EXECUTIVE SUMMARY

The Thai plastics industry can look forward to ongoing growth over 2024-2026 thanks to continuing domestic and global economic expansion, which will then support stronger demand from downstream manufacturers, including players in the packaging, autos and auto parts, electronics and electrical appliances, construction, and medical devices industries. In addition, government schemes to promote investment in the ‘new S-curve’ industries will benefit plastics manufacturers embedded in these supply chains. However, these tailwinds will be met by a number of challenges, including stiff competition and the move by many countries (including Thailand) to restrict or ban single-use plastics, and instead to promote greater consumption of low-carbon biodegradable products. This will add to costs, and with global crude prices volatile, profitability will come under pressure.

Nevertheless, corporations that are vertically integrated from upstream through to downstream processes, that operate across associated parts of the economy, and that can successfully manage stocks, sales and distribution will be able to maintain their profits.

Krungsri Research view

Krungsri Research sees growth patterns developing in the different industry segments over 2024-2026 as follows:

-

Plastic packaging: Turnover will continue to strengthen but growing environmental awareness is undercutting demand for core products (e.g., plastic bags). Producers of flexible and semi-flexible goods will see better rates of growth thanks to stronger demand from buyers in the food and beverage industry and in the retail and e-commerce sectors, while players that deploy advanced production technologies and that output a wide range of high-quality finished goods will likely be able to maintain their growth trajectory.

-

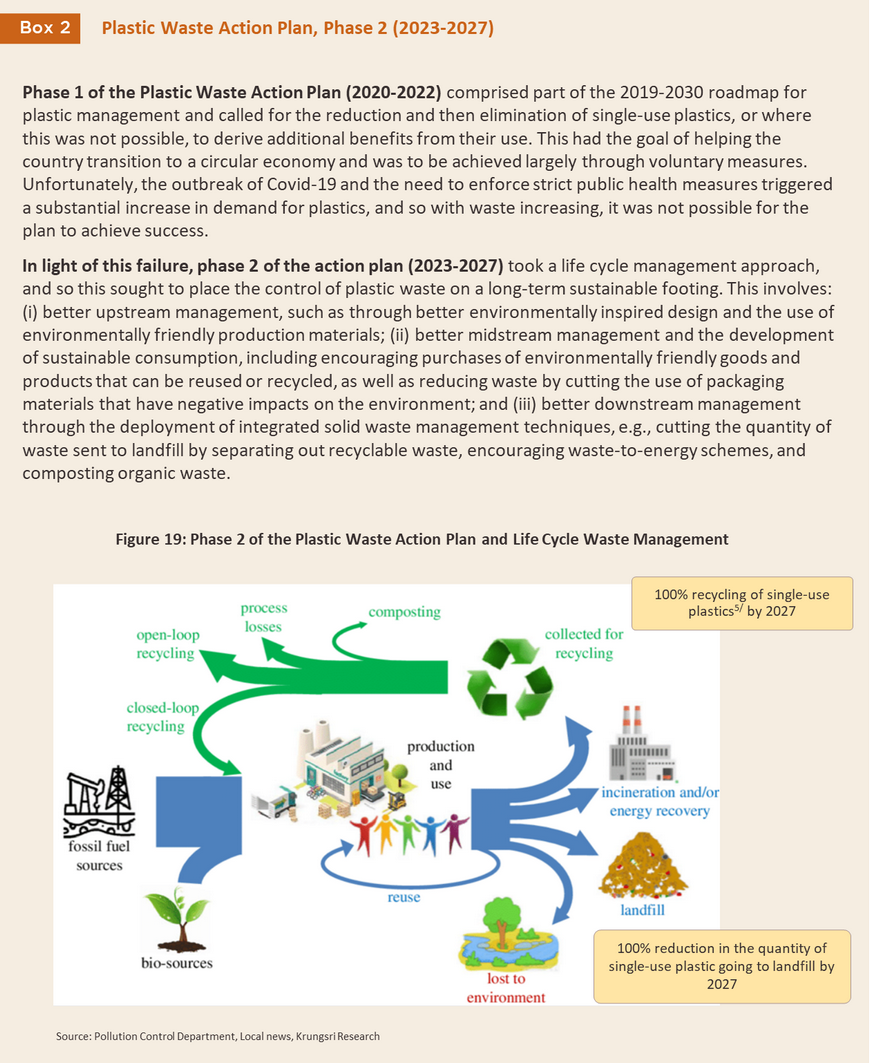

Plastic films, pipes, straws, and flexible tubing: Turnover will grow at normal levels for manufacturers of these goods thanks to an expansion in demand from downstream industries (e.g., food processing and sales, construction and agriculture), though this will not hold for producers of films and drinking straws, which may see growth rates decline as phase 2 of the action plan for plastic waste is implemented. Players will also tend to experience significant levels of competition due to the large number of companies active in this segment. This will shift bargaining power to the demand side when negotiating order sizes and prices, and as a result, income may come under pressure.

-

House- and tableware: Turnover will rise but due to worsening competition, this will be only gradual. Players will increasingly come under pressure from overseas and especially Chinese manufacturers that have lower production costs, and this will raise the risk that profit margins will be steadily eroded.

-

Other plastic parts and products: Turnover will tend to strengthen in line with market conditions in downstream industries that are buyers of plastic products, e.g., auto parts and auto assembly, electronics and electrical appliances, and medical supplies. However, producers face the prospect of intensifying competition, especially from foreign companies manufacturing in Thailand-based production facilities and overseas (most notably in China) that have lower production costs. In addition, some players are excessively reliant on sales to a few major buyers.

Over the mid- to long-term, players will need to overhaul their business models if they wish to maintain growth rates. This will likely include adjusting production lines to increase output of high-value plastics that meet the needs of more specialist, niche markets and of growth in the future industries, that is medical devices, electric vehicles, robotics, and aeronautics. In the face of growing global concerns over the environmental impact of plastics, players will also need to look to the production of environmentally-friendly bio-plastics made from agricultural inputs. In addition, the government is moving forward with its Extended Producer Responsibility measures, which aim to encourage packaging manufacturers to manage consumption of these over their entire lifecycle. Operators will therefore have to revise how their packaging is produced, for example by cutting consumption of inputs, ensuring that their products are reusable or recyclable, and putting in place measures to better manage packaging waste. In keeping with the official target of reaching net zero by 2065, producers will also have to measure their greenhouse gas emissions and to research and deploy innovations for reducing these.

