EXECUTIVE SUMMARY

Output by the Thai chicken industry is forecast to rise by 2.0-3.0% to an annual total of 1.99-2.10 billion broilers over 2024 to 2026, and this will then yield 3.19-3.35 million tonnes of chicken meat (up 1.5-2.5%). The industry will benefit from strengthening demand on domestic and export markets as well as the falling cost of feed, a result of the increasing supply at home and abroad of crops including soy and corn. Domestic consumption of chicken is forecast to climb by 1.0-2.0% per year on: (i) only slow growth in the economy and purchasing power that will then encourage shoppers to buy affordable products; (ii) chicken’s positioning as a low-fat, high-protein food that is suitable for health-conscious modern consumers; and (iii) recovery in the restaurant industry and the tourism sector as foreign arrivals continue to rebound. Exports volume is expected to grow 3.5-4.5% annually. Growth will be driven by: (i) deeper trade relations, in particular, due to the increased penetration by Thai processed chicken products of halal markets in the Middle East, and of sales of chilled and frozen chicken to markets in Lao PDR and Malaysia; (ii) the sluggish performance of the world economy is pushing consumers to seek lower-cost sources of protein; (iii) increasing concerns among consumers about their health and well-being, which given chicken’s low fat content relative to other non-aquatic meats provides the product with a strong value proposition; and (iv) higher demand in the export markets due to lower feed price that leads to declining export prices.

Krungsri Research view

-

Producers of frozen and processed chicken: Recovery in the tourism sector and gradual economic growth will lift domestic demand, while exports will benefit from Thailand’s growing strength in halal markets in the Middle East, as well as from the presence of Thai products in regional markets (e.g., Malaysia). Thai players also benefit from the broad international recognition of their production standards, though several headwinds will limit growth, including the EU’s support for imports from Ukraine and the cancellation of China's anti-dumping measures on chicken products from Brazil.

-

Chicken farms: Demand tends to grow, while the falling cost of feed will help to widen margins, especially for large players that occupy a stronger negotiating position and can enjoy economies of scale. However, smaller operators will have to contend with stiff competition, and this will limit their ability to generate profits.

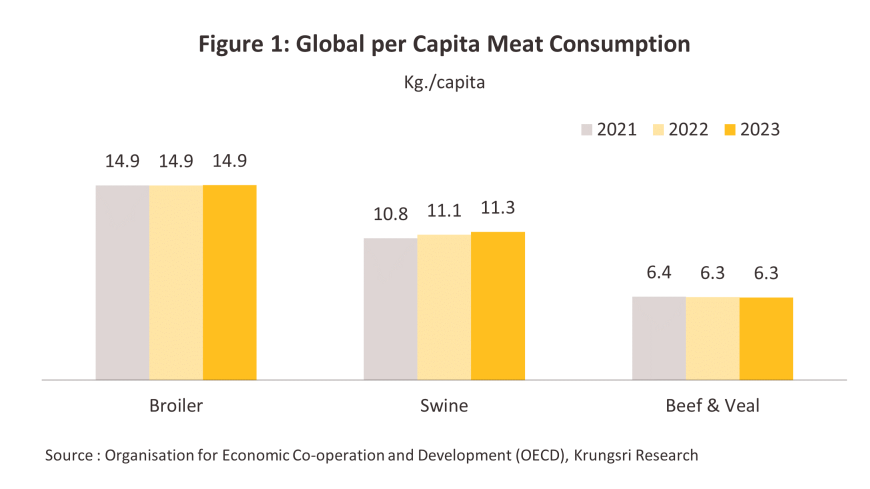

Overview

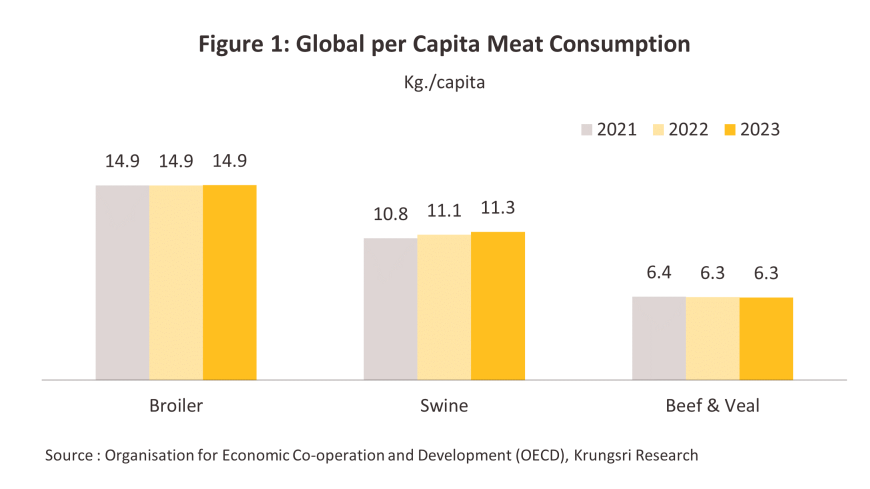

Chicken meat has the advantage of being a protein-rich1/, low-fat commercially-farmed animal, and because modern breeds grow to maturity very rapidly, chicken flocks return profits over a relatively short time-span compared to other meat products. As a commercial undertaking, raising chickens also benefits from the animal’s high conversion rate2/ and resistance to disease, and the result of this is that chicken is farmed and consumed in greater quantities than any other animal; per capita global consumption3/ averages 14.9 kilograms/person/year, compared to 11.1 kilograms for pork and 6.3 kilograms for beef (data correct as of 2022). The majority of the consumable output of the chicken industry is distributed in the form of (i) chilled chicken products, (ii) frozen chicken products, and (iii) chicken that is cooked or flavored and then frozen. Each of these product groups involves a different type of processing.

-

Chilled chicken: Products include whole chickens, filleted chicken meat and offal, and other parts of the body. This is preserved at a temperature of 0-5 degrees Celsius.

-

Frozen chicken: Products include whole chickens, filleted chicken meat and offal, and diced and minced chicken meat, which is stored at temperatures below -18 degrees Celsius.

-

Processed chicken: These are downstream products that provide manufacturers with the opportunity to generate added value. Processed chicken products can be split into two main classes: (i) uncooked processed chicken, which consumers will then prepare themselves, and (ii) semi- or fully-cooked chicken products that are frozen at temperatures below -18 degrees Celsius. This includes grilled chicken legs, smoked chicken wings, chicken satay, chicken burgers, chicken nuggets, chicken steaks, chicken karaage, chicken meatballs, battered and fried chicken, and marinated chicken.

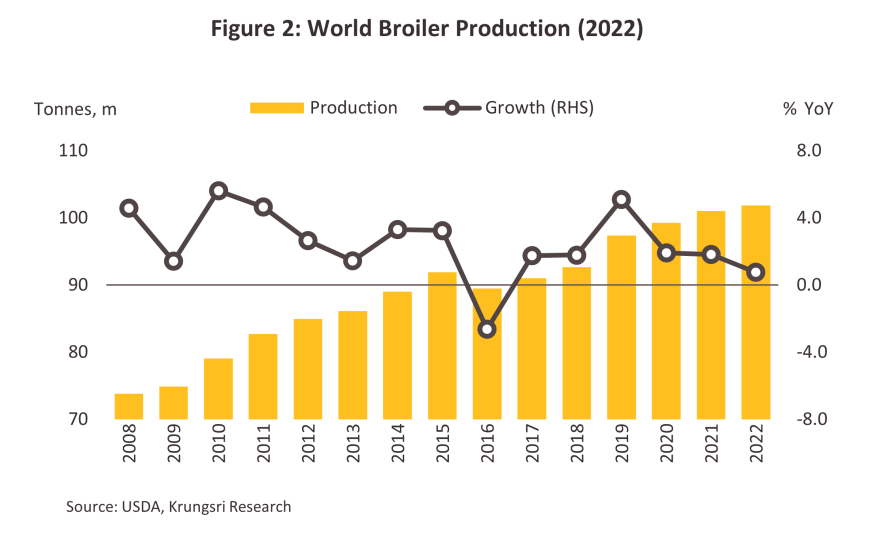

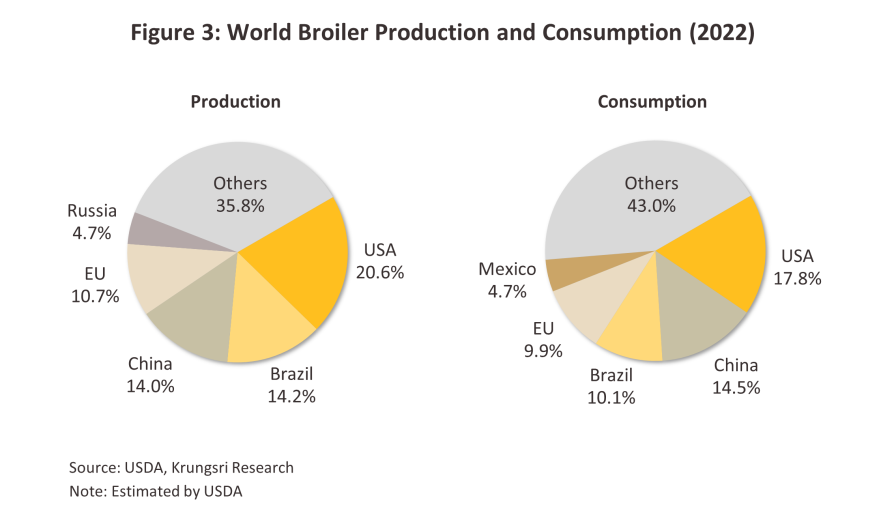

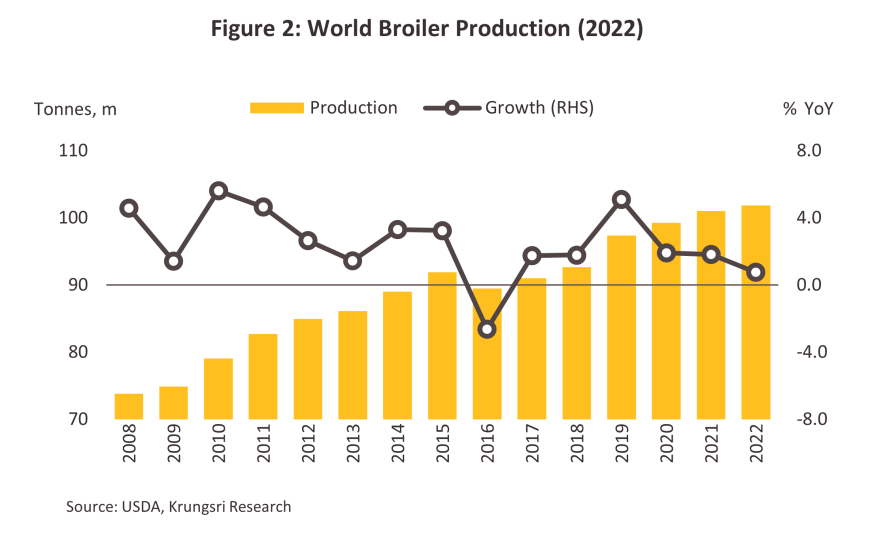

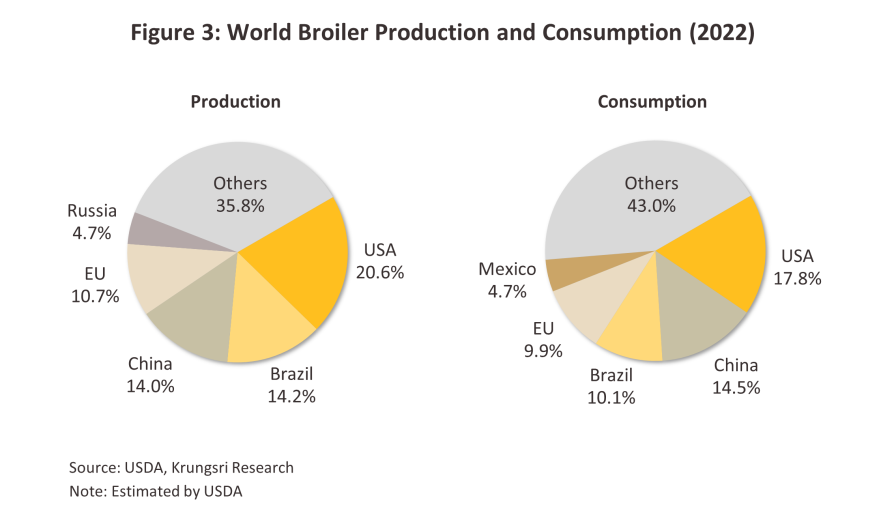

Global output of chicken meat rose 0.8% YoY to 101.8 million tonnes in 2022 (Figure 2). The Americas are the world’s primary source of chicken, accounting for 47.1% of global production, followed by Asia (31.4% of output), Europe (13.0%), Africa (7.2%) and Oceania (1.3%). In terms of individual countries, the USA sits in first place, producing 21.0 million tonnes of chicken per year (20.6% of all global output), followed by Brazil with 14.5 million tonnes (14.2%), China with 14.3 million tonnes (14.0%), and the European Union with 10.9 million tonnes (10.7%) (Figure 3). Thailand’s annual production of chicken meat comes to 3.3 million tonnes, which gives it a 3.2% share of world output and places the country in 7th position globally (source: USDA). Total global consumption came to 99.3 million tonnes in 2022, up 0.7% from 2021, but the overwhelming majority of this is absorbed by domestic markets (an average of 97.5% globally). Thus, the biggest buyers of chicken are US consumers, which with a market sized at 17.7 million tonnes, account for 17.8% of global demand, followed by China (14.4 million tonnes, or 14.5% of the global market), Brazil (10.0 million tonnes, or 10.1%), and the EU (9.9 million tonnes, or 9.9%). Thailand absorbs 2.5 million tonnes of chicken annually (2.5% of global supply), sufficient to put the country in 9th place in the global ranking of consumers.

