The Covid-19 situation has been developing rapidly. The number of reported cases in Thailand has been rising and the virus has spread to most provinces, forcing authorities to impose stricter containment measures. The government ordered a nationwide lockdown starting March 26 to, at least, the end of April. This effectively halted most economic activities except those declared essential, such as food, transportation, and utilities. In this paper, we reassess the impact of the Covid-19 pandemic on the Thai economy. We conclude that the Thai economy would be hurt more severely than we had expected.

We analyzed company-level data from the Department of Business Development under the Ministry of Commerce, comprising 747,390 firms in Thailand, to have a closer look at the impact at the granular level. We estimate a 60% drop in tourist arrivals coupled with a two-month halt in economic activities could cause liquidity problems for 90,000 firms. The most vulnerable to the liquidity shock are restaurant operators, followed by small air transport and hotel operators. Small companies are more vulnerable than others. For large companies, those involved in restaurant, auto dealership, and hotel operations would have greater exposure to the outbreak and would see higher risk of default than large players in other sectors. In all, the Thai economy needs at least Bt1.7 trillion liquidity injection for businesses to survive this shock.

Recent Development: The outbreak, and the spread from Supply to Demand shock

In response to the escalating coronavirus outbreak worldwide, the World Health Organization declared Covid-19 a global pandemic on March 11. The outbreak which reportedly started in China at the end of 2019 had spread to 115 countries when WHO declared Covid-19 a global pandemic. As at April 3, the number of infections worldwide has exceeded one million in over 200 countries, and cases and the death toll continue to rise (Figure 1).

In Thailand, the number of Covid-19 infections is at the inflexion point, between low-infection countries (such as Japan and Singapore) and high-infection countries (such as Italy and the US) (Figure 2). The number of cases in Thailand has recently been rising by about 33% daily. At this rate, the number of infections would exceed 350,000 by April 15, according to Dr. Prasit Watanapa, Dean at the Faculty of Medicine at Siriraj Hospital, Mahidol University. He added that, in order not to overwhelm the country's healthcare system, the increase in the number of local cases must not exceed 20% daily. If Thailand achieves this, the number of infections would only reach 24,269 by April 15.

Number of cases in Thailand are accelerating, and the virus has spread to 60 provinces throughout the country. Recent data show the number of cases is rising steadily with no sign of flattening. Total number of cases was close to 2,000 as at April 3. Cases have risen more rapidly in major provinces (Figure 3).

Pandemic has forced authorities to impose stricter containment measures. The lockdown measures include closing Thailand’s borders to all foreigners (except shippers, diplomats, drivers, pilots and others permitted by the Prime Minister), banning public gatherings, and closing high-risk venues (including department stores, sports stadiums, gyms, and entertainment establishments).

The outbreak itself and strict protection measures immediately hit tourism sector and create supply disruption. Covid-19 pandemic has substantially reduced tourist arrivals. Between 1 and 28 March, the total number of inbound travelers at the five airports tumbled 78.1% YoY, led by Chiang Mai Airport (-91.9%), followed by Don Mueang (-82.7%), Suvarnabhumi (-78.2%), Hat Yai (-75.9%), and Phuket (-69.6%). Many countries have imposed travel restrictions in attempts to contain the outbreak, according to the International Air Transport Association. Stricter measures by many countries would help to contain the spread, but at the same time they would prevent domestic and international travel and deal a severe blow to the tourism industry. It also disturbs global and domestic supply chains, which in turn hit domestic economic activities.

We estimate the number of infections in Thailand will peak in April, but the outbreak would last until May. Hence, we assumed tourist arrivals would remain weak, domestic economic activity would be limited, and there would be stricter containment measures for at least the next 2 months. The SIR model suggests the number of infections in Thailand would reach almost 20,000 within that period. But if the containment measures are insufficient, the number could reach 80,000. The model suggests the domestic outbreak would peak in the second half of April and would be contained by end May.

Disruption to domestic supply side has finally weakened demand. An extended disruption to the supply side will have spillover effects on the demand side. Employees will earn less or possibly be made redundant, and the self–employed merchants will have no income because business activity is suspended. When that happens, the negative income multiplier effect would kick-in and the damage to the economy will be much larger through the negative feedback loop (or, downward spiral of supply-demand interaction).

