EXECUTIVE SUMMARY

The pharmaceuticals industry will enjoy favorable business conditions through the next three years with the forecast 6.0-7.0% annual growth in the domestic sales value in 2025-2027. Sales will be lifted by an expansion in case numbers for non-communicable diseases (NCDs) and infections with notifiable conditions, growth in emerging and reemerging diseases, the impact of a changing climate on public health, and the earlier extension of Universal Health Coverage (especially the Gold Card system), which has significantly improved access to treatments. Nevertheless, the industry will face some challenges, including Thai manufacturers’ limited ability to produce more advanced products or those that depend on high-tech production methods. In addition, players may face financial constraints arising from the need to upgrade production lines, both to meet international standards and to lower carbon emissions.

Krungsri Research view

The outlook for the different segments of the market is described below.

-

Manufacturers of pharmaceuticals: Rising rates of illness will lift income, while the extension of state-backed health services has broadened access to these, and this will then act as a tailwind for those distributing medicines through hospitals, especially manufacturers of vaccines and patented medicines. At the same time, changes to policy have meant that pharmacies are also now playing a more important role in the distribution mix. Less favorably, competition will tend to intensify as new overseas players move into the market. With their better access to technology and capital, these will be at an advantage relative to domestic manufacturers. In addition, income growth will be restrained by the rising cost of imported inputs and precursor chemicals and the need to reduce pollution through improved production processes.

-

Distributors (retail and wholesale): Revenue will continue to trend upward, though intensifying competition will restrain the rate of growth.

-

Retailers and stand-alone pharmacies: Revenue growth will come under pressure from: (i) the continuing expansion in the number of chain store outlets, including Fascino, Save drug (part of the Bangkok Hospital group) and Pure (owned by Big C and which plans to open more Siripharma outlets); (ii) an increase in the floorspace given over to pharmacy sales in modern trade outlets including discount stores, supermarkets, and convenience stores (especially 7-Eleven); (iii) the growing popularity of online sales; and (iv) the increased spending needed to bring pharmacies up to government standards. As such, future growth rates may see a dip relative to earlier trends.

-

Wholesalers: These are increasingly moving into retail markets and exploiting the potential of online channels for sales and marketing. Wholesalers are thus broadening the range of consumers that they serve, and compared to retailers and stand-alone pharmacies, these have the additional advantage of operating with a lower cost-base.

Overview

The pharmaceutical sector includes conventional medicines and medical supplies which are used in the diagnosis and treatment of illnesses. Conventional pharmaceuticals can be split into two groups:

1) Original drugs or patented drugs are medicines that have gone through the lengthy research & development (R&D) process, and therefore would involve significant investment. Manufacturers of original drugs are normally given a 20-year patent1/ protection and when the patent expires, other manufacturers are then allowed to produce those medicines.

2) Generic drugs: These are drugs that are manufactured by a company that was not responsible for their development, but which begins to produce them once the patent for the original drug expires. Although they may be produced under a trademark, this will not be that of the primary manufacturer. Nevertheless, generic drugs are identical to their original counterpart in terms of active ingredients, and so their therapeutic value is likewise indistinguishable. However, because manufacturers of generics may be able to source cheaper inputs and are freed from the burden of research and development costs, generic manufacturing costs may be significantly lower than those of original drugs.

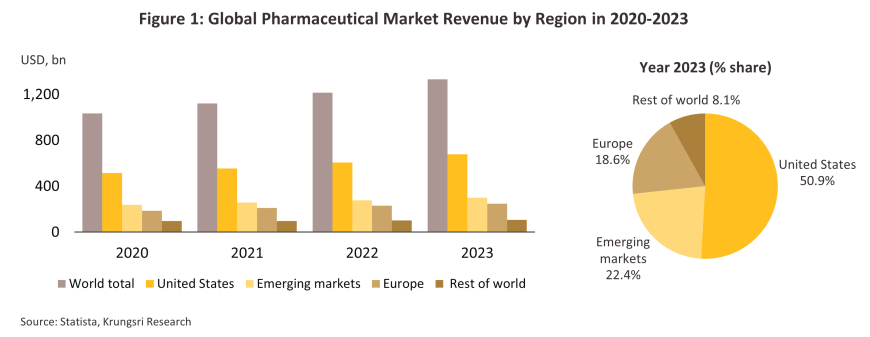

The pharmaceutical and medical supplies industry requires a steady stream of capital to fund ongoing research and development of new precursors and products, and so manufacturing capacity (particularly for patented original or branded medicines) tends to be concentrated in the developed economies, especially in USA and Europe. In addition to their capital markets, these countries also typically provide access to a skilled workforce, an extensive knowledge base, and a high-tech manufacturing infrastructure. Corporations in these nations are then able to export to meet demand from the global market, while developing and newly industrialized countries typically occupy a role as importers of high-value original medicines. Over 2021 and 2022, global pharmaceutical sales expanded by 8.7% annually to a total of more than USD 1 trillion, while in 2023, these grew by another 9.5% YoY to over USD 1.3 trillion (Figure 1). World leading corporations based in the US include Pfizer, Merck and Johnson & Johnson, while in Europe, the Swiss Novartis and Roche and France’s Sanofi are also globally significant players.

The conventional medicines production chain is split into three stages (Figure 2).

1) Primary: This involves R&D of new medicines.

2) Intermediate: This involves the production of ingredients to be combined to make the final product. These are either active pharmaceutical ingredients (APIs), or inactive pharmaceutical ingredients (or excipients) that are normally added to speed up chemical reaction. The ingredients manufactured in this stage are normally already available in the market but required special techniques to achieve the desired chemical reaction or to change the molecular structure of existing chemicals, which normally require advanced technology and a large investment.

3) Manufacture of finished products: This is usually a manufacturing of generic drug, and generally depends on imports since Thailand in fact sources some 90% of the inputs used in the manufacture of pharmaceuticals from abroad. These imports are then used to produce generics in the form of pills, liquids, capsules, creams, powders, and injectables. Product group with the highest value is pain medication. Most Thai players in the pharmaceuticals industry fall into this group.

The Food and Drug Administration (FDA) states that Thailand has over 150 modern pharmaceutical manufacturing facilities certified for Good Manufacturing Practice (GMP). However, less than 10% of these facilities are capable of producing active pharmaceutical ingredients (APIs) independently. Output from the latter includes products such as aluminum hydroxide, aspirin, sodium bicarbonate, and deferiprone, most of which is used as inputs into manufacturer’s own production processes. Research and development also tends to be restricted to work on vaccines (e.g., for HIV, influenza/bird flu, and most recently, for COVID-19). For new drug research and development, Thailand focuses primarily on vaccine innovation at both upstream and downstream levels2/. The country has had a National Vaccine Policy and Strategic Plan in place since 2005, currently operating under its second edition (2023–2027). The plan aims to ensure comprehensive, adequate, and appropriate vaccine3/ coverage for all citizens, both in normal and emergency situations. Additionally, it emphasizes the domestic production of essential vaccines to reduce reliance on imports.

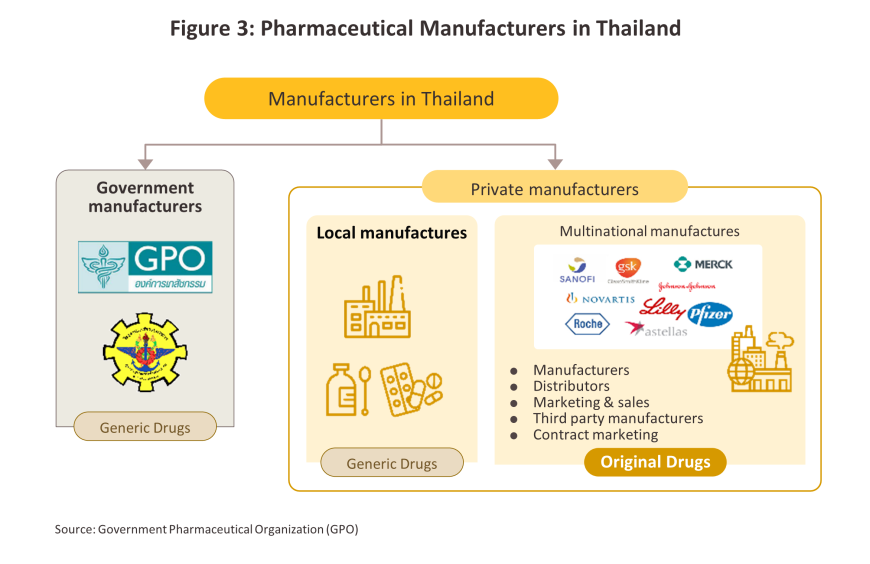

Players in the medicines sector can be split into two groups (Figure 3).

