‘Buy Now Pay Later’ is a form of short-term credit that has gained popularity in some countries for more than a decade. BNPL is generally used to make retail purchases. After credit has been approved and a purchase has been made, buyers will be able to make repayments for this in installments.

The popularity of online BNPL has grown rapidly in many countries in recent years, especially after the outbreak of Covid-19 that triggered the widespread suspension of economic activity as countries went into lockdown. However, this was a positive for online credit issuers such as BNPL providers, since many people were forced to stop work or were laid off. These individuals thus suddenly found themselves without an income, and those without sufficient savings were left with few options other than to take out loans to pay for day-to-day expenses. In addition, as most people recognized the importance of social distancing as a way of avoiding infection, online shopping also became considerably more popular.

BNPL has also been attracting significant interest in Thailand. Several years of economic slowdown combined with the spread of COVID-19 caused the Thai economy to contract -6.1% in 2020 [1] or most severely since the 1997 Asian financial crisis. Although the economy returned to growth of respectively 1.5% and 3.3% in 2021 and 2022, the outbreak of war in Ukraine at the start of 2022 pushed inflation from just 1.2% in 2021 to 6.3% a year later.[2] Naturally, this has eaten into overall consumer spending power. Many consumers seek offhand solutions, and BNPL is one of the options to expand their purchasing power short-term.

For example, suppose that on 15 December, a rice cooker carrying a THB 1,000-price tag was on sale (Figure 1). If a shopper wanted to buy this through a BNPL scheme, she or he could apply for credit at the point of sale. Once this was authorized, the shopper would make the repayments in installments, though she or he would be required to make an initial minimum payment on the day of purchase, which might be set at 40% of the total purchase price, or THB 400. The outstanding balance of THB 600 would need to be repaid as per the credit issuer’s requirements, though this might be spread over 4 equal-sized payments made once per month, or THB 150 for each installment; and if the payments were made on schedule, no interest would be charged. Therefore, with the final payment, the THB 1,000 advanced for the rice cooker would be repaid. However, in the event that payments are made late, the credit issuer is likely to impose some kind of sanction, such as additional interest payments, the borrower being excluded from consideration for future loans, or another punishment as laid out in the loan terms and conditions.

As this example shows, the way BNPL works is very similar to buying on installments or hire-purchase agreements, which have allowed consumers to temporarily extend their purchasing power. In this case, although the buyer had only THB 400 available; by borrowing money through a BNPL system, she or he sidesteps the need to save the full THB 1,000 and is instead able to buy and to use the rice cooker. Her only obligations now are to make the repayments as agreed.

Point-of-sale BNPL services may be used to support in-store/offline sales, or they may appear in online contexts; and these BNPL plans may be provided by either the merchant itself or by a non-merchant third party.

Looking at Table 1, it is clear that model 1, the ‘Offline-Merchant’, is not a new innovation and these types of arrangements may develop entirely without reference to or reliance on modern technology. Rather, these require simply that the merchant reach an agreement with a buyer to offer goods for sale on an installment plan. However, although under model 2, the ‘Offline-3rd Party’, credit is supplied for purchases made within the merchant’s store, the company providing the BNPL services will still need to make use of technology to connect to the merchant’s point-of-sale system and to exchange digital data for underwriting. On the other hand, growth in e-commerce and more recently in mobile commerce is helping to sustain rapid growth rates for model 3, the ‘Online-Merchant’, and model 4, the ‘Online-3rd Party’, BNPL services.

Of the four types of BNPL operations described above, models 2, 3 and 4 are all highly dependent on the use of computer networks and digital technology to exchange data. Fintech companies have thus established a major presence in BNPL value chains, though for each of these models, the details differ according to the roles they play.

The role of non-merchant 3rd parties in offering BNPL services

1) Offline-Merchant:

In this model, the merchant issues credit to shoppers buying in its own stores. Fintech companies, regarded as third parties, thus have very limited role in this system. Both the type of goods sold and the means of issuing new credit are both dependent on the merchant’s own policies. Fintech’s place in this may therefore be restricted to the provision of back-office systems for merchants wishing to exploit digital technology to assist with making decisions over credit applications, or the offering of consultancy services related to BNPL systems.

2) Offline-3rd Party:

Here, although the goods are sold in a brick-and-mortar store, the BNPL services are provided by a third-party non-merchant operator; which could be a commercial bank, a non-bank, or a Fintech operation that has partnered with the merchant. To allow credit decisions to be made and to help offer services to customers, data will need to be exchanged between the merchant and the BNPL provider, and this will require linking their IT systems.

3) Online-Merchant:

In this system, merchants that operate online sales platforms and manage the release of credit to customers themselves often belong to large commercial groups and have access to significant sources of capital. In this model, if the merchant wishes to manage all aspects of operations itself, third parties may have no role to play at all. Alternatively, some merchants may hire in outsiders to help with the development of IT systems or to consult on issues related to the provision of BNPL services.

4) Online-3rd Party:

This model has become very popular nowadays. The merchant sells through online channels alongside BNPL services that are operated by third parties. BNPL products may be distributed in two basic ways: (i) using BNPL service provider’s own platform, which may be a website or a mobile app, that may sell goods from a large number of different merchants; and (ii) offering BNPL services from a fintech operation as a payment option on the merchant’s own platform.

Global growth in online BNPL services

Globally, the value of sales made through online BNPL systems reached USD 214 billion in 2022 , or around THB 7.3 trillion.[3] Given a total market value for all online retail transactions made worldwide of USD 5.72 trillion,[4] online BNPL sales thus accounted for 3.7% of all e-commerce sales.

Several research houses estimate that over 2022-2026, growth in global demand for online BNPL services will grow 40-45% annually.[5] Fintech players will occupy an increasingly important role in BNPL value chains, whether that is through building and deploying their own apps to use as platforms for the sale of goods from a number of different merchants, or by linking their platform with merchants’ apps and then offering BNPL plans to shoppers as an option when checking out.

A key driving force that accelerates growth in demand for BNPL services is the rising trend for businesses to develop super-apps that offer a wide range of goods and services for sale from many different industries. Super-apps bundle together many different services, including finance and banking, tourism, fashion, electronics, and food delivery; and so it is sometimes said of these that they “do everything for you.”

Developing super-apps really revolves around responding to normal day-to-day consumer needs. This means that super-apps need to meet consumer demand for goods and services while also offering a satisfying, easy-to-use, and seamless user experience. When a whole universe of goods is just a finger stroke away, BNPL services that temporarily increase in consumer purchasing power now evolve differently from their traditional models both conceptually and with regard to the value proposition put to consumers.

