Introduction

The stream of new technologies flooding into everyday life shows no signs of abating, and among the most recent of these, artificial intelligence (or AI) has been one of the most prominent. Discussion around the impacts of AI has been very widespread, and AI technologies have rapidly found uses across almost all parts of the economy, The rise of Generative AI (GenAI), or 'creative artificial intelligence,' which can perform various tasks such as content creation, summarization, translation, human interaction, coding, data analysis, and providing recommendations, has prompted many industries, including the banking sector, to explore how AI can be leveraged to develop innovative customer service solutions." Amidst intense competition, data-driven banks can utilize AI to interact with customers by analyzing and processing large volumes of data. This allows for quick and accurate predictions of individual customer needs, enabling banks to offer tailored financial products or services that precisely meet customer requirements. This approach, known as “Hyper-personalization”, allows banks to cater to each customer as if they fully understand their preferences."

What is hyper-personalization and why does it matter?

In the modern era, people seek products or services that align with their lifestyles and express their unique individuality. This has led businesses to deeply understand customer behavior in order to ensure that their products and services can fully and accurately meet the needs of each customer. Since a greater understanding of consumer demand translates into improved business opportunities, the outcome of these changing conditions is that companies need to gain greater insight into individual consumer behaviors and to ensure that their offerings target these in the most comprehensive way possible.

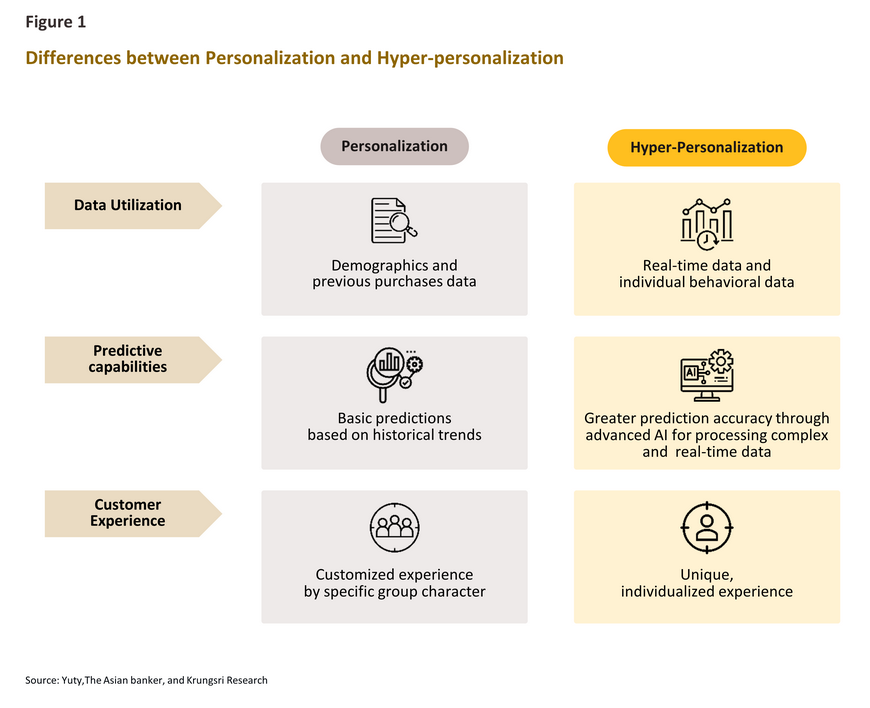

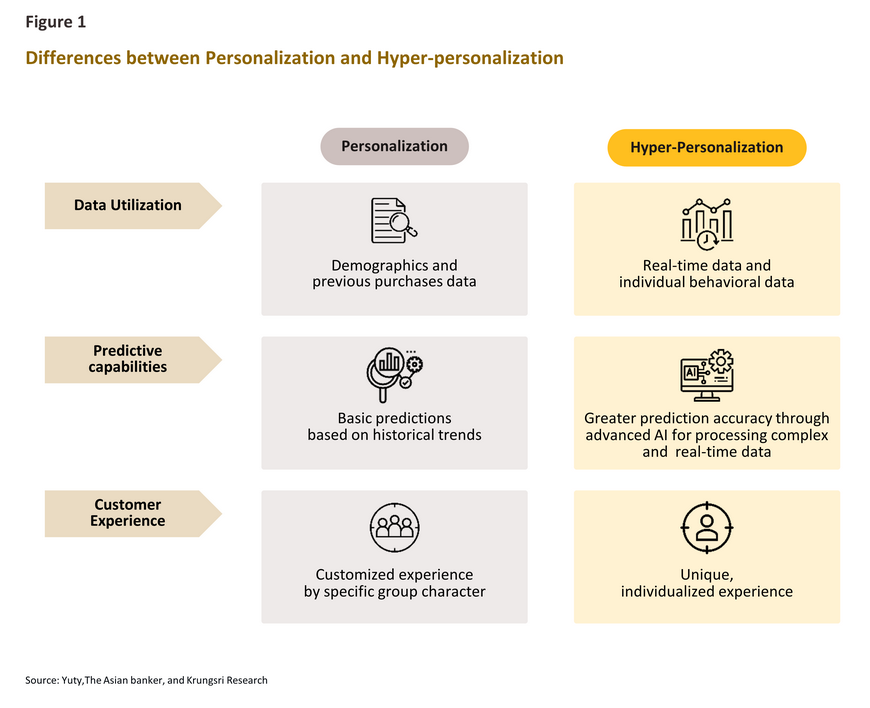

In recent times, personalized marketing strategies have gained significant popularity. Businesses often analyze historical data related to consumers on a group or individual basis, and then offer products or services that specific groups or individuals may be interested in. This approach is known as personalization. This might include, for example, sending out personalized emails or messages to customers that recommend products based on an analysis of known preferences, behaviors, purchasing records, and search histories.

However, these older approaches to personalization, which segment the market based on broader demographic considerations such as sex, age, income, or preferences and likes, and that are based solely on a consideration of historical data, are not capable of accurate. As a result, businesses are exploring new ways of gaining in-depth, individualized consumer insight and then using this to fine-tune their offerings to the personal needs of particular consumers. This has then fed into the development of ‘hyper-personalization’, a new approach called hyper-personalization, which is a more advanced and effective form of personalized marketing, has emerged, offering businesses the ability to create a stronger impression on customers. The key driver of this strategy is the use of AI to process big data in real-time, enabling businesses to gain a deeper understanding of customer needs., for example, shopping and browsing behavior, financial habits, lifestyles and interests, current location, and preferred purchasing channels.