-

Group 1 comprises government agencies: (i) the Government Pharmaceutical Organization (GPO) as a manufacturer of original drugs and importer of high-value products, especially treatments for non-communicable diseases (e.g. cholesterol-lowering medications, diabetes); to be sold at low prices; and (ii) the Defense Pharmaceutical Factory, which emphasize the production of generic drugs as alternatives to imported drugs.

-

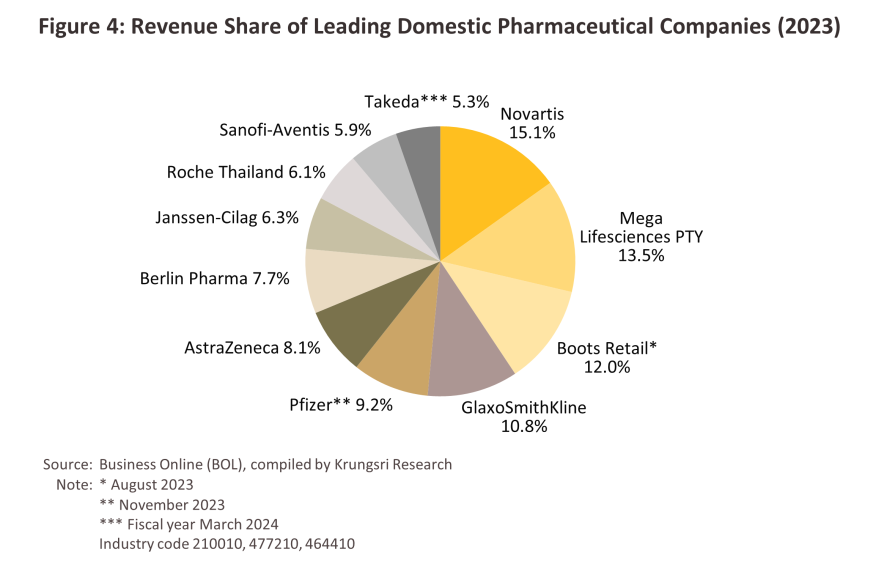

Group 2 comprises private sector producers. This can be divided into two sub-groups: (i) local manufacturers with Thai shareholders, which typically produce general-purpose low-cost generic drugs. Examples include Siam Pharmaceuticals, Berlin Pharmaceutical Industry, Thai Nakorn Patana, Biopharm Chemicals and Siam Pharmacy. Contract manufacturers such as Biolab, Mega Lifesciences and Olic (Thailand) also belong in this group; and (ii) multinational corporations (or MNCs) with foreign shareholders, which focus on original drugs and operate as agents to import pricier drugs for distribution in Thailand, though some have also established production facilities in the country. The private pharmaceutical company with the highest market share in terms of revenue in 2023 was Novartis, followed by Mega Lifesciences PTY, Boots Retail, GlaxoSmithKline, Pfizer and AstraZeneca. (Figure 4).

Currently, two laws govern the manufacture of pharmaceuticals in Thailand. They are: (i) Patent Act B.E. 2522 (1979) and amendments, which grant patent-rights to discoverers and inventors (i.e. protects intellectual property rights), supervised by the Department of Intellectual Property; and (ii) Drug Act B.E. 2510 (1967) and amendments4/, which regulate the manufacture, import, sale and marketing of drugs in Thailand. In terms of regulatory bodies, the Food & Drug Administration (FDA) is responsible for overseeing compliance in the sector. Its tasks include licensing operators and registering drugs for domestic distribution.

90% of Thai production of pharmaceuticals is consumed by the domestic market, leaving just 10% to be exported, while expenditure on medicines accounts for 29.0% of all spending made nationwide on healthcare. The domestic market has been helped by the extension of Thailand’s Universal Health Coverage (UHC), in particular the Universal Coverage Scheme (UCS), which now covers 99.64% of those eligible, and since the Thai population now has a much-improved opportunity to access healthcare, demand for treatments has climbed. Most recently, the government has allocated THB 235 billion to the UCS in the 2025 budget, an increase of 8.3% from the previous year.

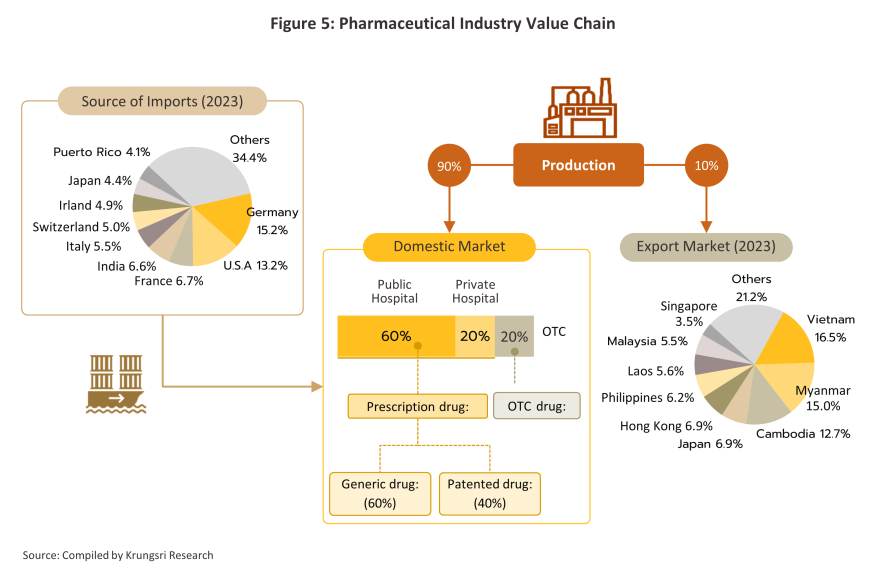

Pharmaceuticals are distributed to the domestic market through two channels (Figure 5).

-

Hospitals: accounts for 80% of the total drug sales value, with public hospitals contributing 60% and private hospitals 20% of the total sales value. Medicines distributed through hospitals are generally prescription drugs, which can be further sub-divided into (i) generic drugs, which account for 61% of the value of medicines distributed via hospitals, and (ii) patented drugs, which make up the remaining 39%. But although this latter group has a smaller share, consumption of patented drugs is growing faster than the consumption of generic drugs, because they are mostly used to treat common chronic non-communicable conditions such as high blood pressure, diabetes, and heart disease.

-

Over-the-counter (OTC) distribution: This accounts for 20% of the domestic market by value. Consumers typically choose to visit pharmacies when they have minor, run-of-the-mill conditions that are not serious enough to warrant full medical care. The data shows that as of July 2024, there were 22,065 pharmacies registered in the country5/, of which 19,126 (86.7) sold modern medicines (as opposed to sellers of traditional treatments) and of these, 17.9% were in Bangkok and 82.1% were upcountry. Pharmacies are either: (i) stand-alone operations (75% of modern pharmacies), which are mostly SMEs; or (ii) chain stores, most of which are operated by large corporations focused on expanding their businesses through franchise networks, such as Fascino and Save Drug (part of the Bangkok Hospital group). However, modern trade operations are also expanding into the pharmacy industry. For example, CP All is opening eXta Plus outlets in Seven Elevens, Big C is opening branches of its Pure and Siripharma brands, and Central introduced the Tops Care pharmacy in 2022. Given this extension in supply, consumer access to medicines and pharmaceutical products is broadening.

