Mid-year Review and Outlook for 2020

Weak growth outlook across ASEAN; some countries may be able to avoid a recession

Fight against COVID-19: Uneven success, infection rates are still high in Indonesia and the Philippines

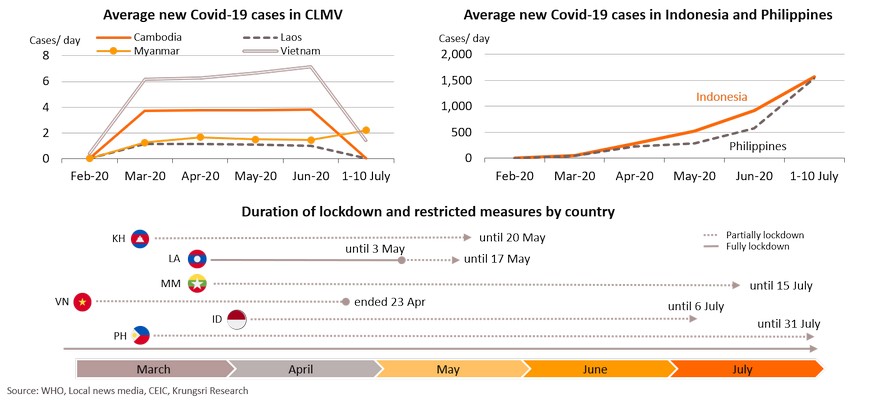

- SE Asian countries were among the first outside China to report COVID-19 cases since January, and the number of cases are still rising. The number of confirmed cases in the region has been accelerating since mid-March to 1180,789 as of 10 July. Since implementing lockdown measures for at least two months, new cases in CLMV is relatively stable with single-digit new cases in June. However, daily new cases in the Indonesia and Philippines have surged from 50 in March to over 1,500 in both countries in the first two week of July. Despite this, Indonesia recently announced plans to fully reopen economy by August, and the Philippines has extended the general community quarantine (GCQ) for Metro Manila to 31 July and will ease restrictions in stages depending on data and available healthcare resources.

- Looking ahead, Indonesia’s and Philippines’ economies would be further pressured by still-high infection rates and extended lockdown, especially given fragile domestic and external demand. CLMV economies are expected to improve gradually supported by stimulus programs to boost domestic consumption and public investment, given weak external demand. However, recovery will be uneven across the region depending on each country’s economic fundamentals.

Bleak outlook for tourism-dependent nations in 2020

Pandemic has affected the real sector, from supply to demand side; hoping for consumption to cushion drop

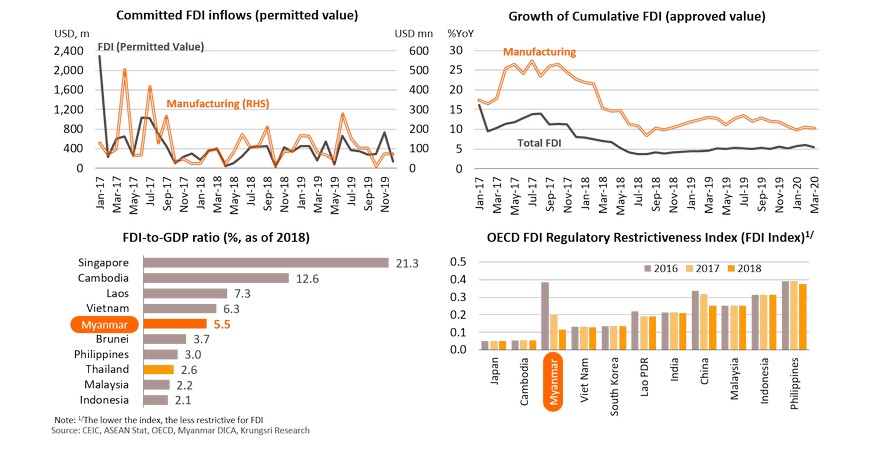

FDI is expected to tumble; public infrastructure investments would play a bigger role to support growth

