EXECUTIVE SUMMARY

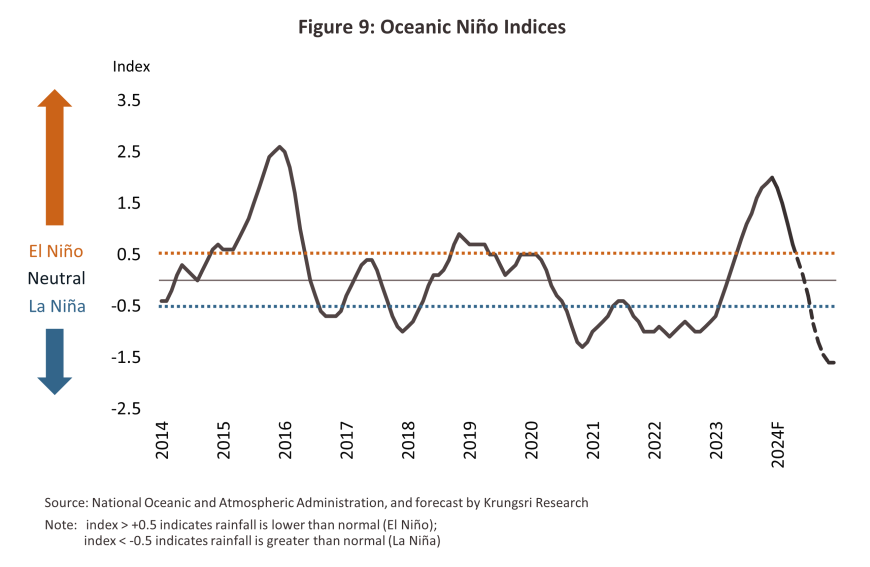

The market for agricultural machinery contracted in 2023 on a combination of the onset of El Niño and the resulting drop in farm yields, and high levels of household debt that then impacted regional spending power and encouraged lenders to tighten approvals of hire-purchase agreements for sales of farm machinery. However, conditions should improve over 2024 to 2026, and the market is expected to swing back to average annual growth of 3.0-4.0% as the climate moves into La Niña conditions and rainfall increases, which would then underpin an expansion in the total area of farmland under cultivation. In addition, sales will benefit from government support for the development of modern tech-enabled agriculture, undertaken to address challenges arising from the aging of Thai society and persistent problems with labor shortages in the agricultural sector, and from changes to the regulatory environment that will require the improvement and modernization of production technologies.

Krungsri Research view

The industry can look forward to improving conditions over the next three years, boosted by more favorable weather and the resulting extension in the area under cultivation, overall economic growth raising spending power, and changes to environmental regulations in major overseas markets, especially in the EU, that will then encourage greater use of modern agricultural machinery. As such, both domestic sales and exports will rise, with positive impacts on the incomes of manufacturers and distributors.

-

Tractor manufacturers: Greater demand for modern tech-enabled farm machinery will drive growth in income. Receipts from exports will also rise, especially from sales of smaller and mid-sized models, for which Thailand is the major regional supplier.

-

Manufacturers of other types of farm machinery: Demand growth will track the expansion in the area cultivated and the rise in overall agricultural outputs, but competition is tending to intensify due to increasing imports and the move by major tractor manufacturers into the production of a wider range of machinery, including power tillers, tillage equipment, rice harvesters, and combine harvesters. This will then put downward pressure on manufacturers’ incomes, most of which are SMEs.

-

Distributors of agricultural machinery (including importers): The improving outlook for the domestic market will lift income for distributors, although dealers of different brands may face significantly different market conditions. Thus, those distributing the highly favored major Thai and imported brands and high-tech machinery will experience higher growth rates than the market average.

Overview

The general category of agricultural machinery describes equipment and machinery that is used as a substitute for human and animal labor in agricultural contexts, and this thus cuts costs and reduces the time spent on the management of livestock and crops. The use of agricultural machinery also helps to maintain and improve yields of agricultural produce, and so this plays a central role in raising productivity in the agriculture and agro-processing sector. Agricultural machinery can be divided into five main groups, as follows1/.

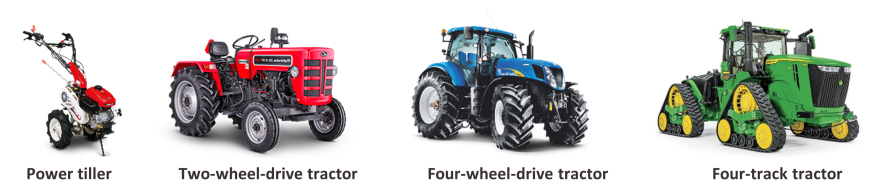

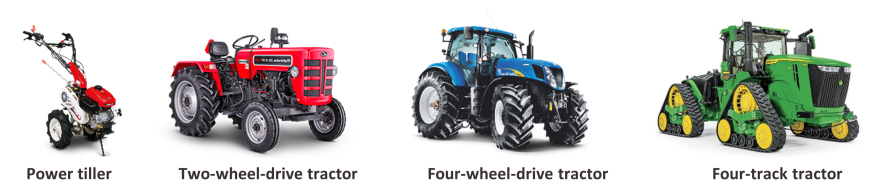

1) Tractors and parts2/, 3/: These are powered machines that are used to prepare agricultural land, as a source of power for pulling or towing, and as a base onto which other machinery may be attached. The latter may include tillers, crop protection equipment and rice harvesters, or alternatively, power from the engine may be used to drive pumps or electric generators. The tractors used in Thailand can be split into the two sub-groups of: (i) two-wheel-drive tractors, walking tractors or power tillers, which are suitable for use in smaller areas that require more careful attention; and (ii) four-wheel-drive tractors, or tractors that have a power output of at least 40 HP, which are typically used for plowing and harrowing, towing other equipment, or when large-scale planting and land-management activities need to be undertaken.

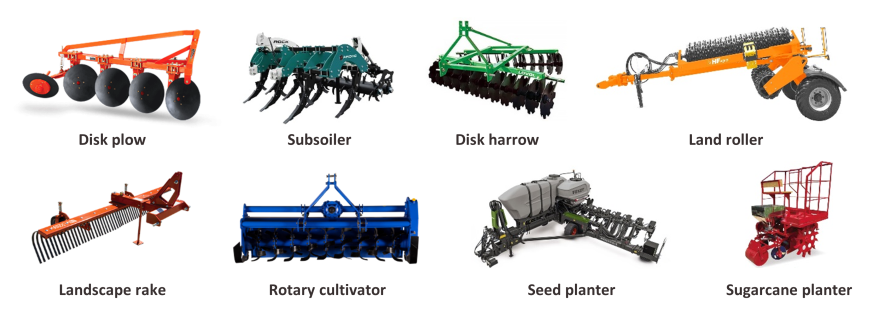

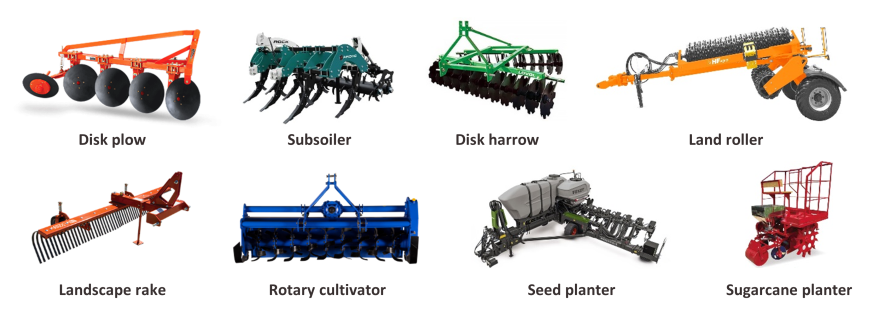

2) Tillage and planting equipment and parts3/: Machinery in this category is used to prepare land for planting. This group can be further divided into machinery used in initial tilling, including moldboard plows, disk plows, subsoilers and listers, and equipment used in the final preparation of soil for planting, such as disk harrows, tooth harrows, land rollers, rakes, rotary cultivators and floats. In addition, this group encompasses the machinery used to plant seeds and other parts of plants (e.g., bulbs, tubers, cuttings, and seedlings), such as spacing drills, rice, potato and sugarcane planters, fertilizer rippers, and other machinery used in similar farming applications.

3) Crop protection equipment and parts4/: These are labor-saving devices used to protect and promote crop growth. This group is comprised of two sub-categories, namely hand- and electric-powered pumps, and electric and non-electric sprays and spray heads together with other parts used in pumps and sprays.

4) Harvesting equipment and parts4/: These replace the human labor traditionally required in the harvesting of agricultural crops. Examples include combine harvesters, sugarcane harvesters, bean and corn harvesters, straw and fodder balers, root and tuber harvesters, slashers and brush cutters, pneumatic elevators and conveyors, and parts for these.

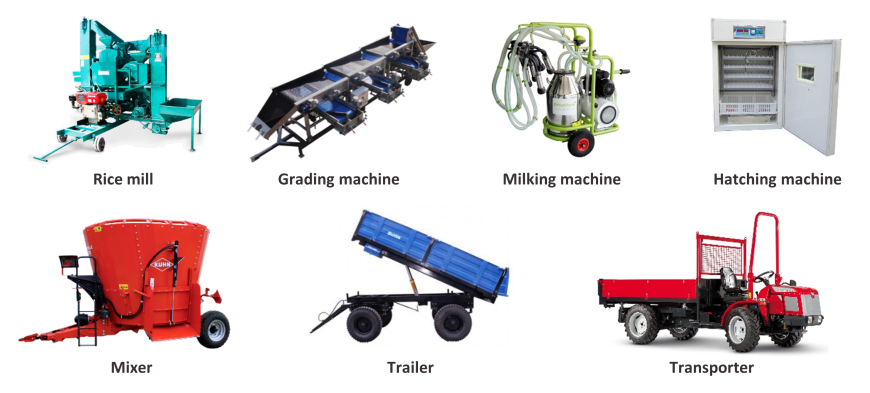

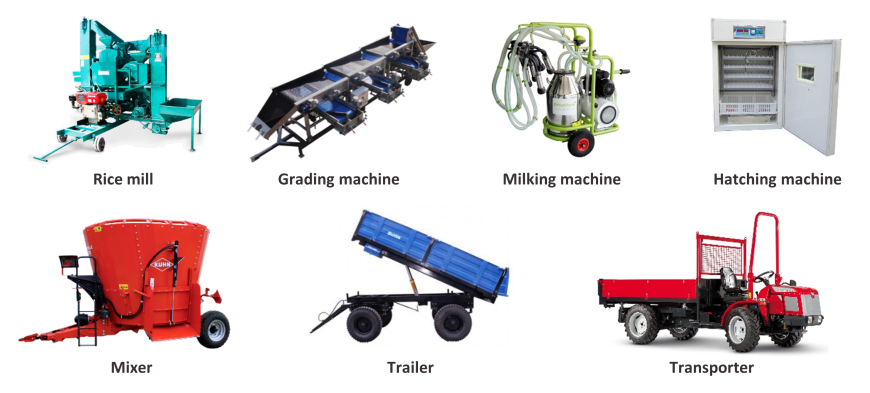

5) Other agricultural machinery4/ can be split into the three sub-categories of: (i) crop processing equipment, including hullers, millers, graders and dryers; (ii) livestock machinery, such as milking machines, poultry equipment, hatchers, food mixers and feeders; and (iii) trailers and transporters fitted with transportation or cargo-carrying capabilities that are used for the movement of agricultural products.

