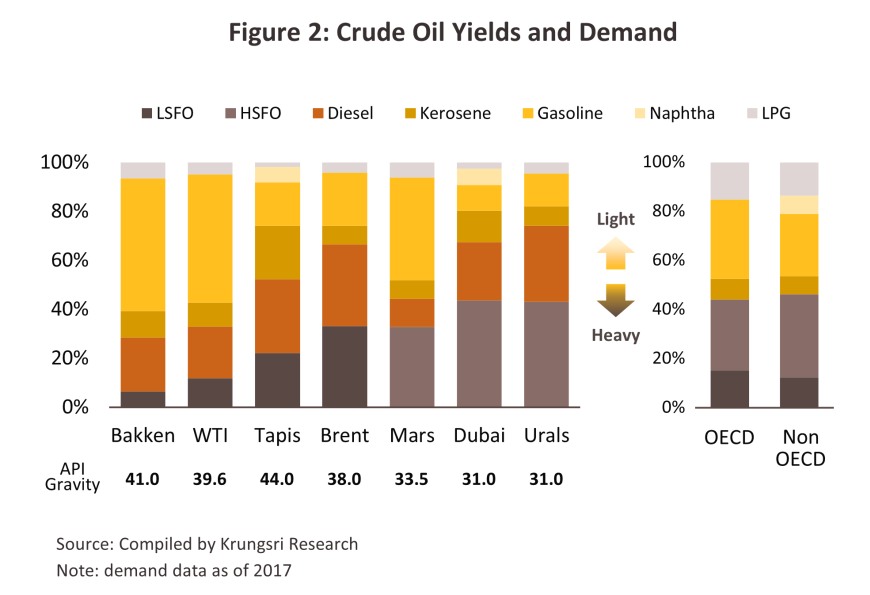

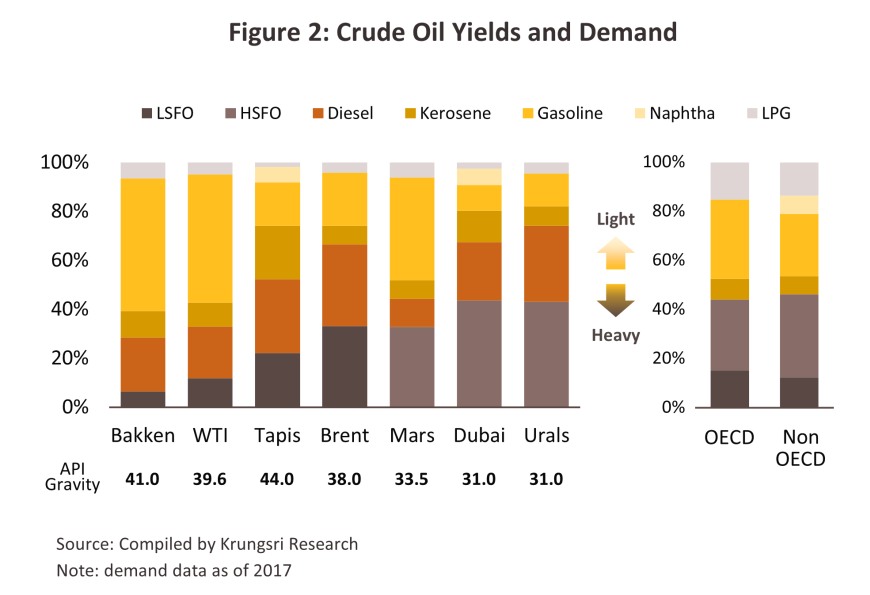

Oil refining is a large-scale, technology-dependent and capital-intensive industry within which corporations leverage their significant investments to generate economies of scale. Given this, returns on investment are typically made over only an extended period, and this constitutes a significant barrier to entry. The refining process involves the fractionation or transformation of crude oil into a variety of petroleum products (Figure 1), including liquified petroleum gas (LPG), naphtha, gasoline, kerosene, diesel, bunker oil, and asphalt. These are used in different applications according to their qualities and properties, though the exact proportions of these different products in refinery output is dependent on the source and profile of the crude oil used as an input.