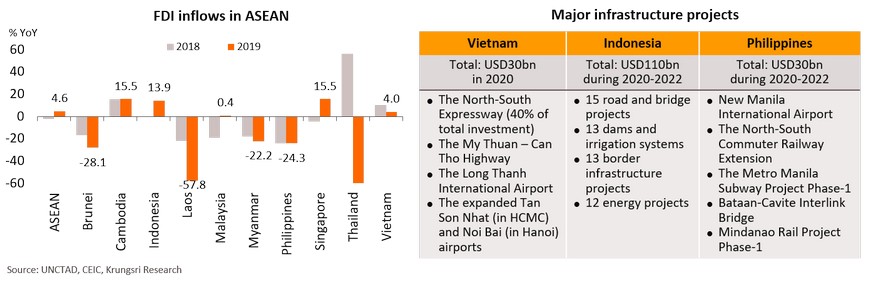

- The lockdowns across the region to contain the COVID-19 outbreak had stalled most manufacturing activities. Tumbling businesses earnings, weak global and regional demand, and expectations of a global economic recession will prompt investors to postpone investment plans. According to UNCTAD (United Nations Conference on Trade and Development), greenfield investment in Asia fell by 37% YoY in 1Q20 while the number of mergers and acquisitions (M&A) had dropped by 35% YoY, as of April. UNCTAD estimates FDI inflows to Developing Asia would contract by 30-45% YoY in 2020, following a 5% drop in 2019.

- The dimmer prospects for FDI inflows would hurt growth in several ASEAN countries, especially Cambodia (FDI accounted for 12.7% of GDP in 2019), Laos (7.3% of GDP), and Vietnam (6.3% of GDP).

- To spur domestic investment to cushion the impact of weaker FDI inflows as well as to stimulate economic growth, governments of several ASEAN countries are accelerating public infrastructure investment projects. Vietnam recently announced it would hasten approval and disbursement of funds for infrastructure projects worth VND700trn (USD30bn, 11.5% of GDP) in 2020. The Philippines passed a bill to support a 3-year investment plan under the Build-Build-Build program worth PHP1.5trn (USD30bn, 9.1% of GDP), at PHP500bn per year over 2020-2022. Some have decided to expand existing investment programs, such as Indonesia which has vowed to add 89 new infrastructure projects worth IDR1.422qdn (USD110bn, 10.4% of GDP).

- Though the primary aim is to stimulate economic growth this year, we anticipate it would be difficult to realize all investments in the targeted period, which means 2020 economic growth would miss targets. Given that most of the public infrastructure projects are huge and require a lengthy regulatory process, especially disbursement and land allocation, it would take some time before the funds would be injected into the economies.

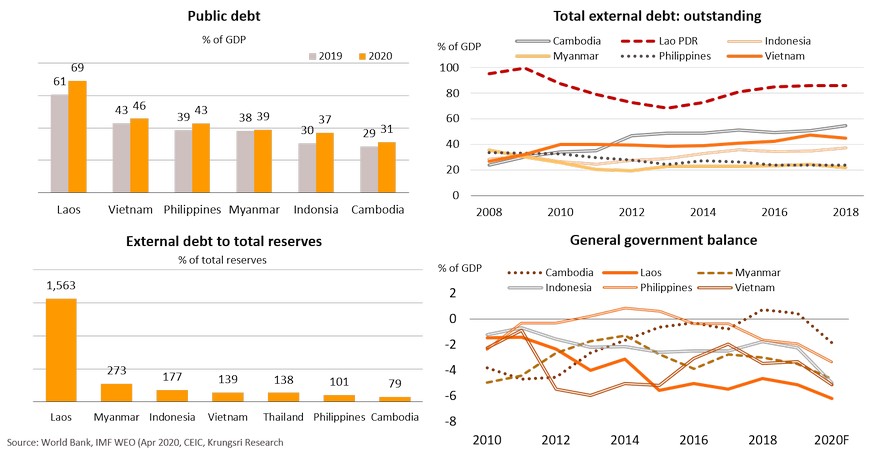

Surging debt levels to finance fiscal stimulus programs could threaten countries with weak fundamentals

- ASEAN countries are among Emerging Markets that will see higher debts as governments seek additional financing to cushion the Covid-19 impact on their economies. Countries with already-high public and external debt will face higher debt risk, especially Laos, Vietnam, Cambodia, and Philippines. In the meantime, there are some nations that also have high external debt to total reserves, which implies limited liquidity to finance a further increase in external debt. Specifically, countries with high external and public debts as well as large fiscal deficits are considered to have weak fundamentals, and would have weaker ability to sustain debt levels and fiscal stability in the future. These will pressure sovereign credit ratings if the pandemic is not contained soon. They include Laos, Vietnam, and Indonesia.

