2022-2024 THAILAND INDUSTRY OUTLOOK

The Thailand Industry Outlook over the next 3 years (2022-2024) covers a range of factors that will have impacts on industries. Those factors include challenges and opportunities to represent the attractiveness of each industry that relies on the macroeconomic environment and sector-specific factors.

The macroeconomic environment

The world economy 2022-2024: Gradual recovery

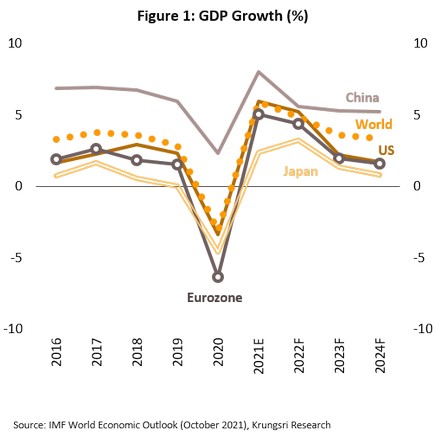

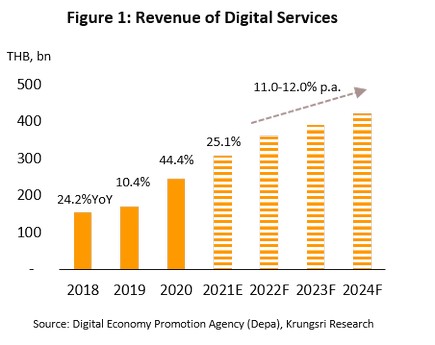

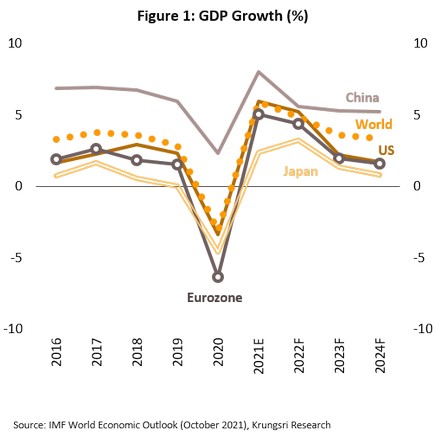

- Over the next 3 years, the world economy is expected to expand at an average rate of 4% per year, slowing to this more moderate rate having hit 5.9% in 2021 on the combined effects of large-scale stimulus spending and the reopening of the major economies (Figure 1). Tailwinds lifting the global economy in the coming period will stem from more vigorous activity in the private-sector, boosted by recovery in services and ongoing growth in manufacturing, which will itself be the beneficiary of the progress of vaccination programs, the relaxation of pandemic control measures, the gradual reopening of many countries, and the effects of accommodative fiscal and monetary policy, although this is being scaled back as the pandemic recedes. However, risks and uncertainty persist, most notably from the possible emergence of new COVID-19 strains, worries over the efficacy of vaccines, and supply chain bottlenecks that may persist until 2022. In addition, the need to combat stronger inflationary pressures through policy normalization and the raising of central bank interest rates may result in higher operating costs for businesses in the period ahead.

- US economy is predicted to enjoy average growth of 3.0% per year over 2022-2024, and so although the rate of expansion will drop from 2021’s 6.0% as the positive effects of stimulatory fiscal and monetary policy and the reopening of the economy dissipate, the outlook remains positive. With unemployment at 4.2% in November 2021 compared to 14.8% in April 2020, labor markets have clearly made significant strides towards recovery, lifting incomes and boosting consumer spending, while in the business sector, investment is rising with stronger demand on domestic and export markets. The economy will further benefit from President Biden’s infrastructure spending plan and the injection of USD 1.2trn into the economy over 2022-2029, while the recent agreement to implement a global minimum tax, effective from 2023, may help to accelerate reshoring. Internationally, tensions with China are likely to persist and the setting up of the ‘Build Back Better World’ as a US competitor for China’s Belt and Road Initiative will intensify competition over access to business partners, with the result that divisions between those embedded in US-oriented and China-oriented value chains can be expected to become much clearer. On the policy front, the Fed will unwind its monetary stimulus, initially through the commencement of QE tapering at the end of 2021, before lifting policy rates in 2022. However, Fed dot plots indicate that 2024 policy rates may remain lower than Fed’s long-term interest rates forecast of 2.5%, and so the expectation is that monetary policy will remain relaxed and supportive of continuing economic recovery.

- Eurozone growth should average 2.6% per year through the next 3 years, after reaching an estimated 5.0% in 2021. The main drivers of growth will be consumption, investment and tourism. The first of these, consumption, will be lifted by recovery in labor markets and a rebound in spending power, itself boosted by an increase in savings during the COVID-19 pandemic. Investment will benefit from the EU Recovery Fund, which is now steadily making allocations that will contribute to many country’s plans for job creation schemes and this will potentially add 0.7-1.0% annually to Eurozone GDP. The tourism sector will also recover, though this will mostly benefit countries in southern Europe (e.g., Spain, Italy, and France). Additional help will come from interest rates that are expected to remain low through to at least the end of 2022, while relaxed monetary policy will continue to support liquidity, although the likely termination at the start of 2022 of the Pandemic Emergency Purchase Programme, which has an asset purchase ceiling of EUR 1.35trn, will mean that its scale will not match that maintained through the pandemic. The Eurozone will, though, face headwinds. Semiconductor shortages should begin to ease in the latter half of 2022 but until then, this will weigh on manufacturing and exports, while the reintroduction in 2023 of EU rules that specify a ceiling on government debt of 60% of GDP and a limit on budget deficits of 3% of GDP may restrain plans to increase investment in countries facing fiscal difficulties. Interest in environmental issues is also building worldwide, but this is particularly notable in Europe, where campaigns to cut investment in fossil fuels and to use clean energy that supplies are currently limited may combine over the short term with the reopening of economies to generate energy shortages and to feed rising inflation.

- For the Japanese economy, growth is likely to be limited to an average of 1.8% annually, down from 2021’s 2.4%. The economy will be the beneficiary of several factors. (i) Exports will continue to expand to serve with recovery in the world’s trade and economy. (ii) Investment will rise to meet the expansion of export and to broaden technological uptake as the country tries to overcome gathering problems with labor shortages. The tourism and related industries will also benefit from the reopening of the country and the ‘Go To Travel’ scheme. (iii) Labor market is improving, as reflected in October 2021’s unemployment rate of just 2.8%. This will then support higher household consumption. (iv) To counter the effects of COVID-19 and to help stimulate the economy, the authorities will inject another JPY 30trn (worth 5.6% of GDP) into the economy. At the same time, the government is pushing forward with its ‘new capitalism’ doctrine. This aims to rebalance economic policy by allocating the benefits of growth more fairly, for example by raising taxes on high-income earners, increasing wages, and promoting greater investment in regional economies. For its part, the Bank of Japan (BOJ) is expected to stay the course with relaxed monetary policies that include negative interest rates, yield curve control (YCC), and quantitative easing, but despite this, recovery will be slow, a situation that will be amplified by the high household savings rate, widespread deflationary mindset, and continuing consumer hesitancy over expenditure.

- For China, growth will decelerate from 2021’s 8.0% to a forecast 5.4% over 2022-2024. In the coming period, economic growth will be held back by the government’s determination to focus on long-term issues and to crack down on speculative pressures, excessive profits, monopolistic practices, and the unbalanced real estate sector. In addition, the government is continuing with its zero-Covid strategy, and this will inevitably delay the reopening of the country. At the same time, though, major drivers of the economy will include the following. (i) Exporters and related parts of the economy will benefit from the rebound in world trade and the strengthening of the global economy, their advantages in manufacturing technologically-based products, and the conclusion of the RCEP and CPTPP agreements. (ii) Household consumption will be lifted by recovery in labor markets and by the government’s ‘common prosperity’ policy and its focus on reducing inequality (e.g., by implementing measures to help small businesses take on new hires and to reduce the cost of living for low-income earners). (iii) Policies to increase investment in technological innovation, environmental protection, and the buildout of new infrastructure will help the economy further, as will greater efforts to reduce the risk of the economy facing future disruptions to manufacturing by raising national self-sufficiency and developing stronger domestic supply chains. (iv) Domestic tourism will benefit from the government’s inward-looking policy of economic growth, which it is adopting as a way of reducing the impacts of turbulence in the world economy and the spread of COVID-19. (v) In terms of economic policy, the Chinese authorities are adopting a ‘cross-cyclical approach’ that makes gradual adjustments to both fiscal and monetary tools, while keeping its focus on long-term trends. These include, for example, the use of targeted policies to stimulate growth in the real economy. These factors will then help the Chinese economy grow steadily, even if the rate of growth slows somewhat from the levels seen in the past.

Structural changes to the world economy…long-term impacts for business and industry

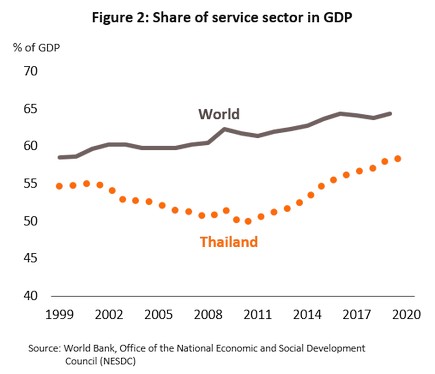

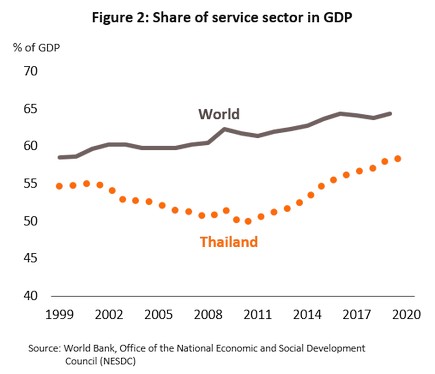

- The structure of the world economy is changing as it continues its transition from a dependency on manufacturing to being largely focused on services; the share of global GDP generated by the service sector rose from 60.4% in 2008 to 64.3% in 2019. In developed economies, this share is generally much higher and around 75% of US and UK GDP comes from services, mostly from modern services such as IT/software and finance. In Thailand, services comprised 58.3% of the economy as of 2020, up from 50.4% in 2008 (Figure 2) but unlike developed economies, traditional services that generate only low levels of added value predominate (e.g., tourism, trade, hotels, and restaurants). By contrast, only 14% of Thai GDP comes from high value-added modern services, which tend to be concentrated in the areas of finance and telecoms.

In the coming period, there is an opportunity for the service sector to increase its contribution to Thai GDP thanks to the growing application of new technology and innovation within the sector, for example through the development of online platforms that provide access to global tourist sites, and the development of robotic and remote surgical systems. At the same time, the manufacturing sector is also turning to “servicification” to add greater value to their products and to widen product differentiation. By using artificial intelligence and big data analytics to improve designs and to offer advice, companies are able both to increase their sales and to manufacture new products that respond more directly and more accurately to consumer needs, and these trends are then raising the importance of services in Thai supply chains. However, bringing the contribution of services to GDP of Thailand up to the level of developed economies will be difficult because (i) the service sector and related businesses (e.g., hotels, restaurants, real estate, and construction) have been badly hurt by the COVID-19 crisis, and (ii) compared to those of developed economies, Thai regulations and policy are relatively unwelcoming to foreign investment in the service sector, as is reflected in Thailand’s ranking of 46 out of 48 in the World Bank’s 2020 Services Trade Restriction Index. The existence of these high barriers to entry means that it is difficult to bring new investment and technology into the sector, and this represents a significant obstacle to the further transition to the provision of modern services. This is a challenge for Thailand to transform service sectors into modern services amid a gradual economic growth.

- Modern technology is transforming the structure of the manufacturing and service sectors broadly and rapidly. This wave of the digital revolution, which is now carrying the whole world along, is helping to generate value creation for manufacturing and service sectors to increase the sustainability of growth and adding to the security of supply chains. Over the next 3 years, some of the more important technological developments to affect the economy will include the following.

- The Internet of Things (IoT): IoT will have a greater role to play in gathering data related to everyday activities from sensors placed in devices including medical equipment, electrical appliances, and auto equipment. The number of IoT applications is steadily increasing, and this is now used by, for example, smart hotel rooms that allow occupants to control the room’s electrical devices through their own mobile phone, and companies that use IoT technology to track and manage goods deliveries.

- Robotics: The use of robots or other machines that are able to carry out precision work and to operate autonomously is reducing losses in manufacturing and increasing work safety. These machines are equipped with onboard software, microprocessors and sensors, and are particularly suitable for use in repetitive tasks, such as transporting dangerous loads in the electronics or construction industries, welcoming guests to hotels, planting crops, and feeding livestock.

- Artificial Intelligence (AI): When AI is used in industry, it is often combined with other technologies such as cloud computing and IoT for use in big data analytics or to develop “cobots” (robotic systems that work alongside humans) that are deployed in, for example, the auto and electronics industries. Use cases for AI include controlling production processes to reduce waste, and predicting optimum maintenance schedules for equipment. AI is also used in medicine to help with diagnosis and pattern recognition, for example in tracking COVID-19 infections, while real estate developers use AI to design buildings.

- 5G technology: This is used to develop networks that allow the work of different machines to be integrated efficiently, cutting labor costs, reducing work times, and slashing manufacturing waste. For example, the Japanese HIROTEC Corp. is using 5G networks to manage the remote control of machines producing auto parts, while the German company MTU Aero Engines is using the technology to help with the design of airplane engines, and in the process it has cut costs by 75%.

- Drones: Drones (pilotless aircraft controlled from a distance) are reducing companies’ dependency on labor and cutting the time taken to survey land, especially in agricultural contexts, where they are being used at all stages, from planning planting schedules through to the harvest. Agricultural drones are also being used to find and track livestock and to spray chemicals, while in the real estate sector, developers are using drones to measure or survey land, especially when doing so in person would be dangerous.

- Blockchain: Blockchains are a means of storing data on distributed ledgers that are accessible to those within a network but with access to this network potentially restricted by the use of passwords. This is a secure way of storing information, and is being used in finance to develop digital assets, in agriculture to maintain supply chain and provenance transparency, and in logistics where, combined with cloud computing, blockchains are used to track deliveries.

- Edge computing: This involves making real time adjustments to manufacturing processes through the application of big data analytics and live information on consumer demand, thus allowing companies to make extremely rapid responses to changes in consumer behavior. Applications of edge computing are currently most often found in health, recreation and transport industries, though it is also used in logistics planning to evaluate climatic conditions and to assess the likelihood of accidents occurring.

- Quantum computing: The switch from binary digital computing to computing systems that take advantage of quantum indeterminacy will potentially lead to an enormous expansion in computational power and speed, adding enormously to the abilities of AI systems. Commercial applications of quantum computing are beginning to emerge, especially in the area of smart devices (e.g., robots and self-driving vehicles).

- 3D printing: Advances in 3D printing technology now allow for the rapid, low-cost design and production of a huge range of products. 3D printing is increasingly being used in manufacturing supply chains connected to the development of auto parts and in ‘recycle bots’ (recycling old 3D printed objects into new products), such as in the production of auto and aircraft parts, electronics equipment, medical devices and dental implants. 3D printing is also being used in the construction sector for the rapid design and building of new structures.

- Synthetic biology: The most common application of synthetic biology is in the production of synthetic meat such as ‘cultured meat’, which is grown from stem cells from the target animal (i.e., from cows, chickens, pigs and tuna), and ‘plant-based meat’, made from plant products that has the taste and texture of real meat. These products reduce exposure to some of the health risks related to meat consumption and provide an alternative source of meat in the event of outbreaks of livestock disease. They also provide a way of meeting demand from the growing number of older consumers.

