Executive Summary

Private-sector electricity generators can look forward to demand growth of 5.0-6.0% annually from 2025 to 2027. This will be driven by ongoing expansion in the domestic economy, progress on the buildout of new government-backed transportation infrastructure that will in turn support greater levels of urbanization, and the increasing number of EVs (both passenger vehicles and buses) on the road. Concerning supply, government policy is focused on ensuring that private-sector investment continues to rise in step with future demand. Policy is especially concentrated on developing the infrastructure and regulatory environment needed to foster the transition to a greater reliance on renewables and clean energy more generally. The private sector is responding to these incentives and so investment in renewables-based production is rising, and this will then help to increase national competitiveness in trade and investment in Thailand.

The industry’s challenges include higher competitive pressures, especially from the expansion in investment in renewables, higher costs to comply with ESG frameworks, and the new technologies and innovations being used in power plants. The market is also influenced by its liberalization and the possibilities offered by private-sector companies relying more heavily on their own power production. These factors may then combine to limit growth in profits.

Krungsri Research View

The outlook for players in the energy sector will vary according to the segment that they occupy.

-

Independent power producers (IPPs): With economic growth boosting consumption of electricity, revenue will continue to expand. Most IPPs are also extending their investments in renewables and in projects overseas (e.g., in Myanmar, Lao PDR, Indonesia, the Philippines, Australia, Japan, and the US), and this will further lift incomes.

-

Small power producers (SPPs): Income will strengthen gradually. Players will have the opportunity to expand their investments in: (i) natural gas cogeneration plants, many of which will see their supply contracts expire in 2025; (ii) renewables via SPP hybrid firms, where production costs may be less than THB 2.0/unit compared to retail prices that may average more than THB 4.0/unit; and (iii) new power stations in the Eastern Economic Corridor.

-

Very small power producers (VSPPs): Income should grow solidly on: (i) government plans to source more than 10,000 MW of renewables-based power (in particular solar, wind, biomass, biogas, and waste-to-energy) by 2027; and (ii) BOI investment support schemes that offer corporate tax breaks for companies investing in clean energy production. Less positively, recent entrants to the market that are involved in the production of electricity from biomass and biogas may face difficulties sourcing sufficient inputs.

Overview

Thailand’s power generation industry is structured in line with the enhanced single-buyer model with state bodies being the sole buyers and distributors of power through the national grid. The Electricity Generating Authority of Thailand (EGAT) is both a producer, a distributor, and by purchasing power from private-sector ‘independent power producers’ (IPPs) and ‘small power producers’ (SPPs), a buyer of electricity. It also has a monopoly in the distribution of electricity in the country. In addition, the Metropolitan Electricity Authority (MEA) and the Provincial Electricity Authority (PEA) are responsible for distributing power as well as buying electricity from ‘very small power producers’ (VSPPs) (Figure 1).

The most important features of the Thai electricity generation industry are as follows: (i) Unlike other goods, electricity cannot be stored and must be distributed to users immediately through a transmission and distribution system. (ii) Expanding capacity to meet future demand requires long-term planning because power stations take 5-7 years to construct depending on the type of power plant. This long-term plan is the national power development plan, which main objective is to ensure that electricity supply is sufficient to meet future demand. (iii) Hence, state bodies have a major role in managing generation and distribution, as well as setting tariffs and investment targets to increase supply to the national grid.

Electricity demand growth will depend on the following:

-

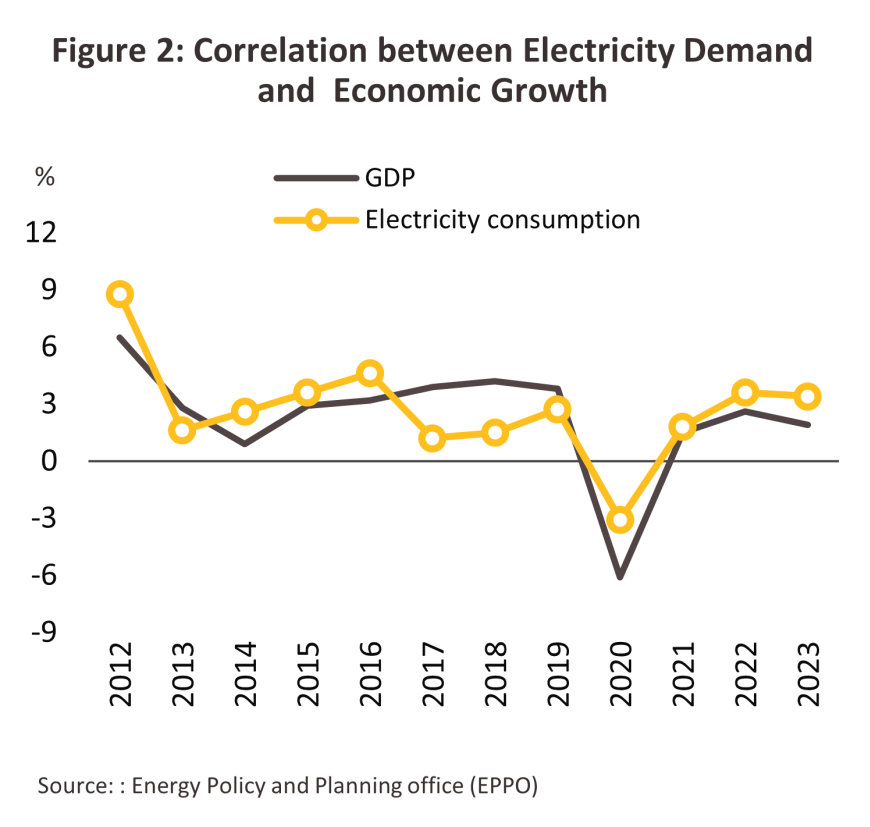

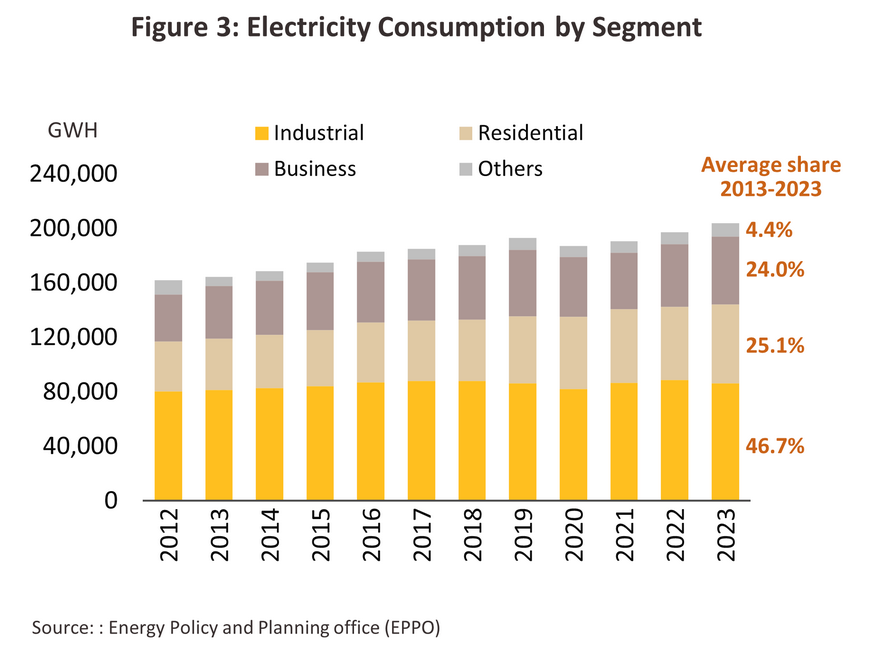

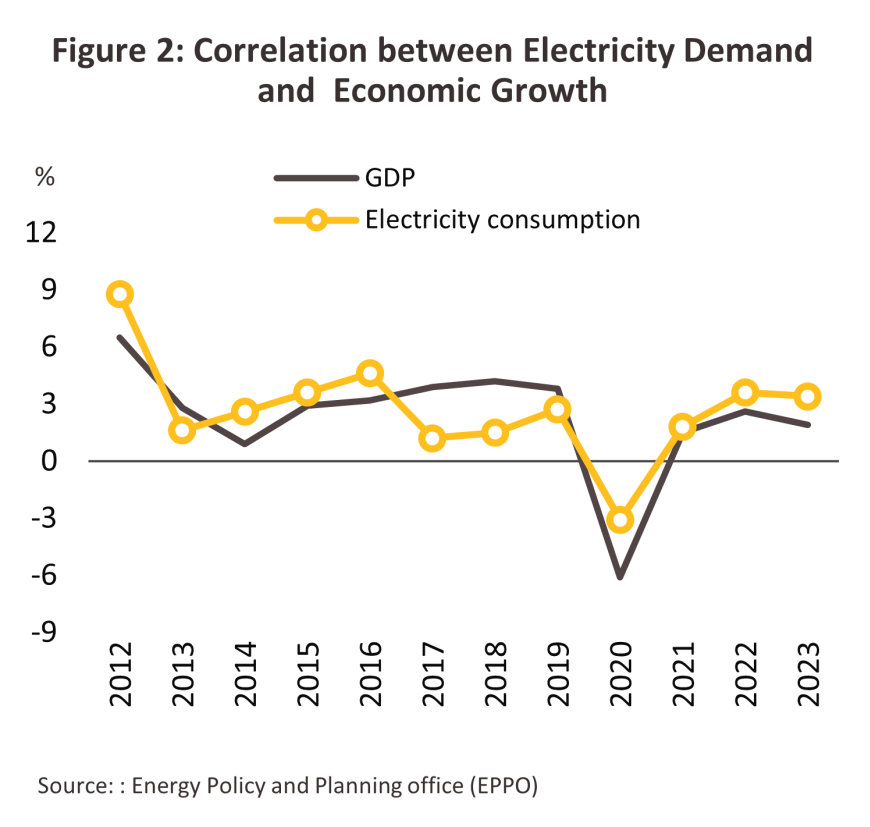

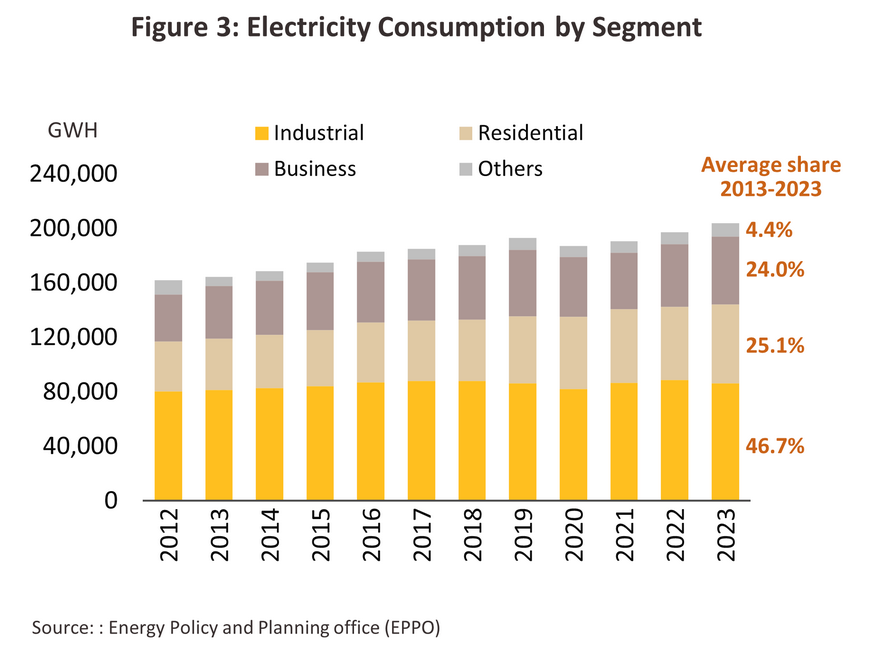

Rising domestic demand. The demand for electricity in the country, which fluctuates with economic conditions (Figure 2), when analyzed by economic sector over the past decade (average from 2013–2023), reveals that the industrial, residential, business, and other sectors account for 46.7%, 25.1%, 24.0%, and 4.2% of the total electricity consumption, respectively (Figure 3). Within the industrial sector, the food industry was the biggest consumer, followed by steel & basic metals, rubber and rubber products, electronics, plastics and textiles. As for the business sector, most electricity usage is related to tourism activities, such as hotels, restaurants and nightclubs, apartments and guesthouses, department stores, and retail-wholesale businesses.

-

Government policy: (i) The Power Development Plan (PDP) and the Alternative Energy Development Plan (AEDP) lays out the desired total generating capacity for each type of power plant1/. (ii) They also set the pricing for renewable energy (because producing power from renewables costs more than electricity produced from fossil fuels, i.e. natural gas, coal, and oil), and this is now used to determine the feed-in tariff2/ (FiT). Previously, the adder system was used to calculate payments3/ (Box 1). (iii) The government also has plans to expand the power distribution network to support the increasing generation capacity, especially from renewable sources. In addition, the Board of Investment (BOI) offers tax breaks for corporate income taxes and waivers for import duties on parts and equipment for companies investing in electricity generation, especially renewable energy (Box 1.2). The government is particularly keen to attract investment inflows to solar, wind, biomass and biogas-based power, and so over 2022 and 2023, an annual average of 450 projects with a total value of THB 30 billion were approved for investment support, up from the earlier average of 200 projects per year valued at THB 20 billion.

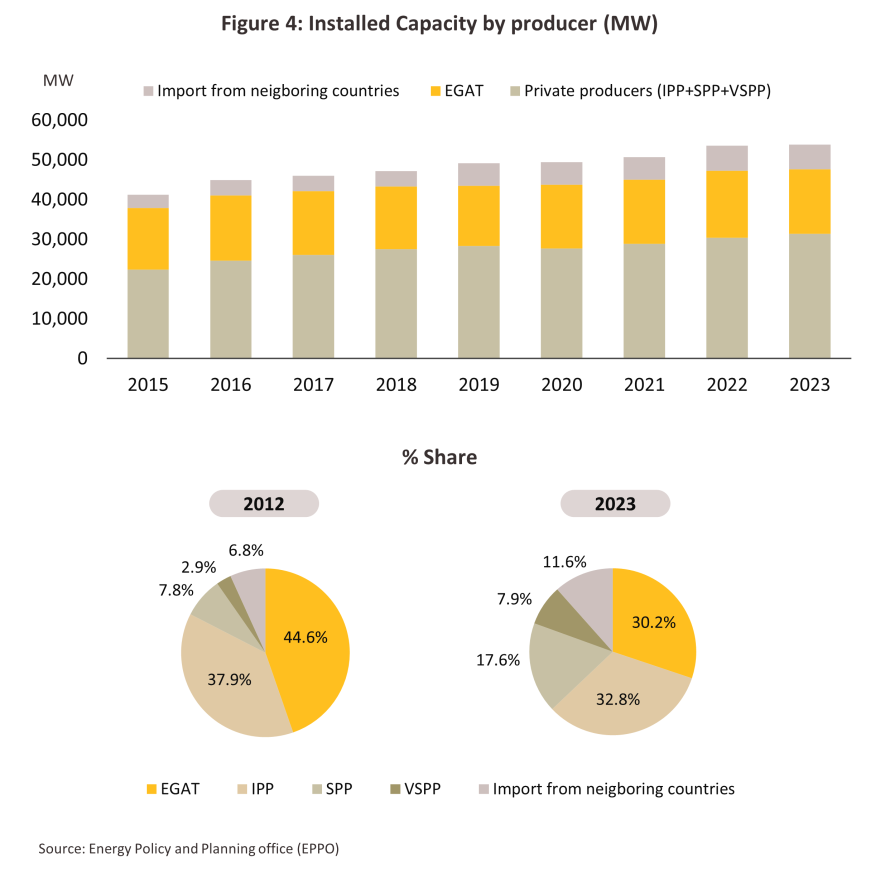

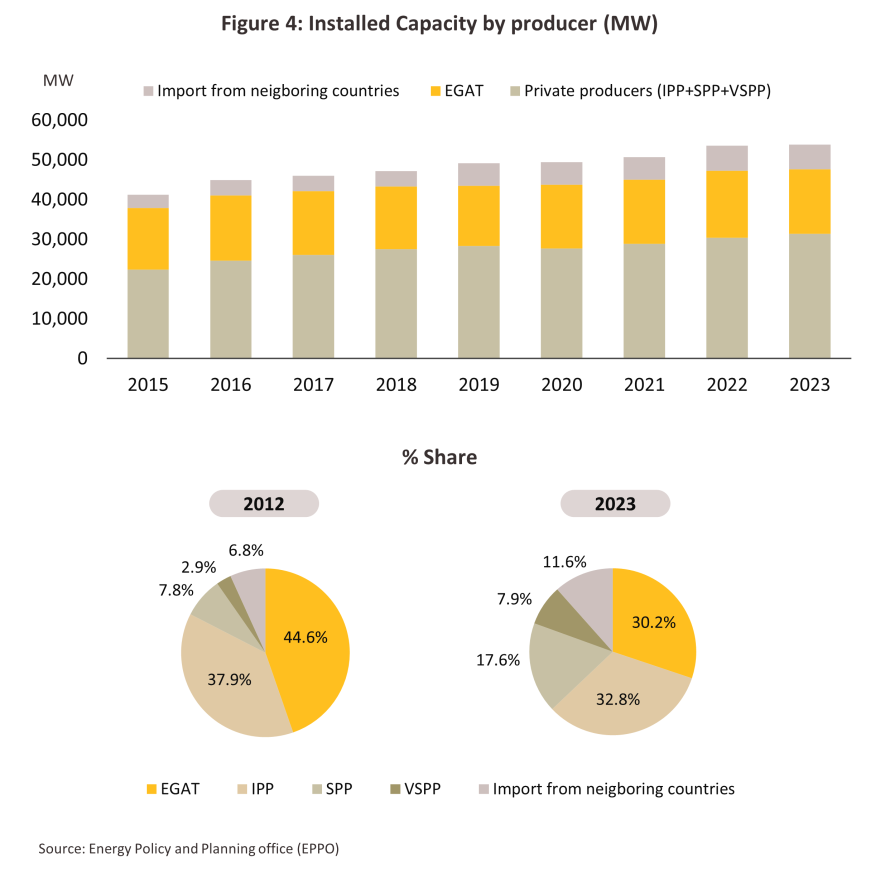

Private-sector generators are playing a greater role in providing supply to the grid, especially very small power providers (VSPPs), and so as of 2023, private-sector providers accounted for 58.3% of total installed capacity, up from 48.6% in 2012. This broke down as 32.8% from IPPs, 17.6% from SPPs and 7.9% from VSPPs, although thanks to a concerted move by governments to increase purchases of electricity generated from renewables (as per the Alternative Energy Development Plan), VSPPs’ market share has increased three-fold over this period (Figure 4). Mirroring this expansion, EGAT’s contribution to the energy mix (including imports from neighboring countries) has contracted from 51.4% to 41.7%.