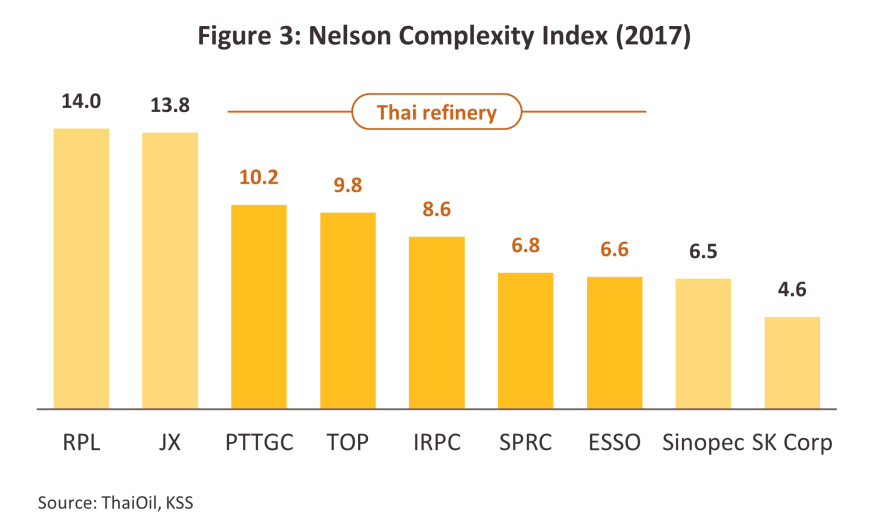

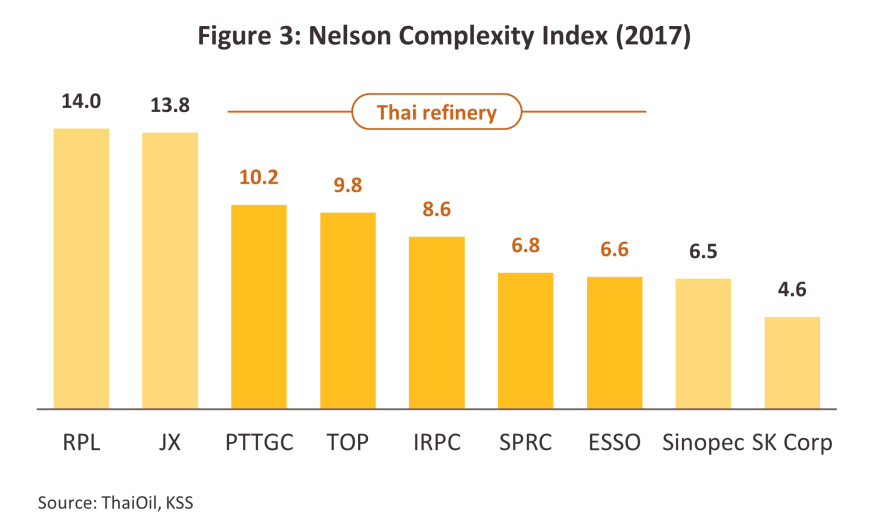

Refineries can be divided into the two broad categories of simple refineries, which distill crude oil to separate this out into its components, though these will vary according to the properties of the crude that is refined, and complex refineries, which add so-called ‘cracking units’ to the process. Complex refineries are more expensive to build and to operate, but in addition to simply distilling crude, these are able to transform heavy, low-value oil products into light, higher-value ones. The extent to which complex refineries are able to transform oil products varies and is measured by the Nelson Complexity Index (NCI). A high NCI indicates that a refinery is able to convert a wider range of products into high-value outputs and so has a greater level of flexibility with regard to the sources of crude that can be used as inputs. Refineries with a high NCI are therefore able to process crude from suppliers in different regions and that thus have different properties1/(Figure 3).

Although refining is a highly capital-intensive industry, refineries themselves have a fairly long lifespan of 30-50 years and so fixed costs per unit are relatively low. Instead, around 95% of costs are variable, and of this, 75-80% is attributable to inputs of crude oil. A further 10% of costs is attributable to the energy used in the refining process, and the remaining 10-15% goes to other areas, such as depreciation (Figure 4).

In addition to the cost of crude, the price of petroleum products is also determined by the interaction of supply and demand, and the latter in turn depends on the level of economic activity since some 70% of all petroleum products are used as transport fuels. The difference between the price of petroleum products and the cost of crude (which is also called the ‘spread’) is used to measure the profitability or margin of each refined product.

The ability of a refinery to turn a profit can be assessed from an examination of its gross refinery margins (GRMs), which are calculated per barrel by subtracting the total refining costs from the combined value of the petroleum products produced from the refining process. In detail, the following factors determine the GRM of a refinery: (i) The cost of crude oil. Changes in the cost of crude will increase the GRM in two situations. These are if increasing demand for petroleum products pushes up the price of crude but refined products increase in price by a greater degree than does crude, or if the supply of crude oil expands and this helps to depress prices for crude and the effect of this is greater on crude than on refined products; (ii) the price of petroleum products; (iii) capacity utilization. If capacity utilization is high, the GRM will likewise be high, and generally, efficiently run refineries will operate with a capacity utilization over 80%2/; (iv) the extent to which a refinery is able to convert inputs into higher-value outputs. An examination of the NCIs of Thai refineries indicates that these are fairly high; and (v) the ability to control costs and to source more desirable crude. Refineries which process heavier crude will usually have a lower GRM than those that are able to use lighter crude; around 46% of the crude processed by Thai refineries is heavy Middle Eastern crude and this means that output tends to be of heavier products, such as diesel and fuel oil (Figure 5).

