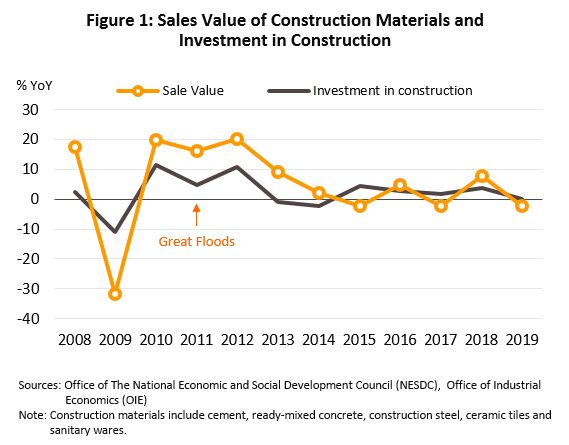

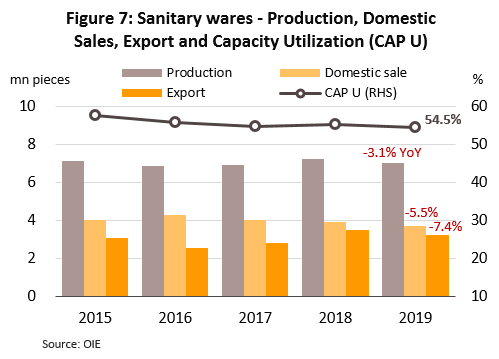

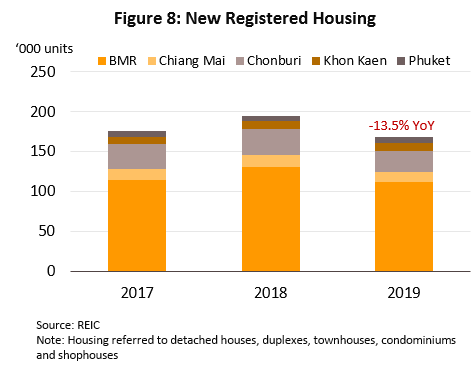

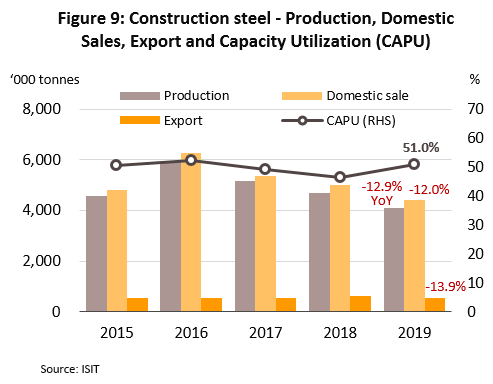

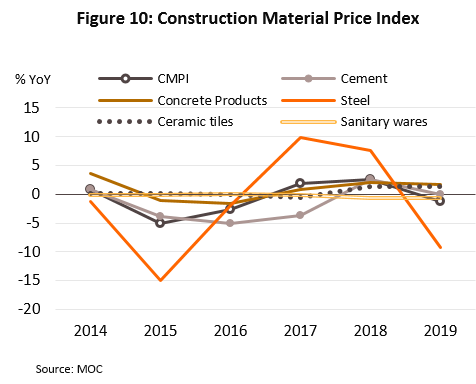

In 2019, domestic demand for building materials[3] shrank by 2.4% (compared to +3.9% in 2018), moving in the same direction as investment in construction, which growth dropped to +2.7% from +3.8% a year earlier. The incremental investment was split between: (i) public-sector spending - growth edged down from +3.2% in 2018 to +3.1% in 2019 due to delays in budget disbursement; and (ii) private-sector spending (mainly on residential accommodation) – growth decelerated to +2.1% from +6.6% in the previous year, attributed to a slowing economy and weak consumer spending (Thai 2019 GDP growth was anemic at +2.4% compared to +4.2% in 2018), and the Bank of Thailand’s revised loan-to-value (LTV) ratios which made made it more difficult for some buyers to secure a housing loan. Meanwhile, exports of construction materials[4] shrank by 2.8% as the real estate markets in the CLM zone softened.

