Executive Summary

The warehouse rentals industry will enjoy ongoing growth over 2023-2025 thanks to the steady expansion in both the Thai and the global economies and its positive impacts on international trade. Tailwinds will also blow from the rebound in the Thai tourism industry, which is helping to stimulate increased levels of domestic consumption. This is thus lifting the manufacturing sector overall. Alongside this, domestic investment is benefitting from the development of industrial estates, most notably those in the Eastern Economic Corridor (EEC), the advanced state of major Thai manufacturing supply chains (e.g., auto assembly, and textiles and clothing), the move by many international players to relocate production facilities as they try to avoid fallout from worsening global geopolitical tensions, and the continuing rapid growth in Thailand’s e-commerce sector. Given this generally positive outlook, players in the industry will move to meet rising demand by increasing the supply of warehouse space available for rent.

With major Thai players, foreign companies, and new entrants to the market continuing to invest in expanding the supply of rented warehousing space, the total supply will increase by at least 1.1-1.3 million sq.m. or at an annual average rate of 5.8%. Given this, problems with a supply glut will worsen in some areas, feeding greater competition and limiting the space within which rents can be lifted.

Krungsri Research view

The outlook for the various segments of the warehousing industry for the period 2023-2025 is described below.

-

General-purpose warehousing: Income growth in the general-purpose segment will likely outpace that of other parts of the industry, with particularly strong performance expected by warehousing in high-potential locations or areas that serve as distribution hubs, such as the BMR and the EEC (in Chonburi, Rayong, and Chachoengsao provinces). However, investment by large and/or new players will increase supply, most of which will be of modern warehousing. This will then take market share from traditional warehouses and SME operators and limit the room for rent rises in many areas. Some players will react to these changes by forming business partnerships or joint ventures with large Thai or international players since this will help companies overhaul their businesses and build competitiveness. Others will respond to changes in the business environment by investing in modern tech-enabled warehousing, thus laying the path to long-term growth in business income.

-

Cold storage units: In this segment, income will tend to remain flat or possibly edge up slightly. Demand will persist for the storage of agricultural produce, other fresh foodstuffs, and processed foods that are to be consumed in Thailand or overseas. Demand will also continue to grow for the use of cold rooms for the storage of medicines and vaccines, especially given the ongoing dangers related to COVID-19 and the demand for vaccines that this continues to feed. Nevertheless, the entrance of new providers to the market means that the supply of cold storage space continues to rise, while escalating operating expenses (especially for electricity and labor) will put downward pressure on profits and margins.

-

Storage space for cereal crops/silos: Income will tend to be somewhat variable since this is dependent on crop outputs and these move with changes in the weather. At the same time, a supply glut continues to weigh on the market, and this will force players to use pricing strategies to attract and keep customers, though this will have the side-effect of putting profits at risk.

Overview

Warehouses are spaces used for the storage of goods, usually as part of the distribution process, and so these support the operation of supply chains connected to manufacturing (for the storage of raw materials, parts, and components) and distribution (for the storage of finished goods). Rented warehouse space therefore forms a part of the logistics sector, and the industry has an important role to play in facilitating business operations in a wide range of industries across the manufacturing, trade and transport sectors.

