EXECUTIVE SUMMARY

The modern trade industry can look forward to average annual growth of 5.0-5.5% over 2024 to 2026. Expansion will be driven by: (i) growth in the economy that will then steadily lift consumer purchasing power; (ii) the continuing rebound in the tourism sector and the positive effects of this on retail businesses, especially for branches and businesses located in the main tourist areas; (iii) progress on government-backed infrastructure megaprojects and the drafting of new planning regulations for Bangkok, which will then allow retailers to extend their retail networks in step with ongoing urban spread; (iv) expansion in online sales; and (v) economic growth in neighboring countries that will generate an uptick in business for retailers in border areas and major regional centers.

Nevertheless, the industry will face a number of challenges including rising levels of competition from incumbents, new entrants to the market, and domestic and overseas online retailers that are distributing through e-marketplaces. This will then force modern trade outlets to increase spending on technology as they look to sharpen their competitiveness, while global megatrends that are encouraging businesses and consumers to focus much more attentively on sustainability and environmentally friendly operations will also impact the industry.

Krungsri Research view

The 2024-2026 outlook for individual segments is given below.

-

Department stores: Sales growth will strengthen from 2023’s 3.6% expansion to growth of 4.0-5.0% annually thanks to the strength of department stores’ customer base, which is largely of mid- to upper-income consumers who have relatively stable purchasing power. Players are also adjusting their business playbooks by focusing on the development of omnichannel platforms and the use of technologies such as AR to provide shoppers with a seamless experience and to make the overall customer journey more attractive. Players will also step up their investments in high-potential markets upcountry and in the broader region, and this will support the development of additional sources of income.

-

Discount stores/hypermarkets/supercenters: 2023’s growth of 2.0% will inch up to 2.0-3.0% over the next three years as the purchasing power of mid- to lower-income consumers slowly strengthens. As they expand into local communities across the country, operators will increasingly adopt multi-format stores by adapting and diversifying the store types that they deploy. At the same time, players will develop premium stores targeting upper-income shoppers, and these trends will help them connect to a wider range of customers. Alongside this, businesses will continue to put their efforts into the development of digital platforms, all the while selling goods at prices that undercut those of other types of retailers. However, a lack of strong product differentiation marking their lines off from those on sale in other segments of the retail market will mean that operators will face stiffening competition.

-

Supermarkets: Annual sales growth may move up slightly from the 6.5% achieved in 2023 to 6.5-7.0% in the coming period. This segment will enjoy the highest growth of the retail sector thanks to players’ ability to match their marketing strategies to the needs of their customers, most of whom have significant purchasing power. Supermarkets benefit from strategies that include: (i) expanding market share by modernizing and focusing their stock lines on high-end goods (e.g., high-quality imported lines, health products and organic products); (ii) expanding their presence into large communities and higher-income provinces; (iii) developing their online offerings to make the consumers’ online journey as smooth as possible. In light of this and the benefits that they gain from their economies of scale, supermarkets will likely be able to sustain healthy levels of turnover.

-

Convenience stores/minimarts: Income rose 5.0% in 2023, and annual growth will continue in the range of 5.0-5.5% over the next 3 years thanks to the continuing expansion in the coverage of branch networks, though outlets are now present in almost every part of the country. Players are also adapting their business strategies by increasing their use of online channels, offering delivery services, and selling a broader range of fresh food and drinks. This will, though, be balanced by an intensification of market pressure as direct competitors open branches to challenge convenience stores, while indirect competitors (e.g., hypermarkets) increasingly shrink their retail formats as they look to steal market share. Thus, the move by major players to partner with traditional retailers is helping these establish a presence on the high street, and this is then affecting convenience store takings. As such, average branch incomes are likely to fall from earlier highs, but while franchisees will face an increased threat to their operations, franchisors will continue to generate profits.