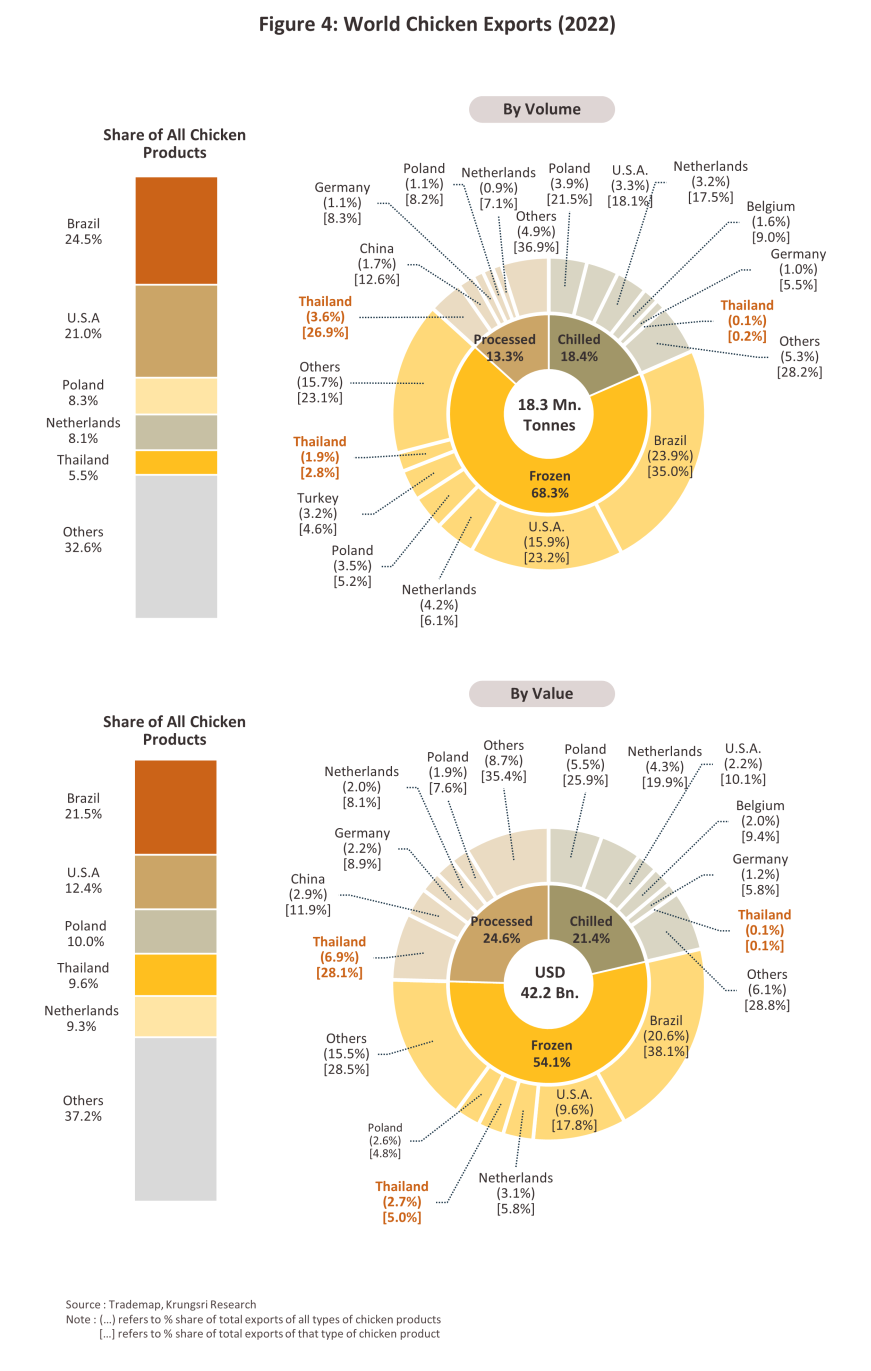

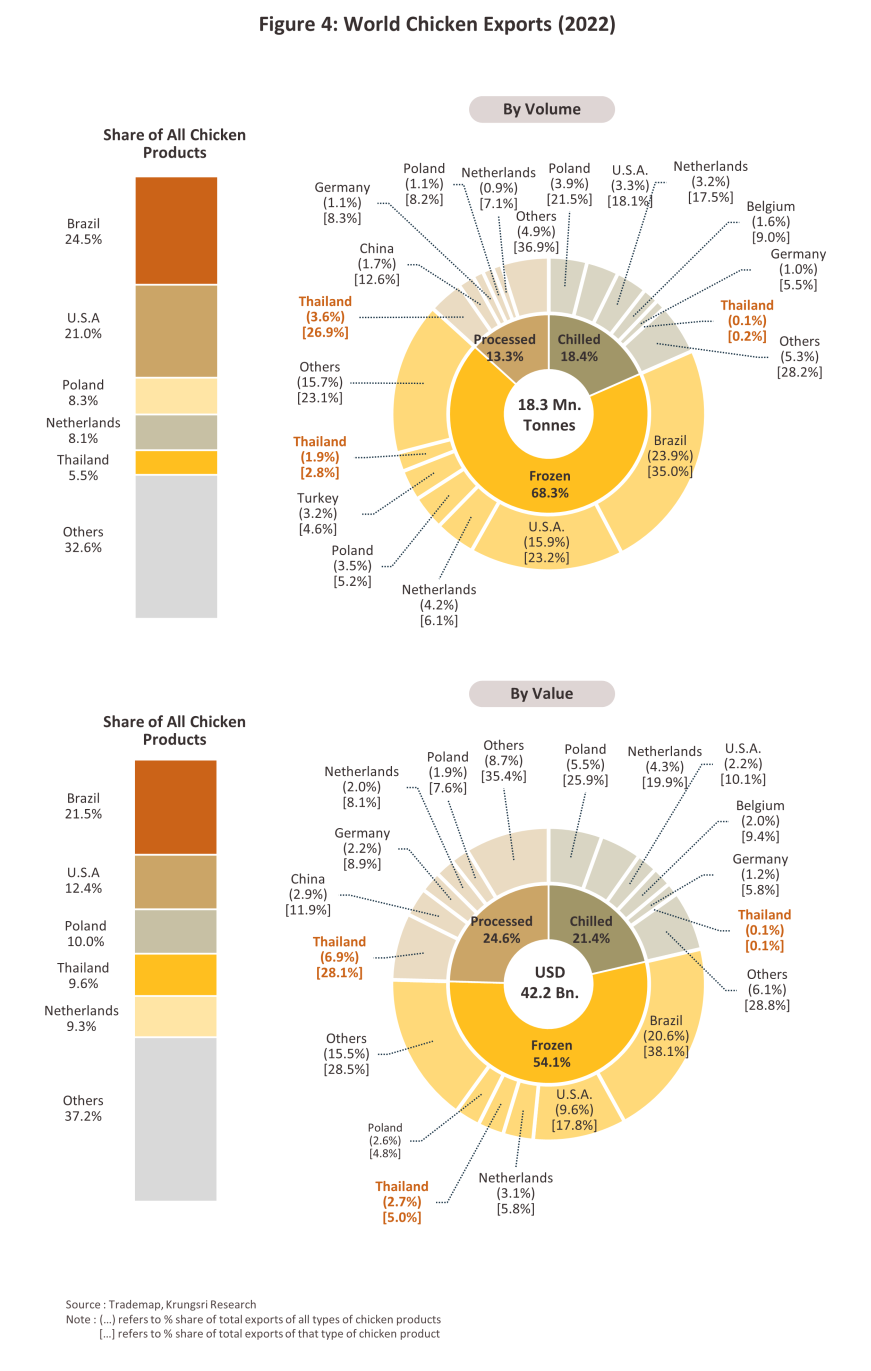

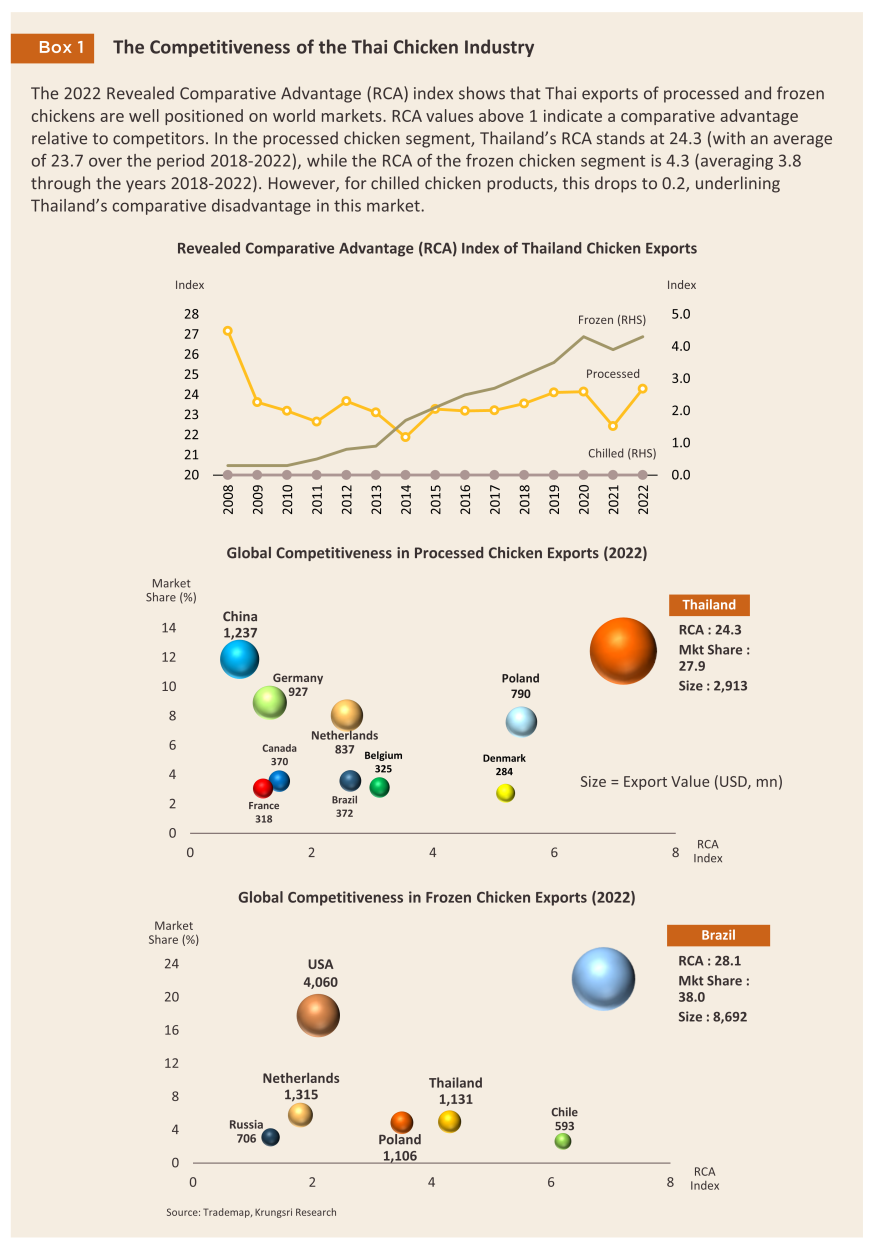

Worldwide, chicken exports totaled 18.3 million tonnes in 2022, which generated receipts of USD 42.2 billion. With a 24.5% share of global market, Brazil is the world’s most important exporter of chicken products, followed by the US (21.0% of the market), Poland (8.3%), the Netherlands (8.1%), and Thailand (5.5%) (Figure 4). Details of exports of the different product groups are given below:

-

Frozen chicken: By volume and value, this accounted for respectively 68.3% and 54.1% of global chicken exports. Within this category, 82.7% of all exports by value were of filleted chicken products, with the remainder being of whole chickens. The world’s three biggest exporters of frozen chicken products were Brazil, the US, and the Netherlands, which together had a greater than 64% market share. By comparison, Thailand had just a 2.8% slice of the market, putting the country in 6th place in the global rankings.

-

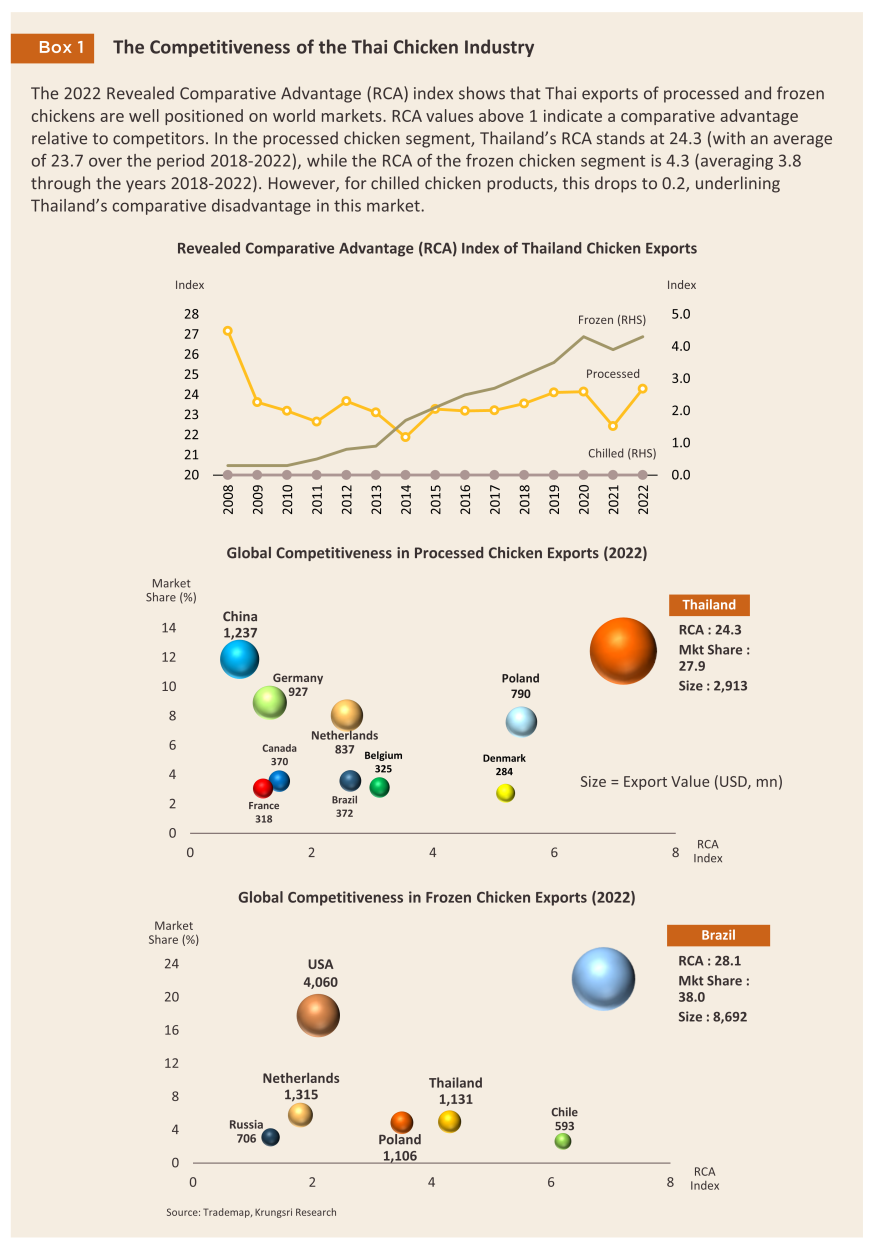

Processed chicken: While by volume, only 13.6% of global exports were of processed chicken, the share jumps to 24.6% when considered by value. Within this segment, Thailand was the world’s biggest exporter, enjoying a 26.9% market share by volume, followed by China (12.6%), Germany (8.3%), and Poland (8.2%).