BNPL value propositions

BNPL’s Customer Value Proposition

Rapid technological progress has transformed daily life, changed patterns of demand, disrupted customer expectations, and upended consumer behavior. On the demand side, modern consumers often prefer to communicate and complete transactions through digital channels rather than by using more traditional means, these individuals thus earning the moniker ‘digital first’ consumers. While on the supply side, Fintech players have taken on a major role in the retail credit market through their transformation into providers of BNPL services.

In this space, the role of Fintech operations is not restricted simply to releasing credit through BNPL mechanisms. Rather, their role extends to include the use of online channels to offer consumers greater value than they receive from retail outlets or traditional financial institutions. One of the strengths of the Fintech industry is therefore that players are able to build platforms and apps that respond much better to the needs of digital first consumers in various aspects.

The President of Affirm, one of the leading global BNPL Fintechs, has said that the popularity of BNPL loans stems from the fact that compared to credit cards, repayment schedules are much more transparent and straightforward.[6] Affirm therefore does not impose a surcharge for late payments but instead, anyone missing a payment will be blacklisted, making it impossible for them to use Affirm BNPL services in the future.[7] Similar mechanisms are used by many other BNPL companies, meaning that each BNPL transaction becomes an opportunity to assess the credit worthiness of the purchaser.

The size of individual credit lines extended under BNPL arrangements can vary widely. Precedence Research categorizes these into small-ticket loans of up to USD 300, mid-ticket loans of USD 300-1,000, and big-ticket loans of over USD 1,000.[8] Likewise, The Economist has said that loans made by Affirm are generally in the range of USD 500 to USD 5,000 each.

From Table 2, it can be seen that the value propositions presented by Fintech players offering BNPL services will likely be successful in attracting a wide range of customers, including the following:

- Digital first consumers who have few financial assets, e.g., students and first jobbers.

- The unbanked.

- Individuals who do not have a credit card or who are unqualified for credit. In Thailand, around 25 million credit cards have been issued[9] to a population of some 70 million (and among credit card holders, most have more than one card each), which means that thereare tens of millions of Thais who still have difficulty accessing personal financial services.Given this, BNPL service providers have the opportunity to meet a significant untapped market for short-term credit to be used for the purchase of goods and services.

BNPL’s Merchant Value Proposition

BNPL Fintechs also present a significant value proposition to sellers. This is because online BNPL services tend to generate faster conversion times for sales, larger basket sizes, and fewer abandonments at checkout (i.e., customers are more likely to complete sales once they have selected items to purchase).

The experience of the US luggage company Samsonite is indicative of these benefits; after adding a BNPL payment option at the end of 2020, the average value of purchases per sale jumped by 25% in 2021.[11] A survey by PayPal carried out in November 2020 further confirms the importance of BNPL services, and among its findings, this showed that almost half of online shoppers aged 18-39 years said that they might not complete a purchase if no BNPL option was available when checking out.[12] It is therefore clear that BNPL plans play a very important role in securing online sales for merchants.

In-store or offline BNPL also plays a similarly important role for brick-and-mortar retailers. A senior manager of Sezzle, another provider of BNPL services, has revealed that comparing the repeat rate for purchases made by Sezzle customers offline and online shows that repeat purchases were 12.9% higher for offline purchases than for their online equivalent. This therefore indicates that offline BNPL could help to engage shoppers and to build greater consumer loyalty when making in-store purchases.[13]

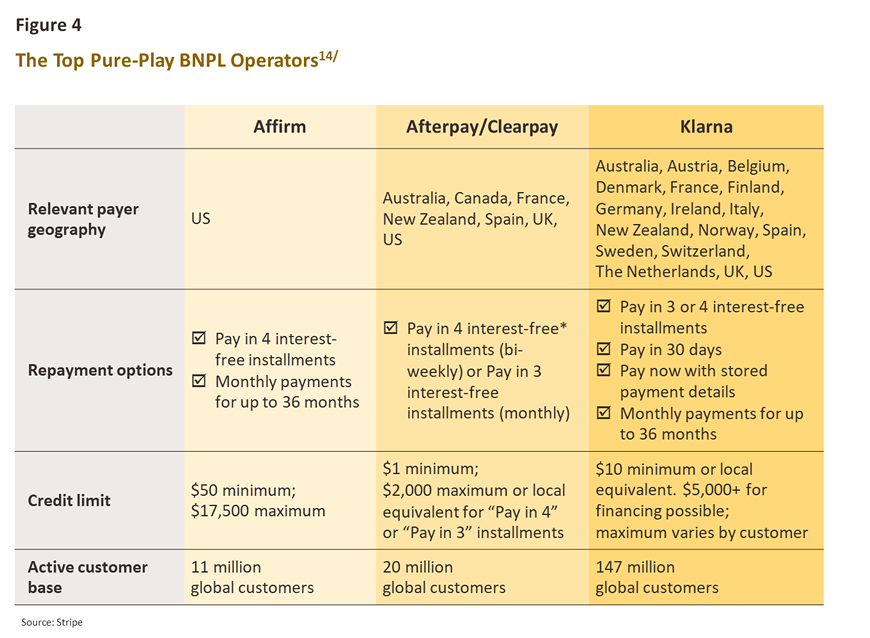

Although there are many companies that might be described as leaders within the market for short-term, unsecured BNPL-type credit, three Fintech players providing BNPL services are routinely among those most discussed. These are Klarna, AfterPay, and Affirm. All three of these have grown by developing an online BNPL platform that operates as an online-3rd party (i.e., Model 4 in Table 1) for a number of brand-name retailers. By following this route, these companies have achieved considerable success in recent years.

BNPL in the global market

Klarna – AfterPay – Affirm

Fintechs that offer BNPL services as their core business are referred to as BNPL pure-plays. Over just the past few years, Klarna from Sweden, Afterpay from Australia, and Affirm from the US have established themselves as the three leading companies in the global BNPL space.

Of these three, Klarna is the largest. The company was established in 2005 (18 years ago) and now has a customer base spread across countries around the world that numbers 147 million individuals, or almost five times the size of the combined customer bases of AfterPay and Affirm. This relative success is partly a matter of timing and first mover advantage; Klarna began offering BNPL services around a decade before its two competitors, thus the company could leverage its knowledge and a rich understanding of the industry to create competitive advantages.

The Business Cycle of Leading BNPL Players

Unfortunately, success is never permanent. Although the economic impacts of the Covid-19 pandemic had accelerated the BNPL market growth and brought the three leading companies to see their fortunes peak, significant numbers of consumers took advantage of these companies’ credit offerings. It is inevitable that debt defaults will occur. In fact, BNPL services target those with weak purchasing power or those facing financial difficulties, which exposes the BNPL providers to a high level of default risk.