Producers: In 2019, the slowdown in the construction sector led to slower growth in the production and distribution of construction materials.

Overall situation for demand, production and exports, 2019

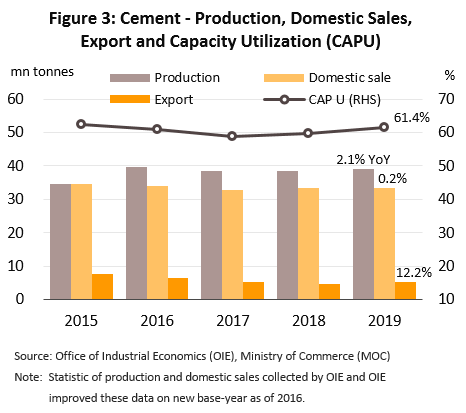

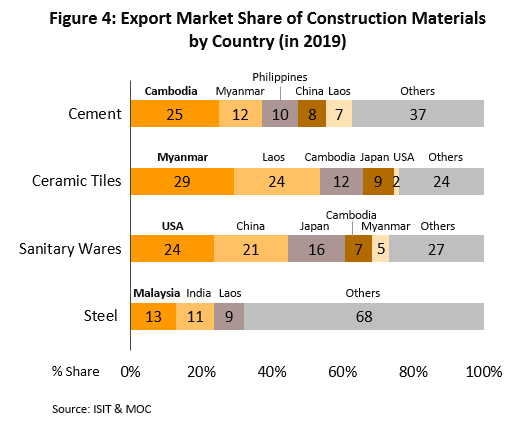

- Cement: Output rose 2.1% in 2019 (from +0.1% in 2018) although domestic demand increased by only 0.2% to 33.5 million tonnes. That follows an increase of 1.8% in 2018 (Figure 3), as spending on public-sector infrastructure and private-sector real estate both stumbled. The situation was better for exports, which reversed from a contraction of 12.2% in 2018 to 12.2% growth in 2019 (or a total of 5.2 million tonnes) as spending on public-sector construction projects accelerated in Cambodia (exports rose 15.1% to 2.6 million tonnes) and Myanmar (up 13.2% to 1.2 million tonnes). However, exports to Lao PDR and Vietnam declined because these countries had stepped up domestic production of cement (Figure 4).

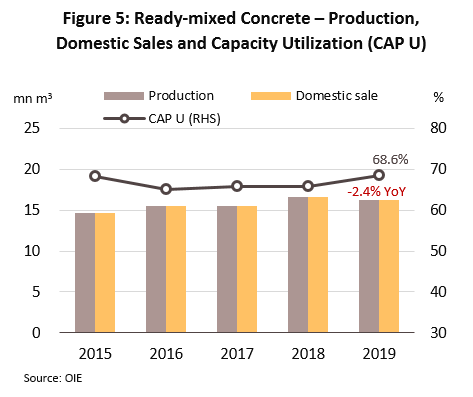

- Ready-mixed concrete: This is produced on-demand, which means essentially zero inventory and no exports. Production and consumption slipped by 2.4% to 16.2 million cu. m. last year, following 7.4% growth in 2018, due to the slowing construction sector and wider economy (Figure 5).