-

Chilled chicken: Considered by value and volume, respectively 21.4% and 18.4% of global exports of chicken products were of chilled chicken. Of this total, 92.0% (by volume) were of filleted products, the remainder being whole chickens. With a 21.5% market share (by volume), Poland was the world’s biggest exporter, followed by the US (18.1%), and the Netherlands (17.5%). Thailand’s presence in this market is very slight, and the country’s 0.2% market share puts it in 29th place in the world rankings.

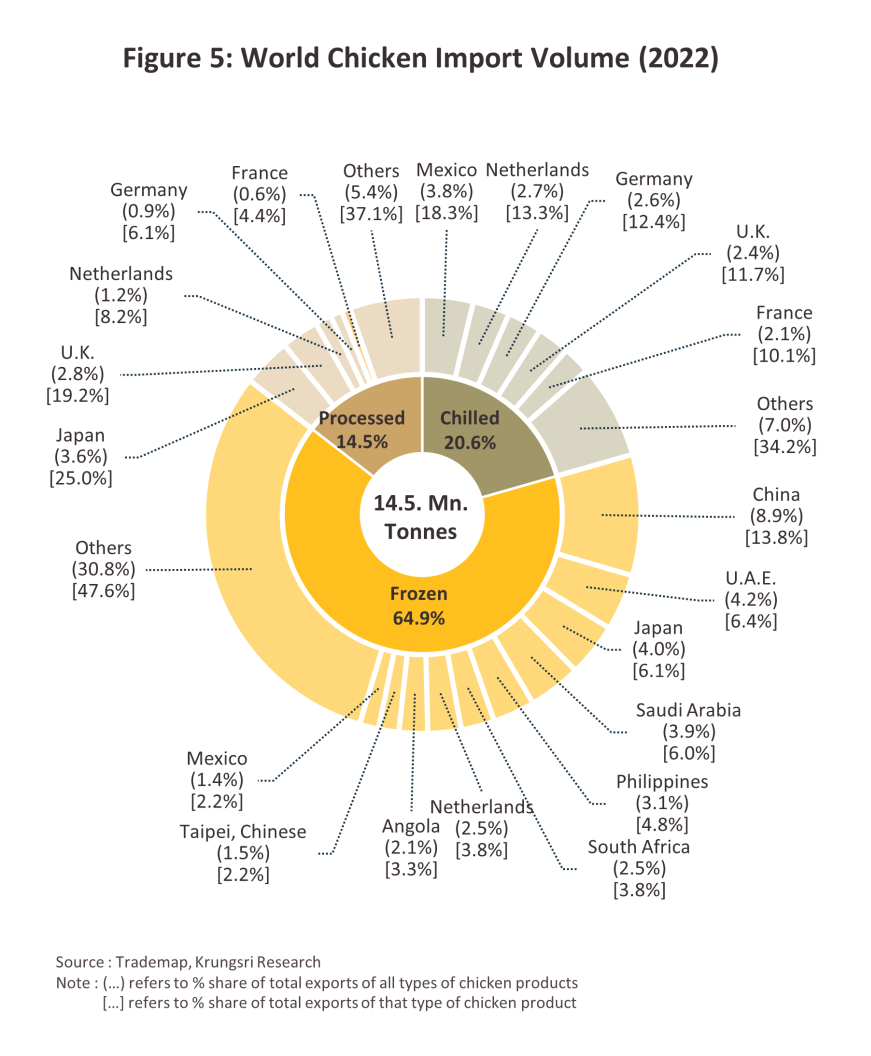

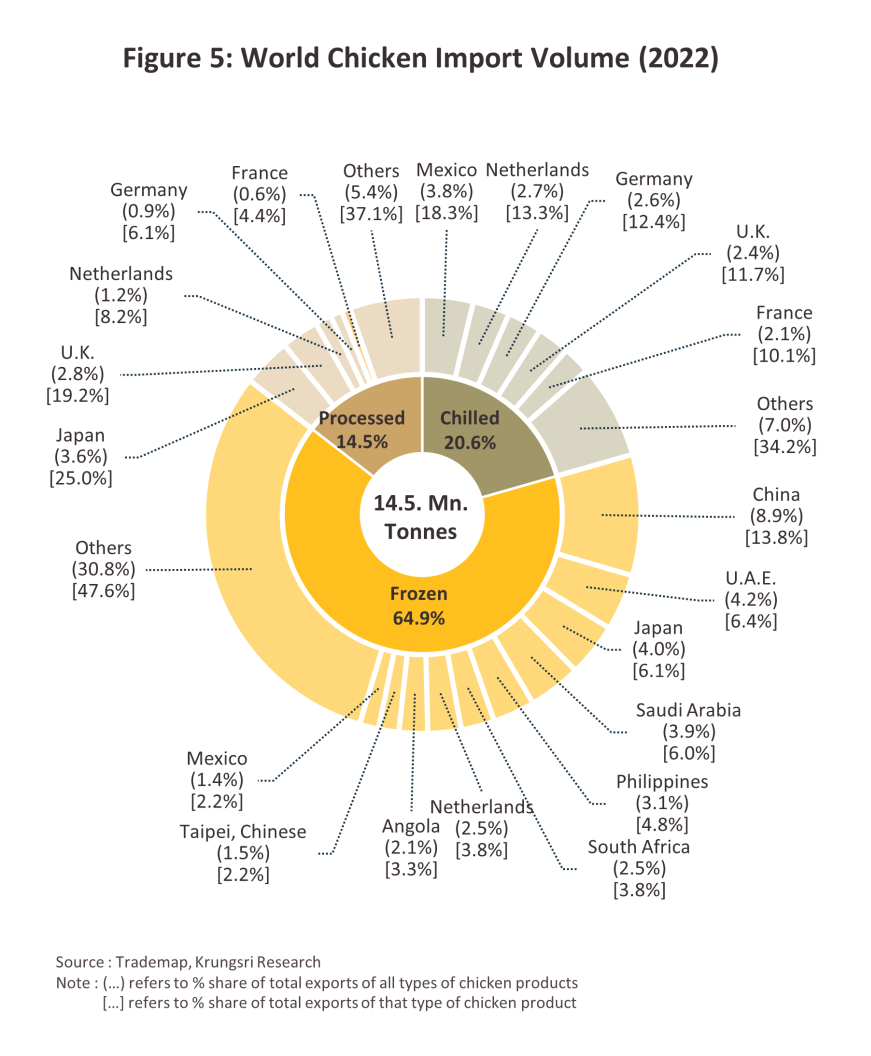

The situation for chicken imports is summarized below (Figure 5).

-

Frozen chicken: This accounts for 64.9% of global demand for chicken by volume. The most important markets are China (13.8% of all imports of frozen chicken worldwide), the UAE (6.4%), Japan (6.1%), and Saudi Arabia (6.0%).

-

Chilled chicken: This segment represents 20.6% of chicken imports worldwide, though importers generally buy from within their own region. Within Europe, the biggest importers are the Netherlands (13.3% of global imports of chilled chicken), Germany (12.4%), the United Kingdom (11.7%), and France (10.1%). Mexico and Canada, representing North America, absorb 18.3% and 5.0% of global exports, respectively.

-

Processed chicken: This accounts for the remaining 14.5% of global chicken imports. The world’s biggest importers are Japan (25.0% by volume of all imports of processed chicken), the United Kingdom (19.2%), the Netherlands (8.2%), Germany (6.1%), and France (4.4%).