In addition, the profitability of individual refineries also depends on: (i) the extent to which business operations are vertically integrated through to downstream activities and on to related areas, since this will help to reduce costs and improve production planning; and (ii) the physical location of the refinery since there will be consequent cuts to transportation costs and improvements to profitability if resources and/or markets are easily accessible.

With a refining capacity of 1.242 million barrels per day, the Thai refining sector is second only to Singapore in size within the ASEAN region. Seven operators are active in the sector, and all production from these comes from complex refineries. These seven players are: PTT Global Chemical (PTTGC), ThaiOil (TOP), IRPC Public Company Limited (IRPC), ESSO3/, Star Petroleum Refining Public Company (SPRC), Bangchak Petroleum (BCP), and FANG. PTT is the largest of these since it is a major shareholder in PTTGC, TOP and IRPC (Figure 6).

As their reference price, Thai ex-refinery prices use those quoted on the Singapore exchange (SIMEX), specifically the Mean of Platts Singapore (MOPS) while the import price parity principle, which is calculated from Singapore prices FOB combined with transportation costs, is used to specify the Thai price ceiling. Singaporean GRMs therefore clearly have a heavy influence on those of Thai refineries (Figure 7).

The retail price of Thai oil products is not determined simply by market forces, which in this case would be a combination of the refining costs, the GRM, the distributors’ marketing margins, and the cost of the crude itself. Rather, the Thai government plays a significant role in determining the movement of prices through the collection of excise duties on refined products and contributions from distributors of oil products to the Oil Fund (Figure 8). The Oil Fund exists to smooth out variability in domestic prices for refined oil products when prices on world oil markets are high or particularly volatile. Subsidies from the Oil Fund are also used by the government to promote consumption of particular fuels, such as E20 and B7.