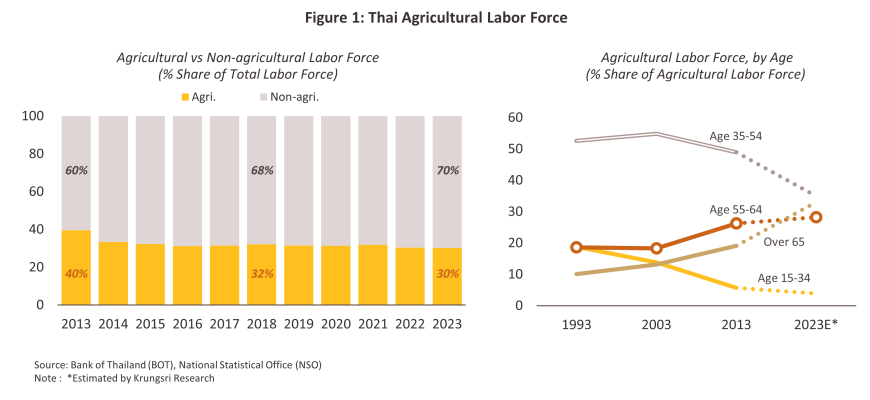

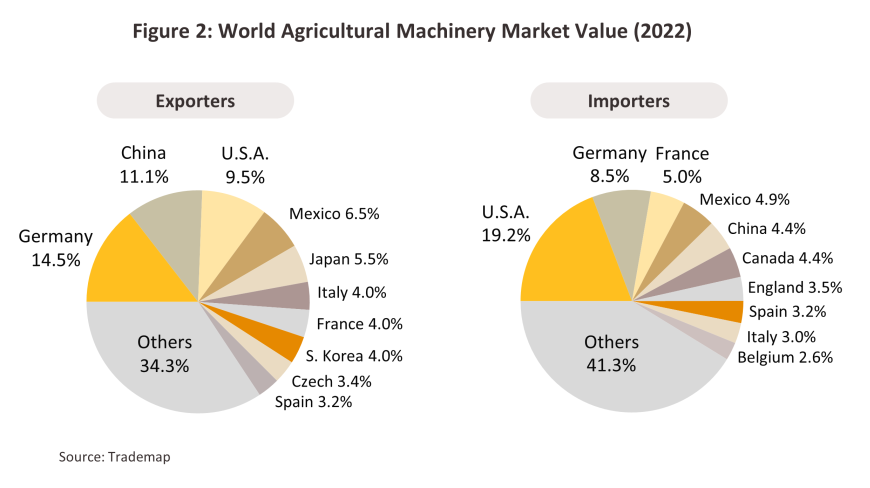

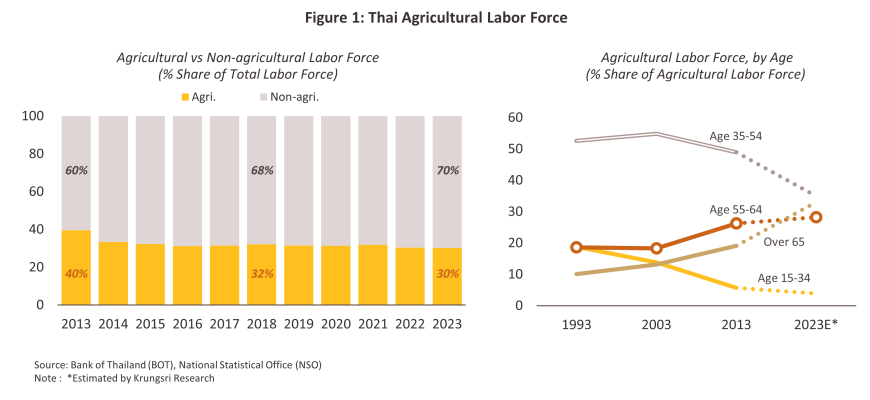

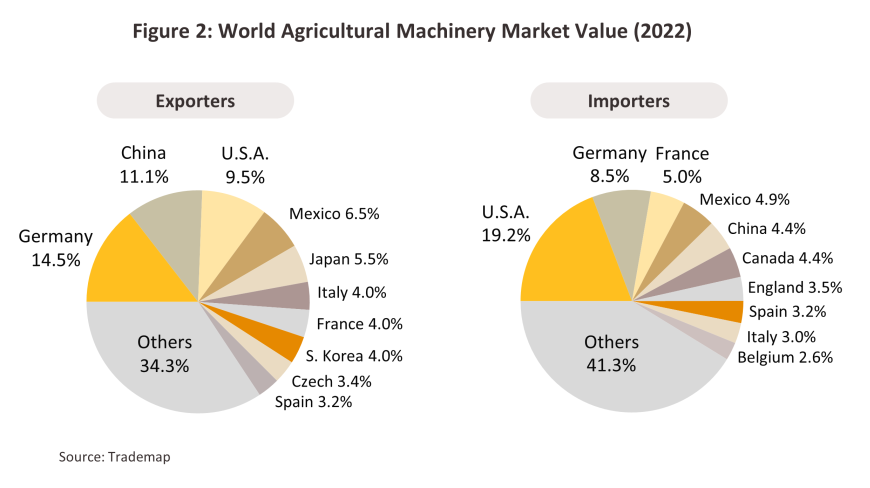

Thailand has a topography and climate that is favorable for agriculture, so the area under cultivation within the country has steadily expanded 5/. At present, Thailand’s agricultural output thus supports both domestic consumption and exports. However, the share of the population working in the industry has been gradually declining, especially the younger cohorts (Figure 1). This is then driving additional mechanization of the sector. Despite this, the country remains strongly dependent on imports of agricultural machinery (29% of the value of the domestic agricultural machinery market). Efforts to develop the domestic agricultural machinery industry that have been in effect since the first National Economic and Social Development Plan (1963-1966) have resulted in Thailand securing a 1.5% share of the global market as of 2022 (the 21st biggest global exporter), up from 0.4% share of the value of global exports of agricultural machinery in 2003. Nevertheless, Thailand’s role in world markets remains somewhat slight compared to the major players (Figure 2), led by Germany (14.5% share of the value of global exports of agricultural machinery), followed by China (11.1%), the US (9.5%), Mexico (6.5%), and Japan (5.5%). These are all important sources of exports to Thailand. The largest global importers of agricultural machinery are the US (19.2% of all imports globally by value), Germany (8.5%), France (5.0%), Mexico (4.9%) and China (4.4%). With a 1.2% share, Thailand ranks 20th in the list of global importers of agricultural machinery.

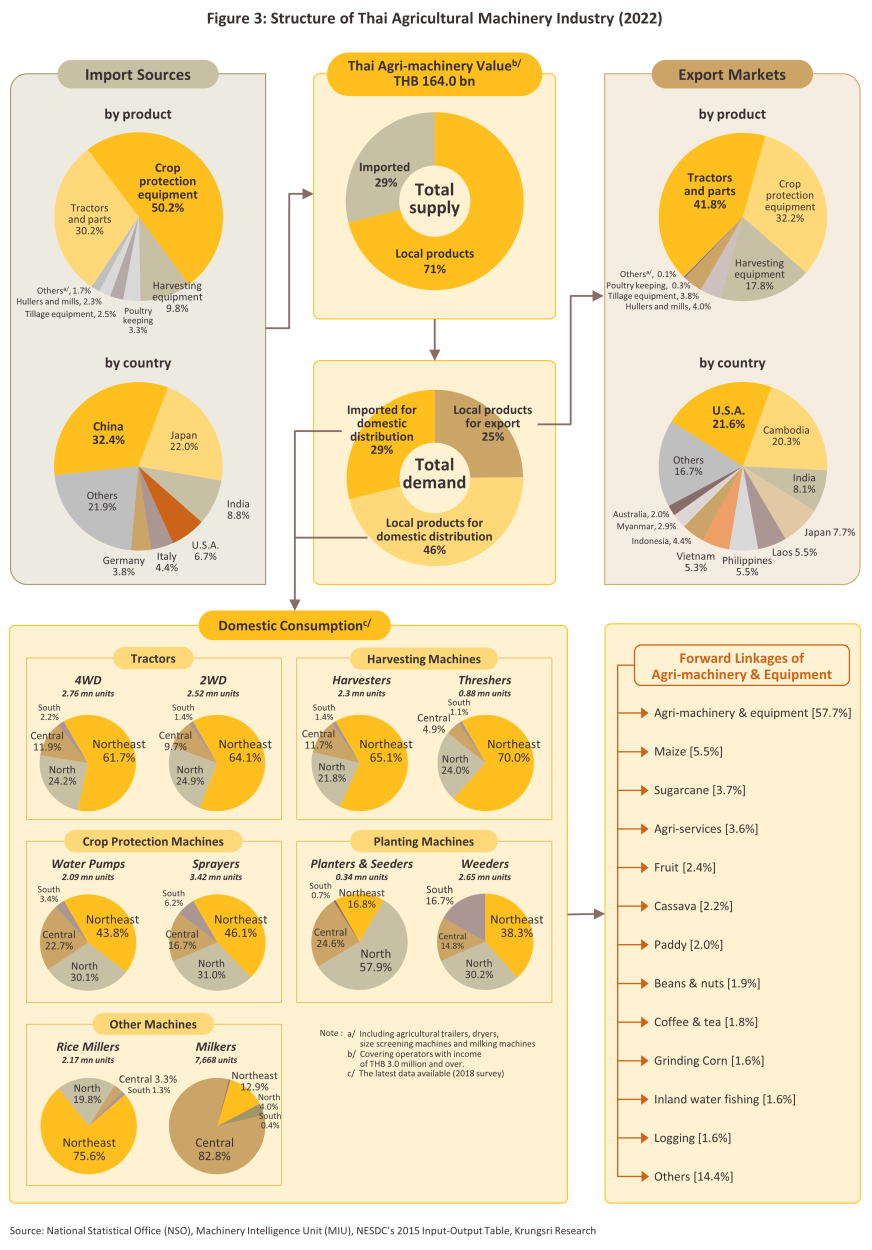

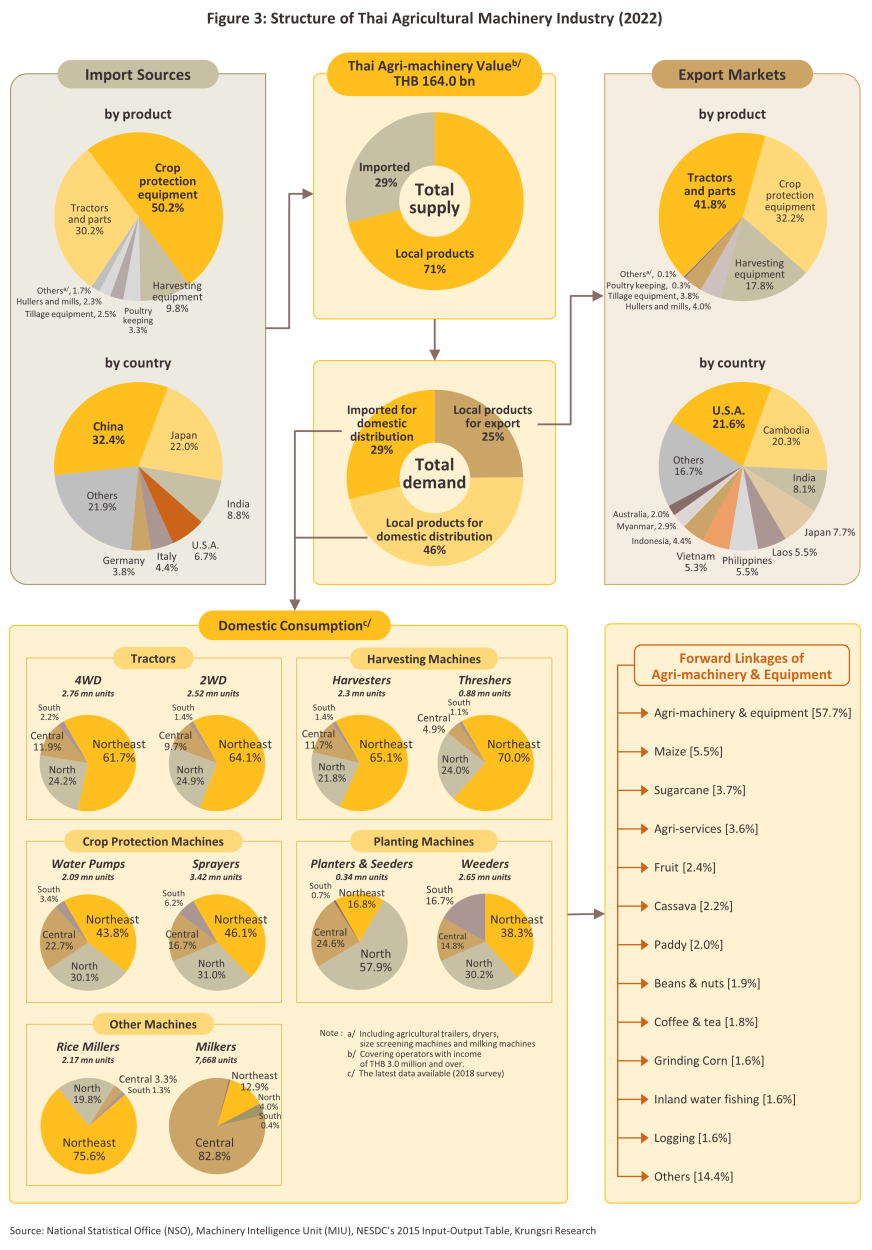

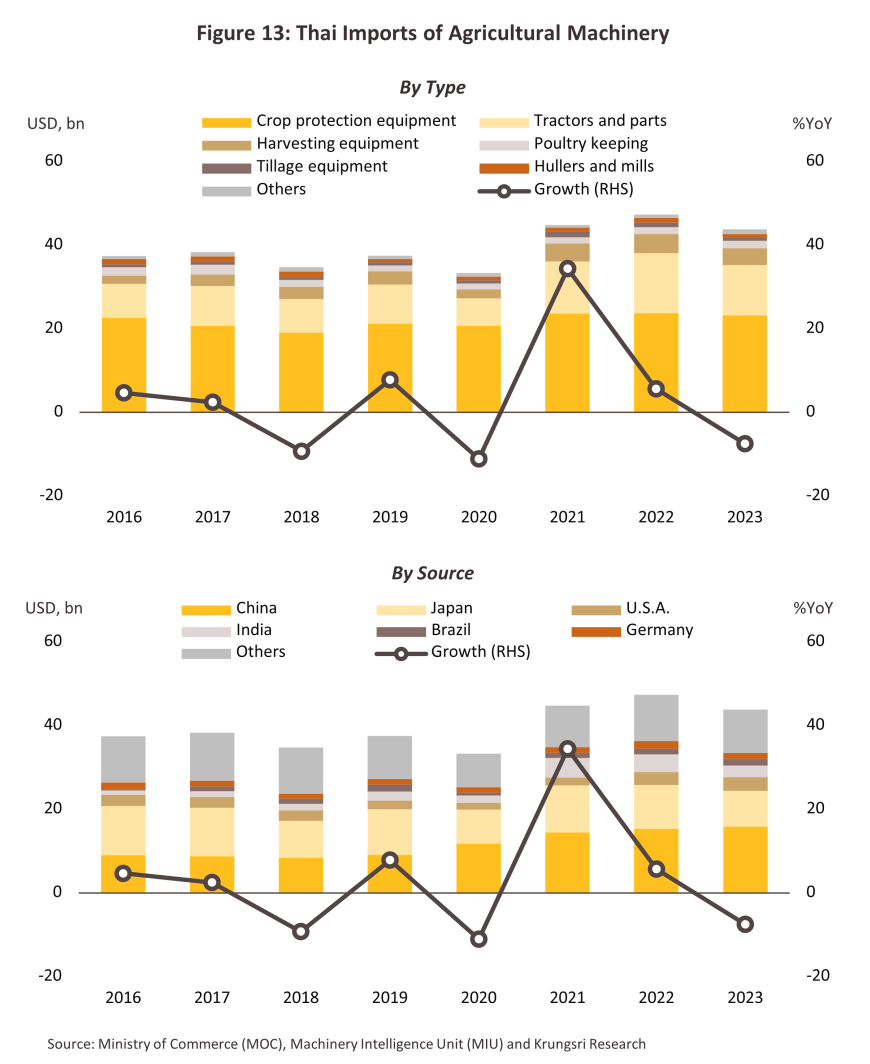

Over the past decade (2013-2022), Thailand has continued to primarily import agricultural machinery, with an average annual growth rate (CAGR) of 3.2%, bringing the total value of these to THB 47.4 billion as of 2022. The majority of this was crop protection equipment and parts (50.2% of the value of all imports of agricultural machinery), followed by tractors and parts (30.2%), and harvesting equipment and parts (9.8%). By value, 32.4% of the value of imports came from China, which was followed in importance by Japan (22.0%), India (8.8%), the US (6.7%) and Italy (4.4%) (Figure 3).

