EXECUTIVE SUMMARY

Over 2024 to 2026, the outlook for the domestic EV industry will remain positive thanks to strength on both the demand and supply sides of the market, driven by: (i) the continuation of subsidies for buyers of BEVs, which will help to push new registrations of total passenger BEVs to an annual total of around 190,000 vehicles; (ii) the enforcement of provisions in the EV 3.0 and EV 3.5 measures requiring manufacturers to compensate for imports of EVs with domestically produced vehicles; and (iii) the growing popularity of EVs, a result of greater awareness of environmental issues, and the increased understanding of EV technology. These will then lift industry-wide production capacity to at least 400,000 – 500,000 EVs annually. Manufacturers that have established production lines in Thailand will thus use these to help meet expanding global demand, with exports initially coming to some 100,000 units annually. Nevertheless, players will have to contend with intensifying competition, the risk of periodic interruptions to chip supply, and the possibility that growth in the provision of charging stations may fail to keep pace with increases in demand.

Krungsri Research view

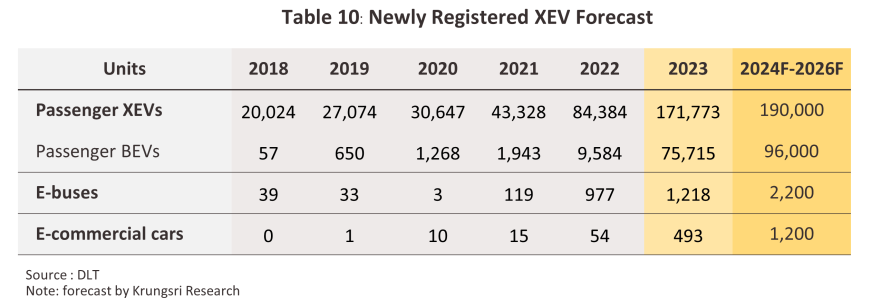

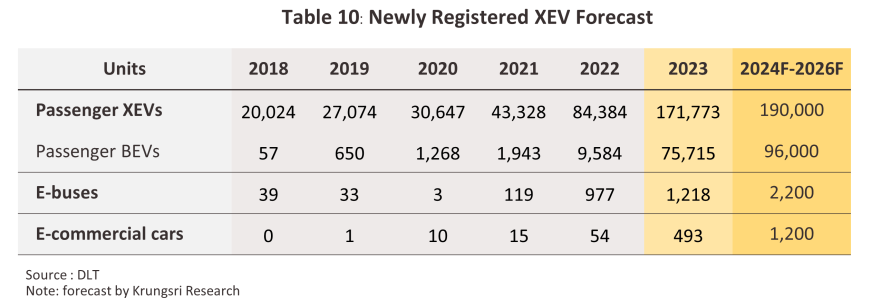

Demand for passenger EVs, electric buses and electric commercial vehicles will continue to expand over the three years from 2024 to 2026, though growth will be strongest for passenger BEVs and e-buses that operate over a longer range and so are able to be deployed on inter-provincial routes.

-

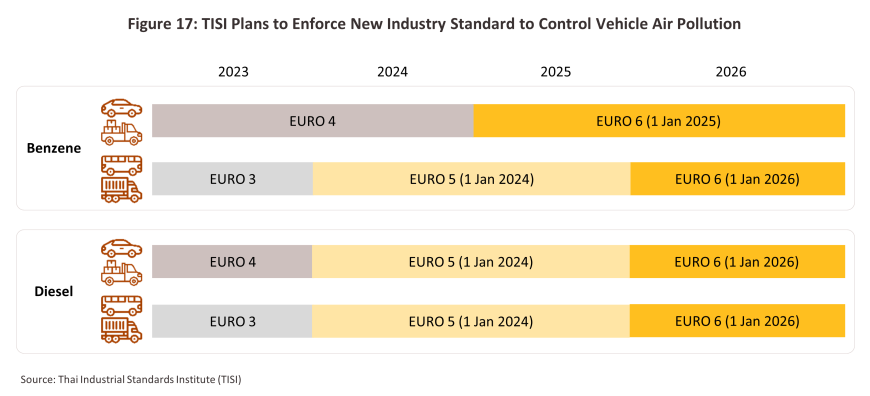

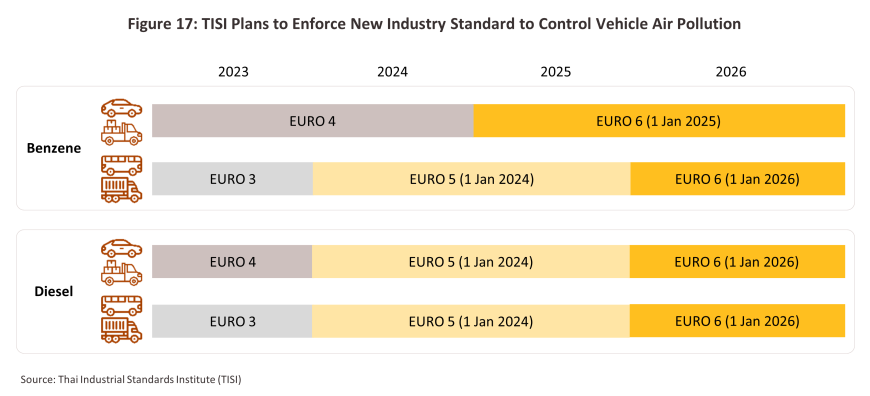

Registrations of new passenger XEVs will climb to around 190,000 per year, of which some 96,000 should be BEVs (up from 80,000-90,000 registrations in 2024). Sales will be lifted by the ongoing provision of subsidies to buyers (available under the EV 3.5 scheme), falling production costs, vehicles’ improving capacity range in distance, the growing number of models available to consumers, increased access to charging points, and the enforcement of the Euro 5 and Euro 6 measures, which will negatively impact the cost of manufacturing ICE-powered vehicles. As well as trend of EVs popularity and greater understanding of EVs technology to address environmental problems. The market will thus benefit from sustained growth, and as such, manufacturers should enjoy solid profitability.

-

Registrations of electric buses and commercial vehicles are forecast to increase to annual averages of respectively 2,200 and 1,200 vehicles. Demand will be boosted by the tax breaks available to commercial buyers, the support for EV pickups provided by the EV 3.5 scheme, the extension in the capacity range of these vehicles, which promises to make their use in longer distance commercial and passenger transport contexts much more viable, the buildout of additional charging stations, the enforcement of the Euro 5 and Euro 6 standards, and the increased use of electric buses for public transport. Again, players in this segment can likely look forward to improving their profitability.

Overview

The EV market is still young and at least initially, its domestic and international growth was driven more by government policy than by market driving forces, which yet remain somewhat underdeveloped. According to the United Nations Framework Convention on Climate Change, or UNFCCC, held in 2015, at which nations agreed to hold global warming to no more than 2 degrees centigrade relative to pre-industrial levels, Thailand has ratified the agreement in 2016. This then led to the drafting of the National Energy Plan, which lays out a route for the shift to clean energy, and the formal commitment to reach net zero carbon emissions over 2065-2070. The electrification of the transport sector has thus become a central part of national energy policy, in particular through the expansion of the EV market, and so over the recent past, much government attention has been devoted to the rollout of measures aimed at stimulating growth in the domestic EV industry.

Over 2016-2021, when the market was beginning to become established, EV production was incentivized by extending government support for manufacturers of eco cars (small, fuel-efficient ICE-powered vehicles) to cover EVs as well. Thus, approved auto manufacturers producing at least 100,000 vehicles annually were allowed to count EVs with eco-cars as part of their qualification for government-backed investment support schemes. The latter provided incentives to manufacturers in the form of 8-year cuts to corporate tax, 90% reductions in the duties paid on imports of auto parts, and further reductions to the duties placed on imports of plant and machinery1/.

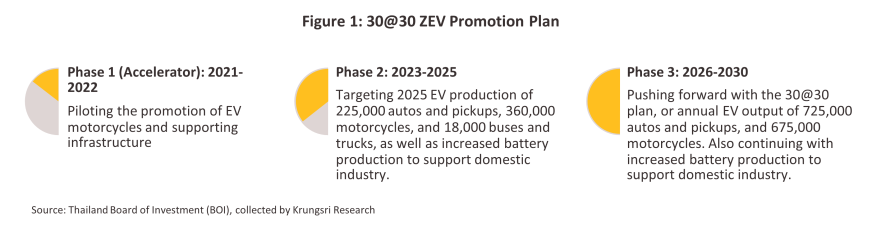

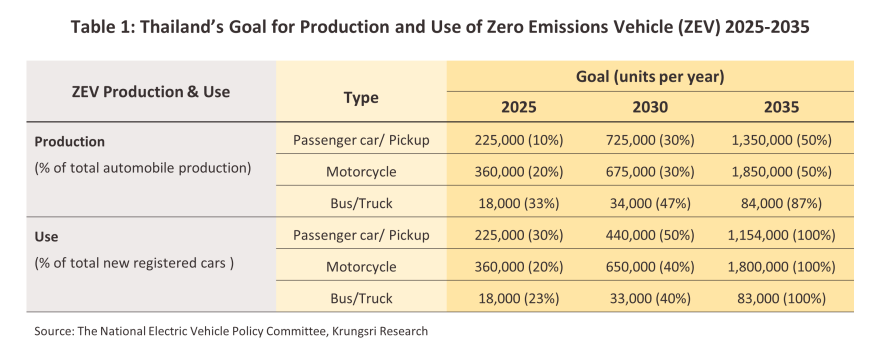

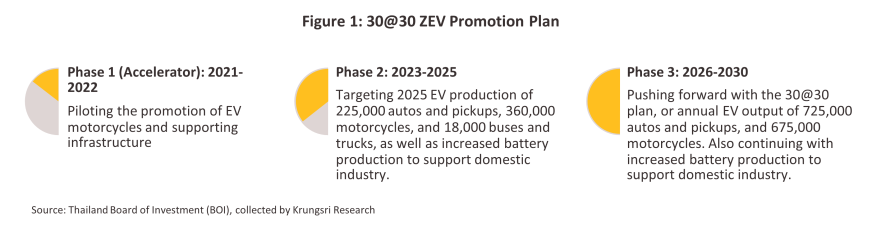

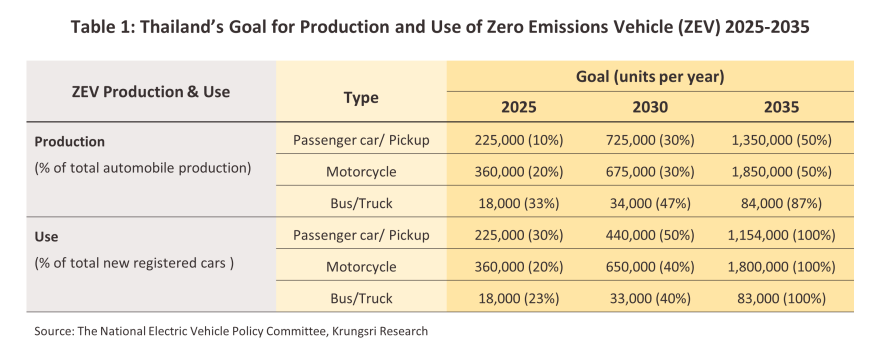

From 2022 onwards, policy changed and became more explicitly focused on driving increased investment in EV production and faster development of the market for these. Thailand’s National Electric Vehicle Policy Committee (EV Board) thus laid out plans for the promotion of ZEVs (zero emission vehicles), and from 12 May 2021, the 30@30 policy officially came into effect. This specifies that by 2030, at least 30% of vehicles coming off Thai production lines should be ZEVs, though promotion of ZEV production is split into three stages, as per Figure 1. Further targets for the production and use of ZEVs specify that by 2025, passenger EVs and e-pickups should comprise at least 10% of all vehicle production and 30% of new vehicle registrations, rising to respectively 30% and 50% by 2030 and 50% and 100% by 2035 (Table 1).

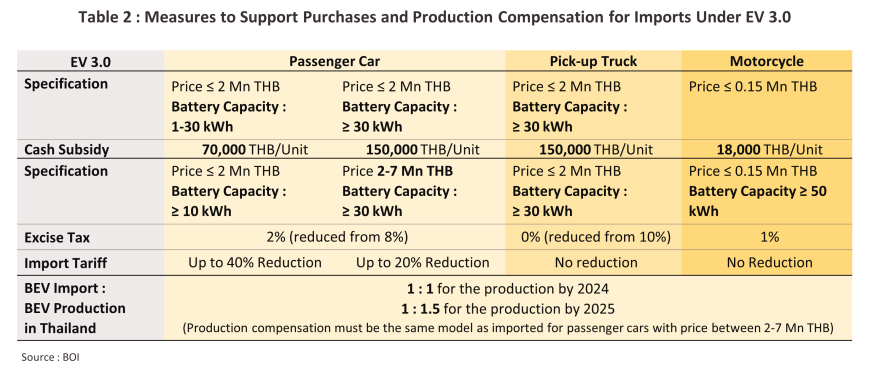

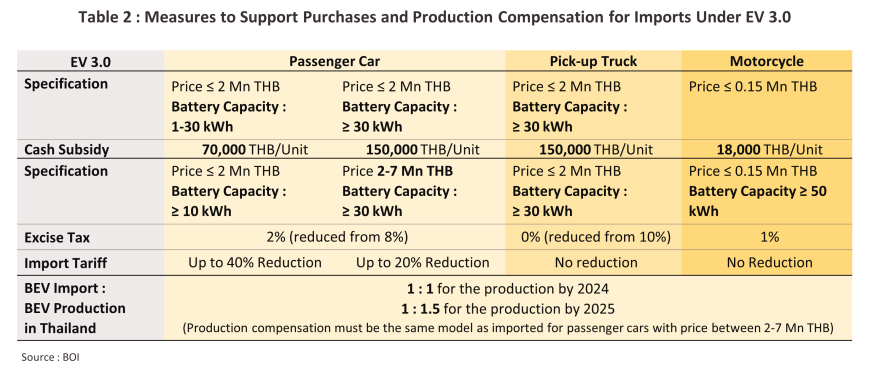

EV 3.0 policy (2022-2025): The main planks of this were as follows (Table 2):

-

Subsidies for battery electric vehicles (BEVs): To stimulate domestic demand for EVs and to encourage manufacturers of EVs and EV parts to set up production facilities in Thailand, over 2022 and 2023, the government offered subsidies to buyers of passenger BEVs worth: (i) THB 70,000-150,000 for imported vehicles costing up to THB 2 million; and (ii) THB 150,000 for domestically produced EV pickups costing up to THB 2 million and with a battery capacity of over 30 kWh.

-

Cutting duties: For imports made between 1 January 2024, and 31 December 2025, the duty charged on imported BEVs has been cut by between 20% and 40%.