- Data analytics: This entails the systematic analysis of big data to help companies offer goods and services that better meet customer demand. For example, data analytics is used in the tourism sector to analyze historic data to make better predictions about demand growth or to recommend personalized packages to potential travelers.

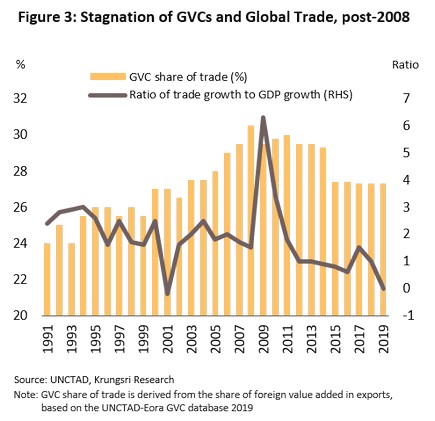

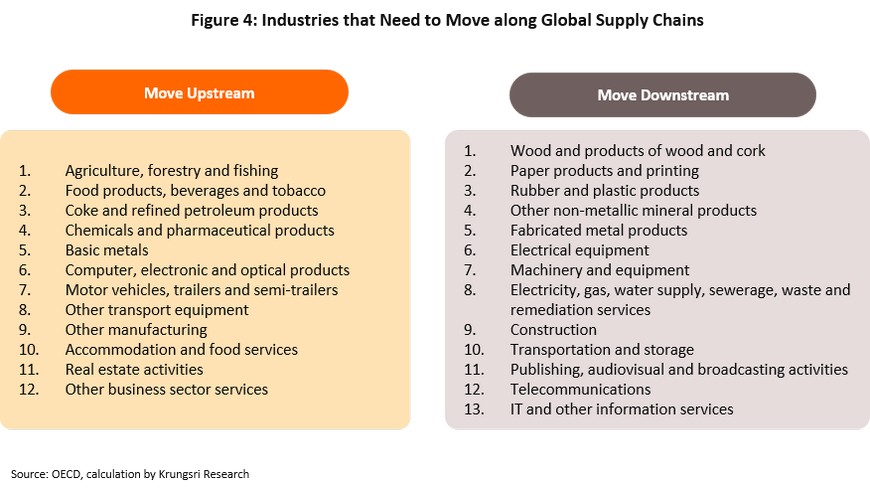

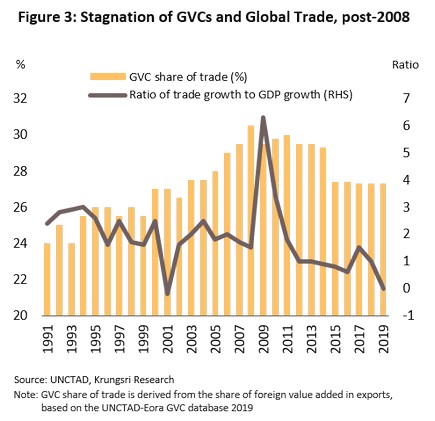

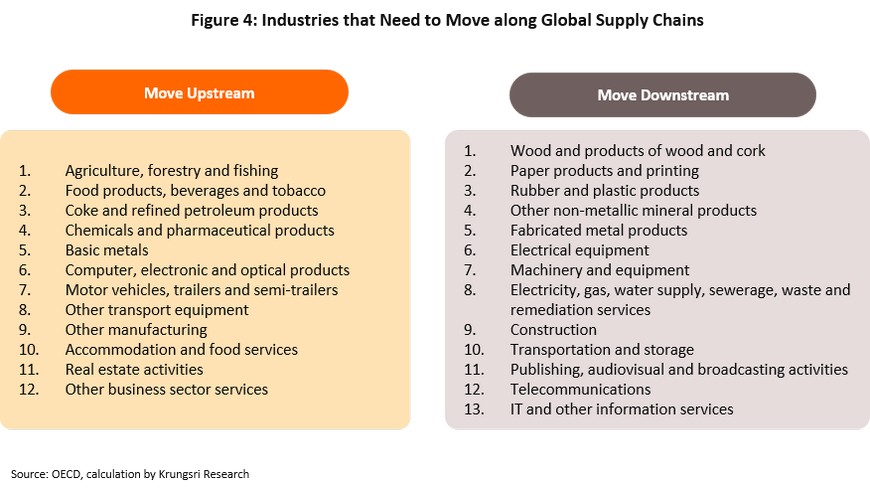

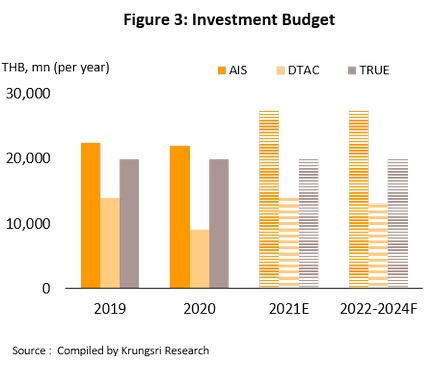

- Global value chains are shortening, and this is adding to competitive pressures for industry. The major economic powers are continuing to erect and maintain barriers to trade, as well as increasing their self-reliance and competing through the development of new technology in upstream industries. These events are partly a result of the COVID-19 crisis and the subsequent stalling of production lines, as seen in the production problems that many auto assemblers are facing due to the global chip shortage, and in light of this, corporations are increasingly turning to sources of inputs within their home region, causing global value chains to shrink at an accelerating rate. As trade channels narrow, competitive pressures are also rising (Figure 3), and in this environment, the broadest range of opportunities will be presented to countries that produce either upstream goods (the starting line for the production process) or downstream products (its ending line), where players are able to produce the greatest added value for global value chains. Countries in this group include the US, the EU and China (World Bank, 2020). However, as competition stiffens, players in the middle of the race that manufacture midstream products, often doing so on order in industries such as electronics, computers and auto assembly, will have to contend with narrowing opportunities to add value through the production process. Manufacturers in this less favorable part of the value chain will therefore need to consider their position and if possible, move further to its extremities, going either up- or downstream as appropriate. Analysis by Krungsri Research indicates that of the industrial sectors important to the Thai economy, players in auto assembly, computer manufacturing and petroleum refining should move upstream, whereas those in the production of electronics and machinery would do best by moving downstream (Figure 4). To achieve this, it may be necessary to build alliances with countries that already compete strongly and effectively in world markets. Doing so would then allow Thai players to add additional value and to establish a sustainable place on global supply chains (for further details please see Thai Industry: How Competitive is Thailand on the World Stage?)

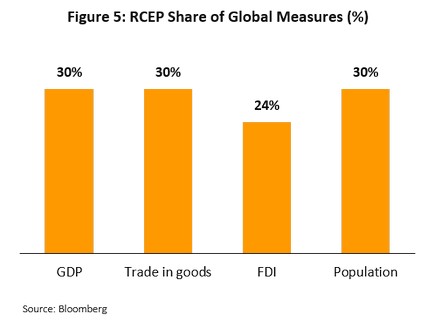

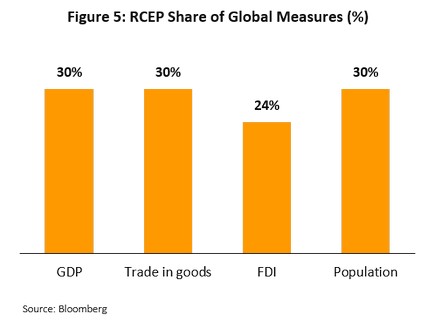

- Integration of global trade is increasingly tending to take the form of regional trade blocs, such as the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The latter has 11 members, namely Japan, Canada, Mexico, Peru, Chile, Australia, New Zealand, Singapore, Malaysia, Brunei and Vietnam. At present, Thailand has no obvious intention to join the CPTPP, mainly because of worries about anti-monopoly rules that would affect in particular the agricultural and pharmaceutical industries. On the other hand, the RCEP agreement has 10 ASEAN members and a further 5 countries that trade with the ASEAN region, namely Australia, China, Japan, New Zealand, and South Korea. The agreement has now been fully ratified[1] and so this will come into effect on 1 January, 2022. Member states have agreed to cut tariffs on around 90% of goods over a 10-20-year period, though reductions will move in step with each country’s readiness for this. Krungsri Research’s assessment of the agreement is that for Thailand, joining RCEP will benefit sales of fresh and processed fruit, fisheries products, rubber products, tires and tire products, plastics, chemicals, components for electrical goods, and computers and computer parts. The total effect of the proposed tariff reductions is not, however, expected to be dramatic since all RCEP members already have free trade agreements with Thailand. Nevertheless, over the long term, the agreement will help to increase security for Thai players embedded in regional manufacturing supply chains, in particular those where Thailand is already competitive and has a strong production base (especially in auto and auto parts manufacturing, petrochemicals, and plastics). Beyond this, over the next few years, the significant size of the RCEP market will help to bring advantages to members through their greater connection to global supply chains[2] (Figure 5).

The Thai economy 2022-2024: An export driven recovery, helped by a cyclical rebound in investment

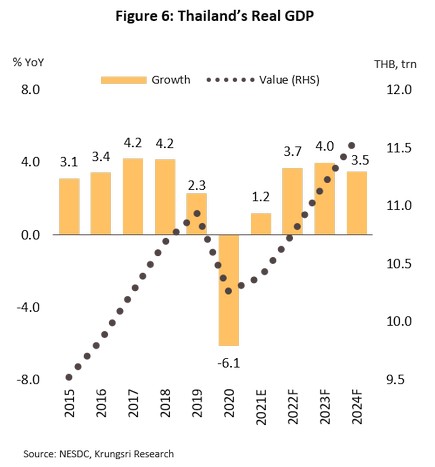

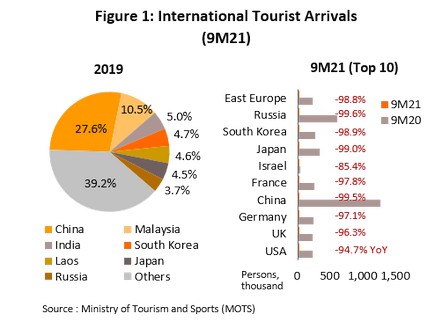

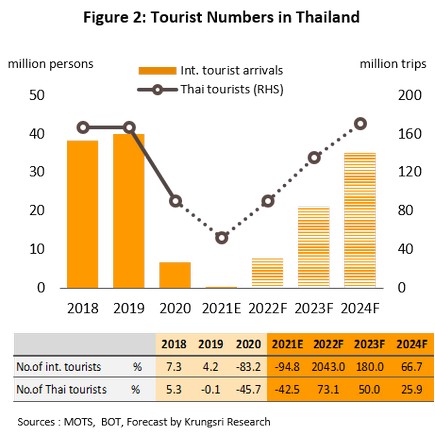

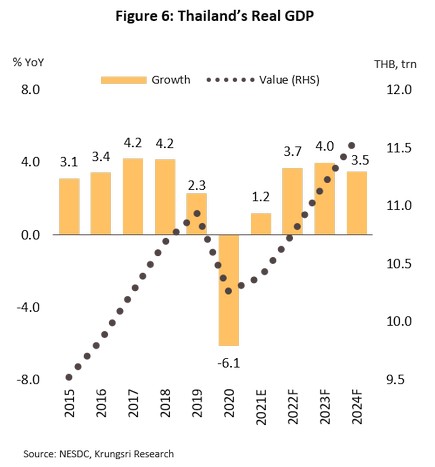

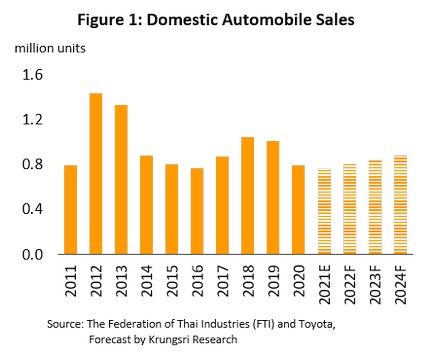

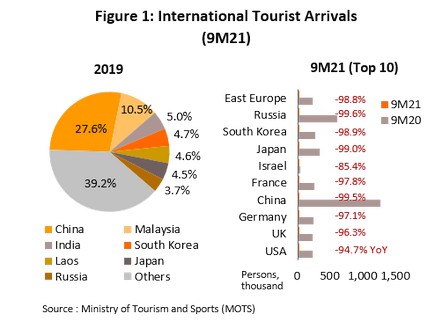

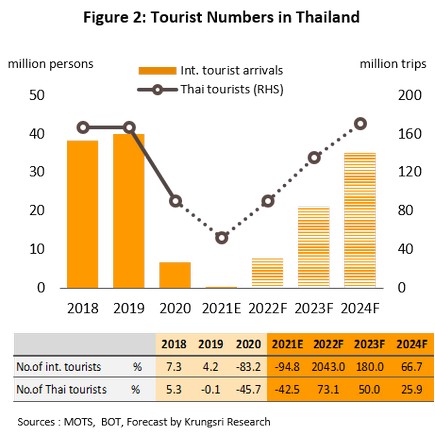

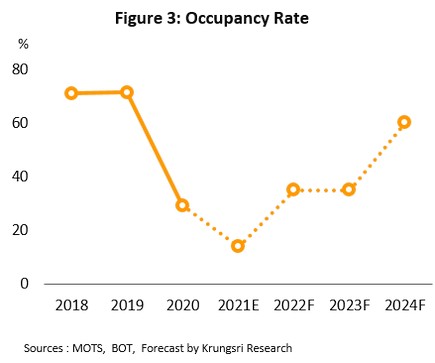

The Thai economy is expected to see average annual growth of 3.7% over the next 3 years. A gradual recovery will begin in the last quarter of 2021 (Figure 6) and this will be supported by a number of factors. (i) The progress of the vaccination program means that the COVID-19 crisis is beginning to pass and this is allowing the domestic economy to recover. In addition, widespread changes to behavior and the adoption of the ‘new normal’, combined with rapid advances towards digitalization, are also stimulating greater demand for goods and services among groups affected by these developments. (ii) The Thai tourism sector will gradually recover with Thailand’s reopening to foreign arrivals at the end of 2021, although the persistence of strict controls in some originating countries and uncertainty over the possibility of new outbreaks will continue to weigh on the sector, and it will not be until 2025 that arrivals will return to their pre-pandemic level. (iii) Exports are continuing to grow and recovery in demand globally, and in particular export markets, will combine with the trend to greater regionalization of trade to ensure that the export sector will be a major driver of economic growth for Thailand in the coming period. An especially notable example of regionalization is the RCEP , which is enforced from the start of 2022, helping to boost trade in the coming period. Despite this rosy outlook, exports will nevertheless come under pressure from supply problems, which may take the form of either shortages of raw material or higher costs, or the periodic imposition of barriers to trade. (iv) Private-sector investment will tend to rise on a combination of cyclical economic recovery and the increase in production needed to support greater digitalization. Investment will also benefit from stronger government spending on infrastructure megaprojects. (v) An additional lift to the economy will come from government stimulus that will include both regular budgetary expenses and disbursements made from what remains of the THB 500bn raised from emergency borrowing. On the monetary side, the Bank of Thailand is expected to keep policy rates at their historic low of 0.5% through to at least the end of 2022, and to leave in place help that includes measures to restructure debts and increase liquidity for household and business debtors. Regulations will also remain relaxed to ensure that assistance is made available to debtors, while the temporary easing of LTV rules will provide a further stimulus to real estate markets.