Electricity generators can be split into two groups according to the energy source that they use.

-

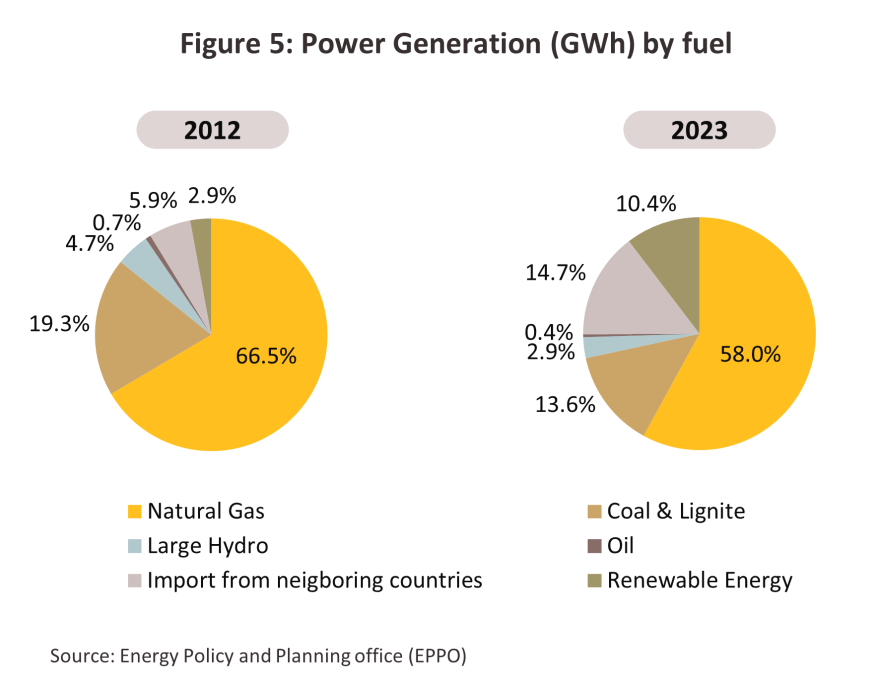

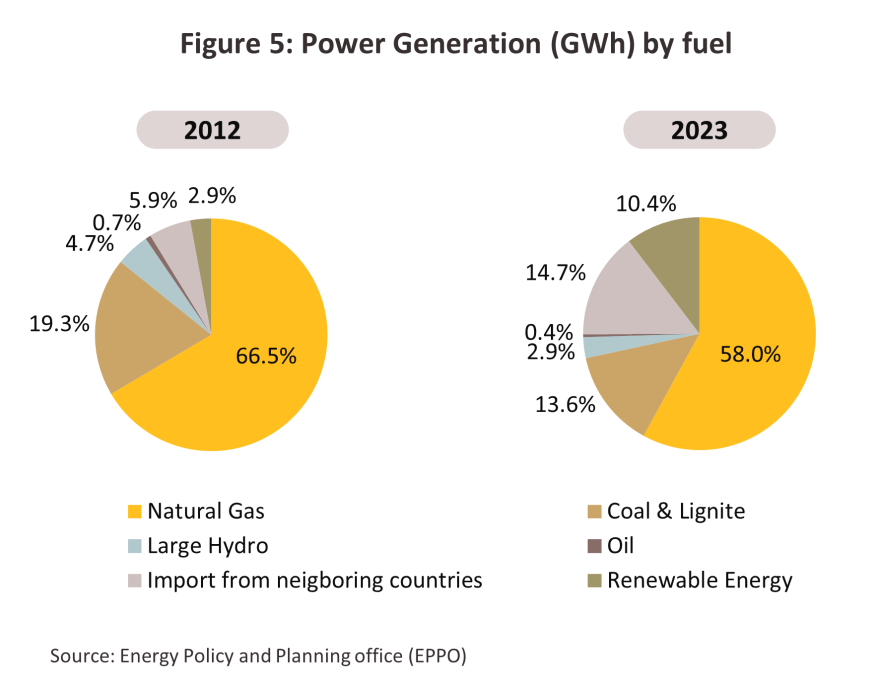

The first group comprises power stations that generate electricity from fossil fuels, i.e., natural gas, coal/lignite and oil, together with large-scale hydroelectric. In Thailand, as of 2023, 58.0% of the electricity that is consumed comes from natural gas (down from 72.0% in 2010 and 66.5% in 2012), which is followed in importance by coal (13.6%), large-scale hydro (3.0%), oil (0.4%) and imports (14.7%) (Figure 5).

-

The second group consists of power producers that generate electricity from renewable sources, including biomass (generally agricultural waste), biogas (from sources including manure, wastewater from agro-processing industries, and energy crops), waste (municipal solid waste and industrial sources for instance), solar, wind and micro-hydro. Previous governments have set a policy of increasing the share of electricity coming from renewables and so power from these sources contributed 10.4% of all electricity used nationally in 2023 (up from 2.1% in 2010 and 2.9% in 2012).

Thailand’s reliance on imports of natural gas from Myanmar has declined steadily in recent years, and so as of 2022, the country was the source of just 42.1% of all Thailand’s imports of natural gas, down by more than half from 2012’s 86.3%. However, this has been made up for by a corresponding rise in imports of liquified natural gas (LNG) from countries including Qatar, Indonesia and Australia, and so this has climbed from 13.7% of imports to 72.7% in 2023 (Figure 6). As sources of gas in the Gulf of Thailand are depleted, this share is expected to rise further, and because global LNG prices are higher than those for domestically sourced gas, this will add to generating costs.

There are three major groups of private-sector players in the power-generating sector.

Independent Power Producers (IPPs)

-

Total installed generating capacity: Over 90 MW. These producers mainly use natural gas and coal to fuel their power stations. As of 2024 (the latest data), there are 13 operators in this category: (i) RATCH Group, (ii) Gulf , (iii) Gulf PD, (iv) Gulf JP NS, (v) Gulf JP UT, (vi) Kaeng Khoi Power Generation, (vii) Ratchaburi Power, (viii) BLCP Power, (ix) Electricity Generating, (x) Glow IPP, (xi) Global Power Synergy, (xii) Hin Kong Power, and (xiii) Gheco-One. The total installed capacity is 18,973.5 megawatts (Table 1).

-

Revenue: Revenue is generated from two sources: (i) a guaranteed ‘minimum intake’ specified in the contract with EGAT, and (ii) power supply directly to the grid to meet demand. Hence, their revenues are dependent on national electricity consumption, although some players also get receipts from their investments in power-generating facilities overseas, including Myanmar, Laos PDR, Indonesia, the Philippines and Australia.

Small Power Producers (SPP)

-

Installed capacity required to qualify as an SPP: 10-90 MW. SPPs typically generate power from natural gas, coal, oil and renewables, and sell mostly to EGAT. A small proportion of their output is sold to industrial consumers that are located near the SPP’s power stations. SPPs can be split into (i) ‘firm’-type SPPs, which have a 20-25-year contract to supply power to EGAT and are normally fueled by natural gas or coal, and (ii) ‘non-firm’ SPPs, (accounting for 30%) primarily use renewable energy sources (such as solar, wind, waste, and biomass) to supply electricity to the MEA. Major producers include B.Grimm Power, Gulf JP, Glow SPP, Gulf TS and Rojana Power (Table 2).

-

Revenue: Revenue is generated from two sources: (i) Derived from long-term contracts with EGAT that, like IPP contracts, come with a minimum revenue guarantee. This means SPPs only have mild exposure to risk of weak earning. (ii) Derived from supplying electricity to industrial consumers located close to the power stations. However, this revenue can fluctuate according to the overall economic conditions and the individual industry cycles. Additionally, businesses receive revenue from government Adder/Feed-in Tariff incentives, depending on the fuel type, and returns on overseas power plant investments, such as solar power plants in Japan, China, South Korea, and Taiwan, as well as wind power plants in Vietnam.

Very Small Power Producers (VSPPs)

-

Installed capacity to qualify as a VSPP: Under 10 MW. VSPPs typically generate electricity from renewables (including solar, wind, hydropower, biomass, biogas and waste) for their own use, and sell any surplus production to the PEA at rates determined by the feed-in tariff (FiT) for that particular generating technology and other circumstances for as long as the project runs (Box 1). The majority of VSPPs that sell electricity fueled by renewables are involved with engineering, designing, procurement and construction, or manufacturers of solar cells and related equipment, as these operators have the necessary expertise to install and maintain the renewable electricity systems (Table 3).