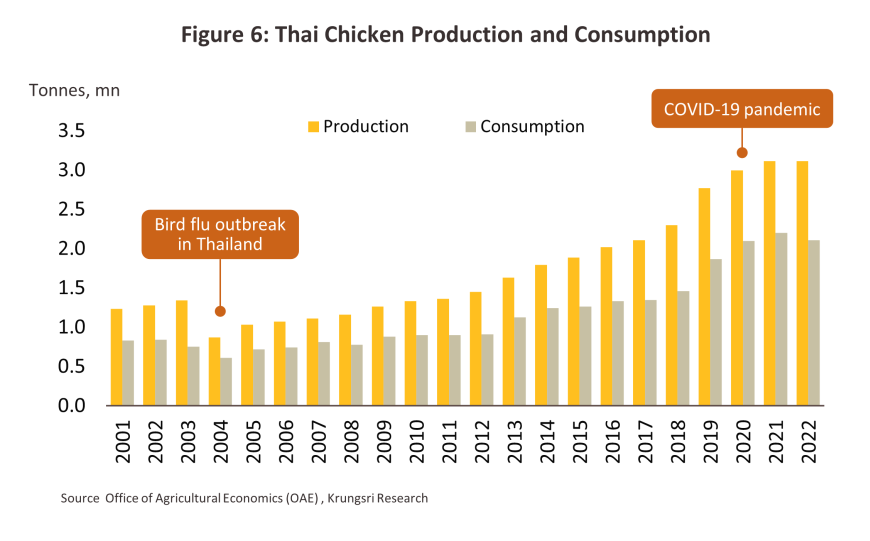

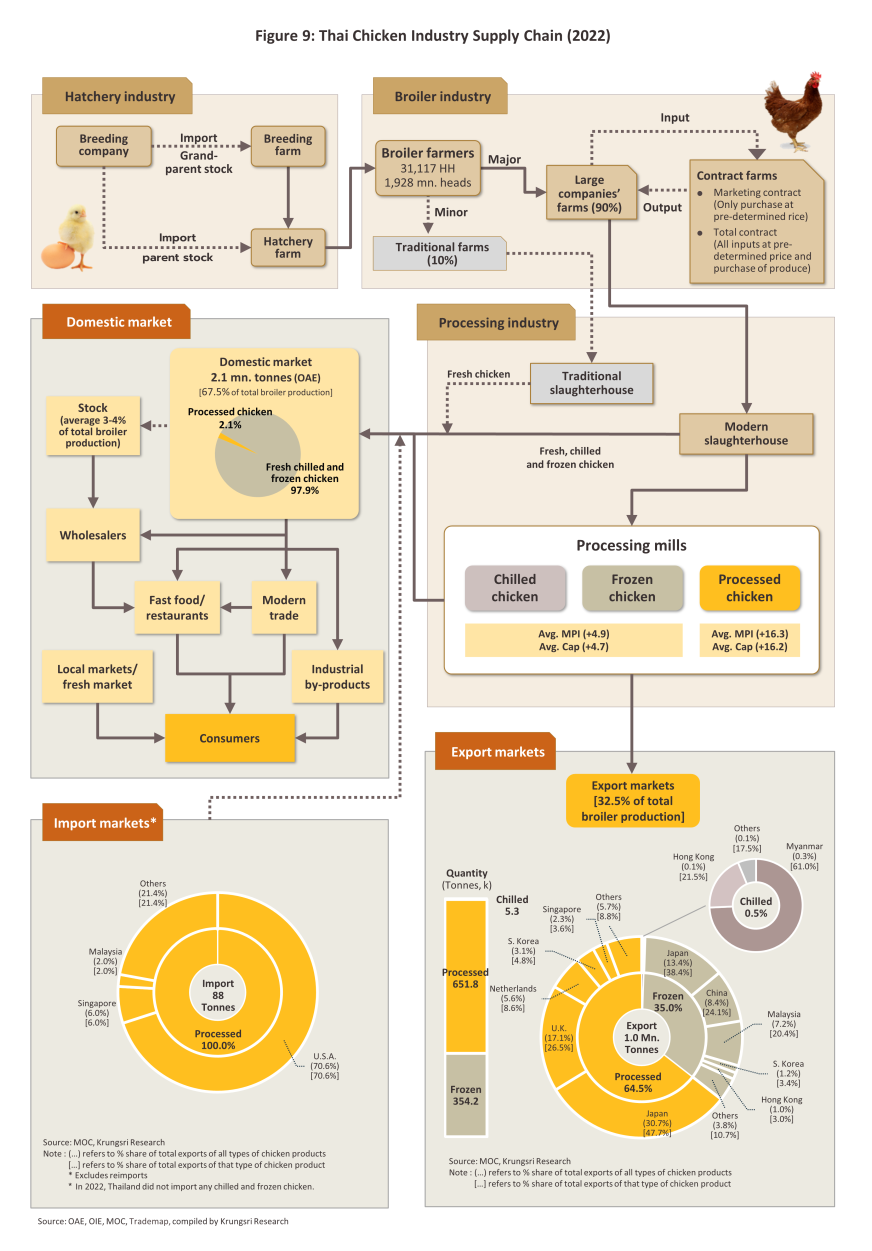

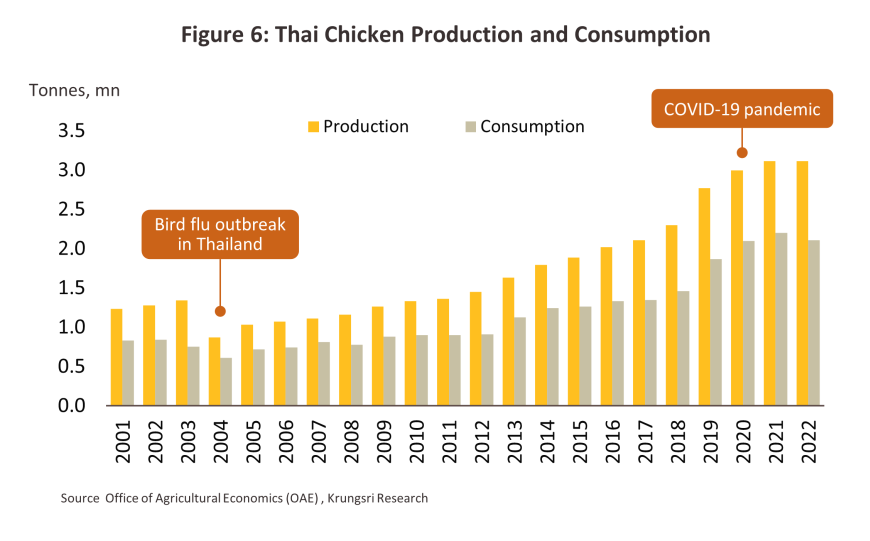

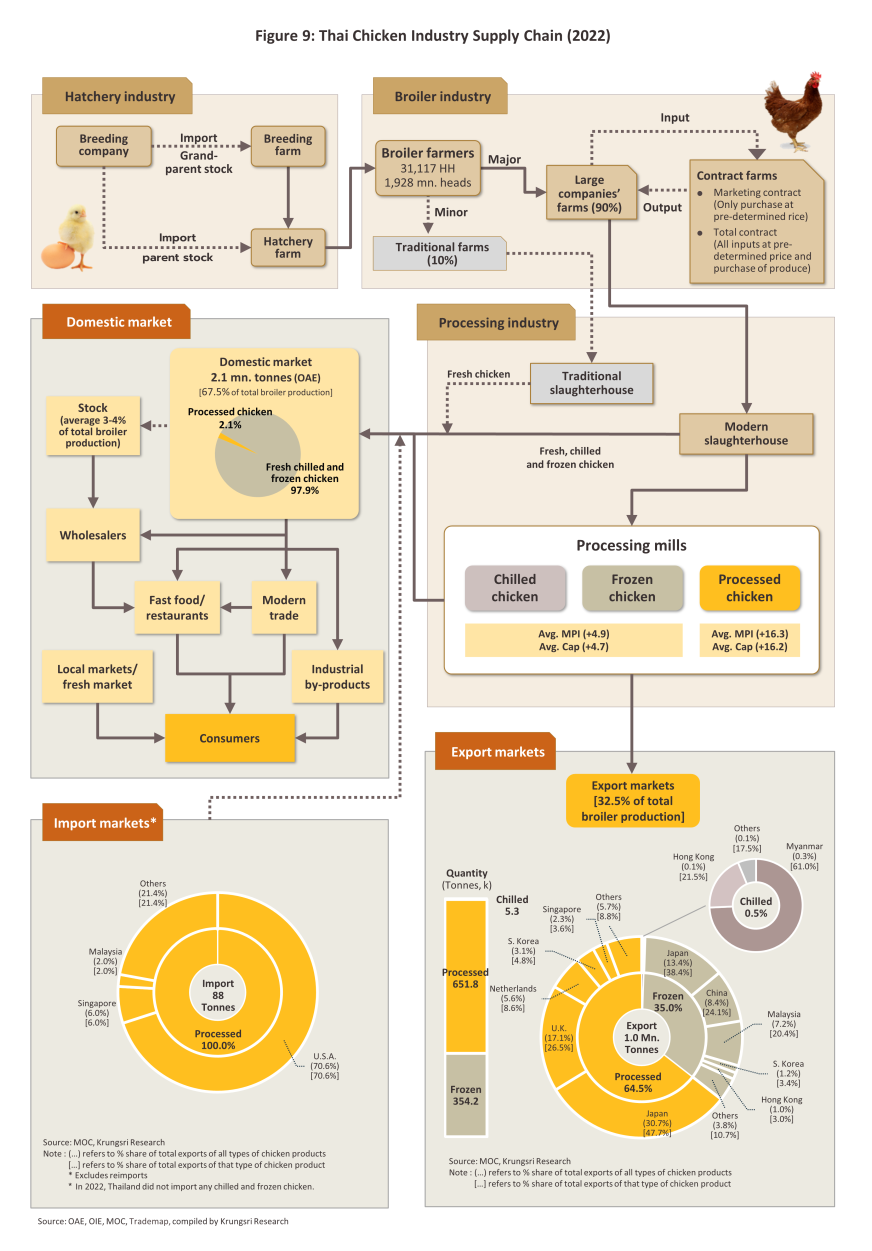

Thai output of chicken products totaled 3.1 million tonnes in 2022, of which 67.5%, or 2.1 million tonnes, was distributed to the domestic market (Figure 6), largely as fresh filleted products. The remainder of national output was then processed into chilled and frozen chicken goods, mostly for export. Indeed, by value, Thailand is the world’s biggest exporter of processed chicken and its 6th biggest exporter of frozen chicken (source: Trademap, 2022).

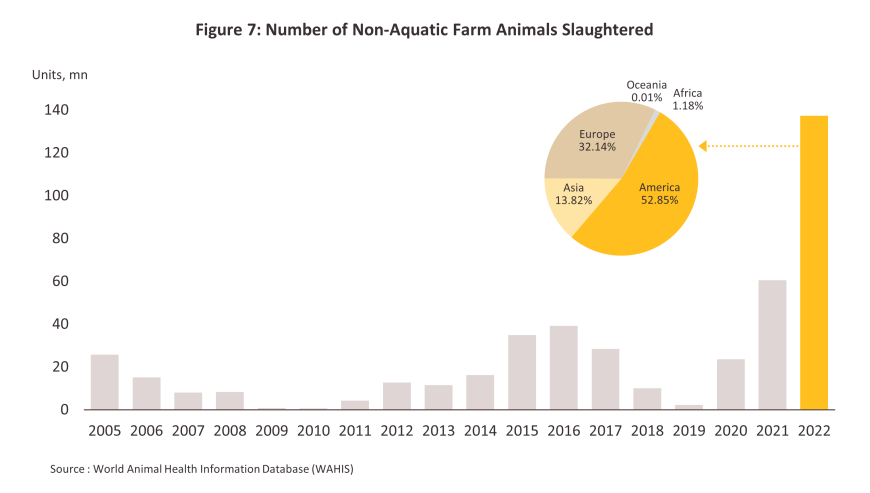

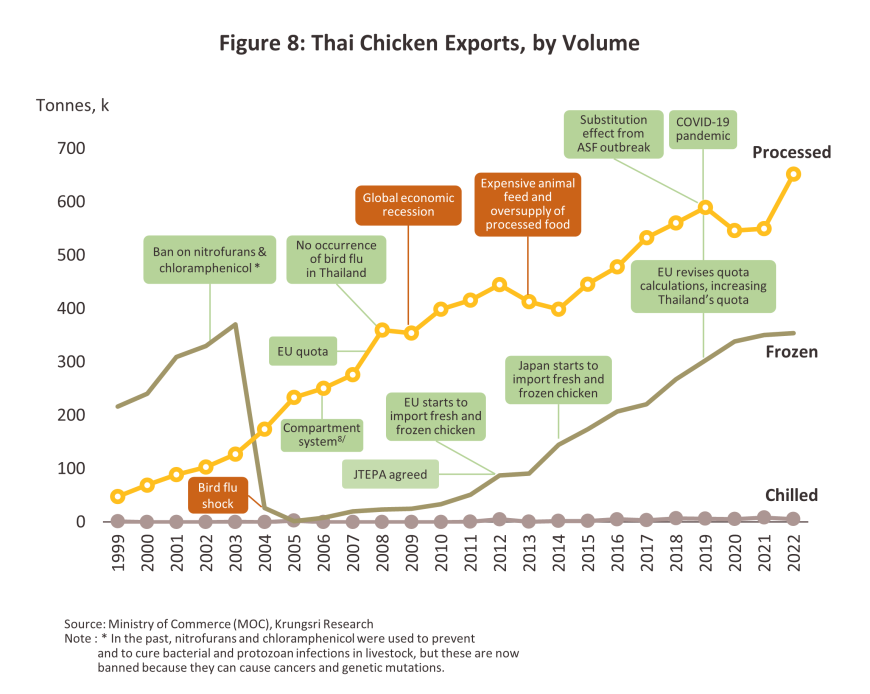

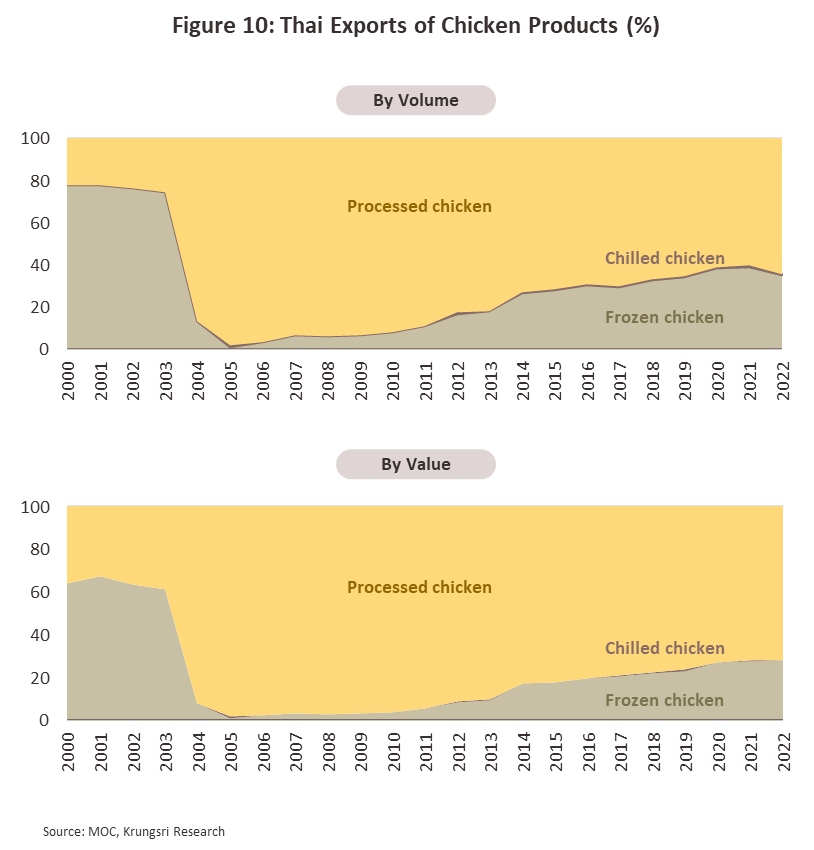

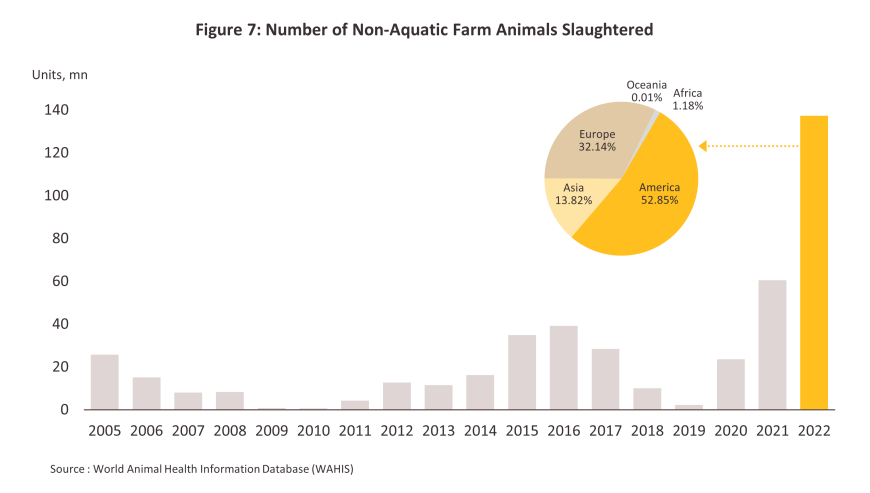

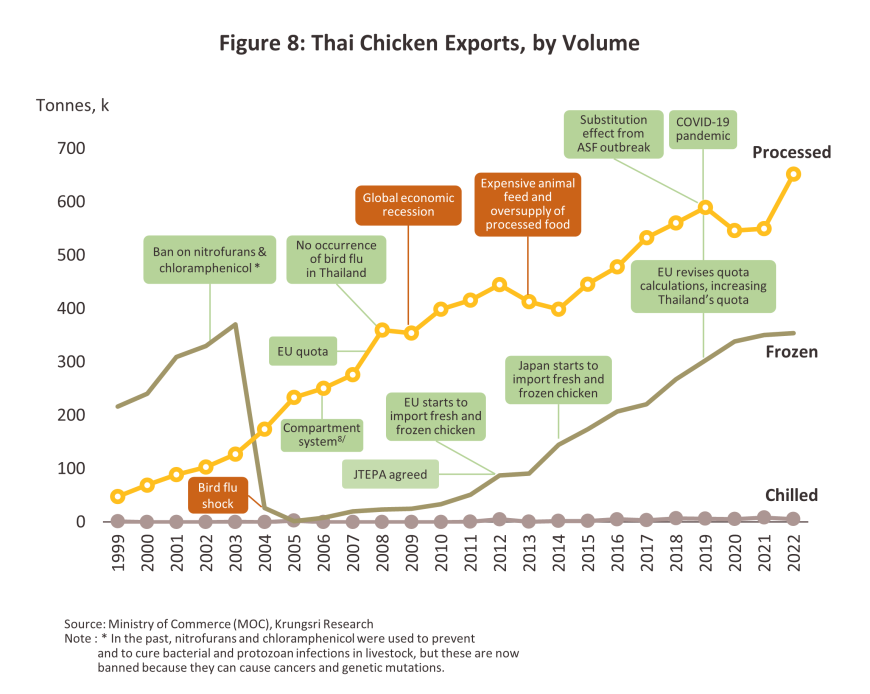

The export market has undergone significant changes since 2004, when Thailand was affected by a major outbreak of bird flu4/. As a result of concerns over possible infection and thus of the safety of raw chicken originating in Thailand, imports by Japan, Germany, South Korea, and China (a combined 79.5% of exports by volume) were halted. In response to this, Thai players overhauled their operations and placed a much greater emphasis on the production and output of processed chicken, which was still welcomed in Thailand’s export markets5/. This then led to the establishment of processed chicken as the sector’s primary product (Figure 7), and so processed chicken now accounts for 64.5% of all Thai exports. As of 2022, Thailand had a 26.9% share of the global market for processed chicken products.

The market for exports of frozen chicken returned to a more positive state after 2011 with the abating of the bird flu outbreak. In addition, the development of evaporative air-cooling systems (EVAPs)6/ for use on Thai chicken farms also helped to cut infection rates, in particular in flocks managed by the major players and on contract farms7/. The introduction of the World Organization for Animal Health’s compartment system8/ was another important factor helping to support the industry, and as such, despite periodic outbreaks elsewhere, no cases of bird flu have been reported in Thailand since 2007 (Figure 7). This then helped to significantly boost exports of frozen chicken to the EU from 2012, and from 2014, to Japan (Figure 8), though sales to the latter were helped further by the signing of the JTEPA agreement. As such, exports of Thai frozen chicken products surged by an annual average of 20.6% over the period 2011-2022, and this then helped Thailand expand its global market share to 2.8% and to lift the country into 6th place in the world ranking of exporters (up from a 0.5% share of the global market and 17th place in 2011). This rapid expansion was helped by: (i) the lifting of restrictions on the import of frozen chicken by Thailand’s trade partners; and (ii) outbreaks of bird flu in other exporting nations, including the US and Europe. Exports of processed chicken products also rose through this period, though this was at the lower rate of 3.1% per year over 2011-2022. Overseas sales have been boosted by confidence in the safety of closed EVAP-style farms operated by the major Thai players, and at present, the most important export markets for Thai processed chicken are Japan, the ASEAN region, and the EU. Sales have also been helped by the exit of the UK from the EU and the resulting changes to quotas for imports of chicken products from Thailand; these now stand at 0.19 million tonnes for imports to the EU and 0.13 million tonnes for those to the UK, giving a total allowance of 0.32 million tonnes, compared to the earlier pre-Brexit quota of 0.27 million tonnes.