However, while the outlook is for growth over the next few years, negative factors will continue to drag on the economy, including fragility in labor markets, and rising household and corporate debt, which may then hold back increases in spending. Other risks and uncertainties could arise from possible further mutations in the COVID-19 virus or from domestic political tensions that may lead to discontinuities in government policy. Domestic and global financial markets may also have to contend with an increase in turbulence and a hike in the cost of finance, potentially unwanted side effects of the scaling back of stimulus measures and policy normalization in the major economies.

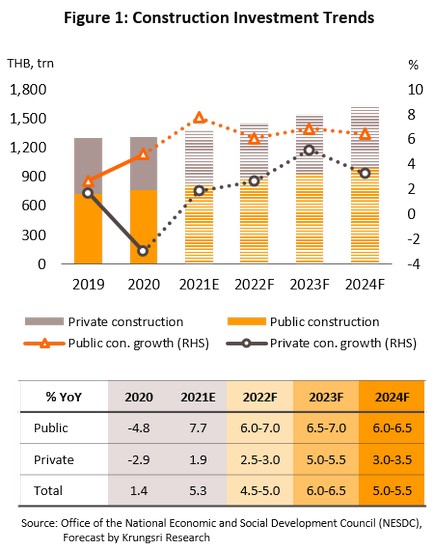

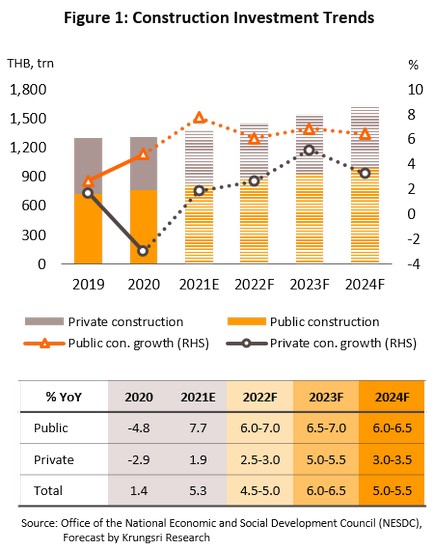

Infrastructure investment…a major driver of overall domestic economic growth

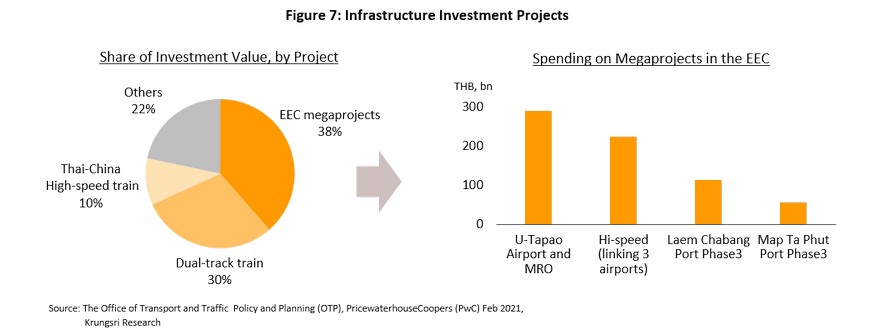

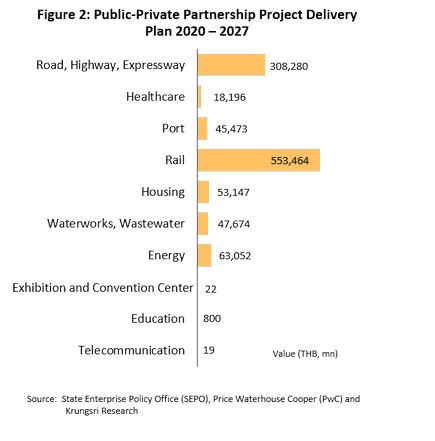

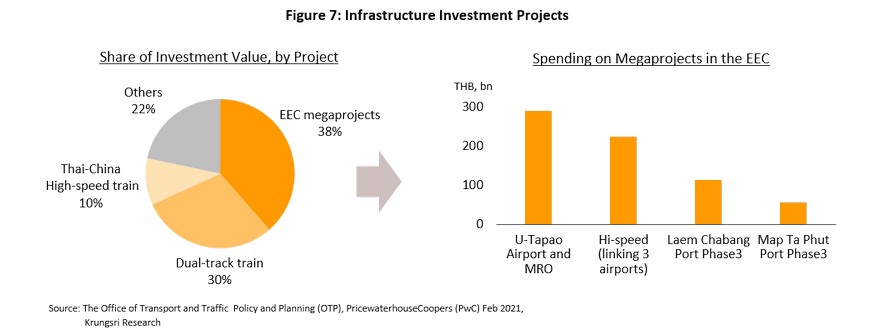

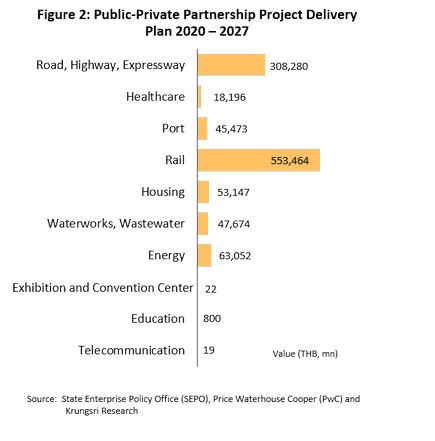

Over the next 2-3 years, an acceleration in spending on government-backed megaprojects will provide an important boost to the economy (Figure 7), though this will be particularly the case for spending on the Eastern Economic Corridor (EEC) since this will help to pull in additional foreign direct investment (FDI). In the coming period, notable government infrastructure projects will include the high-speed rail-link connecting the three airports in the Bangkok region, the development of U-Taphao Airport and the Eastern Airport City, phase 3 of the Laem Chabang Port development, and phase 3 of the Map Ta Phut Port expansion. Phase 2 of the development of the EEC is also scheduled for 2022-2026, and with a budget of THB 2.2trn, this is more valuable that phase 1’s allocation of THB 1.7trn for work carried out over 2018-2021. The government has also said that work on several important developments will take shape in 2022. Most important among these will be the Gulf of Thailand-Andaman Sea land bridge, which will provide logistics support linking the EEC with the Southern Economic Corridor (SEC).

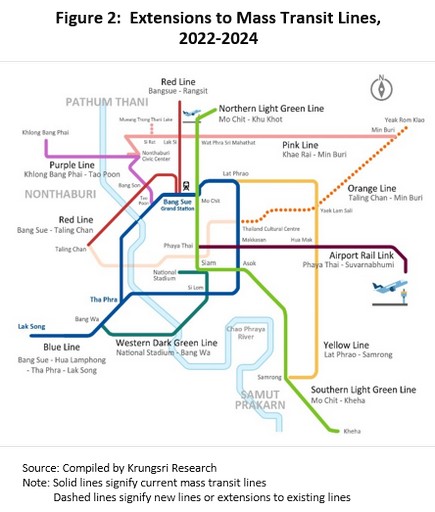

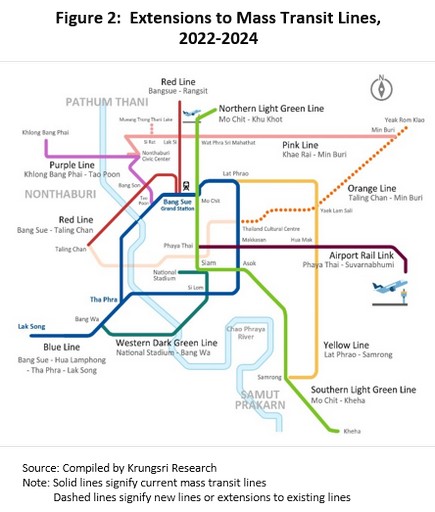

Additional work that will take place on the nation’s communications networks over 2022-2024 will follow the 2018 Transport Action Plan, itself bound by the 20-year strategy for the development of the national transportation system (2018-2037). This will include the following:

- Rail: New rail projects will include the Bangkok-Nakhon Ratchasima high-speed rail line (part of the Thailand-China line), which has been divided into 4 contracts covering around 80 kilometers, phase 2 of the dual-track Khon Kaen-Nong Khai line (167 kilometers), and the Purple Line (South) Tao Pun-Rat Burana extension (23.6 kilometers).

- Road: The Bang Khun Tien-Ban Phaeo section of the M82 motorway will have a length of 16.4 kilometers

- Other infrastructure development: Bidding for work on the development of Terminal 2 on the northern side of Suvarnabhumi Airport (able to handle 30m travelers per year) is scheduled for 2022 and it is hoped that work will be completed by 2024. Selecting contractors for phase 3 of the development of Don Muang Airport should be completed no later than the end of 2021, and work is expected to last 2 years, allowing for services to begin in 2024.

If those infrastructure project investment can be operated as planned, this will help to open opportunities for investment in downstream and related industries across the region. This will be particularly the case for investment in the production of electrical vehicles (EVs), modern medicine, smart electronics, digital technologies, and modern agriculture and future food industry.

The industrial environment

Structural problems are eroding the competitiveness of Thai industry

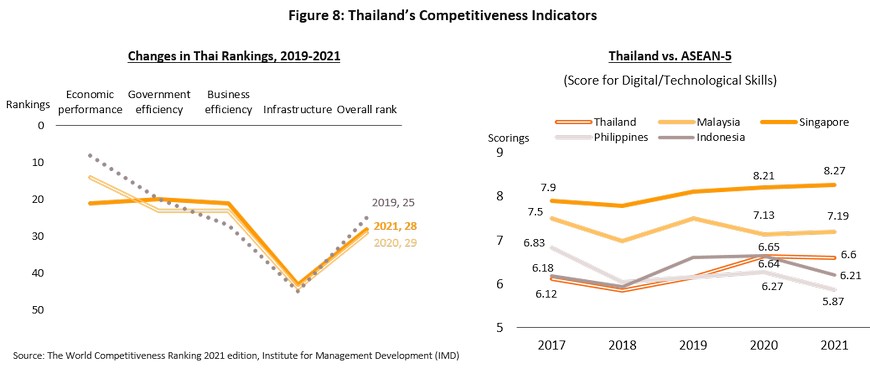

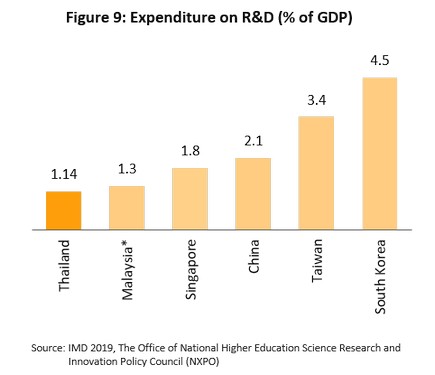

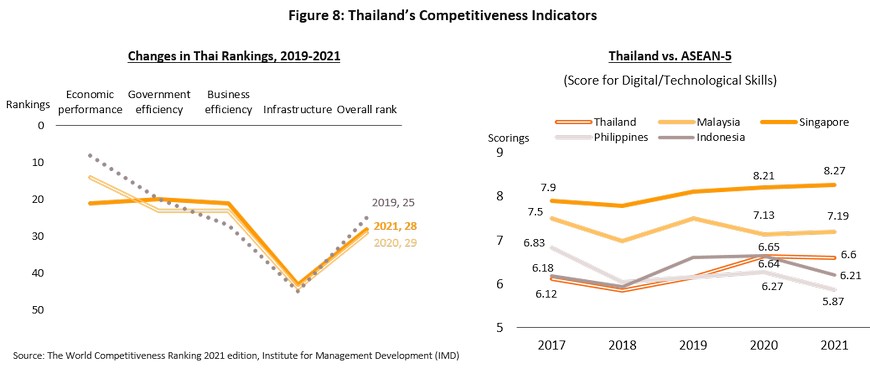

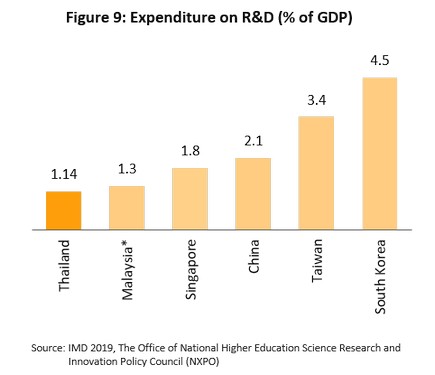

In the 2021 IMD World Competitiveness Ranking, Thailand achieved a ranking of 28, almost unchanged from 2020’s 29th placed position. Although the country was able to improve its position in government efficiency and business efficiency, the COVID-19 pandemic has had severe consequences for the tourism sector and this then affected Thailand’s position for economic performance, pulling this down 7 spots to 21st place (Figure 8). With regard to infrastructure, Thailand has made a slow progress, and although the country is ahead of Indonesia and the Philippines for technology and digital skills, it remains significantly behind Singapore and Malaysia. Thailand’s labor force is short of skilled workers in these areas, which then limits the ability of companies to innovate and develop new intellectual property. In the coming period, this will thus also affect the development of the manufacturing and service sectors. On spending on research and development, Thailand also performs poorly, and the country allocates just 1.14% of GDP to R&D (Figure 9), the lowest rate among its competitors in Asia indicating that it will take an extended period of time to develop the ability of Thai players to generate goods and services value creation through innovation for competing in global market, especially compared to the 5 countries with the most competitiveness including Switzerland, Sweden, Denmark, the Netherlands and Singapore, all of whom drew strengths from their investments in innovation, digitalization, the provision of welfare benefits, and social cohesion.

Changes to the regulatory environment that may affect Thai industry

Real estate

- Rules governing the real estate sector are currently under review, with the aim being to make purchases of land and property in Thailand more attractive to overseas buyers and to increase confidence among long-term foreign residents of the country. These changes include the following.

- The land code: An amendment to the land code may allow non-Thais to own residential property in gated communities with a value of THB 10-15m and over, provided that not more than 49% of the land on any community is owned by non-Thais. The earlier law, specified under section 96 bis of the land code, allows non-Thais to buy land for residential use provided that they have invested at least THB 40m in Thailand, they are buying no more than 1 rai of land, and they have the permission of the relevant minister.

- The Condominium Act: A proposed amendment to the law would allow non-Thais to own more than 49% of the area for sale in any given condominium building but they would not have a right to a vote in the building’s management committee (the 2008 Condominium Act (4th Amendment) permits non-Thais to own condominiums provided that no more than 49% of the area for sale within the building is owned by non-Thais.)

- Renting properties to non-Thais: A proposed amendment to the law would extend the maximum length of leases made to non-Thais to 50 years, with an extension of 40 years then also possible (Article 540 of the Civil and Commercial Code permits leases and extensions to these to be for a maximum of 30 years).

Manufacturing

- Tax on the sugar content of non-alcoholic drinks: This tax has been introduced with the aim of increasing public awareness of the dangers to personal health of consuming excessive amounts of sugar. The tax is being introduced in 4 phases. Phase 1 ran from 16 September, 2017-30 September, 2019, phase 2 is running from 1 October, 2019-30 September, 2022, phase 3 will run from 1 October, 2022-30 September, 2023, and the final phase will run from 1 October, 2023, onwards. The enforcement of this tax may encourage some producers to sell drinks with a lower sugar content or to focus more on health drinks.

