EXECUTIVE SUMMARY

The Thai beverage industry is heavily focused on the domestic market, as 79% of output is consumed within the country. Thanks to the ending of the Covid-19 pandemic and the normalization of economic activity, production, and domestic distribution began to rebound in 2022, but through the first 8 months of 2023, the escalating cost of living, weakening spending power, coupled with the impact of rising costs and increases in the sugar tax weighed on output and consumption. Over 2024 to 2026, however, output should edge up at an average annual rate of 1.5-2.5%, with the domestic market enjoying growth of 3.0-4.0% per year, supported by: (i) the completion of the economic recovery, especially in restaurant, hotel, pub, and bar businesses; (ii) the intensification of the El Niño and the general increase in temperatures; and (iii) ongoing urbanization and expansion in convenience store branch networks. Although the domestic outlook is generally positive, exports will struggle, and growth is expected to come to just 1.5-2.5% annually. Overseas sales will be helped by the reopening of border crossings with neighboring countries and the gradual strengthening of purchasing power in these markets. However, over the past few years, Thai players have increased their investments in production facilities in these countries, and as output from these rises, exports will suffer.

Krungsri Research view

Overall turnover for the Thai beverage industry will strengthen slowly over 2024 to 2026, lifted by greater spending in restaurants, the rebound in the tourism industry, and overall economic recovery. However, the current El Niño will likely strengthen, adding to operating costs connected to the sourcing of water and agricultural inputs.

-

Bottled water producers: Revenue will strengthen on general economic growth, with the recovery in the tourism sector and its impacts on restaurants, hotels, and nightspots being particularly important. Sales will be further helped by strong consumer demand for products that maintain a high degree of purity, and this will be especially beneficial for sellers of bottled water with strong brands. Beyond Thailand, demand for bottled water in the CLMV countries, Thailand’s major export targets, will also rebound with the reopening of border trade.

-

Carbonated drinks producers: A combination of higher temperatures and an uptick in economic activities will spur additional consumer demand for refreshing and thirst-quenching drinks. With the sugar tax continuing to ratchet up, manufacturers will be faced with the prospect of higher costs. Many are adapting to this by switching to non-sugar sweeteners and by opening new product lines targeting more health-conscious consumers (e.g., fruit-flavored sodas and scented, vitamin-enriched, and alcohol-flavored carbonated drinks), and this will then help players diversify their income streams.

-

Breweries: Income will rise gradually within this segment, helped by the return to normal of the country’s nightlife and the resulting improvement in the outlook for restaurants, pubs, bars, and other parts of the entertainment industry. Manufacturers will also increasingly develop new flavors and release new products to the market, and this will add to consumer interest in the segment. Nevertheless, drought will inflate the cost of sourcing agricultural inputs, and this will impact profits.

-

Distilleries: The cost of inputs will likely rise, pushing up prices and undercutting sales, while consumers are also increasingly careful about both their health and unnecessary spending on discretionary items. This will then push distillers to focus on raising the quality of their inputs as they look to add to the consumer experience and build customer satisfaction.

Overview

The Thai beverage industry produces a comprehensive range of product lines, and these are sufficient to meet almost all domestic demand (98.3% of consumption is produced domestically). The industry is thus largely focused on supplying the domestic market, and 78.7%1/ of all output is soaked up by the latter, with the remainder naturally being exported. The 1.7% of demand not coming from domestic suppliers is split 43% non-alcoholic drinks and 57% alcoholic drinks by volume, but 20% and 80% by value. As of 2022, a total of 393 sites producing beverages were registered with the Department of Industrial Works. The majority of these were located in the central region, and by province, the most important areas are: Nakhon Pathom (38 sites), Pathum Thani (30), Chonburi (29), Pra Nakhon Sri Ayutthaya (24), Samut Sakhon (18), and Bangkok (18). These were split between: (i) 332 sites (84% of the total) producing non-alcoholic drinks, and (ii) 61 sites (16% of the total) producing alcoholic drinks.

In 2022, the domestic market for beverages absorbed 12.11 billion liters of drinks, these having a value of USD 14.36 billion2/. By quantity, the market was divided between the non-alcoholic and alcoholic segments in the ratio 77:23 but by value, the relative importance of the two segments flipped to a ratio of 40:60. Details of the market are as follows (Figure 1).

-

Non-alcoholic drinks: 9.34 billion liters of non-alcoholic drinks were distributed domestically in 2022, and these generated receipts of USD 5.70 billion. This segment thus accounts for 77.1% of the domestic market by volume but just 39.7% by value. The most important products are bottled water, which accounted for 53.7% of sales (5.01 billion liters), followed in importance by carbonated drinks and soda (31.1%), ready-to-drink tea (4.3%), fruit juices (3.5%), energy drinks (3.2%), and other products (4.2%).

-

Alcoholic drinks: Domestic sales totaled 2.78 billion liters, which then brought in USD 8.66 billion in income (22.9% and 60.3% of total beverages sales by volume and value). Here, beer was the most important product, with 2.02 billion liters being sold (72.6% market share by volume). Beer was followed in importance by spirits (25.5%), ready-mixed alcoholic drinks (0.9%), wine (0.9%) and alcoholic or fermented fruit juices (0.1%).

In 2022, exports of Thai beverages brought in USD 2.73 billion from total sales of 2.58 billion liters (Figure 2). With a 21.2% share of the export market, Thailand’s most important trade partner was Cambodia, followed by Vietnam (a 15.1% market share), Myanmar (12.5%), the US (12.3%) and China (6.2%). Exports can be split into two main groups. (i) Overseas sales of non-alcoholic drinks accounted for 93.0% of the total by volume and 85.0% by value. The main markets for Thai non-alcoholic drinks were Cambodia (22.2% of exports of non-alcoholic drinks by volume), Vietnam (16.2%), the US (13.1%), Myanmar (9.6%) and China (6.6%). (ii) By volume and value, alcoholic drinks represented respectively 7.0% and 15.0% of all exports. Here, the most important market was Myanmar (49.4% of all exports of alcoholic drinks), followed by the US (12.7%), Cambodia (10.4%), Japan (5.1%) and the Philippines (2.3%).