-

Promoting domestic production: Manufacturers qualifying for investment support under the EV 3.0 scheme that imported EVs for distribution to the Thai market over 2022 and 2023 are required to match these with domestically manufactured vehicles over 2024 and 2025. (i) Manufacturers beginning Thailand-based production in 2024 will need to match these vehicles on a 1-to-1 basis with imports, but those not beginning production until 2025 will be required to manufacture 1.5 vehicles within Thailand for every vehicle that has been imported. (ii) Manufacturers importing models with a battery capacity of less than 30 kWh and with a sticker price of not more than THB 2 million are free to match these with any BEV model distributed domestically, but those importing vehicles with a capacity of 30 kWh or more and selling for THB 2-7 million will be able to manufacture and distribute only those models that have previously been imported.

-

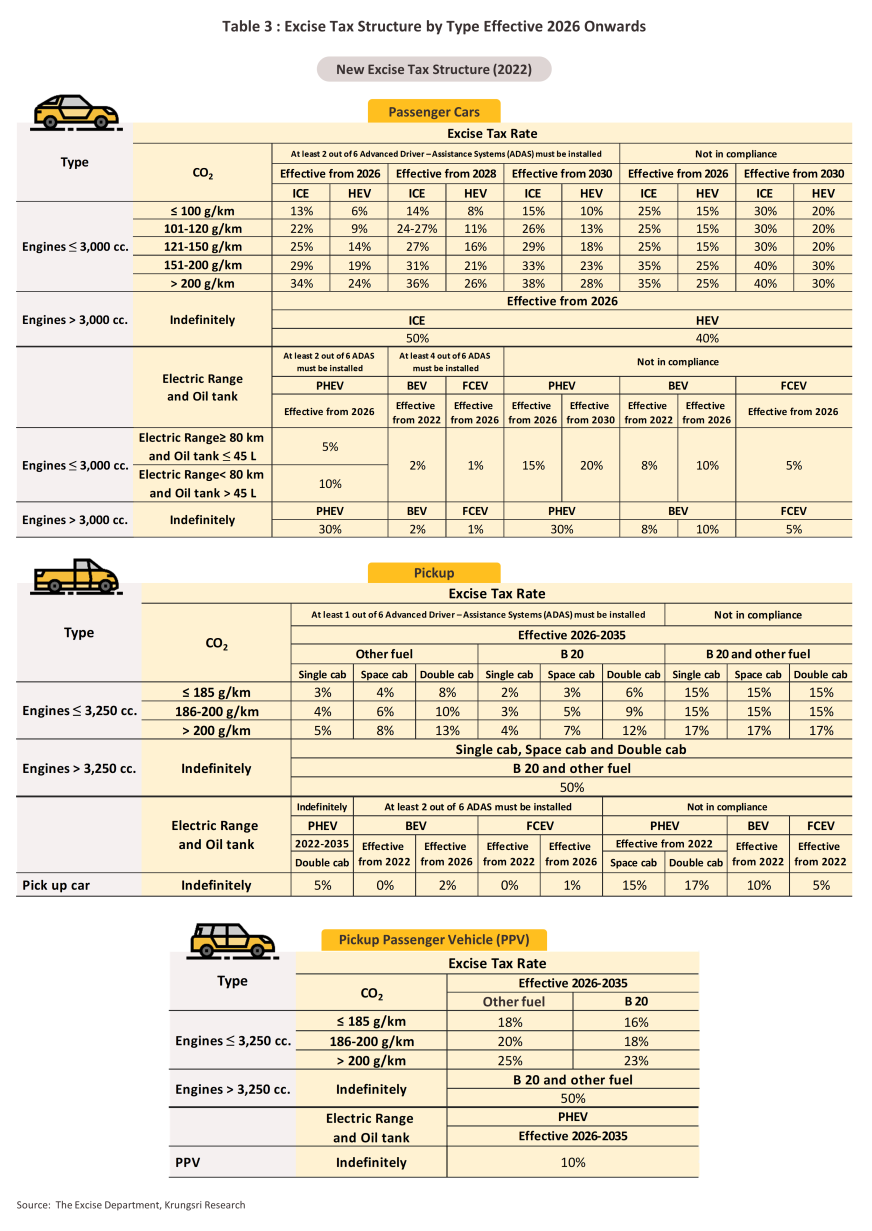

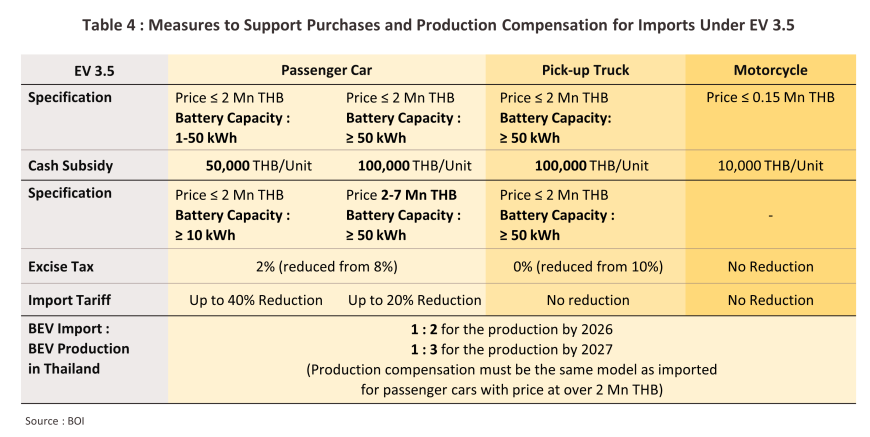

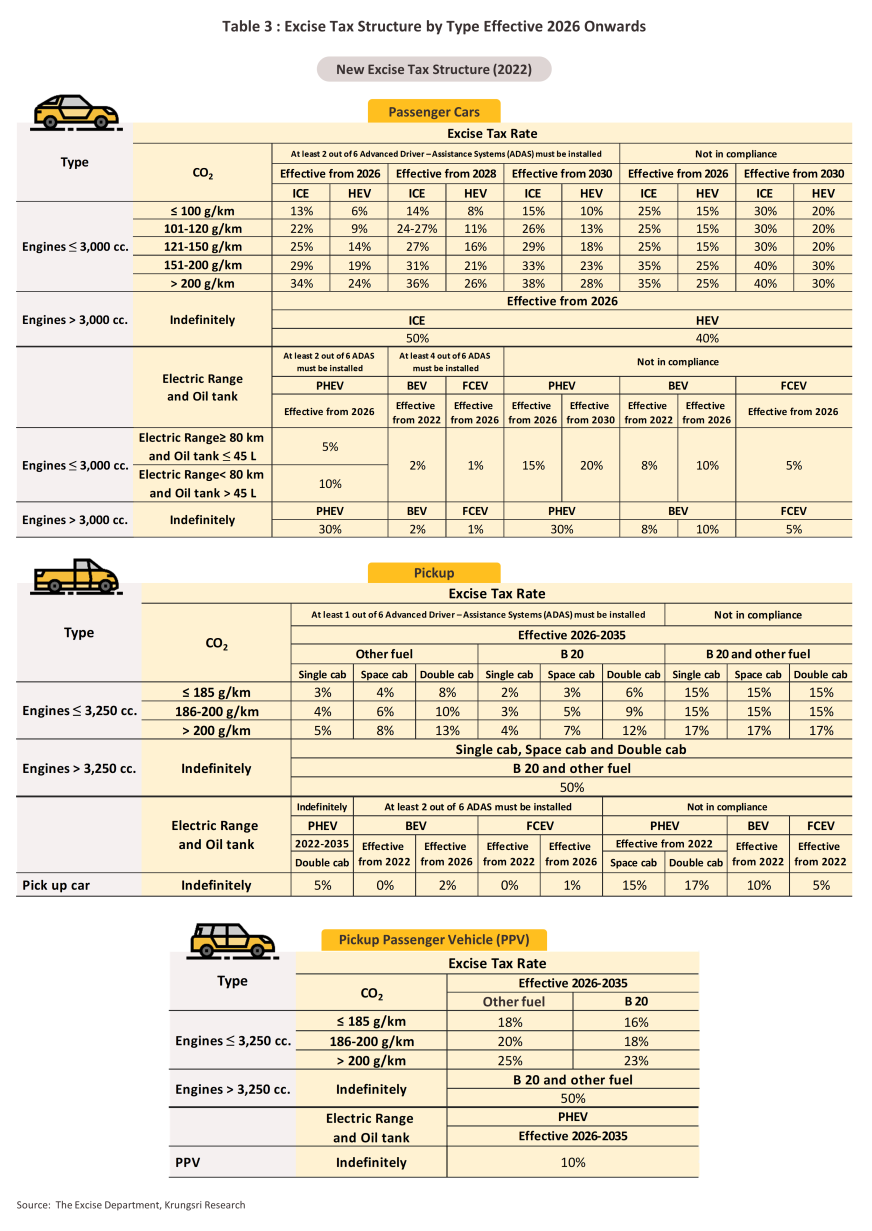

Other measures: (i) The excise payable on new vehicles has been revised (Table 3), with this rising by 1-2% for ICE-powered vehicles every 2 years between 2026 and 2030. Rates will rise by a similar amount for hybrids (HEVs), though this is with the exception of plug-in hybrids (PHEVs), for which increases in excise rates will be much more limited. (ii) Between 1 October 2022, and 30 September 2025, the annual road tax payable by BEV owners will be cut by 80% for the first year following the vehicle’s registration. (iii) Public- and private enterprises are being encouraged to increase provision of EV charging stations, and as of December 2023, the Electric Vehicle Association of Thailand reports that nationally, there were 2,658 public charging stations providing a total of 9,694 charging points.

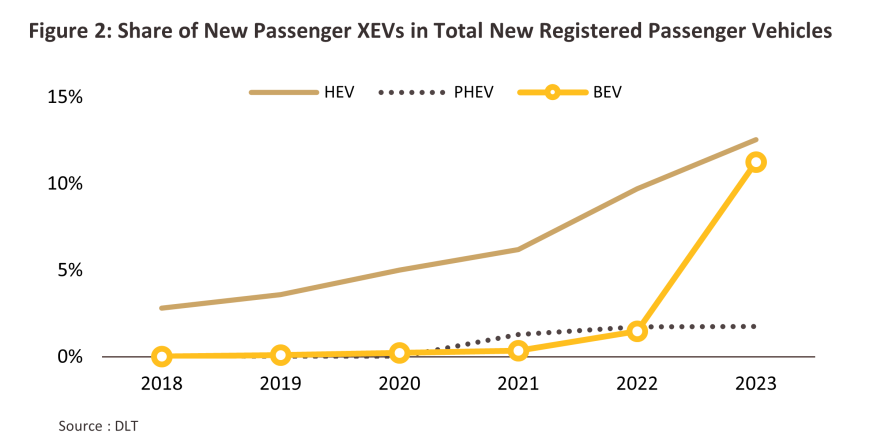

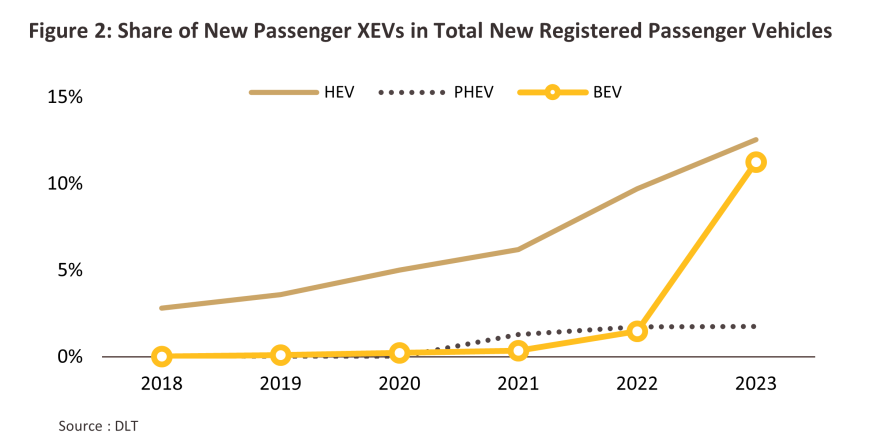

The EV 3.0 measures were a major success, and these contributed to the 524.2% CAGR expansion in the number of new BEVs registered over 2022-2023, which then jumped to 85,299 vehicles (Figure 2). At the same time, EV manufacturers have also increased investment in Thailand-based production facilities. On the expiry of these policies, the government thus moved to maintain its support for the nascent EV industry by rolling out the EV 3.5 measures (2024-2027) (Figure 4). The main features of these measures are described below.

-

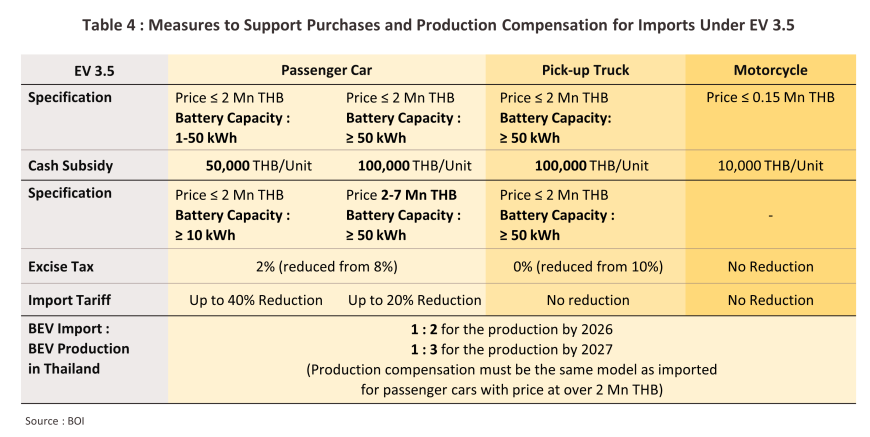

Subsidies: Subsidies for purchases of imported BEVs (over 2024 and 2025) have been reduced to THB 50,000-100,000 for autos priced not more than THB 2 million, and THB 100,000 for pickups also costing not more than THB 2 million but with a battery capacity in excess of 50 kWh.

-

Cutting duties: For passenger BEVs and e-pickups, duties and excise are unchanged from those specified in the EV 3.0 measures2/.

-

Promoting domestic production: Manufacturers benefiting from the EV 3.5 measures and that import EVs over 2024 and 2025 for distribution to the Thai market will be required to match these with domestically-based production over 2026 and 2027. (i) Manufacturers beginning production in 2026 and 2027 will need to produce twice and three times as many EVs within Thailand as they imported respectively. (ii) Companies importing passenger EVs with a retail price of more than THB 2 million will be required to produce the same models within Thailand as they have imported.