- New royal decrees governing regulations in a range of industries. New regulations are being enforced across the economy to bring standards up to date. In construction and civil engineering, this has included rules on Portland cement (effective 15 March, 2022), low carbon wire (effective 27 February, 2022) and hot-rolled steel (28 May, 2022); in electrical goods and electronics, this includes rules on fittings and starters for fluorescent lights (28 January, 2022), energy-saving washing machines (27 February, 2022), and LED lights (29 March, 2022); and for food processors, it includes rules on selling pineapples in sealed packaging (16 January, 2022). As companies move to meet the requirements of these new regulations and so raise standards and improve safety, they will be forced to upgrade and modernize their technology and production processes, but this will then help to increase opportunities for players to access domestic and overseas markets.

Energy and the environment

- The plan for the transition to a carbon-neutral economy (expected to come into effect in 2023) is composed of: (i) the Power Development Plan (PDP 2022); (ii) the Gas Plan; (iii) the Alternative Energy Development Plan (AEDP); (iv) the Energy Efficiency Plan (EEP); and (v) the Oil Plan. The implementation of this will likely increase investment in businesses active in electricity production, natural gas production and importation, and oil refining.

- Changes to the energy sector will include the following:

- As laid out in PDP2018 (rev. 1), renewables generating capacity will be increased, while the share of electricity coming from fossil fuels will fall over the 10 years between 2021 and 2030. As part of this, support will come for power plants running on biomass or biogas and for waste-to-energy schemes, the market will be fully opened to supplies of power from roof-top solar installations, and to help balance supply of alternative energy, investment will be encouraged in the technology needed to store energy. Overall investment in electricity generating companies will therefore tend to accelerate from 2022 onwards.

- The electricity transmission system will be overhauled to increase its flexibility and to extend its reach into areas that have high potential as sources of alternative energy, allowing for a general expansion in the supply of power generated from renewables.

- The market for the importation of LNG will be fully opened, allowing new private-sector players to source and ship LNG (at present, only a few permits for this are issued). This is then expected to lead to lower domestic prices for natural gas.

- The plan to end financial support for biofuels (gasohol E20 and E85, and diesel B10 and B20) has been postponed to 2024 from 2022, in light of the fall in demand for energy that COVID-19 has triggered, the authorities wish to avoid inflicting further harm on ethanol producers and palm growers.

- The introduction of tighter regulations on vehicle exhausts (part of plans to reduce PM 2.5 pollution) have been postponed. Originally, the Euro 5 and Euro 6 regulations were scheduled for introduction in respectively 2021 and 2022, but this has now been pushed back to 2024 and 2025; the development of the new engines that will be needed was judged to be too costly at the moment.

- The Building Energy Code (BEC) lays out fresh energy-saving requirements that cover the design and construction of new buildings. The BEC will affect 9 types of structure: clinics and hospitals, offices, apartment buildings, meeting halls, theatres and cinemas, hotels, bars and nightclubs, educational institutions, shopping centers and department stores. For buildings with a footprint of 10,000 sq.m. and over, the BEC has been enforced from 2021, while for those with sizes greater than respectively 5,000 and 2,000 sq.m., the new rules will be enforced in 2022 and 2023. This will then raise costs related to design, construction and renovation.

Tourism

- Promoting domestic tourism

- The annual THB 40/room registration fee paid by hotels is being suspended (1 July, 2020-30 June, 2022) to reduce the financial burden on hoteliers already suffering from the COVID-19 crisis.

- The government has delayed the implementation of rules on the regulation of buildings offering hotel-type services, and operators of hotels and other types of accommodation will now have until the end of 2024 (not 2021) to make any alterations required by these regulations. These companies can also offset any expenses incurred in this against their tax to twice its value and they may also participate in government-run tourism promotion campaigns, while hotel guests are likewise able to set their hotel expenses against personal tax. Out of Thailand’s total of around 40,000 incorrectly registered providers of accommodation services, some 20,000 requested temporary waivers to the requirement to make alterations to their buildings, and this should help to increase fair competition on price, and the hotel occupancy rate should better reflect real demand.

- The relaxation of COVID-19 control measures will help to stoke recovery in the tourism sector, and from 1 January, 2022, fully-jabbed tourists who meet certain requirements will be able to enter the country quarantine-free.

Finance

- THB 250bn in soft loans has been made available to SMEs that are financially troubled but that remain fundamentally viable. Earlier regulations on soft loans have been relaxed further and credit extended to both new and existing debtors, with repayment schedules extended and collateral rates raised for risky debtors. At the same time, the government has lowered or waived business taxes and fees, and the Bank of Thailand has provided low-cost liquidity to lenders to help them release more credit to businesses and to increase access to loans for at-risk borrowers (this began in February 2021).

- THB 100bn has been allocated to support an asset warehousing scheme. The scheme provides help for sound businesses that have been badly affected by the COVID-19 crisis and that are facing a long, drawn-out recovery (in particular players in the tourism sector) but that have access to transferrable assets; the asset warehousing scheme allows these businesses to temporarily set these assets against their debts. This then means that for as long as the assets are warehoused, debtors will be spared repayments on the loan principal and interest. Businesses participating in the scheme have the option of renting their assets back again, if they need them to carry on their business, or of temporarily shuttering operations completely. Warehousing assets in this way offers the advantages of preventing a flood of unwanted assets entering the market simultaneously and so prompting fire sale discounts, and of allowing operators the option of buying their assets back again, once the business environment has improved. For its part, the government has also waived or cut taxes and other charges related to this procedures, and the Bank of Thailand has supported the program by providing low-cost funding to financial institutions equivalent to the asset-transferred price, as agreed by financial institutions and borrowers.

- Assistance to SME and corporate debtors has included debt restructuring and the establishment of the Corporate Bond Stabilization Fund (CBSF), though as yet, no applications for funding from this have been made.

- Regulations have been relaxed for retail debtors with regard to supervised personal loans, credit card debt, and digital personal loans. This will help to ease the burden of repayments and to temporarily increase liquidity (this program runs from 19 August, 2021, to 31 December, 2022).

- Required contributions to the Financial Institutions Development Fund have been cut from 0.46% to 0.23% for 2 years, beginning in April 2020.

- Plans have been made to prepare financial institutions for future change. These have included: issuing rules for the use of alternative data when offering and issuing digital personal loans (with effect from 15 September 2020); the Payment Systems Roadmap (2019-2021), which emphasizes the use of digital payments as the preferred payment method; and the issuing of rules for the operation of peer-to-peer lending platforms (with effect from July 2020).

- Rules governing the issuance of mortgages and related loans (i.e., LTV rules) have been eased for loans issued between 20 October, 2021, and 31 December, 2022. These changes raised the ceiling on the value of these loans (the LTV ratio) to 100% of the value of the loan collateral (i.e., mortgages may temporarily be taken out that cover the full value of the property being purchased) when these loans are for the purchase of a house, or when the loan is for other purposes but it is secured against a property, or it is a top-up loan. This applies when: (i) the value of the collateral is less than THB 10m and the loan is being made for a second (or more) home; or (ii) the value of the collateral is greater than THB 10m, and the loan is being made for a first (or more) home. These measures have been introduced to stimulate housing markets and related parts, that have combined share of 9.8% of Thailand’s GDP.

Others

- The Ministry of Commerce has banned the import of second-hand motorcycles (including those powered by internal combustion engines, electrical motorcycles and bicycles, and sidecars). These rules will come into effect in February 2022 and will have a negative impact on importers as well as on the broader market for second-hand motorcycles and related industries, e.g., those providing maintenance services and distributors of second-hand parts.

- To allow their growing and processing, the authorities have removed three plant products (hemp, cannabis and kratom) from the list of illegal narcotics. This will now allow for an increase in added value for products derived from these and an expansion in downstream industries.

Krungsri Research believes that the features of the macroeconomic and business environments outlined above will present businesses with both opportunities and threats, and in responding to this situation, players will need to be quick to adapt themselves to evolving economic and social contexts and to a changing regulatory regime. Doing so will allow companies to put down the foundations needed to support the construction of an environment conducive to long-term, sustainable growth.

AGRICULTURE

Rice

Situation in 2021

- Over 10M21, production index of paddy increased 7.7% YoY on the greater availability of water and more favorable climatic conditions from 2H20 onwards. This combined with the government’s income guarantee scheme to encourage farmers to extend the area cultivated or to increase cycle of plantations. However, price index for paddy slumped 18.7% YoY with a sharp fall in the price of both jasmine and glutinous rice. This was a result of: (i) an oversupply of rice in 2021 that then depressed prices; and (ii) strong competition in world markets, which also undercut prices. Given this, overall income index for rice growers slipped 12.5% YoY in line with lower prices.

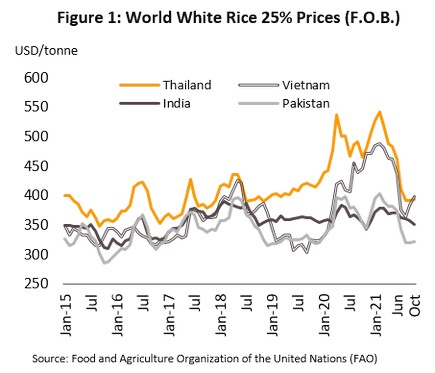

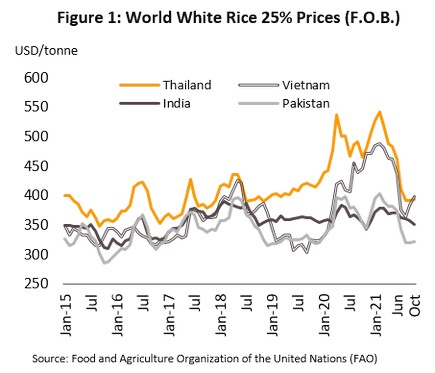

- Export volume inched up 1.4% YoY to 4.6m tonnes in 10M21 after it shrank 31.0% YoY during the first 5 months owing to high cost of Thai rice. A rise in volume was supported by a sharp decrease in rice prices (relative to Vietnam, India, Pakistan and China). However, export value fell 13.2% YoY to USD 2.6bn following lower rice prices.

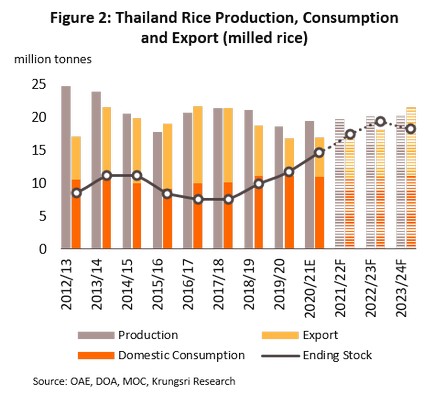

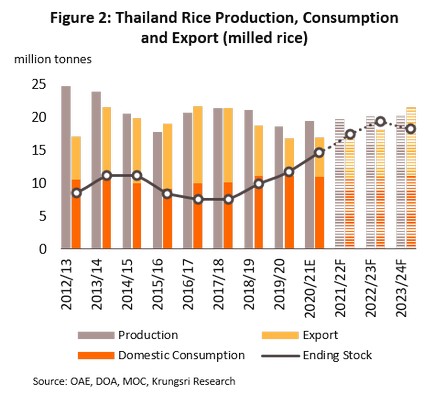

- Outputs in Q4 (when 80% of the main crop is harvested) are expected to rise on (i) favorable weather and rainfall, and (ii) the government stimulus measures to support and earlier high prices, which encouraged farmers to expand the area planted/number of plantings. For 2021 overall, total paddy outputs are forecast to rise 4.4% to 29.9mn tonnes, while falling prices for Thai rice in 2H21, which could enhance Thailand’s competitiveness, is expected to lift exports by 4.6% to 6.0m tonnes.

Outlook for 2022-2024

- The forecast is that annual outputs of paddy is forecast to increase 1.5-2.5% to 30.3-31.3 m tonnes, yielding 19.7-20.3m tonnes of milled rice. helped by (i) likely favorable weather conditions and rainfall (over 2022-2023, crops may continue to benefit from La Niña conditions), which would allow greater access to irrigation water; (ii) the government’s subsidy measures to help farmers and stabilize the rice market, which include income guarantee schemes, crop insurance, help with planting plans, pledging schemes that help slow the release of the new crop to the market, and plans to balance the rice industry and to provide the agricultural sector with sufficient irrigation water.

- Domestic demand is expected to grow to 10.7-11.1m tonnes per year, helped by the easing of the COVID-19 crisis and the reopening of the country to tourism, which will then support stronger demand from food processors, restaurants, hotels and other downstream industries.

- Exports would average 7-8m tonnes annually, with demand especially strong from South Africa, the US, China, Benin, and Japan.

- Export prices will tend to remain close to the low level seen in 2021, held down by anticipated strong outputs in Thailand and high stocks of rice worldwide.

Rubber

Situation in 2021

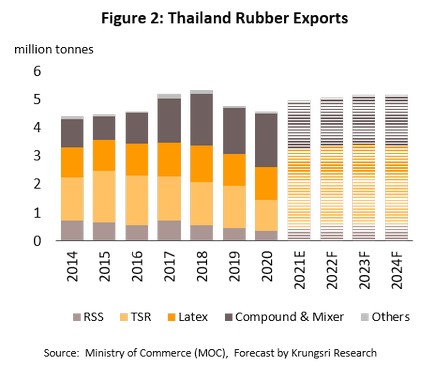

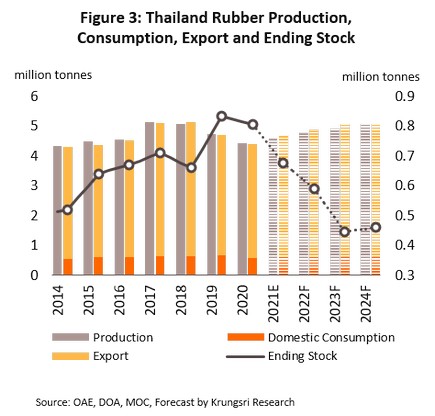

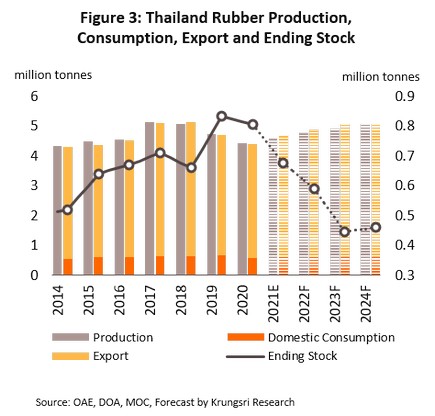

- In 9M21, the index of natural rubber production rose 4.9% YoY, boosted by higher prices and government income guarantee schemes incentivize farmer to tap the rubber. Exports also strengthened, climbing 3.6% YoY to 3.5m tonnes on higher demand for TSR and RSS from tire, autos and auto parts manufacturers in China, where domestic stocks of rubber have fallen, and for latex from surgical gloves and medical devices. This underpinned a 29.2% surge in export prices, which pushed up export value by 33.9% YoY to USD 6.0bn. Domestic demand also increased from downstream industries (autos, auto parts, surgical gloves and rubber medical devices) and government support through increasing purchases by state bodies.