The Development and Structure of the Thai Beverage Industry

The Thai beverage industry began life with the government-backed production of alcoholic drinks, which it undertook as part of its import-substitution strategy, but the industry has increasingly opened up to private-sector investment, and under the impact of BOI incentives to promote its expansion, the Thai drinks industry has matured to the point that it now produces a wide range of alcoholic and non-alcoholic products. The development of particular market segments within the industry is described below.

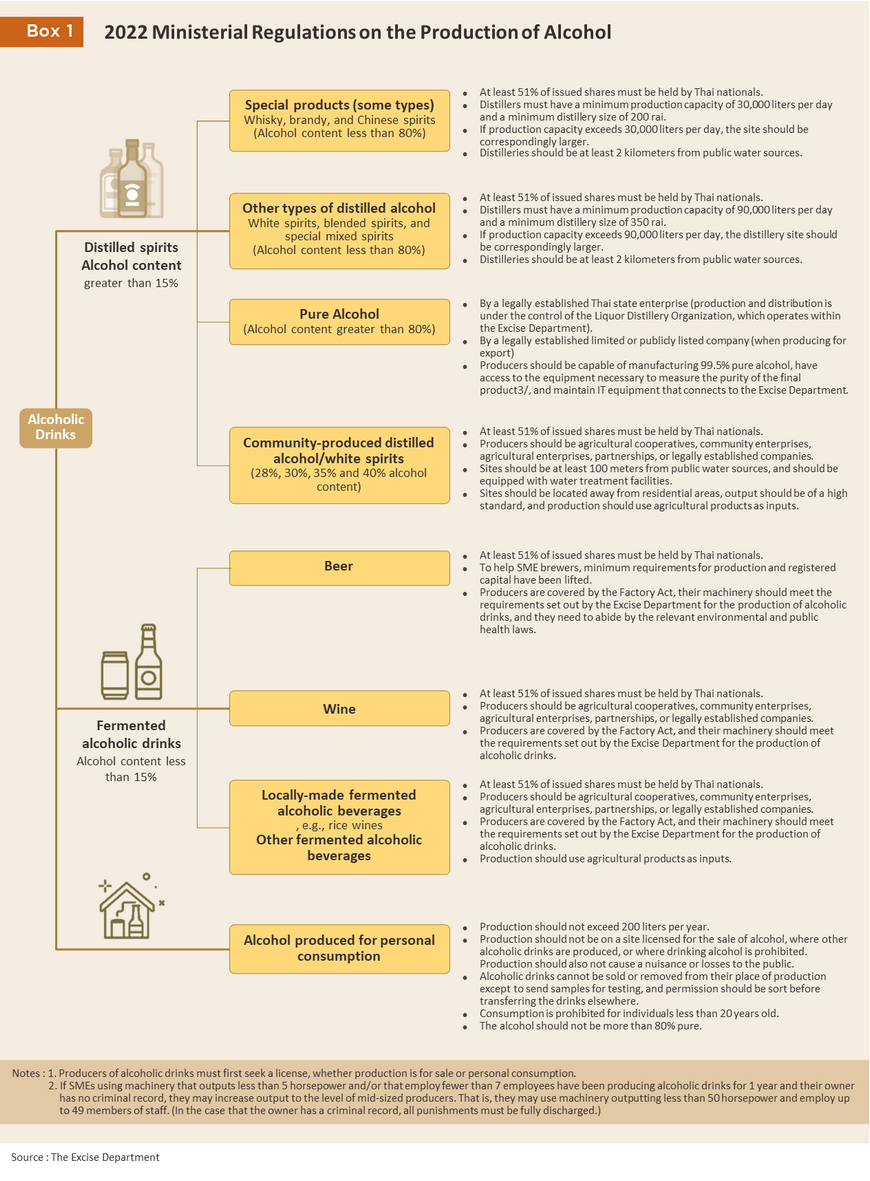

Non-alcoholic drinks: Initially, this part of the industry developed through investments made by foreign companies; Coca Cola began production in Thailand in 1949, and the American-owned Polaris water bottling plant then started operations a year later. As the domestic market for non-alcoholic drinks developed, the Thai government began to take a more active role in supporting its development through, for example, the 1960 act promoting investment in industries manufacturing for domestic consumption, and measures that aimed to stimulate export industries contained in the Third National Economic and Social Development Plan (1972-1976). These development strategies relied on Thailand exploiting its advantages in low labor costs and ready access to the agricultural products used as raw materials in beverage production (i.e., fruit and vegetable juices). As a consequence of this, there was a significant uptick in investment in these industries by both Thai and overseas players, which in turn resulted in production better meeting consumer demand in domestic and export markets. The regulations governing the establishment and registration of facilities for the production of non-alcoholic drinks are laid out in the 1992 Factory Act. These specify requirements based on payroll sizes and site production capacity (Table 1).

The domestic market for non-alcoholic drinks is now very diverse, with a large number of products and producers in the mix. Because of this, the structure of individual segments within the market varies. Details of the most important of these are given below.

-

Bottled water Industry: Initially, entry to this industry required high levels of investment but the continuing development of water filtration technology means that this can now be done to a very high standard at low unit costs and as such, the number of new entrants to the market is increasing. Some players also bottle water under contract to other parties, including hotels and hospitals, as well as producing other beverages, including carbonated drinks, fruit juices, beer and spirits, thus giving these companies advantages in terms of marketing and distribution. The most important Thai producers of bottled water are currently ThaiBev (selling under the Crystal and Chang brands), Boon Rawd (Singha brand), Nestlé Thai (Nestlé Pure Life brand), Coca Cola Thailand (Namthip brand), and Suntory Pepsico (Thailand) (Aquafina brand). As of 2022, these held a 56.7% market share by value, with products distributed through retailers, modern trade outlets, restaurants, and online and via direct sales to home and office purchasers. In addition to these market leaders, local brands also serve immediate, local markets, which they reach through retailers and restaurants.