In the United Kingdom, the Citizen’s Advice Bureau (CAB), a voluntary organization that provides help and advice to individuals in difficulty, estimates that in the second half of 2021, 8.3% of the UK population used BNPL services to pay for consumer goods and day-to-day necessities, including items as basic as food, shampoo, and soap. One example cited by the CAB was of a pensioner who used BNPL plans to pay for his food, despite being fully aware that he would not be able to make the repayments; he went ahead and took out BNPL loans as these were his only way of securing sufficient food.[15]

Defaults began to increase through 2021 and 2022, and in many countries, regulations began to be tightened on the release of BNPL credit. This then had the predictable consequence of slowing growth for all three pure-play BNPL providers.

A report by the management consultants Bain & Company shows that the UK’s Financial Conduct Authority (FCA), the regulator of the UK financial services industry, initially held the view that BNPL services did not qualify as a type of consumer credit and were instead regarded as a form of deferred payment credit. This was because BNPL loans are made over the short term and are generally interest free.[16] However, the UK government now plans to amend the relevant regulations and to bring at least some types of BNPL credit under the oversight of the FCA.[17]

Since the second quarter of 2022, BNPL services have been growing more slowly as reflected in the steep fall in the market capitalization of the leading pure-play BNPL Fintechs. By contrast with the confidence of the previous year, investors seem to lose confidence in the BNPL business model that they may run up against limits to growth as debt defaults rise and government regulators begin to pay much closer attention to the industry.

In June 2021, Klarna hit the major milestone of being the world’s second most valuable Fintech startup, and at that point, the company had a market capitalization of USD 45.6 billion; but within only 13 months, this had slumped to USD 6.7 billion, a seventh of its previous market high.[18] Affirm has faced a similar set of challenges and has likewise gone through the same cycle of boom and bust. Its share price that once reached USD 168.52 at the start of November 2021; but 8 months later, had crashed to USD 18.06,[19] almost an order of magnitude smaller. This has then cut Affirm’s market capitalization from USD 45.6 billion to USD 5.17 billion.[20]

Moving into 2023, BNPL Fintechs now face mounting challenges arising from likely recessions in some national economies, rising interest rates, and the continuing strength of inflationary pressures. In fact, the net effect of these will drive up the demand for BNPL services as consumer purchasing power decreases; but at the same time, consumers are likely to respond to these problems by reining in their expenditure and cutting back on non-essential purchases, which will then cut demand for BNPL credit. It therefore remains to be seen how the widely predicted global slowdown will drive the BNPL business cycle.

Super-apps and the popularity of BNPL plans

The BNPL business models seem to have proved themselves and to have been a success in some regards, and this is reflected in the extent to which players from a wide range of other industries have entered the market and now compete within it. In addition, leading tech companies have also taken the lessons learnt by BNPL Fintech players and applied these to the development of their own payment systems. For example, the US, the retail giants Walmart and Target have expanded the range of channels through which they connect with consumers by building digital wallets and then using these to reward regular customers.[22] These firms also now offer their own BNPL services.

Even PayPal, which was originally simply an online payments system, is now offering BNPL services. Indeed, the company is gradually adding other financial services to its offerings, and it is known that PayPal is in fact moving towards becoming a fully-fledged financial services super-app.

However, just as outsiders have entered the market for BNPL services, leading BNPL companies have expanded into other markets. For example, Klarna has been awarded a European banking license, and the company now plans to offer new services that are adjacent to its core BNPL offerings. These include parcel or delivery tracking, managing the return of goods ordered online, and services to check the potential greenhouse gas emissions associated with particular purchases; while over the longer term, Klarna plans to offer hotel and travel booking services together with virtual shopping services[23] that will be delivered through its app, currently also in the process of becoming another super-app.

Criticisms and controversies

Criticisms and controversies in other countries

Although BNPL services have proved to be a success with a broad range of consumer groups, the BNPL business model has come in for widespread criticism and debate has raged in the western economies on what the proper stance towards these services should be.

1) High interest rates: It has been noted that in reality, some BNPL services impose higher interest rates than do credit cards; but in response, BNPL Fintechs argue that consumers who pay for a purchase using a BNPL plan will face lower total costs than they would do if they made the same purchase on a credit card. This is because the amount of each repayment is clearly laid out, as is the whole schedule for these, which means that borrowers know exactly when repayments will be complete; while credit card issuers may impose hidden fees and the compound interest levied on late payments. The argument is therefore that BNPL loans are both cheaper and more transparent than other types of credit.

2) Creating a culture of debt: Although BNPL is just one form of short-term credit that exists alongside credit cards and other high-interest loans, there is a worry that the widespread availability of BNPL services may encourage the young and inexperienced to take on excessive debt and to develop the belief that being indebted is a perfectly normal situation. This might then encourage habitual indebtedness, and for individuals who are burdened with unsustainable levels of debt, the strain of this can be intolerable. One offramp from this problem would be for the government to partner with BNPL service providers to engage in a public awareness campaign that developed consumers’ financial literacy and built their awareness of issues related to debt. This would then help to encourage consumers to consider the extent of their future indebtedness and to prevent them spending excessively on non-essential goods.

3) The risk of fraud: BNPL payment systems may be exploited for fraud and other illegal activities. Criminals are likely to find these systems easier access than their banking counterparts, since the latter are very closely monitored and are subject to regular threat and risk assessments. Individuals or groups using BNPL systems for fraud could come from different areas; they could be consumers, professional criminals, merchants, or even untrustworthy BNPL operators themselves. In some countries, regulation of the Fintech sector has been very loose, and this may make it relatively easy to commit fraud, for example by carrying out identity theft. Stolen identities may then be used to open a fake account, purchase goods for delivery to a ‘drop address’, and then collect the goods without making any further payments. Financial systems may also be exploited for money laundering. Moreover, it is even possible that merchants may fake purchases and, through these, collect money from BNPL providers.

4) Facilitating impulse purchases: BNPL one-click shopping is extremely straightforward to use, and this makes it possible to complete a purchase in seconds. But for consumers, this may be a double-edged sword because this could encourage shoppers to buy goods or services on impulse before they have fully researched the details of the purchase or thought through its consequential financial burdens.