Overview

Plastics are produced from hydrocarbons, most commonly from chemicals originating from the distillation of crude oil or the separation of natural gas. These initial processes yield products that are then separated into their component chemicals including ethylene, propylene, styrene, phenol and acrylonitrile, which comprise the major inputs into the production of a range of different plastic resins. These are distinguished by properties such as their ductility and heat-tolerance, and depending on the demands of downstream industries, these resins are then molded and shaped into finished goods for use in an enormous range of applications (Figure 1 and Box 1). Recently, interest has grown in manufacturing plastics from renewable resources, and this has included producing plastic goods from polylactic acid (PLA) derived from corn, sugarcane or cassava. These have the advantage of being biodegradable, while in many cases it is possible to use PLA-based plastics in applications that are identical to those of traditional oil-based plastics.

As of 2021 (the latest data available), the plastics industry accounted for 7.7% of Thai GDP, playing an important role linking the petrochemicals sector, which supplies upstream inputs of resins, with end-user industries, to which the plastics industry provides finished and semi-finished products. The most important of these industrial consumers are manufacturers of construction materials, autos, electronics and electrical appliances, and medical equipment.

Manufacturing plastic products involves melting and molding resins that usually come in the form of plastic pellets (or nurdles) and then cooling the molded plastic to produce finished goods that are of the required shape. In addition, dyes and plasticizers may be added to change the color and characteristics of the goods and to make them better suited to their intended use, for example by raising their tolerance to high and low pH values, by making them more resistant to fire or ultra-violet radiation, or by increasing their flexibility. There are many different ways to mold plastics, but deciding which technique to use will depend on how the goods being produced will be used. The main methods are: blow molding, which is suitable for packaging, such as water, oil and shampoo bottles; injection molding, which tends to be used for the manufacture of goods including kitchenwares, toys and parts used in the assembly of electronics, autos, and electrical appliances; compression molding, which is generally used for goods such as plates, bowls, cups and other kitchenwares manufactured from melamine; and extrusion molding, which is used to manufacture plastic bags and sacks, thin films, and PVC water pipes. A survey carried out by the Plastics Institute of Thailand in 2021 revealed that some 39.2% of Thai plastics producers use injection molding, which is followed in importance by films and blow molding1/. Given the range of physical and mechanical properties displayed by different plastics (e.g., their weight, moldability, flexibility, and gas- and water-permeability), these have assumed an extremely important role as upstream inputs into a large number of industries, with particular types of plastic solving problems unique to these downstream consumers. Thus, manufacturers of auto parts use plastics to reduce the weight of components and so increase fuel efficiency, producers of construction materials use plastic products that are long-lasting and resistant to attack by chemicals, and the medical equipment industry uses plastics to add value to their products (Figure 2).

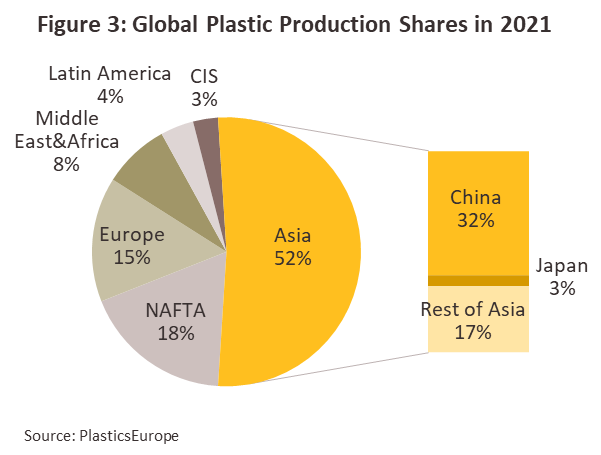

In 2021, 390 million tonnes of plastic were produced globally, a 4.0% increase on 2020’s figure2/. Asia is the principal source of this, accounting for 62% of the world total (Figure 3), with regional production led by China, which alone produces 32% of all plastic manufactured globally. Asia is followed in importance by North America (the NAFTA region, though led by the United States), which produces 18% of the global total, and then Europe, with a further 15% led by Germany. With regard to downstream consumers of plastic nurdles or resins, the packaging industry is the biggest buyer (this absorbs 44% of all output), followed by construction (18%) and auto assembly (8%) (Figure 4).

Thailand occupies an important place in the global plastics industry, and as of 2022, the domestic industry generated market value of around THB 1.1 trillion annually. Production benefits from a domestic petrochemicals industry that is both sizeable and highly efficient compared to its competitors in the ASEAN region, and because plastic resins are products that sit downstream from the petrochemicals industry, this then helps to boost the competitiveness of Thai manufacturers. Major Thai players are also skilled in the research and development of the new products demanded by an ever-shifting market, and by producing a wide range of resins at a spread of price points, Thai companies are able to support the output of a large number of different industries. Indeed, in 2021, Thai manufacturers produced 9.5 million tonnes of plastics, while the country imported just 2.0 million tonnes. 59% of output is consumed on export markets, with the remaining 41% used to manufacture products for domestic industries, most notably for players in auto assembly, electronics and electrical appliances, and construction. Thai plastics converters are therefore embedded in comprehensive supply chains that stretch from upstream raw materials (i.e., domestic producers of natural gas products), through intermediate goods (i.e., petrochemical players manufacturing plastic resins), and down to a large number of downstream industries.