-

Soda and carbonated drinks Industry: This market is somewhat oligopolistic since any new players wishing to enter it will have to invest significant capital in the purchase of machinery, a fixed cost, that they will then hope to recuperate by producing in large enough quantities to generate economies of scale. Players also usually have to import ingredients from a parent company. The most important operators in this market are Coca Cola Thailand (selling Coke, Fanta, Sprite, and Schweppes), Suntory Pepsico (selling Pepsi, Mirinda and 7-Up), ThaiBev (EST Cola), and RJ Group (Big Cola). As of 2022, these four players enjoyed a 98.4% market share by value.

The production of alcoholic drinks began in Thailand with the fermentation of locally-produced beverages made from rice and sugar. In the first stages of the sector’s development (from 1927), the state held a monopoly on the production and distribution of alcohol, which took place at the Bang Yee Kan site in Pathum Thani. Here, ‘white spirits’ were used to produce blended products by adding and infusing these with herbs to create high-alcohol drinks with particular flavors, colors, and aromas, along with a number of other types of liquor. However, from 1959, the government allowed private companies to bid for the rights to run the Bang Yee Kan factory, thereby opening up the production of alcoholic drinks to the private sector. This policy lasted until 1999, when, at the start of the new millennium, the industry was turned around by the liberalization of the markets for production and distribution. Subsequent to this, a large number of new breweries and distilleries were established, as were joint ventures between Thai and foreign companies that produced beer for the Thai market.

Nevertheless, despite these reforms, the market for alcoholic drinks remains tightly regulated. For example, whatever the size of the brewery or distillery, these are automatically classified as ‘category 3’ facilities and so opening these requires a permit, advertising of alcoholic drinks is strictly regulated by the law, and its distribution online is prohibited. This then makes it very difficult for players to compete in the market, though this is especially hard on SME producers, who face an uphill task building brand awareness. The various segments of the alcoholic drinks market are described below.

-

Beer Industry: New ministerial regulations issued in 2022 abolished the earlier requirements for a minimum production capacity of 100,000 liters annually and at least THB 10 million in registered capital, thereby making it substantially easier for microbreweries to begin production. However, the domestic market for beer is still dominated by Boon Rawd Brewery, producers of Singha, Leo, Snowy Weizen and U Beer, Thai Beverage (or ThaiBev), which produces Chang, Archa, and Federbrau, and Heineken. These corporations are highly competitive organizations that enjoy significant commercial advantages, and the result of this is that the three have a combined 95.7% share of the Thai beer market (by value).

-

Spirits Industry: The 2022 ministerial regulations also liberalized the production of spirits, in particular by allowing smaller distilleries to increase output to the level of intermediate-sized producers. Nevertheless, other parts of the market remain tightly controlled, and so for example, very high minimum production levels remain in place for distilleries producing ‘special’ or other types of spirits. The major players in the market for spirits are ThaiBev (selling under the brands Ruang Khao, Hong Thong, and Blend 285), Diageo Moet Hennessy (Thailand) (selling under the brands Johnny Walker, Smirnoff, and Benmore), and Regency Brandy. As of 2022, these companies enjoyed a 71.2% market share by value.

Situation

Domestic beverage production

Output of beverages has been somewhat variable in recent years, and although this increased 2.1% in 2022, output contracted -3.9% YoY over the first 8 months of 2023. For 2023 overall, production is forecast to stabilize or increase between 0.0% and 2.0% (Figure 4).