Overview

The modern trade industry falls within the broader retail sector, which as of 2023, had a total value of THB 2.8 trillion (Figure 1), and the sector thus accounted for 15.7% of Thailand’s total GDP. This was sufficient to put the retail sector second in terms of its importance to the Thai economy, coming after only manufacturing, which has a 24.9% share of GDP. Modern trade players are generally major corporations that operate extended commercial networks, and because they buy in such large quantities, their market strength and negotiating position outweighs that of manufacturers and distributors1/. Stores are managed using modern logistics and distribution techniques, and players are in the process of leveraging a greater use of modern technology and an expanded online presence for the advantages that this provides to their marketing.

Modern trade outlets have enjoyed rapid growth in Thailand, especially in and around Bangkok, tourist areas, and other more urbanized parts of the country. Success has been built on: (i) government policy to allow foreign players that have access to modern management and operational technology to invest in the retail sector2/; (ii) catering to consumers who spend around 40% of their total expenditure on consumer goods on food and drink (Figure 2) and who favor retailers offering a unified shopping experience under a single roof that extends over food, personal care items, and household goods that are generally cheaper than equivalent goods sold in traditional outlets; and (iii) ongoing investment in expanding retailers’ customer base through the opening of new branches.

The majority of the players active in the modern trade segment are major, well-established Thai corporations that are well-versed in revenue generation. These companies benefit from their economies of scale, their access to sources of funding, their extensive commercial and retail networks, and their ability to develop new businesses across a broad front. Some of the most important players are Central Group, Charoen Pokphand (CP) Group, Thai Charoen Corporation (TCC) Group, and The Mall Group (Table 2).