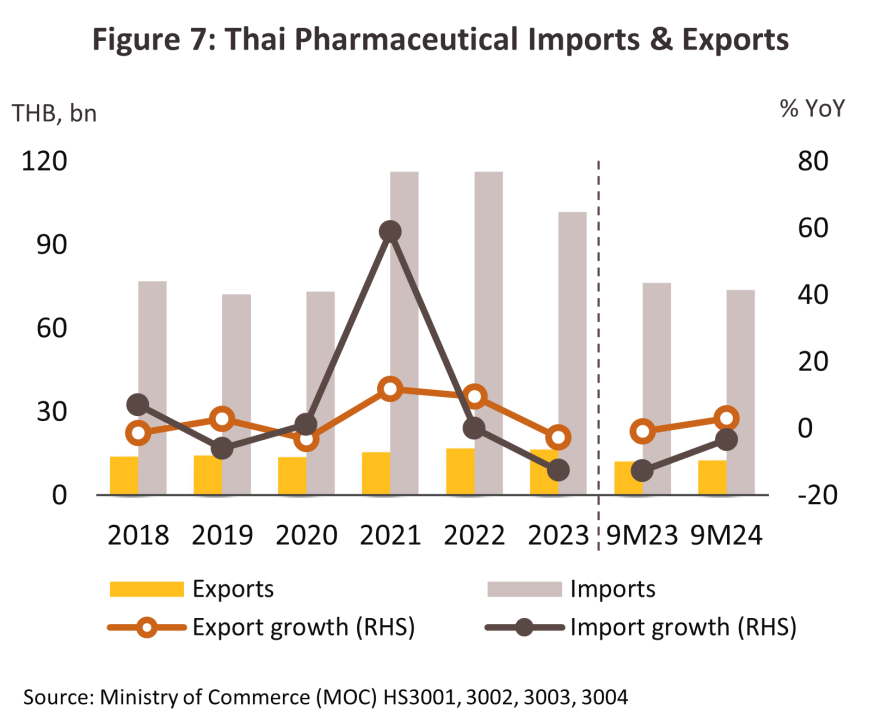

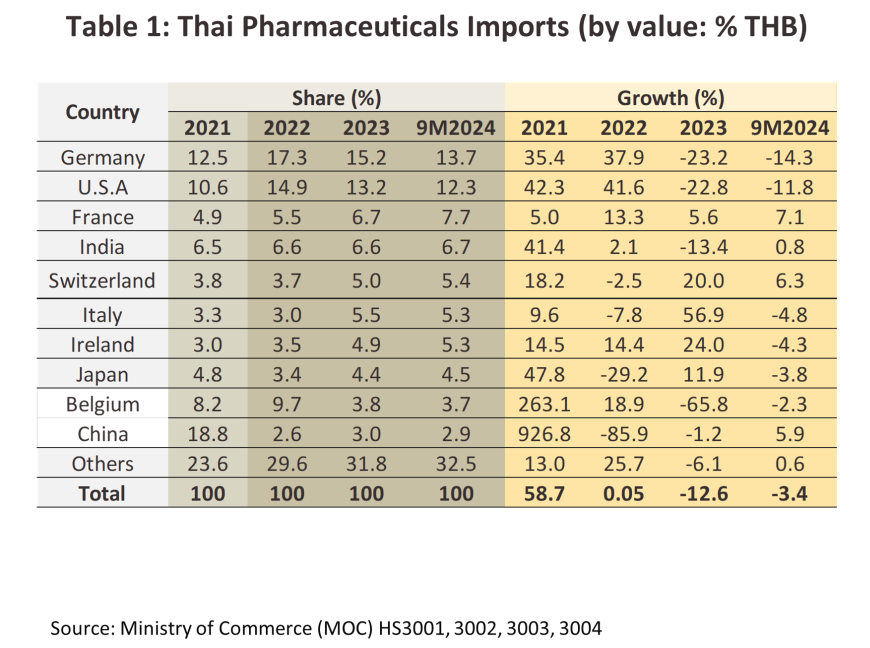

By value, exports6/ of pharmaceuticals grew at an average rate of 5.5% annually over 2017 to 2023, but because these are generally low-value generics, sales of pharmaceutical contributed just 0.2% to overall exports. The main export markets are local to Thailand, with sales into markets in Myanmar, Vietnam, Cambodia and Lao PDR representing around half of the total. Unlike many other parts of the economy, the outbreak of Covid-19 lifted exports, especially of vaccines7/ and in 2023, these made up 6.2% of all pharmaceutical exports by value. Imports are much more varied and include raw materials and precursors, finished goods, and high-value original drugs (e.g., blood treatments, antibiotics, and lipid-lowering agents). The most important sources of these imports are the US, Germany, France and India, although the need to import vaccines during the pandemic meant that there was a significant jump in the volume of these coming from China, Belgium, Germany, the US, and France (in 2023, 28.3% of all import value was accounted for by vaccines).

Headwinds that private-sector pharmaceuticals manufacturers may have to navigate will include: (i) competition from low-cost imports from India and China; (ii) difficulty competing with state manufacturers, which benefit from lower production costs and better access to distribution channels; (iii) reference prices (set by the Ministry of Public Health and the Comptroller General's Department) that aim to help healthcare providers access treatments at a fair cost but that prevent manufacturers from raising their prices for some goods; (iv) higher overheads as a result of the need to operate according to the GMP-PIC/S8/ standards, now that Thailand is a member of the Pharmaceutical Inspection Co-operation Scheme; and (v) the need to allocate appropriate space for the storage and distribution of pharmaceuticals (as per the 2021 requirements set by the Ministry of Public Health, which came into effect on 1 January, 2022), thereby adding further to costs as distributors adapt to ever more challenging market conditions.

Situation

The pharmaceuticals industry saw continuing expansion through 2024 as domestic economic growth lifted consumer spending power. Demand benefited further from the ongoing rebound in the tourism sector, though the effects of this were naturally most pronounced in the major tourist areas. Against this background, a growing number of both Thai and overseas patients (especially medical tourists) are seeking treatment in Thai hospitals and healthcare centers, and so in the 2024 budget year, 7.9 million individuals accessed public healthcare services, up from an average of 7.6 million in 2022 and 2023. Other changes have also affected the market, including an improvement in the ways in which patients can access medical treatments through the universal health system (e.g., by allowing individuals to collect medicines from pharmacies), and the founding of healthtech startups looking to shake up the industry by developing digital platforms for pharmacies (e.g., Arincare), and so facilitate better communication between doctors and pharmacists on the one hand and patients and consumers on the other. Other innovations in this space include the development of platforms that support the use of 24-hour vending machine-based automated distribution systems, which is then further broadening access to pharmaceuticals. Details of the 2024 market situation are given below.