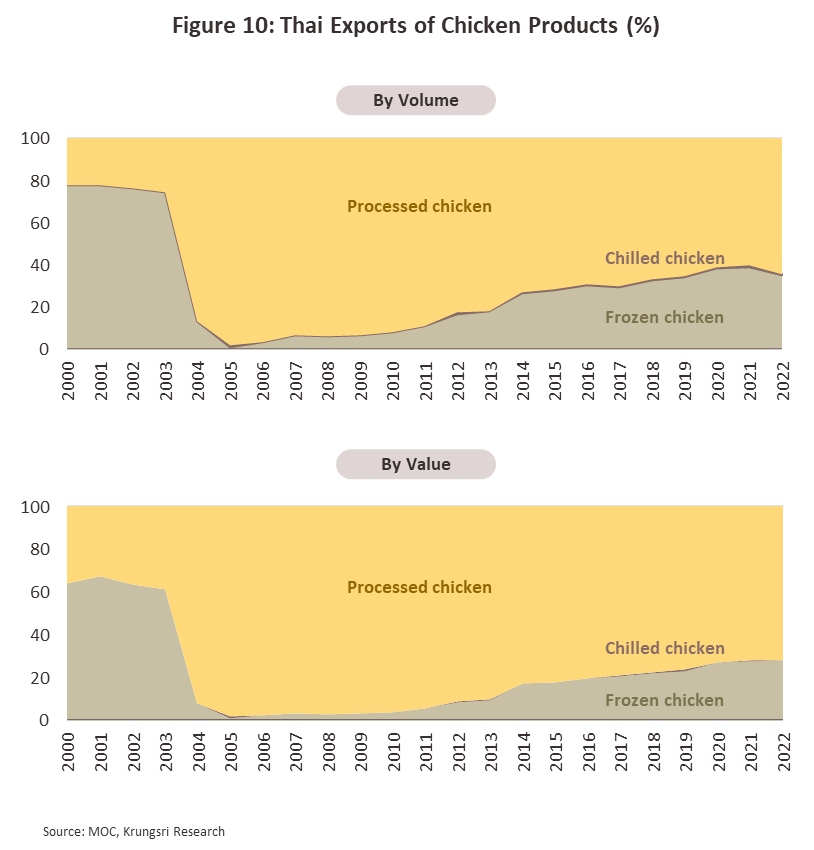

By volume, Thai exports of chicken products are split 64% processed goods, 35% frozen products, and 1% chilled items (data correct as of 2022) (Figure 10). The main export markets are Japan, which buys mostly processed and frozen chicken, and the EU, which imports processed chicken. Thailand’s main competitor is Brazil, the world’s biggest exporter of frozen chicken. Details of individual product categories follow.

-

Processed chicken: This accounts for 64.5% of all exports of chicken products from Thailand. The main markets for these goods are Japan (47.7% of all exports of processed chicken), the United Kingdom (26.5%), the Netherlands (8.6%), and South Korea (4.8%).

-

Frozen chicken: 35.0% of chicken exports are of frozen goods, and these go principally to Japan (38.4% of all exports of frozen chicken products), China (24.1%), Malaysia (20.4%), and South Korea (3.4%).

-

Chilled chicken: Only 0.5% of Thai chicken exports are of chilled chicken products, and the main markets are all bordering or near to Thailand. Thus, Myanmar takes 61.0% of exports of these, followed in importance by Hong Kong (21.5%), Cambodia (7.1%), and Singapore (6.9%).

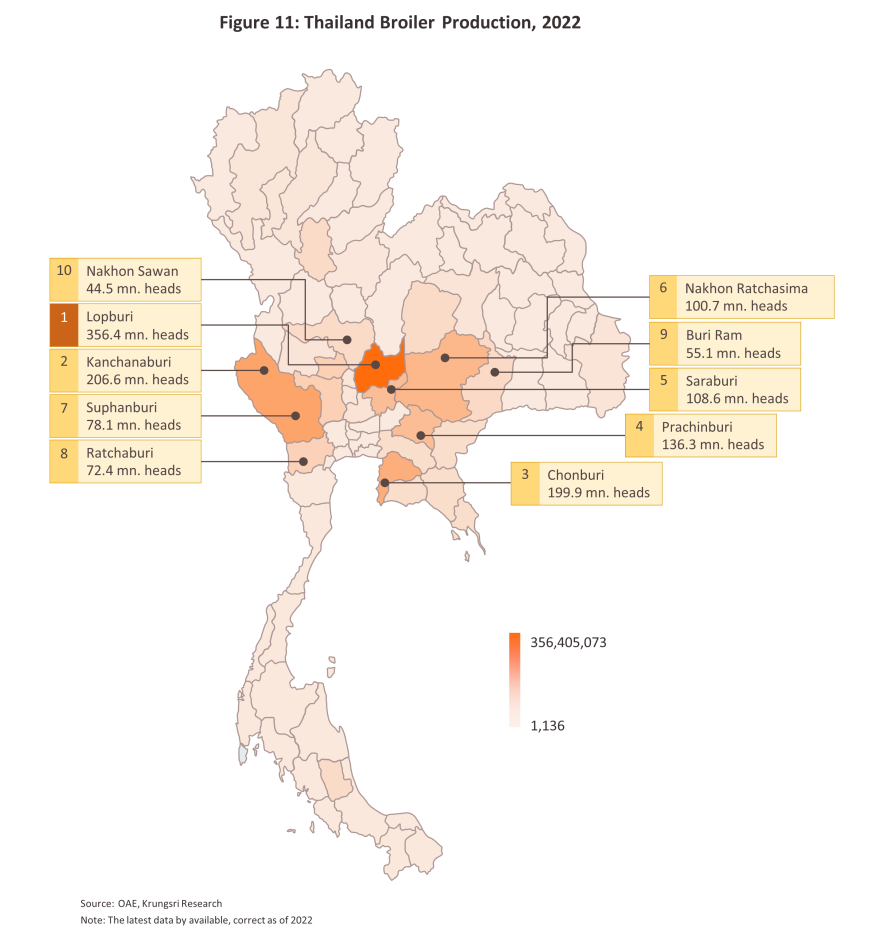

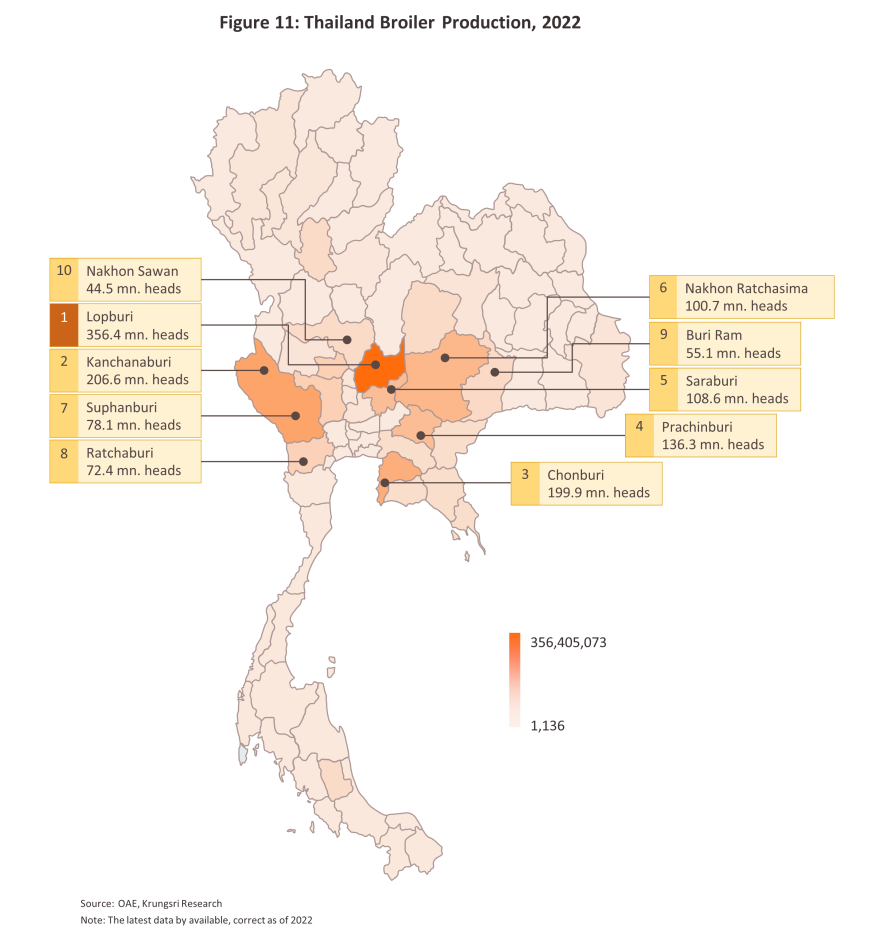

In 2022, output totaled 1.93 billion broilers9/. Around 90% of this was produced by large companies, which typically invest in operations across the length of the supply chain, from upstream production of animal feed, through chicken raising (both via their own, directly managed operations and via independent farmers that operate under contract farming arrangements) to slaughterhouses and downstream food processing plants that operate according to recognized standards. This gives large players advantages concerning their more efficient cost control and their greater economies of scale. Small operations account for the remaining 10% of production, almost entirely dependent on the domestic market (Figure 9). In terms of the geographical distribution of flocks, these are overwhelmingly found in the central region (the source of 72.1% of all chicken produced in Thailand), followed by the northeast (12.6%), the north (8.7%) and the south (6.6%), while by individual province, Lopburi is the most important source of production (18.5% of all national chicken output), followed by Kanchanaburi (10.7%), Chonburi (10.4%), Prachinburi (7.1%) and Saraburi (5.6%) (Figure 11).

Thai operations benefit from the skill of the local workforce, their access to manufacturing technology, their use of modern production techniques, their ability to develop products that effectively meet market demand, the high standards of their farms, and their success in controlling and preventing outbreaks of disease. Beyond this, the fact that Thailand has agreed FTAs10/ with many of its trading partners has also helped to strengthen the competitiveness of Thai operations and widened markets for Thai chicken products.

Situation

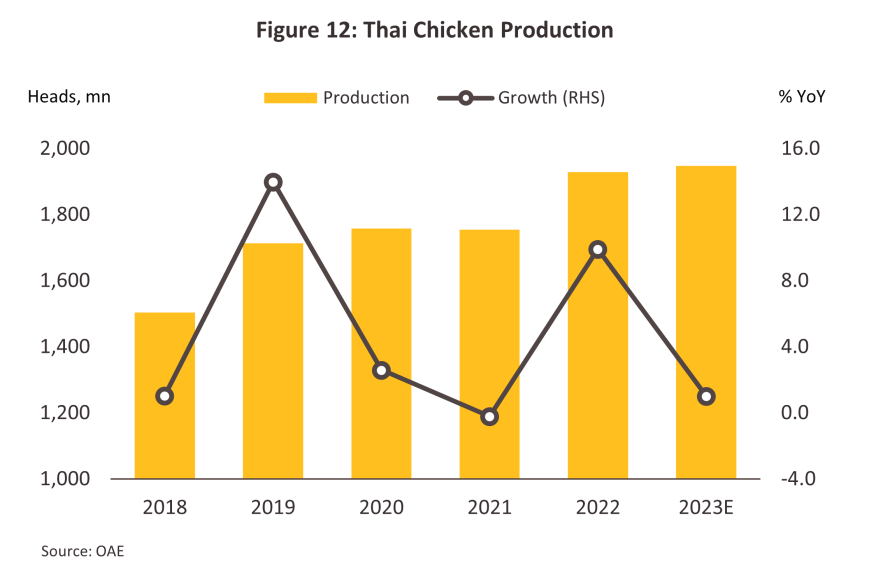

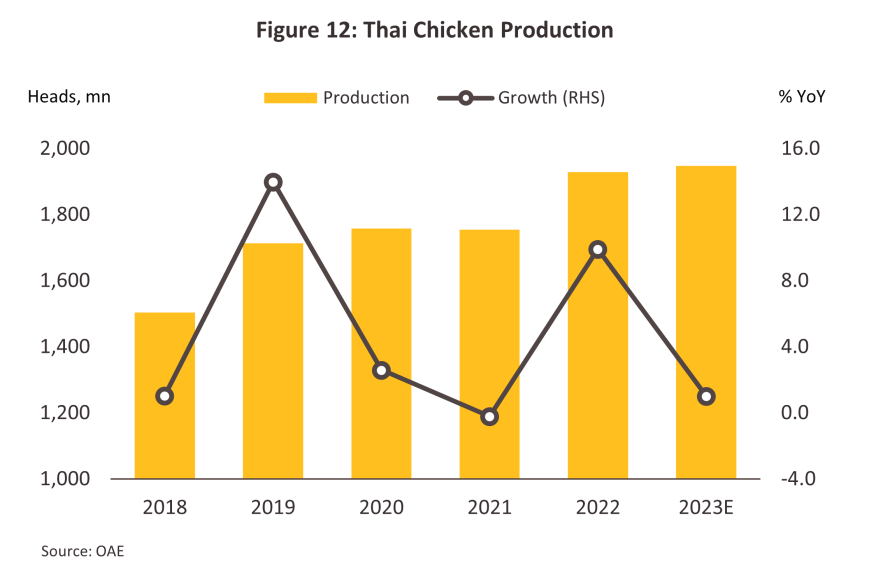

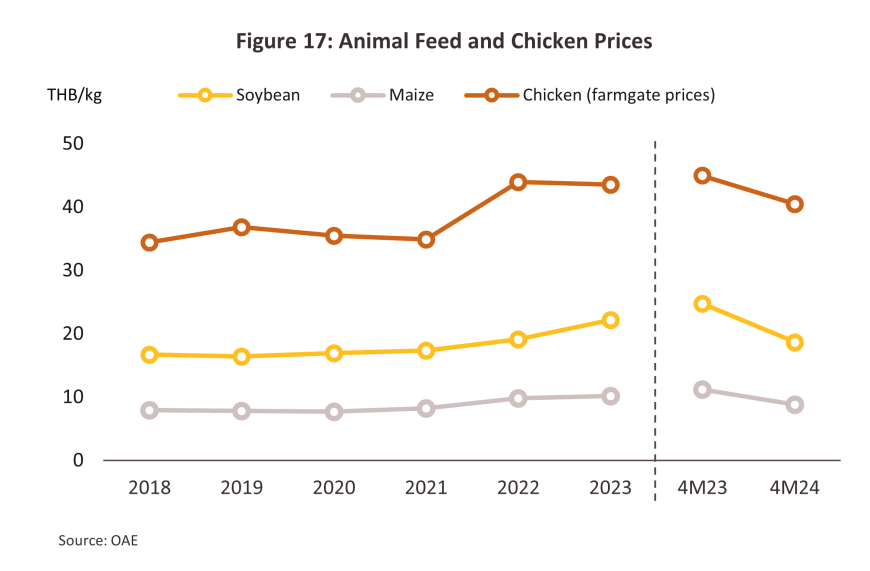

In 2023 output edged up from 2022’s 1.93 billion broilers to 1.95 billion (Figure 12). This 1% increase was mirrored in a similar rise in meat yields, which went from 3.12 to 3.15 million tonnes. Supply was sustained by the incentive effects of higher prices, and at THB 43.6/kg, these compared favorably to the THB 37.1/kg averaged over 2018-2022.