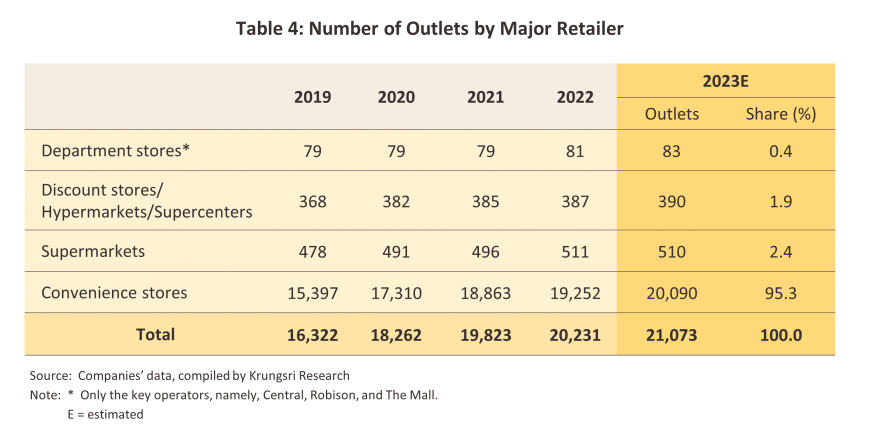

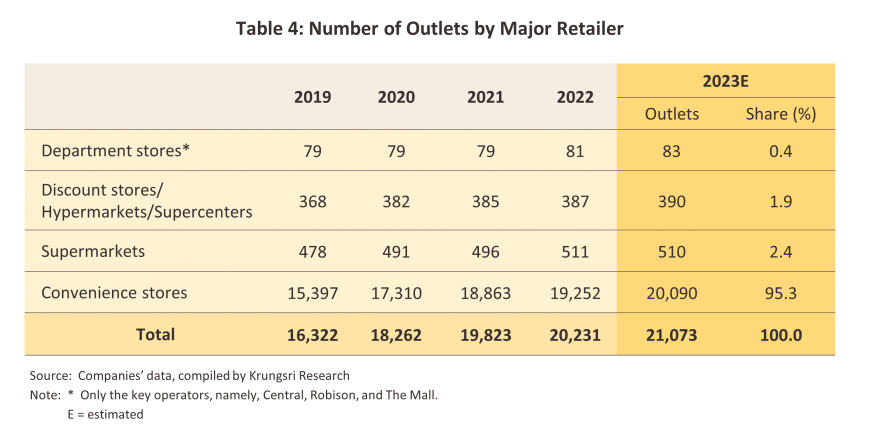

Operators have been steadily expanding their branch networks across different types of sites, including in community malls, service stations, and in areas that serve a large number of residential communities or that experience heavy traffic. Players have also been adjusting their branch sizes to make these more suitable for individual locations or particular consumer groups, and so as of 2023, there were 20,000 modern trade outlets open in Thailand, though more than 90% of these were convenience stores (Figure 3). Most operators continue to attract customers through price cuts, with many also pursuing O2O 6/ (online to offline) strategies that use branch outlets as distribution centers supporting deliveries to consumers in the immediate area, and because this gets goods rapidly into the hands of buyers, it can help to stimulate sales further.

Competition is intense in the modern retail sector given the similarity of the goods sold, the number of modern trade branches in the country, and the rapidly rising threat from online distribution. The latter has grown with the spread of internet access and mobile phone ownership, though this process was turbocharged by the Covid-19 pandemic. Thus, across the country as a whole, in 2022, online sales were triple their level in 2019 (Figure 4), and in 2023, the value of online sales accounted for 20.9% of the entire retail sector, up from 6.2% in 2019, this thus representing average annual growth of 41.2% per year (during 2020-2023). The most popular categories of goods bought online are fashion items (9.6% of total online retail sales in 2023), followed by electronics and electrical appliances (10.1%), health products and cosmetics (6.8%), and food (5.4%) (source: Euromonitor). Mid- to upper-income consumers are also tending to increase the number of purchases made through omnichannel platforms7/, in particular for fashion items (source: Central Retail Corporation), and average omnichannel sales are now 4-5 times the value of sales to single channel customers. Omnichannel sales are also more varied, and so retailers are now focusing their efforts more intensely on developing online platforms.

Situation

The outlook has steadily improved for the modern trade sector with the ending of the Covid-19 pandemic in 2022 and the subsequent easing of public health restrictions. This then allowed economic and social life to return to normal, while retail outlets in tourist areas have benefited from the rapid return to health of the tourism industry. Retailers have been further helped by government stimulus packages including phases four and five of the ‘Half Each’ program, the ‘Shop and Refund’ scheme, and phase four of the ‘We Travel Together’ program (July-October, 2022). Players have also been expanding the reach of their sales channels by developing their presence on e-commerce platforms (e.g., Lazada and Shopee) and social media (e.g., Facebook and Tiktok). This is allowing companies to connect to consumers who are increasingly comfortable making purchases online. As such, sales have grown by 4.0% YoY across the modern trade sector (Table 3).

Krungsri Research expects that in 2023, modern trade sales grew by 4.5-5.0% from their level a year earlier. This positive outlook has been supported by the following factors.

1) The domestic economy has gradually recovered, helped in particular by growth in consumption (up 7.1% YoY) and tourism (the number of domestic trips marked 176.3 million or rose 17.1% YoY, and 28.2 million foreign arrivals were recorded in the year, more than double the 2022 total). The tourism sector benefited from government stimulus measures that included the ‘Shop and Refund’ scheme (January-February), phase 5 of the ‘We Travel Together’ program (March-May), the waiving of visa requirements for tourists arriving from China, Kazakhstan, India, and Taiwan, the extension of opening hours for nightspots in tourist areas (i.e., Bangkok, Phuket, and Chiang Mai), and official measures to help with the cost of living (e.g., subsidies for the cost of electricity and transport fuels from January onwards). As a result, the consumer confidence index rose to the 46-month high of 62.0 in December 2023 (Figure 5), while the retail sales index was up 4.8% relative to 2022 (Figure 6).