Snapshot of COVID-19 impact on regional economy

Cambodia: Pandemic has hurt broad growth, and the economy is projected to contract for the first time

Travel restrictions and the global downturn will reduce tourist arrivals and travel spending

FDI inflows could slump due to weak prospects for tourism, construction, textiles & garment industries

Pandemic dampens already-weak fundamentals; growth had been driven by benefits granted by advanced economies

EU suspends some of Cambodia’s EBA privileges

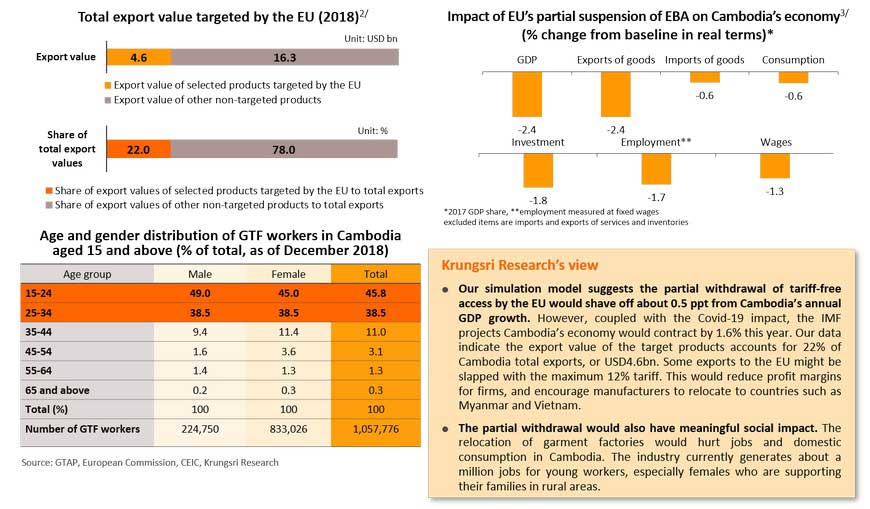

On 12 February, the European Commission voted to partially suspend tariff-free access under the EBA scheme for some of Cambodia1/products, especially garment and footwear, and all travel goods and sugar products, on grounds Cambodia has committed human and political rights violations. The EU says the withdrawal would affect about a fifth of Cambodia’s annual exports to the bloc, or €1bn (USD1.08bn). The decision will be effective 12 August if there is no objection from the European Parliament and the European Council. In response, since last year, the Cambodian government has launched a series of measures to reduce logistic costs and facilitate exports to mitigate the impact of higher tariffs on enterprises.

Diversifying export markets to reduce concentration risks; seeking bilateral FTAs with ASEAN countries

External stability remains a concern given rising exposure to external shocks

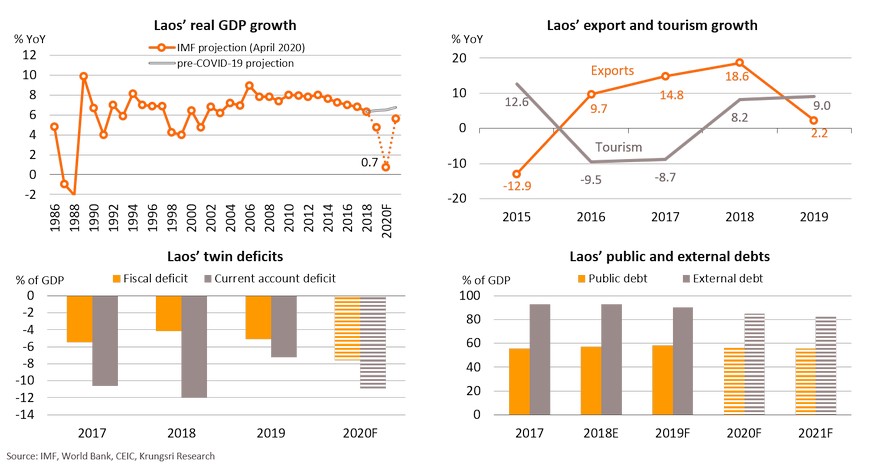

Lao PDR: Pandemic dampens structural vulnerabilities; growth will slump amid rising economic instability

In 2020, Laos’ economic growth is projected to slow to 0.7%, significantly lower than previous projection of 6.5%. The COVID-19 impact has aggravated the country’s structural vulnerabilities – which had slowed growth more than expected to 4.7% in 2019. The worldwide travel restrictions and sharply weaker economic growth in its major export markets – including Thailand and China – would drastically reduce Laos’ tourism and export revenues. This is expected to worsen its already-high current account and fiscal deficits. The government has limited fiscal space, so weak performance in the real sector will dampen already-weak revenue collection and consequently, public and external debt would surge. In addition, international reserves is also expected to deteriorate, which would further weigh on its debt financing and sustainability ability.