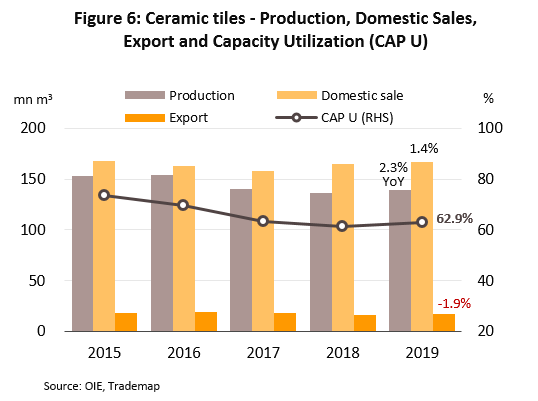

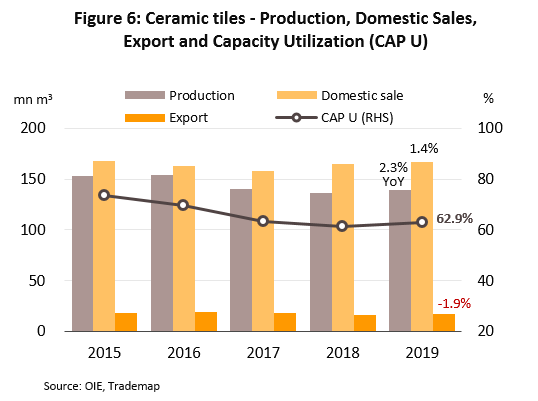

- Ceramic floor and wall tiles: Output grew 2.3%, after shrinking 2.9% in 2018. But demand growth slowed from +4.5% to just +1.4%, or 167 million sq. m. (Figure 6) because, like elsewhere in the sector, falling investment in residential real estate had taken a toll on the industry. Exports fell 1.9% in 2019 as Thailand’s major export markets - Lao PDR and Cambodia (2nd and 3rd largest export markets for Thai tiles) switched to importing cheaper Chinese products. Additionally, these countries also saw softer spending in the real estate sector.

Producers

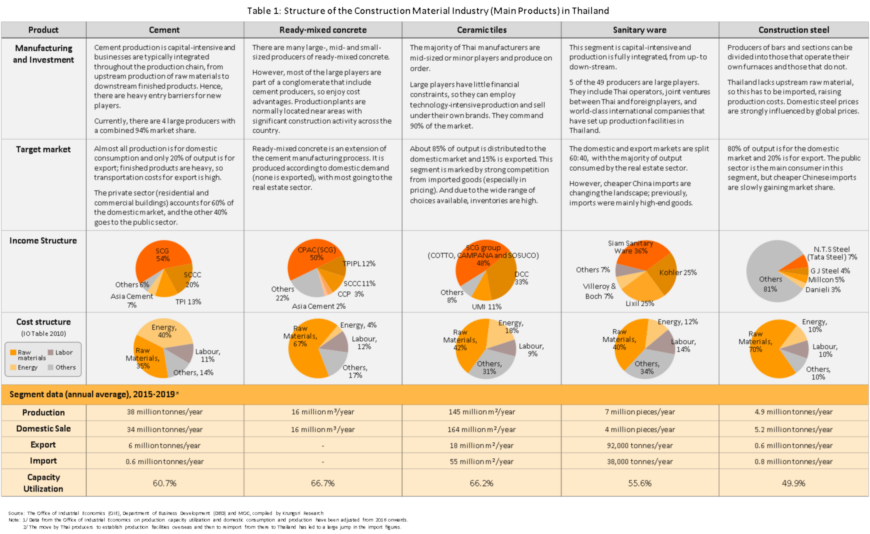

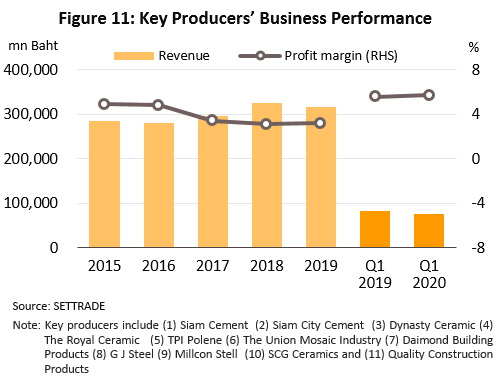

Weak economic conditions, delays in budget disbursement, and a slowing real estate market, all led to weaker revenues for players in 2019. For the 11 players on the SET, aggregate revenue fell by 3.9% to THB334bn, down from THB347bn in 2018 (Figure 11). Construction steel producers saw the biggest drop in revenue of 37.2% as prices on world exchanges tumbled. However, after raw materials, energy is the second biggest cost item at 20-25% of total costs for manufacturers of construction materials, rising to 40% for cement producers (Table 1). And in 2019, price of Dubai crude fell 8.8% to an average of USD63.2/bbl (from USD69.3 in 2018), while prices of natural gas fell by a larger rate of 17.7% to USD2.53/MMBtu. This helped to keep average net profit margin at 3.2%, up fractionally from 3.1% in 2018.

