Introduction

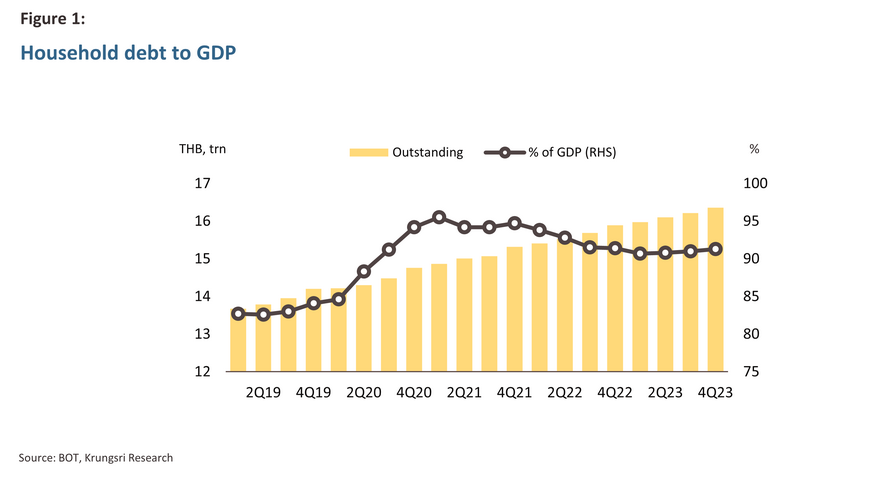

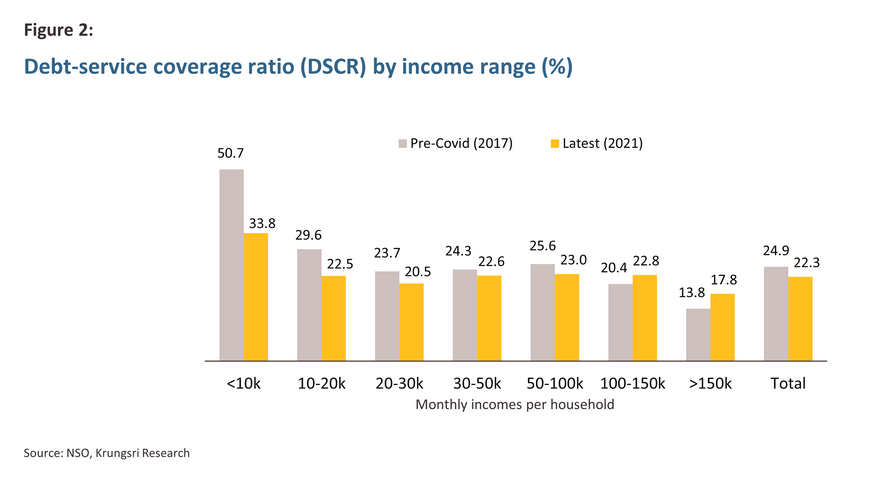

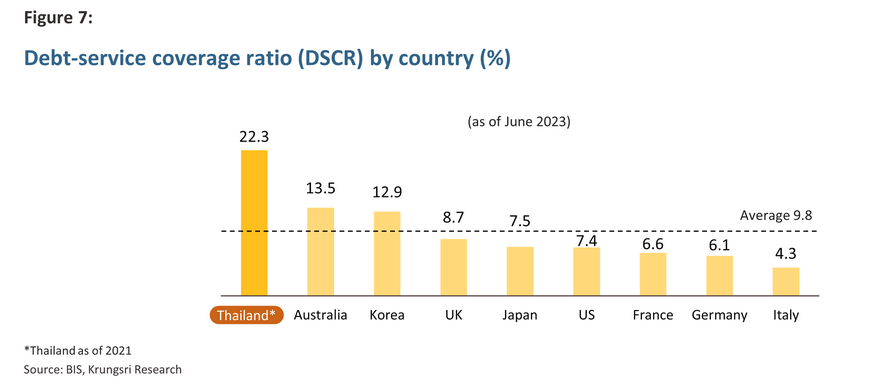

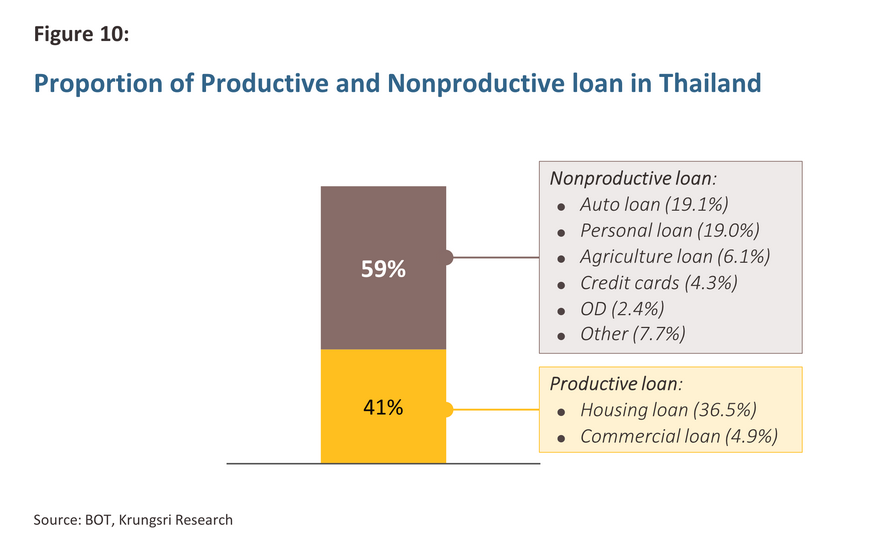

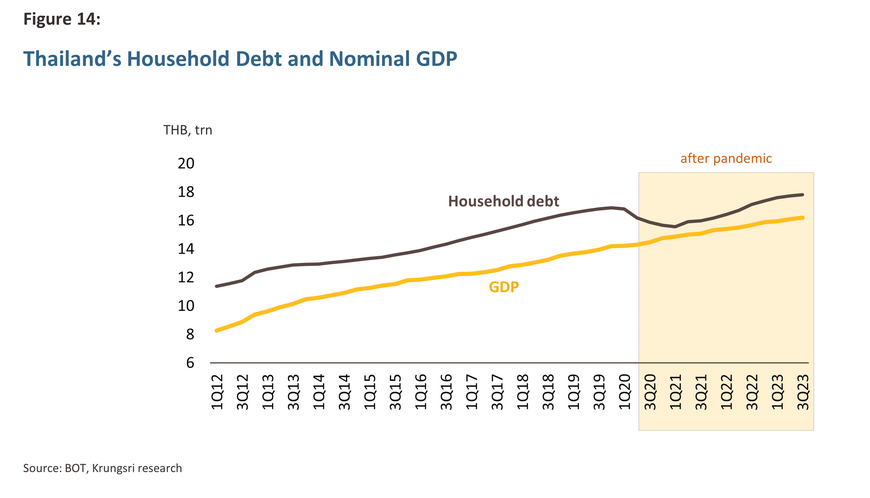

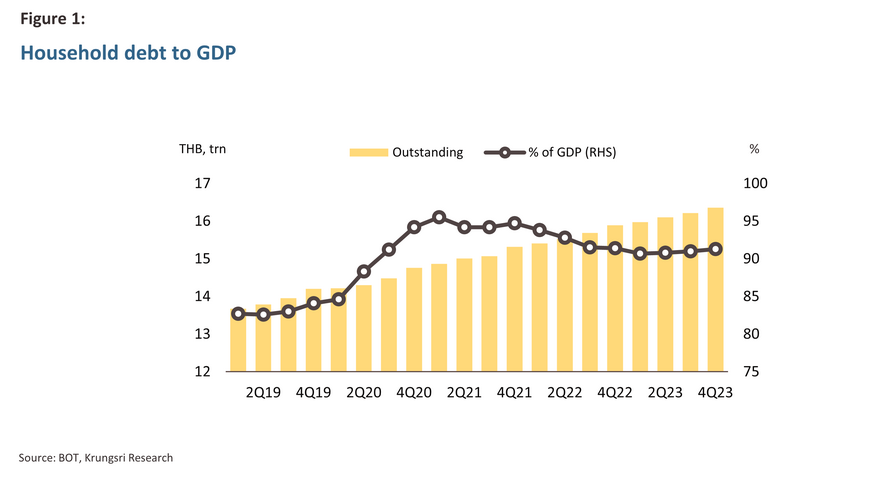

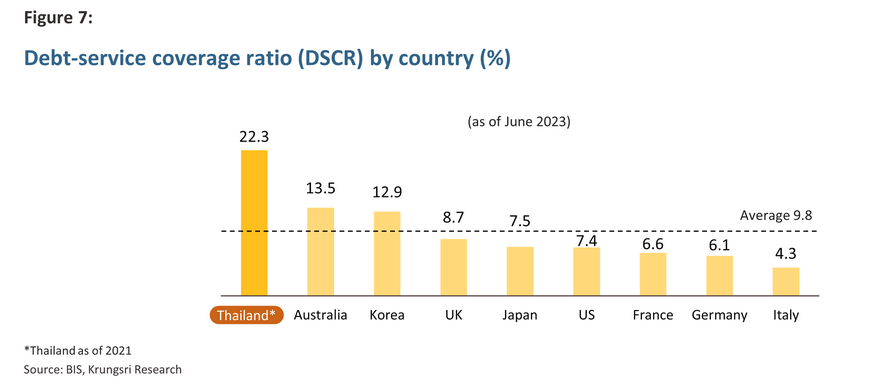

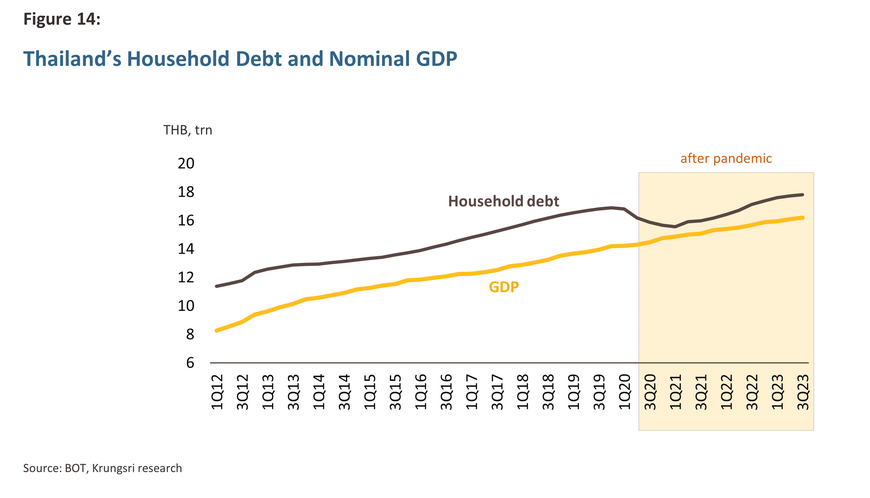

In 2023, Thai household debt rose to 91.3% of GDP, led by expansion of consumer loans and housing debt. Meanwhile, non-performing loans or bad debts (NPLs) in the consumer loans and real estate purchase continued to increase significantly since before the COVID-19 outbreak. Moreover, Thailand is one of the countries with the highest level of household debt to GDP in the world, corresponding to debt-service coverage ratio (DSCR) of 22.3%, significantly exceeding the average level for major countries of 9.8%. Looking ahead, the policy interest rate, kept at a 10-year high of 2.50%, coupled with the persistently high level of debt and DSCR, could potentially lead to more fragile financial stability and economy. This is especially concerning as most of household debt is nonproductive loans that do not directly increase people income, such as personal loans and credit card loans.