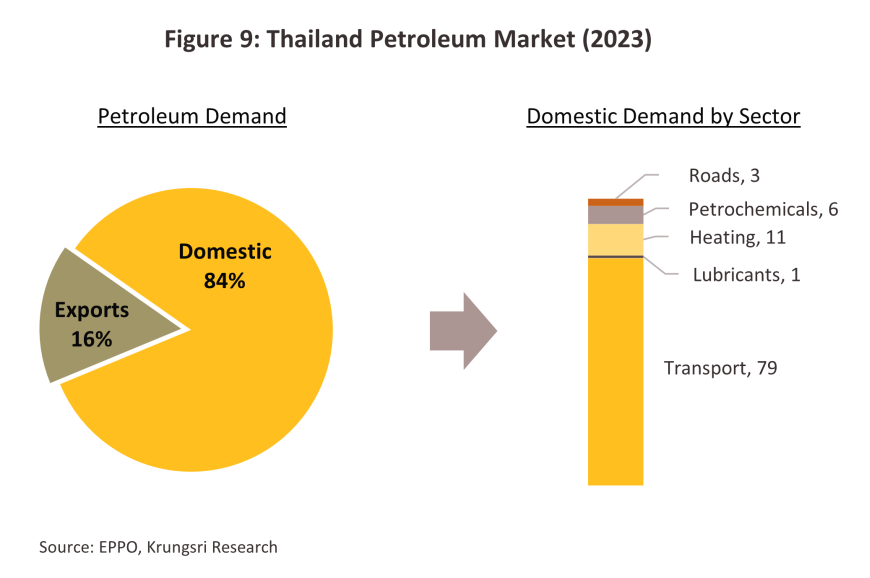

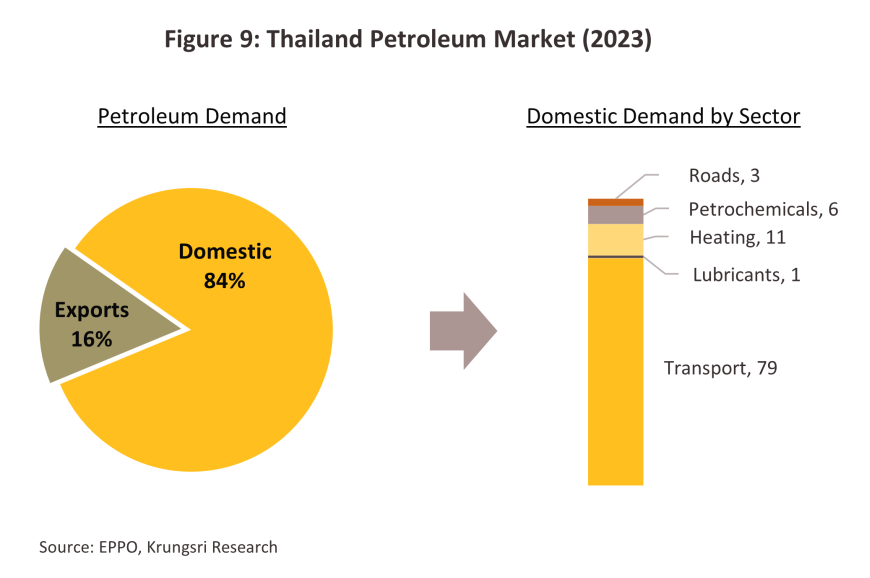

About 84% of the refined products output by Thai refineries is consumed on the domestic market. Of this, 79% is used as transportation fuel (i.e., gasoline, kerosene, and diesel), 11% is used as industrial fuels or in the production of electricity (i.e., diesel and bunker fuel), 6% is used by the petrochemical industry (i.e., LPG and naphtha), and 3% (asphalt) is used in road construction. The 16% that is exported goes largely to the ASEAN zone, which takes approximately 75% of this, and East Asia (Figure 9).

Situation

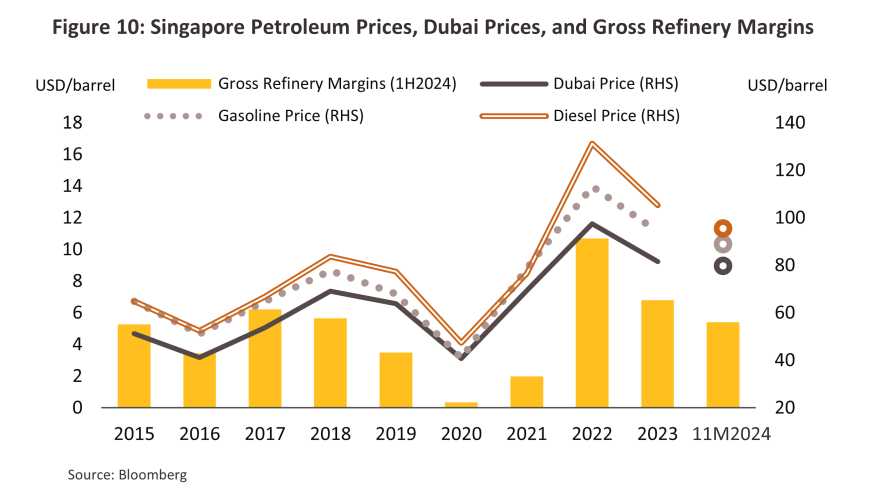

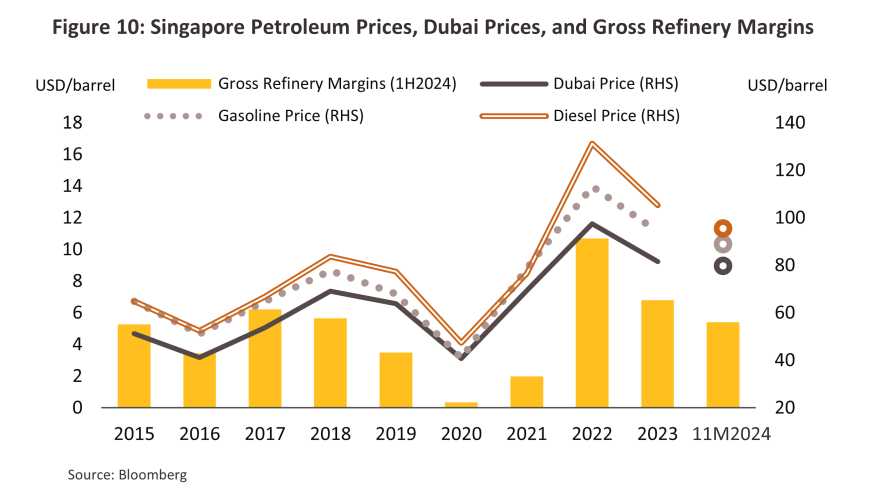

In 2023, the oil refining business faced pressure from the global economic slowdown, following the cyclical downturn. This reduced refinery margins as many countries continued to raise policy interest rates to control global inflation, which remained high at an average of 6.8%. Meanwhile, China, the world's second-largest oil consumer (accounting for 16% of global oil consumption), faced economic slowdown and structural challenges, particularly in the real estate sector. These factors diminished overall oil demand. However, the production cuts by OPEC+ and the ongoing tensions in the Middle East, as well as the prolonged Russia-Ukraine war, helped maintain high global crude oil prices. This was reflected in the average price of Dubai crude oil, which stood at USD 81.5/bbl (-16.4% from 2022), higher than the 2015-2019 average of USD 55.8/bbl by 46.1%. Meanwhile, Singapore gross refinery margins averaged USD 6.8/bbl, higher than the pre-COVID-19 average of USD 3-5/bbl (Figure 10).