Traders

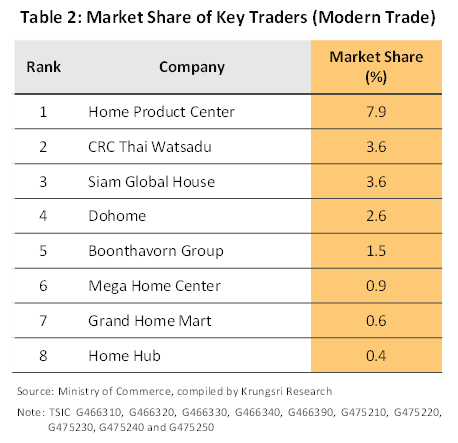

In 2019, revenue for the two modern trade operators registered on the SET (HomePro and Global House) grew by 4.7% YoY (Figure 12). This was driven by: (i) steady expansion of their respective store networks (Figure 13); (ii) strong demand for home decoration and repair products; (iii) increasing preference for buying construction supplies in modern trade outlets; and (iv) wider reach through online channels and greater use of modern trade services. However, although the entry of new players - both large and small - to the market has increased competition and reduced revenue growth to an annual average of 8.1% in 2016-2018, net profit growth remained strong at 7-9%, close to the previous 3 years.

Situation in 1Q20

Production and sales volume of construction materials fell (Table 3) following a 10.1% YoY contraction in construction spending – public construction spending (-13.9% YoY) and private (-4.9% YoY) – due to delays in passing the Fiscal Budget Bill B.E. 2563, a sluggish economy, and falling confidence. Exports of construction materials also shrank, attributed to economic slowdown in the major export markets due to the COVID-19 impact, and lockdown in several countries which had disrupted logistics.

Manufacturers of construction materials registered a 8.8% YoY drop in revenue and 6.4% YoY contraction in net profit, following a drop in sales volume amid subdued construction activities. Steel producers registered the largest drop in revenue (-22.0%), followed by ceramic tile producers (-9.5%), and cement producers (-5.9%). Revenue of construction material traders contracted by 5.6% YoY due to the sluggish construction business in line with the weak economic conditions.

Industry Outlook

2020 will be worse than 2019 for producers and traders of construction materials, as investment in the construction sector is depressed by the COVID-19 impact and there have been extensive delays in disbursing the national budget. Between October 1, 2019 and May 15, 2020, only 49.2% of the budget allocation earmarked for investment had been disbursed, which meant that work on many government projects had to be postponed. However, ongoing infrastructure projects were relatively unaffected. Overall, public sector spending on construction should rise by 1.0-2.0% this year (down from +3.1% in 2019; Figure 14). The situation for the private sector would be worse; construction spending is expected to shrink by 2.5%-3.5% (against +2.1% last year). This is in line with the weak real estate market due to: (i) the COVID-19 impact on the Thai and world economies, and with this, softer spending power of Thai and overseas buyers; (ii) enforcement of the new LTV rules and tighter requirements for a second and subsequent mortgage; and (iii) large supply of unsold new housing stock. Given these factors, business conditions will worsen throughout 2020. But in 2021 and 2022, construction spending by both the private and public sectors should recover and lift demand for construction materials (Figure 14).

Producers: The projected trends for different product groups listed below.

-

Cement: Domestic demand is forecast to contract by 0.8% this year but grow by 5-6% in each of 2021 and 2022 (Figure 15) as construction work picks up again. This growth will be split between (i) public sector projects which account for 40% of all Thai demand (Figure 16), and which will be boosted by accelerating works on infrastructure projects, especially in the Eastern Economic Corridor (EEC); and (ii) private sector (consumes 45% of domestic cement production), led by a recovery in the real estate market, especially in Bangkok Metropolitan Region and the EEC (Figure 17), which will increase demand for construction materials. Export value will drop this year due to slowing construction sectors in the CLM countries, as well as rising domestic production of cement in these countries. In Lao PDR (Thailand’s 5th largest export market at 7% share by value of Thai cement exports), the government has approved the construction of 4 new cement plants in Oudomxay, Khammouane, Luang Prabang and Savannakhet.