-

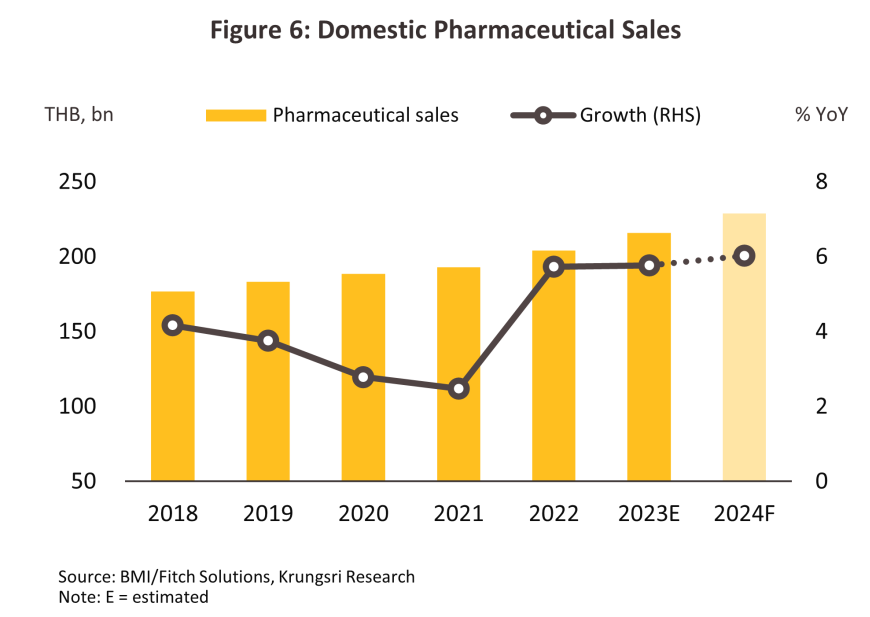

The volume of goods distributed to the domestic market strengthened 6.5% over 9M24. Demand was raised by an increase in the incidence of seasonal illnesses, with cases of influenza and hand, foot and mouth disease rising by respectively 59.7% and 44.6% YoY, and the impacts of air pollution. Demand for treatments for the latter thus rose 11.3% YoY, split between increases of 14.2% YoY for bronchitis, 14.6% YoY for rhinitis, and 7.8% YoY for conjunctivitis. Alongside this, demand for medicines for the treatment of noncommunicable diseases (e.g., hypertension and diabetes) remained steady. Overall, the value of sales of tablets (50.3% of total market value) rose 11.8% YoY, largely on an increase in demand for antipyretics and analgesics. Likewise, sales rose for creams (8.7% of the market, +5.5% YoY), capsules (7.1%, +4.8% YoY) and powders (7.1%, +14.9% YoY). The transition to cooler weather will sustain demand growth through the last quarter, and so for the year overall, the value of the domestic market is forecast to grow 6.0-6.5% YoY, split between the following two major classes of drugs (Figure 6).

1) Prescription treatments/medicines distributed through hospitals: Sales of generics totaled THB 112 billion, up 5.9% from 2023, while distribution of patented drugs rose 6.1% to THB 74 billion.

2) OTC treatments distributed through pharmacies: Sales expanded 5.7% to a value of THB 42 billion as distribution through pharmacies becomes a more important feature of the market, especially within the context of the Gold Card system. Pharmacists are therefore taking on a broader role that includes providing health advice and consultations, following up on the efficacy of treatments, providing a collection point for medicines for Gold Card patients, and using apps to communicate with individuals affected by diabetes, asthma, mental health problems, and more straightforward chronic conditions. For these patients, the medications provided through pharmacies are identical to those available from hospitals.

-

Domestic production9/ contracted -7.2% YoY over 9M24, falling to 28,000 tonnes, though the rate of decline slowed from 2023’s -9.0%. At 48.0% of output, solutions were the largest single segment of the market, and production of these shrank -6.2% YoY. Similarly, production was down -5.2% YoY for tablets (29.5% of output), -12.5% YoY for powders (9.6% of the total), -23.1% YoY for injectables (3.9%), and -18.6% YoY for capsules (2.0%). However, due to the ongoing need to treat chronic skin conditions, production of creams (7.1% of output) moved against this trend and edged up 1.2% YoY. Capacity utilization also weakened in the period, dropping from 50.5% in 2023 to 46.5% in 2024.

-

Exports strengthened through 9M24, rising 3.5% YoY to THB 12.1 billion on a 4.0% YoY increase in sales of medical treatments (94.1% of all exports by value), which was in turn driven partly by a 3.1% YoY improvement in sales to the main markets in the CLMV nations (50.5% of export value). However, overseas sales of vaccines (5.9% of all exports by value) fell back by -3.9% YoY on weaker demand from Hong Kong and the ASEAN market, in particular from Myanmar, Lao PDR, and Indonesia. Nevertheless, by value, exports of vaccines to Malaysia (3.6% of vaccine exports) and Saudi Arabia (1.4% of vaccine exports) rose by respectively 65.1% and 302.0% YoY, moving in line with Statista’s expectation that in these two countries, the overall value of the market for pharmaceuticals will be up by 5.8% and 6.5% in 2024. Imports traveled in the opposite direction, contracting -3.4% YoY to THB 73.8 billion as some medicines (e.g., hypertension treatments) came out of patent protection and so Thai players were able to begin production of generic versions of these. Imports from the US and Germany declined by -11.8% and -14.3% YoY, although those from China (2.9% of imports) climbed 5.9% YoY. Growth in exports to the most important overseas markets will continue through the last part of the year, and so for 2024 in total, export value will strengthen by 3.5-4.5%, while imports will soften by between -4.0% and -5.0%.

-

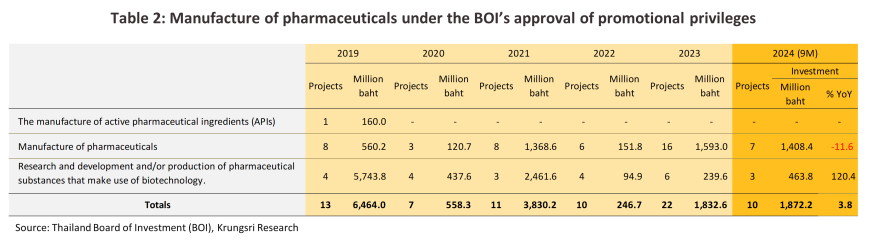

With regard to investment in the industry, 10 projects were approved for BOI investment support over 9M24. These had a combined value of THB 1.87 billion, up 3.8% YoY. 75.2% of this was for investment in the production of pharmaceuticals (-11.6% YoY), while 3 projects worth THB 463.8 million (+120.4% YoY) were focused on biotech research and technology.