Tourism sector would be hit hard by travel restrictions, which would reduce foreign receipts

Export will slump due to weak demand from Thailand and China; wider trade and current account deficit

Investment would be driven by China-led infrastructure projects, but it would be much smaller than in 2019

Investment would be driven by China-led infrastructure projects, but it would be much smaller than in 2019

Fiscal deficit would be the widest in its history due to weak revenue collection; public debt would rise

Larger fiscal deficit has raised concerns about Laos’ ability to service external debts

Myanmar: Growth is projected to slow to 1.8% in 2020; stronger headwinds suggest further downside risks

Manufacturing activity has been disrupted by pandemic

Manufacturing activity in Myanmar has been hit hard by both supply disruption and demand shock. After falling into deep contraction territory in April, the country’s manufacturing activity has gradually recovered in recent months since China – Myanmar’s major source of imports - resumed economic activities. However, Myanmar’s manufacturing sector would remain weak the rest of this year due to a slump in global demand, especially in advanced economies. Myanmar’s major export products are textiles and garments which account for about 30% of total exports, and its key export destinations are advanced economies that are projected to record a recession this year, especially the EU. This would pressure exports and drag production activities. In addition, a downturn in its manufacturing sector would hurt its labor market and dampen domestic consumption. The textiles & garments industry employs over 700,000 workers.

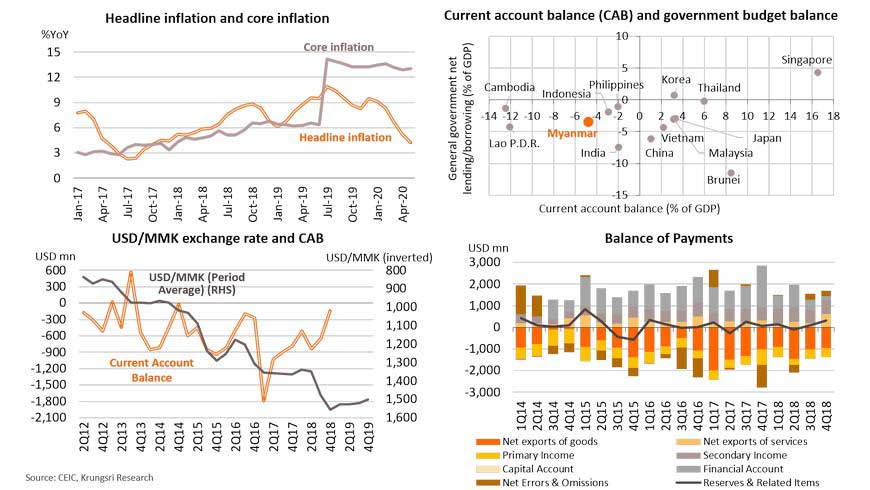

Macroeconomic stability remains broadly weak

Maintaining macroeconomic stability while implementing structural reforms is challenging. The headline inflation has eased in recent months, though relatively high at average of 6.7% in the first five months. Core inflation has also remained high, reflecting a still-high underlying inflation trend. Twin deficits are threatening external stability. The current account deficit is sufficiently financed by FDI inflows, but looking ahead, the growing export-oriented manufacturing sector, more FDI-driven investments, and the implementation of several infrastructure projects, would widen the current account deficit. This would in turn, put downward pressure on the MMK, which is stable currently. The effect of a weaker MMK is normally passed through relatively quickly to domestic prices because Myanmar relies substantially on imports.

Ongoing structural reforms would make Myanmar an attractive FDI destination over the long term

Th pandemic would deter FDI inflows into Myanmar and make it more challenging for the government to meet its USD5.8bn FDI target for FY2019/20. However, we remain optimistic that ongoing structural reforms and liberalization of key industries including banking, insurance, retail and wholesale trade, education, and other priority sectors, coupled with fewer restrictions on FDI and improved ease of doing business, would continue to attract FDI into the country. FDI should continue to flow into the manufacturing sector, especially the garment and textile industry. Myanmar would also benefit from the relocation of labor-intensive production out of China, which has been accelerated by US-China trade tensions.