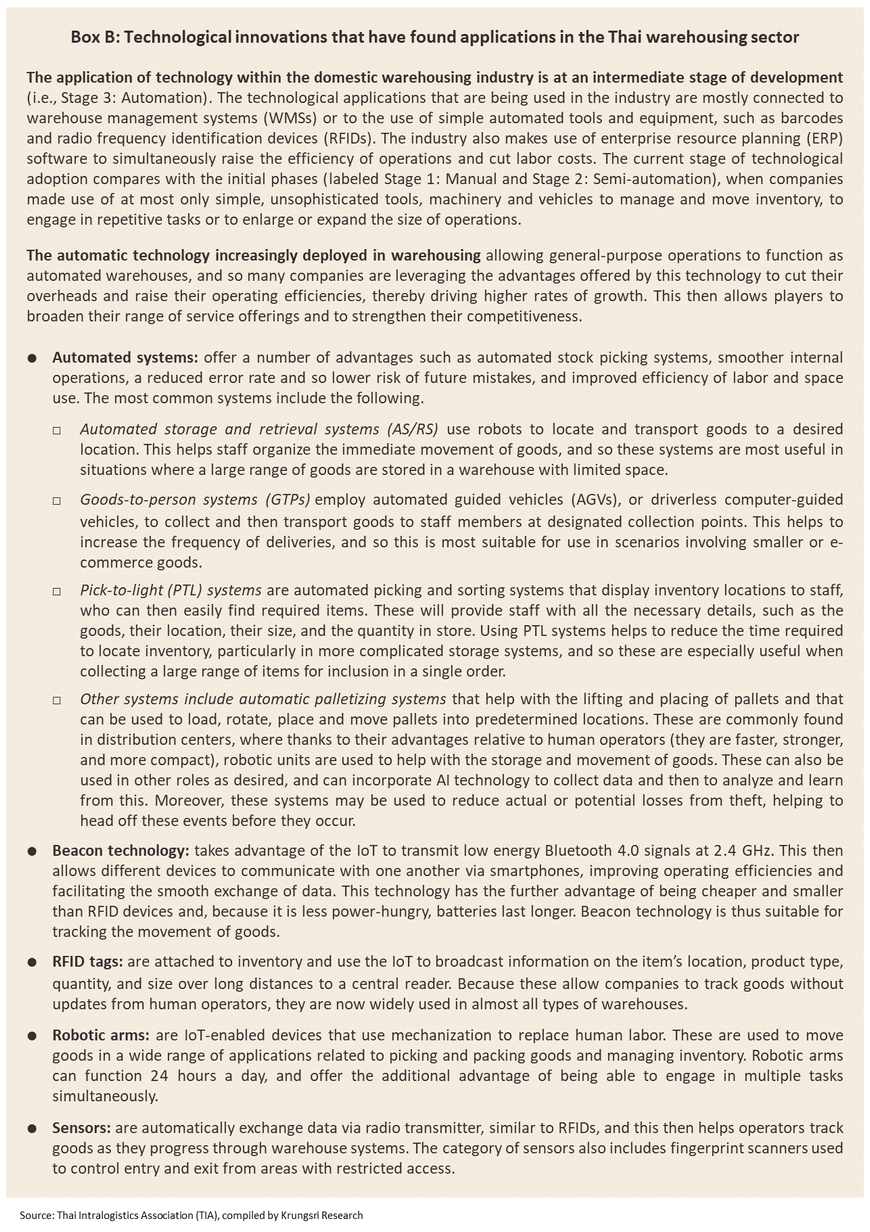

The Thai warehousing industry can be split into two main segments. (i) Traditional warehouses account for 95% of national supply and these typically emphasize the provision of a barebones service, with renters being provided with access to their warehouse space and basic utilities and amenities such as roads, electricity, water, telecommunications, and on-site security. (ii) Modern warehouses offer a much more comprehensive set of services, with operators providing tenants with access to appropriate digital technology and logistics systems that improve the efficiency of goods management (e.g., systems for storing and tracking inventory). These systems also make the procurement, management and distribution of inventory considerably easier, and this combines with the advantage of being less labor-intensive to make modern warehousing an attractive alternative that has the potential to meet market needs more precisely (Figure 1). At present, some providers of traditional warehousing are upgrading their facilities to offer modern warehousing services since this will then enable these companies to broaden their customer base and to generate receipts from additional services beyond core rent-based income streams. Players are also upgrading facilities in other ways, for example by investing in energy saving and environmental protection systems, which then helps to bring their facilities up to recognized industry standards (e.g., the Leadership in Energy and Environmental Design (LEED) scheme), and by installing facilities that increase protection against natural disasters, including floods and earthquakes. Warehouses have in addition been expanded by raising their floors and ceilings, which has the benefit of making the throughput of goods quicker and easier.

Within Thailand, the warehousing industry operates under the supervision of the Committee for the Management of Warehouses, Silos and Cold Storage Units, a part of the Ministry of Commerce. Organizations offering warehouses for rent in Thailand include state industries, such as the Public Warehouse Organization1/, private organizations operating under the management of and supported by the state (e.g., agricultural cooperatives), and fully independent commercial organizations.

The Department of Business Development (operating under the Ministry of Commerce) specifies three categories of rented warehouse operations. (i) General-purpose warehouses are buildings used for the storage of industrial and commercial goods (e.g., general consumer goods, raw materials, and parts and components). (ii) Cooled and frozen storage sites, or cold rooms, are temperature-controlled units that preserve (and so extend the shelf-life of) perishable food, such as seafood, dairy products, flowers, meat, fruit and vegetables, and medicines and vaccines. (iii) Silos are large temperature- and humidity-controlled cylindrical structures used for the bulk storage of cereals and similar crops, including rice, cassava, corn, flour, and rice bran.

The outlook for the warehouse industry is dependent on the general business conditions prevailing in manufacturing and commerce, together with overall levels of investment and household spending. The industry displays two important characteristics that help to determine its overall features: (i) Returns on investment typically occur over 8-13 years. On the one hand, upfront costs, especially those for land and construction tend to be high (on average, putting up new warehouses takes 6-18 months, though this depends on the footprint of the building), while on the other, income comes overwhelmingly from rent, which accumulates only gradually over the long term. Generally, rental rates will vary depending on the size of the space, the type of warehouse, its location, the provision of utilities, and the degree of competition in the area. (ii) The location of any particular warehouse plays a major role in determining its commercial success since this will strongly influence how well goods are stored and how easily they can be redistributed. Given this, evaluating the potential of different sites and the types of warehouses that ought to be constructed plays an important role in determining operators’ long-term growth in income.

Two types of rental agreement are used when renting or leasing warehouse space. .

-

Short-term contracts (not exceeding three years) are generally agreed for those leasing traditional warehouse space. These are usually made with SMEs and/or businesses that experience uncertain or fluctuating business conditions, for example seasonal businesses such as traders in agricultural produce or players in the fashion trade. Operators working in this segment may thus experience higher levels of risk as a result of uncertainty over income.

- Long-term contracts (longer than three years) are typically made with renters that are managing steadier and more predictable levels of stock and these are generally for modern-style warehouse operations, though these may be either ready-built or built-to-suit spaces. The majority of players in this segment are larger operators that are active principally in the real estate and industrial estates industries, including WHA Corporation, JWD InfoLogistics, Wyncoast Industrial Park, and Frasers Property Thailand. Sites operated by these companies tend to be located close to industrial parks, distribution centers, and industrial and manufacturing zones. For landlords, agreeing long-term contracts offers the advantage of being able to manage sites more efficiently and of minimizing fluctuations in income.

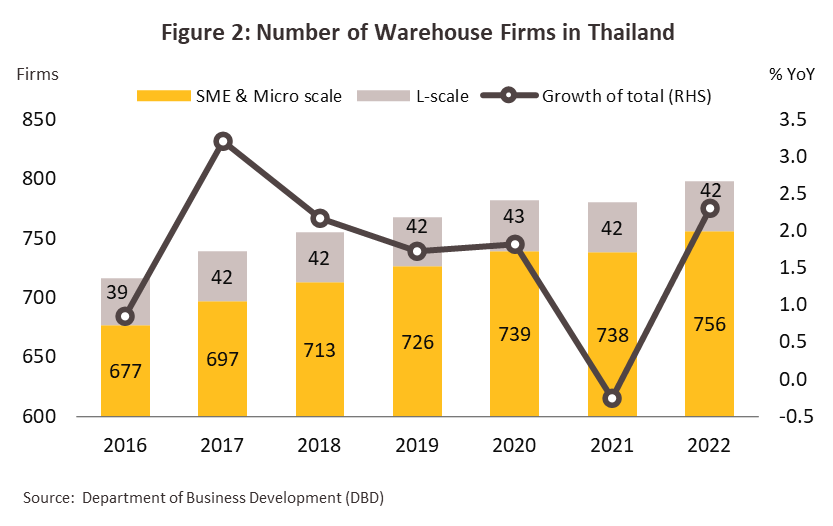

As of 2022, there were 798 companies offering warehouse space for rent (Figure 2). These fall into the following 2 groups.

-

Large players: 42 companies that were registered as active in the industry (5.3% of the total) qualify as large. This group comprises: companies that provide logistics services (e.g., JWD InfoLogistics, Berli Jucker Logistics, Mitr Phol Warehouse Company and Mon Logistics Services); companies that are active in food production and processing (e.g., Zen Corporation, Intersia, Paramee Cold Storage, and Pacific Cold Storage); distributors of household and office goods (e.g., Officemate Logistics); real estate developers (e.g., WHA Corporation, and Prospect Development); and joint ventures with overseas players (e.g., Suzuyo Distribution Center (Japanese), WFS-PG Cargo (French), and Kerry Logistics (Chinese/Singaporean)).

-

SMEs and micro operations: There are 756 SMEs and micro operations active in the market (94.7% of the total). Within this segment, important players include companies in the JWD InfoLogistics, CRC Property and Development, MBK, K Line (Japanese), Chia Tai, Lam Soon, and MK Real Estate groups, as well as BFS Cargo DMK (part of Bangkok Air).