Hyper-personalization depends on the sequential use of a range of technologies and approaches. (i) The collection and aggregation of big data that provide an in-depth profile of individual consumer identities, preferences and behaviors (the ‘who’ and the ‘what’). (ii) The processing and precise prediction of customer needs allow companies to engage in accurate forecasting of consumer demand, which can then be used to build product and service offerings and to develop personalized promotions and recommendations that respond precisely to demand at the individual level (the ‘what’s next’). (iii) Finally, marketing content can be generated on the fly according to individual circumstances and needs. Hyper-personalization therefore offers companies the possibility of developing much more firmly grounded and individualized customer relations, and to do so in real time. For example, if a customer is considering buying a new car and is in the process of test-driving one with a dealer, a bank can now instantly and automatically prepare a promotion offering auto loans or appropriate financial advice tailored to that individual’s circumstances and then send this to him or her via email or SMS, or through a banking app.

Widespread interest in hyper-personalization

Because hyper-personalization opens the way for businesses to build competitive advantage, interest in the area is growing and many companies plan to develop their abilities in this area. Brainy Insights thus estimates that while the global market for hyper-personalization had a value of USD 18.9 billion in 2023, this will rise to USD 74.8 million by 2033,1/ thus growing by some 41% CAGR in the period. Similarly, a 2023 survey by MMA Global2/ found that since this was a favored way of building customer engagement and loyalty, 44% of companies worldwide planned to expand their dependence on individually targeted goods and services.3/

One prominent example of how hyper-personalization frameworks and processes can be deployed is provided by Netflix, the global provider of entertainment streaming services. Netflix uses AI to understand and analyze data drawn from customer interactions, including when users typically consume streaming services, the devices that they use for this, and when they may skip or pause programs. This allows the company to tailor the films, series or other content that it suggests to viewers, and to do so day-by-day as the AI anticipates how a viewer’s interests or consumption of media is likely to change. Moreover, as AI has become more advanced, Netflix has been able to extend its capabilities in this area, most recently moving into the development of a large language model (LLM)4/ that powers a chatbot giving conversational recommendations to viewers.5/ This thus helps to add value to the viewing experience , and indeed Deloitte estimates that a full 60% of Netflix’s income stems from its efforts to build a hyper-personalized experience.6/

Many other companies are deploying hyper-personalization technologies and techniques to likewise build an improved customer experience and to develop new business opportunities, though these changes are particularly clear within the retail sector. One example of this within the Thai context is Lotus’s and its My Lotus’s app, which uses AI to support big data analytics capabilities. Because this then provides the company with much clearer insight into consumer behavior, Lotus’s is better able to generate targeted promotions for consumers that track the changing demands of particular shoppers.7/

AI’s role in hyper-personalization

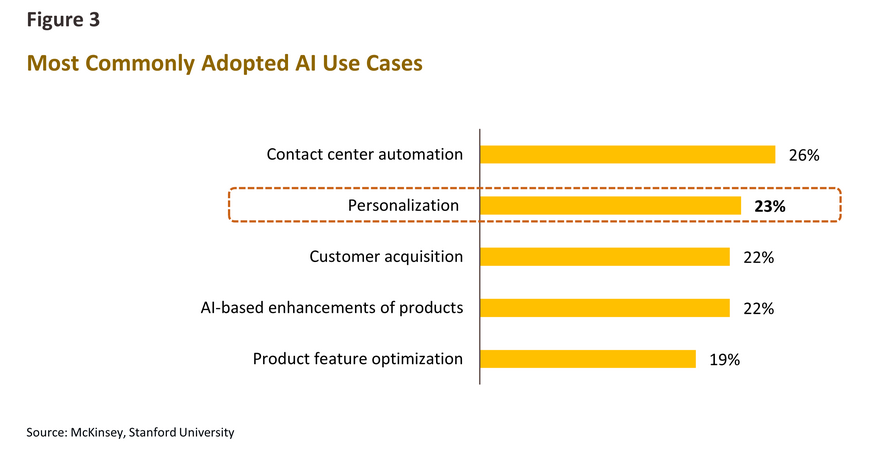

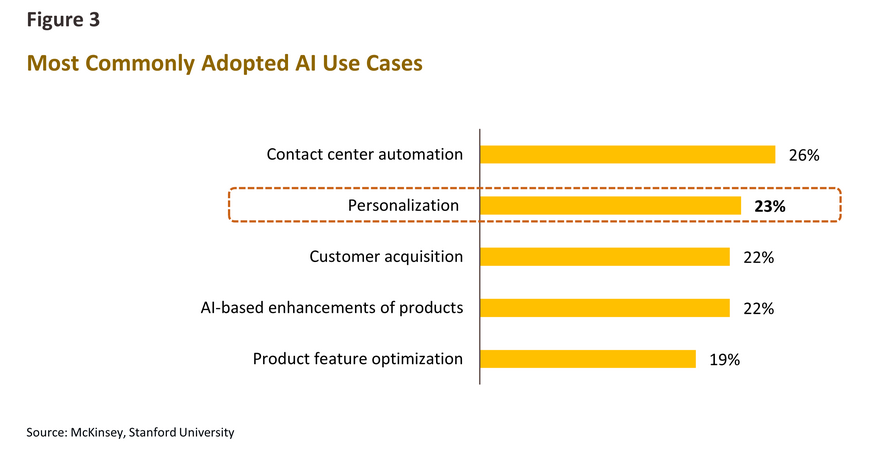

A survey conducted by McKinsey & Company and Stanford University in 2023 found that globally, more than a quarter of companies had decided to use AI to help develop the goods and services that they sold, and that AI is playing a greater role in sales and marketing. In detail, 23% of companies were now using AI to personalize marketing efforts, the second most common use of AI after contact-center automation (Figure 3).8/