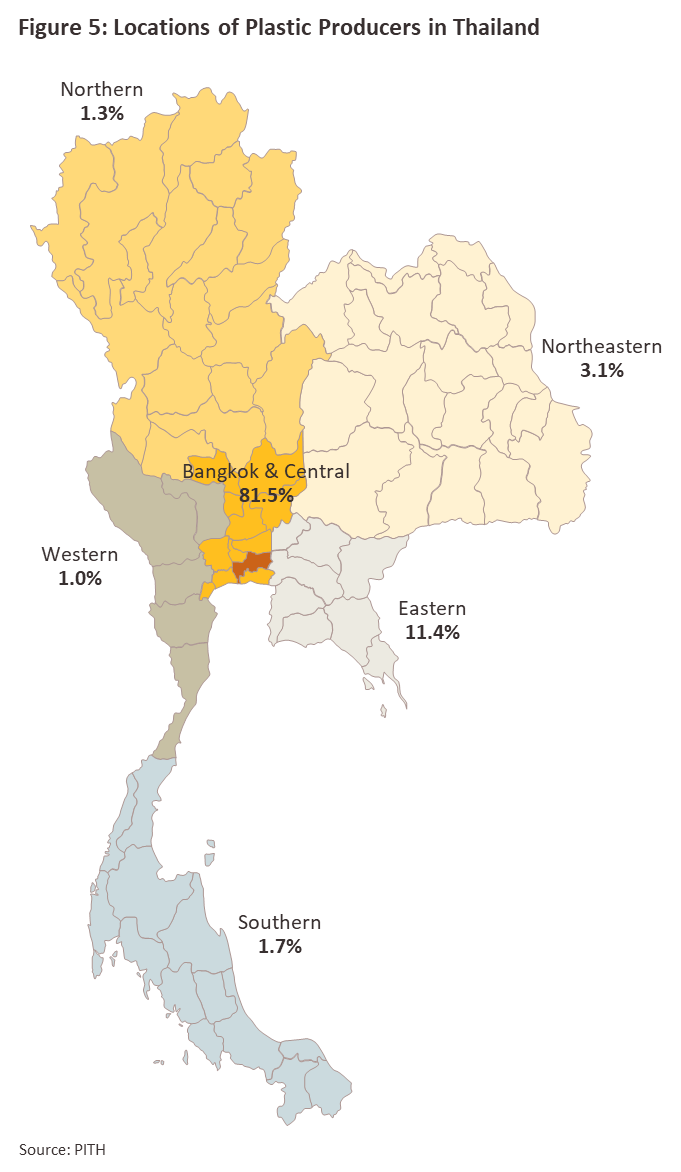

There were 3,262 plastics converters active in Thailand as of 2022, these split 88.5% SMEs and 11.5% large players. The significant number of SMEs in the industry is explained by the fact that barriers to the market are relatively low (the up-front investment costs are moderate, and production utilizes only low to mid-level technology) but the outcome of this is that most output is of general commodity-level products, competition is fairly stiff, and margins are narrow. In terms of geographical distribution, the vast majority of players (79.6%) are clustered in the central region, especially in the Bangkok Metropolitan Region, Samut Prakan and Samut Sakhon, followed by the east (12.4%) and the northeast (3.6%) (Figure 5). Over half (51.8%) are active in the packaging industry, which is followed in importance by furniture and housewares (12.3%), and electronics and electrical appliances (8.7%).

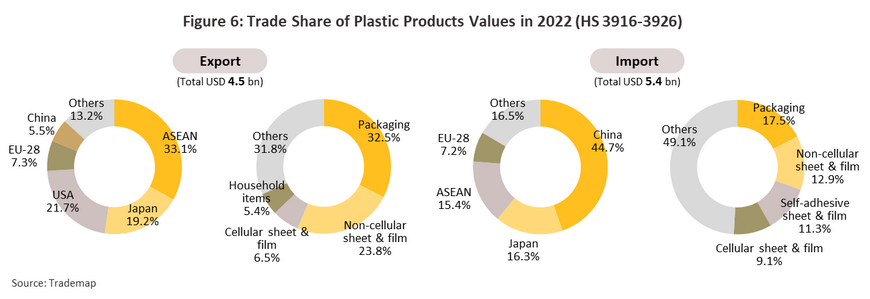

The domestic market accounts for around 80% of Thai plastics production, with this split between the two primary segments of: (i) the consumer market, which meets consumer demand directly through the production of goods such as housewares, bags and straws; and (ii) the market supplying end-user industries, which comprise the five major markets of packaging, electronics and electrical appliances, construction materials, auto parts, and medical devices and supplies. The remaining 20% is sold into export markets, but much of this is of low-value commodity-grade products used in the production of packaging (the most important export segment) and cellular and non-cellular films. The main export markets are the ASEAN zone (33.1% of all exports by value), the US (21.7%) and Japan (19.2%). The most significant imports are plastic packaging (17.5% of all imports), non-cellular films (12.9%) and self-adhesive films (11.3%), the major sources of these being China (44.7% of all imports by value), Japan (16.3%) and the ASEAN region (15.4%) (Figure 6).

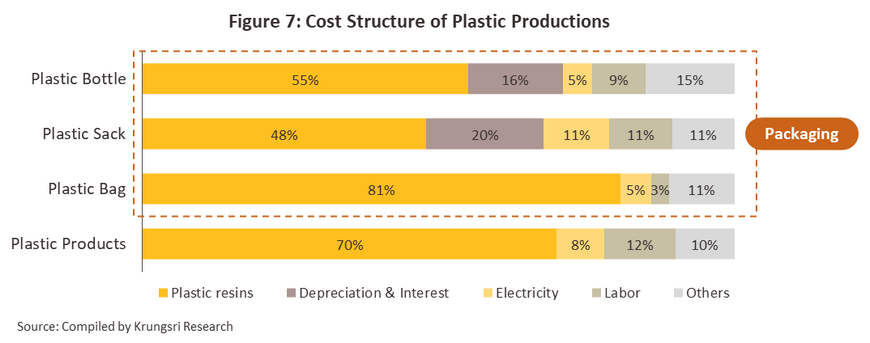

Generally, raw materials (i.e., plastic nurdles or resins) account for around 70% of production costs, with another 10-15% coming from labor, 8% from energy and 7-12% attributable to other expenses. In the case of plastic packaging, (the most important product category) the primary expense is for resins (50-80% of production costs) but the extent of energy and labor costs will depend on the type of inputs being used and the products being manufactured, and with plastic packaging that requires the utilization of more advanced production technology and more expensive machinery, depreciation and interest costs will be relatively high (Figure 7). Overall, the industry’s cost structure is such that fluctuating crude and natural gas prices have a significant impact on manufacturers’ costs and competitiveness.

Situation

The Thai plastics industry faced a barrage of headwinds in 2022. Chief among these was the war in Ukraine, which pushed up prices for crude and other commodities (those for Brent crude jumped 40% from their 2021 level) and boosted inflation rates worldwide. At the same time, the economies of Thailand’s major export markets weakened as the US came under pressure from an aggressive round of rate hikes and China struggled under the closing of the country and the imposition of the government’s zero-Covid policy. These factors also impacted Thailand, and through the year, recovery proceeded only slowly, while strengthening inflation ate into consumer purchasing power. The domestic plastics industry thus came under pressure from both sides, with production costs rising and demand slipping as consumers exercised greater care over their spending, and against this backdrop, it was difficult for manufacturers to pass higher production costs through to downstream industries. Nevertheless, the reopening of Thailand to foreign arrivals lifted consumption in industries connected to the tourism sector, and continuing growth in e-commerce helped to strengthen demand for plastics used in food and drink packaging. Demand for health and hygiene products and for medical equipment also remained strong. The overall situation for the plastics industry in 2022 is described below.