Situation

The warehousing industry has enjoyed sustained growth through the difficult years of the COVID-19 crisis, despite the latter leading to a sharp contraction in the economy in 2020 that was followed by only slow recovery in 2021 and 2022. Demand for domestic warehousing space has been underpinned by very rapid expansion in e-commerce sales in recent years (up 140%, 75% and 8% in each of 2020, 2021 and 2022) 2/, which has itself benefitted from the pandemic-era surge in working from home and the public’s growing familiarity and comfort with online shopping. In 2022, the warehousing industry was also lifted by strengthening international trade that then fed into recovery in the manufacturing sector. In the year, Thai exports hit a historic high of USD 2.7 billion, up 5.7% from the 2021 total on growth in exports of agricultural goods, food and drinks, and industrial goods, while imports also surged 12.8% YoY to a value of USD 3 billion. Beyond this, the easing of the pandemic opened the door to recovery in both domestic and international tourism, and so in the year, a total of 11.2 million foreign arrivals were recorded, up from just 0.4 million in 2021. This then lifted demand for consumer goods and for food and drink. Alongside this, private-sector investment climbed 5.1% YoY, adding to demand for warehousing space for the storage of goods and inputs into manufacturing processes. Players in the warehousing industry therefore met rising demand by stepping up investments in space to be used for the temporary storage of goods in transit. The situation for individual segments in 2022 is described below.

-

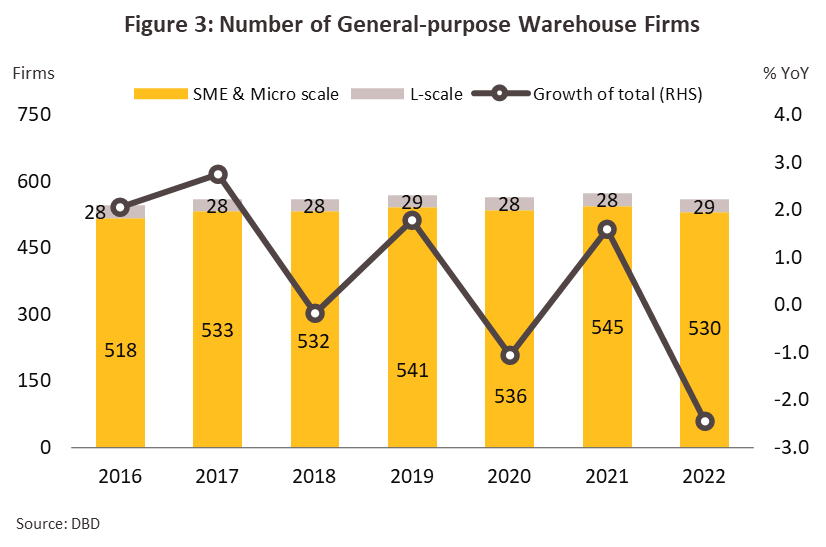

General-purpose warehousing: Players in this segment account for over 70% of the total market, and because general warehousing space can be used for the storage of a huge range of goods and may be extended almost as needed, players in the segment provide warehousing services to a wide variety of industries. However, at around 62% of the total, income from this segment accounts for a slightly smaller proportion of the industry total (as of 2022). There are just 29 large players active in the segment (5.2% of the total market), most of which are providers of logistics services, part of larger commercial groups manufacturing and distributing consumer goods, or developers of industrial estates and parks. By contrast, 530 players (or 94.8% of the total market) are SMEs and micro-scale operations (Figure 3).

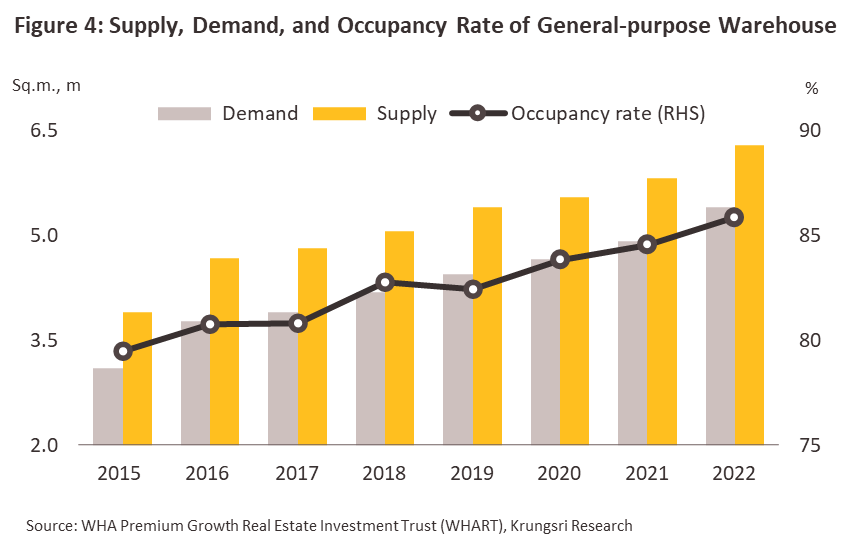

Demand for rented general warehousing space has continued to strengthen, especially within the Eastern Economic Corridor (EEC) for companies that need to store goods prior to manufacture, distribution or export. This includes in particular companies involved in fast-moving consumer goods, players in the auto industry (including manufacturers of EVs), manufacturers of electronics and electronic appliances, and producers and sellers of high-end fashion and lifestyle goods, which managed to maintain solid rates of growth even as the overall economy slowed. Demand is also coming from foreign players relocating production facilities to Thailand and from third-party logistics providers supplying services to online retailers, including SMEs selling direct to the public, given those, growth in demand for warehouse space topped out at 9.8% YoY in the year, meaning that total demand came to 5.4 million sq.m., compared to 4.9 million sq.m. in 2021 (Figure 4).

To respond to rising demand, players have accelerated plans to invest both in the expansion and upgrade of existing sites and in the construction of new warehousing. This is particularly the case for modern built-to-suit premises that are designed to meet the requirements imposed by modern automated inventory systems, though constructing these also reduces the risk that operators will be saddled with unleased property for extended periods. The major players in this segment include the following: (i) Kerry Logistics (Thailand), a provider of last-mile logistics services, is investing in the expansion of its operations on the Bang Na-Trat road to better meet demand from importers of European and Chinese electronics and electrical appliances. In addition, the company is upgrading its facilities in the EEC (in Rayong), which will become a GHP logistics center for the safe handling of food, medicine, and pharmaceuticals. (ii) Charlie Top Logistics is investing in the construction of a 22,000 sq.m. site in the customs freezone close to Laem Chabang Port that should be open for operations in 2023. (iii) Frasers Property Thailand is expanding its 19,000 sq.m. built-to-suit facilities in Samut Prakan, which are targeted at major logistics companies, and later in 2023, the company should open another 11,000 sq.m. built-to-suit site that has been constructed in accordance with LEED green-building standards. (iv) WHA Corporation is expanding the rental space available at the 130,000 sq.m. WHA Mega Logistics Center in Samut Prakan. With logistics businesses seeing solid rates of growth, some players are also increasing investment in neighboring countries, including in Cambodia. These led to an increase in total supply of warehousing growth at 8.1% YoY to 6.3 million sq.m. in 2022. Overall, growth in demand for warehousing space has outpaced supply, with the result that the occupancy rate edged up from 84.6% in 2021 to 85.9% a year later.

