Introduction

Over the past few years, discussion of sustainable development has become increasingly widespread as this has moved into the center of national policy. Alongside this change, both the public and private sectors have pushed to make progress on meeting environmental, social and governance goals (or as these are collectively called, the ESG goals) a core part of their activities across a wide range of areas. To this end, the government has rolled out tax incentives to encourage an increase in domestic sustainable investment through the Thailand ESG Fund,1/ created the Thailand Taxonomy,2/ revised the PDP to promote increased use of clean energy, and is supporting the development of the circular economy.3/ Meanwhile, the private sector is shifting away from its dependency on fossil fuels and towards a greater reliance on the use of alternative energy in manufacturing processes, increasing energy efficiency in commercial buildings and factories, using more environmentally friendly inputs and packaging, raising the quality of waste management processes, and adapting other business processes by, for example, switching to the use of EVs and offsetting emissions through carbon credits (e.g., by funding reforestation projects). Furthermore, the finance and banking sector has also been actively promoting sustainable business practices more visibly as a central allocator of capital in the economy.

Beyond the activities of businesses and state agencies, making progress on sustainability is highly dependent on broad-spread buy-in by consumers. To better understand these issues and to gain insight into consumer motivations and behavior, Krungsri Research has surveyed the extent of support for ESG goals among the Thai public. This includes investigating issues related to finance and consumer activities, including the extent to which consumers are interested in supporting or investing in companies that are at the forefront of the ESG movement, how much of a premium consumers are willing to pay for goods or services supplied by companies that promote ESG, and the strength of brand loyalty for environmentally friendly products. To this end, this study focuses on analyzing data related to consumer attitudes and engagement that are linked to other relevant factors. It aims to help businesses gain a sharper and better-informed insight into the shape of an evolving and sometimes mercurial market as it appears from the consumer’s point of view, enabling businesses to adapt and meet the needs of today’s consumers much more effectively.

Consumer Attitudes Towards ESG Issues Worldwide

Europe

Europe is one of the regions where consumers are aware of and act on sustainability and ESG issues in a concrete manner. The strength of consumers’ concerns has been reflected in much recent research work. A 2023 survey by Civey revealed that almost half of all consumers in France, Germany, Italy, and the UK planned to adopt greener lifestyles and to prioritize more sustainable shopping.4/ In the same year, a survey by the European Commission of EU consumers showed that 56% of respondents reported that their purchasing decisions (for both goods and services) were informed by environmental considerations,5/ while a report by Deloitte indicated that 30% of UK consumers would stop purchasing certain brands or products if questions had been raised over ethical or sustainability-related concerns.6/

The US

A significant proportion of US consumers support the ESG movement, and research by NielsenIQ shows that over 2018 to 2022, compound annual growth in retail sales of goods that were explicitly aligned with ESG goals was 1.7% higher than for goods that were not pro-ESG.7/ The majority of US consumers also want to see businesses commit to ESG goals, and this was reflected in a 2023 survey by Global Strategy Group and SEC Newgate that demonstrated that 72% of consumers thought that it was important for businesses to take action on ESG issues. Moreover, some two-thirds of the public want to see greater corporate transparency when labor or consumer issues come to light,8/ underlining the extent of public interest in the governance issue, or the 'G' of ESG.

Asia-Pacific

A survey by the consultancy Bain & Company9/ shows that 14% of consumers in the Asia-Pacific region are most concerned about environmental and social issues, and so there was a great deal of continuity across Europe, the US and Asia-Pacific in this regard (Figure 1). Asia-Pacific consumers are keen to buy environmentally friendly products from companies that are concerned about their relationships with and impacts on individuals, whether that be staff within the company itself or workers across supply chains. However, differences between Europe, the US and Asia-Pacific emerged in the high proportion of Asian survey respondents (51%) reporting that they were most concerned about their health and the health of their family. Asia-Pacific consumers thus tend to believe that shopping sustainably will help to guarantee better health, and almost 40% planned to increase their spending on sustainable products.

Africa

Research on consumer views on sustainability in Africa is centered on the example of South Africa, where over 90% of the public agree that sustainability is an important issue facing society10/ and that it is necessary for businesses to move onto a much more sustainable footing. Against this background, brands that are explicitly linked to sustainability are viewed as being more modern and contemporary (by 66% of consumers), higher quality (65% of consumers) and more trustworthy (62% of consumers) than other brands, and in the eyes of South Africans, energy production, medicines and food supplements, and apparel are the three industries where issues of sustainability are most important. Beyond this, a survey by PwC11/ also found that 80% of South Africans were prepared to spend more on goods promoting ESG goals, for example locally manufactured goods, goods made from recycled or environmentally friendly inputs, and goods produced by ethical companies.

It is clear that today’s consumers around the world are increasingly aware of and concerned about sustainability and ESG issues, and a considerable portion of individuals are now making purchasing decisions that are informed by this awareness. Indeed, many shoppers are prepared to pay a premium for ESG-informed products or for those that are helping to increase overall levels of sustainable development, and so the whole topic of corporate ESG involvement has taken on a much more central place in almost all areas of the economy.

Krungsri Research’s survey result

Krungsri Research surveyed the attitudes of Thai consumers regarding sustainability issues in February 2024. Responses were gathered in Bangkok and online from 2,846 Thai citizens drawn from a broad spread of ages,12/ occupations, educational and income levels.

I. Profiles of Survey Respondents

Almost half of all respondents qualified as Gen Y (28-43 years old), with slightly more than a third coming from Gen X (44-59 years old). Around two-thirds of those completing the survey were female, another two-thirds were educated to bachelor’s degree level or equivalent, and the same proportion also reported having a monthly income of between THB 15,001 and THB 75,000. Over 85% of respondents worked as company employees or for independent non-private organizations. (Figure 2).

II. Role of ESG in Sustainable Business Growth

The question asking about factors supporting sustainable business growth revealed that for more than two-thirds of survey respondents (66.2%), alignment with ESG goals was paramount. This was followed in importance by the use of modern technology and innovations (22%), producing goods for sale at the lowest possible price (8.5%), and maximizing business growth and profits (3.3%). ESG issues remained top of mind for consumers regardless of age, gender, education, and income.