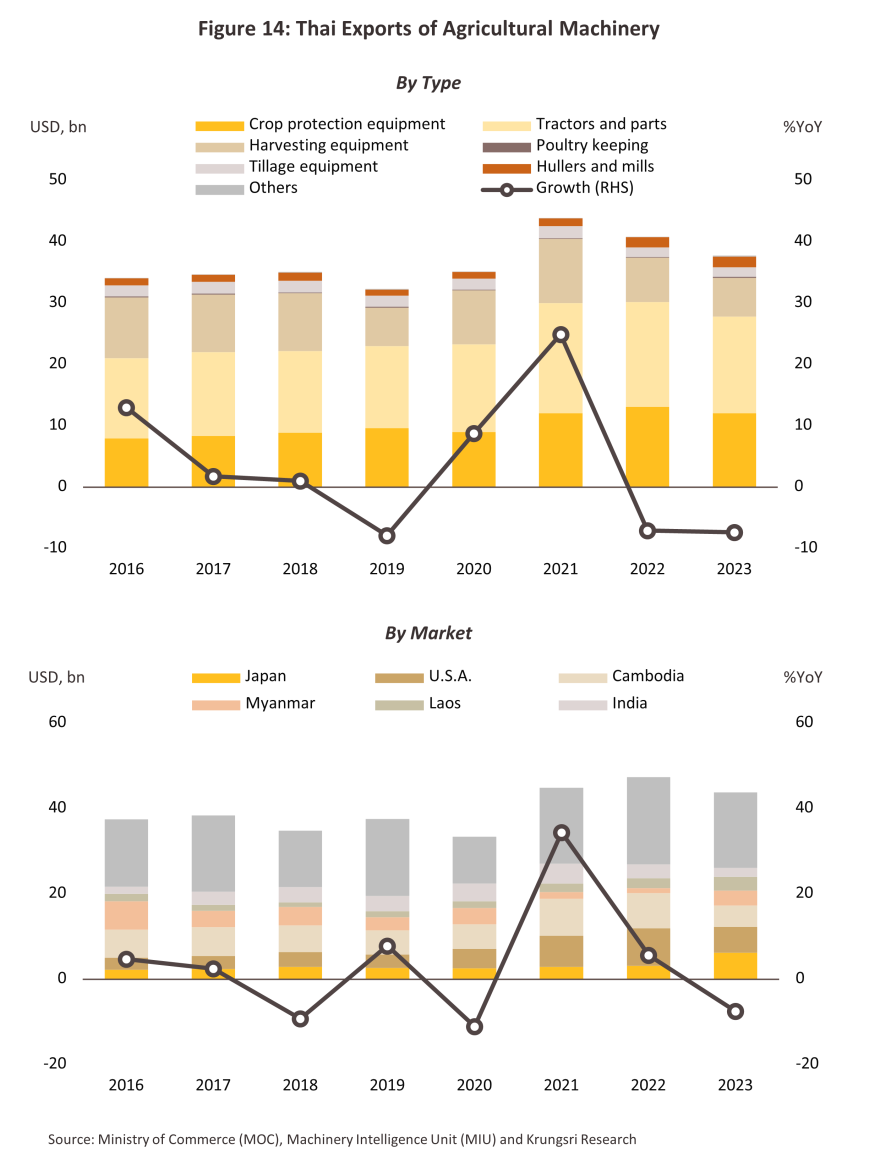

At the same time, exports of agricultural machinery from Thailand have surged 8.0% CAGR, with these bringing in receipts of THB 40.8 billion in 2022. Within this group of products, the most important category was tractors and parts, which generated 41.8% of all income from the exports of agricultural machinery, followed by crop protection equipment and parts (32.2%), and harvesting equipment and parts (17.8%). Thanks to their similar climate, topography, and farming techniques, exports to the CLMV nations were the largest contributor to Thai export earnings (these were the source of 34.0% of income from exports), with these followed by exports to the US (21.6%), India (8.1%), Japan (7.7%) and the Philippines (5.5%) (Figure 3).

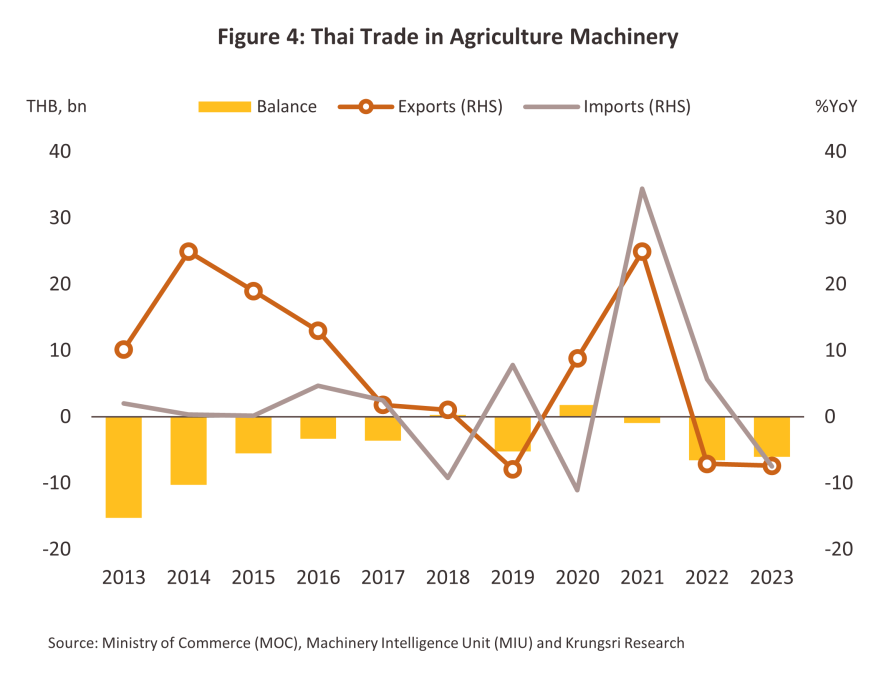

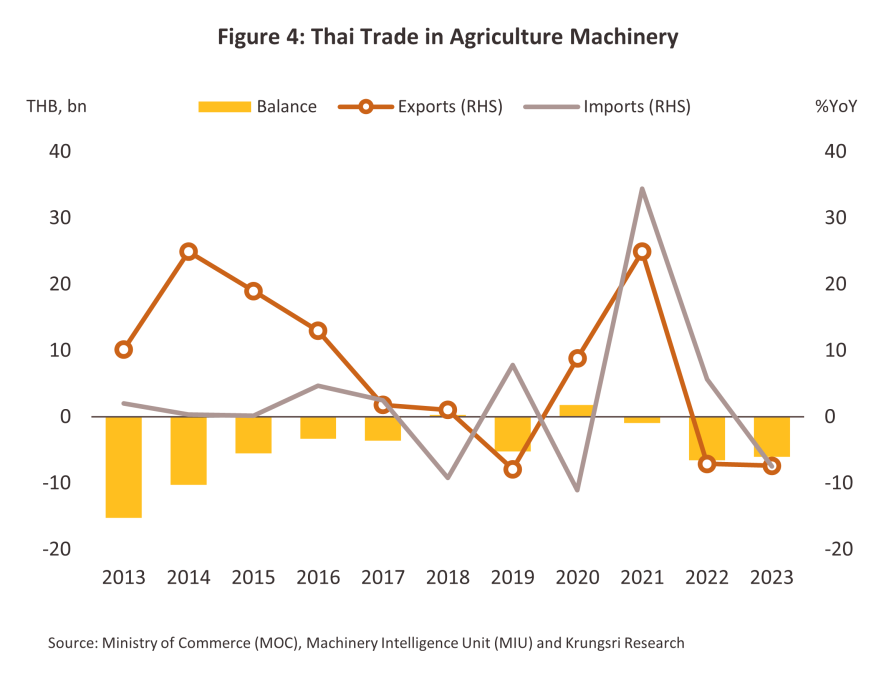

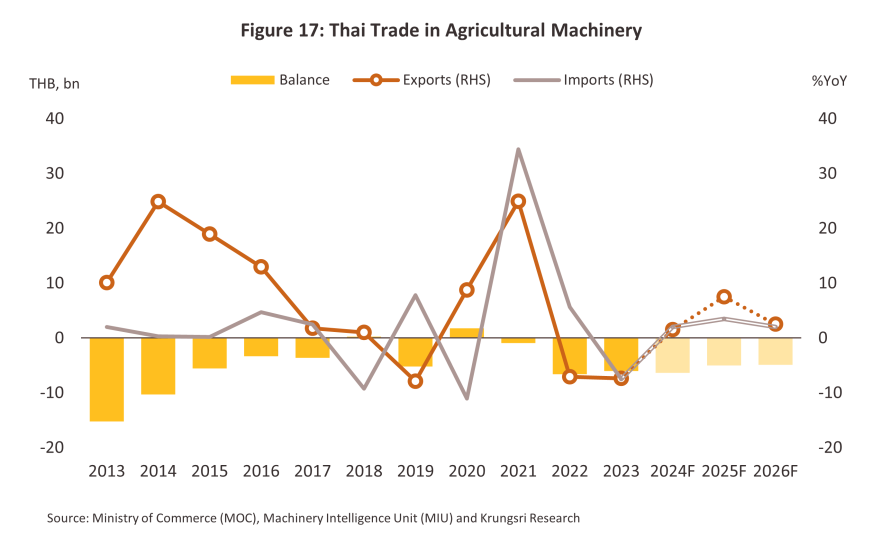

Due to its dependency on imports, Thailand runs a trade deficit within the agricultural machinery industry6/ (Figure 4), especially with regard to crop protection equipment and parts, and ‘other’ agricultural machinery, a category that includes livestock equipment, dryers, and graders.

As of 2022, Thailand’s agricultural machinery had a market value of THB 164.0 billion, of which 28.9% or THB 47.4 billion was attributable to imports. The value of domestically produced machinery totaled THB 116.6 billion, or 71.1% of the market, of which THB 75.9 billion (46.3% of the total, by value) was distributed domestically and THB 40.8 billion (24.9%) was delivered to export markets (Figure 3).