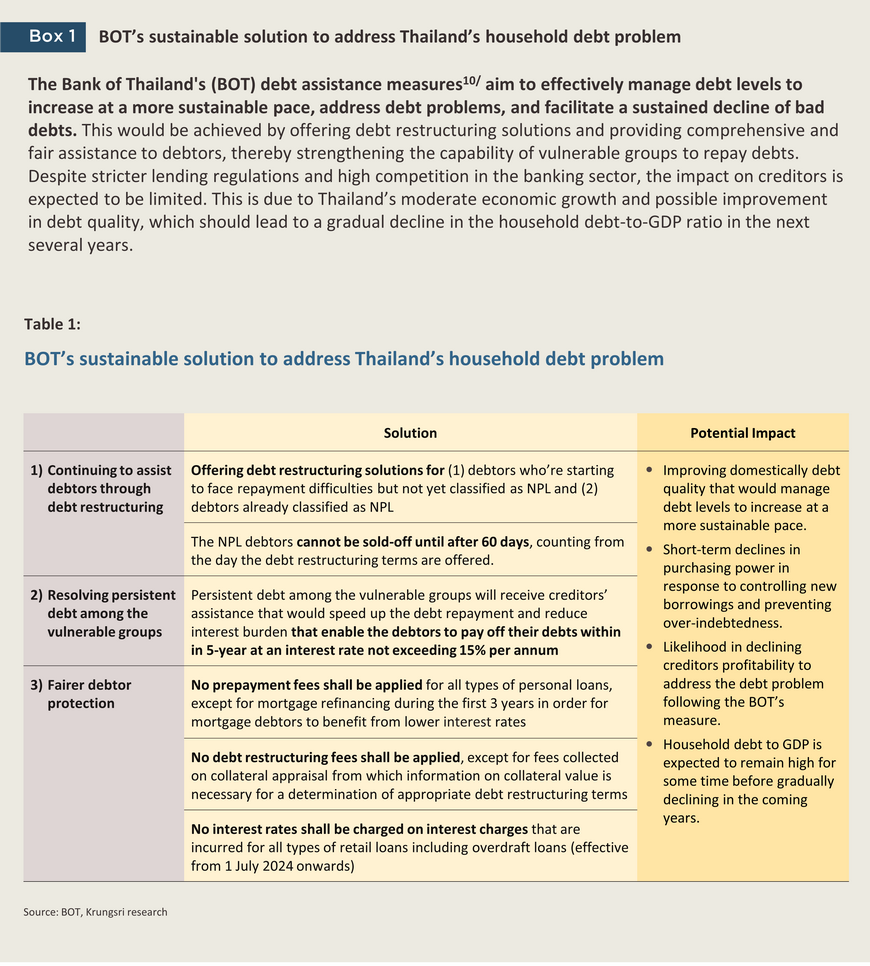

Krungsri Research believes that with the measures implemented by government and the BOT in 2024, the level of household debt tends to gradually decline. However, the debt burden is expected to remain persistently high due to lack of comprehensive measures to address the underlying issue of high debt, particularly insufficient income.

Current situation of Thailand’s household debt

Thai households' debt surged to 91.3% of GDP in 2023, with credit quality and debt repayment ability decreasing.

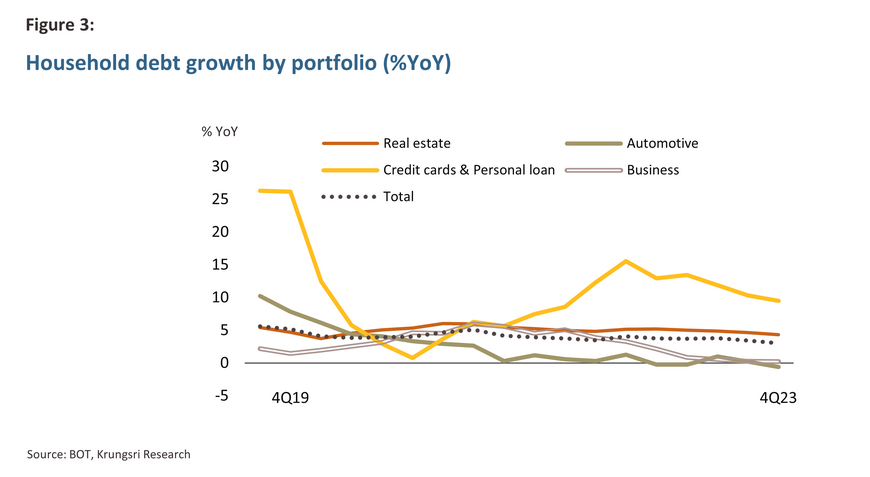

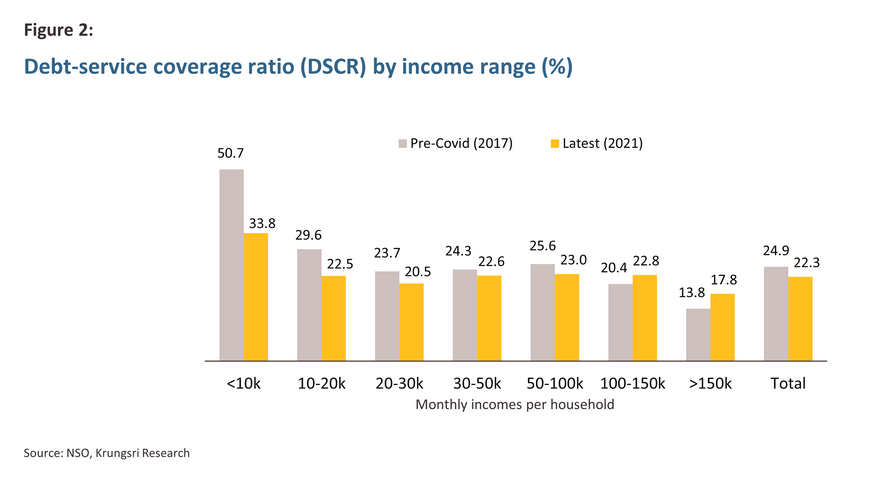

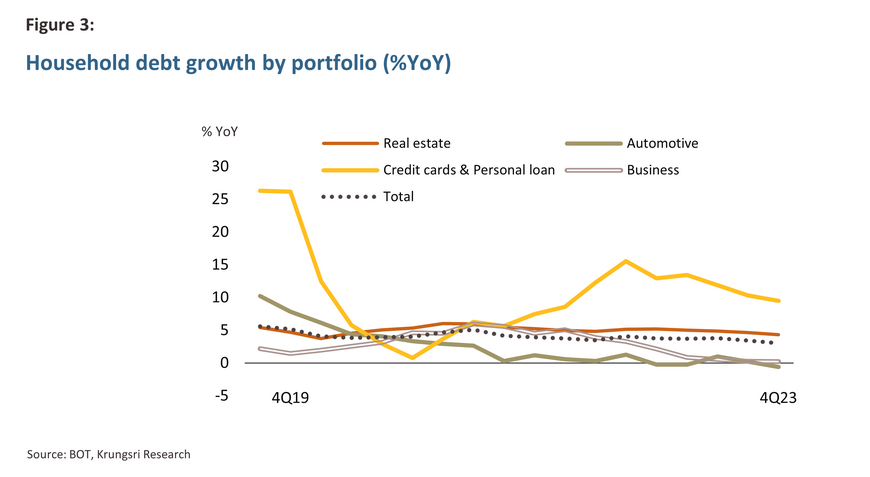

Thailand's household debt increased to 91.3% by the end of 2023, mainly driven by an increase in consumer loans, particularly from credit cards and personal loans (with a 9.5% YoY increase), and real estate loans (up 4.3% YoY). However, auto loans dropped by -0.6% YoY1/. While the Debt-Service Coverage Ratio (DSCR)2/ suggests improvement from pre-Covid period, low-income groups (particularly in those monthly incomes below THB 10,000) remain struggle to pay off debts.