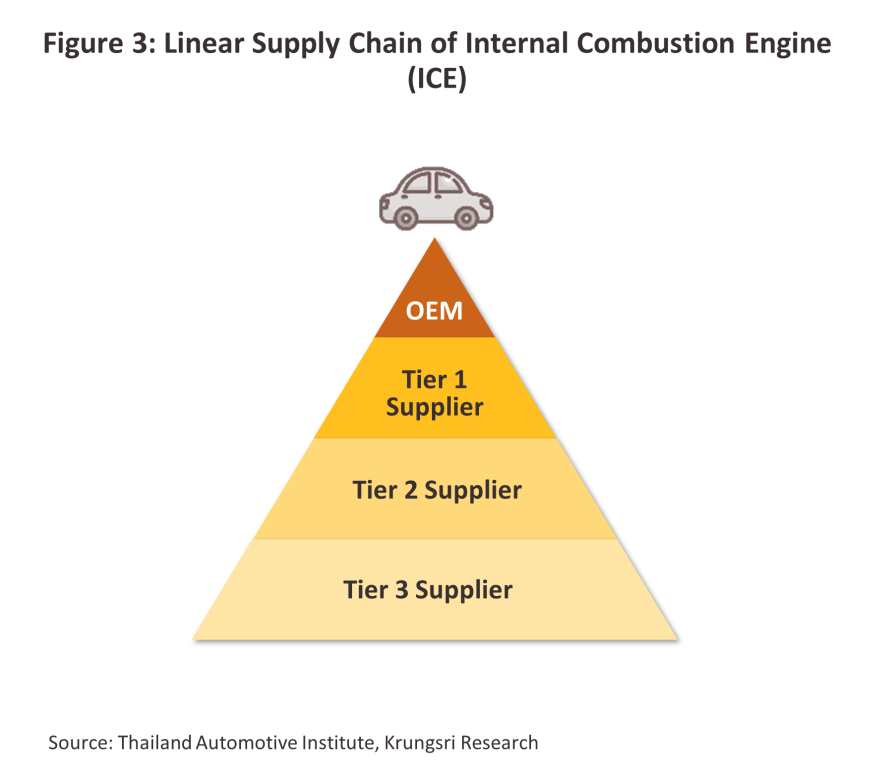

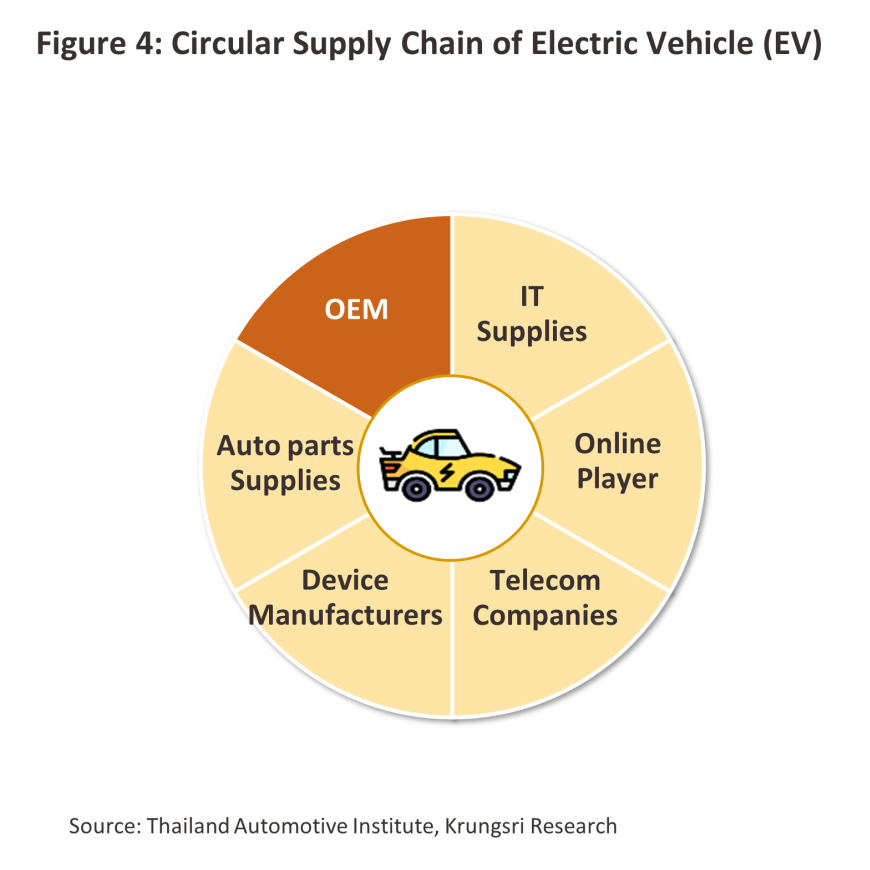

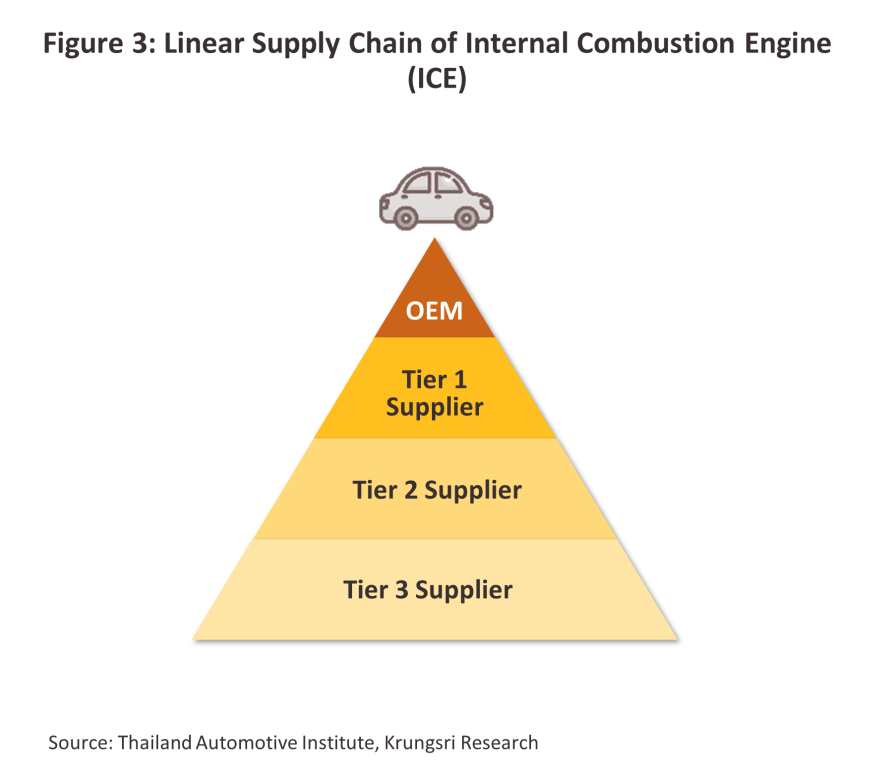

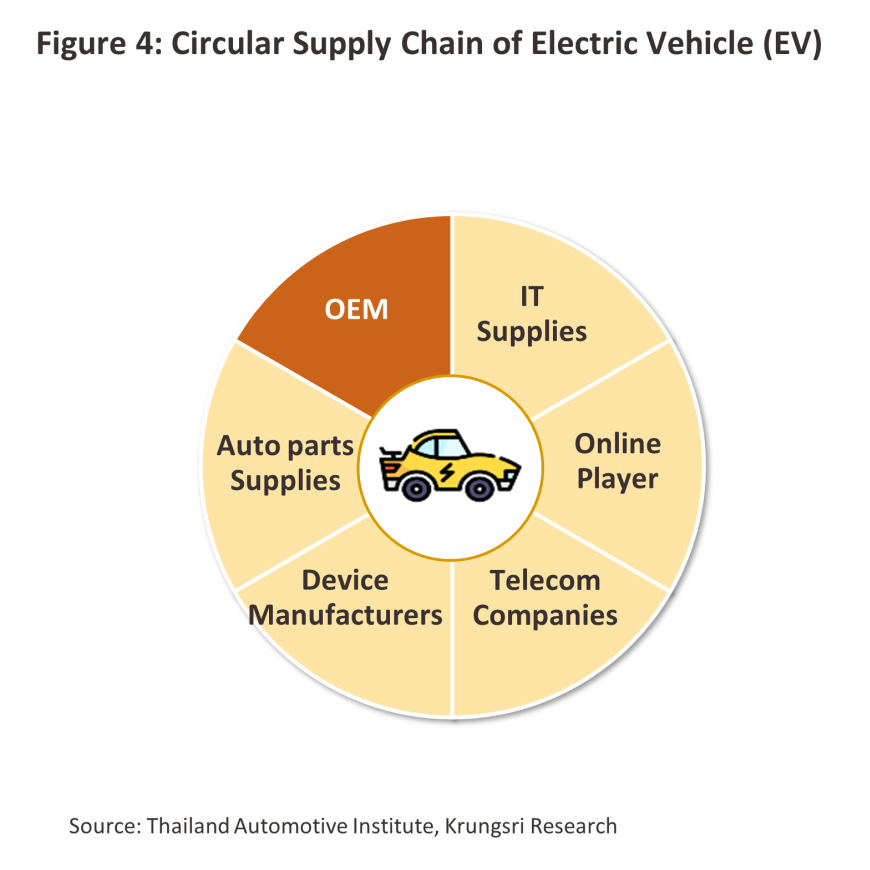

Growth in domestic EV production will have impacts across Thai auto industry supply chains, transforming the traditional ‘linear supply chain’ connection towards ‘circular supply chain’. These older linear supply chains are typically hierarchical, with auto parts manufacturers divided into three layers and supplies filtering up through these in turn (Figure 3): (i) tier 1 producers supply parts directly to auto manufacturers, manufacturing parts as per the latter’s standards; (ii) tier 2 producers manufacture parts for supply to tier 1 producers, from whom they may benefit from technology transfer; and (iii) tier 3 producers supply minor parts to tier 1 and tier 2 companies. However, navigating linear supply chains like this is cumbersome and because it can take an extended period of time for an order to percolate through the various levels, responding to the requirements of just-in-time delivery is difficult. It is therefore often necessary for suppliers to maintain high levels of stock. This makes this kind of operation suitable only for the mass production of autos, when the economies of scale justify structuring supply chains in this way.

However, the manufacture of EVs tends to be more dependent on robotic and automated production lines (as this ensures the necessary precision is maintained) and on the use of hi-tech end-user products. These include automatic driver assistance, impact detection sensors, speed controllers, and onboard systems that connect with online data that is then used to make the travel experience as smooth as possible, for example by collecting data on the weather, road, and traffic conditions or by downloading relevant maps. In the future, this will also extend to providing ever-higher levels of automated driving assistance. Because of these differences, the structure of EV supply chains often diverges markedly from those for ICE-based production, taking a circular, networked form rather than existing as a straight line from start to finish (Figure 4). This network will generally consist of auto parts suppliers, device manufacturers, telecom companies, online players, and IT suppliers, and within this web of connections, the various participants have non-hierarchical relationships with one another. This then helps to make production quicker and more flexible, while doing away with the need for companies to maintain excessive stocks, and the result is that the system is better able to respond to a wider variety of needs. In light of these changes, when responding to the emergence of EV-based supply chains, OEM auto parts manufacturers will need to adapt across a broad front that encompasses technology, manufacturing, management, and organization, all the while keeping a firm focus on how best to add value to products, rather than simply mass producing at the lowest marginal cost.