-

Revenue: They will receive payment when the electricity enters the grid (i.e. it is a COD system). Players that generate power from natural sources (i.e. solar, wind or hydropower) are likely to run at a loss in the first 1-2 years due to high cost of building and outfitting production sites, but following this initial period, the situation will improve supported by revenue from the sale of electricity. However, earnings could be volatile for players which produce electricity from biomass, biogas and waste, because of limited access to and fluctuating prices of raw materials.

The major players in the energy sector that are listed on the stock exchange and that produce power from renewables include Energy Absolute (EA) (solar wind and biogas), SPCG (solar), Gunkul (solar, wind and biomass), TPC Power Holdings (TPCH) (biomass), Thai Solar Energy (TSE) (solar and biomass), and Power Solution Technologies (PSTC) (solar, biomass and biogas). Some of these companies also invest in renewables-based power generation assets abroad.

Situation

Demand for electricity strengthened through 2024 due to a number of factors. (i) The pace of economic activity continued to pick up in areas including exports (adding to consumption of electricity from industry) and the tourism sector (lifting demand from adjacent parts of the economy), while progress on the construction of government mega projects is helping to pull in additional private-sector investment, thereby generating another tailwind to growth. (ii) The cumulative number of EVs on Thai roads is rising steadily, with cumulative registrations of BEVs and PHEVs expected to reach 203,708 units in 2024, up from 122,258 units in 2023. (iii) Peak temperatures hit 44.2°C in April, up from the 5-year average (2019-2023) of 40.1°C. (iv) Government policy aimed to reduce the pressure on household budgets by limiting increases in energy prices4/ in particular by holding the Fuel Adjustment Cost (Ft) rate to 39.72 satang per unit. Given this, electricity prices averaged THB 4.18/unit in 2024, down from THB 4.57/unit in 2023.

Nevertheless, the Thai economic growth remains patchy and limited, and with competition in some markets intensifying and electricity prices above the average THB 3.63/unit maintained over 2019-2021 (prior to Russia’s invasion of Ukraine). The government has also rolled out policies that have encouraged households, businesses, and industrial users to install their own rooftop solar systems. The electricity generated from these is used by the installer, but any excess can be sold back into the national grid, and so to support these trends, prices paid under the feed-in tariff have risen to THB 2.20/unit, up from THB 1.68/unit in 2020. This has then helped to weaken growth in demand for power supplied through the grid. Krungsri Research thus sees growth in electricity consumption running to 5.0-6.0% across all of 2024, up from 3.4% in 2023. Details of how the market fared over the first 9 months of the year are given below.