Outlook

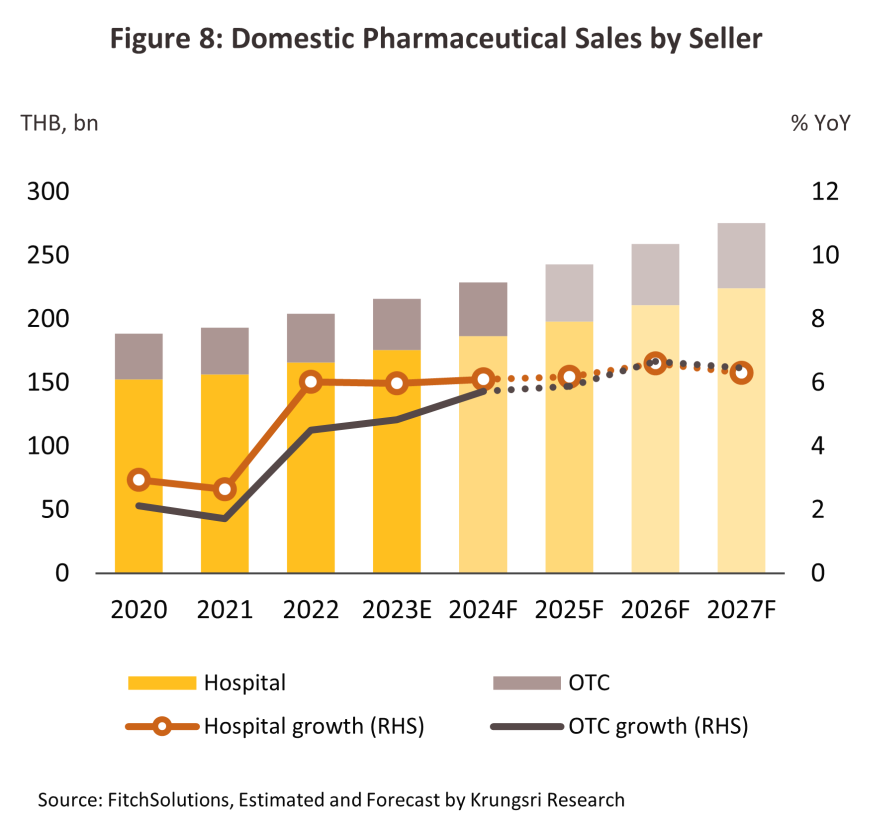

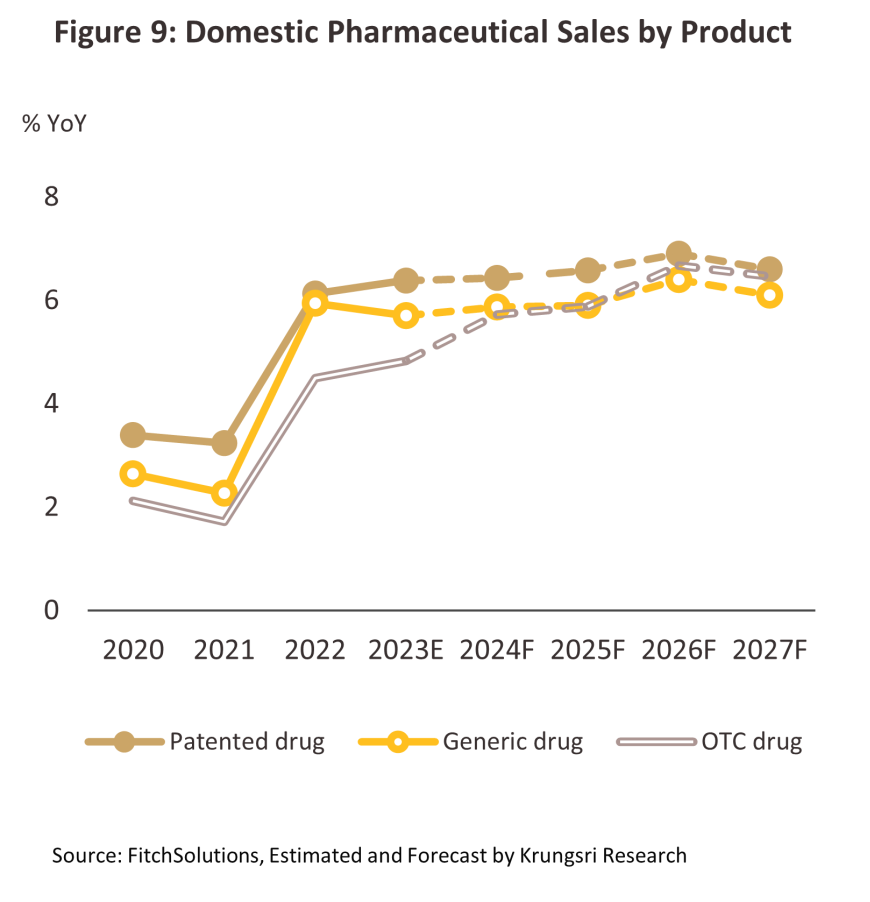

Over 2025-2027, the value of the domestic pharmaceuticals market is forecast to grow by 6.0-7.0% per year (Figure 9), split between growth of 6.4% for goods distributed through hospitals (Figure 8) and 6.3% for those sold over the counter (OTC) in pharmacies. Tailwinds lifting growth will include the following.

-

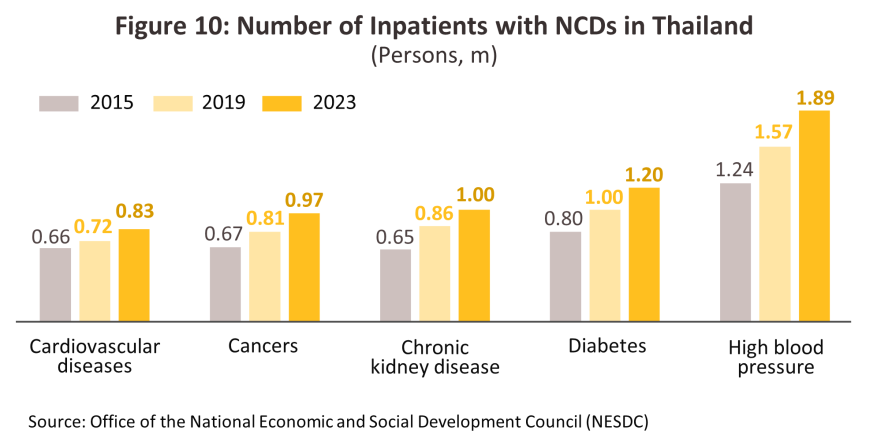

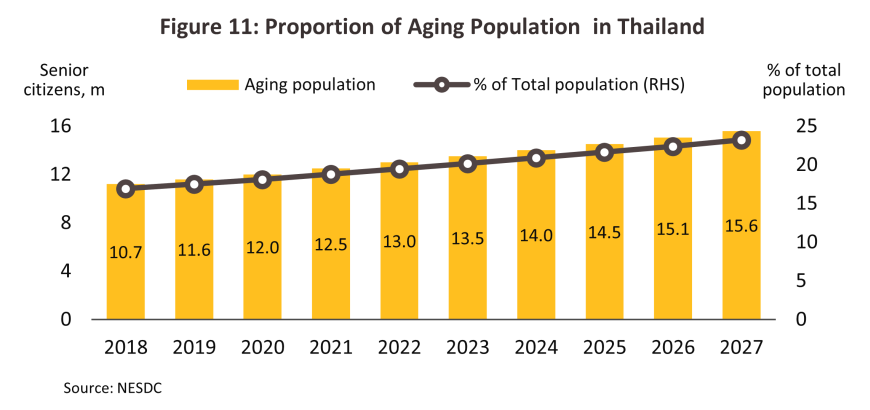

The number of individuals infected with notifiable diseases or affected by non-communicable diseases (NCDs)10/ will continue to increase, with the most prominent of notifiable diseases being influenza, pneumonia, dengue fever, and of NCDs being hypertension and diabetes. Of the two major sources of illness, NCDs are a more important cause of death than the former and thus the World Health Organization estimates that as of 2019, 76.6% of deaths in Thailand were attributable to NCDs. This proportion will continue to rise, principally as a result of two factors. (i) Ongoing demographic changes will mean that by 2033, Thailand will transition from its current status as an aged society (at present, 20% of the population are over 60) to a super-aged society (i.e., more than 28% of the population will be over 60 years old)11/ (Figure 11). Naturally, older individuals are more prone to NCDs, and as of 2023, around 75% of all over-60s in Thailand had at least one NCD, of which the most common were hypertension (46.9%12/ of all over-60s with an NCD had hypertension), diabetes, and stroke. (ii) Continuing urbanization is changing consumer behavior by accelerating the pace of life, but this is also worsening health by reducing the amount of exercise that individuals take. In addition, the number of individuals affected by air pollution (as seen in, for example, cases of respiratory diseases, cardiovascular conditions, and lung cancer) is rising every year. Indeed, as of 2023, Thailand ranked 36th worst out of 134 countries regarding air quality, and in the year, average PM2.5 values were 4.7-times the WHO recommended level13/. The country’s mental health is also worsening, and in 2024, an estimated 2-3% of the country was affected by depression. Given this, overall demand for treatments will strengthen, in particular for patented medicines used to treat more complex conditions.

-

Newly emerging and reemerging disease14/ will tend to multiply, both domestically and in other countries. Recent examples of newly emerging diseases include Covid-19 (although this has now become endemic, if it mutates into a more dangerous strain and a new wave of infections occurs, this would qualify as a reemerging disease) and monkeypox or mpox. Some examples of recent reemerging diseases are SARS, MERS, bird flu (cases of which were identified in Cambodia and South Korea in 2024), diphtheria, and whooping cough. Re-emerging infectious diseases include tuberculosis and malaria.

Accelerating climate change has significant potential to damage human health and degrade ecosystems as summers lengthen, winters shorten, and the morphological transformations of wind patterns significantly modulate the spatial distribution and intensity of PM2.5 pollutants. Indeed, over 2000-2019, global heat-related deaths averaged more than half a million per year, while diseases that are endemic in the tropics are beginning to extend their reach towards the poles, particularly when these rely on parasites as vectors of infection. Most obviously, the spread of mosquitos is now expanding the areas where malaria and dengue fever pose a danger. The WHO is also warning that climate change will likely reduce both the quantity and quality of food that is available to the global population and increase the rate of infections with diseases transmitted via food and drinking water. There is thus an escalating risk through both direct and indirect channels that climate change will increase overall levels of ill-health, whether that be through NCDs, worsening air quality or the emergence or reemergence of diseases. Given this, demand for treatments and for preventative measures (vaccines and pharmaceuticals) will rise.