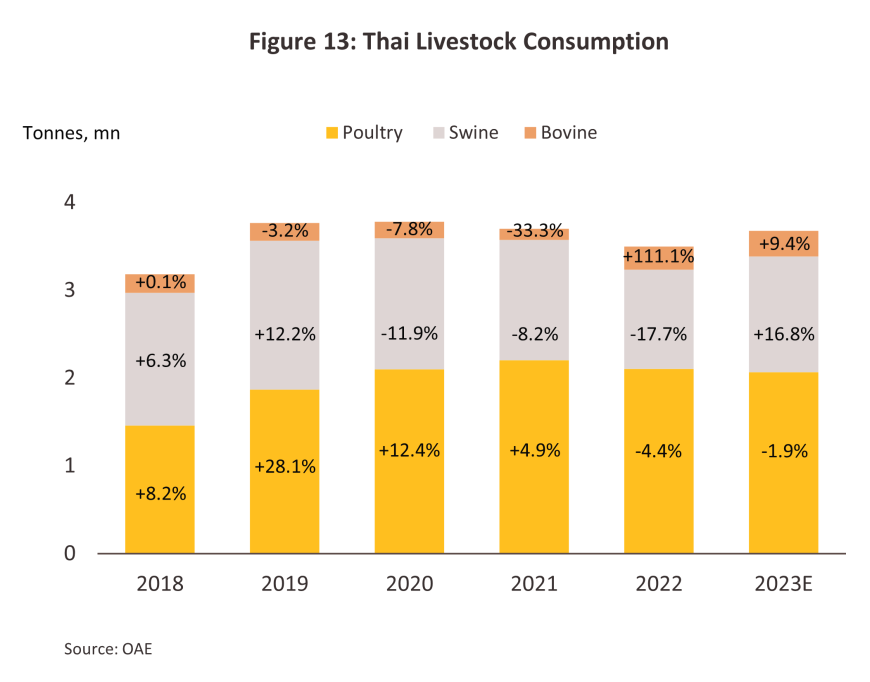

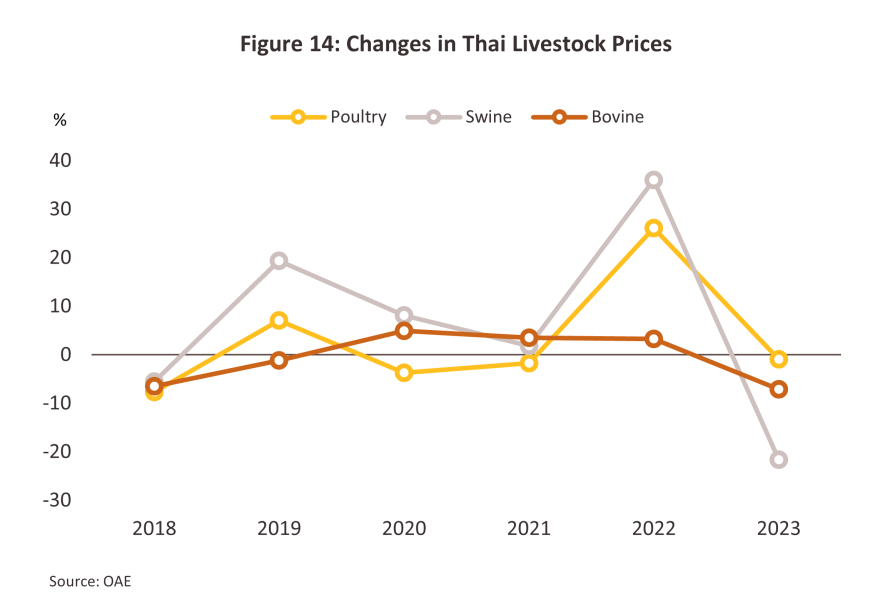

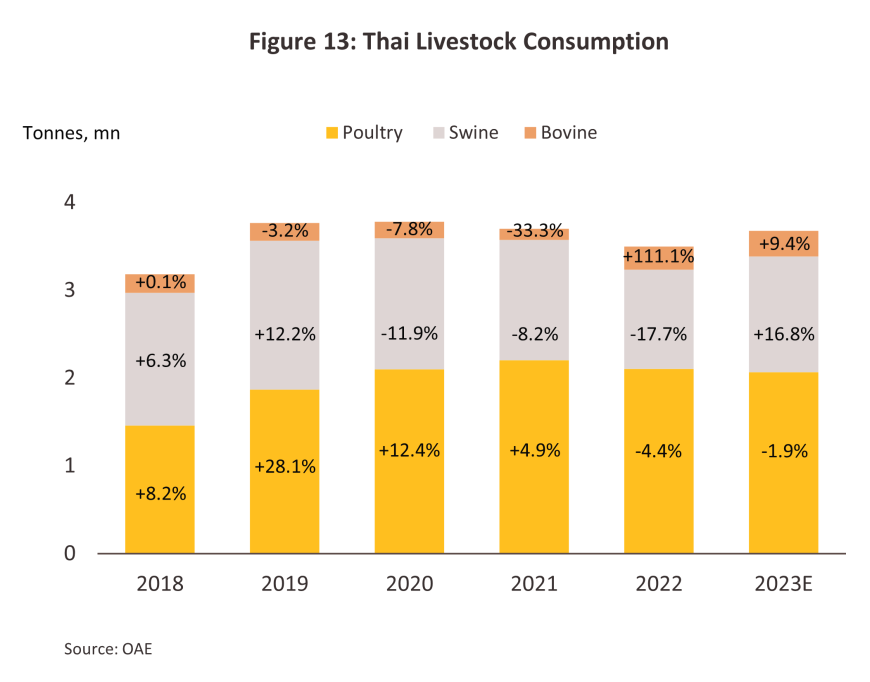

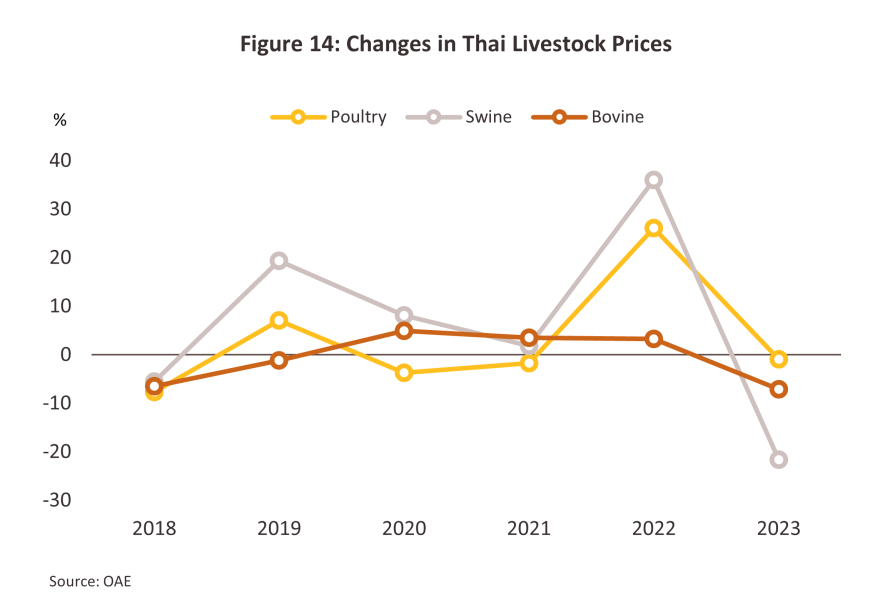

However, domestic consumption moved in the opposite direction, contracting from 2.10 to 2.07 million tonnes in 2023 (down -1.9%). Demand was undercut by falling prices for alternative non-aquatic meat protein (Figure 13 and Figure 14) and by increased consumer confidence in these alternatives, especially for pork following the abating of worries over the spread of African swine fever (ASF).

2023 farm gate prices inched down -0.9% to THB 43.6/kg as a result of the knock-on effects of an increase in the supply of alternative meats. In particular, supplies of pork expanded following the ending of worries over ASF and an uptick in smuggled pork and beef. Given this, farmgate prices for the latter two fell by respectively -21.6% and -7.1%, and this then put downward pressure on chicken prices, though the effects of this were somewhat limited by comparison (Figure 14).

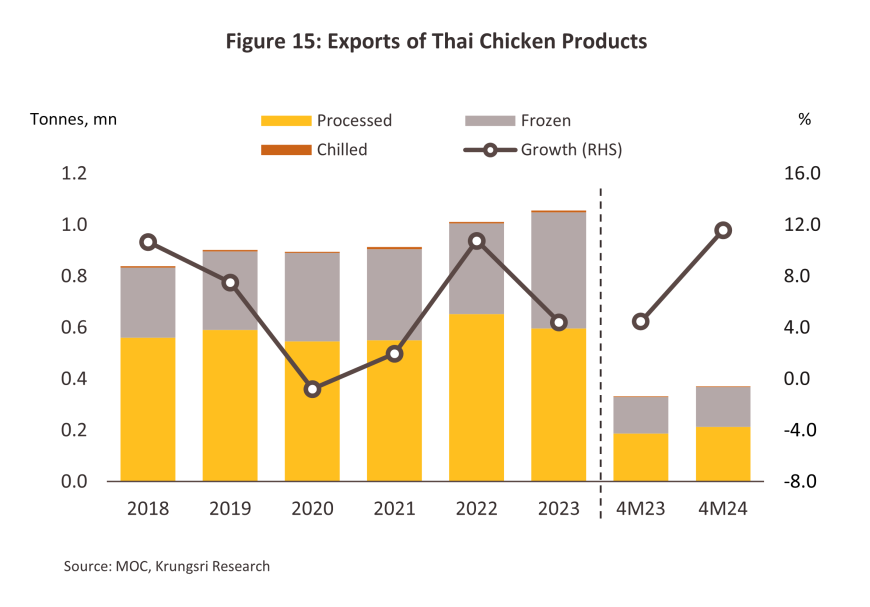

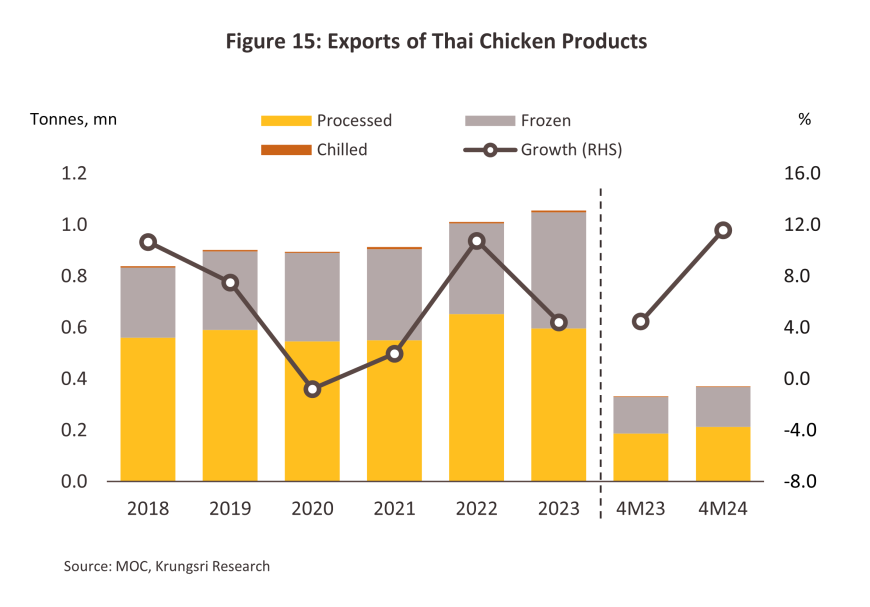

In contrast, exports climbed 4.4% to 1.06 million tonnes in the year. With the global economy sluggish, chicken’s market position as a low-cost source of protein appealed to consumers and as a result, sales rose. In addition, continuing outbreaks of bird flu in some countries further supported exports from Thailand. However, these increases in sales volume were almost completely wiped out by the -4.1% slide in average prices (down to USD 3,865.0/tonne) and so overall export earnings edged up by just 0.2% to USD 4.08 billion. Over 4M24, these tailwinds continued to lift sales, and so exports were up 11.6% YoY to 0.37 million tonnes in the period (Figure 15). Receipts also climbed 4.0% YoY to USD 1.35 billion. The situation in individual segments is described below.

-

Chilled chicken: Exports surged 44.6% to 7,600 tonnes in 2023, though with export prices dropping -5.2% to USD 2,314.1/tonne, earnings rose at the slightly slower rate of 37.1% to reach USD 17.6 million. Overseas sales were helped by the reopening of border crossings, which then boosted sales into important regional markets, most notably Myanmar (+63.3%) and Lao PDR (+382.3%). However, prices have continued to soften over 4M24, and so these are now down -7.0% YoY to an average of USD 2,043.3/tonne. Declines are being driven by the falling cost of animal feed, but government efforts to boost cross-border cooperation, especially with Lao PDR11/, lifted exports 1.9% YoY to 2,600 tonnes, although receipts were still down -5.3% YoY to USD 5.2 million.)

