EXECUTIVE SUMMARY

The ongoing recovery in the tourism sector and consumption are expected to lift the Thai economy through 2024, leading to a more positive outlook for the petrochemical industry. However, weakness in domestic manufacturing and exports may suppress a rise in prices and spreads. Additionally, high levels of household debt could dampen demand for durable goods and hinder activity in downstream industries. For 2025 and 2026, conditions are expected to improve, driven by continued domestic economic growth and softening input costs. This should result in better prices and spreads across various products. Nevertheless, a supply glut in certain outputs (e.g., ethylene, propylene, PE, PP and PX) combined with sluggish demand growth for downstream petrochemicals suggests that production and exports will only increase by 1.0-2.0% annually from 2024 to 2026.

Krungsri Research view

Krungsri Research anticipates the market's development from 2024 to 2026 as outlined below.

-

Petrochemical manufacturers are expected to enjoy consistent profits due to a gradual increase in demand from downstream industries, their ability to integrate across supply chains, and a shift toward higher value-added products. In response to growing export market demand, companies are increasingly investing in overseas production facilities. Additionally, they are enhancing their involvement in related industries, particularly in high-growth markets like China, Indonesia, and Vietnam. These developments will enable businesses to improve their production planning and better adapt to changes in the economic landscape.

-

The industry faces risks from high feedstock costs and the imminent depletion of natural gas resources in the Gulf of Thailand. Consequently, companies may encounter greater challenges in securing inputs and become more exposed to input price fluctuations due to their increasing reliance on imported crude oil and natural gas. As a result, manufacturing margins are likely to come under pressure.

-

Thai players will also face increasing pressure to prioritize self-sufficiency in petrochemical production within key export markets like China, Indonesia, and Vietnam. These countries are benefiting from strong plastics demand and access to key resources for the industry. In response, Thai companies could consider forming joint ventures with established players in these markets. Additionally, shifting focus from the production of commodity-grade products, where price competition is fierce, to a greater emphasis on specialty products may provide a strategic advantage.

Overview

The petrochemical manufacturing business is normally a large-scale operation that employs many complicated and tightly interconnected industrial processes. It involves huge capital investment to establish a petrochemical complex, which requires the use of advanced technology, and the sites that host these complexes need to have access to a wide range of industrial-scale utilities. Given this, the payback period on investment is relatively long.

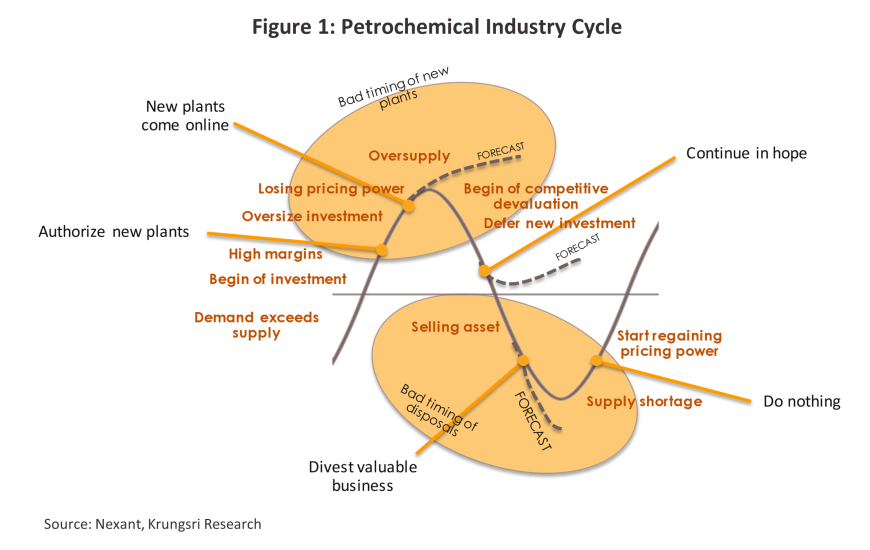

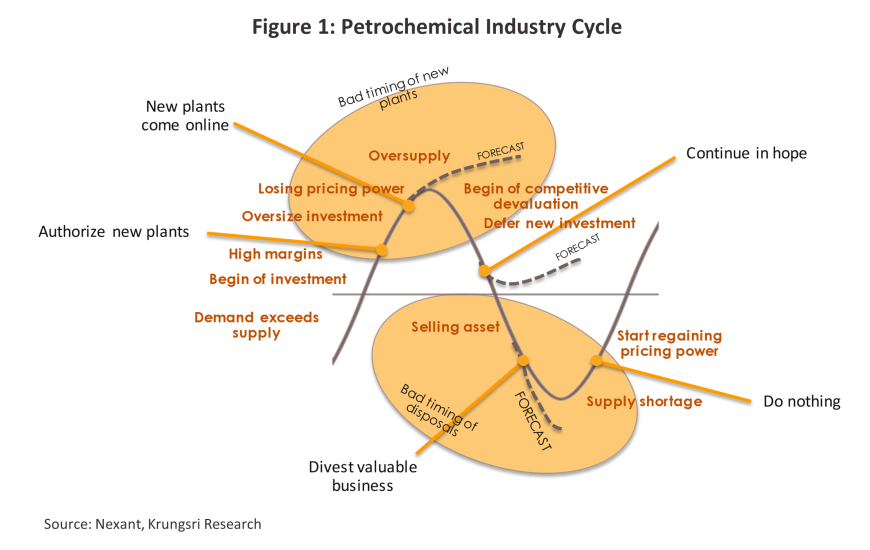

Generally, the petrochemical industry is exposed to cyclical supply-demand conditions and prices, as the desire to exploit economies of scale encourages large and intensive investment to meet anticipated future demand. Decisions to expand existing facilities or invest in new sites are usually made when prices for petrochemicals are high, and this would normally be when an expanding economy is feeding demand for these products or when there is a supply shortage. But construction of a petrochemical complex normally takes 3-7 years, and if the anticipated demand fails to materialize upon completion, there would be excess supply in the market. Global data suggest each natural cycle lasts between 6-9 years, but shocks in the world economy could also affect the supply and demand sides of the equation. Recently, it has thus been harder to identify cyclical movements within the industry at a global scale (Figure 1).

Investments in large global petrochemical complexes are typically made by players in the oil sector that use petroleum products as feedstock. However, some petrochemical output can also be used as feedstock or as primary ingredients in a wide range of industrial processes. The manufacturing process for petrochemicals can be divided into four main stages:

Stage 1: Manufacturers of feedstock typically use products from the petroleum sector, including natural gas, condensates (a product of gas distillation), and naphtha (from the distillation of crude oil). About half the petrochemical production capacity uses naphtha as feedstock, which is especially common in facilities in Asia and Europe. In North America and the Middle East, gas is the preferred feedstock because these areas are rich in natural gas deposits. In addition, recent technological developments are allowing organic products such as sugarcane, cassava and palm to be used as raw material in the production of bioplastics, and investment in these sectors is expected to rise in the future.

Stage 2: Upstream petrochemical industries take feedstock and use them to produce precursor or preliminary petrochemical products. These may be divided into two groups according to their molecular structure: (i) olefins, which include methane, ethylene, propylene and other chemicals that have a base structure formed from four carbon atoms (so-called ‘mixed C4’ chemicals); and (ii) aromatics, which include benzene, toluene and xylene, and are used as inputs in the manufacture of other petrochemical products.

Stage 3: Intermediate petrochemical industries consume upstream products, both olefins and aromatics, and process or combine them with other chemicals to produce intermediate products. Some major products in this industry are vinyl chloride and styrene. These are sold to downstream industries.

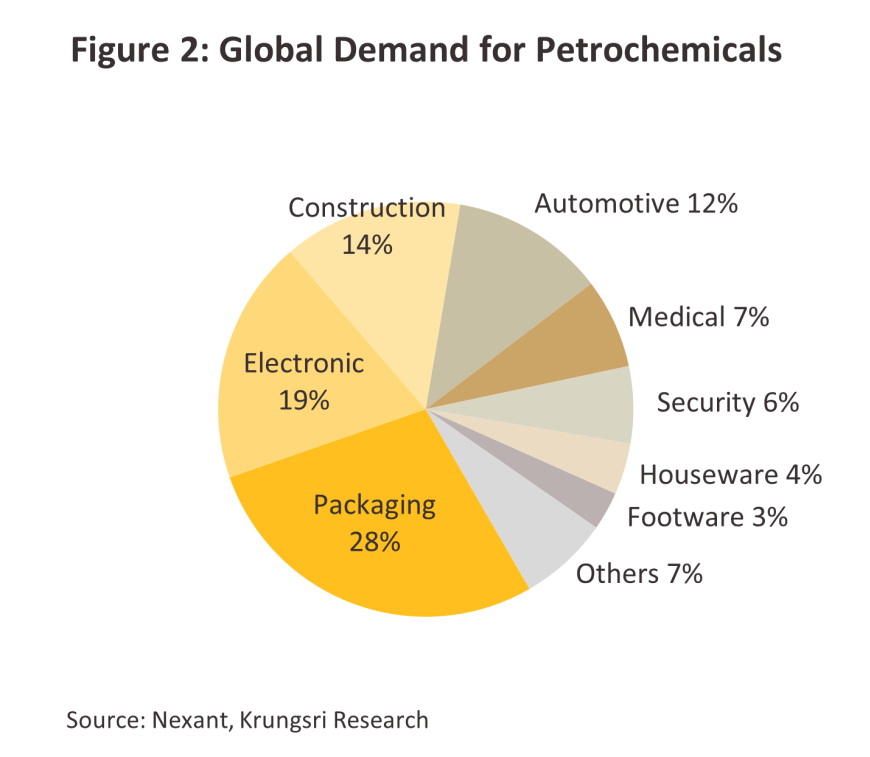

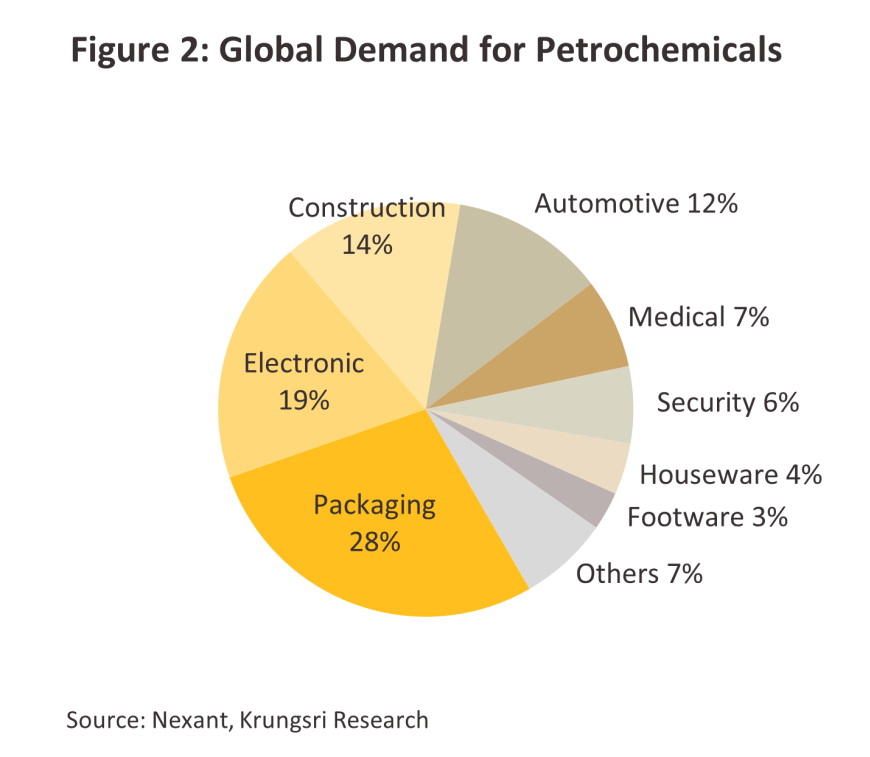

Stage 4: Downstream petrochemical industries take upstream and intermediate goods and use these to make finished products for use in related sectors (Figure 2). Products consumed by the downstream petrochemical industry can be sub-divided into four groups

-

Plastic resin is the most commonly-used product in downstream industries, including packaging, automotive manufacturing, construction material, and consumer goods. The most important plastic resins are polyethylene, polypropylene, polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyethylene terephthalate (PET), and polystyrene (PS).