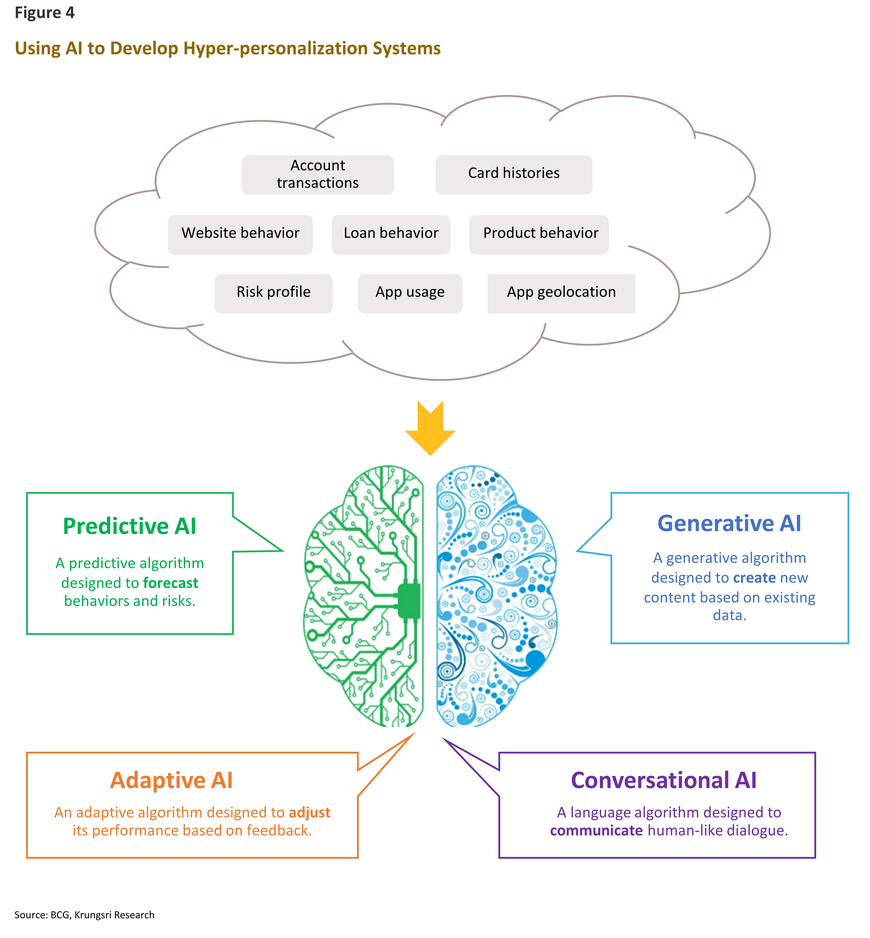

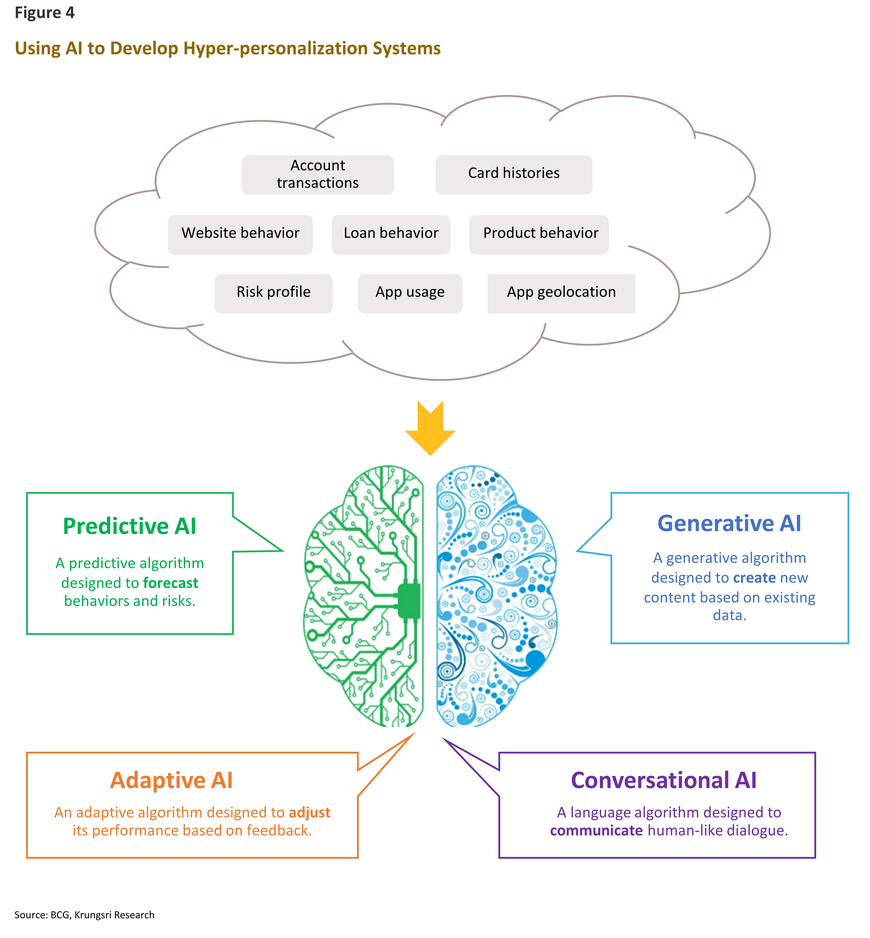

As described above, AI has a central role to play in hyper-personalization processes, partly because the technology is able to undertake the analytical and creative tasks traditionally associated with respectively left- and right-brain activities in humans. In detail, the following AI subfields are making a major contribution to hyper-personalization.

-

Predictive AI (PreAI) assists business decision making by helping to provide expert assessment of the possibility or likelihood of particular outcomes occurring. This is thus a typically left-brain activity covering logic, calculation and assessment. Within the domain of hyper-personalization, PreAI is used as a tool to help businesses analyze and understand their customer base and to provide in-depth insight into market demand. This can also be used to determine the offers best suited to individual customers.

-

Generative AI (GenAI)9/ particular abilities lie in its capacity to generate novel and creative responses to inputs. This includes areas such as creating new content that matches a consumer’s interests or designing a customer journey through all stages from an individual’s initial contact with the company to their becoming a customer of it. This thus parallels traditional right-brain activities that are creative or that require the adoption of a holistic perspective. In addition, GenAI is able to interact with human users using natural language, typically via a chatbot, and so GenAI is now being used to power virtual assistants that can instantly respond to customer queries or other types of instructions.

In addition to the two types of AI described above, other AI types may also be used to improve the development of hyper-personalization. One of these is Adaptive AI, which is able to evolve by incorporating historical data or experiences into its modeling processes, and because this allows these systems to adapt intelligently to novel situations, these can be deployed across a wide range of use cases. Adaptive AI thus offers additional benefits in terms of developing customer relations and responding to customer queries, and in better targeting personalized advertising.10/ Conversational AI also has a role to play here, and as its name suggests, this allows AI to instantly converse with customers with markedly differing needs or interests. The capabilities offered by these AI systems are thus helping both to make hyper-personalization a reality and to improve its responsiveness to consumer demand.