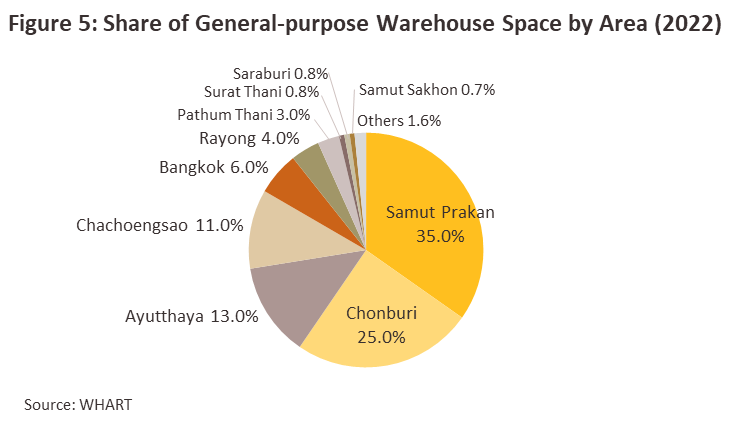

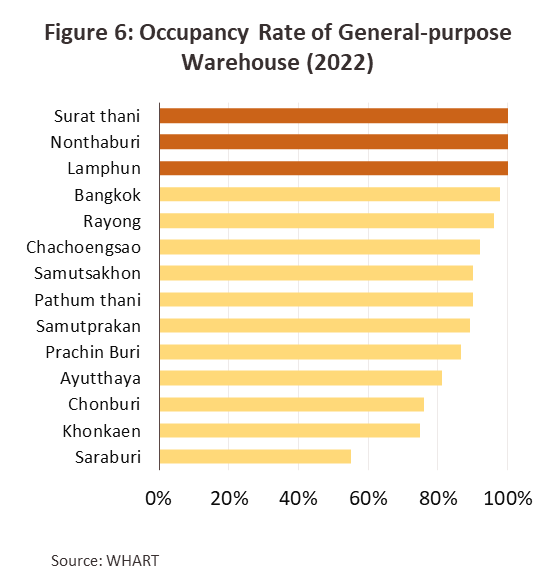

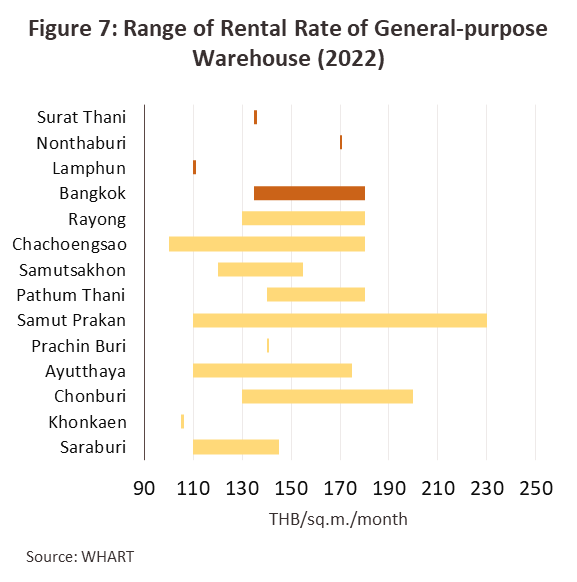

Rented general warehousing space is clustered in the central and eastern regions. The highest concentration is in Samut Prakan, which is home to 35% of the total, followed by Chonburi (25%) and Ayutthaya (13%) (Figure 5). However, rental and occupancy rates differ according to the desirability of the area, the quantity and state of the warehouse space available, the level of competition in local markets, and the area’s travel connections (Figures 6 and 7). For rental rates, the total average rate in 2022 stood at THB 100-230 per square meter per month, similar to those in 2021 (source: WHART). In the EEC and the Bangkok Metropolitan Region, rates averaged THB 160/sq.m./month, rose by 2.8% in 2022 compared to THB 155 a year earlier, while the rental rates in the central region (excluding the Bangkok Metropolitan Region) stood at THB 115-165/sq.m./month. The highest rates were found in Samut Prakan, where the region’s proximity to Bangkok and good travel links lifted these to THB 230/sq.m./month, followed by Chonburi, where the large number of industrial estates pushed rates to THB 200/sq.m./month. In Bangkok, Pathum Thani, Rayong, and Chachoengsao, the highest rates averaged THB 180/sq.m./month, whereas in Ayutthaya and Samut Sakhon (factory hub and distribution centers), the most expensive rental rates came in at THB 175/sq.m./month and THB 115/sq.m./month, respectively.

The 2022 increase in the supply of general warehouse space was largely seen in areas that are strategically important for logistics players around the Bangkok Metropolitan Region, such as in Suvarnabhumi, Bang Pakong, Pathum Thani and Ayutthaya, as well as in the EEC. These areas benefit from the fact that distributing goods from these locations to end users is relatively easy and quick since these locations enjoy good travel connections, they are close to ports, and they have access to Suvarnabhumi airport and the inland container depot at Lat Krabang. They may also be in or near industrial estates that serve as distribution centers.