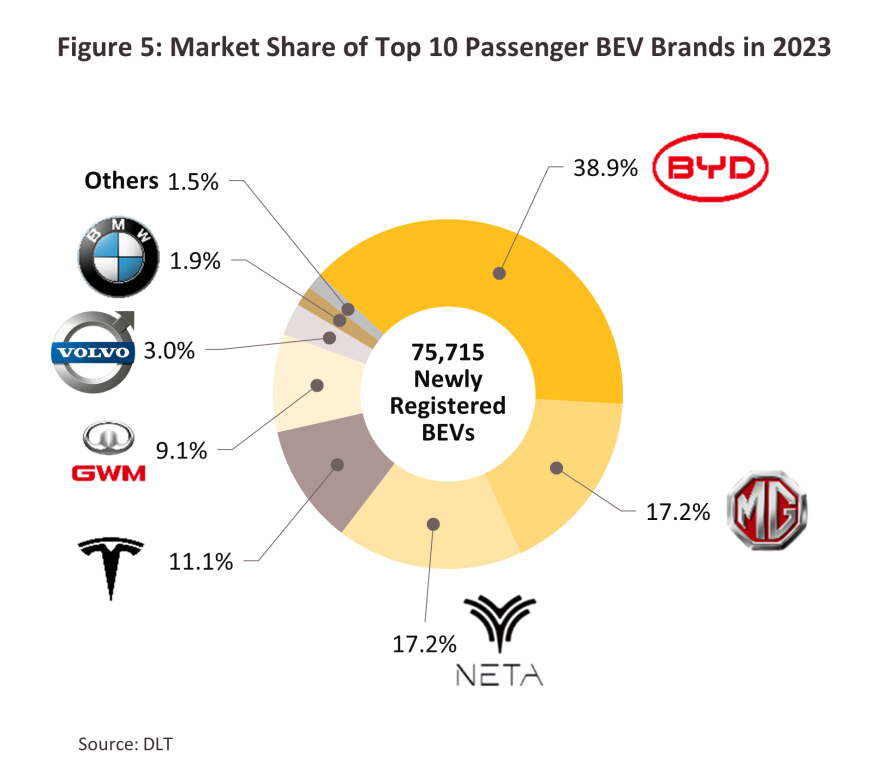

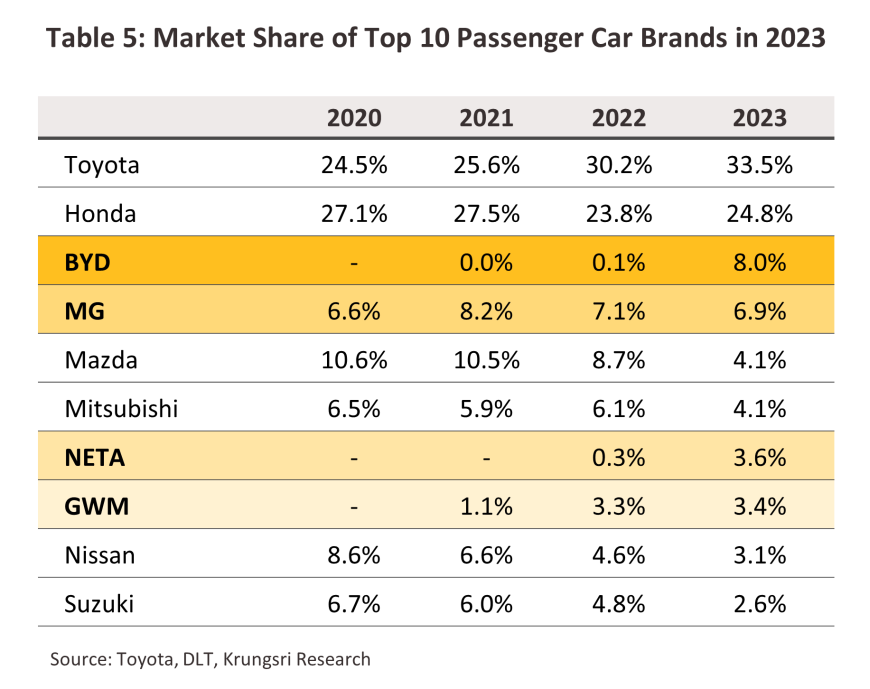

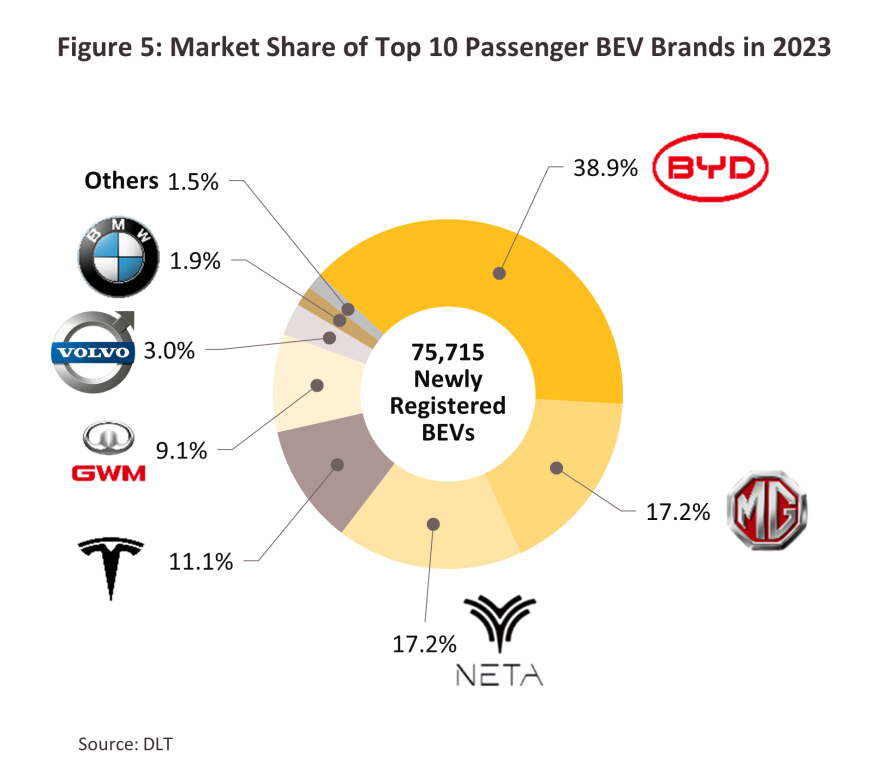

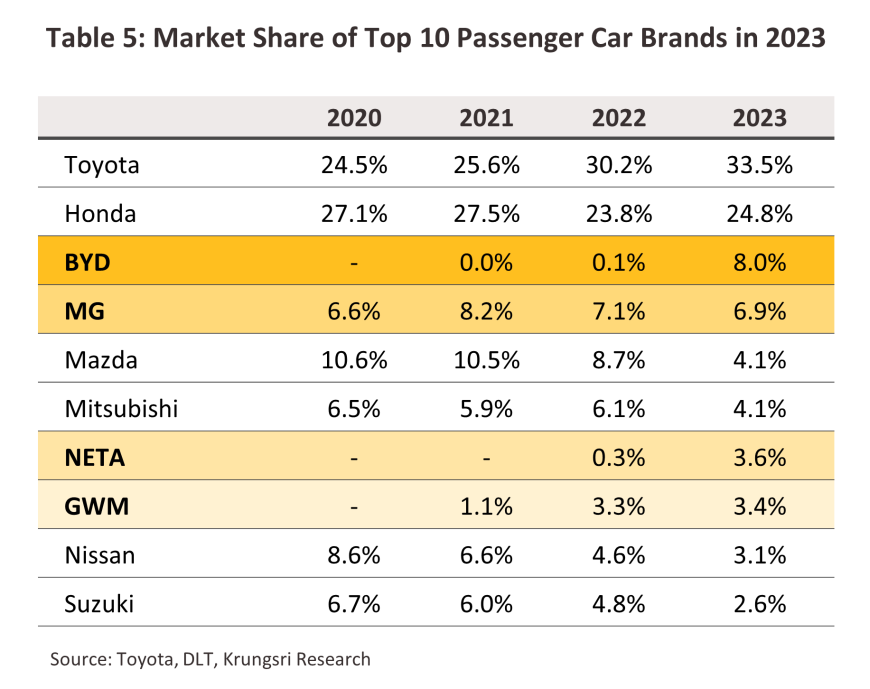

The composition of the market is also undergoing structural change on the supply side, and in 2023, the 10 top selling auto brands in Thailand included 4 Chinese BEV manufacturers, namely BYD, MG, NETA, and GWM. These were in respectively 3rd, 4th, 7th and 8th places and together these controlled 21.9% of the market. This compares sharply to 2021, when the top 10 included just 2 Chinese manufacturers, MG and GWM, which were in 4th and 10th place respectively.

As of 2023, Chinese players claimed a full 82.4% share of the domestic market for passenger BEVs, followed by US auto manufacturers with their 11.1% share (Figure 5). The popular type of passenger BEVs are mostly cheaper models with a long range, such as the BYD ATTO 3, the MG 4 Electric, the NETA V and the ORA Good Cat. These are priced at respectively THB 1.1, 0.9, 0.6 and 1.0 million and have a single-charge range of 420, 425, 320, and 450 kilometers.

Situation

EV registrations

Passenger electric vehicles

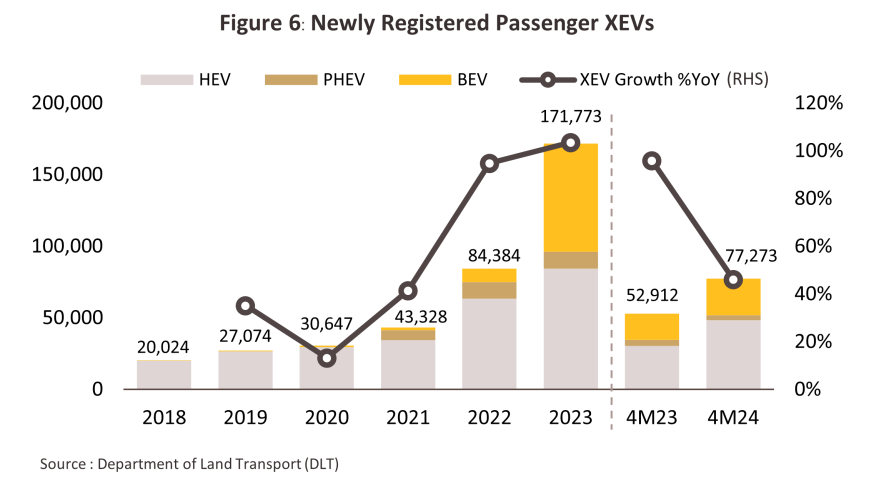

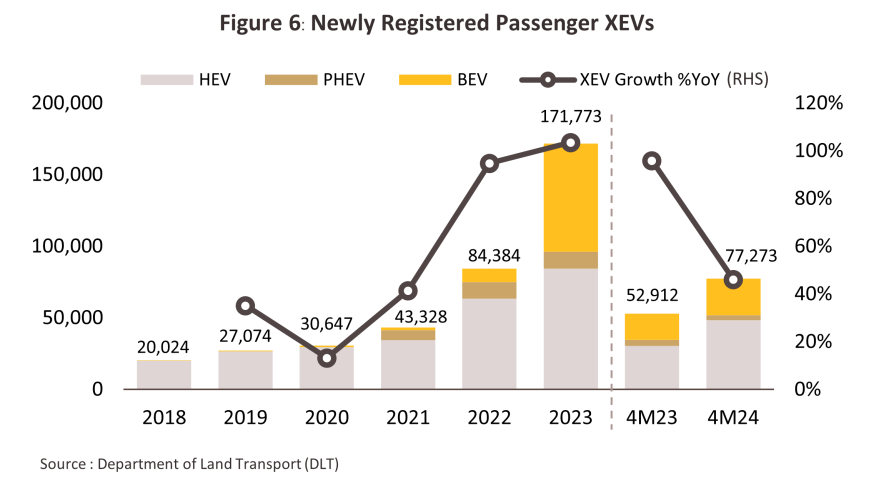

Newly registered passenger xEVs surged 103.6% YoY in 2023 to a total of 171,773 vehicles (Figure 6). This was split between 84,366 HEVs (+32.9% YoY), 11,692 PHEVs (+3.2% YoY) and 75,715 BEVs (+690.0% YoY). These comprised respectively 12.5%, 1.7%, and 11.3% of all newly registered passenger car registrations made in the year. Sales were lifted by the following.

-

Earlier measures promoting production of eco cars: provided transition periods for the market from ICE-powered vehicles through HEVs and PHEVs to full BEVs. Registrations of passenger HEVs thus expanded 19.8% CAGR over 2018-2021 to a total of 110,095 vehicles by the end of the period. Passenger PHEVs were first officially distributed in Thailand in 2021, when registrations reached 7,060 units.

-

Following this, the EV 3.0 measures fed a strong increase in consumer interest in passenger BEVs. In particular, subsidies of up to THB 150,000 per vehicle for purchases of new BEVs helped to boost demand, and this is one reason why BEVs accounted for around 14.0% of the 36,679 orders placed at the 2022 Motor Show (held in December). Orders for BEVs then rose to a 38.4% share of the 53,248 orders made at the 2023 Motor Show (source: The Standard and Post Today, 12 December 2023).

-

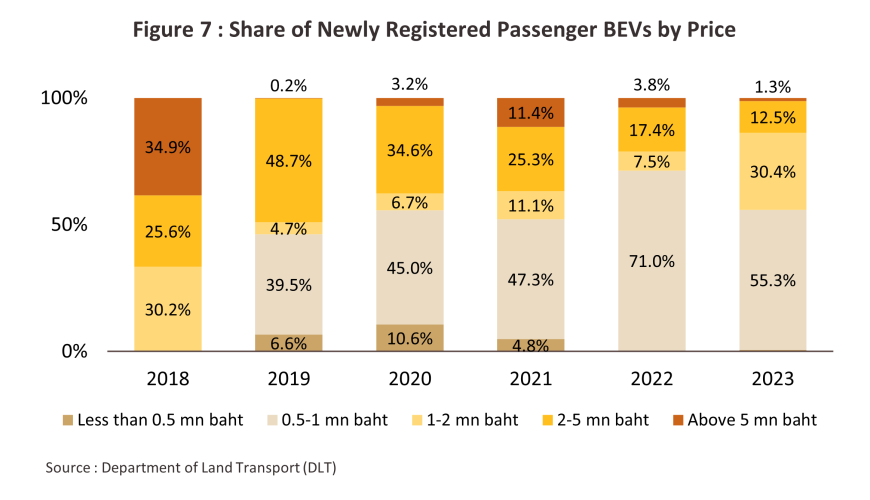

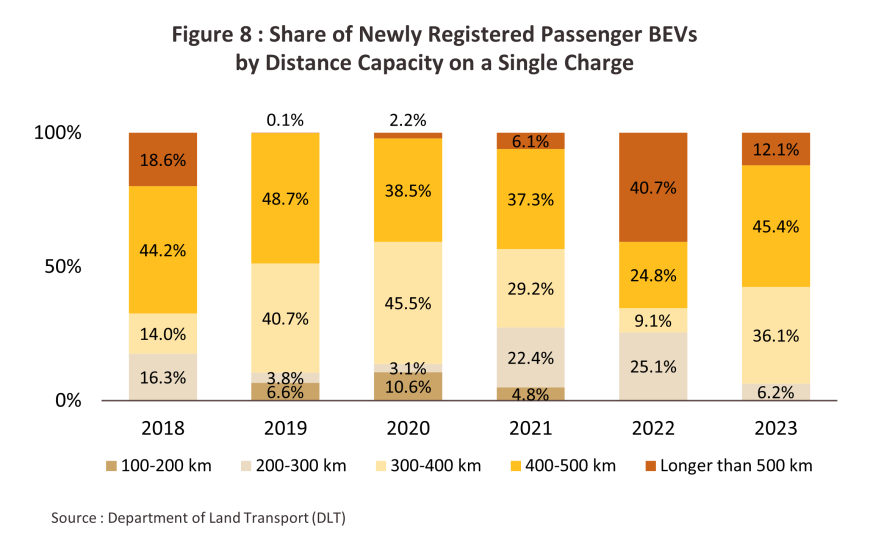

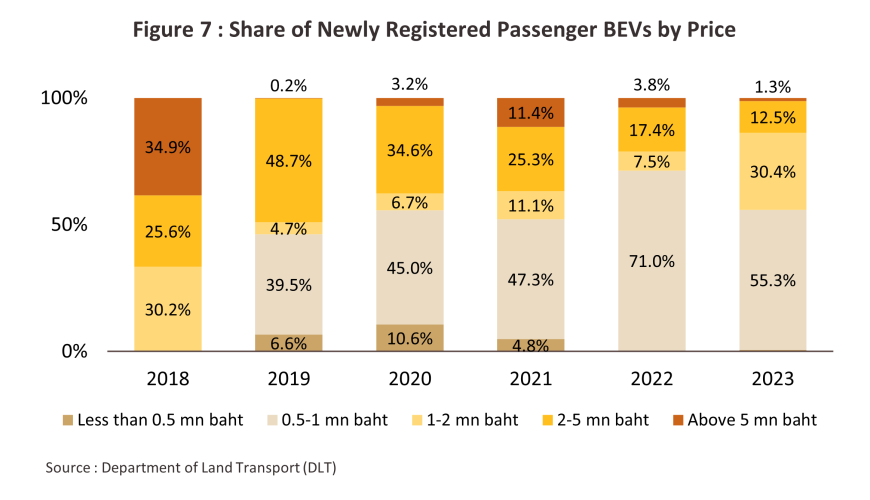

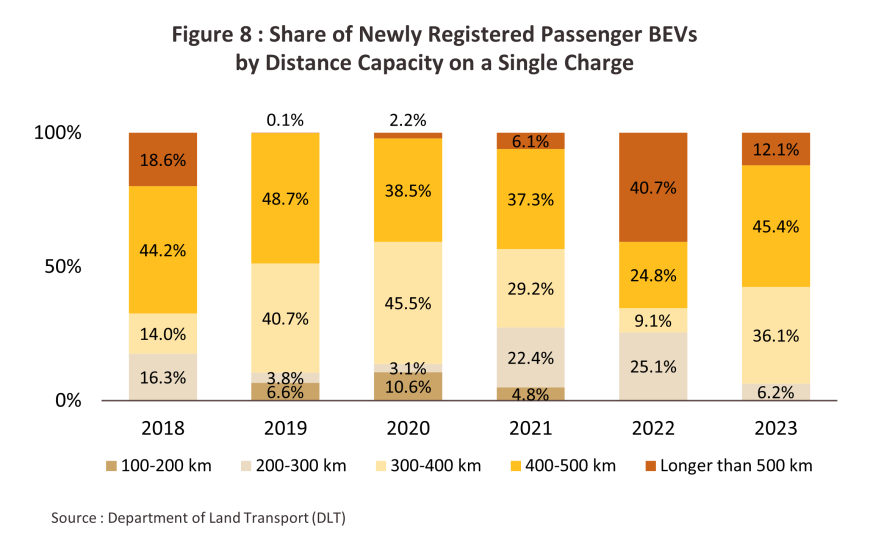

There has been a steady stream of new model development and new brands into the market. Most of which have been imported under BOI investment support schemes and that will therefore need to be matched with domestically produced vehicles under the promotional scheme. Data from the Electric Vehicle Association of Thailand (EVAT) show that as of January 2024, 54 BEV models produced by 25 manufacturers were available for purchase in Thailand. These were priced between THB 0.33 million and THB 31.8 million and had ranges of between 120 and 702 kilometers on a single charge, and so these covered a broad range of market segments. Fractionally under half of these (26 models) were produced by Chinese manufacturers, which are selling many attractively priced models. Indeed, 55.3% of all 2023 passenger BEVs sales were in the THB 0.5-1 million band (up 475.5%), with this followed in importance by the THB 1-2 million range (30.4% of all new passenger BEVs), for which new registrations surged 2,906.5% in the year on strong growth in consumer spending power at the mid to upper sections of the market (Figure 7). By range, the best-selling segments were the 400-500 km/charge and 300-400 km/charge groups, sales of which comprised respectively 45.4% and 36.1% of the total (up by 1,254.8% and 2,826.7% in the year) (Figure 8).