Those who rated the promotion of ESG goals as the most important factor supporting sustainability efforts can be regarded as the ‘ESG top of mind’ group. More than 7 in 10 Gen X and Baby Boomers (i.e., those aged 44 years and over) were categorized as being "ESG top of mind," with the highest proportion compared to other age groups. They had an ‘odds ratio’13/ of approximately 1.8, indicating a higher likelihood of being in this category compared to younger generations. By contrast, only 62% of Gen Y and 49% of Gen Z respondents were classified as ESG top of mind.

It is interesting to note that more than a quarter of younger respondents saw modern technology and innovation as being the most important factor supporting business sustainability, with younger cohorts 1.8-times more likely to have this view than Gen X and Baby Boomer consumers.

In addition, females had a proportion of individuals categorized as "ESG top of mind" at 68%, which is higher than other genders, compared to 65% of men and 53% of LGBTQ+ respondents.

Looking at the relationship between respondents’ views on the importance of ESG issues and their willingness to engage with these in a practical sense themselves, the most committed may be regarded as ESG die-hards. These are both in the ESG top of mind group and are willing to pay extra to support goods and services that are aligned with ESG goals, whatever their specifics. Here, these are christened ‘ESG first’ consumers. Other groups are less committed to supporting ESG goals, and in order of their engagement with these issues, these are: (i) the ‘ESG conscious’, that is those who are members of the ESG top of mind group but are willing to pay extra for goods and services only in some (but not all) areas of ESG; (ii) the ‘ESG aware’, or those who are willing pay extra for goods or services that promote at least one of the three core ESG goals but who are not in the ESG top of mind group; and (iii) the ‘non-ESG’ consumers, i.e., those who are not willing to pay extra for goods or services promoting any of the ESG goals, whatever their views on the importance of ESG alignment for business sustainability.

Econometric analysis of ESG first consumers shows that membership of the ‘ESG first’ group is influenced by education and income. Thus, the share of ESG first consumers is greatest among those with a master’s degree or higher (60%). These individuals are 1.3 times more likely to be ESG first consumers than those with a lower level of educational achievement. By contrast, 50% of those completing their education with a bachelor’s degree and only 34% of those with a lower final qualification were ESG first consumers. Likewise, higher-income earners are more likely than those on lower incomes to be ESG first, with 60% of those earning more than THB 100,000 per month qualifying as ESG first, compared to 51% of those earning THB 30,000-100,000 per month and 42% of those with a monthly income of less than THB 30,000.

Individual attitudes are also likely to be influenced by the work environment since many organizations are overhauling operations to bring these closer into line with the ESG goals and changes to the global business landscape. The survey therefore shows that large corporations, especially those in the banking and finance sector, have a significant role to play in raising awareness of ESG issues among their staff, and indeed, 56% of respondents working at large corporations active in finance and banking14/ were classed as ESG first. This compares to just 40% of those working in other parts of the economy. Moreover, an econometric analysis reveals that individuals working in the finance and banking sector were twice as likely to be in the ESG first group compared to those working in other industries.

In summary, consumers classified as ESG first, who both recognize the importance of ESG goals in sustainable business practices and are willing to contribute financially, are most prevalent among those with high income and education levels. They are also more likely to work in large organizations, particularly in the financial and banking sector.

III. Practical Expressions of Consumer Support for ESG Goals

Consumers are able to make their support of ESG goals concrete through buying ESG-aligned goods or services, or by investing in companies that have a clear policy of promoting ESG goals.

-

Pro-environmental goods (i.e., those focusing on the E of ESG) such as using biodegradable packaging, products with manufacturing processes that help reduce greenhouse gas emissions or have lower carbon emissions compared to similar products from other brands. These may be referred to as "eco-friendly products" or "green products.“

-

Products promoting better livelihoods and positive social outcomes (the S of ESG) such as those that return a higher share of profits to the communities from which inputs are sourced, pay fair wages to employees, and demonstrate care for more disadvantaged members of society. These can be classed as ‘socially responsible’ products.

-

Products and services that promote good governance (the G of ESG), for example, those that do not attempt to deceive consumers, make false advertising claims, or operate aggressive anti-corruption policies both internally and externally. These might be referred to as ‘good governance’ products.

Of the three ESG goals described above, it was found that 1 in 3 survey respondents prioritize spending money to support or invest in businesses that promote good governance (G) as their first priority. This was followed by green goods and services (29% support) and socially responsible products (21% support) (Figure 6). These findings are mirrored in a 2022 PwC survey that showed that in the 25 countries surveyed, support for goods, services and companies focused on the promotion of good governance was significantly stronger than for those concentrating on environmental or social issues.15/

Considered by age cohort, Gen X and Baby Boomers were the greenest groups, with Gen X most likely to favor supporting environmental and governance issues and Baby Boomers tilting towards environmental and social issues. Econometric analysis of the data shows that compared to Gen Y consumers, Baby Boomers were 2 times more likely, and Gen X respondents were 1.4 times more likely, to consider purchasing green goods or investing in companies that care about environmental issues. Evidence of the strength of pro-environmental attitudes among older respondents is also provided by other surveys carried out both in Thailand and elsewhere. Thus, earlier research by the College of Management at Mahidol University shows that of all age groups, Baby Boomers were the most likely to have pro-environmental beliefs,16/ while a survey of investors carried out by Stanford University in 2023 also revealed that Baby Boomer investors see environmental issues as being more important than do other cohorts.17/

Support for social issues was strongest among those completing their education with a final qualification that was lower than a bachelor’s degree, and in this group, 32% of individuals favored investing in socially conscious businesses or otherwise helping socially responsible goods, with support for environmental investment or goods coming to just 18%. Individuals working outside the banking and finance industry were also more favorably inclined towards socially responsible companies and goods than were those employed within the industry, and econometric analysis of the data shows that the former were 1.9-times more likely than the latter to rank social issues as the most important. By contrast, those working in banking and finance or those holding a bachelor’s degree or higher were most likely to rank governance issues as the area most deserving of their support (Figure 7).