-

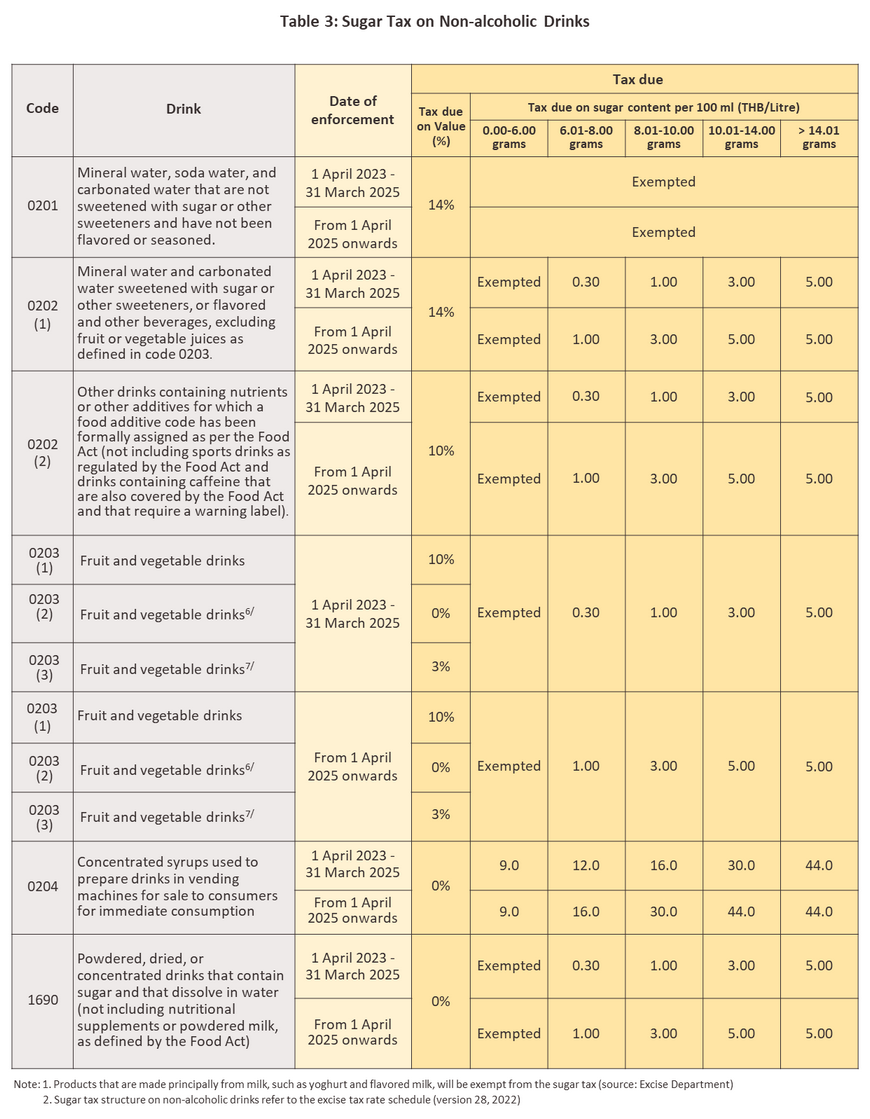

Non-alcoholic drinks: The most important products in this segment are bottled water, carbonated drinks, soda, and sports and energy drinks. The segment’s manufacturing production index (MPI) edged up 0.4% in 2022 on the reopening of the country and the gradual recovery in economic activity, which then lifted demand. However, on the supply side of the market, this was partly offset by higher oil prices, which added to the cost of manufacturing bottles, and more expensive energy that then also added to production and transport costs (Figure 5). For the first 8 months of 2023, output fell back -2.9% YoY due to reduced production in the energy and mineral water beverage group (-13.9% YoY) and fruit-flavored beverages (-5.1% YoY), which are beverage products primarily using sugar as an ingredient. This decline was impacted by the implementation of the new sugar tax structure starting from April 2023 (Figure 3). Nevertheless, overall, non-alcoholic beverage production in Thailand is expected to stabilize or expand within the range of 0.0-2.0% in 2023. This trend is supported by the production of bottled water, soda and carbonated drinks, driven by recovery efforts and the use of alternative sweeteners instead of sugar by manufacturers.

-

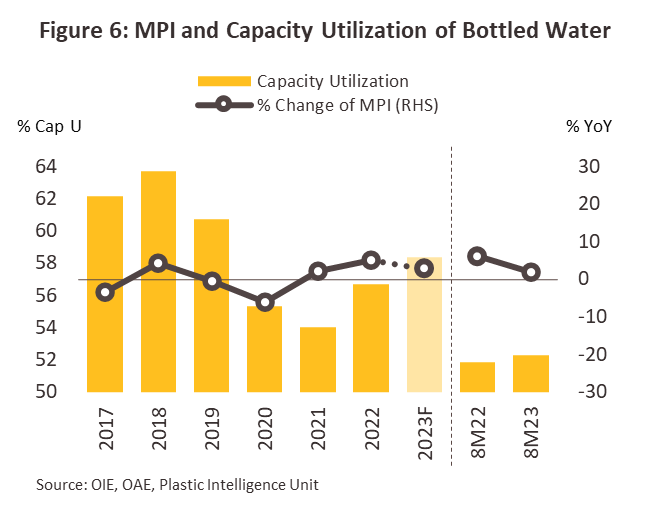

Bottled Water: The MPI for the bottled water segment increased 5.2% in 2022, and this upward trend continued into 8M23 with a further 1.8% YoY increase (Figure 6) as manufacturers responded to an improving economic outlook and the impacts of this on demand. In addition, some players are moving to meet the intensifying El Niño and worries over its potential impact on water sources and prices by increasing inventory levels. Output for the year is thus forecast to rise by 2.0-3.0%.

-

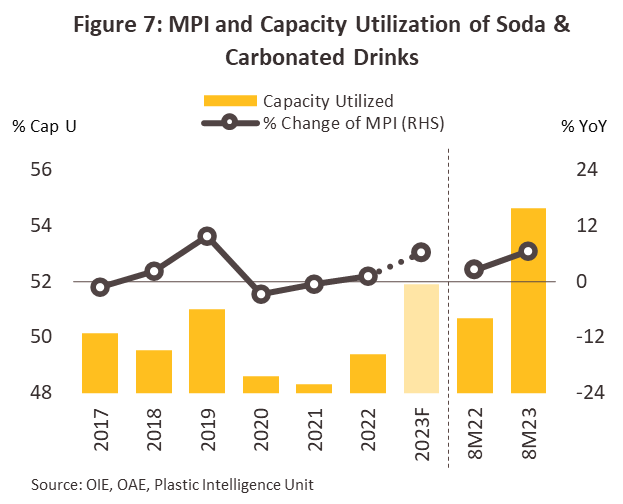

Soda and carbonated drinks: This segment’s MPI increased 1.1% in 2022 but then jumped by another 6.4% YoY over the first 8 months of 2023 (Figure 7) as demand from restaurants and nightspots revived, helped especially by the rebound in the tourism sector. In addition, packaging costs (i.e., of aluminum and plastic nurdles) are beginning to soften, while impacts arising from the higher cost of sugar and the hike in the sugar tax have been limited by the switch by manufacturers to non-sugar sweeteners. Production of soda and carbonated drinks is therefore predicted to rise by another 5.5-6.5% over the length of 2023.

-

-

Alcoholic drinks: The MPI of this segment increased 9.0% in 2022, and output fall -4.9% in first 8 months of 2023. It is anticipated that overall production of alcoholic drink will decline between -4.0% and -5.0% in 2023. In this section of the industry, the main division is between beers and spirits.

-

Beer: In 2022, recovery in the economy and especially the beginning of the rebound in foreign arrivals brought the nightlife industry back to life and this then fed into a 12.1% increase in the beer industry’s MPI, while changes to excise rates encouraged some manufacturers to reduce the alcohol content of their products. However, a combination of the 36.0% YoY-jump in the cost of imported malt over January to August 2023 and, following a build up in inventories in 2022, the decision by some players to run these down again (Figure 9) contributed to a -5.0% YoY drop in output (Figure 8). Overall, output is expected to soften by between -4.5% and -5.0% in 2023.