2) E-commerce sales have continued to rise. Statista estimates that in 2023, online sales hit a record high of around THB 800 billion, and as of March 2023, Euromonitor also estimated that annual online sales of fashion items would be up 19.8% from their 2022 level, with significant rises also seen for health products and cosmetics (+17.1% YoY), electronics and electrical appliances (+9.5% YoY), and food (+7.1% YoY). Likewise, the share of income attributable to omnichannel sales reported by major players has risen sharply (e.g., this is up from 3.0% in 2019 to 18.0% for CRC, and from 3.0% in 2020 to 11.0% for 7-Eleven).

3) Players in the modern trade industry have been renovating their outlets and opening new branches in response to ongoing urbanization in Bangkok and upcountry, for example through the opening of Central Westville Shopping Center in November 2023, which aims to meet demand in western Bangkok, Nonthaburi, and Pathum Thani. The industry has also benefited from progress on government-backed megaprojects, especially those that are connected to the upgrade and extension of transportation networks since these are allowing players to extend their branch coverage into new areas as they look to gain a head-start on their competitors. Examples of these projects include the opening of the Yellow Line (Bangkok-Samut Prakan, July 2023) and the Pink Line (Bangkok-Nonthaburi, November 2023). These have opened opportunities for retailers in areas served by these lines or where mass transit routes connect with other transport modalities (e.g., other metro lines, or car, bus, or river transport), such as at Lat Phrao, Bang Kapi, Srinagarindra and Khu Bon.

4) Retailers have been adjusting their marketing to better address the needs of consumers. This has included: (a) maintaining stricter health and sanitary measures in the post-Covid environment; (b) developing outlets as ‘smart community centers’ that meet a broader range of needs for residents in the immediate area (Lotus has opened five such centers); and (c) using digital technology to better connect with target groups. This consists of: (i) using omnichannel digital platforms, for example by opening Webstores, building mobile applications, developing ‘call to order’ and ‘quick commerce’ operations (i.e., dispatching goods almost as soon as they are ordered), and working with online marketplaces (e.g., Lazada, Shopee, Amazon, Ebay, and Facebook Marketplace) and social media to develop social commerce activities (through Facebook, Line, and e-ordering); (ii) automating store processes, for example by developing cashier-less shops (with shoppers using self-payment systems) and fully automated smart shops; (iii) extending online to offline operations by offering personal shopper, call and shop, and chat and shop services; and (iv) developing live commerce channels, i.e., selling through livestreams broadcast via online and especially social media platforms as these are increasingly popular and are becoming one of the most important online sales channels.

However, the modern trade sector has also come under pressure from: (i) the only slow growth in the economy and the negative impacts on purchasing power of the -1.7% YoY contraction in exports and the -2.5% YoY fall in agricultural incomes; (ii) the rise in household debt to 91.3% of GDP as of Q4 2023 and the still-high the cost of borrowing, which has added to the debt burden and encouraged consumers to be more careful about spending on non-essential goods (source: Bank of Thailand); and (iii) the decision by some consumers to postpone their purchases to take advantage of the government’s ‘Easy E-Receipt’ program, which began on January 1, 2024.

The situation for individual market segments is described below.

1) The number of branches operated by chains continues to grow, and 7-Eleven is opening around 700 branches annually (in 2023, it opened 707, bringing its total network to 14,545 outlets) with a focus in particular on larger stand-alone sites that double up as distribution centers. In addition, Lotus’s go fresh is opening 120-150 stores per year, and CJ More is opening around another 250, while expansion is also continuing in adjacent segments (e.g., Big C Mini is launching 200-300 new branches annually, Tops Daily is opening 8-10, and Foodland is developing its ‘Foodland Grocerant’ convenience-type stores). These are then competing for market share through smaller outlets targeting local communities and new consumer groups. Beyond this, traditional grocers are rebranding as low-cost convenience stores that are also targeting local communities at the sub-district and village level. Examples of these include Tuk De Mee Matratan (TD Tawandang Group), which will expand its network to 8,000 branches, up from 5,000 in 2022, Don Jai (operated by Big C, and which will increase its network from 2022’s 1,000 branches to a total of 6,000), Ran Ni Khai Dee (Lotus’s, with a target of 30,000 branches by 2027), and Buddy Mart (Makro, with a target of 2,000 branches in 2023, up from 300 a year earlier).