There is evidence that employment has been affected substantially. We looked at online job postings and found a sharp drop over the past month. The total number of job posting on the JobDB website as at 31 March had dropped by 22.1% since end-February. This contrasts with the 4% growth in February postings. In March, the sectors hardest hit by the pandemic were Hospitality (-52%), Education (-47%), Beauty & Healthcare (-39%), and Property (-38%). The travel-related sector saw a decline in job postings for the second straight month.

Impact of COVID-19 pandemic on the Thai Economy

Given the rapidly changing situation, we are tweaking our model for the third time to include more accurate assumptions on the impact of global disruption, domestic shutdown, and negative income multiplier effect. Our model suggests the Thai economy would be one of the hardest hit by the pandemic. If we assume a two-month lockdown with a 60% drop in tourist arrivals, the outbreak would reduce global GDP growth by 3.2ppt from baseline forecast (pre-outbreak). ASEAN GDP growth could be reduced as much as 2.1-5.4 ppt from baseline projections (pre-outbreak). Krungsri Research now projects the outbreak would hit the Thai economy hardest among key countries, followed by the EU, Malaysia, and South Korea. We estimate the impact on Thai GDP through the following channels – tourism, supply disruption at home and abroad, and multiplier effect. We now project the Covid-19 pandemic would reduce Thai GDP growth by 5.4 ppt from baseline forecast, compare to previous estimate of -1.8%.

More importantly, our findings suggest that if the domestic lockdown lasts two months instead of one, it would more-than-double the damage to the economy. The non-linear result is largely due to the negative income multiplier effect.

If we assume a one-month lockdown and 30% drop in tourist arrivals, 2020 GDP growth would be reduced by 1.8 ppt from our pre-outbreak forecast, with 2Q growth reduced by 3.5 ppt. The most severe impact in 2Q would come from the tourism sector (-1.6 ppt), followed by domestic supply disruption (-0.9 ppt), global supply disruption (-0.7 ppt) and multiplier effect

(-0.3 ppt).

In a two-month lockdown with 60% drop in tourist arrivals, 2020 GDP growth would reduce by 5.4 ppt from our pre-outbreak forecast, with 2Q growth slashed by 10.5 ppt. The most severe impact in 2Q would come from the multiplier effect (-3.6 ppt), followed by tourism sector (-3.3 ppt), domestic supply disruption (-2.3 ppt), and global supply disruption (-1.3 ppt). In the second half of the year, when the worst should be over, the outbreak would still leave scars on the Thai economy. Weak sentiment would continue to affect the tourism sector and the multiplier effect would have a long-term impact on overall economic activity.

Based on the two-month lockdown scenario, Krungsri Research slashed 2020 GDP growth forecast from -0.8% to -5.0%, the worst since the 1998 Asian Financial Crisis. This is the third consecutive downgrade in less than three months. The Covid-19 repercussions would be much worse as the coronavirus pandemic has spread rapidly across the world, including Thailand, and there may be a need for stricter containment measures for an extended period. Furthermore, the drought crisis and delays in infrastructure investments in Thailand, coupled with deteriorating confidence and the negative feedback loop, would exacerbate the economic pain triggered by the pandemic. Our forecast also accounts for measures from the authorities to support economic activity and prevent a turmoil in financial markets, a sharp drop in exports, the collapse of the tourism industry, and disrupted domestic activities.

By sector, air transportation, hotel & lodging and restaurant sectors would be hardest hit, followed by recreation, petroleum, and business services. The impact is not only generated by the collapse of the tourism sector and supply disruption at home and abroad, but also the multiplier effect (or negative income effect). The last factor would be be (through the feedback loop) in leading the damage in those sectors. In a two-month lockdown with 60% drop in tourist arrivals, the impact of the multiplier effect on industries and businesses would be substantial. Sectors that would see output drop by more than 5%, collectively account for 55% share of the country’s total output compared to only 6% in the case of a one-month lockdown.

The Lockdown and Liquidity Shocks at Firm-level

Most sectors would be unable to maintain revenues and profits. Companies would report lower profitability and might lose their capital. However, firms with high liquidity should survive the tough environment. So, we used current liquidity ratio as an indicator of a firm’s ability to service debts in the near-term” (current liquidity ratio is current assets over current liabilities). This implies a firm with current assets greater than current liabilities would have the ability to service current debts. The pandemic would hurt revenues and reduce accounting assets, predominantly cash. So, firms with current asset lower than current liabilities might be in liquidity trouble (the current liquidity ratio <1).