-

Synthetic fibers, for example polyester and polyamide or nylon fiber, are mostly consumed by the textiles and packaging sectors.

-

Synthetic rubber/elastomers are used in the manufacture of automotive parts, tires, and consumer goods. Examples include styrene butadiene (SBR) and butadiene (BR).

-

Synthetic coatings and adhesive materials, which include polycarbonate and polyvinyl acetate, are used in construction and several other industries.

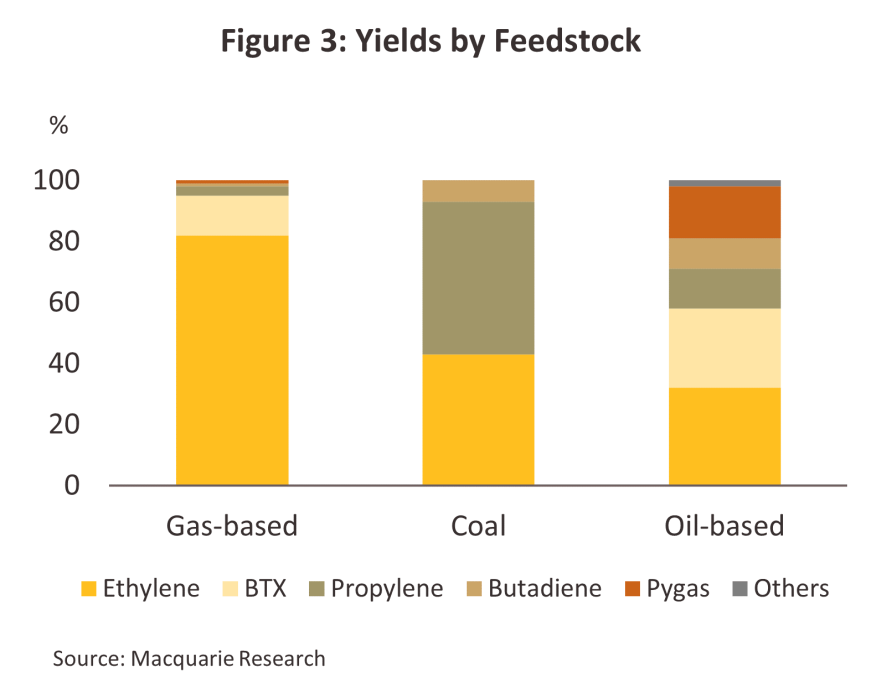

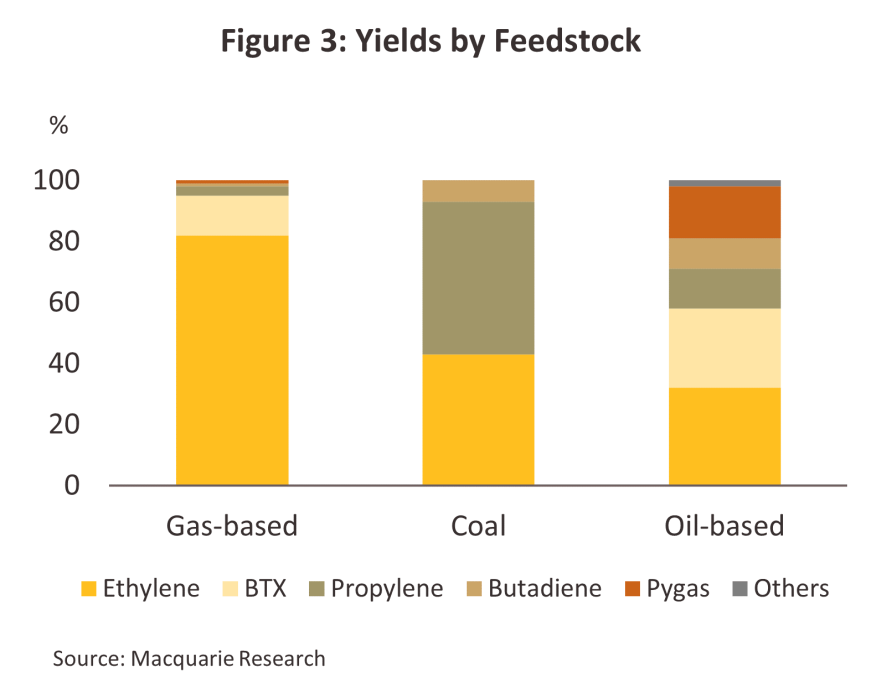

The choice of feedstock made by the individual operator for a particular production process is strongly influenced by the desired output because each feedstock has a different hydrocarbon composition and will produce different petrochemical outputs. For example, using natural gas to produce ethylene yields about 80% ethylene and 20% other products, whereas using naphtha yields only 30% ethylene and 70% other products (Figure 3).

The major cost item in the sector is feedstock which comprises 60-70% of the total production cost. Power and transportation account for another 15-20%, and the remaining 15-20% is attributable to fixed costs. Hence, the production cost is largely dependent on the prices of oil and related products, making this a cost-based industry and producers who are able to keep these under control will have a competitive advantage. More specifically, production overheads, or cash cost, will depend on the type of feedstock used, the production technology employed, and access to feedstock. Therefore, feedstock management is also an important factor in determining costs, and locating production facilities on sites with easy access to raw materials and to markets will reduce transportation overheads and improve competitive advantage.

The ability to manage complex investments is another important factor in determining business success. It would allow manufacturers to better manage costs, reduce exposure to risks arising from fluctuations in product prices, and plan production more effectively. Product flexibility also permits manufacturers to quickly adjust production to meet changing demand, while large-scale operations allow manufacturers to benefit from economies of scale and reduce the marginal cost of production.

The petrochemical market is extensive and globally interconnected. Hence, prices are normally based on a combination of production costs and supply-demand dynamics on global exchanges. Global prices are largely determined by ‘laggard-driven pricing’, which means the market price is set by the cost of producing the last unit consumed. When the cost of the feedstock used in producing that last unit changes, this will thus have a direct effect on prices of output. Research shows prices of upstream and downstream petrochemical products have a 70–85% and 40-70% correlation, respectively, with the cost of feedstock.

The ‘spread’ of a particular petrochemical product refers to the difference between the product price and the cost of raw material; this represents the gross profit margin for each product. However, most downstream petrochemical industries have a product chain stretching from upstream products through intermediate to downstream outputs, so when calculating profit, we must consider spreads for all the products in the supply chain.

Profitability is normally reflected by gross integrated margin (GIM). This is the difference between the total value of petrochemical products less total cost of production. Hence, the GIM depends on the spreads of all the products manufactured, which could rise or fall according to an operator’s cash cost and capacity utilization. However, product mix will vary for different production sites and for different operators, which makes is complicated to assess competitiveness by simply comparing GIM. This has prompted the use of cash cost as the preferred metric for assessing competitiveness, specifically cash cost for ethylene because it is the world’s most commonly produced upstream product at 32% of total global petrochemical output, and is used as feedstock in a wide variety of processes.

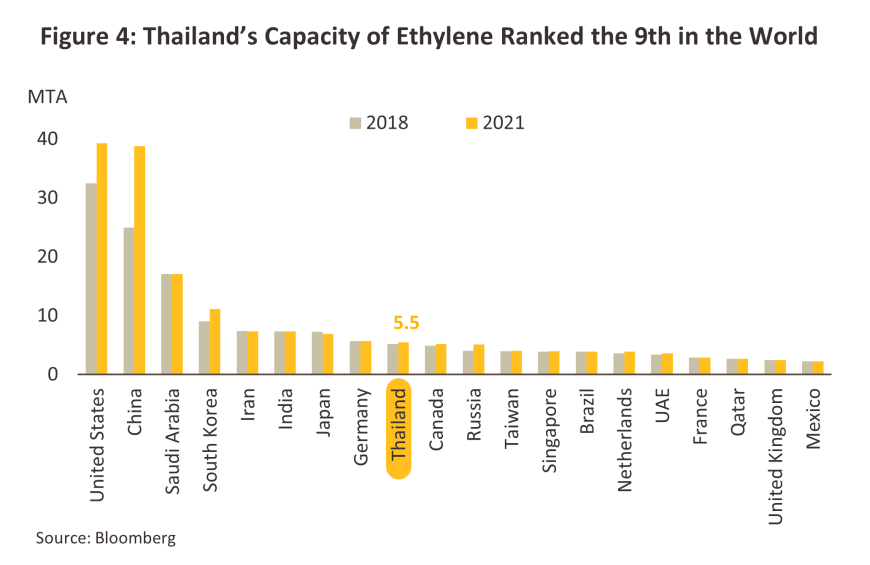

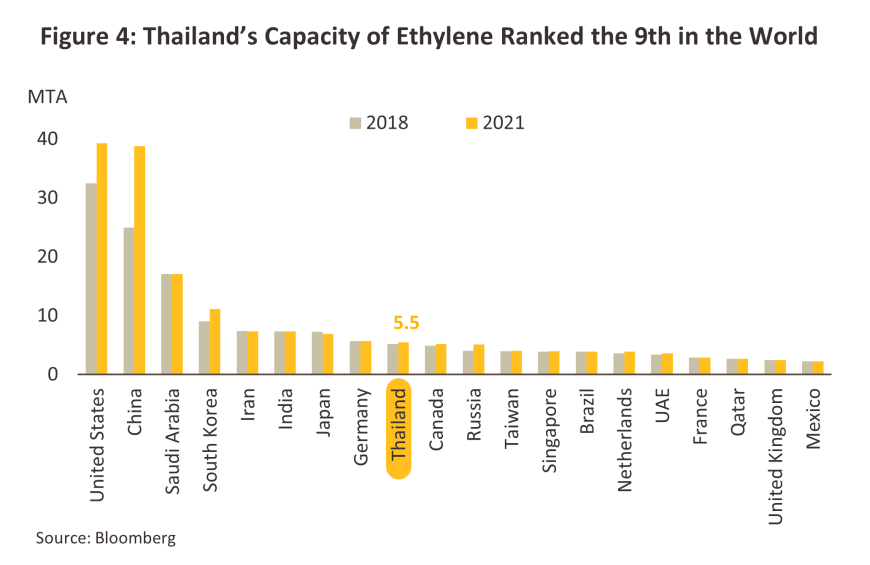

The global petrochemical sector: In 2023, the global petrochemical sector had a market value of around USD 620bn, and that is expected to grow at an average rate of 7.3% per year from 2024 to 2030 (source: Grand View Research)1/. China was both the biggest producer and consumer of petrochemicals at 30-35% of global output and 35-40% of consumption. The US was the world’s single largest source of ethylene, hosting 19.5% of global production capacity, followed by China (19.3%) (Figure 4).