-

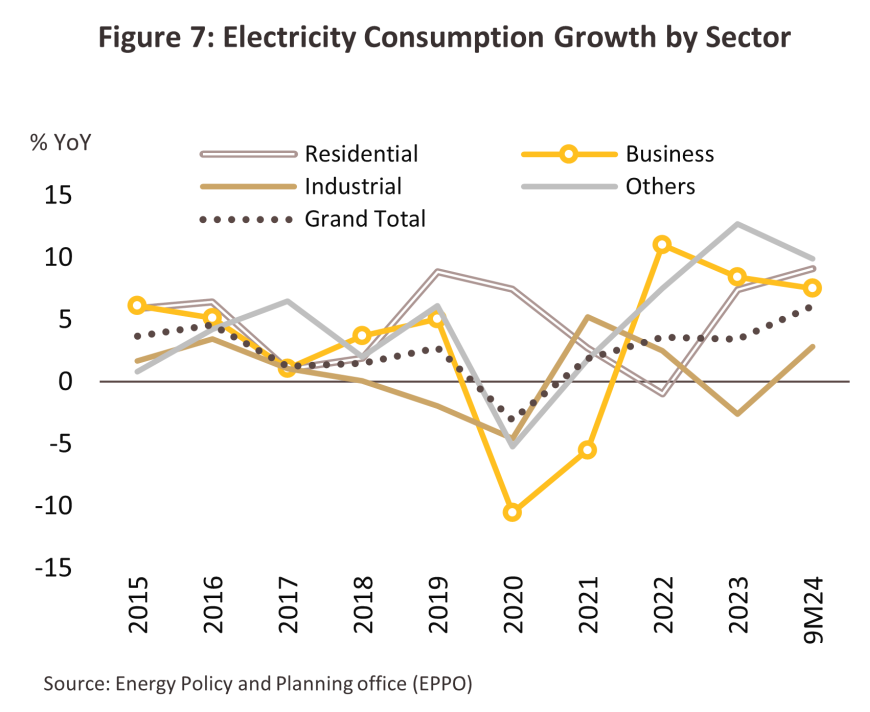

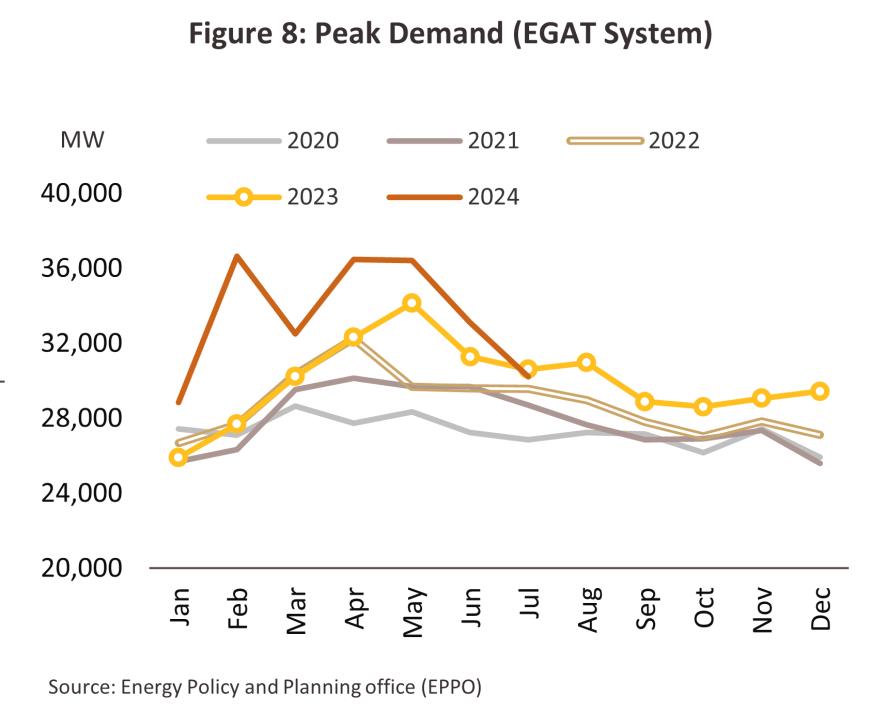

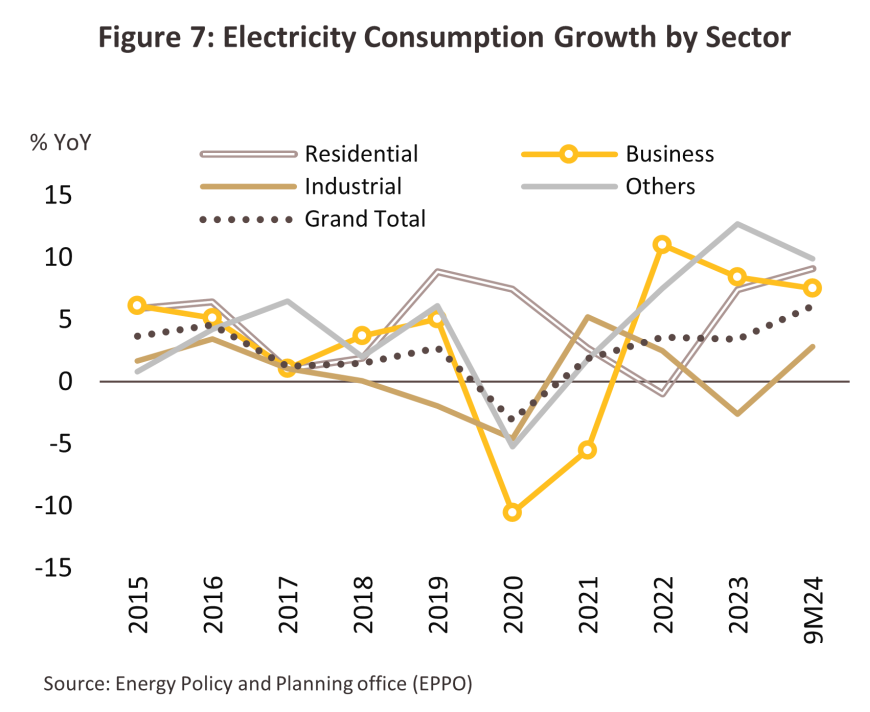

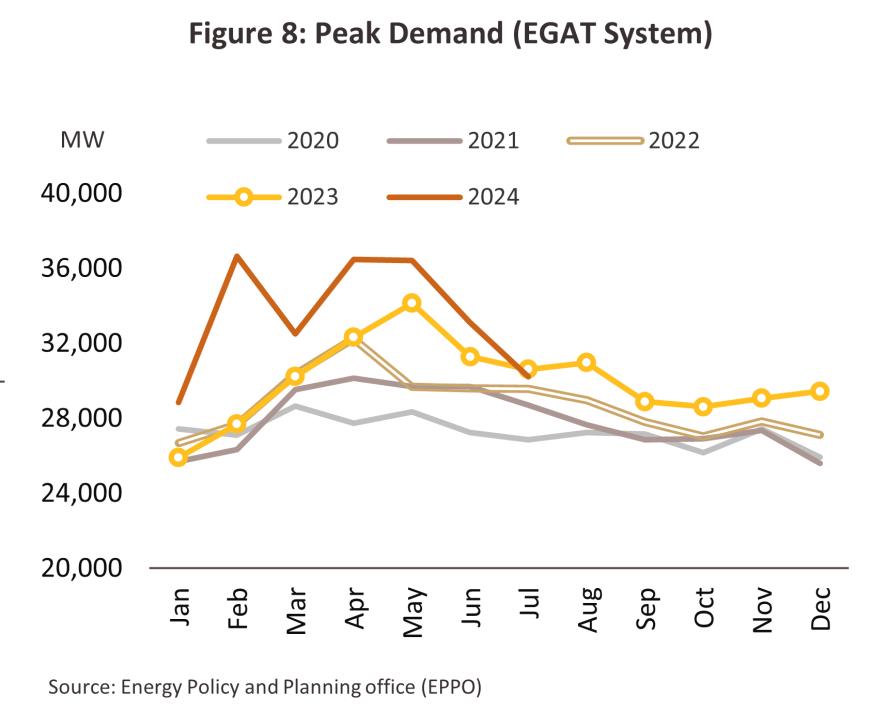

In the period, electricity consumption rose 6.1% YoY to 163,311 GWh. Demand growth came largely from households (29.4% of demand) and businesses (24.8%), for which consumption was up by respectively 9.1% YoY and 7.5% YoY. These increases were driven by the ongoing rebound in the tourism industry and related parts of the economy, including restaurants and nightclubs (+13.2% YoY), hotels (+12.2% YoY), apartments and guesthouses (+12.0% YoY), retailers (+7.6% YoY), hospitals and other healthcare providers (+7.3% YoY), and department stores (+5.6% YoY). Demand from industrial users (40.8% of the market) also rose, though at the slower rate of 2.8% YoY. An increase in electricity demand was thus seen in businesses active in electronics (+10.5% YoY), rubber and rubber products (+6.0% YoY), food processing (+4.4% YoY), plastics (+3.4% YoY) and steel and other metals (+1.6% YoY). The final major source of demand is the agricultural sector and other areas (5.0% of demand), which expanded by 9.9% YoY (Figure 7). Peak demand reached 36,477.8 MW in April (up 6.9% from the peak in 2023) (Figure 8). For the rest of the year, the onset of the tourism high season and the year-end festive season will lift demand, implying growth of 5.0%-6.0% over all of 2024 (up from 3.4% in 2023).

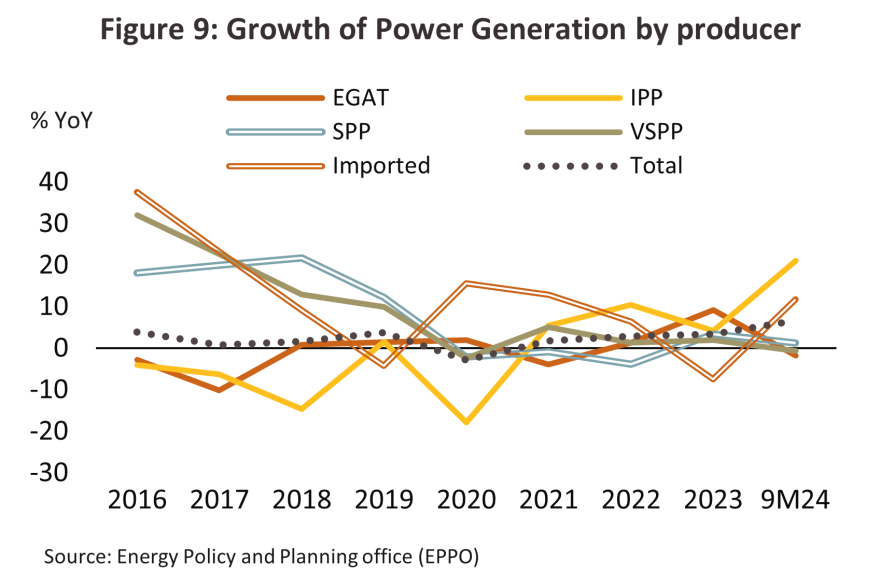

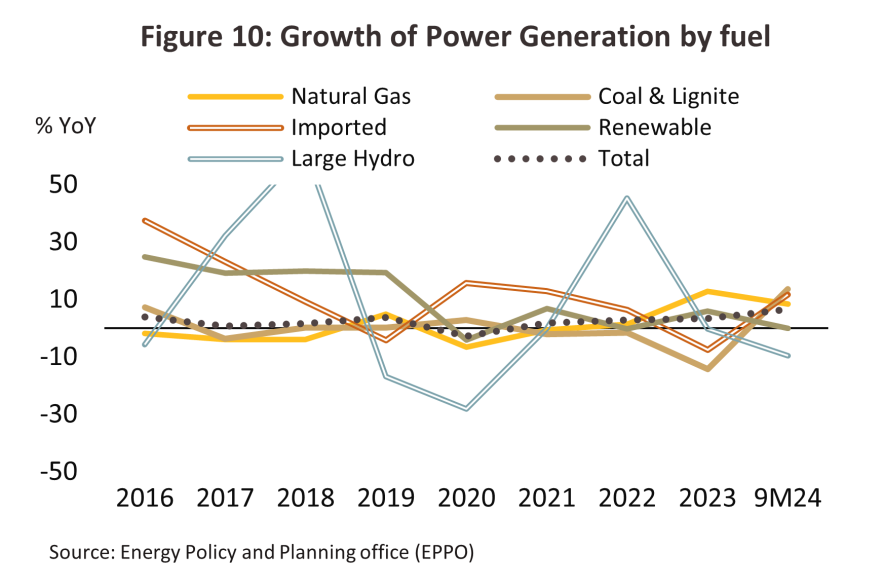

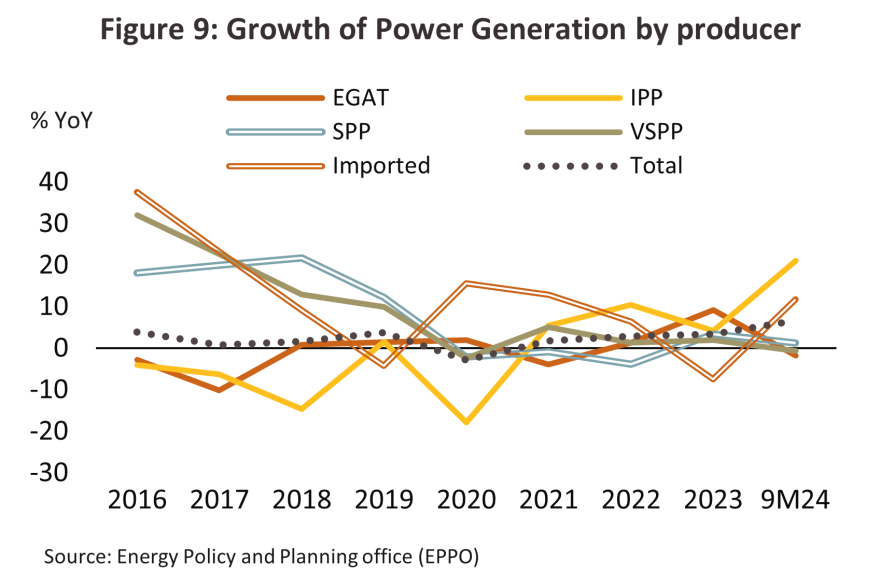

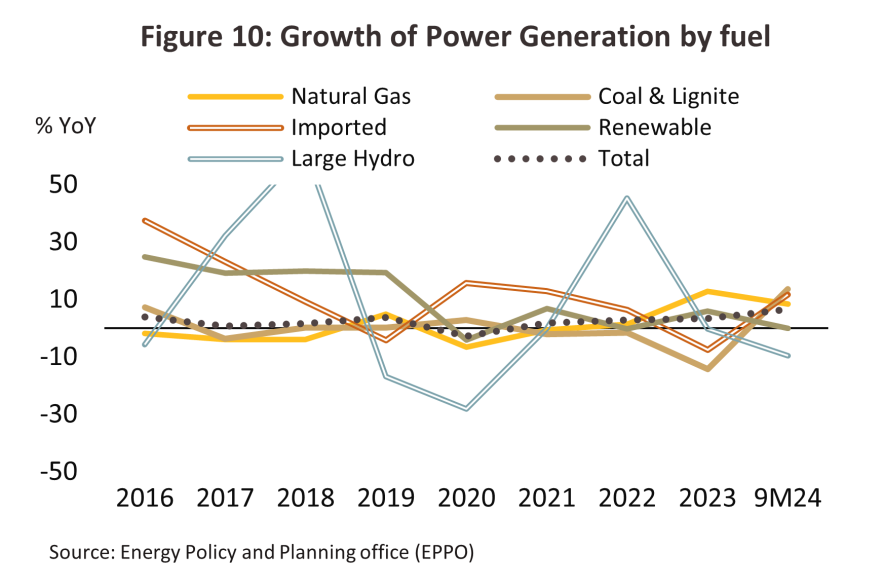

- The national grid was supplied with 169,273 GWh of power in the period, up 6.6% YoY (Figure 9) as generators responded to rising demand. Growth was driven by the expansion in supply from IPPs (28.5% of total generation), for which supply rose 21.0% YoY. However, supply from SPPs and VSPPs (27.3% of the total generation) inched up just 0.9% YoY, while supply from EGAT (29.5%) fell back -1.8% YoY. Imports of electricity from neighboring countries (14.7% of supply) also expanded by 11.7% YoY. The most important sources of power remain natural gas (59.0% of the total generation) and coal (13.6%), with supply from these rising by respectively 8.4% YoY and 5.7% YoY (Figure 10). These increases were due to a combination of falling energy costs and new gas-fired power stations coming online (1,325 MW, up 7.5% from 2023). Demand will likely be lifted further by the end of year celebrations, and so for 2024 overall, production should be up by 6.0-7.0%, a strong increase on 2023’s 3.4% rise.