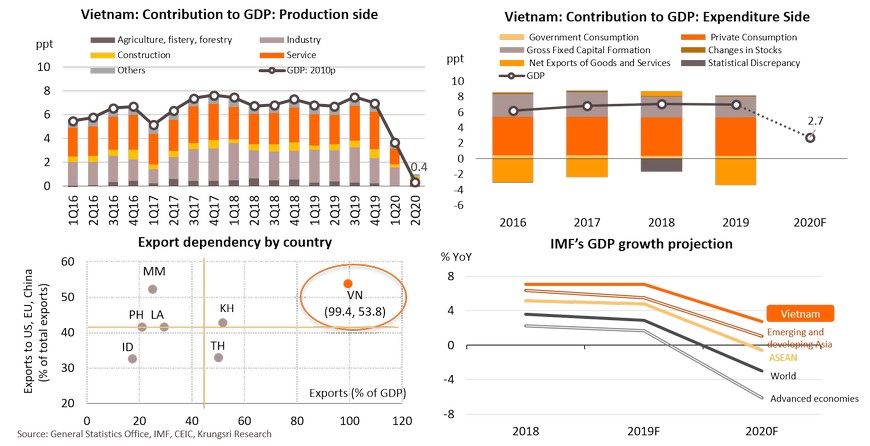

Vietnam: 1H20 GDP grew 1.8% YoY; government might miss its 5% growth target for 2020 but it would remain positive

Vietnam’s economy expanded by 3.8% YoY in 1Q20, a 10-year low, but growth slowed to a 30-year low of 0.4% in 2Q20. This led to in record-low 1.8% YoY GDP growth in 1H20. The COVID-19 pandemic has broadly affected the country’s manufacturing, construction and services sectors because of lockdown and travel restrictions. However, we expect the economy to recover gradually from 3Q20, supported by domestic consumption and investment as external demand remains muted. The positive growth prospects would be driven by an expected increase in FDI inflows because Vietnam is attractive following the signing of several FTAs, especially the EVFTA. However, the government’s 5% growth target for 2020 is ambitious; we are in line with the IMF’s projection of +2.7%. But despite the IMF’s weak projection, Vietnam will remain the fastest-growing economy in ASEAN and emerging and developing Asia this year.

Domestic consumption is still below pre-pandemic level in 1H20; expect mild improvement in 2H20

Production will remain subdued because there is still excess supply

Investment would remain weak but we expect to see more positive FDI sentiment in 2H20

EVFTA is expected to take effect by August 2020; supporting export competitiveness

Vietnam would remain resilient to external shocks given low debt risk and adequate reserves

Indonesia: Growth slows to 3.0% in 1Q20; economy likely to contract for full-year 2020

COVID-19 outbreak exacerbates weak domestic consumption; expect to to deteriorate further

COVID-19 outbreak exacerbates weak domestic consumption; expect to to deteriorate further

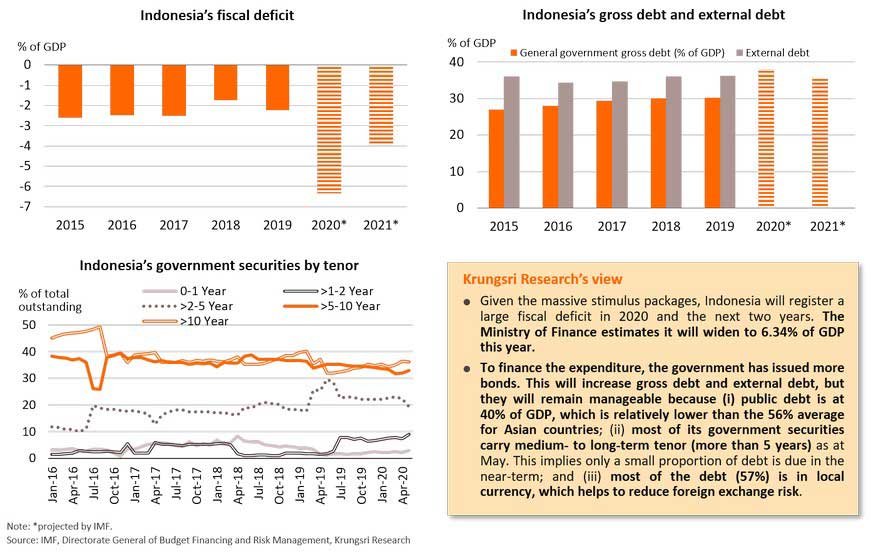

Sizeable budget expenditure will widen fiscal deficit; expect debt to surge but remain manageable

External position could improve slightly given limited demand for imports and adequate reserves

Low inflation and currency stability allow more accommodative monetary policy to support growth

Philippines: After falling by 0.2% in 1Q20, growth tends to worsen and would be negative for the whole year

Private consumption would deteriorate due to worsening labor market conditions and falling remittances

Export would continue to weaken; imports may recover driven by BBB projects in 2H20

Massive stimulus would take 2020 fiscal deficit to a new high; disbursement is likely to be smaller than planned

After delivering deep interest rate cut by 175 bps, BSP would keep its key rates as it prefers positive real rate