IV. When ESG concerns turn into a price tag, how much of a premium are consumers prepared to pay for ESG-aligned goods and services?

Typically, addressing ESG goals imposes higher overheads on businesses, and so if consumers are prepared to pay a premium for goods or services that help to improve ESG issues, this will help to maintain the equilibrium between the potentially contradictory goals of maintaining profitability and increasing sustainability. Fortunately, this survey shows that overall, 9 out of 10 respondents were prepared to support ESG-aligned goods and services through higher prices, and more than half of respondents (56.6%) were willing to pay a higher premium for higher-priced products or services and were 1.4 times more likely to agree to pay a premium to address social and environmental issues than they were for governance issues.

The next question that businesses might be interested in is how much consumers are willing to pay as a premium for ESG products. In this regard, consumers' willingness to pay a premium can be divided into two categories:

-

A premium that increases with the underlying cost of the good or service and that can therefore be expressed as a percentage: The survey shows that for ESG-aligned goods and services costing THB 100, respondents are prepared to pay a 12.4% premium, though this drops to 9.0% when the price rises to THB 500-1,000. This mirrors a survey carried out by Bain & Company18/ of 23,000 consumers worldwide, which showed that, on average, they were prepared to pay a 12% premium for goods or services that reduced environmental impacts.

-

A flat rate premium: This does not increase in line with underlying prices, and this was supported by around a quarter of respondents. They were prepared to pay on average an additional THB 22.5 for ESG-aligned goods or services costing THB 100-1,000.

Comparing the willingness to pay a premium among ESG first consumers and three other groups (i.e., the ESG conscious, the ESG aware, and non-ESG consumers, as defined in section ii above) shows that while ESG first respondents were willing to pay extra across the board, regardless of an item’s specific bearing on ESG issues, consumers in the other three groups were still prepared to pay a premium for some goods and services. Respectively, 89% of these were willing to pay a premium for goods that addressed social issues and 85% for environmental issues; however, for governance issues, support for higher prices fell to 57% (Figure 8). This indicates that although engagement may be somewhat lower in the other three groups compared to the ESG first group, many consumers still recognize the importance of ESG goals and are willing to support this practically by paying higher prices for goods and services that address social and environmental issues in particular.

However, sharper differences emerge between the other three groups regarding the type of premium they support. Unlike the ESG first group, which favors a percentage-based premium, consumers in the other three groups are 1.2 times more likely to favor paying a flat rate to support green and socially conscious goods and services. ESG first consumers also show strong preferences for additional charges as a percentage-based premium. These consumers are 1.4 times and 2.2 times more likely to favor paying percentage-based premiums for socially and environmentally focused goods and services than for those that address governance issues. Compared to the other three groups, ESG first consumers are willing to pay a premium approximately 2.7% higher, regardless of the price of the product or which aspect of ESG it addresses (Figure 9).

This research further considers consumer willingness to pay premiums for goods and services addressing environmental, social, and governance issues, and for each of these, the survey investigated the maximum premium that the market will bear for goods or services costing THB 100, THB 500 and THB 1,000.

93% of respondents were willing to pay some kind of premium for green products or services, split between 63% who would accept an additional charge of 1-10% and a further 30% who were willing to pay an 11% or more premium. Comparing the research findings of Krungsri with those of Bain & Company, which surveyed consumers from 11 countries in the Asia-Pacific region19/ in 2022, it is evident that overall, Thailand has a higher proportion of consumers willing to pay a premium for environmentally friendly products or services, at 93%, which is higher than the regional average of 89%. However, for those willing to pay a higher rate (above 11%), the proportion is lower than the regional average of 47%. Another survey of Thai consumers by Kasikorn Research Center published in 2022 shows that 66.3% of respondents were prepared to pay up to a 20% premium for environmentally friendly goods and services,20/ a result that is broadly in line with the findings of the current research.

When asked how much they would be willing to pay as a premium, the following responses were the most commonly chosen: for goods costing THB 100, 64% of respondents were prepared to pay an additional THB 5-10; for goods costing THB 500, 70% of those asked would pay an extra THB 25-50; and for items priced THB 1,000, 55% of survey respondents would accept a premium of THB 50-100. Analysis of the responses shows that for items priced THB 100, THB 500, and THB 1,000; average acceptable premiums were respectively THB 12.5, THB 47, and THB 85.5.

- Socially responsible goods (S)

95% of respondents thought that it was reasonable to pay extra for socially responsible goods, a higher proportion than for either green or good governance products, though the most popular responses mirrored those for environmentally friendly goods and services. Thus, 65% of respondents would pay THB 5-10 extra on a product costing THB 100, 72% would accept paying an additional THB 25-50 for products costing THB 500, and 54% thought that it was acceptable to pay an additional THB 50-100 for goods and services priced at THB 1,000. The weighted averages of acceptable premiums for socially responsible goods and services at these three price points were thus THB 14.4, THB 55, and THB 93.

- Good governance products (G)

Goods and services related to good governance elicited the lowest levels of support of the three main areas of ESG, though 80% of respondents reported still willing to pay a premium for these. For goods priced at THB 100, the weighted average of acceptable premiums came to THB 10.7, with 67% of survey respondents reporting that they were willing to pay an additional THB 5-10 for this; while for goods priced at THB 500 and THB 1,000, the weighted average of acceptable premiums was respectively THB 44 and THB 79.8. For goods and services at both these price points, the most commonly reported acceptable premium was THB 25-50 (given by 70% and 49% of respondents, respectively).

It is interesting to note that within this group of products, at all three price points, the most commonly chosen acceptable premium was the smallest. This thus differs from the two other product groups, for which responses scaled more closely with prices. One reason for this difference was revealed in interviews with respondents, who reported feeling that companies should already have adopted good governance principles and so it was not the responsibility of consumers to pay extra for this.