In the first 10 months of 2024, the price of Dubai crude oil decreased to an average of USD 80.5/bbl, a decrease of -1.5% YoY, due to the lack of recovery in global crude oil demand as the global economy continues to grow slowly. The United States stimulated its economy by reducing the policy interest rate to 4.25-4.5% from 5.25-5.5% earlier in the year. Meanwhile, China is facing a weakened economy, with the IMF forecasting growth of only 4.8%, lower than the pre-COVID-19 period (2010-2019), which averaged 7.7%. The real estate crisis remains ongoing, and there has been an increase in the use of electric vehicles, as well as a gradual shift to LNG-powered trucks instead of diesel-powered trucks. As a result, OPEC revised its global crude oil demand forecast for 2024 down to 103.8 million barrels per day (a decrease from the January 2024 forecast of 104.36 million barrels per day). However, factors supporting the oil price from falling further include periodic geopolitical tensions, especially in the Middle East, raising concerns about oil supply impacts, production cuts in Libya, and OPEC+ countries continuing to manage oil production within agreed limits.

For the remainder of the year, global crude oil demand is expected to rise slightly due to the onset of winter and the end-of-year holiday season, which typically sees higher travel demand. As a result, the average price of Dubai crude oil for the entire year of 2024 is projected to be around USD 80/bbl.

The overall refining margin in the Singapore market (for the first 9 months of 2024) averaged USD 4.8/bbl, a decrease from USD 7.2/bbl in the same period of 2023. This is in line with the reduced prices of refined products in Singapore market due to weak demand, particularly for diesel, which is primarily used in the industrial sector. During the first 9 months of 2024, the price of diesel in the Singapore market dropped -7.1% YoY (averaging USD 97.4/bbl), and gasoline prices dropped -3.8% YoY (averaging USD 91.5/bbl), leading to a decrease in margins, especially for diesel. As a result, Asian refiners adjusted their refined product production strategies to align with demand. For example, Sinopec (a Chinese state-owned oil refinery) reduced its diesel production by -24.9% YoY in the first half of 2024, while increasing its jet fuel production by 51.0% YoY in the same period to meet the growing demand from the tourism sector (Source: OPEC Monthly Oil Report 2024).

In the first 9 months of 2024, Thai oil refineries benefited from a 1.5% YoY increase in demand for refined products, driven by the rising demand for oil in the transportation sector. This was a result of the continued growth of the tourism sector, especially air travel. This is reflected in a 7.7% YoY increase in LPG usage in transportation and a 17.3% YoY increase in jet fuel consumption. However, the manufacturing sector, which is tied to export performance, showed slower growth (with exports expanding by only 3.9% YoY in the first 9 months of the year), leading to a continued decline in oil demand in the industrial sector. Diesel and fuel oil demand dropped by -0.5% YoY and -13.0% YoY, respectively (Figure 11). For the remainder of the year, the end-of-year holiday season is expected to boost demand for refined products in the Middle Distillate category, resulting in a 1.5-1.7% YoY increase in overall demand for refined products in 2024. Additionally, the utilization rate of oil refineries is expected to rise above pre-COVID-19 levels in 2019 (Figure 12).

Thailand's gross refinery margins in 2024 are expected to decrease compared to 2023, due to consistently high crude oil prices amid gradually increasing demand for refined products. For the first 9 months of the year, the refinery margin averaged USD 5.2/bbl, in line with the Singapore market's refining margin, which averaged USD 4.8/bbl during the same period, down from USD 7.2/bbl in the same period last year. It is expected that in the fourth quarter, refinery margins will increase slightly due to the onset of the high season, which will push up demand for refined products. Meanwhile, oil supply will be pressured by China's reduced exports of refined products, causing the prices of several refined oil products in the Singapore market to rise (Figure 13). As a result, Thailand's refinery margin is expected to increase slightly, with the average for the entire year of 2024 projected to be between USD 5.0-6.0/bbl, down from USD 7.1/bbl in 2023.

Krungsri Research has assessed the key indicators of Thailand's oil refining industry for 2024 as follows.

-

The ex-refinery prices have continued to decrease, particularly for diesel (-2.2% from 2023), while the cost of Dubai crude oil has decreased at a slower rate (-1.8% YoY), resulting in a reduction in the price spread to THB 5.4/liter, down from THB 6.2/liter in 2023. The price spread between ex-refinery gasoline and Dubai crude oil stands at THB 4.2/liter, down from THB 4.5/liter in 2023.