-

Spirits: Distillers’ MPI dropped -11.1% in 2022 on the higher cost of inputs, including that of molasses (+2.0%) and ethanol (+7.6%), prices for which were driven up by the 15.6% rise in the cost of sugarcane. Output fell by another -4.7% over the first eight months of 2023 (Figure 10) on continuing high prices for agricultural inputs, notably for sugarcane (+7.6% YoY) and unmilled rice (+16.1% YoY). Production was also hit by the impacts of the increase in the cost of living, which has reduced sales of luxury goods, adding to inventories and encouraging distilleries to cut back on output and run down stocks (Figure 11). Given this, production of spirits across all of 2023 is forecast to slip by between -3.0% and -4.0%.

Domestic Distribution8/

Domestic distribution of drinks expanded 6.1% YoY in 2022. The market was helped by the ending of pandemic restrictions and the boost that this gave to entertainment businesses such as pubs, bars and restaurants, as well as to the economy overall. In particular, the reopening of these businesses and the return of diners to in-restaurant eating helped to increase the range of distribution channels and to put a greater volume of products in consumer hands. Over January to August 2023, domestic distribution strengthened by another 6.7% YoY thanks to continuing recovery in the tourism sector and the extended period of hot weather that then lifted demand for thirst-quenching drinks. The expectation is now that the quantity of drinks distributed domestically will strengthen by 3.5-4.0% over all of 2023.

-

Non-alcoholic drinks: Distribution expanded 5.8% in 2022 on the normalization of economic activity, and this trend extended through 8M23, lifting distribution by another 10.2% YoY. Recent demand has benefited especially from recovery in restaurants, hotels, and the tourism sector generally, and this will continue to boost the market through the rest of 2023, leading to an anticipated 5.5-6.5% increase in sales for 2023 as a whole. The situation for individual segments is described below.

-

Bottled water: 2022 distribution expanded by 6.5% on: (i) continuing worries about infection with Covid-19 that maintained consumer fears over health and hygiene, thus encouraging consumers to purchase products that appear safer; (ii) the rebound in the tourism sector and recovery in the economy; and (iii) ongoing population growth and urbanization, which is being helped by investment in mass transit systems and other types of infrastructure that is then accelerating urban conglomeration. Over 8M23, growth continued, expanding by another 3.9% YoY (Figure 12) thanks to a combination of the positive effect of trends started in 2022 and the year’s hot weather and the onset of the most recent El Niño, which then boosted sales of bottled water. For 2023, the sales to the domestic market are forecast to increase by 2.5-3.0%.

-

Soda and carbonated drinks: Distribution expanded 5.4% in 2022 following the easing of pandemic controls and the start of the economic recovery, though the boost that this gave to sales in restaurants, bars, pubs and other nightspots was especially important. The market also benefited from the growth in product lines, in particular the development of low- or no-sugar drinks since these are well placed to respond to rising consumer worries over health and wellness. Growth accelerated to 17.1% YoY over the first 8 months of 2023 (Figure 13), helped by continuing sales through restaurants and nightspots, as well as by the year’s hotter weather. In addition, with costs rising, manufacturers are also expected to raise their prices, and in anticipation of this, retailers and distributors are expanding their inventories. Total 2023 distribution is thus forecast to rise by 9.0-11.0%.

-

Alcoholic drinks: The volume of alcoholic drinks distributed domestically rose 6.9% in 2022. As elsewhere in the market, sales were helped by the reopening of the country and the return of foreign tourists to Thailand, which then boosted sales in pubs, bars and similar venues. However, distribution contracted -4.0% YoY in the first eight months of the year as the rising cost of living eroded consumer purchasing power and encouraged individuals to cut back on discretionary spending. This then added to longer term trends that are encouraging consumers to pay greater attention to their health, and this is having negative impacts on sales of alcohol. The expectation is now that total 2023 domestic distribution will shrink by -3.0% to -3.5%. The situation for the main product groups is given below.

-

Beer: The quantity of beer distributed to the domestic market increased 9.9% in 2022. Sales were lifted by the reopening of traditional distribution channels such as restaurants, pubs and bars, and by the increase in consumer choice that has come from the expansion in product lines. The latter has included the development of low- or no-alcohol beer, fruit-scented beers, and new ales and lagers. However, over 8M23, distribution contracted -4.2% YoY (Figure 14) on a combination of higher beer prices (reflecting the increased cost of inputs) and softening purchasing power. For 2023, the volume of beer sold domestically is forecast to shrink by between -3.0% and -4.0%.

-

Spirits: The quantity of spirits distributed domestically fell back -1.0% in 2022 as customers switched to lower strength alcoholic drinks, in particular to beer, where the market is now expanding thanks to the release of new products for drinkers to experiment with. Sales contracted another -1.9% YoY over 8M23 (Figure 15) in the face of continuing consumer concerns about health and the higher cost of inputs, which then forced distillers to raise their prices. Given this, the expectation is that total 2023 sales will fall by -1.0% to -2.0%.

Exports of Thai beverages

In 2022, although exports volume contracted -6.4% to 2.6 billion liters, by value, these rose 6.0% to a total of USD 2.7 billion (Figure 16), while declines were largely concentrated in the markets for spirits (down -15.3%) and carbonated drinks (down -39.7%). Exports returned to growth over 8M23, shrinking -1.2% YoY by volume and -0.1% YoY by value as neighboring countries such as Myanmar and Laos have weak purchasing power and depreciated currency in their own countries. Across all of 2023, exports are predicted to decrease by -0.5 to -1.5%, split between the various market segments as described below.

-

Non-alcoholic drinks: Exports fell back -6.9% by volume in 2022, though by value, they grew 2.5%. Declines were concentrated in the soda and carbonated drinks segment, which due to a combination of ongoing political troubles and prohibitions on the import of some products was particularly hit by problems selling into Myanmar9/. Overseas sales declined the first 8 months of 2023, weakening -0.3% YoY by volume, and -0.3% YoY by value, and for all of 2023, exports of non-alcoholic drinks are expected to strengthen by 0.0-2.0%.