-

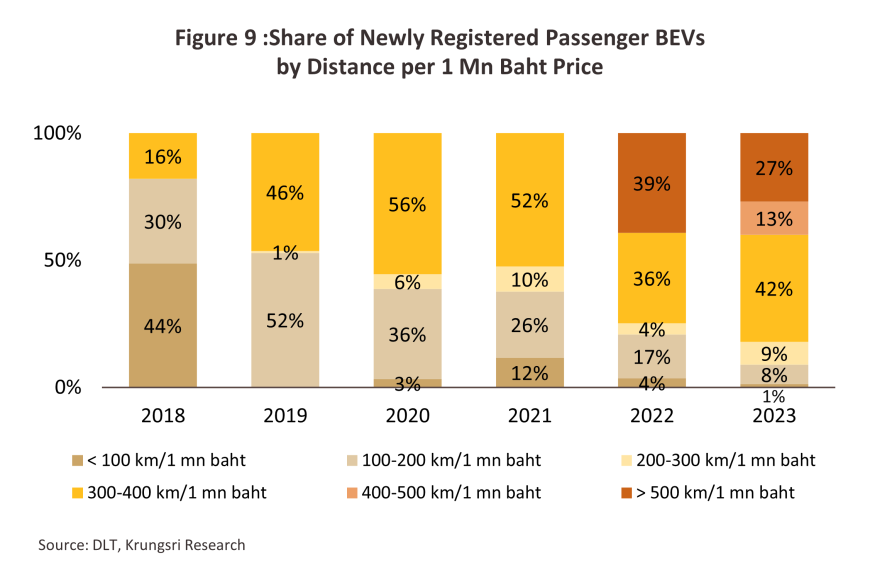

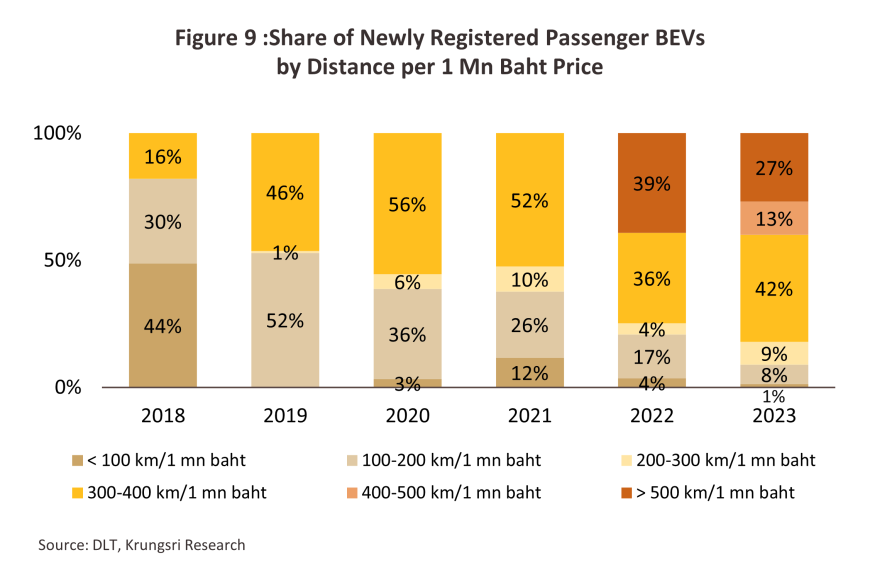

Consumers are also now getting better value for money in terms of the distance per charge per THB 1 million spent on an EV (Figure 9). In 2023, registrations of BEVs with increased ranges in distances at cheaper prices that consumers accepted3/ continued to increase, especially for BEVs with a range of more than 300 km/charge per THB 1 million rose to 82.0% of total BEV registrations, or 60,345 vehicles (+711.2%.)

-

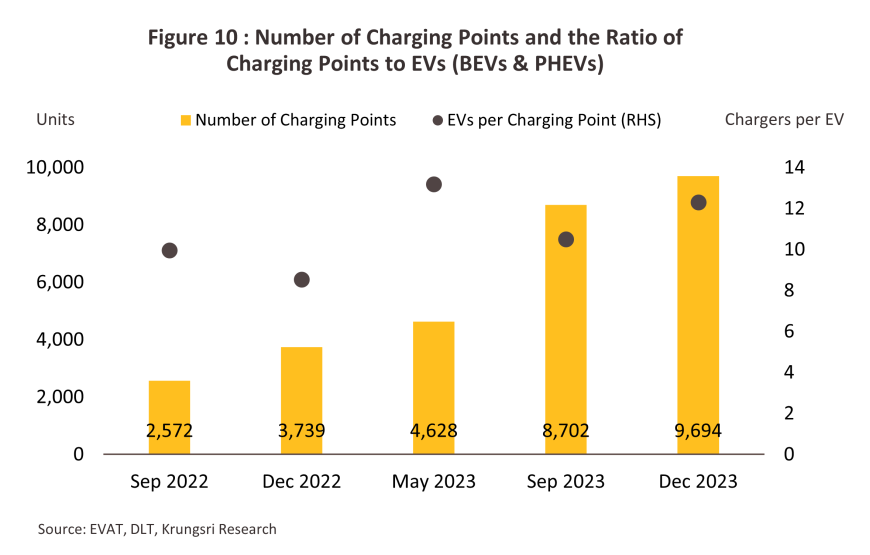

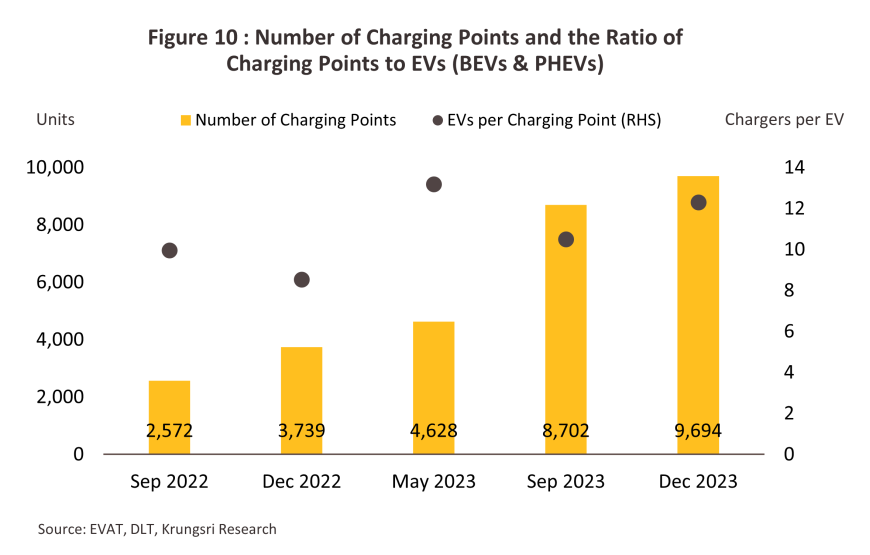

The number of charging stations available nationwide rose 114.5% YoY to 2,658 sites in 2023, providing a total of 9,694 charging points4/ (+159.3% YoY) (Figure 10). However, this translates into an average of 12.3 charging points per registered BEV and PHEV, a number that is far worse than in countries that are leading EV adoption, such as China, where there are just 6.5 EVs per charging point. In addition, power output by Thai charging stations may be insufficient and 2024 research by the IEA shows that for smaller charging stations, this may average just 0.4 kW per vehicle, dramatically below the 3.4 kW in China and 4.8 kW in South Korea.

Over 4M24, these factors continued to lift the market. Registrations of passenger xEVs rose 46.0% YoY to 77,273 vehicles. In particular, registrations of passenger HEVs and BEVs jumped by respectively 59.1% YoY and 39.4% YoY to 48,343 and 25,583 vehicles each. By contrast, the market for PHEVs has been undercut by the swift consumer adoption of BEVs seen since 2023, so registrations of these slumped -19.8% YoY (down to 3,347 vehicles). Nevertheless, the market appears to be slowing and fromm February to April 2024, registrations of passenger BEVs contracted -20.5% YoY as the boost to demand provided by the EV 3.0 measures came to an end in January 2024, to be replaced from February onwards by the less generous subsidies available under the EV 3.5 scheme.