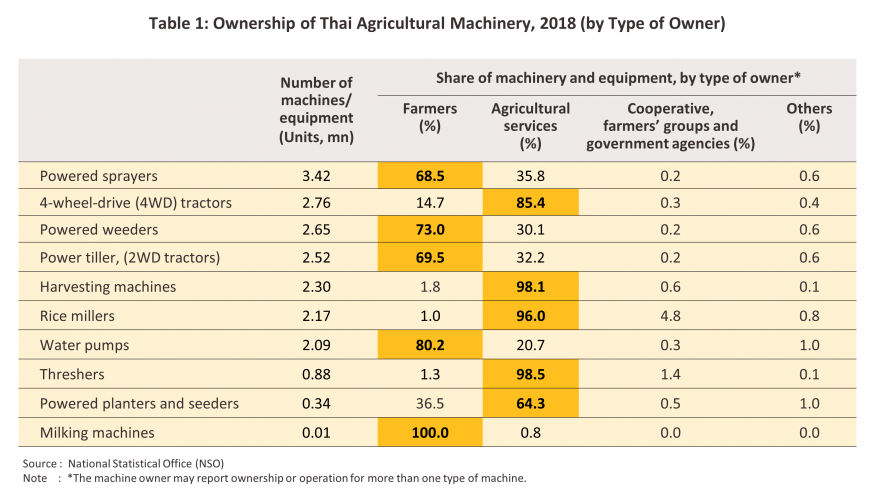

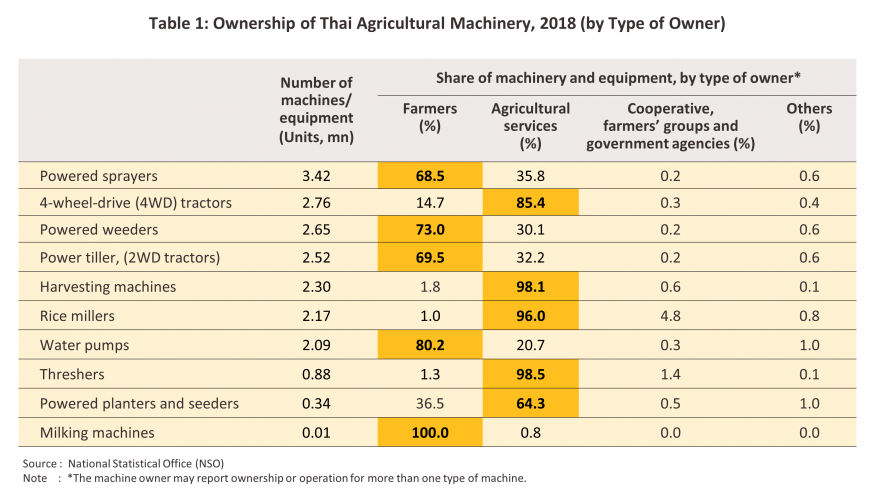

Preliminary results from the 2023 survey of Thai farmers show that the most popular types of agricultural machinery were those used in rice farming7/, and most users of these were small, independent farmers8/, with 71.3% of farmers or corporations working land for agricultural purposes reporting that they utilized agricultural machinery. The most widely used equpiment9/ was four-wheeled tractors (50.8% of farmers landholder who used machinery reported using these), followed by combine harvesters (27.9%), power tillers (20.9%), powered pumps (15.4%), and powered sprayers (12.3%). The highest rates of use were reported in the northeast of the country (80.0% of agricultural machinery demand of farmers in the area), followed by the north (78.5%), the central region (68.8%), and the south (34.4%). Results from the survey of changes in the agricultural sector10/ show that ownership rates of agricultural machinery are highest for smaller equipment and machines, such as insecticide sprayers, weeders, power tillers, and pumps, which small, independent farmers typically own. By contrast, large machinery tends to be owned and operated by agricultural contractors and providers of agricultural services (Table 1). By area, ownership was most widespread in the northeast and the north of the country (Figure 3).

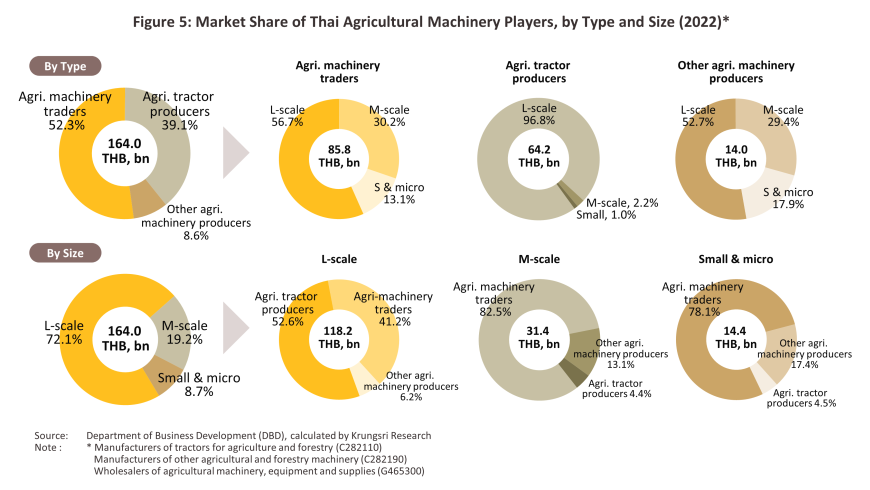

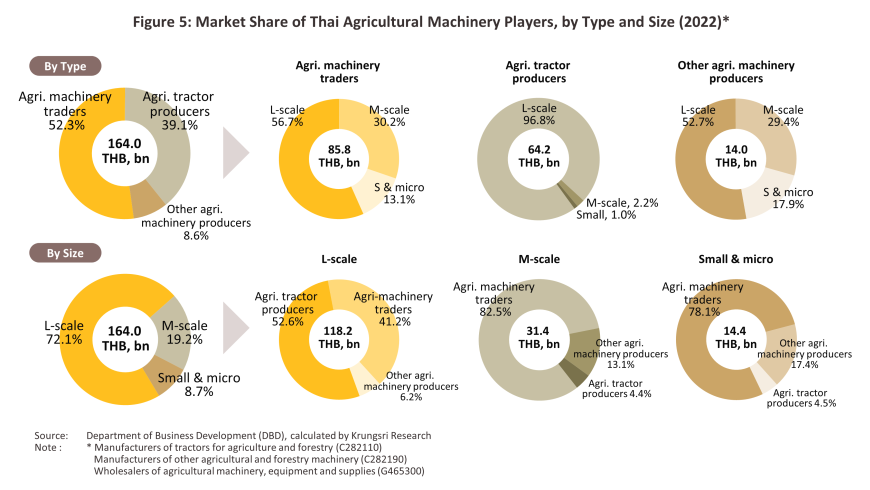

As of 2022, there were 5,111 registered manufacturers and wholesalers of agricultural machinery in Thailand11/, split between 3,407 micro-sized operations (66.7% of all businesses in the industry), 1,370 small operations (26.8%), 232 medium-sized operations (4.5%), and 102 large companies (2.0%). 51.3% of these were unincorporated businesses/sole proprietorships, 48.4% were incorporated businesses, and 0.3% were state enterprises. Of those incorporated companies registered with the Department of Business Development and still operating, 1,1547/, or 73.7% of the total, were micro or small operations, 19.0% were mid-sized operations, and 7.4% were large corporations. However, THB 118.2 billion in income, or 72.1% of all receipts to the industry, went to these large companies, 19.2% were mid-sized operations, and 8.7% were micro or small operations (Figure 5).

Thai manufacturers and assemblers of agricultural machinery can be divided into two groups according to their income, size, and use of technology.

-

Large players: These have significant manufacturing capacity, operate extensive marketing networks at home and abroad, and offer comprehensive after-sales services nationwide. These companies may undertake joint ventures with overseas players and/or they may deploy high-end technology in their manufacturing processes, and so these are able both to compete effectively with imports and to penetrate export markets. Operators may either manufacture their own parts and diesel engines and then assemble these into tractors and other machinery themselves, or they may skip the manufacturing stage and instead import parts for assembly in Thailand. In addition, some companies import agricultural machinery (especially larger items) for distribution to the domestic market.

-

SMEs: These businesses have often developed from companies that began by repairing engines and machinery, and most operate a business model based on using ready-made parts and engines (sourced either overseas or domestically) for adaption or assembly in Thailand. This allows players to offer machinery that is adapted to local conditions and the needs of farmers in the immediate environment. Marketing efforts are thus somewhat limited and these tend to be restricted to the local area only, but the result of this is then that nationally, there are many such players spread across the different regions of the country. These typically rely on low- to middle-end technology, and manufacturing output tends to be concentrated on power tillers, other types of tillage equipment, regular and axial pumps, sprays, rice threshers, combine harvesters, farm trucks, dryers, and small rice mills.

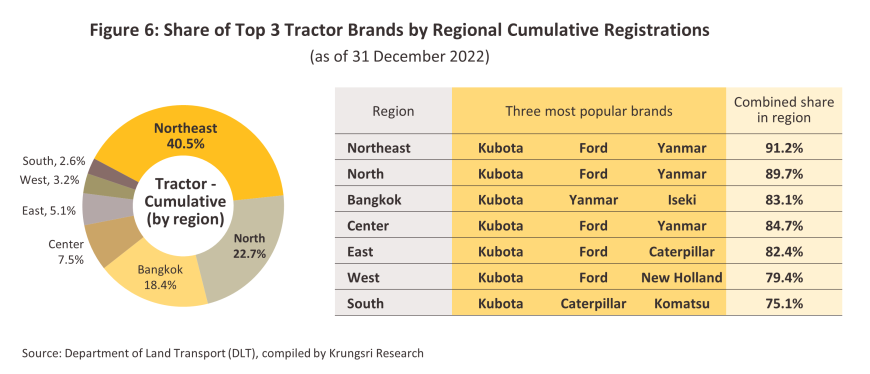

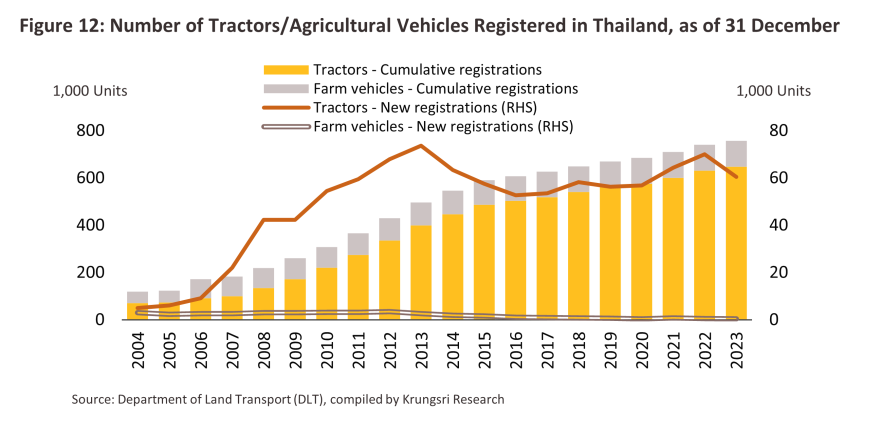

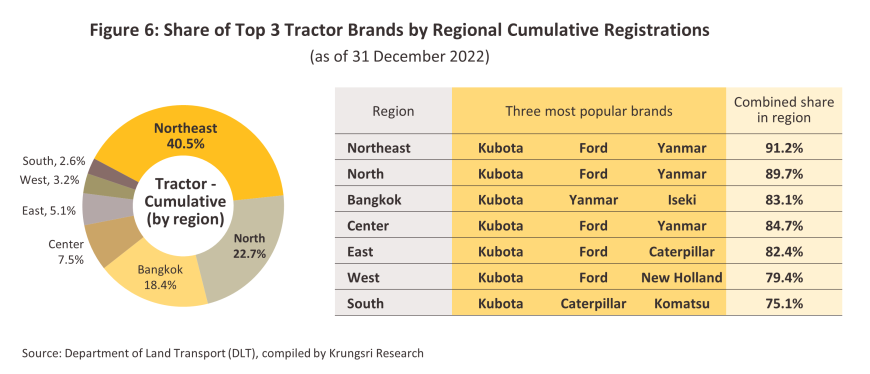

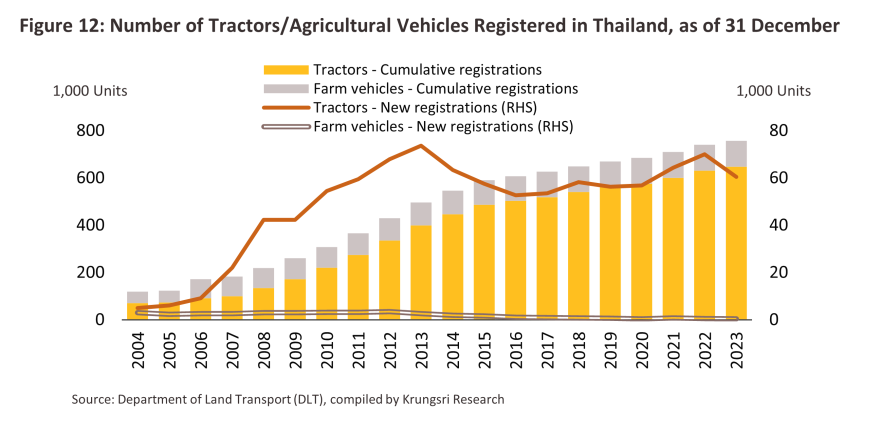

Within the Thai market, brands that are manufactured locally, such as Kubota and Yanmar, have the largest market share, and this is then reflected in the cumulative total of 0.63 million tractors (as per the ror yor 13 specification)12/ and 0.11 million other agricultural vehicles (as per the ror yor 15 specification)12/ registered in Thailand as of the end of 2022 (Figure 6). By contrast, other brands are imported for sale to domestic buyers, and these include Ford, New Holland, John Deere, Iseki, and Massey Furguson (Figure 7). For major manufacturers and importers, important strategies used to support sales efforts include offering loans and hire-purchase finance, extensive after-sales services, and selling accessories and additions for use with their tractors. However, farmers are also able to finance the purchase of agricultural machinery through other institutions that also offer loans and hire-purchase agreements, including the Bank for Agriculture and Agricultural Cooperatives and non-banks such as savings cooperatives and leasing companies.