AI and hyper-personalization in the banking industry

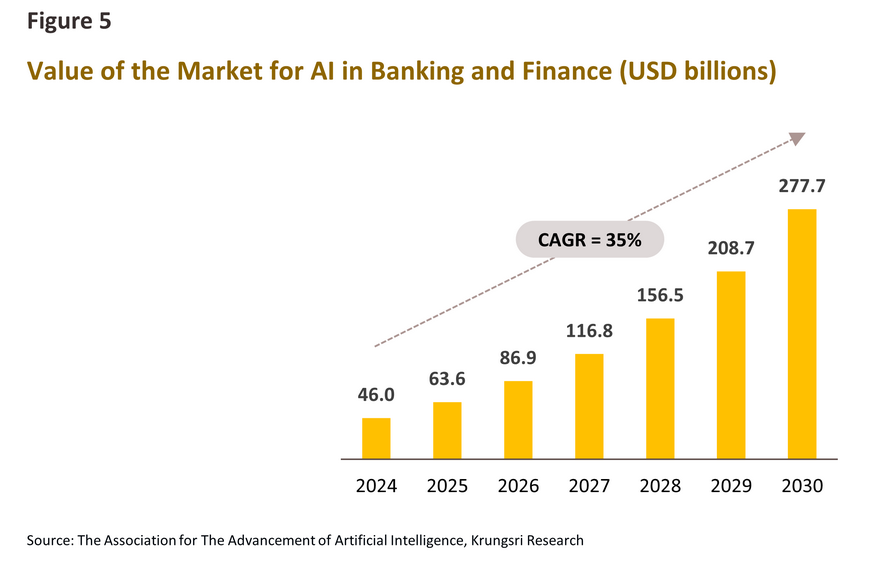

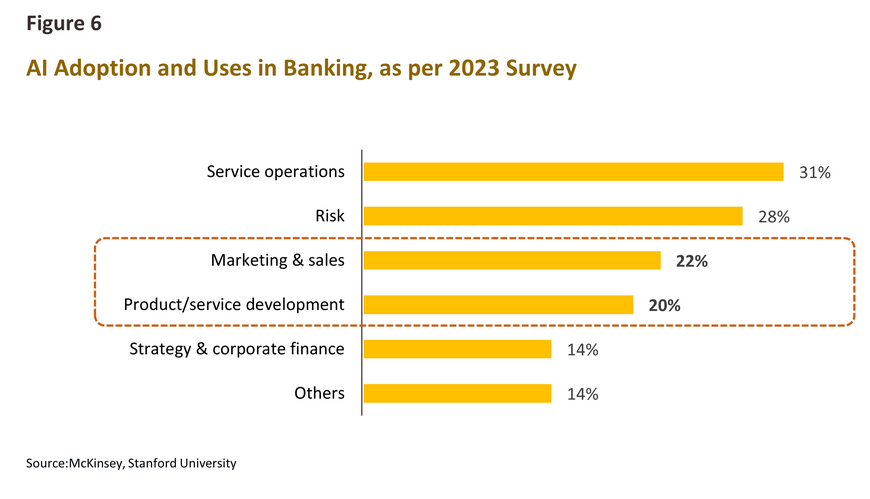

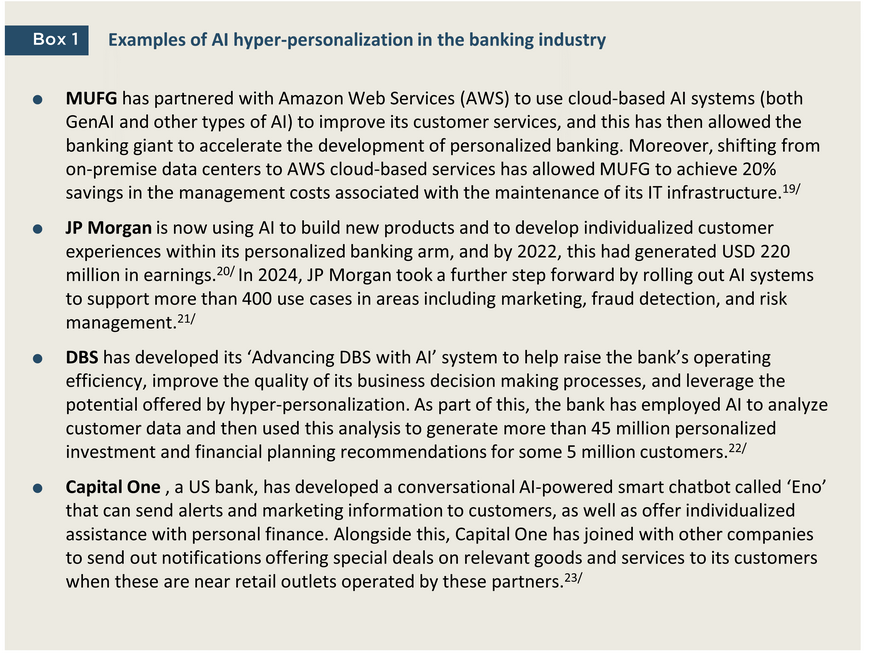

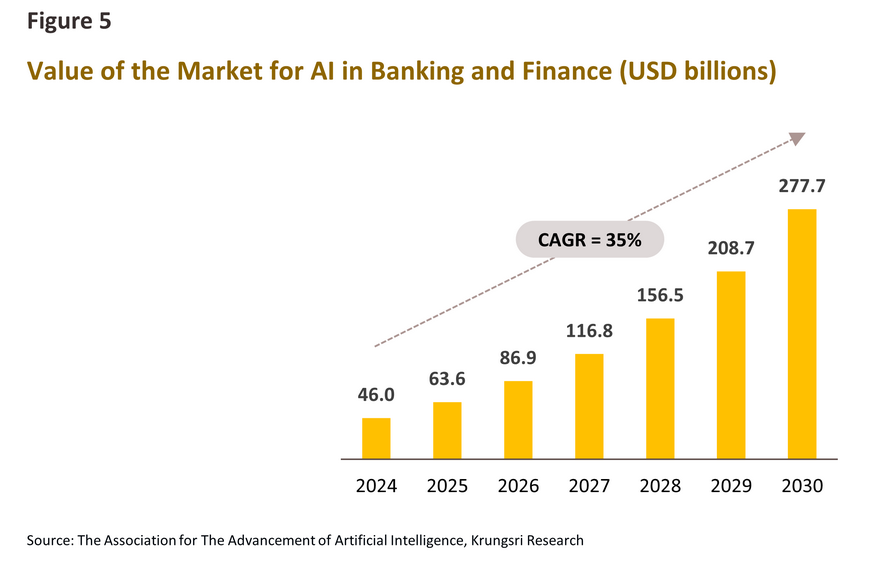

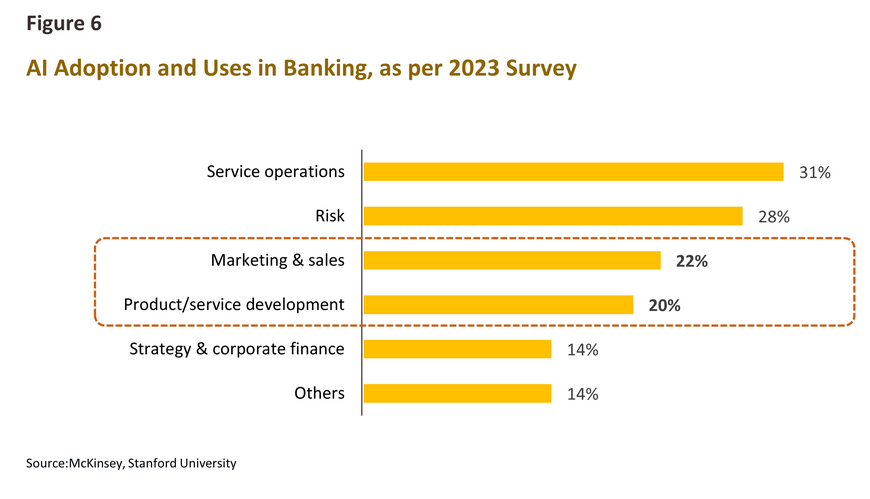

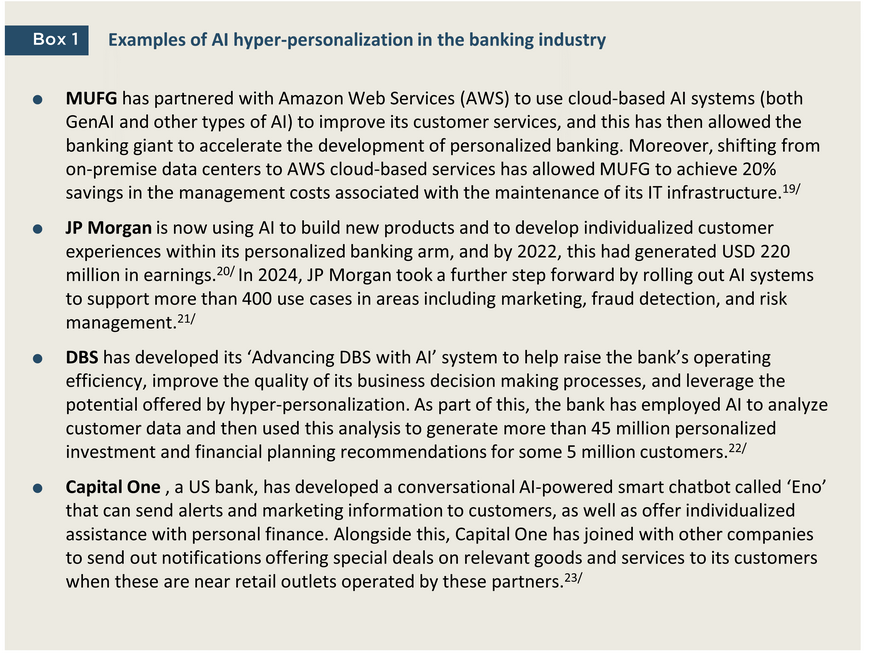

Over the past few years, banks have been stepping up their investments in AI, and so the Association for The Advancement of Artificial Intelligence estimates that from a value of USD 46 billion in 2023, the value of the banking AI market will grow by some 35% CAGR to a total of around USD 277 billion by 203311/ (Figure 5). The 2023 McKinsey and Stanford survey cited above also shows that more than 1 in 5 players in the financial services industry are using AI in sales and marketing, and in the development of goods and services connected to hyper-personalization (Figure 6).