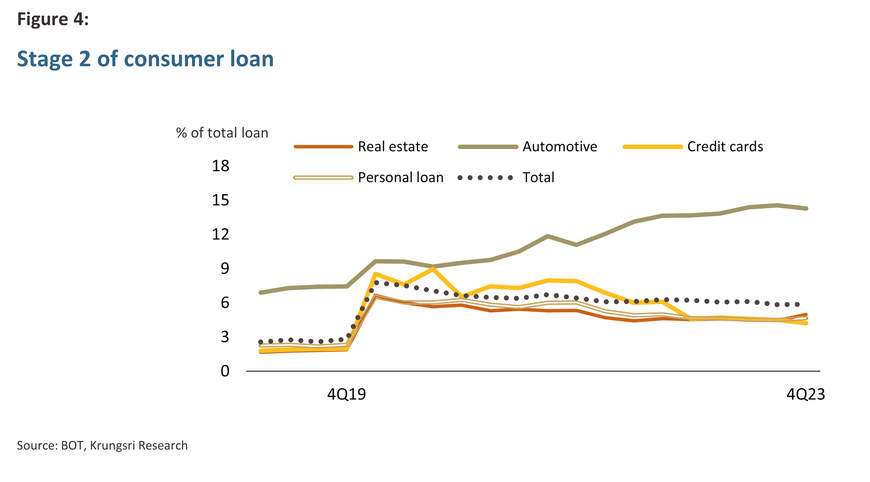

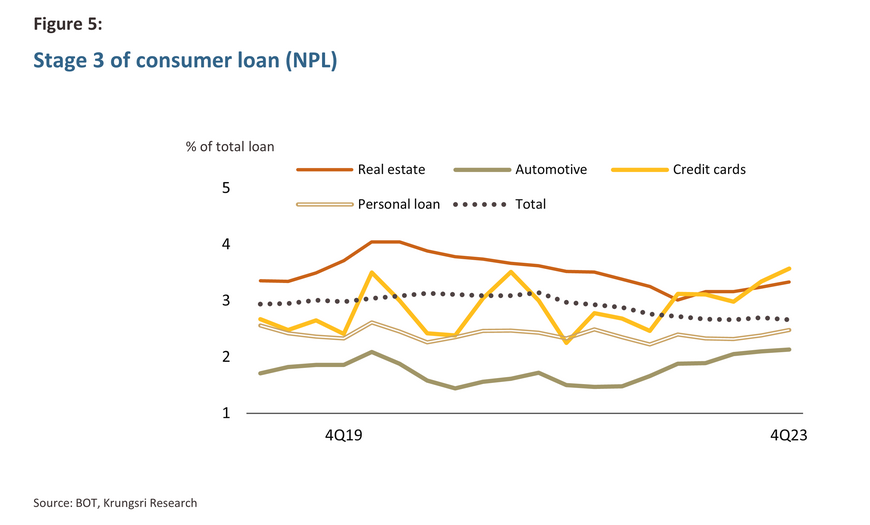

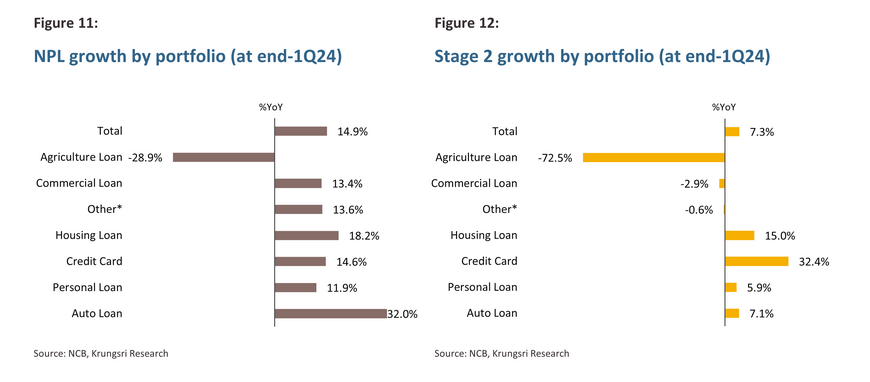

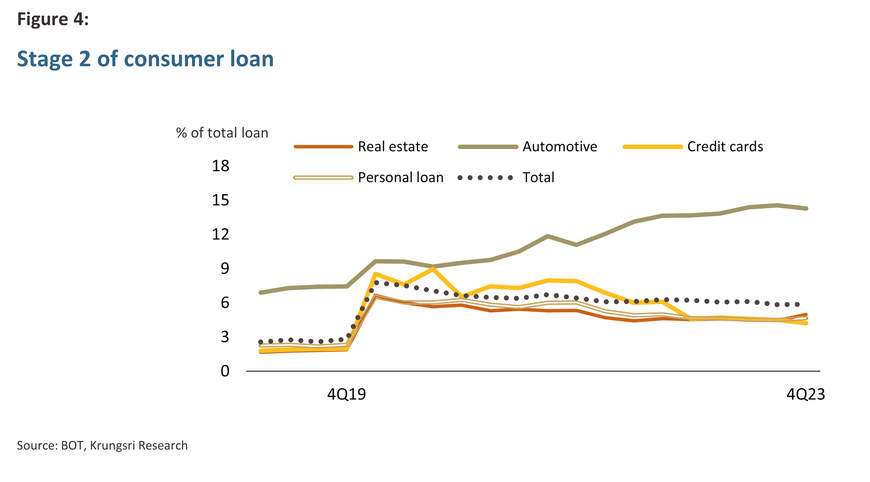

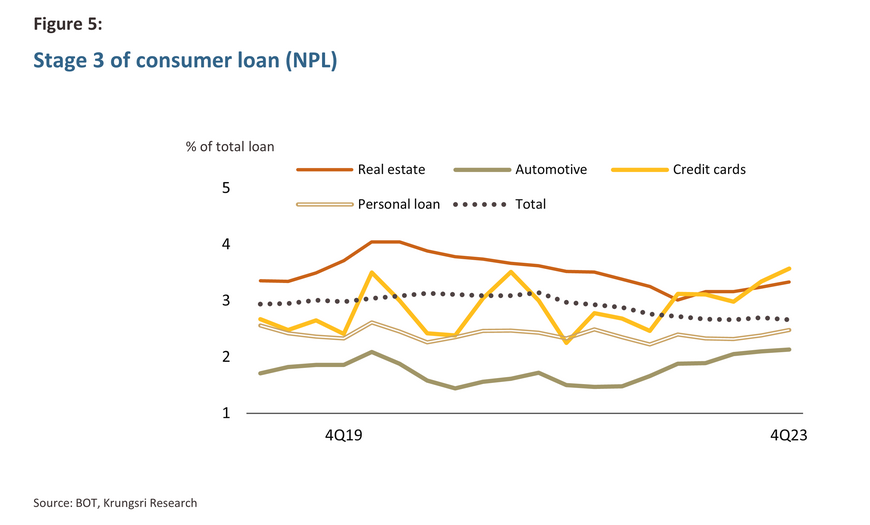

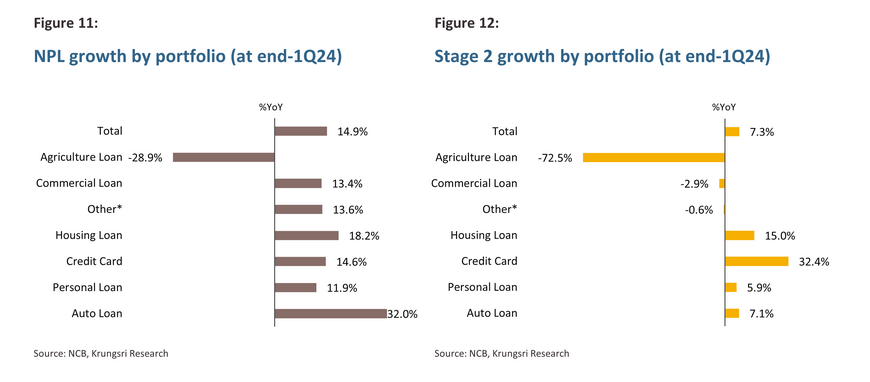

In terms of debt quality, Thai commercial banks' non-performing loans (NPLs)3/ stood at THB 492.8 billion in 4Q23, accounting for 2.66% of total loans, compared to 2.9% at the end of 2019. NPLs of consumer loans, particularly auto loans, increased from 1.86% in 4Q19 to 2.13% in 4Q23. This trend is likely to continue, considering the surge Stage 2 loans or special mention loan (SM)4/ for auto loans, which increased from 7.4% in the pre-Covid period to 14.3% of the total loan by 2023.

Thailand’s household debt compared to the world

Globally, Thailand’s household debt-to-GDP ratios and DSCRs remain among the highest.

