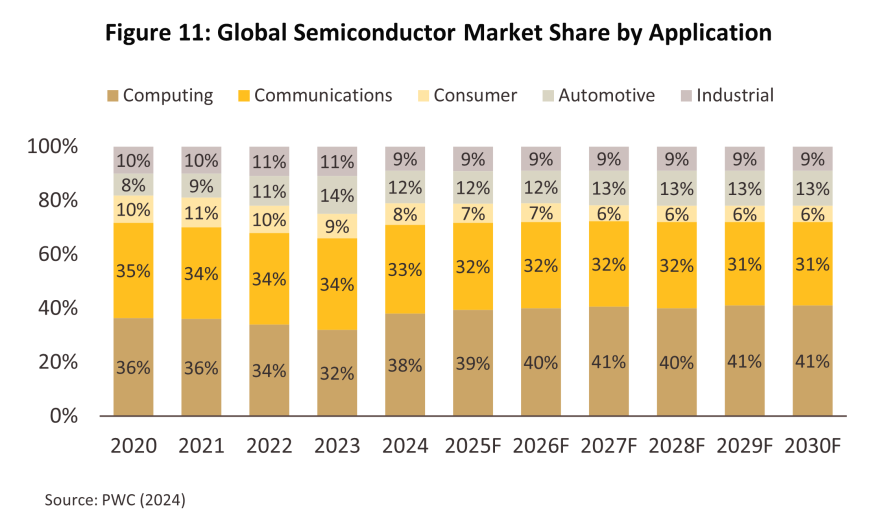

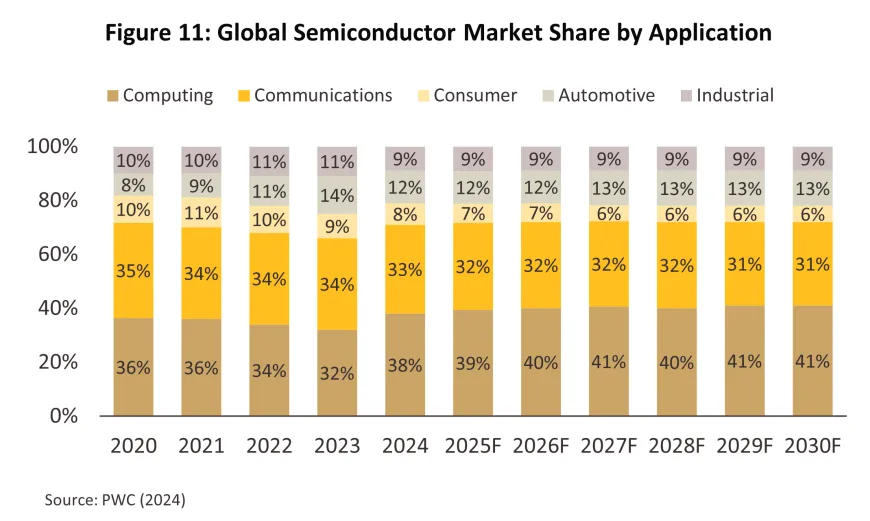

Growth in demand for computing services will support stronger sales of semiconductors for use in data processing and storage, and at around a 40% market share, this will comprise the largest single segment of the market over the period 2025 to 2027 (Figure 11). In particular, demand for memory chips is expected to rise by 13.0% CAGR over 2023-2030, split between growth of 57.5% CAGR for DRAM chips and of 29.1% for NAND chips (PWC, 2024).

-

The continuing strength of the communications industry will mean that demand for use in communications devices will comprise 32% of the global market for semiconductors, thus making this the industry’s second largest segment. Worldwide sales of smartphones will continue to expand through the coming period (Ericsson, 2024), helped by the development and widespread adoption of AI smartphones2/. This will further boost sales of high-capacity processors and memory chips, and so over 2023-2030, global demand from the communications industry is expected to strengthen by 7.7% CAGR (PWC, 2024).

-

The recent global take-off in EV manufacturing3/ has raised the industry to third place in the ranking of industrial consumers of semiconductors (the EV industry will comprise approximately 12% of total global demand). Demand for silicon carbide (SiC) and gallium nitride chips will be especially strong since in addition to having higher levels of power density and efficiency, these operate at higher temperatures than general purpose chips. The value of the EV semiconductor market is therefore forecast to grow by 33.2% CAGR over 2023 to 2030 (PWC, 2024).