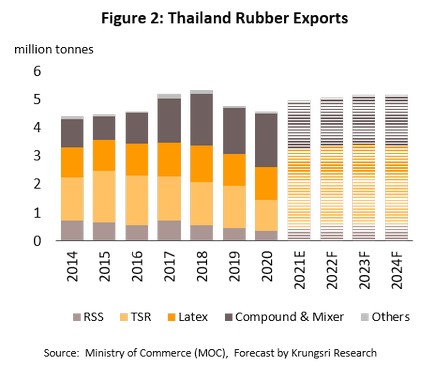

- In the final quarter of 2021, both production and sales of rubber will tend to improve and for the year overall, output of intermediate rubber products is expected to rise 3.0-4.0% to 4.6m tonnes. As regards overseas sales, although a shortage of container space and high freight charges are weighing on the industry, the forecast is that exports will climb 8.0-10.0% to 4.8-5.0m tonnes, helped by: (i) stronger demand from China, Malaysia, Japan and the US; (ii) reducing supply from competitors especially Indonesia and Malaysia that faced persistent problems with outbreaks of leaf fall disease and labor shortages of rubber tapping workers. Export prices are also expected to jump 20.0-30.0% on strong demand and still-high prices for commodities generally, though especially for crude, and given this, the export value will climb by 30.0-35.0% to USD 8.2-8.4bn. Domestic sales should rise by 3.0-4.0% on greater demand from downstream industries and increasing purchases of rubber by state bodies.

Outlook for 2022-2024

- Rubber outputs are predicted to increase at an average annual rate of 3.0-4.0%, supported by (i) the earlier expansion in plantation sizes, and (ii) stronger demand in domestic and export markets and subsequent higher prices.

- Demand will tend to increase, and domestically, the market is expected to expand by 3.0-4.0% annually as the economy rebounds and progress is made on infrastructure projects, generating greater demand for rubber in downstream industries. Exports should also increase by 2.0-3.0% per annum, supported by a recovery in downstream industries, including autos and auto parts, surgical gloves and medical devices, and the manufacture of sanitary and healthcare products connected to the aging of society.

- RSS and TSR: Exports should increase by respectively 1.0-2.0% and 2.0-3.0%, helped by (i) recovery in the auto and auto parts industries, and (ii) the rebuilding of rubber inventories.

- Concentrated latex: Exports are predicted to edge up 1.0-2.0% but the rate of increase will be limited by the high baseline set in 2021 and competition from competitor nations (i.e., Indonesia and Malaysia), which will begin to recover.

- Compound and mixed rubber: Exports would expand by 1.5-3.0% on growth in the electronics, construction, transport, petroleum and chemical industries.

Cassava

Situation in 2021

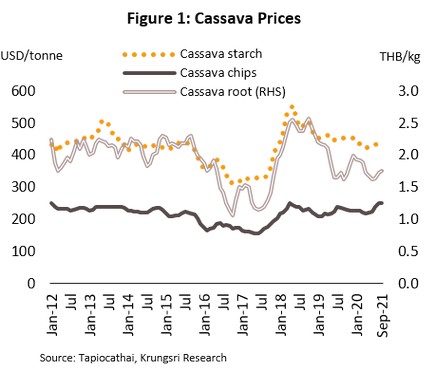

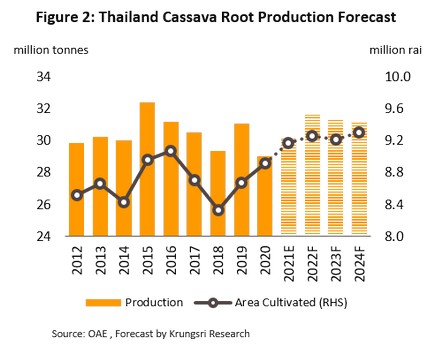

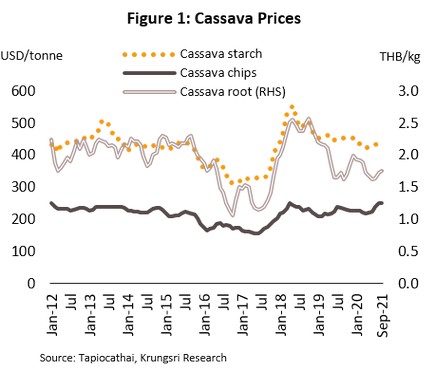

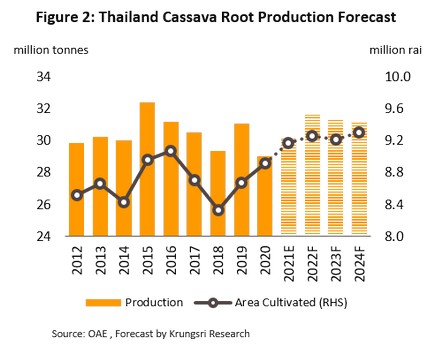

- Over 10M21, the fresh cassava production index rose 8.7% YoY on: (i) an expansion in the area under cultivation, itself helped by (i.1) prices for cassava that have been rising since 2H20, and (i.2) government support for growers, provided in particular through the income guarantee scheme; and (ii) rainfall and irrigation water that were sufficient to support the area under cultivation. Exports of cassava products also performed well in the period.

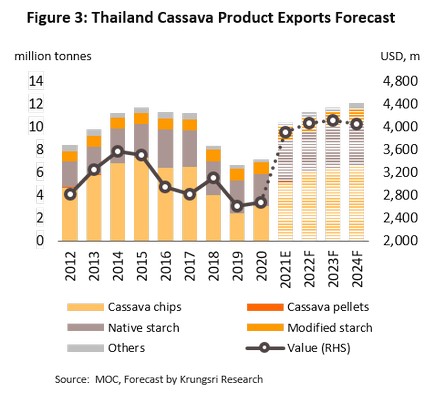

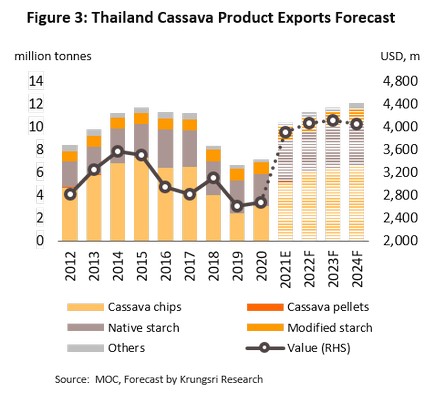

- Exports of cassava chips and cassava pellets (43.0% and 0.2% share of totals respectively) jumped by respectively 59.3% and 45.8% YoY, mostly due to stronger purchases from China driven by: (i) increased demand as a replacement for corn (which is now more expensive) for use in the production of alcohol and ethanol; and (ii) the abating of disease outbreaks in swine herds and chicken flocks, leading to improving demand for use in animal feed production.

- Exports of native (39.0% share) and modified starch (14.6% share) rose by 33.8% YoY and 15.0% YoY, respectively. Demand was again lifted by the Chinese market, especially in downstream industries including food and beverage processing, paper, glue, textiles, chemicals, fiberboard, pharmaceuticals and cosmetics.

- Demand should continue to strengthen in the remainder of the year, and for 2021 overall, the total output of fresh cassava is estimated to hit 30.1m tonnes, up 3.8% (6.7% drop in 2020). Domestic demand would increase by 1.8% (down from 2020’s growth of 4.6%) boosted by use in food processing, energy generation, and alcohol production. Exports would strengthen in all product categories, rising 50.0-55.0% for cassava chip, 40.0-45.0% for cassava pellets, 26.0-30.0% for native starch and 12.0-16.0% for modified starch.

Outlook for 2022-2024

- Outputs of fresh cassava are predicted to expand by 2.0-3.0% annually thanks to an expansion in the area under cultivation, sufficient water supplies, government support for farmers, and the price incentive provided to growers by recovery in the world economy and the government support for exports. Distribution to the domestic market would grow by 2.5-3.5% p.a., on: (i) anticipated recovery in the food industry following the easing of the COVID-19 crisis; (ii) rising demand for cassava for use in ethanol production; and (iii) greater concern over public hygiene that will support stronger demand for cassava chip for use in alcohol production. Exports of cassava products would expand by 5.0-6.0% annually.

- Cassava chip: Exports will rise by 6.0-7.0% per year to a total of 6.1-6.7m tonnes. Demand from the main export market of China will be strong for use in the production of disinfecting alcohol, ethanol (for use in construction and as a power source), and in animal feed.

- Cassava pellets: Exports will tend to remain low at around 10-15 thousand tonnes, with demand mostly for use as a biofuel and as an animal feed.

- Native starch: Exports will edge up by 2.0-3.0% annually to 3.5-3.7m tonnes. Demand will strengthen from China’s food processing, chemicals and beverage production.

- Modified starch: Exports are forecast to strengthen to 1.2-1.3m tonnes per year (up 1.5-2.5%) on rising demand from China and Japan, in particular from players in food, cosmetics and medicines industries.

Sugar

Situation in 2021

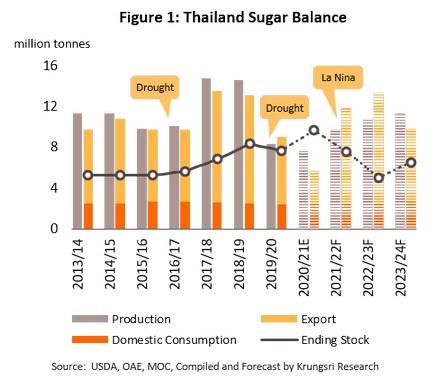

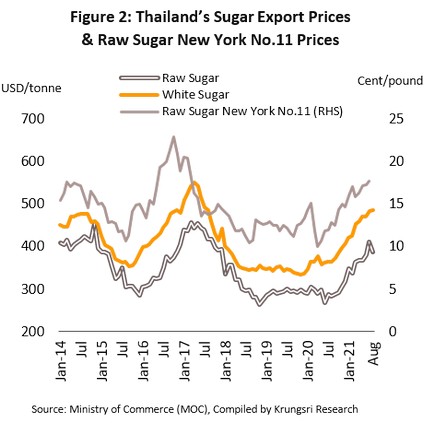

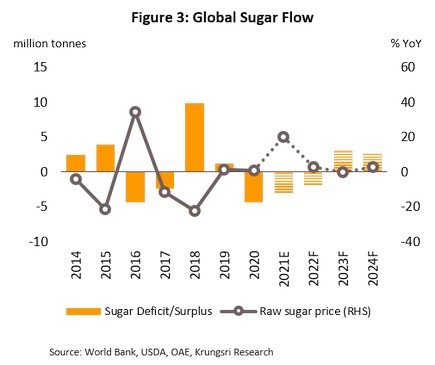

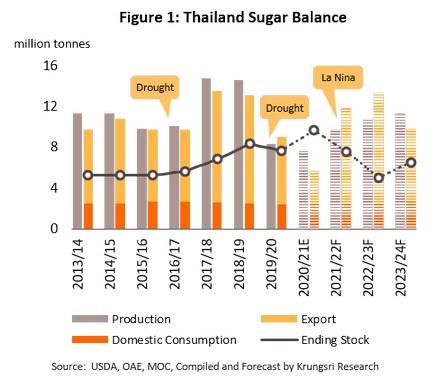

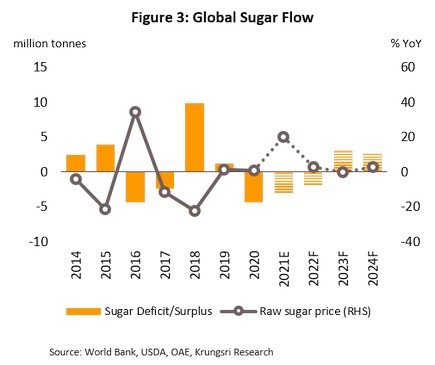

- In the 2020-2021 growing season, outputs of sugarcane for pressing dropped 11.0%, reducing sugar output by 8.5% YoY to 7.6m tonnes. This was a result of (i) prices for cane that were lower than production costs, and (ii) the drought that ran from 2019 to 2020. However, pressing outputs for the 2021-2022 season are expected to be up 28.6% to 85.8m tonnes on (i) better weather and access to irrigation water, and (ii) the stimulus effects of setting the minimum guaranteed price for 2021-2022 and 2022-2023 at THB 1,000/tonne (not including adjustments based on sugar content and other factors).

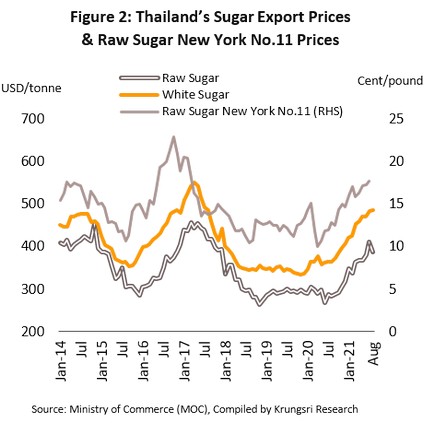

- Over 10M21, exports of sugar and molasses crashed 44.5% YoY to 3.1m tonnes, split between 1.5m tonnes of raw sugar (-52.2% YoY), 1.6m tonnes of granulated sugar (-26.7% YoY) and 0.07m tonnes of molasses (-81.5% YoY). These declines were driven by supply shortages, which then impaired the ability of producers to supply export markets. However, demand remained strong, especially from food processors, producers of beverages, and manufacturers of ethanol and alcohol, and as such, export prices for sugar and molasses jumped 34.4% YoY. This then held back the fall in the value of exports, which slipped 25.4% YoY to USD 1.29bn.

- 2021 exports of sugar and molasses combined are expected to shrink by between -40.0% and -45.0% with regard to volume and by between -20.0% and -25.0% with regard to value. This will follow declines in 2020 of 44.2% and 41.5%, respectively. However, compared to a decline of 4.8% last year, domestic demand is forecast to rise by 1.0-5.0% to 2.3-2.5m tonnes, helped by growth in demand from food processors, brewers and distillers, and producers of ethanol and disinfecting alcohol.

Outlook for 2022-2024

- Output of sugar will tend to rise on the upcoming La Nina which causes water supply to increase and government support for sugarcane growers and sugar producers, including the 70:30 profit split, financial aid for purchases of inputs, and the minimum price guarantees for sugarcane. In addition, the industry will benefit from the minimum price guarantees given by the Thai Sugar Millers Association. Average sugarcane outputs bounce back to around 86-99m tonnes/year, yielding 9.5-11.5m tonnes of sugar annually (this would represent average growth of 10.0-15.0% per year).

- Exports of sugar and molasses should bounce back to around 7-11m tonnes/year (up 25.0-30.0% annually) on: (i) the return of sugar output to its level prior to the 2019-2020 drought; and (ii) recovery in the world economy following the easing of the COVID-19 crisis. Domestic demand is forecast to increase by 2.0-3.0% per year to 2.5-2.7m tonnes/year. The market will be helped by: (i) gradual growth in economic activity, especially for players in the food, beverage, ethanol and disinfectant alcohol industries; and (ii) the setting of a higher minimum ethanol content for the standard gasohol mix.