V. Factors Influencing Consumer Willingness to Pay an ESG Premium

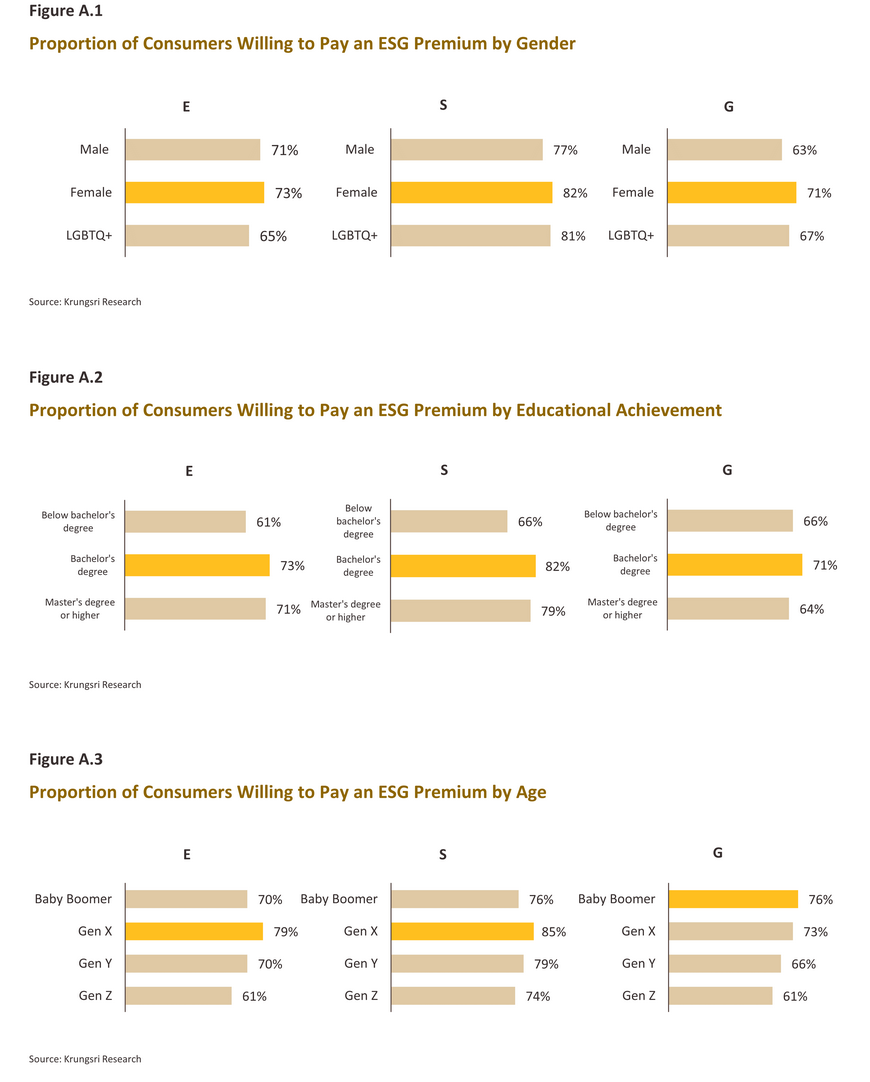

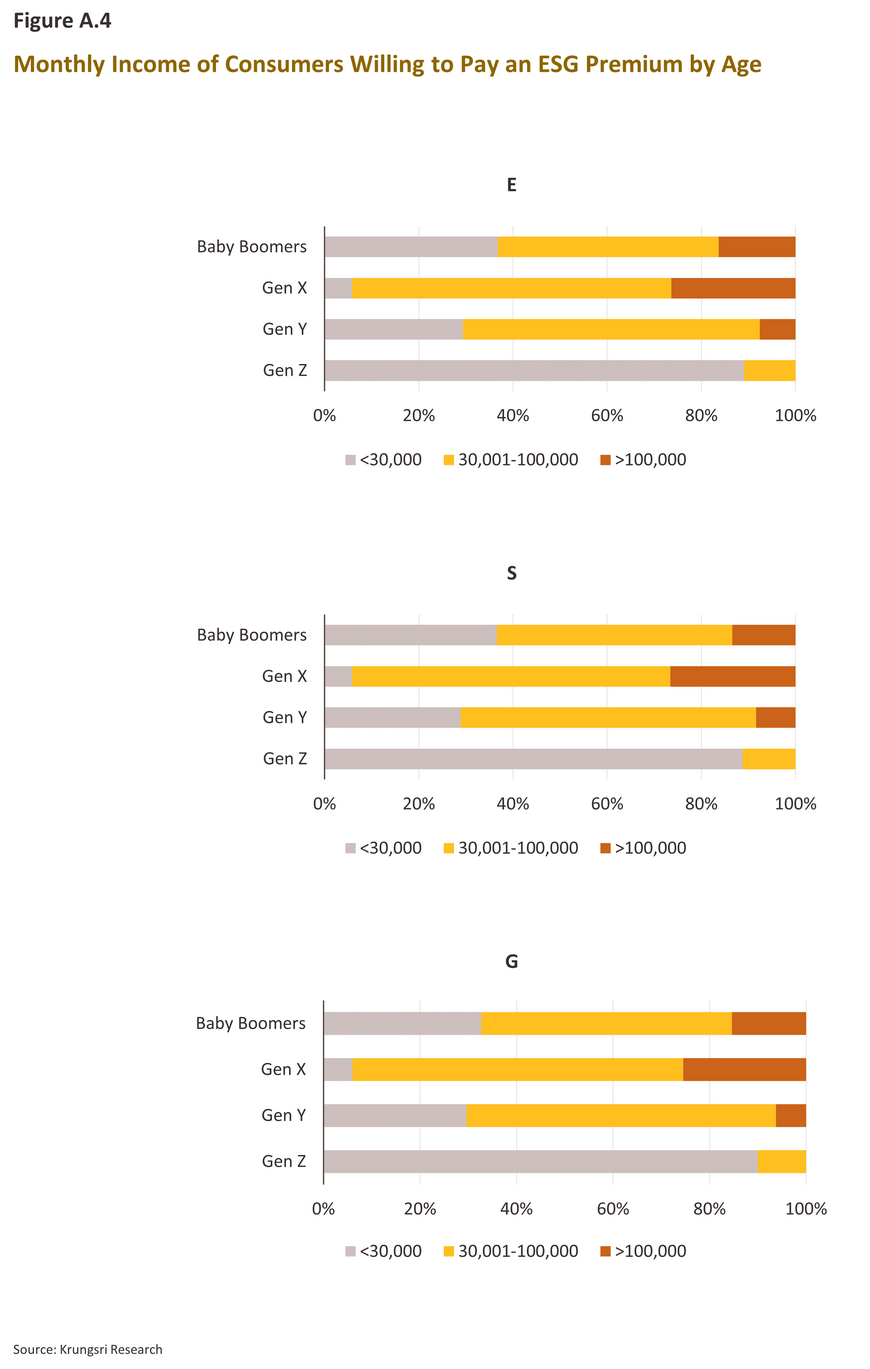

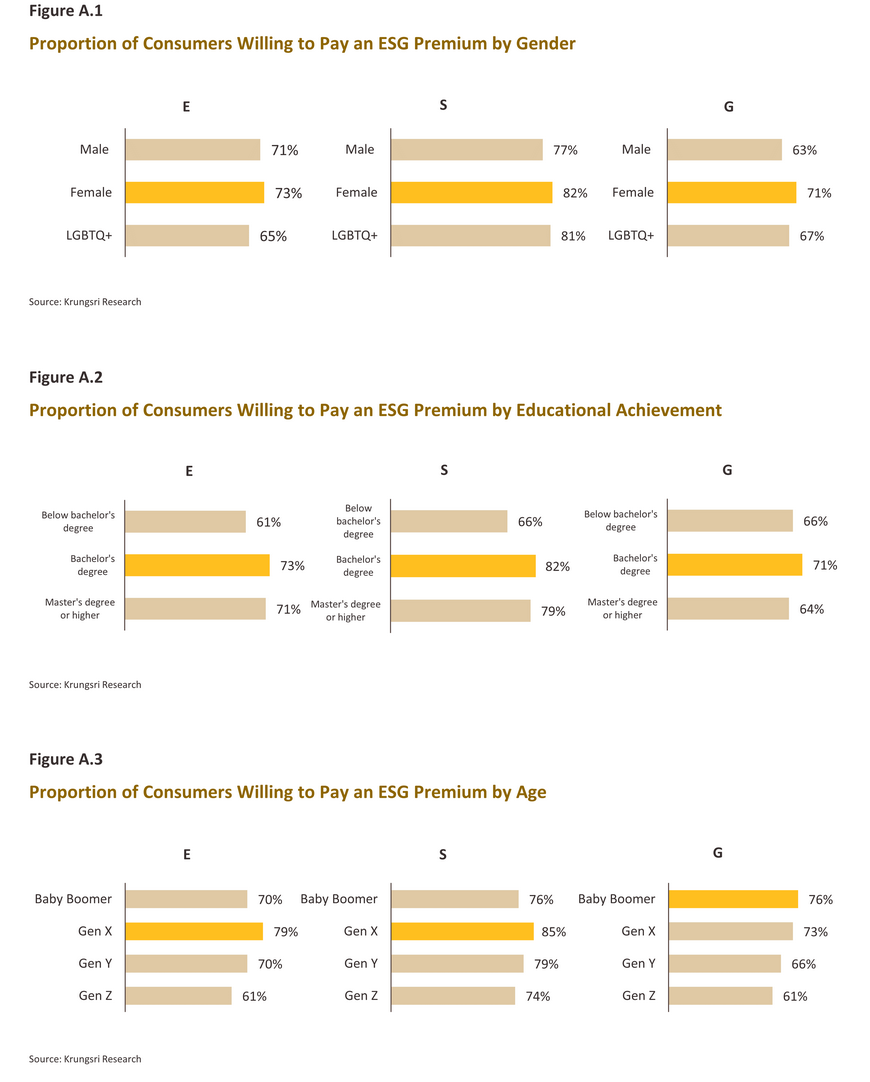

In terms of gender, females were the most willing to pay extra for ESG-aligned goods and services (75%), and so these were 1.4-times more likely than other genders to pay extra for green goods, 1.7-times more likely to pay a premium for socially responsible products, and 1.3-times more likely to pay an additional charge for good governance products. This may be because women tend to be more empathetic than men, a view that is supported by research from Cambridge University that demonstrates how on average women have a greater degree of cognitive empathy than men.21/ Moreover, although LGBTQ+ respondents had the lowest average monthly income of the three gender options given on the survey, these individuals were willing to pay a higher premium than men for socially responsible and good governance products. Overall, this would tend to indicate that male consumers are unlikely to be an ideal target group for businesses looking to impose an additional premium for ESG goods and services.

With regard to respondents’ levels of education, those with a bachelor’s degree were most likely to accept paying a premium for ESG goods and services, though it is interesting to see that those with a master’s degree or higher were less likely to support paying a premium related to good corporate governance issues than were those who finished their education at a level below bachelor’s degree. This may be because, as noted above, those with a better education may feel that good corporate governance is a basic part of running a business and it is the responsibility of businesses themselves not consumers to find the funds required to pay for this.