-

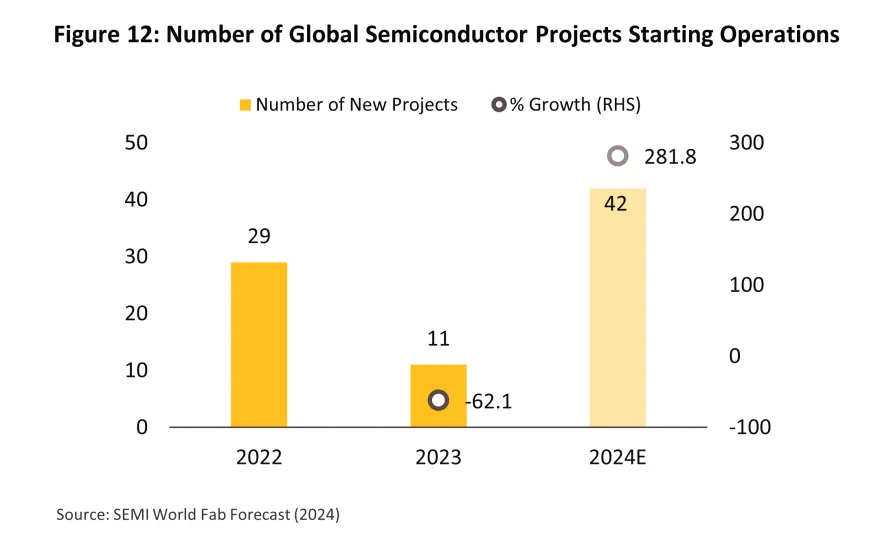

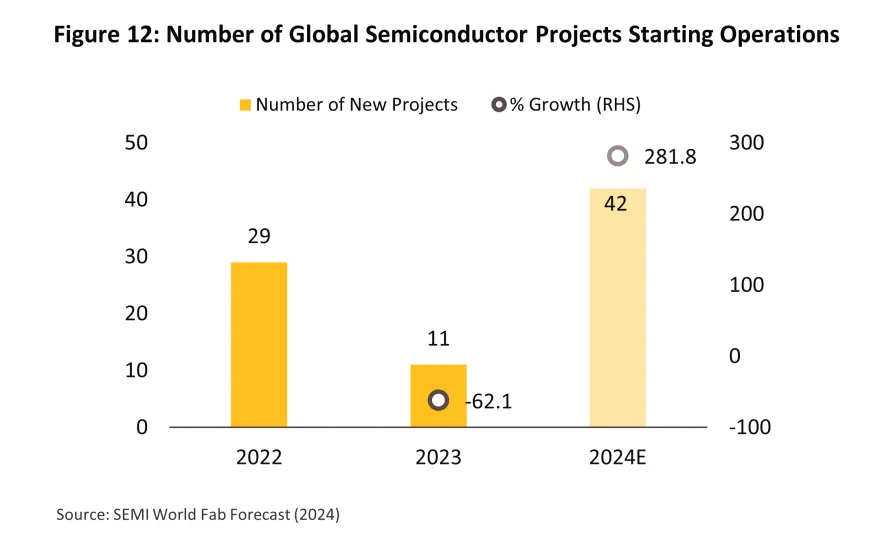

The easing of supply chain disruption problems following an increase in the supply of raw materials (upstream chips) is attributed to accelerated investments in chip manufacturing plants to mitigate chip shortages since 2021. According to the SEMI World Fab Forecast (2024), it is projected that by 2024, there will be 42 new semiconductor manufacturing projects globally (an increase of 281.8%). The top three countries with the most significant increase in chip production are China, Taiwan, and the United States, respectively (Figure 12).

-

The domestic supply chain will strengthen further on the back of rising investment in related parts of the economy (e.g., electrical appliances and smart electronics, EVs, data centers, and HDDs) and the positive effects of this on the outlook for Thailand-based semiconductor production.

Hard disk drives

For the HDD industry over 2025 to 2027, output is expected to increase by an average of 7.0-8.0% annually, in line with an anticipated export value growth of 8.5-9.5% per year. This trend is driven by the rising demand for higher capacity and value-added HDDs, supported by factors such as:

-

HDDs remain cheaper than SSDs, and although SSDs offer faster read-write speeds, data centers need so much storage capacity that cost considerations win out and thus HDDs remain the preferred choice (E&E Intelligence, September 2024).