The role of hyper-personalization in the banking industry

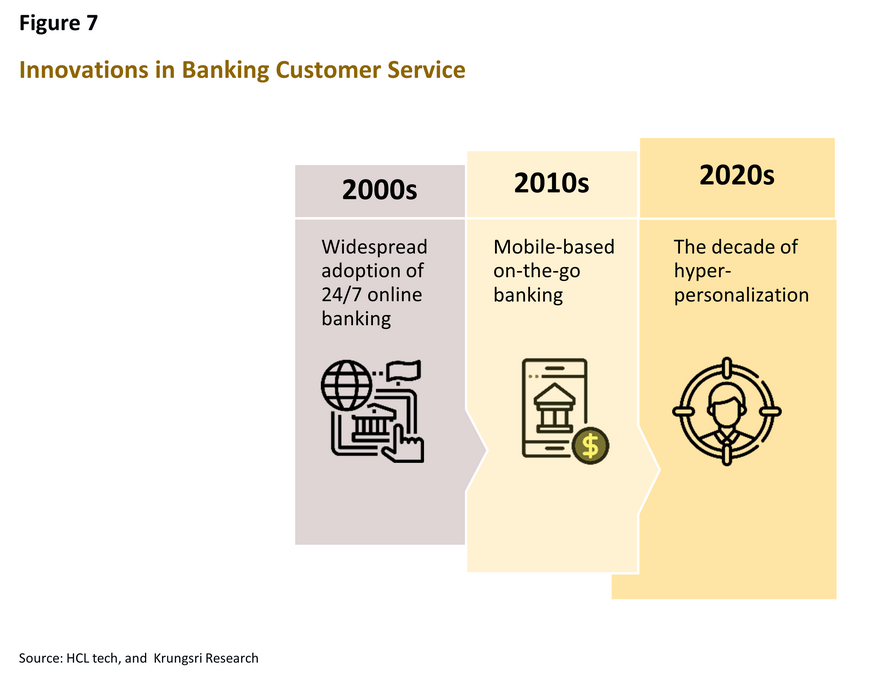

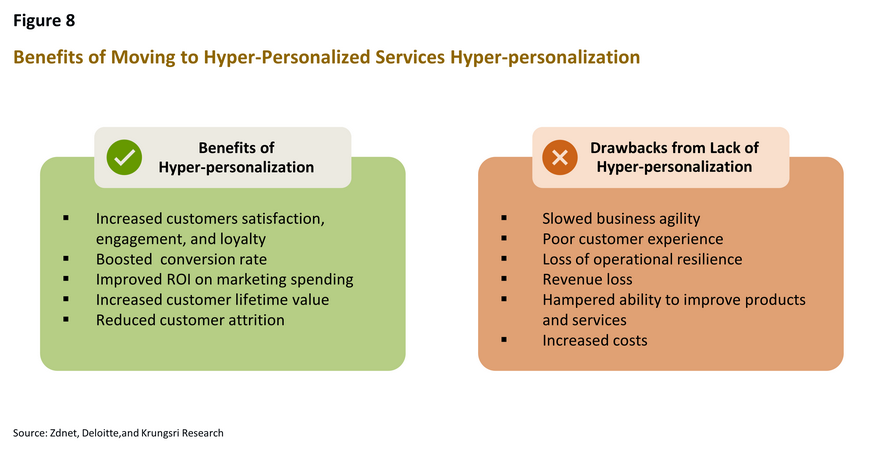

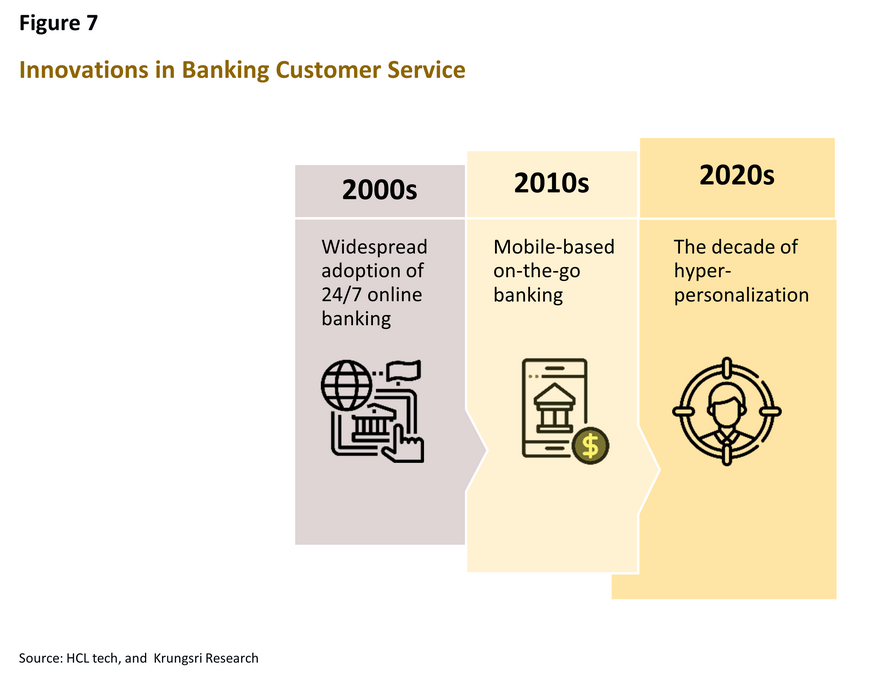

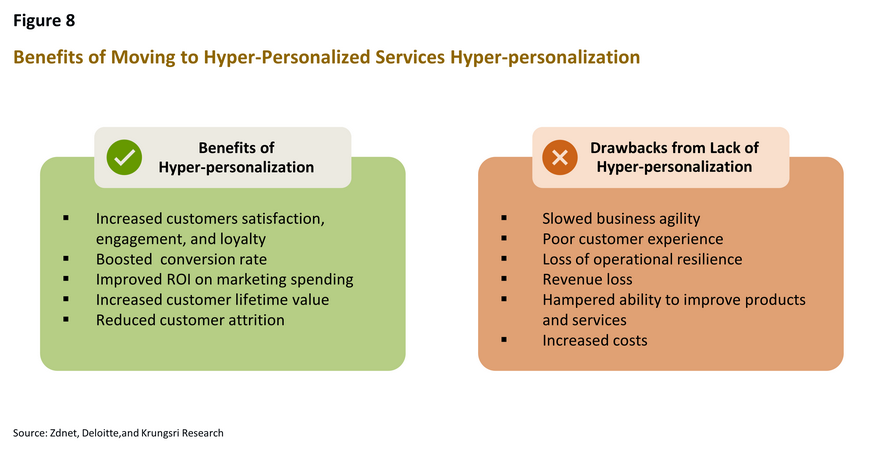

The banking sector has long been a keen adopter of new technology, which it has then used to better match its offerings to consumer needs. Most recently, a 2024 survey by Salesforce showed that 61% of consumers wanted banks to offer financial advice that was tailored to individual customer needs,12/ and so hyper-personalization is becoming a key factor in winning customer loyalty and for demonstrating clearly and unambiguously that the customer is at the heart of enterprise activity. Moreover, both banks and consumers benefit from expansion in the use of hyper-personalization, the most important examples of which are described below.

Benefits for consumers of hyper-personalization

1) Improved customer experience

Hyper-personalization helps to guide customers almost instantly to goods and services that are a very good match for their needs, and so this naturally generates a more pleasant customer experience. This is partly because AI helps to rapidly anticipate individual needs and then to recommend financial products (credit, savings, or promotions) that are appropriate for that particular customer’s lifestyle, with this information delivered in a format and through channels that are individually chosen. Information and recommendations can even be generated and presented to customers when they are online or looking for information on particular financial products. For example, while a customer is filling out a loan application on a website, AI can process the customer's data and enable the bank to immediately contact the customer with financial advice and/or offer loans that are both attractive and suitable for the customer's risk profile. Overall, hyper-personalization will help to provide consumers with a seamless customer experience that optimizes the choices with which they are presented, and this is unlikely to do anything other than improve customer relations.

Banks are able to amplify their hyper-personalization efforts by using virtual assistants when customers contact the bank through smart chatbots or via call centers, and since this will accelerate responses and improve their accuracy and utility, the customer experience will be further improved.

2) Helping customers meet their financial goals

An additional benefit of hyper-personalization is that because AI can process data to help banks understand each customer's financial goals, behavior, and financial status. This enables banks to design financial products, offers, or savings plans tailored to the specific goals of each customer. In addition, AI can help banks to improve their apps by powering a tracking dashboard that displays details on that customer’s financial data together with individually targeted recommendations or product promotions, which will all then help this individual achieve his or her goals.