Situation

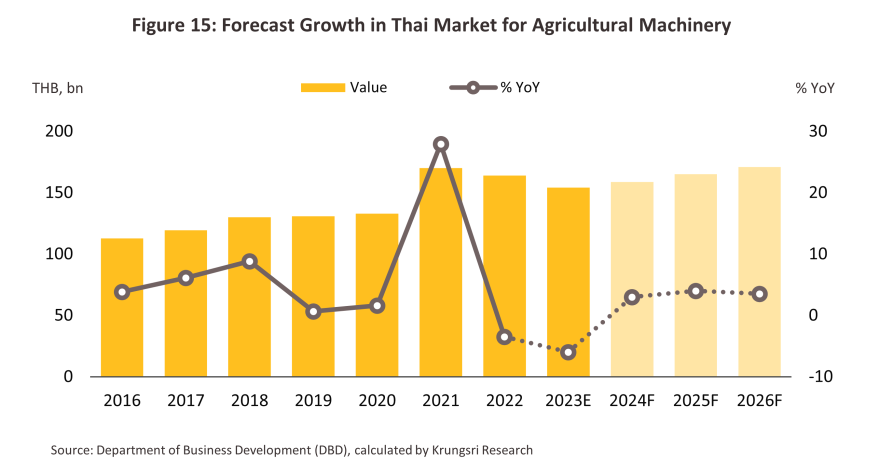

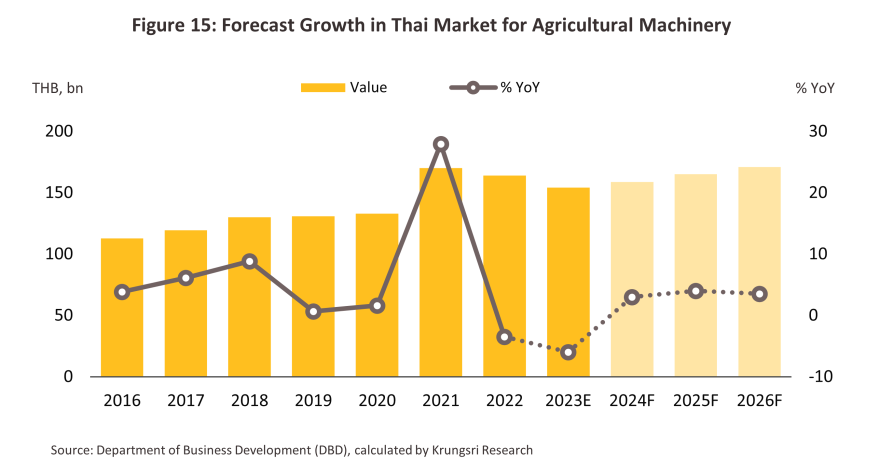

Having already fallen by -3.5% to THB 164.0 billion in 2022, the market for agricultural machinery contracted by another -6.0% in 2023, bringing this down to a total of THB 154.1 billion. Declines were driven by the emergence of El Niño conditions and the impacts of this on agricultural outputs, as well as by ongoing high levels of household indebtedness that have then eroded spending power in the provinces and encouraged lenders to tighten approvals of hire-purchase agreements for the sale of agricultural machinery.

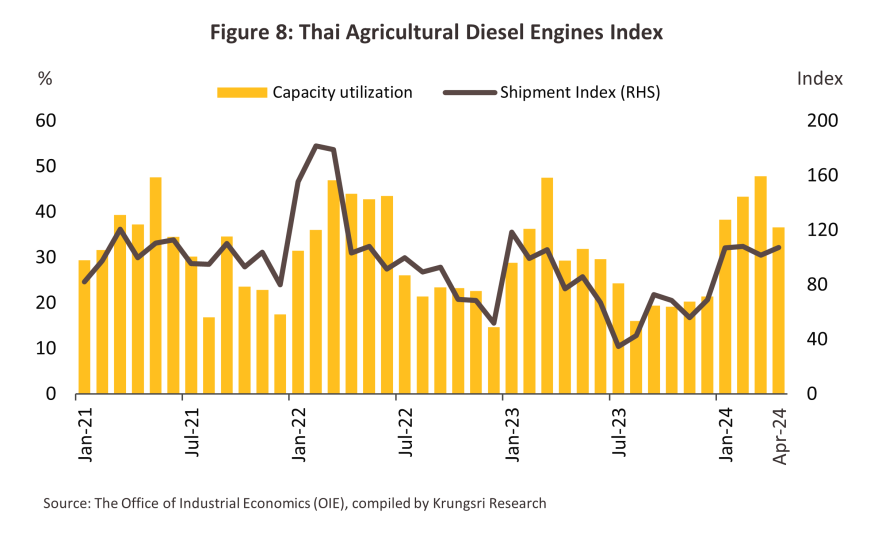

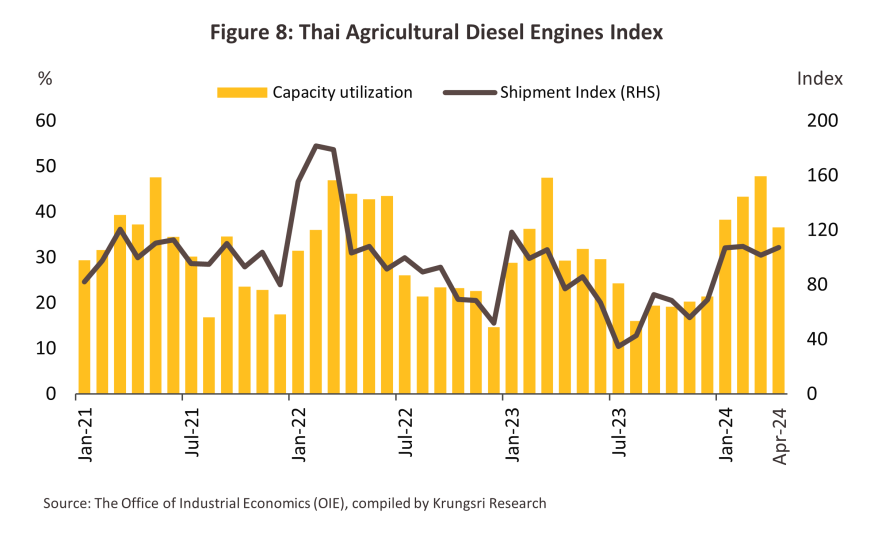

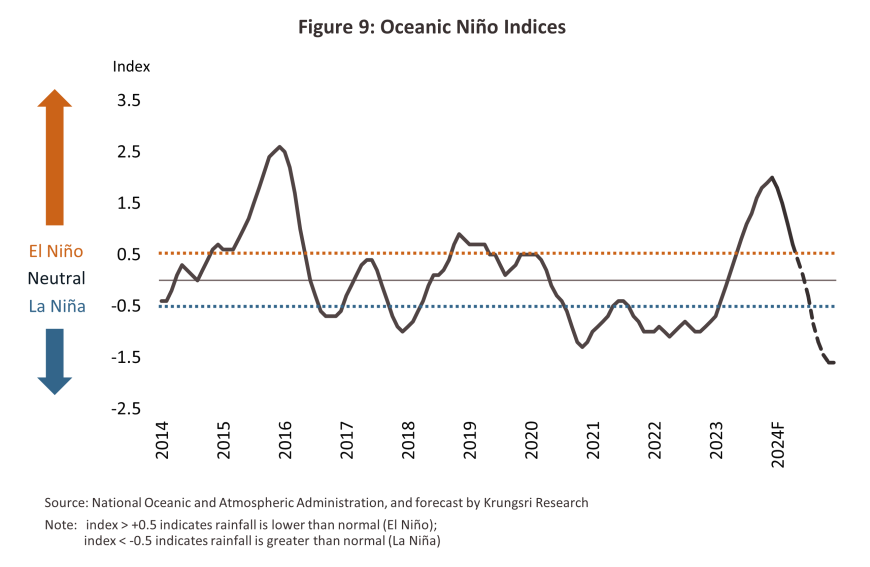

Output of agricultural machinery by domestic manufacturers also slipped in the year. This then showed up in both the -13.9% contraction in the MPI for agricultural diesel engines and the slide in the industry’s capacity utilization from 2022’s 31.3% to just 27.0% in 2023 (Figure 8). This worsening outlook was caused by: (i) the transition to El Niño (Figure 9) that added to worries that demand for agricultural machinery would soften on both domestic and export markets; and (ii) the higher cost of oil and the negative impacts of this on overall levels of usage of machinery in the agricultural sector. In addition, demand for spares and replacement parts also weakened, and this was reflected in the year’s -30.5% slump in the shipment index for agricultural diesel engines.

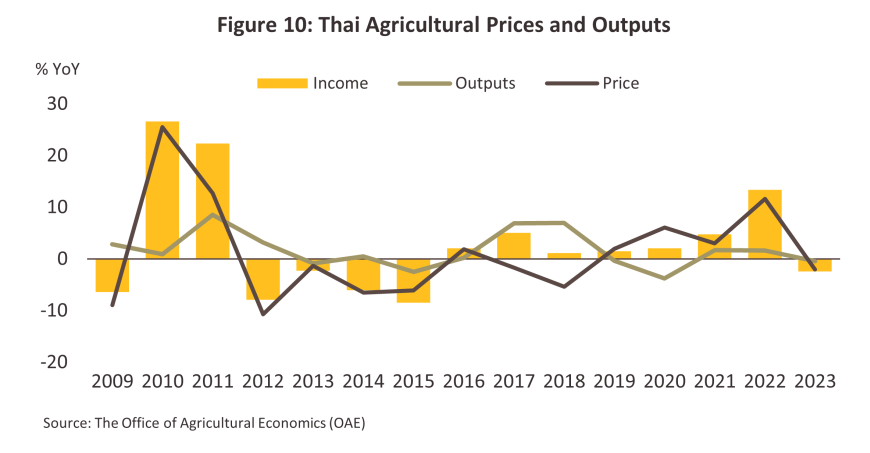

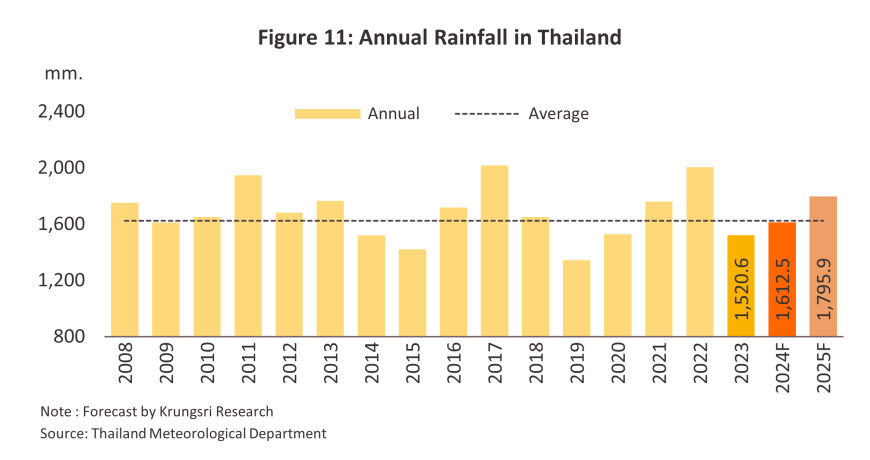

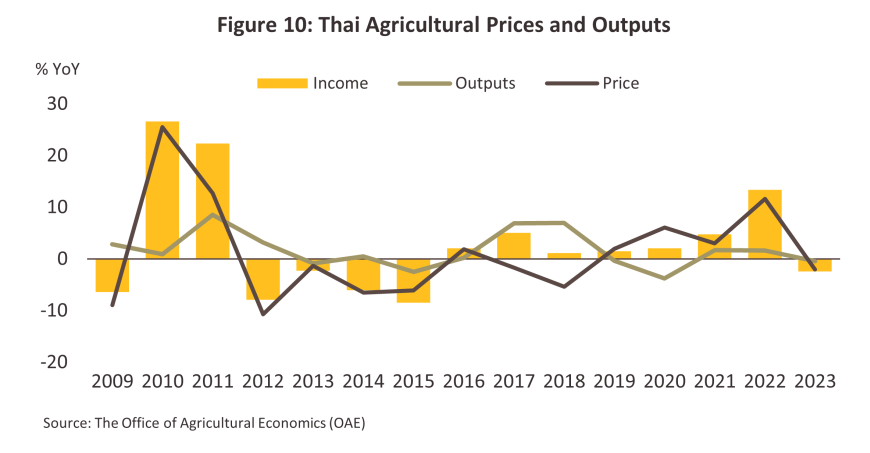

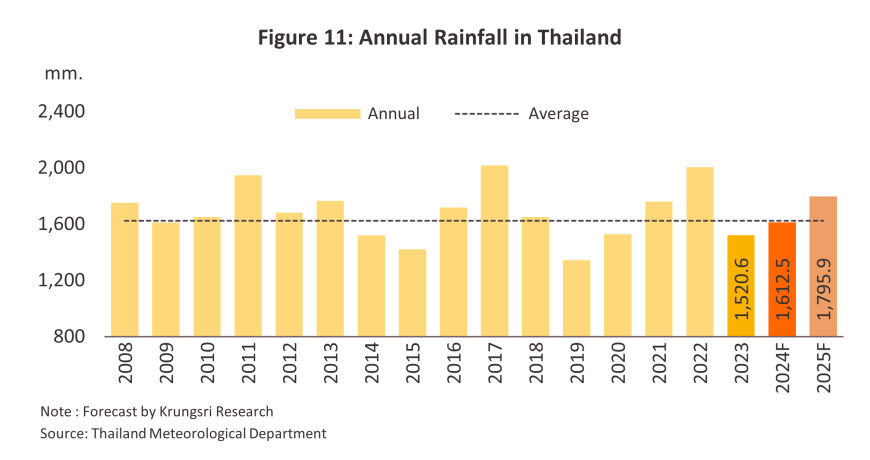

Domestic demand for agricultural machinery softened through 2023 on weaker purchasing power in the agricultural sector. Overall income index to the sector slipped -2.5% as a result of a -2.0% contraction in the agricultural output index and a -0.4% fall in the index of agricultural prices (Figure 10). These were in turn caused by below-average rainfall13/ (Figure 11) and drought resulting from the onset of El Niño. This then undercut outputs and weakened incomes, adding to pre-existing problems with high levels of household debt and dragging on the ability of farmers to spend on agricultural machinery. As such, the number of new tractors registered in Thailand fell -13.6% to 60,429 vehicles, while registrations of other agricultural vehicles slumped -22.4% to just 378 units (Figure 12). Krungsri Research thus estimates that the value of the market (domestically manufactured and distributed units) fell -5.4% to THB 110.3 billion, down from 2022’s total of THB 116.6 billion, which had itself contracted -6.8%.