When we combine our simulated output loss by sector with firm-level data from the Ministry of Commerce, the number firms with stretched liquidity positions would surge as a result of the outbreak. Based on data for 747,390 companies in Thailand, the number of companies that are vulnerable to liquidity shocks would increase from 102,076 in the pre-outbreak situation to 133,444 in a one-month lockdown. This would reach 192,046 in a two-month lockdown – an increase of almost 90,000 cases (Figure 10).

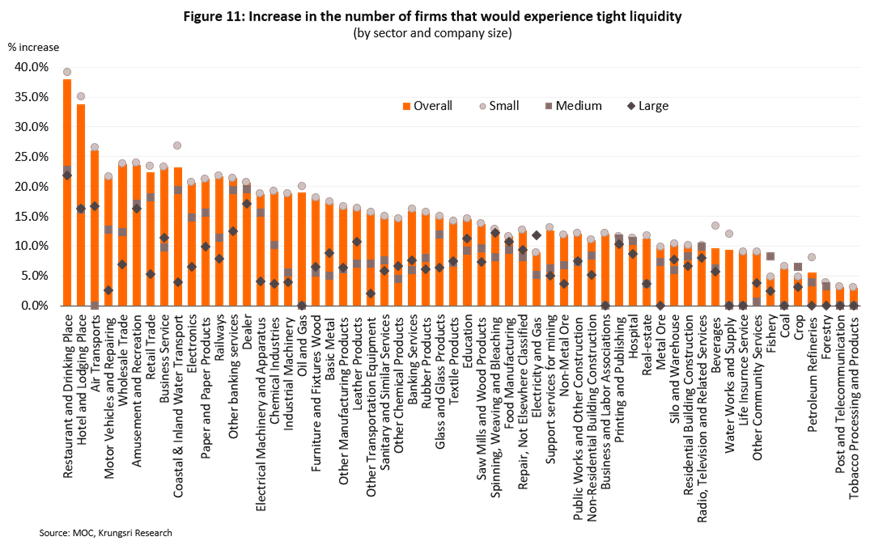

Restaurants, airlines, and hotels will have a difficult year. The number of restaurant operators that would be unable to service their debts is estimated to rise by 39% from pre-outbreak situation. Small hotels and airlines are in a similar situation, with a 35% and 27% increase in the number of operators that would require liquidity, respectively. Even though banks are likely to be hit hard, they still have high liquidity. Most large-scale firms have stronger liquidity positions.

Looking at the impact by size of firm, the most vulnerable are small firms. Overall, there will be a 19.3% increase in the number of small-size firms with insufficient current assets to service their loans. Meanwhile, the number of medium-size and large companies that might be in trouble would increase by 13.0% and 7.2%, respectively. That implies small companies are much more vulnerable to shocks than others. Large-size companies involved in restaurant, auto dealership, and hotel operations - which have high exposure to the outbreak - would face higher risks of default than large players in other sectors. For medium-size firms, restaurant, other banking services, and auto dealership operators are vulnerable.

By location, the number of firms that would face tight liquidity due to the pandemic would surge in Samutsakorn, Chantaburi, and Chonburi provinces. These are provinces that are major tourist destinations or industrial areas. Meanwhile, the number of firms in trouble in Bangkok would increase by 20.6%. The higher possibility of default in these provinces might generate a second-round of negative effects on the local economy, through falling employment and lower income. This would, in turn, hurt the overall economy.

All in, the Covid-19 impact could cause firms in Thailand to seek Bt1.7 trillion worth of short-term liquidity, which is about 10% of GDP (Figure 16). This estimate is based on the total shortfall in the amount required by these firms to pay their liabilities within the next one year. Without restructuring debts and businesses, firms in the wholesale and retail trade would need almost Bt200 billion each to pay their short-term liabilities. Meanwhile, the hotel, air transportation, and restaurant sectors -- the hardest-hit – would require Bt30-50 billion to survive. In total, almost 60% of firms in trouble would need more than Bt1.0 million each.