Oil Palm

Situation in 2021

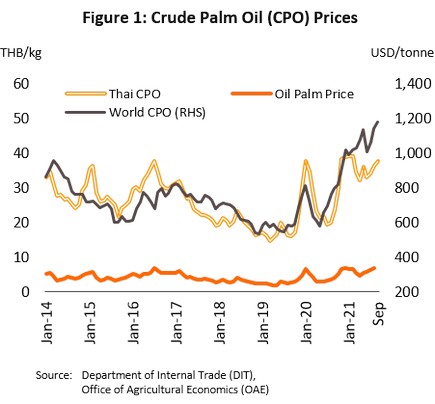

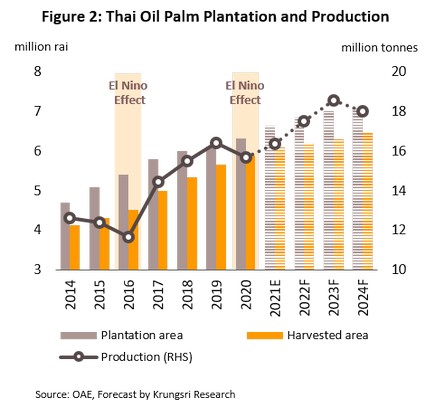

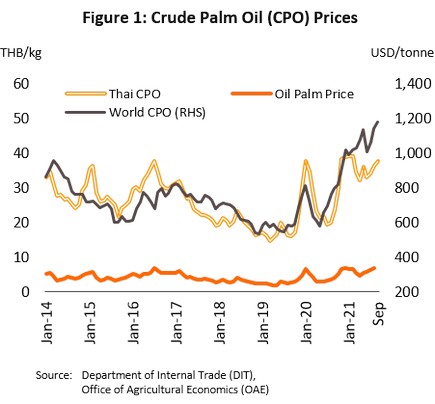

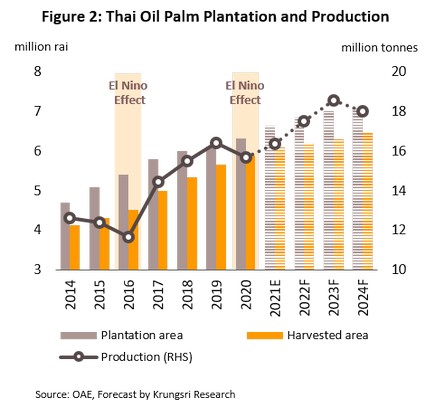

- Over 9M21, quantities of palm fruits used to produce crude palm oil (CPO) totaled 13.1m tonnes, up 2.4% YoY on (i) stronger total demand that lifted prices of palm fruits to THB 6.1/kilo (+52.8% YoY) that encourage farmers to harvest, and (ii) favorable rainfall and weather for cultivation. Palm trees which are properly nourished and harvested with standard guideline could produce high percentage of palm oil to 17.8% from 17.7%. Total output of CPO came to 2.3m tonnes (+3.6% YoY). Unfortunately, domestic demand for use CPO dropped 6.1% YoY to 1.8m tonnes on the COVID-19 pandemic and the combined effects of the lockdown measures and WFH policy, which precipitated a 15.1% YoY slump in sales of transport biodiesel (to 0.86m tonnes). However, exports of palm oil products surged 151.4% YoY to 0.61m tonnes, generating receipts of USD 699.8m (+316.7% YoY) due to government efforts to reduce a supply glut by stimulating exports and stronger global demand, which fed into a 206.0% YoY jump in sales of CPO, bringing this up to 0.55m tonnes. The major export markets were India (up 190.2% YoY to 0.39m tonnes) and Malaysia (up 277.9% YoY to 0.12m tonnes).

- In the remainder of 2021, output will continue to benefit from high prices while demand is driven by export markets with government support. For 2021 overall, output of fresh oil palm is thus forecast to increase 9.5% to 16.4m tonnes. But weaker domestic demand for crude palm oil (esp. those related to energy) will bring demand down by 2.0% to 4.0%. Given the jump in export demand from India and Malaysia seen earlier in the year, 2021 exports are expected to rise 85.0-90.0%, pushing up prices and cutting year-end domestic stocks of CPO to 0.16-0.18m tonnes, below the buffer stock of 0.20-0.25m tonnes. Prices for fresh palm and CPO will rise by respectively 47.3% (to THB 6.7/ kg.) and 32.0% (to THB 37.1/kg.). Prices for exports of palm oil products are also expected to climb 60.0-65.0%.

Outlook for 2022-2024

- Fresh palm output is forecast to rise by 4.0-5.0% per year thanks to (i) the earlier expansion in plantations, with these trees now at an age when yields are high, and (ii) the impact of government income guarantees and potential high prices. In addition, domestic demand for CPO is likely to rise by 4.0-5.0% annually on growth in downstream industries (esp. transportation) and the switch to B10 as the standard diesel mix (i.e., this will now be 10% biodiesel). Exports should return to annual growth at the more normal level of 2.5-3.5%, helped by demand from the major markets of India and Malaysia and by government efforts to rebalance the market for palm oil.

- Income for growers is unlikely to rise, and may become more uncertain. The price of fresh palm fruits is expected to slide on higher quantities in Thai and overseas markets (yields per rai in both Malaysia and Indonesia are trending upwards), and in the process, prices may also show greater variability.

- CPO refineries will see turnover rise at levels similar to those of the recent past. Although demand will be boosted by government support for the industry (e.g., for power generation, promoting greater consumption of biodiesel, and supporting exports), production capacity across the industry exceeds the volume of fresh palm. This excess capacity and stiffer competition for access to raw materials would raise CPO production costs.

Chilled, Frozen and Processed Chicken

Situation in 2021

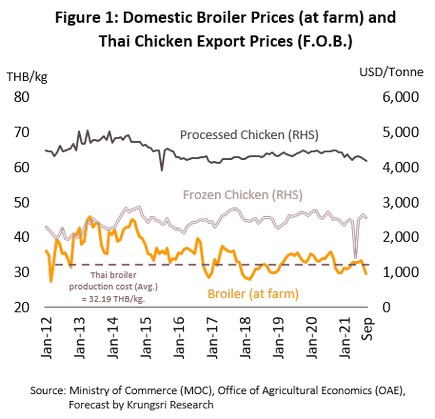

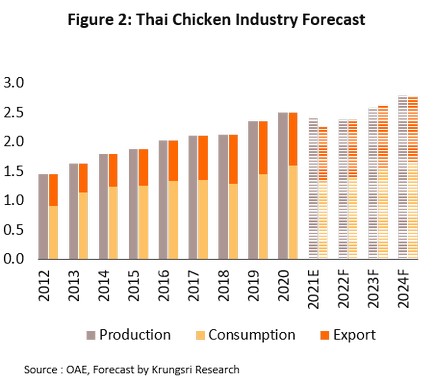

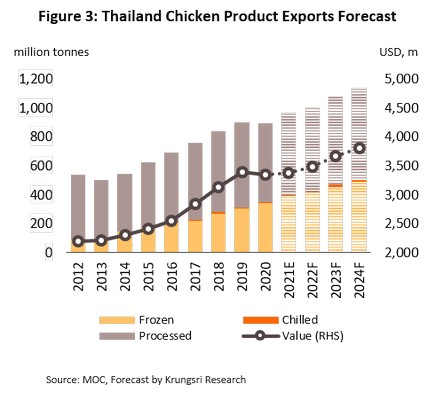

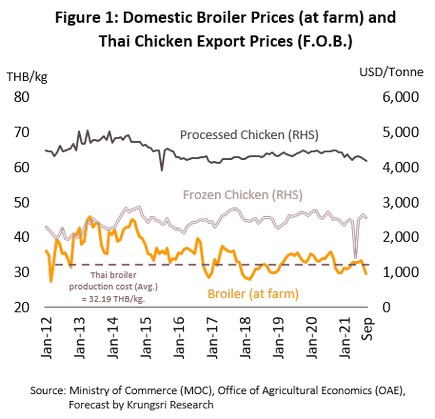

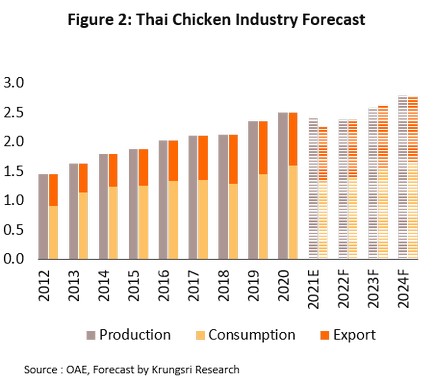

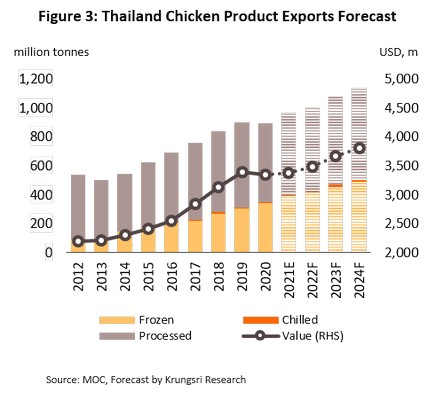

- Over 9M21, output of chilled, frozen and processed chicken slipped 2.5% to 1.9m tonnes due to outbreaks of COVID-19 in processing plants that then forced their temporary closure. Domestic demand shrank 1.4% YoY on weakening consumer purchasing power and the effects of the lockdown on purchases from businesses such as restaurants. However, exports rose 5.2% YoY to 0.7m tonnes, helped by demand provided by the Tokyo Olympics and the rush to reach EU import quotas. Unfortunately, export prices slipped 8.4% YoY and this then cut the value of exports to USD 2.4bn (-3.6% YoY).

- The impact of COVID-19 will continue to be felt across the industry through the remainder of the year. For all of 2021, output is expected to slip by 4.0-5.0% to 2.38-2.40m tonnes, while domestic demand will be reduced by 1.0-2.0%. Exports are forecast to rise 7.0-8.0% to 0.9-1.0m tonnes. COVID-19 has caused production in some exporting countries to slow or to halt. Although Thai producers have also been affected by COVID outbreaks, Thai chicken production processes are held in high regard internationally, and so overseas buyers have turned to Thai producers, particularly those from Malaysia, the Netherlands, South Korea, the CLMV nations, and countries in Africa and the Middle East. However, farm prices have fallen somewhat, dropping to an average of THB 33.0-34.0/kg from THB 35.5/kg in 2020. The temporary closure of processing facilities forced farmers to hold on to their flocks, which then grew beyond the standard export size[1], while there was also insufficient cold storage space for chicken meat that had been processed and so operators were forced to offload stock at discounted prices. At the same time, costs have risen for the prevention and treatment of outbreaks of illness in flocks and workers, feed (especially for corn), and transport and shipping. As such, operators’ margins have narrowed.

Outlook for 2022-2024

- Both supply and demand will strengthen, helped by the impact of economic recovery on both domestic and export markets. Output is thus forecast to rise by 4.0-6.0% annually to 2.58-2.79m tonnes, while domestic demand will increase by 7.0-8.0% per year, lifted by economic recovery especially the rebound in the tourism, hotel and restaurant industries. Exports are also expected to grow at the average annual rate of 5.0-6.0% on stronger demand in major export markets, including Japan, the UK, and China.

- Operators will have to contend with the risk of rising costs due to more expensive animal feed and the imposition of non-tariff barriers to trade, in particular the greater use of those related to animal welfare and environmental protection (e.g., checking that animal feed is not sourced from deforested land, and that animals are raised in environmentally friendly conditions). Players will therefore need to pay greater attention to these issues and to raise production standards to meet these requirements, and increase their competitiveness.

Canned Fish

Situation in 2021

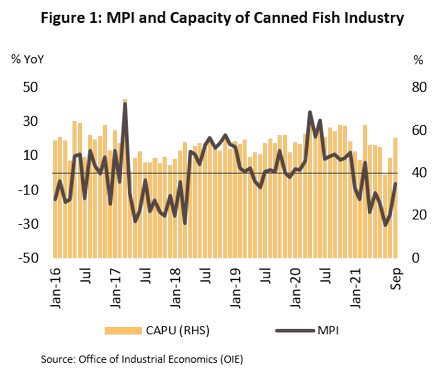

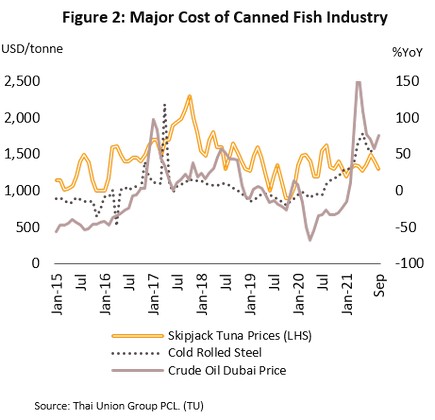

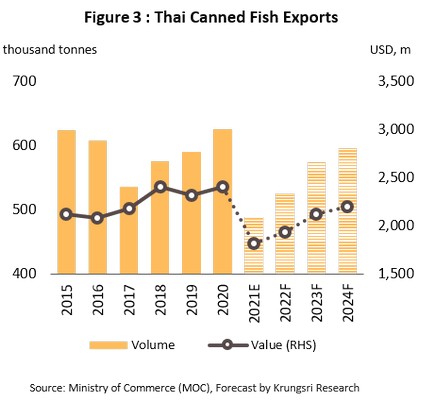

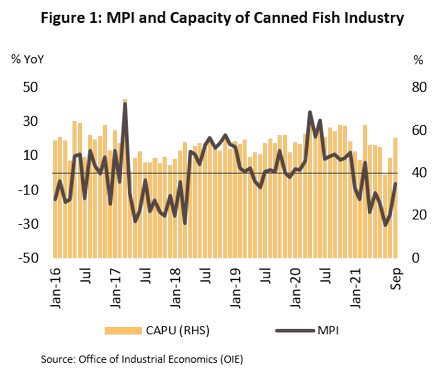

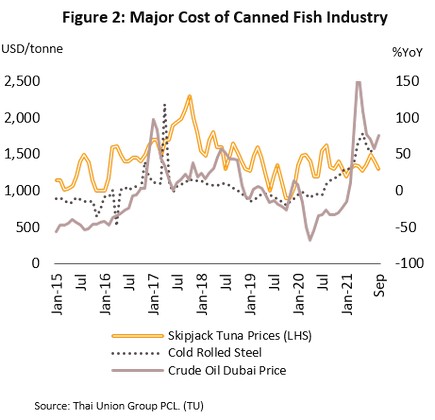

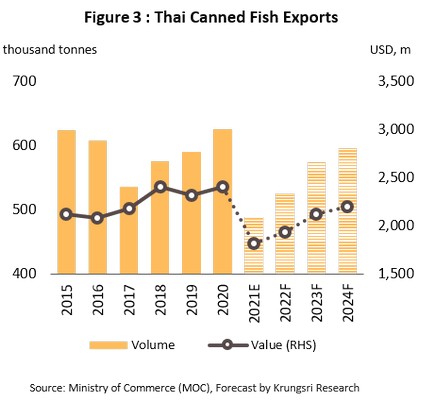

- The canned fish industry suffered its sharpest contraction in 4 years over 9M21 owing to (i) labor shortages caused by the continuing spread of COVID-19; (ii) insufficient sheet steel supply which caused a 53.6% YoY jump in prices and raise production costs; and (iii) transportation problems caused by a shortage of container space and high freight charges that weighed on imports of fish for canning and on exports of finished goods. Output of canned fish dropped 14.1% YoY, with declines seen for both canned tuna (-15.8% YoY) and sardines (-5.8% YoY). This pulled down sales to the domestic market (17.4% of total output) by 8.4% YoY, while exports (82.6% of total output) fell by 23.4% YoY to 0.37m tonnes. In addition, higher import duties and falling demand in major export markets are also weighing on growth in the industry. Thus, exports declined to almost all major overseas markets, including the US (-40.8% YoY), Libya (-64.5% YoY), Japan (-19.6% YoY), Australia (-18.0% YoY), and Saudi Arabia (-36.6% YoY). Export prices also weakened in 9M21, dropping 0.7% YoY for canned tuna and 3.8% YoY for canned sardines to give an overall decline of 2.1% YoY. This was partly caused by stronger competition from players from countries that have lower production costs, including the Philippines, Indonesia, Vietnam and the ACP countries (Africa, Caribbean and the Pacific). As a consequence, the export

s value of canned fish slumped 25.1% YoY to USD 1.40bn.