Worldwide, petrochemical products are used in packaging (28% of output), electronics (19%), construction (14%), automobiles (12%), and a range of other related sectors (27%). Demand for petrochemical products typically grow 1-2 times faster than the general rate of growth in the economy.

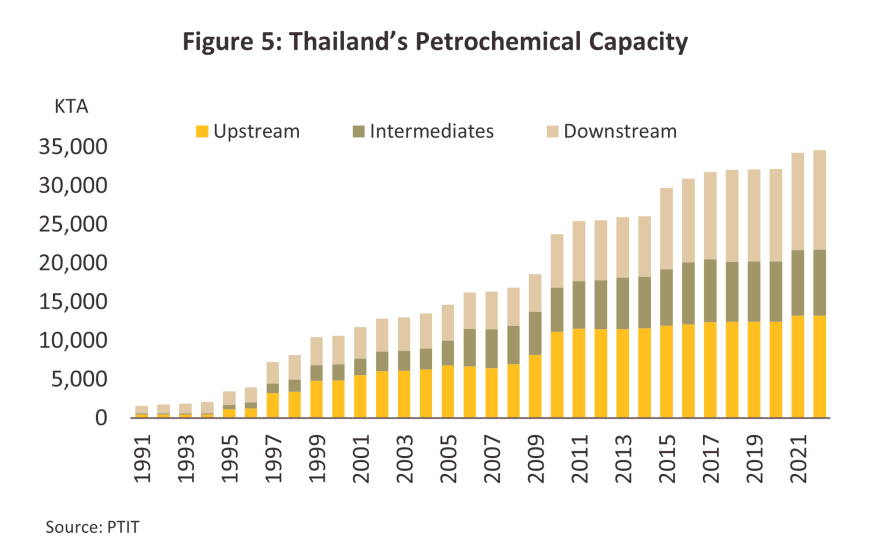

Thai petrochemical sector: In 2022, the Thai petrochemical sector had a total production capacity of 34.6 million tons, the largest in the ASEAN region and 16th largest in the world (Figure 5).

-

In that year, they produced 13.2 million tons of upstream products, 8.5 million tons of intermediate goods, and 12.8 million tons of downstream outputs.

-

Naphtha is the main feedstock (66% of total feedstock consumption), while 69% of production capacity is for olefins.

-

Over 80% of Thai upstream and intermediate production is for domestic use as inputs for further downstream processes. 45% of the downstream output is consumed within Thailand. The primary consumers of downstream products in Thailand are the packaging sector (38% of the total), textile (18%), automobile (12%), electronics (11%), and others (21%). The remaining 55% goes to the export markets (largely in the form of plastic pellets or nurdles), the most important of which are China (31%), Japan (10%), Indonesia (10%), Vietnam (9%) and India (8%).

Situation

Sluggish conditions dominated the global petrochemicals market throughout 2023. Demand was hindered by rising global inflation, which reached 6.8%, leading to a series of interest rate hikes by central banks worldwide and triggering a cyclical slowdown in the industry. Additionally, structural challenges within the Chinese economy, particularly the struggling real estate sector, affected growth in the world’s largest market for petrochemical products. As a result, the expected boost to demand from China’s reopening largely failed to materialize. Consequently, downstream industries suffered, with global demand for petrochemicals falling by another -8.0% in 2023, following a contraction of -3.0% in 2022.

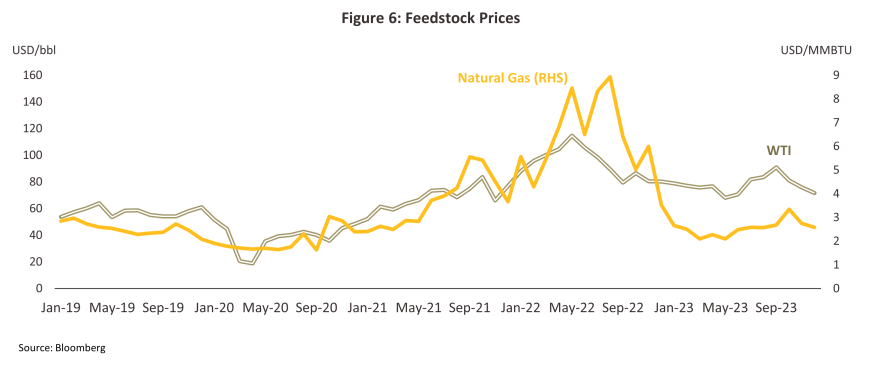

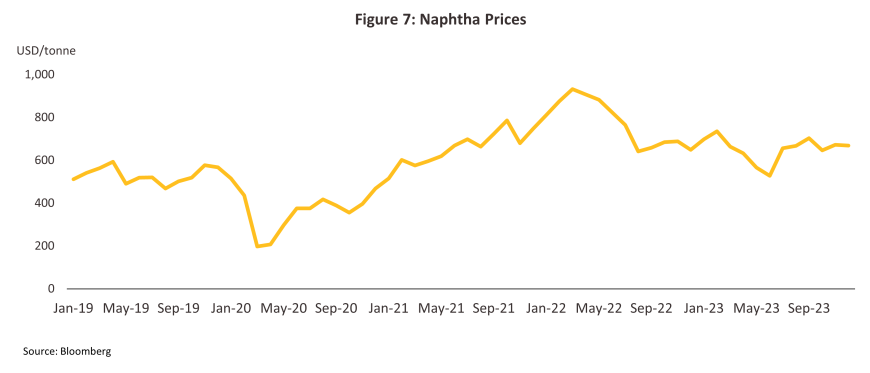

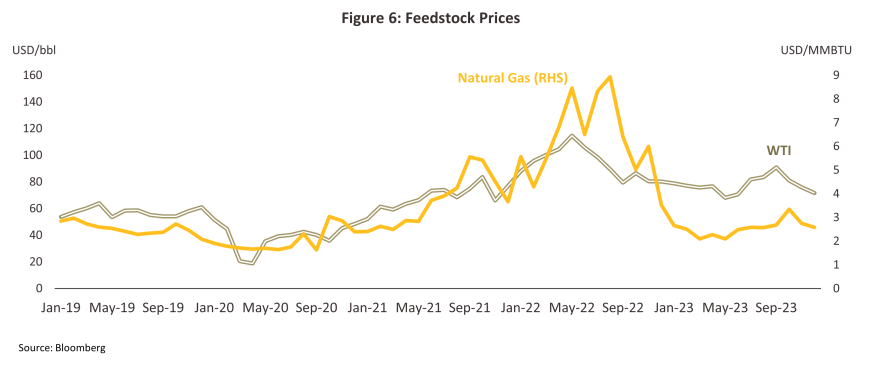

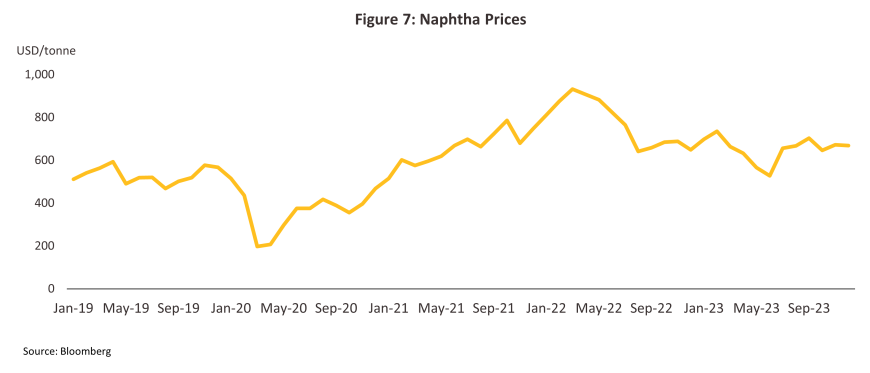

A decline in feedstock costs in 2023 aligned with the softening of crude oil and natural gas prices due to two key factors: (1) fears of a potential energy crunch eased as sales of Russian crude to India and China remained strong despite Western export embargoes, and (2) demand for crude in China, the world's second-largest oil consumer, was impacted by a sluggish domestic economy. Nonetheless, these trends were partially offset by OPEC+ tightening production quotas and ongoing concerns about the protracted Russia-Ukraine war and conflicts involving Israel and Hamas, which heightened fears of wider escalations. Overall, average prices for Dubai Crude fell by 16.4% to USD 82.5/bbl, resulting in naphtha prices (derived from crude) dropping by -15.9% to USD 653/tonne. Similarly, average natural gas prices declined by -59.4% to USD 2.6/MMBtu (Figure 6 and Figure 7).

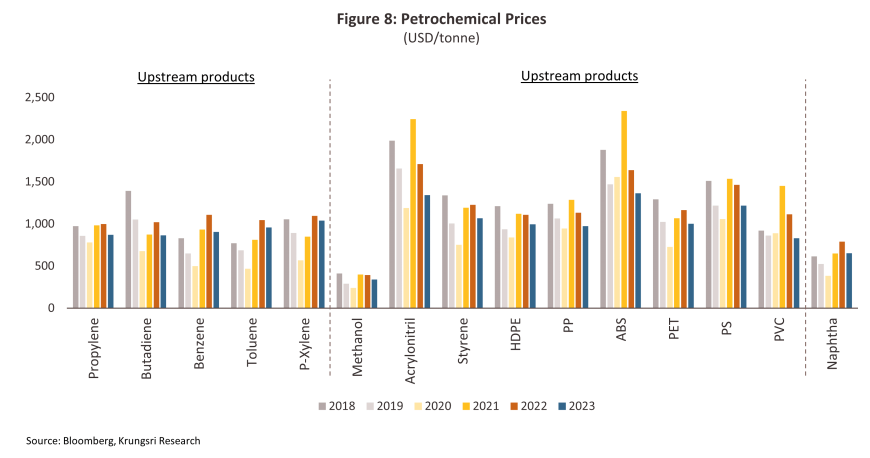

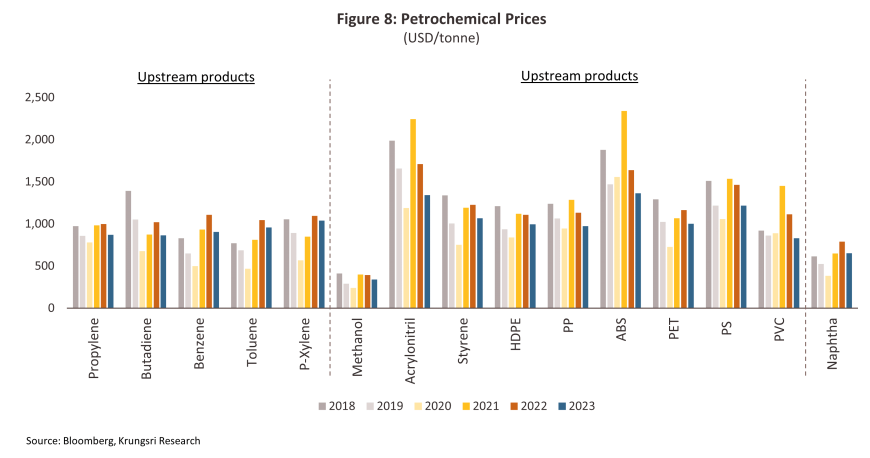

Weaker demand from downstream consumers, including the packaging, electronics, and consumer goods industries, pressured prices for major product groups throughout the year (Figure 8). This decline was exacerbated by widespread destocking among downstream producers, particularly impacting olefin-based production lines. Additionally, the market faced a supply glut due to new production capacities coming online. In China, official policy now aims to reduce imports by promoting self-sufficiency in petrochemical production, which limits access to that market. In response, more price-competitive manufacturers in the US and the Middle East are shifting their sales focus from China to Southeast Asia. Meanwhile, elevated input costs have further worsened spreads for midstream and downstream goods compared to the previous year.