2) Businesses have been adjusting their strategies and adding stock lines that consumers buy on a daily basis, such as fresh and ready-to-eat food, beverages, health products, and fast-moving consumer goods (FMCGs)8/ that are used in regular day-to-day life or that are quickly consumed, as well as bulk items and souvenirs for tourists. Some branches also offer restaurant-type services with fresh food prepared on site and shop space given over to seating areas, which then increases the possibility of selling related FMCGs. Alongside this, branches provide other services that aim to make customers’ lives easier, such as processing payments for utilities and credit cards, offering parcel delivery services, selling tickets, providing access to vending machines, and in some cases, making EV charging stations available to the public.

Outlook

The modern trade industry as a whole can expect to see average annual growth of 5.0-5.5% over 2024 to 2026 (Figure 11) thanks to the impact of the following factors.

1) Domestic purchasing power will strengthen steadily on the back of expected 2.7-3.4% annual growth in the economy (Figure 12), and with tourism remaining an important driver of the latter, retail sales in tourist areas will increase. Alongside this, government measures to stimulate spending (e.g., the Easy E-Receipt scheme, which ran from January 1 to February 15, 2024) will provide short-term boosts to consumption by higher-income earners. In addition, the return to normal patterns of work and activity outside the home will lift sales of food and beverages, luxury goods, fashion items, and beauty products, while longer-term trends toward increasing interest in health and wellness will support stronger sales in related areas, such as sports equipment, healthy foods, and fresh fruit and vegetables.

2) Foreign arrivals are expected to reach 43 million by 2026, adding to the total spend across the industry (Figure 13). One factor driving this increase is the ongoing government support for the industry, including the waiving of visa requirements for tourists arriving from China, Kazakhstan, Taiwan, and India, and the extension of the permitted length of stay for Russian arrivals. As of 2M24, Chinese arrivals numbered 1.2 million from a total of 6.4m foreign tourists, and their return to Thailand will have a positive impact on the retail sector. This is because they are a group with high spending on shopping category. It is accounted for more than 1/3 of the total shopping expenses of foreign tourists (2019 data).

3) The Thai e-commerce market continues to grow, and Euromonitor sees this surging from a value of THB 420 billion in 2022 to THB 910 billion in 2026. Players in the modern trade space will adapt to these changes by developing omnichannel strategies that leverage technology such as AI and big data to boost online sales. Players will also respond to the increasing popularity of ‘buy now, pay later’ schemes9/ by partnering with payment providers to make this type of credit available to consumers.

4) Progress on government-backed infrastructure megaprojects will provide a further boost to operators. For example, the extension of the Bangkok metro system is helping to accelerate the development of areas around the city, thus adding to opportunities for retailers as pockets of untapped consumer purchasing power grow. This can be seen in the case of the construction of the Pink Line in Khu Bon, where the development of a large number of condominium projects will in turn provide the demand needed to support the new Aeon Mall (ground should be broken on this in 2024). Likewise, progress on the build out of special economic zones and the high-speed and twin-track railways will also open up opportunities for retailers to meet demand from new communities.

5) The drafting of new urban planning regulations for Bangkok (the 4th version of these should be enforced from 2025 onwards) will revamp land use in the metropolitan region, in particular in areas newly served by the metro system. For example, the end of the Orange Line (East) in Minburi will be registered as a new urban area, with land designated for commercial use in support of urban residential communities. In the future, this area will therefore feature a greater concentration of office buildings, department stores, and residential developments, and with the local population density rising, commercial opportunities for retailers will expand.