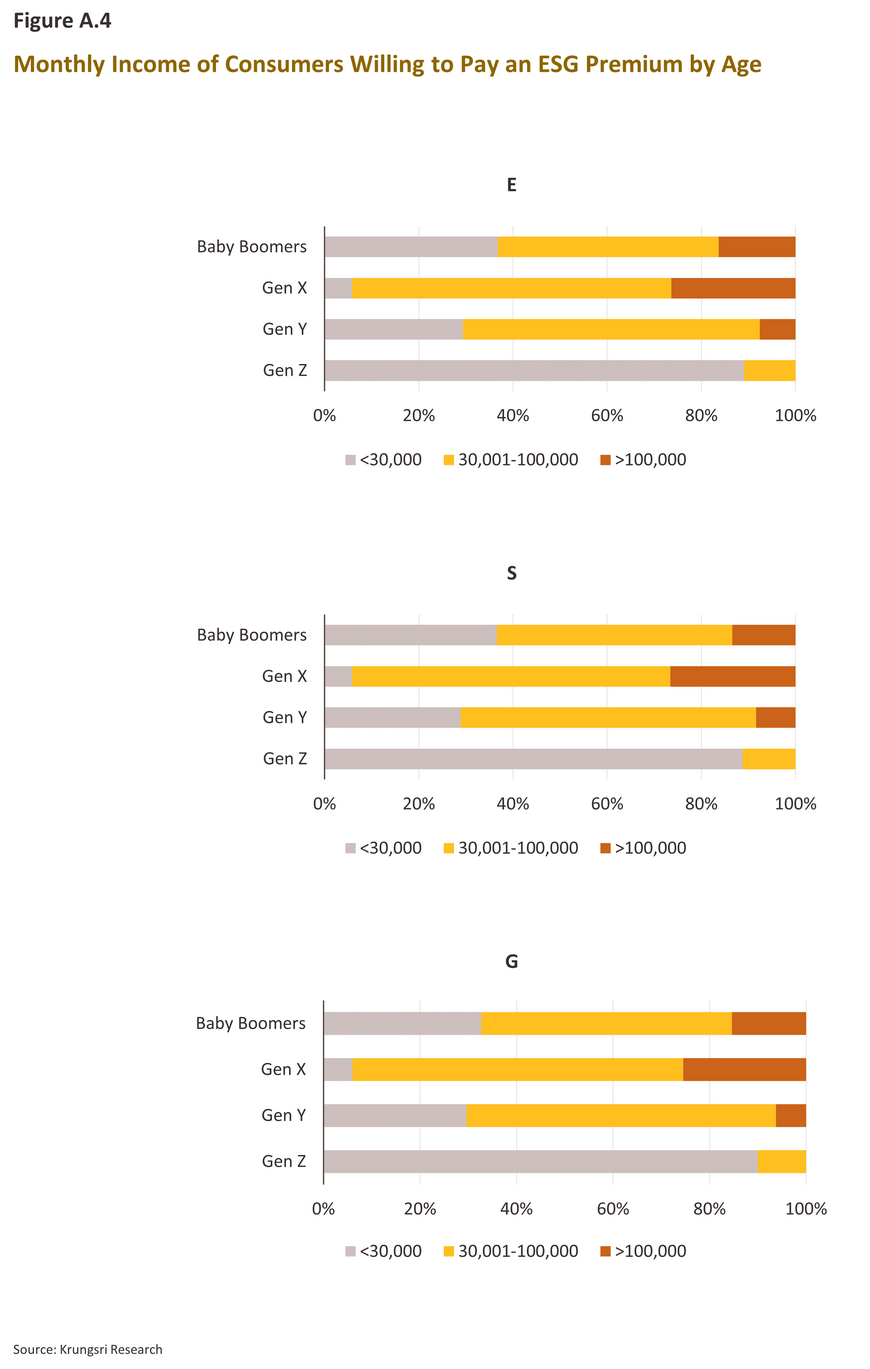

By age, members of Gen X were most willing to pay for green and socially responsible goods or services, while Baby Boomers were more willing than any other age cohort to accept a premium for good governance products. One possible explanation of this is that because individuals in these two groups are older, they are more financially secure and so are better able to pay higher prices to support issues that are close to their hearts. In contrast, members of Gen Y and Gen Z face greater financial constraints, and so this may be why Gen Z consumers are the least willing to pay extra for ESG-aligned products.

Income also had an impact on willingness to pay an ESG premium. Although respondents with a monthly income exceeding 100,000 baht or high-income groups are willing to pay extra to support ESG issues, interestingly, the average percentage-based premiums acceptable to those in these high-income groups were not as high as they were for consumers with lower incomes. Moreover, research found that across all income groups, respondents were keenest to pay a premium for socially responsible goods and services and least keen to pay a good governance supplement (Figure 15).

VI. Green Consumerism and Brand Loyalty

Corporate image plays an extremely important role in determining business sustainability, and so as part of this survey, respondents were asked about the extent and strength of their brand loyalty for green or environmentally friendly products and their manufacturers or retailers. The responses to these questions show that more than half of consumers22/ are willing to support these products, though this may take different forms and be expressed to different degrees. Nevertheless, it is clearly the case that greening a product portfolio may help to build greater brand loyalty among consumers (Figure 16).

However, brand loyalty for green products may dissipate over time, particularly if sustaining this incurs greater costs for consumers. The latter may arise from: (i) pricing costs, i.e., if green goods are priced higher than the level set by the market; (ii) opportunity costs, i.e., when the value proposition of alternatives is more attractive; and (iii) non-monetary costs or the effort cost of expressing loyalty, i.e., if brand loyalty is shown by participating in events. In this case, the costs of maintaining brand loyalty may prove to be excessive and so this may be eroded faster for green products than when loyalty is maintained or expressed through more basic means, such as making repeat purchases or giving word of mouth recommendations (Figure 16).

Brand loyalty is also influenced by gender and income. Females report showing greater brand loyalty towards green products than male or LGBTQ+ respondents as the costs of doing so rise, while low-income earners (those earning up to THB 30,000 per month) are at the opposite end of the spectrum and show the weakest loyalty. This is likely because purchasing decisions made by this group are the most price sensitive (Figure 17) and so when pricing costs rise, high-income earners (those earning more than THB 100,000 per month) are 2.2-times more likely to maintain brand loyalty for green products. However, if opportunity costs or the effort costs of expressing loyalty rise, middle-income earners (those earning THB 30,000-100,000 per month) are 1.3-times more likely than high-income earners to remain loyal to the brand.

Overall, age is not an important determinant of loyalty towards green brands (Figure 18), although Gen Z are more likely than other cohorts to switch their brand loyalty when presented with a more attractive offer. Likewise, education is also largely irrelevant to considerations of brand loyalty, though if opportunity costs rise and alternative brands become more attractive, those with a master’s degree or higher, are 1.3-times more likely to switch their brand allegiance compared to those with a bachelor’s or a lower-level qualification.

Considering just those consumers whose loyalty to eco-friendly brands manifests in the more traditional forms, that is by making repeat purchases and providing word of mouth recommendations, changes in pricing costs, opportunity costs, and the effort costs of expressing loyalty have the following statistically significant effects (Figure 16).