These have a combined production capacity of 3.7 million tonnes per year, and would take Lao’s total capacity to around 12 million tonnes annually[5]. In 2021 and 2022, exports should rise as regional economies and investment in construction in the CLM countries improve. As of April 2020 the IMF forecasts 2021 GDP growth for Cambodia, Lao PDR and Myanmar at 6.1%, 5.6% and 7.5%, respectively, a sharp turnaround from -1.6%, +0.7% and +1.8% forecasts for 2020. But, there are still challenges for Thai cement manufacturers, including ongoing competition because cement is a commodity.

-

Ready-mixed Concrete: Demand in the Thai market is expected to fall by 0.3% in 2020 but recover to grow by 4-5% in each of 2021 and 2022, lifting total domestic demand to 16 million cubic meters/year (Figure 18). Manufacturers will benefit from the anticipated increase in public and private sector construction spending.

-

Ceramic tiles and sanitary ware: The quantity of these goods distributed to the domestic and export markets will fall in 2020 due to the soft Thai real estate market and worsening economic situations at home and abroad. But the outlook is brighter in 2021-2022, when the domestic market will benefit from faster progress in public infrastructure projects. This will help to attract more private-sector investment in residential accommodation, in both high-rise buildings (which typically involves bulk orders for tiles and sanitary ware) especially along new metro lines and stations, and low-rise housing which are more popular in suburban areas around Bangkok. Exports will also increase in 2021 and 2022, but slow growth in real estate markets in neighboring countries will cap the recovery, while the move by the US to revoke GSP privileges for 573 types of Thai products, including ceramic tiles and sanitary ware (effective April 25, 2020) will weigh on exports to the US.

-

Ceramic tiles: Domestic demand will contract by 4-5% in 2020 to 159-160 million sq. m. But in 2021-2022, it would grow by 4-5% annually to 167-176 million sq. m. Exports will drop by 10% this year, before returning to growth of 3-6% per year in 2021 and 2022 (Figure 19).

-

-

Ceramic sanitary ware: The market will shrink by 10-11% this year to 3.0-3.3 million pieces, but in 2021 and 2022, we project it would grow by 4-7% annually to 3.5-3.7 million pieces. Exports of sanitary ware will fall by a faster rate of 12.0% this year but in the following two years, it is projected to register 5-8% growth p.a. (Figure 20).

-

Construction steel (bar and section): Total domestic demand is expected to drop 13% to 3.8 million tonnes this year. But like the other product groups, demand is projected to grow in 2021 and 2022. For construction steel, demand is expected to grow by 2-3% with accelerating public-sector infrastructure projects, the bulk being road and rail transportation links. However, the recovery would be capped by the high level of unsold housing stock. For construction steel, we project exports to tumble by 15.0% this year (Figure 21), followed by zero or marginal growth in the subsequent two years due to high stock levels in several countries. Thai manufacturers will also face more intense competition as a result of (i) Chinese foundries dumping excess stock in the export markets, forcing Thai manufacturers to compete for market share with low-cost Chinese imports, and (ii) more Chinese foundries setting up new operations in Thailand or buying existing operations.

Traders of construction materials: In 2020-2022, the growth of modern trade outlets will outpace that of traditional operations.

-

Modern traders: Revenues will be flat or drop slightly in 2020, moving with the weak construction market, especially the slowdown in real estate projects. But this will be partly offset by higher revenues from the sale of home decoration products. In 2021 and 2022, revenue growth will recover with the better outlook for the real estate market. Modern trade outlets also have an advantage over traditional operations, because of their stronger ability to expand income base driven by the following: (i) reducing shop sizes to allow expansion into local communities; (ii) opening new types of outlets in cooperation with major manufactures to better meet the needs of individual customer groups; for example, the joint venture between Boonthavorn and SCG, which launched the construction material retail operation under the SCG Home Boonthavorn brand will expand to other regions; (iii) increasing the sale of home-brands to control costs and increase profits; and (iv) adding branches in the ASEAN region.