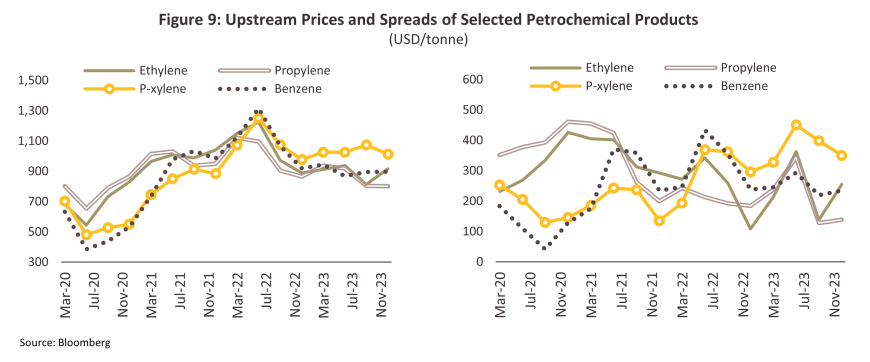

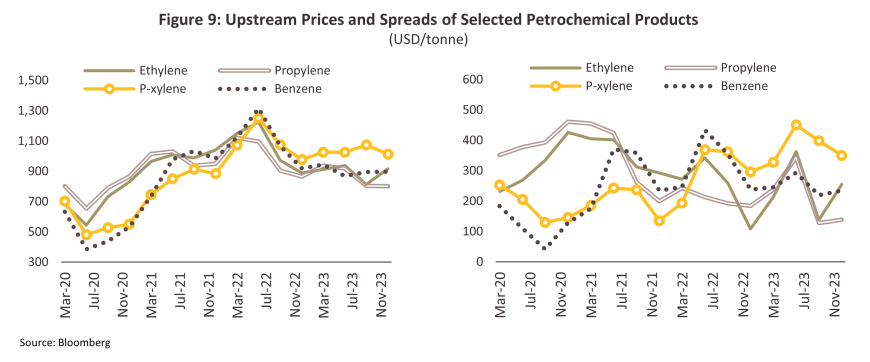

Upstream petrochemical products:

Olefins

-

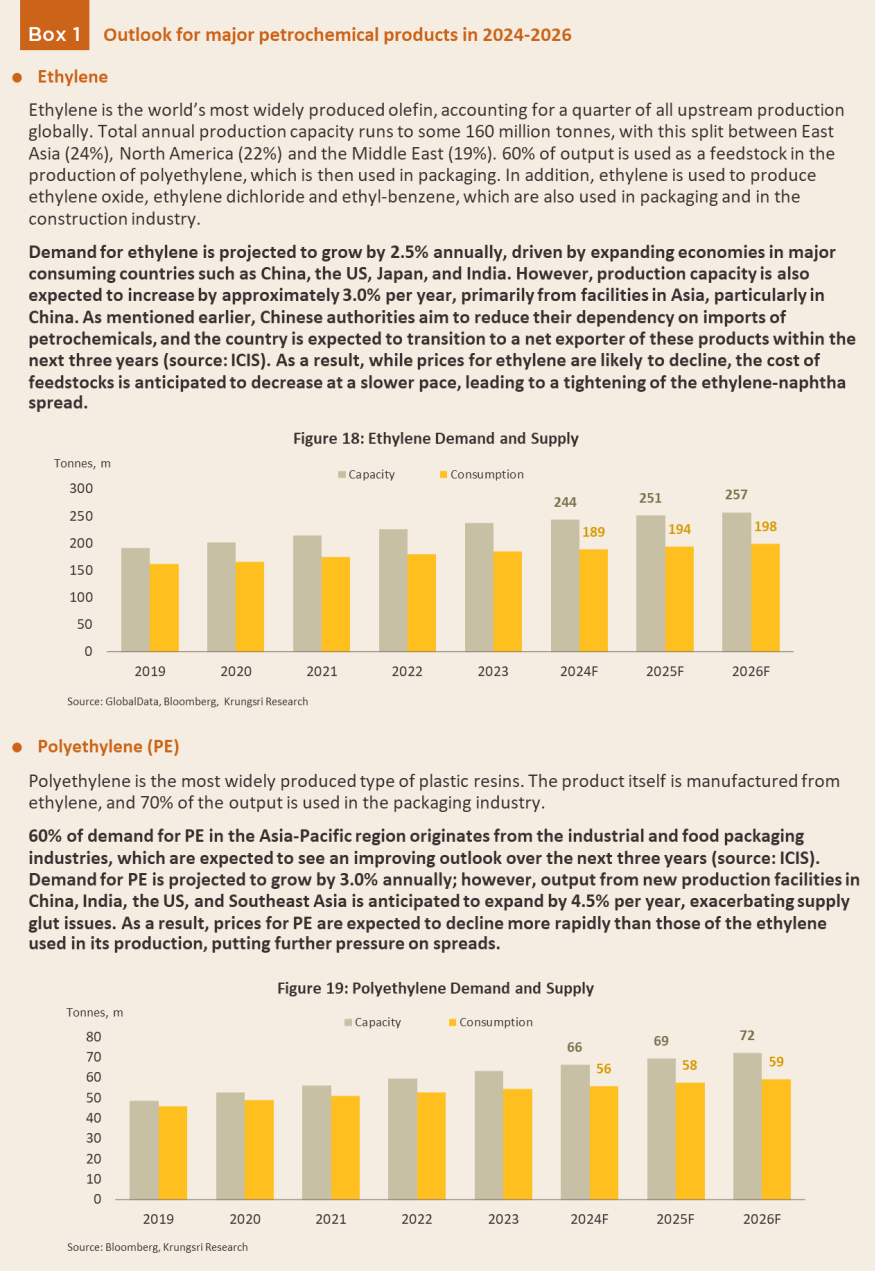

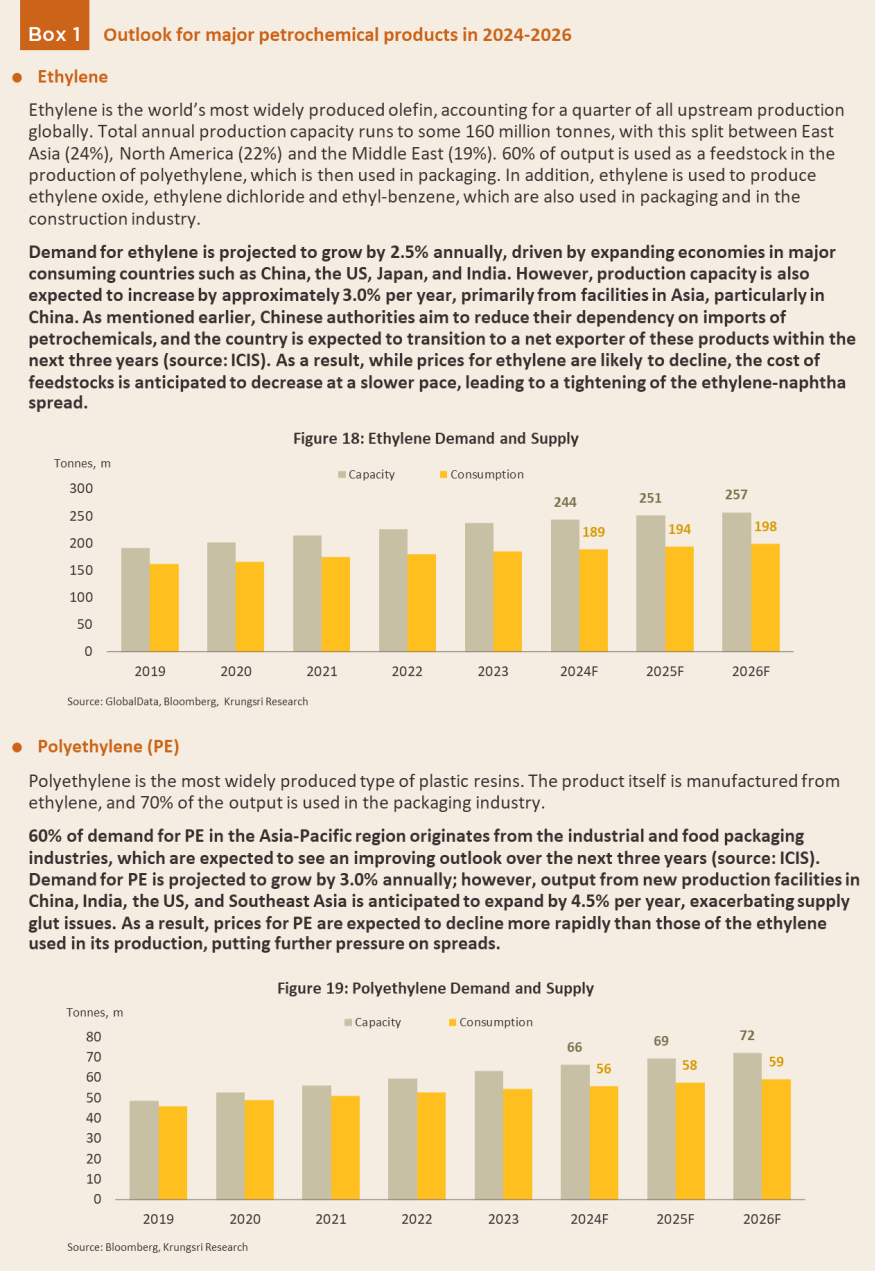

Ethylene: Spreads contracted by -14.1% to USD 242.7/tonne due to weaker demand from downstream industries (e.g., packaging) and a worse-than-expected post-COVID recovery in the Chinese economy. Additionally, the continued commissioning of new production facilities in Asia exacerbated the supply glut, further putting pressure on spreads.