6) The economies in neighboring countries will continue to grow (the IMF sees the CLMV economies expanding by between 2.6% and 6.5% per year), and this will boost markets for retailers based in border areas and major regional centers.

7) Players in the modern trade industry will continue to open new outlets in Bangkok and upcountry as they look to respond to recovery in the tourism sector and to raise their competitiveness, though these will typically be developments targeting the local consumer base or meeting demand from a more tightly defined consumer group. Over 2024-2026, several mega-mixed-use projects will begin their first phase of operations (e.g., One Bangkok, Bangkok Mall and Dusit Central Park), while a number of large shopping malls will also open in second-tier cities (e.g., in Nakhon Sawan, Nakhon Pathom, Nakhon Phanom, and Nong Khai), and the resulting development of new business, retail, and residential areas will open up opportunities for retailers. Players will in addition look to expand their overseas operations in areas where economies are growing and the consumer base is sufficiently large, and this will help businesses broaden their customer base over the long term. Examples of this will include Central’s plan to invest THB 30 billion in its Vietnamese operations over 2022-2026, and TCC’s goal of increasing income from overseas investments in Vietnam, Cambodia, and Lao PDR such that the contribution of this to overall turnover grows from 2023’s 10% to 20-40% within 5-7 years.

However, sales growth will also have to fight against headwinds originating from: (i) the rise in the cost of living and the current high level of household debt, especially among lower-income earners, which is dragging on consumer purchasing power and consumption; and (ii) increasing competition from overseas players, especially from China. At present, these are focusing their attention on areas in and around universities, where they are opening new outlets to meet demand from Chinese students, e.g., in Suanluang Square (Wang Zhong Wang supermarket), Krirk University (Chinese minimarts and restaurants), and Dhurakij Pundit University (Shenzhen Sam supermarket). Competition is also coming from cheap Chinese imports sold through online platforms, especially of electrical appliances, fashionwear, food, and cosmetics.

Challenges facing the industry in the coming period will include the following.

1) Competition is tending to intensify, and the number of modern trade outlets continues to rise. These are being opened both by retailers already active in the industry and new entrants to the market. An example of the latter is Turtle, which has moved from outside advertising into the convenience store market, targeting in particular travelers on the Bangkok metro system, as well as wholesalers such as Makro and Go! Wholesale, which are now trying to break into the retail market.

2) Online competitors are steadily multiplying in number as the retail environment moves fully online. Competition is thus coming from both domestic players (including within the C2C market10/) and overseas companies offering e-marketplace services (e.g., Lazada, Alibaba.com, Shopee, eBay and Amazon). In response, many retailers have developed super app or everyday app that aim to make consumers’ lives easier by providing a comprehensive range of services, and within this changing environment, modern trade operators will need to manage e-commerce supply chains effectively and ensure that their operations are agile, flexible, and efficient. Players will also look to develop new partnerships with companies active in the areas of transport and logistics to offer seamless delivery services.

3) Pressures to use technology to raise competitiveness will increase. This will include the use of: AI to assess consumer demand and spending habits and to run smart stock control systems; automated systems to provide self-payment services and robots to assist with general operations; augmented reality (AR) and virtual reality (VR) to create a virtual shopping experience; the cloud to cut costs associated with the maintenance of IT infrastructure; and data science to analyze complex data and to assist with business planning.

4) Modern trade operations will tend to adapt their corporate mission by shifting their business to a much more sustainable footing. This will be achieved by cutting environmental impacts, reducing waste and greenhouse gas emissions, and moving to a greater reliance on renewable energy. Following this route will help businesses align their activities with changes in consumer behavior that are placing a much greater emphasis on environmentally friendly purchases, for example of fresh food that reduces or eliminates the use of preservatives.

Krungsri Research sees the following factors providing routes to growth for the modern trade industry.