5) Advertising that may neglect to mention important details: Because BNPL loans are a new type of credit arrangement, many consumers may still not fully understand how the system works or what the exact loan terms and conditions are. This situation is worsened by advertising that aims to encourage indebtedness without bringing consumers’ attention to the risks inherent in taking on debt that cannot be repaid or explaining the terms and conditions under which credit is released or the consequences of missing a repayment. In many countries, government agencies are now beginning to insist that to ensure that consumers’ borrowing decisions are made in light of the full knowledge of the facts, advertising for BNPL services needs to be clearer, more balanced, and less misleading.

6) A lack of clarity over disputes and returns: Bloomberg have reported on a case of an individual who bought an expensive but allegedly genuine diamond ring online through Affirm; but on delivery, this turned out to be a fake, and so the ring was returned to the seller. The buyer then asked for Affirm’s assistance; however, the company stated that they were responsible only for the BNPL portion of the exchange, that they were unable to answer any questions about the original seller. Affirm asked the buyer to deal with the merchant directly. At the same time, the merchant denied having received the return, and this then resulted in a lengthy dispute and a protracted and involved investigation. To make matters worse, the buyer also claimed that this process had a negative impact on his credit score and that his ability to access credit had been affected.[25] This is just one example of the problems, and BNPL providers should thus move quickly to learn from the past and to develop new methods of ensuring that disputes between buyers and sellers are resolved quickly, fairly and comprehensively.

These six points of conflict have arisen in developed economies, but the lessons learnt from these can apply just as easily to the development of the BNPL market in other countries, including Thailand. This would then help to allay any fears that consumers, merchants, and the government itself may have about the industry.

BNPL in Thailand

BNPL services in Thailand

Although the Bank of Thailand (BOT) has expressed fears that growth in the BNPL industry may encourage consumers to engage in excessive spending, especially when many commercial banks and non-banks begin to offer these services; at present, the BOT believes that there is only a limited risk that the BNPL market will add significantly to overall household debt. From “Thailand Buy Now Pay Later Market Report 2022” published by Research and Markets in the fourth quarter of 2021, it is estimated that for 2022, the Thai BNPL market would be worth between THB 55 billion and THB 65 billion, or just 0.4% of all household debt.[26] Nevertheless, the situation is dynamic and the market is growing rapidly such that the most recent assessment by Research and Markets published in the third quarter of 2022 estimates that in fact, the Thai BNPL market in 2022 was worth USD 2.98 billion,[27] or THB 101 billion.[28] Moreover, the market is expected to grow at 33% annually over the next 6 years, meaning that by 2028, the market will have grown to a value of USD 16.5 billion, or around THB 562 billion.[28]

For Thais, making digital payments is increasingly becoming a normal part of daily life. Research by ACI Worldwide[29] shows that in 2021, around 9.7 billion real-time payment transactions were made in Thailand, which puts the country in third place in the global rankings, after only India and China. However, taking into account the very different population sizes of these countries and instead counting transactions per head, Thais made an average of 139 real-time digital payment transactions per person per year, compared to just 35 and 13 for India and China respectively. In addition to showing that Thai consumers are strongly disposed to complete transactions through online channels, this also indicates that Thailand’s digital infrastructure is in a healthy state and is ready to support the development of electronic payment systems.

The attitudes of the population towards digital payments and the health of the national payments infrastructure are both reflected in BOT data on the change in the number and value of transactions made through the PromptPay system between 2019 and 2022. During these years, the volume of transfers increased by an average of 77.1% annually, while the total value of PromptPay transactions increased at the lower but still extremely high annual rate of 45.5%. The most recent data available underscores the popularity of the system and so in October 2022,[30] the total value of PromptPay transactions completed nationally came to THB 3.7 trillion, or around THB 120 billion per day. This was from 1.4 billion payments made in the month (or an average of 44.8 million per day). In addition to extremely strong rates of growth in the volume and value of PromptPay transactions, the userbase has also been broadening, and the number of registered accounts has increased from 57 million in June 2021 to 70 million in June 2022, a 22.1% expansion in just one year.[31] This therefore highlights the rapid growth in the number of digital-first consumers in Thailand.

The competitive landscape

As stated above, the digital-first consumers are the key customers for the BNPL market. At present, BNPL services are widely promoted to consumers at large, with this coming from both operators that fall under the oversight of the BOT and those who are outside this, such as Fintech operations or large merchants that offer BNPL. Atome, a BNPL provider to the Thai market that is headquartered in Singapore, has said that around half of its BNPL customers are from Gen Z or millennials. These two groups comprise a significant share of all digital-first consumers, or individuals who are regular users of modern technology. Atome’s experience also highlights the potential for success in the BNPL market and having operated in Thailand for just a single year (from September 2021 to September 2022), the company’s gross merchandise value has broken through the THB 1 billion mark.[32]

Growth of BNPL is having consequences for the banking sector, and in particular for demand for or usage of credit cards and personal loans since they are competing directly to one another. On the consumer side, individuals may look completely past traditional banking products such as loans and credit cards and make purchases through BNPL services instead. For instance, BNPL Fintechs can accept payments through bank accounts, thus borrowers can make payments directly without the need to use credit or debit cards. Meanwhile, on the merchant’s side of the market, many retailers prefer to take payments through BNPL systems rather than via credit card since, in this case, the seller is able to gather valuable consumer data that allows them to better understand their consumers and their needs. When the merchant has sufficient data on its market, it will then be possible to generate additional income through upselling and cross-selling.

BNPL vs Credit Card vs Personal Loan

Consumer credit competition: Will Thailand’s experience mirror that of other countries?

BNPL loans exist within the broader category of unsecured loans, though these are more tightly defined as a kind of point-of-sale (or POS) financing that competes in the same market space as credit cards and personal loans. Table 4 gives an overview of how these different financial products compare against one another.

Because BNPL loans are relatively new to Thailand, there is as yet no research on the impact of these on the credit card industry or on issuance of personal loans. Overall, comparative research concentrates on competition in overseas BNPL markets, where the industry is in a growth phase. A review by McKinsey[33] that compared various types of retail credit revealed that in the US, point-of-sale (POS) financing enjoyed the highest growth rates of all types of unsecured lending. Thus, in 2019 prior to the outbreak of Covid-19, POS financing accounted for 7% of all unsecured credit. However, by 2023, this is estimated to have doubled and to be in the range of 13-15%. Moreover, POS financing is believed to have seen compound annual growth rates (CAGR) of 18-20% from 2020 to 2023, compared to just 8-10% CAGR for personal loans and less than 6% CAGR for credit card debt (Figure 9).