-

The retail price of diesel decreased by -4.0% from 2023, averaging THB 31.6/liter, as the government implemented a policy to cap diesel prices at no more than THB 30/liter during the first quarter of the year and decided to maintain the price at THB 33/liter until the end of the year. Meanwhile, the price of gasoline increased by 2.4%, averaging THB 45.7/liter.

-

The consumption of refined oil products increased by 1.7% from 2023, following the recovery of economic activities, especially in the transportation sector. This can be broken down as follows: (1) Jet fuel consumption surged by 17.0%, compared to 9.6% in 2023, driven by increased air travel as tourism continued to grow; (2) Gasoline consumption increased slightly by 0.5% from 2023, due to the return to normal levels of travel for various activities. However, gasoline demand was limited by weaker purchasing power among some consumer groups and the rapid growth of electric vehicle adoption (the number of electric passenger cars—HEV, BEV, and PHEV—is expected to grow by 25.2% in 2024); (3) LPG consumption grew by 3.0%, driven by demand in the petrochemical industry and transportation (which together account for 25.9% of total LPG consumption); and (4) The consumption of diesel and fuel oil decreased by -0.5% and -13.0%, respectively, due to the sluggish export sector, which reduced industrial demand for oil.

-

Exports of refined oil products increased by 6.0% from 2023, driven by a 20.0% increase in fuel oil exports and a 9.0% increase in gasoline exports. However, exports of other petroleum products, such as diesel and LPG, declined by -1.5% and -6.0%, respectively.

-

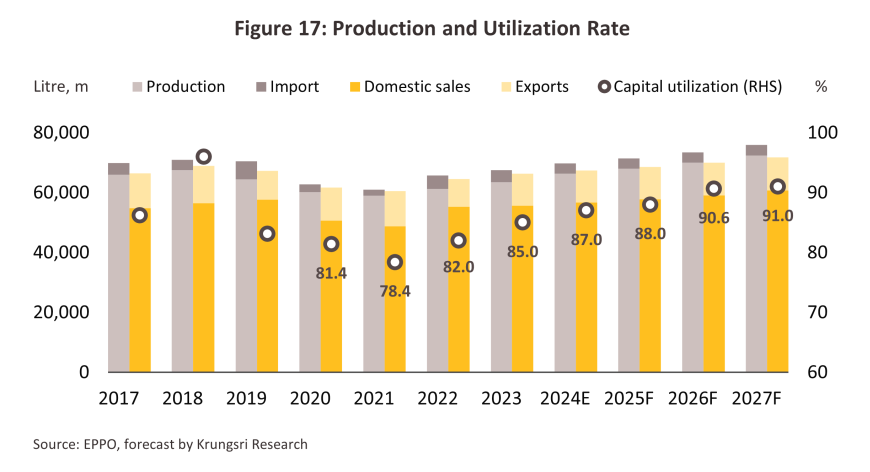

Refined oil production continued to increase, in line with rising demand for oil. Overall oil production expanded by 3.4% from 2023, driven by increases in gasoline (+1.2%) and jet fuel (+19.0%). Meanwhile, diesel production declined by -0.6%. The utilization rate of production capacity rose to 87%, approaching levels seen before the COVID-19 pandemic.

Outlook

The price of Dubai crude oil from 2025 to 2027 will average between 70-80 USD per barrel. The EIA forecasts that oil demand in 2025 will increase by 1.3 million barrels per day to 104.3 million barrels per day, driven by the gradual recovery of the global economy (the IMF predicts global economic growth in the range of 3.2-3.3%). The ongoing interest rate cuts in the US and Europe will help stimulate economic activity, while China will implement moderately eased monetary policies to further boost its economy, which will support higher oil demand. However, trade tensions between China, the US, and allied countries are likely to intensify, putting pressure on production and exports, thereby limiting China’s oil demand to some extent. For oil demand in 2026 and 2027, the continued growth of electric vehicles and the shift towards cleaner energy sources instead of fossil fuels will reduce the demand for oil in the transportation sector. On the supply side, oil supply is expected to rise from the OPEC+ group, which plans to increase production in the first quarter of 2025 by 138,000 barrels per day until September 2026 (down from the original plan of 180,000 barrels per day). As a result, oil production in 2025 will reach 104.2 million barrels per day and will increase only slightly in 2026 and 2027 to match oil demand. However, the increase in oil production from Non-OPEC countries will cause global oil supply to grow at a faster rate than demand, leading to Dubai crude oil prices averaging USD 76/bbl in 2026 and USD 74/bbl in 2027, slightly down from the USD 78/bbl expected in 2025 (Figure 14).