-

According to the latest data available (as of July 2024), renewables capacity contracted to supply the national grid totaled 10,010.5 MW5/, which thus represented an increase of 1.2% from the end of 2023 (Figure 11). The most important increases were seen in solar (+2.2%), followed by biogas (+0.6%) and biomass (+0.5%). In 1H2024, progress is most advanced on the development of the biomass segment, with installed capacity for this now at 99.0% of the target of 3,930 MW. This is followed by solar (91.2%), wind (87.0%), biogas (50.5%), and waste-to-energy (44.7%). Supply will continue to come online through the remainder of the year and so across 2024, capacity is forecast to expand 2.5% YoY to 10,150 MW.

With regard to the supply of renewables, there are currently 1,020 SPPs and VSPPs that have agreed contracts to supply electricity to the grid6/, and these have a contracted capacity of 5,120 MW. This is concentrated in solar production by VSPPs because the public sector has been buying in renewables from these sources since 2021. In addition, the tariffs received by providers have been set at an attractive rate, thus incentivizing both households and commercial and industrial operations to install rooftop solar systems. The government is also continuing to support an expansion in renewables capacity in the private sector through BOI investment promotion schemes that waive corporation tax for operators of qualifying projects, and thanks to this, 399 projects with a total investment value of THB 110 billion were approved for investment support over the first 9 months of 2024. This marked an increase of 241% YoY, and 93.0% of these involve the generation of electricity from biomass, biogas, wind, solar and waste.

Outlook

Private-sector power generators operating in the domestic market will benefit from strengthening demand over 2025 to 2027, with growth in electricity consumption driven by the Thai economic recovery. In addition, government efforts to reduce pressure on household spending will see the freeze on charges kept in place, leaving these at THB 4.18/unit through the first 4 months of 2025. On the supply side, the government has been encouraging an expansion in supply to ensure that this keeps up with the demand, with a focus on expanding the share of electricity coming from renewables and alternative sources. Support for this is laid out in the draft 2024 Power Development Plan and includes efforts to encourage the introduction of emerging technologies within the energy sector (for example, preparing both the infrastructure and the regulatory environment needed to facilitate an increase in the use of hydrogen power, and using depleted oil and gas wells as part of carbon capture and storage facilities). This will then help to develop the ecosystem needed to facilitate the energy transition, which will in turn sharpen Thailand’s relative competitiveness in global trade and investment. Details of the three-year forecast are given below.

-

The supply of electricity should expand steadily as per government policy laid out in the Power Development Plan (PDP) and the Alternative Energy Development Plan (AEDP). These set out a roadmap for ensuring that supply tracks long-term increases in demand, while also ensuring that the industry’s carbon emissions are reduced to 41.5 MtCO2 by 2050. As part of this, the government has placed a strong emphasis on an expansion in investment in new power stations, especially from renewables. The most salient features of the current policy landscape are described below.

-

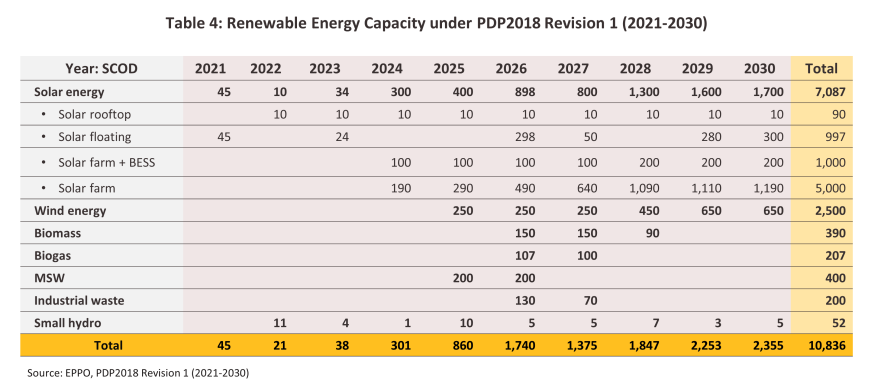

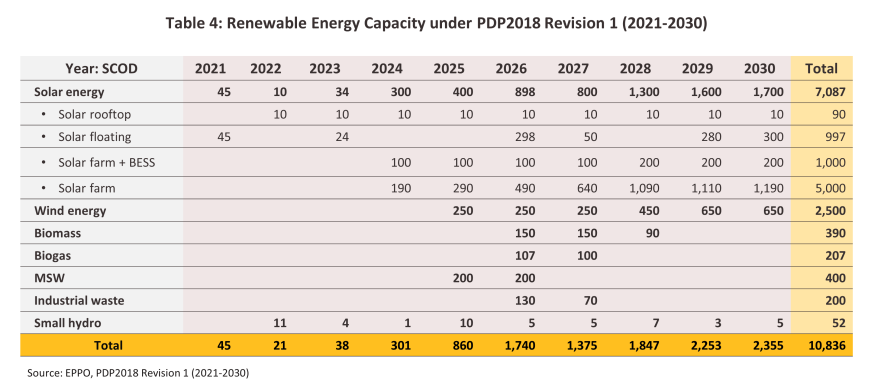

The PDP2018 Revision 1 sets a target of adding 56,431 MW to installed capacity by 2037. This would then be sufficient to meet forecast the peak demand of 53,997 MW (up 1.6-times from its 2023 level) and to replace currently installed capacity that will reach the end of its operating life. In line with global trends towards decarbonizing the energy sector, the target is for renewables to be the most important source of new capacity, with these followed in importance by combined-cycle power plants. Over 2023-2030, there will be a gradual procurement of over 10,000 MW of electricity from renewable energy sources (Table 4).