-

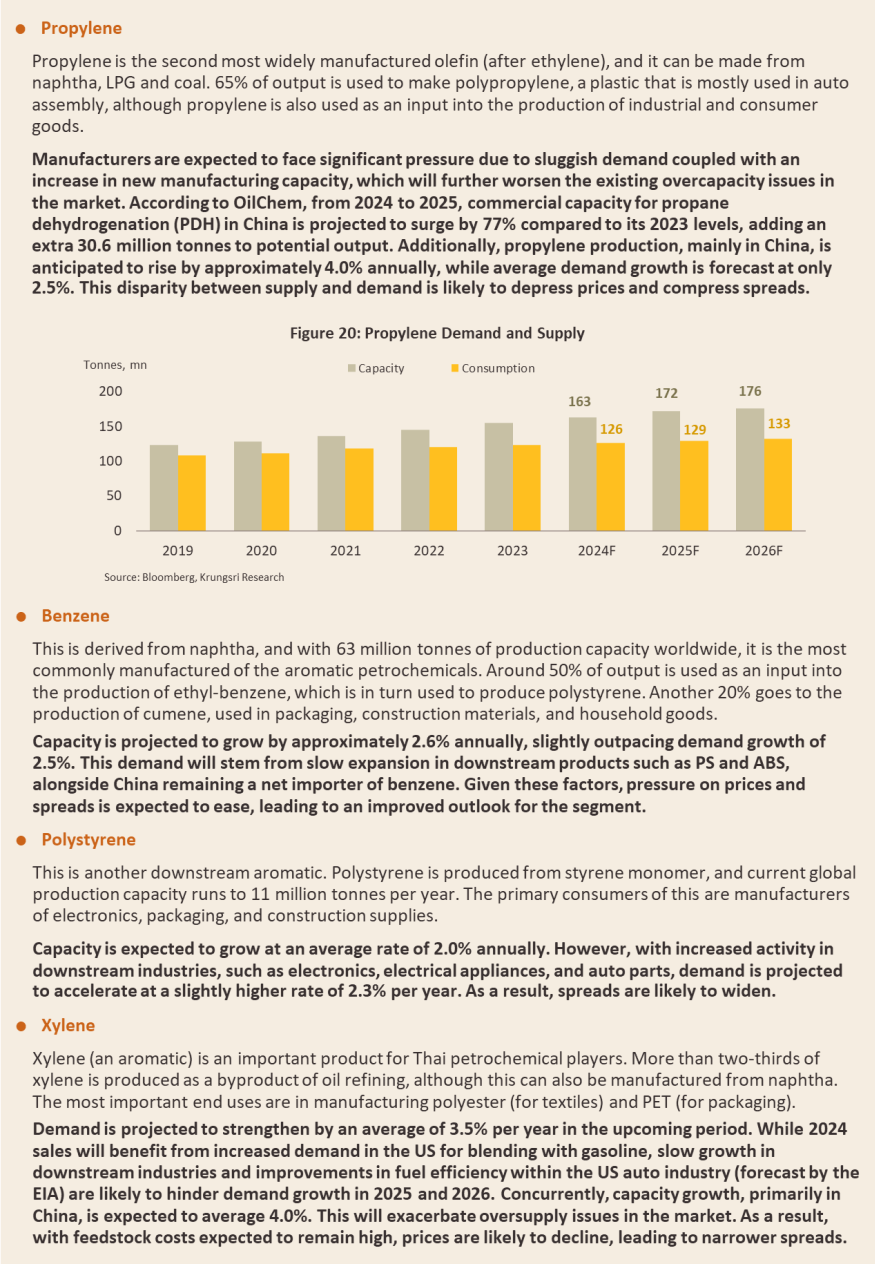

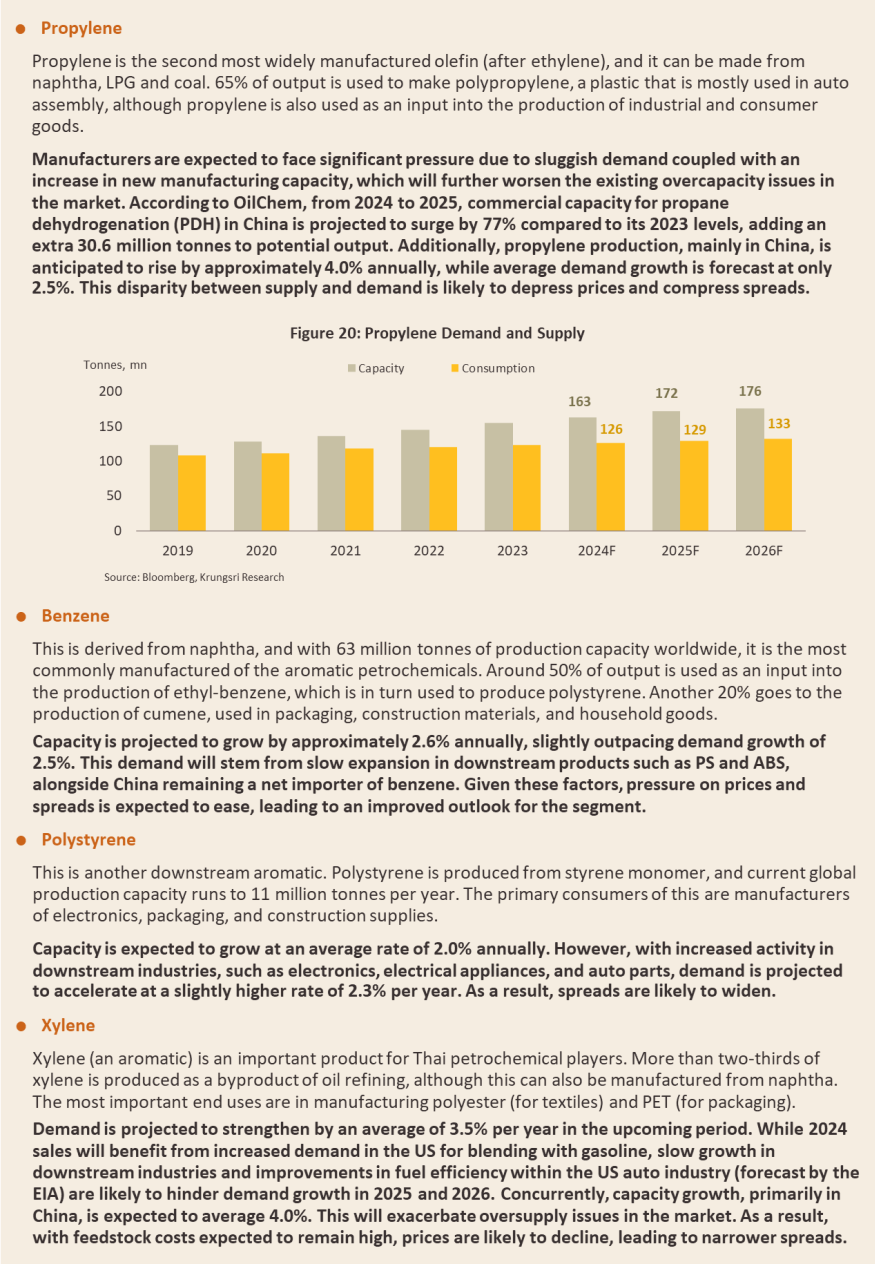

Propylene: Softening demand for the downstream product polypropylene contributed to a tightening of propylene spreads. On the supply side, falling propane prices triggered an expansion in propane dehydrogenation (PDH) capacity across Asia, particularly in China, during the second half of the year. As a result, propylene supply surged by 38.5% to 17.3 million tonnes, while spreads contracted by -3.7% to USD 212.1/tonne (source: OilChem).

Aromatic

-

Para-xylene (PX): Spreads expanded by 20.4% to USD 381.8/tonne. Prices were boosted by stronger demand in the US, where PX is mixed with gasoline, and by the reopening of China, which increased production capacity for purified terephthalic acid (PTA), a midstream product that uses PX as a feedstock, to support downstream consumers in the textiles and fabric industry. Additionally, periodic maintenance of production facilities in Asia kept PX supply tight, further widening naphtha-PX spreads.

-

Benzene: Weak demand from downstream industries (e.g., packaging, electronics and consumer goods) combined with base effects from high prices a year earlier, led to a decline in spreads to USD 248.1/tonne, down -24.9%.

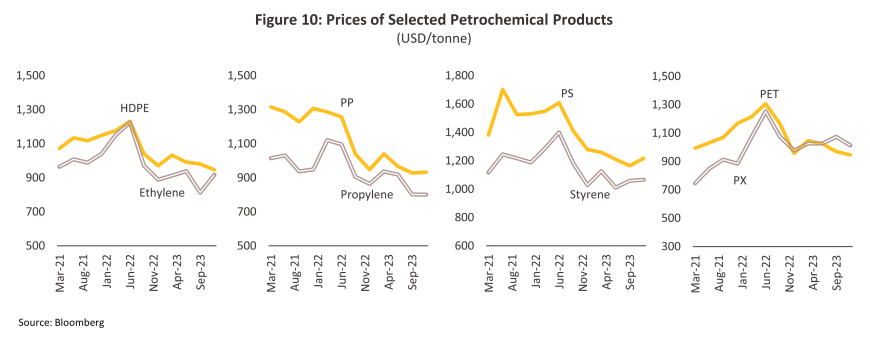

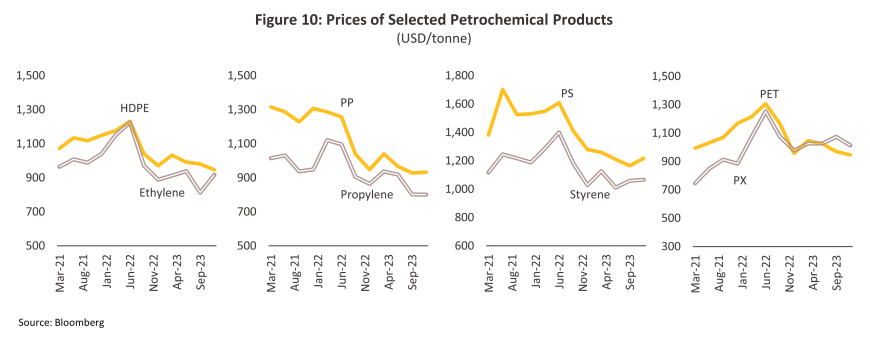

Downstream petrochemical products:

-

High density polyethylene (HDPE): Spreads surged by 99.4% to USD 92.3/tonne due to a significant number of Asian producers shutting down polyethylene production facilities for periodic maintenance in the first half of the year. This tightening of supply helped HDPE prices hold up better than those of the ethylene used as a feedstock. As a result, spreads widened, although they remained below the pre-pandemic 10-year average of USD 119.8/tonne.

-

Polystyrene (PS): While the continued popularity of takeaways and food delivery services sustained demand for general purpose polystyrene used in food packaging, softer consumer spending power weakened demand for high impact polystyrene, which is used in packaging for electronic goods and electrical appliances. As a result, global demand for polystyrene fell by -2.5%. With production capacity expanding by 5.4%, spreads declined by -16.9% to USD 314.9/tonne.

-

Polypropylene (PP): Growth in Chinese production capacity, coupled with intensifying competition from Middle Eastern producers benefiting from a lower cost base, contributed to a decline in spreads by -24.7% to USD 102.5/tonne.

-

Polyethylene terephthalate (PET): Spreads collapsed to USD -38.3/tonne, a decline of -155.8%. This segment was impacted by the opening of new Chinese facilities that added over 5 million tonnes to annual supply, a decrease in pandemic-era demand for hygienic food packaging, and persistently high prices for the PX required as a feedstock.