Thailand continued to run a deficit in its international trade in agricultural machinery, though this narrowed to THB -6.0 billion in 2023, down from THB -6.6 billion a year earlier. THB -4.6 billion of this was for crop-related machineries that included crop protection equipment and parts, dryers, and graders, while THB -1.5 billion was for goods for use with livestock, though almost all of this was machinery and parts for use with poultry. Details of imports and exports follow.

-

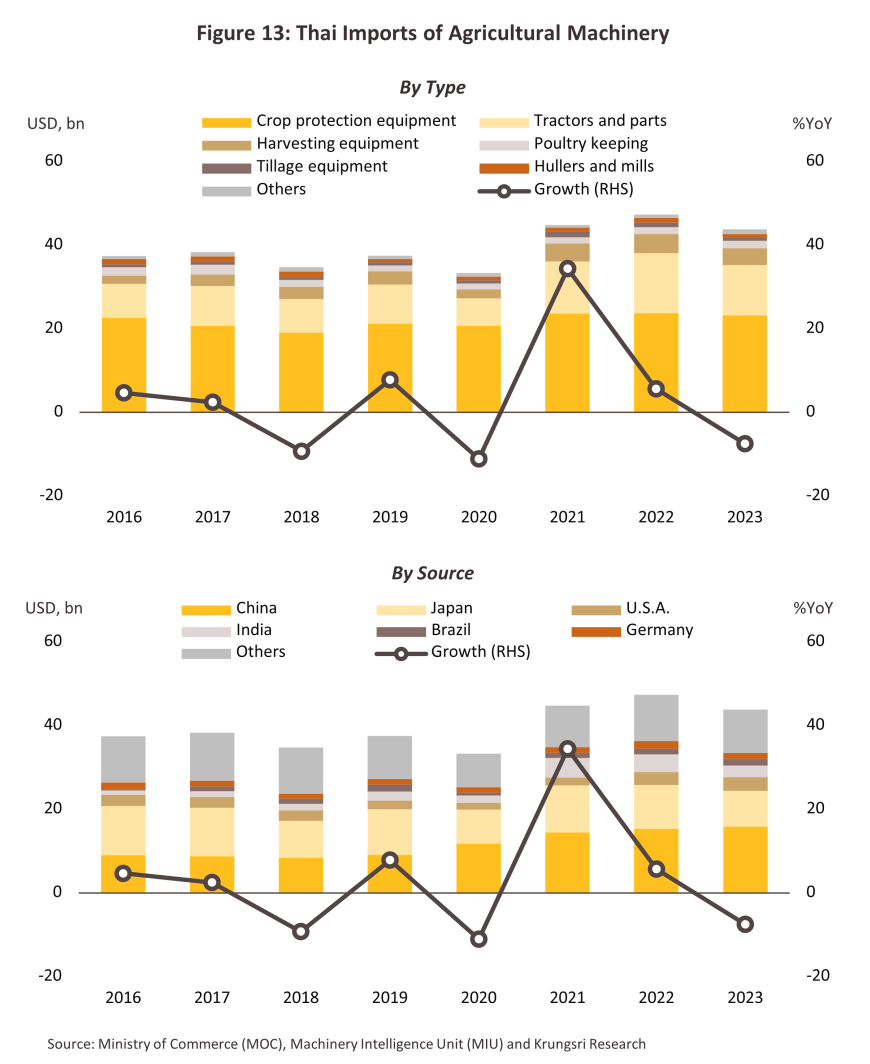

In 2023, imports of agricultural machinery fell -7.5% to THB 43.8 billion, down from THB 47.4 billion in 2022, when they had risen 5.7% (Figure 13). This was attributable to a -8.0% decline in imports of crop equipment to THB 42.1 billion, and in particular to drops in imports of -15.9% for tractors and parts (to THB 12.0 billion), -12.8% for harvesters and parts (to THB 4.0 billion), -2.2% for crop protection equipment and parts, -28.0% for tillers and planters/drills and parts for these, -26.1% for cereal graders, mills, winnowers, polishers, threshers and huskers, and parts, and -22.7% for articulated and semi-articulated vehicles and parts. As elsewhere, sales were hurt by the onset of El Niño conditions, which then triggered a drought and delayed the onset of rains, thereby reducing agricultural outputs. Some farmers also decided to delay or amend their planting schedules, and producers, these factors combined to undercut agricultural incomes and receipts from the provision of agricultural services. The most important source of imports was China, which had a 36.2% market share by value, followed by Japan (19.5%), the US (7.6%), India (6.3%), Brazil (3.5%) and Germany (3.4%) (Figure 13). Exporting countries that saw their income from the Thai market increase in the year included in order of importance China (+3.4%), the US (+3.8%) and Brazil (+7.2%), while the most important exporting nations experiencing a decline in income included Japan (-18.0%), India (-33.5%) and Germany (-17.3%).

-

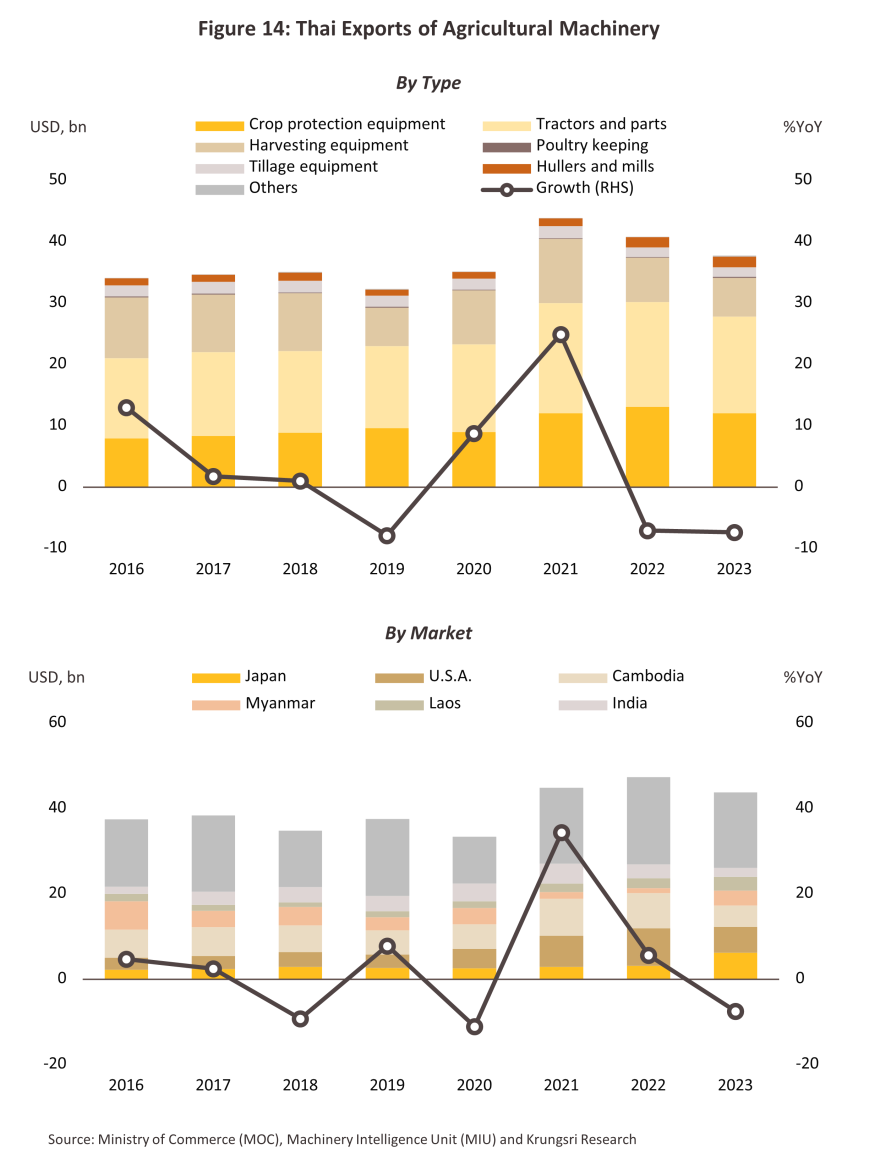

Exports of agricultural machinery also suffered in the year. Having already fallen -7.1% from 2021 to a total of THB 40.8 billion in 2022, these then slipped by another -7.4% to a combined value of THB 37.8 billion in 2023 (Figure 14). Declines were seen across the category of agricultural crop machinery, exports of which shrank -7.7% to THB 37.5 billion. In detail, exports fell -7.7% for tractors and parts (to THB 15.7 billion), -8.3% for crop protection equipment and parts (to THB 12.0 billion), -13.0% for harvesters and parts, and -1.9% for tillers and planters/drills. This is mainly due to the contraction of major markets affected by the El Niño situation as well as Thailand. In particular, exports to Cambodia slumped -39.6% to just THB 5.0 billion, cutting the country's contribution to Thai export earnings from 20.3% of the total to 13.2%. Exports into other markets also contracted as spending power evaporated, and these thus fell -31.0% in the US and -36.9% in India. However, growth was seen in exports to Japan (+97.9%), Myanmar (+198.5%) and Lao PDR (+45.3%). As a result, with a 16.4% of export share, Japan moved into first place in the ranking of Thai export markets. Japan was followed in importance by the US (16.1%), Cambodia (13.2%), Myanmar (9.2%), Lao PDR (8.7%) and India (5.5%) (Figure 14).

Outlook

The domestic market for agricultural machinery is expected to turn around from 2023’s contraction of -6.0% (Figure 15) to average annual growth of 3.0-4.0% over 2024 to 2026, thereby bringing the total value of the market to some THB 158.5-171.0 billion. Going forward, growth will be supported by the following factors.