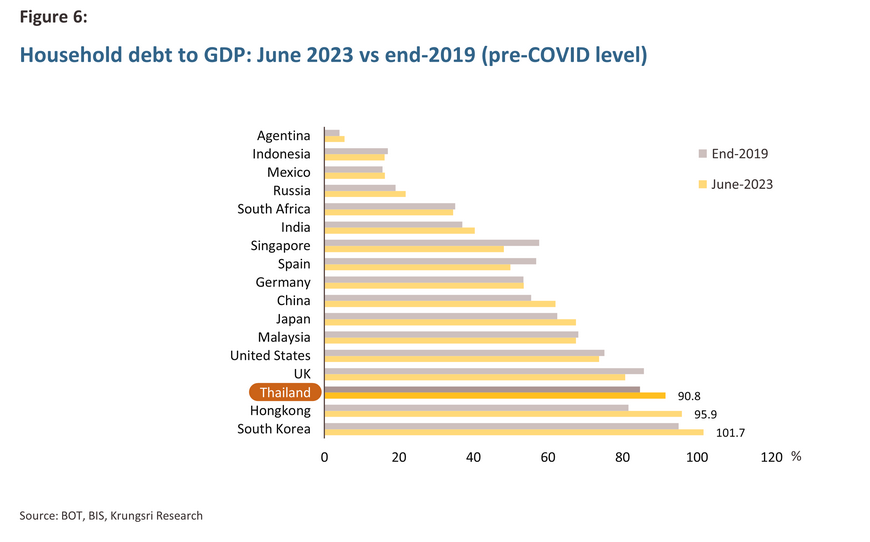

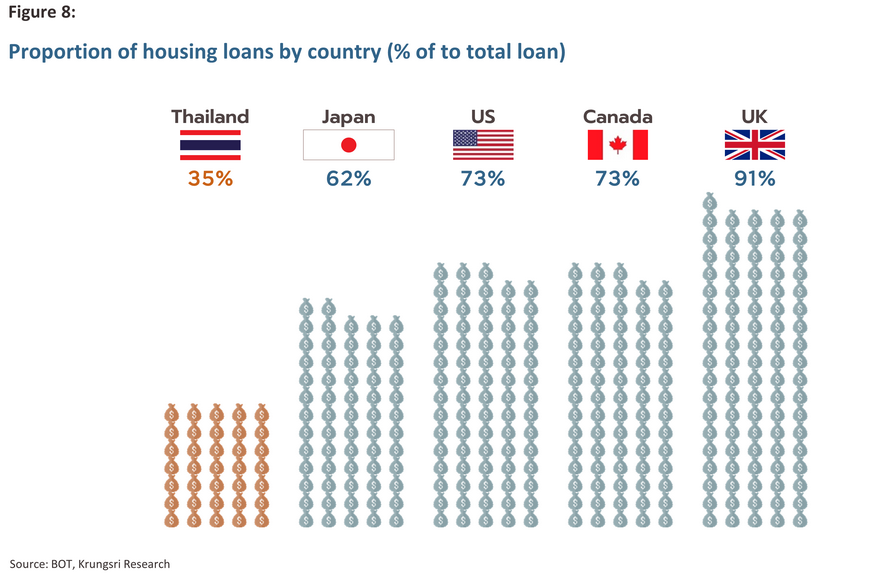

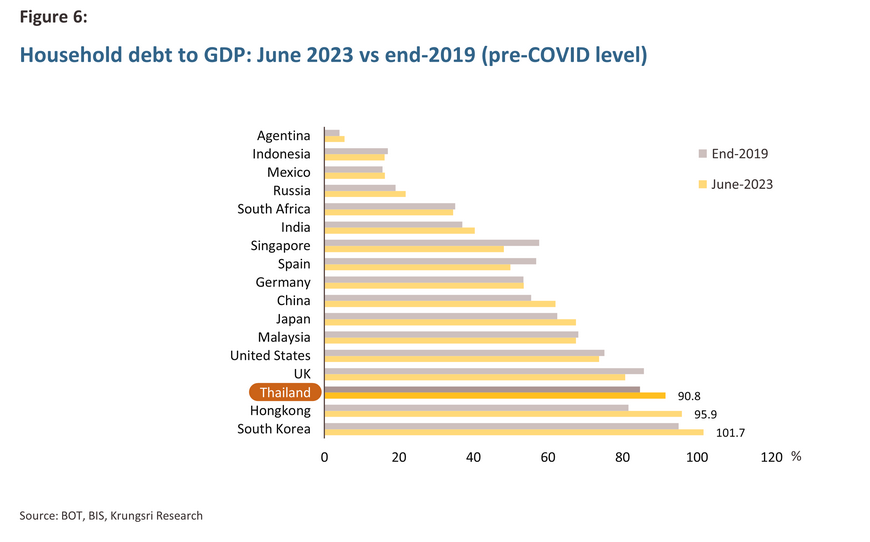

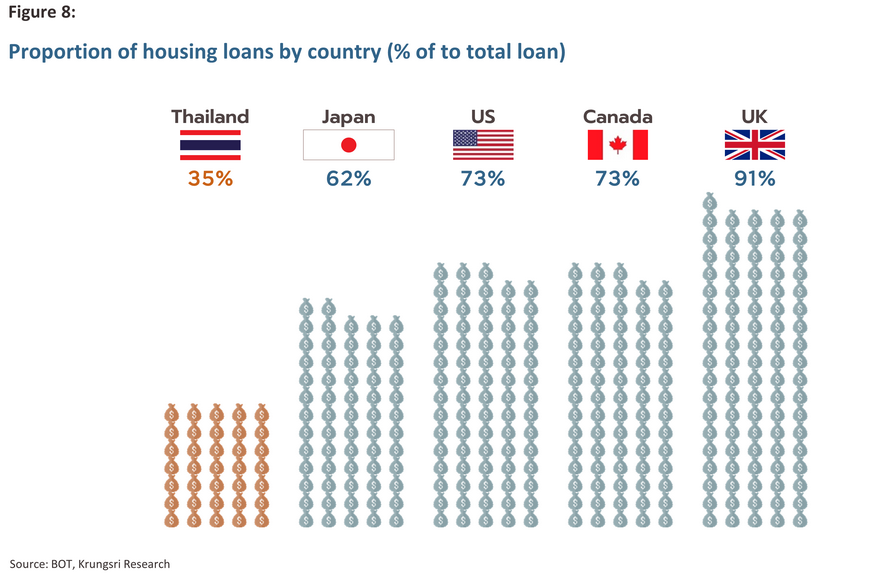

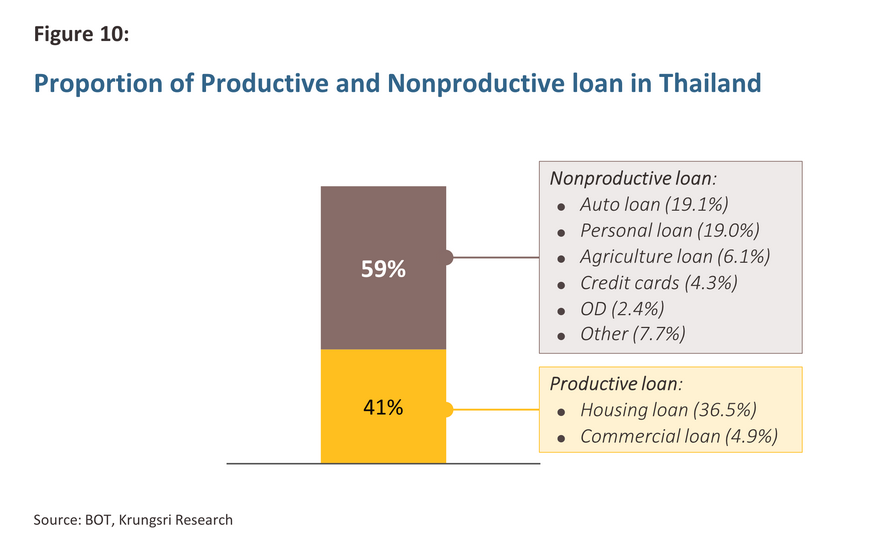

Although Thailand’s household debt to GDP increased significantly from the pre-Covid period being inline with countries, the Bank for International Settlements (BIS) identifies Thailand as remaining among the highest household debt-to-GDP ratios in the world. As of June 2023, Thailand's household debt-to-GDP ratio is second only to South Korea (101.7%) and Hong Kong (95.9%) in the Asia-Pacific region. Moreover, Thailand's DSCR stands at 22.3%, significantly exceeding the average level for major countries of 9.85/. Looking ahead, the policy interest rate, kept at a 10-year high of 2.50%, coupled with the persistently high level of debt and DSCR, could potentially lead to more fragile financial stability and economy. This is especially concerning as most of household debt is nonproductive loans6/ that do not directly increase people income, such as personal loans and credit card loans, unlike other countries, especially developed countries, where real estate loans account for a large proportion of household debt7/.

When household debt increases along with the risk of bad debt

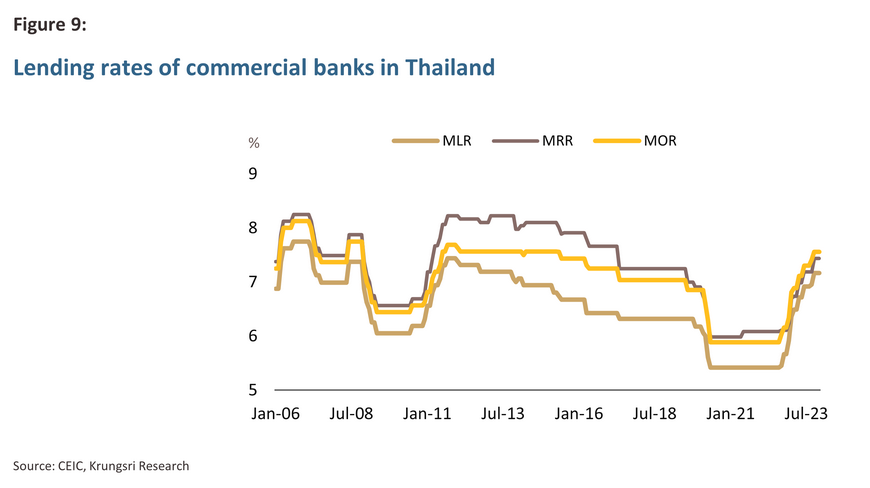

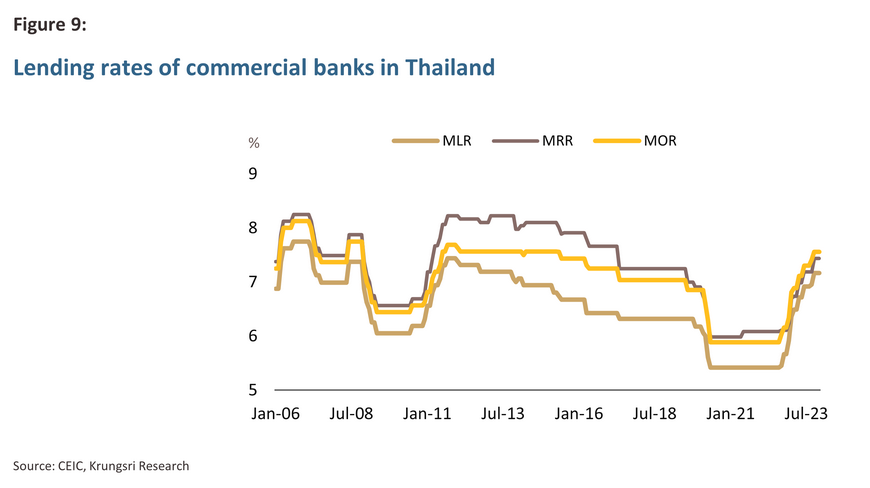

Elevated interest rates may cause more burden to borrowers this year.

As of 1Q24, total outstanding loans held by National Credit Bureau (NCB) members headed to THB13,643 billion, increasing by 2.9% YoY. Comparing to the previous year, NPLs have grown 14.9% considerably driven by auto loan (+32%), housing loan (+18.2%), and credit card loan (+14.6%). This increase was accompanied by a significant rise in Stage 2 loans in credit card and housing loan, by 32.4% and 15.0%8/ respectively, in 1Q24 from the same period last year. This reflects a heightened risk of these loans turning into NPLs in the future, which will worsen the household debt problem in Thailand, making it more difficult to address. Thus, if Thai GDP cannot return to its potential level of above 3%, household debt level relative to GDP may continue to rise above 90% this year. It would take an extended period to bring the debt level back to the BOT target of 80% of GDP.