-

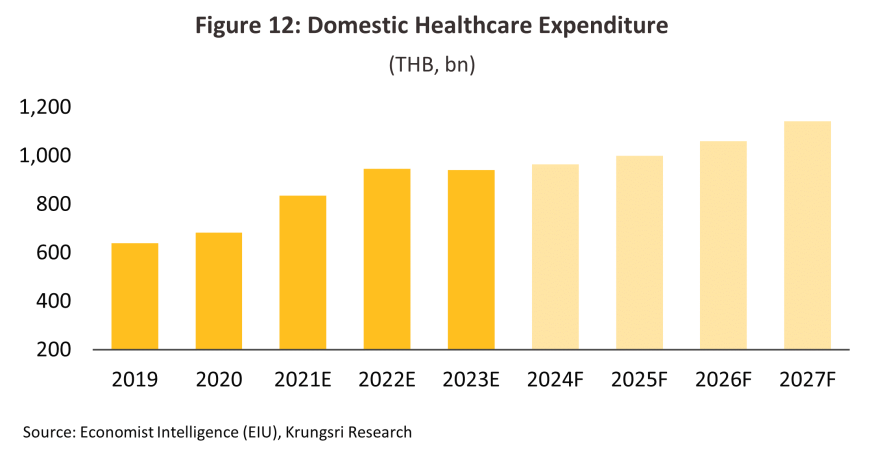

The rollout of the Universal Health Coverage system has expanded access to healthcare, with 74.2% of the population accessing this through the Gold Card, 18.4% doing so through the Social Security system, and another 6.8% receiving healthcare via the civil service scheme. The 2025 budget for the National Health Security Fund grew by 8.3%, partly to fund the increased access to healthcare for Gold Card holders available through the ‘30 baht anywhere’ and ‘cancer anywhere’ programs, an expansion in treatments for type-2 diabetes and hypertension, and the extension in telemedicine services provided to individuals with 42 common illnesses that now allow them to receive medications at home. In addition, the A-MED Care Pharma platform has been developed to allow individuals with 32 minor conditions to collect medication directly from participating pharmacists, while ‘care cabinets’ provide proactive telemedicine services under the ’30 baht anywhere’ scheme, and this then allows individuals to receive medicines at home or at pharmacies covered by the program. The Social Security Office is also expanding payments for health services, including for the entire course of treatments for cancer. The Economist Intelligence Unit thus estimates that over 2025-2027, spending on healthcare in Thailand will grow at an average rate of 5.8% per year, up from 5.0% over 2022-2024 (Figure 12). Privately funded healthcare provision is likewise expanding, and so over the first half of 2024, income from private health insurance premiums jumped 14.3% YoY15/.

-

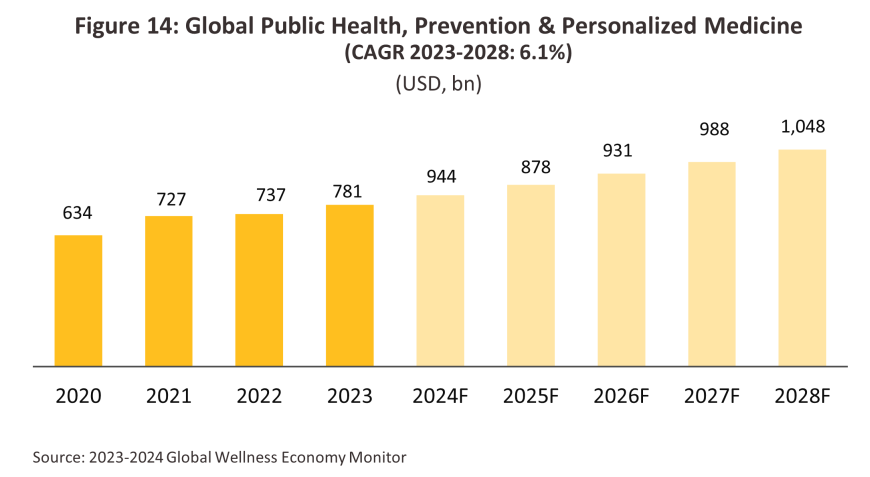

The global health tourism industry is seeing ongoing growth under the twin impacts of the aging of society and the effects of the pandemic on worries over personal health. The Global Wellness Institute estimates that worldwide, income from wellness tourism will grow by 10.2% CAGR over 2023-2028, with the market for wellness treatments expanding to a total value of USD 1.3 trillion by the end of this period (Figure 13). Given Thailand’s leading position within the industry, this will naturally benefit the country. The domestic wellness industry is therefore forecast to be generating income worth THB 760 billion by 2027, more than double 2023’s total of THB 310 billion16/. Among the tailwinds that accelerate growth, the development of the Andaman Wellness Corridor will help to attract a greater number of overseas visitors, and these will comprise an important additional market for the domestic healthcare industry. This will then lift sales of, for example, weight-loss, anti-aging, and sleep-enhancing treatments, though this industry will be concentrated in the major wellness centers of Bangkok and Phuket.

-

Interest in preventative medicine and proactive self-care is growing worldwide as individuals see the importance of making long-term investments in their own health. As a result, demand is rising for treatments that promise to develop the immune system and to strengthen the body’s health generally, including vitamins, herbal treatments, dietary supplements and fortified drinks. Within this area, some players are also using advanced technology to help with the development of personalized precision medicine, which can assist with the planning of self-care routines and the development of personalized treatment plans. This also helps to drive research and development efforts, thus opening up new opportunities for manufacturers of pharmaceuticals.

-

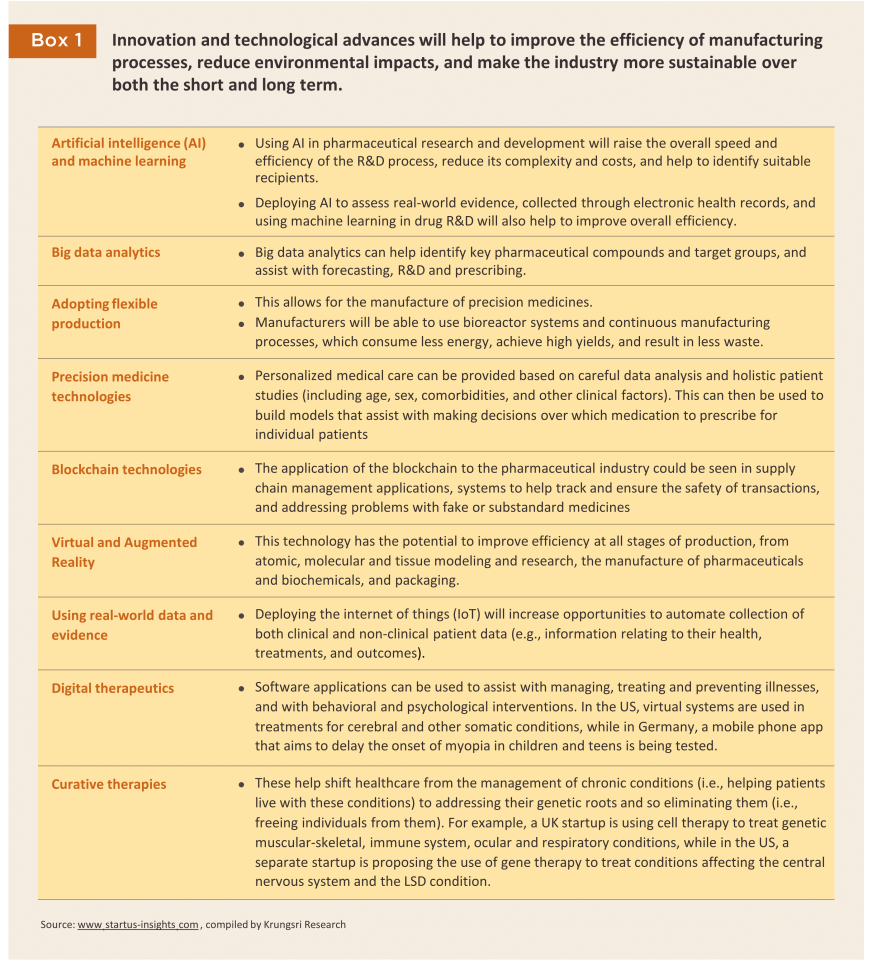

Technological progress and the use of online platforms is increasing manufacturing efficiencies and helping to broaden and improve consumer access to treatments (for more details, see Box 1). Examples of these include: (i) using AI to speed up the search for new compounds (the global market for AI for use in pharmaceuticals research is forecast to grow by 29.6% annually over 2023-203017/); (ii) the use of machine learning to stimulate and to increase the efficiency of R&D efforts; (iii) leveraging big data analytics to rapidly access in-depth information at all stages of the production process, and using 5G networks to facilitate the delivery of telepharmacy services. The development of online platforms is also allowing supply chains to integrate from upstream production all the way through to downstream consumption, and because this helps individuals to access medications much more rapidly, it is possible to treat conditions before they become more serious. In addition, using appropriate technology will help manufacturers reduce the environmental impacts arising from their production processes and to increase the sustainability of their operations over both the short and long term.