-

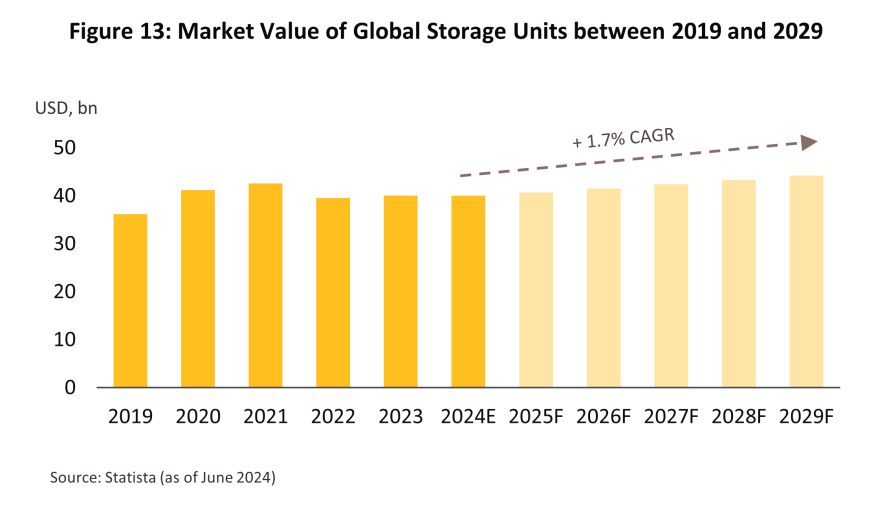

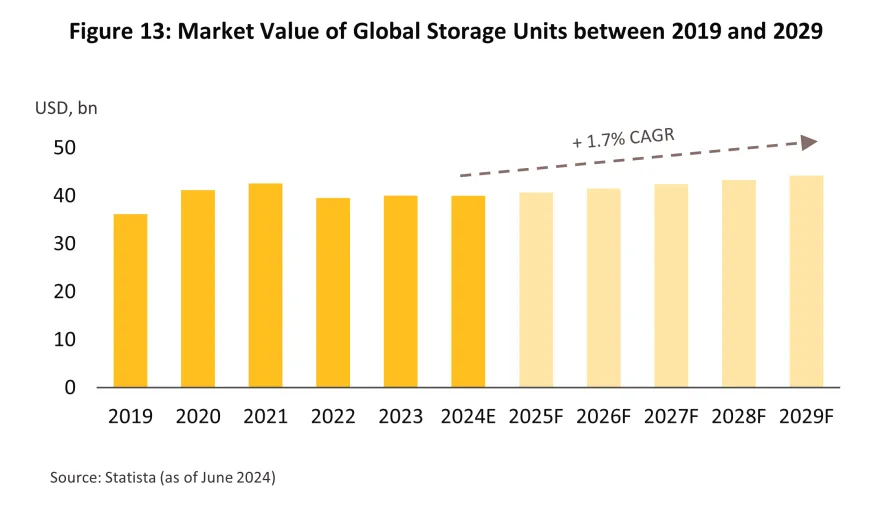

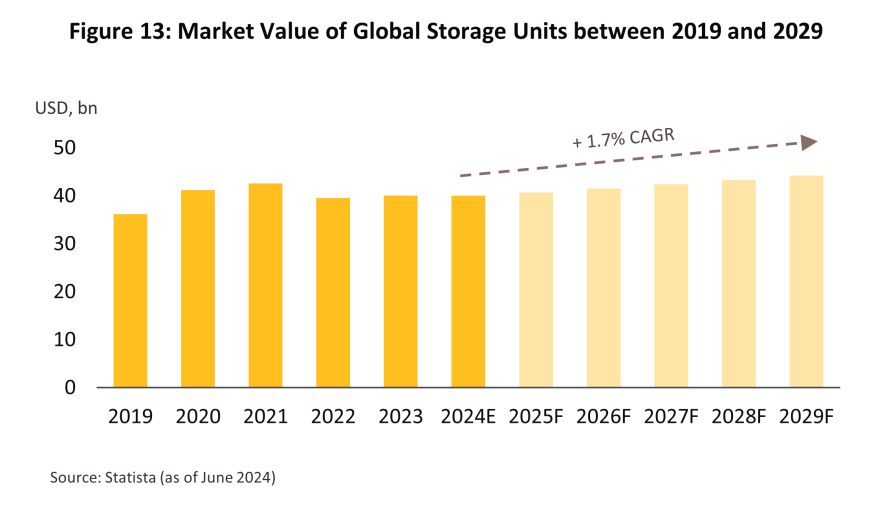

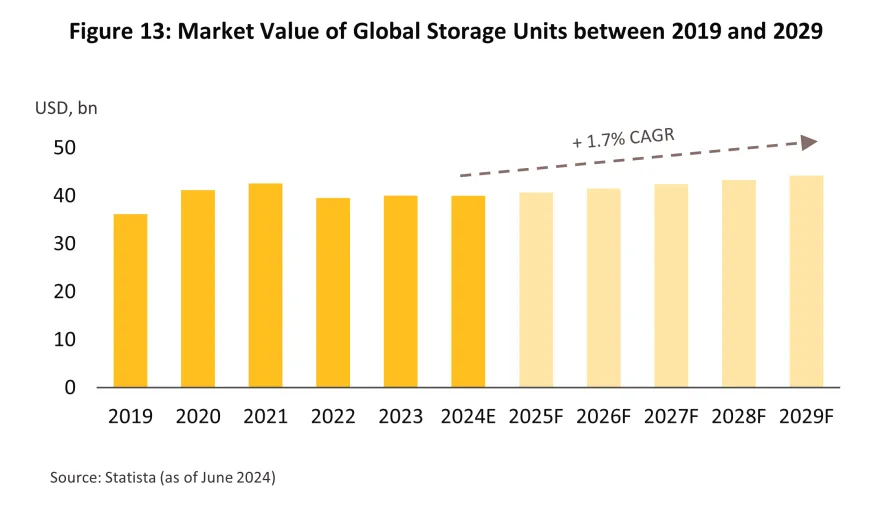

Growth in digital industries (e.g., cloud computing, data centers, generative AI and 5G networks) will support further growth in global output of HDDs, and this will feed through into stronger exports for Thai HDD manufacturers. Likewise, global income from the sale of memory units4/ is forecast to rise by 1.7% CAGR over 2023-2029 (Figure 13) (Statista, June 2024).

-

Global demand for PCs is rising following the release of Windows 11 and the start of a new PC replacement cycle. This follows the post-pandemic drop-off in demand, and so worldwide sales of PCs are expected to reach a new peak in 2025 (Gartner, 9 October 2024).

-

Smartphone usage will continue to increase around the world, and so over 2023-2028, ownership is forecast to expand by 2.9% CAGR, taking total supply from 6.72 billion to 7.74 billion units (Ericsson, 2024). This will then add to demand for cloud-based services and through this, for HDDs.

-

The domestic market will also strengthen, in particular via growth in data centers. Investment in the latter continues to rise, and so over the first 9 months of 2024, 47 applications worth THB 173 billion5/ were made for investment support for projects connected to data centers and the provision of cloud services. Major global players are among those that have been attracted to Thailand, with Quartz Computing (a subsidiary of Alphabet) and DigitalLand Services (part of the GDS group) investing respectively THB 32.76 billion and THB 28 billion in the country6/ (Krungthep Turakij, 1 November 2024).

However, while strengthening demand will benefit electronic manufacturers, the industry will face a number of challenges.