-

Bottled water: In 2022, exports surged 77.1% by volume and 34.3% by value. Growth was seen in both the major markets of Cambodia (+68.5%) and China (+53.0%), which together represent 68% of the total market for bottled water, and in other regional markets in Lao PDR (+54.4%), Myanmar (+429.1%) and Vietnam (+55.1%), where sales rose on the restarting of cross-border trade. Exports continued to strengthen over 8M23, rising 14.0% YoY by volume and 23.6% YoY by value (Figure 17), with increases especially strong in Cambodia (+6.8%), China (+53.7%) and Lao PDR (+66.1%) thanks to confidence in the quality of Thai products, and the reopening (or indeed opening) of border crossings. In addition, exports to China have been boosted by the relaxation of checks on imports, and so for all of 2023, export volume is predicted to expand by 10.0-12.0%.

-

Soda and carbonated drinks: Exports crashed -39.7% by volume and -15.5% by value in 2022. Sales to Myanmar (down -16.4%) were badly hit by the ban on cross-border trade in some product categories, while in Malaysia (down -60.7%), the easing of worries over food security and the threat of natural disasters led to a decline in the need to build stocks. These declines continued across the first eight months of 2023, with exports slipping another -6.4% YoY by volume and -7.5% YoY by value (Figure 18) due to ongoing political and economic woes in Myanmar and Lao PDR that led to declines in sales of respectively -11.4% and -33.4% YoY. In particular, rising inflation and weakening spending power have undercut consumer spending power, forcing individuals to be more careful about purchases of non-essential drinks. Total 2023 export volume is therefore expected to soften by -2.0 to -3.0%.

-

Alcoholic drinks: 2022 exports increased 7.1% by volume and 31.5% by value thanks to the ending of worries about Covid-19 in neighboring countries. This then allowed border crossings to be reopened, and because these are the primary channel for shipping goods from Thailand, this then supported growth in sales to Myanmar and Cambodia of respectively 53.3% and 7.6%. By volume, sales went into reverse over the first 8 months of 2023, declining -11.9% YoY, but by value, these rose another 1.1% YoY. Declines in the volume of exports are likely to continue throughout the year, and so for all of 2023, these should soften by between -10.0% and -11.0%.

-

Beer: By volume, exports increased 1.5% in 2022, but considered by value, growth accelerated to 8.5%. Overseas sales were boosted by the normalization of cross-border trade, and this then lifted exports to Myanmar and Cambodia by 20.8% and 44.1%, respectively. In 8M23, declines of -15.5% YoY in sales to Myanmar fed into a -8.3% YoY drop in exports by volume, though by value, these edged up 4.5% YoY (Figure 19). These markets were hurt by the impact of the 14.0% YoY average rise in prices as well as by increasing investment inflows from Thai breweries looking to expand local production in these markets. Weakness in exports will persist through 2023, and so export volume is expected to fall by -8.0% to -10.0% in the year.

-

Spirits: Exports of spirits fell back -15.3% by volume in 2022, but by value, these surged 46.2%. Declines in the volume of exports were driven by the crash in sales to Taiwan and the Philippines, which slumped by respectively -94.5% and -39.2% and that together account for 21.9% of all exports of Thai spirits (by volume). The relaxation of pandemic worries meant that these two countries scaled back sharply on imports of pure alcohol from Thailand10/, and the continuation of these trends into 8M23 meant that overseas sales contracted another -16.8% YoY by volume while increasing 11.9% YoY by value (Figure 20). In light of these trends, 2023 export volume is predicted to soften by between -14.0% and -16.0%.

Outlook

Over the next few years, output by the Thai beverage industry is expected to grow at an annual average rate of 1.5-2.5%. Such growth will be driven by: (i) the impact of the current El Niño on the weather, and the resulting increased temperatures will in turn create greater demand for drinks; and (ii) the need to restock to meet rising demand lifted by a steady increase in economic activity. However, this will be counterbalanced by the effect of the intensifying El Niño on access to water. Going forward, overall agricultural yields are likely to fall in terms of both volume and quality, resulting in higher prices for agricultural inputs. Meanwhile, packaging costs are expected to soften as energy prices ease. The outlook for the main product groups is given below.

-

Non-alcoholic drinks: Production output should strengthen by some 2.0-3.0% annually, split between increases of 2.0-3.0% for bottled water and of 3.0-4.0% for soda and carbonated drinks. This expansion in manufacturing output will largely be demand-driven by recovery in the tourism sector and the forecast return of total foreign arrivals to their pre-Covid level by 2025. Considering this positive outlook, some manufacturers are expanding production capacity and developing new product lines, with activity especially noticeable within the health drink segment.

-

Alcoholic drinks: Production output of alcoholic drinks is expected to slightly increase between 1.0-2.0% annually. For beer, the annual output may strengthen by 1.0-2.0%, and for spirits, production will remain flat or grow slightly at the rate of up to 1.0% annually. The growth will be supported by higher demands from recovery in the tourism sector and traditional distribution channels such as pubs and bars. However, growth in supply is likely to be hampered by the impacts on agricultural yields of the worsening El Niño, and especially of sugarcane and rice, for which prices are expected to rise.

The volume of drinks distributed domestically is forecast to expand by 3.0-4.0% annually over the next 3 years. Sales will be lifted by what is expected to be hotter weather, the return to normal conditions for restaurants, hotels, pubs, bars, and similar industries. In addition, ongoing urbanization and growth in modern trade branch networks are helping to better connect consumers with products. The outlook for individual segments is as follows.