-

Gen Z consumers show the weakest brand loyalty, with Baby Boomers, Gen X and Gen Y respectively 2.3-times, 2.3-times and 1.5-times more likely to maintain their brand loyalty to eco-friendly brands.

-

Females are 1.3-times more likely than others to display resilient brand loyalty to eco-friendly brands.

-

Those with a bachelor’s degree or a lower-level qualification are 1.3-times more likely than those with a master’s degree or above to remain loyal to an eco-friendly brand.

-

ESG first consumers are around twice as likely to maintain loyalty to eco-friendly brands than non-ESG consumers.

In addition, it was found that income had no significant impact on the maintenance of brand loyalty to eco-friendly brands under the aforementioned conditions in any way.

Krungsri Research view

ESG issues have rapidly moved into a much more prominent position within the business environment, and companies across a broad swathe of industries are having to juggle paying much closer attention to these issues with continuing to meet varied consumer demand. This research therefore hopes to provide a more empirically grounded understanding of these topics, thereby helping businesses to make better informed decisions and to direct their operations more precisely towards meeting market demand. In particular, the following conclusions may be drawn from this work.

Firstly, around half of respondents qualified as ESG first consumers, although membership of this group was significantly influenced by an individual’s education, with the likelihood of membership increasing with educational achievement. Support for the ESG goals and for ESG-aligned goods and services also varied with the size of the company at which an individual worked and the industry within which the enterprise was active. As such, products that make an appeal to the domestic ESG market should at least initially be targeted at more educated consumers employed at large corporations in specific industries, most notably banking and finance.

Secondly, in contrast, those working outside the banking industry, consumers who completed their education with a qualification that was lower than a bachelor’s degree, and students and other younger consumers place a greater importance on social issues than on those related to the environment or good corporate governance. Companies aiming to make inroads into these consumer segments should therefore make clear their concerns with social issues and how this is related to their products. This might be achieved through concerted public relations efforts and by organizing events, which would allow businesses to connect and communicate with these segments more directly.

Thirdly, Gen X and Baby Boomer consumers typically show more engagement with ESG issues compared to other age groups, with approximately three-fifths of these demographics being part of the ESG first group. Therefore, goods or services targeting older consumers should also prioritize addressing environmental, social, and governance issues. Furthermore, given that this segment is financially secure and prioritizes health, ESG-aligned products or services targeting these groups of consumers are typically health-related or sustainable financial products. Thus, effectively communicating to them that the business values and actively practices ESG initiatives can stimulate interest and foster loyalty. Conversely, neglecting ESG issues may lead to disinterest or rejection from these affluent consumer groups who have high purchasing power.

Fourthly, in some cases, businesses may be forced to hike their prices if they release pro-ESG products or if their operations are made more ESG compliant and this then raises overheads as a result of, for example, increasing investment in environmentally friendly production, providing greater support for communities supplying inputs to the enterprise, or deciding to return a greater share of profits to society. This survey indicates that in this case, 9 out of 10 respondents would be willing to pay a higher price, and the fact that such a high proportion of consumers were prepared to do so indicates that this extends beyond the boundaries of the ESG first group. However, businesses will need to be careful not to overplay their hands, and they will have to pay close attention to the limits placed by the market on how far prices may rise to prevent losing their customer base. The survey also reveals that although higher-income consumers are more aware of and concerned with ESG issues, this does not necessarily translate into a willingness to pay a higher premium. This finding is in line with the analysis when comparing the overall level of income across genders, which shows that although women typically earn less than men, they are willing to pay a higher premium for ESG products. Therefore, companies producing goods and services that target higher-income individuals will need to exercise care in assessing the extent to which consumers will tolerate price rises and to be sure not to confuse an ability and willingness to pay with an eagerness to pay more.

Finally, questions regarding goods and services that make an effort to promote their green credentials show that the latter can deepen brand loyalty, though when the costs of maintaining this loyalty rises as a result of higher prices, increased opportunity costs, or more efforts required to express that loyalty, consumers will become increasingly susceptible to the appeals of alternative brands. Nevertheless, ESG first consumers typically demonstrate more resilient brand loyalty for green products even as the cost of doing so rises. Thus, companies that are able to penetrate the ESG first segment and, when doing so, package their green commitments in a clear and easily understood message will be much better placed to maintain their customer base if costs rise.

In summary, this research has made clear the importance of understanding how consumers view ESG issues and the extent to which they are willing to share the burden of addressing these problems, and this knowledge will then help to provide the foundation on which secure and stable growth may be built. Companies also need to actively integrate ESG principles into their operations and effectively convey the outcomes of these endeavors to consumers, who may exhibit varying levels of awareness and willingness to engage in ESG matters. By efficiently meeting these demands, businesses can attract consumers who are more inclined to support ESG initiatives to access their products and services and, at the same time, raise their profile in pro-ESG market segments. This collaboration between commerce and consumers is a key factor in unlocking the doors to success in both economic and social development, aligning with the country's sustainable development objectives moving forward.

References

Cork Gaines (2024): “Millennials and Gen Z are giving up on one of their core values and investing more like boomers”. Retrieved April 17 2024 from https://www.businessinsider.nl/millennials-and-gen-z-are-giving-up-on-one-of-their-core-values-and-investing-more-like-boomers/

Deloitte (2024): “What consumers are doing to adopt a more sustainable lifestyle”. Retrieved April 17 2024 from https://www2.deloitte.com/uk/en/pages/consumer-business/articles/sustainable-consumer-what-consumers-do.html

Hyundai Motor Company (2023): “Study confirms top lifestyle trends for European consumers are sustainability and e-mobility”. Retrieved April 10 2024 from https://www.hyundai.news/eu/articles/press-releases/top-lifestyle-trends-for-european-consumers-are-sustainability-and-e-mobility.html

Jamie Hailstone (2023): “Most Americans Still Unclear About What ESG Means, Survey Finds”. Retrieved April 17 2024 from https://www.forbes.com/sites/jamiehailstone/2023/10/17/most-americans-still-unclear-about-what-esg-means-survey-finds/?sh=5c204be64e9e