New branches will be opened in a wider range of forms.

1) To allow operators to better adapt to the requirements of particular locations or consumer groups, branch sizes may shrink or grow relative to their standard size.

2) New types of stores will emerge, including small lifestyle shopping malls that will be opened in smaller provinces or larger districts. In response to consumers cutting back on the frequency of their visits to remoter large outlets and instead preferring to patronize more local shops, small stores may also be opened nearer residential communities. Hybrid wholesale outlets could also feature more prominently in the mix.

3) In Bangkok and upcountry, players will look to expand their networks by operating through traditional retailers. This will help businesses to improve their negotiating position relative to suppliers, expand their access to sales channels at the sub-district and village level through which they can distribute their house brands, and establish additional long-term sources of income.

4) Online distribution will be extended to include social media platforms and online direct to consumer (D2C)11/ models. This reflects growing consumer demand for an easier and more convenient online experience, especially for ‘quick commerce’ solutions that allow shoppers to make smaller on demand purchases that are then dispatched in no more than half an hour.

5) Technology will be used to undertake much more carefully targeted marketing. For example, AI will be used to design personalized sales promotions that take into account the behavior and needs of individual consumers. Big data analytics will also be used, allowing players to produce marketing plans that exploit companies’ huge stores of information on customers.

1/ One reason why large modern trade operations are able to offer goods at price points below those of traditional retailers is that they are in a position to collect fees from manufacturers and distributors wishing to sell through their shops. Sources of income include: (i) initial fees for stocking new lines; (ii) charges for marketing and other services, e.g., for hosting display stands, access to shelf space, signage, bonuses in the case that sales exceed monthly targets, and the transport and logistics fees incurred in shipping goods from distribution centers to stores; (iii) the fees for producing leaflets and flyers, as well as the provision of free or additionally discounted goods on special occasions (e.g., New Year, the opening of new branches, store renovations and re-openings, and during festivals); (iv) credit terms that extend to 90-120 days; and (v) contracts that allow players to terminate business relations unilaterally.

2/ The 1999 Foreign Business Act allows non-Thais to operate in the retail and wholesale industries (reserved occupations as per Appendix 3 of the Act) if they invest at least THB 100 million in Thailand. Potential investors must also apply for a license from the Foreign Business Committee.

3/ The Standing Committee on Commerce, Industry and Labour has designated large cash & carry operations such as Makro as a particular type of distributor, but this paper considers only retail operations.

4/ Shopping centers/shopping malls are single structures within which many goods and services are retailed, though the exact products that are available will depend on decisions made by renters/occupiers of retail space (these sign contracts with the landlord operating the shopping center to pay rent for this space for a specified period).

5/ In 2021, the Charoen Pokphand Group bought Tesco Lotus, which was rebranded across the board as Lotus’s. This was with the exception of Tesco Lotus Express, which became Lotus’s go fresh.

6/ O2O, or online to offline, marketing combines the advantages of both the on- and offline worlds, allowing companies to raise the quality of their services, expand sales, and engage with a broader consumer base.

7/ Omnichannel distribution mixes online (e.g., websites, social media, or e-commerce) and offline (e.g., in store) marketing and sales. Information on customers from these diverse sources is gathered and analyzed to give retailers an overview of the market and to provide a better understanding of consumer needs and intentions, and this puts them in a better position to offer more comprehensive assistance to potential and actual buyers.

8/ Fast-moving consumer goods are consumer goods that are typically bought in normal day-to-day life, such as food, beverages, and self-care products.

9/ See full report: 'Buy now Pay later’ The Next Wave of Credit Products.

10/ C2C or consumer to consumer selling is an e-commerce model that allows consumers to buy and sell directly to and from one another.

11/ D2C or direct to consumer marketing describes the use of online channels to sell directly to shoppers. This may be through websites and apps, but sales do not pass through an intermediary.

.webp.aspx)