-

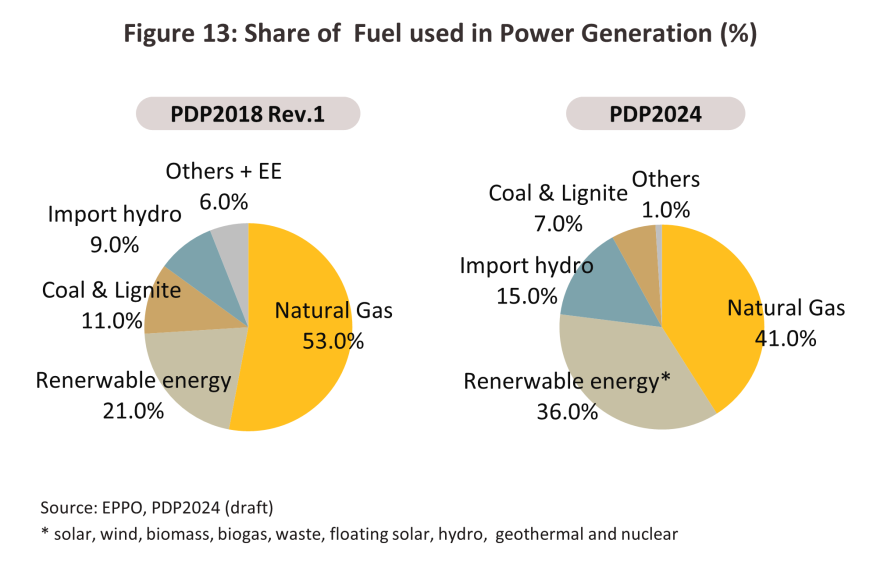

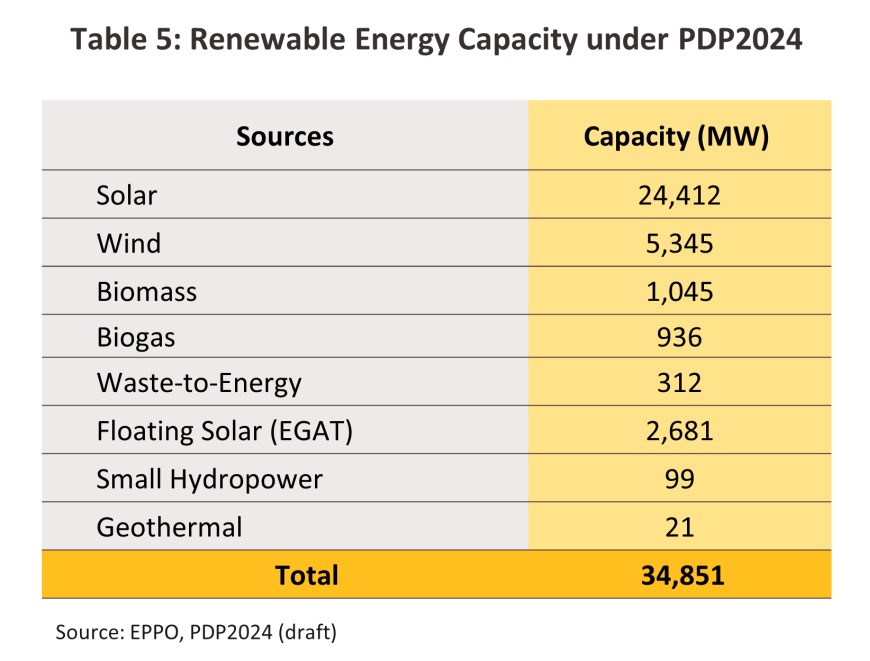

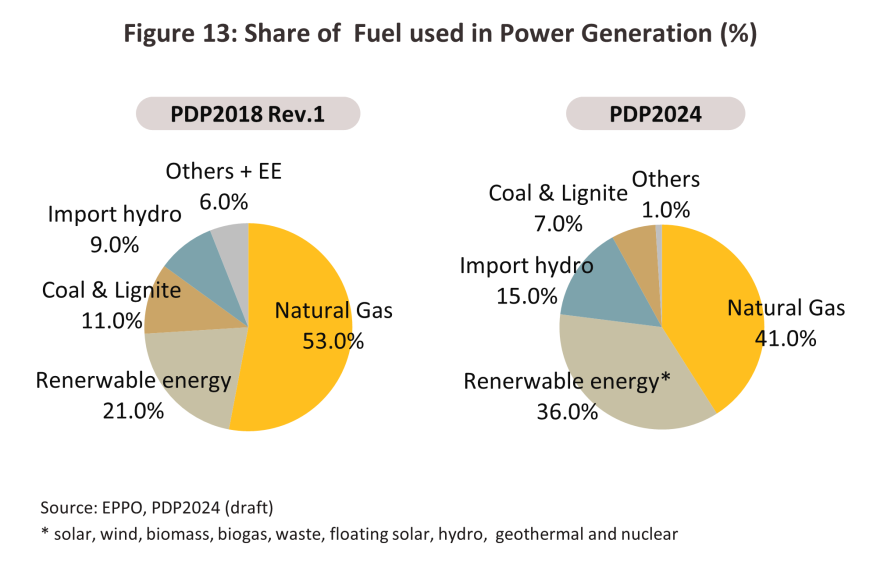

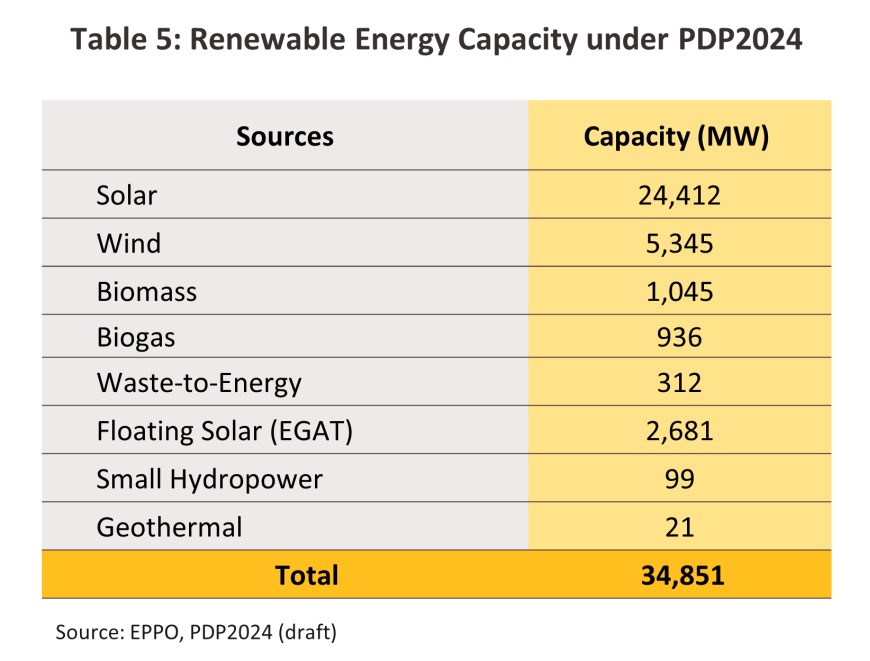

The draft PDP2024 framework, which is expected to come into effect in 2025, will guide the transition of the country’s energy sector to a much more tangible dependency on sources of clean energy. Initially, this will involve adding 77,407 MW of new capacity by 2037, raising the share of all electricity coming from renewables to 51%9/ (this compares with the PDP2018 Rev. 1 target of 36%). Alongside this, the share of electricity coming from natural gas- and coal-fired power stations will fall from its current 60% and 11% to 41% and 7% respectively. The remaining 1.0% will be supplied by a small modular nuclear reactor, due to come online towards the end of the plan’s lifecycle (Figure 13 and Table 5), while officials see the peak demand rising to 54,546 MW10/. Implementation of these plans will thus pull additional investment into the industry as new power stations are constructed, including renewables-based (or ‘green’) generation. In particular, because the draft PDP2024 plan has set a target of having 16% of power supply coming from solar, these trends will benefit players involved in ground-mounted solar power with and without associated energy storage systems.

-

Prices should average THB 3.84/unit over 2024-2037, as per the draft PDP2024. This is up slightly from the earlier THB 3.65/unit under the PDP2018 Rev.1 plan, though this is due to the need to encourage an increase in investment in renewables by paying THB 3.0-5.0/unit to suppliers.

Given these tailwinds on both the demand and supply sides of the markets, private-sector electricity generators–both independent power producers (IPPs) and small power producers (SPPs)–that have long-term supply contracts with EGAT will enjoy rising turnover as demand from the grid increases. However, for SPPs that supply electricity directly to business or industrial consumers, the situation will be more uncertain, and the outlook will be heavily influenced by the state of demand within that particular segment of the economy.