Refined oil prices in the Singapore market are expected to decrease in line with global crude oil prices, while supply is likely to increase due to the expansion of production capacity in Asia, particularly in China, India, and the Middle East. In 2026, more than 1.5 million barrels per day of new production capacity are expected to be added. Meanwhile, oil demand is expected to gradually recover in line with the economic situation and the tourism sector (the IMF estimates that the economies of emerging and developing Asian countries will grow at a rate of 4.5% to 5.0% from 2025 to 2027). As a result, refined oil prices will not decrease significantly. The price difference between refined oil and Dubai crude oil is expected to return to levels close to those before the COVID-19 crisis, resulting in refining margins in the Singapore market averaging USD 5.5-6.0/bbl over the next three years, close to the pre-COVID-19 average of USD 5.0-5.5/bbl (2012-2019).

Domestic refined oil prices are expected to move in the same direction as global crude oil prices. It is anticipated that gasoline prices will average between THB 39.0-44.0/liter, while diesel prices will average between THB 29.0-30.5/liter. The price difference between refinery gate prices and Dubai crude oil is expected to remain stable at around THB 3.5-4.5/liter (Figure 15).

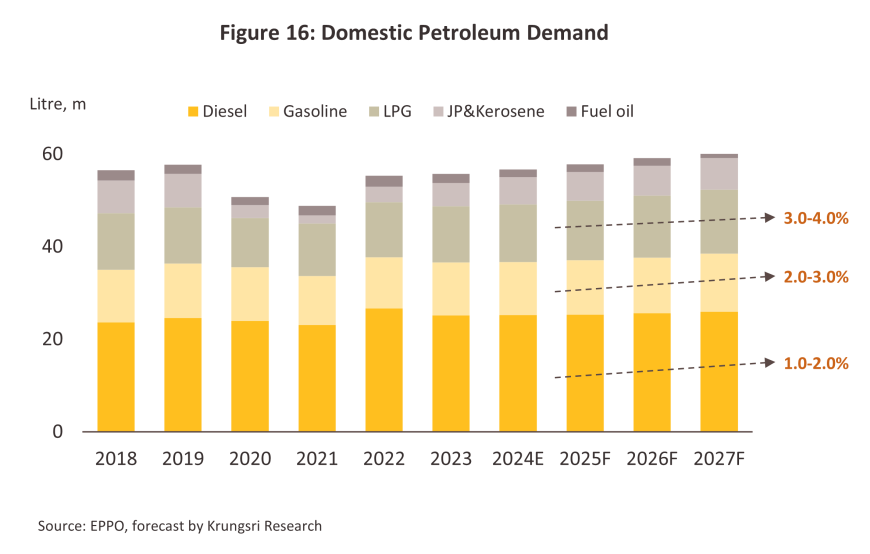

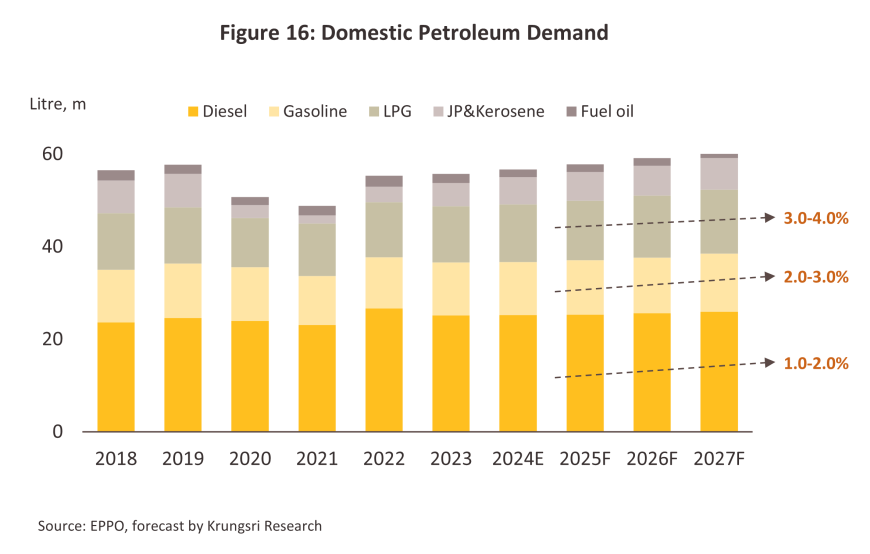

Domestic demand for refined oil is expected to grow at an average rate of 2.0-2.5% per year due to (1) the gradual growth of the Thai economy at a rate of 2.5-3.0% per year, driven by the recovery of the tourism sector, with the number of foreign tourists expected to return to pre-COVID-19 levels by 2025, boosting demand for transportation fuels, including aviation fuel; (2) the continuous expansion of the e-commerce business (expected to grow at an average rate of 10-15% per year), which supports the growing demand for fuel in product transportation; and (3) the increasing integration of trade and investment within ASEAN, which will encourage more use of diesel-powered commercial vehicles. However, the ongoing rise of electric vehicles and the slow recovery of the industrial sector will limit the demand for refined oil in the country. Based on these factors, it is expected that from 2025 to 2027, demand for diesel and gasoline will grow by an average of 1.0-2.0% per year and 2.0-3.0% per year, respectively, while jet fuel consumption is expected to grow by an average of 5.0-10.0% per year (Figure 16).