-

Policies aiming to promote investment in the production of pharmaceuticals include the following.

1) To help reduce dependency on imports, ensure that domestic supply is sufficient to meet demand, and underpin the long-term security of the national public health system, the 13th National Economic and Social Development Plan (2023-2027) supports the development of manufacturing facilities that meet international standards for the production of biopharmaceuticals, medicines, herbal treatments, and vaccines, especially vaccines for newly emerging and reemerging diseases. This will also provide an opportunity for players to invest in R&D and in the manufacture of the new drugs needed in the future.

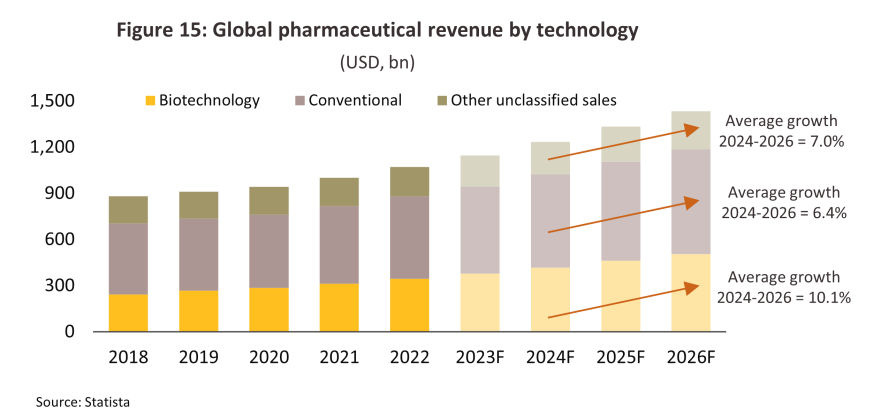

2) The government has plans to develop the country as a medical hub and has included this within its designated new S-curve industries, with this particularly relevant within the context of the EEC development. The government is thus promoting an expansion in R&D in high-tech pharmaceuticals through both direct funding and via favorable tax breaks. As a result, over the first 9 months of 2024, investments in industries that qualified for promotions linked to bio-tech R&D jumped to THB 444 million, up from just THB 44 million in 2023. At the same time, Statista sees total global income from the sale of pharmaceuticals (both prescription-only medicines and over-the-counter treatments) expanding at an average annual rate of 7.3% over the period from 2021 to 2026, up from the 3.5% seen over 2016 to 2020. Bio-tech pharmaceuticals’ market share will also increase to 35%, up from 30% in 2016 (Figure 15).

3) The 2023-2027 Action Plan for the Development of the Thai Pharmaceuticals Industry aims to improve the industry’s R&D efforts. This is focused on the development and manufacture of innovative products, an increase in the value of exports, and over the short term, greater domestic production of herbal ingredients (e.g., green chiretta extracts) and chemical precursors. The plan also proposes a law for the promotion of the medical and health products industry.

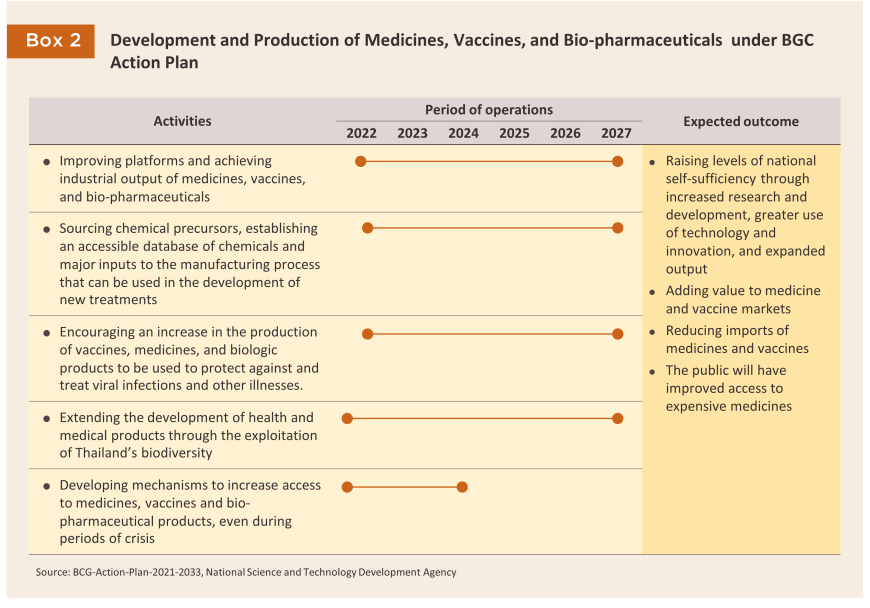

4) The Strategic Plan for the Development of the Bio-Circular-Green Economy covers the years 2021-2027, and the implementation of this will help to further enhance industry value chains (Box 2) through improved R&D, an increased use of technology, and the development of innovative production techniques, especially for more specialized products. The effect of this should be to reduce dependency on imports of, for example, advanced therapeutics, biopharmaceuticals (increasingly in demand for e.g., cancer treatments and the production of vaccines) and probiotics. This will therefore help to raise the industry’s capacity, add to the value of the pharmaceutical and vaccine markets, and improve domestic access to higher cost treatments.