-

Frozen chicken: Exports jumped 27.8% to 452,800 tonnes but with average export prices softening -8.4% to USD 2,923.1/tonne, export earnings rose at the slower rate of 17.0% to reach USD 1.32 billion. Sales have benefited from the ending of the Covid-19 pandemic and the resulting uptick in eating out, which has then shifted demand away from more expensive processed chicken products and towards lower cost frozen chicken, while continuing outbreaks of virulent strains of bird flu in some export markets have also diverted demand to Thailand. Export markets seeing the strongest growth include Japan (+22.2%), Malaysia (+31.3%), and South Korea (+160.5%). Over 4M24, export volume continued to increase, reaching 154.9 thousand tons (+9.2% YoY). The overall export value saw only a slight increase to 422.5 million USD (+0.4% YoY) due to the average export price dropping to USD 2,726.9/tonne (-8.0% YoY). Declining prices led to a significant increase in imports from key trading partners like Japan (+14.7% YoY) to serve demand from the higher number of international tourists visiting their country12/.

-

Processed chicken: Export prices rose 2.3% to USD 4,600.5/tonne in 2023, and this then helped to shrink export volume -8.6% to 595,900 tonnes. Demand also softened on sluggishness in the global economy and the impacts of this on consumer spending power, and thus export earnings slipped to USD 2.74 billion (down -6.5%). However, export volume returned to growth of 13.6% YoY to 212,800 tonnes over 4M24 and this boosted earnings by 5.7% YoY to USD 926.8 million. Sales benefited from the -6.9% YoY softening in average prices to USD 4,356.1/tonne, and this then supported an increase in sales to Japan of 6.6% YoY and to the EU of 19.4% YoY. In addition, Thai companies have been able to boost sales by opening up new export markets, the most important of which include sales into Muslim markets in the middle east that Thai players are entering in cooperation with Saudi Arabian companies13/.

Outlook

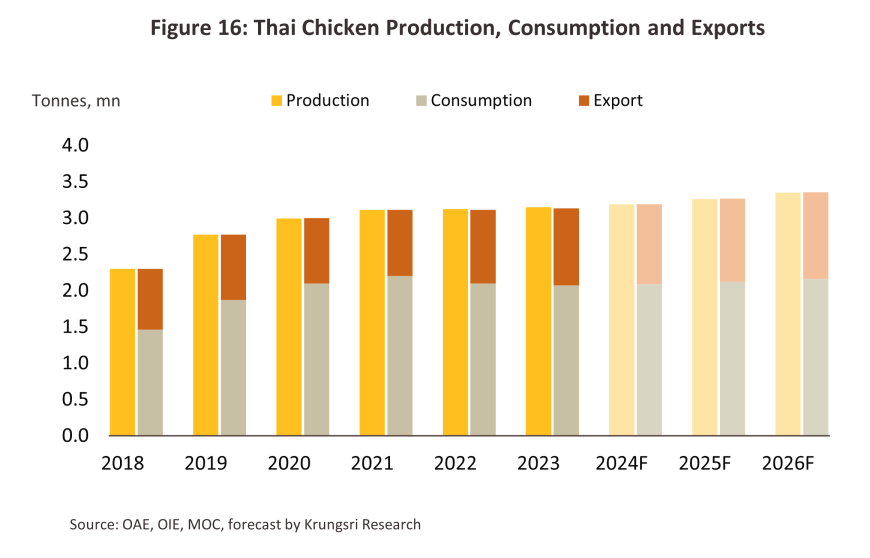

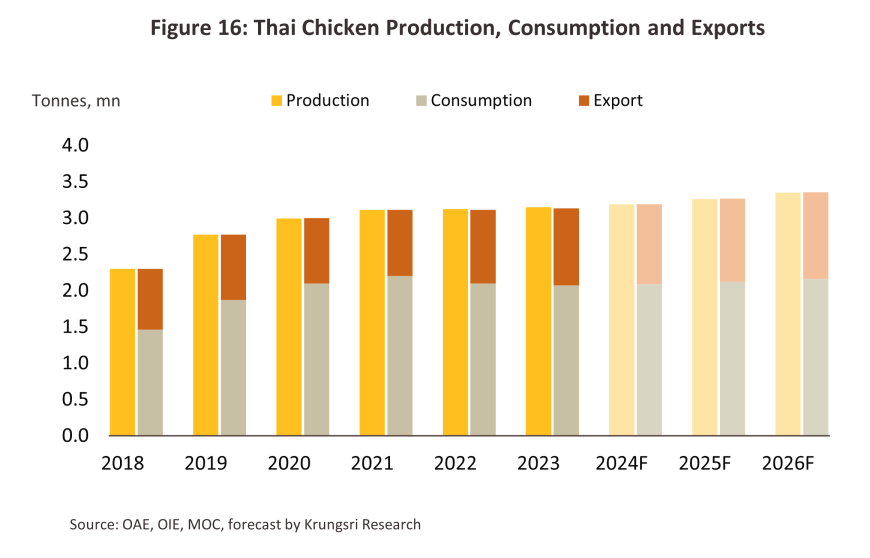

Output is forecast to rise by 2.0-3.0% per year over 2024 to 2026, bringing this to somewhere between 1.99 and 2.10 billion broilers annually. This would then translate into a 1.5-2.5% increase in meat production, thus raising this to 3.19-3.35 million tonnes (Figure 16). This overall positive outlook will be supported by strengthening demand at home and abroad.

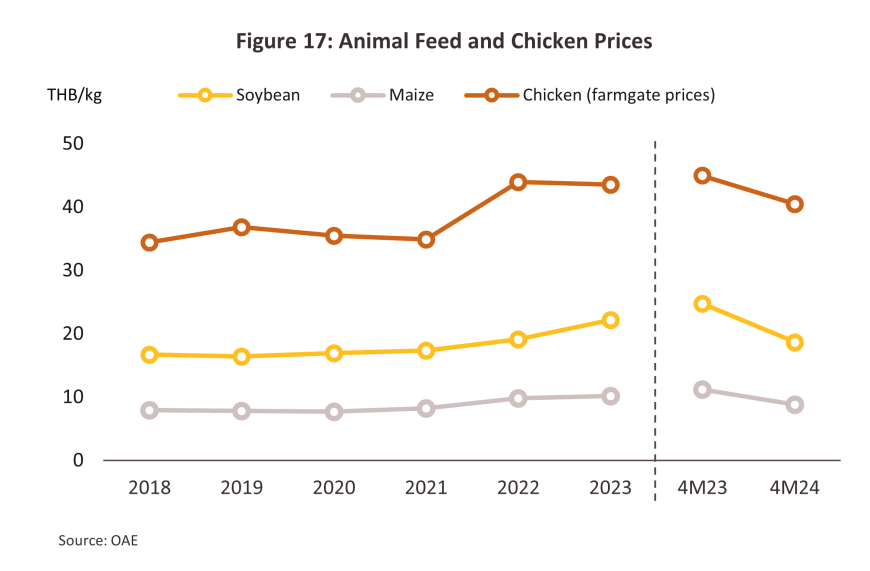

Domestic consumption will increase by an average of 1.0-2.0% annually (Figure 16) on: (i) high levels of household debt and only slowly strengthening spending power that is encouraging consumers to buy cheaper products; (ii) health trends that are encouraging shoppers to consume high-protein foods; (iii) continuing recovery in the tourism sector, which is then lifting the restaurant trade and boosting overall levels of domestic consumption; and (iv) The price of chicken meat is expected to decline following the trend of decreasing animal feed costs, due to an increase in the supply of animal feed raw materials both domestically and internationally. Additionally, the demand for meat in China has decreased due to the slow recovery of the economy, prompting China to release more animal feed raw materials, such as soybeans and animal feed corn, into the global market. As a result, farmgate chicken meat prices have decreased by -9.9% YoY in the first four months of 2024 (Figure 17).

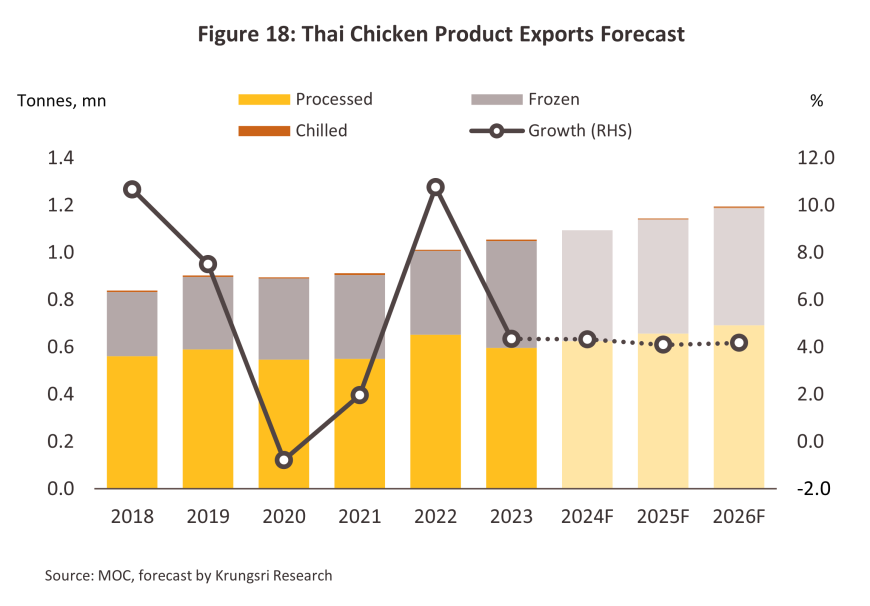

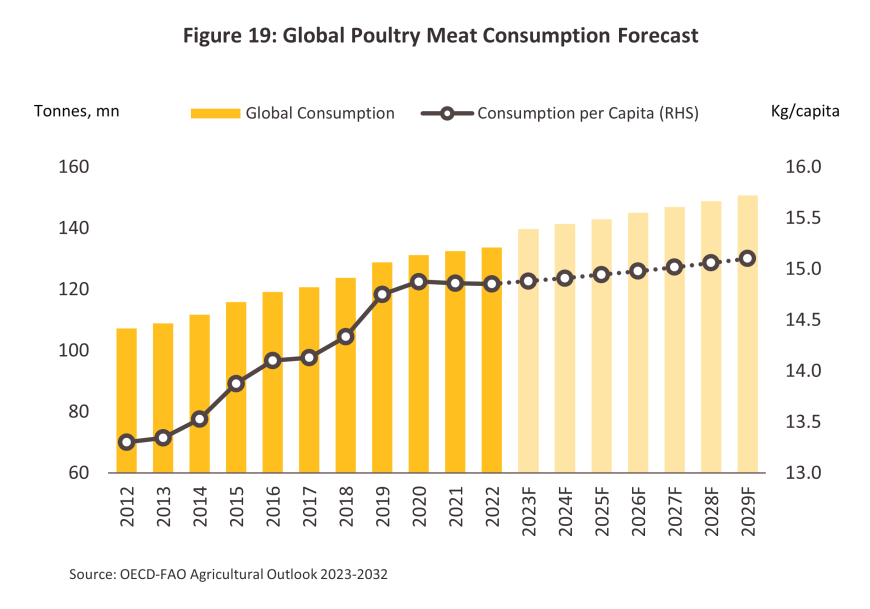

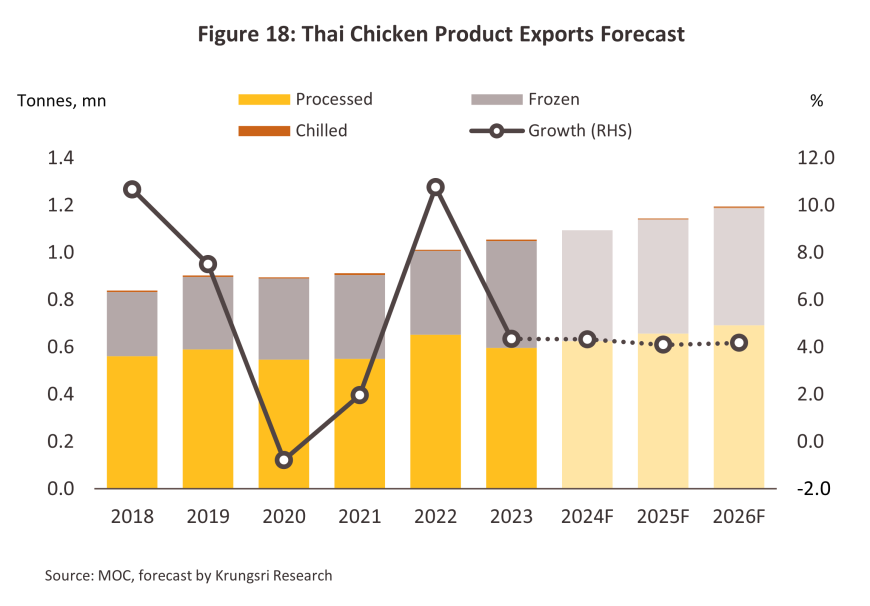

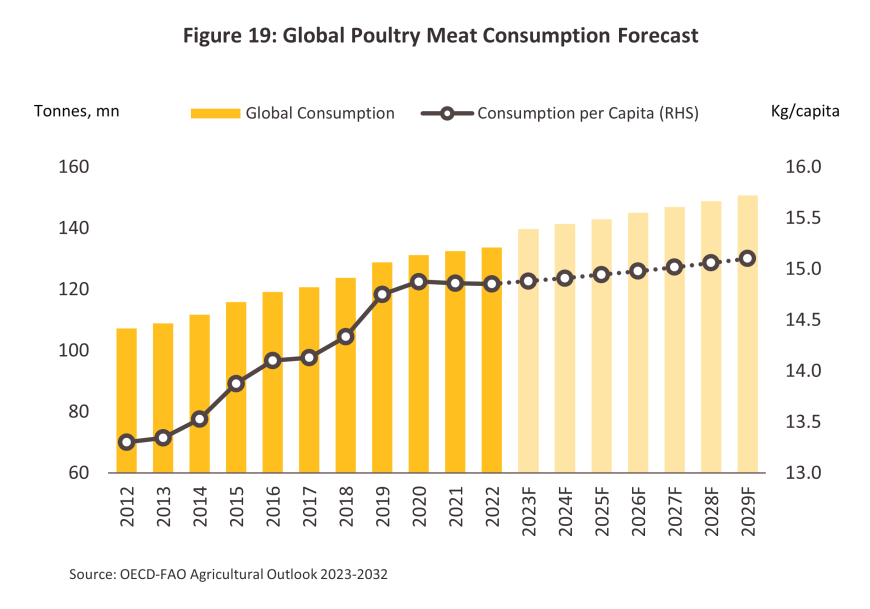

Exports volume is expected to grow 3.5-4.5% annually (Figure 18), to serve growing demand. The OECD-FAO forecast that global demand for chicken will rise by 1.3% annually, thereby climbing from 2023’s 140 million tonnes to 141-145 million tonnes over 2024 to 2026 (Figure 19). Export growth will be driven by: (i) increased cooperation with players in the Middle East looking to expand sales of processed chicken into halal food markets, and stronger sales of chilled and frozen chicken in neighboring countries (e.g., Lao PDR and Malaysia), which will widen the distribution channels available to Thai operators; (ii) the underwhelming performance of the global economy and the positive effects of this on purchases of low-cost protein; (iii) chicken’s low levels of fat compared to most other sources of meat, which makes it a good match for current consumer tastes and concerns about personal health; and (iv) the trend of price reduction is conducive to demand in the export market.