Benefits for banks of hyper-personalization

1) Revenue and business opportunities

Banks have multiple ways to generate revenue through hyper-personalization, starting with recommending related and beneficial products or services that customers may not be aware of or have yet to access. Additionally, banks can expand opportunities by partnering with business partners to offer products from those partners that align with customer interests, alongside the bank's financial services. A study by McKinsey reports that personalized marketing can increase revenue by up to 15%.and lift the marketing return on investment (ROI) by up to 30%.13/ Likewise, a paper by BCG indicates that the use of personalized marketing may increase a bank’s earnings by up to 10%.14/

2) Improved customer retention

While digital banking has greatly enhanced the customer experience, it has also made it much easier for customers to compare and switch between banks. To make matters worse, a 2023 survey by Accenture revealed that over 42% of consumers cannot clearly distinguish between financial service providers in the digital age. , and this lack of perceived strong differentiation between providers of financial services is expected to weaken customer loyalty further. However, hyper-personalization is likely to be one solution that will help to shore up efforts at customer retention. Thus, a survey by Twilo in 2023 showed that if the service that consumers receive from a business is highly personalized and responsive to their particular needs, 56% of respondents would continue to support that company . When banks deeply understand customers' past behavior and preferences and can predict their needs through intelligent AI, it encourages customers to continue using the bank's services without switching to competitors.

Data is the key element

Deepening customer engagement through AI-powered hyper-personalization is dependent on access to high-quality customer data, for example, transaction and purchasing histories together with data on online and social media activities. In addition, companies may draw on customer feedback and surveys of customer opinions, so for example, Bank of America (BofA) has used a survey of 50 million consumers to guide the personalization of its services.17/ However, if a bank’s technological infrastructure or information management services are inadequate, assembling and analyzing big data resources may be problematic. In particular, problems can arise if data remains siloed in different departments or access is otherwise limited since this will necessarily limit the extent to which this can inform business decisions.