-

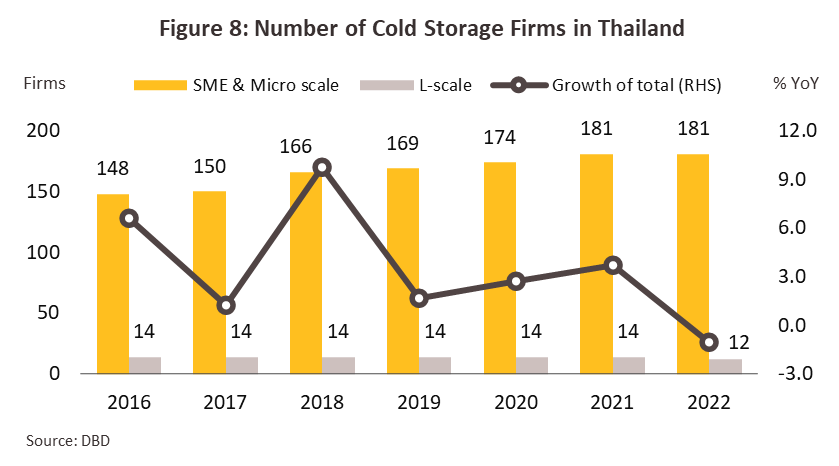

Cold storage facilities: Growth in this segment has been supported by changing consumer behavior, in particular by the rise in demand for food that is quick and easy to consume but that is also safe and hygienic. This has naturally then boosted demand for chilled and frozen processed and ready-to-eat foods, and because these are such a good fit with changing consumer needs, growth has been seen in both domestic and export markets. Sales of these products also benefit from the fact that they are distributed through a wide range of channels, from retail outlets to online distributors. Demand for cold storage facilities has thus strengthened, while companies operating in other parts of the economy, such as food processors (of seafood, fruit and vegetables, bakery and dairy goods, and meat products), have also invested in their own cold storage units to ensure that the quality of their produce is maintained, and so traditional operators may see their customer base shrink. The latest data (as of 2022) show that there are 193 operators of cold storage facilities in Thailand (Figure 8), of which 12 (or 6.2%) are large-scale operations, although the majority of these were companies within larger food producing or processing commercial groups. This then leaves 181 companies (93.8% of the total) that are SMEs and micro-sized operations. At present, companies in this segment are increasingly adopting new technology, such as automated storage and retrieval systems (ASRSs) that make stock picking and storage easier. The use of robotics in conjunction with cold chain management systems (CCMSs) also enables real-time monitoring of the status of goods in storage.

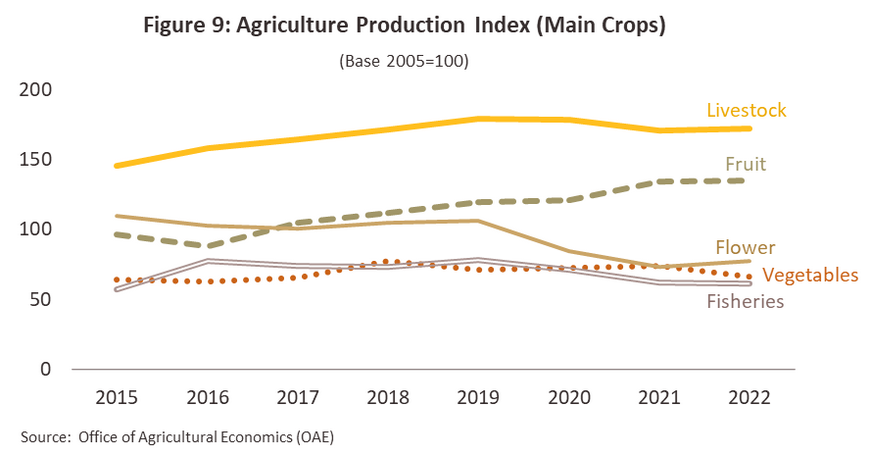

Demand for cold storage units to rent rose through 2022 as the COVID-19 pandemic eased, the tourism industry rebounded, and overall social and economic life returned to normal. This then boosted domestic sales of food and drinks, while exports of agricultural products (plant cultivation, livestock, and fisheries) grew 7.4% from the 2021 level to generate receipts worth USD 29 billion, thereby giving Thailand a 2.7% share of the total global market for food imports3/. In 2022, exports were lifted further by the outbreak of war in Ukraine and the imposition by many countries of restrictions on exports of cereals and other foodstuffs, which then triggered a sharp rise in prices, encouraging many countries to build food security by expanding their food stocks. As such, exports of agricultural and agro-processing goods expanded 8.8%, with rises of 124.6% YoY for chilled and frozen chicken, 10.1% YoY for tinned and processed seafood, 6.2% YoY for tinned and processed fruit, 42.5% YoY for meat products, and 0.7% YoY for milk and dairy products. Outbreaks of livestock diseases (e.g., AFS in swine herds and lumpy skin disease in cows) meant that that domestic outputs dropped and so imports of some foods rose to compensate for this. However, demand for cold storage facilities was limited by widespread flooding in 2H22 that then cut into outputs of many crops. Overall, outputs of vegetables fell -10.1% YoY, while for fisheries products, outputs were down -0.3% YoY. (Figure 9). At the same time, for some segments, consumer purchasing power came under pressure from the year’s significant increase in inflationary pressures.

-

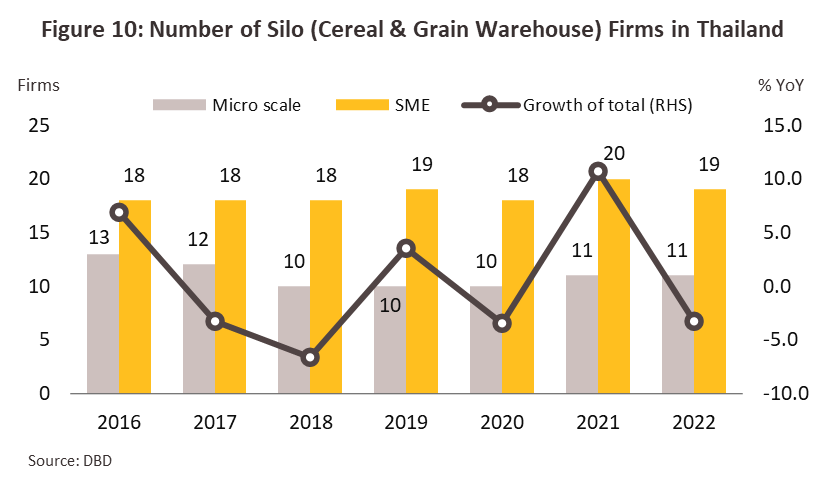

Silos: All silo operators are SMEs or micro-sized operations (Figure 10). 73.3% of companies active in the market are located in the north, the northeast, and the central region (not including the Bangkok Metropolitan Region) since these are both the country’s major rice growing areas and areas where crops are gathered in preparation for export. The remaining 26.7% of operators are in the east or west of the country, or in the Bangkok Metropolitan Region. These areas serve as both hubs for the storage of crops (e.g., cassava and maize) and as regional distribution centers from which goods are moved to processing plants in industrial estates, special economic zones, or nearby areas.