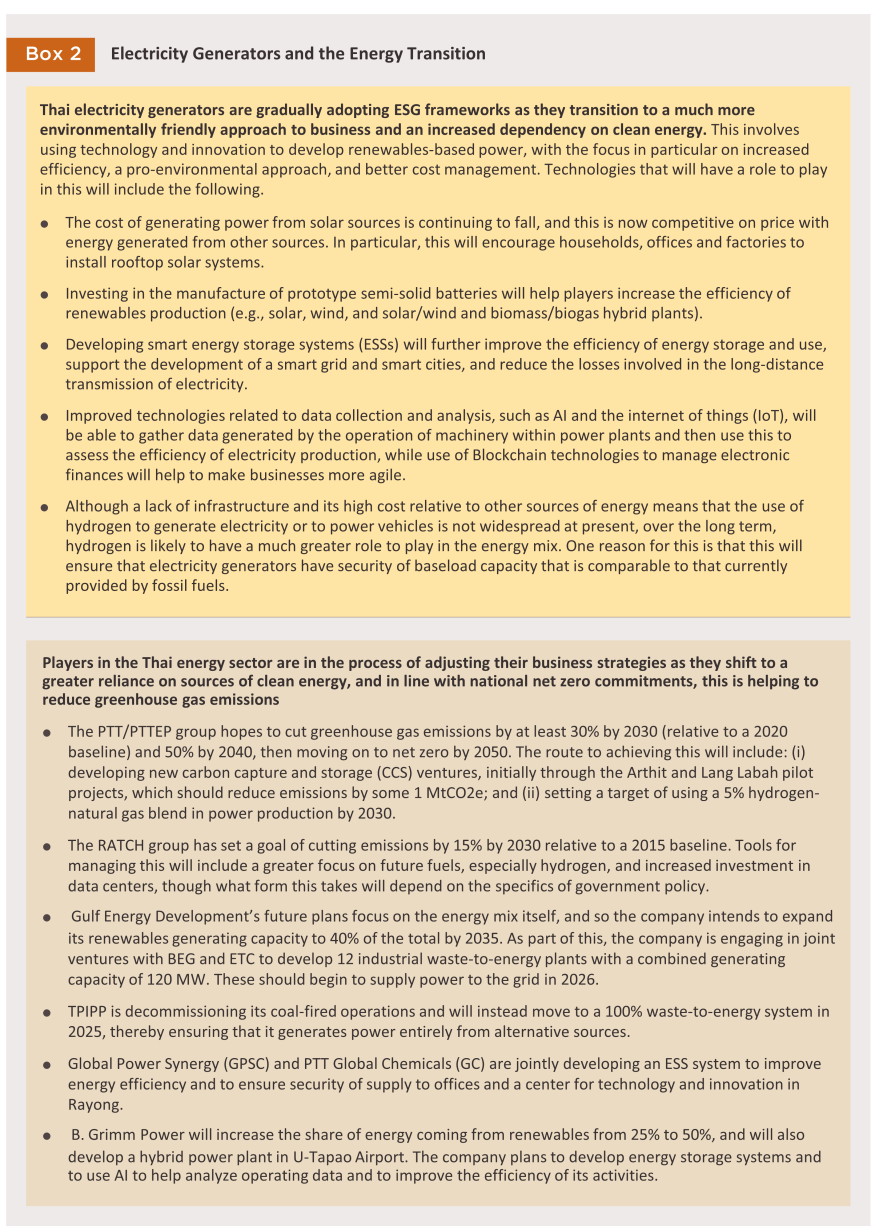

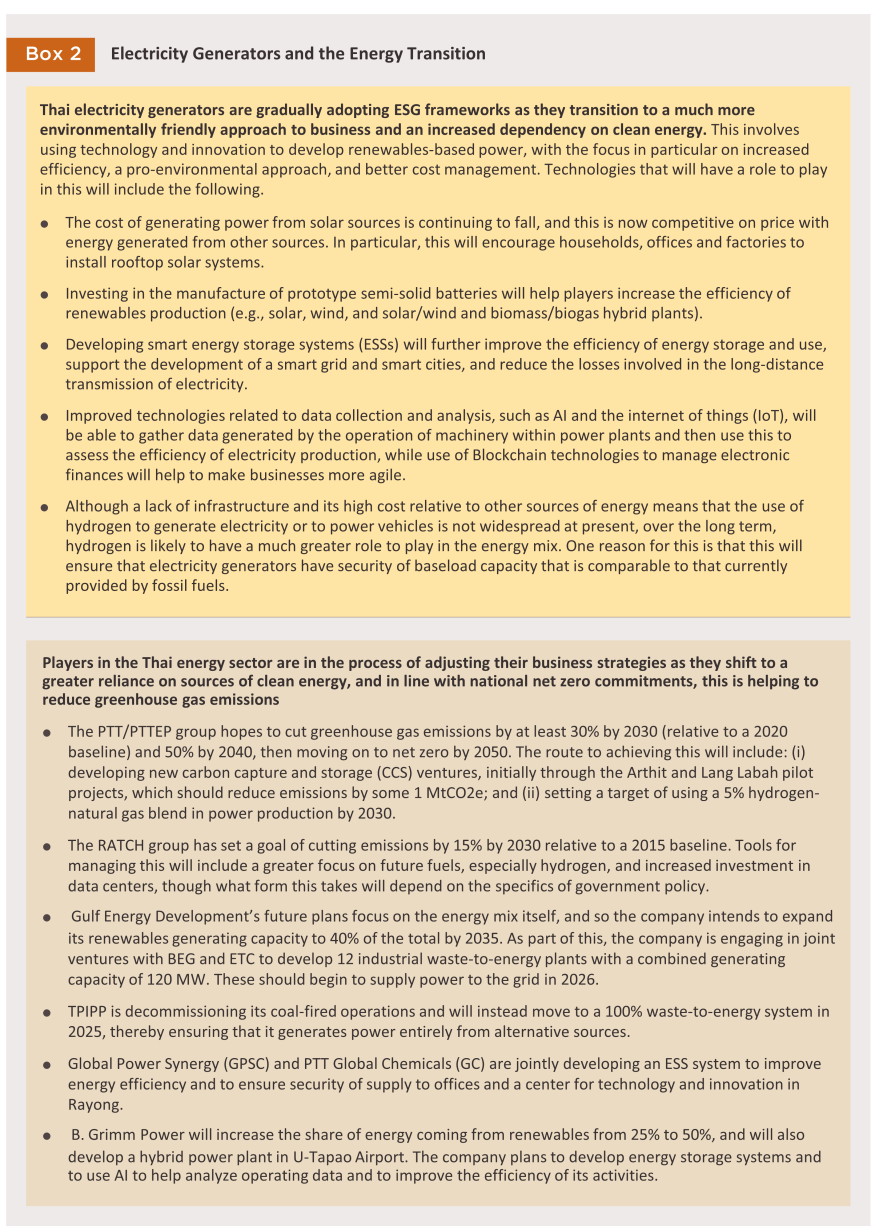

With the world increasingly reorienting itself around environmental issues and the need to cut greenhouse gas emissions, the use of renewables and alternative energy more generally is becoming nearly unavoidable for businesses that wish to maintain or to add to their competitiveness. Thai private-sector electricity generators are therefore adapting to this rapidly changing landscape by shifting to a greater emphasis on environmentally friendly business activities. In particular, players are aligning themselves more closely with the ESG goals by increasing their investments in the production of renewables. This includes stepping up their involvement in initiatives such as hydrogen-based power generation, reforestation/carbon-capture programs, and trading in carbon credits and renewable energy certificates. In addition to broad-based changes in the business and social environment, electricity producers are also being motivated to increase their investment in renewables by targeted BOI schemes. Companies active in this area are typically major players in the energy sector, such as IPPs/SPPs, engineering, procurement and construction (EPC) companies with expertise relevant to the installation of power systems, and producers of solar cells and other related technologies that are moving into renewables. Examples of companies prominent in this area include SPCG, Gunkul Engineering, and TPI Polene Power.

To meet the growing demand for 100% renewable energy (RE100) from international investors planning to invest in Thailand such as Google and Microsoft, which aim to use RE100 by 2035 and have data center investment plans, the government will launch a pilot project for renewable energy trading through Direct Power Purchase Agreements (Direct PPA). The project will cover 2,000 megawatts and allow third-party access (TPA) to the electricity grid. At present, the regulatory framework to manage this is being designed and the transmission and other related fees (i.e., the charge imposed for the use of public-sector infrastructure) are being decided, though initial commercial operations are scheduled to begin in 2025. This will allow companies generating a surplus of electricity to sell this back into the grid or to distribute electricity in a peer-to-peer manner. Beyond this, the government is developing the utility green tariff (UGT) and renewable energy certificates (RECs), which will then help businesses not only access supplies of clean energy from sources in the private-sector but also to demonstrate to customers, regulatory bodies and other interested parties that they have done so, thus underscoring and making public their commitment to sustainability.

To encourage greater participation in energy production by the private sector, there has been a notable uptick in installations of rooftop solar systems in industrial, commercial and residential settings. This has thus added to the share of electricity coming from independent power suppliers (IPSs), and over the long term, this will cut the demand placed on the national grid. Nevertheless, over the short term, supply from renewables will remain limited and problems will need to be addressed including stability of supply, the need for greater investment in high-cost infrastructure, especially energy storage systems, and improvements to the grid to allow distributed energy production to be better integrated. Given these limitations, gas-powered generation will continue to have an important role to play in ensuring that baseload capacity remains sufficient. This will change over the medium term, as dependency on fossil fuels (principally natural gas and coal) comes under continued pressure from both the need to keep pace with international moves to cut greenhouse gas emissions and the rollout of the Thailand Taxonomy within the power industry.

Challenges for the business include the following. (i) Increasing investment in renewables and an uptick in procurement of clean energy supplies from the private sector will add to competition across the industry. Thus, over 2021 to 2023, there was an average of 490 applications made annually for BOI investment support for projects connected to renewables (this excludes waste-to-energy schemes) and these had a value of over THB 55 billion. This compares to an average of 233 projects and a value of THB 23 billion for the period 2018-2020. (ii) Costs will trend upwards under the need to operate according to the ESG (environmental, social and governance) standards and to invest in new technologies for deployment within power stations (e.g., using natural gas and hydrogen together), and this may then put pressure on profits. (iii) The opening up of the market to a broader range of private-sector players and the use of direct PPAs to allow producers and consumers to contract directly with one another11/ may cut overall demand for electricity supplied by the grid. (iv) The long-running threats to stability in Myanmar may impact the supply of energy to Thailand, and there is a risk that this will add to domestic electricity prices.

1/ The Energy Policy and Planning Office (EPPO) has collaborated with the Department of Alternative Energy Development and Efficiency (DEDE) to establish plans currently under the PDP2024 and AEDP2024 frameworks for the years 2024–2037.

2/ The net price for purchases of electricity is set at a rate that reflects the real costs of production of different types of power over the course of the 20-25 years for which contracts to supply run. These are allotted through a process of competitive bidding organized by the Office of Energy Regulatory Commission (ERC).

3/ Under this system, an additional payment is added to the cost of electricity sold to the grid for a period of supply running for 7 years. Admission to the system is on a first-come, first-served basis.

4/ This includes capping prices for diesel and cooking gas, and keeping electricity prices to THB 3.99/unit

for low-income earners using fewer than 300 units per month.

5/ This includes off-grid capacity (i.e., households or companies producing electricity for their own use) but excludes 2,918 MW of large-scale hydro capacity.

6/ This includes companies that have agreed power purchase agreements (PPAs), both those that have reached their commercial operation date (COD) and so are supplying power to the grid and those that have not yet reached their COD and so are not yet actively providing power.

7/ For more details, please see Krungsri Research “Sustainable AI: Planting the Seeds for a Greener AI Industry”

8/ For more details, please see Krungsri Research – Thailand Industry Outlook 2024-2026 “Automobile Industry”

9/ This includes for example, solar, wind, biomass, biogas, waste-to-energy, floating solar, small hydro, geothermal and nuclear (36%), and imported hydro (15%).

10/ Forecast (in the 3 Electricity Authorities system) under the BASE case (Business-as-Usual (BAU) scenario + additional electricity demand (e.g., EV, HST, MRT, and EEC) + Energy Conservation Plan), Draft PDP2024.

11/EGAT defines this as ‘production by consumer’. This allows residential homes that are equipped with solar cells to sell any surplus power that they generate to other nearby residential consumers.

.webp.aspx)