Even AI is advanced, human involvement remains essential

Although AI can recommend products or services tailored to customers as a virtual assistant, some interactions still require human involvement, whether that be because some customers respond more positively to the human touch or because in some situations, humans still deliver a better service than do their AI peers. For example, AI chatbots have an exceptional ability to respond to user input directly, immediately and without ever tiring of their job, but these still show weaknesses in many areas, especially when answering more complex enquiries and interpreting a customer’s emotional state. A study by Accenture (2024)18/ indicates that banks can increase their revenue by up to 6% within three years by integrating AI and human collaboration to provide wealth management advice, tailor products to individual customers, and enhance customer service in contact centers, among other improvements.

Krungsri Research view: The path to success in hyper-personalization

Both banks and bank customers will benefit from the rollout of hyper-personalized systems that are underpinned by new AI technologies, but while these developments may lead to new business opportunities, players in the banking system will need to be alert to how this impacts consumer privacy and security. Additionally, banks act as Data Controllers under the Personal Data Protection Act B.E. 2562. Therefore, customer data security is a critical issue for banks and a significant concern for many people. As seen in a survey carried out by Krungsri Research in late 2023, which showed that having their online behavior monitored and tracked was among consumers’ top-five tech-related worries.24/ Given this, it is incumbent on banks that they reassure their customers that hyper-personalization aims only to improve the customer experience, that only when customers have given their consent will their data be used to develop these systems, and that no expense or effort will be spared in ensuring that data held by banks remains secure and confidential. More generally, banks will also need to carefully consider how they will implement AI systems responsibly, and how they can guarantee that the development and use of AI models will be sufficiently tightly controlled that AI generated results or content will be sure to be truthful, fair and unbiased.

Successfully rolling out hyper-personalized banking services will involve the coordinated and parallel development of both the technological and human resources that support these systems.

Technology, the following will need to be undertaken. (i) Banks will have to assemble big data resources that link and draw on information gathered from departments and units across the enterprise. This will help developers to assemble an in-depth picture of the consumer’s context and to clearly understand the customer journey across its entire length. (ii) The bank’s core IT systems will need to be developed and data resources fully integrated so that AI systems are able to process this in real time. This will strengthen the bank’s ability to support the delivery of digital services and the generation of on-the-fly recommendations of financial products that are a close match for individual demand.25/ (iii) Improving the quality of hyper-personalized services will be possible by marrying AI and other technologies including for example the Internet of Things (IoT)26/ This allows devices and environmental sensors to collect data and then to transmit this over the internet, and utilizing this will help organizations strengthen their understanding of and insight into consumer behavior and preferences. Looking further out, the marriage of AI and quantum computing27/ has the potential to make data analysis even quicker and more powerful, though at present, commercial applications in this area remain some way off.

Human resources, banks should cultivate a work culture that encourages staff to learn about new and emerging technologies and to engage in continuing personal development. This might include developing professional networks that bring in external AI experts to exchange knowledge and ideas with bank staff, while banks will also need to work hard at attracting and retaining staff with the requisite technology and data management skills. In particular, because these are key to ensuring that hyper-personalization is a success, these efforts should be especially focused on data scientists and staff with expertise in AI. More generally, employees should be encouraged to develop the skills required to work with AI, such as their ability to use AI tools, as well as their interpersonal skills and emotional intelligence.

In addition, banks would benefit from cultivating their employees’ appreciation of innovative financial products when these enhance customer satisfaction and ease the customer journey, while by showcasing how AI technology is linked to financial services, banks will be able to attract much greater interest from the public generally and from the skilled IT professionals that they now need to hire.

It is clear from the above that if players in the banking industry wish to maximally benefit from AI-powered hyper-personalization, this will require significant investment in the requisite human and technological resources, which will in turn necessitate comprehensive planning that takes into account the relevant technological, personnel, operational and ethical frameworks. Success in this endeavor will, though, allow organizations to fully utilize the power of AI to drive hyper-personalized marketing, and as such, customers will be matched much more effectively with financial products that are a close fit for their particular needs, and over the longer term, this will help to underline the bank’s commitment to “customer-centric” operations and thus to deepen customer loyalty.

References

Accenture (2024): “Banking on AI Banking Top 10 Trends for 2024” Retrieved April 19 2024 from https://www.accenture.com/content/dam/accenture/final/industry/banking/document/Accenture-Banking-Top-10-Trends-2024.pdf

Adam Wilson (2023): “Personalization vs hyper-personalization: The future of digital marketing”. Retrieved July 9 2024 from https://medium.com/@adamwilsonwebmaxy/personalization-vs-hyper-personalization-the-future-of-digital-marketing-682b97eea621

Amazon (2023): “MUFG Signs Multiyear Global Agreement with AWS to Accelerate Digital Transformation” Retrieved May 19 2024 from https://press.aboutamazon.com/2023/11/mufg-signs-multiyear-global-agreement-with-aws-to-accelerate-digital-transformation

BCG (2019): “What Does Personalization in Banking Really Mean?” Retrieved July 9 2024 from https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-personalization

BCG (2023): “A Generative AI Roadmap for Financial Institutions”. Retrieved May 13 2024 from https://www.bcg.com/publications/2023/a-genai-roadmap-for-fis

Blake Morgan (2022): “How Bank Of America Provides Personalized Digital Service To 55 Million Clients” Retrieved April 19 2024 from https://www.blakemichellemorgan.com/podcast/how-bank-of-america-provides-personalized-digital-service/

Brinda Sereno (2023): “Banking Institutions Should Utilize Hyper-Personalized Strategies to Drive Growth”. Retrieved July 15 2024 from https://tvsnext.com/blog/banking-institutions-should-utilize-hyper-personalization-strategies-to-drive-growth/

Walkme (2022): “Hyper-Personalization”. Retrieved June 25 2024 from https://www.walkme.com/glossary/hyper-personalization/

Deloitte (2023): “2024 banking and capital markets outlook”. Retrieved June 25 2024 from https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

Fat Finger (2023): “Adaptive AI วิวัฒนาการปัญญาประดิษฐ์สุดล้ำ เข้าใจง่ายกว่าที่คุณคิด”. Retrieved June 20 2024 from https://www.averyittech.com/news/Adaptive_AI

Grand View Research (2023): “Artificial Intelligence Market Size, Share, Growth Report 2030”. Retrieved July 9 2024 from https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-market

HCL Tech (2021): “Hyper-personalization: a defining competitive edge in Financial Services”. Retrieved July 9 2024 from https://www.hcltech.com/white-papers/ai-financial-services-industry

JPMorgan Chase & Co. (2023): “Annual Report 2023”. Retrieved September 2 2024 from https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/investor-relations/documents/annualreport-2023.pdf