-

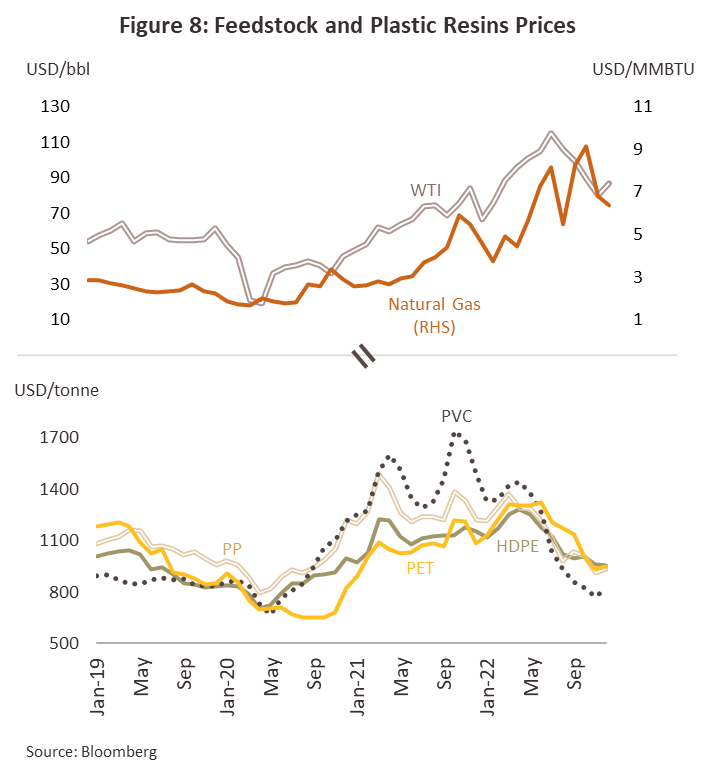

Output of plastics contracted to 6.9 million tonnes, down -7.9% from its level in 2021. This was partly due to new facilities coming into production in China, Vietnam and Indonesia, partly because of excess supply from producers in the US that was then diverted to Asian markets, and partly a result of weaker consumer spending power that then translated into lower demand for downstream goods on global markets. This then drove down prices for many types of plastic, though at the same time, the price of inputs rose, with Brent crude and natural gas up by respectively 40% and 66.1% YoY (Figure 8). Thai manufacturers therefore cut back on their manufacturing capacity as they tried to bring this into line with demand for downstream goods on domestic and export markets.

-

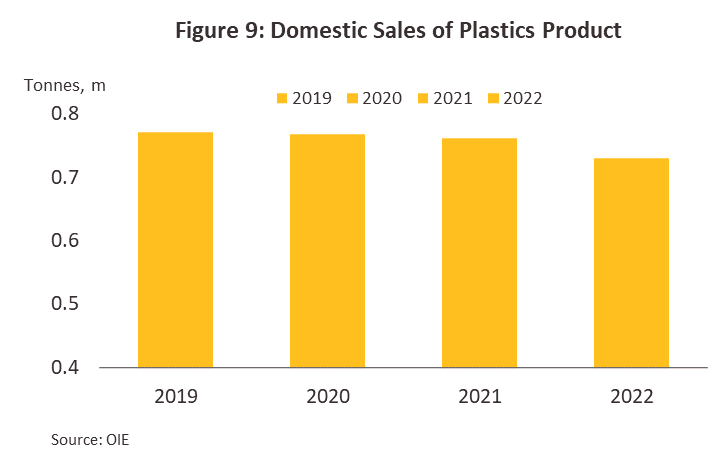

Domestic demand for plastics slipped -4.1% YoY to 730,000 tonnes (Figure 9). Declines were seen across most product groups, including plastic films, sheet plastic, plastic bags, and plastic containers, and only a few items escaped this downturn. The latter included some housewares and plastic bags, which benefited from the continuation of trends to work from home. Moreover, the public remained concerned about hygiene and health and so they tended to avoid reusing plastic items and instead, they continued to consume single-use products.

-

Exports of plastic resins and other plastic products also continued to contract3/.

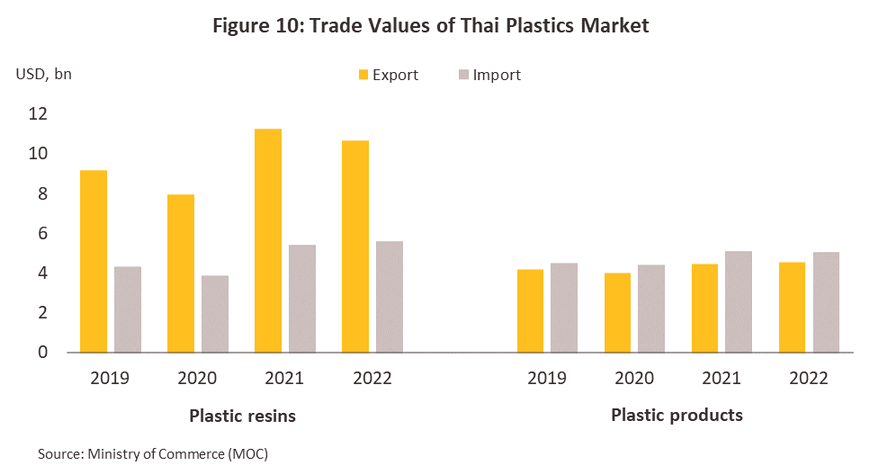

1) Exports of plastic nurdles/resins fell -9.9% YoY to 6.4 million tonnes, which then generated a value of USD 10.7 billion (down -5.1% YoY). Exports fell -7.0% YoY to China (accounting for 35% of all overseas sales of resins, this is Thailand’s most important export market,) and -6.4% YoY and -3.8% YoY to Vietnam and Indonesia, although these rose 5.1% YoY to Japan. Imports of resins also slipped -1.4% YoY to 2.4 million tonnes, though by value, these rose 2.8% YoY to USD 5.6 billion (Figure 10).