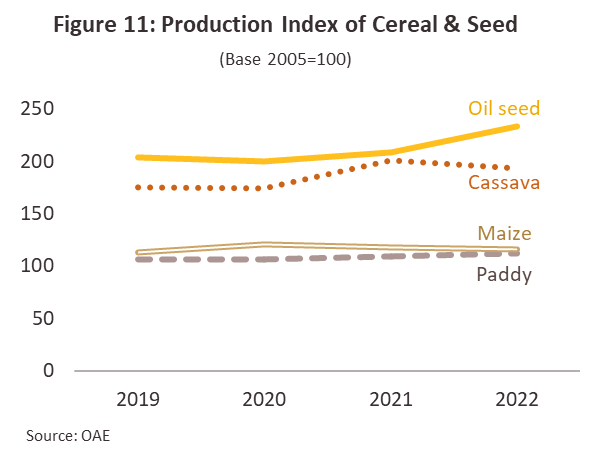

Demand for silo space improved in 2022 thanks to the higher outputs of some crops, an outcome that can be partly attributed to rising prices on global exchanges, most notably for oil seeds (+12.2% YoY) and rice (+2.6% YoY), which then encouraged farmers to increase the area of these under cultivation. Crops for which Thailand has the potential to serve as a major exporter and that are in strong demand globally include oil crops, cereals, and coffee (in 2022, exports of these from Thailand surged 49.9% YoY). In addition, some countries have raised demand for restocking input after stock decreased. China, for example, has increased imports of agricultural inputs following the decline in output triggered by the country’s zero-COVID policy.

Outlook

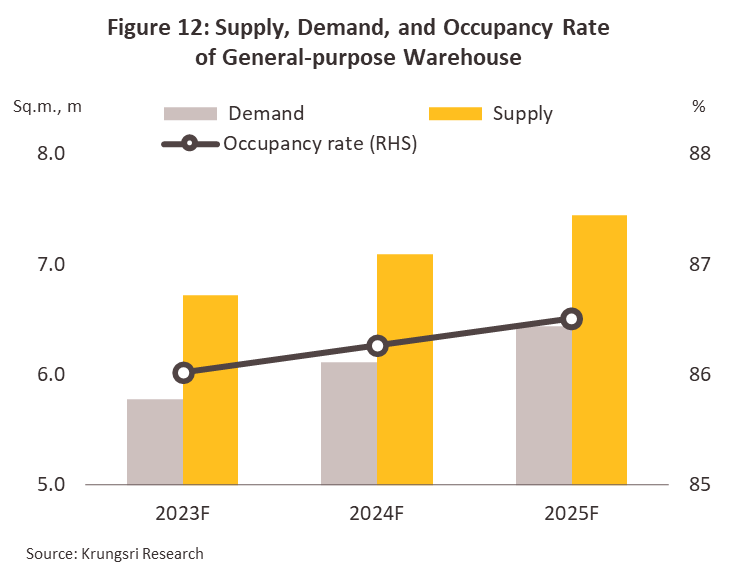

The warehousing industry is growing through 2023, though not at an exceptionally high rate. Demand is being supported by the forecast 5.2% expansion in private-sector consumption and the continuing surge in e-commerce sales, which should expand by 13-15% YoY this year (Source: THECA). However, the slowdown in the global economy has put downward pressure on the Thai export sector, and so the total value of imports and exports is expected to decline by -0.6% and -1.5% YoY, respectively. This is being partly offset by strength in the import and export of agricultural goods and some manufacturing products. Data covering the period January to July show rises of 42.3% YoY for electrical transformers and component parts, 11.8% YoY for ‘other’ computer equipment, 20.6% YoY for rice, 16.8% YoY for chilled, frozen and dried fruit, 14.8% YoY for tinned and processed vegetables, 14.1% YoY for chilled cooked shrimp, 33.5% YoY for chilled and frozen chicken, 111.7% YoY for chilled and frozen pork, 151.4% YoY for chicken eggs (increases in exports of eggs were driven by the entry of Thai suppliers to the Taiwanese market for the first time in March), and 2.8% YoY for orchids. At the same time, imports were up 73.7% YoY for chilled and frozen fresh shrimp, 34.4% YoY for grapes, 36.2% YoY for rice, 27.1% YoY for drinks, and 15.5% YoY for sweets and chocolate. In light of this, Krungsri Research sees total 2023 demand for general warehousing space coming to 5.8 million sq.m., up 7.0% from the 2022 level. Supply will also rise 6.8% YoY to 6.7 million sq.m., giving an average occupancy rate of 86.0%.

The industry will benefit from strengthening demand through 2024 and 2025 (Figure 12) as the Thai economy continues to grow steadily. Operators will tend to invest in the provision of both built-to-suit and ready-built facilities. In the former case, this will be to meet demand from core customers, while in the latter, it will allow players to respond more rapidly to changing market needs and to address demand from new customers. The outlook for individual segments is given below.

-

General-purpose warehousing: Demand is forecast to expand at an average annual rate of 5.6% on a number of factors.

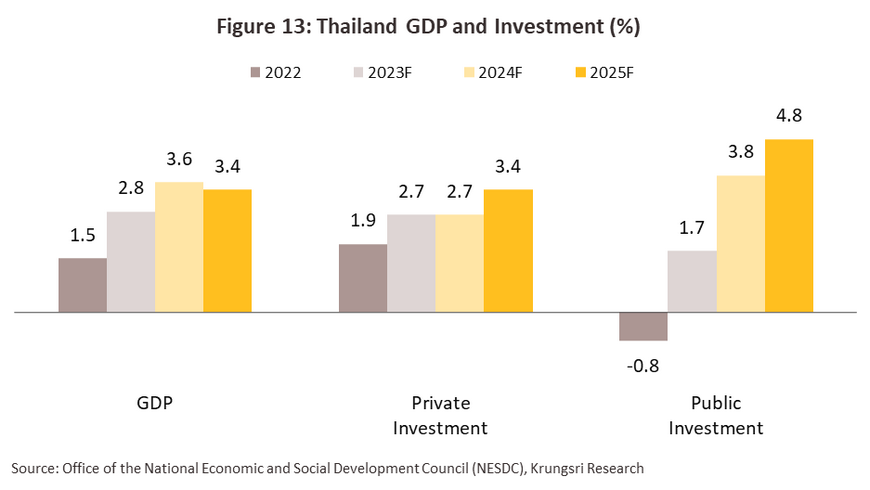

1) Both the Thai and the global economies are expected to grow over the following two years, with the IMF predicting average global growth at 3.0% and 3.2% in 2024 and 2025 and Krungsri Research seeing rates of growth in the Thai economy over these 2 years at 3.6% and 3.4% (Figure 13), and this will naturally boost international trade. The warehousing industry will also benefit from the sharp rebound in the Thai tourism sector (foreign tourist arrivals are expected at 42 million in 2025), which will lift consumption and so add to the tailwinds driving growth in domestic manufacturing and investment.