-

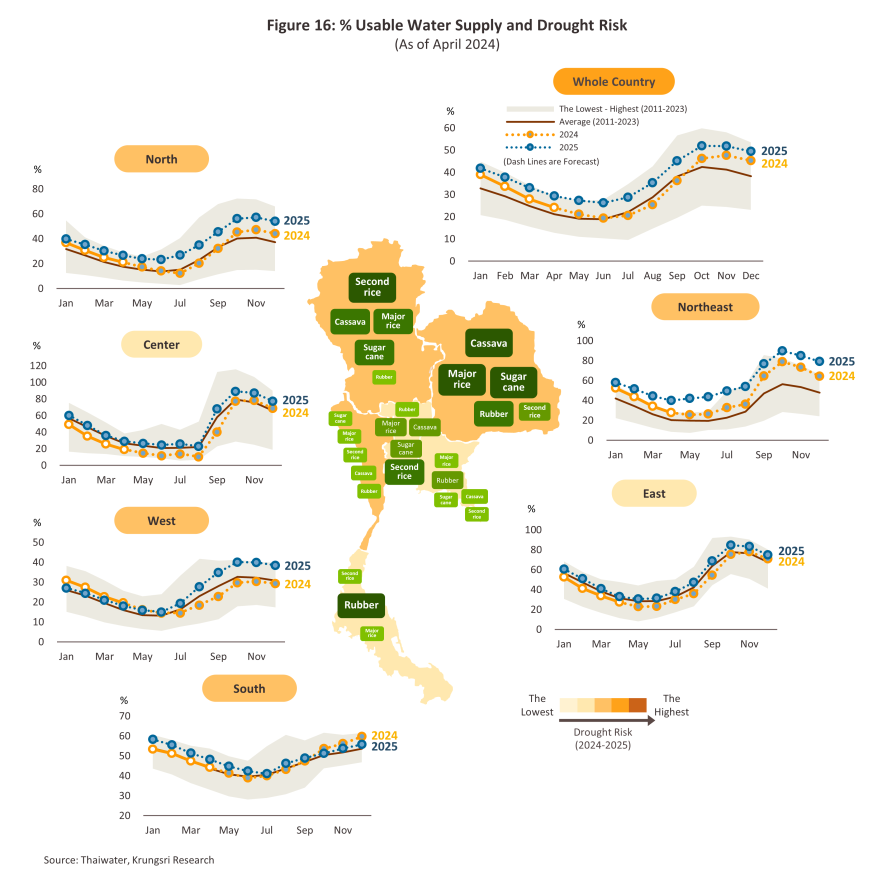

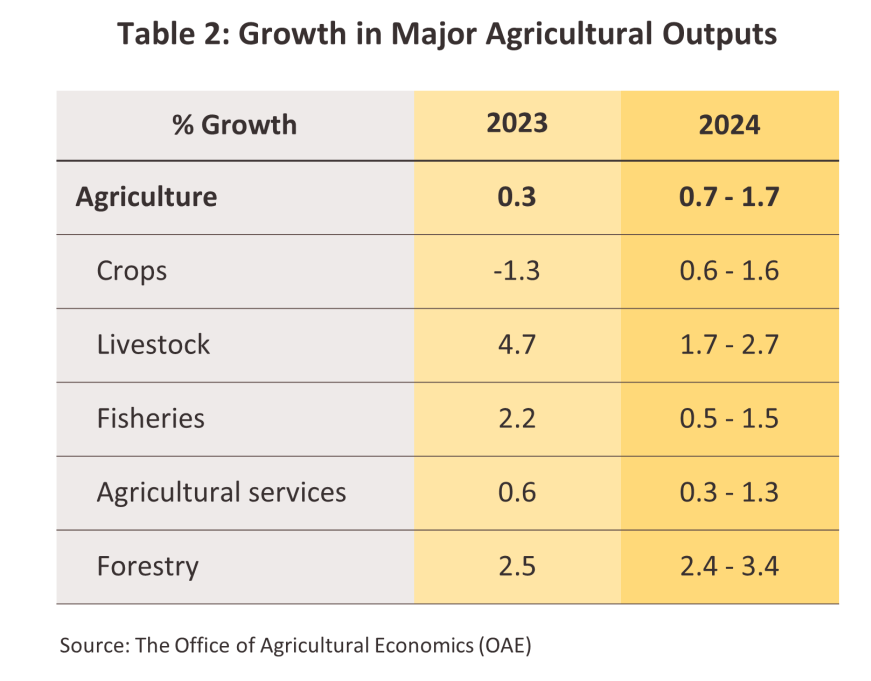

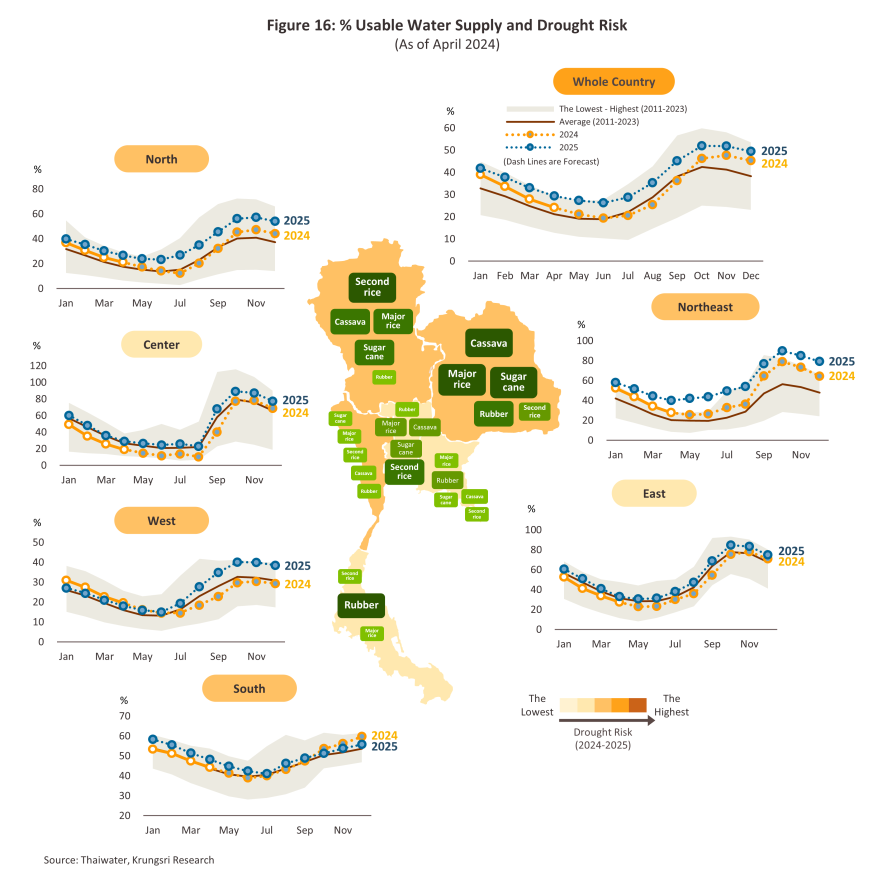

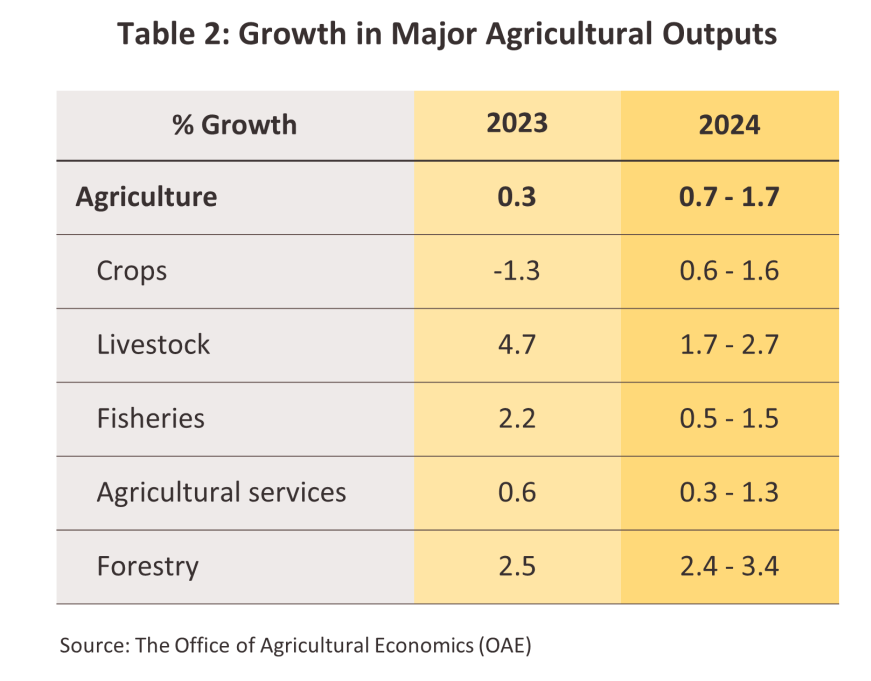

Thailand is forecast to move into La Niña conditions, which will then trigger an improvement to the climate overall, increase rainfall (Figure 11) and improve access to irrigation water (Figure 16). This will tend to raise outputs of both crops and livestock and improve the market for agricultural services (Table 2), with positive knock-on effects for demand for agricultural machinery.

-

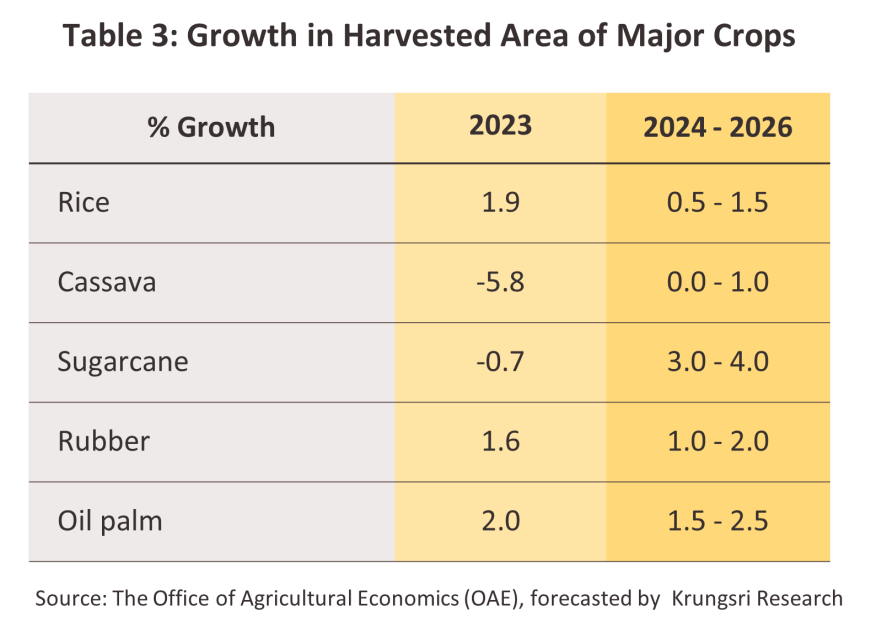

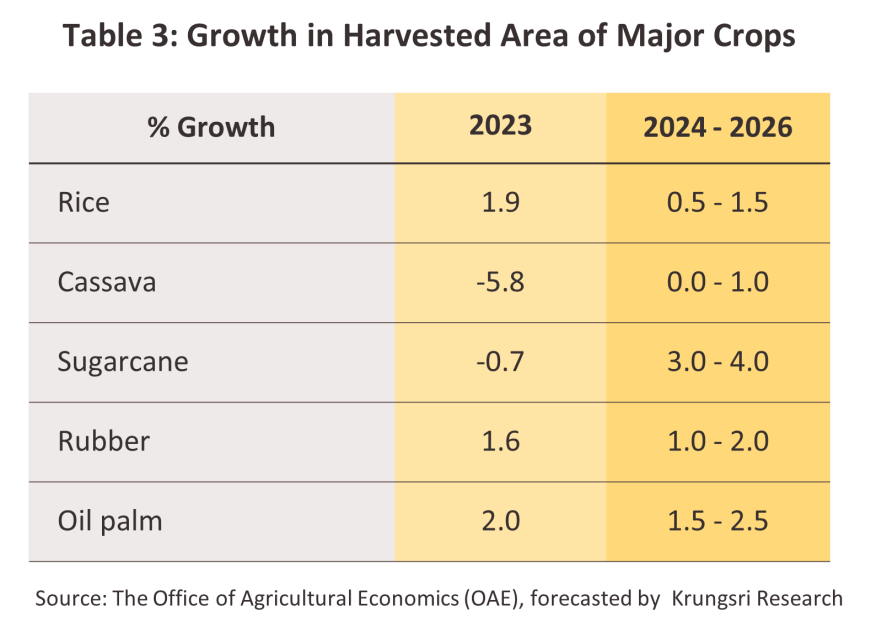

The expansion of agricultural areas for economically significant crops is driven by positive price factors due to expansion in global market demand. This includes crops for food security, energy, and industrial use. This will include rice, cassava, sugarcane, oil palm, and rubber (Table 3), and as the current El Niño weakens, the total harvested area with these should increase.

- Structural issues affecting the industry include the aging of society14/, labor shortages that continue to be experienced across industry, the effects of hikes to the minimum wage on the cost of labor and of agricultural services, and the preferences of non-agricultural individuals interested in investment or turning to agriculture sector. These will all tend to add to demand for agricultural machinery to serve as a replacement for labor.

-

The government is providing ongoing support for the sector. This includes plans to consolidate smaller plots15/, the ‘Smart Farming’ and ‘Young Smart Farmer’ programs, the ‘Zero Burn’ campaign (which aims to reduce air pollution resulting from the harvest of crops), and BOI investment support schemes that hope to encourage the development of the BCG economy within the agricultural sector. These changes extend across supply chains, from upstream agricultural production through to processing, the use of modern farming techniques, and support for agro-industry16/. These initiatives are then helping to precipitate changes within the sector, and greater use of technology and modern machinery is improving both the quantity and quality of farm outputs. As such, demand for modern, larger, and more expensive agricultural machinery will tend to rise.

-

Tighter regulation of goods and manufacturing processes, and behavioral changes to the global market that are increasing controls on agricultural produce will likely be utilized more often by countries imposing non-tariff barriers to trade. Thai farmers will thus need to respond to these changes by improving their management of agricultural processes. This will include making use of more precise and accurate technology, systematically recording data to allow for better supply chain checking, addressing legislation that limits the use of animal labor by increasing dependency on machinery, and adapting to consumer changes that are increasingly favoring organic and other environmentally friendly produce by making greater use of technology and mechanization.

For manufacturers and distributors of agricultural machinery, these factors will all count as a positive and spending on new machinery will tend to track upwards. Moreover, in response to rising demand, providers of agricultural services will also invest more heavily in new equipment and machinery, especially products that make use of new technology and innovations to improve overall efficiency and to make operations more environmentally friendly. Nevertheless, growth in the market will remain limited in 2024 due to the continuing weakness of spending power within the agricultural sector and the current heavy debt burden. In addition, domestic players will be exposed to risk arising from greater competition from cheaper foreign-made alternatives, especially from imported and modified engines, exchange rate volatility that may impact both importers and exporters, and the persistently high cost of inputs (e.g., oil, metal, and plastic) on world markets.