2) Exports of plastic products inched down -0.5% to 1.2 million tonnes, though considered by value, these rose 2.0% to USD 4.6 billion. Exports to the ASEAN region (28.8% of exports) remained broadly unchanged from a year earlier but those to Japan (16.7% of the total) and China declined by respectively -2.9% YoY and -19.9% YoY. By volume, imports edged up 0.7% YoY to 0.98 million tonnes, but by value, these fell back -1.5% YoY to USD 5.0 billion.

Krungsri Research expects that both production and consumption of plastics will strengthen slightly across 2023 thanks to the impact of expansion in e-commerce, strengthening consumption, and recovery in the tourism sector, which is feeding through into steady growth in the economy. In addition, manufacturers are benefiting from lower production costs now that Dubai crude prices are forecast to soften by an average of -16.8% YoY across the year. However, recovery in consumer spending power has as yet been only partial, in part due to continuing weakness in the export sector. Export value has in fact softened steadily since October 2022, and for the first 8 months of 2023, this is down -4.5% YoY. Weakness at both the global level and in the national economies of the major trade partners of the US, Japan, and China has thus undercut demand for both plastic resins and plastic products in downstream industries (e.g., auto assembly, and electronics and electrical appliances). Thai producers are also facing the unwelcome prospect of having to contend with a supply glut for some products that will be caused by the opening of new production facilities in China, Vietnam, and Malaysia, and this has then added to downward pressure on prices. The situation for 2023 is described below.

-

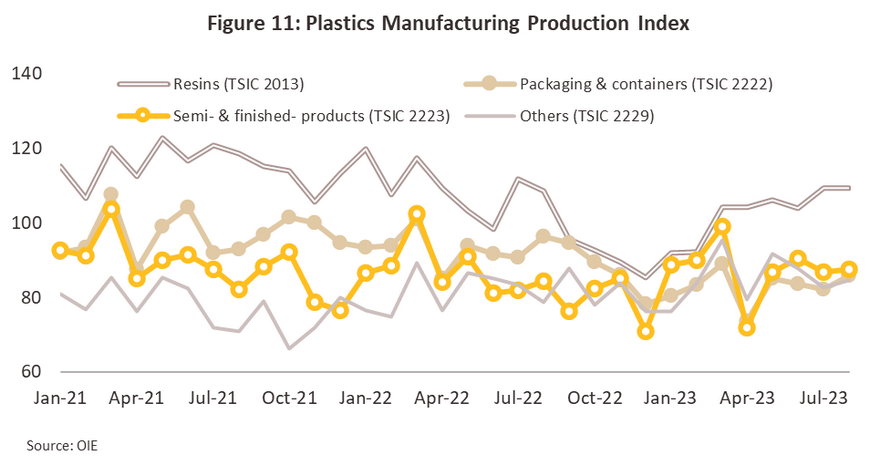

Output of plastic resins should remain flat or increase slightly from its 2022 level. The Manufacturing Production Index (MPI) for Thai plastics resins (TSIC 2013) slipped -6.3% YoY (Figure 11) over 8M23 on weaker purchasing power and the adjustment of production capacity by manufacturers, bringing this into alignment with depressed market conditions in downstream industries. The situation should improve, and demand for resins and other plastic products is expected to strengthen with recovery in domestic consumption and the overall strengthening of purchases that traditionally materializes at the year-end.

-

Production of some plastic products will rise, and the MPI of finished and semi-finished goods is expected to increase by 1-2% YoY, though for ‘other’ goods, the MPI should be up by 4-5% YoY (over 8M23, the MPI for finished and semi-finished plastics edged up 0.16% YoY, while for ‘other’ goods, it was up 4.8% YoY). Stronger demand will be driven by a steadily improving outlook in domestic downstream industries, including auto manufacturers (the number of autos coming off Thai production lines should rise 2.5-3.5% YoY) and electronic equipment (output of hard disk drives and ICs is forecast to increase by 2% and 3% from their 2022 levels). However, production of packaging products will slide by between -10% and -12% (over 8M23, this was down -11.2% YoY), though one reason for this is the comparison with the high baseline set in 2022, when demand for single-use packaging plastics was still strong.

-

Domestic sales of plastic products4/ should strengthen by another 1-2% from their 2022 level. In particular, demand will benefit from additional consumption of pipes and connectors thanks to increased spending on construction projects by the government (expected to rise by 1.69% YoY) and the private sector (up 1.89% YoY), and growth in downstream industries such as auto assembly and food processing.

-

Exports of plastic resins and products are forecast to contract by between -1% and -3% YoY on global economic weakness that is then undercutting demand from downstream industrial consumers. In addition, regional supply (especially of resins) is expanding, and this is eroding Thai market share. Sales of plastic products will also shrink sharply on lower demand from the packaging industry, in particular for bags and sacks (13.5% of the plastic products’ export value), manufacturers of industrial parts and components (19.2%), and producers of films and plastic sheeting made from PE (5.4%).