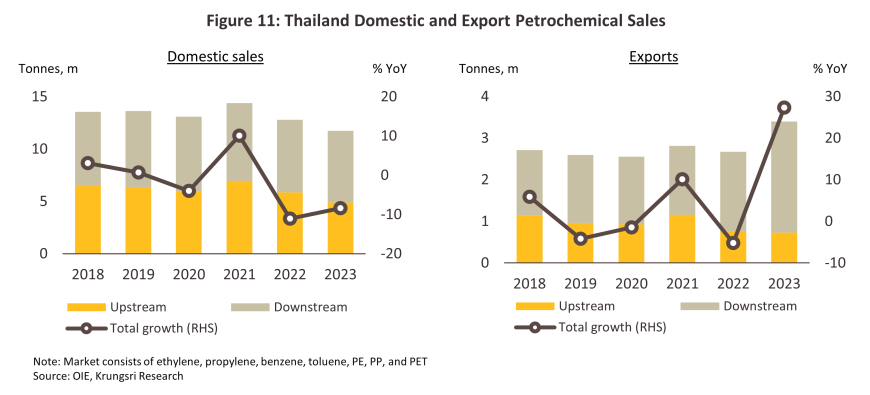

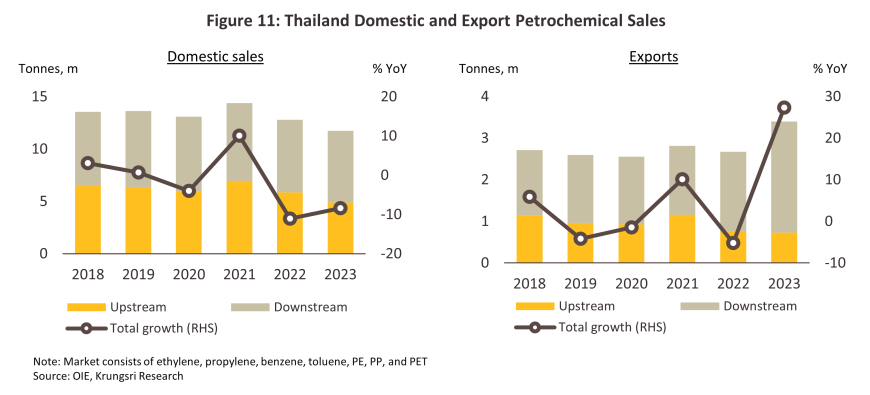

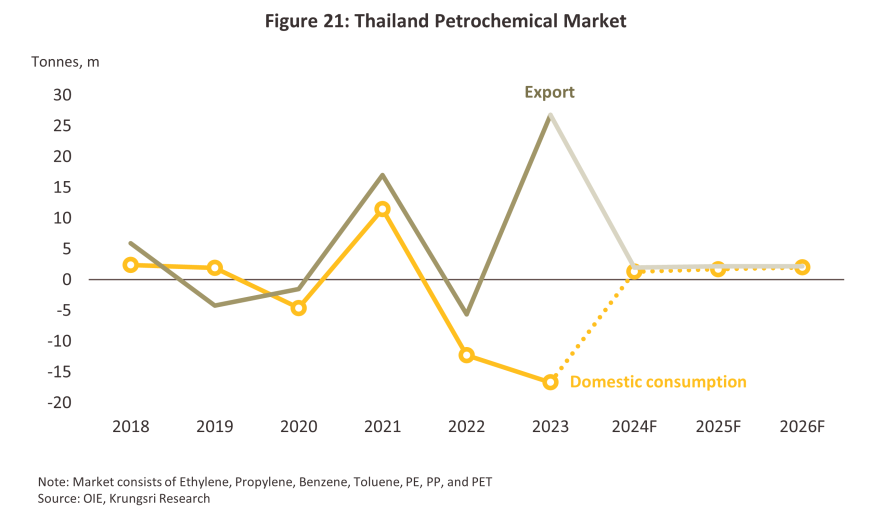

The domestic petrochemicals market was in depressed conditions due to the economic recovery in 2023 being largely confined to the tourism sector and related areas. With imports and exports contracting by -3.1% and -1.7%, respectively, the manufacturing sector struggled. These sluggish conditions also affected downstream consumers, including the packaging, electronics, and construction materials industries, leading to an overall weakening of petrochemical demand. Insights into the 2023 market conditions are provided below (Figure 11).

-

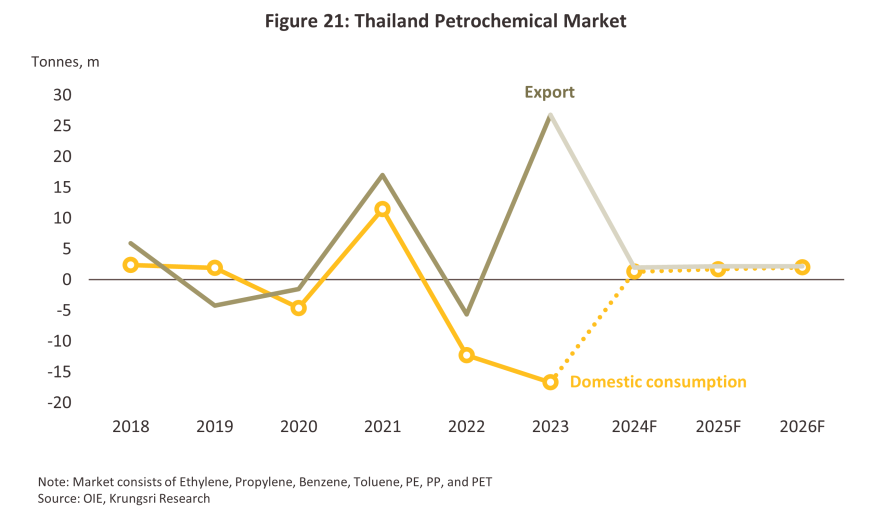

After a decline of -11.1% in 2022, domestic sales fell by an additional -8.4%, totaling 11.7 million tonnes. This decline was split between upstream goods, which decreased by -16.6%, and downstream goods, which fell by -1.4%. As a result, domestic distribution dropped to 4.9 million tonnes for upstream goods and 6.8 million tonnes for downstream goods.

-

In 2023, exports jumped by 27.3%, driven by a 39.6% surge in demand for polyethylene. This increase was primarily fueled by the need for maintenance at numerous Asian production sites during the first half of the year, which diverted demand for polyethylene to Thai producers and distributors. However, demand for many other products, including polypropylene, which used in similar applications to polyethylene, was negatively impacted by several factors: (i) weakness in downstream industries undermined global demand for petrochemicals, while an oversupply in the market was exacerbated by sluggish conditions in China; and (ii) the declining competitiveness of Thai producers compared to those in China, the US and the Middle East, which benefit from a more competitive cost base and have been steadily expanding their production capacity. As a result, Thai players are losing market share (source: Bank of Thailand).

-

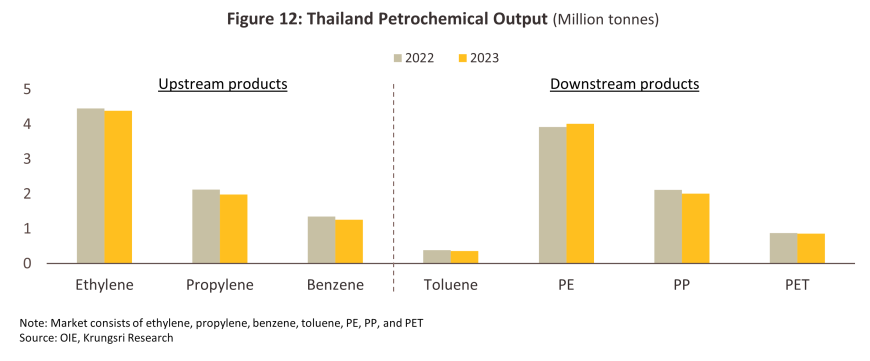

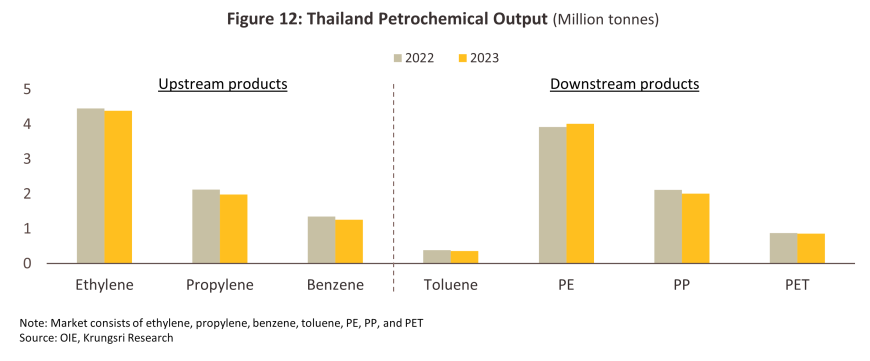

Overall output by the industry declined by -2.4% to 14.9 million tonnes. Weak demand both domestically and internationally contributed to drops of -6.7% in propylene production and -5.3% in polypropylene production. However, strengthening overseas sales of polyethylene boosted its output by 2.1% (Figure 12).

Outlook

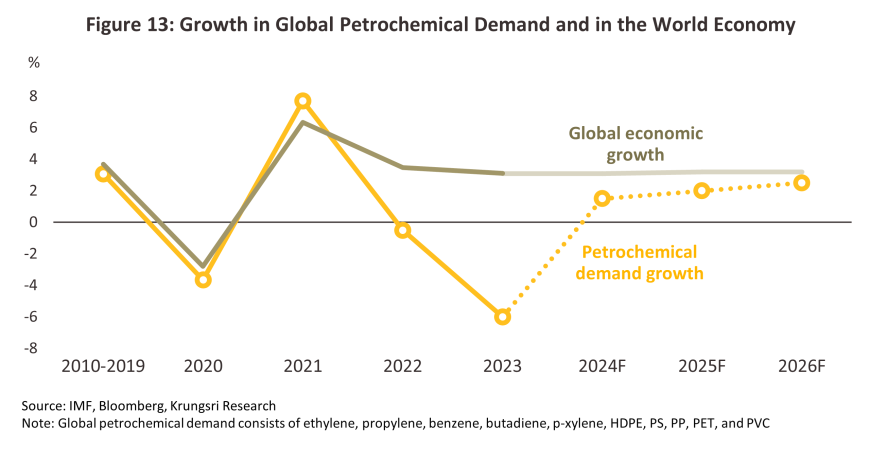

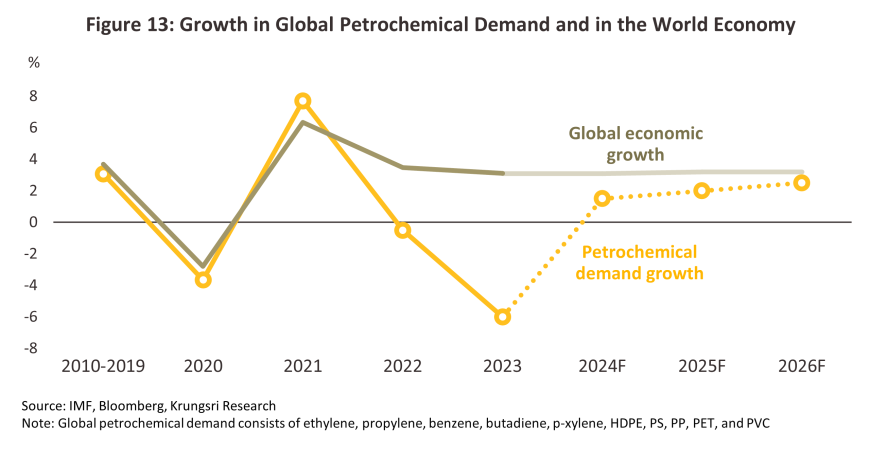

The IMF projects global growth to average 3.2% annually from 2024 to 2026. However, China's growth is expected to decline significantly, dropping from an average of 7.7% from 2010 to 2019 to just 4.2% per year. Given that the Chinese market accounts for 40% of global demand for petrochemicals, overall consumption levels are likely to suffer. Consequently, with new production capacity continuing to come online and consumption strengthening only gradually, petrochemical demand is expected to rise by just 1.5% to 2.5% per year over 2024-2026, falling short of the 3.1% average seen from 2010 to 2019 (Figure 13).