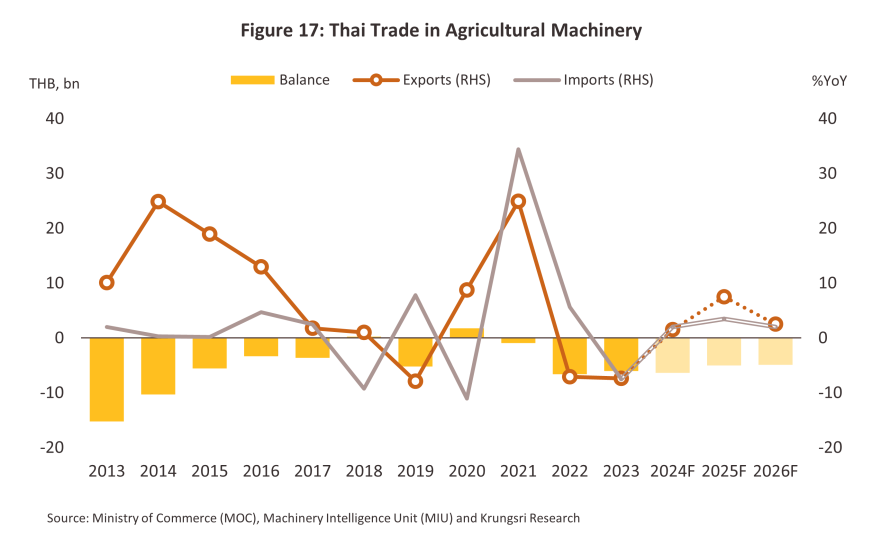

However, Thailand will continue to run a trade deficit in the agricultural machinery industry (Figure 17), with imports expected to grow by 2.0-3.0% annually to THB 44.5-47.0 billion per year. Demand for machinery will be underpinned by the transition to better weather and resulting higher outputs, increased uptake of agricultural services, and stronger investment in agricultural activities by cooperatives, associations, and government bodies. Exports are forecast to rise at a faster rate of 3.5-4.5% annually, thus reaching a total of around THB 38.0-42.0 billion per year. Export markets will be buoyed by strengthening overseas investment in agricultural activities in the ASEAN region, (e.g., in expanding the area under cultivation and developing the agro-industrial and agro-processing industries), and in particular in the CLMV countries. The ASEAN region also remains a global center for the export of major crops, including rice, cassava, sugar and sugarcane, rubber, oil palm, and tropical fruits, and this will further support continuing demand for agricultural machinery, especially for the harvesters and tractors that Thailand excels in and that are well suited to the conditions elsewhere in the region.

Changes to the industry in the coming period

-

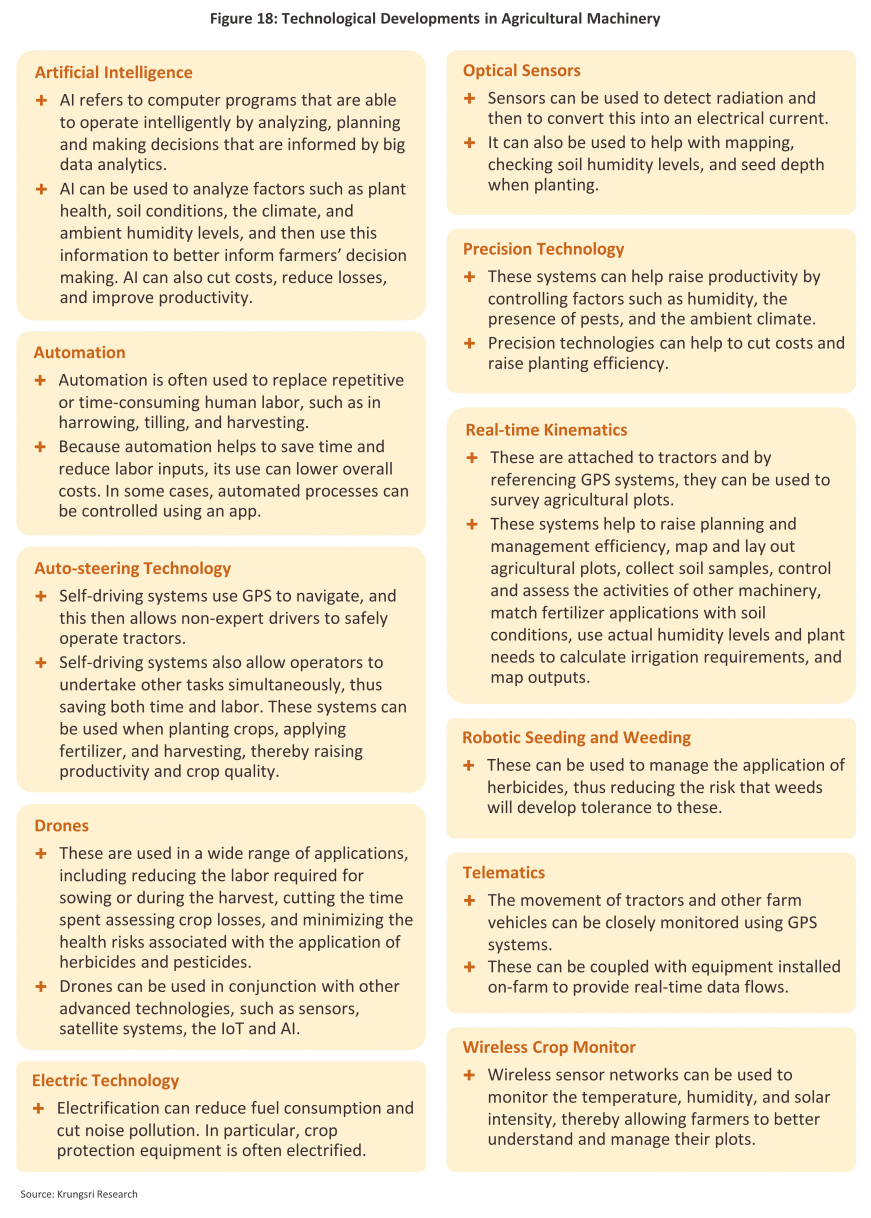

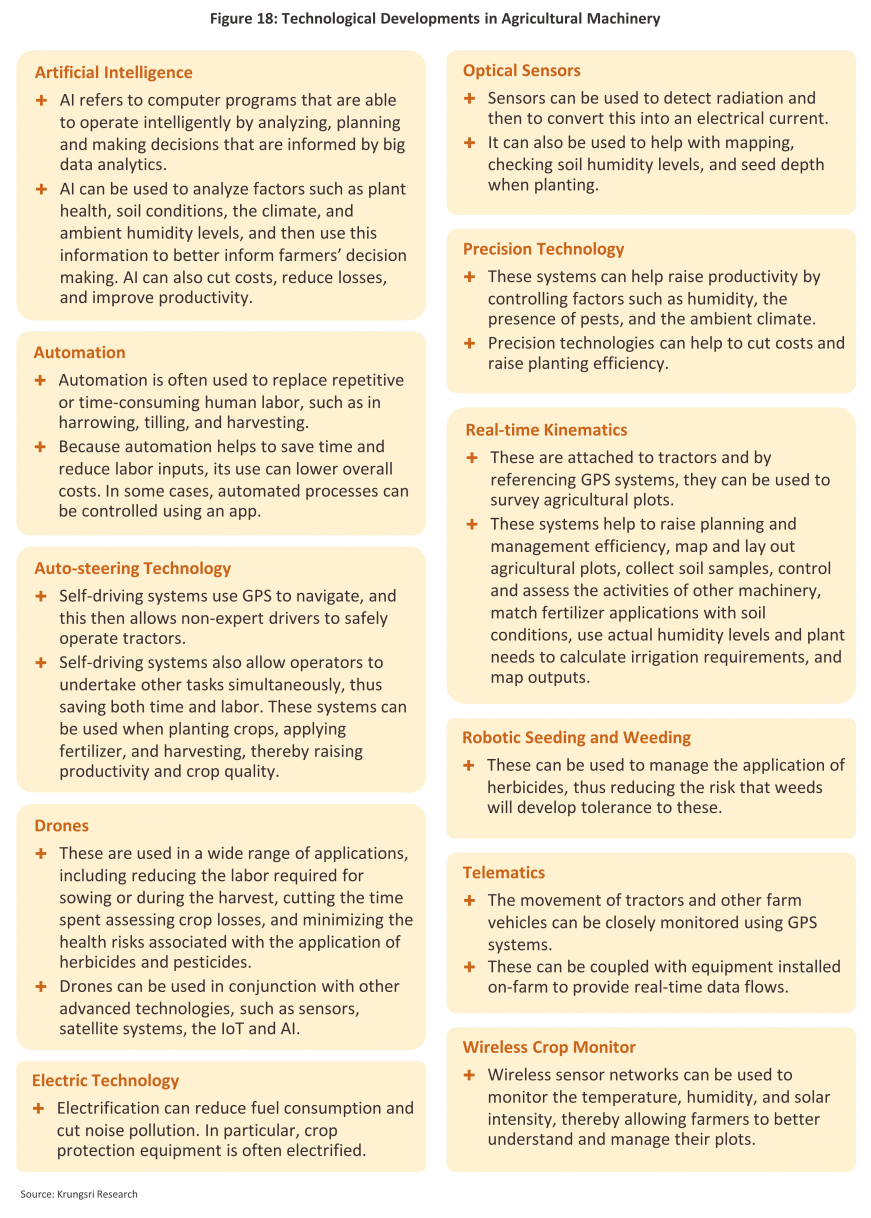

Research and development efforts will be directed in particular at meeting the needs of the market and developing machinery that is as well suited as possible to local conditions. In addition, the transition to modern agriculture will be facilitated by the use of more advanced tech, such as precision technologies, GPS systems, telematics, sensors, AI, and machine learning. This will then allow tractors to operate more autonomously and to engage in a greater degree of independent decision making. Agricultural mechanization will also be accelerated through the greater use of drones and robots (see Figure 18 for more details), which will then save time, cut management costs, and raise productivity. However, most agricultural land in Thailand is owned by small, independent farmers and the regional market is focused largely on more accessible, lower-end machinery. Sales are thus tilted towards cheaper products that are available locally, that are easy to maintain and repair, and that benefit from economies of scale. This will then mean that introducing more advanced, high-tech enabled machinery to the market will be a challenge since machinery such as this is both more expensive initially and more difficult to maintain over the long run.

-

The trend of environmental conservation and ESG (Environmental, Social, Governance) principles is driving the production of electric tractors, which help reduce greenhouse gas emissions and air pollution. Additionally, operational costs are lower because electricity is cheaper than diesel. The International Energy Agency (IEA) estimates that the number of electric tractors worldwide will increase to 1 million units by 2030, supported by government initiatives, advancements in battery technology, and the growing environmental movement.

1/ These are categorized according to their use and the global customs and excise Harmonized System (HS) codes. Source: Research on the agricultural machinery industry carried out by the Office of Industrial Economics.

2/ Comprised of agricultural tractors and tractor parts (e.g., engines, gears, drive trains, chassis, cabs, bodywork, bumpers, windows, brakes, gearboxes, clutches, steering systems, suspension systems, petrol tanks, wheels, exhaust systems, and other parts and equipment used in agricultural tractors).

3/ The example illustration includes the following: power tiller: Mitsubishi Agricultural Machinery, two-wheel tractor: Mahindra, four-wheel tractor: New Holland, four-track tractor: John Deere, disk plow: Kubota, subsoiler: Arbos, disk harrow: Lovol, rake: Kioti, rotary cultivator: Iseki, land roller: HF Agro, seed planter: Fendt, and sugarcane planter: Yanmar.

4/ The example illustration includes the following: water pump: Husqvarna, nebulizer: Solano, manual sprayer: Maruyama, battery spreader: Kisankraft, motor spreader: Nakashi, combine harvester: Claas, baler: Fieldking, conyeyor belt: Spapperi, rice miller: Talaythong, grader: Quadra Agricultural Solutions, milking machines: GreenTech, hatcher: Hightop Poultry Equipment, food mixer: Kuhn, trailer: Solis, and transporter: Antonio Carraro.

5/ As of 2021, 146.9 million rai were used for agricultural purposes, up from 72.8 million rai in 1961, or CAGR of 1.2% per year (source: Food and Agriculture Organization (FAO)).

6/ Between 2016 and 2023, Thailand ran an annual trade deficit of THB 3-6 billion in imports of agricultural machinery (source: Ministry of Commerce (MOC), Machinery Intelligence Unit (MIU), and Krungsri Research).

7/ The most important use of agricultural land is for rice cultivation, which accounts for 66.0 million rai (46.2% of all farmed land), followed by 33.5 million rai (23.4% of the total) used for other farm crops, and 27.1 million rai (19.0%) that is used for rubber plantations.

8/ Average land ownership currently stands at 16.4 rai per farmer, with 65.4% of agricultural land owners holding fewer than 20 rai.

9/ Owners of agricultural land may report using more than one type of agricultural machine.

10/ This survey is carried out every 10 years by the National Statistical Office of Thailand.

11/ From data held by the Office of Small and Medium Enterprise Promotion and applying the business codes used in the Department of Business Development database.

12/ Farm vehicles are defined in the ror yor 13 standard (รย. 13), tractors are defined as self-propelled wheeled or tracked vehicles that are used to undertake tasks such as digging, loading, pushing, pulling or towing. This category excludes vehicles used in personal transport, and as defined by the relevant laws, these may be no more than 4.40 meters wide and 16.20 meters long. Farm vehicles are defined in the ror yor 15 standard (รย. 15). These are vehicles manufactured or assembled for use in agricultural contexts and that are powered by an engine that has not been designed for use in a standard passenger vehicle. These should have three or four wheels, should weigh no more than 1,600 kilograms, should be no more than 2 meters wide and 6 meters long, and should have an engine capacity of no more than 1,200 cc.

13/ Here, ‘average’ refers to the 30-year average for 1991-2020.

14/ The average age of Thai agricultural laborers is rising, and Krungsri Research expects that at present, more than 60% of the agricultural labor force is over 55 years old, and 33% is over 65.

15/ Consolidation of smaller plots involves working smaller areas held by different farmers as a single larger unit (this is not related to consolidating land held by a single owner). This helps to increase productivity, though it typically involves greater investment in technology as a way of reducing long-term costs and improving the quality of outputs.

16/ To qualify for BOI investment support, applicants will need to meet certain criteria, and for investments in the agricultural sector, this may involve making commitments to make greater use of modern technology. This could include supply chain and provenance checking systems, systems for assessing environmental conditions related to planting, electronic/radio frequency pest control systems, and machinery that can sort seeds based on their color.

.webp.aspx)