Electric buses and commercial vehicles

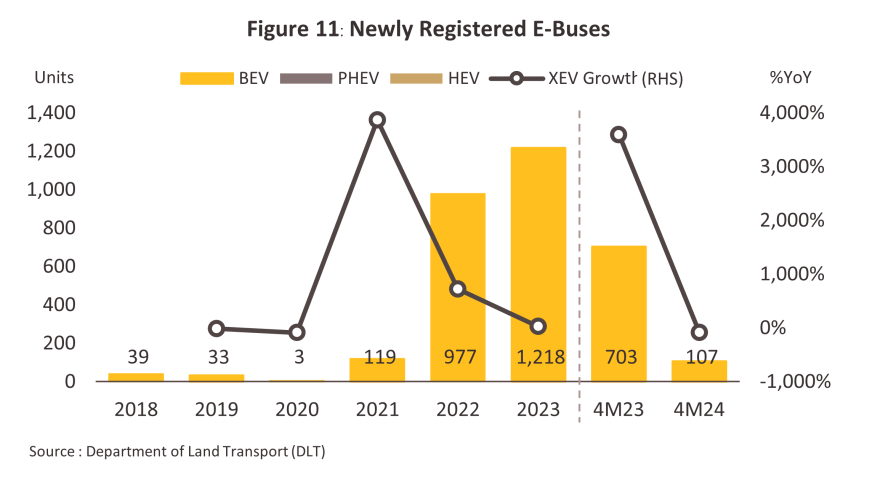

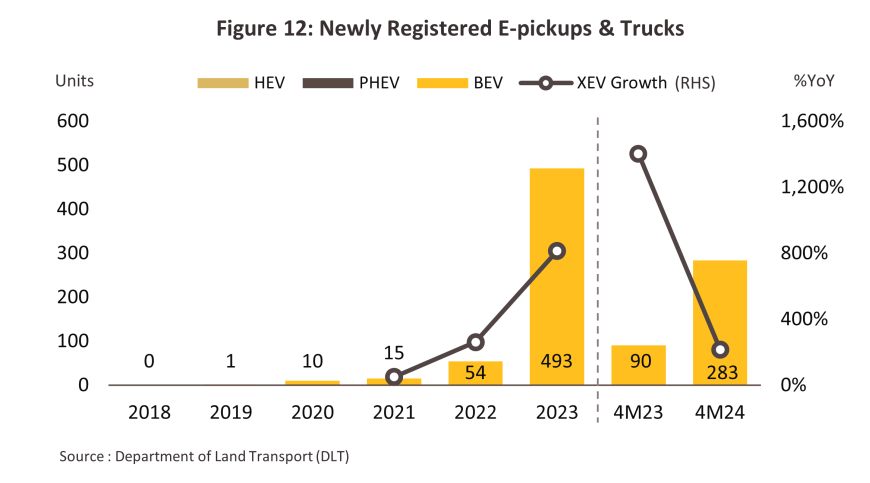

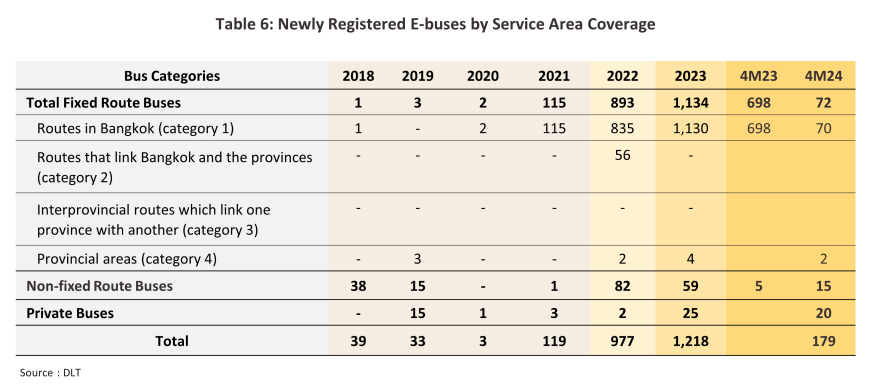

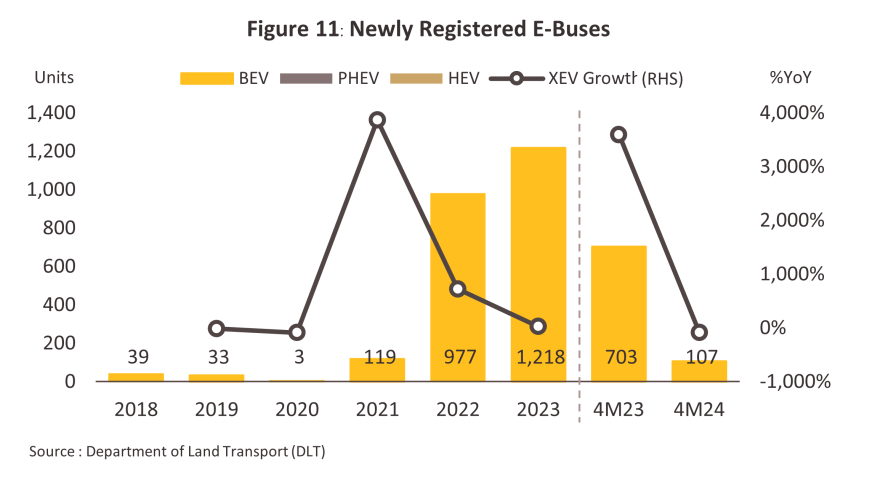

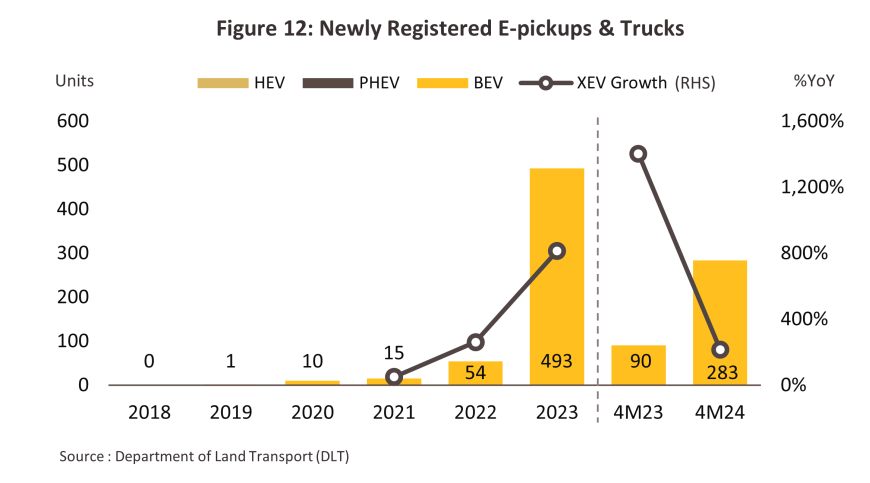

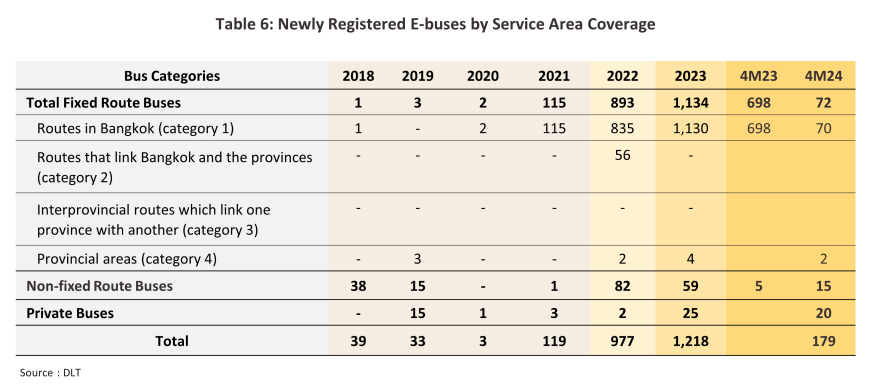

In 2023, new registrations of electric buses rose 24.7% YoY to 1,218 vehicles (Figure 11), split between 1,134 public buses running scheduled services, 59 buses not running on scheduled lines, and 25 privately operated vehicles (respectively 93.1%, 4.8% and 2.1% of all new EV bus registrations, Table 6). These comprised 14.8% of all new bus registrations made in the year. By contrast, although registrations of new EV pickups jumped 813.0% YoY, this was only sufficient to bring the total to 493 vehicles, or just 0.2% of all new registrations of commercial vehicles (Figure 12). Overall, almost all of these were BEVs, and over the recent past, the majority of EV commercial vehicle registrations have been of buses. This has been due to the following.

-

The lower costs associated with fuel/energy and maintenance5/ helped to encourage operators to introduce EV buses prior to the start of official support for EVs in the form of the EV 3.0 measures. Over 2018 and 2019, an average of 35 EV bus registrations were made annually (most of these ran on non-scheduled routes or were privately operated), though following the abating of the Covid-19 pandemic, the market expanded rapidly, and over 2021 to 2023, new registrations jumped 217.0% CAGR.

-

State support for the market has increased from 2021 onwards, and the government has now set a target of 40% of registered buses or 33,000 vehicles being EV buses by 2030, and public and private operators are meeting this challenge by increasing their use of EVs. This has included efforts by the Bangkok Mass Transit Authority and private bus operators to source EV buses for use on Bangkok bus routes6/, as well as increased use by private companies operating elsewhere (for example in the EEC7/).

Nevertheless, growth in this segment is constrained by several factors. The limited range of commercial vehicles means that these are still not suitable for use in many cases, in particular for the long-distance inter-provincial transport of goods and people, and so an examination of the 2023 EV bus registrations shown in Table 6 demonstrates clearly that almost all of these (1,130 vehicles, or 92.8% of the total) are deployed in Bangkok, and just 0.3% are used on upcountry routes. Indeed, at present, there appear to be no registrations for EV buses running on scheduled routes between provinces upcountry. Although imports of newer electric commercial vehicles generally have longer ranges, these are still largely insufficient to meet the needs of the market8/. Electric vehicles used for the transport of goods also typically have a range of less than 400 kilometers per charge and remain priced at a level that makes them uncompetitive. This is compounded by the fact that targeted buyers are mostly in the upcountry, typically struggling with high levels of debt and uncertain income from the sale of agricultural goods. Given this, electric-powered commercial vehicles are at present generally an unattractive value proposition.

New registrations of electric buses crashed -84.8% YoY over 4M24 to just 107 vehicles, thus comprising a mere 5.4% of all new bus registrations. Declines were driven largely by the slump in demand for new buses for use on the main routes in the Bangkok Metropolitan Region, where strong purchases over the previous 2 years have now exhausted the market. The continuing impact of positive factors helped to shift the demand for electric commercial vehicles in the opposite direction, and so registrations of these jumped 214.4% YoY. However, this was from a very low baseline, and at only 283 vehicles, or 0.4% of all commercial vehicle registrations made in the year, this segment remains very slight.