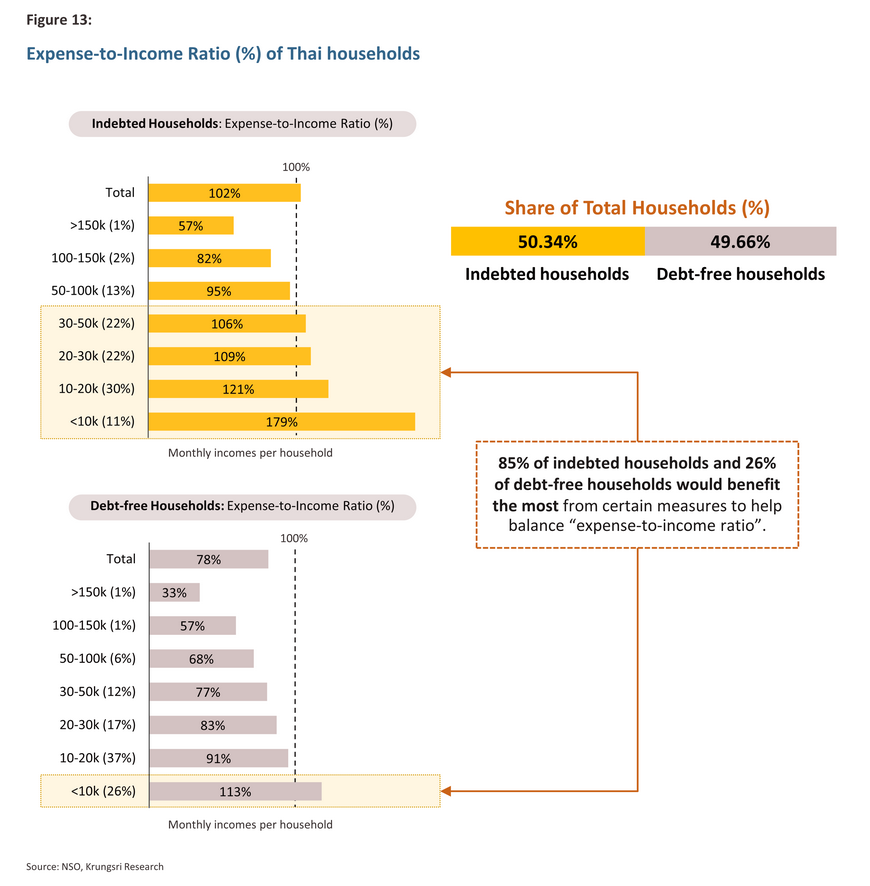

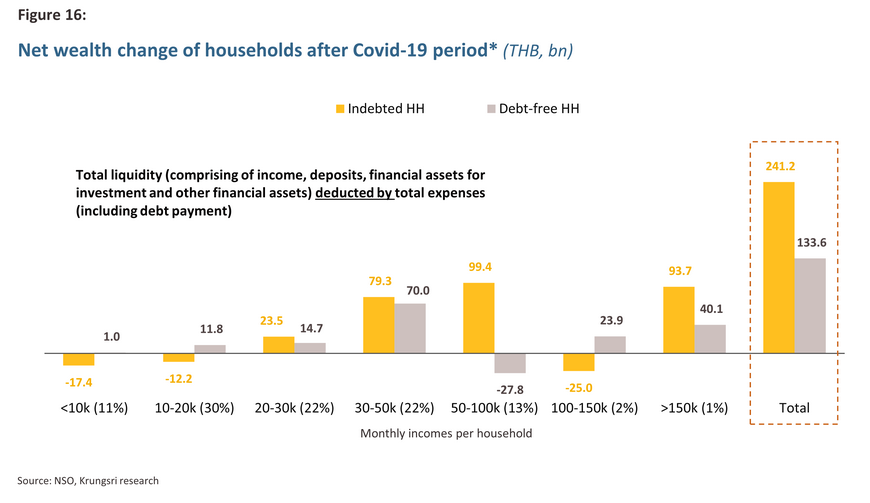

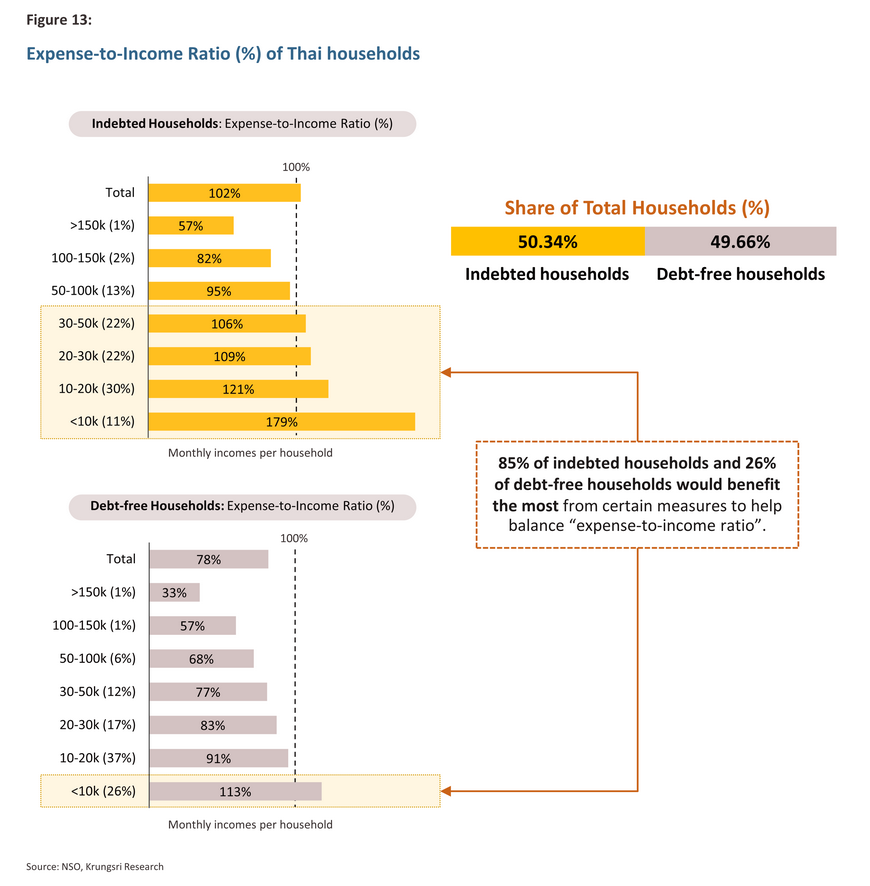

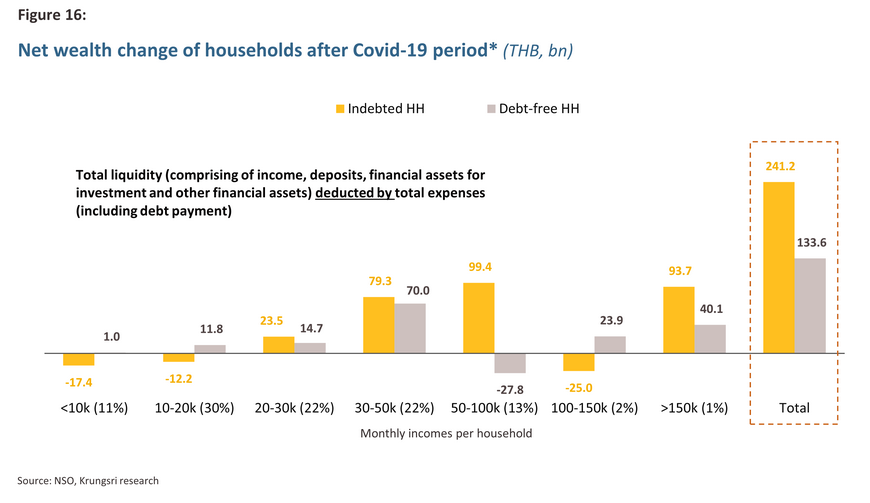

Based on data from the Household Socio-Economic Survey of the National Statistical Office (NSO), Krungsri research found that the targeted measures on the vulnerable groups would be more efficient to address debt, including: (i) indebted households with monthly income below THB50,000 and (ii) debt-free households with monthly income below THB10,000 as they were a vulnerable group of households with weak purchasing power as total expenses including debt repayments exceed their income9/. According to our study, the targeted measures to address debt problem of those in vulnerable group should effectively lift their living standard and boost consumption of households, by improving their expense-to-income ratio.