- In Q4, although the COVID-19 pandemic is beginning to abate, the industry is still saddled with falling orders and high production costs, especially for oil and steel. For 2021, having grown 10.7% in 2020, output of canned fish is forecast to decline by 10.0% to 14.0%. Exports are predicted to drop by 20.0% to 22.0% in volume, largely because of a softening in demand for canned tuna and fell by 22.0% to 24.0% in value.

Outlook for 2022-2024

- The canned fish industry is likely to rebound in the coming period, and output is forecast to strengthen by 5.0%-6.0% per annum on: (i) a recovery in world trade and the global economy, which will spur higher demand in export markets; (ii) Thai players’ advantages with regard to health and hygiene (these are mostly medium to large-scale operations); and (iii) ongoing development of new higher value-added products by Thai seafood companies. As such, the volume and value of exports are predicted to increase by an annual average of respectively 4.0%-7.0% and 3.5%-6.5%.

- Challenges facing the industry will include (i) more unpredictable weather, which may affect the catch; ii) a shortage of inputs; (iii) rising production costs (e.g., for fish, steel and energy); (iv) a shortage of unskilled labor, and increasing barriers to trade, especially of non-tariff barriers (e.g., policies that aim at reducing or preventing unsustainable fishing practices or the use of illegal labor); and v) the industry will rising health concerns and a greater desire to eat fresh food in place of canned or processed foods. These factors will then drag on profits, especially for SMEs.

ENERGY & UTILITIES

Power Generation

Situation in 2021

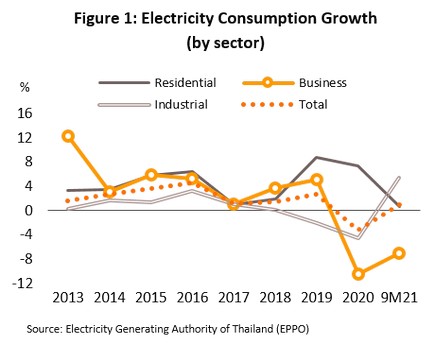

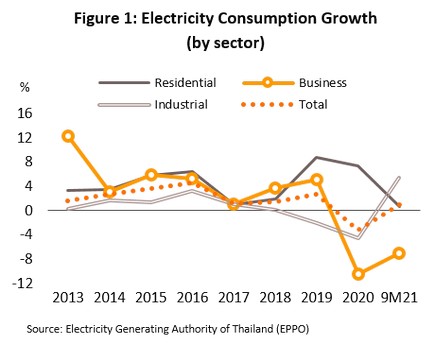

- Demand for electricity rose 1.0% YoY in 9M21 on a 5.5% YoY increase in consumption by industry (responsible for 45.0% of total electricity demand). Individual sectors that reported the greatest rise in electricity usage were, in order, auto assembly, steel and basic metals, rubber and rubber products, electronics, chemicals, and plastics. Household electricity consumption also edged up 0.7% YoY in the period, but consumption by the business sector dropped 7.0% YoY, with the biggest declines seen in areas connected to tourism, including hotels, restaurants, financial institutions, department stores, and apartments and guesthouses. Peak demand was also up 5.2% to a maximum in April of 30,135.3 MW.

- Electricity generation increased 0.7% YoY in 9M21. Generation by EGAT (30.8% of the total) fell 5.5% YoY, while from the private sector, supply from IPPs (22.2% of the total) fell 0.2% YoY and supply from SPPs (25.3% of the total) fell 0.6% YoY but up 3.5% YoY from VSPPs (5.7% of the total). The remainder came from imports from neighboring countries (the remaining 16.0%), which rose 18.4% YoY.

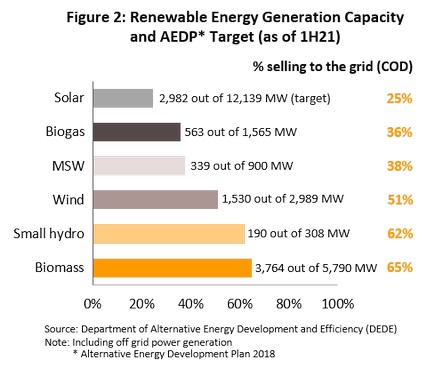

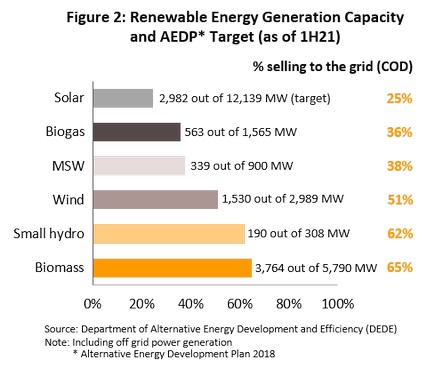

- In 1H21, installed renewables capacity that was contracted to sell into the grid rose 3.1% from its level at the end of 2020 to reach 9,368.4 MW[1]. Biomass, wind and biogas capacity rose by respectively 7.0%, 1.6% and 1.5% in the period. But the quantity of electricity actually supplied to the grid was only 46% of that specified in the AEDP 2018 plan, which sets a goal of 26,491 MW[1] by 2037. The best performing segment was biomass electricity production, which was 65% of the target, followed by micro-hydro, wind, community waste-to-energy, biogas and solar.

- Electricity consumption will continue to rise in the rest of 2021, now that controls on economic activities have been relaxed and the country has reopened to international tourists. Compared to the fall of 3.1% seen in 2020, average demand for electricity in 2021 is thus expected to be up 1.5%.

2022-2024 Outlook

- The power generation sector will see continuing growth in the coming period, with demand expected to rise by 3.6% annually over the next 3 years on gradual economic recovery, and the PDP, which is encouraging investment in each of the 3 main types of power plants, and with this, installed capacity will expand.

- IPPs: Competitive bidding is expected to be held in a number of locations, with the authorities in particular planning to hold auctions for 700 MW of new supply per year in the west of the country over 2021 and 2022. This will replace 8,300 MW of natural gas-powered plants that will see their supply contracts expire over 2025-2027.

- SPPs: Investment in new power plants and additional generating capacity should be ongoing, especially in natural gas cogeneration plants which contracts will expire in 2019-2025, and SPP hybrid renewables, which benefit from input costs that are significantly below retail electricity prices[2]. Investment should also increase in the EEC to meet stronger future demand in the area.

- VSPPs: Investment will accelerate in 2022, and because the government has set targets for increased purchases over 2022-2024, this will particularly affect rooftop solar installations, biomass, biogas, and waste-to-energy schemes. These segments also benefit from producers’ cost competitiveness and access to raw materials.

Oil Refineries

Situation in 2021

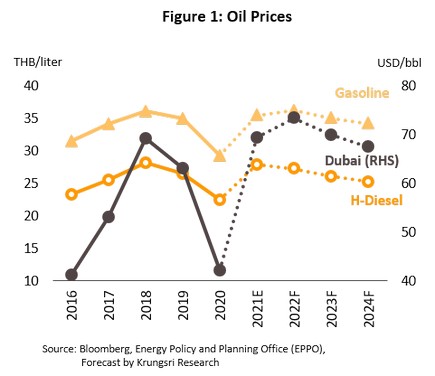

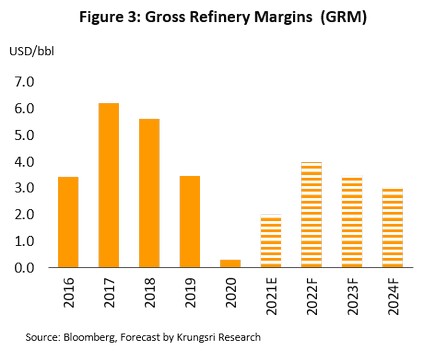

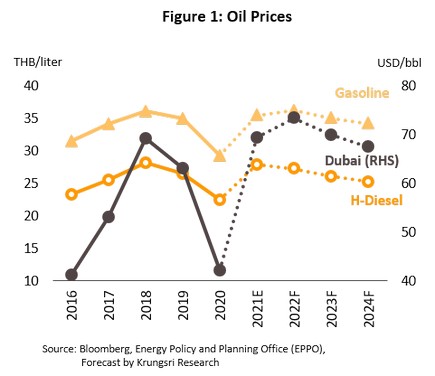

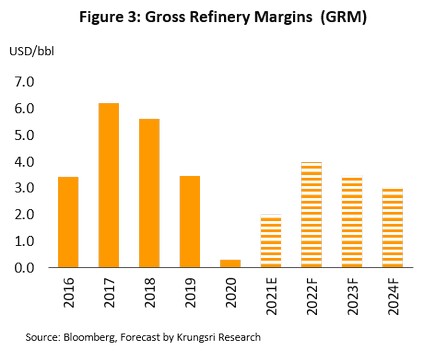

- Global prices for crude oil rose through 9M21 with the economic rebound and ensuing recovery in consumption. The latter took demand to 96.6m bbl/day, while supply lagged at 94.7m bbl/day, and the gap between the two served to push up prices by 58.1% YoY to an average of USD 65.8/bbl. At the same time, average gross refinery margins (GRMs) widened to USD 0.9/bbl, having averaged just USD 0.3 through 9M20.

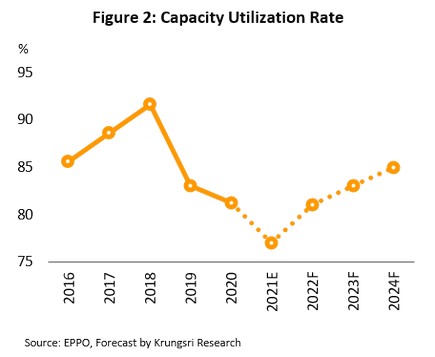

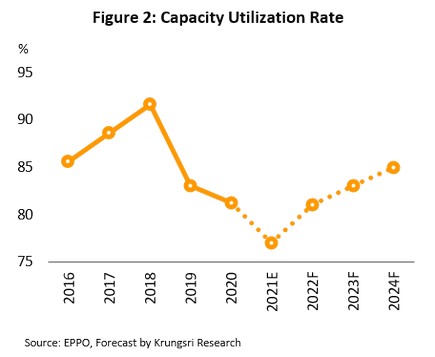

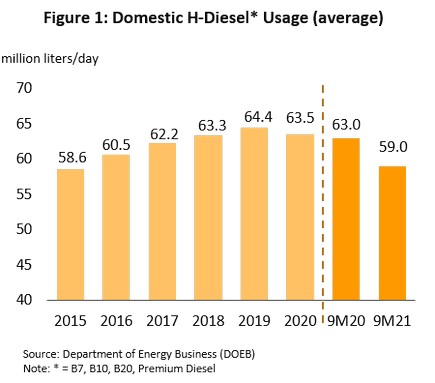

- Thai refiners had to make do with depressed turnover that suffered under the twin impacts of tight global GRMs and the severe outbreak of COVID-19 from April to September that then cut 8.3% YoY from 9M21 demand. Demand for diesel[1] fuel and gasoline[2] (product) thus fell by 6.0% YoY and 8.7% YoY in the period, while sales of jet fuel crashed 46.0% YoY. However, the cost of crude oil that rised in line with global market lifted average pump prices for diesel fuel and gasoline to THB 34.9 and THB 27.3, respectively, from THB 29.3 and THB 20.2 per liter average in 9M20. Capacity utilization stood at 77%.

- In Q4, refiners will see an improvement in the business environment as economic activity rebounds and tourism begins to recover. For all of 2021, the situation will be as follows.

- Dubai Crude oil price should rise to an average of USD 69.5/bbl (against USD 42.2 in 2020), while the Singapore GRM will widen to USD 2.0/bbl (compared to USD 0.3 last year).

- Domestic demand for refined products will be down by between 5.0% and 6.0%, having already fallen 12.1% in 2020, while prices for gasoline and diesel fuel will rise from 2020’s average of THB 29.3 and THB 22.4 per liter to THB 35.5 and THB 27.9 per liter. However, capacity utilization is expected to slip to 77% from last year’s 81% because some refineries have remained down for repairs for longer than expected.

2022-2024 Outlook

- Over the next 3 years, the average price for Dubai crude oil will remain close to its 2021 level, with high capacity limiting the room within which prices may rise. Dubai crude oil is thus forecast to average USD 73.5/bbl in 2022 before sliding back to USD 70.0 and USD 67.5/bbl in 2023 and 2024. Recovering global demand for refined products (with the exception of jet fuel, demand for which is still restricted by limitations on air travel) will then help to increase the Singapore GRM to an average of USD 3.0-4.0/bbl over 2022-2024.

- Domestic prices for refined products will tend to rise with economic recovery. Prices for gasoline are predicted to climb to THB 36.3/liter in 2022, before softening to averages of THB 35.1 and THB 34.3 per liter in 2023 and 2024. Over the same three years, prices for diesel are forecast to average THB 27.3, THB 26.1 and THB 25.3 per liter.

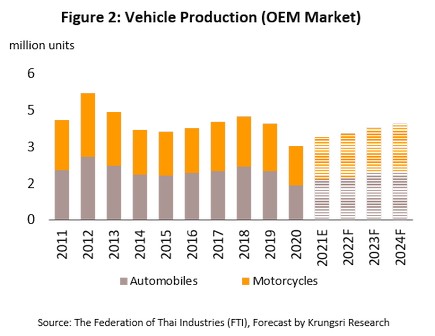

- Operators will benefit from rising turnover and stronger profits as domestic demand recovers and the GRM widens. The expected 3.0-4.0% annual increase in the size of the national vehicle fleet will help to underpin rising consumption of refined products, and thus demand is likely to expand by 2.5-3.5% per year. In addition, because no new refining capacity is planned for the next 3 years, capacity utilization should rise to 80-85%.

Ethanol

Situation in 2021

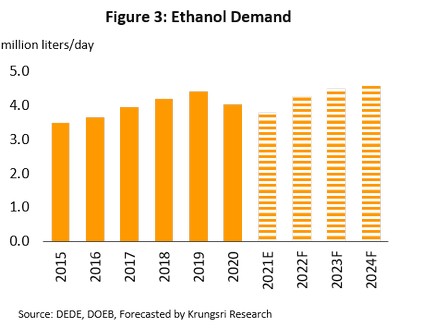

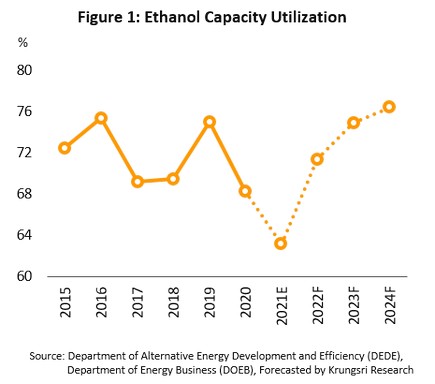

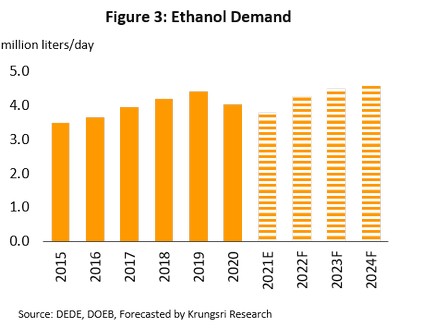

- In 9M21, consumption dropped 9.9% YoY to an average of 3.60m liters/day caused by reduction of gasohol demand (-9.0% YoY). Demand was seriously affected by the outbreak of COVID-19, and restrictions on inter-province travel. For the remainder of 2021, the lifting of these controls and the reopening of the country in November should boost traveling and demand for ethanol. Across the year, demand is expected to average 3.79m liters/day, down 6.1% from 2020’s average of 4.03m liters/day.