The situation in Thailand is similar to that seen overseas, and the state of competition within the market for unsecured credit resembles that in other countries. Banks and other providers of financial services that offer credit cards and personal loans are therefore beginning to feel the effects of POS financing as this increasingly fights for space in the market for retail lending. Indeed, if one compares accessing financing through BNPL plans and other forms of unsecured lending, the former is by far the easiest, quickest, most straightforward and most convenient to arrange, and this will certainly help to support future growth. In contrast to BNPL loans, applying for a personal loan or a credit card at a Thai bank involves a considerable quantity of paperwork, and applicants will need to supply a copy of their ID, confirmation of their income, monthly pay slips, bank statements, and any other documents that the bank may request. Applicants will need to submit a complete set of documents, sign the relevant forms, and then wait for their application to be either accepted or rejected. For individuals who do not have a monthly salary or who are business owners, the situation may be even worse, and they may have to submit their tax withholding certificate (this shows their income for the previous year), their commercial or company registration certificate (for business owners), and 3-6 months of bank statements from a commercial or personal bank account. In some cases, the issuer may insist that sufficient money is kept on deposit as collateral against the credit card balance, with the deposit thus equal to the account’s credit limit.

It is becoming clearer both in Thailand and abroad that banks and other financial institutions are rapidly overhauling their playbooks as they look to compete with BNPL services through increasingly using digital technology to streamline and accelerate the process of applying for credit cards and loans. Some players have even decided to enter the fight by offering their own BNPL services. For example, in the UK, NatWest has begun to offer its own BNPL plans, and consumers can now use these to buy goods for which payments are made in 4 interest-free installments without any other charges. The NatWest BNPL services are accessed through a virtual card that can be stored in an Apple Pay or a Google Pay account, and this card may be used to buy goods from both on- and offline retailers.[34] This is thus very similar to the credit card’s 0% financing scheme.

Although POS financing has been successful in stealing market share from credit cards, these two businesses may not always need to compete against one another. This is because the development of ‘hybrid BNPL’ products will go some way towards reuniting these two former antagonists. On hybrid BNPL plans, buyers can link their credit card to their BNPL account, which then allows them to easily make payments to the BNPL service provider from the card, and in the process, shoppers may also benefit from the extension of their payment terms. This is because final payment for the purchase will now be made when the credit card bill is settled, not when the BNPL payment is made.

The future of BNPL in Thailand

The prospects for Thai BNPL services will be determined by the outcome of four factors. The first of these is the strength of demand for short-term loans, though this should increase with the ongoing troubles besetting the economy. Second, the extent and intensity of competition from similar or identical products vying for space in the market for short-term credit will clearly have a major impact on outcomes. Third, success will be influenced by the development of the infrastructure required to support digital payments systems, together with the ease of access to consumer digital payment platforms. Finally, growth in the market will also be determined by the extent to which providers of BNPL services are able to develop technological solutions to the problem of providing accurate and timely assessments of creditworthiness, though this remains a challenge to be overcome and so BNPL providers will need to find a way of effectively managing the risks that result from this uncertainty.

1. Demand for short-term credit

Despite household debt hitting a high of 86.8% of Thai GDP in the third quarter of 2022 and the resulting call by the BOT to lenders to only release high-quality credit and to avoid encouraging excessive borrowing, a combination of the only partial economic recovery the recent steep uptick in the cost of living, demand for credit remains strong. Both financial institutions and non-banks are competing to develop and issue BNPL products to the public, and retail lending is showing continuing signs of strong growth that will then help to support firmer demand for BNPL services.

2. Competition in the market for BNPL services

Variations of the BNPL model have proliferated with time, both with regard to how and who players have partnered with to provide these services, and with regard to the kinds of credit services offered to consumers through online and offline channels. In addition, companies have also developed BNPL products that compete directly for the market space currently occupied by credit cards. However, some BNPL providers have taken a different track, and instead of competing with credit cards, they have decided to work with issuers to allow borrowers to make repayments via their credit cards. The dynamic of market competition thus underscores the truth of a famous saying originally made in the world of politics that “There are no permanent enemies, and no permanent friends, only permanent interests.”

In Thailand, some BNPL loans impose interest charges. In some regards, this is similar to the situation with credit cards but unlike the latter, interest is fixed and transparent, i.e., the loan agreement clearly states how much is to be repaid per installment, and so this poses a direct appeal to credit card companies’ customer base. In response and as a return challenge to BNPL service providers, many credit card companies have now started to offer promotions that allow card holders to make repayments over 3-10 interest-free installments. Some BNPL plans have also been hybridized such that individuals using these products are issued with a ‘pay-later card’ that is in fact very similar to a standard credit or debit card. Many merchants now accept payments made with these cards and this is helping to spread acceptance of this new type of credit; though these innovative BNPL plans are quite different from the original type of BNPL arrangements where short-term credit are offered at points-of-sale under pre-agreement between BNPL providers and individual merchants and which were somewhat limited in scope. In conclusion, BNPL services continue to evolve, and this evolution will likely support ongoing growth in the market.

3. Improved digital payment infrastructure and financial access

Thailand has a well-developed electronic payments infrastructure, as well as a significant digital-first consumer population who have a strong preference for making online transactions. Indeed, as stated above, the country ranks third globally on the volume of real-time payment transactions, and Thailand is thus better placed than many other countries to move further and faster along this road.

4. Ability to accurately assess borrowers’ creditworthiness

Accurately assessing borrowers’ capacity to repay loans is potentially the most troubling area for BNPL service providers operating in Thailand. At present, levels of household debt are worryingly high, and many are struggling to make their repayments; while the core BNPL business model relies on considering applications from new borrowers based on what is potentially no or only insufficient evidence of their creditworthiness. This then adds significantly to BNPL lenders’ exposure to risk, a situation that may be worsened by the intense competition that rages within the market. BNPL providers thus need to be careful when releasing new credit, and BNPL plans should not be used as a tool to recruit new customers, blindly agreed to without consideration of the attendant risk of debt default. This area thus remains a major challenge to be overcome, and it remains to be seen how market players will use current or future technology to provide the credit scoring that they need to accurately underwrite loan applications.

Challenges facing the banking sector

The Challenges

Challenge 1 ▶ BNPL hybrid products will compete directly with credit cards

BNPL providers will develop hybrid products and then use these to expand their market presence and so compete directly with credit card issuers to stimulate growth. The experience of BNPL companies overseas show that growth can fall off very sharply. In the case of Klarna in the US, the company’s customer base exploded in size in 2020, expanding by 115% from a year earlier. However, growth rates are dropping off rapidly and as Figure 9 shows, by 2023, Klarna’s customer base growth will have slowed to 15.6%, bringing its US userbase to around 40 million. Following this, the forecast is for expansion to slow even more dramatically such that between 2024 and 2026, growth will remain below 10% and will continue to decline.