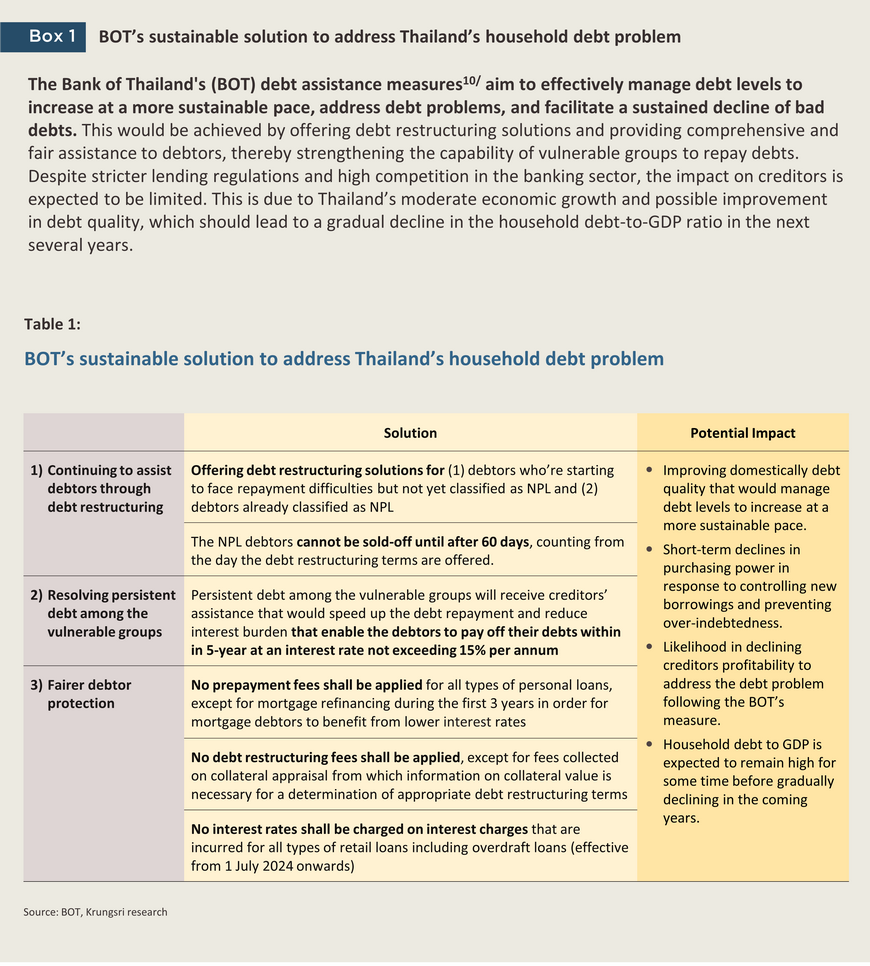

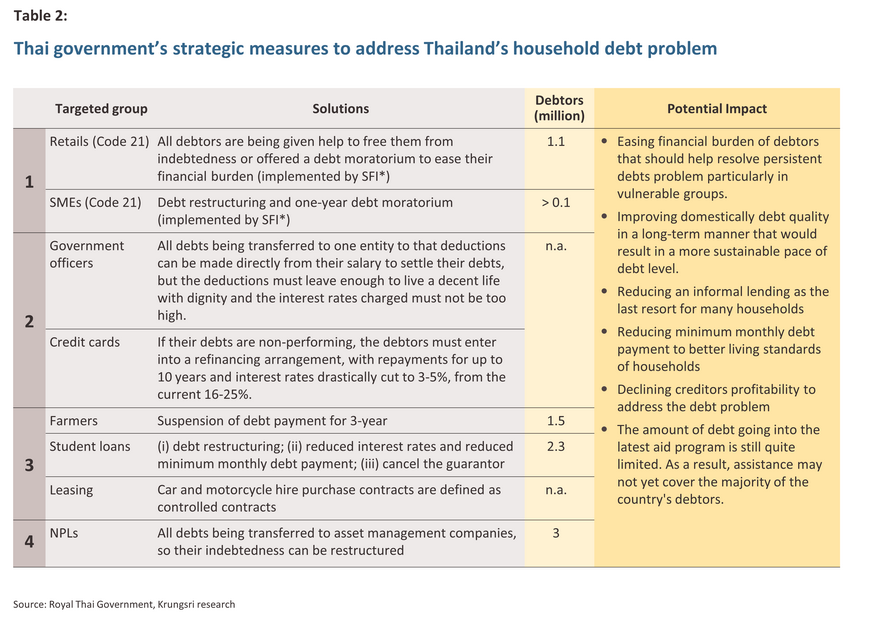

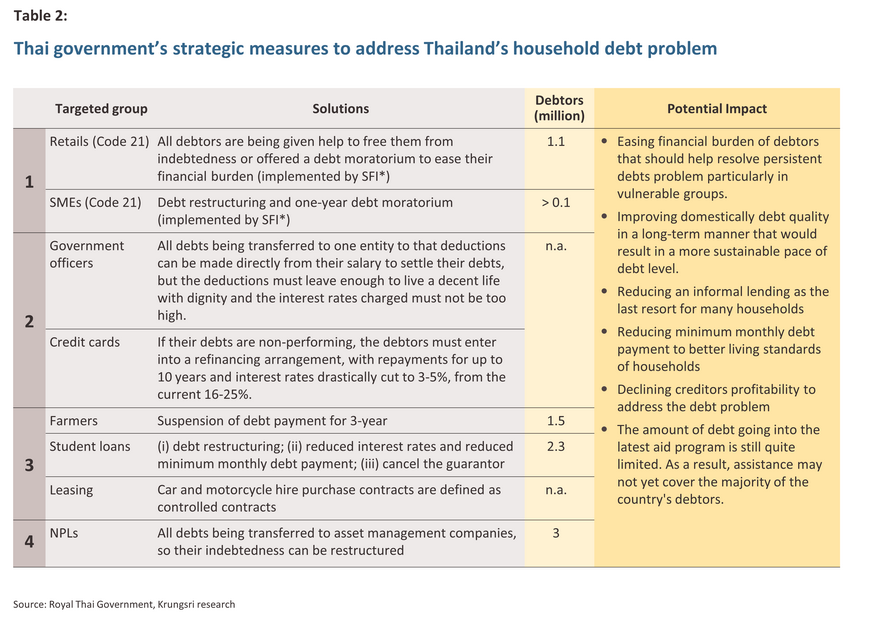

Government measures to address debt in the entire system

The Thai government is now focusing to resolve debt in the entire system, by increasing opportunities for borrowers with informal debt to obtain credit from formal channels and addressing the country’s debt problem by targeting into four-distinct groups of debtors: (i) those who became indebted during the COVID-19 pandemic; (ii) Those with regular income but can no longer able to service the debt; (iii) those who earn irregular income but posses a large amount of debt; and (iv) those who have bad debt with government financial institutions and private assets management companies11/. Initially, these measures should help restructure the country’s formal debt to ease the financial burden of debtors in vulnerable groups (most of measures are expected to be implemented in 2024).

As of 12 February, Thai PM Srettha Thavisin told that more than 630,000 accounts of those effected by Covid-19 (Code 21) with a debt value of more than THB 4 billion have been resolved, while there has already been debt restructuring for more than 10,000 SMEs debtors with debts of more than THB 5 billion. Additionally, the government has also managed to bring down the total amount of informal debt by THB 670 million in 2 months, solving 102,000 out of 140,000 cases reported to authorities as part of the push to reduce the household debt burden.12/

However, the debt going into the project is still relatively small compared to household debt in the entire system. So, assistance to debtors according to these measures may not yet cover the majority of debtors in the country.

Thailand’s household debt outlook

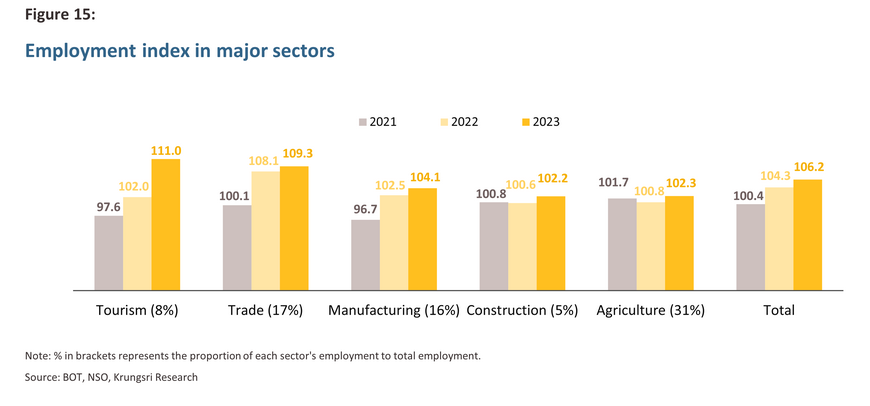

While recovering growth, employment, and real wages are expected reduce overall debt, the persistently high level will continue to weigh on consumption and economic growth.

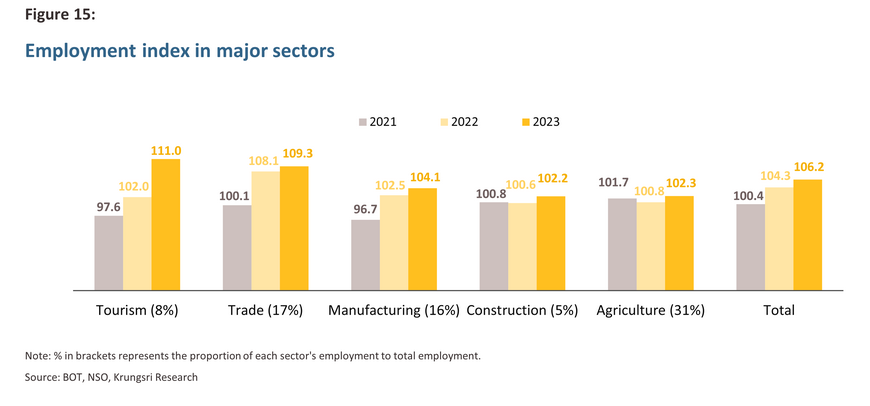

Krungsri research expects household debt-to-GDP ratio to gradually decline through (i) the continued recovery in tourism activity supporting income’s growth of households; (ii) stronger labor market with employment and real wages exceeding pre-pandemic levels in most sectors helping to heighten ability of repaying debt payment; and (iii) expected improvement in domestic debt quality from policymakers’ efforts that would lead to a more sustainable pace of debt level as well as gradual improving domestic debt quality in the future.

However, Thailand’s household debt-to-GDP ratio is likely to stay persistently high for some time due to several headwinds such as (i) the highest interest rate in a decade; (ii) high financial burdens, and low savings in low-income groups; (iii) severe drought leading to decreased farm incomes; and (iv) uncertainty over the government economic policies in 2024. Given the impact from the pandemic, which has increased household debt-to-GDP ratio to above 90%, the negative effects of higher debts would continue to weigh on consumption and economic growth.