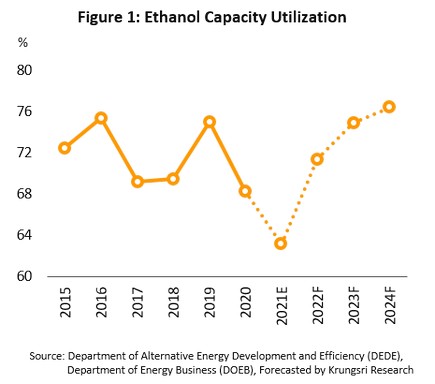

- Ethanol production slipped 7.7% YoY to 3.79m liters/day in 9M21 on a fall in the supply of inputs, in particular of sugarcane, hit by the drought. This caused a 12.7% YoY fall in production of ethanol made from molasses (down to 2.25m liters/day) and a 4.8% YoY drop in production from sugarcane (to 0.19m liters/day). However, thanks to higher quantities and prices that were lower than those for sugarcane, these declines were partly offset by a 1.4% YoY increase in output of ethanol made from cassava, which then rose to 1.36m liters/day. Because demand fell faster than supply, at the end of September, ethanol inventories stood at 101.6m liters (+18.1% YoY), while for all 2021, capacity utilization would fall to 63% from 2020’s 68%.

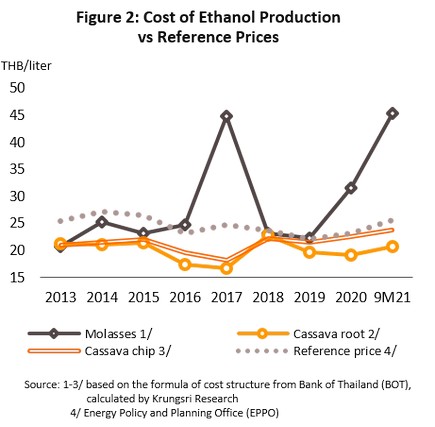

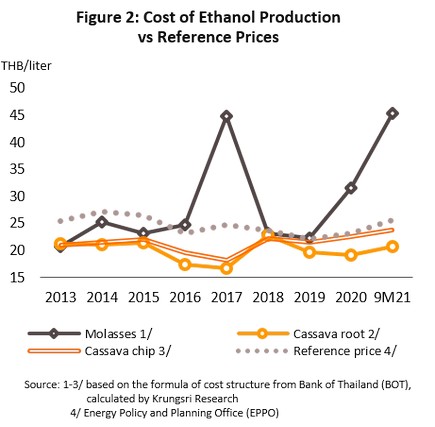

- Manufacturers producing ethanol from fresh cassava and cassava chip stayed profitable in the period, despite the cost of these rising to respectively THB 2.03/kilogram (+14.8% YoY) and THB 5.97/kilogram (+10.6% YoY), which pushed up production costs to THB 20.77/liter (+8.5% YoY) and THB 23.78/liter (+6.8% YoY). However, with average prices running to THB 9.06/kilogram (+74.8% YoY), operators producing from molasses had to shoulder costs that rose to their highest in a decade. This ramped up production costs to THB 45.30/liter (+55.5% YoY), against an average reference price of THB 25-26/liter, rising from THB 23.21/liter in 2020

2022-2024 Outlook

- Demand for ethanol is forecast to rise to 4.2-4.6m liters/day (up 5.5% annually), moving in step with greater consumption of gasohol E10 (95) and E20. (It is estimated that sales of these will increase to the point that they represent 25-30% of all sales of gasohol). This outlook is supported by the following:

- The government plans to make E20 the standard gasoline mix in 2023 (during a process of drawing up a new ethanol reference price). This will stimulate greater consumption of biofuels and replace sales of E10, which the government plans to withdraw from distribution in 2022, boosting demand for ethanol to 6-7m liters/day from the 2021 level of 4-5 liters/day.

- Demand will strengthen steadily with the completion of the vaccine program and the reopening of the country to foreign arrivals, which will then help the economy return to growth.

- The number of vehicles on Thai roads capable of running on gasohol is increasing by 1.5-2.5% per year, and by the end of the period, the total is expected to reach 30-32m vehicles, up from 29.8m as of October 2021. Particularly important will be the annual addition of 0.8-0.9 million new models that are capable of running on E20.

Biodiesel

Situation in 2021

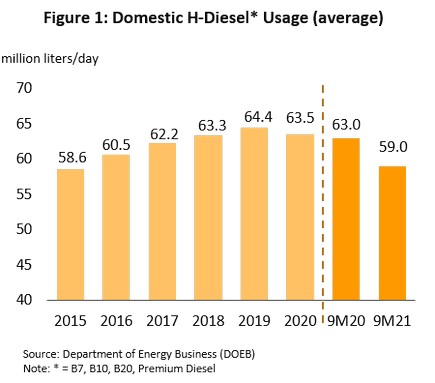

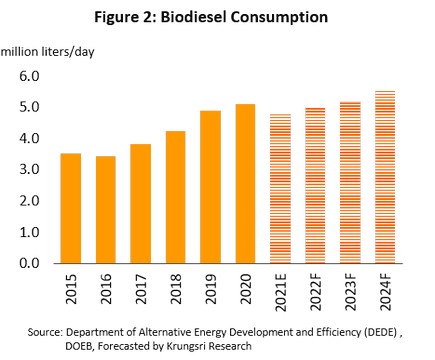

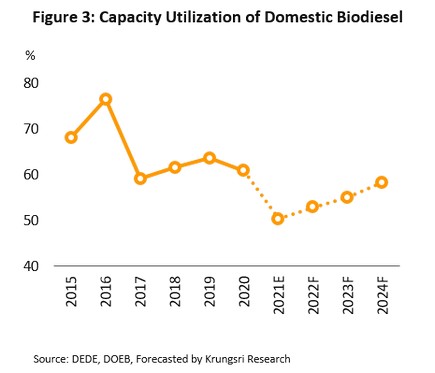

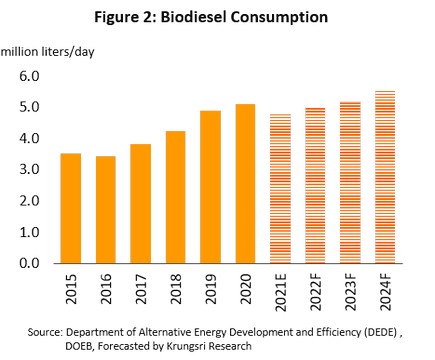

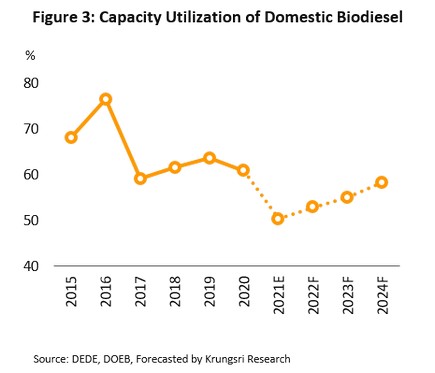

- Production of biodiesel dropped 8.0% YoY over 9M21, slipping to 4.61m liters/day as the effects of the COVID-19 outbreak and the subsequent decline in travel and corresponding increase in working from home cut into consumption of B100 for mixing with mineral diesel. Demand thus declined 9.1% YoY to an average of 4.64m liters/day. In Q4, the slowing of the pandemic and the easing of the lockdown will translate into an improving outlook for the industry, and so for 2021 overall, average biodiesel output and demand will come to respectively 4.74m liters/day (-6.0%) and 4.76m liters/day, 0.35m liters/day below its 2020 level. However, new facilities have come online, lifting production capacity by 13.7% to 9.4m liters/day, and so for 2021, capacity utilization will drop to 50.4%, down from 60.9% in 2020.

- Over 9M21, the biodiesel reference price (used in sales by producers to distributors) increased by 31.6% YoY to THB 39.1/liters or THB 45.2/kg. This was due to: (i) labor shortages in Malaysia and Indonesia (major exporters) that then caused a drop in outputs of palm oil; (ii) increased exports of crude palm oil (CPO) from Thailand; and (iii) a decline in domestic stocks of CPO to the buffer stock level of 0.20-0.25m liters. As such, prices for CPO and palm stearin jumped by respectively 39.9% and 21.8% YoY, ending at THB 35.8/kg and THB 36.2/kg each. The CPO-biodiesel spread was thus wider in 9M21, increasing to THB 9.4/kg from THB 8.8/kg in 9M20.

2022-2024 Outlook

- Overall, the biodiesel industry will be able to look forward to average annual growth of 4.0%-6.0% annually. Demand would increase to 5.3-5.5m liters/day, boosted by the following factors.

- Demand for the use of diesel-powered vehicles in the transportation sector will rise on: (i) an economic recovery; (ii) expansion in e-commerce sales, which will increase use of commercial vehicles (especially pickups); (iii) greater economic integration across the ASEAN region that will drive greater use of commercial vehicles; and (iv) an average increase of 3.0%-4.0% in the number of diesel-powered vehicles on Thai roads.

- Government efforts to restore balance to the palm oil market will include encouraging greater exports of CPO (to reduce the current supply glut), increasing the proportion of B100 in the standard diesel mix, better management and control of stocks, and measures to encourage higher demand for biodiesel through price support managed via the Oil Fuel Fund.

- Major auto manufacturers are developing engines that can run on diesel containing a higher proportion of biodiesel, and these will be installed in large trucks, pickups, SUVs and regular sedans.

PETROCHEMICALS

Petrochemicals

Situation in 2021

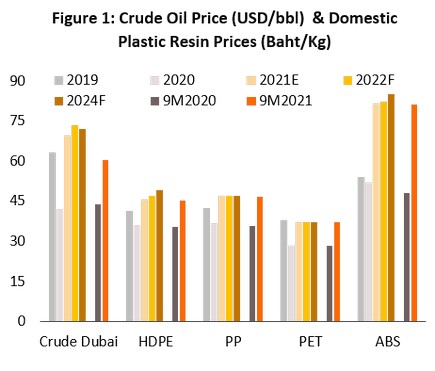

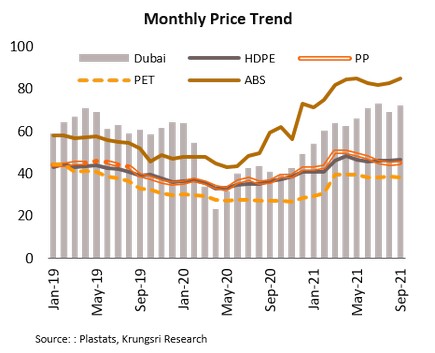

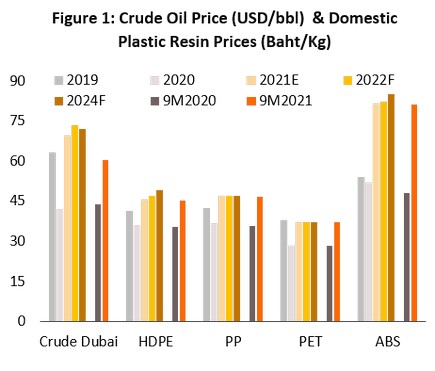

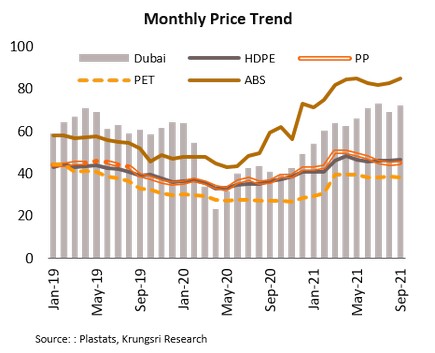

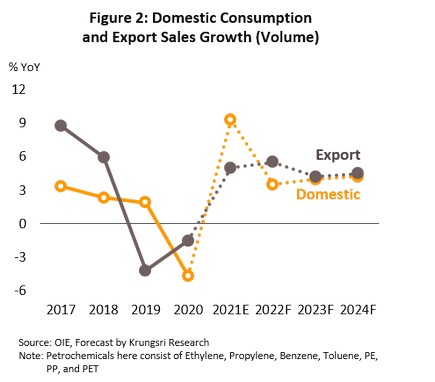

- Demand for petrochemicals strengthened through 9M21 in step with recovery in manufacturing at home and abroad. At the same time, the rising cost of crude oil pushed up prices for all the main petrochemical product groups, including polyethylene (PE), polypropylene (PP), PET and ABS, which were up respectively 28.6%, 30.4%, 30.5% and 68.2% YoY. Demand for petrochemical products from downstream industries is forecast to increase steadily through the rest of the year, and as such, 2021 growth in demand from domestic and export markets is expected to hit 9.0-9.5% and 5.0%, respectively, having each slipped by 4.6% and 1.5% a year earlier.

- Naphtha prices averaged USD 630.3/tonne, up 67.6% YoY on rising crude oil prices. For all of 2021, the cost is expected to average USD 640/tonne.

- Upstream petrochemicals: The ethylene spread averaged USD 373.1/tonne in 9M21, up from USD 278.1 in 9M20, while for benzene, the spread averaged USD 301.6, compared to USD 111.6 a year earlier. For 2021 overall, spreads are forecast to average around USD 340 and USD 278/tonne, respectively.

- Downstream petrochemicals: Polyethylene (PE) spread narrowed to USD 121.2/tonne from USD 152.1 in 9M20 as cost increases outpaced price rises. But for polypropylene (PP), spreads widened from USD 149.4/tonne to an average of USD 282.8. For 2021, spreads for these two products are expected to average USD 120 and USD 282 per tonne, respectively.

- Players in the petrochemicals industry will see improving returns through 2021 thanks to a combination of rising prices and stronger demand from downstream consumers, though the escalating cost of inputs may put some pressure on profits.

2021-2023 Outlook

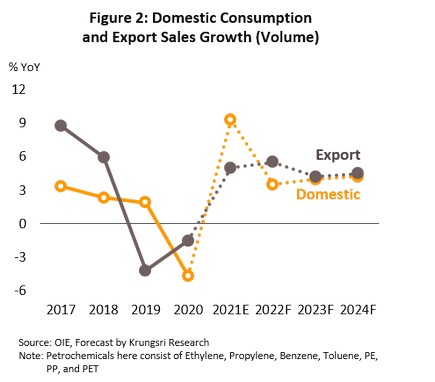

- Demand for petrochemicals is expected to rise from downstream industries (e.g., packaging, construction, auto assembly, and medical devices) combine with continuing worries over public health that will boost demand for single-use plastic goods (i.e., those made from PE, PP, and PET). However, global crude prices are expected to average around USD 70/bbl over 2022-2024, and this will tend to squeeze spreads. Overall, volume of demand for petrochemical products for domestic use and export is expected to grow over the next 3 years at averages annual rate of respectively 3.5-4.0% and 4.5-5.0%.

- Petrochemical players will tend to shift production lines to a stronger emphasis on high-value specialty products, such as ABS, as they look to meet demand for plastics for use in, for example, the production of EV auto parts, batteries and medical equipment. To increase market opportunities and to move beyond depending entirely on traditional products, some players will also increase investment in the production of biodegradable and recycled plastics.