Klarna clearly recognizes the danger inherent in this situation, and to help maintain growth in uptake in its services, the company has now issued the ‘Klarna Card’. This is a physical card that bears many similarities to a credit card, though repayments are made over four installments (Pay-in-four). The card can be used in any store, and so unlike earlier types of BNPL, purchases are not restricted to merchants that have already agreed to partner with a BNPL provider. Affirm, a competing BNPL pure-play operation, also offers a similar product that resembles a credit card and that allows users to buy goods for which repayments are made in four interest-free installments. These kinds of hybrid products will clearly be attractive to some consumers, some of whom will replace their credit cards with BNPL cards.

Challenge 2 ▶ Banks may be relegated to providing only basic financial services, lacking access to consumer data and falling behind in the technological arms race

If consumers switch from using traditional banking products (e.g., credit cards) and instead take advantage of BNPL offerings made by merchants or Fintechs, the market for banking services may shrink to just the provision of basic facilities such as making deposits, withdrawals and transfers. This would then block off access to a rich seam of consumer data that provides banks with insight into consumer demand, including their lifestyle choices and patterns of consumption. When banks miss the opportunity to analyze consumer preferences, there can be a delay in understanding consumer problems or in developing new products; and as a result, they may not be able to speedily response to consumer needs and may lose competitiveness.

By contrast, Fintechs and large merchants that develop their own super-apps for use alongside their BNPL services will gain expertise in the retail credit market and in how best to address consumer demand within this. These companies would then amass significant stores of data and as they expanded their corporate expertise in exploiting this, they would be able to use this to bring consumer problems to light and then use technology to develop new products that helped to solve consumers’ problems. In this situation, if banks are not able to keep pace with developments, they will surely see their customer base eroded.

Challenge 3 ▶ From BNPL to “be NPL”

Although banks can develop and offer their own BNPL services, and through these compete for market share, the situation with household debt remains troubling in Thailand and this clearly represents a major challenge. Debt default is a significant problem within the industry since however BNPL products may be designed or marketed, the fact remains that at their core, they are just another form of ‘unsecured credit’, and this necessarily carries with it the risk that borrowers will not follow through on their requirement to meet the repayment schedule.

In fact, the BOT data shows that as of the end of the third quarter of 2022, the nation’s outstanding credit card balance came to THB 456 billion, with outstanding personal loans under the BOT supervision (excluding loans secured against autos) adding another THB 586 billion to the total.

The National Credit Bureau (NCB) says that as of the same period, 25 million debtors were on their records and that non-performing auto and personal loans were the most worrying. Within personal loans, the combined total of bad loans, that is non-performing and ‘special mention’ loans, came to 13.2% of the total. This is unpleasantly high and indicates that in the future, borrowers may be less able to make their repayments.[36]

Our view: Opportunities for commercial banks as BNPL gains ground in Thailand

Opportunities for commercial banks

At present, Thai commercial banks are presented with three choices through which they may participate in the BNPL market.

1) Enter the BNPL market: Banks may offer BNPL products directly to the market using pre-existing channels to introduce these to customers. In Thailand, examples of this includes ‘K Pay Later’ by Kasikornbank, ‘SCB PAY LATER’ by Siam Commercial Bank, and ‘LHB You’ application by LH Bank, which will bundle BNPL plans into the services that are on offer.[37] For their customers, these kinds of banking products may represent a significant value proposition, and consumers may have a noticeable preference for these over Fintech BNPL plans.

2) Form a join venture or partner with a Fintech: Banks may form joint ventures or business partnerships with Fintech companies to jointly develop a payments system and then to offer BNPL plans to their existing customer base. An example of this is ‘LINE BK’, a joint venture between Kasikornbank and Line (operators of the Line chat app), which has a combined customer base of more than 60 million.[38] These kinds of projects can also be undertaken by companies spun off from the parent bank, as is the case with SCB’s CardX, which is currently negotiating a joint venture with an overseas company to provide BNPL services on e-commerce platforms.[39]

3) Provide financial services or related back-office systems to merchants or BNPL Fintechs:

Banks may also provide financial services or the back-office systems necessary to facilitate payments to merchants or BNPL Fintechs but without themselves entering the market and competing directly. This represents an interesting possibility, given the many different BNPL players now active in the market. These include the following groups.

3.1 BNPL Fintechs: The Singapore-based Atome is an example of pure-play BNPL providers that, at present, offers BNPL on online shopping platforms such as Agoda.

3.2 Online merchants: especially those developing super-apps e.g., (i) SPayLater from Shopee, (ii) LazPayLater from Lazada, (iii) PayLater by Grab, and (iv) Pay Next from True Money.

3.3 In-store merchants: Merchants that offer BNPL plans to help with their in-store sales include Srisawad The Power, a retailer of electrical appliances that offers BNPL services as a major selling point; and SINGER x FN Living Space, a retailer of furniture and electrical appliances made by Singer and FN.

In any case, commercial banks that wish to enter and capture a share of the BNPL market directly (choice 1 above) will need to have both a strong IT capability required for participation in this industry and a customer base that is sufficiently broad to support the investment overheads that are entailed by this approach. In the absence of this, engaging in a partnership or joint venture with a Fintech company that has the requisite expertise and flexibility (choice 2) or simply providing back-office services (choice 3) would be preferable.

As 2023 begins, when many commercial banks, non-banks, platform providers, and merchants, simultaneously decide to enter the BNPL market and try to stake out their claims to this new territory; the Thai market will henceforth certainly prove to be lively, dynamic, and much contested. However, underneath the surface churn, it remains to be seen which players have been able to learn the lessons taught by overseas BNPL markets and to use this to build the foundations required to support solid and sustainable business growth.