Outlook

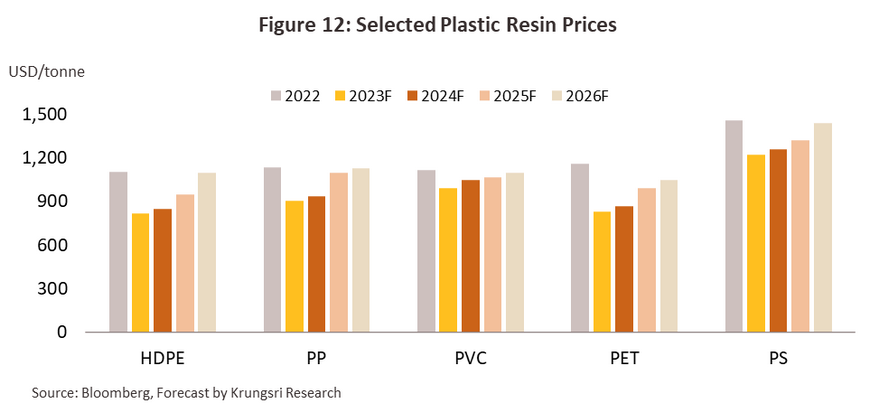

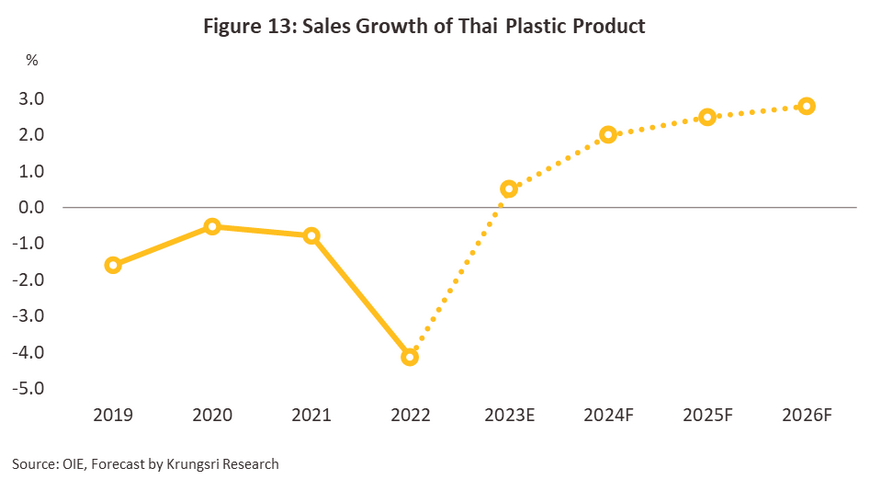

Krungsri Research sees global demand for plastic products to expand by 2.0-3.0% annually over 2024 to 2026, moving with expansion in the world economy (the IMF predicts global growth will average 3.0-3.5% per year over the next 3 years). However, prices for Brent crude are forecast to average USD 80-85/bbl, and so manufacturing costs are likely to remain elevated and global prices for resins will thus tend to slowly trend upwards (Figure12). The outlook for the domestic economy should track global growth, helped by the return of the tourism industry to its pre-pandemic level by 2025, and this should then add to demand for plastics products from downstream industries. Chief among the latter will be manufacturers of packaging, electrical appliances, auto parts, construction materials, and medical devices, which together account for almost 80% of the value of sales of all plastic products. Domestic demand for plastic products is thus forecast to expand by 2.0-3.0% per year (Figure 13), with exports rising at the same rate. The outlook for downstream industries through 2024 to 2026 is summarized below.

-

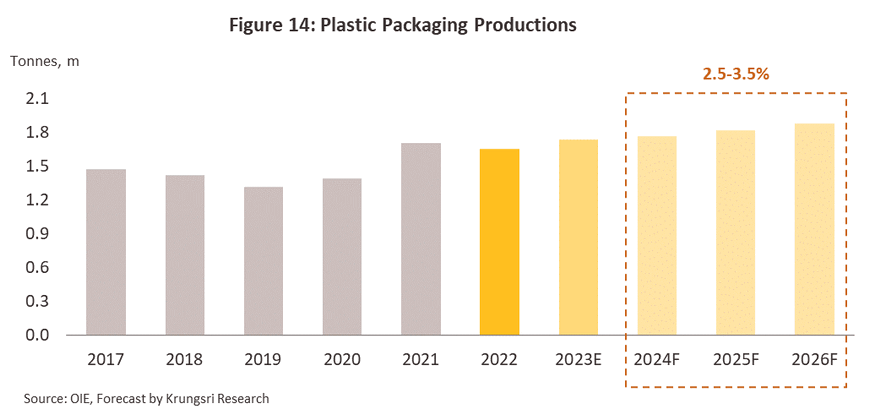

Plastic packaging: Smithers Pira predicts that global demand for flexible packaging will total 33.5 million tonnes in 2023 and this will then expand by an average of 4.2% annually over the following 3 years. Likewise, 2023 demand for rigid packaging will come to 66.8 million tonnes, up 3.0% from 2022, and this will then rise by another 3.4% per year over 2024 to 2026. Having contracted -3.4% in 2022, Krungsri Research forecasts domestic demand strengthening by up to 1.0% in 2023, and then by 2.5-3.5% through the next three years (Figure 14). Sales will be lifted by an improving economic outlook, which will in turn be driven by recovery in the tourism sector, and ongoing worries over hygiene and public health that will encourage players in many industries to increase their use of plastic, though this will be most obviously a factor in the food and drink industry (including for sellers of frozen and processed goods). Sales will also benefit from continuing growth in the retail and e-commerce industries, which will translate into stronger sales of goods including films, plastic food containers, and plastic bottles and bags. However, growth in exports will lag behind the domestic market due to anticipated sluggishness in the main overseas markets of Japan, the US, and China. Manufacturers of plastic packaging will also come under pressure from the price of resins, which will remain high thanks to strong global prices for crude. In addition, Thai players will be affected by the implementation of phase 2 of the plastic waste action plan (2023-2027), under which the Thai government is encouraging greater use of environmentally friendly plastics, such as those made from bio-materials, that can be reused or recycled, or that are biodegradable, with the goal that these should replace oil-based, nondegradable, single-use products. This will then undercut demand for basic plastic products such as bags.