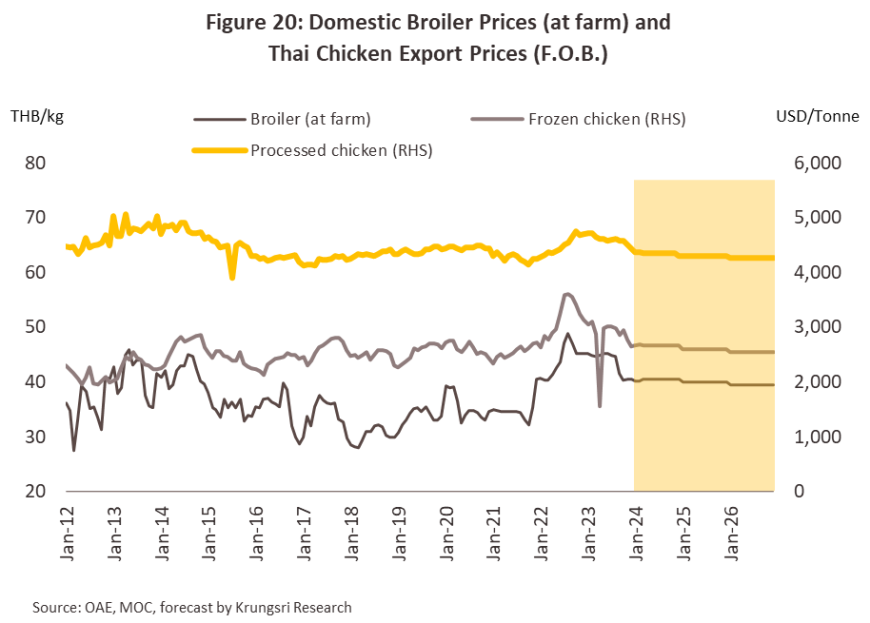

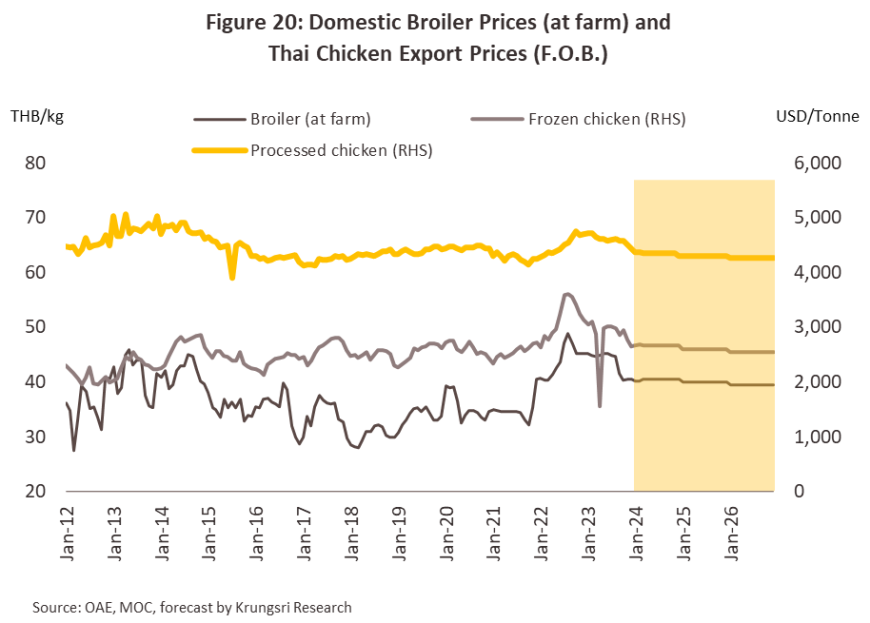

Per-tonne prices for frozen and processed chicken are expected to slip from averages of USD 2,759.6 and USD 4,600.5 to respectively USD 2,500-2,700 and USD 4,200-4,400 over 2024 to 2026 (Figure 20). This will result from the transition to La Niña conditions across the region, which will then support stronger yields of the inputs used to make animal feed, lowering the cost of the latter and allowing farmers to cut chicken prices.

Nevertheless, the industry will continue to face a number of challenges that will drag on growth in export markets.

-

China has lifted anti-dumping measures targeting imports of Brazilian chicken that had kept tariffs on these at 17.8% to 34.2%, and so from 17 February onwards, these measures are no longer in effect14/. This thus now makes low-cost Brazilian imports much more attractive, and with the Chinese economy under-performing and spending power rising only slowly, importers sourcing goods will likely be most influenced by price15/.

-

Efforts are underway to extend the Mercosur free trade agreement, which covers South America’s largest economies (Brazil, Argentina, Paraguay, and Uruguay), to include the new Asian export markets of China, Japan and South Korea16/. Alongside this, Brazil is negotiating a free trade agreement with the EU, and success in either or both of these endeavors would give Brazil a significant competitive advantage in global chicken markets. Unfortunately, since the country is the world’s most important supplier to these, this would add to the competitive pressures that Thai producers have to fight against. This would be particularly problematic in the market for frozen chicken products.

-

In response to the extended Ukraine-Russia war, the EU is temporarily waiving the duties normally placed on imports to the bloc of Ukrainian chicken, one of Ukraine’s more important exports to the EU. These measures had previously been in place and were due to expire in June 2024, but EU authorities have agreed to extend the waiver for another year, meaning that the measures will now run until 5 June, 202517/. However, this is likely to be their final extension. The exemption is now expected to be replaced by a quota allowing duty-free imports of 160,000 tonnes annually (currently, imports of chicken to the EU from Ukraine average around 100,000 tonnes per year). Because the EU is an important market for Thai producers, this will add to the competitive pressures faced by exporters18/.

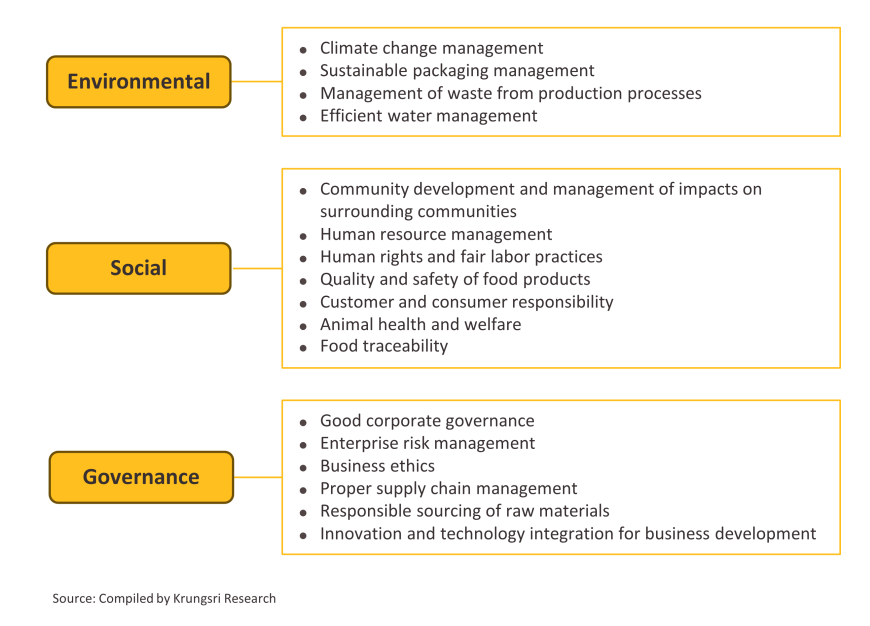

Sustainability

-

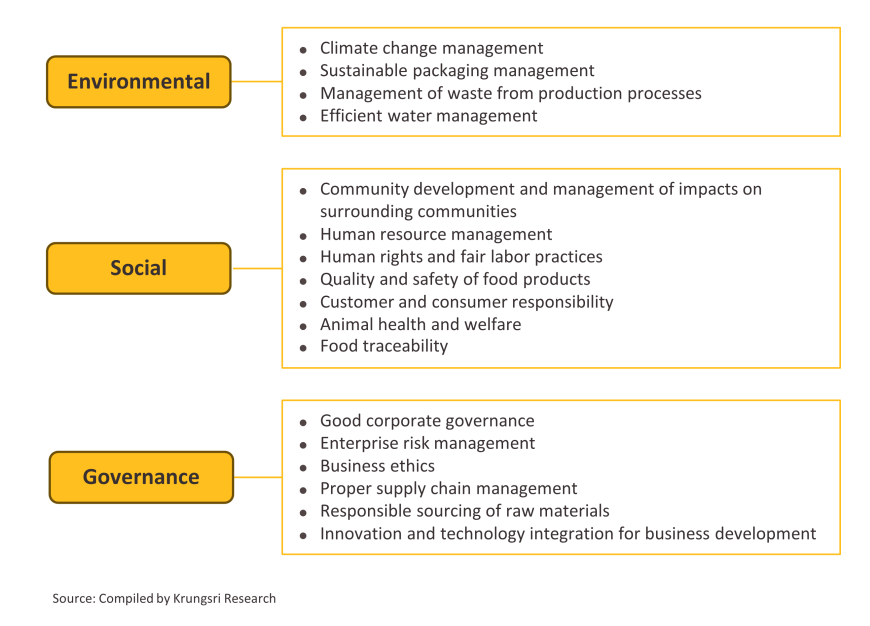

Environment: Players will move to cut their greenhouse gas emissions through: (i) the switch to renewables (e.g., solar, biomass and biogas) and efficiency gains in the machinery used in their production processes; (ii) cutting waste through greater reuse of materials and an increased focus on environmentally friendly packaging; and (iii) offsetting emissions by, for example, participating in community reforestation schemes.

-

Social: Companies will increase their participation in community and social development programs. This will include: (i) providing assistance to communities, for example by using organic waste to improve soil fertility in the local area and to cut the production costs borne by local farmers, and improving income to local communities, for example by employing people with disabilities or helping these individuals to live independently; (ii) providing additional benefits to staff by extending the coverage of these to their families, laying on ongoing personal development for employees, and ensuring that human rights are maintained and that all individuals are treated fairly and equally; (iii) ensuring that the highest production standards are always maintained and that products are free of adulterants; and (iv) maintaining the five core principles of animal welfare19/.

-

Governance: Players in the chicken industry will focus on good governance to ensure that the interests of all stakeholders are maintained. This will involve: (i) ensuring that conflicts of interest do not arise, and that corruption is opposed across the board; (ii) effective management of risk related to the climate, water, natural disasters and other threats; and (iii) maintaining the highest ethical standards and acting with full responsibility towards all stakeholders.

-

The most important cost center for producers is animal feed, and because this accounts for around 70% of all production costs, advances in feed production processes can make significant contributions towards improved sustainability. At present, research on alternative sources of protein is therefore focused on the use of black soldier fly larvae20/ in place of soy21/ since production of the latter is linked to deforestation and in addition, supply may be disrupted by climate change. Fly larvae can also help to accelerate the breakdown of waste organic material and its conversion into compost22/.

1/ Based on the animal’s protein conversion efficiency (PCE) and its energy conversion efficiency, i.e., how efficiently the animal converts food obtained from vegetable or animal sources into body mass. Chicken ranks highest on this score, followed by pork and then beef (source: Alexander et al. and information available online from Our World Data).

2/ The feed conversion rate (FCR) refers to the ratio of the animal weight to the weight of its feed. Chicken farming typically produces 1 kilogram of product per 1.9 kilograms of feed, whereas producing 1 kilogram of pork and beef requires respectively 3.8 and 8 kilograms of animal feed (source: Statista).

3/ Source: OECD-FAO Agricultural Outlook 2023.

4/ Bird flu is caused by an avian virus but the severity of the illness depends on the particular strain. The H5N1 and H7N9 strains are potentially serious variants that can infect humans who are in close contact with infected flocks.

5/ Research shows that the bird flu virus cannot survive temperatures above 70 degrees Celsius so cooking chicken through frying, boiling, steaming, baking or grilling will kill the virus and render the meat safe for human consumption (source: Department of Disease Control, Ministry of Public Health).

6/ EVAP systems are used on farms to provide a closed temperature- and humidity-controlled environment for the raising of commercial livestock. The use of these systems helps to reduce the risk of infection and death from communicable illnesses, although they also have the advantage of allowing for higher stocking ratios, raising average animal weight and providing protection against infestation by animals and insects that can act as disease vectors.

7/ Under contract farming arrangements, independent farms are contracted to produce chickens for large agribusinesses. The latter supply the smaller contracting farm with technology and support, and agree to buy a fixed quantity of chickens.

8/ compartment system was developed by the World Organization for Animal Health (OIE) to help maintain comprehensive hygiene and biosecurity standards in the food processing industry.

9/ Based on the number of chickens being slaughtered annually (source: Office of Agricultural Economics).

10/ Thailand has agreed 14 free trade agreements with 18 countries, and 10 of these allow for the duty-free import of meat products from Thailand, namely Australia, Brunei, China, Indonesia, Japan, Malaysia, Myanmar, New Zealand, Singapore, and Vietnam.

11/ Source: Siamrath

12/ Source: Department of International Trade Promotion

13/ Source: Thansettakij

14/ Source: Agenciabrasil.ebc.com.br

15/ Source: USDA Poultry and Products in China

16/ Source: Japantimes

17/ Source: European Parliament

18/ Source: USDA Poultry and Products in Ukraine

19/ These are: (i) freedom from hunger and thirst; (ii) freedom from discomfort; (iii) freedom from pain, injury, or disease; (iv) freedom to express normal behavior; and (v) freedom from fear and distress.

20/ Source: Worldbank

21/ Fly larvae are around 42% protein, slightly less than the 44% found in soy (source: MDPI Scientific Journals, ResearchGate).

22/ Source: FAO

.webp.aspx)