References

Allied Market Research (July 2021) Buy Now Pay Later Market Outlook 2030. Retrieved October 2, 2022 from https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

ACI worldwide (April 26, 2022) Press Release. “Real-Time Payments Evolution Underway as Asia-Pacific Seeks New Growth Frontiers”. Retrieved September 1, 2022 from https://investor.aciworldwide.com/news-releases/news-release-details/real-time-payments-evolution-underway-asia-pacific-seeks-new

BrandAge online (December 2, 2022) “มีไทยพาณิชย์ แล้ว ทำไมถึงต้องมี “คาร์ด เอกซ์” ค้นคำตอบจากปากของ สารัชต์ รัตนาภรณ์”. Retrieved Dec 3, 2022 จาก https://www.brandage.com/article/33608

Business Wire (July 19, 2022) “Affirm Research Reveals Americans Trust Their Ex More Than Their Credit Card Company”. Retrieved October 30, 2022 from https://www.businesswire.com/news/home/20220719005552/en/Affirm-Research-Reveals-Americans-Trust-Their-Ex-More-Than-Their-Credit-Card-Company

CompaniesMarketCap.com (2022) Affirm and Afterpay Market Capitalization. Retrieved November 14, 2022 from https://companiesmarketcap.com/affirm/marketcap/ and https://companiesmarketcap.com/afterpay/marketcap

Deprez, E Esmé; Weinberger, Evan and Surane, Jennifer (July 28, 2022) “The Buy Now, Pay Later Juggernaut Is About to Be Tested”. Bloomberg. Retrieved September 12, 2022 from https://www.bloomberg.com/news/features/2022-07-28/klarna-affirm-afterpay-face-scrutiny-over-credit-business

Dikshit, Puneet et al. (July 29, 2021) “Buy now, pay later: Five business models to compete”. McKinsey & Company. Retrieved October 7, 2022 from https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

Downes, Hannah (November 29, 2022) “Buy now, pay later schemes explained”. Which? web. Retrieved December 5, 2022 from https://www.which.co.uk/money/credit-cards-loans/credit-cards/buy-now-pay-later-schemes-explained-aI8qz1J5BKC0

eMarketer (June 2022) “Retail E-commerce Sales Worldwide, 2021-2026” Insiderintelligence.com Web. Retrieved October 30, 2022 from https://www.insiderintelligence.com/content/worldwide-ecommerce-growth-drops-single-digits-while-overall-retail-muddles-through

FCA (February 14, 2022) Press Release. “FCA secures contract changes for buy-now-pay-later customers”. Retrieved November 11, 2022 https://www.fca.org.uk/news/press-releases/fca-secures-contract-changes-buy-now-pay-later-customers

FinTech Global (January 28, 2022) “Buy Now, Pay Later providers bite back to debt critics”. Retrieved September 12, 2022 from https://Fintech.global/2022/01/28/buy-now-pay-later-providers-bite-back-to-debt-critics/

GlobalData (May 26, 2022) “‘Buy Now Pay Later’ global transaction value reached $120 billion in 2021, according to GlobalData”. Retrieved October 2, 2022 from https://www.globaldata.com/media/banking/buy-now-pay-later-global-transaction-value-reached-120-billion-2021-according-globaldata/

Lebow, Sara (November 17, 2022) “Where does Klarna go after its user boom ends?”. InsiderIntelligence web. Retrieved December 1, 2022 from https://www.insiderintelligence.com/content/where-klarna-go-after-its-user-boom-ends

Levine, Joshua (September 23, 2021) “Inside Klarna CEO Sebastian Siemiatkowski’s Striking Home”. The Wall Street Journal. Retrieved September 12, 2022 from https://www.wsj.com/articles/klarna-ceo-sebastian-siemiatkowski-home-11632400195

LH Bank News (November 9, 2022) “LH Bank มุ่งสู่ดิจิทัลแพลตฟอร์ม ชูแอป Profita และ LHB You”. Retrieved November 15, 2022 from https://www.lhbank.co.th/th/about-us/news/news-09112022/

Market Plus (5 July 2021) “LINEBK - ช้อปปี้ - อิออน เปิดเกมเขย่าตลาดสินเชื่อดิจิทัล”. Retrieved December , 2022 from https://www.marketplus.in.th/content/detail.php?id=8889

Nasdaq.com (2022) Affirm holdings historical data. AFRM Historical Data. Retrieved November 15, 2022 from https://www.nasdaq.com/market-activity/stocks/afrm/historical

O’BRIEN, Amy (August 8, 2022) “What goes up must come down: A journey through Klarna’s valuation history”. Sifted backed by Financial Times. Retrieved November 14, 2022 from https://sifted.eu/articles/klarna-FinTech-valuation-timeline/

PayPal (April 2021) TRC online survey commissioned by PayPal. Retrieved November 10, 2022 from https://www.volusion.com/payments/paypal-checkout/pay-later

Precedence Research (2021) Buy Now Pay Later Market Report. Retrieved October 2, 2022 from https://www.precedenceresearch.com/buy-now-pay-later-market

PYMNTS (February 8, 2022) “Buy Now, Pay Later Goes Full Circle With Re-Focus on In-store Transactions”. Retrieved October 23, 2022 from https://www.pymnts.com/buy-now-pay-later/2022/buy-now-pay-later-goes-full-circle-with-re-focus-on-in-store-transactions/

Straits Research (2021) Buy Now Pay Later Market Snapshot. Retrieved October 2, 2022 from https://straitsresearch.com/report/buy-now-pay-later-market

Stripe (2022) “An introduction to buy now, pay later payment methods”. Retrieved November 10, 2022 from https://stripe.com/en-th/guides/buy-now-pay-later

The Economist (April 7, 2022) “Britons’ use of consumer credit is rising with the cost of living”. Retrieved September 12, 2022 from https://www.economist.com/britain/2022/04/07/britons-use-of-consumer-credit-is-rising-with-the-cost-of-living

The Economist (August 4, 2018) “Tech startups are reviving point-of-sale lending”. Retrieved September 15, 2022 from https://www.economist.com/finance-and-economics/2018/08/04/tech-startups-are-reviving-point-of-sale-lending

The Economist (March 25, 2021) “America used to be behind on digital payments. Not anymore”. Retrieved September 12, 2022 from https://www.economist.com/finance-and-economics/2021/03/25/america-used-to-be-behind-on-digital-payments-not-any-more

The MoneyPot podcast (January 25, 2022) “BNPL: The Millennial Payment Method Comes of Age”. Retrieved November 18, 2022 from https://www.money2020.com/content/moneypot/the-millennial-payment-method

Tijssen, Jeff and Garner Ryan (October 19, 2021) “Buy Now, Pay Later Moves Center Stage with Consumers and Regulators”. Bain & Company. Retrieved November 10, 2022 from https://www.bain.com/insights/center-stage-with-consumers-and-regulators-bnpl-report-2021

World Bank (June 29, 2022) Press Release “COVID-19 Drives Global Surge in use of Digital Payments”. Retrieved November 15, 2022 from https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments

Yahoo! Finance (November 1, 2022) “The Thailand Buy Now Pay Later Gross Merchandise Value is Expected to Reach $16.5 Billion by 2028”. Retrieved November 3, 2022 from https://finance.yahoo.com/news/thailand-buy-now-pay-later-153000457.html