-

Traditional traders: revenue is forecast to tumble in 2020 along with the weak economy and purchasing power. In 2021-2022, revenues will be flat or increase slightly, but traditional outlets will struggle with competition from modern trade operations and manufacturers that are increasingly distributing directly to construction companies.

In 2020-2022, prices of building materials are expected to decline slightly given lower energy costs. The largest drop would be seen for construction steel; steel prices are still on a downward spiral as the global supply glut is forcing Thai manufacturers to slash prices to match import prices, in order to retain their customers.

New construction technology will have a major influence on industry direction over the next three years. The industry will increasingly emphasize the deployment of modular building systems and on-site assembly of semi-finished components manufactured in a factory. This type of building work will involve the use of 3D printing technology coupled with building information management (BIM) systems, which will allow players to meet the particular needs of individual customers (e.g. real estate developers), in terms of design, construction time or durability. Next-generation players in the construction material industry will need to increase the scale of investment in technology and overhaul their production systems. Meanwhile, the development of future construction materials will be split into three major groups: finished or ready-made goods, environmental-friendly products, and smart products that meet the challenges of the digital society. Examples include self-illuminating cement, translucent wood, and steel fiber for use in reinforced concrete.

Krungsri Research’s view:

In 2020, the construction sector, and through this manufacturers and distributors of construction materials, will suffer from a drop in construction spending. This would be due to both slow budget disbursement for public sector projects) especially infrastructure), and in the private sector, the COVID-19 crisis. However, the sector is projected to rebound in 2021 and 2022 premise don the following: (i) an economic recovery when the COVID-19 is contained; (ii) the government accelerates works on new infrastructure projects; and (iii) private-sector developers start work on new real estate projects in provincial centers.

Producers:

-

Cement: In 2021-2022, revenue will rise in line with the return of construction spending by the public and private sectors. In addition, cement manufacturers will look to expand into new territories (e.g. Australia) to replace existing markets in the CLM countries.

-

Ready-mixed concrete: Revenue growth in 2021 and 2022 will depend on public and private sector construction activity, although large players with the capacity to develop and exploit new revenue streams will likely look to expand overseas, especially into neighboring countries that are planning to develop their infrastructure.

-

Ceramic tiles and sanitary ware: Growth should return to this segment in 2021-2022 with a recovery in the real estate market and consumer purchasing power, but players will have to compete with cheaper imports from China.

-

Construction steel (bar and section): Revenue growth will be limited in 2021 and 2022 because although demand for steel will increase along with accelerating infrastructure projects (e.g. regular and twin-track railway lines and upgrades), Thai manufacturers will have to compete with cheaper Chinese goods because (i) China steel producers are dumping excess output in the Thai market because of a supply glut at home, and (ii) China steel makers are buying up or setting-up foundries in Thailand.

Traders:

-

Modern traders: Revenue for these players should jump in 2021 and 2022 as the economy returns to growth and businesses expand their branch networks, extend the range of distribution channels, and sell more home-brand products. In addition, modern trade operations will benefit from consumers’ increasing preference for shops that carry a wide and comprehensive range of products, and that offer after-sales service such as home repairs and extension/renovation.

-

Traditional traders: Wholesalers will experience slow revenue growth because despite the projected increase in construction-related activity across the country, there will be more intense competition from modern trade outlets and manufacturers selling directly to end customers. For retail operations, strong competition means that revenue will be flat or decline, although sales of home decorations or products used for home extension/renovation could grow.

[1] Data from the Office of Industrial Economics on production capacity utilization and domestic consumption and production have been adjusted from 2016 onwards.

[2/] The move by Thai producers to establish production facilities overseas and then to reimport from there to Thailand has led to a large jump in the import figures.

[3] Calculations of the quantity of construction materials distributed are based on figures for cement, ready-mixed concrete, tiles, sanitary wares and construction steel. These together account for 60% of the market for building materials in Thailand.

[4] Exports are calculated from sales of cement, tiles, sanitary wares and construction steel.

[5] Source: Thai-Lao Business Information Center, laotradeportal.gov.la, October 4, 2019.

.webp.aspx)