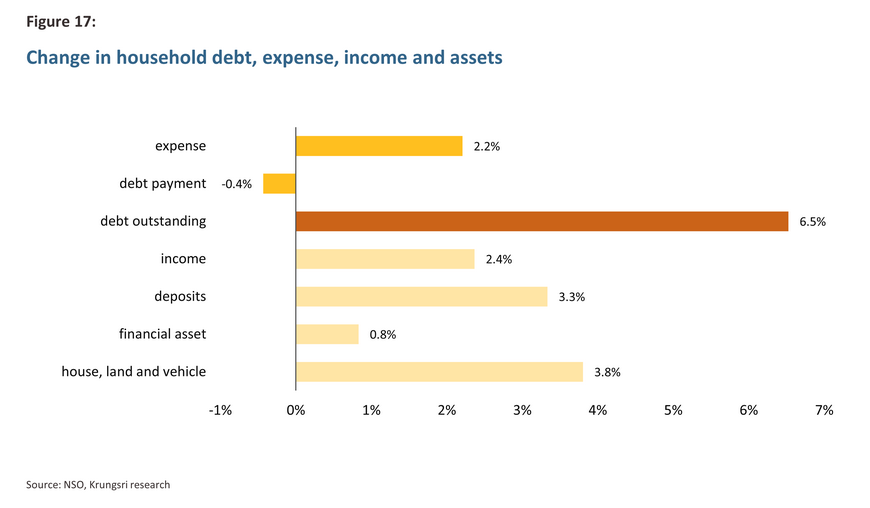

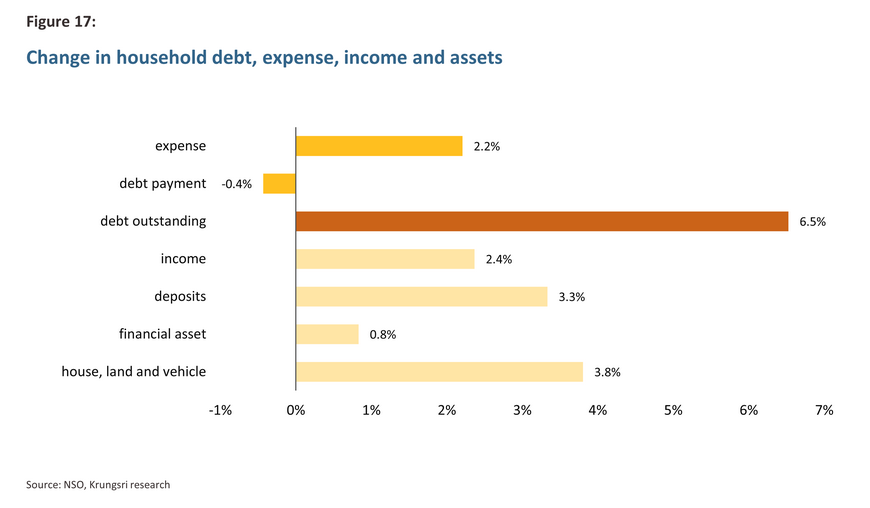

Looking deeper through households’ net wealth, despite most of households showing healthier net wealth, the significant increase in outstanding debt since the pandemic remains cause for caution as it may lead to greater burdens in the future. Calculating from their total liquidity deducted by total expenses, we found that most of households, particularly in high-income groups, have become wealthier than pre-pandemic period13/. After Covid-19 period, the net wealth of households in Thailand increased by a total of THB 316 billion, suggesting room for borrowing and spending, especially for high-income groups.

It is worthing that indebted households are having more net liquidity than debt-free households compared to pre-covid period given that indebted households, high income group in particular, have shifted to holding more liquidity assets, coupled with the results of government measures to alleviate impact from pandemic such as debt suspension and alleviation of expense14/ that should help to reduce the debt burden of household. However, although net liquidity has improved for most household, the sharp increase in outstanding debt since the pandemic still need to be cautious as it could lead to higher financial burdens in the future.