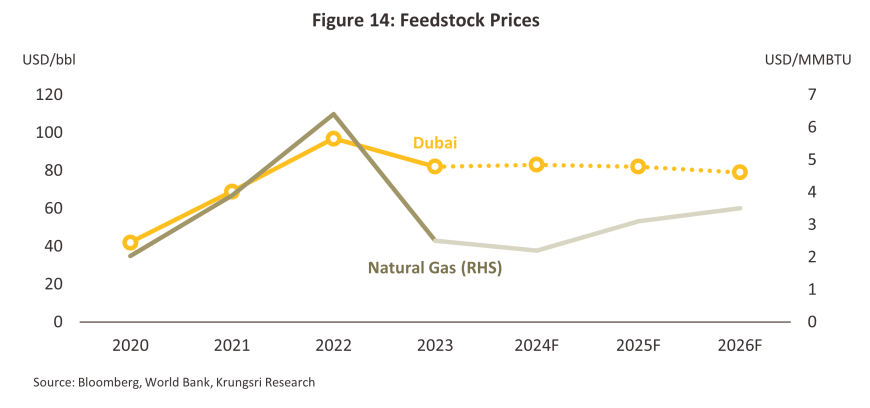

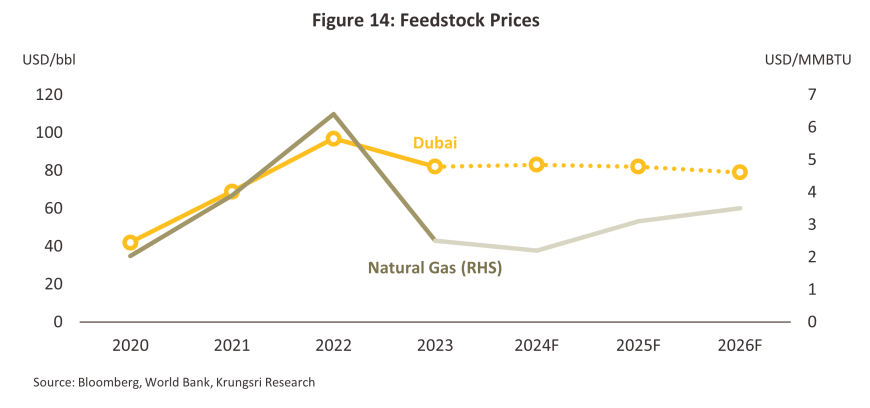

Global oil prices are expected to soften but remain elevated, impacting the petrochemicals industry. The US Energy Information Administration (EIA) forecasts 2024 production to average 102.18 million barrels per day (MMbbl/day), an increase of 0.3 MMbbl/day from the previous year. To better align supply and demand, which is projected to reach 103.1 MMbbl/day in 2024, combined official and voluntary production cuts announced by OPEC+ will reduce market supply by 5.9 MMbbl/day (or 5.7% of total supply) through the end of 2025. In 2025 and 2026, a slowly expanding global economy may help keep demand steady or even increase it slightly. However, escalating geopolitical risks could lead to additional volatility in global crude markets. Krungsri Research anticipates that Dubai Crude prices will average USD 83/bbl in 2024, declining to USD 82 and USD 79 in 2025 and 2026, respectively. In contrast, the EIA forecasts natural gas prices to rise from an average of USD 2.2/MMBtu in 2024 to USD 3.1/MMBtu (Figure 14). Having averaged USD 653/tonne in 2023, naphtha prices are expected to increase to USD 689, USD 633, and USD 602/tonne in 2024, 2025, and 2026, respectively, which will affect the cost, sale price, and spreads of midstream and downstream products.

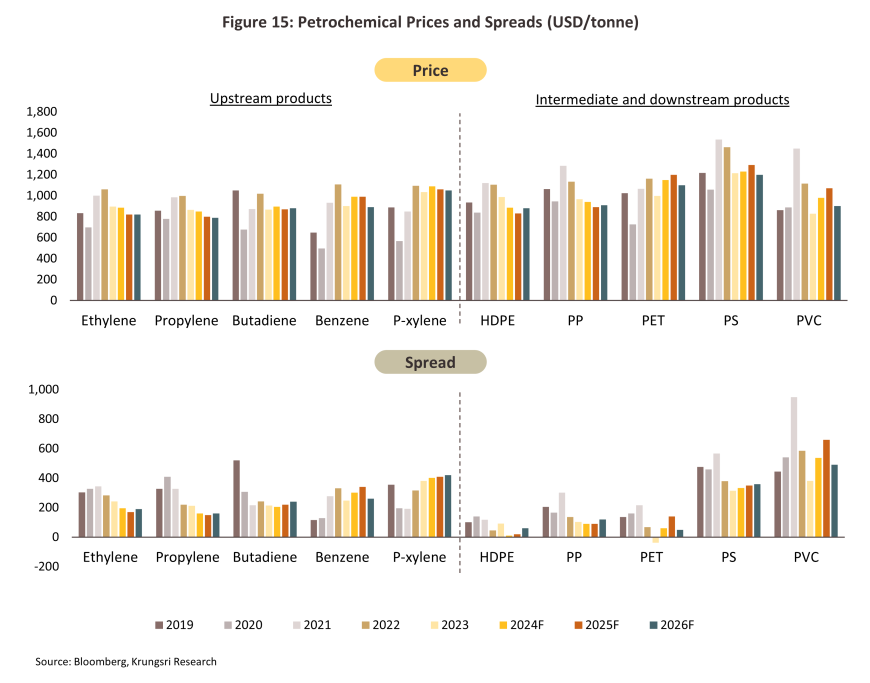

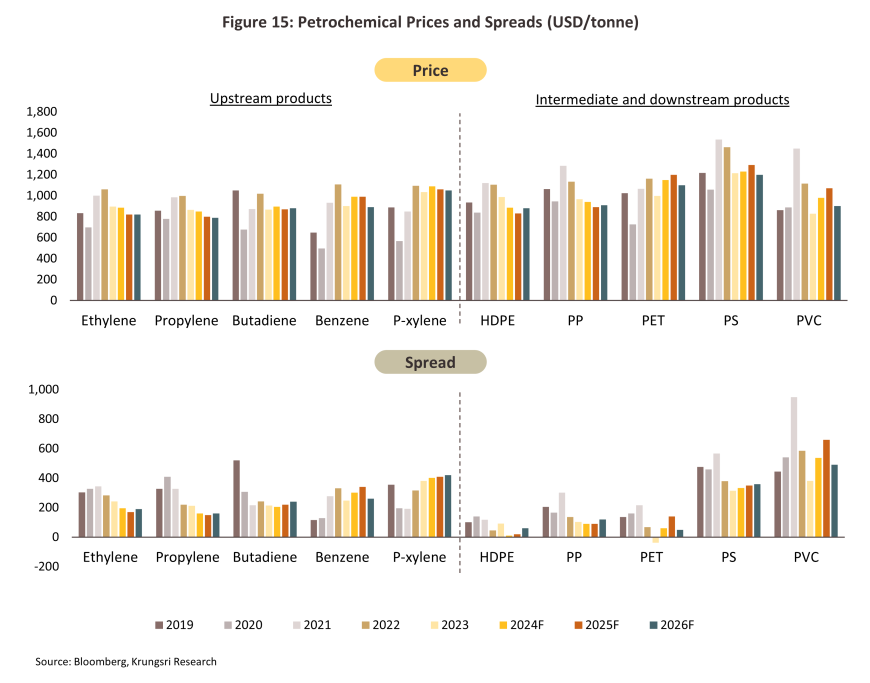

Through 2024, prices for petrochemical products in Asian markets will differ based on the growth of downstream industries (Figure 15) and the positive effects of Chinese restocking. However, uncertainty in the global economy and the continued increase in production capacity across many markets will exacerbate existing supply glut issues, with expectations for the glut to rise to 220 million tonnes in 2024, up from 191 million tonnes in 2022 (source: ICIS)2/. High crude prices will also keep input costs (e.g., naphtha and condensates) elevated, limiting opportunities for price increases or spread expansions. Nonetheless, prices for aromatics are likely to strengthen due to robust demand in export markets, particularly from the US, where PX is used in gasoline blending. In China, production of PTA, which relies on PX as an input, is also expected to increase. As a result, spreads for aromatics may remain stable or even widen slightly.