-

Non-alcoholic drinks: The quantity of domestic sales of non-alcoholic drinks will grow at an annual rate of 3.5-4.5% from 2024 to 2026. (i) Sales of bottled water will rise by 3.0-4.0% annually on (i-a) strengthening demand for products that are safe and hygienic (driven in part by the effects of the Covid-19 pandemic); (i-b) hotter and drier weather that will increase demand, especially in remote areas where drought will force consumers to rely on bottled water, while in coastal regions, seawater ingress will cause drinking water supplies to become saltier and brackish; and (i-c) continuing urbanization and expansion in modern trade networks, which is making it easier for consumers to purchase bottled water. (ii) Sales of soda and carbonated drinks should also expand by 3.5-4.5% per year, helped by: (ii-a) recovery in the restaurant and hotel industries as foreign arrivals swell; (ii-b) forecast hotter weather that will drive demand for refreshing and thirst-quenching non-alcoholic drinks. However, the steady increase in the tax on the sugar content of non-alcoholic drinks, which was last raised in April 2023, will drag on domestic growth in affected product categories, even as manufacturers develop new carbonated drinks that target more health-conscious consumers (e.g., reduced calorie and low-/no-sugar drinks).

-

Alcoholic drinks: Overall sales will remain broadly flat, possibly increasing by up to 2.0% per year. For beers, this will mean that annual domestic sales will rise by 1.0-2.0%, and for spirits growth will be slightly softer between 0.0-1.0%. With a strong impetus from the recovery of the tourism industry and the sustained momentum of business activities, there is a boost in demand from in restaurant, pub, and bar businesses. However, The market will be affected by factors that continue to restrain growth at a low rate : (i) growing consumer interest in personal health that is undercutting demand for alcoholic drinks; (ii) restrictions on sales that limit these to offline channels such as shops, department stores, and bars and restaurants. In addition, the ban on advertising makes it difficult for producers to connect with consumers through print, broadcast, or online media and inform them of new products that they are developing, in particular flavored beers and drinks made with better-quality ingredients that manufacturers hope will improve the customer experience.

Export volumes are predicted to expand by 1.5-2.5% annually during 2024-2026, helped by the reopening of border crossings with neighboring countries (an important part of distribution networks) and the development of new products that will likely meet with success in overseas markets11/.

-

Non-alcoholic drinks: Export volume of non-alcoholic drinks should strengthen at an average annual rate of 1.5-2.5%. (i) Sales of bottled water will increase by 11.5-12.5% per year as regional economies grow and the range of distribution channels broadens within the CLMV countries, especially in Myanmar, Lao PDR, and Cambodia, major markets that currently lack high-quality water sources. (ii) A combination of rising investment in local production facilities in Cambodia and Myanmar by local, Thai, and multinational companies, and the high cost of imports relative to locally produced alternatives will cause overseas sales of soda and carbonated drinks to contract by between -2.0% and -3.0% annually. (iii) Strong demand in Vietnam for products that align with fast-paced and intense working lives will drive growth of 4.5-5.5% annually for exports of energy drinks. (iv) Overseas sales of fruit-based drinks will stay unchanged or edge up by up to 1.0% per year, helped by the strength of the Chinese market, where health-conscious consumers like to purchase fruit juices for mixing with other drinks. However, demand from the US, a major trade partner, is softening on weaker purchasing power and increased consumer concerns over spending.

-

Alcoholic drinks: Overall export volume of alcoholic drinks is expected to slide by between -4.5% and -5.5% per year, with annual falls of -4.0% to -5.0% for beer, and -5.0% to -6.0% for spirits. Declines will be driven by: (i) the tendency for consumers in CLMV countries (Thailand’s most important export markets) to remain careful over unnecessary spending while purchasing power remains weak; and (ii) growing investment by local and international producers in export markets, which is then bringing in more intense competition.

1/ Source: Euromonitor, Ministry of Commerce

2/ Based on figures from the Bank of Thailand that give an average USD-THB exchange rate for 2022 of THB 35.07 to the dollar.

3/ i.e., quality control tools to measure the percentage of alcohol in the finished product and to ensure that this is sufficiently high for it to be distilled, e.g., density meters, gas chromatographs, and UV-visible spectrophotometers (source: the Excise Department).