1) Demand will continue to shift towards SSDs and so over 2023 to 2027, the value of the global market for these is expected to increase by 19.0% CAGR, rising from USD 39 billion to USD 79 billion over the period (Precedence Research, 2024). Demand will be boosted by stronger sales of AI-enabled computers, most of which use SSDs since these offer improved access and write speeds, and total shipments of AI PCs are forecast to jump by 165.5% to 114 million units in 2025 (43% of global PC sales) (Gartner, 25 September 2024).

2) Competitive pressures will tend to intensify as a result of worsening trade tensions and the continuation of the US-China tech war. This may then encourage Chinese manufacturers to dump stock (ICs and electronics goods), and with cheap Chinese goods coming on to both domestic and international markets in greater quantity, Thai manufacturers will see their market share squeezed.

1/ 2024 global sales of IT equipment should be up 6.2% to USD 735.8 billion (Gartner, 2024).

2/ Sales of AI smartphones are forecast to reach 240 million units in 2025 (Gartner, 7 February 2024).

3/ Global EV sales are forecast to rise by 18.2% CAGR over 2024-2030 (IEA, 2024).

4/ These consist of: (i) internal memory units (e.g., HDDs and SSDs); and (ii) external units (e.g., USB flash drives, external HDDs and network-attached storage (NAS) devices) (Statista, June 2024).

5/ This has come largely from major US, Australian, Chinese, Hong Kongese, Singaporean, Japanese, Indian and Thai players (Krungthep Turakij, 1 November 2024).

6/ The data centers operated by DigitalLand Services and Quartz Computing (both in Chonburi) are expected to come online in 2026 and 2027 respectively (Krungthep Turakij, 1 November 2024).

.webp.aspx)