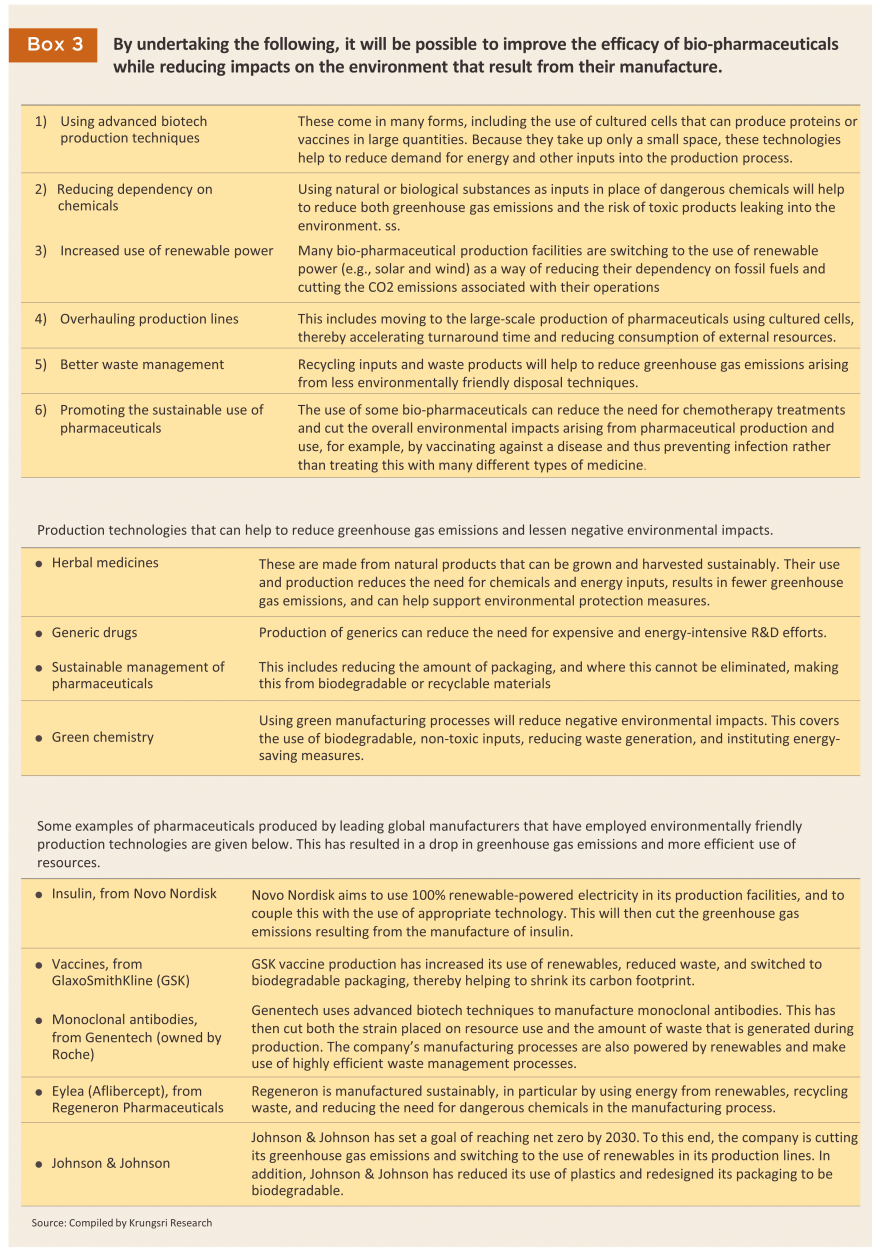

The government is promoting the production of high value and high potential pharmaceutical products, including: (i) high value original or off-patent drugs, such as treatments for hypertension and diabetes, and antibiotics; (ii) biopharmaceuticals (e.g., chemotherapeutic agents and vaccines), for which demand is strengthening and which have an important role to play in reducing greenhouse gas emissions, thus adding to their attractiveness to leading global producers that are in the process of cutting their environmental impacts (Box 3); and (iii) treatments that use gene-editing technologies to build proteins or other molecules that help to combat disease. At present, some Thai companies are beginning to use gene-editing tools to operate at the molecular level when developing and producing improved pharmaceutical products. This will then support the Thai pharmaceuticals industry as it develops the potential to manufacture low-cost, high-quality biopharmaceuticals and vaccines, thus reducing the need to import precursor chemicals and patented treatments18/.

Factors that may drag on growth in the coming years will include the following

-

The Thai industry still lacks a broad-based ability to manufacture more complex or technology-dependent products such as advanced therapeutic agents, biopharmaceuticals, and probiotics. The government is addressing these shortfalls by providing grants for R&D and tax incentives for companies making progress in these areas. If these moves pay off, domestic output–and thus the market value–of these products will rise as players adjust to stronger demand for effective, high-quality treatments.

-

Competition will tend to intensify. (i) New foreign players are entering the market in increasing numbers. These are using Thailand as a base for the production of generics for supply to both the domestic and export markets, and so over 2020-2023, 23 applications worth THB 3.09 billion were made by Chinese players for investment support for projects related to the medical industry, up from just 3 projects worth THB 0.43 billion over 2018 and 2019. In the period, Japanese companies submitted 13 applications worth THB 1.22 billion, up from 7 projects valued at THB 1.07 billion, while South Korean companies made 3 applications worth THB 10.02 billion19/. (ii) Players from other industries (e.g., chemicals, petrochemicals and energy) are increasing their involvement in the pharmaceuticals industry. These changes to the market will drag on growth in income for Thai incumbents.

-

Domestic manufacturers’ production costs are tending to climb on: (i) the need to overhaul production processes to meet the GMP-PIC/S standards and the requirement that manufacturers, importers, and retailers of pharmaceuticals need to meet certain standards regarding the storage of medicines and medical equipment; (ii) the rising cost of imports and of raw materials; and (iii) the additional overheads entailed in reducing environmental impacts and operating according to ESG frameworks20/. The latter includes: (a) using inputs that carry a lighter carbon footprint; (b) developing and investing in new technologies and procedures that allow manufacturers to cut the greenhouse gas emissions associated with the production of pharmaceuticals, for example by using energy generated from renewables (e.g., solar and wind) rather than fossil fuels, reducing particulate and especially PM2.5 pollution, and improving waste management procedures; and (c) improving corporate transparency with regard to the company’s production processes and their environmental impacts, thereby allowing consumers to make better informed purchasing decisions.

-

Joining the CPTPP (currently under discussion) may have consequences for drug patents21/ since the length of patent protection may be extended to 20 years, which would then add to uncertainty about the price of some medicines.

1/ Under the WTO’s Agreement on Trade Related Aspects of Intellectual Property Rights

2/ The upstream production of vaccines includes the BCG vaccine for tuberculosis, the aP vaccine for acellular pertussis, the Tdap vaccine for diphtheria, pertussis, and tetanus, as well as COVID-19 vaccines. Meanwhile, downstream production covers vaccines such as the Rabies vaccine (for rabies), the JE vaccine (for Japanese encephalitis), and the Flu vaccine (for influenza).

3/ Currently, there are basic vaccines available to prevent a total of 13 diseases: tuberculosis, diphtheria, pertussis, tetanus, hepatitis, meningitis caused by Hib, polio, measles, rubella, mumps, Japanese encephalitis (JE), cervical cancer, and diarrhea caused by the rotavirus. (Source: National Vaccine Institute)

4/ The Drug Act has been enforced since 1967 and was amended. The Drug Act (No. 6) B.E. 2562 has been completed and is enforced.

5/ This includes: (i) modern pharmacies, (ii) pharmacies specializing in the sale of prepackaged drugs that are not subject to controls on their sale, (iii) wholesalers of pharmaceuticals, (iv) importers of pharmaceuticals, and (v) manufacturers of pharmaceuticals. (Source: The Food and Drug Administration)

6/ The import and export of goods with HS codes 3001, 3002, 3003 and 3004.

7/ HS3002

8/ The Pharmaceutical Inspection Co-operation Scheme (PIC/S) is a cooperative framework which was set up by GMP inspectors from a number of countries (but especially European ones) that wished to establish universal standards for assessing GMP in pharmaceuticals production. Thailand officially became its 49th member on August 1, 2016.

9/ Source: Office of Industrial Economics. Includes only finished products, e.g., solutions, tablets, capsules, creams, powders, and injectables

10/ Ministry of Public Health, 2020 financial year (October 2019 to March 2020)

11/ Office of the National Economic and Social Development Council)

12/ The Ministry of Public Health reports that of around 9 million elderly individuals, around 4 million have hypertension and more than 2 million have diabetes

13/ Source: 2023 World Air Quality Report

14/ Newly emerging diseases cover four classes of illness: (i) new infectious diseases, that is, diseases that have not previously been encountered and that therefore need to be researched before treatments can be made available; (ii) diseases that are becoming established in new geographical areas; (iii) re-emerging infectious diseases; and (iv) antimicrobial resistant organisms.

15/ “Market conditions for the life assurance industry in 1H24”, The Thai Life Assurance Association, 1 August, 2024.

16/ “Growth in global wellness industry to push Thai earnings to THB 760bn by 2027”, Bangkok Biz News, 18 September, 2023

17/ Source: Grand View Research

18/ Annual Thai imports of medicines and pharmaceuticals cost over THB 100 billion, three-quarters of which is for drug treatments and biopharmaceutical products such as vaccines, drugs, and the expensive but versatile cancer treatment Pembrolizumab.

19/ In 2021, a single application from a South Korean company for investment support for projects connected to the medical industry had a value in excess of THB 10 billion.

20/ Players in the pharmaceuticals industry are increasingly concerned that business processes, from the selection of inputs through to manufacturing and distribution, are both environmentally friendly and enhance the business’s competitiveness. For example, Novartis has invested in the modern technology needed to upgrade its production lines, in particular by using automation and robotics to improve the accuracy and reduce the error rate of manufacturing. The company has also switched to a greater reliance on alternative energy and low-carbon inputs.

21/ The Food and Drug Administration (FDA) is responsible for checking whether drugs registered as generics are under patent protection. The FDA is also tasked with assessing the safety and efficacy of drugs registered for use in the country.