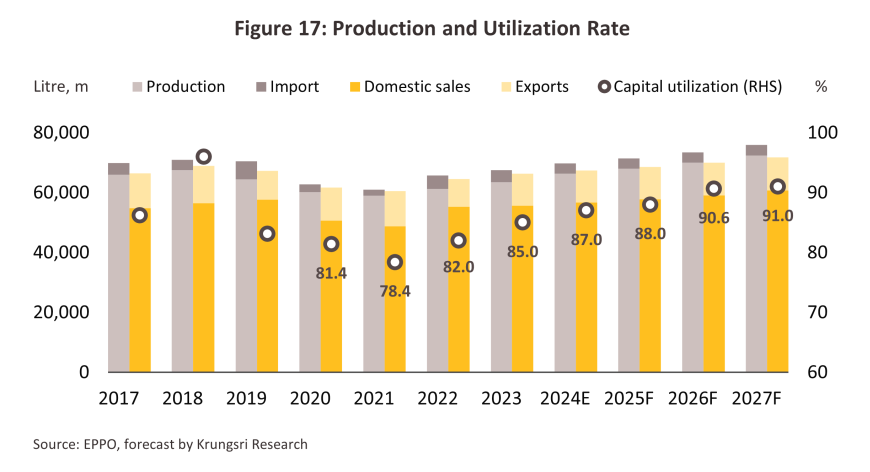

Continuous growth in oil consumption will drive an increase in the production of refined oil at a rate of 2.5-3.5% per year. This will lead to an increase in capacity utilization to 88-91%, up from 87% in 2024, and push refinery margins to an average level of USD 5.5-6.0/bbl, which is higher than the pre-COVID-19 average of USD 5.0-5.5/bbl (2012-2019) (Figures 17 and 18).

To meet the increasing demand for oil in the future and to expand market opportunities, some operators plan to expand refining capacity to increase flexibility in processing a wider variety of crude oils. This will create economies of scale and help reduce production costs. Additionally, operators are focusing on developing clean energy projects, such as adding value to low-value products (e.g., fuel oil) by transforming them into more environmentally friendly and higher-value products (e.g., Euro 5 standard diesel and low-sulfur jet fuel). The use of green hydrogen to reduce the sulfur content of diesel and the production of sustainable aviation fuel (SAF) are also being explored. Under the new Oil Plan and AEDP, a target is set to increase SAF usage in aircraft to 1% by 2030, in line with global trends to reduce carbon dioxide emissions, mirroring the practices of refineries in many countries worldwide.

In the future, as the focus shifts from fossil fuels to clean energy, oil refineries worldwide face the risk of shutdown due to decreasing oil demand. According to Wood Mackenzie, 121 out of 465 oil refineries globally (accounting for 21.6% of the total refining capacity in 2023) may have to shut down by 2030, especially in Europe, where fuel demand for transportation is expected to start declining in 2028. China is expected to have its peak oil demand in 2030 before gradually decreasing as electric vehicles become more prevalent. Therefore, Thailand's oil refining industry must adapt to the challenges posed by global oil price volatility, increasingly stringent environmental regulations, and the cost burdens of compliance with various standards. These factors will pressure the industry's financial performance.

1/ The major components of crude oil are alkane and cycloalkane hydrocarbons, but crude oil usually also contains small quantities of sulfur, nitrogen, and a variety of metals. Crude from different formations typically has its own profile so crude from the Bakken reserves in North Dakota is more than 60% light oil, whereas that from the Urals in Russia is just 30% light oil. This difference is significant since light oil is less dense than heavy oil. This is due to the lower number of carbon atoms that light oil contains, which makes it more combustible and thus more energetic than heavy oil.

2/ Usually, refineries run non-stop since stopping and starting operations incurs heavy costs. Refineries will, however, periodically cease operations for annual planned maintenance. This will normally be for a period of 1-2 months.

3/ In 2023, Bangchak bought a 65.99% share of Esso from ExxonMobil and announcedits intention to buy the remaining shares. This purchase should be completed in 2024.

.webp.aspx)