Domestic output of EV autos

Government policies promoting increased investment in the industry

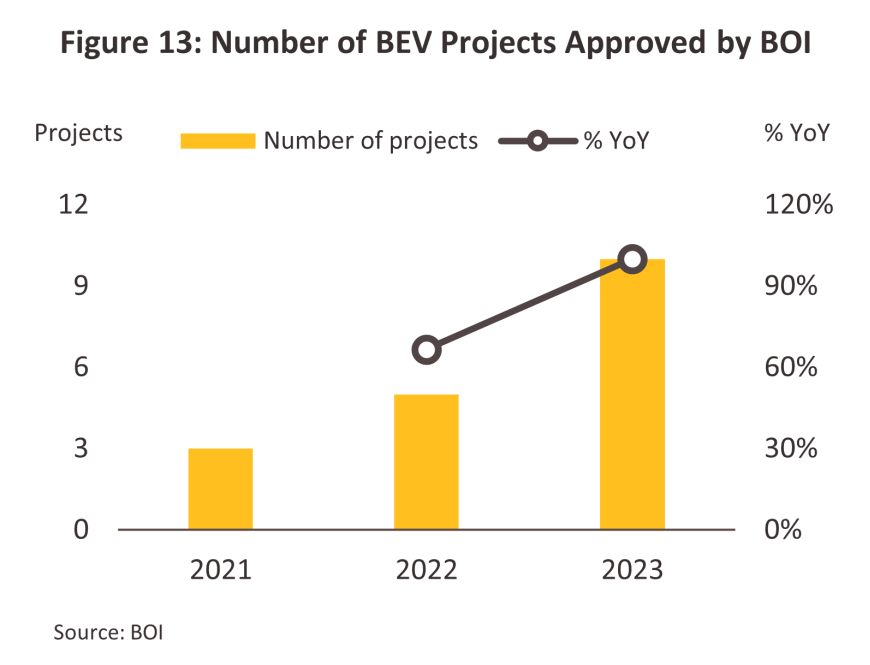

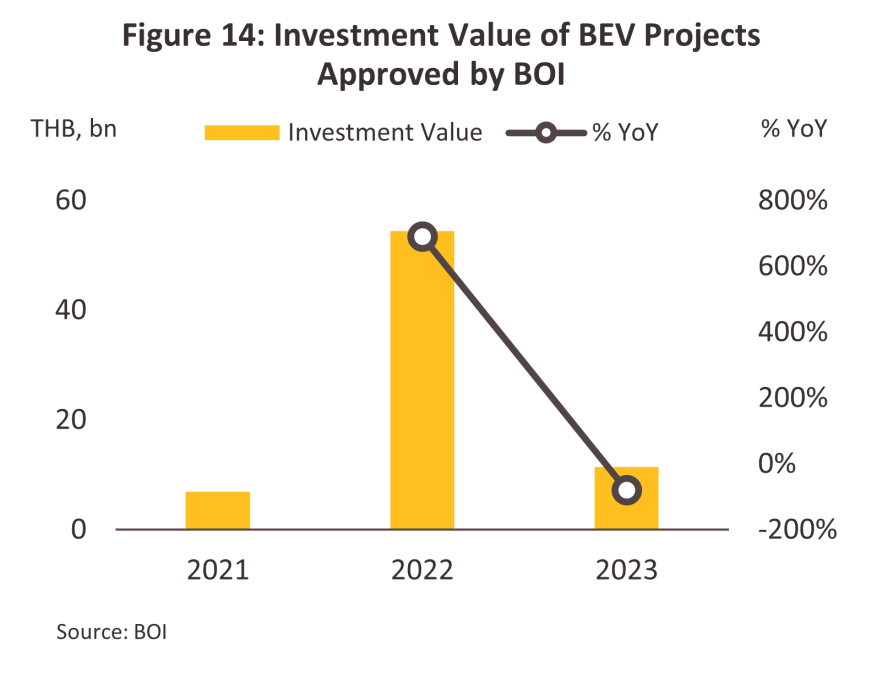

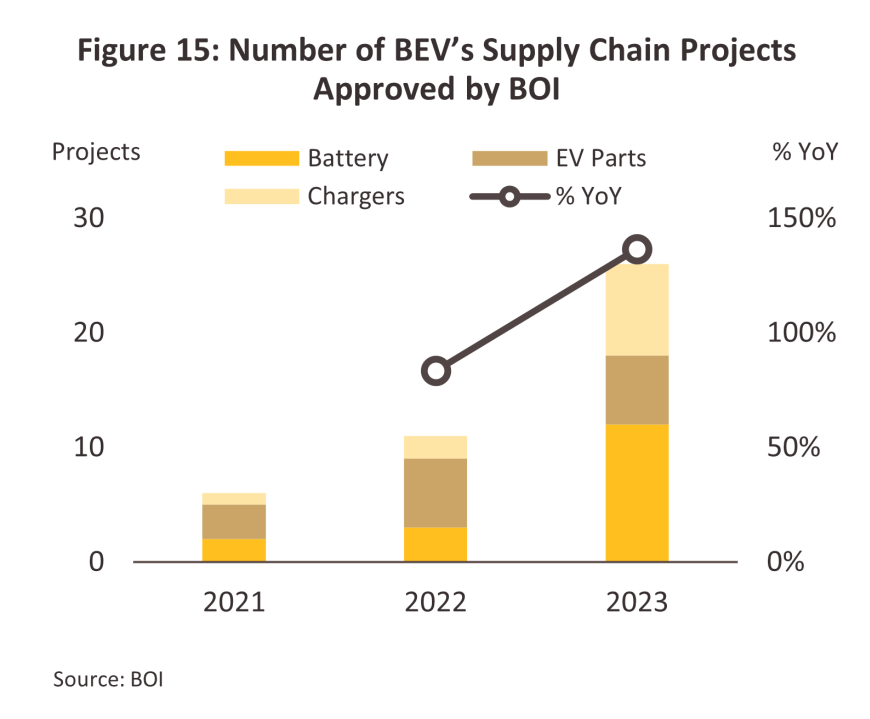

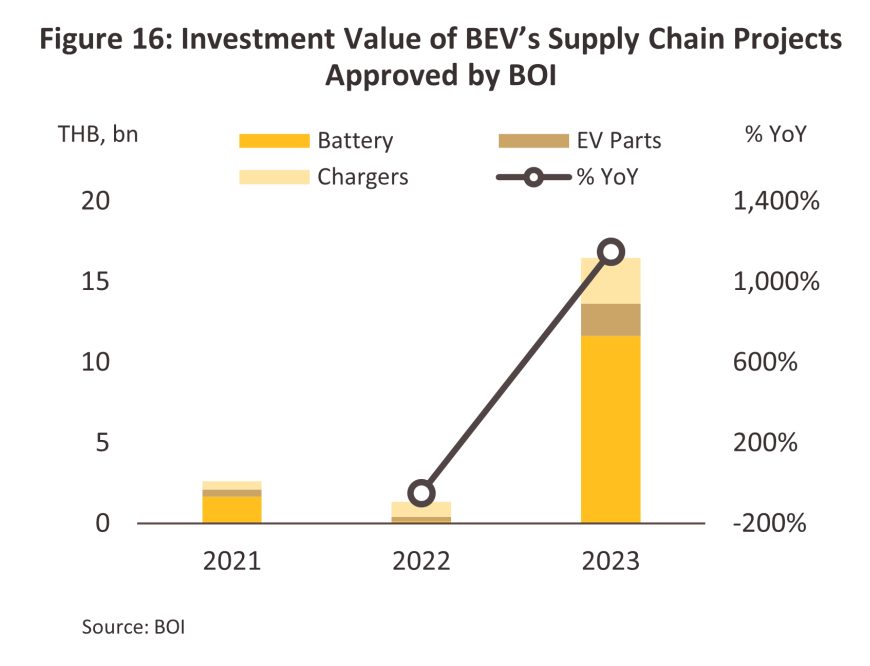

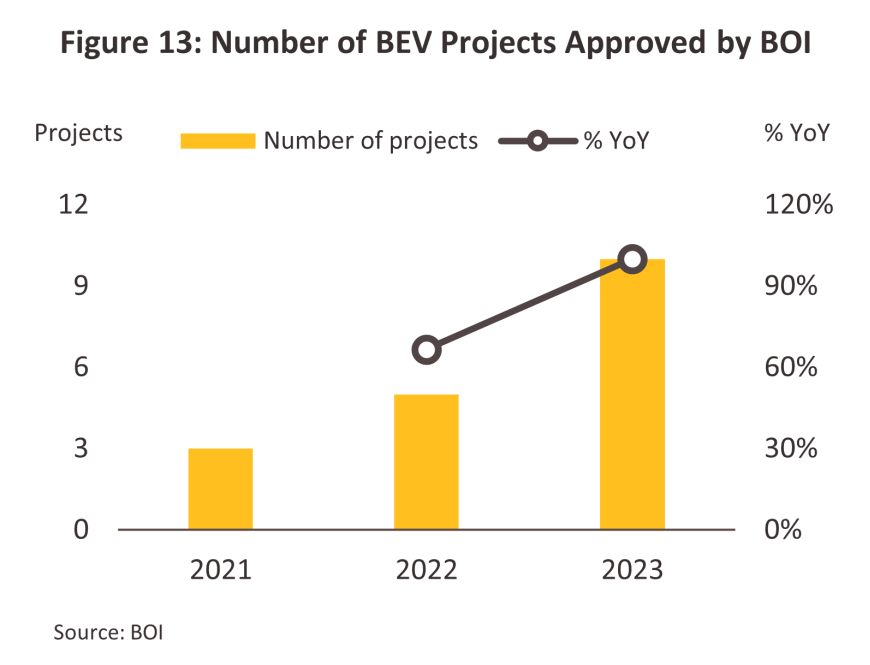

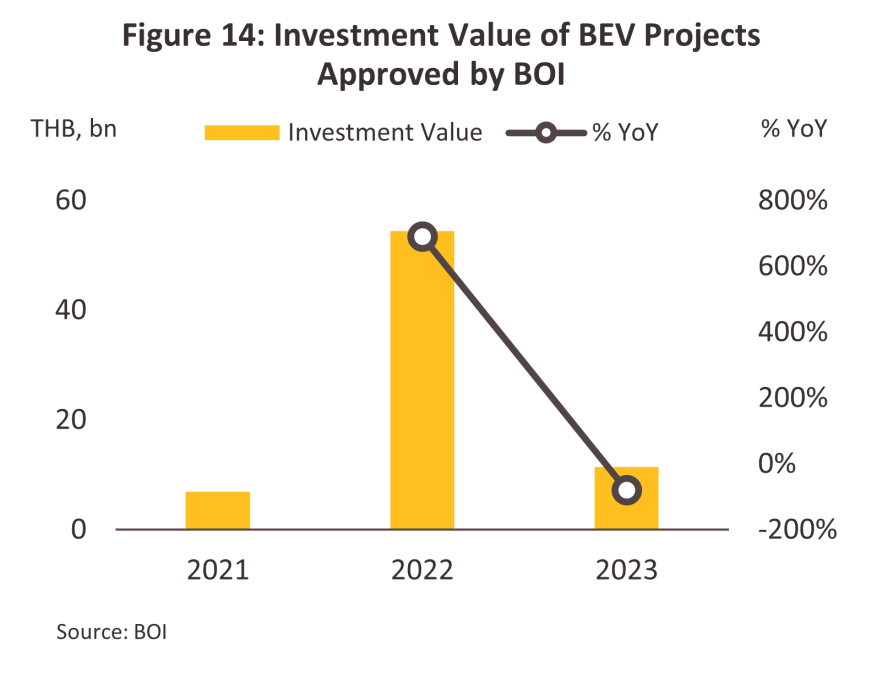

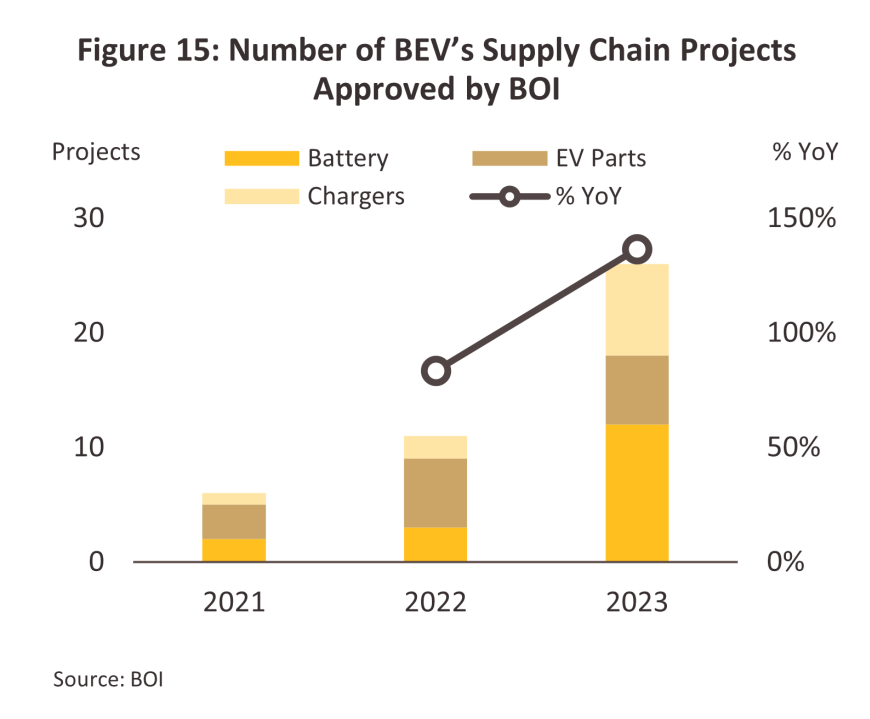

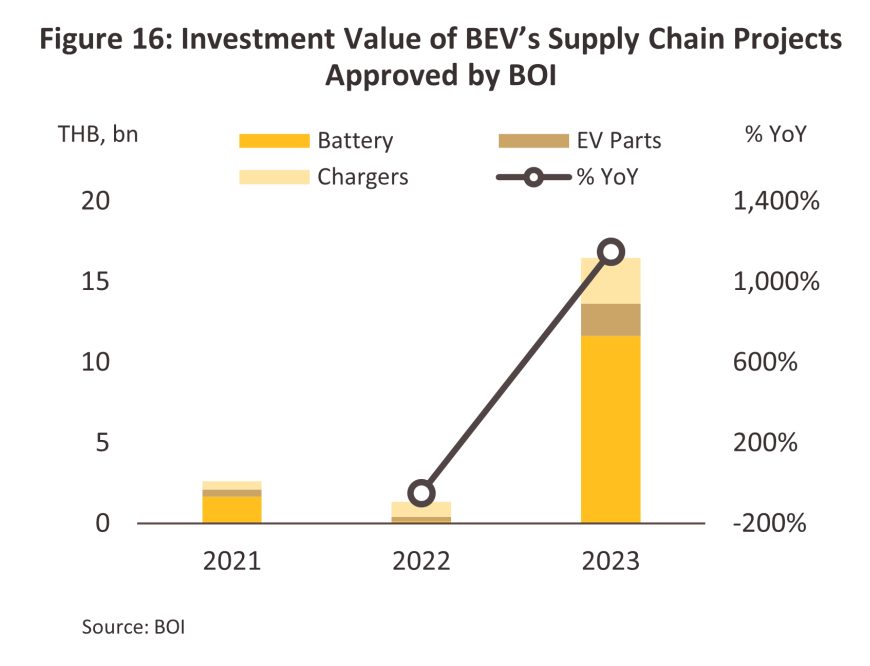

The EV 3.0 measures were first rolled out in 2022, a year when investment in EV production also hit a new high. In the year, 16 applications were approved for investment support for projects connected to the development of EV supply chains (EV assembly itself as well as the production of EV parts and the buildout of new EV charging stations) and these had a total value of THB 55.67 billion, increases of respectively 77.8% and 488.2%. However, THB 54.4 billion of this or 97.63% of the total was attributable to 5 projects targeting the domestic production of EVs. Approved investments in EV assembly thus increased 691.3% YoY in the year, with most of this coming from the leading Chinese manufacturers of MG, GWM, NETA, and BYD (Figure 13 and Figure 14).

In 2023, attention moved to support for EV supply chains, capital inflows to which increased substantially, and so having contracted -49.23% YoY in 2022, the value of approved investments in the manufacture of EV batteries and other EV parts (including major components and chargers) thus increased 1,148.48% YoY to THB 16.48 billion. This represented a full 59.15% of the value of all investments in EVs and EV parts made in the year (Figure 15 and Figure 16). By contrast, investment in EV production itself turned around from growth of nearly 700% a year earlier to a decline of -79.10% YoY, this thus falling to THB 11.38 billion. It appears, though, that the types of investment being made have changed somewhat, and with the overall number of projects approved for investment support increasing to 36, 10 of which were for EV production, the size of individual follow-up investments has shrunk following the initial moves by large-scale investors into the market. This is inline with the ‘flying geese theory’, which the industry movement started from imports, followed by investment in domestically based production facilities operated by major players within that industry. In the case of EV production, the EV 3.0 and EV 3.5 policies have helped to fuel the initial dynamism of the market.

Current EV production

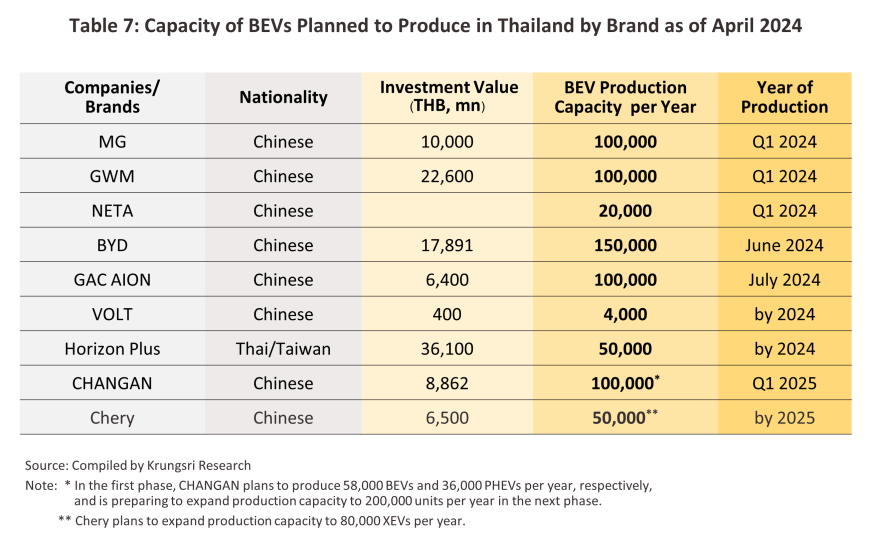

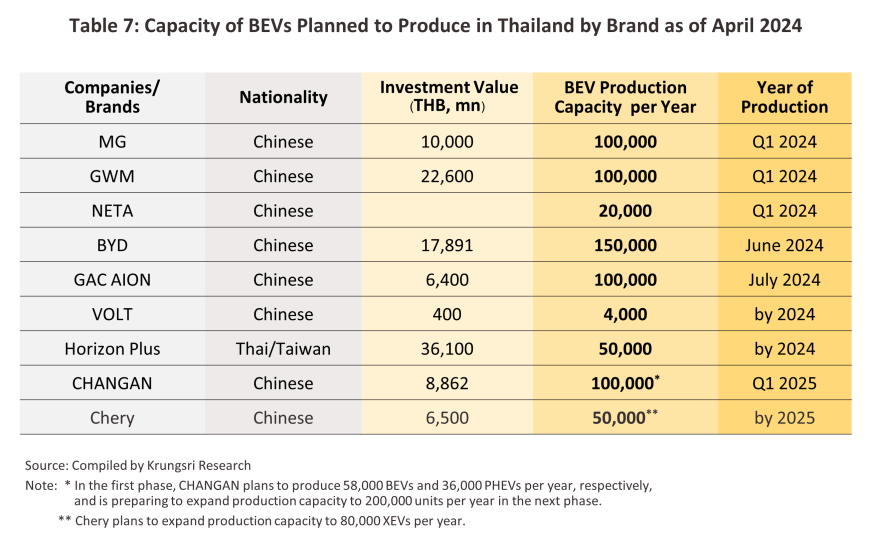

In 2023, only 164 BEVs came off production lines operated by companies that had received EV investment support. Outputs of XEV thus concentrated on the manufacture of HEVs and PHEVs, which came to 146,150 (+62.0% YoY) and 8,990 (+25.0% YoY) vehicles respectively. Since BEVs are a new industry, the market in the early stage needed to pilot through imports. Later, supported by various government measures, the use of BEVs has significantly increased. This surge has attracted many BEV manufacturers to gradually invest in building production plants in Thailand. The Thailand Automotive Industry thus reported that as of May 2024, 14 manufacturers of passenger BEVs9/, 2 manufacturers of electric commercial vehicles10/ and 5 producers of electric buses and trucks11/ had set up or were in the process of setting up EV production lines in Thailand. As per official announcements, this will then give the country a domestic production capacity of around 600,000 BEVs per year, with production lines starting in 2024 and 2025 (Table 7). This production capacity is at a level higher than the minimum production volume required to offset the import of electric vehicles for domestic sale during 2022-2023, according to the investment promotion conditions set by the BOI (Board of Investment). That capacity level is also around 3-times the 170,000 xEVs registered in 2023. It can therefore be expected that in the future, excess capacity will be used to support exports, though for the time being, players will remain concentrated on the domestic market.