กรุงเทพธุรกิจ (13 ธันวาคม 2565) “ธปท. หวั่น ‘สินเชื่อซื้อก่อนผ่อนทีหลัง’กระตุ้นครัวเรือนใช้จ่ายเกินตัว” Retrieved 13 December 2022 from https://www.bangkokbiznews.com/finance/investment/1042564

กรุงเทพธุรกิจ (2 ธันวาคม 2565) “เครดิตบูโร ห่วงลูกหนี้ ‘เจนวาย-เอ็กซ์’กว่า 5ล้านบัญชีเบี้ยวหนี้พุ่ง”. Retrieved December 3, 2022 from https://www.bangkokbiznews.com/finance/investment/1040998

ธนาคารแห่งประเทศไทย (2563) รายงานภาวะเศรษฐกิจไทย ปี 2563. Retrieved October 23, 2022 from https://www.bot.or.th/Thai/MonetaryPolicy/EconomicConditions/AnnualReport/AnnualReport/AanualReport2563.pdf

ธนาคารแห่งประเทศไทย (กันยายน 2563) รายงานนโยบายการเงิน. Retrieved October 23, 2022 from https://www.bot.or.th/Thai/MonetaryPolicy/MonetPolicyComittee/MPR/DocLib/MPRThai_September2565.pdf

ธนาคารแห่งประเทศไทย (ข้อมูลปรับปรุงล่าสุด 10 ตุลาคม 2565) การให้บริการบัตรเครดิตแยกตามประเภทบัตรเครดิต. Retrieved November 27, 2022 from https://www.bot.or.th/App/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=757&language=TH

ธนาคารแห่งประเทศไทย (ข้อมูลปรับปรุงล่าสุด 30 ธันวาคม 2565) ธุรกรรมการโอนและชำระเงินผ่านบริการพร้อมเพย์. Retrieved January 3, 2023 from https://www.bot.or.th/App/BTWS_STAT/statistics/ReportPage.aspx?reportID=921&language=th

ประชาชาติธุรกิจ (29 สิงหาคม 2565) “พร้อมเพย์พุ่ง 70 ล้านหมายเลข เร่งสปีดธุรกรรม หมื่นรายการ/วินาที” Retrieved November 4, 2022 from https://www.prachachat.net/finance/news-1031622

ผู้จัดการออนไลน์ (30 ตุลาคม 2565) “Atome ยอดทะลุพันล.ในปีแรก ขยายกลุ่มท่องเที่ยว-ไลฟ์สไตล์”. Retrieved November 21, 2022 from https://mgronline.com/business/detail/9650000103546

[1] Thailand’s economic status report 2020 by the Bank of Thailand

[2] Monetary policy Q3 report , September 2022, by the Bank of Thailand

[3] Calculated at 34 THB/USD

[4] eMarketer Analyst Report, June 2022

[5] Estimates from several research centers such as GlobalData, Straits Research, Allied Market Research and Precedence Research

[6] Libor Michalek, the current President of Affirm (former President of Technology, Risk and Operations), commented in an interview. Retrieved from https://www.businesswire.com/news/home/20220719005552/en/Affirm-Research-Reveals-Americans-Trust-Their-Ex-More-Than-Their-Credit-Card-Company

[7] ‘Tech startups are reviving point-of-sale lending’, published 4 August 2018, The Economist

[8] https://www.precedenceresearch.com/buy-now-pay-later-market

[9] The BOT database (updated 10 October 2022) reported that the number of credit card services as of August 2022 was 25,476,943 accounts in total.

[10] Worldbank Press Release ‘COVID-19 Drives Global Surge in use of Digital Payments’ published on June 29, 2022

[11] David Oksman, VP of Marketing and eCommerce at Samsonite, interviewed on January 25, 2022, in The MoneyPot podcast on the topic “BNPL: The Millennial Payment Method Comes of Age”

[12] https://www.volusion.com/payments/paypal-checkout/pay-later/

[13] https://www.pymnts.com/buy-now-pay-later/2022/buy-now-pay-later-goes-full-circle-with-re-focus-on-in-store-transactions/

[14] https://stripe.com/en-th/guides/buy-now-pay-later

[15] https://www.economist.com/britain/2022/04/07/britons-use-of-consumer-credit-is-rising-with-the-cost-of-living

[16] https://www.bain.com/insights/center-stage-with-consumers-and-regulators-bnpl-report-2021/

[17] https://www.fca.org.uk/news/press-releases/fca-secures-contract-changes-buy-now-pay-later-customers

[18] https://sifted.eu/articles/klarna-FinTech-valuation-timeline/

[19] Historical stock prices of Affirm Holdings from Nasdaq.com ‘AFRM Historical Data’ https://www.nasdaq.com/market-activity/stocks/afrm/historical

[20] Historical company value of AFRM and APT.AX from https://companiesmarketcap.com/affirm/marketcap/ and https://companiesmarketcap.com/afterpay/marketcap

[21] https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments

[22] https://www.economist.com/finance-and-economics/2021/03/25/america-used-to-be-behind-on-digital-payments-not-any-more

[23] https://www.wsj.com/articles/klarna-ceo-sebastian-siemiatkowski-home-11632400195

[24] https://Fintech.global/2022/01/28/buy-now-pay-later-providers-bite-back-to-debt-critics/

[25] https://www.bloomberg.com/news/features/2022-07-28/klarna-affirm-afterpay-face-scrutiny-over-credit-business

[26] https://www.bangkokbiznews.com/finance/investment/1042564

[27] https://finance.yahoo.com/news/thailand-buy-now-pay-later-153000457.html

[28] Calculated at 34 THB/USD

[29] https://investor.aciworldwide.com/news-releases/news-release-details/real-time-payments-evolution-underway-asia-pacific-seeks-new

[30] https://www.bot.or.th/App/BTWS_STAT/statistics/ReportPage.aspx?reportID=921&language=th

[31] https://www.prachachat.net/finance/news-1031622

[32] https://mgronline.com/business/detail/9650000103546

[33] https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

[34] https://www.which.co.uk/money/credit-cards-loans/credit-cards/buy-now-pay-later-schemes-explained-aI8qz1J5BKC0

[35] https://www.insiderintelligence.com/content/where-klarna-go-after-its-user-boom-ends

[36] https://www.bangkokbiznews.com/finance/investment/1040998h

[37] https://www.lhbank.co.th/th/about-us/news/news-09112022/

[38] https://www.marketplus.in.th/content/detail.php?id=8889

[39] https://www.brandage.com/article/33608