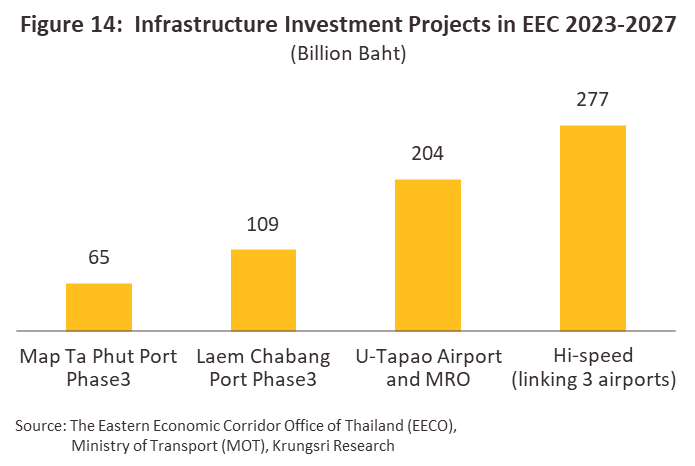

2) Work on projects in industrial estates will stimulate ongoing growth in investment, especially for projects related to phase 2 of the development of the Eastern Economic Corridor (scheduled for the period 2023-2027). In particular, these will focus on infrastructure and communications projects that improve regional connectivity, including extensions to Motorway 7, connections to phase 3 of the development of Laem Chabang and Map Ta Phut ports, and the high-speed rail-link connecting the area’s 3 airports (Figure 14). Also important will be the opening of distribution hubs in the country’s special economic zones (SEZs), including the Nong Khai SEZ (opposite the dry port in Lao PDR), the Chiang Khong Intermodal Facility in Chiang Rai province, and the border distribution hub in Nakhon Phanom. Beyond this, foreign investors will be increasingly likely to move production facilities to Thailand or to expand those already here. This will be driven by a combination of pull factors, that is, the advanced state of Thai supply chains, in particular for auto assembly and the production of textiles and apparel, and push factors, notably the desire to avoid having investments tied up in countries that are subject to rising geopolitical tensions. For example, Sony is transitioning production of digital cameras bound for markets in the US and Europe out of China and into Thailand. This will then add to demand for warehousing space for the storage of goods in transit.

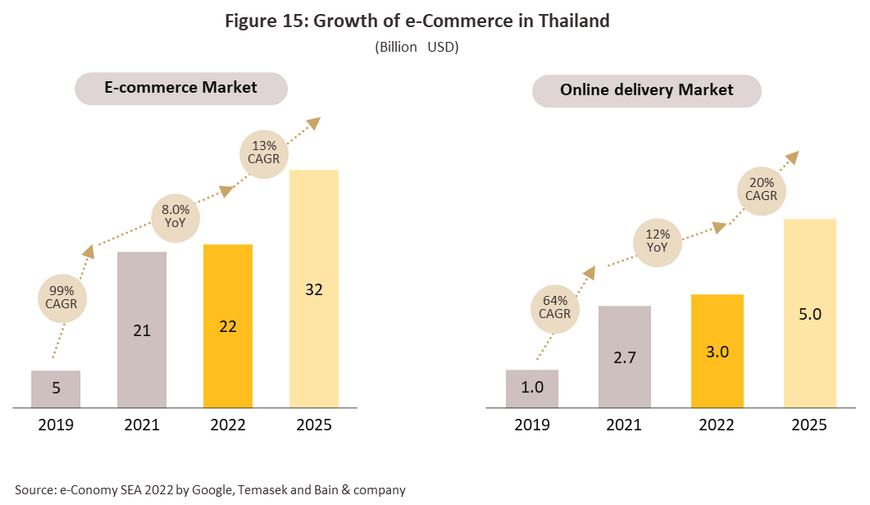

3) The e-commerce and logistics industries will continue to benefit from very solid rates of growth, and the e-Conomy SEA2022 expects that over 2022-2025, the Thai markets for e-commerce and online delivery will enjoy an average growth of respectively 13% and 20% (Figure 15). This will then underpin stronger demand for warehouse space to be used to store and organize goods in transit. E-commerce fulfilment sites will be in particularly strong demand as companies expand their operations to meet continuing growth in e-commerce.

The supply of general warehousing space is forecast to increase at an average annual rate of 5.3%. As this will lag behind demand growth, the occupancy rate should thus rise to around 86-87% during 2024 and 2025. Players will invest in the construction of modern new build-to-suit facilities, most of which are leased on long-term contracts with periodic rent rises agreed in advance, ready-built warehousing, which can instantly meet rapid growth in demand, and fulfillment centers, which will allow operators to better connect with B2B2C customers in Thailand and in neighboring countries. In addition, players will look to develop smaller facilities in urban locations since by being located closer to population centers, companies will be able to accelerate delivery times. To streamline operations and reduce energy and labor costs, companies are also increasingly using technology to assist with inventory management. This includes using robots to pick stock, sensors to track stock locations, and power-storage devices to save on electricity bills. Taking this route also makes it easier for operators to raise rental rates, while lease agreements for tech-enabled sites have the advantage of typically being for longer periods than those signed for traditional warehousing.

-

Cold storage units: Several factors are supporting the outlook for operators of cold storage units. (i) Growth in the food industries and restaurant businesses is adding to demand for temperature-controlled units to be used to keep products fresh (e.g., for fruits, vegetables, dairy products, and meat). In addition, increased consumption of processed and pre-cooked foods, especially of chilled and frozen food, has added to demand for these services that focus more on convenience. (ii) Demand for chiller units is rising with the need to use these to store medicines and vaccines (e.g., for COVID-19), especially when the government is encouraging at-risk groups to get COVID boosters. (iii) In the wake of the Russia-Ukraine war and with El Niño disrupting global weather patterns, worries over food security have risen worldwide, and this has then helped add to growth in exports of food from Thailand. These trends have then been amplified by accelerating consumer interest in healthy eating, and so countries are increasingly building food reserves; so far in 2023, Russia has imposed a ban on exports of rice and rice groats, Algeria has prohibited the export of wheat, sugar and vegetable oils, and Morocco has blocked the export of tomatoes, onions, and potatoes.

Operators will likely respond to strengthening demand by increasing investment in the provision of temperature-controlled storage units. However, players in other parts of the economy will also add to supply, including: (i) operators of chilled and frozen facilities that store fruit on behalf of other organizations, or that hold or process agricultural produce in different locations before this is distributed to buyers or exported, e.g., the facilities run by 24 agricultural cooperatives in 5 provinces4/; (ii) cold storage facilities in the Smart Park industrial estate in Rayong, which forms part of the so-called ‘Eastern Fruit Corridor’ (EFC); (iii) privately-run chilled and frozen storage space owned and run by players in the seafood or sweets and bakery goods industries that provide the supply chain provenance assurances required in some export markets; (iv) storage and distribution centers for agricultural goods that are sited in airports; and (v) players already in the industry that are expanding their provision of temperature-controlled units to broaden their service offerings, such as Kerry Logistics (for the storage of halal food, medicines and medical supplies) and SCG JWD Logistics (a joint venture between SCG Logistics Management and JWD Infologistics).