EV exports

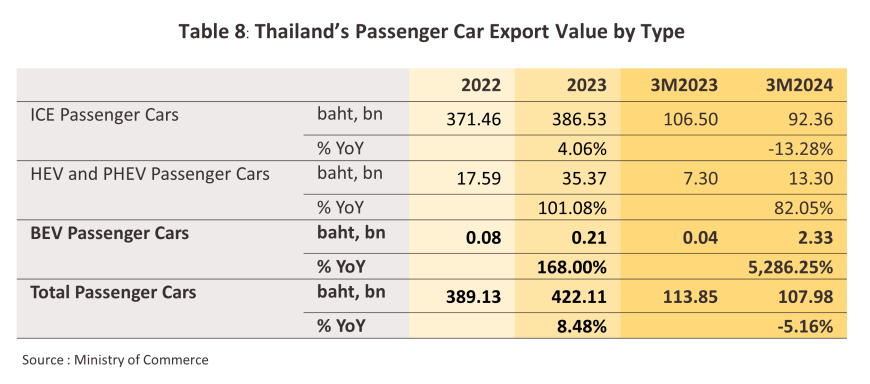

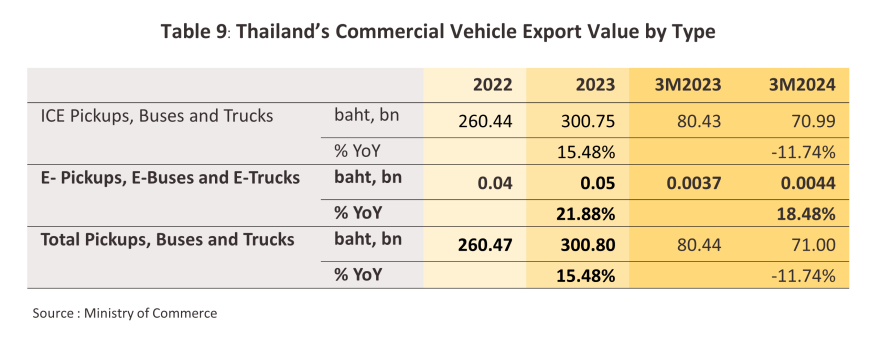

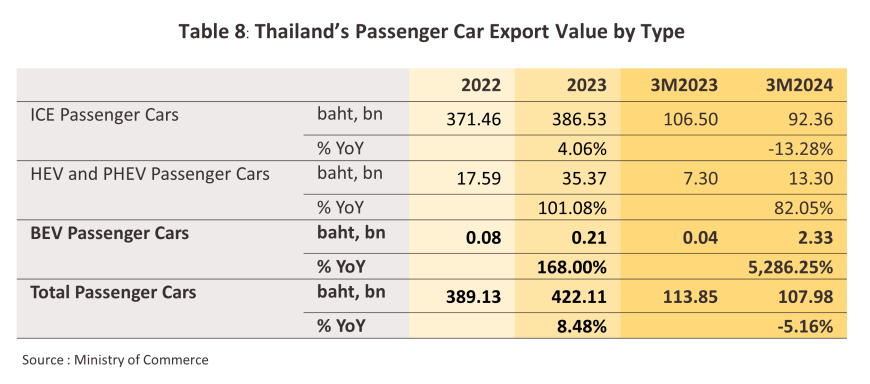

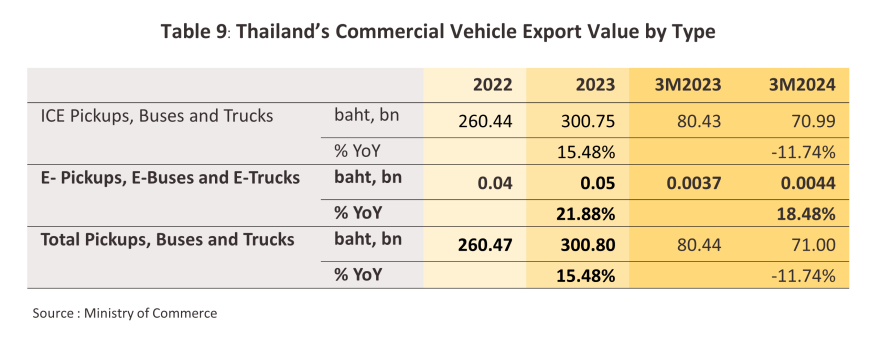

2023 exports of passenger BEVs generated receipts of THB 212.4 million, just 0.05% of the value of all passenger car exports and a weak performance compared to HEVs and PHEVs, which jointly contributed 8.4% to the value of total passenger car exports (Table 8). The most important overseas markets were Singapore and Japan, where sales totaled respectively THB 93.4 million and THB 50.9 million, or 44.0% and 24.0% of all passenger BEV exports. Combined exports of electric buses and commercial vehicles (i.e., pickups and trucks) rose 21.9% YoY to THB 46.5 million (Table 9). 57.4% of this export value (or THB 26.7 million) came from sales into the Australian market.

The value of exports of passenger BEVs picked up dramatically over 3M24 (the latest data available), surging 5,286.3% YoY to THB 2.33 billion. This then comprised a 2.2% share of total passenger car exports, and compares to the 82.1% YoY expansion in receipts from exports of passenger HEVs and PHEVs, which now have a market share of 13.2%. The most important overseas markets were in Mexico and Japan, where sales generated THB 1.07 billion and THB 0.86 billion each, or respectively 45.8% and 36.8% of all income from the export of passenger BEVs). The rapid increase in export value is tracking growth in the global market for EVs, for which combined sales of BEVs and PHEVs are up 25.0% YoY to some 3 million vehicles, and expansion in domestic production capacity. In the case of the latter, MG, GWM and NETA all began to manufacture EVs in Thailand in Q1 of 2024 and these are now able to assemble 220,000 units annually. However, exports of electric buses and commercial vehicles remain weak and make only a slight contribution to overall income; although sales of these increased 18.5% YoY, they brought in just THB 4.4 million in export earnings (0.01% of all income to this product category from overseas sales).

Outlook

New XEV registrations

New registrations of XEVs will tend to track upwards. In 2024 these are forecast to come to around 80,000-90,000. However, the market has been affected by the after-effects of the EV 3.0 policy and the THB 150,000 subsidies that it made available to EV buyers, which then resulted in 75,715 registrations being made in 2023. Nevertheless, stronger growth can be expected over 2025 and 2026, and so for the period 2024-2026, annual new registrations of passenger EVs, electric buses, and electric commercial vehicles are forecast to average respectively 190,000, 2,200, and 1,200 vehicles. For BEV autos in particular, annual registrations should come to around 96,000. The following factors will underpin this positive outlook for the market.

-

Government support for the industry is ongoing, and currently, the EV 3.5 scheme12/ provides buyers of passenger and pickup BEVs with subsidies of THB 50,000-100,000, caps excise duties at 2%, and cuts import duties on passenger EVs by 40%. In addition, companies making purchases of electric buses and commercial vehicles will be eligible for tax reduction13/ that allow companies to claim back tax at 2- to 3-times the value of the cost of EV purchases. Companies will also need to ramp up domestic production in order to meet the conditions of their investment support and to match the 270,000-340,000 vehicles imported annually under the EV 3.0 scheme.

-

Manufacturing costs are falling thanks to steady advances in technology, in particular for batteries, this will then help BEVs remain much more competitive with other vehicle types, even during the expiration periods of the government support measures. The IEA therefore sees electric SUVs and other large EVs becoming competitive with ICE-powered models on price in 2025 and 2026, while small and mid-sized EVs will start to compete effectively over 2026-2028.

-

EV capacity ranges in distances are increasing and as of 2023, this had risen to an average of 380 km/charge globally for passenger EVs and e-SUVs, up by 7.7% CAGR from the 150-270 km/charge averaged in 2015 (source: IEA, 2024), while for BEV buses, this had improved from 250 km/charge in 2019 to 330 km/charge in 2023, or CAGR of 7.2% (source: ZETI Data Explorer). Continuing investment in the development of powertrains and batteries will underpin an extension of these trends, and so ranges should continue to lengthen. This will then allow BEV vehicles to better meet market demand and to find a broader range of uses in commercial and passenger transport, for example on inter-provincial bus routes.

-

Number of models will be increasing thanks to truncated production lines and shorter assembly times compared to ICE vehicles, and this is allowing BEV manufacturers to compete with one another through the release of a wider range of models that are a tighter match to varied consumer needs. Thus, in 2023, 590 BEV models were available globally, and this range has increased 24.8% CAGR since 2016. By contrast, the number of ICE models available globally has shrunk by -2.0% annually, down from 1,500 in 2016 to 1,300 in 2023, and this trend is likely to continue into the future.

-

Access to charging points is improving due to ongoing investment in their installation, especially upcountry, and this will continue to provide the infrastructure necessary to support increased BEV ownership. In 2023, the number of charging stations jumped 114.5%, with the supply of individual charging points also up 159.3%.

-

The Euro 5 and Euro 6 standards will be enforced in 2024 and 2025 for respectively larger petrol- and diesel-powered vehicles and smaller petrol-powered vehicles (Figure 17). These changes are being driven by the tightening of regulations by the Thai Industrial Standards Institute that aim to reduce air pollution and alleviate problems with PM2.5 particulates. However, this will also add to the cost of manufacturing ICE-powered units14/, thereby raising their retail price relative to EVs.

-

The use of electric buses is increasing both on regular scheduled routes15/ and in areas of significant economic importance, most notably in the EEC. Indeed, the Eastern Economic Corridor Office of Thailand (EECO) has set a target of having 6,000 electric buses on EEC roads by 2028 (source: Manager, 28 February 2023).

-

More acceptance of EVs is being driven by two main factors. (i) Consumers are showing greater understanding of EV technology and of the issues around charging electric vehicles. Thus, a survey by Deloitte (2024) of public attitudes shows that the share of respondents reporting concerns over a lack of knowledge of EV technology fell from 34% in 2023 to 25% in 2024. This also dropped from 44% to 39% with regard to worries over EVs’ range per charge. 25% of the public (up from 14% in 2023) now expect to be able to charge an EV at a public charging station, while the proportion of respondents willing to wait 10-40 minutes for an EV to charge has also increased from 61% to 71%. (ii) Concerns about the environment are rising among the public, and in 2024, environmental issues were cited as the second most important reason for buying an EV, up from fifth place in 2023, with 71% of respondents giving this as a motivation.

XEV exports

EV manufacturers that have established production lines in Thailand will begin manufacturing passenger EVs for exports over 2024-2026, and overseas sales of these should come to some 100,000 passenger EVs annually. This outlook is supported by the following considerations.

-

EV production capacity is increasing to meet demand for exports. The 14 EV manufacturers that will begin Thailand-based production of BEVs in 2024 and 2025 have a combined potential output of 400,000 to 600,000 vehicles per year. This is significantly greater than can be absorbed by the domestic market, where demand is forecast to come to around 270,000-340,000 units annually, and so this allows for exports of 150,000-250,000 vehicles per year. At present, Thai EV production capacity is almost entirely in the hands of Chinese players. Indeed, these are rapidly capturing the global EV market, and have already won an approximately 60% share of EV sales worldwide. It can thus be expected that the Thai EV industry will move more strongly into export markets in the coming period.

-

Global demand for EVs will continue to strengthen, and the IEA (2024) sees sales of smaller EVs (i.e., of passenger and small commercial EVs) rising to respectively 40% and 50% of total worldwide sales of small vehicles in 2030 and 2035, or to totals of 45 million and 65 million vehicles in each of these two years. This strong growth in sales will result from a combination of ongoing government support and the wide range of models available to consumers around the world, especially of BEVs and PHEVs. Deloitte (2020) thus sees these accounting for respectively 81.0% and 18.6% of global sales of small EVs by 2030.

-

China, the EU, the US and the ASEAN region all have solid potential for future growth, and the 2020 Deloitte report sees the first three of these accounting for 49%, 27% and 14% of global sales of EVs by 2030. EY (2023) also expects that EV sales in the ASEAN region will expand by 16-39% CAGR over 2021-2035, and by the end of this period, the ASEAN EV market should be worth USD 80-100 billion (up from USD 2 billion in 2021) on sales of around 8.5 million vehicles annually.

Despite rapidly growing demand and the overall positive outlook for the industry, EV manufacturers will still have to negotiate a number of challenges on the supply side of the market.

1) Both large players and smaller new brands are entering the market, particularly under the influence of government efforts to encourage increased investment, and this is adding to competitive pressures. However, this is as expected by the ‘flying geese theory’. Players will also have to compete with a greater flow of vehicles from China, which is currently flooding the world with exports of low-cost EVs.

2) Chips are a core upstream input into EV manufacture. If supply faces shortages again, this will potentially have major impacts on assembly lines. In fact, the worsening trade conflict between the US and China is continuing to cause periodic problems, but supply chain disruptions could worsen substantially if the trade war intensifies further and trends towards deglobalization and the bifurcation of world trade deepen.

3) There may be an imbalance between growth in EV sales and the supply of charging stations/points, and if the latter is insufficient to support the former, this will drag on the market. This has the potential to be a particular problem in upcountry areas, where demand may come from commercial users transporting people and goods over long distances.

1/ In addition, policies put in place in 2019 to encourage increased output of EVs specified that applicants for investment support for BEV production were allowed to apply for government schemes providing assistance to manufacturers of HEVs (the deadline for applications was 31 December 2019). The Board of Investment required that applicants begin HEV production within 3 years of being granted a license for this investment support, with BEV production then commencing no more than 3 years after the day on which the manufacture of HEVs began.

2/ For passenger BEVs costing THB 2-7 million and BEV pickups costing up to THB 2 million, the required battery size has been increased to over 50 kWh (up from 30 kWh).

3/ For example, the NETA V has an average retail price of THB 549,000 and a range of 302 km/charge (or 550.8 km/THB 1m), and 12,777 of these were sold in 2023 (16.9% of all passenger BEVs sales). Likewise, the ORA Good Cat costs on average THB 959,000 and has a range of 500 km/charge (or 521.4 km/THB 1m), and 6,712 of these were sold in the year (8.9% of total passenger BEV sales).

4/ Split between 4,533 DC or fast chargers (+237.8% YoY) and 5,161 AC chargers (+114.7% YoY%).

5/ A 2021 World Bank analysis of the total cost of ownership (TCO) of electric buses operating in Shenzhen shows that EV busses had respectively 52.8% and 65.6% lower cost of fuel/energy and maintenance than ICE-powered buses.

6/ As of 1 January 2024, 2,017 buses had been licensed by the Department of Land Transport to operate on 123 lines.

7/ Thanks to support from a number of agencies and their encouragement of the development of relevant technology, knowledge transfer, and the buildout of the required infrastructure, around 100 EV buses were newly registered for usein the EEC in 2023, though the target is for this to rise to 6,000 by 2030.

8/ For example, the TAKANO TTE 500 and JAC T8 electric pickups are imported for distribution in Thailand but these have ranges of just 120 and 330 kilometers per charge each.

9/ MG, GWM, NETA, BYD, GAC Aion, Changan, Volt, Chery, BMW, Mercedes-Benz, MINE Mobility, FOMM, Horizon Plus and Honda (Source: Thailand Automotive Industry, and collated from other sources).

10/ Takano and NEX Point (Source: Thailand Automotive Industry).

11/ Cho Thavee, Nex Point, Sakun C Innovation, Panus Assembly, and Absolute Assembly (Source: Thailand Automotive Industry).

12/ On 21 February 2024, the EV Board agreed at its first meeting of the year to amend phase two of its support for the EV industry (the EV 3.5 scheme). This extended the scope of the measures to include EV passenger vehicles that carried a total of up to 10 passengers, and it is hoped that this will broaden the appeal of EVs for commercial users.

13/ Companies and partnerships are able to reclaim corporation tax against the purchase price of electric buses or commercial vehicles to a value of 1.5-times their cost in the case of imports and 2-times their cost in the case of domestically assembled vehicles. There is no ceiling on the value of this provision.

14/ A study by the Ministry of Energy presented to a meeting of the National Environment Board shows that the enforcement of the Euro 5 measures will increase costs by around THB 25,000 per vehicle.

15/ Thai Smile Bus Company aims to increase the number of electric buses it operates in the BMR from 2023’s 2,100 to 3,100 in 2024 (source: Daily News, 2 January 2024).

.webp.aspx)