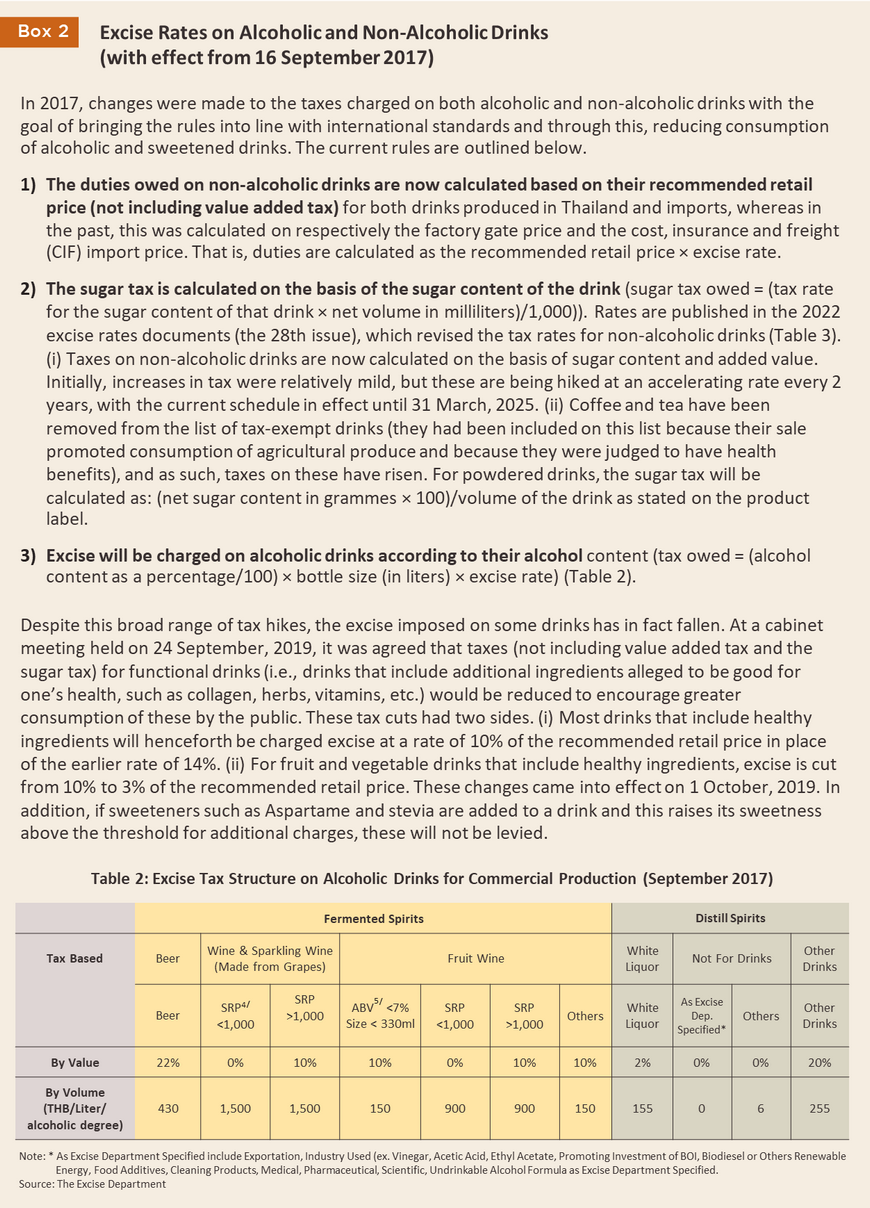

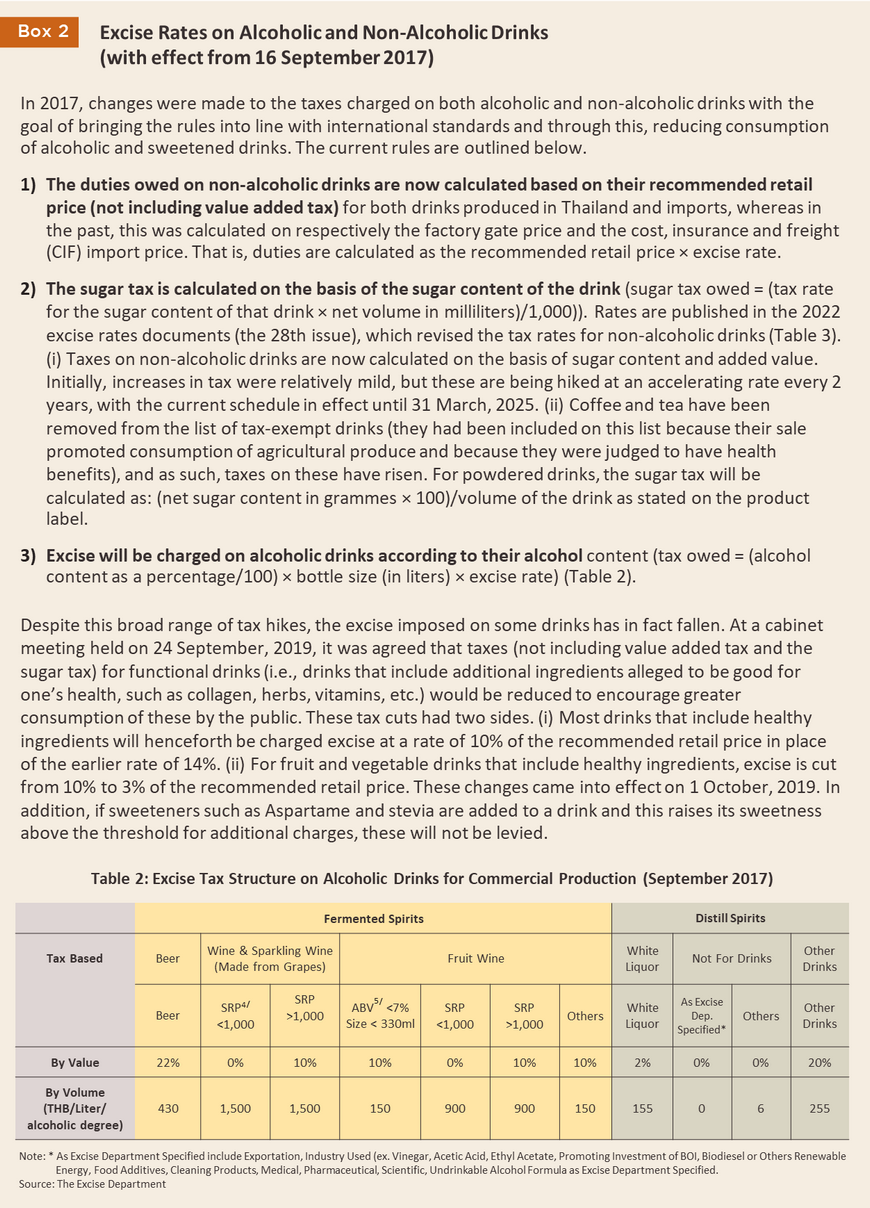

4/ The recommended retail price is the price that the manufacturer suggests retailers sell the product at.

5/ Alcohol by volume is simply the percentage of alcohol in the drink. In Thailand, this is also referred to as its degree.

6/ Data for 2022 is from Euromonitor, whereas that for 8M23 is from the Office of Industrial Economics.

7/ Source: Announcement by the Excise Department on the criteria for charging added tax on fruit and vegetable drinks that have been sweetened or that contain other additives.

8/ Data for 2022 is froSource: Announcement by the Excise Department on the criteria for charging added tax on fruit and vegetable drinks that have been sweetened or that contain other additives.m Euromonitor, whereas that for 8M23 is from the Office of Industrial Economics.

9/ This includes carbonated drinks, energy drinks, tea- and coffee-based drinks, ready-to-drink coffee, and plain and condensed milk. The ban came into effect in May 2021 and remains in place (source: Thai government).

10/ Pure alcohol is at least 80% alcohol. At this level of purity, it is suitable for use as an input into industrial processing or for mixing and producing alcoholic drinks (Source: U.S. Food & Drug Administration and the Thai Excise Department).

11/ Source: The Department for International Trade Promotion

.webp.aspx)