-

Storage space for cereal crops/silos: Demand will tend to fluctuate with the outputs of the major crops, which will in turn be determined by the climate. Overall, operators will tend to cut back on investments in additional supply due to: (i) the considerable pre-existing oversupply of storage space; and (ii) the impacts of El Niño on crop outputs over 2024 and 20255/. Nevertheless, demand may strengthen slowly as players compete to buy stock for export or to gradually re-release this back to the market when prices rise. Competition within the market will come from warehouse operators, traders and middlemen, processing and packaging plants, producers of animal feed, and power plant companies (for storing woodchips or raw materials).

Locations that are likely to see growth in the coming period will include the following (Figure 16):

-

Warehouse space located close to centers of production: This includes the Bangkok Metropolitan Region, industrial estates, regional centers in the provinces, and areas that are recipients of government support for targeted industries. The latter includes Ayutthaya province (a hub for the manufacture of electronics and electrical appliances that is also blessed with good communication links to the north and northeast), the EEC and nearby areas (a center of manufacturing and international trade in autos and electronics), and centers of regional importance.

-

Warehouse space located close to consumer markets: The increased supply of warehousing space will meet additional demand resulting from growth in e-commerce sales. This will be concentrated in the Bangkok Metropolitan Region, Samut Prakan (a center of e-commerce and logistics) and important regional centers (e.g., Chonburi, Phitsanulok, Nakhon Ratchasima, Khon Kaen, Ubon Ratchathani, and Surat Thani). In addition, warehouse units may be transformed into micro-fulfilment centers in easy-to-access urban areas.

-

Warehouse space in border regions: Demand will tend to grow under the impact of investment promotion schemes organized by the Board of Investment and the Industrial Estate Authority of Thailand, as well as in areas where progress is being made on road, rail, air and sea transportation infrastructure that better connects Thailand to neighboring countries. This will increase the impact of Thailand’s favorable position at the center of Southeast Asia and so feed demand for space in areas such as Tak, Mukdahan, Sa Kaew, Trat, Songkhla, Chiang Rai, and Nong Khai. This will particularly help SEZs and sites in border regions that are being opened up by new transport connections (e.g., warehouses with access to the Laos-China rail-link, the Chiang Khong Intermodal Facility in Chiang Rai, and the Nakhon Phanom distribution center).

Beyond this, investing in warehouse space overseas will present an additional opportunity for Thai investors to increase their offerings and expand their customer base. This process is being accelerated by the high growth potential of many countries in the region, most notably Vietnam and Indonesia. When expanding into some AEC countries, Thai players also now have the opportunity to engage in joint ventures or to own local companies outright, and indeed, Thai companies already investing in overseas warehouse operations include PM Thoresen Holdings (in Vietnam) and JWD Logistics (in Cambodia).

However, competition is likely to intensify in the coming period. (i) Large players (e.g., WHA Corporation, Kerry Logistics, SCG JWD Logistics, Sahathai Terminal, and Siam JNK) are increasing their spending on new rented warehouse space, both for the construction of built-to-suit and for ready-built modern warehousing. This may result in an oversupply of traditional warehousing space in some areas and this will limit players’ ability to raise rents; (ii) Investment inflows to the industry are also increasing from new entrants to the market, especially from construction and real estate companies (e.g., Sena Development will provide its comprehensive ‘Metrobox’ warehousing services to customers in Samut Prakan and Ayutthaya), foreign players, and joint ventures that are being undertaken to extend the provision of logistics services into warehousing. Examples of these include Charlie Top Logistics, a joint venture between Whale Logistics and Chonburi Concrete to develop a warehousing site within the customs free zone in Laem Chabang that should be open for commercial operations in 2023, and the joint venture between Alpha Industrial Solutions and Tokyu Land Asia to develop a 87,000 sq.m. warehouse complex in Rangsit, which is also expected to be completed in 2023. (iii) In some areas, restrictions imposed by planning regulations limit construction of warehousing such that in ‘green zones’ (land used for farming and agriculture), developers may not build collection or cold-storage units that have a footprint in excess of 2,000 sq.m. (iv) Costs are trending upwards, including those for land purchases, construction, financing, utilities, technology, and labor (the latter is being driven by labor shortages).

Faced with this situation, companies will need to raise their operating efficiency by increasing their uptake of technology and by instituting improved cost management systems, though in the process being careful not to compromise service quality. This could involve using technology to facilitate all aspects of operations, from storing goods to transferring and transporting these. This might also include deploying other management technologies or switching to the use of automated warehouses since these have lower labor costs and make more efficient use of available floorspace. Players in the warehousing industry will also need to address the environmental impacts of their business operations by placing a greater focus on the sustainability of their activities. This would entail addressing the ESG (environmental, social, governance) agenda, which is at present a major concern of many international customers. This could be achieved by switching from fossil fuel to solar power, using EVs, or by better controlling warehouses’ internal temperatures (running cold storage units typically incurs extremely high charges for electricity). Structures could thus be better cooled using natural ventilation, they could be constructed with double layer paint, or they could be built along ‘green building’ lines, thus allowing warehouse operators to compete more effectively by offering services that meet the needs of customers wishing to improve the sustainability of their businesses.

1/ The Public Warehouse Organization (PWO) is a state enterprise tasked with maintaining stable prices for agricultural products. To fulfil this remit, the PWO offers services for the storage and gradual distribution of agricultural produce to domestic and international markets, as determined by government policy. The PWO also offers services to state and private organizations for the depositing of agricultural goods and their use in ‘pledging schemes’, as well as operating a wharf for the loading and unloading of goods in transit in and out of the country.

2/ Source: Thailand e-Commerce Association (THECA)

3/ Source: Trade Policy and Strategy Office

4/ Chonburi, Chachoengsao, Rayong, Chanthaburi, and Trat.

5/ Data from the National Oceanic and Atmospheric Administration (NOAA) shows that over the last 60 years, severe El Niños and La Niñas have occurred roughly every 12-15 years, with the last of these having been recorded in respectively 2015-2016 and 2010-2011. However, as climate change takes hold, extreme weather is occurring more often and one result of this is that the timeframe over which El Niños and La Niñas happen has shortened, these now swapping every 2-3 years. Krungsri Research thus believes that a moderate to strong El Niño will run from 2023 to 2025.