-

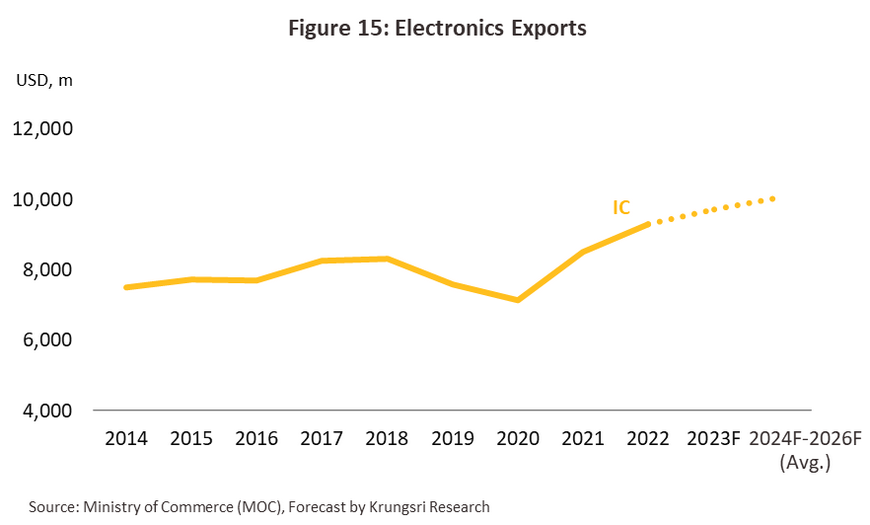

Electronics and electrical appliances: The electronics industry: Production and export volume trends are expected to increase by 3-4% and 4-5% respectively each year, driven by the global semiconductor sales rebound (Figure 15). This is bolstered by: i) The growing demand for AI chips in AI-based applications such as data centers, edge infrastructure, and endpoint devices. Gartner predicts a 25.6% increase in AI chip sales by 2024. ii) The continuous rise in demand for semiconductors for electric vehicles (EVs) and the development of autonomous vehicles with Full Driving Automation. Currently, semiconductors used in cars represent 42% of the global market share. iii) The onset of a new cycle of PC replacements in 2024-2025. Furthermore, foreign companies in the electronics industry are increasing their investments in Thailand. In 8M23, the Thailand Board of Investment (BOI) granted promotional privileges to 10 major electronics companies from Taiwan, with investments exceeding 30 billion baht. This positions Thailand as the largest PCB production cluster in ASEAN. For electrical appliances, production is expected to expand to meet both domestic and export market demands. This growth reflects the ongoing opportunity for the Asian market to expand due to low ownership rates of electrical appliances, especially air conditioning units, in many countries (with ownership rates below 20% of all households).

-

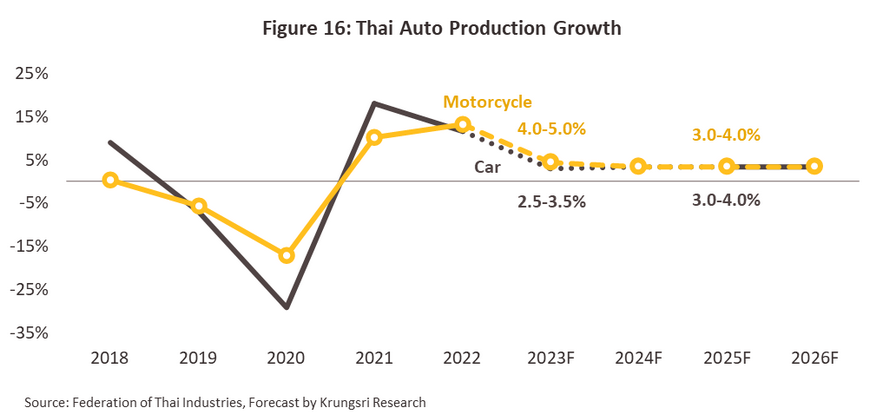

Auto parts: Domestic output of autos and motorcycles is expected to climb by 3.0-4.0% (to 1.99-2.19 million vehicles for autos and to 2.16-2.38 million vehicles for motorcycles) annually (Figure 16), and this will naturally support increased production of auto parts. Domestic vehicle sales will be boosted by the improving outlook for the Thai economy and greater demand for commercial vehicles, the market for the latter benefiting from accelerated progress on the build out of infrastructure networks as stakeholders move to prepare for increased investment in the EEC, as laid out in phase 2 of the EEC development plan (for the period 2023-2027). Demand will be buoyed further by growth in logistics and online retail businesses. Alongside this, sales of replacement auto parts (the replacement equipment manufacturer, or REM market) will benefit from the estimated 2-3% annual increase in the number of vehicles on Thai roads that are over 5 years old. Exports of plastic auto parts will rise with the forecast global expansion in auto sales (Euromonitor sees worldwide auto sales expanding 3-6% annually). In particular, rapid growth in the market for EVs will provide a strong boost to plastics manufacturers since to reduce weight, EVs use over 50% more plastic than ICE-powered vehicles, though this will especially affect the market for specialty products, such as polypropylene compounds.

-

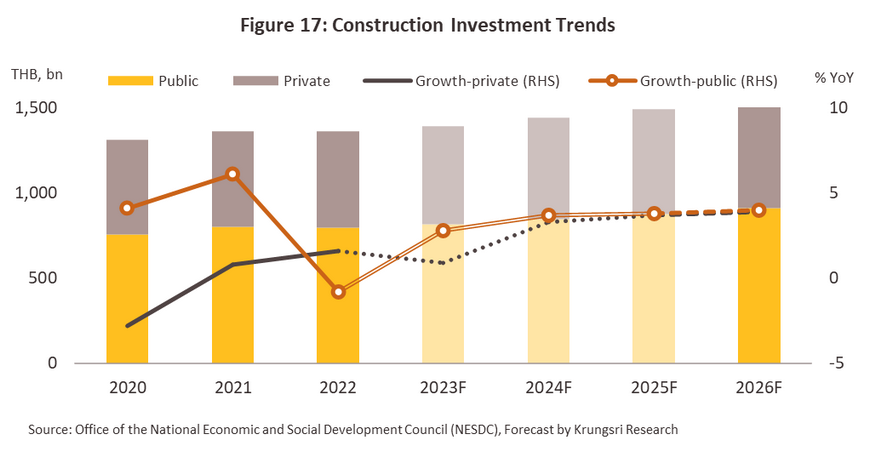

Construction: Overall spending on construction will be up 2.0-3.0% in 2023, and this is then forecast to accelerate to growth of 3.0-4.0% over 2024 to 2026 (Figure 17). The market will be helped by increased investment in large-scale infrastructure, most notably projects connected to the EEC (this will be worth THB 340 billion), work on other infrastructure megaprojects, and the construction of new factories and industrial estates. This should then help to crowd in additional private-sector investment in, for example, residential developments along new mass transit and other transportation routes. Given this, demand for plastic or plastic-based construction materials (e.g., sheet plastic and rigid and flexible tubing) will improve.