Jen Christensen (2022): “All around the world, women are better empathizers than men, study finds”. Retrieved April 17 2024 from https://edition.cnn.com/2022/12/26/health/empathy-women-men/index.html

Joeri Van den Bergh (2022): “8 out of 10 South African consumers want brands to drive change for sustainability”. Retrieved April 17 2024 from https://www.insites-consulting.com/blog/sustainability-in-south-africa/

Mark Segal (2023): “Consumers Willing to Pay 12% Premium for Sustainable Products: Bain Survey”. Retrieved April 17 2024 from https://www.esgtoday.com/consumers-willing-to-pay-12-premium-for-sustainable-products-bain-survey/

Mckinsey & Company (2023): “Consumers care about sustainability—and back it up with their wallets”. Retrieved April 10 2024 from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/consumers-care-about-sustainability-and-back-it-up-with-their-wallets

Nattapon Muangtum (2020): “Voice of Green การตลาดโลกสวย เทรนด์รักษ์โลก 2020 จาก CMMU”. Retrieved April 17 2024 from https://www.everydaymarketing.co/trend-insight/voice-of-green-marketing-cmmu-eco-trend-2020/

PwC (2022): “Empowered consumers are prepared to make changes in response to supply chain disruptions and inflation”. Retrieved April 17 2024 from https://www.pwc.com/gx/en/news-room/press-releases/2022/global-consumer-insights-pulse-survey.html

PwC (2023): “South Africa Economic Outlook What consumers are seeing on their horizon.”. Retrieved April 17 2024 from https://www.pwc.co.za/en/assets/pdf/economic-outlook/sa-economic-outlook-what-consumers-are-seeing-on-their-horizon.pdf

Zara Lightowler et al. (2022): “Unpacking Asia-Pacific Consumers’ New Love Affair with Sustainability”. Retrieved April 17 2024 from https://www.bain.com/insights/unpacking-asia-pacific-consumers-new-love-affair-with-sustainability/

ศูนย์วิจัยกสิกรไทย (2022): “ศูนย์วิจัยกสิกรไทยสำรวจพฤติกรรมผู้บริโภค “รักษ์โลก” และแนวคิดการลงทุนด้วยกรอบ ESG”. Retrieved May 3 2024 from https://thaipublica.org/2022/07/kbank-survey-esg-consumers/

สำนักงานพัฒนาวิทยาศาสตร์และเทคโนโลยีแห่งชาติ (สวทช.) (2021): “เศรษฐกิจหมุนเวียน CIRCULAR ECONOMY”. Retrieved April 23 2024 from https://www.bcg.in.th/data-center/articles/circular-economy/

Appendix

1/ Mutual funds offering tax incentives to investors help to increase the competitiveness of listed companies, particularly with regard to ESG issues https://www.sec.or.th/TH/Template3/Articles/2566/221266.pdf

2/ A central standard for classifying and grouping economic activities according to their environmental sustainability, which can then be used as a reference by interested stakeholders https://www.bot.or.th/th/financial-innovation/sustainable-finance/green/Thailand-Taxonomy.html

3/ An economic system designed to conserve and enhance the utilization of natural capital over the long term https://www.bcg.in.th/data-center/articles/circular-economy/

4/ https://www.hyundai.news/eu/articles/press-releases/top-lifestyle-trends-for-european-consumers-are-sustainability-and-e-mobility.html

5/ https://commission.europa.eu/strategy-and-policy/policies/consumers/consumer-protection-policy/key-consumer-data_en

6/ https://www2.deloitte.com/uk/en/pages/consumer-business/articles/sustainable-consumer-what-consumers-do.html

7/ https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/consumers-care-about-sustainability-and-back-it-up-with-their-wallets

8/ https://www.forbes.com/sites/jamiehailstone/2023/10/17/most-americans-still-unclear-about-what-esg-means-survey-finds/?sh=5c204be64e9e

9/ https://www.bain.com/insights/unpacking-asia-pacific-consumers-new-love-affair-with-sustainability/

10/ https://www.insites-consulting.com/blog/sustainability-in-south-africa/

11/ https://www.pwc.co.za/en/assets/pdf/economic-outlook/sa-economic-outlook-what-consumers-are-seeing-on-their-horizon.pdf

12/ This included Baby Boomers (those 60 and over), Gen X (44-59 years old), Gen Y (28-43 years old) and Gen Z (up to 27 years old).

13/ The odds ratio is used in logistic regression to evaluate the likelihood of an event occurringgiven the influence of particular other variables.

14/ This research divides companies into 2 groups: (i) those large corporations that employ over 1,000 individuals,ฃand (ii) those companies that employ up to 1,000 individuals.

15/ This survey gathered 9,069 responses from consumers aged 18 or over in 25 countries. For more details, please see: https://www.pwc.com/gx/en/news-room/press-releases/2022/global-consumer-insights-pulse-survey.html

16/ For more details, please see: https://www.everydaymarketing.co/trend-insight/voice-of-green-marketing-cmmu-eco-trend-2020/ and https://www.krungsri.com/th/research/research-intelligence/green-deposits-2024

17/ The survey was carried out jointly by Stanford University, the Hoover Institution and the Rock Center for Corporate Governance. For more details, please see: https://www.businessinsider.nl/millennials-and-gen-z-are-giving-up-on-one-of-their-core-values-and-investing-more-like-boomers/

18/ Consumers Willing to Pay 12% Premium for Sustainable Products: Bain Survey - ESG Today

19/ In January 2022, Bain & Company surveyed the opinions of 16,824 citizens in 11 countries in the Asia-Pacific region (Singapore, Australia, Japan, South Korea, Thailand, Malaysia, Vietnam, China, India, Indonesia, and the Philippines).

20/ ศูนย์วิจัยกสิกรไทยสำรวจพฤติกรรมผู้บริโภค "รักษ์โลก" และแนวคิดการลงทุนด้วยกรอบ ESG - ThaiPublica

21/ https://edition.cnn.com/2022/12/26/health/empathy-women-men/index.html

22/ Respondents answering ‘Strongly agree’ or ‘Agree’.