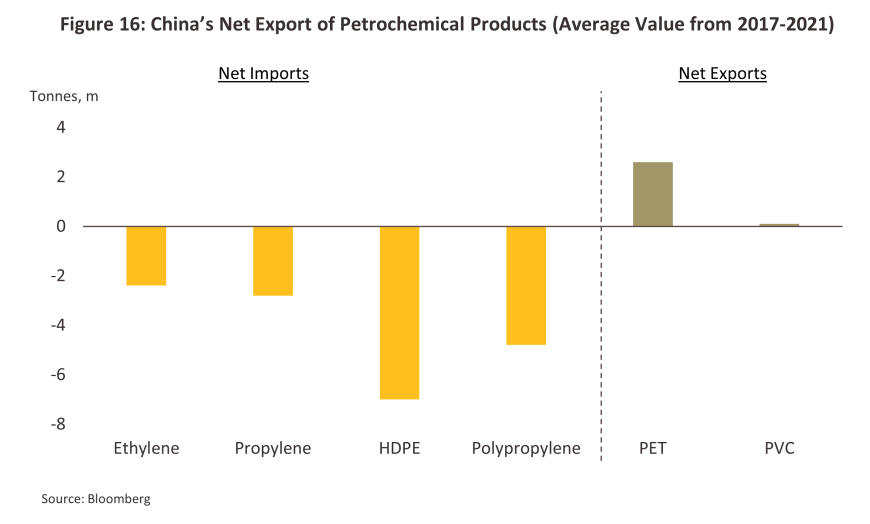

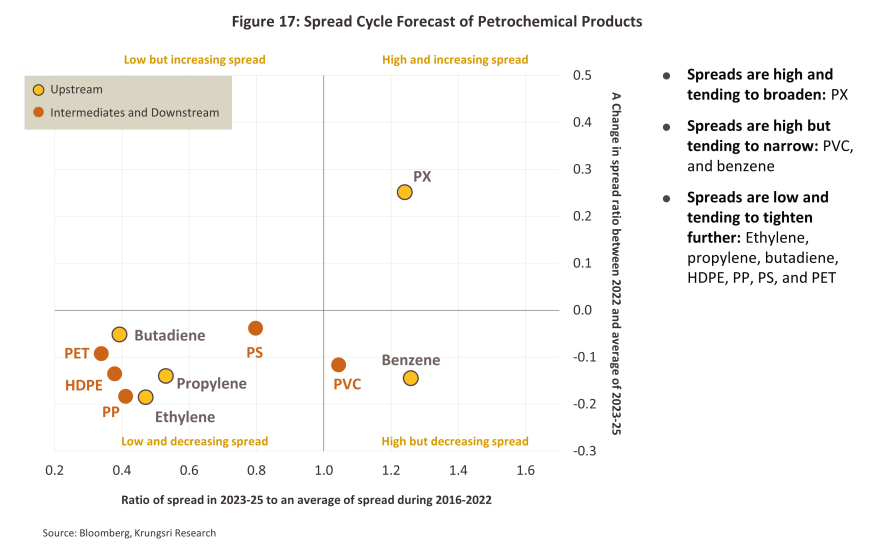

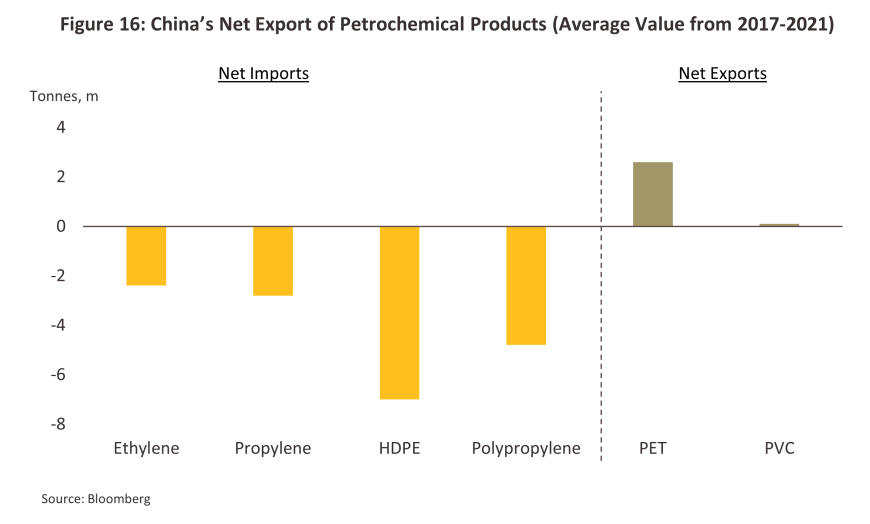

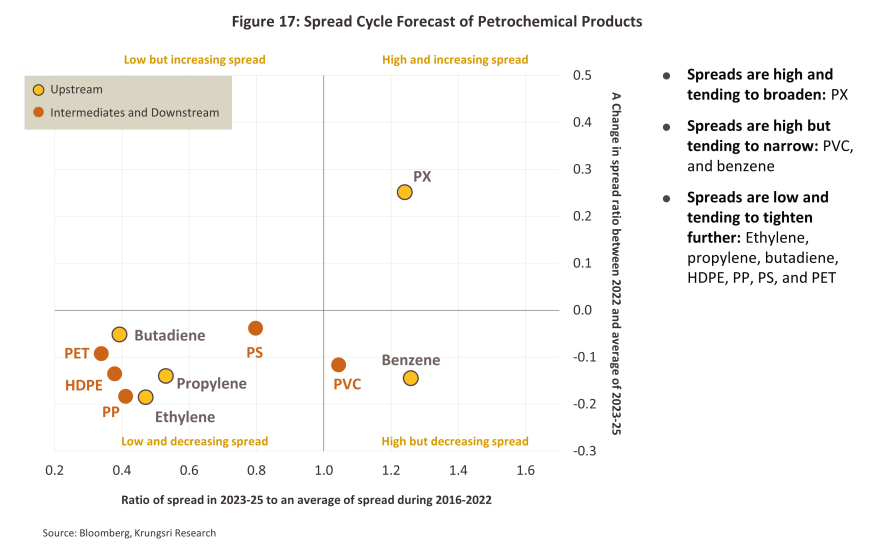

Average prices for petrochemical products will remain largely unchanged in 2025 and 2026 relative to their level in 2024, although because the cost of inputs will likely fall more rapidly than prices for finished products, spreads should remain flat or broaden slightly. The outlook for the major export markets of the US and China is for growth to remain somewhat weak and so demand from downstream industrial consumers of petrochemicals will strengthen only slowly, while the problems connected to oversupply from Asian producers described above will likely worsen, in particular for ethylene, propylene, PE, PP and PX. Most notably, Chinese production capacity has expanded following the increase in investment seen during the Covid-19 pandemic, when the country made the strategic decision to reduce its dependency on imports and ultimately move to becoming a net exporter of products such as PET and PVC (Figure 16). However, the outcome of this is now that many segments of the market are oversupplied, depressing prices and narrowing spreads, or at the very least making it substantially more difficult for manufacturers to widen these. The outlook for individual products over 2024-2026 is described below (Figure 17).

Thailand’s economic growth is projected to accelerate from 1.9% in 2023 to 2.4% in 2024, driven by a continued recovery in the tourism sector and domestic demand. This improvement will positively impact the domestic petrochemical market, particularly with strong demand for packaging from downstream consumers, including food, beverage, and self-care product manufacturers. The resolution of chip shortages is also expected to boost production in the electrical appliances and electronics sectors, helping to meet previously unmet demand. As a result, companies will aim to rebuild inventories following the destocking cycle of the previous year, which should help stabilize prices and prevent significant declines in spreads. However, growth remains uneven, and manufacturing and exports face challenges amid clearer signs of a slowdown in the latter half of the year. High household debt, standing at 89.6% of GDP as of Q2 2024, will further pressure demand for durable goods, such as automobiles and other downstream products. Additionally, increased production capacity across Asia is likely to exacerbate the supply glut, capping potential price increases and limiting the expansion of spreads. Looking ahead to 2025 and 2026, ongoing economic growth and declining feedstock costs, particularly for naphtha, should bolster prices and spreads for several products. Nevertheless, growth will be tempered by sluggish demand from certain downstream consumers and persistent oversupply issues in products like ethylene, propylene, PE, PP, and PX. As a result, Krungsri Research anticipates that demand in both domestic and export markets will rise by 1.0-2.0% per year from 2024 to 2026 (Figure 21).

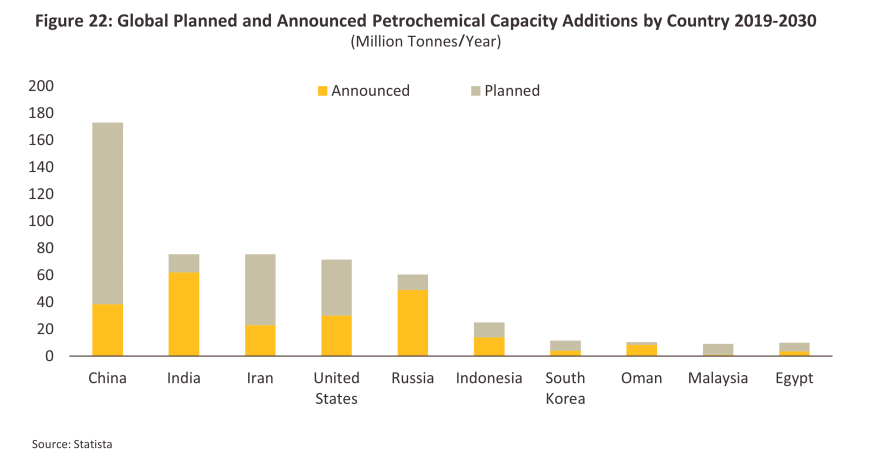

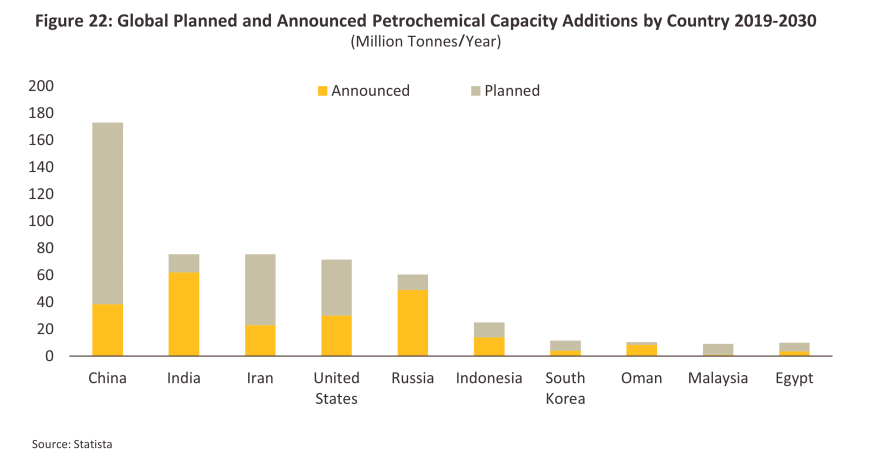

Several factors will shape the outlook for prices and spreads across the petrochemical industry. (1) Geopolitical Tensions: Ongoing conflicts, particularly the Ukraine-Russia war and the Israel-Hamas conflict, may continue or even escalate. An escalation in the latter could disrupt shipping in the Red Sea, a crucial route for 11% of global trade (source: IMF). This disruption could reignite supply chain issues and increase volatility in feedstock prices. (2) China's Structural Challenges: As the largest consumer of 40% of global petrochemical production, China faces a demographic shift and rapid population aging, leading to a long-term structural slowdown in its economy. The government's focus on wealth redistribution, rather than extending real estate sector debt, has significantly reduced demand for petrochemicals. This decline will exacerbate existing overcapacity issues in the industry. (3) Production Capacity: Trade tensions have led to increased production capacity in certain segments, worsening the existing supply glut (Figure 22) and intensifying regional competition. For example, (i) China: The China National Petroleum Corporation, the country’s largest oil producer, is shifting focus to low-carbon petrochemical production, with plans to add 3.1 million tonnes of new capacity by 2025, primarily for ethylene, propylene, butadiene, and high-value products like polyolefins, ethylene vinyl acetate and styrene-butadiene rubber. (ii) India: Bharat Petroleum Corp (BPCL), Oil and Natural Gas Corp (ONGC), and Indian Oil Corp (IOCL) aim to increase their crude oil to petrochemicals conversion rate from 4-5% to 10-15%, focusing on PE and PP. This aligns with government goals to transform India into a net exporter of petrochemicals.(4) Environmental Trade Regimes: Countries like the US and EU are implementing trade regimes that target imports with high embodied carbon levels. This shift will affect various sectors within the petrochemical industry along the entire manufacturing supply chain. (5) Global Plastics Treaty: A proposed treaty seeks to tackle the plastic pollution crisis through a "system change scenario" established by the United Nations. The goal is to reduce plastic pollution by 80% by 2040. This initiative will have significant implications for Thailand, impacting all aspects of plastic production, use, and waste management, although the treaty is still under discussion.

Nevertheless, the industry will continue to face several headwinds, particularly with the implementation of phase 2 of Thailand’s plastic waste management plan (2023-2027). This phase will tighten sustainability standards, aiming not only to encourage the public to reduce and ultimately eliminate single-use plastics but also to enforce extended producer responsibility (EPR) for better management of packaging waste throughout its entire lifecycle. Additionally, the oversupply of production capacity is expected to worsen due to approximately 1,473 projects slated to come online between 2023 and 2027 (source: Global Data). This influx will significantly boost Chinese production of PP (source: ChemOrbis), thereby increasing pressure on downstream manufacturers of both PP and PET.

1/ Grand View Research: Petrochemicals Market Size & Trends

2/ The supply glut is largely attributable to the overproduction of upstream products such as ethylene, propylene, butadiene, benzene, toluene and p-xylene.

.webp.aspx)