-

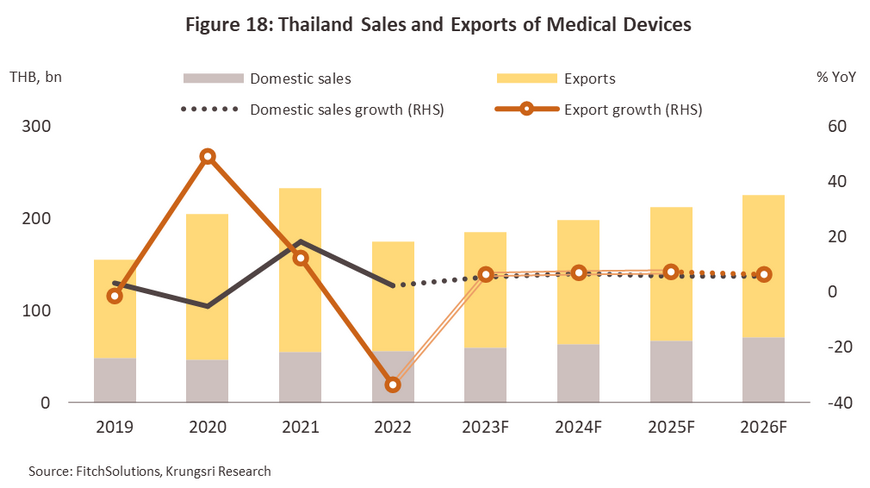

Medical devices: The value of goods distributed to the domestic market will rise by 5.5% in 2023 and then by 6.0-7.0% annually over 2024 to 2026. Exports are also expected to expand by 6.5% in 2023 and then by an average of 6.5-7.5% in each of the following three years (Figure 18). Demand will be lifted by a range of factors. (i) Thailand’s transition to an aged society will increase rates of non-communicable diseases (e.g., diabetes, heart disease, and strokes) and of more complicated, ongoing conditions. This will also stoke additional demand for medical equipment for use by the elderly in their day-to-day lives (e.g., oxygen concentrators, nebulizers, and hand rails). (ii) The market for health tourism is strengthening (Allied Market Research sees the global value of this jumping from USD 9.9 billion in 2023 to USD THB 24.4 billion by 2027), as is consumer interest in personal health and wellness. This is then driving stronger demand for medical equipment that can be used at home, such as personal heart monitors and wrist-mounted blood-pressure monitors. (iii) The healthcare industry is expanding. (iv) The government has laid out plans that will make Thailand the ASEAN center for the production of medical devices by 2027. (v) Thailand's trading partners have a continuous demand for medical equipment. For instance, the United States requires various medical tools, both in the category of disposable materials (such as medical gloves) and diagnostic equipment and solutions. China and Japan seek blood group testing kits (In vitro diagnostic devices) along with medical equipment related to elderly care, among other things.

-

Plastics are increasingly likely to replace metal, ceramic, and glass in the manufacture of medical devices since plastic is cheaper and in many cases, has equivalent properties, e.g., it is easy to form, it is light, it is resistant to chemicals and radiation, and unlike metal, it does not erode and generate contaminants. In addition, it can be used to create compounds involving rubber and bio-materials that are safe, effective, and that meet the needs of particular use-cases. In particular, specialized resins can be used to manufacture smart materials and implants, such as artificial heart valves.

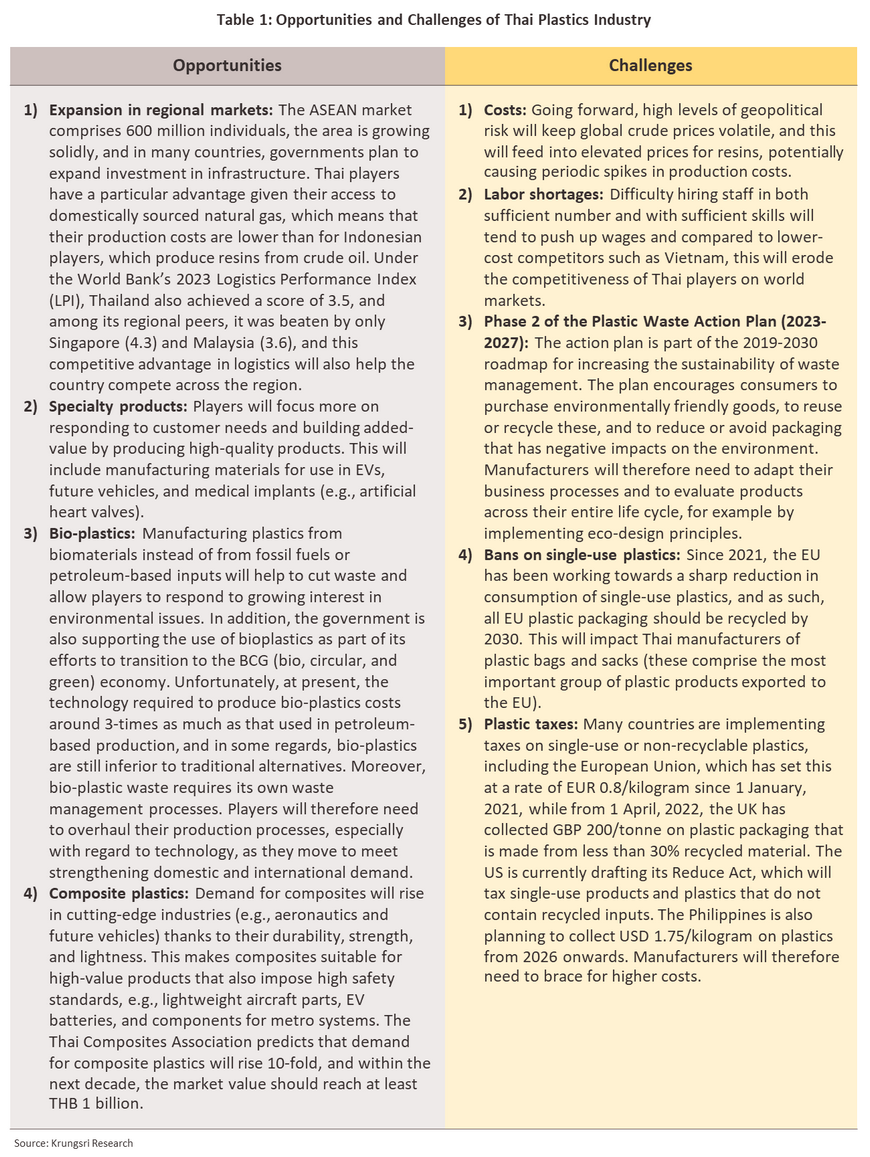

Opportunities and challenges facing plastics manufacturers

1/ This involved a survey of 3,262 manufacturers, or 64.8% of the companies active in the industry. It should be noted that manufacturers may use more than one molding method.

2/ Source: PlasticsEurope

3/ Source: Ministry of Commerce

4/ Source: OIE, Plastic products refers to plastic sacks, bags, containers (e.g., bottles, boxes, crates, etc.), films and sheet, pipes and connectors, and tablewares.

5/ Single-use plastic products include 1) plastic bottles of all types, 2) bottle caps, 3) single-layer plastic film packaging (HDPE, LL, LDPE), 4) plastic bags with handles, and 5) plastic cups and containers