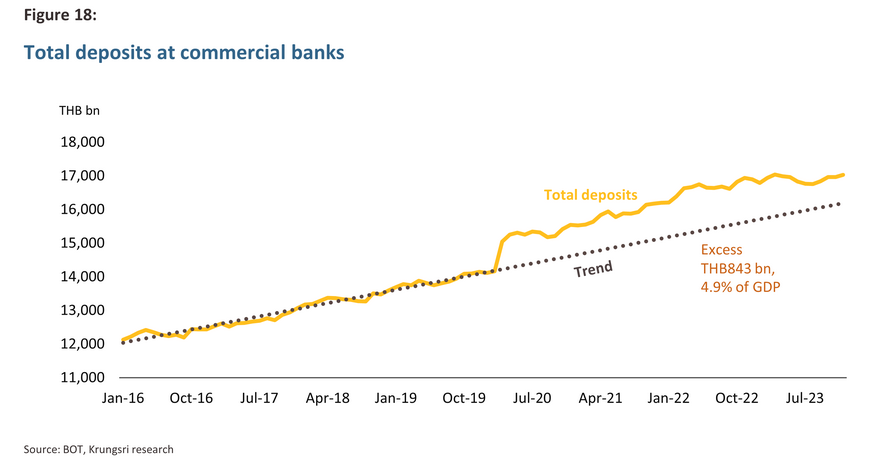

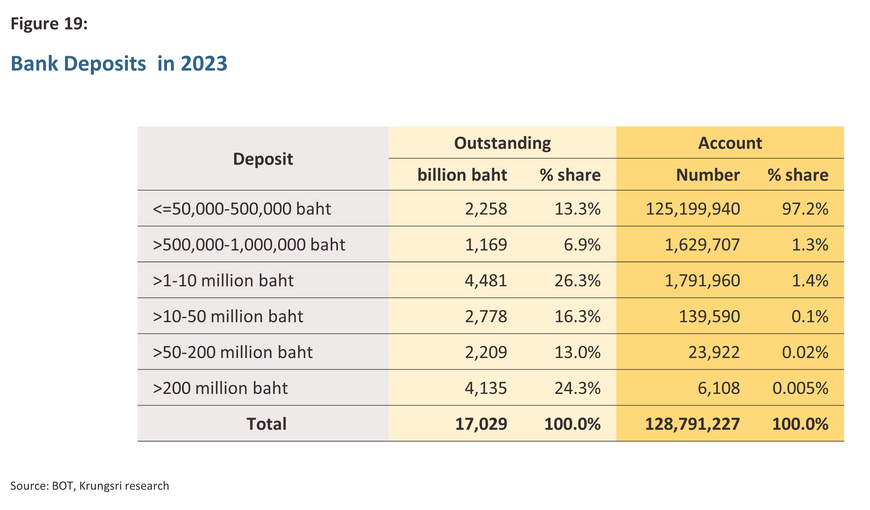

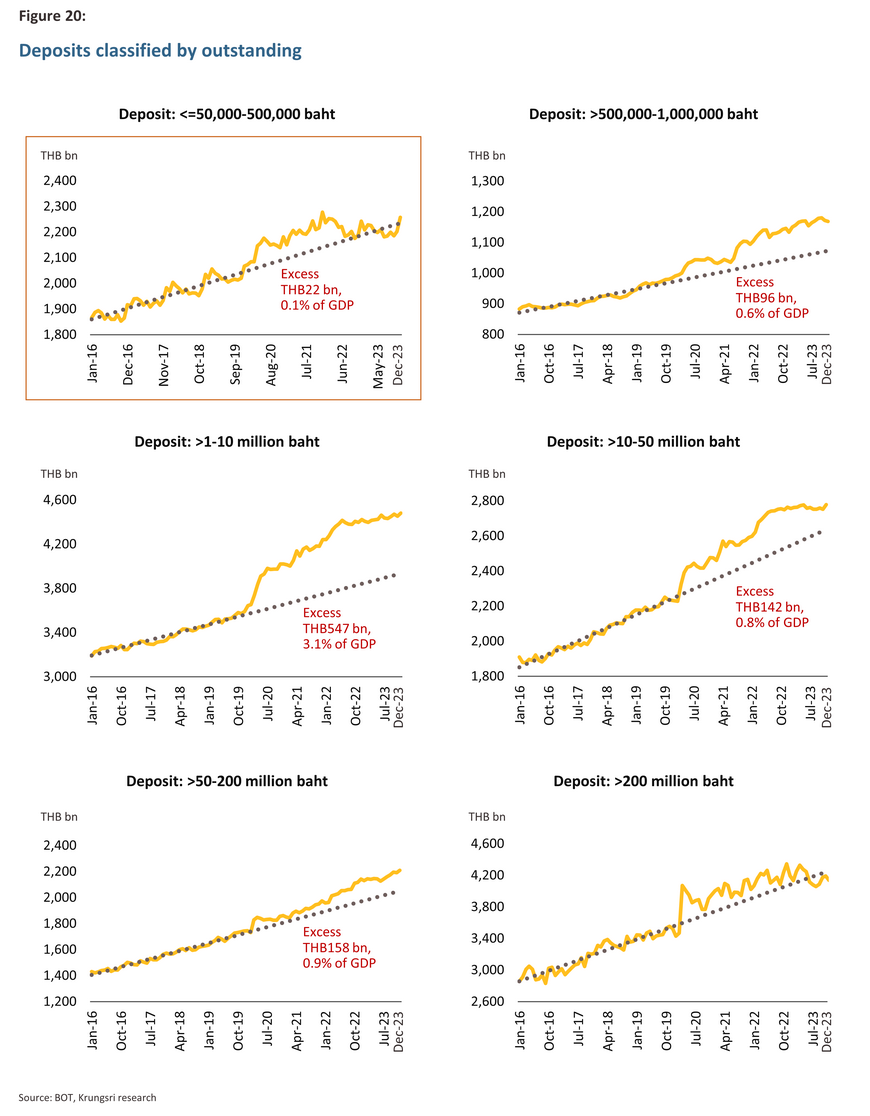

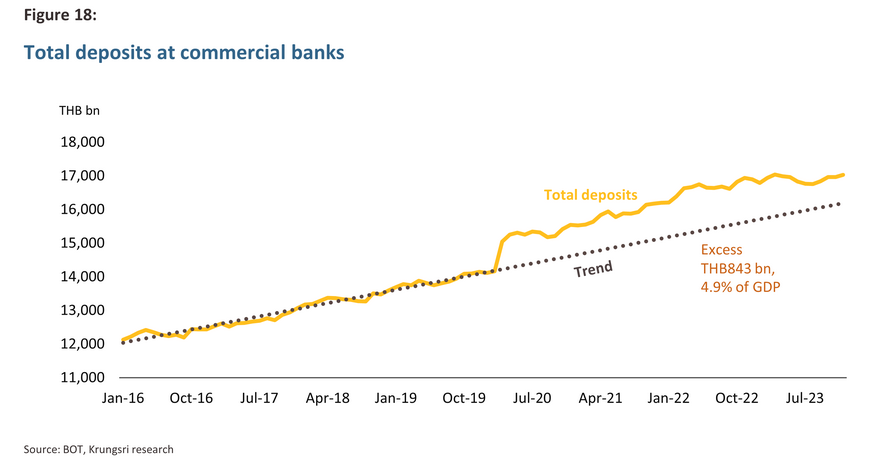

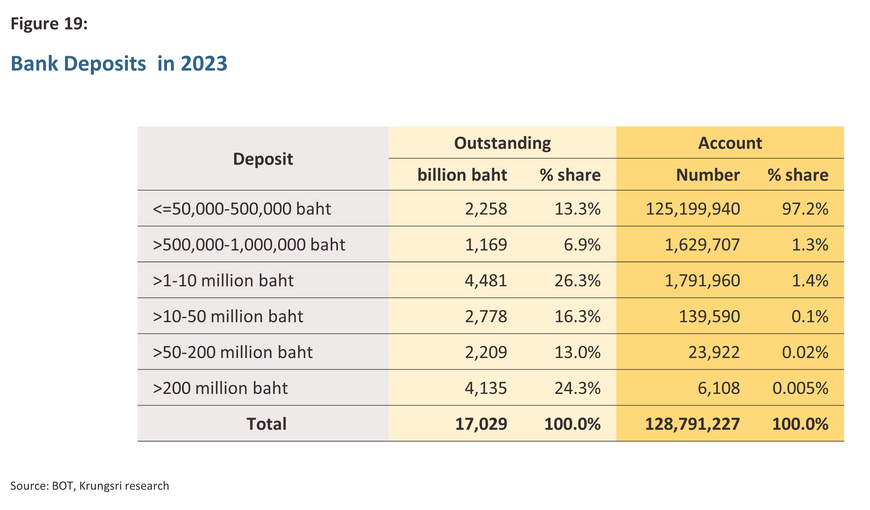

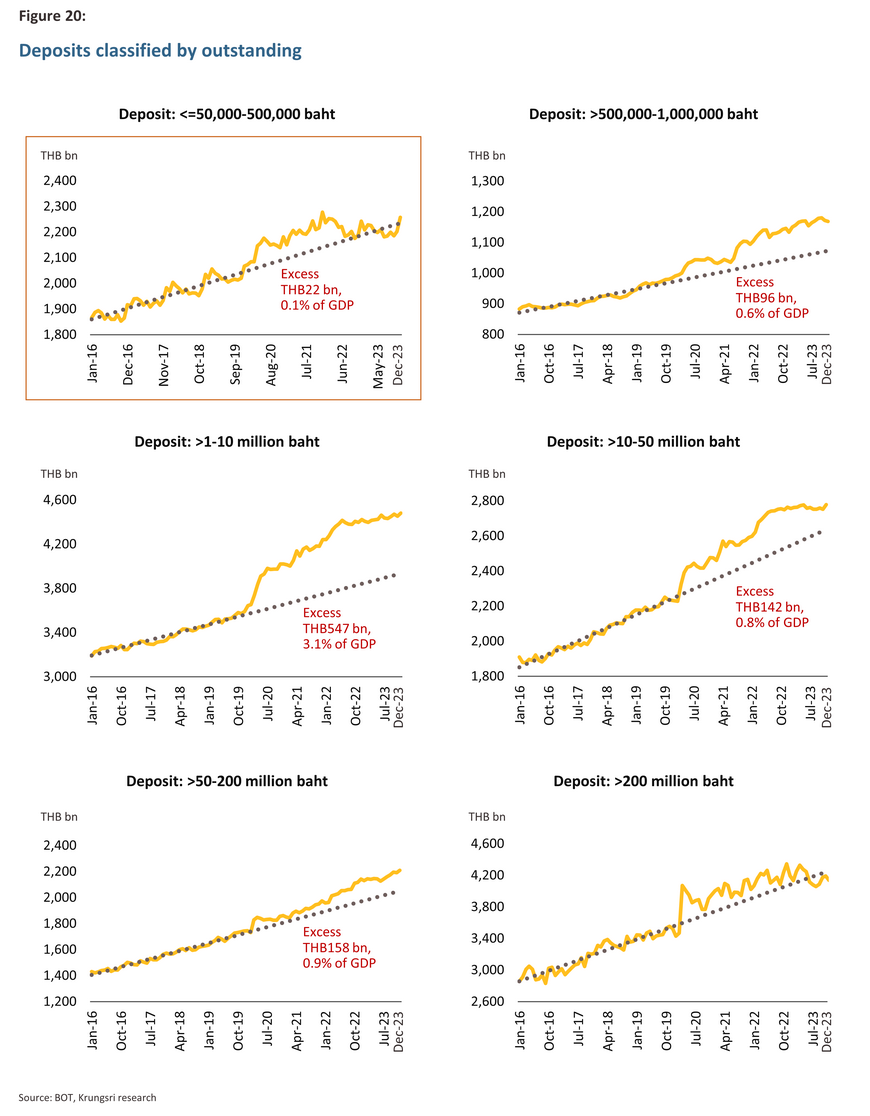

Thailand’s overall savings picture presents a same story. Thailand's overall bank deposits surpass pre-pandemic levels by over THB800 billion, but excess deposits among middle-lower income groups have declined significantly. Outstanding of total bank deposits15/ stood at THB17.03 trillion at the end of 2023, a 0.8% increase from the previous year and higher than THB14.1 trillion at end-2019 (pre-pandemic period). There was THB 843 billion excess deposits (4.9% of GDP) where most excess savings are in deposits with outstanding balance of THB1-10 million, amount THB 547 billion (3.1% of GDP), implying high purchasing power for middle- to upper-income class. This excess deposits would enable the certain household groups to increase their spending. However, the number of deposit accounts in these groups (more than 500,000-baht deposits) totaled less than 4 million, which is quite low compared to Thailand’s population of over 70 million. Additionally, middle- to low-income groups (less than 500,000-baht deposits) have already run down their deposits and they might continue to struggle in spending ahead.

Krungsri Research view

Thailand's structural problems remain a challenging on reducing household debt.

Although Thailand’s household debt to GDP has gradually declined from its peak of 95.5% in the first quarter of 2021, as of the end of 2023 it’s still increased to 91.3% to GDP, considered to remain one of the highest in the world. Anyway, this is partly reflected in the high ability of Thai people to access financial services or credit compared to the others, particularly the neighbor countries such as Philippines, Indonesia, and CLMV. The most debt increase compared to same period last year were consumer loans and real estate purchase. In the meantime, the NPL stood at 2.66% to total loan, mainly driven by consumer loans. The root cause of this problem, apart from behavioral attitudes about saving and spending, is that total expenses including debt repayments have been exceeding their income especially low to middle-income households. This was leading to more borrowing for liquidity management in daily spending.

In addition, we found that more than 59% of household debt is non-productive loans that do not directly increase people income and have a short repayment but high interest, such as personal loans and credit card loans, which result in a high debt payment causing more burden to the borrowers. According to the United Nations16/, the number of elderly people in Thailand who are over 65 years of age will increase to more than 20% of populations in 2029 which would then qualify Thailand as a super-aged society, same as Japan, Germany, Italy, and France. Given high debt burden and lower capability of debt repayment, this should lead to greater financial burdens and fragile economy in the future if there is no comprehensive measure to address root cause of the problem.

Based on data from the Household Socio-Economic Survey of the National Statistical Office (NSO), we found that middle to high-income group of households remain in good financial health and have no struggle on repaying their debts as their income is still higher than expenses, with higher net liquidity compared to pre-pandemic period. However, the sharp increase in outstanding debt since the pandemic still need to be cautious as it could lead to higher financial burdens in the future.

In conclusion, with the measures implemented by government and the BOT in 2024 such as debt restructuring and resolving persistence debt, Krungsri Research views that these measures should help to ease the financial burden of debtors in vulnerable groups and gradually lower the level of household debt, but the debt burden is expected to remain persistently high. However, with the comprehensive measures to address the underlying issue of high debt, particularly insufficient income, spending behavior, and creating incentives to save money, it should help to stabilize income level of household, reduce poverty, and make Thailand ready to enter the aging society.

References

Bank of Thailand. (2024). “How bad is Thai household debt? Why should it not be overlooked?”. Retrieved from https://projects.pier.or.th/household-debt

Chula Digital Collections. (2022). “The Determinants of Thai Household Debt: A Macro-level Study”. Retrieved from https://digital.car.chula.ac.th/cgi/viewcontent.cgi?article=1337&context=jdm

Bank of Thailand. (2024). “Media Briefing: Sustainable debt solution Ep.1”. Retrieved from : https://www.bot.or.th/th/news-and-media/news/news-20240117.html

Bank of Thailand. (2024). “Banking Sector Quarterly Brief (Q4 2023 and 2023)”. Retrieved from : https://www.bot.or.th/th/news-and-media/news/news-20240313.html

Bank of Thailand. (2024). “Media Briefing: Sustainable debt solution Ep.2”. Retrieved from : https://www.bot.or.th/content/dam/bot/documents/en/news-and-media/news/2024/news-en-20240219.pdf

Thailand's Ministry of Finance. (2023). “A sustainable solution to address Thailand’s household debt problem”. Retrieved from https://www.thaigov.go.th/news/contents/details/76358

1/ Loan to household classified by purpose at end of 4Q23, https://app.bot.or.th/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=985&language=TH

2/ Debt Service Coverage Ratio (DSCR): a measure used to evaluate a business or individual's ability to pay off their debt.

3/ Non-Performing Loan (NPL): a loan in which the borrower is in default and has not paid the monthly principal and interest repayments more than 90 days.

4/ Special Mention Loan (SM): a loan in which the borrower is in default and has not paid the monthly principal and interest repayments for 30-90 days.

5/ BIS Data Portal (June 2023), https://data.bis.org/topics/DSR/tables-and-dashboards

6/ According to the BOT, at the end of 4Q23, more than 59% of household debt is non-productive loans that do not directly increase people income, such as personal loans and credit card loans.

7/ Bank of Thailand, https://projects.pier.or.th/household-debt/

8/ Prachachat, https://www.prachachat.net/finance/news-1562000

9/ The Household Socio-Economic Survey in 2017 and 2021 by National statistical office (NSO)

10/ Media Briefing แบงก์ชาติชวนคุย #แก้หนี้ยั่งยืนEp.1: https://www.bot.or.th/th/news-and-media/news/news-20240117.html Ep.2: https://www.bot.or.th/th/news-and-media/news/news-20240313.html

11/ Thairath, https://www.thairath.co.th/money/economics/thailand_econ/2749198

12/ Thairath, https://www.thaipbs.or.th/news/content/336913

13/ The Household Socio-Economic Survey in 2017 and 2021 by National statistical office (NSO)

14/ The Government Public Relation Department (PRD), https://www.prd.go.th/th/content/category/detail/id/31/iid/79430

15/ Bank of Thailand: All Commercial Banks' Deposits Classified by Sizes and Maturity (2023), https://app.bot.or.th/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=187&language=ENG

16/ UN World Population Prospect 2022