JPMorgan Chase & Co. (2023): “Investor Day 2023: Global Technology”. Retrieved September 2 2024 from https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/investor-relations/documents/events/2023/jpmc-investor-day-2023/global-technology.pdf

McKinsey & Company (2023): “What is personalization?”. Retrieved July 9 2024 from https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-personalization

MMA (2023): “The State of AI in Marketing and CX”. Retrieved July 15 2024 from https://www.mmaglobal.com/documents/state-ai-marketing

Netflix Research (2023): “Large Language Models as Zero-Shot Conversational Recommenders”. Retrieved June 25 2024 from https://research.netflix.com/publication/large-language-models-as-zero-shot-conversational-recommenders

Plaid (2023): “Tech Talk: Unlock the future of banking personalization to win and retain customers”. Retrieved June 20 2024 from https://plaid.com/blog/unlocking-the-future-banking-personalization/

Plaid (2023): “Tech Talk: Unlock the future of banking personalization to win and retain customers”. Retrieved June 20 2024 from https://plaid.com/blog/unlocking-the-future-banking-personalization/

Saleforce (2023): “The Connected Financial Services Report” . Retrieved September 2 2024 from https://www.salesforce.com/content/dam/web/en_us/www/documents/resources/research-reports/financial-services-report.pdf

Sameer Garde (2024): “Driving Performance With Content Hyper-Personalization Through AI And LLMs”. Retrieved June 20 2024 from https://www.forbes.com/councils/forbesbusinesscouncil/2024/02/23/driving-performance-with-content-hyper-personalization-through-ai-and-llms/

Techsauce Team (2024): “ยกระดับ ‘My Lotus's’ ให้ตรงใจลูกค้า ด้วยการใช้ AI และ Big data”. Retrieved June 20 2024 from https://techsauce.co/news/upgrading-my-lotus-by-using-ai-and-big-data?fbclid=IwAR1hwlO32CvYc4LGJJEI8aqJU51A_ihSprXWfxtaGuTJCC8QrGtW04tz2Jg

The Asian Banker (2023): “Hyper-personalisation is changing the banking experience”. Retrieved April 23 2024 from https://www.theasianbanker.com/updates-and-articles/hyper-personalisation-is-changing-the-banking-experience

The Brainy insights (2023): “Hyper Personalization Market”. Retrieved July 2 2024 from https://www.thebrainyinsights.com/report/hyper-personalization-market-14004

Wipro (2021): “Hyper-personalization: a defining competitive edge in Financial Services”. Retrieved July 9 2024 from https://www.wipro.com/blogs/harpreet-arora/hyper-personalization-a-defining-competitive-edge-in-financial-services/

ZDnet (2023): “AI and data: Honing hyper-personalization to build the bank of the future”. Retrieved June 2 2024 from https://www.zdnet.com/article/ai-and-data-honing-hyper-personalization-to-build-the-bank-of-the-future/

ZDnet (2023): “How to achieve hyper-personalization using generative AI platforms”. Retrieved June 2 2024 from https://www.zdnet.com/article/how-to-achieve-hyper-personalization-using-generative-ai-platforms/

1/ https://www.thebrainyinsights.com/report/hyper-personalization-market-14004

2/ MMA (Mobile Marketing Association) Global is a non-profit association with more than 800 members drawn from the ranks of leading global corporations (e.g., Uber, Mastercard, Meta, Google, Citi, etc.) The association is focused on accelerating transformation and innovation in marketing through the use of mobile and other new technologies. The organization works on research, identifying and promoting best practices, and building business networks with the goal of helping businesses improve the efficiency and effectiveness of their marketing efforts.

3/ The survey analysis is based on responses from 102 chief marketing officers working in countries around the world. For more details, see: https://www.mmaglobal.com/documents/state-ai-marketing

4/ Large language models, or LLMs, are AI systems built on neural networks or foundation models that have been trained on vast datasets. This enables the AI system to understand and communicate with human users through natural language.

5/ https://research.netflix.com/publication/large-language-models-as-zero-shot-conversational-recommenders

6/ https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-hp-the-future-of-retail-banking.pdf

7/ยกระดับ ‘My Lotus's’ ให้ตรงใจลูกค้า ด้วยการใช้ AI และ Big data | Techsauce Report-2024.pdf

8/ https://aiindex.stanford.edu/wp-content/uploads/2024/04/HAI_AI-Index-Report-2024.pdf

9/ For more details, see https://www.krungsri.com/en/research/research-intelligence/generative-ai-2023

10/ https://www.averyittech.com/news/Adaptive_AI

11/ The banking and finance industry is the second most tech-intensive part of the economy, coming after only the healthcare industry source: Artificial Intelligence Market Size, Share, Growth Report 2030 (grandviewresearch.com)

12/ The survey respondents comprised 6,058 individuals in 12 countries, including Australia, Brazil, France, and the US. For more details, see: financial-services-report.pdf (salesforce.com)

13/ https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-personalization

14/ https://www.bcg.com/publications/2019/what-does-personalization-banking-really-mean

15/ https://www.accenture.com/content/dam/accenture/final/industry/banking/document/Accenture-Banking-Top-10-Trends-2024.pdf

16/ These results are from a survey of 3,001 consumers in countries including the US, the UK, Australia and Japan. For further details, see: https://segment.com/state-of-personalization-report/

17/ https://www.blakemichellemorgan.com/podcast/how-bank-of-america-provides-personalized-digital-service/

18/ https://www.accenture.com/content/dam/accenture/final/industry/banking/document/Accenture-Banking-Top-10-Trends-2024.pdf

19/ https://press.aboutamazon.com/2023/11/mufg-signs-multiyear-global-agreement-with-aws-to-accelerate-digital-transformation

20/ Global Technology (jpmorganchase.com)

21/ 2023 Annual Report (jpmorganchase.com)

22/ https://www.dbs.com/artificial-intelligence-machine-learning/artificial-intelligence/dbs-ai-powered-digital-transformation.html

23/ https://www.walkme.com/glossary/hyper-personalization/ , https://www.capitalone.com/digital/eno/ และ

https://tvsnext.com/blog/banking-institutions-should-utilize-hyper-personalization-strategies-to-drive-growth/

24/ For more details, see Hopes and Fears around Emerging Technologies

25/ The Bank of Ayudhya is investing over THB 15bn in its ‘Jupiter Project’, which aims to improve core banking services. For more details, https://www.thairath.co.th/money/personal_finance/banking_bond/2759920

26/ For more details on the use of IoT in the banking industry, see Tech Trends in the Banking Sector in 2023

27/ Quantum computing takes advantage of quantum phenomena to massively accelerate computational processes. One outcome of this will then be to overcome some of the barriers holding back the further development of AI systems, and research projects investigating quantum-powered AI have demonstrated promising results